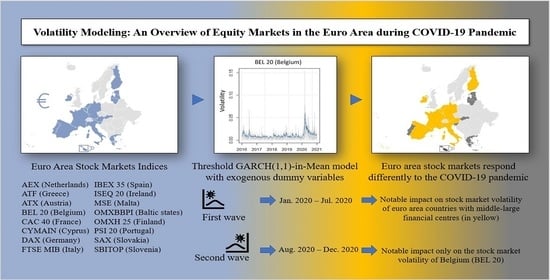

Volatility Modeling: An Overview of Equity Markets in the Euro Area during COVID-19 Pandemic

Abstract

1. Introduction

2. Literature Review

2.1. Impact of Older Global Crises on Stock Market Volatility

2.2. Impact of COVID-19 Pandemic on Stock Market Volatility

2.3. Our Contribution to Existing Literature

3. Data and Methodology

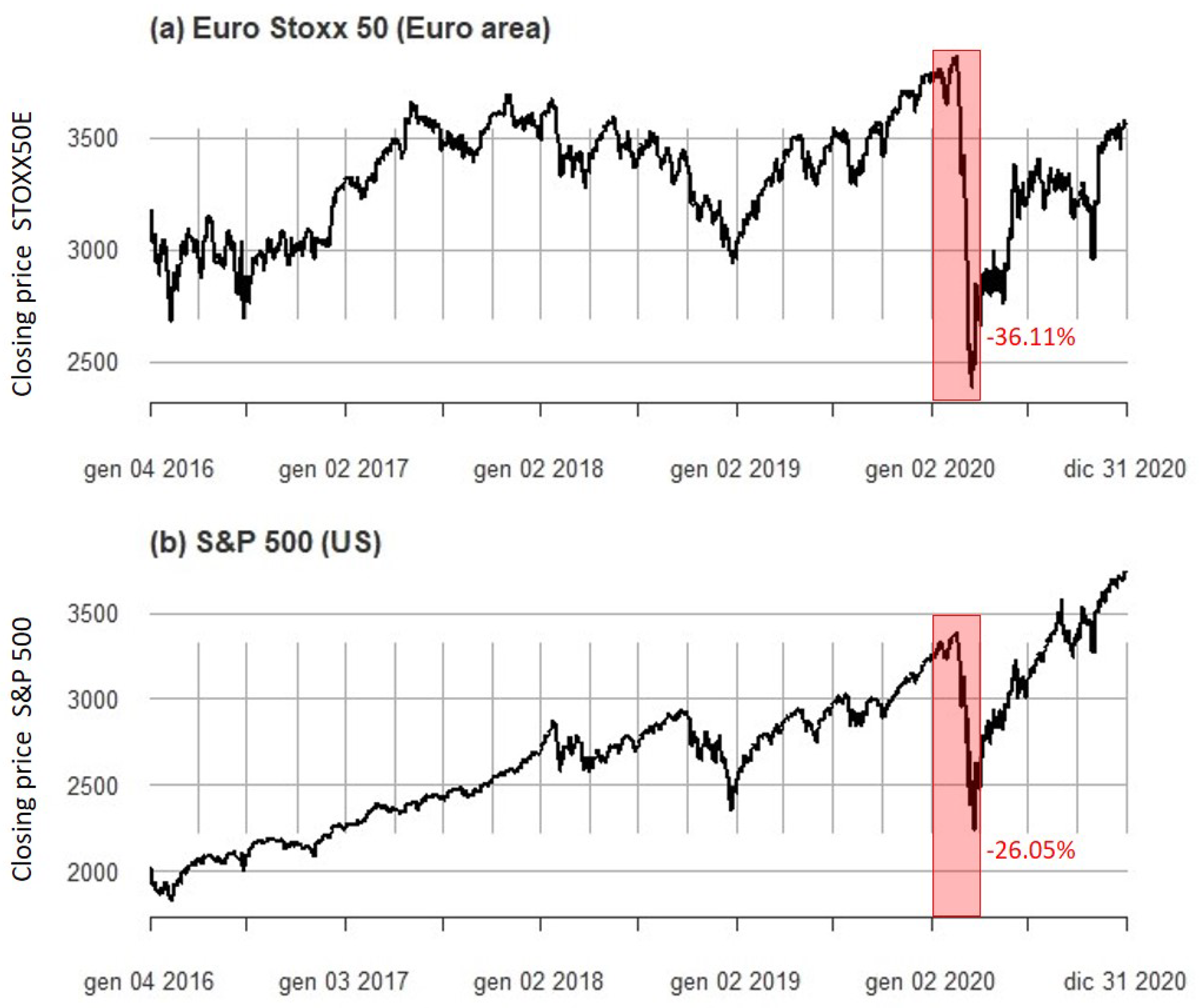

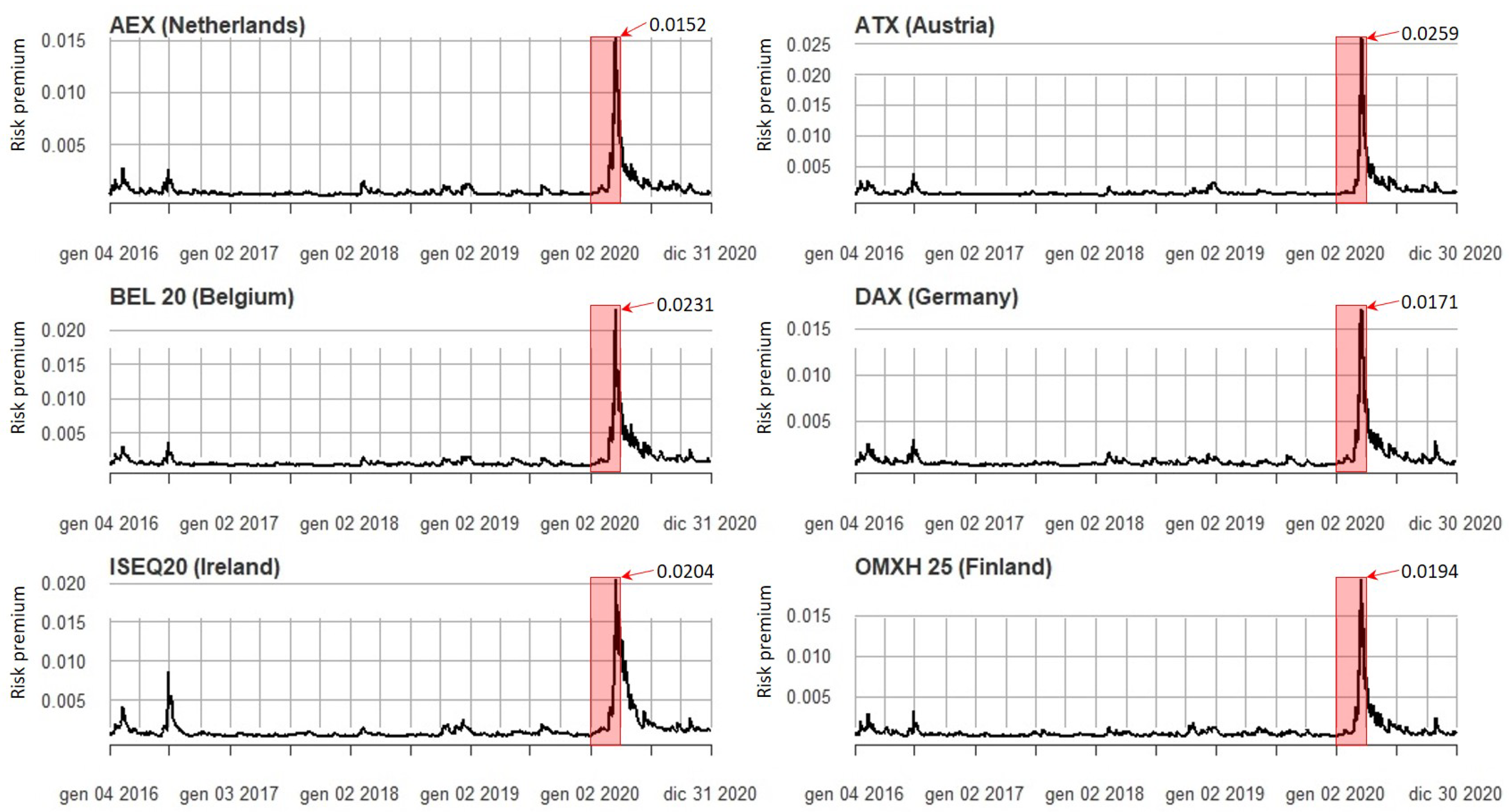

3.1. Data

- -

- is the daily return on index i at time t;

- -

- is the daily closing price of index i at time t;

- -

- is the daily closing price of index i at time .

3.2. Threshold GARCH(1,1)-in-Mean Model with Exogenous Dummy Variables

- -

- assumes the value of 1 during the 1st wave of COVID-19 infections, i.e., for the period from 1 January 2020 to 31 July 2020, otherwise it is equal to 0;

- -

- assumes the value of 1 during the 2nd wave of COVID-19 infections, i.e., for the period from 1 August 2020 to 31 December 2020, otherwise it is equal to 0.

- Conditional Mean Equation

- Conditional Volatility Equation

4. Results

4.1. Descriptive Statistics Summary and Statistical Tests Results

4.2. Results of Conditional Mean Equation

4.3. Results of Conditional Volatility Equation

4.4. Diagnostic Tests Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Tables

| Indices | Descriptive Statistics | ||||||

|---|---|---|---|---|---|---|---|

| Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | |

| AEX | 0.0003 | 0.0008 | 0.0859 | −0.1138 | 0.0111 | −1.1254 | 14.7819 |

| ATF | 0.0001 | 0.0011 | 0.1167 | −0.1726 | 0.0191 | −1.3415 | 14.8481 |

| ATX | 0.0001 | 0.0005 | 0.1021 | −0.1467 | 0.0141 | −1.3637 | 18.5989 |

| BEL 20 | 0.0000 | 0.0004 | 0.0736 | −0.1533 | 0.0124 | −1.9360 | 23.3493 |

| CAC 40 | 0.0002 | 0.0004 | 0.0806 | −0.1310 | 0.0125 | −1.3055 | 16.2452 |

| CYMAIN | −0.0003 | −0.0002 | 0.0610 | −0.1003 | 0.0131 | −0.5587 | 6.5466 |

| DAX | 0.0002 | 0.0007 | 0.1041 | −0.1305 | 0.0128 | −0.9537 | 15.0829 |

| FTSE MIB | 0.0001 | 0.0008 | 0.0855 | −0.1854 | 0.0154 | −2.1878 | 24.7958 |

| IBEX 35 | −0.0001 | 0.0003 | 0.0823 | −0.1515 | 0.0136 | −1.8426 | 22.4667 |

| ISEQ 20 | 0.0001 | 0.0004 | 0.0752 | −0.1078 | 0.0130 | −1.3129 | 12.8696 |

| MSE | −0.0001 | 0.0000 | 0.0570 | −0.0366 | 0.0057 | 0.5105 | 13.0212 |

| OMXBBPI | 0.0002 | 0.0004 | 0.0467 | −0.1076 | 0.0070 | −5.1608 | 80.6275 |

| OMXH 25 | 0.0003 | 0.0005 | 0.0666 | −0.1068 | 0.0119 | −1.0886 | 10.7075 |

| PSI 20 | −0.0001 | 0.0002 | 0.0753 | −0.1027 | 0.0112 | −1.1566 | 12.6782 |

| SAX | 0.0001 | 0.0000 | 0.0582 | −0.0723 | 0.0104 | −0.2386 | 6.4761 |

| SBITOP | 0.0002 | 0.0003 | 0.0596 | −0.0938 | 0.0080 | −1.9417 | 25.7543 |

| Indices | Statistical Tests | |||

|---|---|---|---|---|

| JB Test | ADF Test | PP Test | ARCH-LM Test | |

| AEX | 11959 *** | −10.695 * | −1312 * | 81.2 *** |

| ATF | 11855.24 *** | −9.8266 * | −1177.6 * | 155 *** |

| ATX | 18443 *** | −10.086 * | −1262.7 * | 81.3 *** |

| BEL 20 | 29957.67 *** | −10.339 * | −1246.7 * | 239 *** |

| CAC 40 | 14480.48 *** | −11.004 * | −1312.7 * | 127 *** |

| CYMAIN | 2278.41 *** | −8.7463 * | −1403.1 * | 131 *** |

| DAX | 12209.41 *** | −10.608 * | −1338.5 * | 108 *** |

| FTSE MIB | 33638.95 *** | −10.091 * | −1462.8 * | 275 *** |

| IBEX 35 | 27741.8 *** | −10.545 * | −1382.8 * | 283 *** |

| ISEQ 20 | 9178.65 *** | −10.573 * | −1168 * | 138 *** |

| MSE | 8813.51 *** | −8.9582 * | −1328.1 * | 179 *** |

| OMXBBPI | 349400.4 *** | −9.0819 * | −1426.8 * | 90.8 *** |

| OMXH 25 | 6268.2 *** | −10.807 * | −1232.8 * | 149 *** |

| PSI 20 | 8885 *** | −10.973 * | −1257.1 * | 106 *** |

| SAX | 2194.21 *** | −11.783 * | −1319.2 * | 263 *** |

| SBITOP | 35174.43 *** | −8.6752 * | −1481.4 * | 94.4 *** |

| Indices | Estimated Coefficients | ||||

|---|---|---|---|---|---|

| AEX | −0.0001 | −0.0014 | 0.0006 | 4.9886 * | |

| ATF | 0.0000 | −0.0020 * | 0.0003 | 0.0787 ** | 1.5743 |

| ATX | −0.0003 | −0.0030 * | 0.0012 | 0.0630 * | 4.9269 *** |

| BEL 20 | −0.0004 . | −0.0020 | −0.0013 | 0.0701 * | 6.2861 *** |

| CAC 40 | 0.0000 | −0.0013 | −0.0004 | 3.0109 . | |

| CYMAIN | −0.0018 * | −0.0012 | 0.0000 | 10.0000 . | |

| DAX | −0.0003 | −0.0012 | −0.0003 | 4.3670 *** | |

| FTSE MIB | −0.0002 | −0.0004 | 0.0003 | 2.1409 | |

| IBEX 35 | −0.0006 | −0.0021 | −0.0004 | 4.6646 | |

| ISEQ 20 | −0.0007 * | −0.0018 | 0.0004 | 0.0626 * | 8.0101 *** |

| MSE | −0.0003 | −0.0011 ** | −0.0010 | 10.0000 | |

| OMXBBPI | 0.0001 | 0.0011 * | 0.0000 | 5.1703 | |

| OMXH 25 | −0.0005 | 0.0001 | 0.0004 | 5.9322 ** | |

| PSI 20 | −0.0004 | −0.0003 | 0.0001 | 4.3760 | |

| SAX | 0.0004 | −0.0001 | 0.0002 | −0.3616 | |

| SBITOP | 0.0001 | 0.0001 | 0.0002 | 3.6820 | |

| Indices | Diagnostic Tests | |

|---|---|---|

| Weighted Ljung-Box Test | Weighted ARCH-LM Tests | |

| AEX | 5.307 | 4.74 |

| ATF | 2.603 | 6.232 |

| ATX | 1.817 | 1.686 |

| BEL 20 | 4.052 | 1.557 |

| CAC 40 | 6.085 . | 2.869 |

| CYMAIN | 2.365 | 0.824 |

| DAX | 4.206 | 2.271 |

| FTSE MIB | 2.374 | 0.48 |

| IBEX 35 | 4.375 | 0.305 |

| ISEQ 20 | 3.855 | 6.64 |

| MSE | 4.03 | 1.339 |

| OMXBBPI | 21.169 *** | 5.524 |

| OMXH 25 | 4.648 | 2.702 |

| PSI 20 | 26.59 *** | 3.939 |

| SAX | 18.74 *** | 6.20 |

| SBITOP | 5.126 | 1.802 |

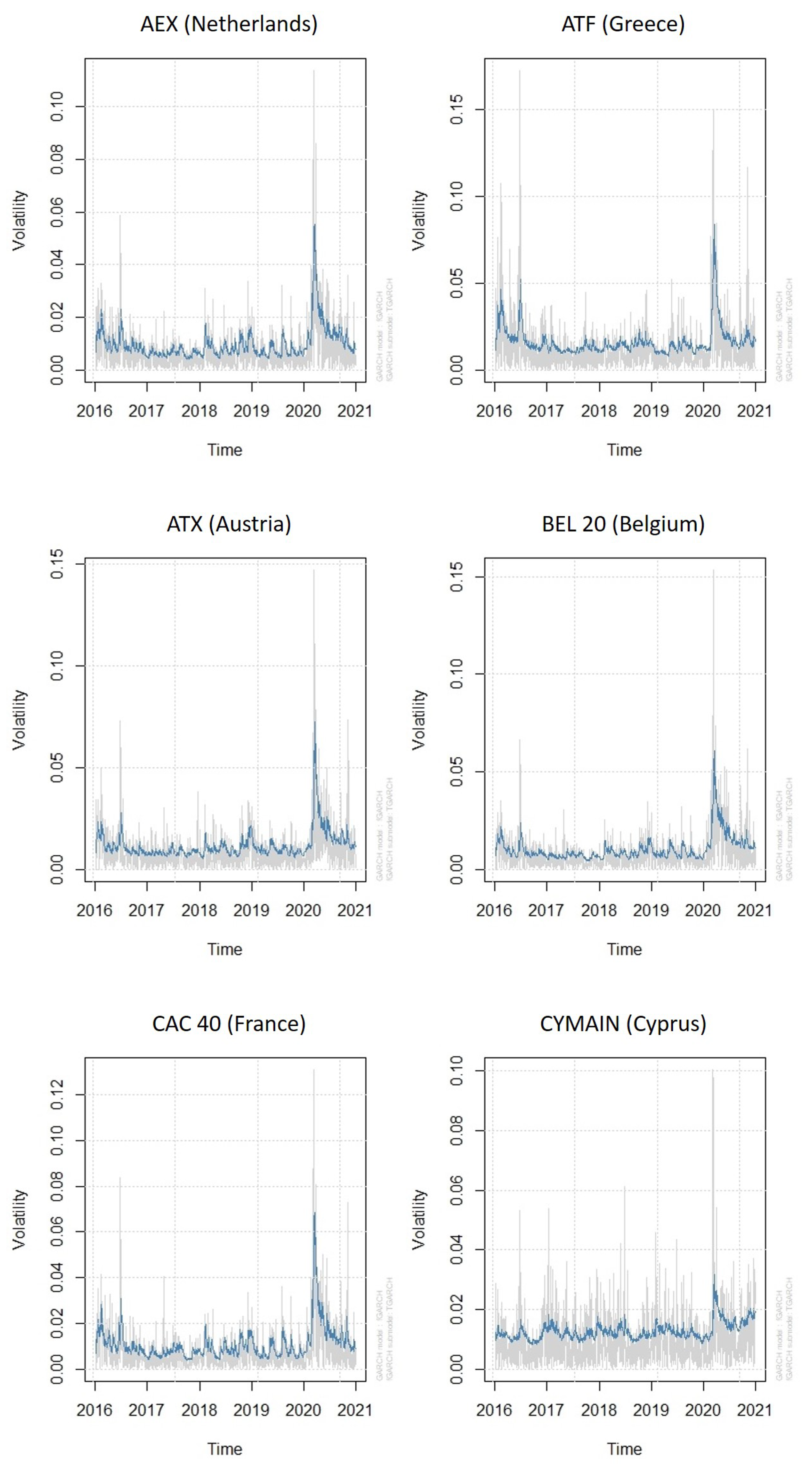

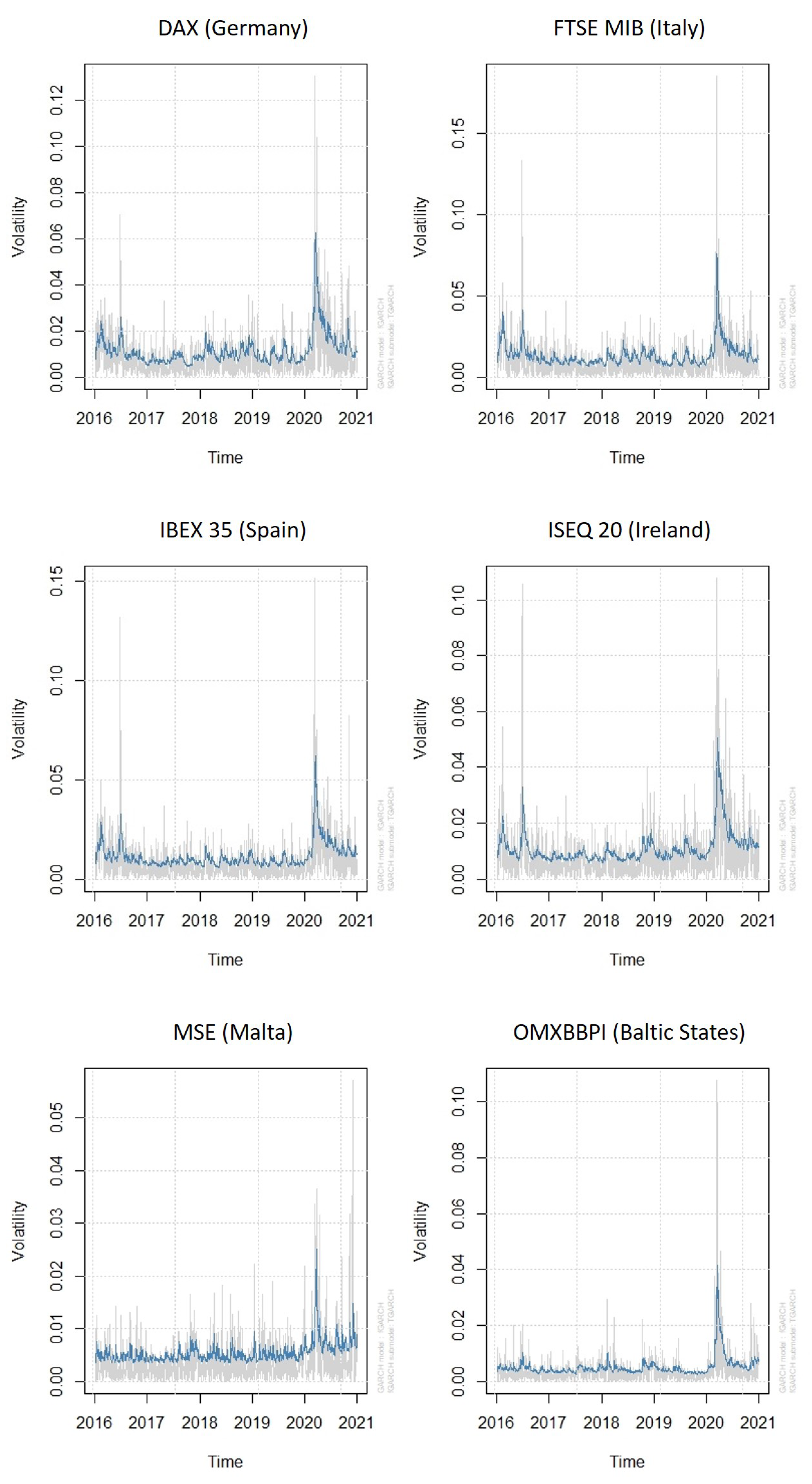

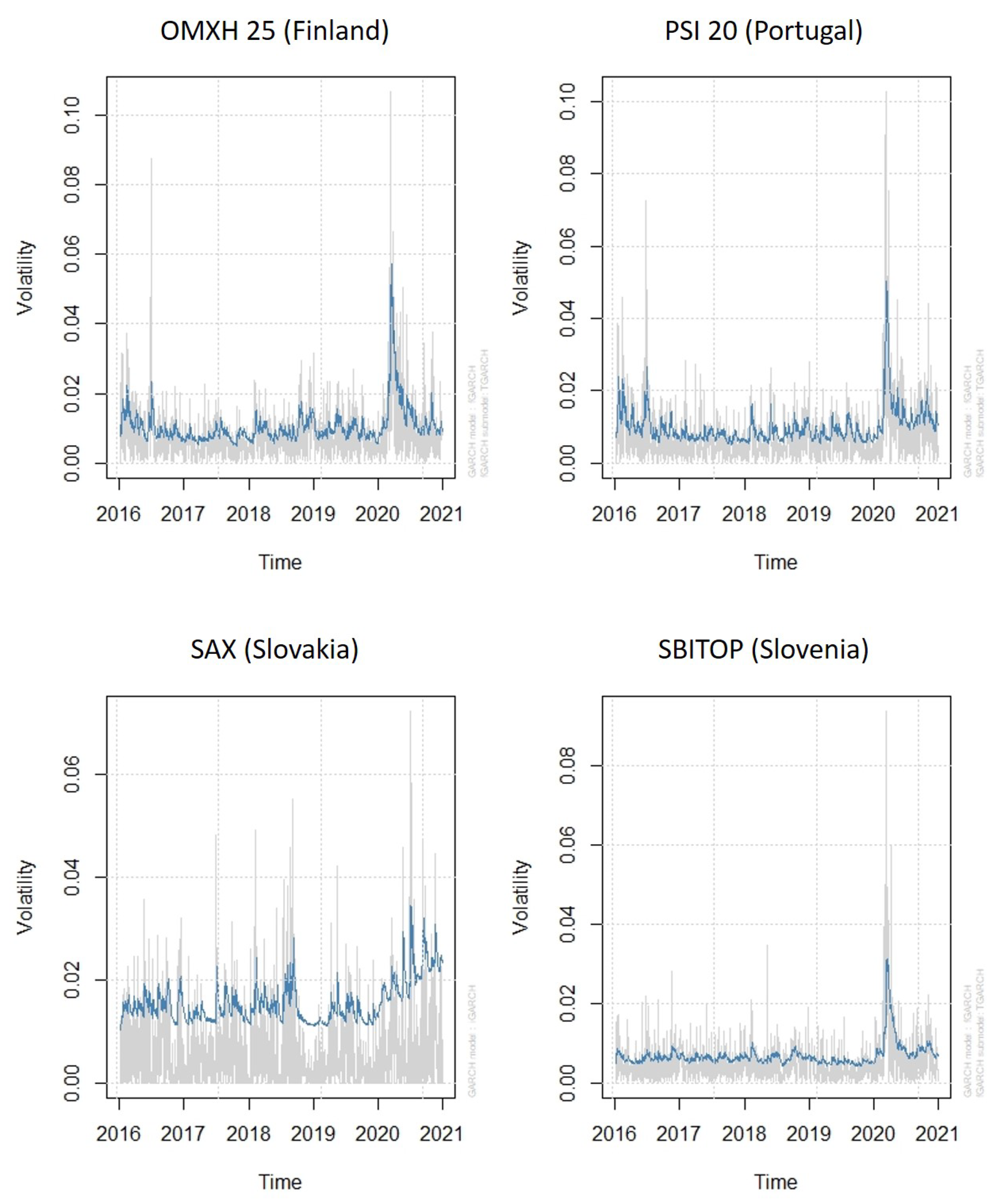

Appendix B. Conditional Volatility Plots

References

- Bhowmik, R.; Wang, S. Stock Market Volatility and Return Analysis: A Systematic Literature Review. Entropy 2020, 22, 522. [Google Scholar] [CrossRef]

- Jin, X.; An, X. Global financial crisis and emerging stock market contagion: A volatility impulse response function approach. Res. Int. Bus. Financ. 2016, 36, 179–195. [Google Scholar] [CrossRef]

- Neaime, S. Financial crises and contagion vulnerability of MENA stock markets. Emerg. Mark. Rev. 2016, 27, 14–35. [Google Scholar] [CrossRef]

- European Council. Timeline—Council Actions on COVID-19. Available online: https://www.consilium.europa.eu/en/policies/coronavirus/timeline/ (accessed on 17 February 2021).

- World Health Organization. Timeline: WHO’s COVID-19 Response. Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/interactive-timeline (accessed on 17 February 2021).

- Organisation for Economic Co-Operation and Development (OECD). OECD.Stat—Quarterly National Accounts: Quarterly Growth Rates of Real GDP, Change Over Previous Quarter. Available online: https://stats.oecd.org/index.aspx?queryid=350# (accessed on 19 February 2021).

- International Monetary Fund (IMF). World Economic Outlook Update (January 2020). Available online: https://www.imf.org/en/Publications/WEO/Issues/2021/01/26/2021-world-economic-outlook-update (accessed on 20 February 2021).

- Chaudhary, R.; Bakhshi, P.; Gupta, H. Volatility in International Stock Markets: An Empirical Study during COVID-19. J. Risk Financ. Manag. 2020, 13, 208. [Google Scholar] [CrossRef]

- Organisation for Economic Co-Operation and Development (OECD). GlobalFinancialMarketsPolicy Responses to COVID-19 (March 2020). Available online: https://www.oecd.org/coronavirus/policy-responses/global-financial-markets-policy-responses-to-covid-19-2d98c7e0/ (accessed on 19 February 2021).

- Cboe Global Markets. What is the VIX Index? Available online: https://www.cboe.com/tradable_products/vix/ (accessed on 20 February 2021).

- Cboe Global Markets. VIX Index Historical Data, VIX Data for 2004 to Present (Updated Daily). Available online: https://ww2.cboe.com/products/vix-index-volatility/vix-options-and-futures/vix-index/vix-historical-data# (accessed on 20 February 2021).

- Just, M.; Echaust, K. Stock market returns, volatility, correlation and liquidity during the COVID-19 crisis: Evidence from the Markov switching approach. Financ. Res. Lett. 2020, 37, 101775. [Google Scholar] [CrossRef] [PubMed]

- Baek, S.; Mohanty, S.K.; Glambosky, M. COVID-19 and stock market volatility: An industry level analysis. Financ. Res. Lett. 2020, 37, 101748. [Google Scholar] [CrossRef] [PubMed]

- Di Persio, L.; Garbelli, M.; Wallbaum, K. Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis. Risks 2021, 9, 33. [Google Scholar] [CrossRef]

- Goswami, S.; Gupta, R.; Wohar, M.E. Historical volatility of advanced equity markets: The role of local and global crises. Financ. Res. Lett. 2020, 34, 101265. [Google Scholar] [CrossRef]

- Singhania, M.; Anchalia, J. Volatility in Asian stock markets and global financial crisis. J. Adv. Manag. Res. 2013, 10, 333–351. [Google Scholar] [CrossRef]

- Wasiuzzaman, S.; Angabini, A. GARCH Models and the Financial Crisis—A Study of the Malaysian Stock Market. Int. J. Appl. Econ. Financ. 2011, 5, 226–236. [Google Scholar] [CrossRef]

- Okičić, J. An Empirical Analysis of Stock Returns and Volatility: The Case of Stock Markets From Central And Eastern Europe. South East Eur. J. Econ. Bus. 2015, 9, 7–15. [Google Scholar] [CrossRef]

- Ahmad, W.; Bhanumurthy, N.; Sehgal, S. The Eurozone crisis and its contagion effects on the European stock markets. Stud. Econ. Financ. 2014, 31, 325–352. [Google Scholar] [CrossRef]

- Zhu, Z.; Bai, Z.; Vieito, J.P.; Wong, W.K. The impact of the global financial crisis on the efficiency and performance of Latin American stock markets. Estud. Econ. 2019, 46, 5–30. [Google Scholar] [CrossRef]

- Liu, H.; Manzoor, A.; Wang, C.; Zhang, L.; Manzoor, Z. The COVID-19 Outbreak and Affected Countries Stock Markets Response. Int. J. Environ. Res. Public Health 2020, 17, 2800. [Google Scholar] [CrossRef] [PubMed]

- Zaremba, A.; Kizys, R.; Aharon, D.Y.; Demir, E. Infected Markets: Novel Coronavirus, Government Interventions, and Stock Return Volatility around the Globe. Financ. Res. Lett. 2020, 35, 101597. [Google Scholar] [CrossRef]

- Engelhardt, N.; Krause, M.; Neukirchen, D.; Posch, P.N. Trust and stock market volatility during the COVID-19 crisis. Financ. Res. Lett. 2021, 38, 101873. [Google Scholar] [CrossRef]

- Yousef, I. Spillover of COVID-19: Impact on Stock Market Volatility. Int. J. Psychosoc. Rehabil. 2020, 24, PR261476. [Google Scholar] [CrossRef]

- Adenomon, M.O.; Maijamaa, B.; John, D.O. On the Effects of COVID-19 outbreak on the Nigerian Stock Exchange performance: Evidence from GARCH Models. Preprints 2020, 2020040444. [Google Scholar] [CrossRef]

- Shehzad, K.; Xiaoxing, L.; Kazouz, H. COVID-19’s disasters are perilous than Global Financial Crisis: A rumor or fact? Financ. Res. Lett. 2020, 36, 101669. [Google Scholar] [CrossRef]

- Szczygielski, J.J.; Bwanya, P.R.; Charteris, A.; Brzeszczynski, J. The only certainty is uncertainty: An analysis of the impact of COVID-19 uncertainty on regional stock markets. Financ. Res. Lett. 2021, 101945. [Google Scholar] [CrossRef] [PubMed]

- Bora, D.; Basistha, D. The outbreak of COVID-19 pandemic and its impact on stock market volatility: Evidence from a worst-affected economy. J. Public Aff. 2021, e2623. [Google Scholar] [CrossRef]

- Bhunia, A.; Ganguly, S. An assessment of volatility and leverage effect before and during the period of Covid-19: A study of selected international stock markets. Int. J. Financ. Serv. Manag. 2020, 10, 113–127. [Google Scholar] [CrossRef]

- Benzid, L.; Chebbi, K. The Impact of COVID-19 on Exchange Rate Volatility: Evidence Through GARCH Model. SSRN 2020. [Google Scholar] [CrossRef]

- Yousef, I.; Shehadeh, E. The Impact of COVID-19 on Gold Price Volatility. Int. J. Econ. Bus. Adm. (IJEBA) 2020, 8, 353–364. [Google Scholar] [CrossRef]

- Investing.com. European Indices. Available online: https://it.investing.com/indices/european-indices (accessed on 16 January 2021).

- Jarque, C.M.; Bera, A.K. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ. Lett. 1980, 6, 255–259. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Box, G.E.P.; Pierce, D.A. Distribution of Residual Autocorrelations in Autoregressive-Integrated Moving Average Time Series Models. J. Am. Stat. Assoc. 1970, 65, 1509–1526. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Mandelbrot, B. The Variation of Certain Speculative Prices. J. Bus. 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Engle, R.F.; Lilien, D.M.; Robins, R.P. Estimating Time Varying Risk Premia in the Term Structure: The Arch-M Model. Econometrica 1987, 55, 391–407. [Google Scholar] [CrossRef]

- Francq, C.; Zakoian, J.M. GARCH Models: Structure, Statistical Inference and Financial Applications, 2nd ed.; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2019. [Google Scholar]

- Hentschel, L. All in the family Nesting symmetric and asymmetric GARCH models. J. Financ. Econ. 1995, 39, 71–104. [Google Scholar] [CrossRef]

- Zakoian, J.M. Threshold heteroskedastic models. J. Econ. Dyn. Control 1994, 18, 931–955. [Google Scholar] [CrossRef]

- Choudhry, T. Day of the week effect in emerging Asian stock markets: Evidence from the GARCH model. Appl. Financ. Econ. 2000, 10, 235–242. [Google Scholar] [CrossRef]

- Kiymaz, H.; Berument, H. The day of the week effect on stock market volatility and volume: International evidence. Rev. Financ. Econ. 2003, 12, 363–380. [Google Scholar] [CrossRef]

- Panait, I.; SlĂvescu, E.O. Using Garch-in-Mean Model to Investigate Volatility and Persistence at Different Frequencies for Bucharest Stock Exchange during 1997–2012. Theor. Appl. Econ. 2012, 19, 55–76. [Google Scholar]

- Ghalanos, A.; Kley, T. rugarch: Univariate GARCH Models. 2020. Available online: https://cran.r-project.org/web/packages/rugarch/index.html (accessed on 16 January 2021).

- Ghalanos, A. Introduction to the Rugarch Package. (Version 1.4-3). 2020. Available online: https://cran.r-project.org/web/packages/rugarch/vignettes/Introduction_to_the_rugarch_package.pdf (accessed on 16 January 2021).

- Fisher, T.J.; Gallagher, C.M. New Weighted Portmanteau Statistics for Time Series Goodness of Fit Testing. J. Am. Stat. Assoc. 2012, 107, 777–787. [Google Scholar] [CrossRef]

- Oxera Consulting LLP, European Commission. Primary and Secondary Equity Markets in the EU, Final Report, November 2020. Available online: https://www.oxera.com/publications/primary-and-secondary-equity-markets-in-the-eu/ (accessed on 2 February 2021).

- Engle, R.F.; Ghysels, E.; Sohn, B. Stock Market Volatility and Macroeconomic Fundamentals. Rev. Econ. Stat. 2013, 95, 776–797. [Google Scholar] [CrossRef]

- Conrad, C.; Custovic, A.; Ghysels, E. Long- and Short-Term Cryptocurrency Volatility Components: A GARCH-MIDAS Analysis. J. Risk Financ. Manag. 2018, 11, 23. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R. Oil shocks and stock market volatility of the BRICS: A GARCH-MIDAS approach. Glob. Financ. J. 2021, 48, 100546. [Google Scholar] [CrossRef]

- Yu, X.; Huang, Y. The impact of economic policy uncertainty on stock volatility: Evidence from GARCH-MIDAS approach. Phys. A Stat. Mech. Its Appl. 2021, 570, 125794. [Google Scholar] [CrossRef]

| Indices | Estimated Coefficients | |||||||

|---|---|---|---|---|---|---|---|---|

| Skew | Shape | |||||||

| AEX | 0.0004 *** | 0.0004 ** | 0.0001 | 0.0873 *** | 1.0000 *** | 0.8875 *** | 0.8192 *** | 7.2964 *** |

| ATF | 0.0006 *** | 0.0002 | 0.0002 | 0.1038 *** | 0.5067 *** | 0.8810 *** | 0.9046 *** | 4.9754 *** |

| ATX | 0.0005 *** | 0.0004 * | 0.0002 | 0.0801 *** | 1.0000 *** | 0.8840 *** | 0.8849 *** | 9.1205 *** |

| BEL 20 | 0.0004 *** | 0.0005 ** | 0.0003 * | 0.0791 *** | 1.0000 *** | 0.8910 *** | 0.8614 *** | 6.3989 *** |

| CAC 40 | 0.0004 *** | 0.0005 * | 0.0002 | 0.1032 *** | 1.0000 *** | 0.8793 *** | 0.8709 *** | 5.6029 *** |

| CYMAIN | 0.0007 * | 0.0001 | 0.0003 | 0.1083 *** | 0.0946 | 0.3173 *** | 1.0090 *** | 5.3504 *** |

| DAX | 0.0004 *** | 0.0005 ** | 0.0001 | 0.0850 *** | 1.0000 *** | 0.8916 *** | 0.8754 *** | 5.1223 *** |

| FTSE MIB | 0.0006 ** | 0.0005 * | 0.0001 | 0.0878 *** | 1.0000 *** | 0.8789 *** | 0.8667 *** | 5.9696 *** |

| IBEX 35 | 0.0006 ** | 0.0006 * | 0.0003 | 0.0940 *** | 0.7096 *** | 0.8679 *** | 0.8994 *** | 5.8759 *** |

| ISEQ 20 | 0.0004 *** | 0.0004 ** | 0.0002 . | 0.0669 *** | 0.8617 *** | 0.9027 *** | 0.9281 *** | 7.3227 *** |

| MSE | 0.0010 ** | 0.0005 . | 0.0006 . | 0.1863 *** | 0.3021 * | 0.6654 *** | 0.9168 *** | 3.7888 *** |

| OMXBBPI | 0.0003 ** | 0.0002 | 0.0001 | 0.1373 *** | 0.1196 | 0.8420 *** | 0.9254 *** | 4.2957 *** |

| OMXH 25 | 0.0005 *** | 0.0004 ** | 0.0001 | 0.0816 *** | 1.0000 *** | 0.8781 *** | 0.8589 *** | 10.6766 *** |

| PSI 20 | 0.0006 *** | 0.0003 . | 0.0003 | 0.1103 *** | 0.6996 *** | 0.8419 *** | 0.9172 *** | 7.2217 *** |

| SAX | 0.0000 | 0.0000 | 0.0000 | 0.1643 * | 0.0650 | 0.8357 * | 1.0157 *** | 2.1865 *** |

| SBITOP | 0.0003 ** | 0.0002 | 0.0001 | 0.0878 *** | 0.3042 * | 0.8800 *** | 0.9752 *** | 5.2810 *** |

| Indices | Volatility Peaks | Volatility Persistence | |

|---|---|---|---|

| AEX | 0.0551 | 0.9540 | |

| ATF | 0.0840 | 0.9573 | |

| ATX | 0.0725 | 0.9458 | |

| BEL 20 | 0.0606 | 0.9507 | |

| CAC 40 | 0.0687 | 0.9562 | |

| CYMAIN | 0.0317 | 0.9395 | |

| DAX | 0.0626 | 0.9543 | |

| FTSE MIB | 0.0757 | 0.9447 | |

| IBEX 35 | 0.0621 | 0.9383 | |

| ISEQ 20 | 0.0505 | 0.9536 | |

| MSE | 0.0250 | 0.7954 | |

| OMXBBPI | 0.0415 | 0.9406 | |

| OMXH 25 | 0.0571 | 0.9415 | |

| PSI 20 | 0.0502 | 0.9258 | |

| SAX | 0.0345 | 1 | |

| SBITOP | 0.0313 | 0.9449 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duttilo, P.; Gattone, S.A.; Di Battista, T. Volatility Modeling: An Overview of Equity Markets in the Euro Area during COVID-19 Pandemic. Mathematics 2021, 9, 1212. https://doi.org/10.3390/math9111212

Duttilo P, Gattone SA, Di Battista T. Volatility Modeling: An Overview of Equity Markets in the Euro Area during COVID-19 Pandemic. Mathematics. 2021; 9(11):1212. https://doi.org/10.3390/math9111212

Chicago/Turabian StyleDuttilo, Pierdomenico, Stefano Antonio Gattone, and Tonio Di Battista. 2021. "Volatility Modeling: An Overview of Equity Markets in the Euro Area during COVID-19 Pandemic" Mathematics 9, no. 11: 1212. https://doi.org/10.3390/math9111212

APA StyleDuttilo, P., Gattone, S. A., & Di Battista, T. (2021). Volatility Modeling: An Overview of Equity Markets in the Euro Area during COVID-19 Pandemic. Mathematics, 9(11), 1212. https://doi.org/10.3390/math9111212