Inframarginal Model Analysis of the Evolution of Agricultural Division of Labor

Abstract

1. Introduction

2. Materials and Methods—An Infra-Marginal Model

2.1. Model Definition

2.2. Optimal Decision Mode and Division of Labor Structure

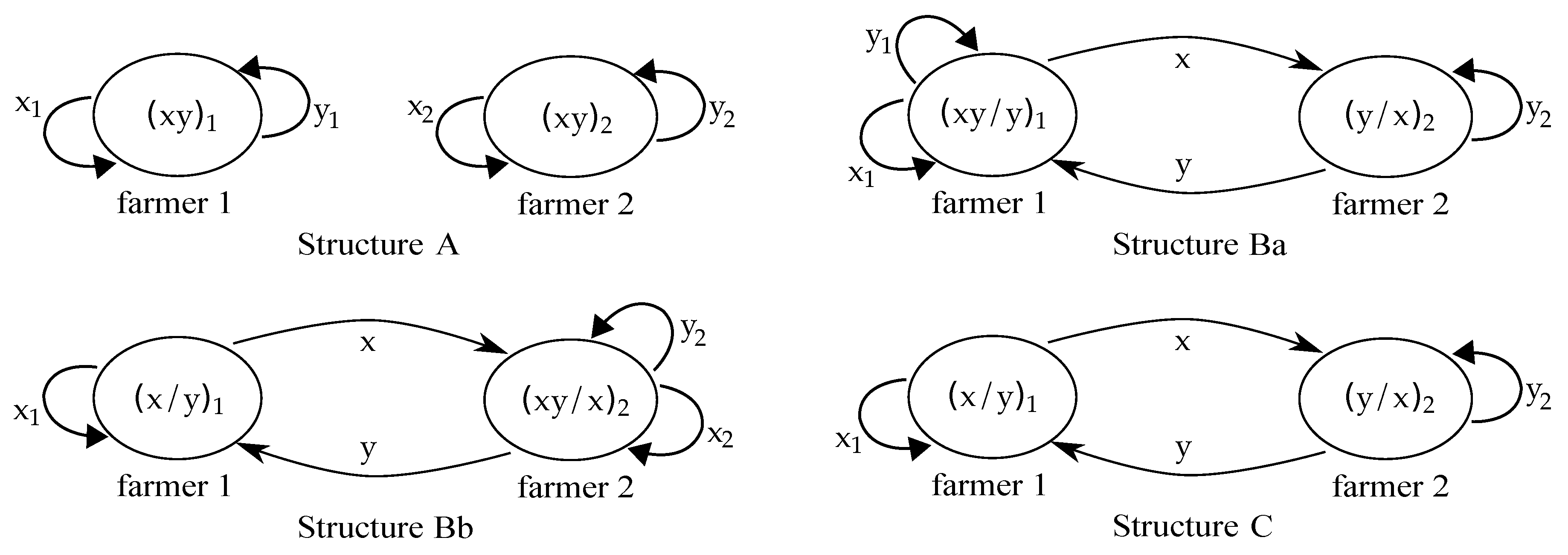

- Self-sufficiency mode is generally expressed as and defined as , for . This indicates that all agricultural products or labor services are self-sufficient. With an economy of two farmers, this kind of social organization structure is called self-sufficiency Structure A.

- Semi-specialized mode is when farmers produce products or services with comparative advantages, generally expressed as and . The mode corresponds to the case where , meaning that Farmer 1 produces certain self-sufficient quantities of products x and y, sells products x, and purchases products y. Consider the example of the labor of plant protection and weeding in agricultural production. Farmer 1 purchases a small portable spraying machine to spray chemicals on his own and others’ crops and he takes care of his own weeding partially. In addition, he also purchases weeding labor services from other farmers. Namely, he outsources the labor services of weeding. The mode corresponds similarly to .

- Complete-specialization mode is when farmers produce products or services with comparative advantage, expressed as and . The mode , or , represents the case where Farmer 1 specializes in producing goods or services x and is self-sufficient in selling x and buying goods or services y. The mode , or , represents that Farmer 2 specializes in producing goods or services y and is self-sufficient in selling y and buying goods or services x.

3. Optimization Analysis—Decision and Corner Equilibrium

3.1. The Selection of Self-Sufficiency Mode

3.2. The Selection of Semi-Specialized Mode

3.3. The Selection of Complete-Specialized Mode

4. Selection Logic and Structural Evolution of Division of Labor

4.1. General Equilibrium and Comparative Static Analysis

- With the corner equilibrium relative price for this structure, Farmer 2 prefers , rather than mode or , given that: (1) , which is equivalent to ; and (2) , which is equivalent to .

- Farmer 1 prefers mode than any other mode. This requires: (1) , which is true if ; and (2) , which is true if .

- Farmers are semi-specialized rather than fully specialized in producing products or services. This requires , which is equivalent to .

4.2. The Logic and Decision Mechanism of Farmers Participating in the Division of Labor

- If (k is the transaction efficiency coefficient between farmers), the general equilibrium structure is self-sufficient, and the farmers produce two products or services themselves.

- If and , Ba or C is selected. When , the general equilibrium structure is Ba, in which Farmer 1 produces both products or services, while Farmer 2 specializes in producing y, and the transaction is carried out between Farmer 1 selling x and Farmer 2 selling y. When , the general equilibrium structure is C, in which Farmers 1 and 2 specialize in the production of products or services x and y, respectively, forming a pair of trading partners through market transactions.

- If and , Bb or C is selected. When , the general equilibrium structure is Bb, in which Farmer 1 specializes in the production of comparative advantage products or services x and Farmer 2 produces both products, and the transaction is carried out between Farmer 1 selling x and Farmer 2 selling y. When , the general equilibrium structure is C.

4.3. The Function Logic of Comparative Advantage on the Choice of Farmer Specialization

- From the fact that and , we observe that the higher is the degree of farmers’ exogenous technology comparative advantage, the smaller is the critical value of transaction efficiency coefficient. That means that, if the “threshold” of crossing the self-sufficient structure is lowered, it urges the division of labor to take place under the condition of low transaction efficiency. In this way, farmers can strive for the benefits of comparative advantage and division of labor to make up for the loss of advantages and benefits in the self-sufficient structure.

- With and , we know that, in the structural selection of partial and complete division of labor, the higher is the degree of farmers’ exogenous technology comparative advantage, the more likely it is to have for a given transaction efficiency coefficient, that is, the equilibrium level of division of labor may be higher. That means that farmers are more likely to choose the production modes that allow them to maximize their comparative advantages and specialize in producing superior products or services, to avoid the efficiency loss of resource allocation in the partial division of labor structure and gain more comparative benefits and division of labor economy.

- The level of specialization in Structure C is higher than that of Structure Ba or Structure Bb. Since the level of division of labor is positively correlated with individual specialization level, the division of labor in Structure C is obviously higher than that in other structures. Therefore, the complete division of labor Structure C becomes a general equilibrium, that is the farmers choose to specialize in the production of products or services with the comparative advantages of exogenous technology, satisfyingThis means that the greater is the degree of balance between farmers’ relative preference and relative productivity, the higher is the level of division of labor, and the more inclined farmers are to specialize in division of labor.

5. Summary

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1

Appendix A.2

References

- Schultz, T.W. Transforming Traditional Agriculture; Commercial Press: Beijing, China, 1987; pp. 35–78. [Google Scholar]

- Sheng, H. Division of Labor and Transactions; Shanghai People’s Press: Shanghai, China, 2006; pp. 45–82. [Google Scholar]

- Cheng, W.; Liu, M.; Yang, X. A Ricardo model with endogenous comparative advantage and endogenous trade policy regime. Econ. Rec. 2000, 76, 172–182. [Google Scholar] [CrossRef]

- Cheng, W.; Sachs, J.; Yang, X. An inframarginal analysis of the Ricardian model. Rev. Int. Econ. 2000, 8, 208–220. [Google Scholar] [CrossRef]

- Zhang, D. A Note on “An Inframarginal Analysis of The Ricardian Model”. Pac. Econ. Rev. 2006, 11, 505–512. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, Y. New Classical Economics and Infra-marginal Analysis; Social Science Literature Press: Beijing, China, 2003; pp. 240–268. [Google Scholar]

- Dixit, A.; Norman, V. Theory of International Trade: A Dual, General Equilibrium Approach; Cambridge University Press: Cambridge, UK, 1980. [Google Scholar]

- Yang, X.; Borland, J. A Microeconomic Mechanism for Economic Growth. J. Political Econ. 1991, 3, 460–482. [Google Scholar] [CrossRef]

- Jiang, X. Outsourcing of Production Process—Measurement Model Based on Expert Questionnaire. South. Econ. 2014, 12, 96–104. [Google Scholar]

- Pang, C. Integration, Outsourcing and Economic Evolution—Infra-marginal New Classical General Equilibrium Analysis. Econ. Res. 2010, 3, 114–128. [Google Scholar]

- Buchanan, J.; Stubblebine, W. Externality. Economica 1962, 29, 371–384. [Google Scholar] [CrossRef]

- Koopman, T. Three Essays in the State of Economic Science; McGraw-Hill: New York, NY, USA, 1957. [Google Scholar]

- Arrow, K.; Enthoven, A.; Hurwicz, L. Studies in Linear and Nonlinear Programming; Uzawa, H., Ed.; Stanford University Press: Stanford, CA, USA, 1958. [Google Scholar]

- Yang, X. Introduction to Economic Cybernetics; Hunan People’s Press: Changsha, China, 1984. [Google Scholar]

- Borland, J.; Yang, X. Specialization and a New Approach to Economic Organization and Growth. Am. Econ. Rev. 1992, 82, 386–391. [Google Scholar]

- Cheng, W.; Yang, X. Inframarginal analysis of division of labor A survey. J. Econ. Behav. Organ. 2004, 55, 137–174. [Google Scholar]

- Yang, X. Driving Force I—Exogenous Comparative Advantage and Trading Efficiency. In Economic Development and the Division of Labor; Blackwell Publishers: Malden, MA, USA, 2003; pp. 57–95. [Google Scholar]

- Sachs, J.; Yang, X.; Zhang, D. Pattern of trade and economic development in the model of monopolistic competition. Rev. Dev. Econ. 2002, 6, 1–25. [Google Scholar] [CrossRef][Green Version]

- Yang, X.; Zhang, D. Economic development, international trade, and income distribution. J. Econ. 2003, 78, 163–190. [Google Scholar] [CrossRef]

- Wen, M.; King, S. Push or pull? The relationship between development, trade and primary resource endowment. J. Econ. Behav. Organ. 2004, 53, 569–591. [Google Scholar] [CrossRef]

- Liu, P.; Yang, X. Theory of irrelevance of the size of the firm. J. Econ. Behav. Organ. 2000, 42, 145–165. [Google Scholar] [CrossRef]

- Li, K. A General equilibrium model with impersonal networking decisions and bundling sales. In The Economics of E-Commerce and Networking Decisions: Applications and Extensions of Inframarginal Analysis; Ng, Y.-K., Shi, H., Sun, G., Eds.; Macmillan: London, UK, 2003. [Google Scholar]

- Sun, G.; Yang, X. Agglomeration economies, division of labor and the urban land-rent escalation. Austr. Econ. Pap. 2002, 41, 164–184. [Google Scholar] [CrossRef]

- Yang, X. Economic Development and the Division of Labor; Blackwell: Cambridge, MA, USA, 2003. [Google Scholar]

- Yang, X. An equilibrium model of hierarchy. In The Economics of E-Commerce and Networking Decisions: Applications and Extensions of Inframarginal Analysis; Ng, Y.-K., Shi, H., Sun, G., Eds.; Macmillan: London, UK, 2003. [Google Scholar]

- Yang, X. The division of labor, investment, and capital. Metroeconomica 1999, 50, 301–324. [Google Scholar] [CrossRef]

- Du, J. Endogenous, efficient long-run cyclical unemployment, endogenous long-run growth, and division of labor. Rev. Dev. Econ. 2003, 7, 266–278. [Google Scholar] [CrossRef]

- Yang, X.; Yeh, Y. A general equilibrium model with endogenous principal—Agent relationship. Austr. Econ. Pap. 2002, 41, 15–36. [Google Scholar] [CrossRef]

- Shi, H.; Yang, X. A new theory of industrialization. J. Comp. Econ. 1995, 20, 171–189. [Google Scholar] [CrossRef]

- Rosen, S. Substitution and the division of labor. Economica 1978, 45, 235–250. [Google Scholar] [CrossRef]

- Mussa, M.; Rosen, S. Monopoly and Product Quality. J. Econ. Theory 1978, 18, 301–317. [Google Scholar] [CrossRef]

| Structure | Relative Price p | Relative Parameter Interval | Real Income per Capita (Utility) | |

|---|---|---|---|---|

| Farmer 1 | Farmer 2 | |||

| A | N.A. | |||

| Ba | with | |||

| Bb | with | |||

| C | ||||

| Parameter Interval | |||||

| Equilibrium Structure | A | Ba | C | Bb | C |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, X.; Chang, J.-M.; Sun, H. Inframarginal Model Analysis of the Evolution of Agricultural Division of Labor. Mathematics 2019, 7, 1152. https://doi.org/10.3390/math7121152

Jiang X, Chang J-M, Sun H. Inframarginal Model Analysis of the Evolution of Agricultural Division of Labor. Mathematics. 2019; 7(12):1152. https://doi.org/10.3390/math7121152

Chicago/Turabian StyleJiang, Xueping, Jen-Mei Chang, and Hui Sun. 2019. "Inframarginal Model Analysis of the Evolution of Agricultural Division of Labor" Mathematics 7, no. 12: 1152. https://doi.org/10.3390/math7121152

APA StyleJiang, X., Chang, J.-M., & Sun, H. (2019). Inframarginal Model Analysis of the Evolution of Agricultural Division of Labor. Mathematics, 7(12), 1152. https://doi.org/10.3390/math7121152