The Influences of Asymmetric Market Information on the Dynamics of Duopoly Game

Abstract

1. Introduction

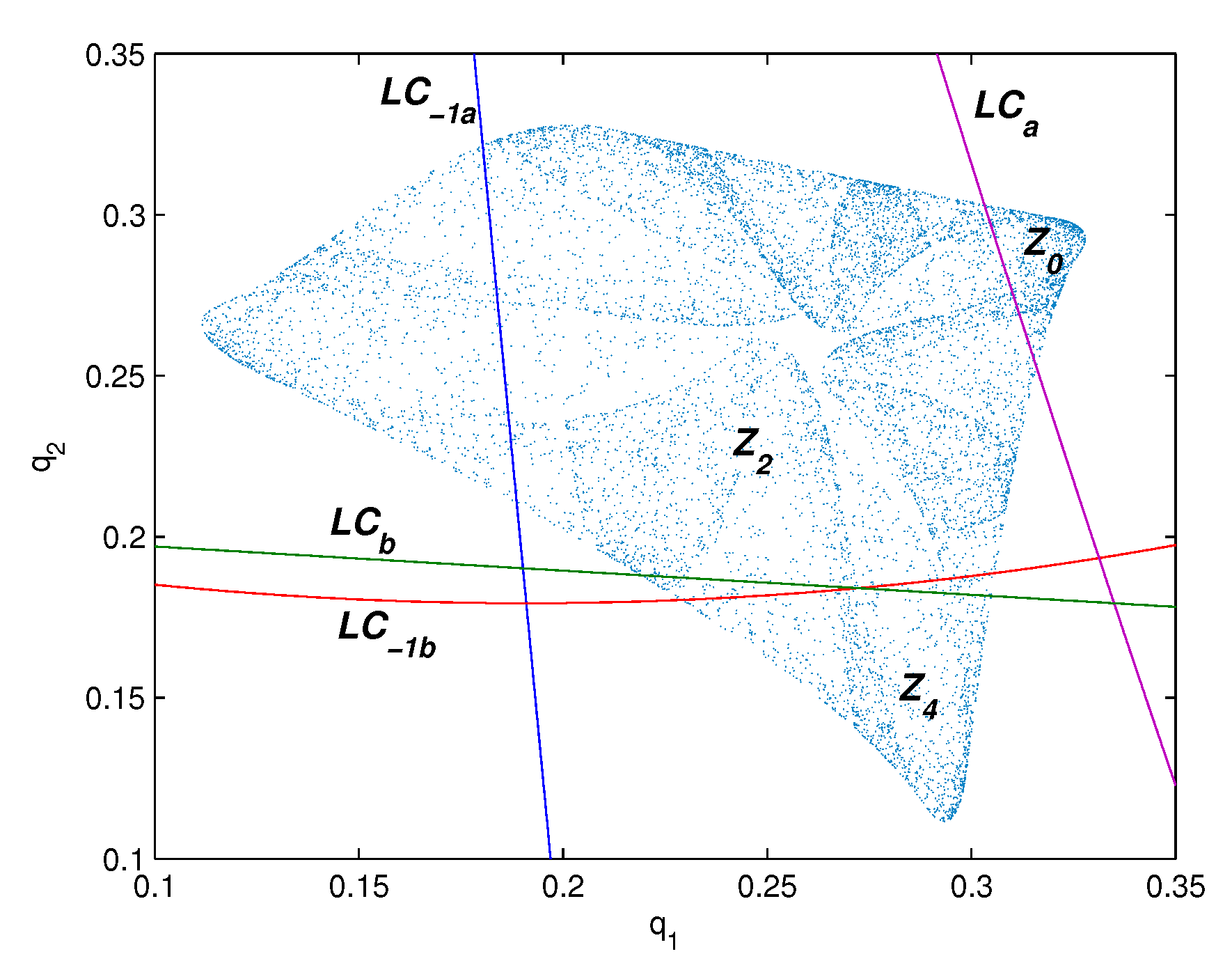

2. The Model

- It is a concave function that means the marginal utility of each good is decreasing.

- The marginal utility of good 1 is not independent of good 2. This means .

- It is not homogeneous, . It means that utility rises by a scalar if each good is multiplied by the same scalar.

- Under the budget constraint we have the following maximization problem,

3. Main Results

3.1. Fixed Points and Stability

- If it is a dissipative map,

- If it is a conservative map,

- Otherwise it is called an undissipative map.

- If the fixed point is locally asymptotically stable and is called an attracting node.

- If the fixed point is unstable repelling node.

- If and (or and ) the fixed point is a saddle point.

- If and (or and ) the fixed point is a non-hyperbolic point.

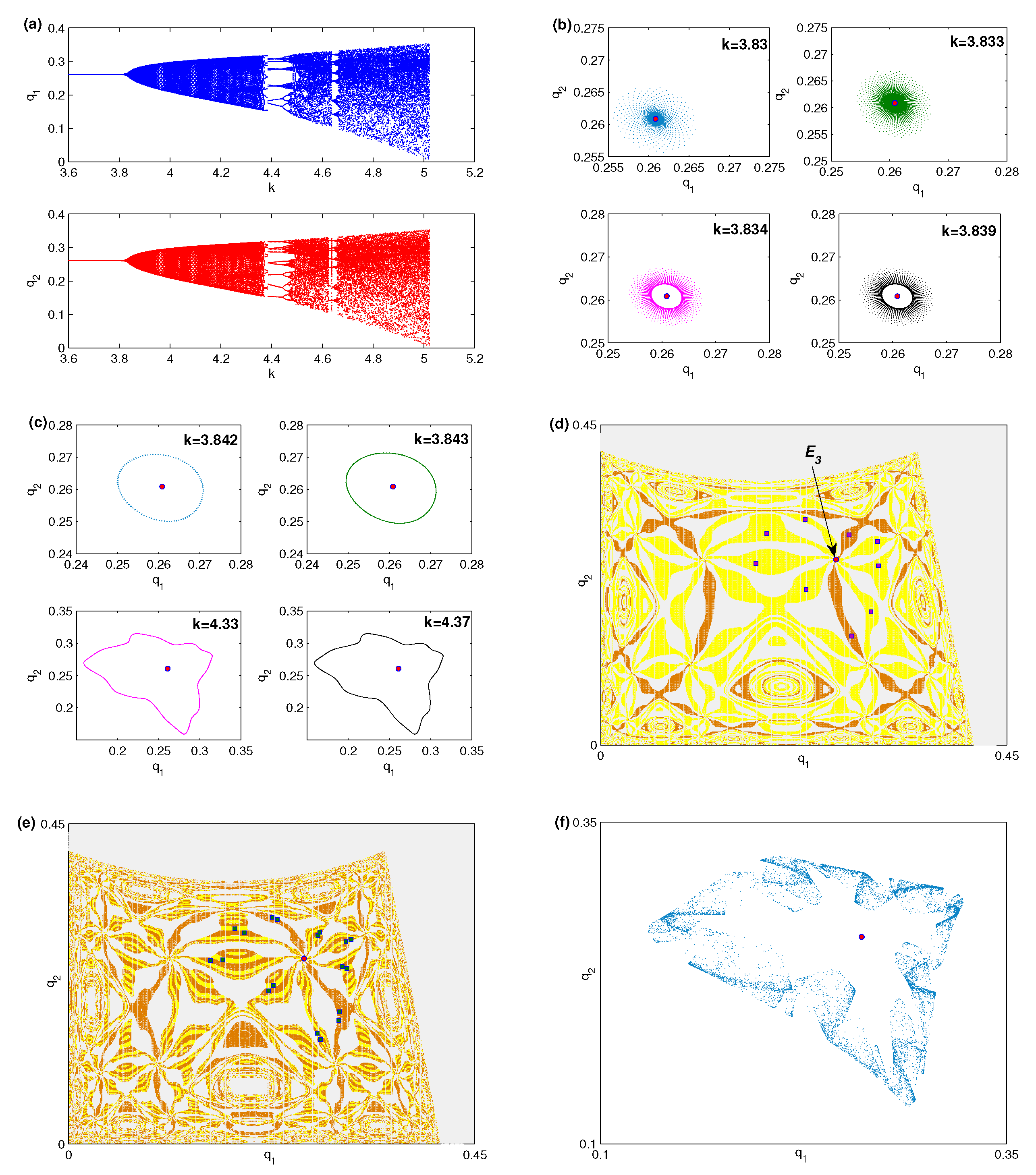

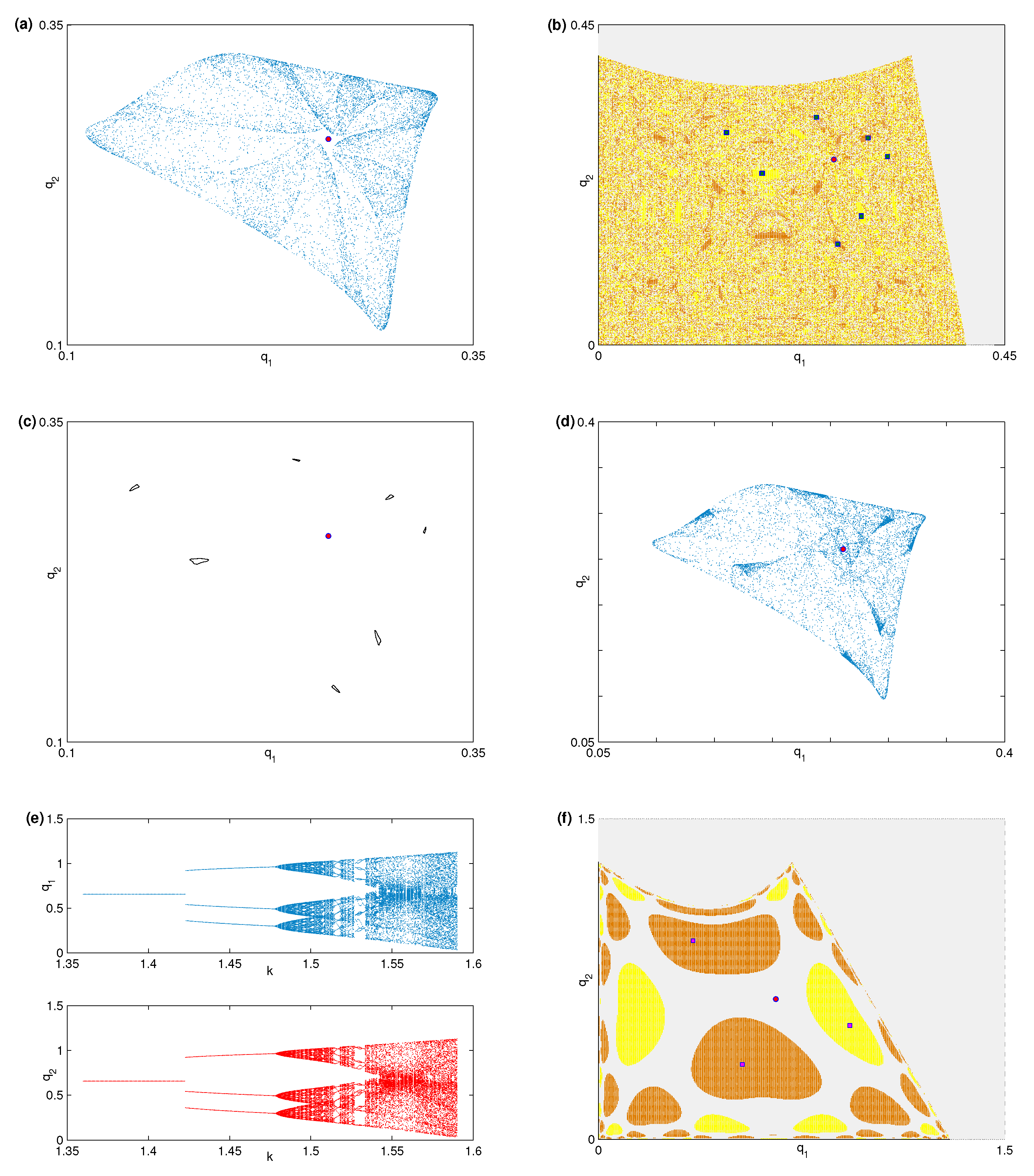

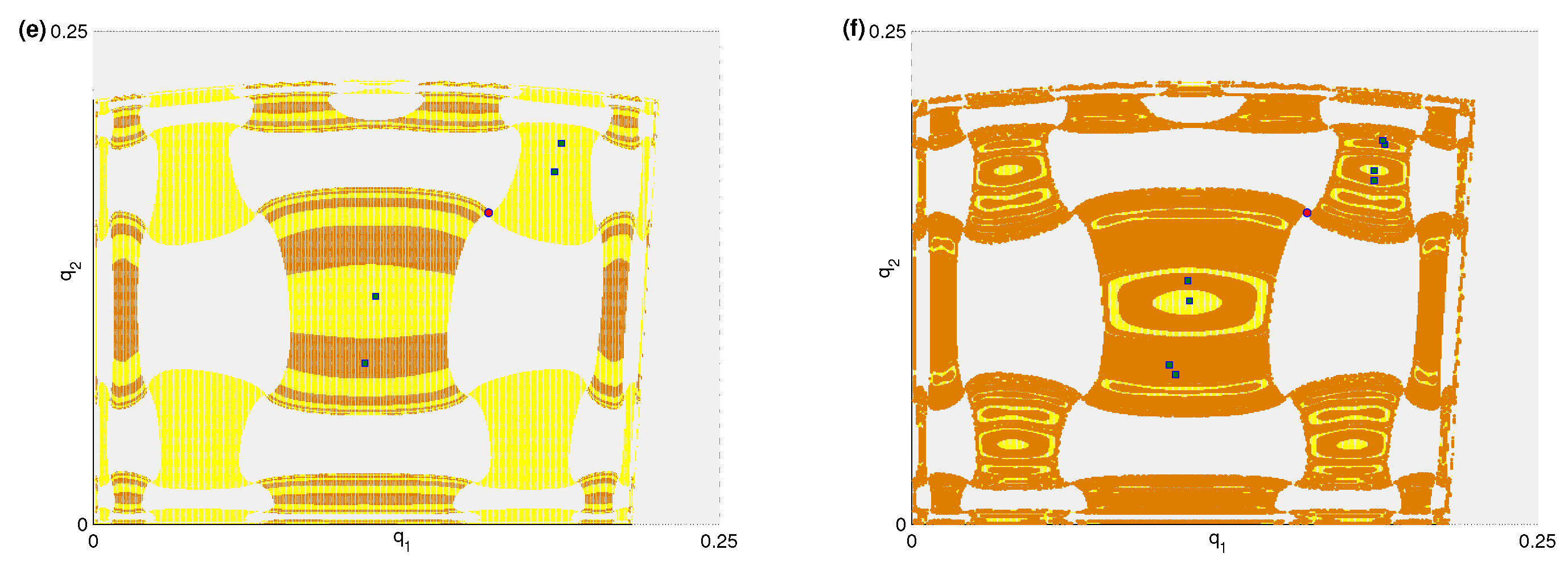

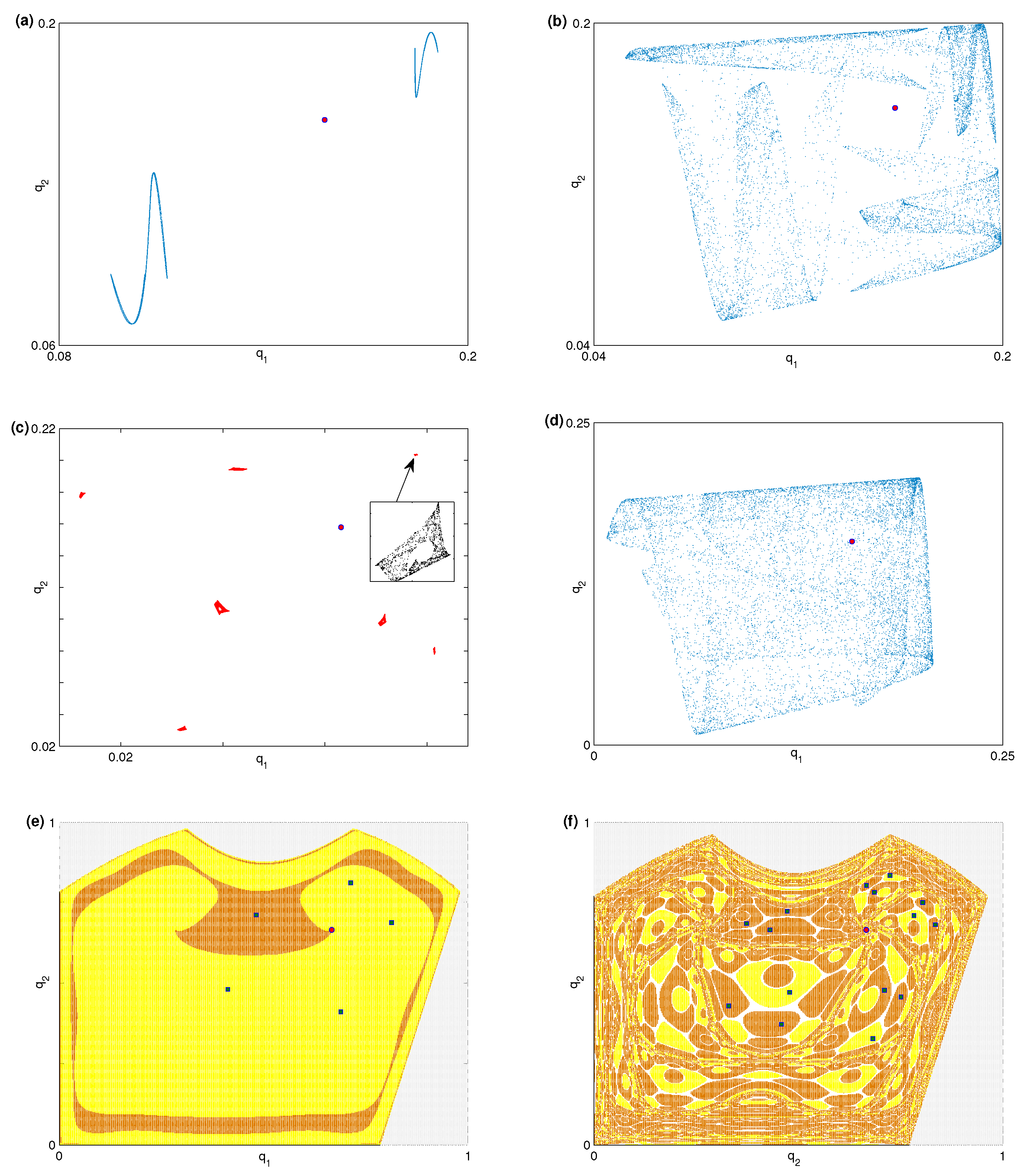

3.2. Local and Global Analysis via Numerical Simulation

3.3. Critical Curves and Noninvertibility

4. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Puu, T. Chaos in duopoly pricing. Chaos Solitons Fractals 1991, 1, 573–581. [Google Scholar] [CrossRef]

- Askar, S.S.; Al-khedhairi, A. Dynamic investigations in a duopoly game with price competition based on relative profit and profit maximization. J. Comput. Appl. Math. 2020, 367, 112464. [Google Scholar] [CrossRef]

- Naimzada, A.K.; Raimondo, R. Chaotic congestion games. Applied Math. Comput. 2018, 321, 333–348. [Google Scholar] [CrossRef]

- Askar, S.S.; Al-khedhairi, A. On complex dynamic investigations of a piecewise smooth nonlinear duopoly game. Chaos Solitons Fractals 2020, 139, 110001. [Google Scholar] [CrossRef]

- Askar, S.S.; Al-khedhairi, A. The dynamics of a business game: A 2D-piecewise smooth nonlinear map. Phys. A Stat. Mech. Its Appl. 2020, 537, 122766. [Google Scholar] [CrossRef]

- Ma, J.; Sun, L.; Hou, S.; Zhan, X. Complexity study on the Cournot-Bertrand mixed duopoly game model with market share preference. Chaos 2018, 28, 023101-10. [Google Scholar] [CrossRef] [PubMed]

- Tuinstra, J. A price adjustment process in a model of monopolistic competition. Int. Game Theory Rev. 2004, 6, 417–442. [Google Scholar] [CrossRef]

- Elsadany, A.A. Dynamics of a Cournot duopoly game with bounded rationality based on relative profit maximization. Appl. Math. Comput. 2017, 294, 253–263. [Google Scholar] [CrossRef]

- Cavalli, F.; Naimzada, A.; Tramontana, F. Nonlinear dynamics and global analysis of a heterogeneous Cournot duopoly with a local monopolistic approach versus a gradient rule with endogenous reactivity. Commun. Nonlinear Sci. Numer. Simul. 2015, 23, 245–262. [Google Scholar] [CrossRef]

- Ahmed, E.; Hegazi, A.S.; Elettreby, M.F.; Askar, S.S. On multi-team games. Phys. A Stat. Mech. Its Appl. 2006, 369, 809–816. [Google Scholar] [CrossRef]

- Tramontana, F. Heterogeneous duopoly with isoelastic demand function. Econ. Model. 2010, 27, 350–357. [Google Scholar] [CrossRef]

- Zhang, J.; Da, Q.; Wang, Y. Analysis of nonlinear duopoly game with heterogeneous players. Econ. Model. 2007, 24, 138–148. [Google Scholar] [CrossRef]

- Ma, J.; Si, F. Complex Dynamics of a Continuous Bertrand Duopoly Game Model with Two-Stage Delay. Entropy 2016, 18, 266. [Google Scholar] [CrossRef]

- Peng, Y.; Lu, Q. Complex dynamics analysis for a duopoly Stackelberg game model with bounded rationality. Appl. Math. Comput. 2015, 271, 259–268. [Google Scholar] [CrossRef]

- Tramontana, F.; Elsadany, A.E.A. Heterogeneous triopoly game with isoelastic demand function. Nonlinear Dyn. 2012, 68, 187–193. [Google Scholar] [CrossRef]

- Leonard, D.; Nishimura, K. Nonlinear dynamics in the Cournot model without information. Ann. Oper. Res. 1999, 89, 165–173. [Google Scholar] [CrossRef]

- Askar, S.S. Tripoly Stackelberg game model: One leader versus two followers. Appl. Math. Comput. 2018, 328, 301–311. [Google Scholar] [CrossRef]

- Ahmed, E.; Elettreby, M.F. Controls of the complex dynamics of a multi-market Cournot model. Econ. Model. 2014, 37, 251–254. [Google Scholar] [CrossRef]

- Peng, J.; Miao, Z.; Zheng, L. Study on dynamical properties and simulation of a four-dimensional nonlinear discrete dynamics. In Proceedings of the 2011 IEEE International Conference on Industrial Engineering and Engineering Management, Singapore, 6–9 December 2011. [Google Scholar] [CrossRef]

- Askar, S.S.; Alnowibet, K. Nonlinear oligopolistic game with isoelastic demand function: Rationality and local monopolistic approximation. Chaos Solitons Fractals 2016, 84, 15–22. [Google Scholar] [CrossRef]

- Ueda, M. Effect of information asymmetry in Cournot duopoly game with bounded rationality. Appl. Math. Comput. 2019, 362, 124535. [Google Scholar] [CrossRef]

- Singh, N.; Vives, X. Price and quantity competition in a differentiated duopoly. Rand J. Econ. 1984, 15, 546–554. [Google Scholar] [CrossRef]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Askar, S.S. The Influences of Asymmetric Market Information on the Dynamics of Duopoly Game. Mathematics 2020, 8, 1132. https://doi.org/10.3390/math8071132

Askar SS. The Influences of Asymmetric Market Information on the Dynamics of Duopoly Game. Mathematics. 2020; 8(7):1132. https://doi.org/10.3390/math8071132

Chicago/Turabian StyleAskar, Sameh S. 2020. "The Influences of Asymmetric Market Information on the Dynamics of Duopoly Game" Mathematics 8, no. 7: 1132. https://doi.org/10.3390/math8071132

APA StyleAskar, S. S. (2020). The Influences of Asymmetric Market Information on the Dynamics of Duopoly Game. Mathematics, 8(7), 1132. https://doi.org/10.3390/math8071132