1. Introduction

In classical financial theory, the market is assumed to be arbitrage free and complete, and so standard Brownian motion is often used as noise to characterize the prices of financial derivatives. However, in real-world financial markets, prices often exhibit long-range dependence and non-stationarity, which are inconsistent with the characteristics of standard Brownian motion. Consequently, many authors have proposed using fractional Brownian motion (fBm) to construct market models (see, for examples, Mandelbrot and Van Ness [

1]), with its simple structure and properties in memory noise. Unfortunately, starting with Rogers [

2], there has been an ongoing dispute on the proper usage of fractional Brownian motion in option pricing theory. A troublesome problem arises because fBm is not a semimartingale and therefore, “no arbitrage pricing” cannot be used. Although this is a consensus, the consequences are not clear. The orthodox explanation is simple: fBm is not a suitable candidate for the price process. But, as shown by Cheridito [

3], assuming that market participants cannot react immediately, any theoretical arbitrage opportunities will disappear. On the other hand, in 2003, Hu and ksendal [

4] used the Wick–Itô-type integral to define a fractional market and showed the market was arbitrage free and complete. In that case, the prices of financial derivatives satisfied the following fractional Black–Scholes model:

with

, where

is a fractional Brownian motion with Hurst index

,

and

are two parameters, and the integral

denotes the fractional Itô integral (Skorohod integral). For further studies on fractional Brownian motion in Black–Scholes models, refer to works by Bender and Elliott [

5], Biagini [

6], Bjork-Hult [

7], Cheridito [

3], Elliott and Chan [

8], Greene-Fielitz [

9], Necula [

10], Lo [

11], Mishura [

12], Rogers [

2], Izaddine [

13], and additional references cited therein.

In this paper, we consider the application of the quasi-likelihood method in continuous stochastic systems. Our goal is to establish the quasi-likelihood estimations for parameters

and

in Equation (

1) and to establish their asymptotic behaviors. As is well known, there are many papers on parameter estimation of stochastic differential equations, but the use of the quasi-likelihood method to deal with parameter estimation problems of stochastic differential equations without independent increments has not been seen so far. Clearly, the solution of (

1) does not have independent increments unless

. We briefly describe the quasi-likelihood method as follows.

Let

be a stochastic process such that its distribution contains unknown parameters

with

. Assume that

are samples extracted from

X, and that

is the probability function (e.g., density function) of the increment

for

. Since the process

X generally does not have independent increments, the function

is generally not a likelihood function. However, we can still use the usual method to obtain an estimator, which is called a quasi-likelihood estimator.

Let

be fractional Brownian motion with Hurst index

defined on the probability space

. Consider the fractional Black–Scholes model as follows:

with

, where

, and the stochastic integral is the fractional Itô integral [

14]. By using the Itô formula, we get

with

, which is called the geometric fractional Brownian motion (gmfBm).

In this paper, for simplicity, throughout, we let

H be known. Denote

and

Now, let be known, and let the gmfBm be observed at some discrete time instants satisfying the following conditions:

- (C1)

and as .

- (C2)

There exists such that as .

We get a quasi-likelihood function of parameter

and

as follows

where

is the density of the random variable

. Then, the logarithmic quasi-likelihood function is given by

with

, where

. By using the quasi-likelihood function, we get that the estimators

and

of

and

satisfy the equations

When

, by solving the above equation system, we get the estimators of

and

as follows:

where

and

for every

. When

, we have

and the random variables

are independent identical distributions, the above logarithm quasi-likelihood function is a classical logarithm likelihood function, and we have

and the asymptotic behavior of the two estimators can be easily established, so in the discussion later in this paper, unless otherwise stated, it is assumed that

.

Our study focuses on the asymptotic properties of two estimators. Given the Gaussian properties of the sample, we expect these estimators to exhibit quadratic variation, facilitating the derivation and simplification of their asymptotic behavior using fractional Brownian motion. To fully characterize this behavior, we rely on key properties of fractional Brownian motion, which not only underpin the theoretical understanding of complex stochastic processes but also provide a foundation for applying quasi-likelihood methods in parameter estimation.

The structure of this paper is as follows. In

Section 2, we briefly describe the basic properties of fractional Brownian motion. In

Section 3 and

Section 4 we discuss the strong consistency and asymptotic normality of the estimator

and analyze the asymptotic behavior under the cases where the parameter

is known and unknown. To prove these two asymptotic behaviors, we rely on two key results related to fractional Brownian motion. Although these results have been proven for a finite observation interval, they also hold when the observation length

tends to infinity. In

Section 5, we consider the asymptotic behavior of the estimator

. In

Section 6, we provide numerical verification and empirical analysis of the estimators

and

. In

Section 7, we conclude that the proposed fractional Brownian motion quasi-likelihood method performs well theoretically and empirically, offering a practical framework for financial parameter estimation.

2. Preliminaries

In this section, we briefly recall some basic results on fractional Brownian motion. For more aspects on the material, we refer to Bender [

15], Biagini et al. [

6], Cheridito-Nualart [

16], Gradinaru et al. [

17], Hu [

4], Mishura [

12], Nourdin [

18], Nualart [

19], Tudor [

20], and references therein.

A zero mean Gaussian process

defined on a complete probability space

is called the fBm with Hurst index

provided that

and

for

. Let

be the completion of the linear space

generated by the indicator functions

with respect to the inner product

When

, we know that

, and when

, we have

for all

. The application

is an isometry from

to the Gaussian space generated by

, and it can be extended to

. Denote by

the set of smooth functionals of the form

where

(

f and all its derivatives are bounded) and

. The

derivative operator (the Malliavin derivative) of a functional

F of the above form is defined as

The derivative operator

is then a closable operator from

into

. We denote by

the closure of

with respect to the norm

The

divergence integral is the adjoint of derivative operator

. That is, we say that a random variable

u in

belongs to the domain of the divergence operator

, denoted by

, if

for every

. In this case,

is defined by the duality relationship

for any

. Generally, the divergence

is also called the Skorohod integral of a process

u and denoted as

and the indefinite Skorohod integral is defined as

. If the process

is adapted, the Skorohod integral is called the fractional Itô integral, and the Itô formula

holds for all

and

.

4. Asymptotic Normality of Estimator

In this section, we examine the asymptotic distribution of

. We keep the notations from

Section 3, and denote by

and

the convergence in distribution and probability, as

n tends to infinity, respectively. From the structure of estimator

, one can find its asymptotic distribution depends on the asymptotic distribution of

. By the definition of

, we can check that

for

, where

is given in Lemma 8 and

with

. From the proof later given, we find that the two terms

and

admit same asymptotic velocity under some suitable assumptions of

. However, when

and conditions (C1) and (C2) hold, we know that (see proof of Lemma 9 in the following)

almost surely, as

. But

converges in

for

, and

converges in distribution for

. This indicates that

and

do not have the same asymptotic velocity for all

, which means that such models have inflection points when

. The reason for this situation is that

tends to infinity. If we assume that

tends to infinity logarithmically, the scenario is different. The following lemma provides the asymptotic normality of

, and its proof is given at the end of this section.

Lemma 9. Let be defined in Lemma 2, and let conditions and hold.

- (1)

When , we havewhere denotes the normal random variable with mean a and variance , and - (2)

When , we obtain - (3)

When , we have where .

4.1. The Asymptotic Distribution of When Is Known

In this subsection, we obtain the asymptotic distribution of

, provided

is known. By (

8), Lemma 3, and the fact that

, for all

, we get

with

.

Lemma 10. Let the condition hold, , and denote - (1)

For , we have as .

- (2)

For , we have , as , provided that condition holds with .

- (3)

For , we have as n tends to infinity, provided that condition holds with .

Proof. Let

. By Lemma 7 we have

for all

. Clearly,

for

and

for

if

. It follows from (

15) that

as

n tends to infinity under the conditions of statements (1) and (2).

We now verify statement (3). Let

. It follows from Lemma 2 that

as

n tends to infinity, provided that

since

as

n tends to infinity. □

Theorem 3. Let μ be known and let conditions (C1) and (C2) hold

- (1)

Let and , then, as , we have - (2)

Let , then, as , we have

Proof. Let

. Then, we have

Moreover, we have

for

, and

for all

and

.

For statement (1), we have

for all

, and by (

23) and (

24), we also have

since

for

. Combining these with (

21), (

23), Lemma 9, Lemma 10, and Slutsky’s theorem, we obtain statement (1).

For statement (2), we have

for all

if

. It follows from (

23) and (

24) that

for all

since

. Combining these with (

21), (

23), Lemma 9, Lemma 10, and Slutsky’s theorem, we obtain statement (2) because

. □

Theorem 4. Let μ be known and . If conditions (C1) and (C2) hold with . We then haveas n tends to infinity, where is given in Lemma 9. Proof. By (

8), Lemma 3, and the fact

, for all

, we get

On the other hand, we have

when

. Therefore, the asymptotic normality follows from (

26), (

27), Lemma 9, and Slutsky’s theorem, and we get

when

and as

n tends to infinity. □

4.2. The Asymptotic Distribution of When Is Unknown

In this subsection, we consider the asymptotic distribution of estimator

when

is unknown. Based on (

10), Lemma 4, and the fact that

, we obtain the following result

with

, where

. As a corollary of Lemma 4, the following lemma provides an estimate for the remainder term

Lemma 11. Let conditions and hold.

- (1)

For , we have

- (2)

For , we have , provided .

Proof. By Lemma 7 and the proof of Lemma 4, we get

for all

. Clearly,

and

for all

. Moreover, when

, we have

Similarly,

for all

and

for all

. Noting that

and

for all

, we obtain that

converges almost surely to 0 for

and that it converges almost surely to 0 for

provided

. Thus, the lemma follows from Lemma 4 and (

30). □

Theorem 5. Let μ be unknown and let conditions (C1) and (C2) hold.

- (1)

For , if , we have - (2)

For , we have

Proof. Clearly, we have

for all

and

for

, and moreover

for all

. It follows that

for all

, and

for all

, and

for all

, since

for

and

for all

. Combining this with (

29), Lemma 9, Lemma 11, and Slutsky’s theorem, we obtain the theorem. □

Lemma 12. Let conditions and hold with . For , we have Proof. Similar to the proof of Lemma 11, we get

for all

. It follows from Lemma 7 and Lemma 2 that

as

n tends to infinity. □

Theorem 6. Let and μ be unknown. If conditions and hold with , we then haveas n tends to infinity, where is given in Lemma 9. Proof. Let

. By (

10), Lemma 4, and the fact that

, we get

Therefore, using Equations (

33) and (

34) and Lemma 9, we have

when

and as

n tends to infinity. □

4.3. Proofs of Lemmas in Section 4

In this subsection, we complete the proof of Lemma 9.

Proposition 1. Let the conditions in Lemma 1 hold.

- (1)

For , we havein distribution, where - (2)

For , we havein distribution. - (3)

For , we havein , where denotes a Rosenblatt random distribution with .

The lemma is an insignificant extension for some known results, and its proof is omitted (see, for examples, Theorem 5.4, Proposition 5.4, Theorem 5.5 in Tudor [

20]). In fact, for

, such convergence have been studied and can be found in Breuer and Major [

23], Dobrushin and Major [

24], Giraitis and Surgailis [

25], Nourdin [

26], Nourdin and Reveillac [

27] and Tudor [

20]. On the other hand, for more material on the Rosenblatt distribution and related process, refer to Tudor [

20].

Proof of Lemma 9. Let

be given. We have

We also have

for

and

for

. On the other hand, by Taylor’s expansion, we may prove

for

if

. It follows from Lemma 7 that

for

and

for

. Combining the above three convergences and the proof of Lemma 8, we obtain that

for

and

for

. Thus, by (

16) and Proposition 1, to end the proof, we check that

for all

under some suitable conditions for

. By the fact

with

and

, we get that

for all

, where

for

.

Now, in order to end the proof, we estimate the last three items in (

42) in the two cases

and

.

Cases I:

. Clearly, the sequence

converges. It follows that

and

as

n tends to infinity. Combining these with Lemma 8 and (

42), we obtain convergence (

41) for all

. Thus, by Proposition 1, (

16), (

39), and Slutsky’s theorem, we obtain the desired asymptotic behavior

for all

, and statement (1) follows.

Cases II:

. From

and Taylor’s expansion, we get that

as

n tends to infinity, which implies that

as

n tends to infinity. Similarly, we also have

and

as

n tends to infinity. On the other hand, we have

as

n tends to infinity, where

denotes the classical Beta function. It follows from Taylor’s expansion that

for all

, as

n tends to infinity. Combining these with Lemma 8 and (

42), we obtain convergence (

41) for all

if

. Thus, we obtain the desired asymptotic behavior

for all

by Proposition 1, (

16), and (

40), and statement (2) follows.

Now, we verify statement (3). Let

. By Lemma 7, we have

and moreover, from the proof of statement (2) in Lemma 9, we also have

where

. Noting that

admits a normal distribution for all

, we see that

from (

52). It follows from (

16), statement (3) in Proposition 1, and (

51) that

as

n tends to infinity. Moreover, by (

51) we obtain

Combining this with (

54), (

53), and Proposition 1, we get

as

n tends to infinity. Finally, by Proposition 1, (

53), (

55), and Slutsky’s theorem, we obtain

Thus, the three convergences in statements (2) and (3) follow. □

6. Numerical Simulation and Empirical Analysis

In this section, the effectiveness of the proposed estimator is validated through numerical simulations. The results demonstrate that the estimator exhibits strong applicability and reliable performance in practical scenarios. To further assess the precision of the two estimation methods, Monte Carlo simulations were conducted in MATLAB 2017b, where the simulated estimates were compared against the true values, and their mean values and standard deviations were calculated to provide a comprehensive evaluation of the estimator’s performance. In addition, real trading data from the Chinese financial market were retrieved via the Tushare Pro platform using Python 3.10. With the known value of H, the parameters and were estimated, and track plots were generated in MATLAB and compared with the logarithmic closing prices of the stock, thereby further validating the effectiveness of the pseudo-likelihood estimation.

6.1. Numerical Simulation

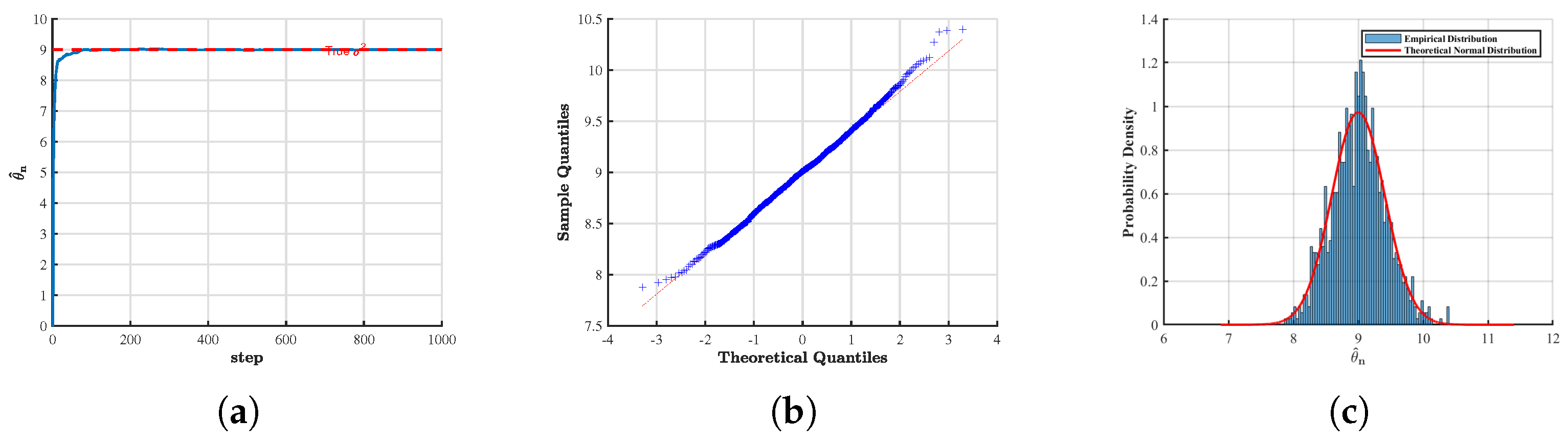

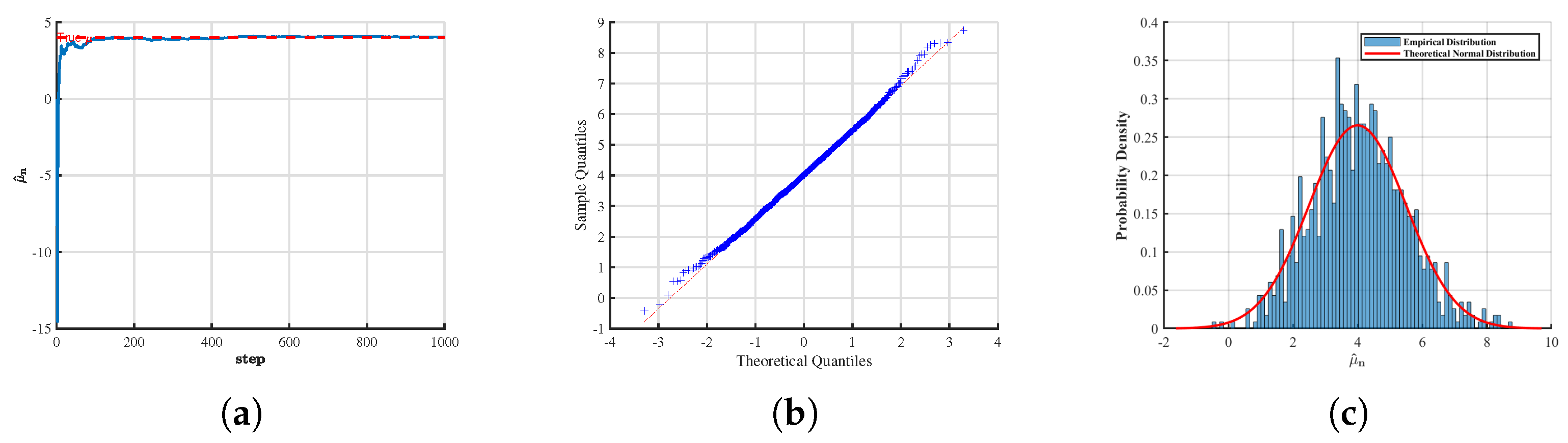

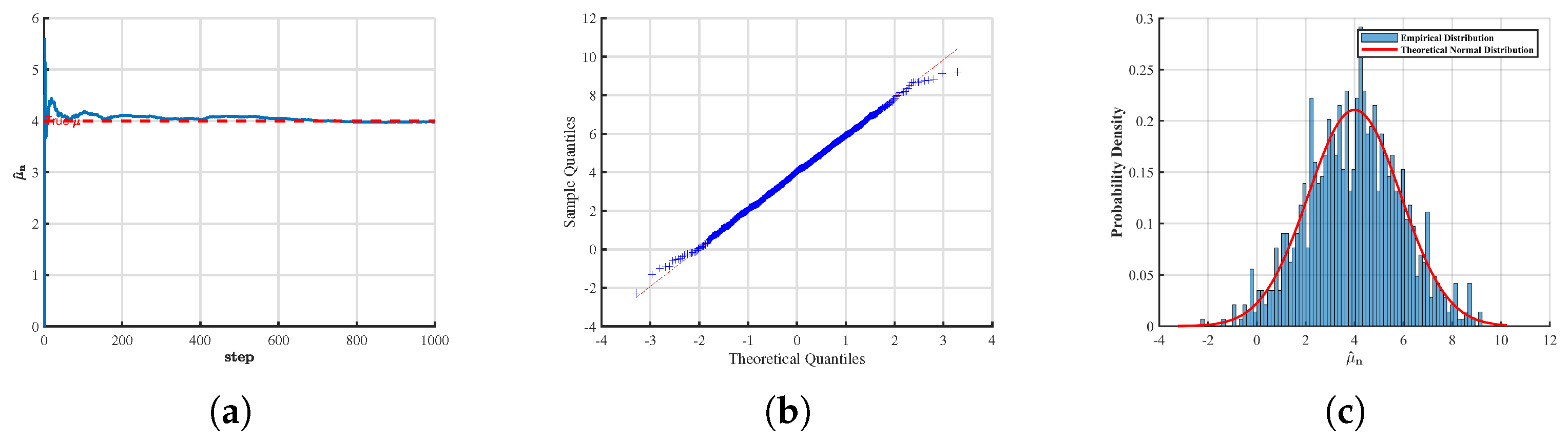

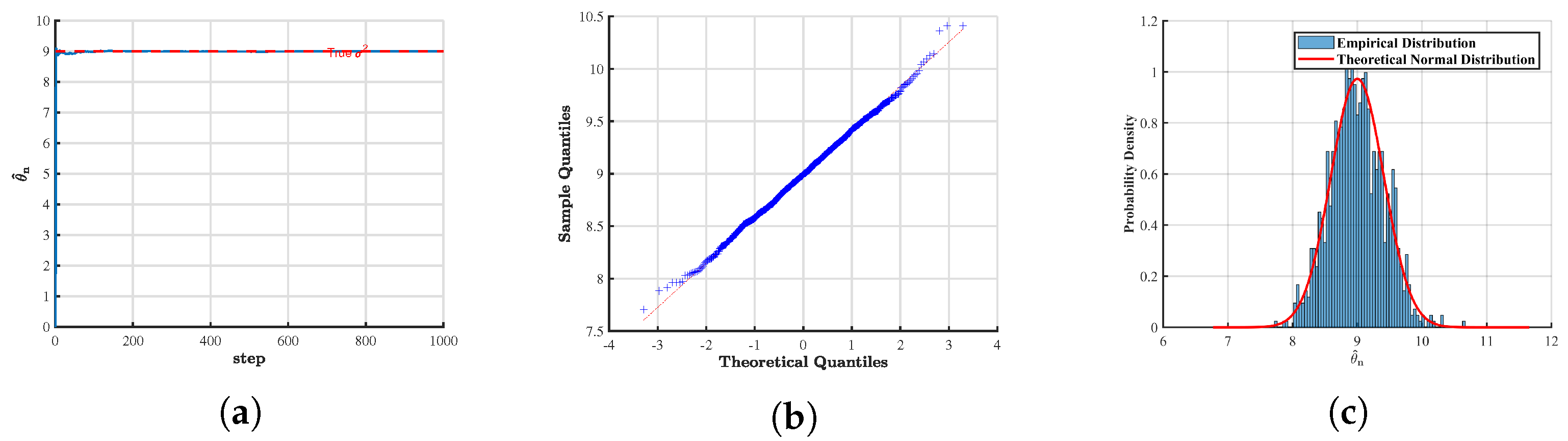

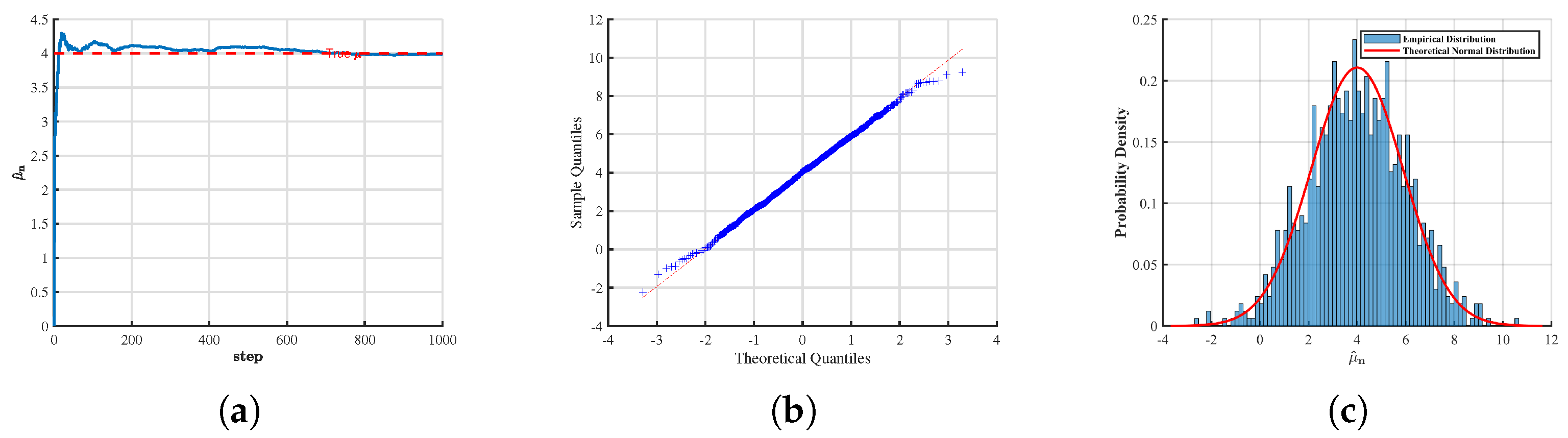

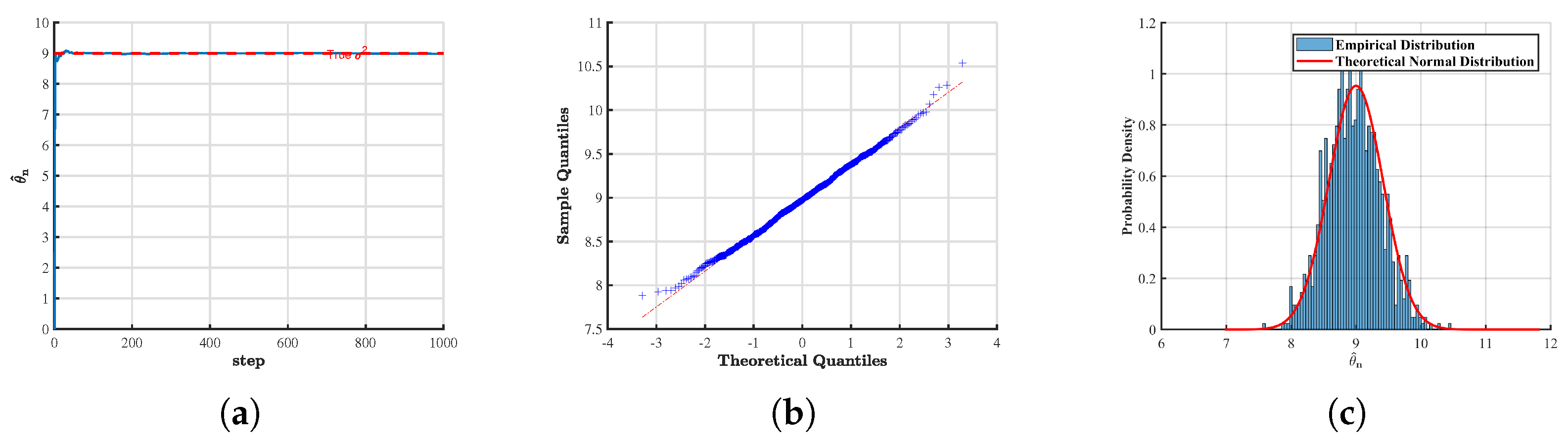

First, we emphasize that in all the figures presented below, the sample size was fixed at , and the time step was chosen as . The parameters were set to and . In the analysis of the asymptotic distribution, the number of replications, i.e., the simulated sample paths, was specified as . For the sake of notational consistency, we denote throughout the subsequent discussion. To assess the effectiveness and robustness of the proposed estimation method, we designed two primary experimental scenarios:

- 1.

Case with Partially Known Parameters

In the case where the parameter

is known, we estimated the parameter

and further examined its estimation path, quantile–quantile plot, and asymptotic distribution. The corresponding results for the estimator

are presented for

(

Figure 1) and

(

Figure 2).

In the case where the parameter

is known, we estimated the parameter

and examined its estimation path and asymptotic distribution. Similarly, figures present the estimation paths and asymptotic distribution of

when

(

Figure 3) and

(

Figure 4).

- 2.

Case with Completely Unknown Parameters

In this scenario, where both

and

are unknown, we estimated both parameters simultaneously and analyzed their estimation paths and asymptotic distributions. Figures present the estimation paths and asymptotic distribution of

and

when

(

Figure 5 and

Figure 6) and

(

Figure 7 and

Figure 8).

Case 1: The asymptotic behavior of the estimators of and when is known.

Case 2: The asymptotic behavior of the estimators of and when both parameters are unknown.

From the above figures, it can be observed that for different values of H, the numerical simulation results of the convergence and asymptotic properties of the estimators and are largely consistent with the theoretical predictions. The discrepancies are minor, indicating that the obtained estimates exhibit a high degree of accuracy.

In addition, to investigate the asymptotic behavior of the proposed estimators for different sample sizes, we considered three sample sizes: , 2000, and 3000. The comparison of theoretical variance with empirical variance, as well as the corresponding errors, was carried out. The specific experimental design is outlined as follows:

Table 1: Theoretical variance, empirical variance, and their errors for parameter

when

is known.

Table 2: Theoretical variance, empirical variance, and their errors for parameter

when

is known.

Table 3: Joint analysis of the variance estimates and errors for both parameters when

and

are unknown.

The discrepancies are minor, indicating that the obtained estimates exhibit a high degree of accuracy.

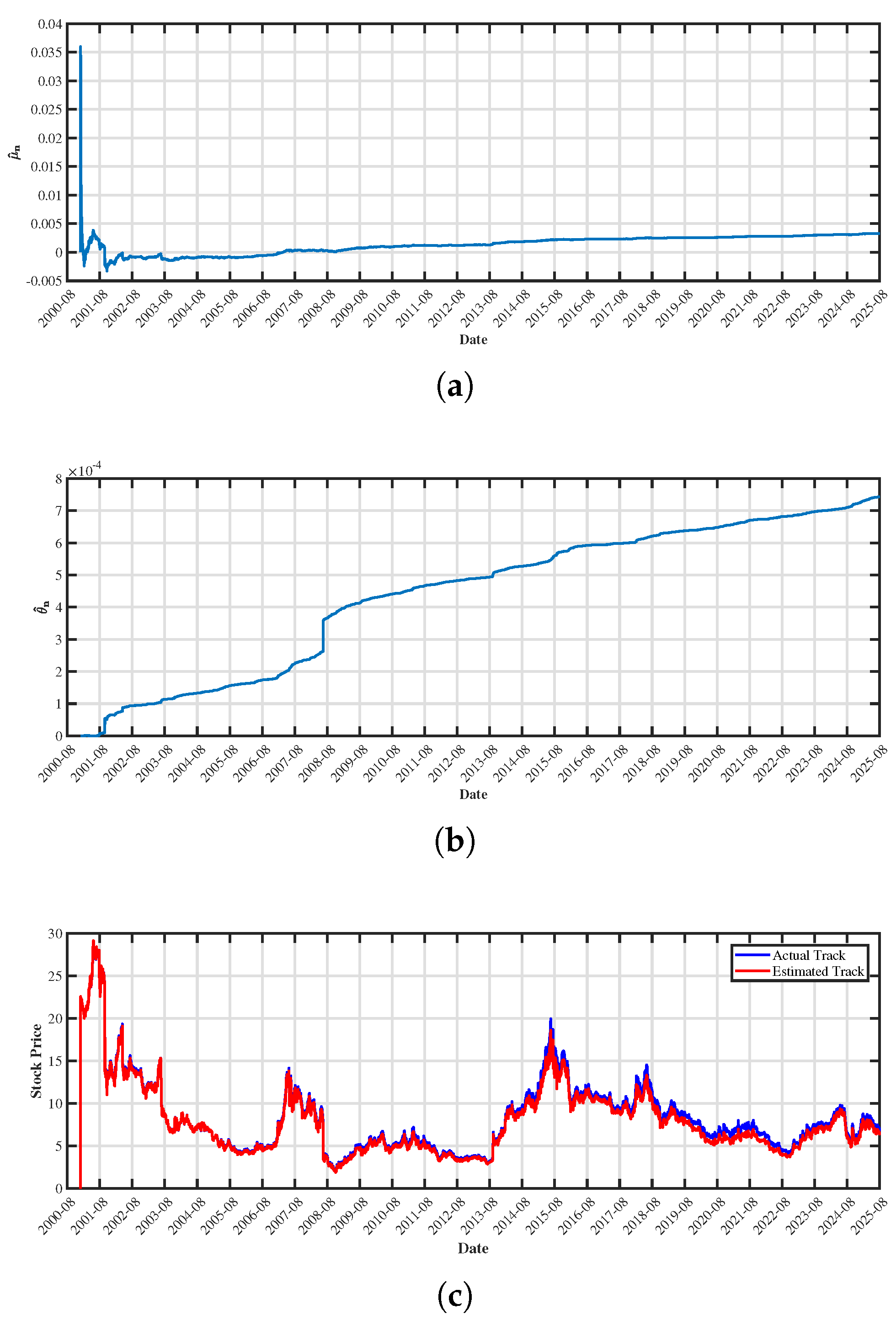

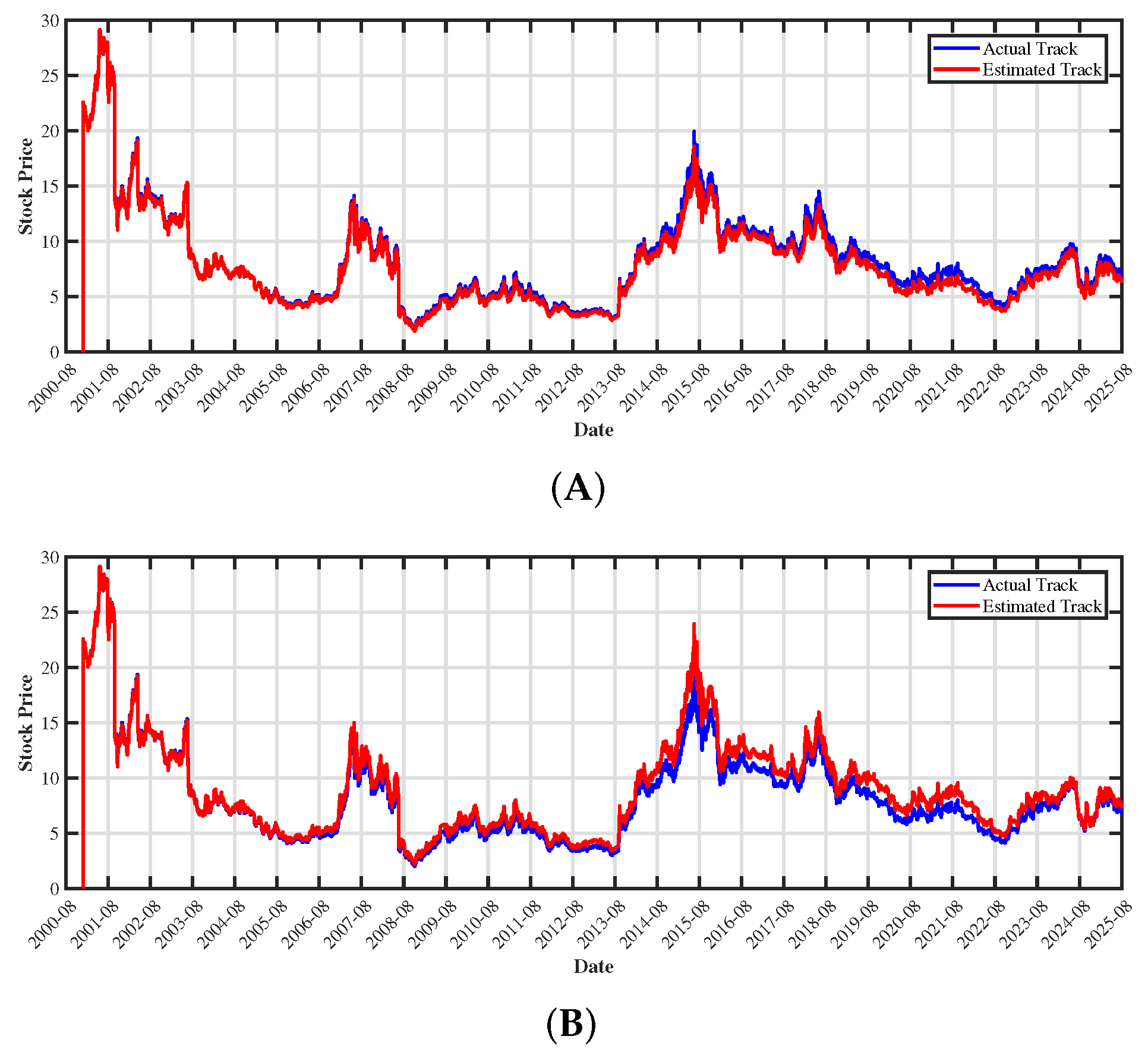

6.2. Empirical Analysis

To further evaluate the performance of the proposed model and estimation method in a real-world market setting, we conducted an empirical analysis using Heilan Home Co., Ltd. Jiangyin, Jiangsu Province, China (stock code: 600398), a representative stock from the Chinese A-share market. Daily closing price data were retrieved via the Tushare Pro platform using Python, covering the period from 28 December 2000, to 26 August 2025. Data cleaning and preprocessing were carried out to ensure consistency. As supported by the theoretical results in

Section 3, the estimators were consistent as the sample size

; therefore, the full sample period was employed to guarantee robustness. The Hurst exponent of the stock return series was first estimated using the R/S method, yielding

, which suggested the presence of long-memory effects.

Based on this, the key model parameters

and

were estimated within the quasi-likelihood framework proposed in this paper. To provide an intuitive evaluation of model fit, simulated price track were generated in MATLAB using the estimated parameters and compared with the actual closing prices observed. The comparison demonstrated that the model captured the overall price dynamics effectively, thereby confirming both the applicability of the mixed fractional Brownian motion Black–Scholes framework and the reliability of the proposed quasi-likelihood estimation method on real financial data. Furthermore, we simulated stock price tracking using both the fractional Brownian motion model proposed in this study and the classical Black–Scholes model. The comparative results are presented in

Figure 9 and

Figure 10. As illustrated, our proposed model provides a notably better fit to the observed price dynamics, particularly in capturing volatility clustering and the long-memory behavior inherent in the price process. These results further highlight the advantages and practical applicability of our model in financial data modeling and empirical analysis.