A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem

Abstract

1. Introduction

2. Literature Review

2.1. Supplier Selection and Order Allocation

2.2. Sustainable Supplier Selection and Order Allocation

2.3. Research Gap and the Contribution of This Paper

3. System Description and Assumptions

- There is a planned allocation schedule of money for each period during a planning horizon.

- Money remaining at the end of a period is inflated by interest rate and carried forward to the next period.

- Payment for purchase and transportation costs are made as an order is placed.

- Nonzero transportation lead time exists between an order placement and the arrival of the ordered amount.

- Major and minor ordering costs occur when an order is placed.

- The major ordering cost occurs as a fixed amount when an order is placed.

- The minor ordering cost occurs in proportion to an order size.

- A supplier has limited production capacity and thus has an order size limit per order.

- A supplier has a limited number of transportation vehicles.

- Any amount of an item can be purchased at a price higher than supplier’s regular price from a spot market.

- 3BL factor scores of each potential supplier are prepared for input to an SSS & OA decision.

| item number, | |

| 3BL index, | |

| supplier number, | |

| period, , where denotes the end period of the planning horizon. |

| set of suppliers who sell item , | |

| set of items sold by supplier , | |

| demand forecast of item during future period , | |

| standard deviation of error of , | |

| volume of item , | |

| warehouse capacity of the buyer during period , | |

| holding cost of item , | |

| shortage cost of item , | |

| unit purchase price for item paid by the buyer to supplier during period , | |

| unit spot market price during period for item , | |

| operating working capital limit in period t, , | |

| capital originally allocated to period t, , | |

| inventory control related cost (holding plus shortage costs) in period t, | |

| replenishment related cost in period t, | |

| per-period discount (interest) rate. | |

| per-period minimum order quantity specified by supplier for item , | |

| per-period minimum purchase amount set by supplier , | |

| per-period maximum purchase limit for item specified by supplier | |

| major ordering cost for supplier , | |

| minor ordering cost for item for supplier , | |

| th 3BL factor score of supplier , | |

| th 3BL factor target score of period , | |

| supplier lead time, | |

| freight fair per vehicle of supplier during period , , | |

| volume capacity per vehicle of supplier , | |

| number of vehicles available for transportation of supplier in period , | |

| purchase already made at the start of past period and in delivery of item from supplier , | |

| inventory position of item at the start of planning, | |

| very large number. |

| inventory position of item at the end of period , | |

| positive part of , | |

| negative part of , | |

| purchase amount of item from supplier during the present period (period 1), | |

| planned purchase amount of item from supplier during future period , | |

| purchase quantity of item from the spot market for the present period, | |

| planned purchase quantity of item from the spot market for period , | |

| replenishment level of item after the arrival of orders scheduled to arrive at the start of period , | |

| positive deviation from target in period , | |

| binary integer for controlling the minimum order quantity requirement, | |

| binary integer for controlling the minimum purchase amount requirement, | |

| binary integer for controlling major ordering cost, | |

| binary integer for controlling minor ordering cost, | |

| safety factor of item , . |

4. Model Formulation

4.1. Relevant Costs

4.2. Operating Working Capital Requirement

4.3. 3BL Target Constraints

4.4. Mathematical Programming Model

5. Solution Method

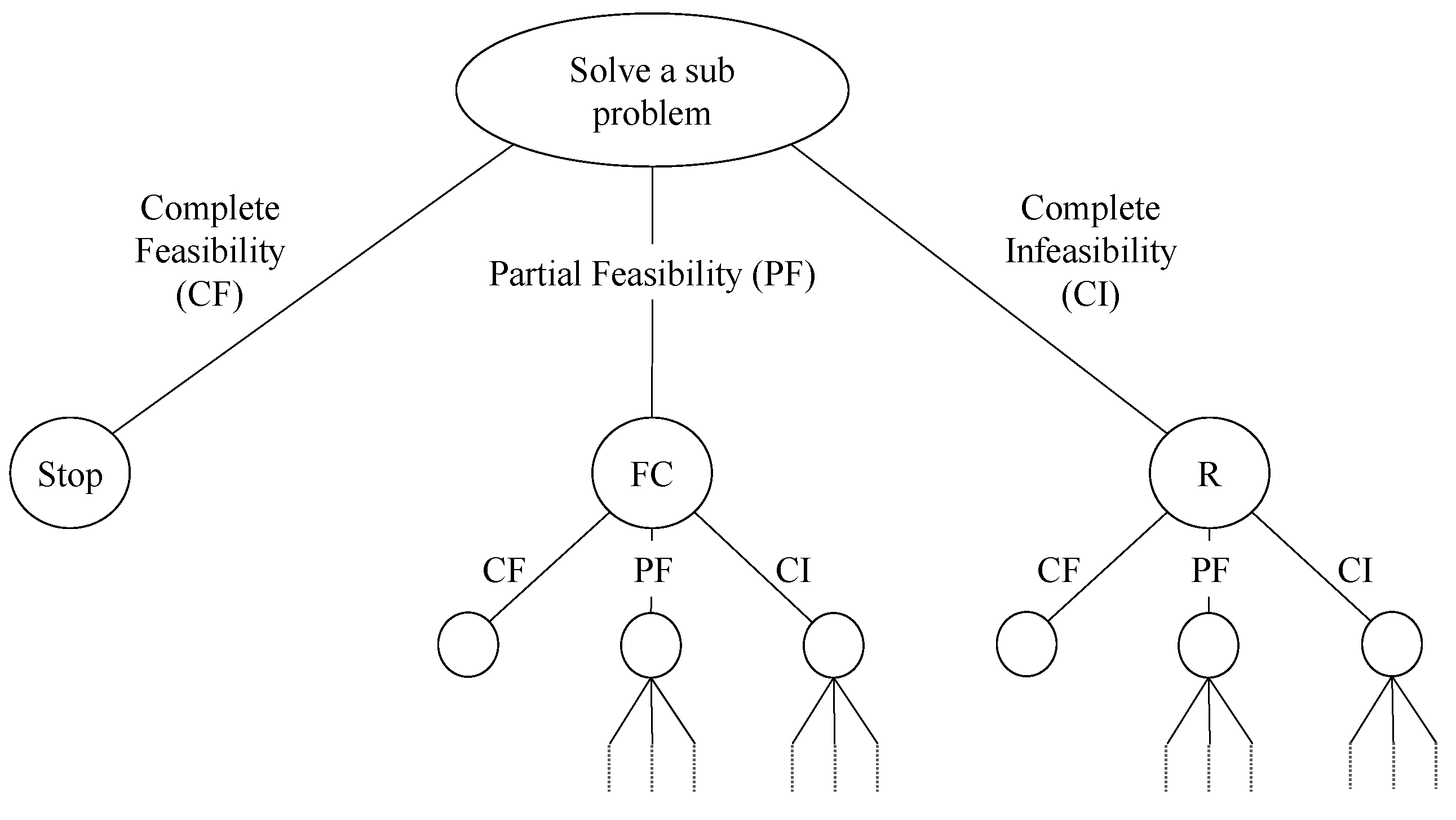

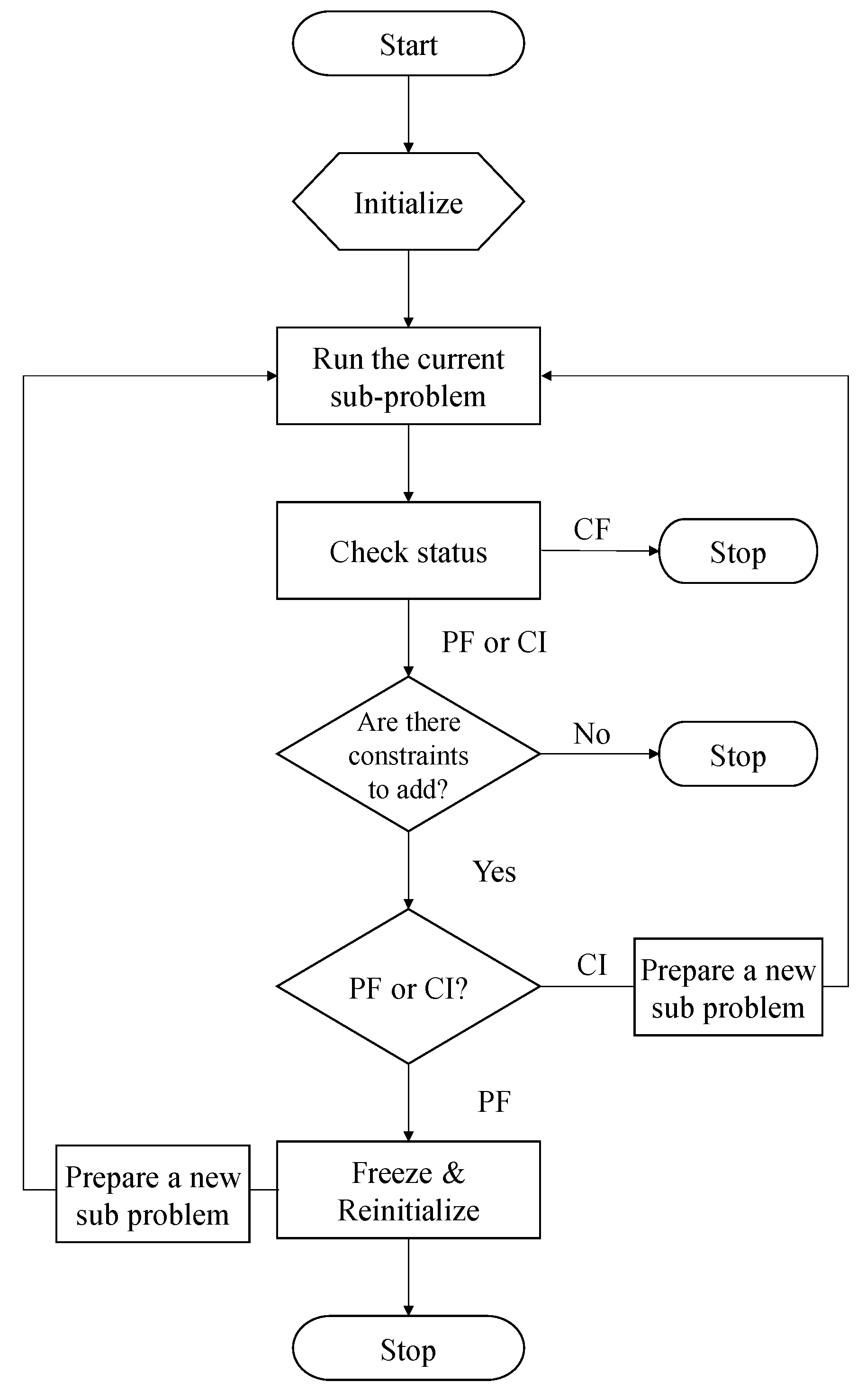

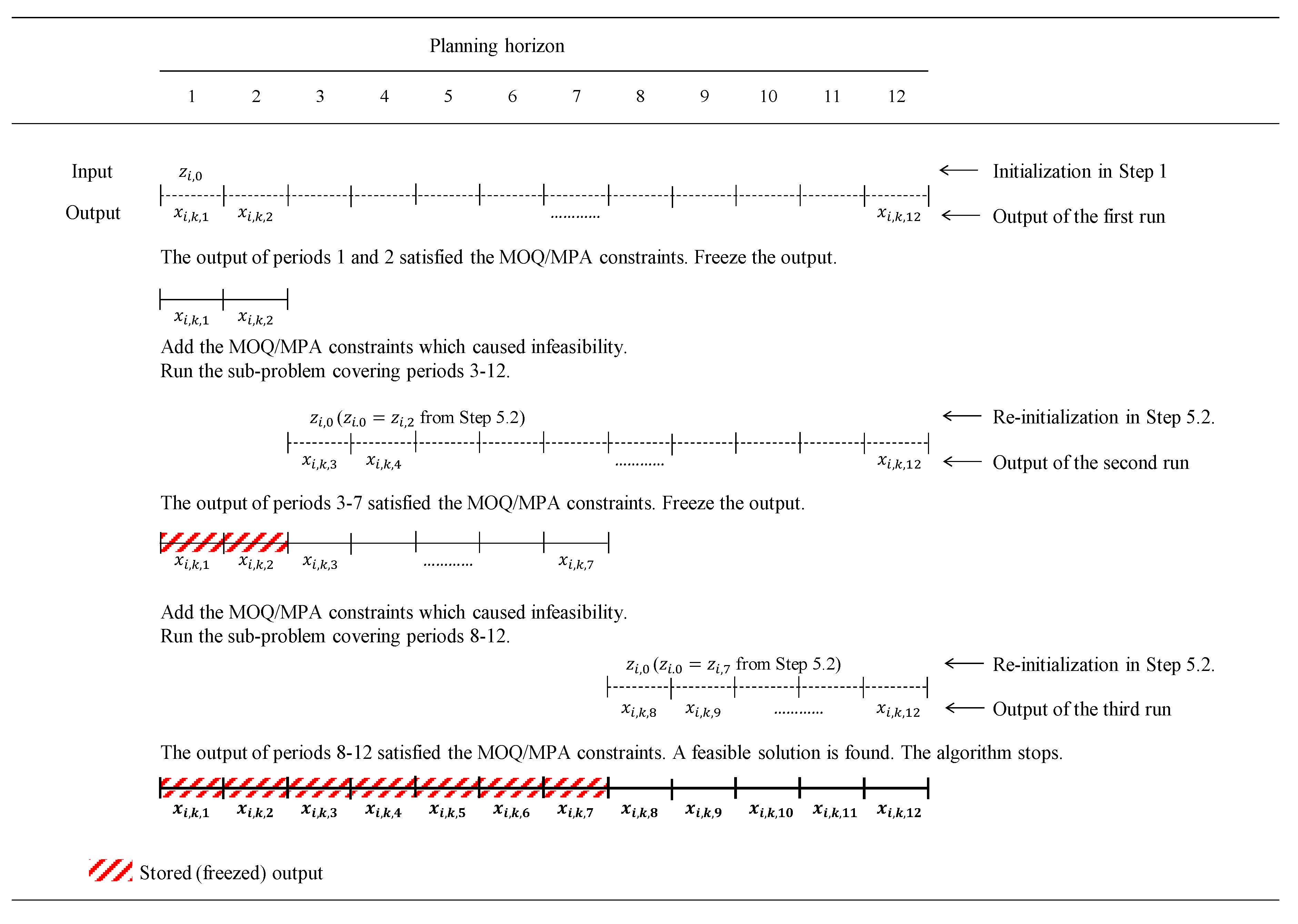

5.1. Conceptual View of the Proposed Algorithm

5.2. Branch-and-Freeze (BF) Algorithm

6. Numerical Experiments

6.1. Accuracy Test of the BF Algorithm

- There are 10 suppliers in the system.

- Transportation lead time is zero.

- Each supplier can deliver all five types of items.

- The unit period length is four weeks.

- The planning horizon length is sized to 48 weeks, which amounts to 1 year.

6.2. Experiment to Estimate the Maximum Solvable Problem Size of the BF Algorithm

7. Managerial Implications

7.1. Academic Implications

7.2. Managerial Implications

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Data Availability

References

- Ghadimi, P.; Toosi, F.G.; Heavey, C. A multi-agent systems approach for sustainable supplier selection and order allocation in a partnership supply chain. Eur. J. Oper. Res. 2018, 269, 286–301. [Google Scholar] [CrossRef]

- Fazlollahtabar, H. An integration between fuzzy promethee and fuzzy linear program for supplier selection problem: Case study. J. Appl. Math. Model. Comput. 2016, 1. Available online: http://www.lawarencepress.com/ojs/index.php/JAMMC/article/download/30/543 (accessed on 10 December 2018).

- Kannan, D. Role of multiple stakeholders and the critical success factor theory for the sustainable supplier selection process. Int. J. Prod. Econ. 2018, 195, 391–418. [Google Scholar] [CrossRef]

- Kuo, R.; Lee, L.; Hu, T.-L. Developing a supplier selection system through integrating fuzzy ahp and fuzzy dea: A case study on an auto lighting system company in taiwan. Prod. Plan. Control 2010, 21, 468–484. [Google Scholar] [CrossRef]

- Roehrich, J.K.; Hoejmose, S.U.; Overland, V. Driving green supply chain management performance through supplier selection and value internalisation: A self-determination theory perspective. Int. J. Oper. Prod. Manag. 2017, 37, 489–509. [Google Scholar] [CrossRef]

- CMMI Product Team. Cmmi for Acquisition; Version 1.3.; Software Engineering Institute: Pittsburgh, PA, USA, 2010. [Google Scholar]

- ITSqc. Available online: http://www.itsqc.org (accessed on 10 December 2018).

- Musalem, E.P.; Dekker, R. Controlling inventories in a supply chain: A case study. Int. J. Prod. Econ. 2005, 93, 179–188. [Google Scholar] [CrossRef]

- Kiesmüller, G.P.; De Kok, A.; Dabia, S. Single item inventory control under periodic review and a minimum order quantity. Int. J. Prod. Econ. 2011, 133, 280–285. [Google Scholar] [CrossRef]

- Park, J.H.; Kim, J.S.; Shin, K.Y. Inventory control model for a supply chain system with multiple types of items and minimum order size requirements. Int. Trans. Oper. Res. 2018, 25, 1927–1946. [Google Scholar] [CrossRef]

- Yao, M.; Minner, S. Review of multi-supplier inventory models in supply chain management: An update. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2995134 (accessed on 10 December 2018).

- Ghorbani, M.; Bahrami, M.; Arabzad, S.M. An integrated model for supplier selection and order allocation; using shannon entropy, swot and linear programming. Procedia Soc. Behav. Sci. 2012, 41, 521–527. [Google Scholar] [CrossRef]

- Nazari-Shirkouhi, S.; Shakouri, H.; Javadi, B.; Keramati, A. Supplier selection and order allocation problem using a two-phase fuzzy multi-objective linear programming. Appl. Math. Model. 2013, 37, 9308–9323. [Google Scholar] [CrossRef]

- Jadidi, O.; Cavalieri, S.; Zolfaghari, S. An improved multi-choice goal programming approach for supplier selection problems. Appl. Math. Model. 2015, 39, 4213–4222. [Google Scholar] [CrossRef]

- Jadidi, O.; Zolfaghari, S.; Cavalieri, S. A new normalized goal programming model for multi-objective problems: A case of supplier selection and order allocation. Int. J. Prod. Econ. 2014, 148, 158–165. [Google Scholar] [CrossRef]

- Sodenkamp, M.A.; Tavana, M.; Di Caprio, D. Modeling synergies in multi-criteria supplier selection and order allocation: An application to commodity trading. Eur. J. Oper. Res. 2016, 254, 859–874. [Google Scholar] [CrossRef]

- Shabanpour, H.; Yousefi, S.; Saen, R.F. Future planning for benchmarking and ranking sustainable suppliers using goal programming and robust double frontiers dea. Transp. Res. Part D Transp. Environ. 2017, 50, 129–143. [Google Scholar] [CrossRef]

- Robb, D.J.; Silver, E.A. Inventory management with periodic ordering and minimum order quantities. J. Oper. Res. Soc. 1998, 49, 1085–1094. [Google Scholar] [CrossRef]

- Zhao, Y.; Katehakis, M.N. On the structure of optimal ordering policies for stochastic inventory systems with minimum order quantity. Probab. Eng. Inf. Sci. 2006, 20, 257–270. [Google Scholar] [CrossRef]

- Zhou, B.; Zhao, Y.; Katehakis, M.N. Effective control policies for stochastic inventory systems with a minimum order quantity and linear costs. Int. J. Prod. Econ. 2007, 106, 523–531. [Google Scholar] [CrossRef]

- Meena, P.; Sarmah, S. Multiple sourcing under supplier failure risk and quantity discount: A genetic algorithm approach. Transp. Res. Part: Logist. Transp. Rev. 2013, 50, 84–97. [Google Scholar] [CrossRef]

- Zhou, B. Inventory management of multi-item systems with order size constraint. Int. J. Syst. Sci. 2010, 41, 1209–1219. [Google Scholar] [CrossRef]

- Aktin, T.; Gergin, Z. Mathematical modelling of sustainable procurement strategies: Three case studies. J. f Clean. Prod. 2016, 113, 767–780. [Google Scholar] [CrossRef]

- Bian, Y.; Lemoine, D.; Yeung, T.G.; Bostel, N.; Hovelaque, V.; Viviani, J.-L.; Gayraud, F. A dynamic lot-sizing-based profit maximization discounted cash flow model considering working capital requirement financing cost with infinite production capacity. Int. J. Prod. Econ. 2018, 196, 319–332. [Google Scholar] [CrossRef]

- Chen, T.-L.; Lin, J.T.; Wu, C.-H. Coordinated capacity planning in two-stage thin-film-transistor liquid-crystal-display (tft-lcd) production networks. Omega 2014, 42, 141–156. [Google Scholar] [CrossRef]

- Chao, X.; Chen, J.; Wang, S. Dynamic inventory management with cash flow constraints. Nav. Res. Logist. 2008, 55, 758–768. [Google Scholar] [CrossRef]

- Bendavid, I.; Herer, Y.T.; Yücesan, E. Inventory management under working capital constraints. J. Simul. 2017, 11, 62–74. [Google Scholar] [CrossRef]

- Azadnia, A.H.; Saman, M.Z.M.; Wong, K.Y. Sustainable supplier selection and order lot-sizing: An integrated multi-objective decision-making process. Int. J. Prod. Res. 2015, 53, 383–408. [Google Scholar] [CrossRef]

- Oxford. What Is a Pestel Analysis? Available online: https://blog.oxfordcollegeofmarketing.com/2016/06/30/pestel-analysis/ (accessed on 10 December 2018).

- Handfield, R.; Walton, S.V.; Sroufe, R.; Melnyk, S.A. Applying environmental criteria to supplier assessment: A study in the application of the analytical hierarchy process. Eur. J. Oper. Res. 2002, 141, 70–87. [Google Scholar] [CrossRef]

- Lu, L.Y.; Wu, C.; Kuo, T.-C. Environmental principles applicable to green supplier evaluation by using multi-objective decision analysis. Int. J. Prod. Res. 2007, 45, 4317–4331. [Google Scholar] [CrossRef]

- Lee, A.H.; Kang, H.-Y.; Hsu, C.-F.; Hung, H.-C. A green supplier selection model for high-tech industry. Expert Syst. Appl. 2009, 36, 7917–7927. [Google Scholar] [CrossRef]

- Hsu, C.-W.; Hu, A.H. Applying hazardous substance management to supplier selection using analytic network process. J. Clean. Prod. 2009, 17, 255–264. [Google Scholar] [CrossRef]

- Kannan, G.; Pokharel, S.; Kumar, P.S. A hybrid approach using ism and fuzzy topsis for the selection of reverse logistics provider. Resour. Conserv. Recycl. 2009, 54, 28–36. [Google Scholar] [CrossRef]

- Yeh, W.-C.; Chuang, M.-C. Using multi-objective genetic algorithm for partner selection in green supply chain problems. Expert Syst. Appl. 2011, 38, 4244–4253. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Çifçi, G. A novel hybrid mcdm approach based on fuzzy dematel, fuzzy anp and fuzzy topsis to evaluate green suppliers. Expert Syst. Appl. 2012, 39, 3000–3011. [Google Scholar] [CrossRef]

- Shaw, K.; Shankar, R.; Yadav, S.S.; Thakur, L.S. Supplier selection using fuzzy ahp and fuzzy multi-objective linear programming for developing low carbon supply chain. Expert Syst. Appl. 2012, 39, 8182–8192. [Google Scholar] [CrossRef]

- Govindan, K.; Khodaverdi, R.; Jafarian, A. A fuzzy multi criteria approach for measuring sustainability performance of a supplier based on triple bottom line approach. J. Clean. Prod. 2013, 47, 345–354. [Google Scholar] [CrossRef]

- Shen, L.; Olfat, L.; Govindan, K.; Khodaverdi, R.; Diabat, A. A fuzzy multi criteria approach for evaluating green supplier’s performance in green supply chain with linguistic preferences. Resour. Conserv. Recycl. 2013, 74, 170–179. [Google Scholar] [CrossRef]

- Dobos, I.; Vörösmarty, G. Green supplier selection and evaluation using dea-type composite indicators. Int. J. Prod. Econ. 2014, 157, 273–278. [Google Scholar] [CrossRef]

- Kannan, D.; Govindan, K.; Rajendran, S. Fuzzy axiomatic design approach based green supplier selection: A case study from singapore. J. Clean. Prod. 2015, 96, 194–208. [Google Scholar] [CrossRef]

- Awasthi, A.; Kannan, G. Green supplier development program selection using ngt and vikor under fuzzy environment. Comput. Ind. Eng. 2016, 91, 100–108. [Google Scholar] [CrossRef]

- Trapp, A.C.; Sarkis, J. Identifying robust portfolios of suppliers: A sustainability selection and development perspective. J. Clean. Prod. 2016, 112, 2088–2100. [Google Scholar] [CrossRef]

- Qin, J.; Liu, X.; Pedrycz, W. An extended todim multi-criteria group decision making method for green supplier selection in interval type-2 fuzzy environment. Eur. J. Oper. Res. 2017, 258, 626–638. [Google Scholar] [CrossRef]

- Gupta, H.; Barua, M.K. Supplier selection among smes on the basis of their green innovation ability using bwm and fuzzy topsis. J. Clean. Prod. 2017, 152, 242–258. [Google Scholar] [CrossRef]

- Luthra, S.; Govindan, K.; Kannan, D.; Mangla, S.K.; Garg, C.P. An integrated framework for sustainable supplier selection and evaluation in supply chains. J. Clean. Prod. 2017, 140, 1686–1698. [Google Scholar] [CrossRef]

- Yu, F.; Yang, Y.; Chang, D. Carbon footprint based green supplier selection under dynamic environment. J. Clean. Prod. 2018, 170, 880–889. [Google Scholar] [CrossRef]

- Banaeian, N.; Mobli, H.; Fahimnia, B.; Nielsen, I.E.; Omid, M. Green supplier selection using fuzzy group decision making methods: A case study from the agri-food industry. Comput. Oper. Res. 2018, 89, 337–347. [Google Scholar] [CrossRef]

- Kannan, D.; Khodaverdi, R.; Olfat, L.; Jafarian, A.; Diabat, A. Integrated fuzzy multi criteria decision making method and multi-objective programming approach for supplier selection and order allocation in a green supply chain. J. Clean. Prod. 2013, 47, 355–367. [Google Scholar] [CrossRef]

- Govindan, K.; Jafarian, A.; Nourbakhsh, V. Bi-objective integrating sustainable order allocation and sustainable supply chain network strategic design with stochastic demand using a novel robust hybrid multi-objective metaheuristic. Comput. Oper. Res. 2015, 62, 112–130. [Google Scholar] [CrossRef]

- Gören, H.G. A decision framework for sustainable supplier selection and order allocation with lost sales. J. Clean. Prod. 2018, 183, 1156–1169. [Google Scholar] [CrossRef]

- Ayhan, M.B.; Kilic, H.S. A two stage approach for supplier selection problem in multi-item/multi-supplier environment with quantity discounts. Comput. Ind. Eng. 2015, 85, 1–12. [Google Scholar] [CrossRef]

- Yang, Y.H.; Kim, J.S. An adaptive joint replenishment policy for items with non-stationary demands. Oper. Res. 2018, 1–20. [Google Scholar] [CrossRef]

- Theodore Farris, M.; Hutchison, P.D. Cash-to-cash: The new supply chain management metric. Int. J. Phys. Distrib. Logist. Manag. 2002, 32, 288–298. [Google Scholar] [CrossRef]

- Hofmann, E.; Kotzab, H. A supply chain-oriented approach of working capital management. J. Bus. Logist. 2010, 31, 305–330. [Google Scholar] [CrossRef]

- Agrawal, N.; Smith, S.A. Estimating negative binomial demand for retail inventory management with unobservable lost sales. Nav. Res. Logist. 1996, 43, 839–861. [Google Scholar] [CrossRef]

- Chen, J.; Zhao, X.; Zhou, Y. A periodic-review inventory system with a capacitated backup supplier for mitigating supply disruptions. Eur. J. Oper. Res. 2012, 219, 312–323. [Google Scholar] [CrossRef]

| Author(s) | Problem Type | Model Type | Demand Process | Number of Items | Number of Periods | New Solution Method | Constraints | Transportation Lead Time | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Supplier Selection | Order Allocation | Determi-nistic | Stochastic | Single Item | Multi-Item | Single Period | Multi-Period | |||||||||

| Single Supplier | Multiple Supplier | Stationary | Non-Stationa-ry | MOQ/MPA | WCM | Sustainability | ||||||||||

| Zhao and Katehakis [19] | √ | √ | √ | √ | ||||||||||||

| Zhou et al. [20] | √ | √ | √ | √ | √ | |||||||||||

| Chao et al. [26] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Zhou [22] | √ | √ | √ | √ | √ | √ | ||||||||||

| Kiesmüller et al. [9] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Kannan et al. [49] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Meena and Sarmah [21] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Govindan et al. [38] | √ | √ | √ | √ | √ | √ | √ | √ | ||||||||

| Ayhan and Kilic [52] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Trapp and Sarkis [43] | √ | √ | √ | √ | √ | |||||||||||

| Aktin and Gergin [23] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Bendavid et al. [27] | √ | √ | √ | √ | √ | √ | ||||||||||

| Gören [51] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Ghadimi et al. [1] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Bian et al. [24] | √ | √ | √ | √ | √ | √ | √ | |||||||||

| Park et al. [10] | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||

| This model | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | ||||

| 5000.00 | 0.01 | 0 |

| Item | ||||

|---|---|---|---|---|

| All items | 2.00 |

| Supplier | ||

|---|---|---|

| All suppliers |

| Supplier | ||

|---|---|---|

| Item 1 to 5 | Item 1 to 5 | |

| All suppliers |

| Supplier | ||

|---|---|---|

| Item 1 to 5 | Item 1 to 5 | |

| All suppliers |

| Method | Average Annual Discounted Cost | Average Percent Deviation (%) | Standard Deviation of Percent Deviation | Average CPU Time | Average Number of Sub-Problems Solved |

|---|---|---|---|---|---|

| GAMS | $805,041.43 | - | - | 1.467 s | - |

| BF algorithm | $811,630.50 | 0.82% | 0.34% | 2.920 s | 5.5 |

| GAMS Solver | Size of the Problem That Can Be Solved (Number of Items, Number of Constraints, and Number of Variables) | |

|---|---|---|

| GAMS Solver | BF Algorithm | |

| COINGLPK | (12, 92,688, 56,928) | (17, 182,268, 111,233) |

| XPRESS | (69, 2,892,300, 1,743,045) | (108, 7,054,224, 4,244,544) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.S.; Jeon, E.; Noh, J.; Park, J.H. A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem. Mathematics 2018, 6, 325. https://doi.org/10.3390/math6120325

Kim JS, Jeon E, Noh J, Park JH. A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem. Mathematics. 2018; 6(12):325. https://doi.org/10.3390/math6120325

Chicago/Turabian StyleKim, Jong Soo, Eunhee Jeon, Jiseong Noh, and Jun Hyeong Park. 2018. "A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem" Mathematics 6, no. 12: 325. https://doi.org/10.3390/math6120325

APA StyleKim, J. S., Jeon, E., Noh, J., & Park, J. H. (2018). A Model and an Algorithm for a Large-Scale Sustainable Supplier Selection and Order Allocation Problem. Mathematics, 6(12), 325. https://doi.org/10.3390/math6120325