Navigating Structural Shocks: Bayesian Dynamic Stochastic General Equilibrium Approaches to Forecasting Macroeconomic Stability

Abstract

1. Introduction

2. Literature Review

3. Model

3.1. Household

3.2. Firm

3.3. Equilibrium Dynamics Under Flexible and Sticky Prices

3.3.1. Equilibrium Dynamics Under Flexible Prices

3.3.2. Equilibrium Dynamics Under Sticky Prices

4. Results and Discussion

4.1. Bayesian Estimation

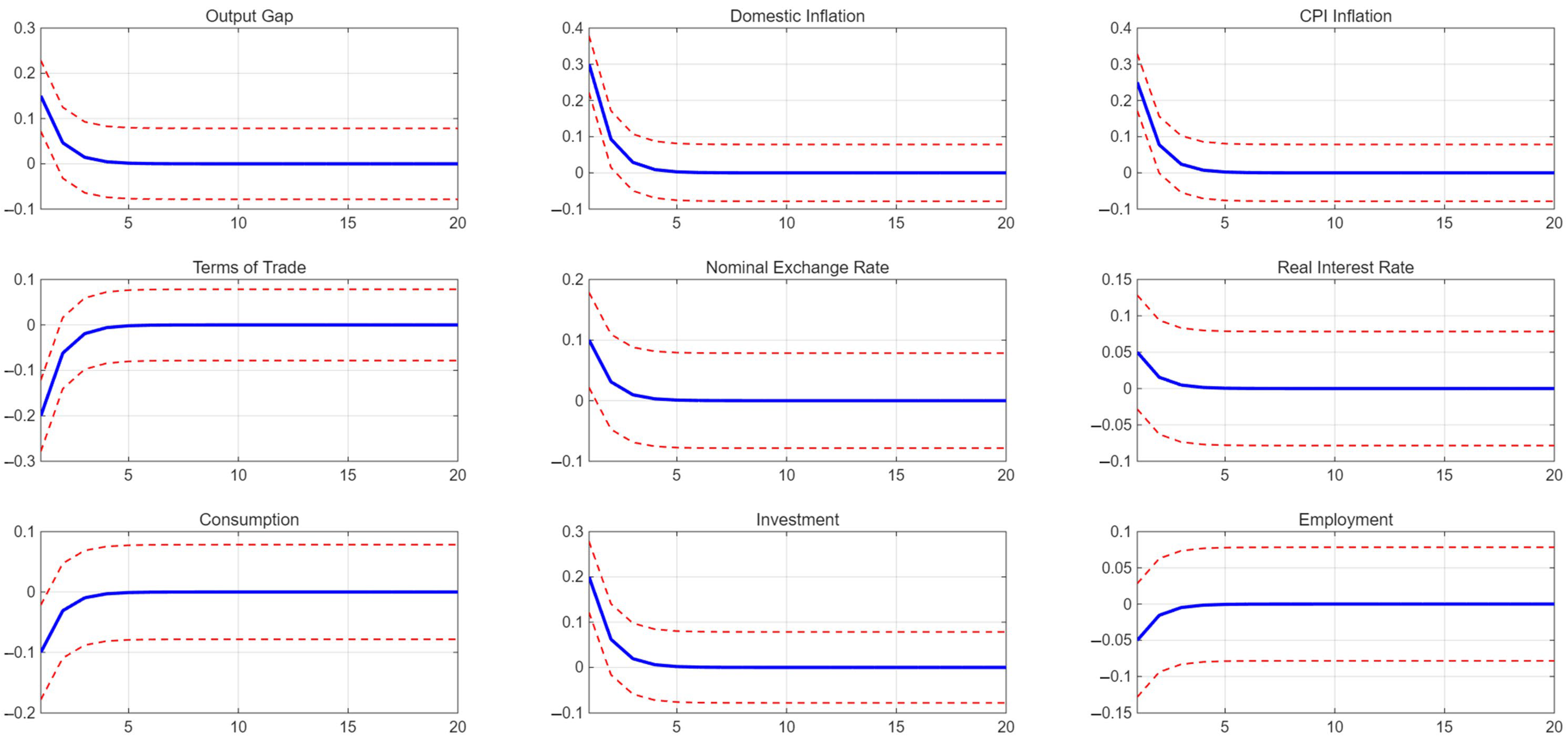

4.2. Cost-Push Effect Simulation

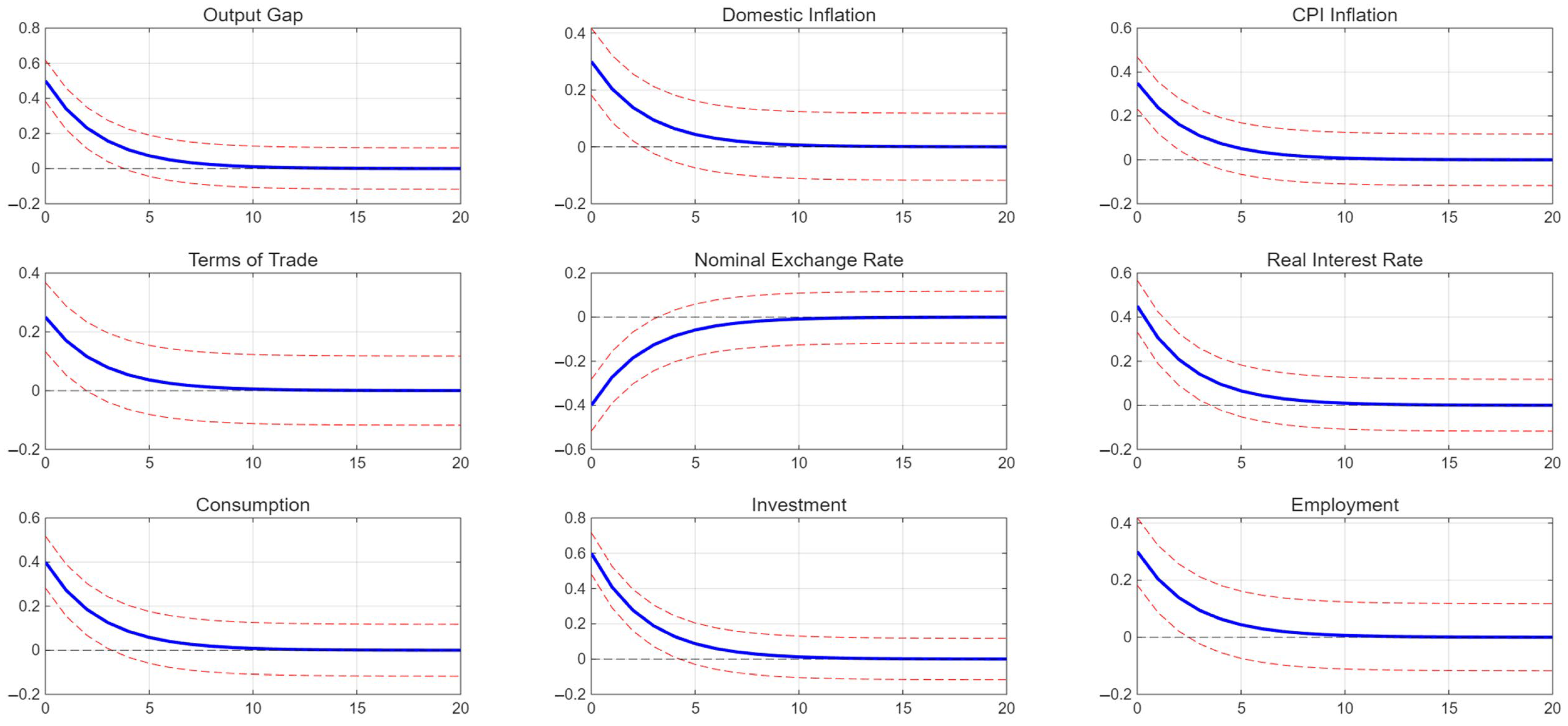

4.3. Monetary Policy Effect Simulation

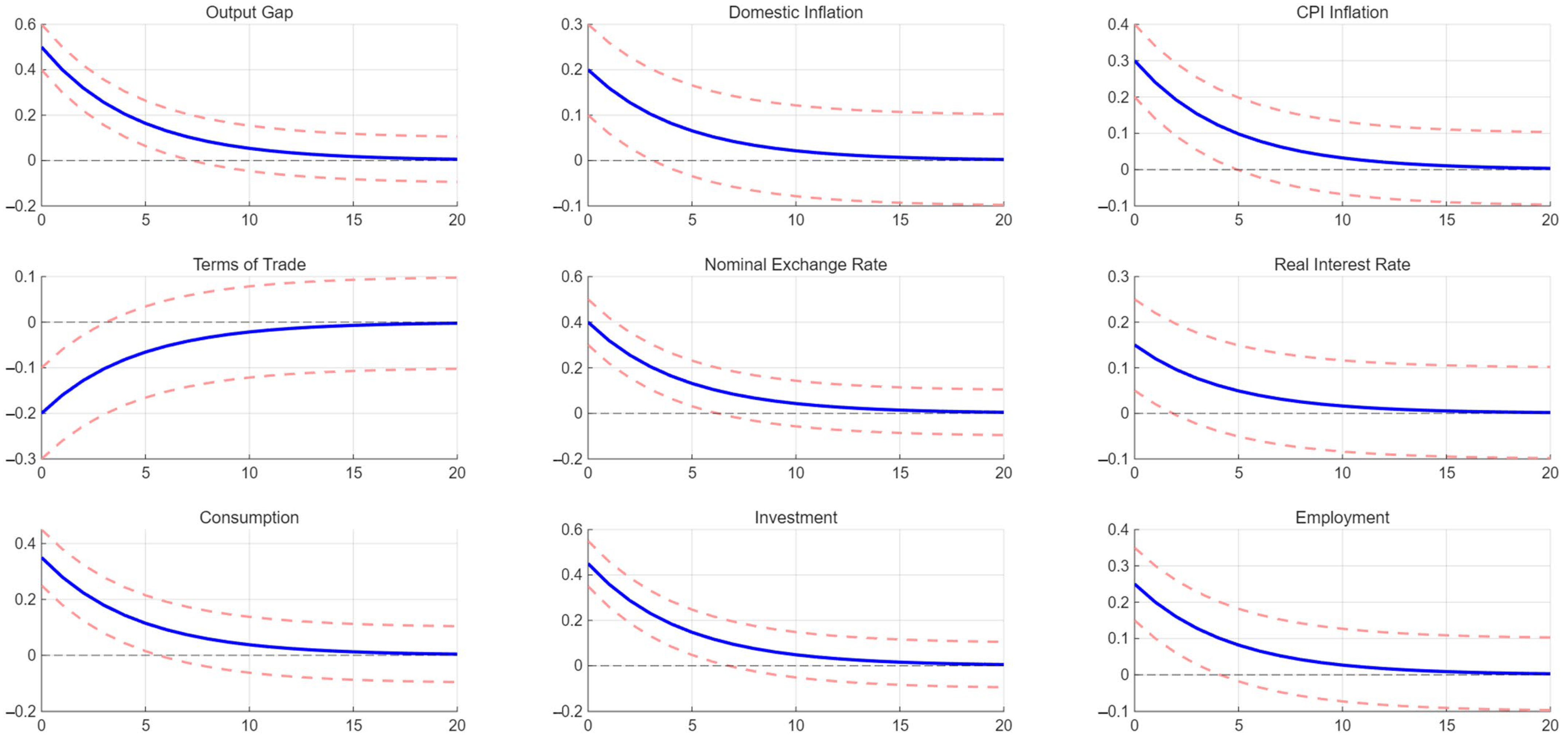

4.4. Foreign Income Effect Simulation

4.5. Variance Decomposition

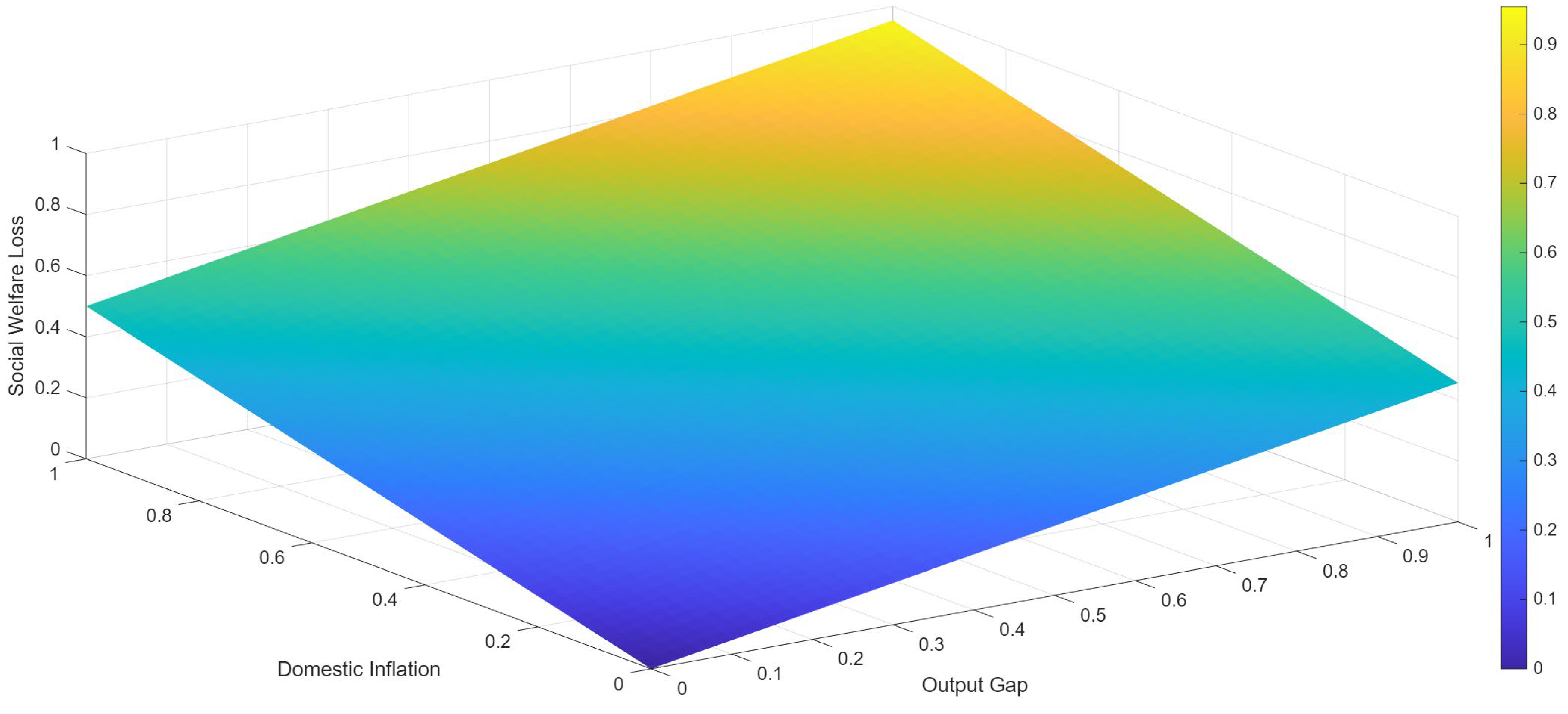

4.6. Social Welfare Loss Simulation

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Liu, X.; Lam, R.; Schipke, A.; Shen, G. A Generalized Okun’s Law: Uncovering the Myth of China’s Labor Market Resilience. Rev. Dev. Econ. 2018, 22, 1195–1216. [Google Scholar] [CrossRef]

- Li, E.X.N.; Li, H.; Wang, S.; Yu, C. Macroeconomic Risks and Asset Pricing: Evidence from a Dynamic Stochastic General Equilibrium Model. Manag. Sci. 2019, 65, 3585–3604. [Google Scholar] [CrossRef]

- Gong, X.-L.; Lu, J.-Y.; Xiong, X.; Zhang, W. Liquidity Constraints, Real Estate Regulation, and Local Government Debt Risks. Financ. Innov. 2025, 11, 5. [Google Scholar] [CrossRef]

- Altug, S.; Young, W. Real Business Cycles after Three Decades: A Panel Discussion with Edward Prescott, Finn Kydland, Charles Plosser, John Long, Thomas Cooley, and Gary Hansen. Macroecon. Dyn. 2015, 19, 425–445. [Google Scholar] [CrossRef]

- Kehoe, P.J.; Midrigan, V.; Pastorino, E. Evolution of Modern Business Cycle Models: Accounting for the Great Recession. J. Econ. Perspect. 2018, 32, 141–166. [Google Scholar] [CrossRef]

- Fernández-Villaverde, J.; Guerrón-Quintana, P.A. Estimating DSGE Models: Recent Advances and Future Challenges. Annu. Rev. Econ. 2021, 13, 229–252. [Google Scholar] [CrossRef]

- Calvo, G.A. Staggered Prices in a Utility-Maximizing Framework. J. Monet. Econ. 1983, 12, 383–398. [Google Scholar] [CrossRef]

- Rotemberg, J.J. Sticky Prices in the United States. J. Political Econ. 1982, 90, 1187–1211. [Google Scholar] [CrossRef]

- Mertens, K.R.; Ravn, M.O. Fiscal Policy in an Expectations-Driven Liquidity Trap. Rev. Econ. Stud. 2014, 81, 1637–1667. [Google Scholar] [CrossRef]

- Gross, T.; Notowidigdo, M.J.; Wang, J. The Marginal Propensity to Consume over the Business Cycle. Am. Econ. J. Macroecon. 2020, 12, 351–384. [Google Scholar] [CrossRef]

- Kaplan, G.; Violante, G.L. The Marginal Propensity to Consume in Heterogeneous Agent Models. Annu. Rev. Econ. 2022, 14, 747–775. [Google Scholar] [CrossRef]

- Miranda-Agrippino, S.; Ricco, G. The Transmission of Monetary Policy Shocks. Am. Econ. J. Macroecon. 2021, 13, 74–107. [Google Scholar] [CrossRef]

- Akinci, Ö. Financial Frictions and Macro-Economic Fluctuations in Emerging Economies. J. Money Credit. Bank. 2021, 53, 1267–1312. [Google Scholar] [CrossRef]

- Görtz, C.; Tsoukalas, J.D.; Zanetti, F. News Shocks under Financial Frictions. Am. Econ. J. Macroecon. 2022, 14, 210–243. [Google Scholar] [CrossRef]

- Banerjee, S.; Behera, H. Financial Frictions, Bank Intermediation and Monetary Policy Transmission in India. Econ. Transit. Inst. Change 2023, 31, 749–785. [Google Scholar] [CrossRef]

- Bashir, U.; Khan, S.; Jones, A.; Hussain, M. Do Banking System Transparency and Market Structure Affect Financial Stability of Chinese Banks? Econ. Change Restruct. 2021, 54, 1–41. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Sockin, M.; Xiong, W. China’s Model of Managing the Financial System. Rev. Econ. Stud. 2022, 89, 3115–3153. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. Fintech, Cryptocurrencies, and CBDC: Financial Structural Transformation in China. J. Int. Money Financ. 2022, 124, 102625. [Google Scholar] [CrossRef]

- Cai, M.; Del Negro, M.; Herbst, E.; Matlin, E.; Sarfati, R.; Schorfheide, F. Online Estimation of DSGE Models. Econom. J. 2021, 24, C33–C58. [Google Scholar] [CrossRef]

- Poudyal, N.; Spanos, A. Model Validation and DSGE Modeling. Econometrics 2022, 10, 17. [Google Scholar] [CrossRef]

- Dave, C.; Sorge, M.M. Fat-tailed DSGE Models: A Survey and New Results. J. Econ. Surv. 2025, 39, 146–171. [Google Scholar] [CrossRef]

- Čapek, J.; Crespo Cuaresma, J.; Chalmovianský, J.; Reichel, V. Real-Time Data, Revisions and the Predictive Ability of DSGE Models. Oxf. Bull. Econ. Stat. 2025, obes.12677. [Google Scholar] [CrossRef]

- Funke, M.; Li, X.; Zhong, D. Household Indebtedness, Financial Frictions and the Transmission of Monetary Policy to Consumption: Evidence from China. Emerg. Mark. Rev. 2023, 55, 100974. [Google Scholar] [CrossRef]

- Wahid, A.; Kowalewski, O. Monetary Policy Spillovers and Inter-Market Dynamics Perspective of Preferred Habitat Model. Economies 2024, 12, 98. [Google Scholar] [CrossRef]

- Wu, R.; He, Y.; Teng, Z. Energy Price Instability and Energy Efficiency: Korea’s Macroeconomic Framework during the COVID-19 Pandemic. PLoS ONE 2025, 20, e0321793. [Google Scholar] [CrossRef] [PubMed]

- Dufour, J.-M.; Khalaf, L.; Kichian, M. Identification-Robust Analysis of DSGE and Structural Macroeconomic Models. J. Monet. Econ. 2013, 60, 340–350. [Google Scholar] [CrossRef]

- Marchionatti, R.; Sella, L. Is Neo-Walrasian Macroeconom(Etr)Ics a Dead End? An Assessment of Recent Criticisms of DSGE Models. J. Post Keynes. Econ. 2017, 40, 441–469. [Google Scholar] [CrossRef]

- Dosi, G.; Roventini, A. More Is Different … and Complex! The Case for Agent-Based Macroeconomics. J. Evol. Econ. 2019, 29, 1–37. [Google Scholar] [CrossRef]

- Storm, S. Cordon of Conformity: Why DSGE Models Are Not the Future of Macroeconomics. Int. J. Political Econ. 2021, 50, 77–98. [Google Scholar] [CrossRef]

- Pu, Z.; Fan, X.; Xu, Z.; Skare, M. A Systematic Literature Review on Business Cycle Approaches: Measurement, Nature, Duration. Oeconomia Copernic. 2023, 14, 935–976. [Google Scholar] [CrossRef]

- Bylund, E.; Iversen, J.; Vredin, A. Monetary Policy in Sweden After the End of Bretton Woods. Comp. Econ. Stud. 2024, 66, 535–590. [Google Scholar] [CrossRef]

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate Change Challenges for Central Banks and Financial Regulators. Nat. Clim. Change 2018, 8, 462–468. [Google Scholar] [CrossRef]

- Hall, S.G.; Henry, S.G.B. Macro Modelling at the NIESR: Its Recent History. Natl. Inst. Econ. Rev. 2018, 246, R15–R23. [Google Scholar] [CrossRef]

- Renault, M. Macroeconomics under Pressure: The Feedback Effects of Economic Expertise. Eur. J. Hist. Econ. Thought 2023, 30, 275–298. [Google Scholar] [CrossRef]

- Qin, C.; Lou, H.; Li, L. Assessing the Economic Impact of Climate Risk on Green and Low-Carbon Transformation. Front. Environ. Sci. 2025, 13, 1557388. [Google Scholar] [CrossRef]

- Song, W.; Zhao, M.; Yu, J. Price Distortion on Market Resource Allocation Efficiency: A DID Analysis Based on National-Level Big Data Comprehensive Pilot Zones. Int. Rev. Econ. Financ. 2025, 102, 104128. [Google Scholar] [CrossRef]

- Rahaman, S.U.; Abdul, M.J. Quantifying Uncertainty in Economics Policy Predictions: A Bayesian & Monte Carlo Based Data-Driven Approach. Int. Rev. Financ. Anal. 2025, 102, 104157. [Google Scholar]

- Nölke, A.; Ten Brink, T.; Claar, S.; May, C. Domestic Structures, Foreign Economic Policies and Global Economic Order: Implications from the Rise of Large Emerging Economies. Eur. J. Int. Relat. 2015, 21, 538–567. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, K.; Liu, Z.U.S. Money Supply and China’s Business Cycles. Emerg. Mark. Financ. Trade 2018, 54, 957–980. [Google Scholar] [CrossRef]

- Yan, M.; Shi, K. Revisiting the Impact of US Uncertainty Shocks: New Evidence from China’s Investment Dynamics. Open Econ. Rev. 2024, 35, 457–495. [Google Scholar] [CrossRef]

- Kang, C. China’s Monetary Policy under the “New Normal”. China Int. J. 2018, 16, 74–96. [Google Scholar]

- Huang, Y. The Framework of Macroeconomic Policy in China. China Econ. J. 2025, 18, 21–36. [Google Scholar] [CrossRef]

- Hamilton, J.D. Calling Recessions in Real Time. Int. J. Forecast. 2011, 27, 1006–1026. [Google Scholar] [CrossRef]

- Ng, S.; Wright, J.H. Facts and Challenges from the Great Recession for Forecasting and Macroeconomic Modeling. J. Econ. Lit. 2013, 51, 1120–1154. [Google Scholar] [CrossRef]

- Cassou, S.P.; Scott, C.P.; Vázquez, J. Optimal Monetary Policy Revisited: Does Considering US Real-Time Data Change Things? Appl. Econ. 2018, 50, 6203–6219. [Google Scholar] [CrossRef]

- Claveau, F. Evidential Variety as a Source of Credibility for Causal Inference: Beyond Sharp Designs and Structural Models. J. Econ. Methodol. 2011, 18, 233–253. [Google Scholar] [CrossRef]

- Dou, W.W.; Lo, A.W.; Muley, A.; Uhlig, H. Macroeconomic Models for Monetary Policy: A Critical Review from a Finance Perspective. Annu. Rev. Financ. Econ. 2020, 12, 95–140. [Google Scholar] [CrossRef]

- Feto, A.; Jayamohan, M.K.; Vilks, A. Applicability and Accomplishments of DSGE Modeling: A Critical Review. J. Bus. Cycle Res. 2023, 19, 213–239. [Google Scholar] [CrossRef]

- Lozej, M.; Walsh, G. Fiscal Policy Spillovers in a Monetary Union. Open Econ. Rev. 2021, 32, 1089–1117. [Google Scholar] [CrossRef]

- He, Y. External Financial and Monetary Policy Shocks: Do They Matter for Korean Macroeconomy? Heliyon 2024, 10, e30143. [Google Scholar] [CrossRef]

- Ge, X.; Li, X.-L.; Li, Y.; Liu, Y. The Driving Forces of China’s Business Cycles: Evidence from an Estimated DSGE Model with Housing and Banking. China Econ. Rev. 2022, 72, 101753. [Google Scholar] [CrossRef]

- Sun, T.; Bian, X.; Liu, J.; Wang, R.; Sriboonchitta, S. The Economic and Social Effects of Skill Mismatch in China: A DSGE Model with Skill and Firm Heterogeneity. Econ. Model. 2023, 125, 106345. [Google Scholar] [CrossRef]

- Zhang, X. Public Sector Employment Rigidity and Macroeconomic Fluctuation: A DSGE Simulation for China. PLoS ONE 2024, 19, e0308663. [Google Scholar] [CrossRef]

- Zheng, T.; Guo, H. Estimating a Small Open Economy DSGE Model with Indeterminacy: Evidence from China. Econ. Model. 2013, 31, 642–652. [Google Scholar] [CrossRef]

- Xiao, B.; Fan, Y.; Guo, X. Exploring the Macroeconomic Fluctuations under Different Environmental Policies in China: A DSGE Approach. Energy Econ. 2018, 76, 439–456. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, Y.; Zhu, Y. COVID-19 Pandemic, Sustainability of Macroeconomy, and Choice of Monetary Policy Targets: A NK-DSGE Analysis Based on China. Sustainability 2021, 13, 3362. [Google Scholar] [CrossRef]

- Zhang, Y.; Hyder, M.; Baloch, Z.A.; Qian, C.; Saydaliev, H.B. Nexus between Oil Price Volatility and Inflation: Mediating Nexus from Exchange Rate. Resour. Policy 2022, 79, 102977. [Google Scholar] [CrossRef]

- Wang, C.; Yao, Q. Dynamic Characteristics of China’s Inflation: A Two-Country DSGE Model Based on a Multi-Level Vertical Industrial Structure. Econ. Res.-Ekon. Istraživanja 2023, 36, 2080730. [Google Scholar] [CrossRef]

- Eickmeier, S.; Kühnlenz, M. China’s Role in Global Inflation Dynamics. Macroecon. Dyn. 2018, 22, 225–254. [Google Scholar] [CrossRef]

- Zhan, J. Macroeconomic and Trade Policy Impacts Based on DSGE Model. Int. Rev. Econ. Financ. 2024, 95, 103469. [Google Scholar] [CrossRef]

- Xu, M.; Zhong, T.; Xie, Q.; Liu, H. Foreign Demand, Competition Strategy, and Export Markups: Evidence from Chinese Multi-Product Exporters. China World Econ. 2022, 30, 187–209. [Google Scholar] [CrossRef]

- Yang, C.-H. R&D Responses to Labor Cost Shock in China: Does Firm Size Matter? Small Bus. Econ. 2023, 61, 1773–1793. [Google Scholar] [CrossRef]

- Aghion, P.; Bergeaud, A.; Lequien, M.; Melitz, M.J.; Zuber, T. Opposing Firm-Level Responses to the China Shock: Output Competition versus Input Supply. Am. Econ. J. Econ. Policy 2024, 16, 249–269. [Google Scholar] [CrossRef]

- Li, H.; Yu, Z.; Zhang, C.; Zhang, Z. Determination of China’s Foreign Exchange Intervention: Evidence from the Yuan/Dollar Market. Stud. Econ. Financ. 2017, 34, 62–81. [Google Scholar] [CrossRef]

- Lu, D.; Xia, T.; Zhou, H. Foreign Exchange Intervention and Monetary Policy Rules under a Managed Floating Regime: Evidence from China. Appl. Econ. 2022, 54, 3226–3245. [Google Scholar] [CrossRef]

- Li, X.; Wang, N.; Duan, J.; Shi, W. Exchange Rate Stability and Expectation Management under Heterogeneous Expectations. Int. Rev. Financ. Anal. 2024, 95, 103453. [Google Scholar] [CrossRef]

- Fu, L.; Ho, C.-Y. Monetary Policy Surprises and Interest Rates under China’s Evolving Monetary Policy Framework. Emerg. Mark. Rev. 2022, 52, 100895. [Google Scholar] [CrossRef]

- Kim, S.; Chen, H. From a Quantity to an Interest Rate-Based Framework: Multiple Monetary Policy Instruments and Their Effects in China. J. Money Credit. Bank. 2022, 54, 2103–2123. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. China’s Monetary Policy Framework and Global Commodity Prices. Energy Econ. 2024, 138, 107767. [Google Scholar] [CrossRef]

- Chamon, M.; Liu, K.; Prasad, E. Income Uncertainty and Household Savings in China. J. Dev. Econ. 2013, 105, 164–177. [Google Scholar] [CrossRef]

- Zhang, G.; Han, J.; Pan, Z.; Huang, H. Economic Policy Uncertainty and Capital Structure Choice: Evidence from China. Econ. Syst. 2015, 39, 439–457. [Google Scholar] [CrossRef]

- Song, Z.; Xiong, W. Risks in China’s Financial System. Annu. Rev. Financ. Econ. 2018, 10, 261–286. [Google Scholar] [CrossRef]

- Rong, S.; Liu, K.; Huang, S.; Zhang, Q. FDI, Labor Market Flexibility and Employment in China. China Econ. Rev. 2020, 61, 101449. [Google Scholar] [CrossRef]

- Li, Y.; Qi, Y.; Liu, L.; Yao, J.; Chen, X.; Du, T.; Jiang, X.; Zhu, D. Monetary Policy and Corporate Financing: Evidence from Different Industries. Cities 2022, 122, 103544. [Google Scholar] [CrossRef]

- Xiang, J.; Li, L. Monetary Policy Uncertainty, Debt Financing Cost and Real Economic Activities: Evidence from China. Int. Rev. Econ. Financ. 2022, 80, 1025–1044. [Google Scholar] [CrossRef]

- Li, X.-L.; Yang, M.; Ge, X.; Zhao, C. Monetary Policy Uncertainty and Corporate Credit Financing in China: The Role of Accounting Information Quality. Econ. Model. 2025, 144, 106990. [Google Scholar] [CrossRef]

- Liu, T.-Y.; Chang, H.-L.; Su, C.-W.; Lobonţ, O.-R. Is There Inflation in China? Evidence by a Unit Root Approach. Int. Rev. Econ. Financ. 2017, 52, 236–245. [Google Scholar] [CrossRef]

- Chiang, S.-H.; Lee, C.-C.; Liao, Y. Exploring the Sources of Inflation Dynamics: New Evidence from China. Econ. Anal. Policy 2021, 70, 313–332. [Google Scholar] [CrossRef]

- Pan, C.; Huang, Y.; Lee, C.-C. The Dynamic Effects of Oil Supply Shock on China: Evidence from the TVP-Proxy-VAR Approach. Socio-Econ. Plan. Sci. 2024, 95, 102026. [Google Scholar] [CrossRef]

- Ji, J. Exchange Rate Pass-through to Domestic Inflation in a Pricing Model Incorporating Distribution Chain Structure. J. Appl. Econ. 2022, 25, 432–453. [Google Scholar] [CrossRef]

- Hagemejer, J.; Hałka, A.; Kotłowski, J. Global Value Chains and Exchange Rate Pass-through—The Role of Non-Linearities. Int. Rev. Econ. Financ. 2022, 82, 461–478. [Google Scholar] [CrossRef]

- Ye, M.; Si Mohammed, K.; Tiwari, S.; Ali Raza, S.; Chen, L. The Effect of the Global Supply Chain and Oil Prices on the Inflation Rates in Advanced Economies and Emerging Markets. Geol. J. 2023, 58, 2805–2817. [Google Scholar] [CrossRef]

- Liao, W.; Shi, K.; Zhang, Z. Vertical Trade and China’s Export Dynamics. China Econ. Rev. 2012, 23, 763–775. [Google Scholar] [CrossRef]

- Fernald, J.G.; Spiegel, M.M.; Swanson, E.T. Monetary Policy Effectiveness in China: Evidence from a FAVAR Model. J. Int. Money Financ. 2014, 49, 83–103. [Google Scholar] [CrossRef]

- Zhang, D.; Vigne, S.A. The Causal Effect on Firm Performance of China’s Financing–Pollution Emission Reduction Policy: Firm-Level Evidence. J. Environ. Manag. 2021, 279, 111609. [Google Scholar] [CrossRef]

- Su, S.; Ahmad, A.H.; Wood, J. How Effective Is Central Bank Communication in Emerging Economies? An Empirical Analysis of the Chinese Money Markets Responses to the People’s Bank of China’s Policy Communications. Rev. Quant. Financ. Account. 2020, 54, 1195–1219. [Google Scholar] [CrossRef]

- Du, X.; Cheng, J.; Zhu, D.; Xing, M. Does Central Bank Communication on Financial Stability Work?——An Empirical Study Based on Chinese Stock Market. Int. Rev. Econ. Financ. 2023, 85, 390–407. [Google Scholar] [CrossRef]

- Vasilcovschi, N.; Verga, G. An Empirical Analysis of the Central Bank of China’s Monetary Policy and the Impact of Its Communications on Market Interest Rates, Liquidity and Credit. Sci. Ann. Econ. Bus. 2023, 70, 499–527. [Google Scholar] [CrossRef]

- Jiang, Y.; Li, C.; Zhang, J.; Zhou, X. Financial Stability and Sustainability under the Coordination of Monetary Policy and Macroprudential Policy: New Evidence from China. Sustainability 2019, 11, 1616. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, X.; Zhang, Z.; Cui, Z.; Zhang, Y. Role of Fiscal and Monetary Policies for Economic Recovery in China. Econ. Anal. Policy 2023, 77, 51–63. [Google Scholar] [CrossRef]

- Zhu, L.; He, J. China Financial Stability and Asymmetric Implications for Economic Stability. Econ. Change Restruct. 2024, 57, 16. [Google Scholar] [CrossRef]

- Li, X.-L.; Zhang, R.-J. Effects of Credit Misallocation on Systemic Risk of Non-Financial Corporations: The Role of Monetary Policy. China Econ. Rev. 2025, 93, 102450. [Google Scholar] [CrossRef]

- Lin, C.; He, L.; Yang, G. Targeted Monetary Policy and Financing Constraints of Chinese Small Businesses. Small Bus. Econ. 2021, 57, 2107–2124. [Google Scholar] [CrossRef]

- Lu, L.; Peng, J.; Wu, J.; Lu, Y. Perceived Impact of the Covid-19 Crisis on SMEs in Different Industry Sectors: Evidence from Sichuan, China. Int. J. Disaster Risk Reduct. 2021, 55, 102085. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Cheng, Z.; Gong, R.K.; Li, J. Riding out the COVID-19 Storm: How Government Policies Affect SMEs in China. China Econ. Rev. 2022, 75, 101831. [Google Scholar] [CrossRef]

- Fambo, H.; Ge, S. Chinese Investment in Africa: Exploring Economic Growth Through Export Diversification. Fudan J. Hum. Soc. Sci. 2025, 18, 303–327. [Google Scholar] [CrossRef]

- Woo, W.T. China’s Soft Budget Constraint on the Demand-Side Undermines Its Supply-Side Structural Reforms. China Econ. Rev. 2019, 57, 101111. [Google Scholar] [CrossRef]

- Zhang, B.; Ai, X.; Fang, X.; Chen, S. The Transmission Mechanisms and Impacts of Oil Price Fluctuations: Evidence from DSGE Model. Energies 2022, 15, 6038. [Google Scholar] [CrossRef]

- Zhou, D.; Zhang, J.; Huan, H.; Hu, N.; Li, Y.; Cheng, J. Assessing the Impact of External Shocks on Prices in the Live Pig Industry Chain: Evidence from China. Sustainability 2025, 17, 1934. [Google Scholar] [CrossRef]

- Lin, B.; Xu, B. How to Effectively Stabilize China’s Commodity Price Fluctuations? Energy Econ. 2019, 84, 104544. [Google Scholar] [CrossRef]

- Ding, S.; Zheng, D.; Cui, T.; Du, M. The Oil Price-Inflation Nexus: The Exchange Rate Pass-through Effect. Energy Econ. 2023, 125, 106828. [Google Scholar] [CrossRef]

- Chen, P.; Miao, X. Understanding the Role of China’s Factors in International Commodity Price Fluctuations: A Perspective of Monetary-Fiscal Policy Interaction. Econ. Anal. Policy 2024, 81, 1464–1483. [Google Scholar] [CrossRef]

- Efrat, K.; Hughes, P.; Nemkova, E.; Souchon, A.L.; Sy-Changco, J. Leveraging of Dynamic Export Capabilities for Competitive Advantage and Performance Consequences: Evidence from China. J. Bus. Res. 2018, 84, 114–124. [Google Scholar] [CrossRef]

- Wu, H.; Li, J.; Zhao, Y. Foreign Demand Shocks, Product Switching, and Export Product Quality: Evidence from China. World Econ. 2023, 46, 276–301. [Google Scholar] [CrossRef]

- Wang, L.; Huang, X.; Sun, Q. Do Export Demand Shocks Affect the Export Quality of Multi-product Firms? Evidence from China. Rev. Int. Econ. 2024, 32, 1071–1103. [Google Scholar] [CrossRef]

- Wang, S.; Zhou, S. RMB Internationalization and the Effectiveness of Exchange Rate Intervention. Ann. Econ. Financ. 2022, 23, 385–416. [Google Scholar]

- Zhou, C. Capital Controls in China: A Necessity for Macroeconomic Stability. J. Financ. Stab. 2024, 75, 101335. [Google Scholar] [CrossRef]

- Chang, C.; Liu, Z.; Spiegel, M.M. Capital Controls and Optimal Chinese Monetary Policy. J. Monet. Econ. 2015, 74, 1–15. [Google Scholar] [CrossRef]

- Huo, W.; Chen, X.; Bo, L.; Luo, F. Navigating Global Monetary Interdependencies: A Comprehensive Analysis of ECB Rate Hikes on China’s Technology-Driven Economy. J. Knowl. Econ. 2024, 15, 18081–18115. [Google Scholar] [CrossRef]

- Shao, H.; Zhou, B.; Wang, D.; An, Z. Navigating Uncertainty: The Micro-Level Dynamics of Economic Policy Uncertainty and Systemic Financial Risk in China’s Financial Institutions. J. Knowl. Econ. 2024, 16, 5831–5861. [Google Scholar] [CrossRef]

- Lin, Y.-C.; Sung, B.; Park, S.-D. Integrated Systematic Framework for Forecasting China’s Consumer Confidence: A Machine Learning Approach. Systems 2024, 12, 445. [Google Scholar] [CrossRef]

- Ye, M.; Friginal, E. Portrayals of Chinese Companies in American and British Economic News Tweets during China’s Macroeconomic Transitions 2007–2023. Humanit. Social. Sci. Commun. 2024, 11, 1472. [Google Scholar] [CrossRef]

- Ullah, A.; Bouri, E.; Bukhari, A.A.A.; Bukhari, W.A.A. Global Supply Chain Pressure and Chinese Business and Consumer Confidence. Res. Int. Bus. Financ. 2025, 77, 102966. [Google Scholar] [CrossRef]

- Cai, F.; Wang, M. Growth and Structural Changes in Employment in Transition China. J. Comp. Econ. 2010, 38, 71–81. [Google Scholar] [CrossRef]

- Meng, X. Labor Market Outcomes and Reforms in China. J. Econ. Perspect. 2012, 26, 75–102. [Google Scholar] [CrossRef]

- Hao, J.; Wen, W.; Welch, A. When Sojourners Return: Employment Opportunities and Challenges Facing High-Skilled Chinese Returnees. Asian Pac. Migr. J. 2016, 25, 22–40. [Google Scholar] [CrossRef]

- Cui, Y.; Meng, J.; Lu, C. Recent Developments in China’s Labor Market: Labor Shortage, Rising Wages and Their Implications. Rev. Dev. Econ. 2018, 22, 1217–1238. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, W. Regional Economic Resilience in China: Measurement and Determinants. Reg. Stud. 2021, 55, 1228–1239. [Google Scholar] [CrossRef]

- Duan, W.; Madasi, J.D.; Khurshid, A.; Ma, D. Industrial Structure Conditions Economic Resilience. Technol. Forecast. Soc. Change 2022, 183, 121944. [Google Scholar] [CrossRef]

- Ma, L.; Li, X.; Pan, Y. Global Industrial Chain Resilience Research: Theory and Measurement. Systems 2023, 11, 466. [Google Scholar] [CrossRef]

- Li, H.; Zheng, D.; Zhu, X. Impact of Supply Chain Pressure on Macroeconomy and Stock Returns–Evidence from US Aggregate and Sectoral Markets”. Econ. Bull. 2025, 45, 370–383. [Google Scholar]

- Wang, Y.; Zhu, Q.; Wu, J. Oil Price Shocks, Inflation, and Chinese Monetary Policy. Macroecon. Dyn. 2019, 23, 1–28. [Google Scholar] [CrossRef]

- Chen, R.; Tao, K.; Jin, C.; Zhang, J.; Zhang, S. Navigating Uncertainty: The Impact of Economic Policy on Corporate Data Asset Allocation. Int. Rev. Econ. Financ. 2025, 97, 103783. [Google Scholar] [CrossRef]

- Chen, J.; Sousa, C.M.P.; He, X. Nonlinear Effects of Dynamic Export Pricing on Export Sales: A Longitudinal Investigation. J. Int. Mark. 2019, 27, 60–78. [Google Scholar] [CrossRef]

- Rodrigue, J.; Tan, Y. Price, Product Quality, and Exporter Dynamics: Evidence from China. Int. Econ. Rev. 2019, 60, 1911–1955. [Google Scholar] [CrossRef]

- Hu, M.; Li, Y.; Yang, J.; Chao, C.-C. Actual Intervention and Verbal Intervention in the Chinese RMB Exchange Rate. Int. Rev. Econ. Financ. 2016, 43, 499–508. [Google Scholar] [CrossRef]

- Zhang, Z.; Li, H.; Zhang, C. Oral Intervention in China: Efficacy of Chinese Exchange Rate Communications. Int. Rev. Financ. Anal. 2017, 49, 24–34. [Google Scholar] [CrossRef]

- Chen, P.; Wu, J.; Nie, B. Economic Uncertainty, Monetary Policy, and Global Commodity Price Dynamics: The Role of “China Factors”. Appl. Econ. 2025, 1–22. [Google Scholar] [CrossRef]

- Wu, J. Economic Policy Uncertainty, Investor Sentiment, and Stock Price Synchronisation: Evidence from China. Math. Probl. Eng. 2022, 2022, 7830668. [Google Scholar] [CrossRef]

- Yuan, X.; Liu, K. The Impact of the Financial Cycle on the Economic Cycle and the Regulatory Role of Monetary Policy: Evidence from China. Int. J. Emerg. Mark. 2024. [Google Scholar] [CrossRef]

- Liu, Q.; Siu, A. Institutions and Corporate Investment: Evidence from Investment-Implied Return on Capital in China. J. Financ. Quant. Anal. 2011, 46, 1831–1863. [Google Scholar] [CrossRef]

- Bo, H.; Driver, C.; Lin, H.-C.M. Corporate Investment during the Financial Crisis: Evidence from China. Int. Rev. Financ. Anal. 2014, 35, 1–12. [Google Scholar] [CrossRef]

- Xu, W.; Pan, Z.; Wang, G. Market Transition, Labor Market Dynamics and Reconfiguration of Earning Determinants Structure in Urban China. Cities 2018, 79, 113–123. [Google Scholar] [CrossRef]

- Yao, W.; Zhu, X. Structural Change and Aggregate Employment Fluctuations in China. Int. Econ. Rev. 2021, 62, 65–100. [Google Scholar] [CrossRef]

- Yue, Y.; Hou, J.; Zhang, M.; Ye, J. Does the Sticky Relationships of Global Value Chains Help Stabilize Employment? Evidence from China. Struct. Change Econ. Dyn. 2024, 69, 632–651. [Google Scholar] [CrossRef]

- Clarida, R.; Gali, J.; Gertler, M. The Science of Monetary Policy: A New Keynesian Perspective. J. Econ. Lit. 1999, 37, 1661–1707. [Google Scholar] [CrossRef]

- Woodford, M.; Walsh, C.E. Interest and Prices: Foundations of a Theory of Monetary Policy. Macroecon. Dyn. 2005, 9, 462–468. [Google Scholar] [CrossRef]

- Galí, J. The State of New Keynesian Economics: A Partial Assessment. J. Econ. Perspect. 2018, 32, 87–112. [Google Scholar] [CrossRef]

- Chen, Y.; Li, T.; Shi, Y.; Zhou, Y. Welfare Costs of Inflation: Evidence from China. Soc. Indic. Res. 2014, 119, 1195–1218. [Google Scholar] [CrossRef]

- Egan, P.G.; Leddin, A.J. The Chinese Phillips Curve—Inflation Dynamics in the Presence of Structural Change. J. Chin. Econ. Bus. Stud. 2017, 15, 165–184. [Google Scholar] [CrossRef]

- He, Y.; Teng, Z. Navigating Uncharted Waters: The Transformation of the Bank of Korea’s Monetary Policy in Response to Global Economic Uncertainty. Mathematics 2024, 12, 1657. [Google Scholar] [CrossRef]

- Kovalchuk, A. Experimental Insights on Investment Strategies for Sustainable Growth Amid China’s Economic Uncertainty. SAGE Open 2025, 15, 21582440251343353. [Google Scholar] [CrossRef]

- Yu, J.; Shi, X.; Laurenceson, J. Will the Chinese Economy Be More Volatile in the Future? Insights from Urban Household Survey Data. Int. J. Emerg. Mark. 2020, 15, 790–808. [Google Scholar] [CrossRef]

- Saint Akadiri, S.; Ozkan, O. Risk across the Spectrum: Unpacking the Nexus of Global Oil Uncertainty, Geopolitical Tensions, Energy Volatility, and US-China Trade Tensions. Energy Policy 2025, 202, 114609. [Google Scholar] [CrossRef]

- Chen, Y.; Sun, C.; Zhang, X. Analyzing and Forecasting China’s Financial Resilience: Measurement Techniques and Identification of Key Influencing Factors. J. Financ. Stab. 2025, 76, 101372. [Google Scholar] [CrossRef]

- Chen, Y.; Wu, F.; Hua, G. Do Financial Structural Characteristics Affect Economic Resilience? Int. J. Fin. Econ. 2007, 12, 427–444. [Google Scholar] [CrossRef]

| Parameter | Definition | Prior Mean | Posterior Mean | 95% HPD Interval | Distribution | Posterior Deviation |

|---|---|---|---|---|---|---|

| Inverse intertemporal elasticity of substitution | 1.50 | 1.21 | [1.08, 1.33] | Gamma | 0.06 | |

| Inverse labor supply elasticity | 2.00 | 2.85 | [2.10, 3.52] | Gamma | 0.31 | |

| Degree of price stickiness | 0.75 | 0.68 | [0.62, 0.75] | Beta | 0.04 | |

| Price elasticity of goods demand | 4.00 | 4.33 | [3.70, 4.90] | Gamma | 0.38 | |

| Inflation elasticity to output gap | 0.30 | 0.42 | [0.31, 0.53] | Beta | 0.05 | |

| Monetary policy response to domestic inflation | 1.50 | 1.82 | [1.57, 2.05] | Gamma | 0.12 | |

| Monetary policy response to CPI inflation | 1.50 | 1.65 | [1.45, 1.83] | Gamma | 0.09 | |

| Monetary policy response to GDP gap | 0.25 | 0.35 | [0.26, 0.44] | Gamma | 0.05 | |

| Monetary policy response to exchange rate | 0.10 | 0.08 | [0.05, 0.11] | Gamma | 0.02 | |

| Persistence of technology shock | 0.70 | 0.82 | [0.74, 0.89] | Beta | 0.04 | |

| Persistence of monetary shock | 0.60 | 0.58 | [0.49, 0.66] | Beta | 0.04 | |

| Persistence of cost-push shock | 0.65 | 0.77 | [0.68, 0.86] | Beta | 0.04 | |

| Persistence of foreign income shock | 0.80 | 0.93 | [0.89, 0.97] | Beta | 0.02 | |

| Persistence of technology shock | 0.50 | 0.42 | [0.35, 0.48] | Inverse Gamma | 0.03 | |

| Persistence of monetary shock | 0.50 | 0.68 | [0.55, 0.80] | Inverse Gamma | 0.06 | |

| Standard deviation of cost shock | 0.50 | 0.31 | [0.24, 0.38] | Inverse Gamma | 0.04 | |

| Standard deviation of foreign income shock | 0.50 | 1.15 | [0.98, 1.33] | Inverse Gamma | 0.09 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; He, Y. Navigating Structural Shocks: Bayesian Dynamic Stochastic General Equilibrium Approaches to Forecasting Macroeconomic Stability. Mathematics 2025, 13, 2288. https://doi.org/10.3390/math13142288

Wang D, He Y. Navigating Structural Shocks: Bayesian Dynamic Stochastic General Equilibrium Approaches to Forecasting Macroeconomic Stability. Mathematics. 2025; 13(14):2288. https://doi.org/10.3390/math13142288

Chicago/Turabian StyleWang, Dongxue, and Yugang He. 2025. "Navigating Structural Shocks: Bayesian Dynamic Stochastic General Equilibrium Approaches to Forecasting Macroeconomic Stability" Mathematics 13, no. 14: 2288. https://doi.org/10.3390/math13142288

APA StyleWang, D., & He, Y. (2025). Navigating Structural Shocks: Bayesian Dynamic Stochastic General Equilibrium Approaches to Forecasting Macroeconomic Stability. Mathematics, 13(14), 2288. https://doi.org/10.3390/math13142288