Abstract

Corporate Social Responsibility (CSR) actively enhances social, economic, and environmental well-being, increasingly impacting society. It plays a vital role in building a trustworthy and transparent image for the banking system’s relationship with the community. In this context, the paper aims to analyse the effects of delayed adaptation by the banking system to reporting requirements, as well as the reasons that may cause oscillating behaviour on their part. Accordingly, three scenarios are developed to describe the behaviour of banks that experience regular fluctuations in the level of external sustainability reporting requirements, meaning the pressure to comply with these requirements may vary over time. The research method employed involves a dynamic analysis, utilising a mathematical model described by a nonlinear system with time delay. The goal of the research is to identify the equilibrium point of the system and analyse its asymptotic stability. Moreover, the critical time delay is provided, beyond which banks’ responses become oscillatory rather than stable. Numerical simulations illustrate the theoretical findings and reveal a critical delay value under which banks can stabilise their resources to meet sustainability requirements.

Keywords:

CSR reporting; balance point; oscillating behaviour; stability; mathematical model; sustainability in the banking system MSC:

34D20; 34H05; 91-10

1. Introduction

Corporate Social Responsibility (CSR) is a set of practices and initiatives through which companies actively contribute to improving social, economic, and environmental well-being, considering their impact on society. In the banking sector, CSR has evolved from a marketing option to an essential practice, playing a significant role in establishing a reputation for trust and fostering transparent relationships with customers, investors, and the community. Corporate Social Responsibility Reporting (CSRR) refers to the process by which financial institutions disclose their activities and initiatives related to social responsibility, demonstrating their commitment to ethical principles, sustainability, and social well-being. In the banking sector, CSRR can include information about investments in environmental projects, education, health, or disadvantaged communities, as well as the implementation of transparent and fair corporate governance practices.

As regulatory requirements and public expectations for sustainability and business ethics increase, CSRR in the banking sector becomes even more vital. Banks face strict regulations and must demonstrate through clear, detailed reporting that they responsibly allocate resources, actively contributing to the development of a sustainable economy and supporting their communities.

In this context, CSRR in the banking system is not just a way of meeting legal requirements or satisfying consumer expectations, but also an opportunity to generate long-term value by building customer trust and loyalty, attracting investment, and enhancing the organisation’s reputation. CSRR also demonstrates a bank’s commitment to operating transparently and responsibly, showing a balanced relationship between profitability and the impact on society and the environment.

On the other hand, some banks use specific mechanisms to avoid genuinely implementing CSR (greenwashing). Bank leaders may be hesitant to embrace CSR, especially when the benefits are not immediate. Therefore, without external pressure, banks might delay meaningful action and only superficially adopt CSR. Additionally, differences between emerging and developed markets play a role. Banks in emerging markets often struggle to enforce CSR rules because of underdeveloped financial infrastructure. The lack of strong regulatory authorities can enable banks to avoid meeting CSR standards for a long time. This creates an uneven banking sector, where banks in developed economies adopt CSR more quickly, while those in emerging markets lag behind.

The motivation of our research is based on the need to understand how delays in adapting to external sustainability reporting requirements influence the dynamic behaviour of banks. Thus, we analyse the impact of delays in adapting to reporting requirements that can cause oscillatory behaviour. Banks may experience regular fluctuations in external sustainability reporting demands, meaning that the pressure to comply will periodically rise and fall rather than stay constant. Therefore, starting from three possible scenarios of how banks adopt CSRR requirements and respond to regulations, investor pressure, and market demands, two main research hypotheses were formulated, i.e.,

H1.

The delay in adapting to external sustainability reporting requirements significantly affects banks’ response behaviour.

H2.

There is a critical delay threshold at which banks’ responses become oscillating.

This approach may also be considered as a novelty and the main contribution of our paper to the existing literature. This integrates scenario-based reasoning with dynamic systems analysis, offering a quantitative framework to assess the long-term implications of delayed CSR compliance. This contributes to the literature by providing theoretical insights into the stability of banks’ sustainability strategies and informing policy interventions that promote timely and effective CSR reporting.

The research method used to validate these hypotheses is the dynamic analysis of a mathematical model within a nonlinear system with time delay, followed by numerical simulations. The aim of the paper is to identify the critical value of the time delay, beyond which, over time, the banks stabilise their resources, strategies, and competencies to achieve a stable capacity and meet sustainability requirements.

Based on the compliance scenarios described in Section 3, the research hypotheses (H1 and H2) are investigated through a nonlinear delay differential model that captures the dynamic interaction between external sustainability reporting and the bank’s capacity to adapt. The model explicitly incorporates a time delay parameter, which reflects the institutional inertia in banks’ adaptation to CSRR. By analysing the local stability of the system and identifying bifurcation thresholds, the paper demonstrates how delays influence the stability and responsiveness of banks’ behaviour (thereby directly testing H1 and H2). This modelling approach represents a key contribution of the paper and complements the qualitative scenario-based reasoning with numerical simulation.

The structure of the paper is as follows. Section 2 presents a review of the literature. Scenarios for banks’ compliance with CSR requirements are described in Section 3. The mathematical model and its local stability are developed in Section 4. Section 5 refers to numerical simulations that substantiate the theoretical results. Conclusions are given in the final section of the paper.

2. Literature Review

The literature deals with the issue of CSRR from different perspectives. Several authors have been concerned with summarising the information provided by the literature on CSRR given the complexity of the information contained in these reports. From this perspective, De Haas [1] provides a quasi-complete picture of the content of the concept of sustainable banks and how they apply the required sustainability requirements. Erben et al. [2] study the social factors impacting the sustainable business growth perception within the ESG concept, highlighting the importance of integrating social dimensions into sustainability reporting.

Other authors examined the tools used in reporting through a broad systematic review of the literature, such as Olanipekun et al. [3]. Similarly, Vartiak [4] conducts a comparative analysis of report content, and de Villiers and Alexander [5] perform a comparison between two countries regarding the structure of CSRR, an analysis based on the legitimacy provided by isomorphism. Lee et al. [6] compare the CSRR of Chinese and Nordic banks, concluding that Nordic banks report much more complete and transparent information. Löw et al. [7] empirically investigate the content of CSRR, focusing on transparency and the factors influencing it in banks across Europe.

Nițescu et al. [8] and DeLisle et al. [9] investigated the impact of CSR implementation on the financial performance of banks, highlighting the need for investments in digital transformation and innovation to achieve sustainability objectives. Ho et al. [10] analyse the reaction of the financial market to CSR spending made by companies, and their results show that companies that assume social objectives record a higher profitability, and the financial market reacts positively to increased CSR spending. However, the reaction is less favourable when spending exceeds the industry norm.

Regarding the quality of information contained in CSRR, Michelon et al. [11] investigate the content, type of information, and managerial orientation while showing that the lack of complete information can lead to reputational erosion, and Matuszak and Różańska [12] show the need for complete information to be published on the website.

Carnevale et al. [13] examine the effects of CSR transparency on company performance. Nazari et al. [14] and, respectively, Gerged et al. [15], analyse the complexity of information included in CSRR, along with the degree of understanding of reports as a measure of confusion and their contribution to report evaluation. Koh et al. [16] assessed the relationship between CSRR performance and the quality of reported information, especially when requested by shareholders. In the same context, Khan et al. [17] explore the influence of regulations on CSR practices and banks’ voluntary compliance with CSR regulatory requirements.

An important part of the literature is dedicated to the study of potential links [5] between CSRR and a bank’s value and their financial performance. In this sense, Andrikopoulos et al. [18], and later Sorour [19], emphasise the need for transparency in CSRR but also the identification of the factors that underlie it. In their conception, transparency is linked to the size of financial institutions, respectively, to the accounting value and the market value of capital.

Gambetta et al. [20] examine how banks with a lower profitability tend to publish higher-quality information regarding CSR. Khan et al. [21], Buallay et al. [22], and Bo and Battisti [23] conclude, based on theoretical studies, that the integration of sustainability aspects is positively linked to the financial performance of banking institutions.

Chantziaras et al. [24] discuss the issue of compliance with social norms in the banking system, with a focus on the factors underlying voluntary compliance with CSR requirements. Also, Khan [17] reiterates the idea of voluntary compliance with CSRR, starting from the influence of regulations on CSR practices, and Jain et al. [25] emphasise the importance of compliance with ethical norms in CSRR.

A significant portion of the literature focuses on greenwashing, a practice that has frequently been identified, including in the banking sector. Dempere et al. [26] summarise concepts, arguments, and aspects not covered in existing research on the greenwashing phenomenon, while Galetta et al. [27] employ the PRISMA methodology for the literature review, emphasising the need to fight against greenwashing. Birindelli et al. [28] demonstrate that greenwashing practices negatively affect company performance but suggest that female leadership has a moderating effect in this relationship. Testa et al. [29] examine stakeholder pressures and the role of corporate strategies regarding the genuine or symbolic integration of CSR practices, highlighting the significant influence of shareholder attitudes.

After reviewing the literature, we have identified a methodological gap regarding the banks’ CSRR compliance behaviour. Consequently, we have chosen to approach this aspect from a mathematical model with a time delay perspective, which is further described in Section 4. The inclusion of time delay was considered since it considerably affects the banks’ behaviour to external sustainability requirements. Moreover, we have identified a critical threshold of the delay at which banks’ behaviour becomes oscillating. Though our method is more abstract, it is also more relevant since it captures the complexity of banks’ behavioural trends in adopting the CSRR requirements.

3. Compliance Scenarios Regarding Sustainability in Banking

In the banking system, CSR standards are not well-defined, which causes banks to postpone compliance with sustainability reporting while waiting for clear guidelines. In addition, differences between international regulations can create uncertainty and difficulties in implementing uniform standards.

Table 1 compares the application of three sustainability compliance scenarios in banking. In formulating these scenarios, the authors considered how banks adopt CSRR requirements and respond to international regulations, investor pressure, and market forces.

Table 1.

Scenarios regarding sustainability in banking.

According to Table 1, Scenario 1 would be suitable for a rapid and efficient transition to a sustainable banking system, but it requires strong institutional support. Scenario 2 is the most likely to be followed, as many countries have not yet fully implemented CSR regulations in the banking system, and banks face serious bureaucratic barriers. Scenario 3 could lead to a voluntary but uneven adoption, which will contribute to an increased risk of greenwashing.

By analysing the three scenarios in Table 1, it can be argued that the banking system can facilitate the transition to a sustainable economy, minimising risks and maximising the positive impact of responsible finance. Furthermore, banking authorities should combine clear regulation with institutional support (to accelerate compliance) and independent auditing mechanisms to combat greenwashing.

The scenarios described in Table 1 highlight the variability of institutional, regulatory, and market-driven pressures that influence banks’ compliance behaviour. These qualitative differences are captured quantitatively in our model through parameters such as the delay (regulatory adaptation inertia) parameter (dependence on past requirements) and banks’ internal response capacity. Thus, each scenario corresponds to a different configuration of the model parameters, with Scenario 1 representing low-delay/high-capacity regimes, with Scenarios 2 and 3 associated with high-delay/low-capacity cases that may trigger oscillatory behaviour, as predicted by hypotheses H2.

The two identified research hypotheses are related to the mathematical model described in Section 4.

4. Model Description and the Study of Local Stability

In this section, a mathematical model is introduced, and it serves to operationalise the two research hypotheses as follows:

- H1 is tested by analysing how the system’s stability is influenced by variations in the delay parameter, representing the time banks need to respond to sustainability requirements.

- H2 is validated through the identification of a critical value beyond which a Hopf bifurcation occurs, and the system transitions from stable to oscillatory behaviour.

In this context, the parameters of the model reflect both external pressures and banks’ internal capacity, with specific emphasis on how delays in adaptation affect long-term stability.

To analyse the dynamic behaviour of banks in response to external sustainability reporting requirements, we propose a nonlinear delay differential system inspired by Chiș et al. [30] and Mircea et al. [31]. It describes the result of the relationship between two variables at a moment t ∈ IR. The variable denoted by S(t) is the level of external reporting requirements for sustainability (institutional pressures, regulations, investor expectations, and bank requirements for sustainable financing). The variable R(t) stands for the capacity of banks to respond to these requirements (allocated resources, compliance strategies, and development of internal competencies for sustainability).

We assume that the evolution of S(t) is governed by a logistic-type growth dynamic, tempered by the banks’ response R(t). The effect of the banks’ response at a given moment is given by −kS(t)R(t), k > 0, and the average growth rate of external requirements is rS(t), r > 0. Therefore, the rate of change for the external requirements is given by:

The evolution of R(t) is modelled as a delay differential equation to reflect the realistic delay in a bank’s adaptation to new or evolving sustainability standards. The rate of change in the capacity of organisations to respond to these requirements (allocated resources, compliance strategies, and development of internal sustainability competencies) is described by the following:

where τ > 0, p > 0, s > 0, a ∈ [0, 1), and S(t − τ) represents the characteristic of external requirements at the moment t − τ.

The parameter τ is the delay in adapting to reporting requirements. Banks with high internal bureaucracy or without CSR resources have a high delay in adaptation.

The parameter p is the rate of increase in reporting requirements. If new CSR standards are adopted quickly, the value of p is high. If changes are slow and predictable, p is low. The increase in reporting requirements from banks regarding climate risks leads to a higher p.

The parameter a measures the dependence on previous requirements versus adaptation to new regulations. A low value of parameter a means banks base their reporting on old requirements and have difficulties adapting to new standards. A high value of a indicates greater flexibility regarding recent regulatory changes. If banks rely only on past standards and do not adopt CSR, they have a low a.

The parameter s stands for the capacity of banks to provide an adaptive response. However, this also may include misleading information (greenwashing) to appear compliant. Companies with well-developed CSR teams, financial resources, and technology have a high value of parameter s (respond efficiently to reporting requirements). Banks without CSR expertise have a low s (difficult adaptation). A clear CSR strategy leads to a high s.

The differentiable functions f, g: IR + → IR+ represent the reactions of the banks on the implementation of reporting requirements and self-sustainability (internal sustainability culture). The banks can impose strict sustainable financing criteria (e.g., green loans, CSR reporting obligations for access to financing), or they can have regulations that are not so strict, or their implementation is optional. The banks can have a proactive organisational culture in sustainability (e.g., voluntarily adopting CSRR), or the sustainability is perceived only as an external obligation [32].

Therefore, the mathematical model of the bank’s responses to external sustainability reporting requirements is given by the following:

with the initial condition

In what follows, we define the nonlinear functions f and g as saturating Hill-type functions of the form:

These functions satisfy

S(θ) = φ(θ), θ ∈ [−τ, 0], R(0) = R0.

We can notice that when x increases, f approaches, indicating that the banks’ response becomes saturated. This means that beyond a certain point, further increases in external requirements do not significantly enhance the banks’ response. The fourth power of x in the numerator indicates a nonlinear response, meaning that small changes in x can lead to significant changes in f(x) when x is small, but the response levels off as x increases. The function f(x) increases rapidly when x is small and then slows down as x becomes large. This indicates that banks are highly responsive to initial increases in external requirements, but their responsiveness decreases as the requirements continue to rise.

Similarly to f(x), as x increases, g(x) approaches 1, indicating that the banks’ internal capacity to respond becomes saturated. Beyond a certain point, further improvements in internal capacity do not significantly enhance the banks’ response. The third power of x in the numerator indicates a nonlinear response, meaning that small changes in x can lead to significant changes in g(x) when x is small, but the response levels off as x increases. The function g(x) increases rapidly when x is small and then slows down as x becomes large. This indicates that banks are highly responsive to initial improvements in internal capacity, but their responsiveness decreases as the capacity continues to grow.

The system (3) is a set of nonlinear delay differential equations (DDEs) with continuous and Lipschitz-continuous right-hand sides on Given the initial condition S(θ) = φ(θ), θ ∈ [−τ, 0], and R(0) = R0, the standard theory of functional differential equations [33] guarantees the existence and uniqueness of a local solution.

To do a dynamic analysis, we are interested in finding the positive equilibrium point and its local asymptotic stability. It is the positive solution of the algebraic system:

rS − kSR = 0

pf (S) + sg(R) – R = 0.

If and , then the coordinates of the positive equilibrium point denoted by (S0, R0) are given by (3):

Using the translation the linearized system at (S0, R0) is

where ρ1 = f′(S0) and µ1 = g′(R0).

The characteristic equation of (6) is

where m = 1 − sµ1 −kS0 and c = pρ1kS0.

λ2 + mλ + ac + (1 − a)ce−λτ = 0,

Proposition 1.

If there is no delay in adapting to reporting requirements (τ = 0), and k < and , then (S0, R0) is locally asymptotically stable.

Proof.

If there is no delay, the characteristic equation becomes

where c = pkS0f′(S0) > 0.

λ2 + mλ + c = 0,

Using the Routh-Hurwitz criteria, from m > 0 we obtain

which is equivalent to

that leads to the conclusion. □

1 − s g′(R0) − kS0 > 0,

The asymptotic stability of the equilibrium point (S0, R0) means that if the system is slightly perturbed from this equilibrium state, it will return to the equilibrium over time. Then, small deviations of S(t) and R(t) will decay, and the system will stabilise back to (S0, R0). It signifies that banks can achieve a stable state in their sustainability reporting efforts, provided they manage their resources and strategies effectively. This stability is important for maintaining a consistent compliance with sustainability requirements and for the long-term success of sustainability initiatives in the banking sector [34,35].

Given that one of the two situations holds, we are interested in studying the existence of a Hopf bifurcation when the time delay is considered a bifurcation parameter. This occurs when the system’s equilibrium point changes its stability as the time delay τ is varied, leading to the emergence of periodic solutions (limit cycles).

Proposition 2.

If and are the roots of (7), where

and

where

The equilibrium point (S0, R0) is locally asymptotically stable for τ ∈ [0, τ0). When the bifurcation parameter crosses the threshold value τ0, a Hopf bifurcation occurs.

Proof.

Assume that for the critical value τ = , the characteristic equation admits a pair of purely imaginary roots λ = ±i, > 0. We substitute λ = iω into (7), and by separating real and imaginary parts we obtain

that leads to

The frequency verifies the equation:

Thus, for , the critical frequency is given by (8), and the corresponding delay is given by (9), at which a Hopf bifurcation occurs. □

To confirm the occurrence of a Hopf bifurcation, we verify the transversality condition, which requires that the real part of the eigenvalue crosses the imaginary axis with non-zero speed as τ varies. This is equivalent to

that leads to

This confirms the occurrence of the Hopf bifurcation.

In Proposition 2, a critical threshold of the time delay is determined, and when τ crosses this value, the equilibrium point of the system (where S(t) and R(t) are constant) loses stability. This means that the system’s response to external reporting requirements and the capacity of banks to meet these requirements will no longer settle at a steady state. When the equilibrium loses stability, a small-amplitude periodic solution emerges. This implies that the level of external reporting requirements and the capacity of banks to respond will start to oscillate over time rather than settle at a constant value. The periodic solutions indicate that the system will exhibit regular, predictable cycles of behaviour. For example, the pressure from external reporting requirements and the banks’ response capacity might increase and decrease cyclically.

5. Numerical Simulation

In this section, we perform numerical simulations using Mathematica 13.1 software. The numerical simulations are framed with two specific objectives: (i) To validate the existence of a critical delay threshold beyond which the system exhibits oscillatory behaviour (supporting H2), and (ii) to illustrate how varying the delay parameter affects the stability of the system and the banks’ capacity to respond to sustainability requirements (supporting H1). The section has also been restructured to emphasise how the simulation results substantiate the theoretical findings and contribute to the broader implications of the study.

We consider that the banks are moderately influenced by external sustainability reporting requirements. The banks’ strong adaptive capacity allows them to respond effectively to these requirements. The growth rate of external requirements, r = 0.5, ensures that the banks face a consistent increase in reporting demands. The banks’ response significantly impacts the external requirements, leading to a stricter reporting environment for k = 1.2.

The moderate rate of increase in reporting requirements, p = 0.35, allows the banks to gradually enhance their reporting processes without exhausting their resources. The banks’ flexibility, a = 0.25, towards new regulations ensures that they remain compliant with evolving standards, reducing the reliance on past requirements. The banks’ high adaptive capacity, s = 1.75, allows for a higher compliance with the new reporting requirements, supporting the increase in CSR teams and technological resources.

For these values, the equilibrium point is S0 = 1.5526, R0 = 0.4166. The threshold value for the time delay is τ0 = 1.39.

To enhance clarity, this section is organised into two subsections, each corresponding to one of the hypotheses.

5.1. Numerical Simulations of Hypothesis H1

This subsection corresponds to Hypothesis H1, which stands that the delay in adapting to external sustainability reporting requirements significantly affects banks’ response behaviour.

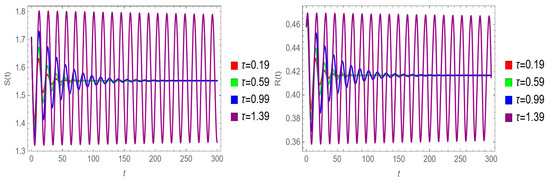

In Figure 1, we can visualise the level of external reporting requirements for sustainability S(t) and the capacity of banks to respond to these requirements R(t), choosing the initial conditions in the neighbourhood of the equilibrium point and different values of time delay, less than or equal to the critical value.

Figure 1.

The orbits of S(t) and R(t) for different values of time delay τ.

From Figure 1, we can see that the three curves (red, green, and blue) have initial oscillations, after which they stabilise. This suggests that, for certain values of the delay parameter (less than the critical value), both the sustainability reporting requirements and the banks reach a stable state. Thus, banks can respond to sustainability requirements, indicating an efficient allocation of resources, effective compliance strategies, and the rapid development of internal competencies. Also from Figure 1, the purple curves start with larger amplitude oscillations and continue the same behaviour for the critical value of the delay parameter. This reflects the fact that both the sustainability reporting requirements and the banks face significant fluctuations. Therefore, the simulations show how different values of the delay parameter affect the stability of the system, illustrating the oscillatory behaviour that can occur when banks delay compliance with CSR standards.

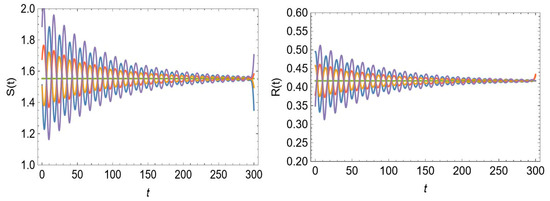

In Figure 2, for a value of time delay τ = 1.2 less than the critical one, we can notice that the choice of the initial conditions does not influence the time evolution of the level of external reporting requirements for sustainability S(t) and of the capacity of banks to respond to these requirements R(t).

Figure 2.

The orbits of S(t) and R(t) for various initial conditions, and τ = 1.2.

These findings validate H1 and are consistent with Scenario 1 (Table 1).

5.2. Numerical Simulation of Hypothesis H2

This subsection focuses on Hypothesis H2, which predicts the emergence of oscillatory behaviour once the delay exceeds a critical threshold. Numerical simulations demonstrate that, beyond this threshold, the system undergoes a Hopf bifurcation and enters a regime of sustained periodic oscillations. These results confirm H2 and correspond to Scenarios 2 and 3 (Table 1), where the institutional inertia and low adaptation capacity lead to unstable compliance dynamics

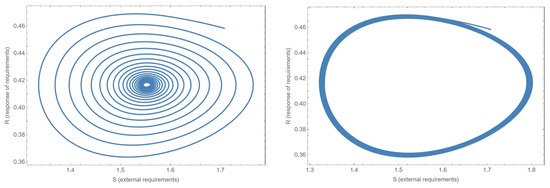

In Figure 3, choosing the initial condition in a neighbourhood of (S0, R0), the trajectories of the system are displayed in the phase plane (S, T). For a value of the time delay less than the critical one (left), (S0, R0) is asymptotically stable, and for the critical value of time delay, a supercritical Hopf bifurcation occurs, and a stable limit cycle appears.

Figure 3.

The orbits in the phase plane (S, R) for τ = 1.2 (left) and τ = 1.39 (right). A supercritical Hopf bifurcation takes place.

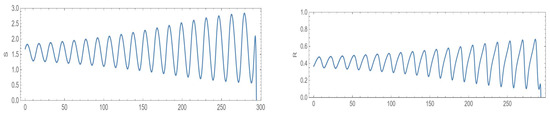

Figure 4 illustrates that when the time delay exceeds the critical value, τ = 1.5 > 1.39, the system becomes unstable, as shown by the increasing amplitude of oscillations over time.

Figure 4.

The orbits of S(t) and R(t) for τ = 1.5.

The simulations show that different values of the delay parameter affect the system’s stability, illustrating the oscillating behaviour that can happen when banks delay compliance with CSR standards.

6. Conclusions

The paper investigates the important role of CSRR in the banking sector. It stresses that CSRR is not just a regulatory requirement but also an opportunity for banks to build trust, enhance transparency, and demonstrate their commitment to sustainability.

To illustrate the banks’ regulatory compliance, we consider a mathematical model with two variables: the level of external reporting requirements for sustainability S(t) and the capacity of banks to respond to these requirements R(t). It is described by a nonlinear differential system with a time delay. The positive equilibrium point is found. Moreover, the critical value of the time delay for which the system has an oscillatory behaviour is determined.

The numerical findings show the time evolution of the level of external reporting requirements for sustainability and the capacity of banks to respond to external reporting requirements. The equilibrium point is asymptotically stable. For a critical value of the time delay, there is a limit cycle, and the behaviour is oscillatory, indicating the need for banks to change their strategies to reach a stable state and to meet sustainability requirements effectively.

The theoretical findings and the numerical simulation validate both hypotheses of the research and confirm that the delay in adapting to external sustainability reporting requirements has an impact on the response behaviour of banks. Thus, when the delay is less than the critical one, banks can stabilise their responses. However, the critical delay threshold leads to oscillatory behaviour. This analysis indicates that Scenario 2 is viable for pursuit. Therefore, it is essential to implement adaptive strategies within the banking system to manage time lags more effectively and ensure consistent compliance with sustainability requirements.

In conclusion, we recommend that regulators implement clear policies, provide technical support, and offer financial incentives to promote compliance in the banking system. Additionally, independent audit mechanisms are suggested to prevent greenwashing and ensure the effectiveness of sustainability efforts. Thus, banks can improve their CSR reporting practices and contribute to a more sustainable financial system.

This study is based on a theoretical dynamic model and numerical simulations rather than empirical data from a specific sample of banks. Future research should aim to calibrate the model using real-world data from a diverse and representative set of banks across different regulatory environments and regions. This would allow for the empirical validation of the theoretical thresholds identified and enhance the practical relevance of the model’s predictions. Moreover, a second future direction of our research is to develop optimal control strategies to manage the trade-off between the rapid adaptation to new sustainability requirements and maintaining operational efficiency. Thus, by applying advanced control techniques like the Model Predictive Control (MPC), future sustainability needs can be anticipated, and a bank’s responses can be effectively adjusted.

Author Contributions

Conceptualization, L.D., G.M., M.N., G.G.N. and N.S.; methodology, L.D., G.M., M.N., G.G.N. and N.S.; software, G.M. and M.N.; validation, L.D., G.M., M.N., G.G.N. and N.S.; formal analysis, L.D., G.M., M.N., G.G.N. and N.S.; investigation, L.D., G.M., M.N., G.G.N. and N.S.; resources, L.D., G.M., M.N., G.G.N. and N.S.; data curation, L.D., G.M., M.N., G.G.N. and N.S.; writing—original draft preparation, L.D., G.M., M.N., G.G.N. and N.S.; writing—review and editing, L.D., G.M., M.N., G.G.N. and N.S.; visualisation, L.D., G.M., M.N., G.G.N. and N.S.; supervision, L.D., G.M., M.N., G.G.N. and N.S.; project administration, G.G.N.; funding acquisition, L.D., G.M., M.N., G.G.N. and N.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No data was used.

Acknowledgments

This work was conducted as associate members of ECREB—East European Center for Research in Economics and Business, Faculty of Economics and Business Administration, West University of Timisoara.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- De Haas, R. Sustainable Banking; EBRD Working Paper No. 282; European Bank for Reconstruction and Development: London, UK, 2023. [Google Scholar]

- Erben, M.; Kuděj, M.; Kubálek, J. The social factors impact on sustainable business growth perception within the ESG concept. Amfiteatru Econ. 2025, 27, 196–213. [Google Scholar] [CrossRef]

- Olanipekun, A.O.; Omotayo, T.; Saka, N. Review of the Use of Corporate Social Responsibility (CSR) Tools. Sustain. Prod. Consum. 2021, 27, 425–435. [Google Scholar] [CrossRef]

- Vartiak, L. CSR reporting of companies on a global scale. Procedia Econ. Finance 2016, 39, 176–183. [Google Scholar] [CrossRef]

- de Villiers, C.; Alexander, D. The institutionalization of corporate social responsibility reporting. Br. Account. Rev. 2014, 46, 198–212. [Google Scholar] [CrossRef]

- Lee, S.Y.; Kim, Y.; Kim, Y. Engaging consumers with corporate social responsibility campaigns: The roles of interactivity, psychological empowerment, and identification. J. Bus. Res. 2021, 134, 507–517. [Google Scholar] [CrossRef]

- Löw, E.; Klein, D.E.; Pavicevac, A. Corporate Social Responsibility Reports of European Banks—An Empirical Analysis of the Disclosure Quality and Its Determinants; Working Paper Series No 56; European Banking Institute e.V.: Frankfurt am Main, Germany, 2020. [Google Scholar]

- Nițescu, D.C.; Ciobanu, R.; Călin, A.E.; Rusu, A.G.; Vierescu, E.M. From Cost to Opportunity: The Role of CSR In Banking. Amfiteatru Econ. 2025, 27, 235–252. [Google Scholar] [CrossRef] [PubMed]

- DeLisle, R.J.; Grant, A.; Mao, R. Does environmental and social performance affect pricing efficiency? Evidence from earnings conference call tones. J. Corp. Financ. 2024, 86, 102585. [Google Scholar] [CrossRef]

- Ho, J.C.; Chen, T.-H.; Wu, J.-J. Are corporate social responsibility reports informative? Evidence from textual analysis of banks in China. China Financ. Rev. Int. 2022, 12, 101–120. [Google Scholar] [CrossRef]

- Michelon, G.; Pilonato, S.; Ricceri, F. CSR reporting practices and quality: Lessons from the context of social and environmental disclosure. Crit. Perspect. Account. 2015, 33, 59–78. [Google Scholar] [CrossRef]

- Matuszak, L.; Różańska, E. Online corporate social responsibility (CSR) disclosure in the banking industry: Evidence from Poland. Soc. Responsib. J. 2019, 16, 8–20. [Google Scholar] [CrossRef]

- Carnevale, C.; Mazzuca, M.; Venturini, S. Corporate Social Reporting in European Banks: The Effects on a Firm’s Market Value. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 159–170. [Google Scholar] [CrossRef]

- Nazari, J.A.; Hrazdil, K.; Mahmoudian, F. Assessing social and environmental performance through narrative complexity in CSR reports. J. Contemp. Account. Econ. 2017, 13, 166–178. [Google Scholar] [CrossRef]

- Gerged, M.; Kuzey, C.; Hamrouni, A.; Karaman, A.S. CSR awarding: A test of social reputation and impression management. Int. Rev. Econ. Financ. 2022, 96, 103706. [Google Scholar]

- Koh, K.; Yen, L.; Tong, H. Corporate social responsibility (CSR) performance and stakeholder engagement: Evidence from the quantity and quality of CSR disclosures. Corp. Soc. Responsib. Environ. Manag. 2022, 30, 2–18. [Google Scholar] [CrossRef]

- Khan, H.Z.; Bose, S.; Johns, R. Regulatory influences on CSR practices within banks in an emerging economy: Do banks merely comply? Crit. Perspect. Account. 2020, 71, 102096. [Google Scholar] [CrossRef]

- Andrikopoulos, A.; Samitas, A.; Bekiaris, M. Corporate social responsibility reporting in financial institutions: Evidence from Euronext. Res. Int. Bus. Financ. 2014, 32, 27–35. [Google Scholar] [CrossRef]

- Sorour, M.K.; Shrives, P.J.; El-Sakhawy, A.A.; Soobaroyen, T. Exploring the evolving motives underlying corporate social responsibility (CSR) disclosures in developing countries: The case of “political CSR” reporting. Account. Audit. Account. J. 2021, 34, 1051–1079. [Google Scholar] [CrossRef]

- Gambetta, N.; García-Benau, M.A.; Zorio-Grima, A. Corporate social responsibility and bank risk profile: Evidence from Europe. Serv. Bus. 2017, 11, 517–542. [Google Scholar] [CrossRef]

- Khan, H.Z.; Bose, S.; Mollik, A.T.; Harun, H. “Green washing” or “authentic effort”? An empirical investigation of the quality of sustainability reporting by banks. Account. Audit. Account. J. 2021, 34, 338–369. [Google Scholar] [CrossRef]

- Buallay, A.; Fadel, S.M.; Alajmi, J.; Saudagaran, S. Sustainability reporting and bank performance after financial crisis: Evidence from developed and developing countries. Compet. Rev. 2021, 31, 747–770. [Google Scholar] [CrossRef]

- Bo, S.; Battisti, E. Green finance and greenwashing: Charting a sustainable path forward. Qual. Res. Financ. Mark. 2024, in press. [CrossRef]

- Chantziaras, A.; Dedoulis, E.; Grougiou, V.; Leventis, S. The impact of religiosity and corruption on CSR reporting: The case of U.S. banks. J. Bus. Res. 2020, 109, 362–374. [Google Scholar] [CrossRef]

- Jain, A.; Keneley, M.; Thomson, D. Voluntary CSR disclosure works! Evidence from Asia-Pacific banks. Soc. Responsib. J. 2015, 11, 2–18. [Google Scholar] [CrossRef]

- Dempere, J.; Alamash, E.; Mattos, P. Unveiling the truth: Greenwashing in sustainable finance. Front. Sustain. 2024, 5, 1362051. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V.; Paltrinieri, A. A PRISMA systematic review of greenwashing in the banking industry: A call for action. Res. Int. Bus. Financ. 2024, 69, 102262. [Google Scholar] [CrossRef]

- Birindelli, G.; Chiappini, H.; Nabeel-Ud-Din Jalal, R. Greenwashing, bank financial performance and the moderating role of gender diversity. Res. Int. Bus. Financ. 2024, 69, 102235. [Google Scholar] [CrossRef]

- Testa, F.; Boiral, O.; Iraldo, F. Internalization of Environmental Practices and Institutional Complexity: Can Stakeholders Pressures Encourage Greenwashing? J. Bus. Ethics 2018, 147, 287–307. [Google Scholar] [CrossRef]

- Chiș, O.; Neamțu, M.; Opriș, D. Deterministic and stochastic model for the role of the immune response time delay in periodic therapy of the tumors. Curr. Comput.-Aided Drug Des. 2011, 7, 338–350. [Google Scholar] [CrossRef]

- Mircea, G.; Neamțu, M.; Opriș, D. Sisteme Dinamice Din Economie, Mecanică, Biologie Descrise Prin Ecuații Diferențiale Cu Argument Întârziat; Editura Mirton: Timișoara, Romania, 2003. [Google Scholar]

- Qi, S.; Pang, L.; Qi, T.; Zhang, X.; Pirtea, M. The correlation between the green bond market and carbon trading markets under climate change: Evidence from China. Technol. Forecast. Soc. Chang. 2024, 203, 123367. [Google Scholar] [CrossRef]

- Hale, J.K.; Verduyn Lunel, S.M. Introduction to Functional Differential Equations; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013; Volume 99. [Google Scholar]

- Stankevičienė, J.; Noja, G.G.; Pirtea, M.; Ţăran, A.; Gînguță, A.; Giovanis, A. Technological innovations for sustainable business success: Enhancing processes and performance. Bus. Process. Manag. J. 2025, in press. [CrossRef]

- Pirtea, M.; Nicolescu, A.-C. Corporate Governance Codes of Best Practice of Top Romanian Banks. Ann. Fac. Econ. Univ. Oradea 2013, 1, 390–397. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).