1. Introduction

Not only chaosbut also other types of movement patterns (like period and quasiperiod) that come from experimental data and those generated by simulations of a given model reflect phenomena in mathematics and the sciences (including economics) (for motivation, see, e.g., Reference [

1,

2]).

Since it seems that chaos is something undesirable, one can try to avoid or prevent it [

3]. Conversely, there are numerous situations where having random-looking and irregular patterns is in fact desirable, e.g., the record of EEG. So, it depends on the specific situation whether chaos is desirable or undesirable.

Therefore, many scientists have applied chaos control theory in the hope of achieving suppression (called chaos control) and stimulation (chaos anti-control) for improvement of performance and preservation of stability, which would lead to improved economic efficiency of market models.

Economic dynamics has not been investigated for a long time because of the high mathematical computational requirements. With the recent development of computers, especially ready-made software packages, and the development of mathematical theory, economists can now fairly easily handle complex dynamical systems [

4].

For investigative purposes, new methods for controlling the dynamical properties of the

impulsive method of dynamical systems theory are used. This changes the systems variable in the form of instantaneous pulses periodically occurring [

5,

6].

The focus of this paper is on chaos control and anti-control of the heterogeneous Cournot oligopoly model introduced in Reference [

7] by investigation of impulsive control (the theory of imperfect competition à la Cournot has been deeply researched for more than the past century (see, e.g., Reference [

8,

9,

10,

11]), and influence of demand type functions have been considered: linear in Reference [

12], piecewise linear in Reference [

11], for duopoly, iso-elastic in Reference [

13], for triopoly and other, more sophisticated, types in Reference [

14,

15]). For this purpose, the

impulsed dynamical system is introduced. For chaos and regularity determination, the 0-1 test for chaos, the maximal Lyapunov exponent, and the Power Spectrum Density (PSD) [

16] are used, supported by time histories of trajectories, bifurcation diagrams, and basins of attractions.

Using the after-going technique in Equation (

2) and application of the previously mentioned methods, it will be shown that there are impulse values for which the impulsed system Equation (

11) admits a self-excited cycle or chaotic trajectory (Property 1 and 2). This demonstrates the effectivity of the selected method of chaos suppression and stimulation with its practical importance.

The paper starts with an introduction to the topic in

Section 1, followed by the impulsive control system declaration in

Section 2, and continuing with the main results in

Section 3 and

Section 4, where firstly chaos control is researched and secondly chaos anti-control is observed. In the following

Section 5, the results of the previous two sections are compared. Next, in

Section 6, some alternative approaches to the investigation of impulse control are given to show different possibilities of chaos control and anti-control of the researched system. The paper closes with concluding notes in the last part,

Section 7.

2. The Impulsive Control System

Let

be a discrete dynamical system; usually

X is assumed to be a compact metric space and

continuous onto (not necessarily into) map. Without loss of generality, we can assume that the dimension of

X equals

k and the dynamics of

is given by the difference equation

with

for any

, and the underlying initial condition

.

Following the ideas of Reference [

17] (see also references therein), the next

impulsive difference equation can be defined for dynamics control of the original difference Equation (

1):

where

and

is an increasing sequence of natural numbers,

is the step size, and

is the constant injection quantity applied at every

step. Note that the above (impulse) difference equation is introduced in a “symmetric” way, meaning that the same valued injection

is applied at every

step to every variable.

Hence, the

impulsed dynamical system can be classified using

since

where

is the floor function, and

stands for

-th iteration of

f, that is

Using Equation (

4), one can easily derive

from which it follows that any

p-cycle of

F generates a

-cycle of Equation (

2).

Now, consider the

heterogeneous Cournot oligopoly model (HCOM) introduced in Reference [

7] (also see Reference [

18]), where it is considered a set of identical quantity setting agents

that compete in the same market for a homogeneous good, in which demand is summarized by a linear inverse-demand function

,

a and

b being its scalar parameters. Let us denote by

the quantity of goods that is a generic

i-th agent, with

selling in the market at time-period

n. All the agents bear the same constant marginal production cost

c, so that the generic

i-th agent earns the profit

The oligopoly, in this case, is characterized by introducing heterogeneous decision mechanisms, used to decide what quantity of goods to produce by considering a population structured into two groups of agents of different kinds. The first group, denoted by

, includes boundedly rational players that use the

gradient rule first proposed in Reference [

19] and are hence called the

gradient players group;

includes agents that adopt an imitation-based decision mechanism and are called

imitator players.

The collective behavior of the whole heterogeneous population of

N players is described by the following 2-dimensional non-linear discrete dynamical system:

where

The system Equation (

8) has two stationary states. The first one (non-zero if

) takes the form

, where

and the second one is located on the positive part of the horizontal axis, that is,

, where

. Their stability is:

Proposition 1 - (i)

The equilibrium is locally asymptotically stable ifwhereand - (ii)

The equilibrium is (hyperbolic) stable if

Deep analysis of the dynamic properties of the HCOM Equation (

8) model was performed in Reference [

20] through the investigation of hidden-attractors and multistability.

Finally, by applying impulsive control Equation (

2), HCOM Equation (

8) becomes an

injected heterogeneous Cournot oligopoly model (IHCOM):

with

where

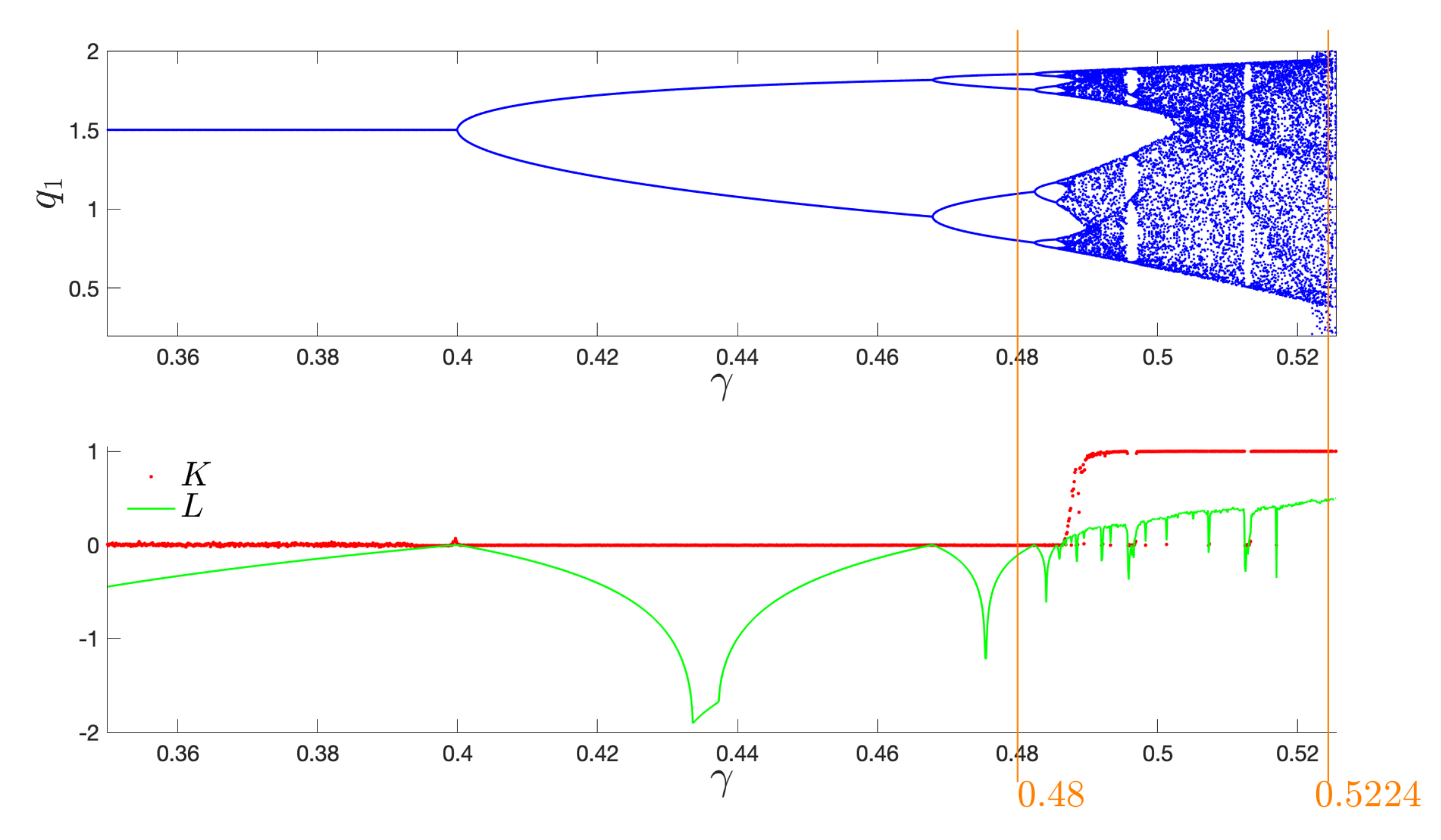

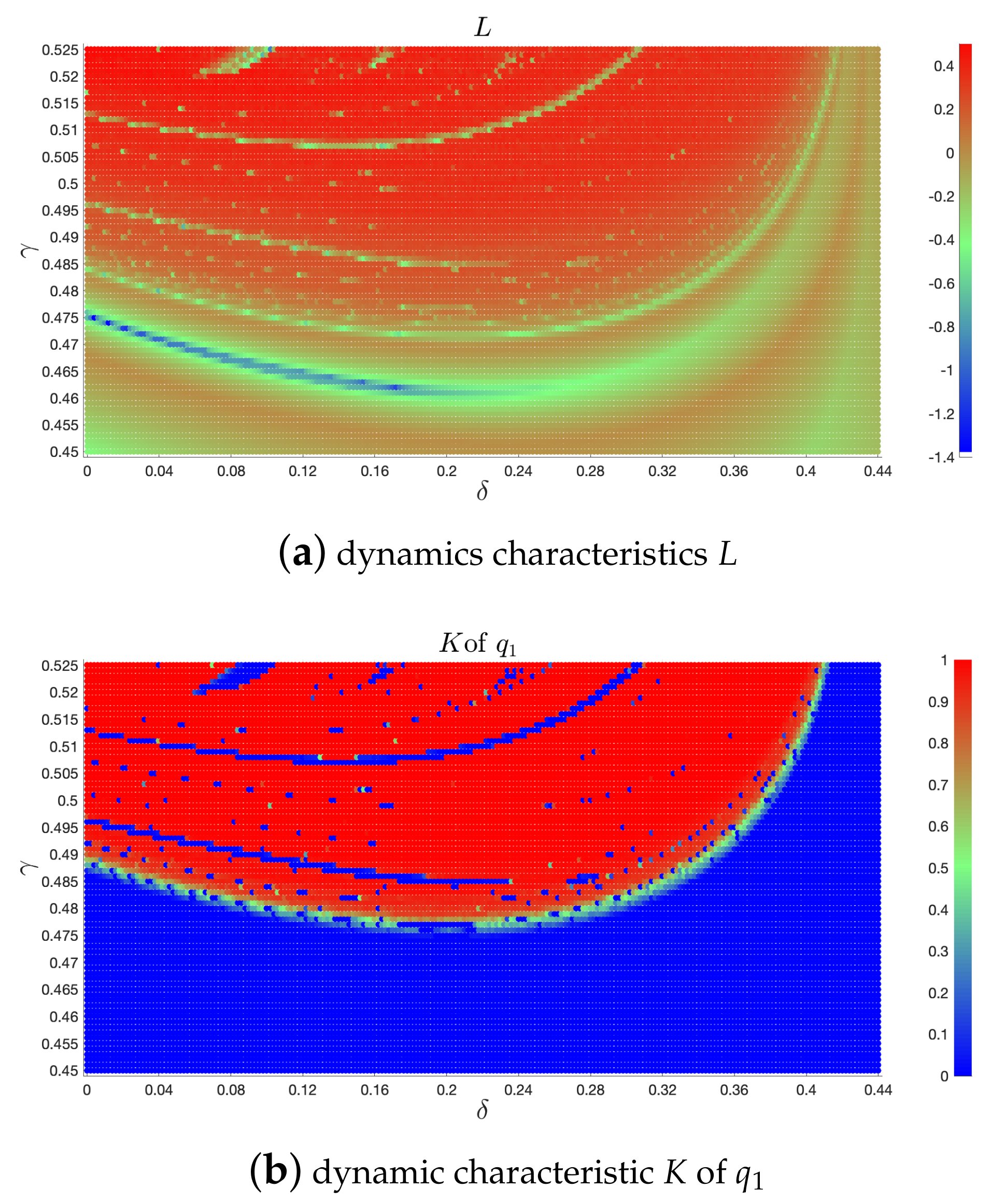

In the following, all simulations were performed with the initial condition located close to the stationary point: , and trajectories up to were evaluated (K, L, bifurcation diagrams, and PSD), while 20% were skipped to omit the system’s distortions.

For the further investigation, the system’s IHCOM Equation (

11) parameters were set as in Reference [

7], summarized in

Table 1. The parameter

varies from

to

to show the original system’s HCOM dynamics. Bifurcations with outputs of the 0-1 test for chaos

K (see Reference [

21,

22,

23,

24,

25]) and maximal Lyapunov exponent

L, are given in

Figure 1. Hereafter, for the sake of simplicity, we analyze only the first variable

since variables

and

are joined together by the way they are defined. If

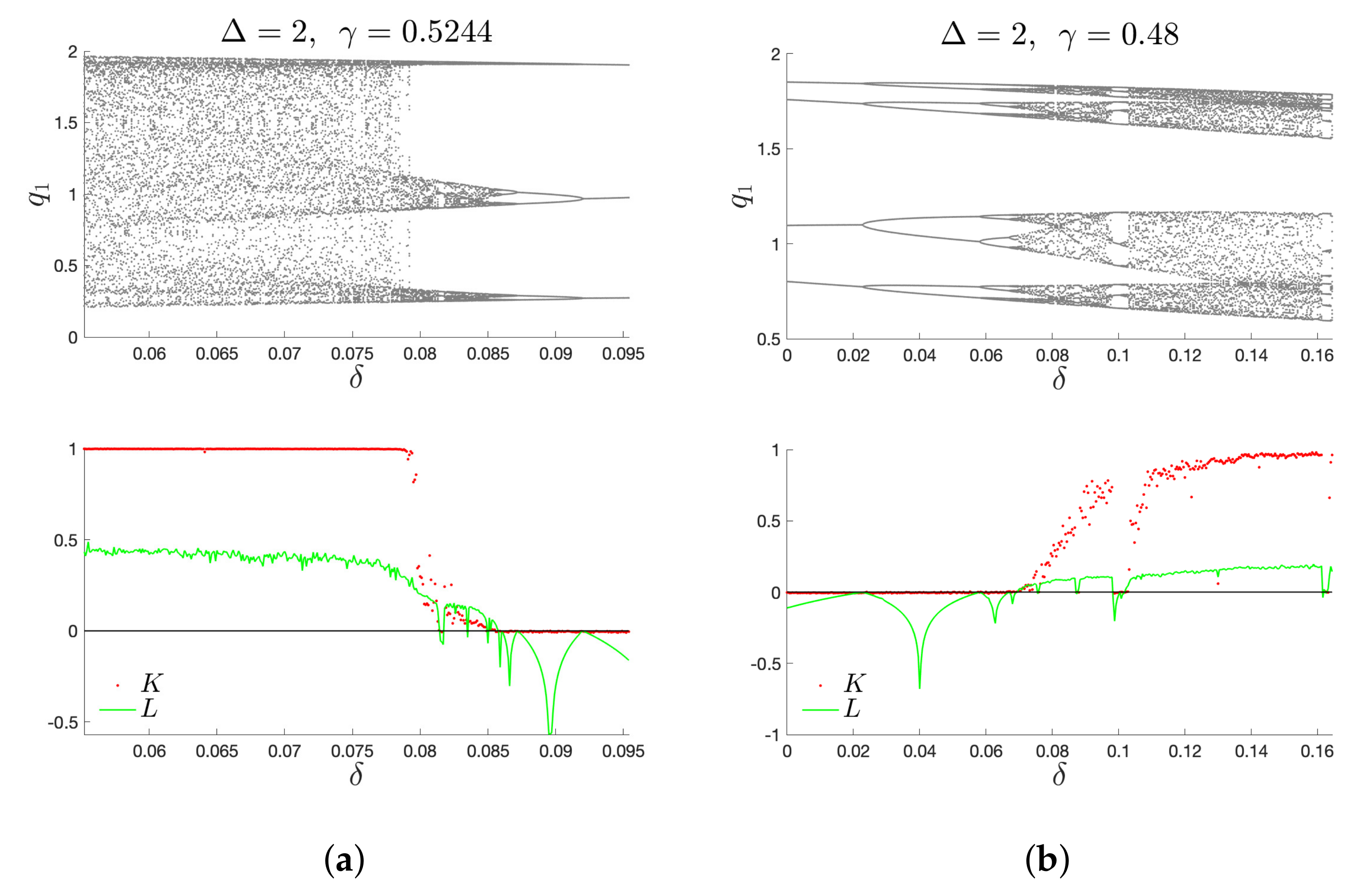

is a variable parameter, one can easily compare

K,

L, and bifurcation diagrams of

and

varying

for

(

Figure 2a) and

(

Figure 2b). Their dynamics are identical on

and

(

Figure 2a1 with

Figure 2a2 and

Figure 2b1 with

Figure 2b2, respectively) for both parameters of

. It is worth noting that

, while the results in

Figure 2 concentrate on the interval

or

for

or

, respectively, since the complement cases are those for which the system HCOM Equation (

8) diverges. Consequently, two values,

and

, are pointed out. HCOM admits a periodic structure for

and chaos for

for the parameters given in

Table 1. These two values are picked as starting to control and anti-control the chaos (

Section 3 and

Section 4).

3. Chaos Control

In this section, the impulsed system IHCOM Equation (

11) is investigated for

(i.e.,

for

, that is, the impulse

is applied at each step) and

corresponding to chaotic behavior (

Figure 1) of the original HCOM Equation (

8). Hence, the task is to suppress chaotic behaviour of the original HCOM Equation (

8) model.

The exploration was done using a bifurcation diagram of the variable

versus the impulse

(for brevity, DB

stands for bifurcation diagram varying

). The bifurcation analysis is supported by outputs of

K and

L, computed by the algorithm introduced in Reference [

26]. The 0-1 test for chaos, initially designed for testing for the existence of chaos, and later for identifying strange non-chaotic attractors (see, e.g., Reference [

17]), returns binary output: values close to 0 which indicate regularity, and values close to 1 which indicate the presence of chaos. This test is applicable to continuous [

27] and also to discrete dynamical systems [

28], as well as to real data [

29].

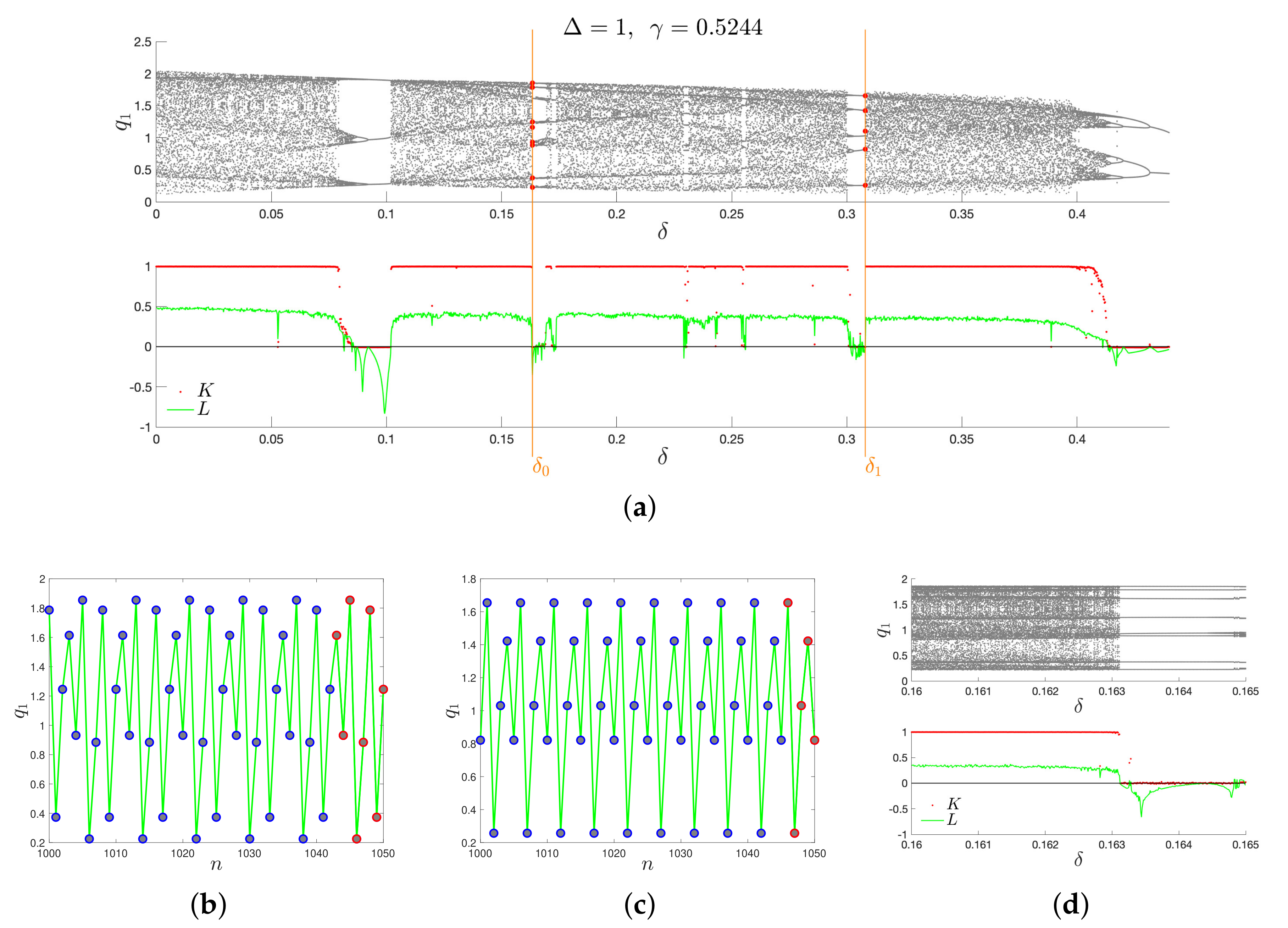

As

Figure 3 reveals, there exist periodic windows among chaotic windows, indicating the possibility to choose impulses

for which the IHCOM Equation (

11) evolves along some stable cycle. That is visible from bifurcation diagram in

Figure 3a-upper and its magnified part in

Figure 3d.

In particular, the two parameters and are highlighted. In both cases, they correspond to stable cycles , which generates a period–8 stable cycle (highlighted by the red mark), and , which generates a 5–period stable cycle (highlighted by the red mark).

Property 1. For IHCOM Equation (8) with and : - (i)

there is at least one such that IHCOM Equation (11) admits a self-excited cycle, - (ii)

there is at least one such that IHCOM Equation (11) admits chaotic trajectories.

The proof of Property 1 is given by computer graphics analysis studying the basin of attractions and behavior of trajectories of perturbed equilibria as the initial point. Dynamics quantifiers, such as the 0-1 test for chaos, and maximal Lyapunov exponent were applied; see

Figure 3a-lower.

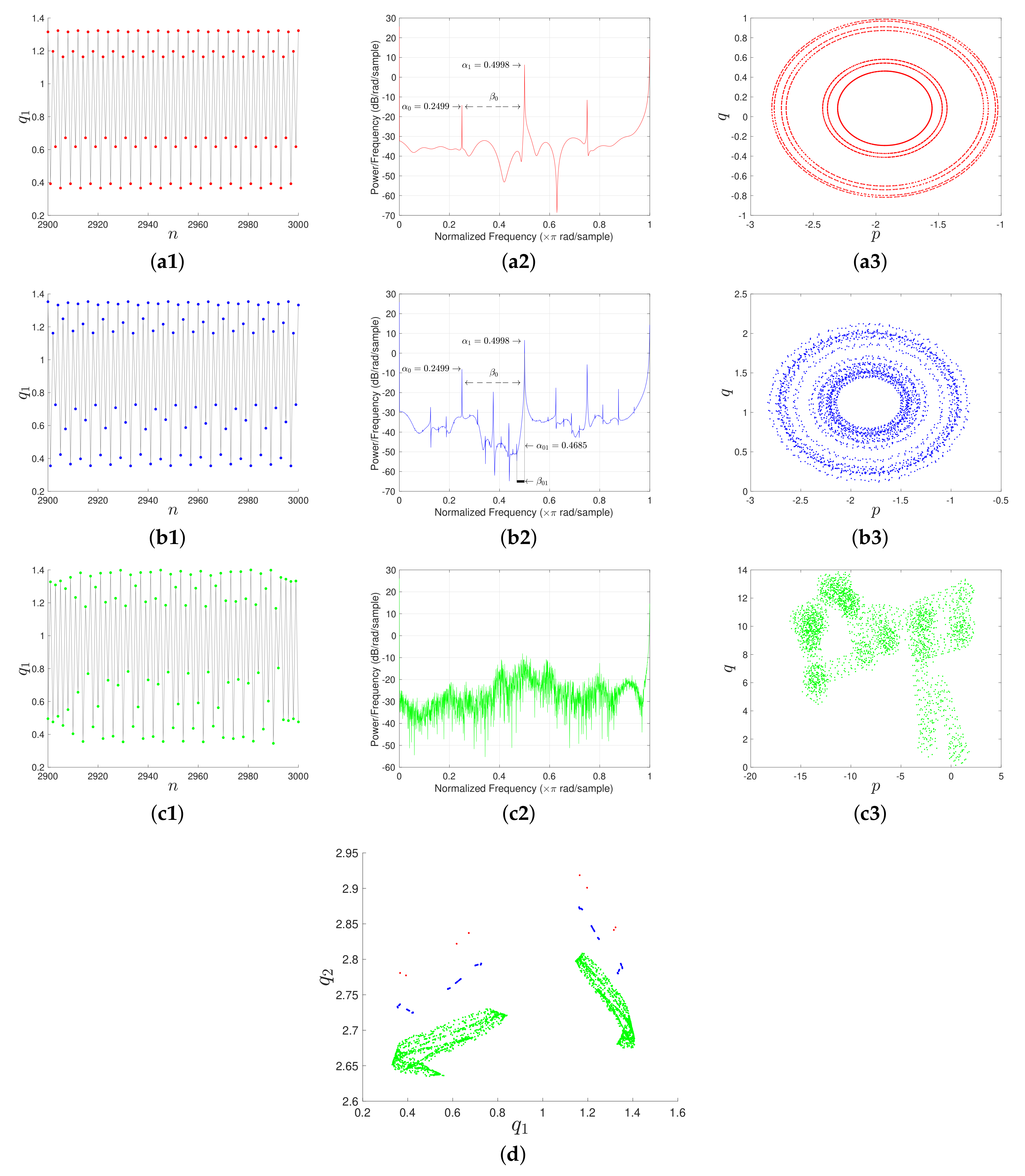

The motion of both variables

and

allows the observation of the full variety of the dynamics character. That is, for a suitable value of

, one can observe period in

Figure 4a1–a3, chaos in

Figure 4c1–c3, and also quasiperiod in

Figure 4b1–b3. Time histories (

Figure 4a1,b1,c1) and PSD (

Figure 4a2,b2,c2) are shown together with aggregated density plots for all three cases with a congruent color scheme. The quasiperiodic pattern is clearly visible in

Figure 4d, where the numerous full portions (blue marks) indicate that the entire orbit closes and does not repeats itself. The quasiperiodicity is also revealed by the PSD in

Figure 4b2, which clearly shows that the periodic orbit in

Figure 4a1 presents the first fundamental frequency

and the harmonic

. For

Figure 4b2, as a consequence of Neimark-Sacker bifurcation, which generally generates quasiperiodicity, a new set of subharmonics are created, e.g.,

, close to the first frequencies

and

, at small distance

.

Finally,

Figure 4a3,b3,c3 show boundedness or unboundedness of translation variables in the

plane of the 0-1 test for chaos, detecting the regularity or irregularity, respectively, of the movement character. Outputs of

Figure 4, together with parameters, are aggregated in

Table 2.

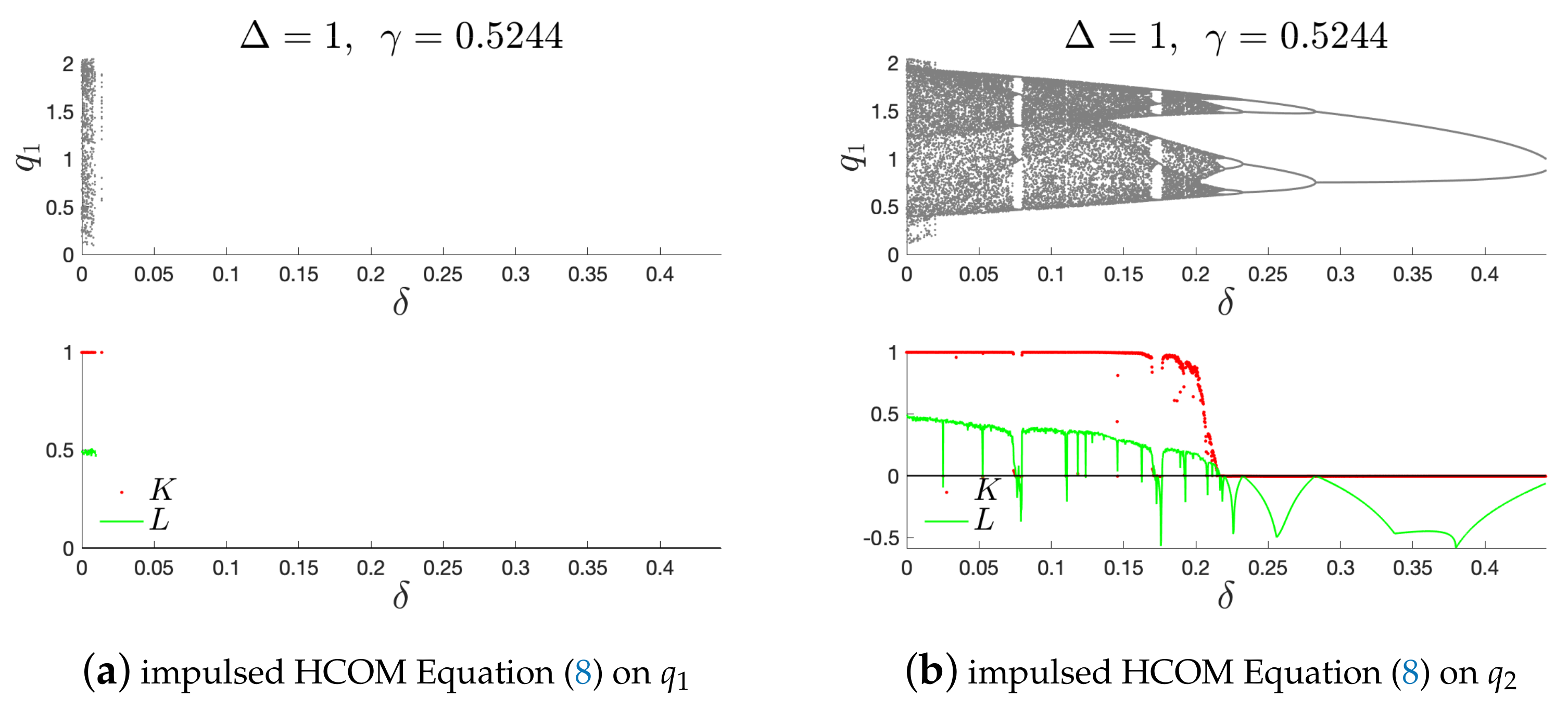

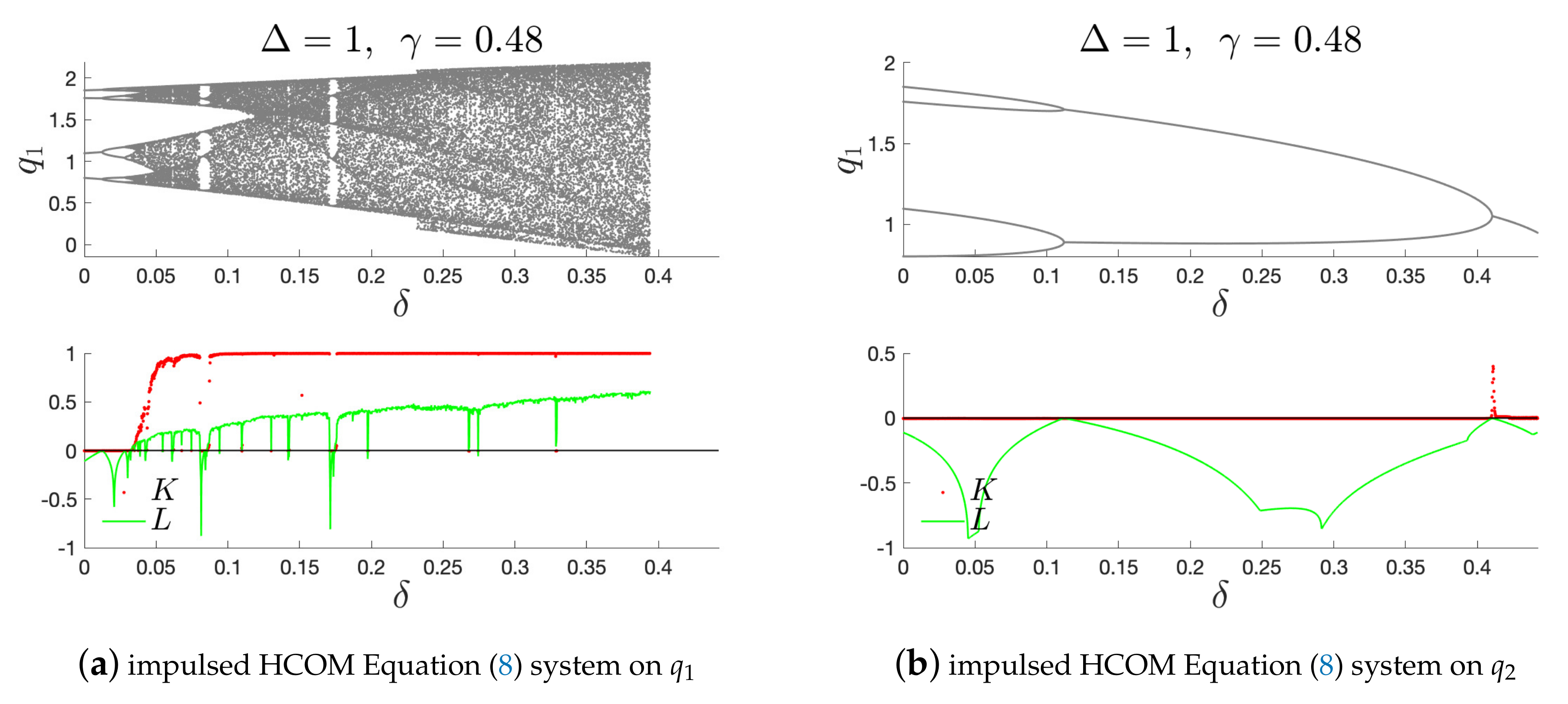

6. Alternative Impulse Control Approach

Furthermore, it is possible to control dynamical behavior even if the impulses are applied rarely, e.g., every

steps, as shown in

Figure 8.

In addition, the IHCOM Equation (

11) can be designed as follows:

i.e., only the first variable is impulsed. Note that, for

and

, the system diverges and chaos is not possible to control; see

Figure 9a. And, if

, chaos anti-control is possible if

; for

, the system diverges, see

Figure 10a. Modifying the IHCOM Equation (

11) by injection only on the second variable:

one can obtain analogous results. In this case, for

, chaos is possible to control (see

Figure 9b), but, for

, anti-control of chaos is not possible (see

Figure 10b). This demonstrates the importance of the choice of which variable injection is applied.

7. Conclusions

In this paper, the main focus was on dynamics investigation of a newly introduced injected two-dimensional discrete dynamical system.

Firstly, the original model HCOM Equation (

8) is recalled (in

Section 2) with a set of the driving parameters (in

Table 1), where the system parameter

is used and is crucial for further investigation. For the following research, two of the values were picked (

and

) using bifurcation analysis in

Figure 1. The first one,

, corresponds to the regular, and the second one,

, to the chaotic case.

Secondly, the original model is researched under the influence of injection of some additions at every iteration step. Hence, the IHCOM Equation (

11) is introduced, and its rich dynamics are extensively studied for two cases through massive numerical simulations:

- (i)

in

Section 3, for

to control chaos, with the main results given in Property 1 and

Figure 3,

- (ii)

in

Section 4, for

to anti-control chaos, see the main results: Property 2 and

Figure 5.

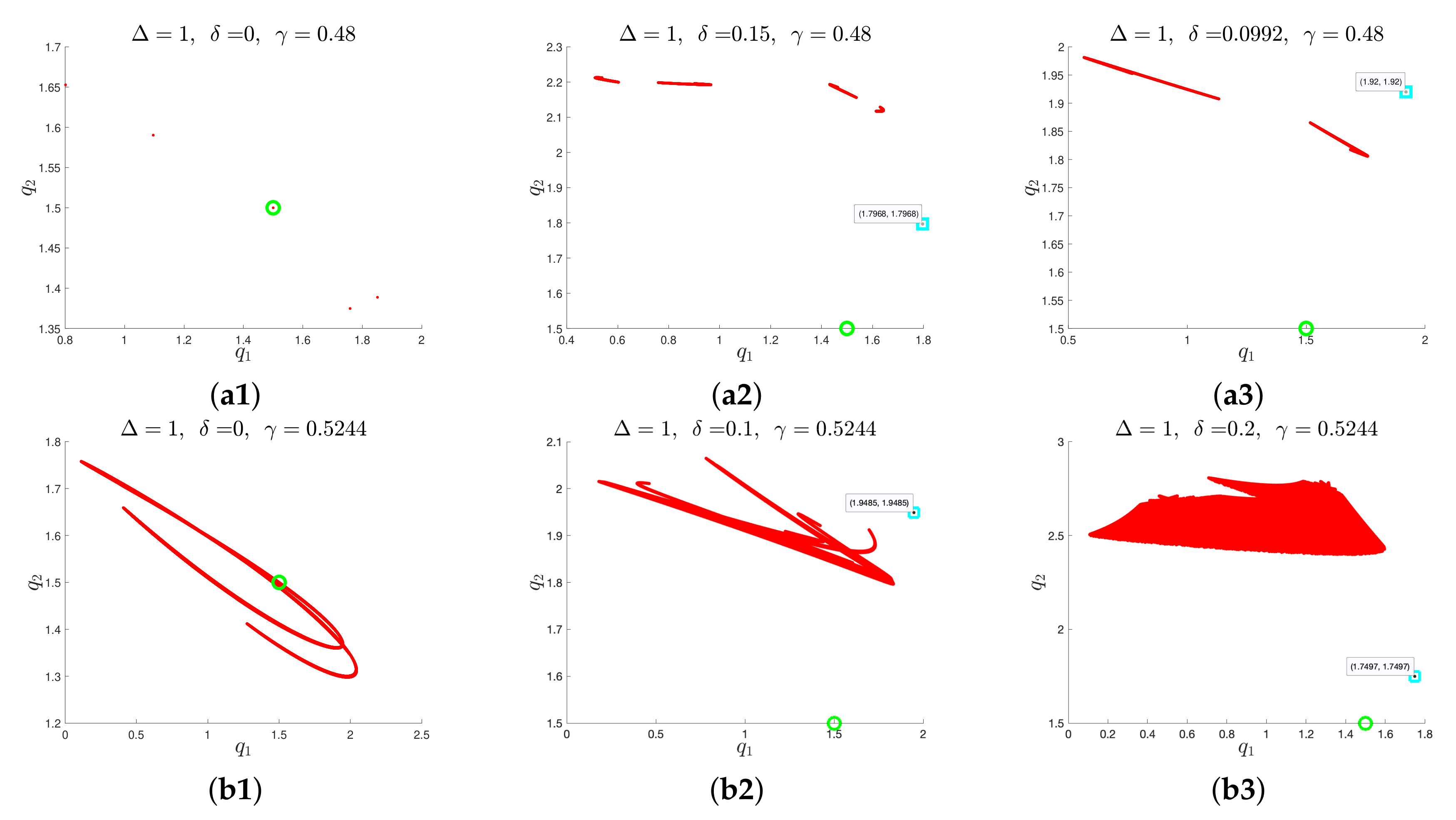

Next, in

Section 5, the previous controlling mechanisms were compared by showing selected density plots (

Figure 6) and the regularity detection on

place (

Figure 7).

An alternative approach to impulse control is given in

Section 6, where non-symmetric impulses were applied and appropriate analysis was given in

Figure 9 and

Figure 10.

As a final comment, let us point out that the injected value was picked as positive number, meaning some addition to the market is given at every time step. It is also possible to anti-control the chaos or to control the model by some tax, that is, the injection value is negative. This case sometimes causes massive divergences of both values and . Hence, this case is left for further research.