A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions

Abstract

1. Introduction

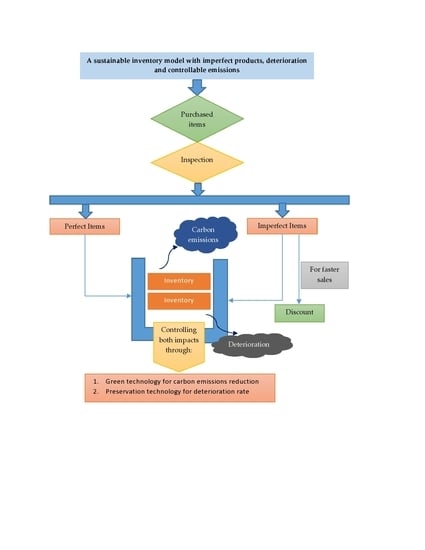

- (1)

- This study aids retail managers to make optimum decisions on replenishment, selling price, and technology investment to maximize the total profit when a carbon emission tax is charged, deterioration and defective products affect the inventory level, and demand is sensitive to price and emission reductions.

- (2)

- We propose a model that separates the inventory of the perfect and imperfect quality products and allows a discount strategy for the imperfect items, which helps the retailer to run the business smoothly without any interruptions in the profit margin.

- (3)

- We studied a synergy on the reduction in product deterioration and carbon emissions for both the perfect and imperfect quality products.

2. Literature Review

2.1. Inventory Model with Defective and Deteriorating Products

2.2. Sustainable Inventory Model

3. Mathematical Model Formulation

| Notations | Description |

| Parameters | |

| g | Constant part of the demand function for perfect items |

| g1 | Constant part of the demand function for imperfect items |

| h | Index of price elasticity |

| AOC | Ordering cost per cycle |

| j | Coefficient of customer’s choice for low carbon |

| λ | Percentage of emission reduction per unit product |

| prc | Purchase cost per unit |

| h1 | Unit holding cost per unit time of the perfect items |

| h2 | Unit holding cost per unit time of the imperfect items |

| m | Constant part of the holding cost |

| n | Time-varying coefficient of the holding cost |

| cscr | Screening cost per unit |

| r | Discount rate on imperfect items |

| ϕ1 | Deterioration rate of the perfect items |

| ϕ2 | Deterioration rate of the imperfect items |

| q | Sensitive parameter of preservation technology |

| γ | Per unit invested amount in preservation technology |

| σ | Percentage of imperfect items |

| u | Fixed cost of transportation per trip |

| v | Variable cost per unit transported per distance traveled |

| dst | Distance traveled |

| nt | Number of trips |

| wp | Product weight |

| tcp | Truck capacity |

| Fct | Fixed cost per truck per trip |

| ng | No. of gallons per truck per distance traveled |

| e | Greenhouse gas (GHG) emissions per gallon of diesel truck fuel |

| Tc | Carbon emission tax per ton of GHG emissions |

| cfh | Fixed carbon emissions of holding inventory |

| cvh | Variable carbon emission factor per holding cost |

| π | Maximum portion of carbon emissions that can be reduced by utilizing green technology |

| Y | Efficiency of greener technology |

| Decision variables | |

| sp | Selling price per unit |

| L | Replenishment cycle |

| G | Green investment cost in carbon reduction per cycle |

| Other variables | |

| D | Demand rate for perfect items (units/year) |

| D1 | Demand rate for imperfect items (units/year) |

| S | Order quantity/maximum stock per cycle |

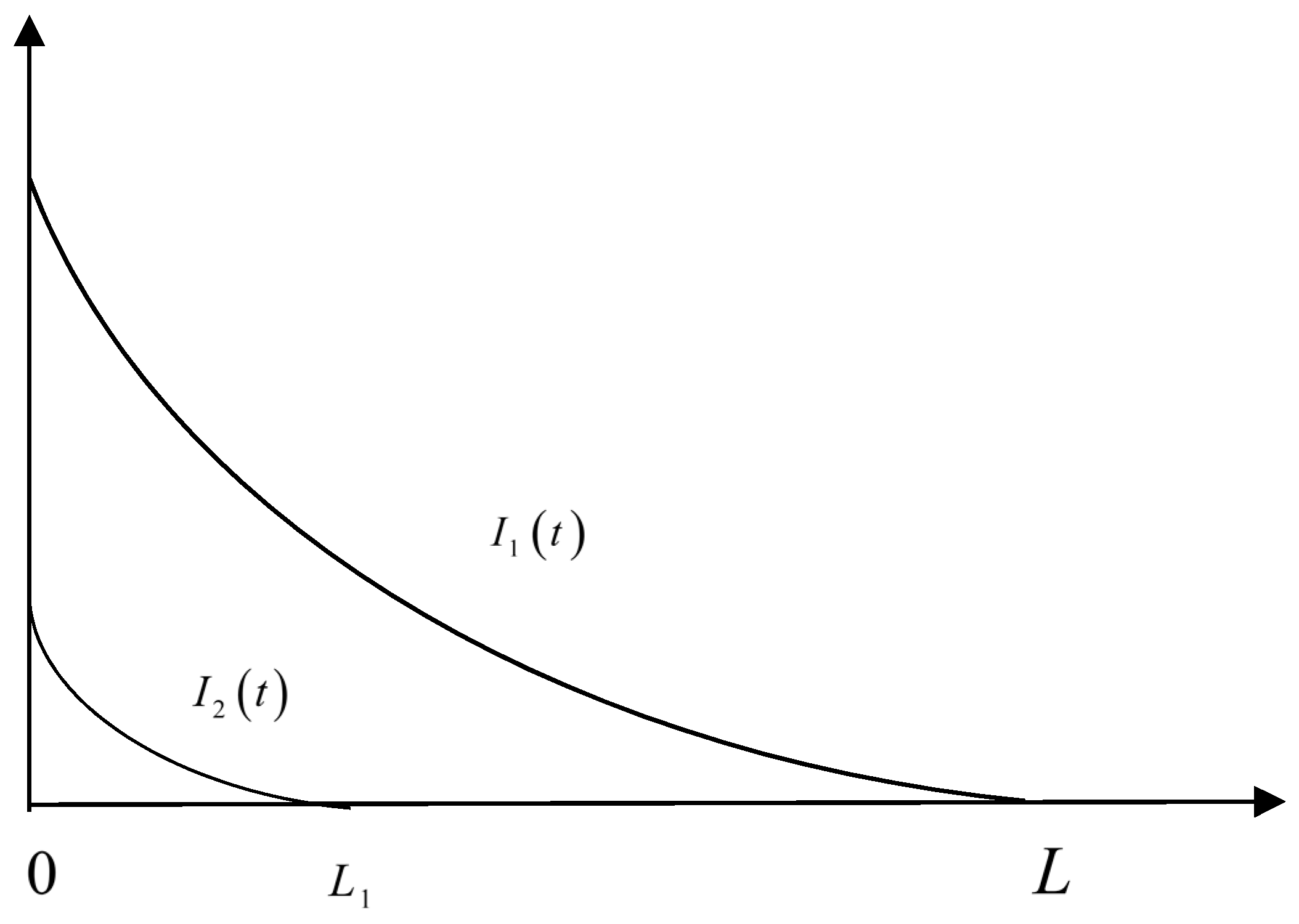

| I1(t) | Level of inventory for the perfect items at time t |

| I2(t) | Level of inventory for the imperfect items at time t |

3.1. Problem Description

3.2. Mathematical Forms of the Proposed Model

3.3. Investment in Carbon Emission Reduction

3.4. Theoretical Derivation

4. Numerical Illustrations and Discussions

4.1. Algorithm

| Algorithm 1. (Solution Algorithm) |

|

|

|

|

|

|

|

|

|

|

|

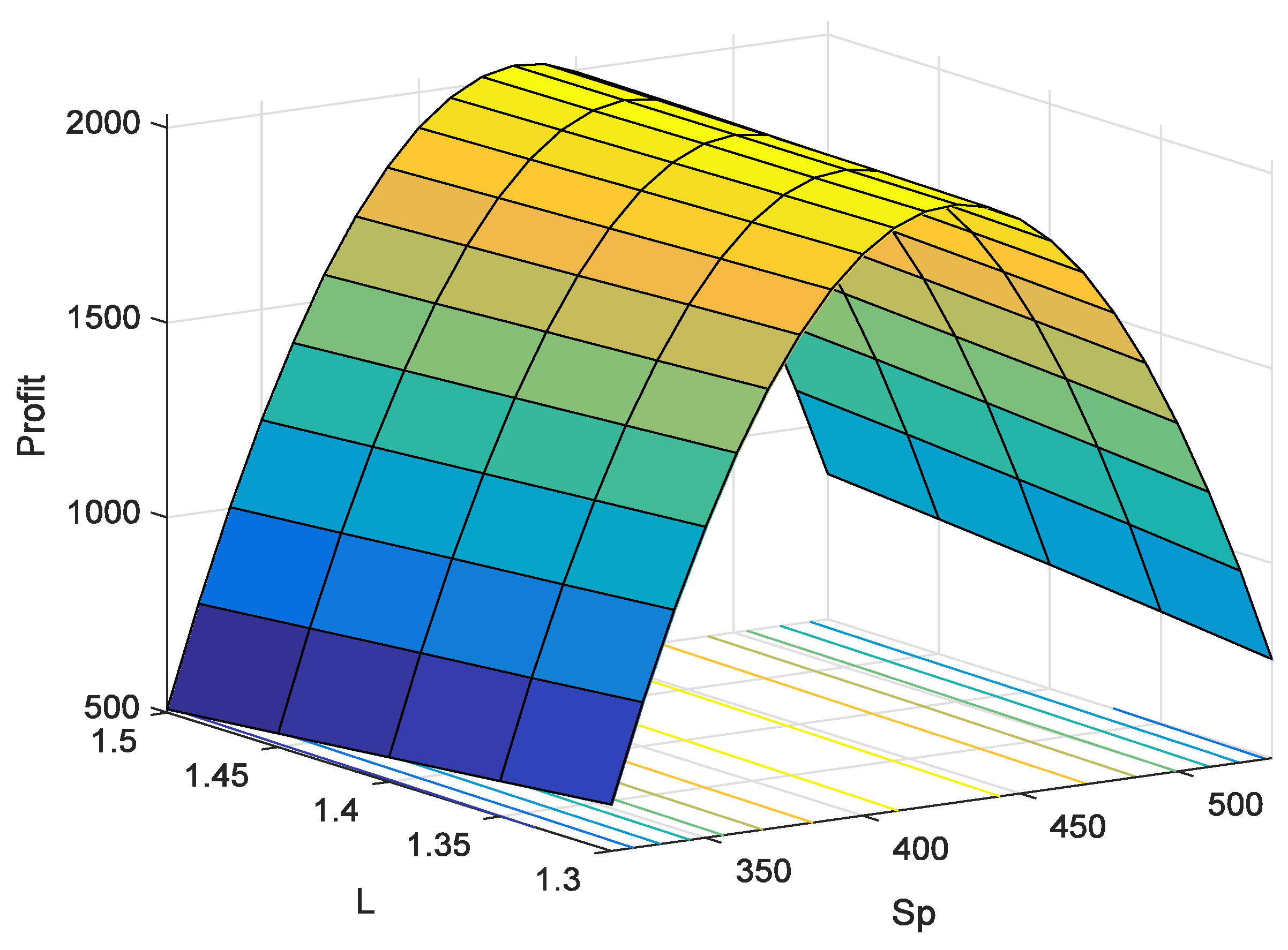

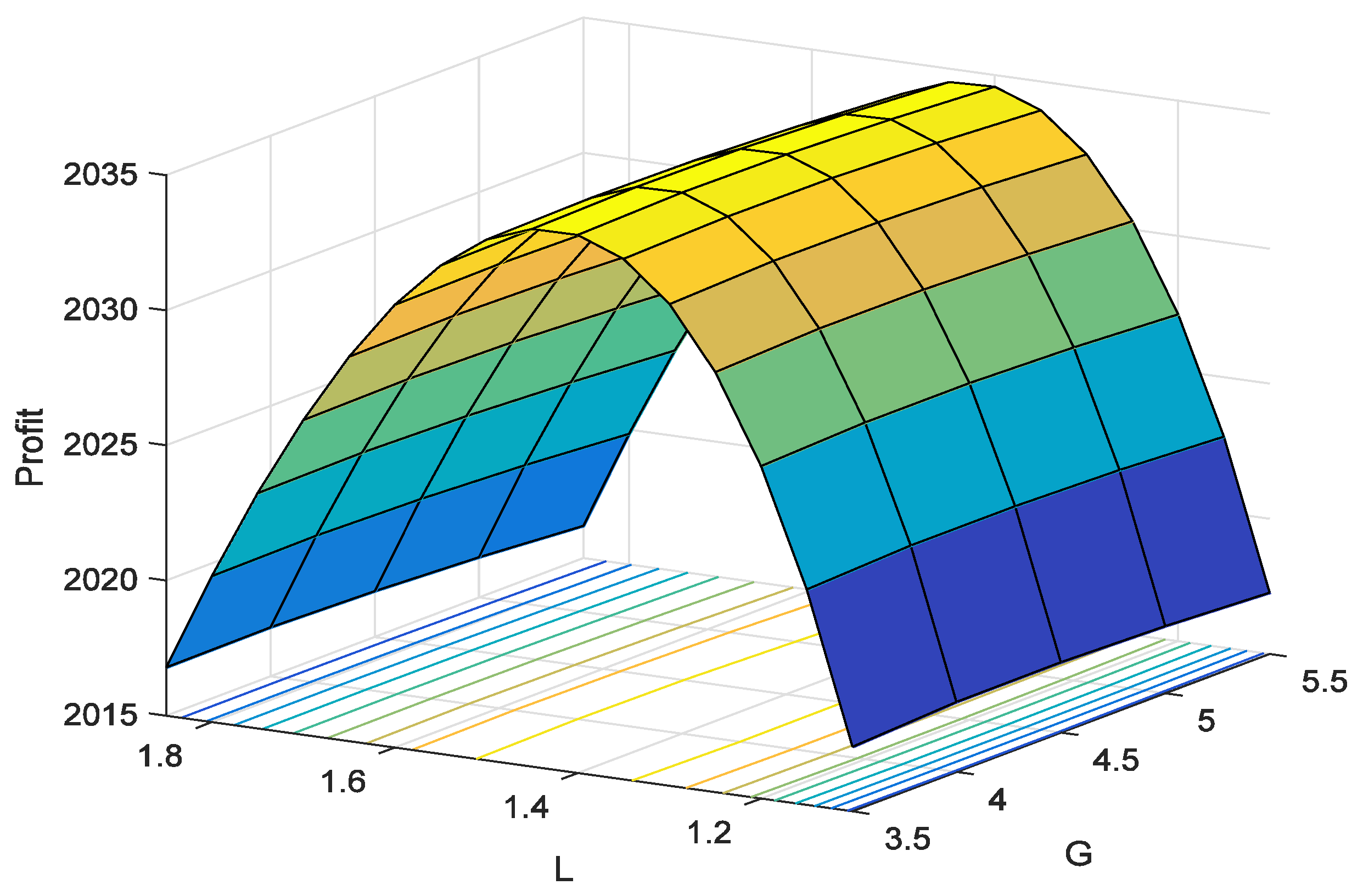

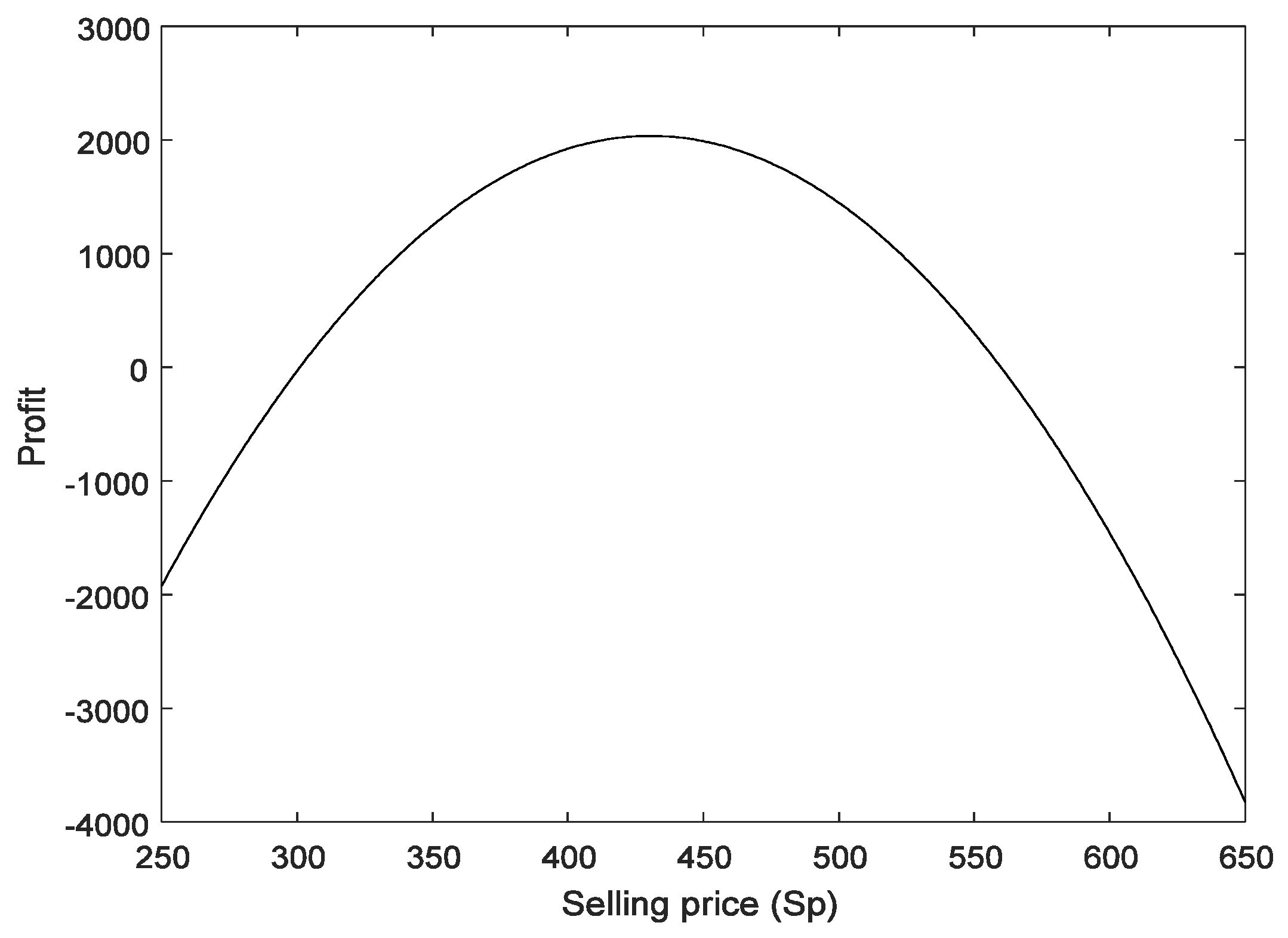

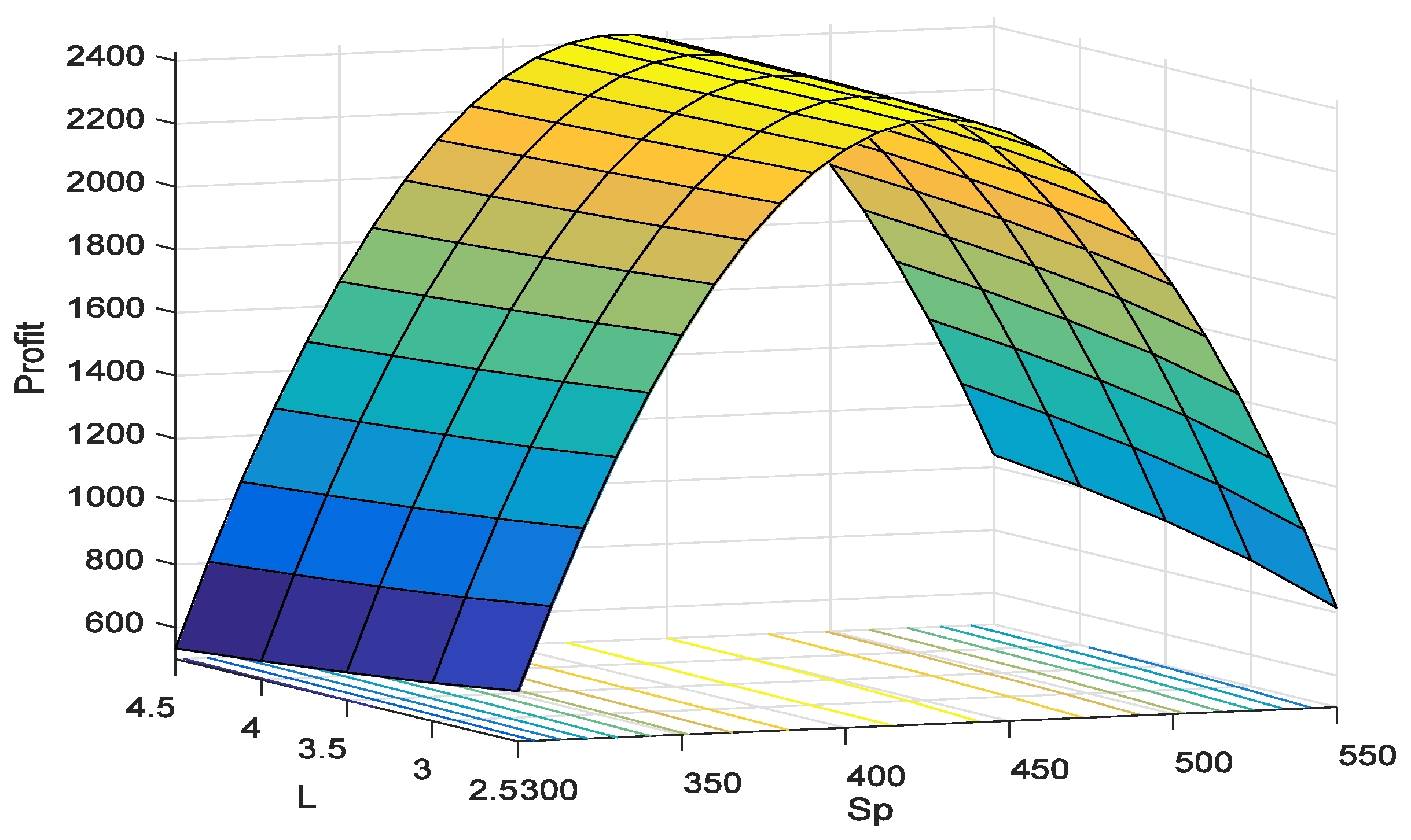

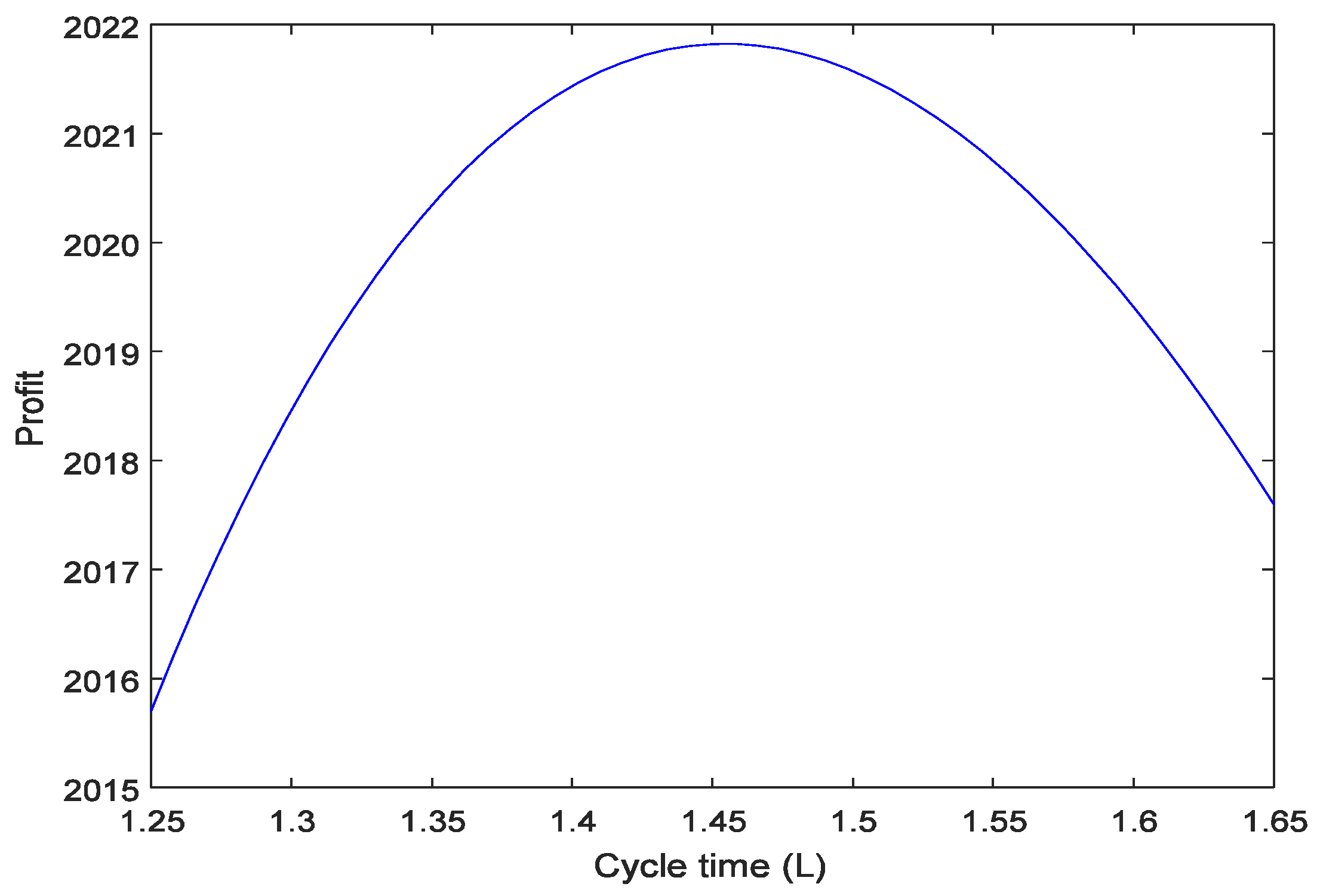

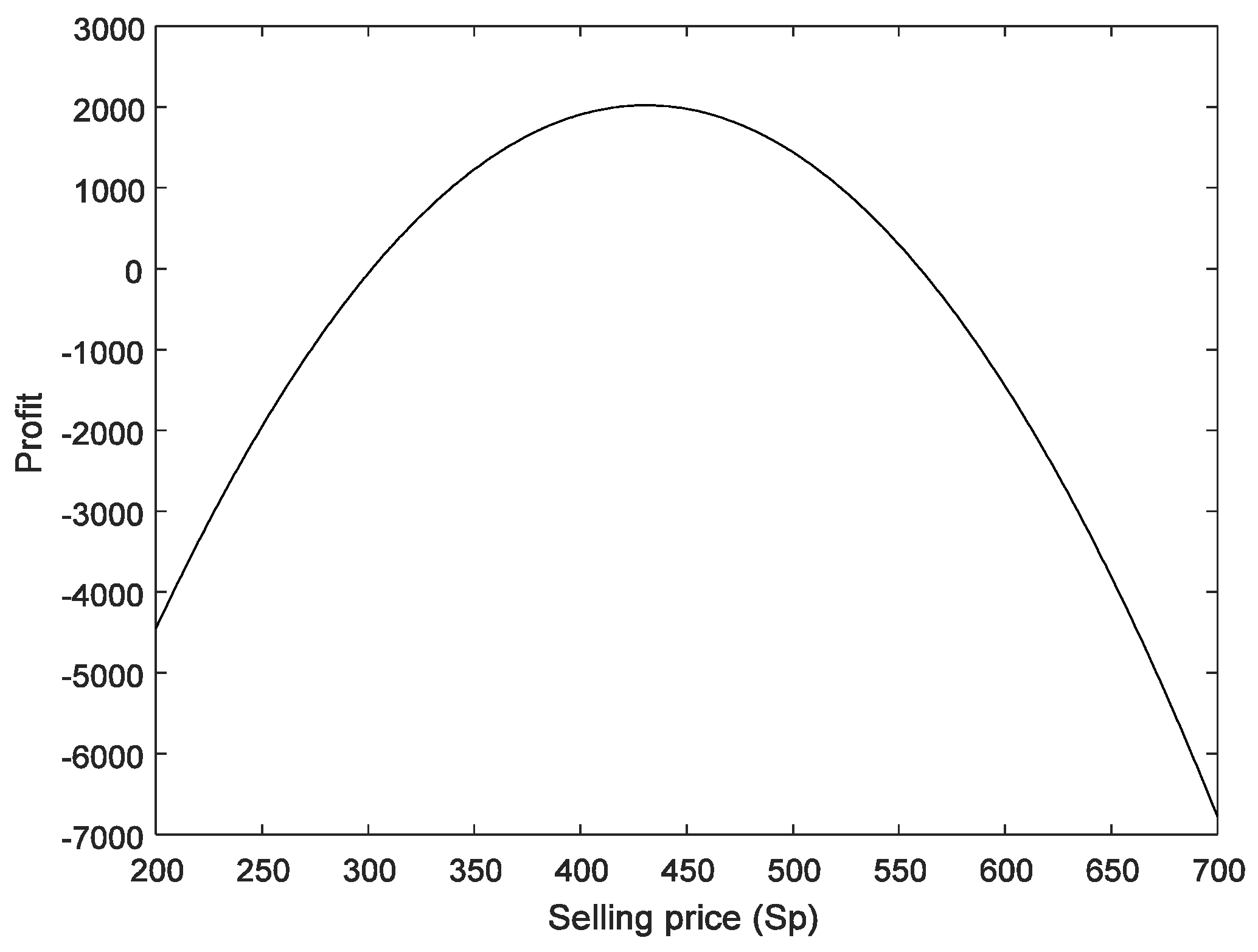

4.2. Numerical Examples

4.3. Sensitivity Analysis

- (1)

- When the carbon emission tax (Tc) increases, the selling price (sp) of the products increases. Consequently, this also intensifies the green investment (G) and the replenishment cycle (L). In contrast, the profit of the system (α) decreases. In an increasing emission tax situation, the retailer must invest more in controlling the emissions and, thus, increases the selling price to compensate for these expenses. Then, the total lot size requires more time to sell the products, resulting in an increased replenishment cycle; however, this strategy declines the retailer’s profit.

- (2)

- When the product weight (wp) increases, the decision for green technology investment also increases to anticipate the increasing emissions from extra fuel in the transportation system. Simultaneously, the selling price and the replenishment cycle decrease. The increasing costs will consequently diminish the retailer’s profit.

- (3)

- Suppose the deterioration rate of perfect items (ϕ1) increases. This will decrease the selling price, replenishment cycle, and profit, while green technology investment is relatively constant. The increasing deterioration rate decreases the total profit due to increasing product loss. Due to the risk of deterioration, the retailer decreases the selling price to sell the products quickly to avoid this unavoidable circumstance. However, the change in the deterioration rate of the imperfect items (ϕ2) does not change the decision variables and the total profit.

- (4)

- When the discount rate (r) for the defective items increases, the selling price decreases while the profit for the retailer increases. The discount rate and selling price boost the sales and, as a result, this instantly penetrates the profit of the retailer. However, as the discount is a catalyst to increase sales, the retailer invests more in green technology.

- (5)

- When the amount of imperfect portion (σ) increases, this simultaneously increases the selling price and the replenishment cycle. In contrast, this significantly decreases the retailer’s total profit and highly decreases the need for green investment. An increase in the percentage of imperfect items causes a major loss for the retailer; hence, the retailer may increase the selling price to reduce the impact.

- (6)

- The holding cost for the perfect items and imperfect items provides a similar sort of observation, except for the replenishment cycle. However, the effect is higher from the perfect items as their percentage is also larger. When per unit holding cost increases, the retailer’s total profit decreases, and, again, the retailer may increase the selling price to reduce the impact.

- (7)

- When the unit GHG emissions of the truck fuel (e) increase, this results in a decrease in the total profit as it causes higher costs. This also greatly increases the replenishment cycle to reduce the delivery frequency, which will curb the total emissions.

- (8)

- The profit also declines due to an increase in the number of trips (nt). In the real case, when the retailer is bound to increase the trip number, this intensifies the transportation costs and the number of carbon emissions; therefore, the retailer needs to invest more in green technology to curb the emissions. In the end, it results in a decrease in profit.

- (9)

- As we expected, the efficiency of greener technology (Y) helps the retailer to invest less in green technology. However, it does not increase profit significantly. The selling price and replenishment cycle also remain constant.

4.4. Managerial Insights

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

References

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2007: The Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Gao, X.; Zheng, H.; Zhang, Y.; Golsanami, N. Tax policy, environmental concern and level of emission reduction. Sustainability 2019, 11, 1047. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Chiu, A.S.F. Effects of carbon-emission and setup cost reduction in a sustainable electrical energy supply chain inventory system. Energies 2019, 12, 1226. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Tsao, Y.C.; Tseng, M.L. Sustainable inventory system with controllable non-instantaneous deterioration and environmental emission rates. J. Clean. Prod. 2020, 244, 118807. [Google Scholar] [CrossRef]

- Sarkar, B.; Ahmed, W.; Choi, S.B.; Tayyab, M. Sustainable inventory management for environmental impact through partial backordering and multi-trade-credit-period. Sustainability 2018, 10, 4761. [Google Scholar] [CrossRef]

- Tiwari, S.; Daryanto, Y.; Wee, H.M. Sustainable inventory management with deteriorating and imperfect quality items considering carbon emissions. J. Clean. Prod. 2018, 192, 281–292. [Google Scholar] [CrossRef]

- Lou, G.X.; Xia, H.Y.; Zhang, J.Q.; Fan, T.J. Investment strategy of emission-reduction technology in a supply chain. Sustainability 2015, 7, 10684–10708. [Google Scholar] [CrossRef]

- He, Y.; Huang, H. Optimizing inventory and pricing policy for seasonal deteriorating products with preservation technology investment. J. Ind. Eng. 2013, 793568, 1–7. [Google Scholar] [CrossRef]

- Mishra, U.; Tijerina-Aguilera, J.; Tiwari, S.; Cárdenas-Barrón, L.E. Retailer’s joint ordering, pricing, and preservation technology investment policies for a deteriorating item under permissible delay in payments. Math. Probl. Eng. 2018, 6962417, 1–14. [Google Scholar] [CrossRef]

- Saltveit, M.E. Effect of ethylene on quality of fresh fruits and vegetables. Postharvest Biol. Technol. 1999, 15, 279–292. [Google Scholar] [CrossRef]

- Barry, C.S.; Giovannoni, J.J. Ethylene and Fruit Ripening. J. Plant Growth Regul. 2007, 26, 143–159. [Google Scholar] [CrossRef]

- Kazemi, N.; Abdul-Rashid, S.H.; Ghazilla, R.A.R.; Shekarian, E.; Zanoni, S. Economic order quantity models for items with imperfect quality and emission considerations. Int. J. Syst. Sci. Oper. Logist. 2018, 5, 99–115. [Google Scholar] [CrossRef]

- Daryanto, Y.; Christata, B.R.; Kristiyani, I.M. Retailer’s EOQ model considering demand and holding cost of the defective items under carbon emission tax. IOP Conf. Ser. Mater. Sci. Eng. 2020, 847, 012012. [Google Scholar] [CrossRef]

- Rosenblatt, M.J.; Lee, H.L. Economic production cycles with imperfect production processes. IIE Trans. 1986, 18, 48–55. [Google Scholar] [CrossRef]

- Porteus, E.L. Optimal lot sizing, process quality improvement and setup cost reduction. Oper. Res. 1986, 34, 137–144. [Google Scholar] [CrossRef]

- Vishkaei, B.M.; Niaki, S.T.A.; Farhangi, M.; Rashti, M.E.M. Optimal lot sizing in screening processes with returnable defective items. J. Ind. Eng. Int. 2014, 10, 70. [Google Scholar] [CrossRef]

- Yu, H.F.; Hsu, W.K. An integrated inventory model with immediate return for defective items under unequal-sized shipments. J. Ind. Prod. Eng. 2017, 34, 70–77. [Google Scholar] [CrossRef]

- Salameh, M.K.; Jaber, M.Y. Economic production quantity model for items with imperfect quality. Int. J. Prod. Econ. 2000, 64, 59–64. [Google Scholar] [CrossRef]

- Goyal, S.K.; Huang, C.K.; Chen, K.C. A simple integrated production policy of an imperfect item for vendor and buyer. Prod. Plan. Control 2003, 14, 596–602. [Google Scholar] [CrossRef]

- Maddah, B.; Jaber, M.Y. Economic order quantity for items with imperfect quality: Revisited. Int. J. Prod. Econ. 2008, 112, 808–815. [Google Scholar] [CrossRef]

- Teng, H.M.; Hsu, P.H. Revisit economic ordering strategy for items with imperfect quality and backordering. Int. J. Manag. Enterp. Dev. 2013, 12, 251–262. [Google Scholar] [CrossRef]

- Lin, T.Y. An economic order quantity with imperfect quality and quantity discounts. App. Math. Model. 2010, 34, 3158–3165. [Google Scholar] [CrossRef]

- Wahab, M.I.M.; Jaber, M.Y. Economic order quantity model for items with imperfect quality, different holding costs, and learning effects: A note. Comput. Ind. Eng. 2010, 58, 186–190. [Google Scholar] [CrossRef]

- Alamri, A.A.; Harris, I.; Syntetos, A.A. Efficient inventory control for imperfect quality items. Eur. J. Oper. Res. 2016, 254, 92–104. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Khan, M.A.; Panda, G.C.; Konstantaras, I. Price discount facility in an EOQ model for deteriorating items with stock-dependent demand and partial backlogging. Int. Transact. Oper. Res. 2019, 26, 1365–1395. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Goel, S.K.; Mittal, M. Economic order quantity model for deteriorating items with imperfect quality and permissible delay on payment. Int. J. Ind. Eng. Comput. 2011, 2, 237–248. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Mittal, M.; Khanna, A. Effects of inspection on retailer’s ordering policy for deteriorating items with time-dependent demand under inflationary conditions. Int. J. Syst. Sci. 2013, 44, 1774–1782. [Google Scholar] [CrossRef]

- Moussawi-Haidar, L.; Salameh, M.; Nasr, W. Effect of deterioration on the instantaneous replenishment model with imperfect quality items. Appl. Math. Model. 2014, 38, 5956–5966. [Google Scholar] [CrossRef]

- Dye, C.Y. The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 2013, 41, 872–880. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Hasan, M.R.; Wee, H.M.; Daryanto, Y. Non-instantaneous deteriorating inventory model under the joined effect of trade-credit, preservation technology and advertisement policy. Kybernetes 2020, 49, 1645–1674. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Wee, H.M.; Huang, C.V. Preservation technology investment, trade credit and partial backordering model for a non-instantaneous deteriorating inventory. RAIRO-Oper. Res. 2019, in press. [Google Scholar] [CrossRef]

- Hsu, P.H.; Wee, H.M.; Teng, H.M. Preservation technology investment for deteriorating inventory. Int. J. Prod. Econ. 2010, 124, 388–394. [Google Scholar] [CrossRef]

- Dye, C.Y.; Yang, C.T.; Wu, C.C. Joint dynamic pricing and preservation technology investment for an integrated supply chain with reference price effects. J. Oper. Res. Soc. 2017, 69, 811–824. [Google Scholar] [CrossRef]

- Li, G.; He, X.; Zhou, J.; Wu, H. Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 2019, 84, 114–126. [Google Scholar] [CrossRef]

- Mashud, A.H.M. A deteriorating inventory model with different types of demand and fully backlogged shortages. Int. J. Logis. Sys. Manag. 2020, 36, 16–45. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Goh, M.; Shaikh, A.A. Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int. J. Prod. Econ. 2018, 200, 16–36. [Google Scholar] [CrossRef]

- Khan, M.A.; Shaikh, A.A.; Panda, G.C.; Konstantaras, I.; Taleizadeh, A.A. Inventory system with expiration date: Pricing and replenishment decisions. Comput. Ind. Eng. 2019, 132, 232–247. [Google Scholar] [CrossRef]

- Mishra, V.K.; Singh, L.S.; Kumar, R. An inventory model for deteriorating items with time-dependent demand and time-varying holding cost under partial backlogging. J. Ind. Eng. Int. 2013, 9, 1–5. [Google Scholar] [CrossRef]

- Sicilia, J.; González-De-la-Rosa, M.; Febles-Acosta, J.; Alcaide-López-de-Pablo, D. An inventory model for deteriorating items with shortages and time-varying demand. Int. J. Prod. Econ. 2014, 155, 155–162. [Google Scholar] [CrossRef]

- Tiwari, S.; Wee, H.M.; Sarkar, S. Lot-sizing policies for defective and deteriorating items with time-dependent demand and trade credit. Eur. J. Ind. Eng. 2017, 11, 683–703. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Wee, H.M.; Huang, C.V.; Wu, J.-Z. Optimal replenishment policy for deteriorating products in a newsboy problem with multiple just-in-time deliveries. Mathematics 2020, 8, 1981. [Google Scholar] [CrossRef]

- Saren, S.; Sarkar, B.; Bachar, R.K. Application of various price-discount policy for deteriorated products and delay-in-payments in an advanced inventory model. Inventions 2020, 5, 50. [Google Scholar] [CrossRef]

- Hasan, M.R.; Mashud, A.H.M.; Daryanto, Y.; Wee, H.M. A non-instantaneous inventory model of agricultural products considering deteriorating impacts and pricing policies. Kybernetes 2020, in press. [Google Scholar] [CrossRef]

- Khakzad, A.; Gholamian, M.R. The effect of inspection on deterioration rate: An inventory model for deteriorating items with advance payment. J. Clean. Prod. 2020, 254, 120117. [Google Scholar] [CrossRef]

- Bonney, M.; Jaber, M.Y. Environmentally responsible inventory models: Non-classical models for a non-classical era. Int. J. Prod. Econ. 2011, 133, 43–53. [Google Scholar] [CrossRef]

- Shi, Y.; Zhang, Z.; Chen, S.C.; Cárdenas-Barrón, L.E.; Skouri, K. Optimal replenishment decisions for perishable products under cash, advance, and credit payments considering carbon tax regulations. Int. J. Prod. Econ. 2020, 223, 107514. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Hazarkhani, B.; Moon, I. Joint pricing and inventory decisions with carbon emission considerations, partial backordering and planned discounts. Ann. Oper. Res. 2020, 290, 95–113. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Widyadana, G.A. Low carbon supply chain coordination for imperfect quality deteriorating items. Mathematics 2019, 7, 234. [Google Scholar] [CrossRef]

- Yang, D.; Xiao, T.; Huang, J. Dual-channel structure choice of an environmental responsibility supply chain with green investment. J. Clean. Prod. 2019, 210, 134–145. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Alizadeh-Basban, N.; Sarker, B.R. Coordinated contracts in a two-echelon green supply chain considering pricing strategy. Comput. Ind. Eng. 2018, 124, 249–275. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279, 123699. [Google Scholar] [CrossRef]

- Datta, T.K. Effect of green technology investment on a production-inventory system with carbon tax. Adv. Oper. Res. 2017, 4834839, 1–12. [Google Scholar] [CrossRef]

| j | L* | sp* | G* | λ* | Profit (α*) |

|---|---|---|---|---|---|

| 0 | 1.448 | 430.673 | 1.242 | 0.0105 | 2022.424 |

| 2 | 1.434 | 430.542 | 3.186 | 0.0170 | 2028.214 |

| 4 | 1.422 | 430.480 | 4.064 | 0.0183 | 2035.097 |

| 10 | 1.386 | 430.304 | 5.414 | 0.0192 | 2057.208 |

| 15 | 1.355 | 430.130 | 6.059 | 0.0195 | 2076.320 |

| 21 | 1.317 | 429.876 | 6.613 | 0.0196 | 2099.737 |

| Parameter | % Change | sp* | G* | L* | α* | % Changes in | |||

|---|---|---|---|---|---|---|---|---|---|

| sp* | G* | L* | α* | ||||||

| Tc | −20 | 427.168 | 4.061 | 1.296 | 2071.114 | −0.77 | −0.08 | −8.87 | 1.77 |

| −10 | 428.691 | 4.061 | 1.353 | 2055.223 | −0.42 | −0.07 | −4.88 | 0.99 | |

| 10 | 431.913 | 4.069 | 1.480 | 2017.875 | 0.33 | 0.12 | 4.08 | −0.85 | |

| 20 | 433.239 | 4.074 | 1.535 | 2001.093 | 0.64 | 0.25 | 7.97 | −1.67 | |

| wp | −20 | 430.928 | 3.999 | 1.580 | 2098.410 | 0.10 | −1.59 | 11.08 | 3.11 |

| −10 | 430.699 | 4.033 | 1.495 | 2066.155 | 0.05 | −0.77 | 5.14 | 1.53 | |

| 10 | 430.273 | 4.095 | 1.358 | 2005.108 | −0.05 | 0.76 | −4.47 | −1.47 | |

| 20 | 430.075 | 4.124 | 1.302 | 1976.047 | −0.09 | 1.48 | −8.42 | −2.90 | |

| ϕ1 | −20 | 430.515 | 4.064 | 1.424 | 2035.563 | 0.008 | −0.01 | 0.16 | 0.02 |

| −10 | 430.498 | 4.064 | 1.423 | 2035.330 | 0.004 | −0.002 | 0.08 | 0.01 | |

| 10 | 430.463 | 4.065 | 1.421 | 2034.865 | −0.004 | 0.02 | −0.06 | −0.01 | |

| 20 | 430.446 | 4.065 | 1.420 | 2034.632 | −0.008 | 0.03 | −0.14 | −0.02 | |

| ϕ2 | −20 | 430.480 | 4.064 | 1.422 | 2035.098 | 0.00 | 0.008 | 0.01 | 0.00 |

| −10 | 430.480 | 4.064 | 1.422 | 2035.098 | 0.00 | 0.008 | 0.01 | 0.00 | |

| 10 | 430.480 | 4.064 | 1.422 | 2035.097 | 0.00 | 0.008 | 0.01 | 0.00 | |

| 20 | 430.480 | 4.064 | 1.422 | 2035.097 | 0.00 | 0.008 | 0.01 | 0.00 | |

| r | −20 | 434.957 | 3.920 | 1.796 | 1935.716 | 1.04 | −3.54 | 26.29 | −4.88 |

| −10 | 432.900 | 3.986 | 1.613 | 1984.356 | 0.56 | −1.92 | 13.41 | −2.49 | |

| 10 | 427.412 | 4.164 | 1.218 | 2088.789 | −0.71 | 2.47 | −14.31 | 2.64 | |

| 20 | 422.903 | 4.309 | 0.986 | 2147.114 | −1.76 | 6.03 | −30.63 | 5.50 | |

| σ | −20 | 417.921 | 4.207 | 1.244 | 2365.504 | −2.92 | 3.53 | −12.54 | 16.24 |

| −10 | 424.024 | 4.138 | 1.330 | 2203.151 | −1.50 | 1.81 | −6.49 | 8.26 | |

| 10 | 437.084 | 3.989 | 1.519 | 1868.429 | 1.53 | −1.85 | 6.85 | −8.19 | |

| 20 | 444.772 | 3.899 | 1.638 | 1682.148 | 3.32 | −4.06 | 15.19 | −17.34 | |

| h1 | −20 | 429.887 | 4.069 | 1.423 | 2060.422 | −0.14 | 0.13 | 0.07 | 1.24 |

| −10 | 430.183 | 4.067 | 1.423 | 2047.749 | −0.07 | 0.07 | 0.04 | 0.62 | |

| 10 | 430.779 | 4.062 | 1.422 | 2022.469 | 0.07 | −0.05 | −0.01 | −0.62 | |

| 20 | 431.078 | 4.059 | 1.422 | 2009.863 | 0.14 | −0.11 | −0.03 | −1.24 | |

| h2 | −20 | 430.356 | 4.067 | 1.418 | 2035.468 | −0.03 | 0.06 | −0.31 | 0.02 |

| −10 | 430.418 | 4.065 | 1.420 | 2035.282 | −0.01 | 0.04 | −0.15 | 0.01 | |

| 10 | 430.542 | 4.063 | 1.424 | 2034.914 | 0.01 | −0.02 | 0.17 | −0.01 | |

| 20 | 430.603 | 4.062 | 1.427 | 2034.730 | 0.03 | −0.05 | 0.33 | −0.02 | |

| e | −20 | 427.754 | 4.077 | 1.306 | 2057.582 | −0.63 | 0.32 | −8.17 | 1.10 |

| −10 | 429.251 | 4.069 | 1.368 | 2045.652 | −0.29 | 0.13 | −3.78 | 0.52 | |

| 10 | 431.597 | 4.061 | 1.473 | 2024.925 | 0.26 | −0.09 | 3.60 | −0.50 | |

| 20 | 432.621 | 4.058 | 1.522 | 2015.092 | 0.50 | −0.15 | 7.02 | −0.98 | |

| nt | −20 | 431.528 | 4.017 | 1.593 | 2084.431 | 0.24 | −1.16 | 12.05 | 2.42 |

| −10 | 431.033 | 4.040 | 1.506 | 2060.373 | 0.13 | −0.59 | 5.91 | 1.24 | |

| 10 | 429.947 | 4.087 | 1.352 | 2012.143 | −0.12 | 0.57 | −4.92 | −1.13 | |

| 20 | 429.133 | 4.120 | 1.261 | 1979.473 | −0.31 | 1.38 | −11.34 | −2.73 | |

| Y | −20 | 430.489 | 4.615 | 1.423 | 2034.130 | 0.002 | 13.56 | 0.07 | −0.05 |

| −10 | 430.484 | 4.321 | 1.422 | 2034.656 | 0.001 | 6.31 | 0.03 | −0.02 | |

| 10 | 430.477 | 3.839 | 1.422 | 2035.474 | −0.001 | −5.53 | −0.01 | 0.02 | |

| 20 | 430.474 | 3.640 | 1.422 | 2035.799 | −0.001 | −10.42 | −0.03 | 0.03 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mashud, A.H.M.; Roy, D.; Daryanto, Y.; Ali, M.H. A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions. Mathematics 2020, 8, 2049. https://doi.org/10.3390/math8112049

Mashud AHM, Roy D, Daryanto Y, Ali MH. A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions. Mathematics. 2020; 8(11):2049. https://doi.org/10.3390/math8112049

Chicago/Turabian StyleMashud, Abu Hashan Md, Dipa Roy, Yosef Daryanto, and Mohd Helmi Ali. 2020. "A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions" Mathematics 8, no. 11: 2049. https://doi.org/10.3390/math8112049

APA StyleMashud, A. H. M., Roy, D., Daryanto, Y., & Ali, M. H. (2020). A Sustainable Inventory Model with Imperfect Products, Deterioration, and Controllable Emissions. Mathematics, 8(11), 2049. https://doi.org/10.3390/math8112049