Distributed Energy Sharing Network Equilibrium in Industrial Parks Under Carbon Emissions Trading Mechanism

Abstract

1. Introduction

- (1)

- What are the conditions for reaching network equilibrium for distributed energy sharing in industrial parks under a carbon emissions trading mechanism?

- (2)

- Under network equilibrium conditions, what is the most ideal level of low-carbon energy, product trading volume, and trading prices for park enterprises?

- (3)

- What is the impact of a carbon emission cap allocated to enterprises by the government on the network equilibrium decisions of distributed energy sharing in industrial parks?

- (4)

- How does the carbon trading price in the carbon trading market affect the network equilibrium decisions of distributed energy sharing in industrial parks?

2. Literature Review

3. Problem Description and Model Assumptions

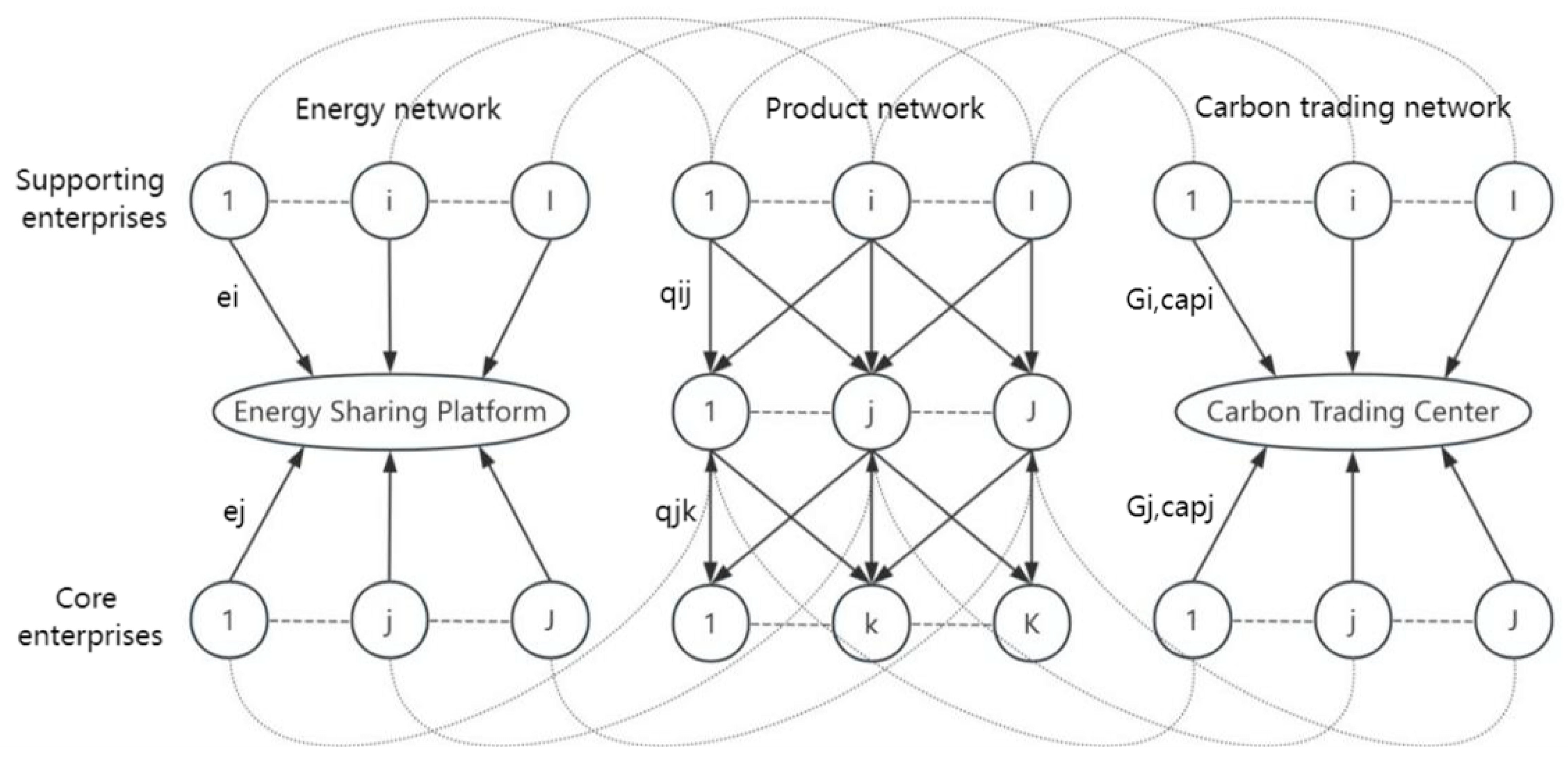

3.1. Description of the Problem

3.2. Model Assumptions

4. Analysis of Equilibrium Conditions of Distributed Energy Sharing Network in Industrial Park

4.1. Optimal Decision Behavior and Equilibrium Conditions for Supporting Enterprises

4.2. Optimal Decision Behavior and Equilibrium Conditions for Core Enterprise

4.3. Optimal Decision Behavior and Equilibrium Conditions in Demand Markets

4.4. Optimal Decision Behavior and Equilibrium Conditions for Carbon Trading Centers

5. Construction and Solution of the Network Equilibrium Model

- i.e., solving , such that

6. Numerical Example Analysis

6.1. Numerical Examples

6.2. Analysis of Numerical Results

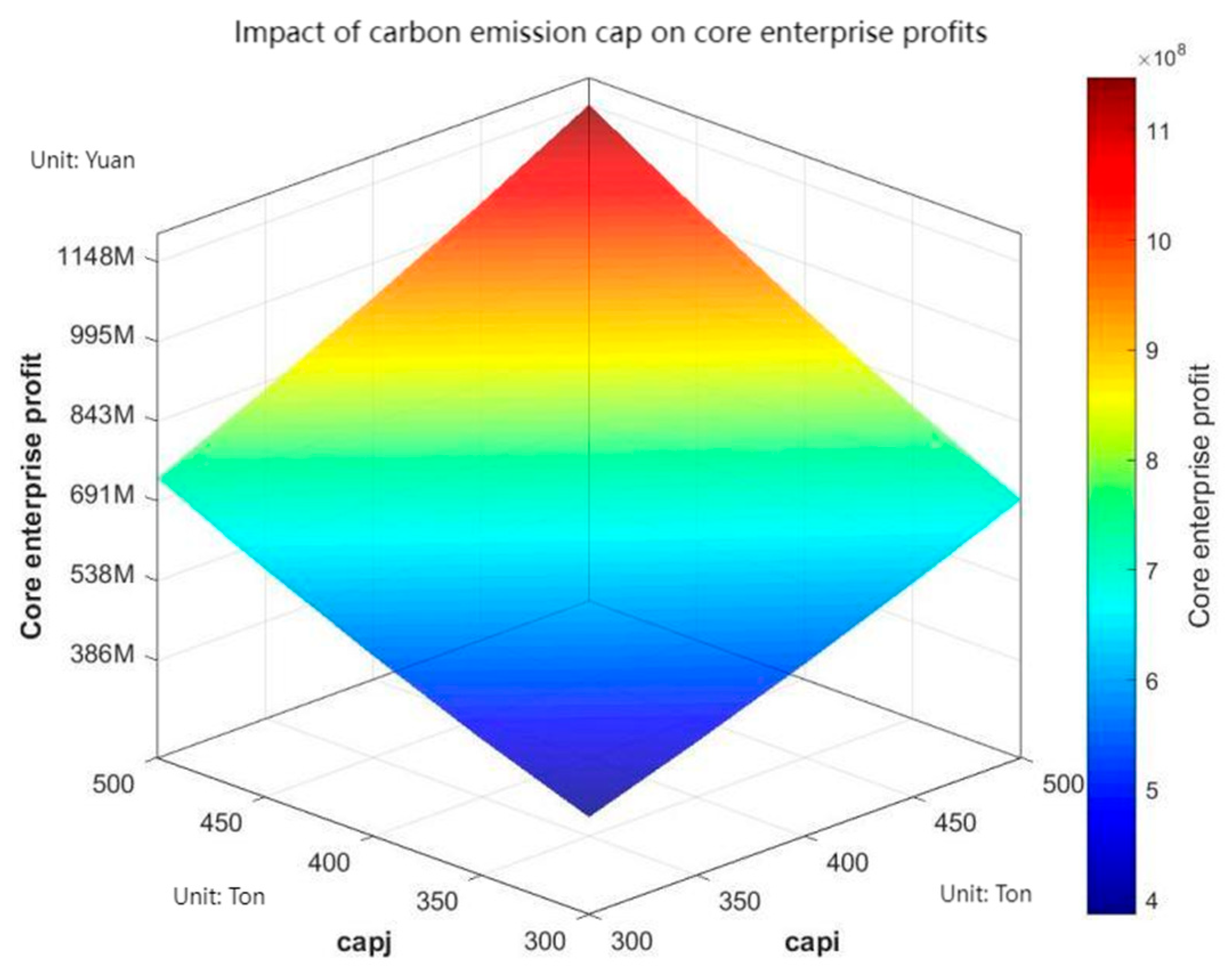

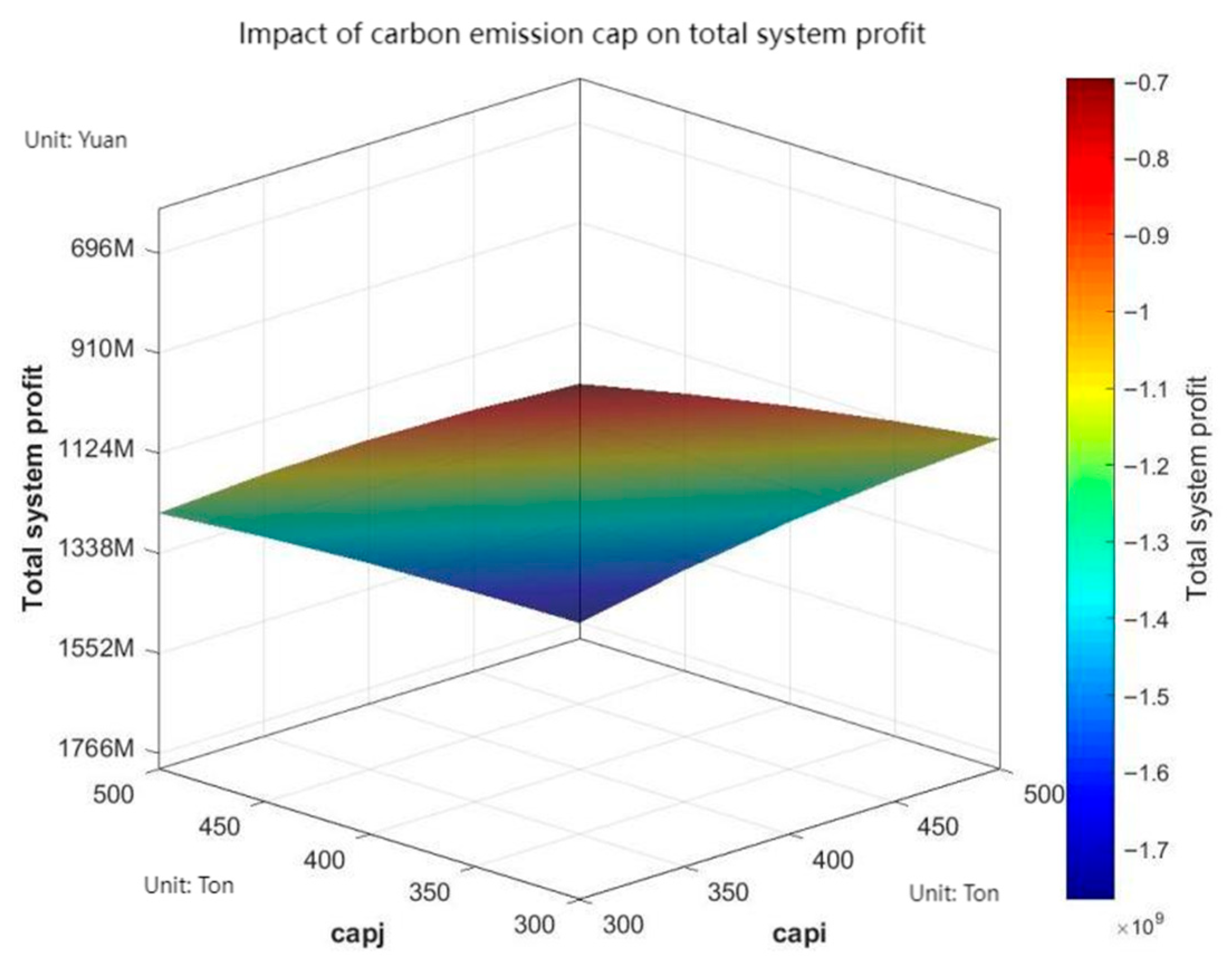

6.3. Impact of Carbon Emission Cap on Network Equilibrium

6.4. Impact of Carbon Trading Prices on Network Equilibrium

7. Conclusions

- (1)

- Although the government’s raising of the carbon emission cap for supporting enterprises will raise the trading volume and market price of products, as well as the profits of core enterprises, it will reduce the low-carbon level of distributed energy among supporting enterprises, decrease the profits of supporting enterprises, and lower the overall system profit. When the carbon emission cap of the supporting enterprises was raised from 200 to 350, the profit decreased from −11.576 billion to −16.88 billion. As a result, the total system profit deteriorated. This suggests that the government’s elevation of the carbon emission cap for supporting enterprises will reduce the enthusiasm of supporting enterprises for distributed energy sharing, affect the low-carbon level of distributed energy of supporting enterprises, increase the actual carbon emissions per unit of product, force supporting enterprises to buy more carbon emission cap from the core enterprises, widen the polarization of enterprises’ profits, and negatively affect the supporting enterprises’ profits and the system’s total profits.

- (2)

- The government’s raising of the carbon emission cap for core enterprises will raise the trading volume and market price of products, as well as the profits of core enterprises, but it will likewise lower the low-carbon level of distributed energy of core enterprises, the supporting enterprises’ profits, and the system’s total profits. This suggests that the government’s elevation of the carbon emission cap for core enterprises will lead to an increasing carbon cap available for sale in carbon trading by core enterprises, thereby reducing the incentive for core enterprises’ distributed energy sharing. Through the equilibrium constraint of carbon trading, core enterprises will gain higher profits through carbon trading, while supporting enterprises will have lower profits due to increased carbon trading costs, which in turn widens the polarization of enterprises’ profits and negatively affects total system profits.

- (3)

- The increase in carbon trading price will lead to different degrees of decline in product trading volume and product price, distributed energy low-carbon level of core enterprises and supporting enterprises, profits of both parties, and total system profits. When the carbon trading price rose from 2.5 CNY per ton to 10 CNY per ton, the product trading volume, energy low-carbon level, and profits of core and supporting enterprises all showed a monotonous downward trend, and the total system profit decreased by 37.1%. This indicates that a higher carbon trading price will increase the carbon trading cost of enterprises, reduce the enthusiasm for enterprise production, and have a negative impact on the distributed energy sharing of industrial parks, which in turn affects the profits of enterprises as well as the total profits of the system.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Sovacool, B.K.; Geels, F.W.; Iskandarova, M. Industrial Clusters for Deep Decarbonization. Science 2022, 378, 601–604. [Google Scholar] [CrossRef]

- Zhu, D.; Yang, B.; Wu, Y.; Deng, H.; Dong, Z.; Ma, K.; Guan, X. Joint Trading and Scheduling Among Coupled Carbon-Electricity-Heat-Gas Industrial Clusters. IEEE Trans. Smart Grid 2023, 15, 3152–3164. [Google Scholar] [CrossRef]

- Gilani, M.A.; Kazemi, A.; Ghasemi, M. Distribution System Resilience Enhancement by Microgrid Formation Considering Distributed Energy Resources. Energy 2020, 191, 116442. [Google Scholar] [CrossRef]

- Han, X.; Sun, L.; Tao, Y.; Zhao, J.; Wang, G.; Yuan, D. Distributed Energy-Sharing Strategy for Peer-to-Peer Microgrid System. J. Energy Eng. 2020, 146, 04020033. [Google Scholar] [CrossRef]

- Guo, X.; Xiao, B. Effects of China’s Low-Carbon Policy Under Stochastic Shocks—A Multi-Agent DSGE Model Analysis. Environ. Sci. Pollut. Res. 2023, 30, 65177–65191. [Google Scholar] [CrossRef]

- Liu, B.; Ding, C.J.; Hu, J.; Su, Y.; Qin, C. Carbon Trading and Regional Carbon Productivity. J. Clean. Prod. 2023, 420, 138395. [Google Scholar] [CrossRef]

- Wang, Z.; Wu, Q. Carbon Emission Reduction and Product Collection Decisions in the Closed-Loop Supply Chain with Cap-and-Trade Regulation. Int. J. Prod. Res. 2020, 59, 4359–4383. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does Carbon Emissions Trading Promote Green Technology Innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The Effect of Emission Trading Policy on Carbon Emission Reduction: Evidence from an Integrated Study of Pilot Regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Wang, X.; Huang, J.; Liu, H. Can China’s Carbon Trading Policy Help Achieve Carbon Neutrality? the Five-Sphere Integrated Plan Perspective. J. Environ. Manag. 2022, 305, 114357. [Google Scholar] [CrossRef]

- Wu, R.; Tan, Z.; Lin, B. Does Carbon Emission Trading Scheme Really Improve the CO2 Emission Efficiency? Steel Industry. Energy 2023, 277, 127743. [Google Scholar] [CrossRef]

- Du, M.; Antunes, J.; Wanke, P.; Chen, Z. Ecological Efficiency Assessment Under the Construction of Low-Carbon City: A Perspective of Green Technology Innovation. J. Environ. Plan. Manag. 2021, 65, 1727–1752. [Google Scholar] [CrossRef]

- Yu, J.; Sun, L. Supply Chain Emission Reduction Decisions, Considering Overconfidence under Conditions of Carbon Trading Price Volatility. Sustainability 2022, 14, 15432. [Google Scholar] [CrossRef]

- Fan, X.; Chen, K.; Chen, Y.-J. Is Price Commitment a Better Solution to Control Carbon Emissions and Promote Technology Investment? Manag. Sci. 2023, 69, 325–341. [Google Scholar] [CrossRef]

- Li, F.; Yang, Y.; Zhang, W.; Li, J. A Study on the Co-Opetition Game Between Low-Carbon Supply Chains Under Carbon Cap-and-Trade Policy. Manag. Decis. Econ. 2025, 46, 2986–2999. [Google Scholar] [CrossRef]

- Wang, H.; Lin, C. The Dual-Channel Low-Carbon Supply Chain Network Equilibrium with Retailers’ Risk Aversion Under Carbon Trading. Sustainability 2025, 17, 2557. [Google Scholar] [CrossRef]

- Xu, Y.; Dong, C.; Zhang, B.; Gong, M.; Wang, X. The synergistic effect of carbon trading and green credit on manufacturing enterprises’ production decisions and sustainability performance. Int. Rev. Econ. Finance 2025, 103, 104519. [Google Scholar] [CrossRef]

- Chen, W.; Chen, J.; Ma, Y. Renewable Energy Investment and Carbon Emissions under Cap-and-Trade Mechanisms. J. Clean. Prod. 2021, 278, 123341. [Google Scholar] [CrossRef]

- Wei, C.; Zhang, L.; Du, H. Impact of Cap-and-Trade Mechanisms on Investments in Renewable Energy and Marketing Effort. Sustain. Prod. Consum. 2021, 28, 1333–1342. [Google Scholar] [CrossRef]

- Yan, Y.; Sun, M.; Guo, Z. How do Carbon Cap-and-Trade Mechanisms and Renewable Portfolio Standards Affect Renewable Energy Investment? Energy Policy 2022, 165, 112938. [Google Scholar] [CrossRef]

- Meng, C.; Zhang, R.; Liu, B. Energy Performance Contracting in a Supply Chain under Cap-and-Trade Regulation and Carbon Tax Policy. Int. Trans. Electr. Energy Syst. 2022, 2022, 1716380. [Google Scholar] [CrossRef]

- Fu, H.; Song, L. Differential Game Model of Distributed Energy Sharing in Industrial Clusters Based on the Cap-and-Trade Mechanism. IEEE Access 2023, 11, 67707–67721. [Google Scholar] [CrossRef]

- Wu, C.; Chen, X.; Hua, H.; Yu, K.; Gan, L.; Shen, J.; Ding, Y. Peer-to-Peer Energy Trading Optimization for Community Prosumers Considering Carbon Cap-and-Trade. Appl. Energy 2024, 358, 122611. [Google Scholar] [CrossRef]

- He, Y.; Zeng, Z.; Liao, N. Multi-Objective Optimization of Regional Power Generation Mix Considering Both Carbon Cap-and-Trade Mechanisms and Renewable Portfolio Standards. Renew. Energy 2024, 231, 120937. [Google Scholar] [CrossRef]

- Zhang, L.; Liu, D.; Cai, G.; Lyu, L.; Koh, L.H.; Wang, T. An Optimal Dispatch Model for Virtual Power Plant that Incorporates Carbon Trading and Green Certificate Trading. Int. J. Electr. Power Energy Syst. 2022, 144, 108558. [Google Scholar] [CrossRef]

- Gao, L.; Yang, S.; Chen, N.; Gao, J. Integrated Energy System Dispatch Considering Carbon Trading Mechanisms and Refined Demand Response for Electricity, Heat, and Gas. Energies 2024, 17, 4705. [Google Scholar] [CrossRef]

- Huo, S.; Li, Q.; Pu, Y.; Xie, S.; Chen, W. Low Carbon Dispatch Method for Hydrogen-Containing Integrated Energy System Considering Seasonal Carbon Trading and Energy Sharing Mechanism. Energy 2024, 308, 132794. [Google Scholar] [CrossRef]

- Wang, Z. Evaluation and Application of Port Industrial Upgrading Based on Global Value Chain of Complex Network. J. Coast. Res. 2020, 110, 231–234. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, G. Closed-Loop Supply Chain Network Equilibrium Strategy Model with Environmental Protection Objectives. Chin. J. Popul. Resour. Environ. 2020, 18, 251–261. [Google Scholar] [CrossRef]

- Wan, X.; Jiang, B.; Li, Q.; Hou, X. Dual-Channel Environmental Hotel Supply Chain Network Equilibrium Decision under Altruism Preference and Demand Uncertainty. J. Clean. Prod. 2020, 271, 122595. [Google Scholar] [CrossRef]

- Jiang, T.; Lin, Y.; Nguyen, T. Market Equilibrium in Multi-tier Supply Chain Networks. Nav. Res. Logist. 2021, 69, 355–370. [Google Scholar] [CrossRef]

- Fargetta, G.; Scrimali, L.R.M. A Sustainable Dynamic Closed-Loop Supply Chain Network Equilibrium for Collectibles Markets. Comput. Manag. Sci. 2023, 20, 19. [Google Scholar] [CrossRef]

- Ni, L.; Chen, C.; Wang, X.; Chen, X. Modeling Network Equilibrium of Competitive Ride-Sourcing Market with Heterogeneous Transportation Network Companies. Transp. Res. Part C Emerg. Technol. 2021, 130, 103277. [Google Scholar] [CrossRef]

- Xie, S.; Xu, Y.; Zheng, X. On Dynamic Network Equilibrium of a Coupled Power and Transportation Network. IEEE Trans. Smart Grid 2021, 13, 1398–1411. [Google Scholar] [CrossRef]

- Chen, Z.; Deng, Y.; Xie, C.; Guan, C.; Pan, T. Network Equilibrium of Battery Electric Vehicles Considering Drivers’ Resting Behavior. Transp. Res. Part C Emerg. Technol. 2023, 155, 104305. [Google Scholar] [CrossRef]

- Li, C.; Zhang, W.; Yee, H.M.; Yang, B. Optimal Decision of a Disaster Relief Network Equilibrium model. AIMS Math. 2023, 9, 2657–2671. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, X.; Sun, H.; Zhao, X. Three-Echelon Closed-Loop Supply Chain Network Equilibrium under Cap-and-Trade Regulation. Sustainability 2021, 13, 6472. [Google Scholar] [CrossRef]

- Yang, Y.; Xu, X. Production and Carbon Emission Abatement Decisions Under Different Carbon Policies: Supply Chain Network Equilibrium Models with Consumers’ Low-Carbon Awareness. Int. Trans. Oper. Res. 2023, 31, 2734–2764. [Google Scholar] [CrossRef]

- Xiao, Y.-X.; Zhang, R.-Q. Supply chain Network Equilibrium Considering Coordination Between After-Sale Service and Product Quality. Comput. Ind. Eng. 2022, 175, 108848. [Google Scholar] [CrossRef]

- Peng, Y.; Chen, B.; Veglianti, E. Platform Service Supply Chain Network Equilibrium Model with Data Empowerment. Sustainability 2022, 14, 5419. [Google Scholar] [CrossRef]

| Literature | The Number of Network Layers | Inclusion of Carbon Trading | Solution Methods | Characterization of Dynamic Behaviors | Improvements Presented in This Work |

|---|---|---|---|---|---|

| Zhang et al. (2021) [37] | 2 (Production, Carbon trading) | YES | Variational inequality | Static equilibrium | Add a new energy network layer and build a three-party supernetwork |

| Fu et al. (2023) [22] | 1 (Energy sharing) | YES | Differential game | Dynamic evolution | Add a new energy network layer and build a three-party supernetwork |

| Yang et al. (2023) [38] | 2 (Production, Carbon trading) | YES | Variational inequality | Static equilibrium | Introduce distributed energy sharing and heterogeneous enterprise decision-making |

| Wu et al. (2024) [23] | 1 (Community energy) | YES | Mixed integer programming | Optimize decisions | Expand to the scale of industrial parks and adopt an equilibrium model to capture interaction |

| Notations | Definitions |

|---|---|

| Supporting enterprises, | |

| Core enterprises, | |

| Demand market, | |

| Supply of products from supporting enterprises to core enterprises | |

| Supply of products from core enterprise to demand market | |

| Supporting enterprises’ prices charged to core enterprises for their products | |

| Product prices charged by the core enterprise to the demand market | |

| The product transaction costs of a supporting enterprise are a function of | |

| Product transaction costs when the core enterprise trades with a supporting enterprise as a function of | |

| Transaction costs of the product when the core enterprise trades with the demand market as a function of | |

| Transaction cost of a product in the demand market is a function of | |

| Distributed energy low carbon levels for supporting enterprises | |

| Distributed energy low carbon levels for core enterprises | |

| Coefficient of impact of energy low carbon level of supporting companies on the emission reduction per unit of product | |

| Coefficient of impact of energy low carbon level of core enterprises on emission reductions per unit of product | |

| Initial carbon emissions from supporting companies | |

| Initial carbon emissions from core enterprises | |

| Carbon cap for supporting companies | |

| Carbon cap for core enterprises | |

| Carbon trading prices | |

| Transaction costs per unit of carbon emissions | |

| , | Lagrange multipliers |

| Projects | Equilibrium Results | Projects | Equilibrium Results | Projects | Equilibrium Results |

|---|---|---|---|---|---|

| 15,228.005979 | 5546.224101 | 0.949996 | |||

| 15,227.968469 | 5546.224101 | 0.949996 | |||

| 15,228.005273 | 10,387.321697 | 0.950050 | |||

| 15,227.968469 | 10,387.321697 | 0.950050 | |||

| 103.224338 | 103.224338 | ||||

| Supporting enterprise profit | −1,157,576,495 | Core enterprise profit | 396,702,840.6 | Total profit | −760,873,654.7 |

| 200 | 250 | 300 | 350 | |

|---|---|---|---|---|

| 15,228.00598 | 16,325.45845 | 17,422.73749 | 18,520.19482 | |

| 15,227.96847 | 16,325.43881 | 17,422.72926 | 18,520.19452 | |

| 15,228.00598 | 16,325.45845 | 17,422.73749 | 18,520.19482 | |

| 15,227.96847 | 16,325.43881 | 17,422.72926 | 18,520.19452 | |

| 5546.22410 | 5649.81233 | 5753.63499 | 5857.23782 | |

| 5546.22410 | 5649.81233 | 5753.63499 | 5857.23782 | |

| 10,387.32172 | 10,987.794431 | 11,588.302389 | 12,188.773848 | |

| 10,387.32172 | 10,987.794431 | 11,588.302389 | 12,188.773848 | |

| 0.949996 | 0.949992 | 0.949988 | 0.949984 | |

| 0.949996 | 0.949992 | 0.949988 | 0.949984 | |

| 0.950026 | 0.950026 | 0.950026 | 0.950026 | |

| 0.950026 | 0.950026 | 0.950026 | 0.950026 | |

| Supporting enterprises profit | 103.224338 | 103.926435 | 106.782793 | 111.976893 |

| Core enterprise profit | 103.224338 | 103.926435 | 106.782793 | 111.976893 |

| Total system profit | −1,157,576,495 | −1,323,310,790 | −1,500,096,667 | −1,687,990,407 |

| 350 | 400 | 450 | 500 | |

|---|---|---|---|---|

| 13,869.39326 | 15,228.00598 | 16,043.08685 | 17,944.64144 | |

| 13,869.37169 | 15,227.96847 | 16,043.03839 | 17,944.56324 | |

| 13,869.39326 | 15,228.00598 | 16,043.08685 | 17,944.64144 | |

| 13,869.37169 | 15,227.96847 | 16,043.03839 | 17,944.56324 | |

| 4903.90086 | 5546.22410 | 5931.76476 | 6831.55940 | |

| 4903.90086 | 5546.22410 | 5931.76476 | 6831.55940 | |

| 9386.81358 | 10,387.32171 | 10,987.66767 | 12,388.39909 | |

| 9386.81358 | 10,387.32171 | 10,987.66767 | 12,388.39909 | |

| 0.949996 | 0.949996 | 0.949996 | 0.949996 | |

| 0.949996 | 0.949996 | 0.949996 | 0.949996 | |

| 0.950032 | 0.950026 | 0.950023 | 0.950014 | |

| 0.950032 | 0.950026 | 0.950023 | 0.950014 | |

| Supporting enterprises profit | 103.182007 | 103.2243383 | 103.7438552 | 105.1657968 |

| Core enterprise profit | 103.182007 | 103.2243383 | 103.7438552 | 105.1657968 |

| Total system profit | −967,568,997.4 | −1,157,576,495 | −1,279,718,981 | −1,588,434,631 |

| 2.5 | 5 | 7.5 | 10 | |

|---|---|---|---|---|

| 15,243.92779 | 15,228.00598 | 15,212.08417 | 15,196.16235 | |

| 15,243.89038 | 15,227.96847 | 15,212.04656 | 15,196.12465 | |

| 15,243.92779 | 15,228.00598 | 15,212.08417 | 15,196.16235 | |

| 15,243.89038 | 15,227.96847 | 15,212.04656 | 15,196.12465 | |

| 5550.31682 | 5546.22410 | 5542.13137 | 5538.03865 | |

| 5550.31682 | 5546.22410 | 5542.13137 | 5538.03865 | |

| 10,397.32959 | 10,387.3217 | 10,377.3138 | 10,367.3059 | |

| 10,397.32959 | 10,387.3217 | 10,377.3138 | 10,367.3059 | |

| 0.950021 | 0.949996 | 0.949971 | 0.949946 | |

| 0.950021 | 0.949996 | 0.949971 | 0.949946 | |

| 0.950051 | 0.950026 | 0.950001 | 0.949976 | |

| 0.950051 | 0.950026 | 0.950001 | 0.949976 | |

| Supporting enterprises profit | 103.226692 | 103.224338 | 103.221984 | 103.219630 |

| Core enterprise profit | 103.226692 | 103.224338 | 103.221984 | 103.219630 |

| Total system profit | −1,114,502,493 | −1,157,576,495 | −1,200,557,362 | −1,243,445,093 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, H.; Wu, X.; Zhang, Y.; Yan, W. Distributed Energy Sharing Network Equilibrium in Industrial Parks Under Carbon Emissions Trading Mechanism. Mathematics 2025, 13, 3816. https://doi.org/10.3390/math13233816

Fu H, Wu X, Zhang Y, Yan W. Distributed Energy Sharing Network Equilibrium in Industrial Parks Under Carbon Emissions Trading Mechanism. Mathematics. 2025; 13(23):3816. https://doi.org/10.3390/math13233816

Chicago/Turabian StyleFu, Haoyan, Xiaochan Wu, Yuzhuo Zhang, and Weidong Yan. 2025. "Distributed Energy Sharing Network Equilibrium in Industrial Parks Under Carbon Emissions Trading Mechanism" Mathematics 13, no. 23: 3816. https://doi.org/10.3390/math13233816

APA StyleFu, H., Wu, X., Zhang, Y., & Yan, W. (2025). Distributed Energy Sharing Network Equilibrium in Industrial Parks Under Carbon Emissions Trading Mechanism. Mathematics, 13(23), 3816. https://doi.org/10.3390/math13233816