Optimal Investment in Preservation Technology for Variable Demand under Trade-Credit and Shortages

Abstract

1. Introduction

- Time-varying holding cost

- Demand rate is the non-linear function of the sales price

- Preservation technology investment for preserve the deteriorating items

- One-layer trade credit policy

- Partially backlogged shortages accumulate at an exponential rate

2. Literature Review

3. Notation and Assumptions

3.1. Notation

| Parameters | |

| purchasing cost; (in $/unit) | |

| holding cost; (in $/unit/unit time) | |

| ordering cost; (in $/order) | |

| price elasticity constant; | |

| expiry dates of the product (in years) | |

| μ | rate of preservation; |

| upstream trade credit (in years) | |

| vendor’s gained interest (percentage/year) | |

| vendor’s lost interest (percentage/year) | |

| backlogging parameter; | |

| amount of back-ordered demand (units) | |

| vendor’s order quantity (in units) | |

| backlogging cost; (in $/unit time) | |

| additional charge because of lost sales (in $/unit) | |

| Decision variables | |

| cycle time (in years) | |

| selling price of an item (in $/unit) | |

| investment for preservation technology (in $/unit) | |

| Functions | |

| ; time-varying cost of holding, where the cost of holding increased by its (in $/unit/year) | |

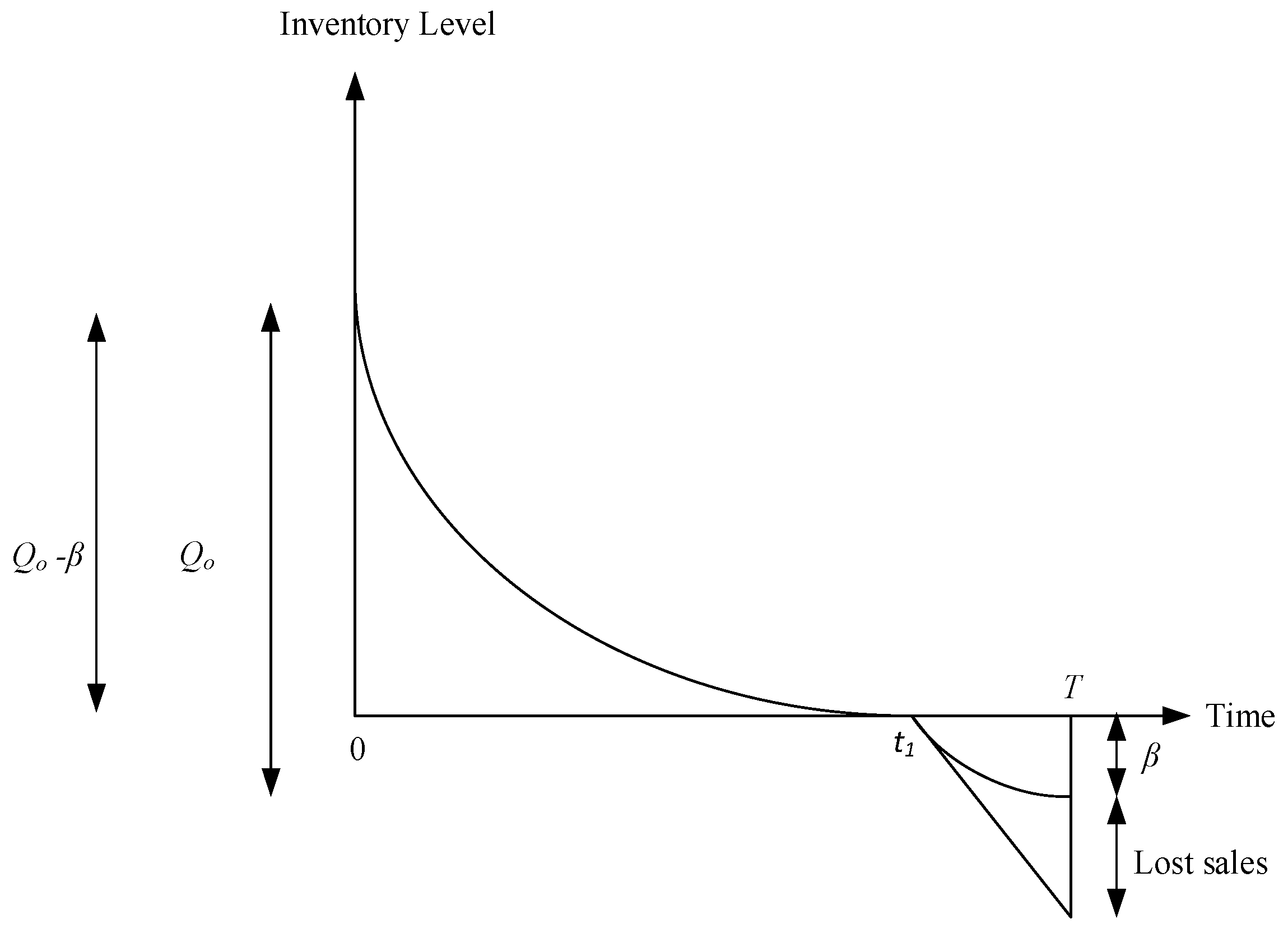

| ; time is taken for inventory level to reach zero, where (in years) | |

| level of inventory before the shortages; (units) | |

| level of backordered; (units) | |

| amount of a sales loss at a time (units) | |

| vendor’s net profit function per unit time per scenario; (in $) |

3.2. Assumptions

- The inventory structure works with only a single product.

- The price-sensitive non-linear demand is the sales price function ; where the scaling direction is denoted by and the price elasticity constant is denoted by .

- The instant proportion of deterioration is specified by where is the expiry dates of an item and also . Moreover, as tends to infinity then tends to zero which provides the idea that the product is non-declining.

- The amount for the condensed rate of deterioration is given by and also supposed to be continuously increasing. In other words, , and without loss of generality, presume .

- A credit period of years is provided to its vendor by the supplier. The vendor will gain interest during the interval on sold items and, during the interval , will lose interest in unsold stocks.

- The portion of backlogged shortages symbolized by , which is a declining function and also differentiable with regard to time .

- For a negative inventory, an exponential partial backlogged sum is characterized as ; where indicates the parameter of backlogging with , a wait time until the further refilling.

- The inventory scheduling limit is endless.

- The refilling amount is unlimited with no lead time.

- During cycle time, there is not an alternative or restoration for the deteriorating item.

4. Mathematical Model

- Scenario-(i):

- Scenario-(ii):

- Ordering cost;

- Purchasing cost;

- Average holding cost;

- Preservation technology capital;

- Backlogging cost:

- Additional charge because of lost sales:

5. Computational Algorithm

6. Numerical Illustrations and Sensitivity Analysis

6.1. Numerical Illustrations

6.2. Sensitivity Analysis

- As the scaling demand rate rises, the investment , quantity , and net profit rise whereas the sales price and cycle time decrease. Thus, the increase is beneficial as it helps increase the net profit of the vendor. The rise is advantageous to this model as it aims to increase the net benefit of the vendor.

- As the price elasticity constant increases, the cycle time also increases whereas the sales price and net profit decrease. Moreover, as the values increase the order quantity and investment increases linearly then decrease slowly. Thus, the rise has a detrimental effect as it lowers the net benefit function.

- As the purchase cost increases, the sales price and cycle time increase whereas the investment , quantity , and net profit decrease. It is apparent that the rise in the sale price directly influences the demand rate and the decline in the overall profit feature. The rise is also not beneficial.

- As the increases, the quantity and cycle time also increase while the increases, the quantity , and cycle time decrease. However, the rise in ordering and holding costs is not preferable as the net profit function decreases.

- As the rate of preservation and maximum fixed lifespan increases, the cycle time also increases slowly.

- The backlogging parameter increases, the order quantity, cycle time, preservation technology investment, sales price, and net profit decreases. Thus, the increase shows a negative effect as the overall profit function decreases.

- As the credit period rises, the quantity and cycle time decrease whereas the net profit function increases. It suggests that if the credit time is longer, then the net profit is also higher.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abad, P.L. Optimal pricing and lot-sizing under conditions of perishability and partial backordering. Manag. Sci. 1996, 42, 100–104. [Google Scholar] [CrossRef]

- Alfares, H.K. An inventory model with stock-level dependent demand rate and variable holding cost. Int. J. Prod. Econ. 2007, 108, 259–265. [Google Scholar] [CrossRef]

- Zhang, J.; Bai, Z.; Tang, W. Optimal pricing policy for deteriorating items with preservation technology investment. J. Ind. Manag. Optim. 2014, 10, 1261–1277. [Google Scholar] [CrossRef]

- Shah, N.H.; Jani, M.Y.; Chaudhari, U. Optimal replenishment time for a retailer under partial upstream prepayment and partial downstream overdue payment for quadratic demand. Math. Comput. Model. Dyn. Syst. 2018, 24. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Goh, M.; Shaikh, A.A. Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in the supply chain. Int. J. Prod. Econ. 2018, 200, 16–36. [Google Scholar] [CrossRef]

- Pal, B.; Adhikari, S. A price-sensitive imperfect production inventory model with exponential partial backlogging. Int. J. Syst. Sci. Oper. Logist. 2019, 6, 27–41. [Google Scholar] [CrossRef]

- Noh, J.S.; Kim, J.S.; Sarkar, B. Stochastic joint replenishment problem with quantity discounts and minimum order constraints. Oper. Res. 2019, 19, 151–178. [Google Scholar] [CrossRef]

- Bhuniya, S.; Sarkar, B.; Pareek, S. Multi-product production system with the reduced failure rate and the optimum energy consumption under variable demand. Mathematics 2019, 7, 465. [Google Scholar] [CrossRef]

- Pervin, M.; Roy, S.K.; Weber, G.W. Deteriorating inventory with preservation technology under price and stock sensitive demand. Am. Inst. Math. Sci. 2020, 16, 1582–1612. [Google Scholar] [CrossRef]

- Malik, A.L.; Sarkar, B. Coordination supply chain management under flexible manufacturing, stochastic lead-time demand, and a mixture of inventory. Mathematics 2020, 8, 911. [Google Scholar] [CrossRef]

- Ghare, P.M.; Schrader, G.H. A model for the exponentially decaying inventory system. J. Ind. Eng. 1963, 14, 238–243. [Google Scholar]

- Philip, G.C. A generalized EOQ model for items with Weibull distribution. AIIE Trans. 1974, 6, 159–162. [Google Scholar] [CrossRef]

- Amudha, R.; Chandrasekaran, E. An EOQ model for deteriorating with quadratic demand and time-dependent holding cost. Int. J. Emerg. Sci. Eng. 2013, 1, 5–6. [Google Scholar]

- Kumar, V.; Pathak, G.; Gupta, C.B. A Deterministic inventory model for deteriorating items with selling price dependent demand and parabolic time-varying holding cost under trade credit. Int. J. Soft Comput. Eng. 2013, 3, 33–37. [Google Scholar]

- Sarkar, B.; Sarkar, S. An improved inventory model with partial backlogging, time-varying deterioration, and stock-dependent demand. Econ. Model. 2014, 30, 924–932. [Google Scholar] [CrossRef]

- Shah, N.H.; Jani, M.Y. Economic order quantity model for non-instantaneously deteriorating items under order-size-dependent trade credit and price-sensitive quadratic demand. AMSE J. 2016, 37, 1–19. [Google Scholar]

- Arif, M.G. An inventory model for deteriorating items with non-linear selling price dependent demand and exponentially partial backlogging shortage. Ann. Pure Appl. Math. 2018, 16, 105–116. [Google Scholar] [CrossRef]

- Iqbal, M.W.; Sarkar, B. Recycling of lifetime-dependent deteriorated products through different supply chains. RAIRO-Oper. Res. 2019, 53, 129–156. [Google Scholar] [CrossRef]

- Jani, M.Y.; Shah, N.H.; Chaudhari, U.B. Inventory control policies for time-dependent deteriorating item with variable demand and two-level order linked trade credit. In Optimization and Inventory Management; Springer: Singapore, 2020; pp. 55–67. [Google Scholar]

- Tiwari, S.; Ahmed, W.; Sarkar, B. Sustainable ordering policies for non-instantaneous deteriorating items under carbon emission and multi-trade-credit-policies. J. Clean. Prod. 2020, 240, 118183. [Google Scholar] [CrossRef]

- Dye, C.Y.; Hsieh, T.P. An optimal replenishment policy for deteriorating items with effective investment in preservation technology. Eur. J. Oper. Res. 2012, 218, 106–112. [Google Scholar] [CrossRef]

- Mishra, V.K. Deteriorating inventory model using preservation technology with salvage value and shortages. Adv. Prod. Eng. Manag. 2013, 8, 185–192. [Google Scholar] [CrossRef]

- Mishra, U.; Cárdenas-Barrón, L.E.; Tiwari, S.; Shaikh, A.A.; Treviño-Garza, G. An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment. Ann. Oper. Res. 2017, 254, 165–190. [Google Scholar] [CrossRef]

- Shah, N.H.; Chaudhari, U.B.; Jani, M.Y. Optimal policies for a time-varying deteriorating item with preservation technology under selling price and trade credit-dependent quadratic demand in a supply chain. Int. J. Appl. Comput. Math. 2017, 3, 363–379. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Sarkar, M.; Pareek, S. An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling price dependent demand, and investment. RAIRO-Oper. Res. 2019, 53, 39–57. [Google Scholar] [CrossRef]

- Iqbal, M.W.; Sarkar, B. Application of preservation technology for lifetime dependent products in an integrated production system. J. Ind. Manag. Optim. 2019, 16, 141–167. [Google Scholar]

- Ullah, M.; Sarkar, B. Effects of preservation technology investment on waste generation in a two-echelon supply chain model. Mathematics 2019, 7, 189. [Google Scholar] [CrossRef]

- Chaudhari, U.B.; Shah, N.H.; Jani, M.Y. Inventory modelling of deteriorating item and preservation technology with advance payment scheme under quadratic demand. Optim. Inventory Manag. 2020, 3, 69–79. [Google Scholar]

- Umakanta, M.; Wu, J.Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279, 123699. [Google Scholar]

- Saha, S.; Chatterjee, D.; Sarkar, B. The ramification of dynamic investment on the promotion and preservation technology for inventory management through a modified flower pollination algorithm. J. Retail. Consum. Serv. 2021, 58, 102326. [Google Scholar] [CrossRef]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 1985, 36, 335–338. [Google Scholar] [CrossRef]

- Teng, J.T. On the economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 2002, 53, 915–918. [Google Scholar] [CrossRef]

- Sarkar, B. An EOQ model with delay in payments and time-varying deterioration rate. Math. Comput. Model. 2012, 55, 367–377. [Google Scholar] [CrossRef]

- Maihami, R.; Abadi, N.K. Joint control of inventory and its pricing for non- instantaneously deteriorating items under permissible delay in payments and partial backlogging. Math. Comput. Model. 2012, 55, 1722–1733. [Google Scholar] [CrossRef]

- Sarkar, B.; Gupta, H.; Chaudhuri, K.; Goyal, S.K. An integrated inventory model with variable lead time, defective units, and delay in payments. Appl. Math. Comput. 2014, 237, 650–658. [Google Scholar] [CrossRef]

- Shah, N.H.; Chaudhari, U.; Jani, M.Y. An inventory model with an expiration date of items and deterioration under two-level trade credit and preservation technology investment for time and price-sensitive demand: DCF approach. Int. J. Logist. Syst. Manag. 2017, 27, 420–437. [Google Scholar] [CrossRef]

- Ghoreishi, M.; Weber, G.W.; Mirzazadeh, A. An inventory model for non-instantaneous deteriorating items with partial backlogging, permissible delay in payments, inflation, and selling price-dependent demand and customer returns. Ann. Oper. Res. 2018, 226, 221–238. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Shaikh, A.A.; Tiwari, S.; Treviño-Garza, G. An EOQ inventory model with nonlinear stock dependent holding cost, nonlinear stock dependent demand, and trade credit. Comput. Ind. Eng. 2020, 139, 105557. [Google Scholar] [CrossRef]

- Saren, S.; Sarkar, B.; Bachar, R.K. Application of various price-discount policy for deteriorated products and delay in payments in an advanced inventory model. Inventions 2020, 5, 50. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Sana, S.S. Multi-item EOQ inventory model in a two-layer supply chain while demand varies with a promotional effort. Appl. Math. Modeling 2015, 39, 6725–6737. [Google Scholar] [CrossRef]

| Author(s) | Sales Price Dependent Demand | Time-Dependent Holding Cost | Time-Dependent Deterioration | Preservation Technology Investment | Shortages | Trade-Credit |

|---|---|---|---|---|---|---|

| Abad [1] | √ | √ | ||||

| Zhang et al. [3] | √ | √ | ||||

| Shah et al. [4] | √ | √ | √ | |||

| Tiwari et al. [5] | √ | √ | √ | |||

| Ghare and Schrader [11] | √ | √ | √ | √ | ||

| Kumar et al. [14] | √ | √ | ||||

| Iqbal and Sarkar [18] | √ | √ | √ | |||

| Dey et al. [25] | √ | √ | √ | |||

| Ullah and Sarkar [27] | √ | √ | √ | |||

| Chauhari et al. [28] | √ | √ | √ | |||

| This paper | √ | √ | √ | √ | √ | √ |

| Parameters | Values | Cycle Time (T) (Years) | Sales Price (S) ($) | Preservation ($) | Order (Units) | ($) |

|---|---|---|---|---|---|---|

| 8000 | 0.870 | 35.58 | 3.48 | 46.80 | 1323.11 | |

| 9000 | 0.812 | 35.46 | 3.57 | 49.35 | 1494.86 | |

| 11,000 | 0.718 | 35.27 | 3.71 | 53.79 | 1839.51 | |

| 12,000 | 0.680 | 35.19 | 3.77 | 55.72 | 2012.27 | |

| 1.12 | 0.438 | 92.74 | 2.53 | 27.44 | 5152.01 | |

| 1.26 | 0.617 | 48.58 | 3.40 | 46.24 | 2843.97 | |

| 1.54 | 0.909 | 29.05 | 3.65 | 50.65 | 1007.20 | |

| 1.68 | 1.072 | 25.41 | 3.54 | 46.68 | 618.50 | |

| 8 | 0.709 | 28.26 | 3.67 | 65.82 | 1826.53 | |

| 9 | 0.737 | 31.81 | 3.65 | 57.96 | 1740.57 | |

| 11 | 0.785 | 38.91 | 3.63 | 46.53 | 1603.13 | |

| 12 | 0.805 | 42.47 | 3.62 | 42.26 | 1546.88 | |

| 32 | 0.659 | 35.17 | 3.36 | 45.06 | 1678.30 | |

| 36 | 0.712 | 35.26 | 3.51 | 48.49 | 1672.46 | |

| 44 | 0.809 | 35.44 | 3.77 | 54.66 | 1661.94 | |

| 48 | 0.853 | 35.53 | 3.88 | 57.47 | 1657.13 | |

| 0.24 | 0.771 | 35.32 | 3.67 | 52.38 | 1668.06 | |

| 0.27 | 0.767 | 35.33 | 3.66 | 52.02 | 1667.55 | |

| 0.33 | 0.757 | 35.37 | 3.63 | 51.33 | 1666.52 | |

| 0.36 | 0.753 | 35.39 | 3.62 | 50.99 | 1666.02 | |

| 0.096 | 0.762 | 35.35 | 3.64 | 51.70 | 1667.06 | |

| 0.108 | 0.762 | 35.35 | 3.64 | 51.69 | 1667.04 | |

| 0.132 | 0.762 | 35.35 | 3.64 | 51.66 | 1667.02 | |

| 0.144 | 0.762 | 35.36 | 3.64 | 51.64 | 1667.01 | |

| 1.6 | 0.758 | 35.37 | 3.95 | 51.44 | 1666.40 | |

| 1.8 | 0.760 | 35.36 | 3.78 | 51.56 | 1666.74 | |

| 2.2 | 0.763 | 35.35 | 3.51 | 51.77 | 1667.30 | |

| 2.4 | 0.765 | 35.35 | 3.40 | 51.86 | 1667.54 | |

| 3.2 | 0.757 | 35.37 | 4.03 | 51.38 | 1666.18 | |

| 3.6 | 0.760 | 35.36 | 3.82 | 51.54 | 1666.64 | |

| 4.4 | 0.764 | 35.35 | 3.49 | 51.79 | 1667.37 | |

| 4.8 | 0.765 | 35.35 | 3.35 | 51.90 | 1667.67 | |

| 0.4 | 0.786 | 35.40 | 3.71 | 53.32 | 1669.74 | |

| 0.45 | 0.774 | 35.38 | 3.67 | 52.47 | 1668.37 | |

| 0.55 | 0.751 | 35.34 | 3.61 | 50.92 | 1665.72 | |

| 0.6 | 0.740 | 35.32 | 3.58 | 50.19 | 1664.43 | |

| 0.4 | 0.763 | 35.35 | 3.64 | 51.74 | 1667.13 | |

| 0.45 | 0.762 | 35.35 | 3.64 | 51.70 | 1667.08 | |

| 0.55 | 0.761 | 35.36 | 3.64 | 51.64 | 1666.98 | |

| 0.6 | 0.761 | 35.36 | 3.64 | 51.61 | 1666.93 | |

| 0.48 | 0.762 | 35.35 | 3.64 | 51.71 | 1667.09 | |

| 0.54 | 0.762 | 35.35 | 3.64 | 51.69 | 1667.06 | |

| 0.66 | 0.762 | 35.36 | 3.64 | 51.65 | 1667.00 | |

| 0.72 | 0.762 | 35.39 | 3.64 | 51.63 | 1666.97 | |

| 0.24 | 0.796 | 35.65 | 3.72 | 53.33 | 1657.06 | |

| 0.27 | 0.780 | 35.50 | 3.68 | 52.57 | 1661.93 | |

| 0.33 | 0.742 | 35.21 | 3.60 | 50.64 | 1672.38 | |

| 0.36 | 0.720 | 35.06 | 3.54 | 49.44 | 1677.99 | |

| 0.08 | 0.789 | 35.49 | 3.71 | 53.25 | 1661.48 | |

| 0.09 | 0.776 | 35.42 | 3.68 | 52.47 | 1664.24 | |

| 0.11 | 0.748 | 35.29 | 3.61 | 50.86 | 1669.86 | |

| 0.12 | 0.734 | 35.22 | 3.57 | 50.03 | 1672.71 | |

| 0.096 | 0.791 | 35.35 | 3.72 | 53.68 | 1668.12 | |

| 0.108 | 0.776 | 35.36 | 3.68 | 52.64 | 1667.56 | |

| 0.132 | 0.749 | 35.38 | 3.60 | 50.78 | 1666.53 | |

| 0.144 | 0.737 | 35.38 | 3.57 | 49.96 | 1666.06 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jani, M.Y.; Betheja, M.R.; Chaudhari, U.; Sarkar, B. Optimal Investment in Preservation Technology for Variable Demand under Trade-Credit and Shortages. Mathematics 2021, 9, 1301. https://doi.org/10.3390/math9111301

Jani MY, Betheja MR, Chaudhari U, Sarkar B. Optimal Investment in Preservation Technology for Variable Demand under Trade-Credit and Shortages. Mathematics. 2021; 9(11):1301. https://doi.org/10.3390/math9111301

Chicago/Turabian StyleJani, Mrudul Y., Manish R. Betheja, Urmila Chaudhari, and Biswajit Sarkar. 2021. "Optimal Investment in Preservation Technology for Variable Demand under Trade-Credit and Shortages" Mathematics 9, no. 11: 1301. https://doi.org/10.3390/math9111301

APA StyleJani, M. Y., Betheja, M. R., Chaudhari, U., & Sarkar, B. (2021). Optimal Investment in Preservation Technology for Variable Demand under Trade-Credit and Shortages. Mathematics, 9(11), 1301. https://doi.org/10.3390/math9111301