1. Introduction

The Black-Scholes-Merton Model for European options is based upon some Ansatz for the stock price. Specifically, the process for the stock price is characterized by continuity, and it has the ability to hedge continuously with transaction costs and has constant volatility [

1,

2,

3].

In the Black-Scholes-Merton Model, the price of a financial asset is given by the soluton of the stochastic differential equation

where

is a Brownian motion, and the value

of the option is given by the solution of the

evolution equation,

in which

t is time,

S is the current value of the underlying asset, for example a stock price, and

r is the rate of return on a safe investment. The value of the option is subject to the satisfaction of the terminal condition,

, when

. Finally,

σ is the volatility of the model.

The Black-Scholes-Merton Model assumes constant volatility

σ. However, in real problems,

σ is not a constant. One possible generalisation of the model, Equation (

2), is to consider that the volatility depends upon the time,

t, and on the value of the stock,

S,

i.e.,

. It has been proposed that

σ is a function of a mean Orstein–Uhlenbeck process [

4].

Consider that

, where

y is given by the stochastic differential equation with the Orstein–Uhlenbeck term [

5,

6,

7]:

The new Brownian motion

can be correlated with

and be expressed as follows:

in which

describes a Brownian motion independent of

and

ρ is the correlation factor with values

.

Hence, the Black-Scholes Equation (

2) in the case of stochastic volatility is modified and the value

u of the option is given by the

evolution equation

where the operators,

are defined as follows:

The function

is

and

satisfies the terminal condition

at time

.

The operator

gives the Black-Scholes-Merton Equation (

2) with volatility

,

expresses the correlation term between the two Brownian motions,

and

, of the European option and of the volatility, respectively, and

is the Orstein-Uhlenbeck process term. Finally. the term

, the so called premium term, expresses the market price of the volatility risk [

6]. The function

in Equation (

9) is the risk-premium factor which drives the volatility and follows from the second Brownian motion,

, where in the case of absolute correlation,

i.e.,

,

does not play any role in the model. The first term of the

rhs side of Equation (

9) is called the excess return-to-risk ratio [

6]. The statistical importance of stochastic volatility has been confirmed in [

8].

The purpose of this work is the study of the Black-Scholes-Merton Model with stochastic volatility, Equation (

5), by using the method of group invariant transformations, specifically the Lie (point) symmetries of the equation. The importance of Lie symmetries is that they provide a systematic method to facilitate the solution of differential equations because they provide first-order invariants which can be used to reduce the differential equations. Moreover, Lie symmetries can be used for the classification of differential equations. Furthermore, we can extract important information for the differential equation, consequently for the model, from the group of invariant transformations admitted.

The first application of the Lie symmetries in financial modeling was performed by Gazizov & Ibragimov in [

9]. They studied the admitted group of invariant transformations for the Black-Scholes-Merton Equation (

2), with constant volatility and they proved that Equation (

2) admits as Lie symmetries the elements of Lie algebra,

( In the Mubarakzyanov Classification Scheme [

10,

11,

12,

13]). This means that Equation (

2) is maximally symmetric and according to the Theorem of Sophus Lie [

14] there exists a transformation on the space of variables

in which Equation (

2) can be written in the form of the heat equation. The last was an important result because the mathematical methods from physical science can be used for the study of differential equations in financial mathematics. A similar result has been found for the one-factor model of commodities [

15], which means that the three different equations, the heat equation, the Black-Scholes-Merton equation and the one-factor model of commodities equation, are equivalent at the mathematical level even if they describe different subjects.

In recent years, Lie symmetries have covered a big range of applications in financial mathematics. For instance, the group invariants of the Cox-Ingersoll-Ross Pricing Equation have been studied in [

16] and the nonlinear Merton model in [

17]. As far as concerns the Asian option, a Lie symmetry classification has been performed in [

18]. As for generalisations of the Black-Scholes-Merton Model, the Lie symmetries and the reduction process of the nonautonomous model can be found in [

19,

20], while another generalisation of Equation (

2) with a “source” was studied in [

21].

Furthermore, in [

22,

23], the symmetry analysis of the space- and time-dependent one-factor model of commodities and of the nonautonomous two-dimensional Black-Scholes-Merton Equations were performed. For other applications of Lie symmetries in financial mathematics, see, for instance, [

24,

25,

26], and references therein.

The stochastic volatility model, Equation (

5), is a

evolution equation. Below, we perform a symmetry analysis and we determine the group invariant solutions. In particular, we restrict our analysis to the model in which the risk premium factor vanishes without necessarily

and from Equation (

9), only the term which expresses the return-to-risk ratio survives. Moreover, we study two models for European options with stochastic volatility, the Heston model [

27] and the Stein–Stein model [

28]. The latter is a model without correlation between the two Brownian motions,

and

i.e.,

in Equation (

4). The plan of the paper is as follows.

In

Section 2, we give the basic properties and definitions for the Lie point symmetries of differential equations and we perform the symmetry classification for our model. We find that Equation (

5) without the risk premium factor is always invariant under the

Lie algebra. However, when

is constant, Equation (

5) is invariant under a larger Lie algebra. The application of the Lie symmetries to Equation (

5) can be found in

Section 3, in which we reduce the

evolution equation by using the zeroth-order invariants provided by the Lie symmetries and we derive invariant solutions. In

Section 4 and

Section 5 we study two models of stochastic volatility for European options, the Heston model and the Stein-Stein model, respectively. For these two models, we find that both are invariant under the Lie algebra

, and we apply the Lie symmetries to solve the equations of the two models. For the Heston model, the closed-form solution is expressed in terms of Kummer Functions, whereas for the Stein–Stein model, the closed-form solution is expressed in terms of Hypergeometric Functions. Furthermore, we give some numerical solutions for the two models. Finally, in

Section 6, we discuss our results and draw our conclusions

2. Lie Symmetry Analysis

We consider the Black-Scholes-Merton Equation with stochastic volatility governed by the evolution Equation (

5) for which the premium term depends only upon the return-to-risk ratio. For a time-independent rate-of-return, Equation (

5) becomes

Let Φ be the map of an one-parameter point transformation such as

with infinitesimal transformation (

ε is the parameter of smallness.)

and generator

Consider now that

is a solution of Equation (

10) and under the map Φ, Equation (

11),

is also a solution of Equation (

10). Then, we say that the generator

of the infinitessimal transformation of the one-parameter point transformation, Φ, is a Lie (point) symmetry of (Equation

10) and Equation (

10) is invariant under the action of the map Φ. That means that there exists a function

ψ such that the following condition holds [

29]

or, equivalently,

where

is the second prologation/extension of

X in the space of variables

. Specifically

is defined from the following formula

where

are given by the relations

and

The importance of the existence of a Lie symmetry for a partial differential equation is that from the associated Lagrange’s system,

Zeroth-order invariants,

, can be determined which can be used to reduce the number of the independent variables of the differential equation.

In the following, we perform a classification of the Lie symmetries of Equation (

10). Function

is defined by the requirement that Equation (

10) admit Lie symmetries. The latter requirement can be seen as a geometric selection rule as the Lie symmetries are generated from the elements of the Homothetic Algebra [

30] of the (pseudo)Riemannian space, which defines the Laplace operator in the

evolution Equation (

10). In our case, the (pseudo)Riemannian manifold is defined by the Brownian motions,

of the stock price,

S, and of the volatility,

, respectively.

Before we proceed with the symmetry analysis, we remark that Equation (

10) is a linear equation which means that it always admits the linear symmetry,

and the infinite-dinensional abelian subalgebra of solutions,

, where function

is a solution of the original Equation (

10) [

31].

2.1. Classification

From the symmetry condition Equation (

17), we get a system of thirty-one equations ( for the derivation of the system, we used the symbolic package SYM of Mathematica [

32,

33]) in which the solution of the system gives the form of the generator Equation (

16) of the transformation Equation (

11), that transforms solutions into solutions. From the latter system, we have the following results.

For arbitrary function,

, Equation (

10) admits the Lie symmetries

plus the vector fields

. The algebra in which the Lie symmetries form is the

.

When

, Equation (

10) admits the Lie symmetries

plus the vector fields

. The Lie Brackets of the Lie algebra are given in

Table 1.

We remark that the two-factor model of commodities is invariant under the same algebra of point transformations [

15,

23]. That is an expected result because the two-factor model of commodities follows from the one-factor model in which the second factor, product, follows an Orstein-Uhlenbeck process. Moreover, as we discussed in the Introduction, the one-factor model is maximally symmetric just like the Black-Scholes-Merton Equation.

On the other hand

means that the volatility

σ is constant. However, the second Brownian motion,

in the space wherein

σ is defined, interacts with the Brownian motion

and modifies the Black-Scholes-Merton Model. However, in the case for which the correlation

ρ vanishes,

i.e.,

, Equation (

10) is not reduced to Equation (

2) but only when the Orstein-Uhlenbeck process is identically zero, that is,

. Otherwise, the price

u depends upon the Orstein-Uhlenbeck process.

We continue with the reduction of Equation (

10) by applying the zeroth-order Lie invariants. Furthermore for every reduced equation we study the Lie symmetries.

4. Heston Model

In the Heston model for stochastic volatility the stock price,

S, and the volatility,

, satisfy the stochastic differential equation given below

where, in comparison with Equation (

1) and Equation (

3), we observe that

and

. The differential equation which corresponds to that model is

Before we proceed with the symmetry analysis of Equation (

46), we perform the coordinate transformation

. Then, Equation (

46) becomes

in which we have made the replacements

and

. Equation (

47) can be compared with Equation (

5) for

. However, the risk premium factor of Equation (

9) is not zero and has absorbed the term of the Orstein–Uhlenbeck process.

From the Lie symmetry condition, Equation (

17) for Equation (

47) we find that this equation admits the Lie symmetries

plus the

, that is, Equation (

47) is invariant under the Lie algebra

.

We continue with the application of the Lie symmetries in order to reduce Equation (

48). We follow the results of

Section 3.1, that is, we apply the group invariants of the subalgebra

.

We find that the corresponding invariant solution of Equation (

47) is

where

satisfies the linear second-order differential equation:

the solution in closed form of which is expressed in terms of Kummer Functions.

In

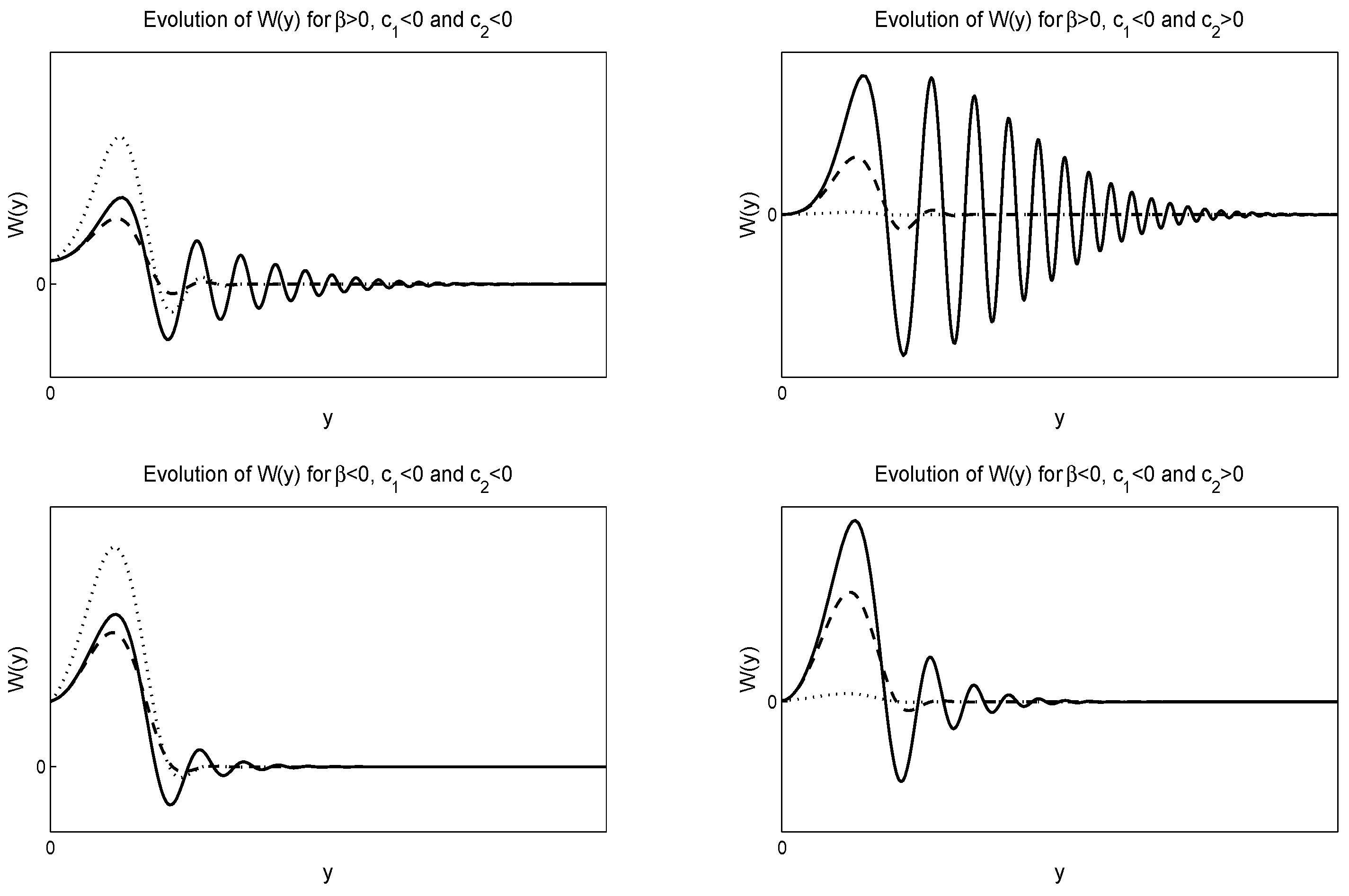

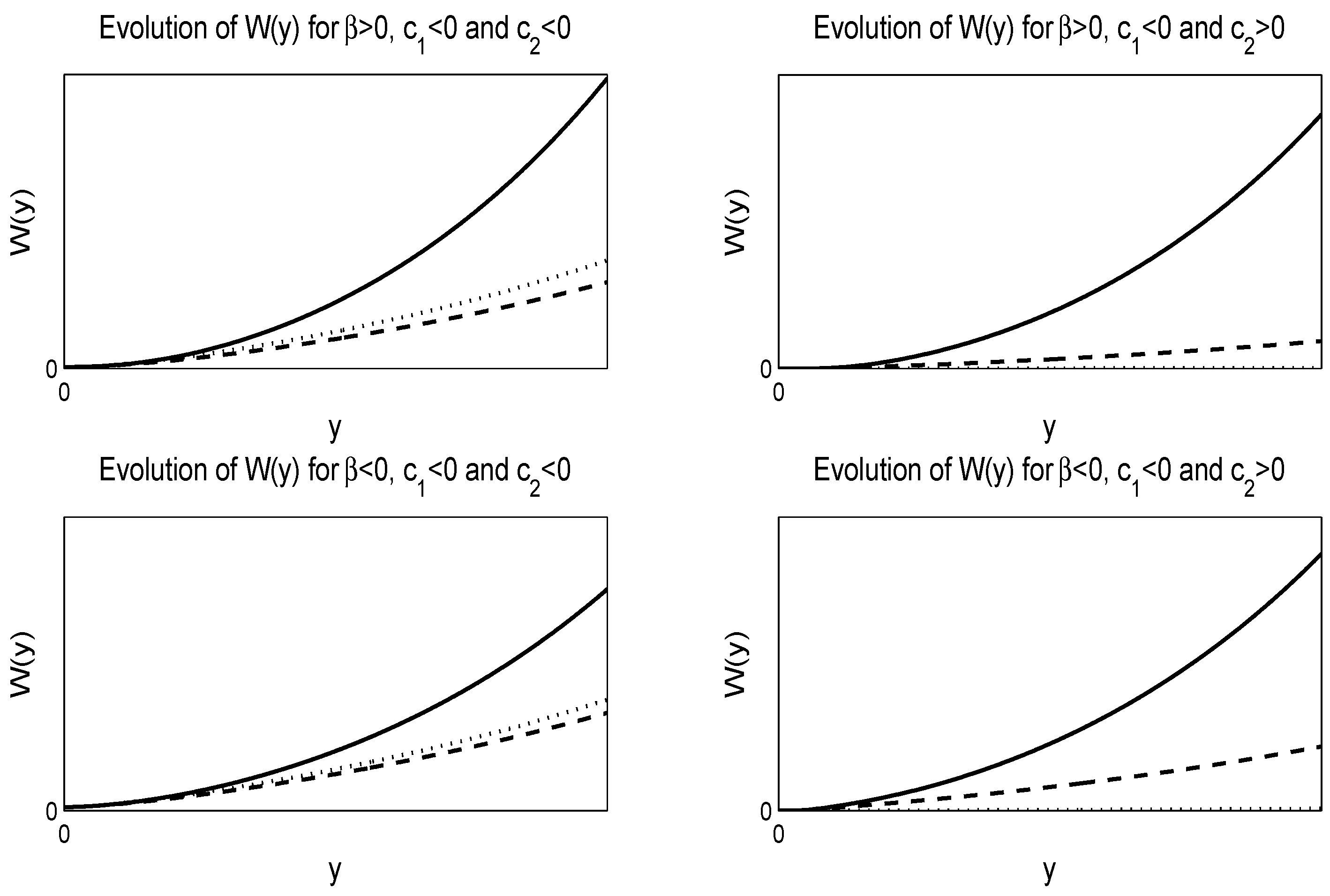

Figure 1 and

Figure 2, we give numerical solutions of Equation (

50).

Figure 1 is for negative value of

whereas

Figure 2 is for positive value of

, where

.

5. Stein-Stein Model

The model which has been proposed by Elias M. Stein and Jeremy C. Stein [

28] describes an European option with stochastic volatility for which the correlation among the two Brownian motions vanishes,

i.e.,

, in Equation (

4). Moreover, they considered that the risk premium factor is constant,

i.e.,

and the volatility is

, while the stochastic differential equation is

Therefore, from Equation (

5), we have that the

evolution differential equation of the Stein-Stein model is

From the Lie symmetry condition Equation (

17), we find that Equation (

53) admits the Lie symmetries

which form the Lie algebra

, and it is the admitted algebra of the Heston model and of Equation (

10) for the arbitrary function

.

Following the steps of the previous sections, we find that the invariant solution of the Stein–Stein model with respect to the Lie algebra

is

where

is given by the linear second-order differential equation

The closed-form solution of this equation can be expressed in terms of the Hypergeometric Functions, where

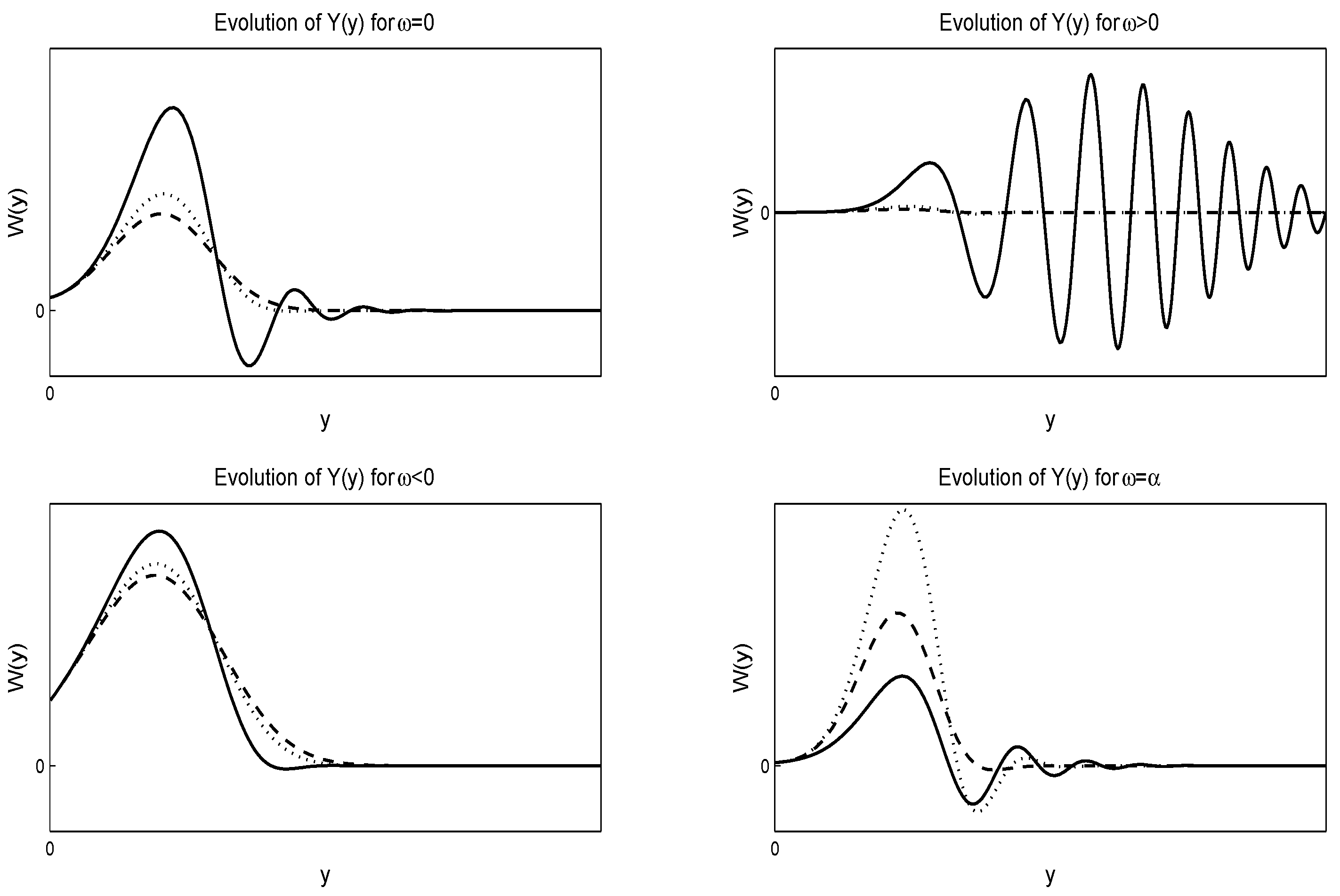

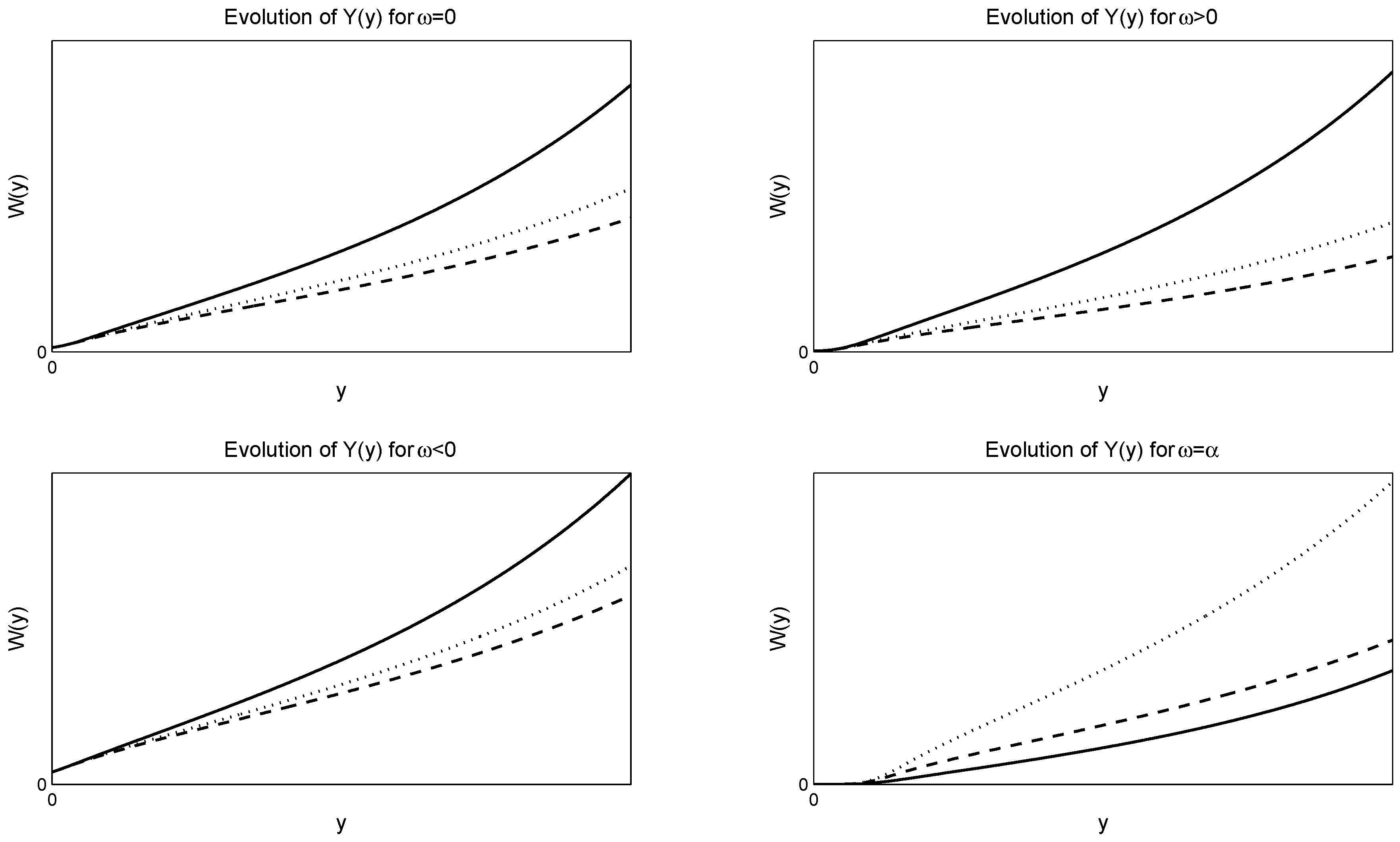

. In

Figure 3 and

Figure 4, we give the numerical evolution of

for various values of the parameters,

and

α, for negative

and positive

respectively, where

.

6. Conclusions

Volatility with a stochastic process has been shown to be essential for Financial Mathematics. In this work, we studied the algebraic properties, i.e., the Lie symmetries, of the modified Black-Scholes-Merton Equation for European options with a stochastic volatility. We have shown that the autonomous model without the risk premium factor is invariant under a group of point transformations which form the Lie Algebra for an arbitrary functional form of the volatility, σ. Moreover, when the volatility is constant but the price of the option depends on the second Brownian motion, in which the volatility is defined, the modified Black-Scholes-Merton Model is invariant under six, plus the infinity, Lie point symmetries and it is not maximally symmetric as theBlack-Scholes-Merton Equation with nonstochastic volatility is.

Furthermore, we showed that the Black-Scholes-Merton Model, in which the volatility is constant, but is defined by an Orstein-Uhlenbeck process, is invariant under the same group of point transformations as that of the two-factor model of commodities. The reason for that is that the two models have in common the terms which follow from the Orstein-Uhlenbeck process.

Moreover, we applied the zeroth-order invariants of the Lie symmetries, and we reduced the model to a linear second-order differential equation. As far as the case of constant volatility is concerned, we found the closed forms of the group invariant solutions.

Finally, we studied the algebraic properties and the invariant solutions of two models, the Heston model and the Stein-Stein model, with stochastic volatility of special interest. For each model, we found the invariant solution and we gave some figures for the evolution of the models. Of course because Equation (

5) is a linear equation, the general solution is given by the linear combination of the invariant solutions that we have found, while the latter are constrained by the initial conditions and the boundary conditions of the model.

A general consideration of Equation (

5), in which the risk premium factor plays a role is still in progress, and the results will be published elsewhere.