Evolutionary Game Analysis of the Effects of Problem Size and the Problem Proposing Mechanism on the Problem Processing Mechanism in a New Main Manufacturer–Supplier Collaborative System

Abstract

:1. Introduction

2. Methods

2.1. Theoretical Backgrounds and Assumptions

2.1.1. Main Manufacturer–Supplier Collaborative Mode

2.1.2. Problem Processing Mechanism in M-S Collaborative Supply Chain

2.1.3. Problem Size and Problem Processing Mechanism

2.1.4. Problem Proposing Mechanism and Problem Processing Mechanism

2.2. Payoff Matrix for Manufacturer and Supplier.

3. Results

3.1. Equilibrium Points and Their Stability Analysis

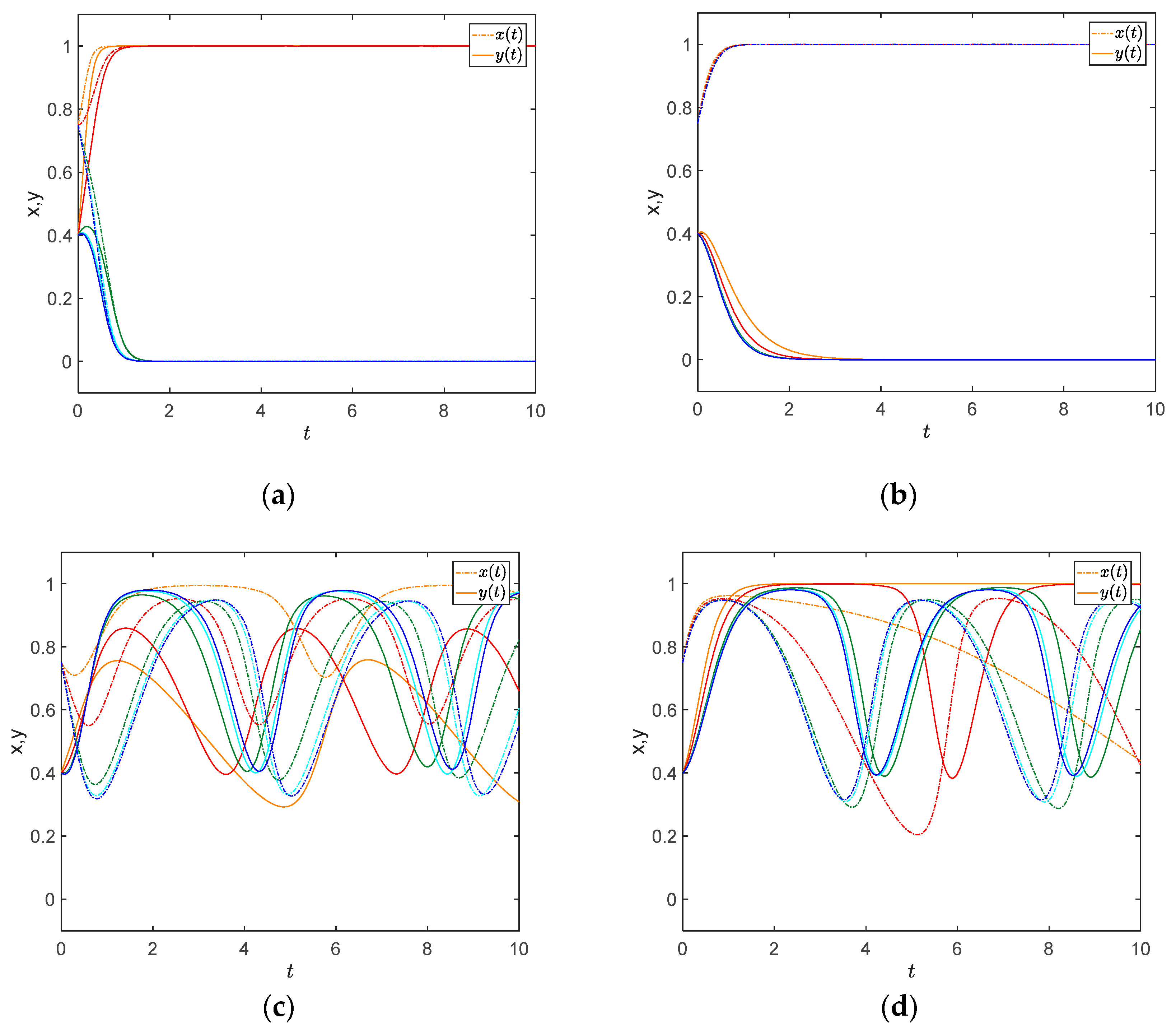

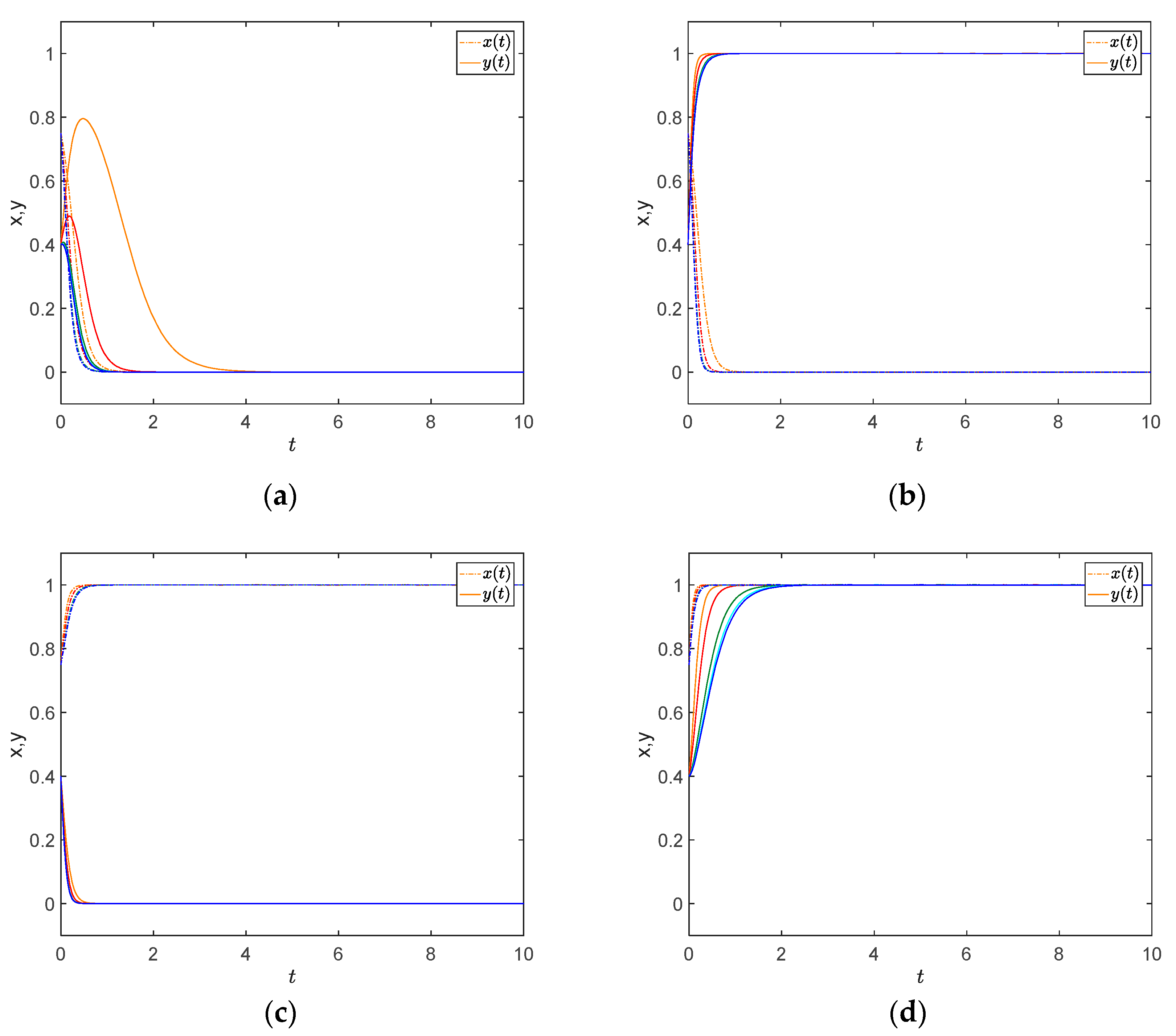

3.2. Impact of the Problem Size

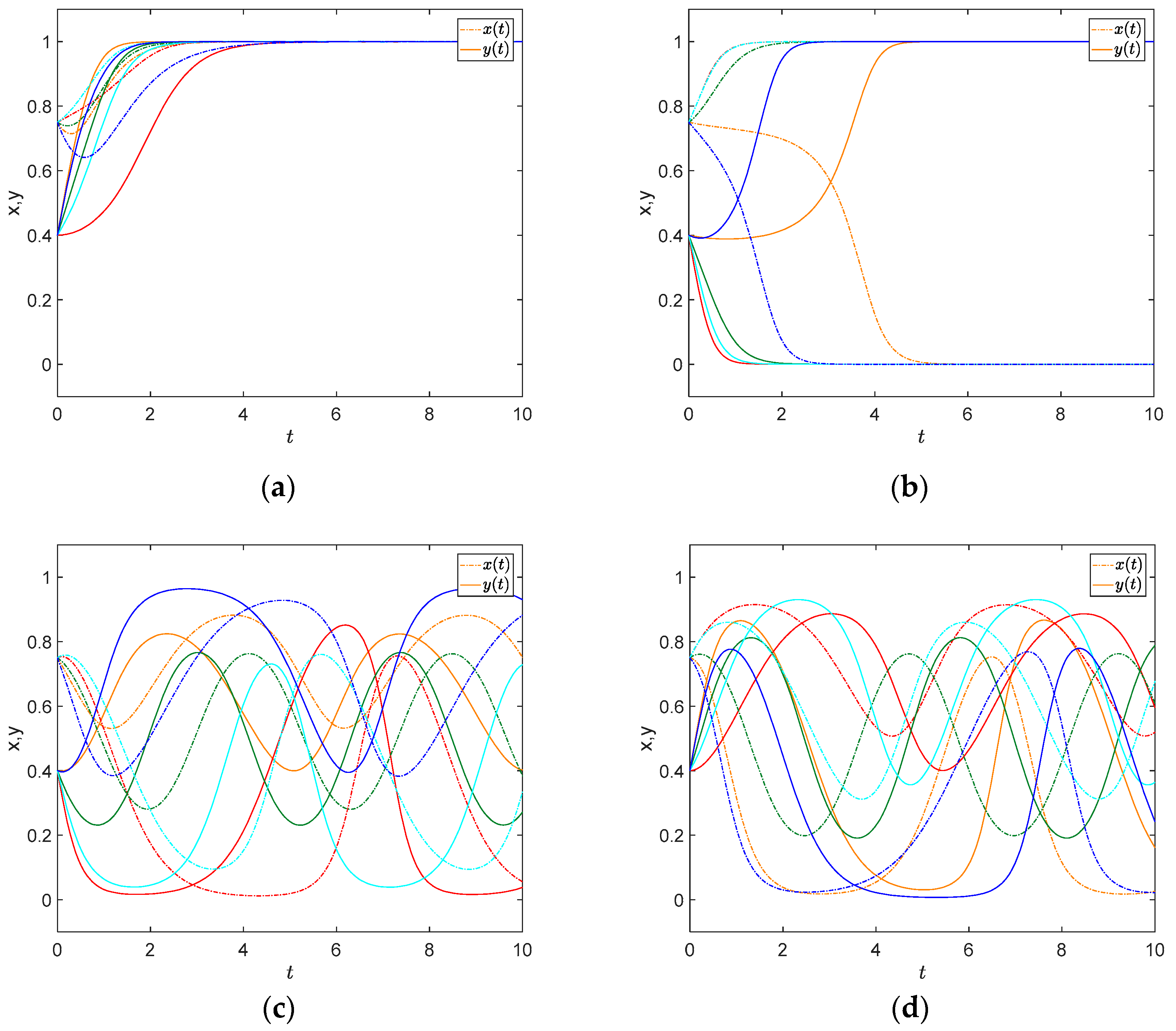

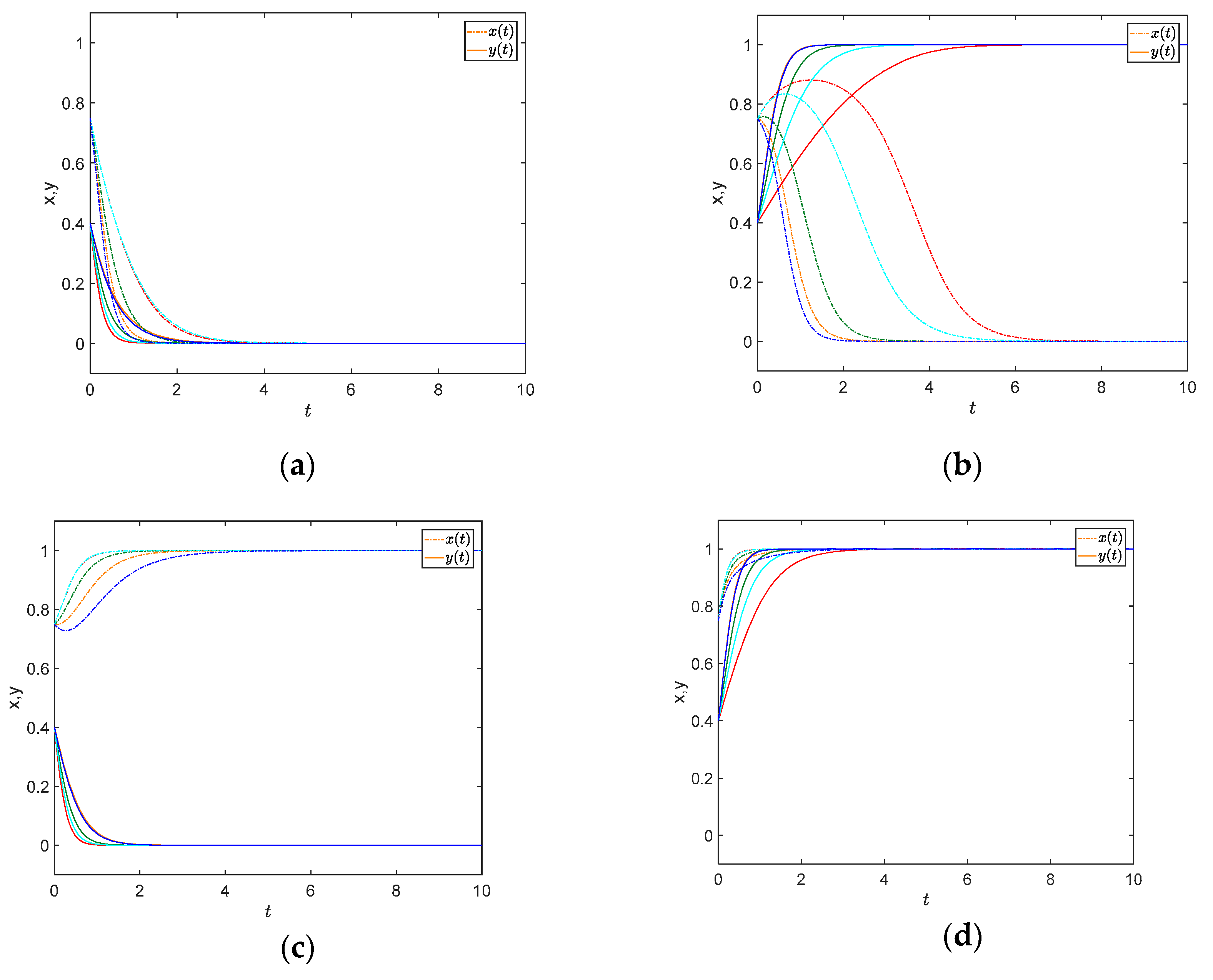

3.3. Impact of The Problem Proposing Mechanism

4. Discussion

4.1. Theoretical Implication

4.2. Managerial Implication

4.3. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Lambert, A.J.D. Optimal disassembly of complex products. Int. J. Prod. Res. 1997, 35, 2509–2524. [Google Scholar] [CrossRef] [Green Version]

- Lewis, C. A Case Study in the Use of Computer-Based Training in Statistical Process Control. J. Oper. Res. Soc. 1986, 37, 669–675. [Google Scholar] [CrossRef]

- Delbridge, R.; Oliver, N. Narrowing the gap? Stock turns in the Japanese and Western car industries. Int. J. Prod. Res. 1991, 29, 2083–2095. [Google Scholar] [CrossRef]

- Paknejad, M.J.; Nasri, F.; Affisco, J.F. Lead-time variability reduction in stochastic inventory models. Eur. J. Oper. Res. 1992, 62, 311–322. [Google Scholar] [CrossRef]

- Akai, K.; Sakamoto, K.; Nishino, N.; Kageyama, K. Game Theoretic Analysis of Exclusive Contract for Carbon Fiber Reinforced Plastic in the Aviation Industry. Procedia CIRP 2016, 41, 1043–1048. [Google Scholar] [CrossRef] [Green Version]

- Golmohammadi, A.; Taghavi, M.; Farivar, S.; Azad, N. Three strategies for engaging a buyer in supplier development efforts. Int. J. Prod. Econ. 2018, 206, 1–14. [Google Scholar] [CrossRef]

- Baptista, S.; Barbosa-Póvoa, A.P.; Escudero, L.F.; Gomes, M.I.; Pizarro, C. On risk management of a two-stage stochastic mixed 0–1 model for the closed-loop supply chain design problem. Eur. J. Oper. Res. 2019, 274, 91–107. [Google Scholar] [CrossRef]

- Chan, C.K.; Fang, F.; Langevin, A. Single-vendor multi-buyer supply chain coordination with stochastic demand. Int. J. Prod. Econ. 2018, 206, 110–133. [Google Scholar] [CrossRef]

- Chintapalli, P.; Disney, S.M.; Tang, C.S. Coordinating Supply Chains via Advance-Order Discounts, Minimum Order Quantities, and Delegations. Prod. Oper. Manag. 2017, 26, 2175–2186. [Google Scholar] [CrossRef] [Green Version]

- Wlazlak, P.; Säfsten, K.; Hilletofth, P. Original equipment manufacturer (OEM)-supplier integration to prepare for production ramp-up. J. Manuf. Technol. Manag. 2019, 30, 506–530. [Google Scholar] [CrossRef]

- Erfurth, T.; Bendul, J. Integration of global manufacturing networks and supply chains: A cross case comparison of six global automotive manufacturers. Int. J. Prod. Res. 2018, 56, 7008–7030. [Google Scholar] [CrossRef]

- Nosoohi, I.; Nookabadi, A.S. Outsource planning with asymmetric supply cost information through a menu of option contracts. Int. Trans. Oper. Res. 2019, 26, 1422–1450. [Google Scholar] [CrossRef]

- Dwaikat, N.Y.; Money, A.H.; Behashti, H.M.; Salehi-Sangari, E. How does information sharing affect first-tier suppliers’ flexibility? Evidence from the automotive industry in Sweden. Prod. Plan. Control 2018, 29, 289–300. [Google Scholar] [CrossRef]

- Zhang, M.; Guo, H.; Huo, B.; Zhao, X.; Huang, J. Linking supply chain quality integration with mass customization and product modularity. Int. J. Prod. Res. 2019, 207, 227–235. [Google Scholar] [CrossRef]

- Patra, P.; Kumar, U.D.; Nowicki, D.R.; Randall, W.S. Effective management of performance-based contracts for sustainment dominant systems. Int. J. Prod. Res. 2019, 208, 369–382. [Google Scholar] [CrossRef]

- Tang, O.; Musa, S.N. Identifying risk issues and research advancements in supply chain risk management. Int. J. Prod. Res. 2011, 133, 25–34. [Google Scholar] [CrossRef] [Green Version]

- Gintis, H. Game Theory Evolving: A Problem-Centered Introduction to Modeling Strategic Behavior; Princeton University Press: Princeton, NJ, USA, 2000. [Google Scholar]

- Strull, G. The coming challenge of lsi. In Proceedings of the Aerospace & Electronic Systems and Communications Technology Groups National Telemetering Conference, Amsterdam, The Nederland, 28–29 April 1969; p. 327. [Google Scholar]

- Tang, C.S.; Yang, S.A.; Wu, J. Sourcing from suppliers with financial constraints and performance risk. Manuf. Serv. Oper. Manag. 2017, 20, 70–84. [Google Scholar] [CrossRef]

- Li, S.; Zhao, X.; Huo, B. Supply chain coordination and innovativeness: A social contagion and learning perspective. Int. J. Prod. Res. 2018, 205, 47–61. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, J. Supply chain network equilibrium with strategic supplier investment: A real options perspective. Int. J. Prod. Res. 2019, 208, 184–198. [Google Scholar] [CrossRef]

- Zhang, C.; Fang, D.; Yang, X.; Zhang, X. Push and pull strategies by component suppliers when OEMs can produce the component in-house: The roles of branding in a supply chain. Ind. Market. Manag. 2018, 72, 99–111. [Google Scholar] [CrossRef]

- Hu, B.; Qi, A. Optimal procurement mechanisms for assembly. Manuf. Serv. Oper. Manag. 2018, 20, 655–666. [Google Scholar] [CrossRef]

- Wu, X.; Zhou, Y. Buyer-specific versus uniform pricing in a closed-loop supply chain with third-party remanufacturing. Eur. J. Oper. Res. 2019, 273, 548–560. [Google Scholar] [CrossRef]

- He, J.; Ma, C.; Pan, K. Capacity investment in supply chain with risk averse supplier under risk diversification contract. Transp. Res. Part E Logist. Transp. Rev. 2017, 106, 255–275. [Google Scholar] [CrossRef]

- Nikoofal, M.E.; Gümüş, M. Quality at the source or at the end? Managing supplier quality under information asymmetry. Manuf. Serv. Oper. Manag. 2018, 20, 498–516. [Google Scholar] [CrossRef]

- Hu, J.; Hu, Q.; Xia, Y. Who should invest in cost reduction in supply chains? Int. J. Prod. Res. 2019, 207, 1–18. [Google Scholar] [CrossRef]

- Nakkas, A.; Xu, Y. The Impact of Valuation Heterogeneity on Equilibrium Prices in Supply Chain Networks. Prod. Oper. Manag. 2019, 28, 241–257. [Google Scholar] [CrossRef]

- Braziotis, C.; Tannock, J.D.; Bourlakis, M. Strategic and operational considerations for the Extended Enterprise: Insights from the aerospace industry. Prod. Plan. Control 2017, 28, 267–280. [Google Scholar] [CrossRef]

- Tong, X.; Chen, J.; Zhu, Q.; Cheng, T.C.E. Technical assistance, inspection regime, and corporate social responsibility performance: A behavioural perspective. Int. J. Prod. Res. 2018, 206, 59–69. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Honoring complexity in sustainable supply chain research: A rough set theoretic approach (SI: ResMeth). Prod. Plan. Control 2018, 29, 1367–1384. [Google Scholar] [CrossRef]

- Li, X.; Chen, J.; Ai, X. Contract design in a cross-sales supply chain with demand information asymmetry. Eur. J. Oper. Res. 2019, 275, 939–956. [Google Scholar] [CrossRef]

- Zhuo, W.; Shao, L.; Yang, H. Mean-variance analysis of option contracts in a two-echelon supply chain. Eur. J. Oper. Res. 2018, 271, 535–547. [Google Scholar] [CrossRef]

- Huang, Q.; Yang, S.; Shi, V.; Zhang, Y. Strategic decentralization under sequential channel structure and quality choices. Int. J. Prod. Res. 2018, 206, 70–78. [Google Scholar] [CrossRef]

- He, Q.; Wang, N.; Yang, Z.; He, Z.; Jiang, B. Competitive collection under channel inconvenience in closed-loop supply chain. Eur. J. Oper. Res. 2019, 275, 155–166. [Google Scholar] [CrossRef]

- Levner, E.; Ptuskin, A. Entropy-based model for the ripple effect: Managing environmental risks in supply chains. Int. J. Prod. Res. 2018, 56, 2539–2551. [Google Scholar] [CrossRef]

- Awasthi, A.; Chauhan, S.S.; Goyal, S.K.; Proth, J.M. Supplier selection problem for a single manufacturing unit under stochastic demand. Int. J. Prod. Res. 2009, 117, 229–233. [Google Scholar] [CrossRef]

- Giri, B.C.; Bardhan, S. Sub-supply chain coordination in a three-layer chain under demand uncertainty and random yield in production. Int. J. Prod. Res. 2017, 191, 66–73. [Google Scholar] [CrossRef]

- Yeung, W.K.; Choi, T.M.; Cheng, T.C.E. Supply chain scheduling and coordination with dual delivery modes and inventory storage cost. Int. J. Prod. Res. 2011, 132, 223–229. [Google Scholar] [CrossRef]

- Aljazzar, S.M.; Jaber, M.Y.; Moussawi-Haidar, L. Coordination of a three-level supply chain (supplier–manufacturer–retailer) with permissible delay in payments. Appl. Math. Model. 2016, 40, 9594–9614. [Google Scholar] [CrossRef]

- Xiao, T.; Chen, G. Wholesale pricing and evolutionarily stable strategies of retailers with imperfectly observable objective. Eur. J. Oper. Res. 2009, 196, 1190–1201. [Google Scholar] [CrossRef]

- Yi, Y.; Yang, H. Wholesale pricing and evolutionary stable strategies of retailers under network externality. Eur. J. Oper. Res. 2017, 259, 37–47. [Google Scholar] [CrossRef]

- Wang, L.; Zheng, J. Research on low-carbon diffusion considering the game among enterprises in the complex network context. J. Clean. Prod. 2019, 210, 1–11. [Google Scholar] [CrossRef]

- Weibull, J.W. Evolutionary Game Theory; The MIT Press: Cambridge, MA, USA, 1995. [Google Scholar]

- Friedman, D. Evolutionary games in economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Trautrims, A.; MacCarthy, B.L.; Okade, C. Building an innovation-based supplier portfolio: The use of patent analysis in strategic supplier selection in the automotive sector. Int. J. Prod. Res. 2017, 194, 228–236. [Google Scholar] [CrossRef] [Green Version]

- Dinis-Carvalho, J.; Moreira, F.; Bragança, S.; Costa, E.; Alves, A.; Sousa, R. Waste identification diagrams. Prod. Plan. Control 2015, 26, 235–247. [Google Scholar]

- Chick, S.E.; Hasija, S.; Nasiry, J. Information elicitation and influenza vaccine production. Oper. Res. 2016, 65, 75–96. [Google Scholar] [CrossRef]

- Ibrahim, M.F. Integration of three echelon supply chain (supplier-manufacturer-distributor-drop shipper) with permissible delay in payment and penalty contract. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2018; Volume 337, p. 012027. [Google Scholar]

| Supplier | Main Manufacturer | |

|---|---|---|

| Deal with the problem (D) | Not deal with the problem (N) | |

| Deal with the problem (D) | , | , |

| Not deal with the problem (N) | , | , |

| Scenario | The Existing Condition | ESSs |

|---|---|---|

| ① | and | and |

| ② | and | and |

| ③ | and | No ESS exists |

| ④ | and | No ESS exists |

| ⑤ | , , and or | |

| ⑥ | , , and or | |

| ⑦ | , , and or | |

| ⑧ | , , and or |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, M.; Zhu, J.; Kumaraswamy, P.; Wang, H. Evolutionary Game Analysis of the Effects of Problem Size and the Problem Proposing Mechanism on the Problem Processing Mechanism in a New Main Manufacturer–Supplier Collaborative System. Mathematics 2019, 7, 588. https://doi.org/10.3390/math7070588

Zhang M, Zhu J, Kumaraswamy P, Wang H. Evolutionary Game Analysis of the Effects of Problem Size and the Problem Proposing Mechanism on the Problem Processing Mechanism in a New Main Manufacturer–Supplier Collaborative System. Mathematics. 2019; 7(7):588. https://doi.org/10.3390/math7070588

Chicago/Turabian StyleZhang, Ming, Jianjun Zhu, Ponnambalam Kumaraswamy, and Hehua Wang. 2019. "Evolutionary Game Analysis of the Effects of Problem Size and the Problem Proposing Mechanism on the Problem Processing Mechanism in a New Main Manufacturer–Supplier Collaborative System" Mathematics 7, no. 7: 588. https://doi.org/10.3390/math7070588