Modeling and Simulation of Impact and Control in Social Networks with Application to Marketing

Abstract

1. Introduction

- The problems of analyzing networks and calculating the resulting opinions of network agents are interpreted in terms of marketing problems. No doubt, they will find applications in other fields such as politics and sociology [47].

- Algorithms for identifying strong subgroups (representing opinion leaders) and satellites (other members of the target audience) as well as for calculating some quantitative characteristics of a network using the R programming language [48] are implemented and tested on model examples.

- A new algorithm for calculating the resulting opinions of agents is developed, implemented in the R language and tested on model examples.

- Models of optimal opinion control on networks are constructed and investigated by computer simulations using the author’s method of qualitatively representative scenarios [49].

- Differential game-based models of opinion control on networks with budget constraints in the form of equalities and inequalities are constructed and analytically investigated. Some marketing interpretations are made.

2. Network Analysis and Calculation of Resulting Opinions of Agents

- (i)

- is there a stable resulting opinion for each agent?

- (ii)

- will the entire group converge to the same resulting opinion (consensus) ?

3. Optimal Control over Networks

- (a)

- for any two scenarios ,

- (b)

- for any other scenario there exists a scenario such that

4. Game-Theoretic Models of Opinion Control over Networks

- -

- in the first case,

- -

- in the second case,

- (1)

- There are enough marketing resources in total, and they are allocated among the firms so that each firm has enough marketing resources. In this case, the total payoff of all firms with independent behavior coincides with the total payoff in the case of their cooperation.

- (2)

- There are enough marketing resources in total, but they are poorly allocated among the firms: some firms have a lack of marketing resources. In this case, the total quantity of marketing resource used by the firms in independent behavior is less than the total quantity of marketing resource used in cooperation. On the interval corresponding to the lack of marketing resources, the dependence of payoffs on the quantity of resource used is strictly monotonic; hence, the total payoff of all firms with independent behavior is smaller than the total payoff in the case of their cooperation.

- (3)

- There is a lack of marketing resources in total, but they are allocated so that some firms have enough marketing resources. In this case, the total quantity of marketing resource used by the firms in independent behavior is smaller than the total quantity of marketing resource used in cooperation. Consequently, the total payoff of all firms with independent behavior is smaller than the total payoff in the case of cooperation.

- (4)

- Each firm has a lack of marketing resources. Then, there is a lack of marketing resources in total. In this case, by the lemma the total payoff of all firms with independent behavior does not exceed the total payoff in the case of cooperation.

5. Conclusions

- A system of descriptive, optimal control, and game-theoretic models for a conceptual analysis of social networks in various fields has been constructed. The marketing interpretation of the results has been given as an example. In this case, one or more influence agents model the competitive firms as marketing agents, and the basic agents describe the target audience of this/those influence agent(s). Of course, applications to politics, organizational and regional control, and other areas are also possible.

- Algorithms for analyzing the network and calculating the resulting opinions of agents have been developed, implemented in the R programming language and tested on model examples.

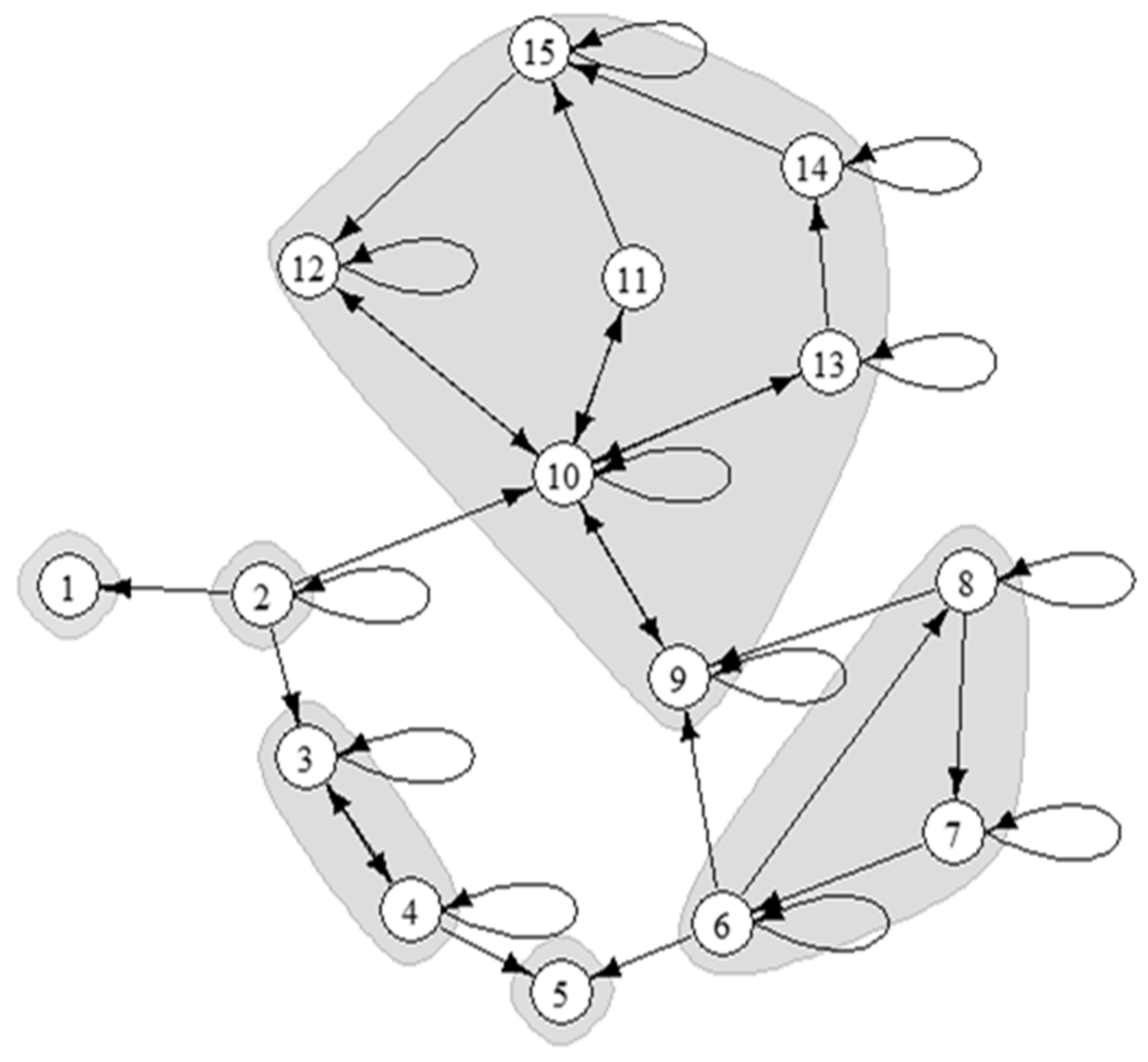

- Computer simulations of the optimal opinion control problems over networks have been performed using model examples in the domain of marketing and the hypothesis of sufficient impact on the members of strong subgroups (opinion leaders of the target audience) has been experimentally confirmed. The qualitatively representative scenarios of simulation have been identified.

- Explicit solutions to the differential games of opinion control over networks with marketing budget constraints in the form of equalities and inequalities have been analytically constructed. For the case of inequalities, a special method for solving the problem has been proposed.

- A comparative analysis of the independent and cooperative behavior of the players has been carried out, and the results have been interpreted in terms of marketing problems. In the sense of total payoff, cooperation is more profitable. Some conclusions regarding the optimal allocation of the marketing budget have been made. Namely, there are four possible cases in terms of the marketing resources availability: when there are enough marketing resources in total or not, and when each firm has enough resources, or some firms have a lack of marketing resources. The posed game theoretic problem is solved for all cases.

Author Contributions

Funding

Conflicts of Interest

References

- French, J.R. A formal theory of social power. Soc. Netw. 1977, 63, 35–48. [Google Scholar] [CrossRef]

- Harary, F. A criterion for unanimity in French’s theory of social power. In Studies in Social Power; Institute of Sociological Research: Ann Arbor, MI, USA, 1959; pp. 168–182. [Google Scholar]

- De Groot, M.H. Reaching a consensus. J. Am. Stat. Assoc. 1974, 69, 118–121. [Google Scholar] [CrossRef]

- Golub, B.; Jackson, M. Naïve Learning in Social Networks and the Wisdom of Crowds. Am. Econ. J. Microecon. 2010, 2, 112–149. [Google Scholar] [CrossRef]

- Hegselman, R.; Krause, U. Opinion dynamics and bounded confidence models: Analysis and simulation. J. Artif. Soc. Soc. Simul. 2002, 5, 3–33. [Google Scholar]

- Krause, U. A discrete nonlinear and non-autonomous model of consensus formation. In Communications in Difference Equations; Gordon and Breach Publishers: Amsterdam, The Netherlands, 2000; pp. 227–236. [Google Scholar]

- Lorenz, J. A stabilization theorem for dynamics of continuous opinions. Phys. A Stat. Mech. Appl. 2005, 355, 217–223. [Google Scholar] [CrossRef]

- Berger, R.J. A necessary and sufficient conditions for reaching a consensus using De Groot’s method. J. Am. Stat. Assoc. 1981, 76, 415–419. [Google Scholar] [CrossRef]

- Chatterjee, S.; Seneta, E. Toward consensus: Some convergence theorems on repeated averaging. J. Appl. Probab. 1977, 14, 159–164. [Google Scholar] [CrossRef]

- DeMarzo, P.M.; Vayanos, D.; Zwiebel, J. Persuasion bias, social influence, and unidimensional opinions. Q. J. Econ. 2003, 118, 909–968. [Google Scholar] [CrossRef]

- Zhang, D.; Gatica-Perez, D.; Bengio, S.; Roy, D. Learning influence among interactive Markov chains. In Proceedings of the Neural Information Processing Systems (NIPS), Cambridge, CA, USA, 24–29 November 2005; pp. 132–141. [Google Scholar]

- Saul, L.K.; Jordan, M.I. Mixed memory Markov models: Decomposing complex stochastic processes as mixtures of simpler ones. Mach. Learn. 1999, 37, 75–87. [Google Scholar] [CrossRef]

- Oliver, N.; Rosario, B.; Pentland, A. Graphical models for recognizing human interactions. In Proceedings of the Neural Information Processing Systems (NIPS), Denver, CO, USA, 30 November–5 December 1998; pp. 924–930. [Google Scholar]

- Howard, A.; Jebara, T. Dynamical systems trees. In Uncertainty in Artificial Intelligence; Elsevier: Amsterdam, The Netherlands, 2003; pp. 260–267. [Google Scholar]

- Jackson, M. Social and Economic Networks; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Jackson, M.O.; Wolinsky, A. A strategic model of social and economic networks. J. Econ. Theory 1996, 71, 44–74. [Google Scholar] [CrossRef]

- Chwe, M.S.-Y. Communication and coordination in social networks. Rev. Econ. Stud. 2000, 67, 1–16. [Google Scholar] [CrossRef]

- Buttle, F.A. Word of mouth: Understanding and managing referral marketing. J. Strat. Mark. 1998, 6, 241–254. [Google Scholar] [CrossRef]

- Godes, D.; Mayzlin, D. Using online conversations to study word-of-mouth communication. Mark. Sci. 2004, 23, 545–560. [Google Scholar] [CrossRef]

- Goldenberg, J.; Libai, B.; Muller, E. Talk of the network: A complex systems look at the underlying process of word-of-mouth. Mark. Lett. 2001, 12, 211–223. [Google Scholar] [CrossRef]

- Masuda, N.; Kawamura, Y.; Kori, H. Analysis of relative influence of nodes in directed networks. Phys. Rev. E 2009, 80, 046114. [Google Scholar] [CrossRef]

- Newman, M.E.J. The structure and function of complex networks. SIAM Rev. 2003, 45, 167–256. [Google Scholar] [CrossRef]

- Robins, G.; Pattison, P.; Elliott, P. Network models for social influence processes. Psychometrica 2001, 66, 161–189. [Google Scholar] [CrossRef]

- Watts, D.J. The “new” science of networks. Annu. Rev. Sociol. 2004, 30, 243–270. [Google Scholar] [CrossRef]

- Chkhartishvili, A.G.; Gubanov, D.; Novikov, D. Social Networks: Models of Information Influence, Control and Confrontation; Springer Science and Business Media LLC: Berlin, Germany, 2019. [Google Scholar]

- Sedakov, A.A.; Zhen, M. Opinion dynamics game in a social network with two influence nodes. Vestn. St. Petersburg Univ. Appl. Math. Comput. Sci. Control. Process. 2019, 15, 118–125. [Google Scholar] [CrossRef]

- Zhen, M. Stackelberg equilibrium in opinion dynamics game in social network with two influence nodes. In Contributions to Game Theory and Management, Proceedings of the Collected Papers of the Twelfth International Conference “Game Theory and Management”, Saint Petersburg, Russia, 3–5 July 2019; Petrosyan, L., Zenkevich, N., Eds.; Saint Petersburg State University: Saint Petersburg, Russia, 2019; Volume XII, pp. 366–386. [Google Scholar]

- Weber, G.-W.; Defterli, Ö.; Gök, S.Z.A.; Kropat, E. Modeling, inference and optimization of regulatory networks based on time series data. Eur. J. Oper. Res. 2011, 211, 1–14. [Google Scholar] [CrossRef]

- Weber, G.-W.; Alparslan-Gök, S.Z.; Söyler, B. A New Mathematical Approach in Environmental and Life Sciences: Gene–Environment Networks and Their Dynamics. Environ. Model. Assess. 2008, 14, 267–288. [Google Scholar] [CrossRef]

- Belen, S.; Kropat, E.; Weber, G.-W. Dynamical gene-environment networks under ellipsoidal uncertainty: Set-theoretic regression analysis based on ellipsoidal OR. In Proceedings of the Dynamics, Games and Science I: DYNA 2008, in Honor of Maurício Peixoto and David Rand, University of Minho, Braga, Portugal, 8–12 September 2008; pp. 545–571. [Google Scholar]

- Kropat, E.; Weber, G.-W.; Akteke-Ozturk, B. Eco-finance networks under uncertainty. In Proceedings of the International Conference on Engineering Optimization, Rio de Janeiro, Brazil, 1–5 June 2008. [Google Scholar]

- Liu, Y.; Zeng, C.; Luo, Y. Dynamics of a New Rumor Propagation Model with the Spread of Truth. Appl. Math. 2018, 9, 536–549. [Google Scholar] [CrossRef]

- Hamilton, J.D. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 1989, 57, 357. [Google Scholar] [CrossRef]

- Timmermann, A. Moments of Markov switching models. J. Econ. 2000, 96, 75–111. [Google Scholar] [CrossRef]

- Savku, E.; Weber, G.-W. A Stochastic Maximum Principle for a Markov Regime-Switching Jump-Diffusion Model with Delay and an Application to Finance. J. Optim. Theory Appl. 2017, 179, 696–721. [Google Scholar] [CrossRef]

- Weber, G.-W.; Meyer-Nieberg, S.; Kropat, E. Singularly perturbed diffusion-advection-reaction processes on extremely large three-dimensional curvilinear networks with a periodic microstructure—Efficientsolution strategies based on homogenization theory. Numer. Algebra Control. Optim. 2016, 6, 183–219. [Google Scholar] [CrossRef][Green Version]

- Kropat, E.; Meyer-Nieberg, S.; Weber, G.-W. Bridging the gap between variational homogenization results and two-scale asymptotic averaging techniques on periodic network structures. Numer. Algebra Control. Optim. 2017, 7, 223–250. [Google Scholar] [CrossRef]

- Özmen, A.; Kropat, E.; Weber, G.-W. Robust optimization in spline regression models for multi-model regulatory networks under polyhedral uncertainty. Optimization 2016, 66, 2135–2155. [Google Scholar] [CrossRef]

- Ergün, S.; Gök, S.Z.A.; Aydoğan, T.; Weber, G.-W. Performance analysis of a cooperative flow game algorithm in ad hoc networks and a comparison to Dijkstra’s algorithm. J. Ind. Manag. Optim. 2017, 13, 1–16. [Google Scholar] [CrossRef]

- Martin-Gutierrez, S.; Losada, J.C.; Benito, R.M. Impact of individual actions on the collective response of social systems. Sci. Rep. 2020, 10, 1–14. [Google Scholar] [CrossRef]

- Lin, X.; Newell, R. Further developments in output structural controllability and an assessment of structural techniques. J. Process. Control. 1991, 1, 283–292. [Google Scholar] [CrossRef]

- Liu, Y.-Y.; Slotine, J.-J.; Barabasi, A.-L. Controllability of complex networks. Nature 2011, 473, 167–173. [Google Scholar] [CrossRef] [PubMed]

- Yao, P.; Hou, B.-Y.; Pan, Y.-J.; Li, X. Structural Controllability of Temporal Networks with a Single Switching Controller. PLoS ONE 2017, 12, e0170584. [Google Scholar] [CrossRef] [PubMed]

- Cremonini, M.; Casamassima, F. Controllability of social networks and the strategic use of random information. Comput. Soc. Netw. 2017, 4, 10. [Google Scholar] [CrossRef] [PubMed]

- Li, M.; Wang, X.; Gao, K.; Zhang, S. A Survey on Information Diffusion in Online Social Networks: Models and Methods. Information 2017, 8, 118. [Google Scholar] [CrossRef]

- Agieva, M.T.; Korolev, A.V.; Ougolnitsky, G.A. Modeling and simulation of impact and control in social networks. In Communications in Computer and Information Science, Proceedings of the Modelling and Simulation of Social-Behavioural Phenomena in Creative Societies: First International EURO Mini Conference, MSBC 2019, Vilnius, Lithuania, 18–20 September 2019; Agarwal, N., Sakalauskas, L., Weber, G.-W., Agarwal, N., Sakalauskas, L., Weber, G.-W., Eds.; Springer: Berlin, Germany, 2019; Volume 1079, pp. 29–40. [Google Scholar]

- Agieva, M.; Ougolnitsky, G. Regional Sustainable Management Problems on Networks. In Proceedings of the International Scientific Conference “Competitive, Sustainable and Secure Development of the Regional Economy: Response to Global Challenges” (CSSDRE 2018), Volgograd, Russia, 18–20 April 2018; Volume 39, pp. 6–9. [Google Scholar] [CrossRef]

- Kabacoff, R. R in Action. Data Analysis and Graphics with R; Manning Publications: Shert Allen, NY, USA, 2011. [Google Scholar]

- Ougolnitsky, G.A.; Usov, A.B. Computer simulations as a solution method for differential games. In Computer Simulations: Advances in Research and Applications; Pfeffer, M.D., Bachmaier, E., Eds.; Nova Science Publishers: New York, NY, USA, 2018; pp. 63–106. [Google Scholar]

- Nevison, C.H.; Roberts, F.S. Discrete Mathematical Models with Applications to Social, Biological, and Environmental Problems. Am. Math. Mon. 1977, 84, 834. [Google Scholar] [CrossRef][Green Version]

- Agieva, M.T.; Babicheva, Y.V.; Okulist, N.M.; Ougolnitsky, G.A. Problems of analysis and prediction in the control of target audience in marketing. Large Scale Syst. Control 2019, 79, 27–64. (In Russian) [Google Scholar]

| Model Element | Mathematical Sense | Interpretation in Marketing |

|---|---|---|

| Basic agent | Network node | Segment of audience |

| Influencing agent | Network node | Market participants (firms), advertising agencies, mass media, etc. |

| Opinion of basic agent | Real value associated with each node (basic agent) that varies with time | Agent’s monthly (annual) expenses on firm’s products, or the number of visits to firm’s enterprises, or some numerical score of firm’s products (services) |

| Trust (influence) | Arc between initial and terminal nodes (initial trusts terminal, terminal influences initial) | Word-of-mouth, other communications of agents |

| Degree of trust of basic agent to another one (degree of influence of another agent on basic agent) | Real value associated with each network arc | Quantitative characteristic of trust |

| Resulting opinion | Limiting value of opinion over infinite time horizon | Stable resulting opinion over long period of time |

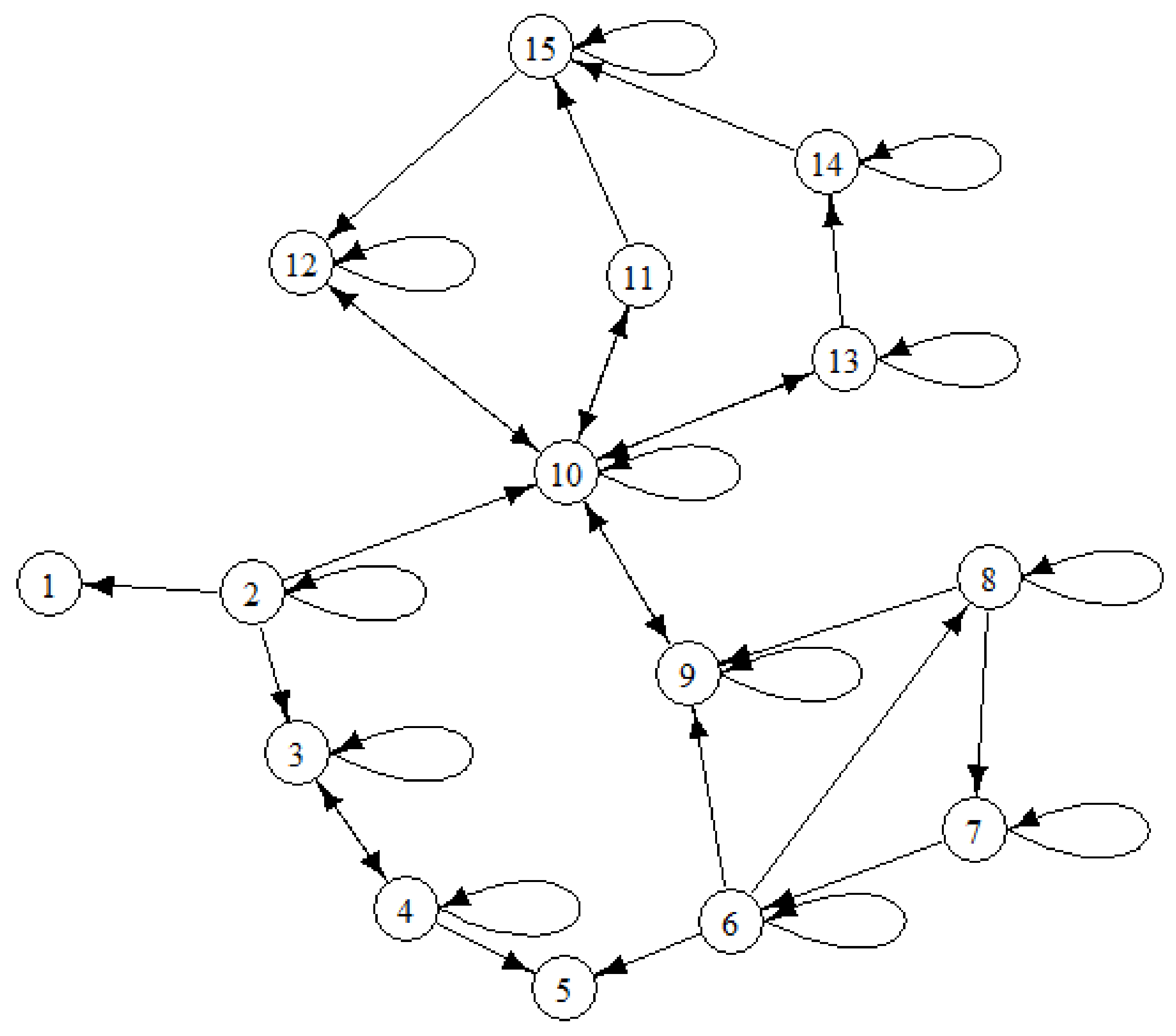

| Strong subgroup | Nondegenerate strong network component | Determines its own resulting opinions and also the dependent opinions of other agents |

| Satellite | Subset of nodes representing degenerate strong components | Resulting opinions are completely determined by strong subgroups |

| Impact on opinions | Additive term of opinion vector (more complex cases are also possible) | Marketing action plan |

| Impact on degrees of trust (influence) | Additive term of influence matrix (more complex cases are also possible) | Marketing action plan |

| Goal of control | Domain in state space of network | Range of desired opinions |

| T = 200 | T = 500 | T = 20,000 | |

|---|---|---|---|

| Impact on all agents | x1 = … = x4 = 1794; x5 = 1595; x6 = x7 = x8 = 1494; x9 = 1569; x10 = … = x15 = 1719 J = 283,253.3 | x1 = … = x4 = 2314; x5 = 2114; x6 = x7 = x8 = 2014; x9 = 2089; x10 = … = x15 = 2239 J = 272,897.1 | x1 = … = x4 = 29,184; x5 = 28,984; x6 = x7 = x8 = 28,884; x9 = 28,959; x10 = … = x15 = 29,109 J = 251,515.4 |

| Impact on strong subgroups members only | x1 = x2 = 2623; x3 = 2562; x4 = 2545; x5 = 2394; x6 = x7 = x8 = 2632; x9 = 2374; x10 = 2494; x11 = 2485; x12 = 2468; x13 = 2477; x14 = 2442; x15 = 2451 J = 307,121.9 | x1 = 3633; x2 = 3639; x3 = 3595; x4 = 3584; x5 = 3415; x6 = x7 = x8 = 3339; x9 = 3393; x10 = 3524; x11 = 3518; x12 = 3507; x13 = 3513; x14 = 3491; x15 = 3497 J = 288,059.9 | x1 = 55,612; x2 = 55,672; x3 = x4 = 55,670; x5 = 55,471; x6 = x7 = x8 = 55,372; x9 = 55,466; x10 = x11 = 55,595; x12 = 55,594; x13 = 55,595; x14 = x15 = 55,594 J = 252,273 |

| Time Horizon T | Payoff J |

|---|---|

| 200 | 2,937,211 |

| 500 | 2,917,487 |

| 1000 | 2,906,170 |

| 20,000 | 2,883,652 |

| 40,000 | 2,881,675 |

| 60,000 | 2,880,795 |

| 80,000 | 2,880,269 |

| 100,000 | 2,879,910 |

| 120,000 | 2,879,645 |

| 140,000 | 2,879,438 |

| 160,000 | 2,879,272 |

| 180,000 | 2,879,134 |

| 200,000 | 2,879,017 |

| Model Problems | Applications to Marketing |

|---|---|

| Network analysis | 1. Audience segmentation, identification of strong subgroups that determine the inner common resulting opinions of subgroups members and also the individual resulting opinions of other agents as a linear combination of resulting opinions of strong subgroups 2. Calculation of centrality, prestige and other characteristics of audience |

| Prediction over network | Calculation of resulting opinions of all agents without purposeful impact on them |

| Optimal control over network | Choice of optimal marketing actions (impact) for audience by one firm |

| Dynamic games over networks | Choice of compromise impact on audience in the case of competition and/or cooperation of firms |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Agieva, M.T.; Korolev, A.V.; Ougolnitsky, G.A. Modeling and Simulation of Impact and Control in Social Networks with Application to Marketing. Mathematics 2020, 8, 1529. https://doi.org/10.3390/math8091529

Agieva MT, Korolev AV, Ougolnitsky GA. Modeling and Simulation of Impact and Control in Social Networks with Application to Marketing. Mathematics. 2020; 8(9):1529. https://doi.org/10.3390/math8091529

Chicago/Turabian StyleAgieva, M. T., A. V. Korolev, and G. A. Ougolnitsky. 2020. "Modeling and Simulation of Impact and Control in Social Networks with Application to Marketing" Mathematics 8, no. 9: 1529. https://doi.org/10.3390/math8091529

APA StyleAgieva, M. T., Korolev, A. V., & Ougolnitsky, G. A. (2020). Modeling and Simulation of Impact and Control in Social Networks with Application to Marketing. Mathematics, 8(9), 1529. https://doi.org/10.3390/math8091529