1. Introduction

The rising importance of environmental issues, governmental regulations through imposing tariffs, and social responsibility has led to increased research attention on sustainable supply chain management. Sustainability in supply chain management has emerged as a critical focus for businesses worldwide, driven by increasing environmental concerns and societal expectations. A sustainable supply chain integrates environmental, social, and governance (ESG) principles into operational practices to minimize ecological harm while promoting social equity and economic viability. Its overarching goal is to reduce the negative environmental impact of supply chains while enhancing social welfare and maintaining profitability.

The importance of this study lies in addressing one of the most pressing global challenges: carbon emissions. Carbon emissions are nearly irreversible and have far-reaching consequences for climate change, biodiversity loss, and public health. Governments worldwide are implementing policies such as subsidies, penalties, and cap-and-trade regulations to curb emissions. However, achieving meaningful reductions requires coordinated efforts across supply chains involving vendors, buyers, and consumers. This study contributes to this effort by exploring how pricing strategies can align economic incentives with environmental goals through green technology investments and carbon emission reductions.

The complexity of carbon reduction initiatives stems from several factors: government intervention through carbon pricing mechanisms; coordination among supply chain participants; investments in green technologies; consumer awareness of ESG concerns; and willingness to pay higher prices for environmentally sustainable products. These challenges necessitate innovative approaches that balance profitability with sustainability.

The high-tech industry serves as a compelling example of these dynamics. For instance, producing an iPhone X generates approximately 80 kg of carbon emissions. In Sweden, where carbon taxes are among the highest globally, Apple could face taxation exceeding USD 10 per unit—a cost that could amount to approximately USD 2 billion annually if applied globally. To address these challenges, Apple has implemented significant sustainability measures. As outlined in its 2020 Environmental Progress Report, Apple achieved 100% carbon neutrality across its operations by 2019 through initiatives such as renewable energy adoption and collaboration with over 100 supply chain partners to transition to sustainable practices. Furthermore, Apple has committed to ensuring that every device sold will have a net-zero climate impact by 2030. This case study highlights the broader implications for global industries: prioritizing environmental sustainability can yield substantial benefits for companies while addressing critical societal concerns.

Literature Review

In the era of environmental concerns and trade protection through imposing tariffs, Daryanto et al. [

1] explored low carbon supply chain coordination for imperfect quality deteriorating items. Hua et al. [

2] focused on deriving an economic lot size by incorporating carbon footprints into inventory management, aiming to minimize total costs under constant demand conditions. Dwicahyani et al. [

3] introduced a supply chain inventory system that includes a warehouse and a distributor, addressing environmental and remanufacturing capacity constraints. Their analysis indicated that while the system may increase waste and carbon emissions, it can reduce energy consumption. They also noted that increasing the collection of returned products could lower the total joint cost. Ghosh et al. [

4] examined the optimization of production batch sizes under conditions of stochastic market demand, carbon emission caps, and partial stock outs, taking into account significant emission sources like production, storage, and transportation. Tiwari et al. [

5] developed a pricing and inventory model that accounts for housing, transportation, imperfect quality, and related carbon emission costs. Yang and Chen [

6] explored the use of green quality costs and sales revenue sharing as mechanisms to achieve Pareto optimality in supply chain operations. Bai et al. [

7] suggested that governmental subsidies for carbon emission reduction could incentivize manufacturers to invest in green technology facilities.

Turki et al. [

8] investigated the differences between new and remanufactured products, considering factors such as random machine failures, carbon constraints, and random demand. Their study analyzed the effects of carbon emission caps, carbon trading prices, and the proportion of recycled materials on carbon emissions. Chelly et al. [

9] contributed to the field of operations management (OM) by focusing on low-carbon supply chain management (LCSCM) within the broader context of green supply chain management (GSCM). Their review highlighted supply chain management research specifically aimed at reducing carbon emissions and managing associated constraints. Yu et al. [

10] established a closed-loop inventory model involving a manufacturer and a retailer, with both return and demand rates being sensitive to price. Their study aimed to optimize sales prices, return prices, batch sizes for new and returned components, and production quantities delivered to retailers. Taleizadeh et al. [

11] considered carbon reduction, return policies, and quality improvement as key factors, examining technology investment, trading, and capping strategies to reduce carbon emissions in forward logistics. They also studied hybrid remanufacturing of imperfect quality products under technology licensing in reverse logistics, assessing the impact of remanufacturing on carbon emission reduction, quality enhancement, and overall supply chain efficiency.

Integrating environmental protection into traditional supply chain design through the collection and reuse of used products is a primary goal of closed-loop systems, which encompass both forward and reverse supply chains. A study by Nahr et al. [

12] developed a bi-objective, multi-period, multi-product closed supply chain network, incorporating environmental considerations, discount strategies, and system uncertainties. Entezaminia et al. [

13] focused on developing cost-effective and environmentally friendly control policies for companies implementing green investments, analyzing the impact of cost and system parameters on these strategies. Taleizadeh et al. [

14] also explored a vendor-managed inventory system, where suppliers make replenishment decisions at the buyer’s location to enhance supply chain coordination, considering partial stock outs and limited storage capacity. Ramandi and Bafruei [

15] examined the reduction of greenhouse gas emissions in a two-tier supply chain with one supplier and one retailer under government policies, focusing on emissions from transportation. Roy and Sana [

16] investigated strategies for simultaneously reducing lead time and setup costs in a two-stage supply chain model under trade credit financing, considering the impact of variable production rates and batch sizes on delivery times. Rout et al. [

17] developed a sustainable supply chain inventory management (SSCIM) model using an integrated approach with a single supplier and multiple buyers, addressing item spoilage and imperfect production. Jiang and Jiang [

18] analyzed cooperative and competitive dynamics between original equipment manufacturers (OEMs) and contract manufacturers (CMs) concerning green investments. Hoque [

19] proposed a single-manufacturer multi-retailer integration model, incorporating carbon neutrality mechanisms and imperfect remanufacturing processes. Heydari et al. [

20] analyzed supply chain coordination between a manufacturer and a buyer under demand conditions sensitive to price and green quality, applying a hybrid strategy combining green cost and revenue sharing to achieve channel coordination. Recently, Sarkar and Bhuniya [

21] developed a model focusing on flexible manufacturing–remanufacturing with green investments under variable demand. Their work emphasizes the integration of service facilities to enhance customer satisfaction and sustainability. Sarkar and Guchhait [

22] examined the impact of information asymmetry on green supply chains, incorporating cap-and-trade policies, service levels, and vendor-managed inventory strategies. They utilized RFID technology to mitigate asymmetry and improve coordination. Guchhait et al. [

23] proposed an extended MRP framework within hybrid energy-enabled smart production systems. Their model integrates renewable energy sources and reverse logistics, demonstrating cost savings and enhanced sustainability. Guchhait and Sarkar [

24] analyzed the economic implications of outsourcing logistics to 4PL providers in flexible production systems, particularly for deteriorating products. Their findings suggest significant cost reductions and improved efficiency.

Table 1 shows the differences between this study and existing studies. Our study can fill the research gap for sustainable supply chains inside thoroughly regarding negotiation mechanism.

Environmental issues must be addressed and implemented over the long term because the implementation of environmental protection is crucial to whether a company can operate sustainably and whether society can survive healthily forever. Pricing strategy is related to the competitiveness of enterprises in the market. The above two problem characteristics are very important for today’s business operations.

This study considered the setup, holding, green facility cost, and penalty cost when the demand is sensitive to price and green technology level. The goals are the improvements in manufacturing processes, energy efficiency, product design optimization, recycling initiatives, and pollution reduction. By examining pricing strategies within a sustainable supply chain framework under cap-and-trade regulation, this study provides valuable insights into how businesses can align their operations with environmental objectives while maintaining economic competitiveness.

2. Modelling

This study developed a quantity-discount pricing strategy model with a market price and technology level of carbon emission reduction sensitive demand. Take the famous retailer, Walmart, as an example. We compared the effects of the three cases when facing a leader of the supply chain.

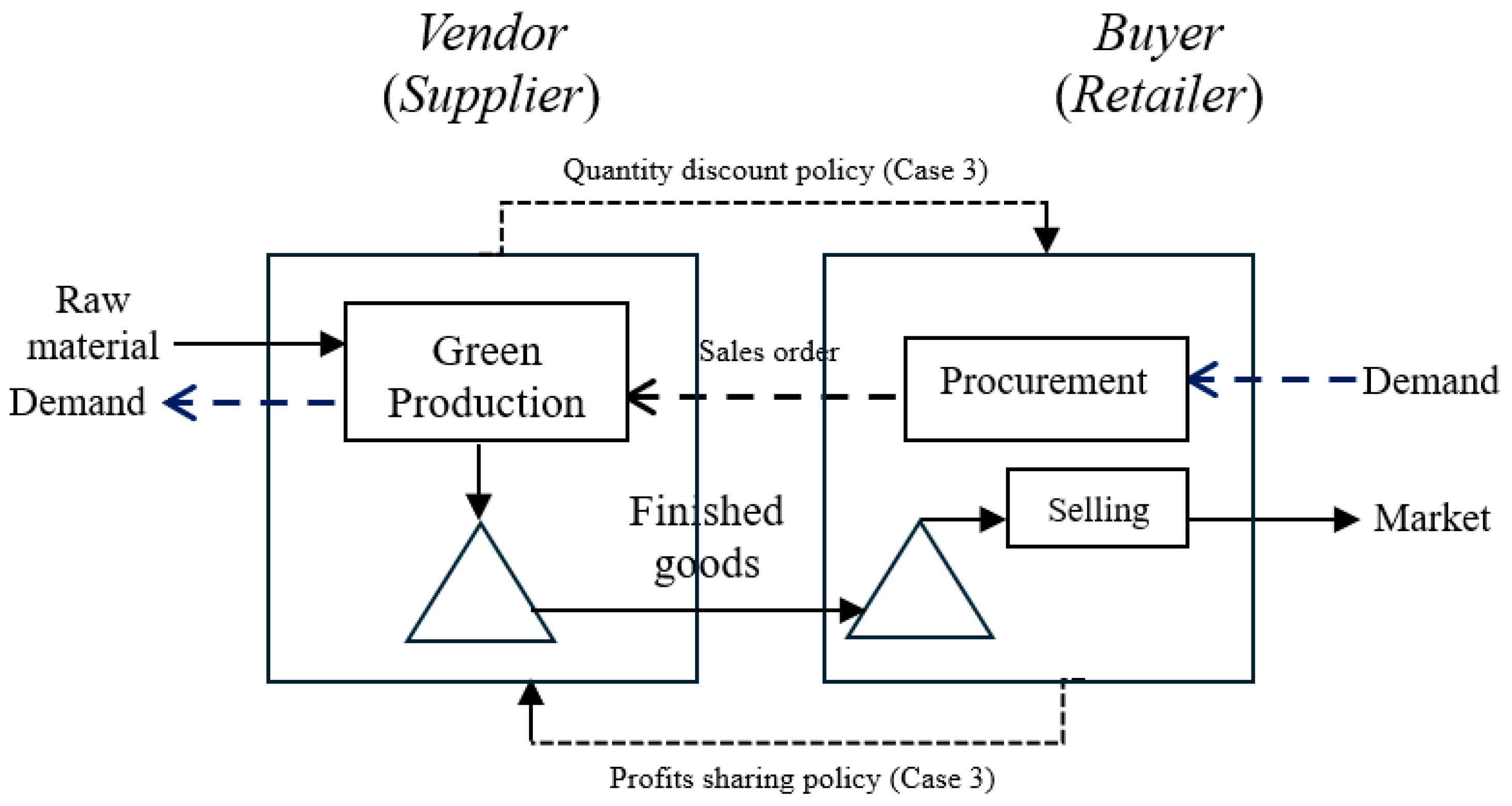

Figure 1 shows how the two parties behave in a two-echelon supply chain in our study.

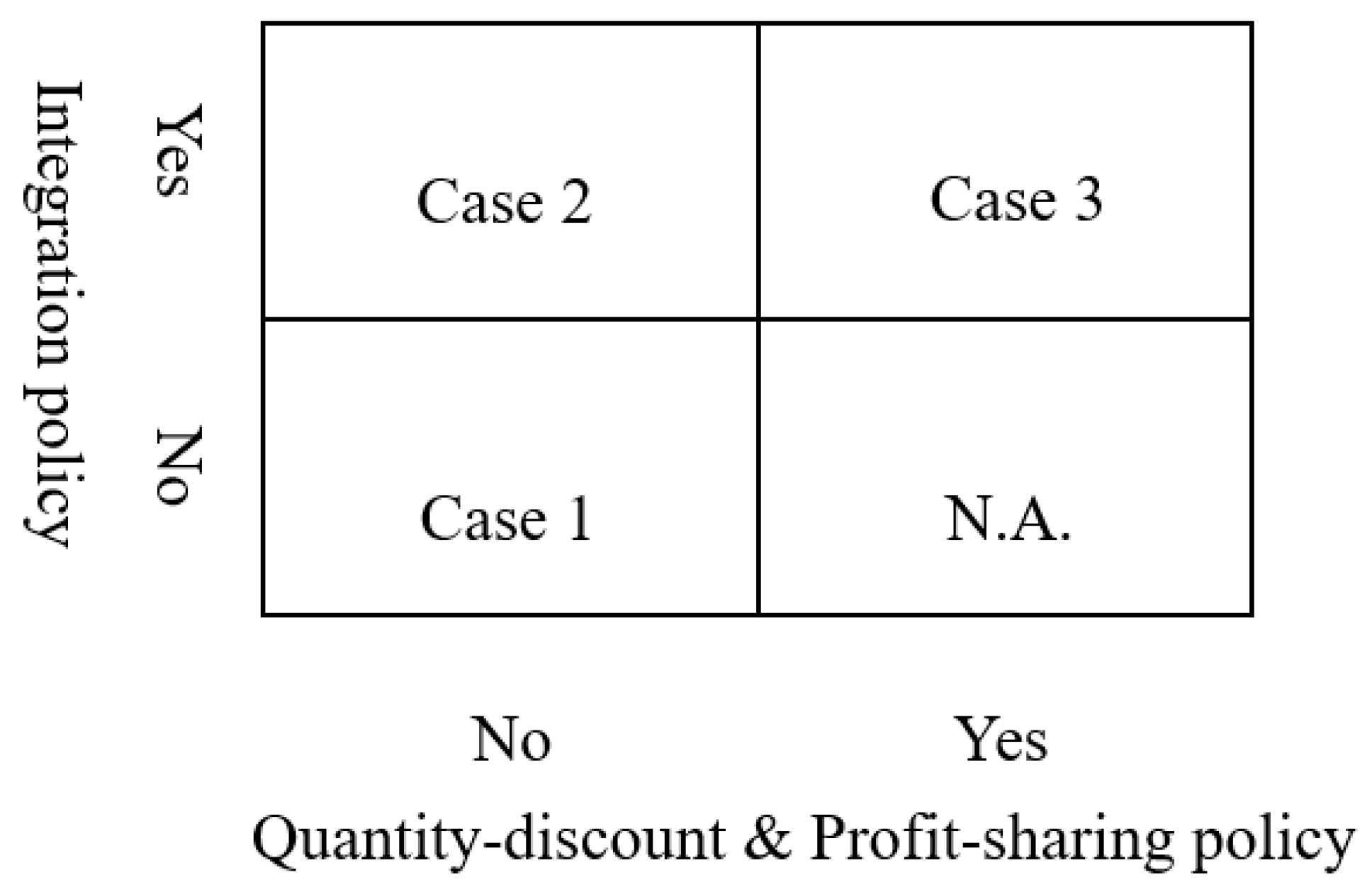

The scenario matrix of our study is shown in

Figure 2. Case 1 is an equal strength case in point when the supplier is also very powerful, and they will make their own buying and selling decisions. Case 2 is an example of an unequal relationship between vendor and buyer, when Walmart’s suppliers have a high dependence on Walmart. Suppliers will choose to integrate into Walmart’s system to seek opportunities for stable development of their own businesses. So, the vendor will cooperate with the buyer to make decisions. In the example of Case 3, in addition to being highly dependent on Walmart, the supplier may have competitors in the Walmart system. Therefore, in addition to complying with the integration, the supplier also provides discounts, combined with Walmart’s profit-sharing mechanism, to create a win-win opportunity for both buyers and sellers. To ensure mutually beneficial strategy, in Case 3, a negotiation factor is incorporated to enable profit sharing between both parties.

The mathematical model developed in this paper is based on the following assumptions:

- (a)

There is one vendor and one buyer.

- (b)

The vendor’s (or manufacturer’s) replenishment rate is finite.

- (c)

The demand rate is sensitive to market price and technology level of carbon emission reduction.

- (d)

All unit quantity discounts are considered.

- (e)

The vendor is fully responsible for carbon emission reduction.

- (f)

The players have complete knowledge of each other’s information.

Three cases are discussed: the first case considers a buyer’s market, where the buyer prioritizes maximizing their profit. The second case considers the integration to maximize vendor-buyer profit. The third case considers integration and quantity discount.

The decision variables are as follows:

S: The technology level of carbon emission reduction

Pm: Market price

Tb: The replenishment period for the buyer

N: Number of replenishments per cycle for the retailer

Pb: Buyer’s unit purchase cost from the vendor in Case 3 (constant in Cases 1 and 2)

The buyer’s other related parameters are:

d: Market demand rate

d0: Potential market demand rate

d1: Technology level sensitive coefficient of carbon emission reduction on market demand

d2: Price-sensitive coefficient on market demand

Cb: Setup cost per replenishment

Fb: Holding cost per dollar per unit time

The vendor’s related parameters are:

Cv: Setup cost per production cycle

Cvb: Fixed cost to process each replenishment to the buyer

Fv: Holding cost per dollar per unit time

Pv: Unit purchase cost

: Production rate

C: Cap (or called quota) of carbon emission regulated by the government

Cp: Unit price per carbon emission that can be bought (or sold) from an organization when the manufacturer’s carbon emission exceeds (or is less than) the cap C

: Facility cost of green technology, where is the influence coefficient

: Carbon emission for each one produced product, where . a: base carbon emission per unit product when the carbon emission reduction technology level is zero, a > 0; and b: influence coefficient of emission reduction technology on reducing emissions, b > 0.

Other related parameters:

: Negotiation factor between vendor and buyer for sharing extra profit

TPb: Buyer’s total profit, considering net sales revenue, setup cost, and holding cost

TPv: Vendor’s total profit, considering net sales revenue, setup cost, and holding cost

TP: Total profit, considering net sales revenue, setup cost, and holding cost, where

: Green cost, including facility cost and the penalty cost (or subsidy) with government cap-and-trade regulation,

:

TP#: Total profit considering net sales revenue, setup cost, holding cost, and green cost, where .

When the demand is sensitive to market price and technology level of carbon emission reduction, it is assumed as follows:

The buyer’s total profit is expressed as:

On the right side of Equation (2), the first item represents net sales revenue, the second item represents setup cost, and the last item represents holding cost. The vendor’s (or manufacturer’s) total profit can be expressed as:

On the right side of Equation (3), the first item represents net sales revenue, the second item represents the setup cost, and the third item represents the holding cost. The expression

represents the average inventory level for the vendor when the replenishment rate is constant. The sum of Equations (2) and (3) can be expressed as:

Generally, the pressure of carbon emission reduction is placed on the manufacturer (or vendor) instead of the retailer (or buyer). The vendor’s green cost and total profit are expressed as:

where

On the right-hand side of Equation (5), the first item represents the cost of facility investment in carbon emission reduction, and the second item represents the loss (or earn) when the actual carbon emission exceeds (or falls short of) the cap of carbon emission. The sum of Equations (2) and (6) are written as:

In Equation (7), there are four decision variables. Within the whole system of the vendor and buyer, including the green cost of carbon emission reduction, the problem is:

Subject to

.

Let

be the optimal solution of (8). After substituting

and demand

d in Equation (1) into Equations (2) and (3),

and

are expressed as:

Case 1: Considering a buyer’s market without a quantity discount

In this case, the vendor offers a fixed price to the buyer and the buyer decides the values of Pm and Tb in Equation (9). Since the value of S (i.e., green technology level) in Equation (9) is related to the green cost of carbon emission reduction, it is reasonable for the vendor to set the value of to be equal to .

Case 2: Considering vendor-buyer integration without quantity discount

In this case, the vendor and buyer make the decision in Equation (8) simultaneously.

Case 3: Considering integration and quantity discount

The vendor offered a discount-price to the buyer. In this case, there are five decision variables: , S, , N and in Equation (8). Let the optimum values of and in Case 1 be expressed as and , respectively.

Two pricing strategies for sharing the extra profit are discussed as follows:

Strategy I: Sharing the extra profit from net sales revenue, setup cost, and holding cost. The characteristic of Strategy I is when the discount price remains stable.

Strategy II: Sharing the extra profit from net sales revenue, setup cost, holding cost, and green cost. The green cost may be positive or negative depending on whether or respectively. The characteristic of Strategy II is that the discount price adjusts according to the government’s carbon emission cap.

The extra total profit for the buyer (or the vendor) in Case 3 is defined as the difference in total profit between Case 3 and Case 1. It is written as:

and

A key parameter in negotiating the profit share between the vendor and the buyer,

, is defined as:

If

, it means the vendor’s extra total profit is equal to the buyer’s extra total profit. If

(or

, the vendor’s profit is more than 100 times (or 10 times) compared to the buyer’s extra total profit. A constrained problem in Case 3 can be rewritten as:

5. Conclusions

This study explores two quantity-discount pricing strategies under cap-and-trade regulations, where demand is influenced by market price and green technology. A key finding is that it is feasible to increase profits for the vendor, buyer, and consumer simultaneously using quantity discounts. Offering greater price discounts, which involves sacrificing some of the vendor’s profit to enhance the buyer’s profit, leads to higher total profits.

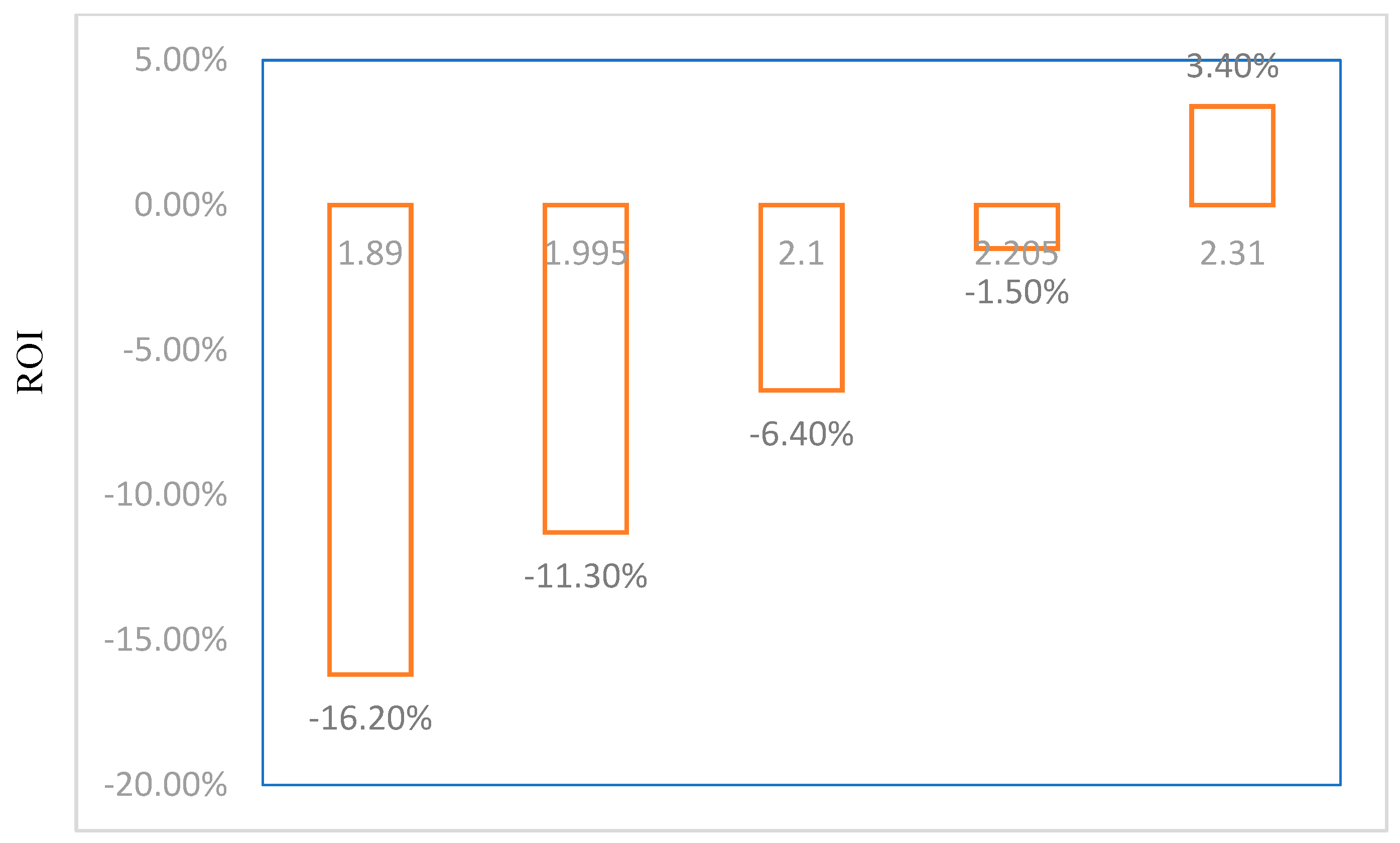

A critical value of C = 211,033 is identified as a strategic threshold. If the government’s cap is below this value, the buyer will opt for Strategy I, while the vendor will choose Strategy II. Conversely, if the cap exceeds this value, each player will select the opposite strategy. This critical value guides strategic decisions and highlights the importance of incorporating negotiation factors to distribute extra profits based on each player’s contribution. For government policy, this critical value suggests that setting caps below or above this threshold can significantly influence market strategies and outcomes. Another critical value, C = 223,786, is crucial for setting reasonable carbon emission quotas. If the quota is below this value, vendors may be reluctant to invest in green technology. This finding underscores the need for governments to set quotas that encourage sustainable investments.

From the vendor’s perspective, the return on investment in green technology is positive only under specific conditions, such as when C = 231,000. This indicates that vendors may be interested in investing in green technology if the return is positive. The study contributes to understanding strategic decision-making under cap-and-trade regulations, emphasizing the importance of critical values and sensitivity coefficients in guiding investments and pricing strategies. It highlights how changes in setup costs, holding costs, and sensitivity coefficients can impact production cycles and inventory management. From the sensitivity analysis, it is shown that:

If the buyer (retailer) is willing to share more profits, the seller (supplier) can offer higher price discounts to encourage the buyer to place larger orders; this will increase the profits of both parties.

The critical point of C (the cap of carbon emission) can be a metric for selecting Strategy I and Strategy II. In addition, C is also a key factor affecting ROI. If the value of C is too low, the ROI will be negative, and the company will suffer losses.

In addition, when the subsidy for carbon emission reduction obtained by the supplier is lower than the critical value, the supplier will suffer cost losses and may be unwilling to invest in green technology. Therefore, the government should set a carbon emission cap above the critical point.

Extending the production cycle can reduce the setup cost per unit time.

Reducing the time interval between replenishments can reduce holding costs.

A higher Cp value (Unit price per carbon emission) can promote lower carbon emission.

For future research, exploring how different regulatory frameworks and technological advancements can further influence these strategies would be beneficial. Additionally, examining the impact of consumer preferences and benefits could provide valuable insights into how businesses can align their strategies with growing eco-consumer demands.