Abstract

This paper studies a variation of the continuous-time mean-variance portfolio selection where a tracking-error penalization is added to the mean-variance criterion. The tracking error term penalizes the distance between the allocation controls and a reference portfolio with same wealth and fixed weights. Such consideration is motivated as follows: (i) On the one hand, it is a way to robustify the mean-variance allocation in the case of misspecified parameters, by “fitting" it to a reference portfolio that can be agnostic to market parameters; (ii) On the other hand, it is a procedure to track a benchmark and improve the Sharpe ratio of the resulting portfolio by considering a mean-variance criterion in the objective function. This problem is formulated as a McKean–Vlasov control problem. We provide explicit solutions for the optimal portfolio strategy and asymptotic expansions of the portfolio strategy and efficient frontier for small values of the tracking error parameter. Finally, we compare the Sharpe ratios obtained by the standard mean-variance allocation and the penalized one for four different reference portfolios: equal-weights, minimum-variance, equal risk contributions and shrinking portfolio. This comparison is done on a simulated misspecified model, and on a backtest performed with historical data. Our results show that in most cases, the penalized portfolio outperforms in terms of Sharpe ratio both the standard mean-variance and the reference portfolio.

1. Introduction

The Markowitz mean-variance portfolio selection problem has been initially considered in [1] in a single-period model. In this framework, investement decision rules are made according to the objective of maximizing the expected return of the portfolio for a given financial risk quantified by its variance. The Markowitz portfolio is widely used in the financial industry due to its intuitive formulation and the fact that it produces, by construction, portfolios with high Sharpe ratios (defined as the ratio of the average of portfolio returns over their volatility), which is a key metric used to compare investment strategies.

The mean-variance criterion involves the expected terminal wealth in a nonlinear way due to the presence of the variance term. In a continuous-time dynamic setting, this induces the so-called time inconsistency problem and prevents the direct use of the dynamic programming technique. A first approach, from [2], consists of embedding the mean-variance problem into an auxiliary standard control problem that can be solved by using stochastic linear-quadratic theory. Some more recent approaches rely on the development of stochastic control techniques for McKean–Vlasov (MKV) type control problems. MKV control problems are problems in which the equation of the state process and the cost function involve the law of this process and/or the law of the control, possibly in a non-linear way. The mean-variance portfolio problem in continuous-time is a McKean–Vlasov control problem of the linear-quadratic type. The state diffusion, which represents the wealth of the portfolio, involves the state process and the control in a linear way while the cost involves the terminal value of the state and the square of its expectation due to the variance criterion. In [3], the authors solved the mean-variance problem as a McKean–Vlasov control problem by deriving a version of the Pontryagin maximum principle. More recently, [4] developed a general dynamic programming approach for the control of MKV dynamics and applied it for the resolution of the mean-variance portfolio selection problem. In [5], the mean-variance problem is viewed as the MKV limit of a family of controlled many-component weakly interacting systems. These prelimit problems are solved by standard dynamic programming, and the solution to the original problem is obtained by passage to the limit.

A frequent criticism addressed to the mean-variance allocation is its sensitivity to the estimation of expected returns and covariance of the stocks and the risk of a poor out-of-sample performance. Several solutions to these issues have been considered. An approach consists of using a more sophisticated model than the Black–Scholes model, in which the parameters are stochastic or ambiguous and to take decisions under the worst-case scenario over all conceivable models. Robust mean-variance problems have thus been considered in the economic and engineering literature, mostly on single-period or multi- period models; see, e.g., [6,7,8]. In a continuous-time setting, ref. [9] have developed a robust approach by studying the mean-variance allocation with a market model where the model uncertainty affects the covariance matrix of multiple risky assets. In [10], the authors study the problem of utility maximization under uncertain parameters in a model where the parameters of the model do not evolve freely within a given range, but are constrained via a penalty function. Let us also mention uncertain volatility models in [11,12] for robust portfolio optimization with expected utility criterion. Another approach is to rely on the shrinking of the portfolio weights or of the wealth invested in each risky asset in order to obtain a more sparse or more stable portfolio. In [13], the authors find single-period portfolios that perform well out-of-sample in the presence of estimation error. Their framework deals with the resolution of the traditional minimum-variance problem with the additional constraint that the norm of the portfolio-weight vector must be smaller than a given threshold. In [14], the authors study a one-period mean-variance problem in which the mean-variance objective function is regularized with a weighted elastic net penalty. They show that the use of this penalty can be justified by a robust reformulation of the mean-variance criterion that directly accounts for parameter uncertainty. In the same spirit, in [15], -norm regularized models are used to seek near-optimal sparse portfolios.

In this paper, we investigate the mean-variance portfolio selection in continuous time with a tracking error penalization. This penalization represents the distance between the optimized portfolio composition and the composition of a reference portfolio with the same wealth but fixed weights that have been chosen in advance. Typical reference portfolios widely used in the financial industry are the equal weights, the minimum variance and the equal risk contribution (ERC) portfolios. The equal weights portfolio studied, e.g., in [16], is a portfolio where all the wealth of the investor is invested in risky assets and divided equally between the different assets. The minimum variance portfolio is a portfolio where all the wealth is invested in risky assets and portfolio weights are optimized in order to attain the minimal portfolio volatility. The ERC portfolio, presented in [17] and in the monography [18], is totally invested in risky assets and optimized such that the contributions of each asset to the total volatility of the portfolio are equal. The mix of the mean-variance and of this tracking error criterion can be interpreted in two different ways: (i) From a first viewpoint, it is a procedure to regularize and robustify the mean-variance allocation. By choosing reference portfolio weights which are not based on the estimation of market parameters, or which are less sensible to estimation error, the allocation obtained is more robust to parameters estimation error than the standard mean-variance one. (ii) From a second viewpoint, this optimization permits to mimic an allocation corresponding to the reference portfolio weights while improving its Sharpe ratio via the consideration of the mean-variance criterion.

We tackle this problem as a McKean–Vlasov linear-quadratic control problem and adopt the approach developed in [19], where the authors give a general method to solve this type of problems by means of a weak martingale optimality principle. We obtain explicit solutions for the optimal portfolio strategy and value function, and provide asymptotic expansions of the portfolio strategy and efficient frontier for small values of the portfolio tracking error penalization parameter. We then compare the Sharpe ratios obtained by the standard mean-variance portfolio, the penalized one and the reference portfolio in two different ways. First, we compare these performances on simulated market data with misspecified market parameters. Different magnitudes of parameter misspecifications are used to illustrate the impact of the parameter estimation error on the performance of the different portfolios. In a second time, we compare the performances of these portfolios on a backtest based on historical market data. In these tests, we shall consider three reference portfolios cited above: the equal weights, the minimum variance and the equal risk contribution (ERC) portfolios. Finally, we will also consider the case where the reference portfolio weights are all equal to zero. This case corresponds to a shrinking of the wealth invested in the different risky assets along the investment horizon.

The rest of the paper is organized as follows. Section 2 formulates the mean-variance problem with tracking error. In Section 3, we derive explicit solutions for this control problem and provide expansion of this solution for small values of the tracking error penalization parameter. Section 4 is devoted to the applications of those results and to the comparison of the mean-variance, penalized and reference portfolio for the different reference portfolios presented above. We show the benefit of the penalized portfolio compared to the standard mean-variance portfolio and the different reference portfolios on simulated and historical data in terms of Sharpe ratio and the lower sensitivity of the penalized portfolio to parameter estimation error.

2. Results

Throughout this paper, we fix a finite horizon T∈, and a complete probability space on which a standard -adapted d-dimensional Brownian motion W= is defined. We denote by the set of all -valued, measurable stochastic processes adapted to such that . We consider a financial market with price process , composed of one risk-free asset, assumed to be constant equal to one, i.e., ≡ 1, and d risky assets on a finite investment horizon . These assets price processes satisfy the following stochastic differential equation:

where is the appreciation rate, and is the volatility matrix of the d stocks. We denote by the covariance matrix. Throughout this paper, we will assume that the following nondegeneracy condition holds

for some , where is the identity matrix.

Let us consider an investor with total wealth at time denoted by , starting from some initial capital > 0. It is assumed that the trading of shares takes place continuously and transaction cost and consumptions are not considered. We define the set of admissible portfolio strategies = as

where represents the total market value of the investor’s wealth invested in the ith asset at time t. The dynamics of the self-financed wealth process X= associated to a portfolio strategy ∈ is then driven by

Given a risk aversion parameter , and a reference weight ∈, the objective of the investor is to minimize over admissible portfolio strategies a mean-variance functional to which is added a running cost:

This running cost represents a running tracking error between the portfolio composition of the investor and the reference composition of a portfolio of same wealth and constant weights . The matrix is symmetric positive definite and is used to introduce an anisotropy in the portfolio composition penalization. The penalization , which we will call “tracking error penalization", is introduced in order to ensure that the portfolio of the investor does not move away too much from this reference portfolio with respect to the distance .

The mean-variance portfolio selection with tracking error is then formulated as

and an optimal allocation given the cost will be given by

We complete this section by recalling the solution to the mean-variance problem when there is no tracking error running cost, and which will serve later as benchmark for comparison when studying the effect of the tracking error with several reference portfolios.

Remark 1 (Case of no tracking error).

When , it is known, see e.g., [2] that the optimal mean-variance strategy is given by

where is the wealth process associated to . The vector , which depends only on the model parameters of the risky assets, determines the allocation in the risky assets.

In the sequel, we study the quantitative impact of the tracking error running cost on the optimal mean-variance strategy.

3. Solution Allocation with Tracking Error

Our main theoretical result provides an analytic characterization of the optimal control to the mean-variance problem with tracking error.

Theorem 1.

There exist a unique pair solution to the system of ODEs

where . The optimal control for problem (3) is then given by

with

and is the wealth process associated to . Moreover, we have

Proof.

Given the existence of a pair solution to (5), the optimality of the control process in (6) follows by the weak version of the martingale optimality principle as developed in [19]. The arguments are recalled in Appendix A.

Here, let us verify the existence and uniqueness of a solution to the system (5).

- (i)

- We first consider the equation for K, which is a scalar Riccati equation. The equation for K is associated to the standard linear-quadratic stochastic control problem:where is the controlled linear dynamics solution toBy a standard result in control theory ([20] Ch. 6, Thm. 6.1, 7.1, 7.2), there exists a unique solution to the first equation of system (5) (more, if is nonzero). In this case, we have .

- (ii)

- Given K, we consider the equation for . This is also a scalar Riccati equation. By the same arguments as for the K equation, there exists a unique solution to the second equation of (5), provided thatfor some . We already have that . From the fact that , together with the nondegeneracy condition on the matrix , we have that . Since > 0, and under the nondegeneracy condition of matrix , we can use the Woodbury matrix identity to obtainWe then get

- (iii)

- Given , the equation for Y is a linear ODE, whose unique continuous solution is explicitly given by

- (iv)

- Given , R can be directly integrated into

□

We can see from the expression of the optimal control (6) that the allocation in the risky assets has two components. One component is determined by the vector with leverage , and the second one by the vector with leverage . Computing the average wealth = associated to , we can express the control as a function of the initial wealth of the investor and the current wealth

where we set and .

Remark 2.

In the case when Γ is the null matrix, Γ = , we see that the first component of the optimal control (7) vanishes,

and the system of ODES (5) of becomes

which yields the explicit forms

We get , and . The first line of the optimal control equation vanishes and the second line can be rewritten as

Computing the integral in this expression, we recover the optimal control of the classical mean-variance problem (4).

Remark 3(Limit offor).

If we consider Γ in the form , the optimal control can be rewritten as

We show in Appendix D that and are bounded functions of the penalization parameter γ, thus .

We rewrite as

and we get that . Thus the second term of (8) vanishes and we get

which corresponds to the reference portfolio.

Remark 4(Expansion for).

We take . Since the covariance matrix Σ is symmetric, there exists an invertible matrix and a diagonal matrix such that . We can then rewrite the matrix as

with

where is the i-th diagonal value of the diagonal matrix D. From the nondegeneracy condition of the covariance matrix, we have . As , we want to write the Taylor expansion of the diagonal elements of the inverse matrix equal to . We have that , thus . We can then write the Taylor expansion of the matrix as

keeping only the terms up to the linear term in γ.

Putting this expression in the differential equation of K, and keeping only the terms up to the linear term in γ, we get the differential equation

where we set . We look for a solution to this equation of the form

Putting this expression in the differential Equation (9), we get two differential equations, for the leading order and the linear order in γ respectively

which yield the explicit solution

where is the solution to the differential equation in the unpenalized case.

From the expansion for K, we can write the expansion of the differential equation for Λ up to the linear term in γ. We use the expansion

and we get the following expansion of the differential equation of Λ

As before, we look for a solution of this differential equation of the form

Plugging this expression into the Equation (10), we get the two following differential equations

The first differential equation yields the solution . Replacing by this value in the second differential equation, we get the equation

and obtain the solution

We can also compute the first order expansion of

where we set

and we have

The last expansion we need to compute before rewritting the optimal control is the expansion of . We can rewrite

with

We see that for , we recover the classical mean-variance optimal control. For non-zero values of γ, we see that a mix of three different portfolio allocations is obtained. The weight of the allocation is modified and two allocations and appear with weights and .

From this expansion of the control , we can compute the first order asymptotic expansion in γ of the equation giving the relation between the variance of the terminal wealth of the portfolio and its expectation. In the classical mean-variance case, this equation is called the efficient frontier formula. As shown in Appendix C, with the tracking error penalization, the first order asymptotic expansion in γ gives

The leading order term corresponds to the efficient frontier equation of the classical mean-variance allocation computed in [2], and thus for , we recover this classical result. The linear term in γ contains contributions of the three perturbative allocations. A modification of "leverage" of the original mean-variance allocation and two different allocations and .

4. Applications and Numerical Results

In this section, we apply the results of the previous section and study the allocation obtained by considering four different static portfolios as reference. First, we shall study these allocations on simulated data, in the case of misspecified parameters. The misspecification of parameters means that the market parameters used to compute the portfolio allocations are different from the ones driving the stocks prices. This study allows us to estimate the impact of the estimation error on the portfolio performance. For a second time, we perform a backtest and run the different portfolios on real market data. To simplify the presentation, we will assume now that the tracking error penalization matrix is in the form with . With this simplification, we have and we can rewrite the system of ODEs (5) and the optimal control (6) as

and

where

We will consider three different classical allocations as reference portfolio.

- Equal-weights portfolio: in this classical equal-weights portfolio, the same capital is invested in each asset, thuswhere d is the number of risky assets considered and is the vector of ones.

- Minimum variance portfolio: the minimum variance portfolio is the portfolio which achieves the lowest variance while investing all its wealth in the risky assets. The weight vector of this portfolio is equal toThese weights correspond to the one-period Markowitz portfolio when every asset expected return is taken equal to 1. In that case, only the portfolio variance is relevant and is minimized during the optimization process.

- ERC portfolio: the equal risk contributions (ERC) portfolio, presented in [17] and in the monograph [18] is constructed by choosing a risk measure and computing the risk contribution of each asset to the global risk of the portfolio. When the portfolio volatility is chosen as the risk measure, the principle of the ERC portfolio lays in the fact that the volatility function satisfies the hypothesis of Euler’s theorem and can be reduced to the sum of its arguments multiplied by their first partial derivatives. The portfolio volatility of a portfolio with weights vector can then be rewritten asThe term under the sum , corresponding to the i-th asset, can be interpreted as the contribution of this risky asset to the total portfolio volatility. The equal risk contribution allocation is then defined as the allocation in which these contributions are equal for all the risky assets of the portfolio, for every . The equal risk contribution allocation is thus obtained when the portfolio weights are given byWith this risk measure, the ERC portfolio weights can be expressed in a closed-form only in the case where the correlations between every couple of stocks are equal, that is , with the additional assumption that . Under these assumptions, and with the constaint that , the weights of this portfolio are equal towhere is the volatility of the i-th asset.In the general case, the weights of the ERC portfolio do not have a closed form and must be computed numerically by solving the following optimization problem

- Control shrinking (zero portfolio): this is the portfolio where all weights are equal to zero, for all i. This case corresponds to a shrinking of the controls of the penalized allocation, in the same spirit as the shrinking of regression coefficients in the Ridge regression (or Tikhonov regularization).

4.1. Performance Comparison with Monte Carlo Simulations

In this section we compare, for each reference portfolio, the classical dynamic mean-variance allocation, the reference portfolio and the “tracking error" penalized portfolio. In a real investment situation, expected return and covariance estimates are noisy and biased. Thus, in order to compare the three portfolios and observe the impact of adding a tracking error penalization in the mean-variance allocation, we will run Monte Carlo simulations, assuming that the real-world expected returns and covariances are equal to reference expected returns and covariances plus some noise:

with the volatilties and correlations and

where the covariance matrix is obtained from and . The noise follows a standard normal distribution and is its magnitude. We use Monte Carlo simulations to estimate the expected Sharpe ratio of each portfolio, equal to the average of the portfolio daily returns R divided by the standard deviation of those returns: .

We consider an investment horizon of one year, with 252 business days and a daily rebalancing of the portfolio. The risk aversion parameter is chosen so that the targeted annual return of the classical mean-variance allocation is equal to , thus according to [2]. The initial wealth of the investor is chosen equal to 1 and we choose the penalization parameter . Indeed, as the value of depends on the value of the stocks expected return and covariance matrix and on the targeted return, and can be very big, we express a function of this in order for the penalization to be relevant and non-negligible.

For each reference portfolio, we compare the reference portfolio, the classical mean-variance allocation and the penalized one for values of noise amplitude ranging from 0 to 1. For each value of , we run 2000 scenarios and we plot the graphs of the average Sharpe ratio as a function of .

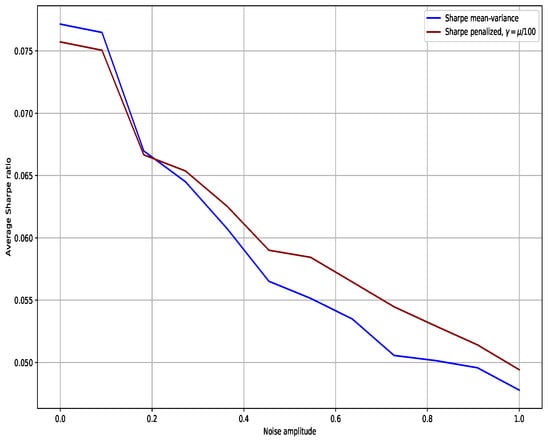

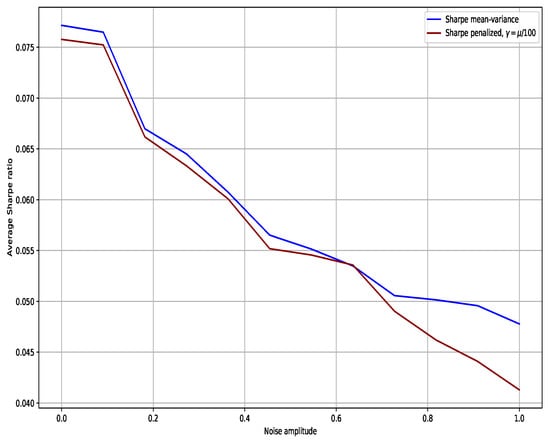

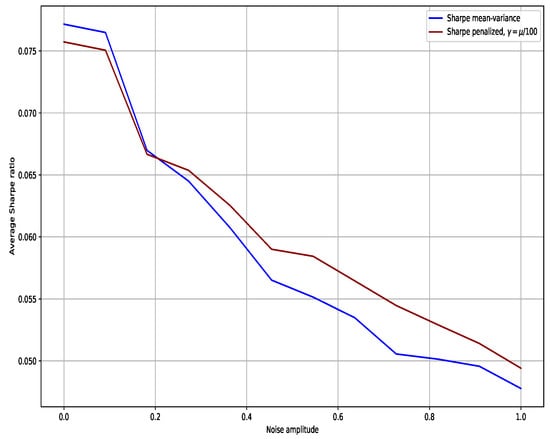

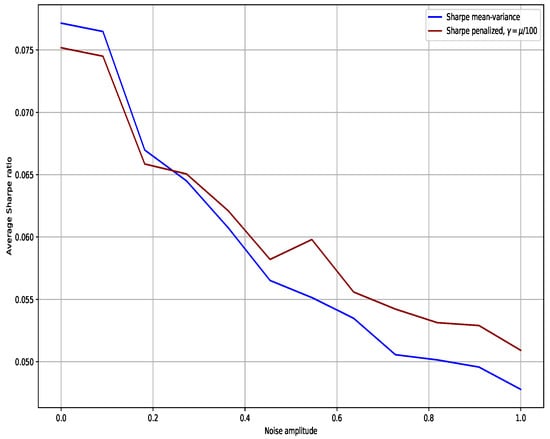

On the Figure 1, Figure 2, Figure 3 and Figure 4, we can see that in the four cases, the mean-variance and the penalized portfolios are superior to the reference. In the case where the equal weights portfolio is chosen as reference, the penalized portfolio’s Sharpe ratio is lower than the mean-variance one for small values of . For greater than approximately 0.25, the penalized portfolio’s Sharpe ratio becomes larger and the gap with the mean-variance’s Sharpe tends to increase with . The same phenomenon occurs in the case where the ERC portfolio is chosen as reference, with a smaller gap between the mean-variance and penalized portfolios’ Sharpe ratios. When the minimum variance portfolio is chosen as reference, the penalized portfolio’s Sharpe ratio is lower than the one of the mean-variance portfolio for all in the interval . This is certainly due to the sensitivity of the minimum variance portfolio to the estimator of the covariance matrix. Finally, in the case of the control shrinking, the Sharpe ratio of the penalized portfolio is significantly higher that the Sharpe ratio of the mean-variance portfolio, for every value of the noise amplitude in the interval .

Figure 1.

The highest average Sharpe ratio attained by the equal-weight portfolio is equal to 0.047 for .

Figure 2.

The highest average Sharpe ratio attained by the minimum-variance portfolio is equal to 0.057 for .

Figure 3.

The highest average Sharpe ratio attained by the ERC portfolio is equal to 0.051 for .

Figure 4.

In this case the reference weights are equal to zero, and no Sharpe ratio is computed for the reference portfolio.

- Equal-weights reference portfolio

- Minimum-variance reference portfolio

- ERC reference portfolio

- Control shrinking (zero reference)

4.2. Performance Comparison on a Backtest

We now compare the different allocations on a backtest based on adjusted close daily prices available on Quandl between 2013-09-03 and 2017-12-28 for four stocks: Apple, Microsoft, Boeing and Nike. Here we chose a value of which corresponds to an annual expected return of . In our example, we express again as a function of and we consider two different values, and .

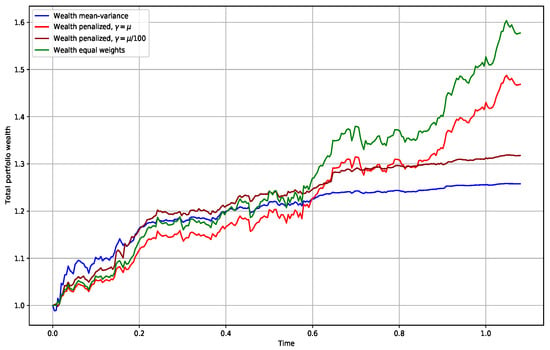

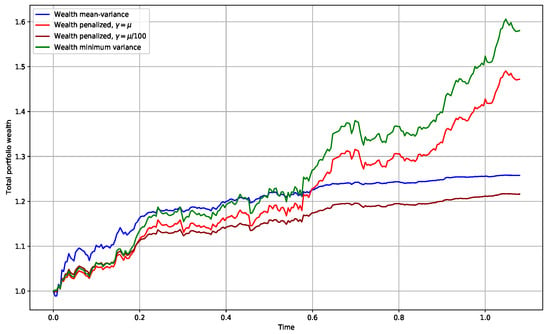

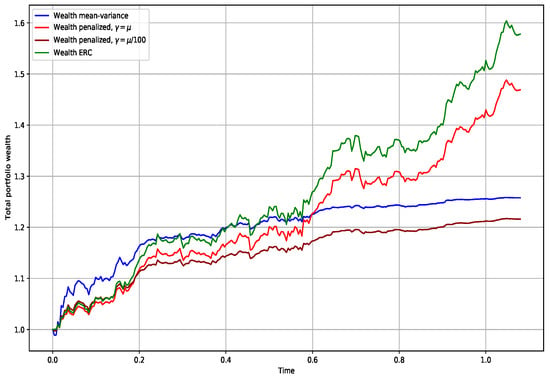

Figure 5, Figure 6 and Figure 7 show the total wealth of the four different portfolios, mean-variance, reference and the penalized portfolio with the big and the small penalization as a function of time. On these graphs we observe that, at the beginning of the investment horizon, the mean-variance allocation has the largest wealth increase, hence the largest leverage. As the wealth of this portfolio attains the target wealth, expressed as in the mean-variance control Equation (4), its leverage decreases and its wealth curve flattens. The same phenomenon occurs for the penalized allocation with large penalization parameter . In this case, the high value of the penalization parameter keeps the penalized portfolio controls close to the ones of the mean-variance portfolio. On the contrary, the reference portfolios have constant weights and no target wealth. We can see that in each case the reference portfolio’s wealth keeps increasing over the entire horizon. The wealth of the penalized portfolio with penalization parameter follows the wealth of these reference portfolio due to the small value of the tracking error penalization.

Figure 5.

Sharpe ratios: Mean-variance: 0.183; Equal weights: 0.258; Penalized : 0.260; Penalized : 0.226.

Figure 6.

Sharpe ratios: Mean-variance: 0.183; Minimum variance: 0.255; Penalized : 0.256; Penalized : 0.220.

Figure 7.

Sharpe ratios: Mean-variance: 0.183; ERC: 0.258; Penalized : 0.260; Penalized : 0.225.

For these three reference portfolios, we observe that the penalized portfolio with penalization parameter outperforms both the mean-variance and the reference portfolios in terms of Sharpe ratio whereas the penalized portfolio with penalization parameter outperforms the mean-variance but underperforms the reference portfolio. This can be attributed to the larger weight of the mean-variance criterion with respect to the tracking error in the optimized cost (2) with penalization parameter .

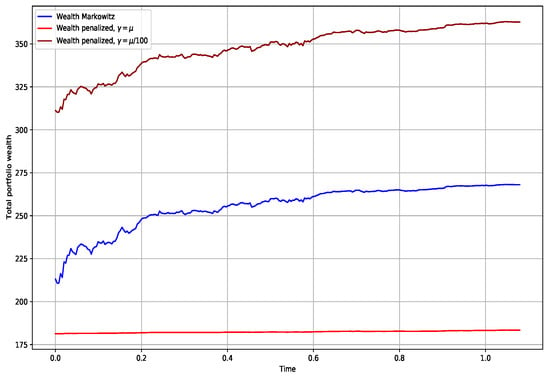

Finally, Figure 8 corresponds to the case of a reference portfolio with weights all equal to zero. This corresponds to a shrinking of the optimal control of the penalized portfolio. In that case, for a better visualization, we plot the total wealth of the mean-variance and penalized portfolios for penalization parameters and normalized by the standard deviation of their daily returns. On this graph, we can see that the normalized wealth of the two penalized portfolio is higher than the one of the mean-variance allocation. Similarly to the three precedent reference portfolios, the two penalized portfolios outperform the mean-variance allocation in terms of Sharpe ratio. As previously, we observe that the Sharpe ratio of the penalized portfolio with penalization parameter is greater than the one with , due to the larger weight of the mean-variance criterion in the functional cost.

Figure 8.

Total wealth of the mean-variance and penalized portfolios for and , normalized by the standard deviation of daily returns, as a function of time. Sharpe ratios: mean-variance: 0.183; Penalized : 0.252; Penalized : 0.221.

- Equal-weights reference portfolio

- Minimum variance reference portfolio

- ERC portfolio

- Zero portfolio (shrinking)

5. Conclusions

In this paper, we propose an allocation method based on a mean-variance criterion plus a tracking error between the optimized portfolio and a reference portfolio of same wealth and fixed weights. We solve this problem as a linear-quadratic McKean–Vlasov stochastic control problem using a weak martingale approach. We then show using simulations that for a certain degree of market parameter misspecification and the right choice of reference portfolio, the mean-variance portfolio with tracking error penalization outperforms the standard mean-variance and the mean-variance allocations in terms of Sharpe ratio. Another backtest based on historical market data also shows that the mean-variance portfolio with tracking error outperforms the traditional mean-variance and the reference portfolios in terms of Sharpe ratio for the four reference portfolios considered.

Compared to the approaches of robust and bayesian optimization ([9,21]), the regularization of the mean-variance allocation by a tracking-error penalization offers a more intuitive and simple approach from the financial point of view as the specification of the reference portfolio has a clear operationnal meaning. The benchmark tracking with improvement of the Sharpe ratio is intrinsically linked to the method described in this article and is, by definition, absent of the two other approaches.

Depending on the penalization parameter , the choice of the reference portfolio plays an important role. If this reference portfolio is not agnostic and the computation of its weights is based on estimated market parameters, it will also be impacted by the parameter misspecification and the allocation will be more sensitive to estimation errors. The allocation would be more robust when an agnostic portfolio to market parameters, such as the equal-weights portfolio or the zero portfolio (control shrinking), is chosen as reference.

In our approach, the mean-variance criterion in the optimized cost function is based on estimated market parameters. Hence, while regularized by the tracking-error penalization, the allocation obtained still has a sensitivity to parameter misspecification. This constitutes a limitation compared to a robust optimization approach which optimizes the portfolio in the worst case scenario and is then unimpaired by parameter misspecification. Nevertheless, as the optimization of the mean-variance allocation with tracking error is based on estimators of the market parameters and not on a worst-case scenario, this allocation should outperform the robust approach for smaller values of parameter misspecification.

A potential direction for further studies would be to compare quantitatively the approach of the tracking error penalization with the robust optimization and the Bayesian approach. It would also be interesting to compare the method presented in this paper with Deep Learning based approaches such as the ones presented in [22,23].

Author Contributions

W.L. and G.L. designed the experiments; W.L. performed the experiments; W.L. and G.L. analyzed the data; W.L., G.L. and H.P. contributed to the mathematical analysis; H.P. designed the theoretical framework of this study. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

This work is issued from a CIFRE collaboration between BNP Paribas Global Markets and LPSM.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Proof of Theorem 1

The proof of Theorem 1 is based on the weak optimality principle lemma stated in [19], and formulated in the case of the mean-variance problem (3) as:

Lemma A1 (Weak optimality principle).

Let be a family of real-valued processes in the form

for some measurable functions on , , such that:

- =, for all ,

- the function is nondecreasing for all

- the map is constant for some .

Then, is an optimal portfolio strategy for the mean-variance problem with tracking error (3), and

We aim to construct a family of processes as in Lemma A1, and given the linear-quadratic structure of our optimization problem, we look for a measurable function in the form:

for some deterministic processes to be determined. Condition in Lemma A1 fixes the terminal condition

For any , with associated wealth process , let us compute the derivative of the deterministic function with as in (A1). From the dynamics of in (1) and by applying Itô’s formula, we obtain

where

By completing the square in , and setting and , we rewrite as

with . The expression in (A2) is then rewritten as

Therefore, whenever

holds for all , we have

which is nonnegative for all , i.e., the process satisfies the condition of Lemma A1. Moreover, we see that if and only if , .

is solution to a linear McKean–Vlasov dynamics and, since , and , satisfies the square integrability condition , which implies that is -progressively measurable and . Therefore, , and we conclude by the verification Lemma A1 that it is the unique optimal control. □

Appendix B. Computation Linear Expansion of αγ for Γ = γ𝕀d → 0

Appendix C. Computation Linear Expansion of Var (XT) for Γ = γ𝕀d →0

We recall that the linear expansion of the optimal control can be written as

where the coefficients , and are given by (12). The average total wealth of the portfolio constructed by the optimal control at time t is given by the ODE

where we set . We get the solution

with

and

The average of the square of the portfolio wealth at time t is given by the ODE

which gives the solution

We can then compute the variance of the terminal total wealth of the portfolio given by the control (11)

Appendix D. Proof that Kt and Λt are Bounded in γ

To prove this, we use a theorem from [24] (also in [25], Theorem 14.1, p. 93). We rewrite the differential equation of K as

with , where denotes the euclidean norm in .

For , the partial derivatives and exist and are continuous in the neighbourhood of the solution . Then the partial derivative

exists, is continuous, and satisfies the differential equation

Recalling that the derivative of the inverse of a nonsingular matrix M whose elements are functions of a scalar parameter p w.r.t this parameter is equal to , we can compute the partial derivatives and , and we obtain the following differential equation for

This ODE has an explicit solution given by

with equal to

and

We have , thus and is bounded in for every .

In the same spirit, we rewrite the differential equation of as

with . The partial derivative

exists, is continuous and satisfies the differential equation

which gives the explicit solution

with equal to

and

We showed that for every . Thus , and , . is then bounded in for every . □

References

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Zhou, X.Y.; Li, D. Continuous-time mean-variance portfolio selection: A stochastic LQ framework. Appl. Math. Opt. 2000, 42, 19–33. [Google Scholar] [CrossRef]

- Andersson, D.; Djehiche, B. A maximum principle for SDEs of mean-field type. Appl. Math. Opt. 2011, 63, 341–356. [Google Scholar] [CrossRef]

- Pham, H.; Wei, X. Dynamic programming for optimal control of stochastic McKean–Vlasov dynamics. SIAM J. Control. Optim. 2017, 55, 1069–1101. [Google Scholar] [CrossRef]

- Fischer, M.; Livieri, G. Continuous time mean-variance portfolio optimization through the mean field approach. ESAIM Probab. Stat. 2016, 20, 30–44. [Google Scholar] [CrossRef]

- Fabozzi, F.J.; Huang, D.; Zhou, G. Robust portfolios: Contributions from operations research and finance. Ann. Oper. Res. 2010, 176, 191–220. [Google Scholar] [CrossRef]

- Pinar, M.C. On robust mean-variance portfolios. Optimization 2016, 65, 1039–1048. [Google Scholar] [CrossRef]

- Liu, J.; Zeng, X. Correlation Ambiguity and under-Diversification. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2692692 (accessed on 18 September 2020).

- Ismail, A.; Pham, H. Robust Markowitz mean-variance portfolio selection under ambiguous covariance matrix. Math. Financ. 2019, 29, 174–207. [Google Scholar] [CrossRef]

- Guo, I.; Langrené, N.; Loeper, G.; Ning, W. Robust Utility Maximization under Model Uncertainty via a Penalization Approach. 2020. Available online: https://papers.ssrn.com/abstract=3612503 (accessed on 18 September 2020).

- Matoussi, A.; Possamaï, D.; Zhou, C. Robust Utility Maximization in non-Dominated Models with 2BSDEs. 2015. Available online: http://arxiv.org/abs/1201.0769 (accessed on 18 September 2020).

- Lin, Q.; Riedel, F. Optimal Consumption and Portfolio Choice with Ambiguity. 2014. Available online: http://arxiv.org/abs/1401.1639 (accessed on 18 September 2020).

- DeMiguel, V.; Garlappi, L.; Nogales, F.J.; Uppal, R. A generalized approach to portfolio optimization: Improving performance by constraining portfolio norms. Manag. Sci. 2009, 55, 798–812. [Google Scholar] [CrossRef]

- Ho, M.; Sun, Z.; Xin, J. Weighted elastic net penalized mean-variance portfolio design and computation. SIAM J. Financ. Math. 2015, 6, 1220–1244. [Google Scholar] [CrossRef]

- Chen, C.; Li, X.; Tolman, C.; Wang, S.; Ye, Y. Sparse Portfolio Selection via Quasi-Norm Regularization. 2013. Available online: http://arxiv.org/abs/1312.6350 (accessed on 18 September 2020).

- Duchin, R.; Levy, H. Markowitz versus the Talmudic portfolio diversification strategies. J. Portfolio Manag. 2009, 35, 71–74. [Google Scholar] [CrossRef]

- Maillard, S.; Roncalli, T.; Teïletche, J. The properties of equally weighted risk contribution portfolios. J. Portfolio Manag. 2010, 36, 60–70. [Google Scholar] [CrossRef]

- Roncalli, T. Introduction to Risk Parity and Budgeting; CRC Press: Boca Raton, FL, USA, 2013. [Google Scholar]

- Basei, M.; Pham, H. A weak martingale approach to linear-quadratic McKean–Vlasov stochastic control problems. J. Optimiz. Theory App. 2019, 181, 347–382. [Google Scholar] [CrossRef]

- Yong, J.; Zhou, X.Y. Stochastic Controls: Hamiltonian Systems and HJB Equations; Springer Science & Business Media: New York, NY, USA, 1999. [Google Scholar]

- De Franco, C.; Nicolle, J.; Pham, H. Bayesian learning for the Markowitz portfolio selection problem. Int. J. Theor. Appl. Financ. 2019, 22, 1950037. [Google Scholar] [CrossRef]

- Ta, V.-D.; Liu, C.-M.; Tadesse, D.A. Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading. Appl. Sci. 2020, 10, 437. [Google Scholar] [CrossRef]

- Rundo, F.; Trenta, F.; di Stallo, A.L.; Battiato, S. Grid Trading System Robot (GTSbot): A Novel Mathematical Algorithm for Trading FX Market. Appl. Sci. 2019, 9, 1796. [Google Scholar] [CrossRef]

- Gronwall, T.H. Note on the derivatives with respect to a parameter of the solutions of a system of differential equations. Ann. Math. 1919, 20, 292–296. [Google Scholar] [CrossRef]

- Hairer, E.; Nørsett, S.P.; Wanner, G. Solving Ordinary Differential Equations I: Nonstiff Problems, 2nd ed.; Springer: Cham, Switzerland, 1993. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).