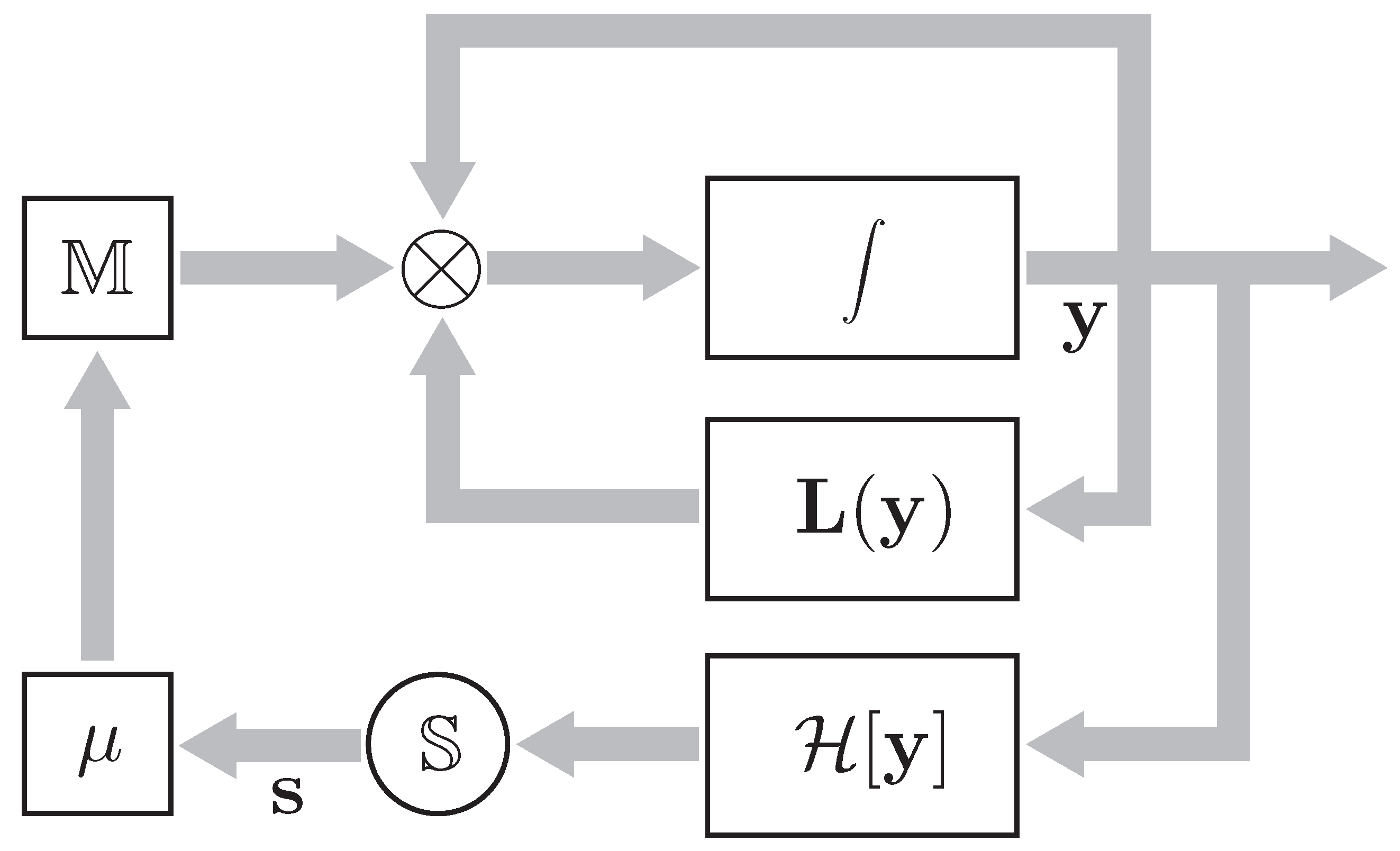

5.1. Model of Economic System with Investment Exchange

Consider an economic system composed of three subsystems exchanging investments. The state of each subsystem is characterized by its investment-conditioned yield (output in value units) and total investments (the sum of investments per unit time). The investment relations between the subsystems are an important economic indicator of their interaction, which is described by the connectivity index .

The investment balance of the economic system has the form

with the following notations:

as the investment flow in own manufacture;

as the investment flow from other subsystems into subsystem

i; finally,

as the investment flow from subsystem

i into other subsystems. Denote by

the investment flows from subsystem

i into subsystem

j. Then

Consider a random mechanism of investment flows between subsystems. Let the portions of investments be randomly and independently distributed among subsystems with some prior probabilities Please note that with a prior probability the portions of investments stay within subsystem i. In the aggregate, all portions of investments form the investment flow .

For each subsystem, the admissible investment flow is completely exhausted. Therefore, the probabilities

satisfy the constraint

We assume that the portions of investments are distributed rather fast, and hence at each time instant

t the dynamics of this process can be considered a sequence of locally stationary states with the entropy [

2,

21]

subject to upper constraints on an admissible investment flow

for each subsystem. By definition, the admissible investment flow

depends on the yield of subsystem

i. This dependence will be characterized by functions

. As is well-known, initial investments are required for the operation of an economic system, which are not connected with yield. At initial stages of system operation, there may be no yield at all. Therefore, the functions

have a constant term

and also a variable term

that linearly depends on yield (in first approximation), i.e.,

Using the functions

, we write the corresponding system of constraints on the investment activity of all subsystems as

The entropy operator that maps the space of yields into the space of investment flow matrices is described by the perturbed constrained maximization problem of entropy (

57) on set (

59). In view of relations (

56), the solution to this problem has the form

Please note that the own investment flows

in (

54) are given by

The total investment flow makes up

where

Now, consider the phenomenology of yield dynamics, taking into account that this variable is nonnegative. A change in yield occurs under the influence of two oppositely directed processes: the depreciation of yield due to its consumption (accumulation) and the update of yield through investments. To ensure the nonnegativity of yield, for convenience its variability can be interpreted in terms of the relative rate of change

In the first approximation, the relative rate of change

is proportional to the difference in the aging rates, due to depreciation and update, through investments. Assuming that each of the listed components of the rate of change

is in turn proportional to the yield

with a coefficient

and also to the total investment flow

with a coefficient

, we can write the balance relation

Substituting the total investments expression (

62) into this relation, we obtain the following system of nonlinear differential equations describing yield dynamics in the economic system composed of three interacting subsystems:

Suppose that the total investments are linearly connected with yield (

58). In this case, the above system of nonlinear differential equations takes the form

Here the vector

c consists of the components

and the elements of the matrix

are given by

System (

66) with positive initial conditions (nonzero initial yield) has nonnegative solutions.

5.3. Analysis of Stationary States: Existence and Stability

Of economic interest are the states

in which the yields in all subsystems are positive. In economic literature, such states are called full profitability states. The dependence of full profitability states and their stability on the connectivity index

is illustrated in

Table 2. Clearly, such states exist and are stable only for the values

For

they do not exist. The following notations are adopted in this table:

as the stability domain (

53);

as the stability indicator, + for stable and − for unstable;

as the maximum eigenvalue.

The dependence of the stationary yields of different subsystems on the connectivity index (

) and also the stability domains (

) are shown in

Figure 2. Please note that these states exist for

and are stable up to

.

Now, consider -profitability states (). There may exist three states from this class, namely

: ;

: ;

: ;

The dependence of

-profitability states on the connectivity index is illustrated in

Table 3,

Table 4 and

Table 5.

From these tables it follows that the -profitability states exist for all values of the connectivity indices, but they are stable only for ; the -profitability states exist for , but are unstable; the -profitability states exist for

The last class of states consists of -profitability states.

The dependence of

-profitability states on the connectivity index is illustrated in

Table 6.

From

Table 6 it can be observed that the 1-profitability states exist for the connectivity index

but sufficient stability conditions for them are not satisfied.

The dependence of

-profitability states on the connectivity index is illustrated in

Table 7.

From

Table 7 it can be observed that the 2-profitability states exist for all values of the connectivity index

but sufficient stability conditions for them are not satisfied.

The dependence of

-profitability states on the connectivity index is illustrated in

Table 8.

From

Table 8 it can be observed that the 3-profitability states exist for all values of the connectivity index

but sufficient stability conditions for them are not satisfied.

Thus, the complete range of the connectivity index can be divided into the following subintervals:

on which all types of stationary states exist, but only full profitability states are stable;

on which all types of stationary states exist, except for the -profitability ones; full and -profitability states are stable;

on which all types of stationary states exist, except for the - and -profitability ones; full and -profitability states are stable;

on which full-, -, - and -profitability states exist; full and -profitability states are stable.