Appendix B. Proofs of Lemmas

This section lists the main proofs of the lemmas in the paper.

Proof of Lemma 2. For each , solving , we can find a solution of . If , then ; if not, then .

Next, we prove . Note that is a strictly decreasing function of . Hence, for implies or . We then derive for ; we have , and thus . Moreover, for , we have or . Hence, we derive . Combining with , we derive .

Consequently, we have . Meanwhile, and are mutually exclusive. Moreover, the definitions of and imply that and are mutually exclusive. We then derive that , , and are mutually exclusive.

It is concluded that , , and constitute a precision partition for . □

Proof of Lemma 3. Assume ; then, .

Taking the first derivative of

with

yields

where

and

.

Note that for all . Hence, for all , . In other words, strictly decreases with . Combining with , subject to . Since is a continuous function with and , for , and ; we have and , where are arbitrarily small and greater than 0. In addition, and depend on .

In summary, given , we have . Moreover, , ; we derive and . □

Proof of Lemma 4. We divide the proof into two parts.

(1) We prove the given ; then, , .

Recall the expression of the first derivative of

in (

A2). If

, we have

. Recall

. For

,

,

, which implies

. Combining with Lemma 3, we have

.

(2) Taking the first derivative of

with

yields

Note that for all . Combining with , we have for all , which implies for all . Combining with , we have for all , which implies . Hence, and . □

Proof of Lemma 5. Recall

increases with

and

for

. Based on the expression of

in (

A3), we derive that

strictly decreases with

.

Given , we have . Combining with , there must exist a unique subject to . We derive if and if .

Combining with , we derive . Since is a strictly decreasing function of if , there must exist a unique subject to . We then derive if and if . Hence, we derive .

Note that the sets and are mutually exclusive. We have if . Therefore, any precision in the set is lower than any precision in the set . □

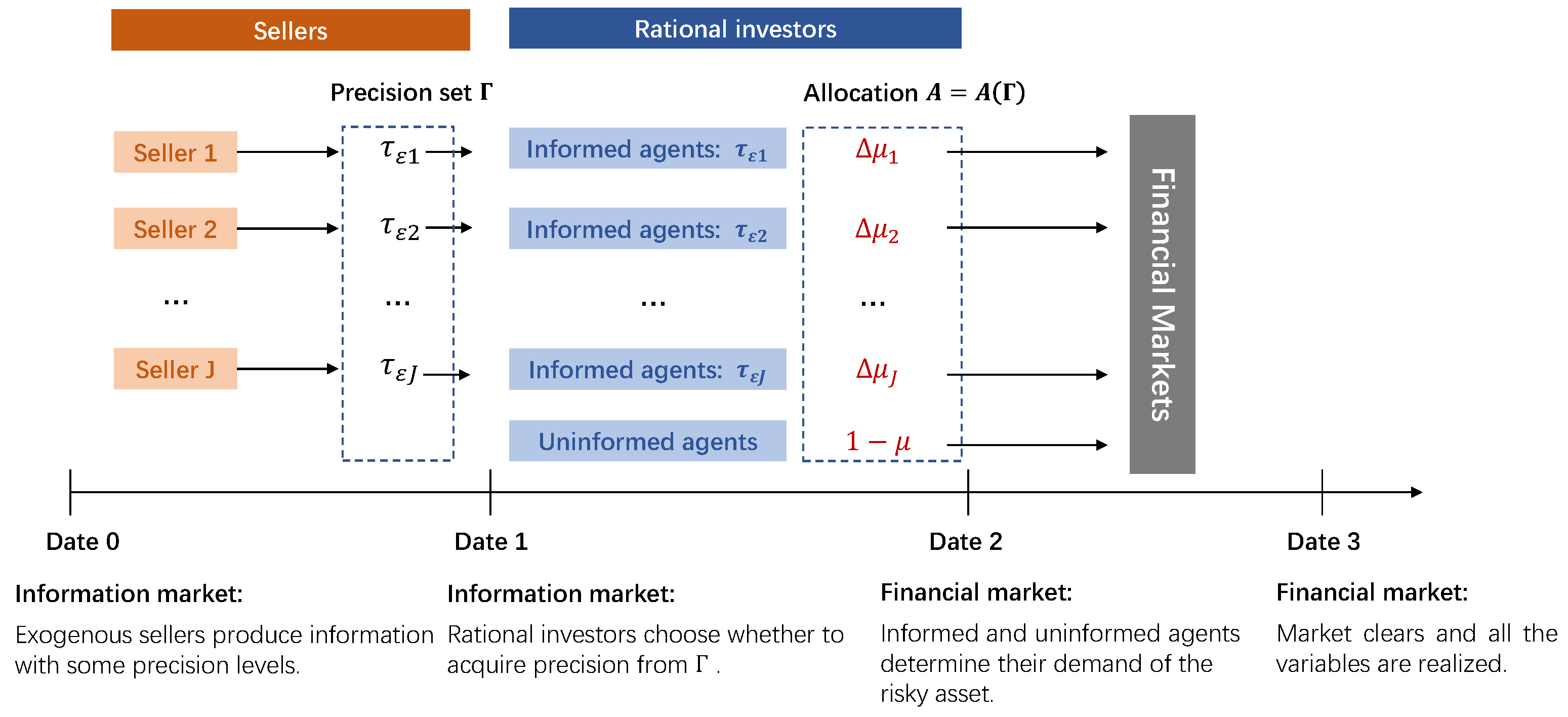

Proof of Lemma A1. Definition 2 implies that rational investors need to solve the following optimization problem for information acquisition:

Proposition 5 implies that when all rational investors acquire

, their net expected gain is equal to zero, i.e.,

where allocation

denotes that all rational investors acquire

and the price informativeness is

Due to

, we derive

. Note that the net expected gain

is a concave function with

given allocation

. Combining with

, the net expected gain of a rational investor with precision

given allocation

meets the condition

Next, we prove that all rational investors’ net expected gain is equal to zero in the information market equilibrium.

Suppose that all rational investors acquire a level of precision from

. Meanwhile, the corresponding allocation is denoted as

. We then have

where

.

Furthermore, due to

, we derive

Hence, given allocation

, the net expected gain of a rational investor with precision

satisfies

In other words, the net expected gain of rational investors with precision given any allocation is always less than or equal to zero.

Moreover, rational investors can always choose to be uninformed and have zero net expected gain. Since all rational investors have identical net expected gain in information market equilibrium, we then derive that all rational investors must have zero net expected gain in equilibrium.

Finally, we claim that all informed agents choose the same precision level in information market equilibrium.

It is assumed that equilibrium is characterized by allocation . Rational investors can acquire at most two various levels of precision with the same net expected gain because the net expected gain is a concave function with precision given allocation . Moreover, Definition 2 implies all rational investors have identical net expected gain in information market equilibrium. Combining with , we derive that there exists only one level of precision such that . Hence, all informed agents acquire identical precision levels in equilibrium. □

Appendix C. Proofs of Propositions

This section lists the main proofs of the propositions in the paper.

Proof of Proposition 1. For notation simplification, we use , , and p to substitute for , , and .

Consider the linear strategy. From Equations (

5) and (

6), the demands for informed agents and uninformed agents can be rewritten by

and

.

Combining with the market-clearing condition shown in Equation (

2) yields

, where

,

,

, and

.

Hence, given the linear strategy, the information set is observable equivalent (O.E.) to .

Define

,

. Based on the projection theorem, we have

and

, since

. Going back to Equation (

5), the trading strategy of the informed agent

is given by

where

.

Similarly, since

, going back to Equation (

6), the strategy of the uninformed agent

i is given by

Substituting the expressions of

and

into the market-clearing condition shown in Equation (

2) yields

where

,

.

Combining with (

A14), we rewrite (

A12) and (

A13) by

where

.

Note that we omit some notations as functions of allocation A for notation simplification. These notations are as follows:

,

,

,

,

,

,

, and

. Moreover, the coefficients of

in Equation (

1) are verified by

,

, and

. □

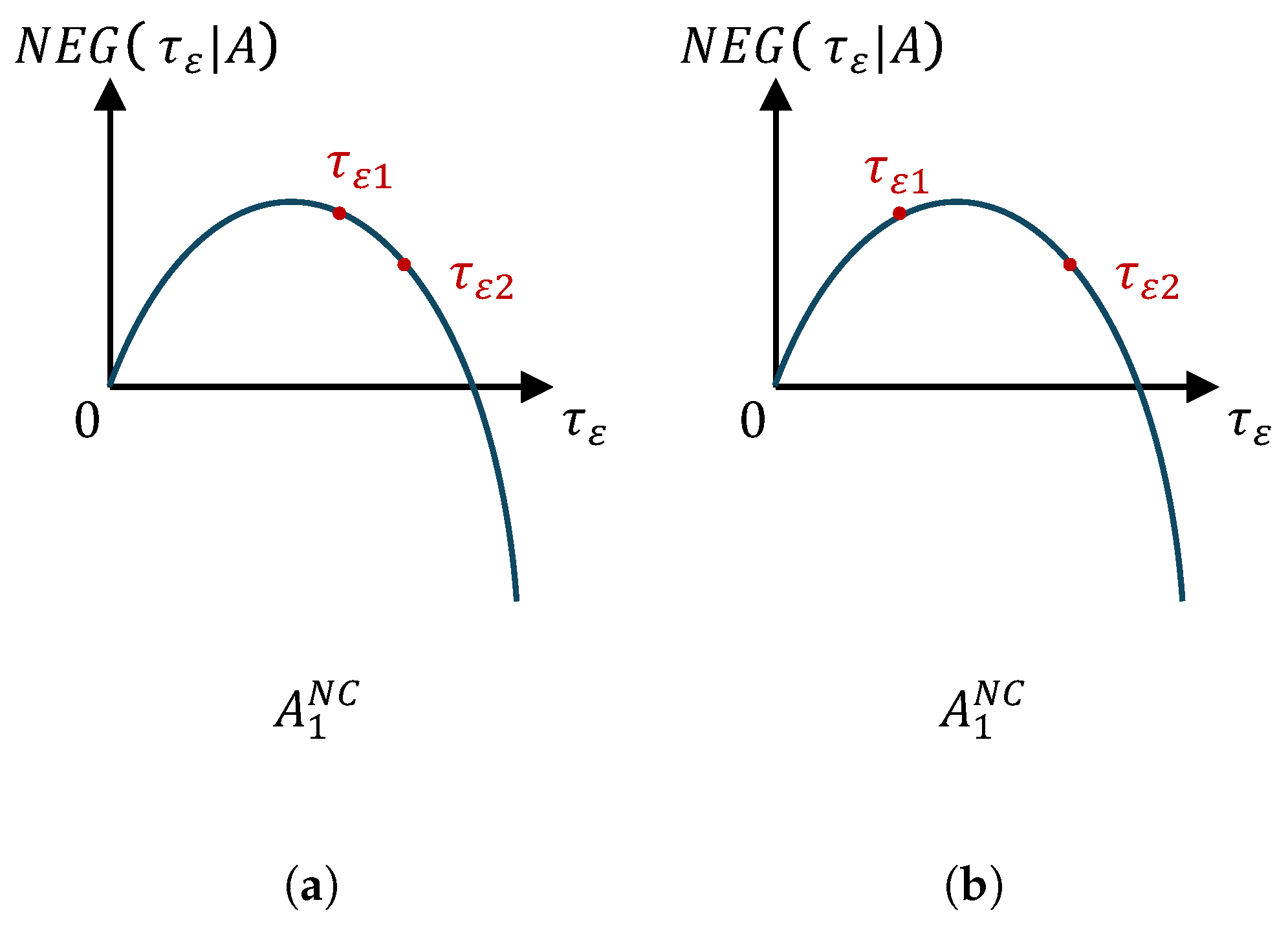

Proof of Proposition 2. We use mathematical induction to complete our proof. The total proof is divided into three parts.

We consider a scenario where the information market features two sellers denoted as and information precision set only contains two elements, and (i.e., Scenario ). Meanwhile, rational investors need to make their optimal information acquisition decisions from the set .

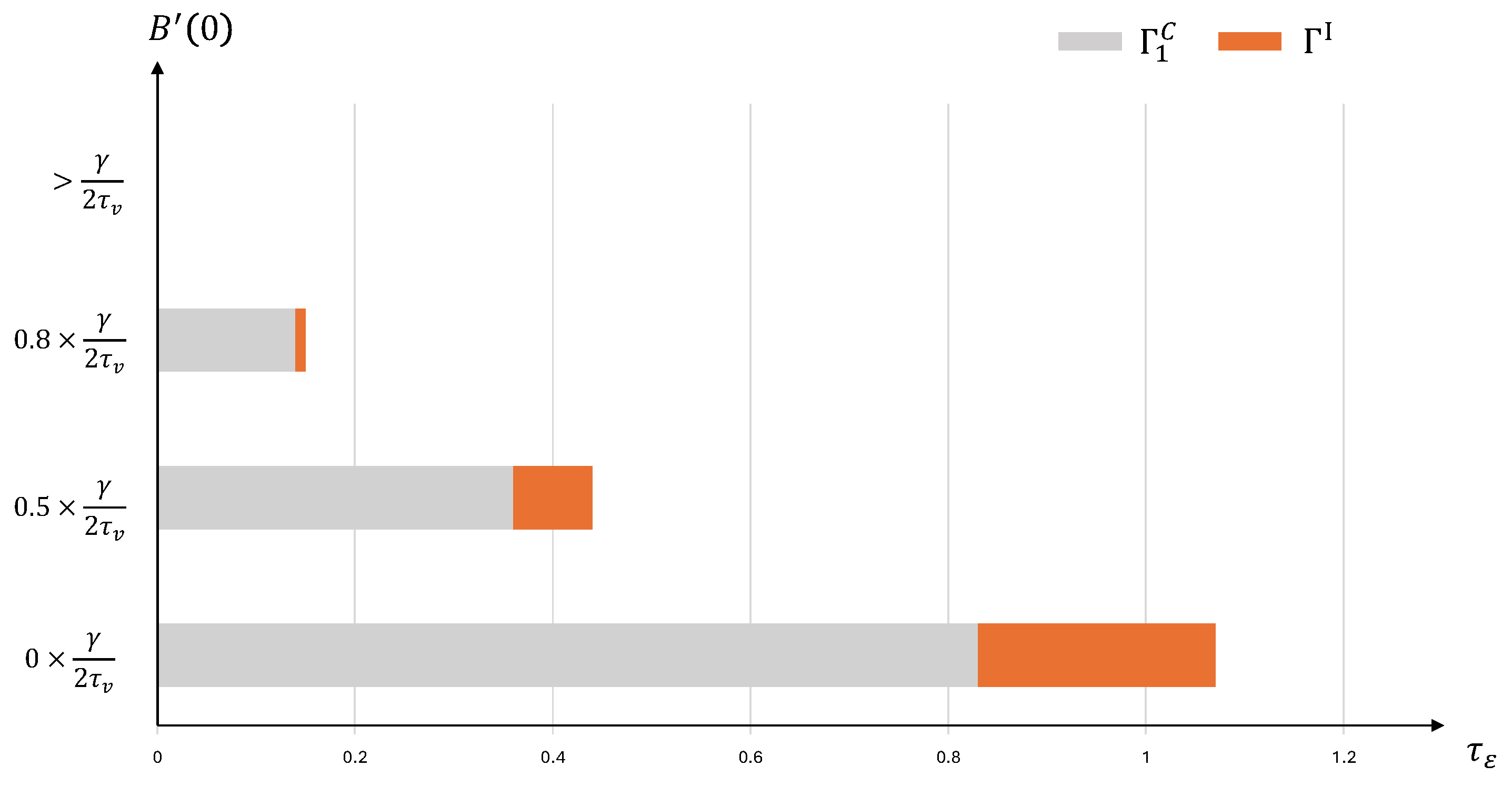

We first judge whether the allocation

is an information market equilibrium. There are four possible types of allocation

illustrated in

Figure A1,

Figure A2, and

Figure A3, respectively.

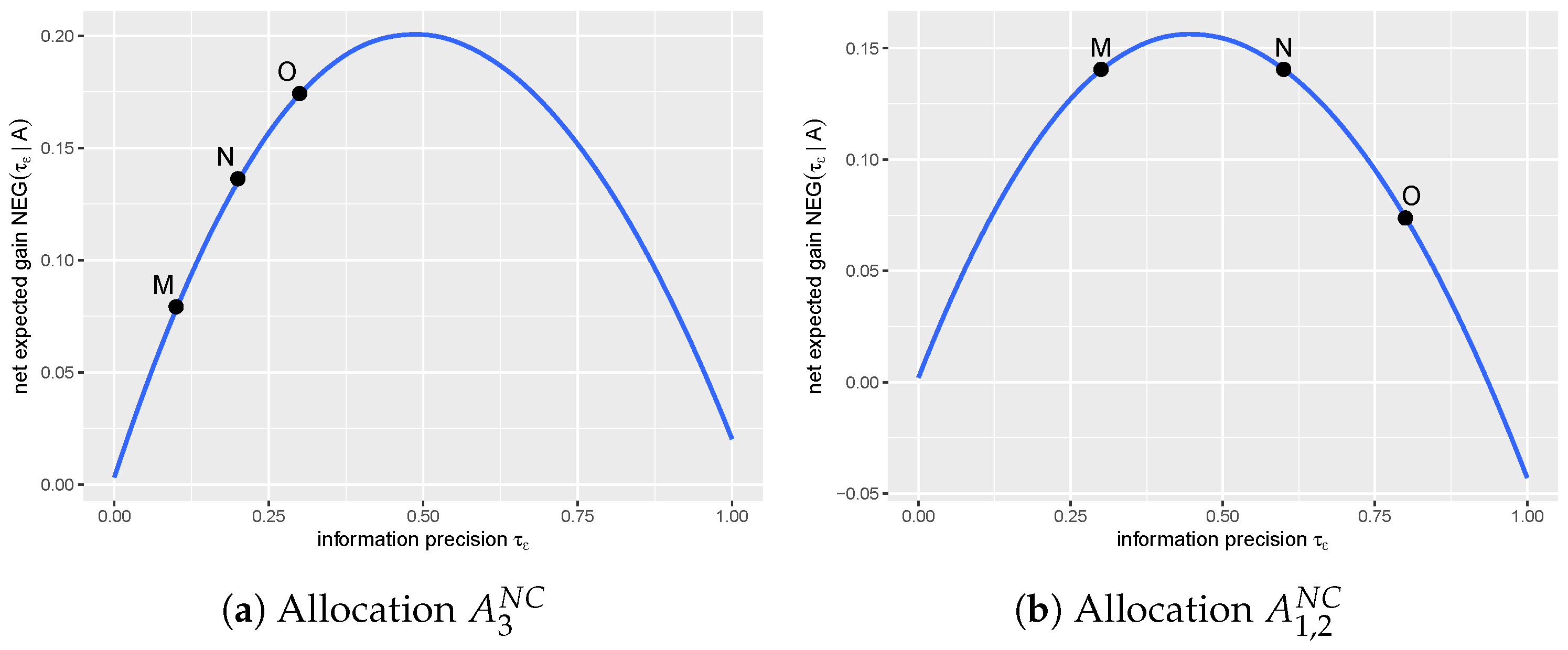

In

Figure A1, each type of allocation

is a non-zero corner equilibrium because

and all investors have identical net expected gain.

In

Figure A2, the third type of allocation

is not an information market equilibrium because

. We then turn to verify whether the allocation

is an information market equilibrium. There are four possible evolutionary routes for allocation

given this type of allocation

. Each evolutionary route leads to a non-zero corner equilibrium.

In evolutionary route a, allocation is a non-zero corner equilibrium because and all rational investors have identical net expected gain.

In evolutionary route c, although allocation is not an information market equilibrium (see ), we can find a non-zero corner equilibrium characterized by another allocation where a part of the rational investors acquire and others acquire . Moreover, allocation can be built in the following ways:

Expanding

yields

where

,

.

(

A17) implies that

is a strictly increasing function with

.

and

implies there exists a value of

such that

where

,

,

.

Similarly, we can analyze a non-zero corner equilibrium in evolutionary route b and a non-zero corner equilibrium in evolutionary route d.

In

Figure A3, there are three various evolutionary routes given the fourth type of allocation

. Similarly, allocation

in evolutionary route a and allocation

in evolutionary routes b and c are non-zero corner equilibria, respectively.

We conclude there exists a non-zero corner equilibrium in the information market where two sellers produce precision and . In the equilibrium, all rational investors acquire identical precision, or a part of the investors acquire and others acquire .

It is assumed that there exists a non-zero corner equilibrium in the scenario where the information market features

sellers with the precision set

(i.e., Scenario

). Meanwhile, the equilibrium is characterized by an allocation

or an allocation

, where

. The allocation

denotes that all rational investors acquire

. The allocation

denotes that a part of the investors acquire

and others acquire

. Meanwhile,

and

satisfy

We attempt to analyze the existence of information market equilibrium in a situation where the information market features sellers with a precision set (i.e., Scenario ), by using the assumption depicted in Part 2.

Case 1: It is assumed that there is a non-zero corner equilibrium characterized by allocation in the Scenario .

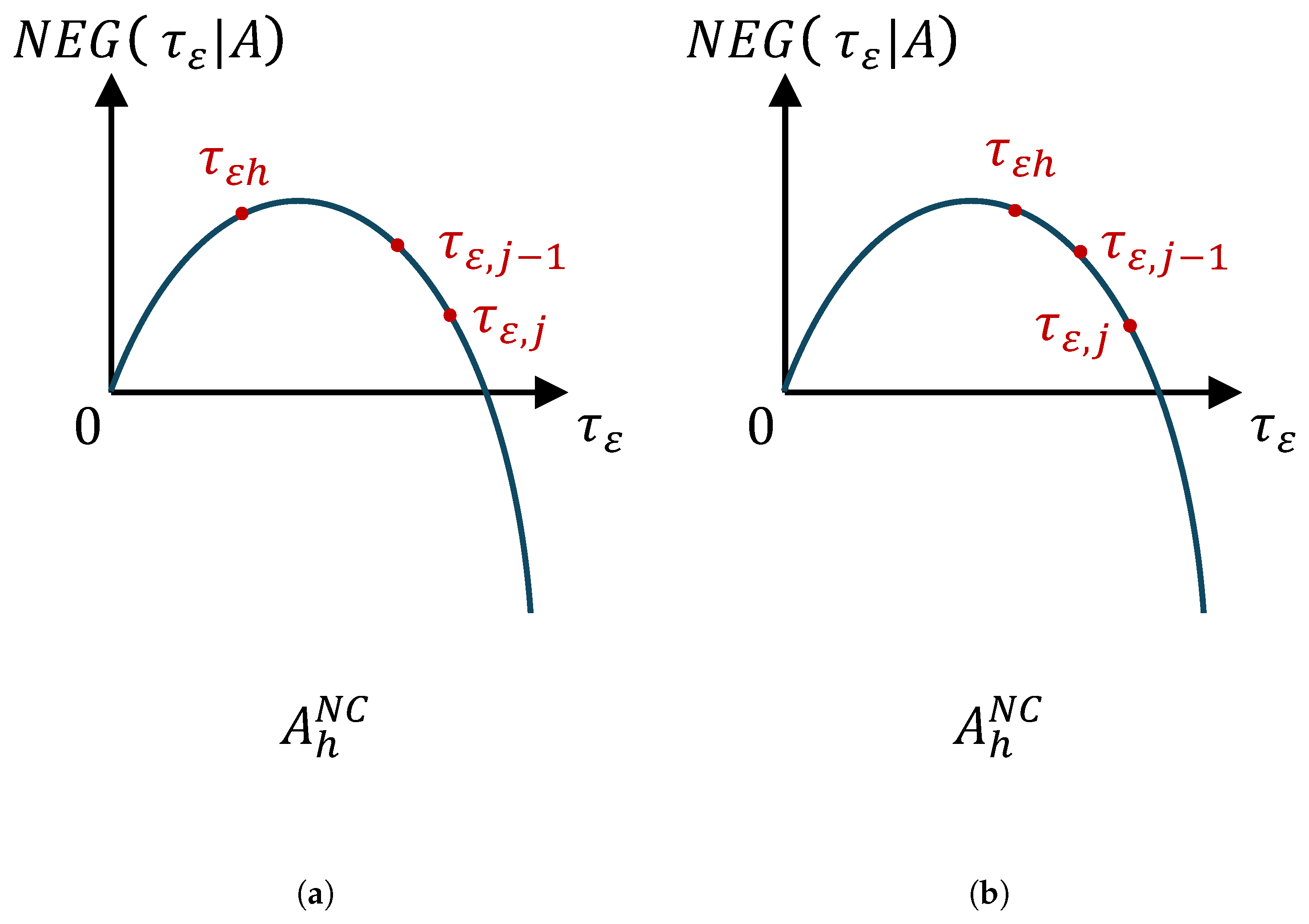

(1) Suppose .

There are a total of two possible types of allocation

illustrated in

Figure A4. We find that each type of allocation

indicates a non-zero corner equilibrium in the Scenario

. This occurs because

.

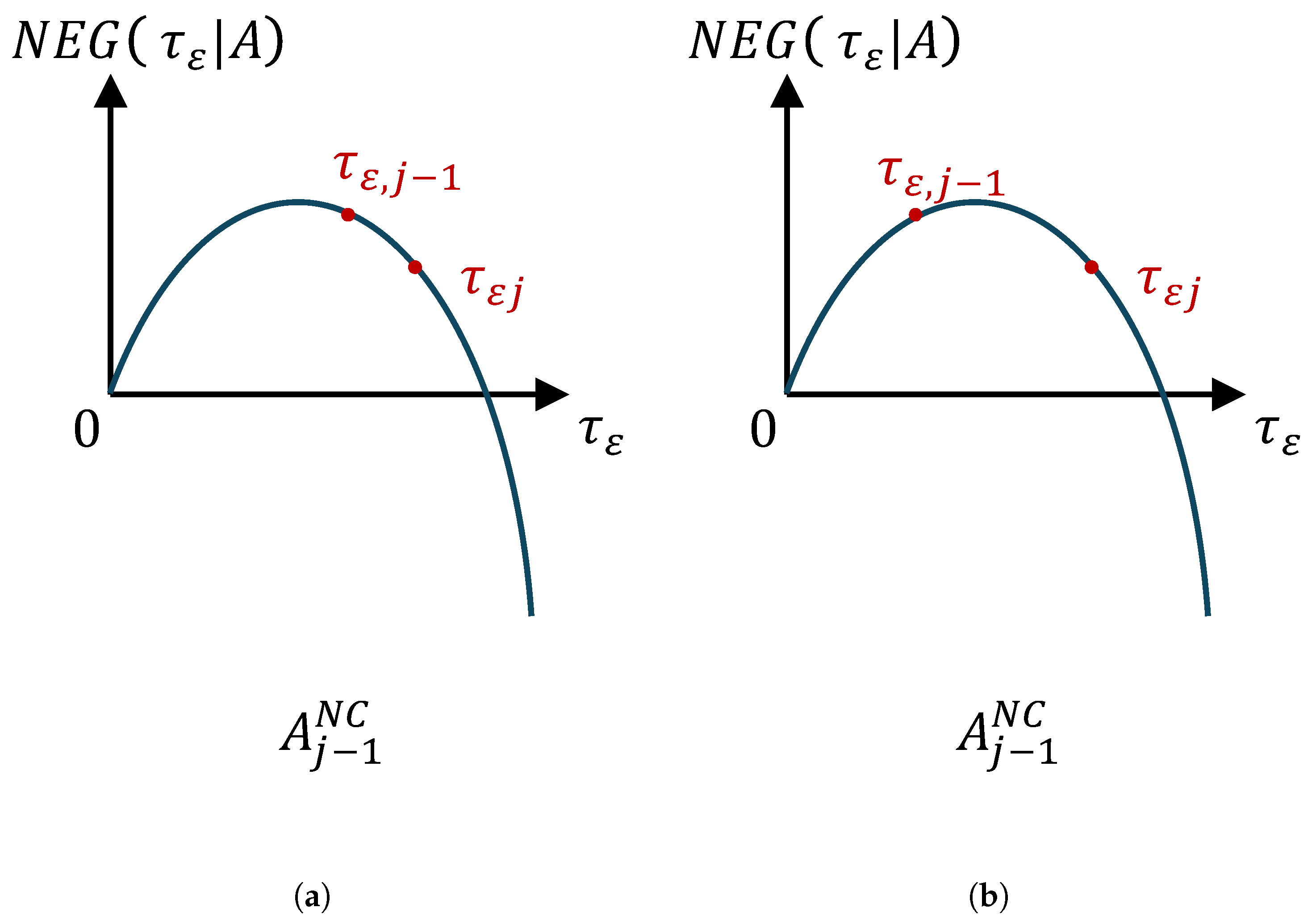

(2) Suppose .

There are a total of four possible types of allocation

. The fourth type of allocation

is similarly analyzed as the allocation

illustrated in

Figure A2. We focus on the other three types of allocation

illustrated in

Figure A5 and

Figure A6.

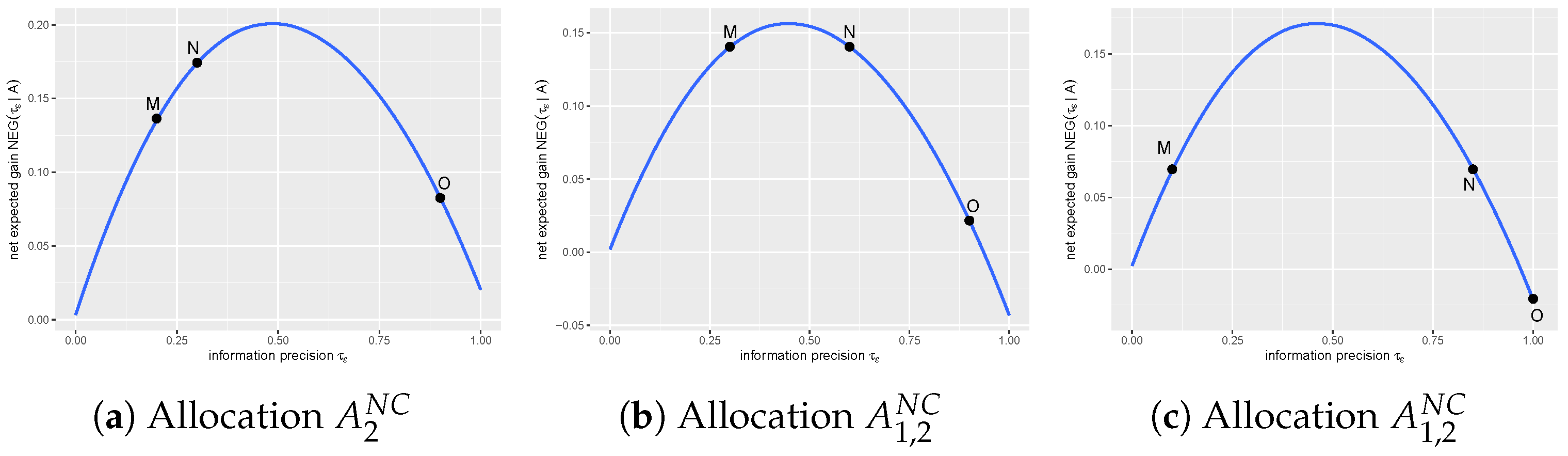

In

Figure A5, each type of allocation

is a non-zero corner equilibrium because

.

In

Figure A6, the third type of allocation

has three various evolutionary routes. In evolutionary route a, allocation

is a non-zero corner equilibrium; in evolutionary routes b and c, allocation

is a non-zero corner equilibrium.

Hence, we conclude that if there exists a non-zero corner equilibrium characterized by in the Scenario , we will derive that there exists a non-zero corner equilibrium in the Scenario .

Case 2: It is assumed that there is a non-zero corner equilibrium characterized by the allocation in the Scenario .

Combining and , we derive . Therefore, allocation is still a non-zero corner equilibrium in the Scenario .

We have completed our mathematical induction through the above proof. First, we prove there exists a non-zero corner equilibrium in the Scenario . Second, we assume there exists a non-zero corner equilibrium in the Scenario . Third, given the assumption, we derive that there exists a non-zero corner equilibrium in the Scenario . Hence, when the information market features sellers, there always exists a non-zero corner equilibrium characterized by the allocation shown in Proposition 2. □

Figure A1.

The relationship between the net expected gain and information precision given two different types of allocation . Panels (a,b) characterize the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A1.

The relationship between the net expected gain and information precision given two different types of allocation . Panels (a,b) characterize the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A2.

The relationship between the net expected gain and information precision given the third type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A2.

The relationship between the net expected gain and information precision given the third type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A3.

The relationship between the net expected gain and information precision given the fourth type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A3.

The relationship between the net expected gain and information precision given the fourth type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A4.

The relationship between the net expected gain and information precision given two different types of allocation . In the figure, Panels (a,b) represent the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given an allocation A, implying . Points between and are ignored.

Figure A4.

The relationship between the net expected gain and information precision given two different types of allocation . In the figure, Panels (a,b) represent the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given an allocation A, implying . Points between and are ignored.

Figure A5.

The relationship between the net expected gain and information precision given two different types of allocation . In the figure, Panels (a,b) represent the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given , implying .

Figure A5.

The relationship between the net expected gain and information precision given two different types of allocation . In the figure, Panels (a,b) represent the first and second types of allocation , respectively. In both panels, the position of the point is higher in vertical height than the point given , implying .

Figure A6.

The relationship between the net expected gain and information precision given the third type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Figure A6.

The relationship between the net expected gain and information precision given the third type of allocation . In the figure, the orange lines denote potential evolutionary routes. An allocation in bold black in an evolutionary route indicates an information market equilibrium. For instance, allocation in bold black in route a is a non-zero corner equilibrium. Specifically, allocation denotes that a part of the rational investors acquire and others acquire . Moreover, the position of the point is higher in vertical height than the point given an allocation A, implying .

Proof of Proposition 3. Based on Lemma A1, there is only one precision level in information market equilibrium. In the following, we examine whether allocation where is an information market equilibrium.

We divide our proof into three sub-proofs. First, we prove is equivalent to ; second, we prove there exists a unique such that ; third, we prove that the price informativeness when all informed agents acquire .

We prove . We divide our proof into two parts.

(1) .

For

, the net expected gain of informed agents with precision

given

satisfies

Due to , we derive . Hence, , .

Moreover,

implies that

. We then derive

(2) .

Note that

. For

, we have

Expanding

yields

Due to

, we can always find an allocation

such that

. Expanding

yields

Comparing the coefficients of (

A23) and (

A24) yields

.

The above two parts of the proof imply that is equivalent to .

We prove that there exists unique precision such that .

Since has finite elements, we can always find such that .

It is assumed that there is another precision

such that

. The net expected gain of informed agents with precision

given allocation

satisfies

Note that the net expected gain of informed agents with precision

given

satisfies

We then have .

Note that the net expected gain of uninformed agents is always equal to zero (see ). As a result, implies because is a concave function with precision given . This is in contrast with our assumption that . Thus, the optimal precision , which maximizes price informativeness, is unique.

We prove when all informed agents acquire .

Combining with , as a concave function, we derive that decreases with , where .

Due to

, where

, we derive

Since

,

. We have

Comparing the coefficients of the left-hand and right-hand sides yields

which implies

. □

Proof of Proposition 4. We first show that allocation

,

is not an information market equilibrium. Note that

.

as a concave function implies that

for

. We then have

Hence, allocation is not an information market equilibrium.

Next, we indicate that each type of allocation leads to an information market equilibrium, where allocation denotes the “equilibrium allocation” in the scenario in which rational investors can only choose precision from the set . As , by using the result in Proposition 2, we derive that allocation is equal to allocation , where , or allocation , where .

Suppose that

, where allocation

satisfies

(1) Consider .

Note that

is a concave function with given allocation

. Due to

and

,

, we derive

Combining with (

A32), we derive allocation

as a non-zero corner equilibrium.

(2) Consider .

(a) Suppose .

Therefore, allocation is a non-zero corner equilibrium.

(b) Suppose .

Since

, we have

. Combining the fact that

is a concave function with given

and

yields

Note that

for

. Given

, we derive

Due to

, we have

Comparing the coefficients of (

A37) and (

A38) yields

. Due to

, we then have

Moreover, given an allocation

A, expanding

yields

Since , is a strictly increasing function of .

Combining (

A36) and (

A39) yields

Therefore,

holds. Combining this with the assumption

, we derive that there exists an allocation

where a part of the rational investors acquire

and others acquire

such that

Clearly, allocation

is a non-zero corner equilibrium. This occurs because

Suppose that

, where

Due to the concave feature of

, for

,

, we derive

Hence, allocation is still a non-zero corner equilibrium.

In conclusion, by using the “equilibrium allocation” in the situation where rational investors can only choose precision in the set , there always exists a non-zero corner equilibrium characterized by an allocation satisfying the conditions in Proposition 4. □

Proof of Proposition 5. Given an information precision set , there is a unique interior equilibrium characterized by equilibrium allocation where all informed agents choose the same precision level based on Proposition 3. In this case, price informativeness is denoted as .

As information quality enhances, the precision set changes to ; similarly, there is a unique interior equilibrium characterized by equilibrium allocation where all informed agents choose the same precision level . In addition, price informativeness is denoted as .

Note that ; we then have by using Proposition 3.

As costs of information acquisition decrease, more informed agents will acquire information due to higher information value. Following the expression of price informativeness in Proposition 3, it is concluded that price informativeness increases in financial markets. □

Proof of Proposition 6. Proposition 6 is directly derived from Proposition 3. QED. □