Abstract

Sustainability concerns and rising consumer environmental awareness (CEA) have fundamentally reshaped competitive dynamics in modern supply chains. This study examines the influence of CEA on pricing and environmental effort competition between store brand (SB) and national brand (NB) products in a two-stage supply chain with one manufacturer and one retailer. We develop a mathematical model to evaluate strategic interactions under three power structures: Manufacturer Stackelberg (MS), Retailer Stackelberg (RS), and Vertical Nash (VN), considering two environmental investment scenarios: NB-only investment and bilateral SB-NB investment. Our findings indicate that (i) when only NB products invest environmentally, CEA increases environmental effort levels, wholesale prices, and retail prices for both brands, expanding total channel value rather than merely redistributing profits; (ii) CEA and channel competition on jointly determine optimal channel power structure, with MS dominating in differentiated markets with low CEA while RS yields superior outcomes under high competition and high CEA; (iii) retailers consistently achieve maximum profits under VN structure through balanced negotiation positions; and (iv) bilateral environmental investment causes price convergence across structures, shifting competitive focus from governance to operational excellence. By integrating environmental investment, channel power structure, and channel competition into a unified framework, this study offers managers practical decision tools for selecting optimal channel structures based on observable market conditions. Furthermore, it demonstrates how grocery retail chains and consumer goods manufacturers can transform environmental initiatives from compliance costs into value creation mechanisms that enhance both profitability and sustainability.

Keywords:

supply chain management; consumer environmental awareness; store brand; environmental effort MSC:

90B06; 91A65; 90B50

1. Introduction

Sustainability has emerged as a defining force in modern supply chain management, fundamentally reshaping how companies balance operational efficiency with environmental responsibility. Today’s consumers increasingly demand that businesses deliver affordable, high-quality products while simultaneously minimizing their ecological footprint. This dual pressure creates unprecedented challenges for supply chain participants who must navigate the tension between cost competitiveness and responsibility for the environment. The transformation manifests particularly clearly in retail markets, where traditional competitive dynamics now intersect with sustainability imperatives. For example, U.S. store brands reached USD 271 billion in sales in 2024, captured more than one-fifth of market share, and grew at rates exceeding national brands [1]. Moreover, the COVID-19 pandemic accelerated this shift in fundamental ways. Supply shortages heightened consumer awareness of product availability, prompting many to discover store brands as reliable alternatives, and a substantial proportion maintained this preference even after supply chains normalized [2]. These developments demonstrate that environmental consciousness and supply chain resilience now jointly determine competitive advantage in contemporary retail environments.

Within this evolving landscape, the competition between store brands (SBs) and national brands (NBs) takes on increasingly complex dimensions that extend far beyond traditional price and quality considerations. A store brand represents a retailer-owned private label, whereas a national brand denotes a manufacturer-owned brand [3]. However, this ownership distinction only partially captures the strategic dynamics at play. Retailers now actively position their store brands as credible, often sustainability-forward alternatives that directly challenge the historical dominance of national brands. This positioning reflects broader market trends where environmental considerations influence not only consumer choice but also channel relationships and competitive strategies. In response to these pressures, manufacturers invest heavily in environmental efforts, which involve measurable improvements in ecological performance achieved through green technologies, sustainable materials, and transparent operations. Furthermore, practical initiatives such as sustainable packaging innovations and blockchain-based supply chain traceability make environmental commitments both visible to consumers and verifiable throughout the distribution network [4,5].

This competitive reality raises critical strategic questions that demand systematic investigation, particularly regarding how CEA shapes optimal pricing and environmental investment decisions when both store brands and national brands compete for market share. The answer depends on multiple interacting factors that create complex tradeoffs for decision-makers. Product substitutability, defined as the degree to which consumers perceive SBs and NBs as interchangeable alternatives, plays a crucial role by intensifying cross-price effects when substitutability is high. Under high substitutability conditions, even small changes in environmental positioning or pricing can trigger substantial market share shifts between brands. Moreover, channel power structures fundamentally determine how environmental investments translate into market outcomes and profit distributions. In MS scenarios, manufacturers act as leaders, determining wholesale prices and environmental effort levels for NBs while anticipating retailer responses. Under RS structures, retailers leverage their leadership position to influence pricing and positioning for both brand types, extracting maximum value from their dual role as SB owner and NB distributor. The VN structure, characterized by simultaneous decision-making, creates yet different equilibrium outcomes where neither party enjoys first-mover advantages. In addition, recent academic discussions of evolving private-label “battle fronts” and the systematic integration of sustainability considerations into retail strategy confirm that environmental factors now sit at the center of contemporary SB-NB competition [6,7,8].

Against this backdrop, this study investigates the following research questions:

- How does CEA influence the retail prices of SB and/or NB products?

- How does CEA affect the wholesale price of NB products?

- What is the optimal level of environmental effort in SB and/or NB products?

To examine these questions systematically, this study develops a comprehensive game-theoretic model of a two-stage supply chain comprising one NB manufacturer and one retailer that offers both store-brand and national-brand products. The modeling approach captures the strategic interactions between channel members under different environmental investment scenarios and power structures. Specifically, the analysis considers two distinct environmental investment regimes that reflect realistic market conditions. The first regime allocates environmental effort exclusively to the national brand, representing scenarios where manufacturers lead sustainability initiatives while retailers maintain traditional store brands. The second regime extends environmental efforts to both store brands and national brands, capturing markets where sustainability competition occurs across all product offerings. Furthermore, the study compares three channel power structures: Manufacturer–Stackelberg, Retailer–Stackelberg, and Vertical Nash, employing backward induction and simultaneous optimization techniques to derive equilibrium retail prices, wholesale prices, environmental effort levels, and profit distributions.

Our findings reveal several counterintuitive insights that challenge established channel competition theories. First, when only NBs invest environmentally, CEA simultaneously increases environmental effort levels, wholesale prices, and retail prices for both brands, thereby expanding total channel value rather than merely redistributing profits. Second, the optimal channel power structure proves contingent on the interaction between CEA and channel competition. Specifically, MS structures dominate in differentiated markets characterized by low environmental awareness, and RS structures deliver superior outcomes for both manufacturers and retailers under conditions of high competition and elevated CEA, while VN structures consistently maximize retailer profits through balanced negotiation positions. Third, bilateral environmental investment fundamentally alters these dynamics. When both SB and NB products adopt environmental strategies, traditional structural advantages diminish and retail prices converge across power structures, indicating a strategic shift from governance-based competition to operational excellence. These findings suggest that environmental investment represents a paradigm shift in retail channel management, transforming sustainability initiatives from operational constraints into strategic value creation mechanisms.

The remainder of the paper is organized as follows. Section 2 reviews relevant literature streams to position our contribution within existing knowledge and identify research gaps. Section 3 presents the model framework, decision variables, and underlying assumptions that structure the analysis. Section 4 develops the equilibrium analysis under each environmental investment regime and power structure, deriving closed-form solutions and comparative statics. Section 5 provides numerical illustrations that demonstrate key relationships and discuss managerial implications for practitioners. Section 6 concludes with a synthesis of key insights, acknowledges limitations of the current approach, and suggests promising directions for future research.

2. Literature Reviews

Research on SB-NB competition under sustainability pressures can be grouped into four interconnected dimensions: consumer perception and brand image, pricing and channel management, supply chain structure and coordination, and CEA-centric green supply chains. Organizing the literature along these dimensions highlights the mechanisms that are essential for understanding how environmental effort, channel leadership, and substitutability interact in contemporary retail markets.

Consumer perception research establishes critical demand-side foundations. Store image and SB attitudes shape perceived quality and value, creating persistent heterogeneity in private-label adoption across markets [9]. Moreover, retailer price-image strongly influences purchase intentions, particularly in emerging economies where value perceptions evolve rapidly [10]. Risk-mitigation instruments such as money-back guarantees strengthen SB credibility by reducing the perceived risk of trial [11]. Evidence from the pandemic period shows that reliability and availability enhance perceived brand helpfulness, leading to durable loyalty shifts toward private labels that persist beyond the crisis [2]. Taken together, these findings inform demand specifications in which SB and NB preferences respond to non-price signals and interact with environmental investments.

Studies on pricing and channel management highlight the mechanisms of cross-brand transmission. Multi-channel analyses demonstrate that balanced retail pricing benefits both SB and NB when cross-brand externalities are internalized [12]. Furthermore, the introduction of SBs into multi-echelon chains generates systematic feedback between brand prices and margins, which requires joint modeling of retailer and manufacturer responses [13]. The timing of price commitments is also crucial. Early commitments reallocate bargaining power and alter surplus division, which motivates explicit leader-follower structures in analytical frameworks [14]. These insights suggest that environmental effort operates through reaction functions, potentially redistributing channel gains in ways that traditional models fail to capture.

Research on supply chain structure and coordination explains how organizational forms shape competitive intensity. Coordination mechanisms enhance profitability in both centralized and decentralized systems, demonstrating that leadership position matters as much as the instruments that are deployed [15]. In supply chains where common manufacturers serve multiple retailers, cooperative arrangements often outperform pure competition. However, higher substitutability consistently intensifies rivalry and reshapes optimal pricing [16,17]. These findings justify the integration of MS, RS, and VN structures with explicit substitutability parameters, while also indicating that the profitability of each leadership form depends heavily on the level of substitutability.

Policy-oriented and CEA-focused green supply chain studies connect environmental instruments to operational decisions. Game-theoretic models incorporate tariffs and greening into pricing, showing how policy interventions translate into price and profit adjustments [18]. In addition, dual-channel competition research compares green and non-green positioning, demonstrating how market shares are redistributed [19]. Coordination research further highlights the tradeoffs between green quality and sales effort [20], while competition between recycling channels explains collection and pricing outcomes under different leadership settings [21]. Models that focus on CEA show that heightened awareness supports green investment and justifies price premiums when perceived greenness meets expectations [22,23]. Moreover, additional evidence confirms that rising CEA triggers demand shifts and channel realignment [24]. Contract design studies under carbon taxation also demonstrate when cooperative abatement is superior to unilateral action [25,26].

Recent contributions further enrich the analytical landscape. For example, studies on sustainability-resilience interactions reveal how policy interventions and investment efficiency affect profitability under disruption [8]. Reviews highlight packaging innovations that reduce environmental impact and enhance brand value [4]. In addition, empirical work links green marketing to loyalty through perceived value [6], while comparative analyses emphasize contextual differences across markets [27]. Operational research identifies waste-management levers in emerging economies [28], and digital technologies support greener operations by improving transparency [5]. Furthermore, behavioral considerations such as fairness concerns interact with environmental mindsets in purchase decisions [29]. Meanwhile, private-label competition continues to evolve toward new “battle fronts,” opening fresh strategic opportunities for channel members [7]. Table 1 synthesizes recent 2024–2025 contributions and highlights a critical gap: although these studies examine issues ranging from PLB loyalty drivers to resilience-pricing interactions, none simultaneously incorporates SB-NB rivalry, CEA, environmental effort, channel leadership, and substitutability within a unified framework. This fragmentation restricts a comprehensive understanding of how these factors interact to shape equilibrium outcomes.

Table 1.

Comparative summary of 2024–2025 studies.

Despite these advances, the literature has not yet integrated environmental effort, channel leadership, and substitutability into a single SB-NB model. Prior work tends to analyze these elements separately. For instance, some studies focus on environmental investment without considering leadership structures, others investigate power structures without addressing sustainability, and still others examine substitutability without incorporating environmental dimensions. However, the absence of an integrated framework leaves critical questions unanswered. This study addresses the gap by developing a game-theoretic model that co-determines environmental effort levels, optimal leadership structures, and pricing strategies under varying substitutability conditions. By analyzing both NB-only and joint investment regimes across MS, RS, and VN, the study provides the first systematic mapping from observable conditions, such as CEA and substitutability, to implementable leadership and pricing recommendations. The results also uncover new interactions, including how substitutability moderates the CEA-leadership relationship and how environmental effort redistributes channel profits differently under alternative structures. In this way, the study advances theoretical understanding and provides practical guidance for sustainable retail competition.

3. Model Description

This study investigates how CEA shapes the strategic decisions of supply chain participants that offer both SB and NB products. We consider two environmental investment scenarios: CO, where environmental efforts apply only to NB products, and CC, where both NB and SB products adopt environmental efforts. Moreover, to evaluate channel power structures, we follow [30] and study three game models: Manufacturer–Stackelberg (MS), Retailer–Stackelberg (RS), and Vertical Nash (VN).

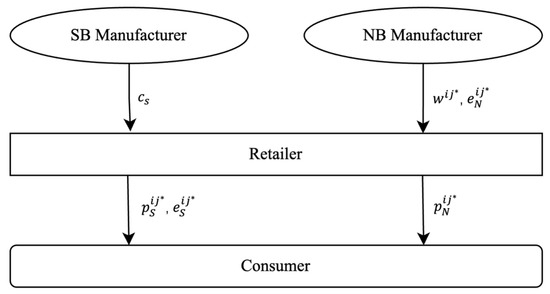

Figure 1 illustrates the supply chain structure. The NB manufacturer sets the unit wholesale price and the total environmental level for NB products; the retailer sets retail prices for both NB and SB products and, when applicable, the environmental level for SB products. SB products are produced by the retailer’s contracted manufacturer at a fixed unit cost of (NB products’ unit cost is ). Table 2 and Table 3 summarize decision variables and parameters used throughout the analysis. In addition, apart from environmental attributes, we assume no exogenous quality diversity between the two brands so that environmental decisions, prices, and power structures drive all differences observed in equilibrium.

Figure 1.

Supply Chain Structure.

Table 2.

Decision Variables.

Table 3.

Model Parameters.

We analyze the following channel power structures, each with an explicit two-stage timing that clarifies who moves first and how the follower responds:

- Manufacturer–Stackelberg (MS). Stage 1: the NB manufacturer (leader) chooses NB’s wholesale price and environmental level. Stage 2: the retailer (follower) chooses retail prices for NB and SB and, in CC, the SB environmental level.

- Retailer–Stackelberg (RS). Stage 1: the retailer (leader) chooses retail prices for NB and SB and, in CC, the SB environmental level. Stage 2: the NB manufacturer (follower) responds with NB’s wholesale price and environmental level. Moreover, choosing a retail price for NB is equivalent to choosing a margin given the wholesale price (e.g., used later in analysis).

- Vertical Nash (VN). The manufacturer and retailer make decisions simultaneously, yielding a Nash equilibrium outcome.

We define the environmental investment function of brand l as follows [23]:

where denotes the environmental investment cost for brand . The variable represents the environmental level of the product. This level can be understood as a normalized index () that reflects how environmentally friendly the product is. For example, it may capture improvements such as cleaner production technologies, the use of recyclable materials, or higher energy efficiency. A higher indicates a greater degree of environmental performance.

The parameter is the cost coefficient of environmental investment. A larger indicates lower efficiency, since the marginal cost of achieving an additional unit of environmental level becomes higher. In other words, the investment cost function is convex in the environmental level, and increases as rises. However, the efficiency of environmental investment differs between SB and NB products. Without loss of generality, we assume , since NB manufacturers usually possess more advanced production technology and equipment and therefore can reach a given environmental standard at a lower cost.

Next, we define the demand functions of brand l, adapted from [30], under two cases. The first case (C, O) considers an environmental NB product () and a conventional SB product (). The second case (C, C) considers both NB and SB products as environmental (). In both cases, demand is affected by retail prices and environmental investment levels:

Case 1: (C, O)

Case 2: (C, C)

Here, () is the coefficient of consumer environmental sensitivity, representing how strongly consumers value environmental attributes. The larger , the more likely consumers are to pay a premium for environment friendly products [31]. Moreover, is the intensity of inter-brand competition. A higher implies greater substitutability between SB and NB products and thus stronger price competition ().

To ensure well-posed optimization, we impose the following conditions:

- Environmental levels: ; .

- Non-negativity: .

To simplify the model, we assume that the baseline fixed cost (without environmental investment) is equal for both brands (). Moreover, both the NB manufacturer and the retailer are risk-neutral, and their objective is to maximize expected profits.

4. Model Analysis

We analyze the competition between SB and NB by examining six scenarios under different channel power structures and environmental investment decisions, denoted as COMS, CORS, COVN, CCMS, CCRS, and CCVN.

4.1. One Traditional SB and One Environmental NB (C, O)

In scenario (C, O), we evaluate supply chain performance with two product types: a traditional SB and an environmentally conscious NB. The profit maximization problems for the retailer and manufacturer are

4.1.1. Manufacturer–Stackelberg (COMS)

In the COMS scenario, the decision sequence follows:

Step 1: The NB manufacturer determines the wholesale prices and environmental investment level for NB products.

Step 2: The retailer sets retail prices for both SB and NB products.

Using backward induction, we derive the first-order conditions with respect to and :

The Hessian matrix of Equation (7) satisfies that . Hence, we obtain the optimal solutions for and by solving Equations (8) and (9):

The optimal retail prices become

Finally, the equilibrium profits are

Theorem 1.

There exists a unique equilibrium in COMS for retail prices of SB and NB products, environmental level, and wholesale price of NB products.

From Equation (16), the NB manufacturer’s optimal profit is independent of the competition intensity . Additionally, we find that , , and .

Corollary 1.

Under COMS, as competition intensity β increases:

- Optimal prices and increase.

- NB manufacturer’s profit remains unchanged.

- Retailer’s profit increases.

Corollary 1 indicates that increased product substitutability benefits the retailer while leaving the NB manufacturer’s profit unaffected. Higher competition intensity leads to increased retail prices for both products, while wholesale price and environmental investment remain unchanged.

From Equations (10) and (11), we observe that , and .

Corollary 2.

Under COMS, higher environmental level leads to increased optimal prices for both NB and SB products , .

Corollary 2 demonstrates that enhanced environmental investment in NB products increases NB retail prices, reducing price pressure on SB products and allowing the retailer to raise SB prices for profit maximization.

From Equations (12)–(17), we derive , , , , and .

Corollary 3.

Under COMS, as consumer environmental sensitivity τ increases, all equilibrium values increase: retail prices (, wholesale price (, environmental level (, and profits ().

Corollary 3 shows that higher environmental sensitivity amplifies the demand impact of environmental investment, enhancing NB brand awareness and demand. The retailer responds by increasing SB prices alongside NB price increases, resulting in higher profits for both parties.

4.1.2. Retailer–Stackelberg (CORS)

In CORS, the retailer possesses stronger bargaining power within the supply chain. The wholesale price set by the NB manufacturer depends on retail prices determined by the retailer. The decision sequence is:

Step 1: The retailer determines optimal retail prices for SB and NB products.

Step 2: The NB manufacturer sets the wholesale price and environmental investment level.

We define the NB retail price as:

where represents the retailer’s margin on NB products.

Substituting Equation (18) into Equation (6), the first order conditions for the wholesale price and the environmental level of NB products can be expressed as

Solving Equations (20) and (21) yields the optimal wholesale price and environmental level for NB products:

Substituting Equations (22) and (23) into Equation (7), the optimal retail prices of SB and NB products are obtained by solving the first-order functions with respect to and :

From Equations (22) and (23), the following conditions hold: , and . Consequently, .

By substituting Equations (24) and (25) into Equations (22) and (23), we further obtain:

Finally, the optimal profit for the NB manufacturer and the retailer are given as follows ():

Theorem 2.

There exists a unique solution under CORS for the retail prices of SB and NB products, the environmental level, and the wholesale price of NB products.

Corollary 4.

Under CORS, as the intensity of competition between SB and NB (captured by β) increases, the profit of the NB manufacturer decreases.

The mechanism underlying Corollary 4 reflects fundamental competitive dynamics. When substitutability between SB and NB products rises, intensified price competition forces the NB manufacturer to reduce wholesale prices to maintain market position, directly compressing profit margins. The retailer, controlling both brands, strategically manages this competitive pressure through portfolio optimization. Under CORS, other key relationships, including how consumer environmental sensitivity affects retail prices, environmental levels, and retailer profit, parallel those found in COMS. These similarities and differences across scenarios will be examined through numerical analysis in Section 5.

4.1.3. Vertical Nash (COVN)

In the COVN scenario, there is no leader in the supply chain. The decision process follows simultaneous moves: the NB manufacturer decides the wholesale price and environmental level for NB products, while the retailer decides retail prices for both SB and NB products.

For the optimization problem, the NB manufacturer and retailer independently maximize their profits. In COVN, we obtain the optimal wholesale price and environmental level for NB products by solving Equations (8), (9), (20) and (21):

Similarly, the optimal retail prices for SB and NB products are

Finally, the optimal profits for the NB manufacturer and retailer are

Theorem 3.

There exists a unique solution in COVN for the retail prices of SB and NB products, the environmental level, and the wholesale price of NB products.

4.2. One Environmental SB and One Environmental NB (C, C)

In (C, C), we evaluate competition between SB and NB when both brands introduce environmental investment to acquire market share and increase profits. The two brands differ in retail price and environmental level. The profit maximization functions for the manufacturer and retailer are

4.2.1. Manufacturer–Stackelberg (CCMS)

In CCMS, the decision process follows:

Step 1: The NB manufacturer decides the wholesale price and environmental level of NB products.

Step 2: The retailer decides retail prices for SB and NB products and the environmental level of SB products.

Using backward induction, we obtain the first-order conditions with respect to , and :

Solving Equations (38)–(40), and are

Finally, we acquire the optimal solutions for , and :

Theorem 4.

There exists a unique solution in CCMS for the retail prices of SB and NB products, the environmental level of SB products, and the environmental level and wholesale price of NB products.

4.2.2. Retailer–Stackelberg (CCRS)

Under CCRS, the retailer holds stronger market control than the NB manufacturer, possessing greater bargaining power within the supply chain. The wholesale price determined by the NB manufacturer depends on retail prices set by the retailer, while the retailer sets prices based on the manufacturer’s response function. The decision process unfolds as follows:

Step 1: The retailer first decides optimal retail prices for SB and NB products and the environmental level of SB products.

Step 2: The NB manufacturer decides the optimal wholesale price and environmental level for NB products.

For the optimization problem, similar to CORS, we set . Then, we derive the first-order conditions with respect to the wholesale price and the environmental level of NB products.

Solving Equations (49) and (50),

Next, we substitute (49) and (50) to Equations (36) and (37). Solving the first order condition of , and . Finally, the optimal , and can be obtained ():

Theorem 5.

There exists a unique solution in CCRS for the retail prices of SB and NB products, the environmental level of SB products, and the environmental level and wholesale price of NB products.

4.2.3. Vertical Nash (CCVN)

In CCVN, there is no leader in the supply chain. The NB manufacturer decides the wholesale price and environmental level for NB products, while the retailer decides retail prices for both products and the environmental level for SB products. Both parties independently maximize profits. The optimal solutions are obtained by solving Equations (38), (39), (49) and (50):

Theorem 6.

There exists a unique solution in CCVN for the retail prices of SB and NB products, the environmental level of SB products, and the environmental level and wholesale price of NB products.

Corollary 5.

Under CCVN, as consumer environmental sensitivity increases, the environmental level and the wholesale price of NB products () increase. Moreover, and are independent of competition intensity between SB and NB, as shown in Equations (58) and (59).

Corollary 5 reveals a distinctive feature of the VN structure when both brands invest in the environment. The independence of NB environmental decisions from competition intensity occurs because simultaneous decision-making eliminates strategic commitment effects present in sequential games. Under CCVN, the NB manufacturer optimizes environmental investment based solely on consumer willingness to pay for greenness, unaffected by cross-price elasticities between brands. This contrasts sharply with leader-follower structures, where competition intensity shapes environmental strategies through anticipated competitive responses. The positive relationship between consumer environmental sensitivity and both wholesale price and environmental effort confirms that green investment remains profitable even without first-mover advantages, provided consumers value environmental attributes sufficiently.

5. Numerical Analysis

To verify the analytical results from Section 4 and explore the complex interactions between CEA competition intensity and channel power structures, we conduct comprehensive numerical simulations with parameter values calibrated to reflect realistic market conditions. We set and , assuming equal production efficiency between brands as a baseline. This normalization is widely adopted in channel competition models, ensuring that profitability differences arise from strategic choices rather than exogenous cost asymmetry [23,30]. For competition intensity, we examine two scenarios: , representing low and high substitutability between SB and NB products. Similar ranges have been used to capture markets spanning from differentiated products to near-substitutes [16,17]. Consumer environmental sensitivity varies continuously in the interval (0.05, 0.95), spanning from minimal environmental awareness to near-complete purchase decisions based on environmental attributes. This specification follows prior green supply chain studies [18,19,23], which avoid extreme boundary values while covering the full spectrum of consumer preferences.

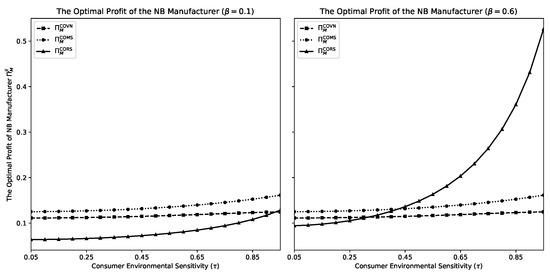

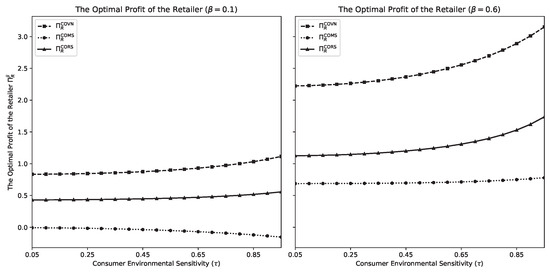

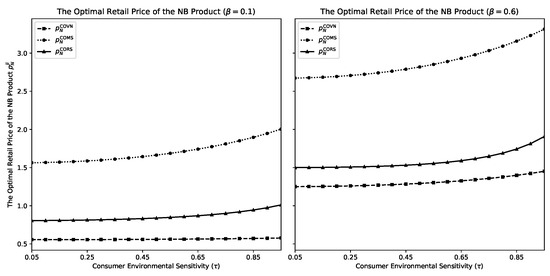

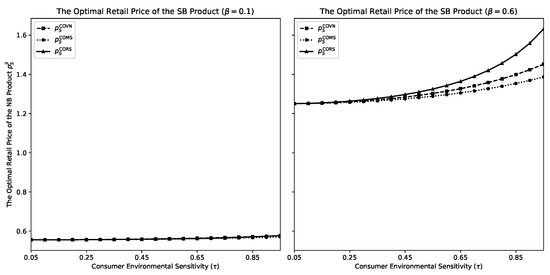

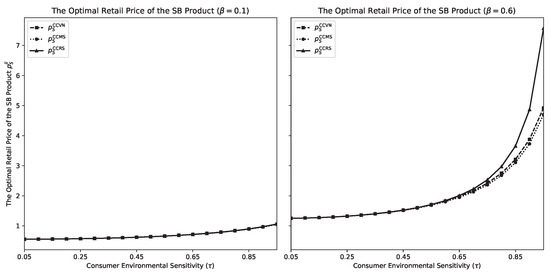

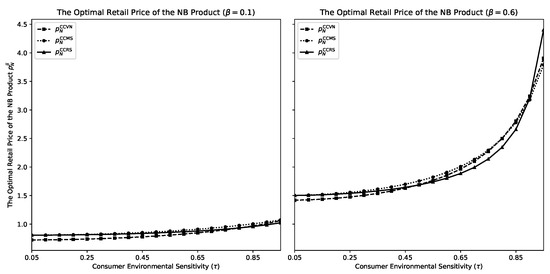

The following analysis presents six key observations derived from Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7, each examining how equilibrium outcomes, including manufacturer profits, retailer profits, and retail prices for both SB and NB products, respond to variations in consumer environmental sensitivity across different channel structures (MS, RS, and VN) and competition intensities. These observations reveal nuanced patterns that extend beyond the theoretical predictions, demonstrating how market conditions fundamentally alter the strategic value of channel leadership and environmental investment. Table 4 subsequently synthesizes these findings to provide integrated strategic guidance for supply chain participants navigating increasingly sustainability-focused retail markets.

Figure 2.

The Optimal Profit of the NB Manufacturer (C, O).

Figure 3.

The optimal profit of the retailer (C, O).

Figure 4.

The optimal retail price of the NB product (C, O).

Figure 5.

The optimal retail price of the SB product (C, O).

Figure 6.

The optimal retail price of the SB product (C, C).

Figure 7.

The optimal retail price of the NB product (C, C).

Table 4.

Summary of key observations from numerical analysis.

Figure 2 illustrates the NB manufacturer’s optimal profit under COMS, CORS, and COVN scenarios across different competition intensities. Manufacturer profits are higher under high competition () than under low competition (). Under low competition, the MS structure dominates, whereas under high competition, the RS structure yields the highest profits, with the profit gap widening as consumer environmental sensitivity increases.

Observation 1.

When only NBs invest environmentally, the NB manufacturer’s profit is maximized under the MS structure in low-competition settings, whereas the RS structure yields the highest profit under high-competition conditions, particularly when consumer environmental sensitivity is high.

Observation 1 shows that the NB manufacturer’s profitability is critically shaped by market competition intensity and CEA. Under low competition, profit is maximized in the MS structure, where the wholesale price mechanism allows the manufacturer to retain stable margins even as CEA increases. By contrast, under high competition, the RS structure yields the highest profit, particularly when CEA is high, since retailers’ pricing strategies become more responsive to consumer preferences for environmental attributes.

Figure 3 illustrates the retailer’s optimal profit under different scenarios (COMS, CORS, and COVN) across varying competition intensities. The analysis reveals how retailer profitability responds to changes in consumer environmental sensitivity under different channel power structures.

Observation 2.

When only NBs invest environmentally, retailers consistently achieve maximum profits under the VN structure regardless of competition intensity ( or ). The VN structure dominates both MS and RS structures across all CEA levels, with the profit gap widening as increases. Under high competition, retailer profits increase more steeply with environmental sensitivity, particularly in the VN scenario, where profits reach approximately 3.5 at .

This observation has significant managerial implications for retailer strategy. The superiority of VN suggests that retailers benefit from balanced negotiation positions rather than clear leadership hierarchies when environmental differentiation is asymmetric. Retailers should resist both excessive manufacturer dominance and the responsibilities of channel leadership, instead advocating for simultaneous decision-making processes that allow flexible responses to market conditions without first-mover disadvantages.

Figure 4 presents the optimal retail prices for NB products under the three channel structures. The price trajectories reveal how information asymmetries and decision sequences affect NB pricing strategies across different market conditions.

Observation 3.

When only NBs invest environmentally, the optimal retail price of NB products consistently satisfies across all parameter values. This hierarchy persists regardless of competition intensity, with the price differential expanding as consumer environmental sensitivity increases. Under high competition (), NB retail prices range from approximately 1.2 to 3.5 as increases, maintaining the structural ordering throughout.

The consistent price hierarchy provides clear guidance for channel strategy. Manufacturers facing MS structures should anticipate higher retail prices that may limit volume but protect margins. Conversely, under VN structures, lower prices may enhance market penetration but compress channel margins. This suggests manufacturers should carefully evaluate volume-margin tradeoffs when negotiating channel arrangements, particularly in environmentally conscious markets where price premiums are sustainable.

Figure 5 displays SB retail price patterns across the three power structures. The analysis reveals how competition intensity fundamentally alters the relationship between channel structure and SB pricing.

Observation 4.

When only NBs invest environmentally, the optimal retail price of SB products in the MS structure is lowest under low competition (), while under high competition (), the relationship reverses with . The reversal occurs because intense competition enables retailers to leverage cross-brand coordination more effectively under RS leadership, extracting margins from portfolio optimization rather than individual brand positioning.

This competition-dependent reversal has important strategic implications. In differentiated markets, retailers should maintain competitive SB prices under MS to compensate for NB uncertainty. However, in competitive markets, RS structures enable premium SB pricing through coordinated portfolio management. Retailers must therefore assess market competitiveness before determining optimal pricing strategies, recognizing that channel structure effects on SB pricing are contingent rather than universal.

Figure 6 shows SB retail prices when both brands invest in environmental quality. The patterns reveal how bilateral environmental investment transforms pricing dynamics across different competitive conditions.

Observation 5.

When both SB and NB products invest environmentally, SB retail prices exhibit minimal differentiation across channel structures under low competition (), with prices nearly identical for MS, RS, and VN. However, under high competition (), structural differences emerge, with all prices increasing sharply as consumer environmental sensitivity rises from approximately 1.2 at to over 7.0 at .

The convergence under low competition suggests that bilateral environmental investment neutralizes structural advantages when markets are differentiated. Managers should recognize that environmental parity shifts competitive focus from channel governance to execution capabilities. Under high competition, however, structural choices remain relevant as environmental sensitivity increases, indicating that channel leadership becomes more important as green markets mature and competition intensifies.

Figure 7 illustrates NB retail pricing when both brands pursue environmental strategies. The analysis reveals complex interactions between competition, environmental sensitivity, and channel structure.

Observation 6.

When both brands invest environmentally, NB retail prices satisfy under low competition with low environmental sensitivity. As competition intensity or consumer environmental sensitivity increases, these structural differences diminish. Under high competition (), prices converge across all structures when is low but diverge slightly as environmental sensitivity rises, with all prices reaching approximately 4.5 at .

The conditional nature of structural effects on NB pricing under bilateral investment provides nuanced managerial guidance. In nascent green markets with limited competition, sequential decision-making (MS or RS) creates commitment value that supports premium pricing. However, as markets mature through either increased competition or environmental awareness, structural advantages erode. Manufacturers should therefore prioritize operational excellence and product quality over channel positioning in mature green markets, while leveraging structural advantages primarily in emerging environmental segments.

Table 4 synthesizes the key observations from our numerical analysis, revealing how CEA, competition intensity, and channel power structures jointly determine equilibrium outcomes in SB and NB competition. The analysis demonstrates that optimal channel leadership is fundamentally contingent on market conditions: manufacturer-led structures excel in differentiated markets with low environmental awareness, while retailer-led structures generate superior outcomes when both competition and CEA are high. Retailer profits consistently maximize under vertical Nash structures regardless of market conditions, reflecting the value of balanced negotiation positions. Price hierarchies remain stable for NBs (MS > RS > VN) but exhibit competition-dependent reversals for SBs, indicating asymmetric structural effects across product categories.

The impact of CEA on retail pricing emerges as a universal driver of price increases, though the magnitude and pattern vary significantly by environmental investment configuration. Under unilateral NB investment, CEA amplifies existing structural differences, creating persistent price premiums that benefit environmentally differentiated products. This effect enables sustained value extraction throughout the channel, with both manufacturers and retailers capturing portions of the environmental premium. However, bilateral environmental investment fundamentally transforms these dynamics: structural advantages that dominate under asymmetric investment erode when both brands pursue environmental strategies, particularly in differentiated markets where competition is limited.

Competition intensity acts as a critical moderating variable that determines when channel structure matters. In low-competition environments with unilateral NB investment, manufacturer leadership through MS structures enables effective value capture and coordinated pricing. As competition intensifies, this advantage shifts to retailer-led structures, where portfolio coordination across both brands creates mutual benefits. The finding that RS structures can simultaneously enhance manufacturer and retailer profits under high competition and high CEA challenges traditional zero-sum perspectives on channel power, suggesting that environmental differentiation can expand total channel value rather than merely redistributing existing profits.

The transition from unilateral to bilateral environmental investment represents a fundamental shift in competitive dynamics. When both brands invest in environmental initiatives, traditional structural advantages based on sequential decision-making diminish, especially under low competition, where prices converge across MS, RS, and VN structures. This convergence indicates that environmental parity shifts competitive focus from channel governance to operational capabilities and execution excellence. Firms operating in markets approaching environmental saturation should therefore prioritize efficiency and quality over structural positioning.

These findings provide actionable guidance for channel strategy in environmentally conscious markets. Early-stage green markets with asymmetric investment reward first-mover advantages and structural positioning, justifying investments in channel leadership. As markets mature and bilateral investment becomes standard, success depends increasingly on operational excellence rather than governance arrangements. The observation that environmental investment can create shared value rather than triggering destructive competition suggests opportunities for collaborative sustainability initiatives that benefit all channel members. Managers should therefore view environmental strategy not as a cost burden but as a value creation mechanism that, when properly structured, enhances profitability across the supply chain.

6. Conclusions and Discussions

This study investigates how CEA influences store brand-national brand competition within a two-stage supply chain comprising one NB manufacturer and one retailer. Through game-theoretic analysis of two environmental investment scenarios under three channel power structures (MS, RS, and VN), we reveal fundamental insights into sustainable retail competition dynamics.

Our primary findings demonstrate that when only NBs invest in environmental efforts, higher CEA simultaneously increases environmental effort levels, wholesale prices, and retail prices for both brands, generating profit improvements across the channel. This dual benefit challenges conventional wisdom that environmental investment merely redistributes value; instead, it expands total channel value. While previous studies have examined SB-NB competition primarily through price-quality schemas [7] or focused on store image and price perceptions [10], our research integrates environmental investment as a strategic dimension that fundamentally alters competitive dynamics. Specifically, our analysis reveals that retailers consistently achieve maximum profits under the VN structure regardless of competition intensity, reflecting the strategic value of balanced negotiation positions where neither party exercises first-mover advantages. Meanwhile, manufacturers’ optimal structure depends critically on market conditions: the MS structure dominates in differentiated markets with low CEA, whereas the RS structure yields superior manufacturer profits under high competition, particularly when environmental sensitivity is elevated.

Furthermore, the interaction between CEA and product substitutability emerges as the critical determinant of optimal channel structures. Consider a practical example: in the organic food segment, where products are highly differentiated (low substitutability) and consumers exhibit moderate environmental awareness, a manufacturer like Unilever would benefit from maintaining MS leadership for its eco-friendly brands. This allows them to set wholesale prices that capture the environmental premium. Conversely, in commodity categories like recycled paper products, where substitutability is high, retailers like Walmart would achieve better outcomes through RS structures, coordinating prices across their Great Value store brand and national brands to maximize category profits. This finding extends beyond traditional dual-channel analyses by [19], who examine green versus non-green competition in separate channels, demonstrating how environmental investment reshapes power dynamics within integrated retail channels where both brands compete directly.

The transition from unilateral to bilateral environmental investment fundamentally transforms these competitive dynamics. When both brands pursue environmental strategies, traditional structural advantages diminish significantly. For instance, when Target introduces eco-friendly store brands to compete with established green national brands, the previously clear pricing hierarchies blur. Under low competition with bilateral investment, retail prices converge across MS, RS, and VN structures, indicating that environmental parity shifts competitive focus from channel governance to operational excellence. This convergence suggests that mature green markets reward execution over structure—a retailer’s ability to communicate environmental benefits or a manufacturer’s efficiency in sustainable production matters more than who leads pricing decisions.

These findings yield concrete managerial implications readily applicable to current market conditions. Environmental investment should be reconceptualized as a strategic profit driver rather than a compliance cost. For example, P&G’s investment in concentrated detergents not only reduced environmental impact but also decreased shipping costs and shelf space requirements, creating value throughout the supply chain. Manufacturers should expand beyond targeting only environmentally conscious consumers: Patagonia’s “Don’t Buy This Jacket” campaign paradoxically enlarged their market by converting previously indifferent consumers into environmental advocates, justifying premium pricing across their entire product line. This conversion strategy justifies higher environmental investment levels while maintaining competitive advantage against SBs.

Channel power structure decisions prove equally critical and should reflect observable market conditions. Unlike [19], who examine green versus non-green competition in dual-channel settings with centralized and decentralized structures, our analysis reveals that optimal power structures depend on the interaction between environmental investment patterns and market characteristics within traditional retail channels. When competition intensity and CEA are both low, MS structure consistently yields higher manufacturer profitability. However, when both factors are high, the RS structure benefits both parties through better coordination of environmental efforts and pricing strategies. Retailers can leverage their SB positioning strategically by pursuing environmental differentiation when CEA is high, while placing greater emphasis on price competition when substitutability is the dominant force. Given the practical difficulty of accurately assessing competition intensity and CEA, information sharing between manufacturers and retailers becomes essential. Through a collaborative market intelligence exchange, both parties can determine optimal channel structures and achieve mutually beneficial outcomes despite measurement uncertainty.

However, our study faces several limitations that suggest promising research directions. The deterministic demand assumption, while enabling clear identification of fundamental relationships, cannot capture market uncertainty that characterizes real retail environments. Future research could incorporate stochastic demand to examine how uncertainty moderates the relationships between CEA, channel structure, and performance outcomes. Moreover, our static analysis cannot capture the dynamic nature of environmental investment decisions. As [8] demonstrates, sustainability-resilience interactions evolve through feedback loops that could fundamentally alter optimal power structures over time. Dynamic models where environmental effort levels adjust based on market feedback and competitive learning could reveal path dependencies and lock-in effects not visible in our equilibrium analysis. Additionally, behavioral factors likely moderate our findings in important ways. While we assume rational decision-making, [29] shows that fairness concerns significantly influence green supply chain outcomes. Extending our framework to incorporate bounded rationality and fairness preferences could explain why some firms maintain suboptimal power structures despite clear CEA signals, potentially revealing when behavioral considerations override economic incentives. The simplified two-stage structure, though analytically tractable, also abstracts from multi-tier networks where environmental efforts cascade through multiple supply chain levels, creating amplification or dampening effects that could alter our core insights.

Despite these limitations, this study makes several important contributions. Unlike existing literature that primarily focuses on price-image relationships [10] or separates environmental from traditional competition, we provide an integrated framework capturing how environmental investment reshapes established SB-NB power dynamics. While [7] identifies emerging battlefronts, including online–offline integration and strategic collaboration between brands, our findings suggest that environmental investment creates an entirely new competitive dimension transcending traditional channel boundaries. The framework provides actionable guidance on when to invest environmentally, who should lead pricing decisions, and how to leverage consumer awareness for competitive advantage.

In conclusion, CEA fundamentally transforms SB-NB competition from traditional price-based rivalry to multidimensional competition involving environmental effort levels, channel power structures, and strategic positioning. This contribution advances beyond existing literature that primarily focuses on price-image relationships [10] or separate green and non-green product competition [19] by providing an integrated framework that captures how environmental investment reshapes power dynamics within established SB-NB relationships. As sustainability becomes increasingly central to retail strategy, understanding these dynamics proves essential for achieving both profitability and environmental objectives in modern supply chains. The evidence that environmental investment can create shared value rather than trigger destructive competition suggests opportunities for collaborative sustainability initiatives benefiting all channel members, pointing toward a future where environmental excellence and commercial success are mutually reinforcing rather than conflicting objectives.

Author Contributions

Conceptualization, Y.X.; Methodology, Y.X.; Software, Y.X. and Y.L.; Validation, Y.X., Y.L. and N.S.; Formal analysis, Y.X.; Investigation, Y.X., Y.L. and N.S.; Data curation, Y.X.; Writing—original draft, Y.X.; Writing—review & editing, Y.X., Y.L. and N.S.; Visualization, Y.X., Y.L. and N.S.; Project administration, Y.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| CEA | Consumer environmental awareness |

| SB | Store brand |

| NB | National brand |

| MS | Manufacturer Stackelberg |

| RS | Retailer Stackelberg |

| VN | Vertical Nash |

| SBs | Store brands |

| NBs | National brands |

| PLB | Private Label Brand |

| IoT | Internet of Things |

| CO | An environmental investment scenario in which environmental efforts apply only to NB products |

| CC | An environmental investment scenario in which both NB and SB products adopt environmental efforts |

| COMS | A scenario in which only NB products engage in environmental investment under the Manufacturer Stackelberg leadership structure |

| CORS | A scenario in which only NB products engage in environmental investment under the Retailer Stackelberg leadership structure |

| COVN | A scenario in which only NB products engage in environmental investment under the Vertical Nash structure, with no leader in the supply chain and both parties making decisions simultaneously |

| CCMS | A scenario in which both NB and SB products engage in environmental investment under the Manufacturer Stackelberg leadership structure |

| CCRS | A scenario in which both NB and SB products engage in environmental investment under the Retailer Stackelberg leadership structure |

| CCVN | A scenario in which both NB and SB products engage in environmental investment under the Vertical Nash leadership structure, in which no leader exists and both parties make decisions simultaneously |

References

- PLMA. Sales of U.S. Store Brands Surged in 2024; Private Label Manufacturers Association: Amsterdam, The Netherlands, 24 March 2025. [Google Scholar]

- Mookherjee, S.; Malampallayil, S.; Mohanty, S.; Tran, N.X. Pandemic-led brand switch: Consumer stickiness for private-label brands. J. Consum. Behav. 2024, 23, 2767–2780. [Google Scholar] [CrossRef]

- Gielens, K.; Ma, Y.; Namin, A.; Sethuraman, R.; Smith, R.J.; Bachtel, R.C.; Jervis, S. The future of private labels: Towards a smart private label strategy. J. Retail. 2021, 97, 99–115. [Google Scholar] [CrossRef]

- Hamdi, M. Sustainable Packaging Trends in the Consumer Packaged Goods Market. Bachelor’s Thesis, Extension School, Harvard University, Cambridge, MA, USA, 2024. [Google Scholar]

- Hayyat, A. The effect of organizational green operations and digitalization to promote green supply chain performance. In Human Perspectives of Industry 4.0 Organizations; CRC Press: Boca Raton, FL, USA, 2024; pp. 183–223. [Google Scholar] [CrossRef]

- Krishnan, V.; Nusraningrum, D.; Prebakarran, P.N.; Wahid, S.D.M. Fostering consumer loyalty through green marketing: Unveiling the impact of perceived value in Malaysia’s retail sector. J. Ecohumanism 2024, 3, 4318–4335. [Google Scholar] [CrossRef]

- Ndlovu, S.G. Private label brands vs national brands: New battle fronts and future competition. Cogent Bus. Manag. 2024, 11, 2321877. [Google Scholar] [CrossRef]

- Saidi, D.; Ait Bassou, A.; El Alami, J.; Hlyal, M. Sustainability and resilience analysis in supply chain considering pricing policies and government economic measures. Int. J. Adv. Comput. Sci. Appl. 2024, 15, 123–136. [Google Scholar] [CrossRef]

- Collins-Dodd, C.; Lindley, T. Store brands and retail differentiation: The influence of store image and store brand attitude on store own brand perceptions. J. Retail. Consum. Serv. 2003, 10, 345–352. [Google Scholar] [CrossRef]

- Diallo, M.F. Effects of store image and store brand price-image on store brand purchase intention: Application to an emerging market. J. Retail. Consum. Serv. 2012, 19, 360–367. [Google Scholar] [CrossRef]

- Huang, Z.; Feng, T. Money-back guarantee and pricing decision with retailer’s store brand. J. Retail. Consum. Serv. 2020, 52, 10189. [Google Scholar] [CrossRef]

- Kurata, H.; Yao, D.Q.; Liu, J.J. Pricing policies under direct vs. indirect channel competition and national vs. store brand competition. Eur. J. Oper. Res. 2007, 180, 262–281. [Google Scholar] [CrossRef]

- Cheng, R.; Duan, Y.; Zhang, J.; Ke, H. Impacts of store-brand introduction on a multiple-echelon supply chain. Eur. J. Oper. Res. 2021, 292, 652–662. [Google Scholar] [CrossRef]

- Li, W.; Chen, J. Pricing and quality competition in a brand-differentiated supply chain. Int. J. Prod. Econ. 2018, 202, 97–108. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, J. Pricing decisions with retail competition in a fuzzy closed-loop supply chain. Expert Syst. Appl. 2011, 38, 11209–11216. [Google Scholar] [CrossRef]

- Huang, H.; Ke, H.; Wang, L. Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly retailers. Int. J. Prod. Econ. 2016, 178, 12–21. [Google Scholar] [CrossRef]

- Wu, C.H.; Chen, C.W.; Hsieh, C.C. Competitive pricing decisions in a two-echelon supply chain with horizontal and vertical competition. Int. J. Prod. Econ. 2012, 135, 265–274. [Google Scholar] [CrossRef]

- Madani, S.R.; Rasti-Barzoki, M. Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: A game-theoretic approach. Comput. Ind. Eng. 2017, 105, 287–298. [Google Scholar] [CrossRef]

- Jamali, M.B.; Rasti-Barzoki, M. A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Ranjan, A.; Jha, J.K. Pricing and coordination strategies of a dual-channel supply chain considering green quality and sales effort. J. Clean. Prod. 2019, 218, 409–424. [Google Scholar] [CrossRef]

- Ranjbar, Y.; Sahebi, H.; Ashayeri, J.; Teymouri, A. A competitive dual recycling channel in a three-level closed loop supply chain under different power structures: Pricing and collecting decisions. J. Clean. Prod. 2020, 272, 122623. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Basiri, Z. Balancing price and green quality in presence of consumer environmental awareness: A green supply chain coordination approach. Int. J. Prod. Res. 2020, 59, 1957–1975. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Yang, H.; Chen, W. Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus cost-sharing. Omega 2018, 78, 179–191. [Google Scholar] [CrossRef]

- Yang, H.; Luo, J.; Wang, H. The role of revenue sharing and first-mover advantage in emission abatement with carbon tax and consumer environmental awareness. Int. J. Prod. Econ. 2017, 193, 691–702. [Google Scholar] [CrossRef]

- Kadam, C. Green Marketing Strategies in Developing and Developed Markets. Master’s Thesis, University of Vaasa, Vaasa, Finland, 2024. [Google Scholar]

- Phonthanukitithaworn, C.; Srisathan, W.A.; Worakittikul, W.; Inthachack, M.; Pancha, A.; Naruetharadhol, P. Conceptualising the effects of green supply chain on firms’ propensity for responsible waste disposal practices in emerging markets. Int. J. Sustain. Eng. 2024, 17, 429–447. [Google Scholar] [CrossRef]

- Li, F.; Xiong, H. Green supply chain decision-making considering fair concerns and consumer environmental mindset. Heliyon 2025, 11, e42916. [Google Scholar] [CrossRef]

- Choi, S.C. Price competition in a duopoly common retailer channel. J. Retail. 1996, 72, 117–134. [Google Scholar] [CrossRef]

- Chitra, K. In search of the green consumers: A perceptual study. J. Serv. Res. 2007, 7, 173–191. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).