2. Related Work

Our study touches on six streams of literature: e-commerce price discrimination, personalized pricing in digital markets, dynamic pricing strategies, targeted advertising and consumer behavior, online advertising and pricing strategies, and mechanism design in e-commerce.

E-commerce price discrimination: Dynamic norm-breaking pricing events in e-commerce may affect consumer behavior. Garbarino and Maxwell [

1] show that norm-violating strategies lower perceived fairness. They also reduce trust and increase the likelihood of consumer complaints or search for alternatives. Despite its potential to increase profits, online price discrimination (OPD) remains limited in practice. This is mainly due to concerns over consumer fairness perceptions. Heidary et al. [

2] explore OPD from a firm-level perspective. They identify economic, technological, legal, and ethical barriers to adoption. Among these, the fear of consumer backlash is especially significant Empirical research supports this concern. Hufnagel et al. [

3] find that personalized pricing can boost profits. However, it may also trigger feelings of unfairness. These negative perceptions can harm long-term customer relationships. This raises the issue of whether fairness constraints should be embedded into pricing design. Cohen et al. [

4] proposed four fairness metrics: price fairness, demand fairness, surplus fairness, and no-purchase valuation fairness. Their analysis shows that each type of fairness affects firm profits, consumer surplus, and overall welfare. The results emphasize a trade-off between fairness and efficiency in pricing strategies. Other studies extend this debate by looking at incentive mechanisms beyond pricing. Yu et al. [

5] examine rebate policies in the e-commerce supply chain. They compare no-rebate, platform-funded, manufacturer-funded, and cooperative rebate models. Platform-funded rebates are shown to increase trade-in rates and product demand. In contrast, rebates funded solely by manufacturers may reduce demand due to price increases. These findings highlight the role of incentive structure in shaping consumer behavior and platform outcomes.

Price discrimination in e-commerce has been extensively studied, focusing on how online platforms segment consumers and charge differentiated prices based on demand elasticity, purchasing power, and other observable characteristics. Early works such as those from Rohani and Nazari [

6] and Yuan and Han [

7] examine consumer behavior under dynamic pricing mechanisms and the role of consumer expectations in shaping purchasing decisions. However, these studies largely concentrate on identifying optimal pricing strategies within competitive or monopolistic settings, with relatively little attention paid to the interaction between price discrimination and other critical e-commerce elements, such as personalized advertising or platform design. More recent contributions highlight how data granularity enables more precise price discrimination, thereby boosting profitability but simultaneously intensifying concerns about fairness and market transparency. Nevertheless, these studies primarily examine static models or single-firm settings, leaving the dynamics between price discrimination and personalized advertising strategies underexplored. Our research addresses this gap by examining the co-evolution of pricing and advertising strategies in competitive platform environments.

Personalized pricing in digital markets: Recent literature extensively examines the effects of personalized pricing (PP) on firm profits and consumer welfare. Despite concerns about increased price competition, PP can improve market coverage and benefit certain consumer groups. Choudhary et al. [

8] find that PP may lead to non-monotonic pricing. In some cases, high-value consumers receive lower prices than low-value ones. Firm quality decisions also vary. When a low-quality firm adopts PP, both firms may reduce quality. In contrast, PP adoption by a high-quality firm leads to quality improvements. Consumer identity management adds further complexity to pricing strategies. Chen et al. [

9] showed that while more consumer data typically intensifies price competition, this effect weakens if consumers actively conceal their identities to avoid discrimination. These strategic behaviors reshape firm incentives under personalized pricing. The welfare implications of PP are context-dependent. Dubé and Misra [

10] used machine learning to evaluate welfare outcomes. They found that although many consumers benefit from lower prices, the total consumer surplus may decline. This reflects the uneven distribution of gains. Mazrekaj et al. [

11] added an ethical dimension. Through simulation, they argue that PP may not always outperform uniform pricing. Competition dynamics further influence PP’s outcomes. Rhodes and Zhou [

12] showed that PP can intensify price competition and reduce profits. This effect is especially pronounced when firms can also differentiate their products. Similarly, Li et al. [

13] identified a “prisoner’s dilemma” effect, while PP can be profitable, it may trigger aggressive price undercutting. Firms may prefer to invest in product differentiation, especially when PP implementation costs are high. Thus, the profitability of PP depends on both cost structures and strategic interaction. Another key factor is platform-level information sharing. Hu et al. [

14] analyzed how e-commerce platforms decide whether to share consumer data with third-party sellers. High commission rates and a large share of new consumers increase the likelihood of data sharing. This enables PP but introduces trade-offs between platform revenue and consumer trust.

Personalized pricing has become increasingly relevant as platforms leverage consumer data to tailor prices based on individual preferences and behaviors. Yu et al. [

15] and Smith et al. [

16] demonstrate the profitability of segmented pricing strategies, showing that targeted offers can significantly enhance revenue. However, existing studies predominantly emphasize the profitability and technical aspects of consumer segmentation, without adequately addressing broader concerns such as consumer privacy, ethical considerations, and the potential backlash against personalized pricing practices. In particular, the increasing prevalence of consumer price comparison behavior raises important questions regarding consumer welfare and market efficiency under personalized pricing regimes. This study seeks to fill this gap by exploring how personalized pricing strategies can be designed in a way that balances profit maximization with platform traffic sustainability and consumer welfare considerations, thereby offering a more holistic perspective on the deployment of personalized pricing in digital platforms.

Dynamic pricing strategies: Dynamic pricing strategies have been widely studied, especially in the context of monopolists selling perishable goods. Dasu and Tong [

17] investigated how dynamic pricing performs when strategic consumers are involved over a finite time horizon. This suggests that dynamic pricing is most effective when consumers perceive scarcity. Consumer behavior also plays a crucial role in dynamic pricing. Yuan and Han [

7] examined the impact of adaptive consumer search on pricing strategies. They showed that higher historical prices raise consumer price expectations, which in turn reduces search intensity. Additionally, they found that cost shocks affect price adjustments asymmetrically. Rohani and Nazari [

6] focused on how uniform and dynamic pricing influence consumer behavior. They observed that high-involvement consumers respond more positively to dynamic pricing, experiencing greater emotional benefits, which in turn increases the likelihood of repeat purchases and word-of-mouth. Further theoretical insights into pricing dynamics are provided by Besbes and Sauré [

18]. They showed that optimal pricing policies tend to follow a monotonic path until a shift occurs. Their analysis also highlights how uncertainty in demand timing and nature affects pricing strategies. Similarly, Feng et al. [

19] explored dynamic pricing for platform vendors, considering two-sided network effects. Their study identified the importance of product mix selection and the pricing mechanism, comparing membership fees with commission fees. They found that platforms should account for network effect intensity and the competitive advantages of first-party products when setting pricing strategies. For moderate network effects, commission fees prove more beneficial. Finally, Smith et al. [

16] focused on personalized pricing, using consumer-level panel data to analyze its profitability. They concluded that hierarchical models generate the most profitable pricing policies, suggesting the effectiveness of segmented pricing strategies for maximizing profit.

Dynamic pricing refers to the practice of adjusting prices based on sellers’ costs, anticipated consumer demand, and observed purchasing behavior, and it has been widely applied in e-commerce settings. Dasu and Tong [

17] and Feng et al. [

19] investigated how platforms adjust pricing strategies under uncertainty and competitive pressures, while these studies highlight the critical role of consumer demand and perceived scarcity in shaping dynamic pricing decisions, they do not sufficiently consider how external factors, such as product exposure or advertising intensity, influence pricing strategies. Despite the extensive insights the dynamic pricing literature offers into consumer behavior and market dynamics, the interplay between dynamic pricing and dynamic advertising remains largely unexplored. Addressing this gap, the present study investigates how advertising efforts (through increased product exposure) directly alter consumer behavior and indirectly impact pricing mechanisms. By integrating advertising dynamics into pricing strategy considerations, this research contributes to a more comprehensive understanding of dynamic pricing in digital marketplaces.

Targeted advertising and consumer behavior: The role of targeted advertising in shaping consumer behavior has been extensively studied. Grier and Brumbaugh [

20] explored how advertisements targeting different cultural groups are perceived by both target and non-target viewers. They emphasized the importance of understanding cultural nuances in effectively managing consumer responses to targeted advertising. Similarly, Aaker et al. [

21] investigated the impact of target marketing on both target and non-target markets, highlighting the need to consider viewer distinctiveness in marketing strategies. Gal-Or et al. [

22] introduced a game theoretic model to analyze targeted advertising strategies in television. They found that resource allocation should differ based on the competitive environment. Improving recognition intensifies price competition, whereas increasing accuracy does not. This finding underscores the complexity of targeted advertising in competitive markets. Targeted advertising can also signal product attributes.Anand and Shachar [

23] developed a signaling model, demonstrating that targeting can serve as a signal of product quality. However, its effectiveness depends on consumers’ awareness that firms understand their preferences. Lii and Sy [

24] explored the influence of internet-based differential pricing on consumer behavior. They found that perceived price fairness significantly affects consumer emotions, which, in turn, influence behavioral responses such as word-of-mouth and repurchase intention. The effectiveness of targeted advertising in enhancing product diffusion has also been studied. Hariharan et al. [

25] showed that targeted advertising can outperform mass advertising, especially in markets with distinct early and late adopters. They argued that timing and resource allocation are critical for maximizing product diffusion and firm profits. Similarly, Esteves and Resende [

26] explored targeted advertising and price discrimination in a duopoly market. Their results suggest that targeted advertising can soften price competition, leading to higher prices compared to mass advertising, while targeted advertising has its advantages, it is not universally beneficial. Summers et al. [

27] investigated how behaviorally targeted ads influence consumer self-perceptions and behavior. They emphasize the importance of targeting accuracy and suggest that behaviorally targeted ads can be more effective than traditional advertising methods. Similarly, Boerman et al. [

28] provided a comprehensive review of online behavioral advertising, identifying key factors influencing its effectiveness. These include advertiser-controlled factors (e.g., personalization level) and consumer-controlled factors (e.g., knowledge and privacy concerns).

Despite these advantages, targeted advertising is not always beneficial. Brahim et al. [

29] examined the impact of targeted advertising on firm competition and consumer behavior in a duopoly setting. They found that targeted advertising may not always enhance firm profits, particularly when advertising costs are high. Their results challenge the belief that targeted advertising universally benefits firms, highlighting the need to consider advertising costs and market segmentation in strategic decision-making. Shin and Yu [

30] developed a micro-model to analyze how targeted advertising influences consumer inferences about product utility. They found that targeting accuracy affects consumer beliefs about product category fit and firm quality, which in turn increases search behavior. This creates advertising spillovers, influencing firms’ equilibrium advertising strategies. Their analysis shows that, although higher targeting accuracy can improve ad effectiveness, it may also lead to free-riding by competitors, complicating firms’ decisions on advertising investment. Marotta et al. [

31] examined the welfare implications of targeted advertising technologies, focusing on how consumer data sharing affects stakeholders in online advertising. They developed an analytical model to evaluate the economic and welfare impacts of targeting technologies under different consumer information regimes. The study found that the optimal information regime for maximizing consumer welfare depends on the degree of consumer heterogeneity along horizontal (product preferences) and vertical (purchasing power) dimensions. The authors suggested that regulatory interventions may be necessary to align the incentives of advertisers, intermediaries, and consumers and optimize overall welfare. Choi et al. [

32] investigated how consumers’ privacy choices affect targeted advertising throughout the purchase journey. They developed a multi-period game theoretic model to analyze how consumers’ decisions to opt in or out of tracking affect their exposure to ads and purchase behavior. The study found that consumers are more likely to opt in when ad effectiveness is moderate or if they have low sensitivity to ad wear out. This opt-in behavior reduces ad repetition and increases product surplus, providing insights into strategic interactions among consumers, advertisers, and ad networks under privacy regulations.

Targeted advertising has long been a major area of research in e-commerce, focusing on how customized advertisements influence consumer perceptions and behavior. Foundational studies such as those by Grier and Brumbaugh [

20] and Aaker et al. [

21] emphasize the critical role of cultural nuances and audience distinctiveness in shaping consumer responses. Subsequent contributions, including Gal-Or et al. [

22], introduced game theoretic and signaling models to analyze how targeted advertising affects market competition. Further research, such as those from Hariharan et al. [

25] and Esteves and Resende [

26], explore the comparative advantages of targeted advertising over mass advertising. Recent research has deepened the understanding of how targeted advertising shapes consumer behavior in increasingly complex digital contexts. These advancements highlight the growing importance of integrating targeted advertising with dynamic pricing strategies. However, despite significant progress in understanding how targeted advertising influences consumer behavior and platform competition, much of the literature continues to treat advertising and pricing decisions as parallel rather than interdependent processes. Existing research predominantly focuses on the effectiveness of targeted advertising in shaping individual consumer responses while paying relatively limited attention to how targeted advertising strategies interact with dynamic pricing mechanisms to influence cross-platform competition. Moreover, analyses of advertising strategies often assume static or exogenous pricing. Our study addresses this gap by explicitly modeling the co-evolution of targeted advertising and dynamic pricing decisions, offering a more comprehensive framework for understanding consumer behavior and strategic competition in digital marketplaces.

Online advertising and pricing strategies: Chen et al. [

33] explored competitive dynamics in individual marketing with imperfect targeting, showing that mistargeting can soften price competition and benefit all firms. Similarly, Fan et al. [

34] analyzed when media companies should adopt pricing versus advertising strategies, finding that selling content is optimal with high quality and low access costs, while advertising is preferred with high access costs. Furthermore, Baye and Morgan [

35] showed that price advertising can substitute brand advertising and may paradoxically reduce profits while increasing prices for both loyal and non-loyal consumers. Moving to platform pricing strategies, Amaldoss et al. [

36] found that asymmetric pricing may be adopted when multi-homing is valuable, highlighting the importance of considering externalities in platform pricing decisions. Similarly, Johnson et al. [

37] examined how shifting consumer data rights can improve ad targeting, ultimately benefiting consumers by increasing relevant exposure and improving targeting options. In the context of retail, Zhang [

38] found that multichannel retailing is not always optimal. This finding was further explored by Yan [

39] who showed that higher compatibility with e-marketing enhances strategic alliances and cooperative advertising efforts. Additionally, Xu et al. [

40] demonstrated that prominent advertising positions may not always be desirable for competitive firms, as there is a trade-off between capturing immediate demand and benefiting from higher equilibrium prices when weaker competitors occupy those positions. As advertising strategies evolve, Choi and Sayedi [

41] analyzed how publishers and advertisers adjust their strategies when new advertisers enter the market, while Aparicio et al. [

42] found that online retailers exhibit higher price dispersion due to algorithmic pricing, location-based price discrimination, and persistent price disparities. Regarding cross-platform strategies, Can-Zhong and Yi-Na [

43] showed that cross-platform externalities can shift platform pricing tactics and enhance consumer benefits, suggesting that platforms can gain competitive advantages over independent rivals. In a similar vein, Guchhait et al. [

44] compared three pricing models for news vendor markets, providing insights into how different pricing structures affect overall market performance. In terms of pricing models in online advertising, Asdemir et al. [

45] discussed the trade-offs between CPM and CPC models, highlighting the strategic decisions advertisers face under different market conditions. Similarly, Hu et al. [

46] identified conditions under which CPA outperforms CPC, offering insight into how risk aversion and market uncertainty influence pricing model preferences. Furthermore, Lu et al. [

47] found that dynamic pricing strategies dominate static ones, reinforcing the need for flexibility in pricing strategies. Likewise, Adikari and Dutta [

48] proposed an auto pricing strategy (APS) for real-time bidding, addressing the dynamic nature of the RTB process and its impact on pricing decisions. Cao et al. [

49] highlighted how price promotions can undermine the credibility of referral marketing in e-commerce, showing the trade-offs that firms face when deciding between these two strategies. In the realm of advertising intermediaries, D’Annunzio and Russo [

50] examined how intermediaries disclose consumer information to advertisers, and how such transparency affects profitability and the incentives for publishers to outsource ad sales. Furthermore, Liu et al. [

51] studied how consumer anchoring affects online purchasing behaviors, providing a model that incorporates cognitive biases in consumer decision making. Finally, Ma et al. [

52] examined the optimal search-based advertising strategies for e-commerce platforms. They found that platforms typically prefer decentralized advertising mechanisms (DAM) when sellers have high reserve benefits, while centralized mechanisms (CAM) are more suitable when benefits are low. This provides valuable insights for platforms seeking to optimize their advertising strategies and pricing schemes to maximize profits.

The relationship between online advertising and pricing strategies has been extensively studied. Early research, such as those by Chen et al. [

33] and Fan et al. [

34], analyze how imperfect targeting and content quality influence firms’ choices between direct pricing and advertising-based models. Baye and Morgan [

35] further demonstrate the complex substitution effects between brand and price advertising, showing that investments in branding can increase prices for both loyal and non-loyal consumers. More recent studies have expanded this research area by incorporating cross-platform externalities and algorithmic innovations. For instance, Amaldoss et al. [

36] and Can-Zhong and Yi-Na [

43] highlighted how multi-homing behaviors and cross-platform competition influence asymmetric platform pricing and advertising strategies. At the micro level, studies such as those from Liu et al. [

51] and Cao et al. [

49] investigate how consumer psychology, including anchoring biases and the credibility of referral marketing, affects the interaction between advertising and pricing strategies, while this body of literature provides important insights into individual mechanisms—such as how advertising can substitute for direct pricing, or how competition affects data sharing—existing research typically examines pricing and advertising strategies in isolation or within static frameworks. Few studies have explored how online advertising influences overall pricing strategies or whether advertising can be leveraged to adjust consumer behavior, including price sensitivity. The dynamic co-evolution of advertising efforts and pricing strategies on digital platforms, particularly the role of advertising as a lever to shift consumer price sensitivity and purchasing behavior, remains under explored. Our study addresses this gap by explicitly modeling the interaction between dynamic advertising exposure and dynamic pricing strategies, and by investigating their combined impact on consumer behavior, price competition, and platform profitability in competitive environments.

Mechanism design in e-commerce: Mechanism design plays a critical role in e-commerce, particularly in aligning individual incentives with collective goals. Maskin [

53] provides a foundational overview of mechanism design, focusing on implementation theory. Maskin explained how mechanisms can be engineered to achieve desired social outcomes, introducing key concepts such as monotonicity and no veto power, which are essential for implementing social choice rules. This foundational work sets the stage for further exploration of mechanisms in various contexts. Expanding on this, Myerson [

54] presented a comprehensive review of the evolution of mechanism design in economic theory. Myerson highlighted its progression from classical resource allocation problems to more complex models that account for incentive constraints. This emphasizes the importance of designing mechanisms that not only consider efficiency but also address issues such as adverse selection and moral hazard, which are critical in markets with imperfect information. In the realm of e-commerce, Balakrishnan et al. [

55] developed a model that incorporates consumer valuation uncertainty and heterogeneous shopping behaviors. Their analysis examines equilibrium scenarios and explores the impact of “showrooming” behavior on retail and online pricing strategies. This behavior, where consumers research products in physical stores but purchase online, adds complexity to pricing strategies in e-commerce. Further advancing the understanding of dynamic pricing in digital environments, Fu et al. [

56] developed game theoretic models to analyze dual-channel e-retail structures. Their findings reveal that e-retail prices on both self-support and open e-platforms are influenced by the service quality and commission fees of the platforms. They show that higher service quality on one platform leads to higher prices, forcing competing platforms to either enhance their service quality or lower their prices, thus demonstrating the competitive dynamics in multi-channel retail settings. In a similar vein, Liu et al. [

57] examined the impact of compatibility costs, product value differences, and royalty rates on firms’ strategies in a co-opetition setting. Their game theoretic model provides insights into optimal compatibility strategies for digital platforms, shedding light on how firms navigate cooperation and competition in the digital age. Lastly, Bergemann and Bonatti [

58] explored the role of data in digital platforms, specifically how platforms use data to match sellers with heterogeneous consumers and sell targeted ads to maximize revenue. They highlight the platform’s informational advantage, which allows it to control consumer behavior and extract surplus from sellers. However, the study also notes that the presence of off-platform sales channels limits the platform’s ability to discriminate between prices. Furthermore, they analyze how data governance policies, such as privacy protection, can influence both consumer welfare and platform revenue.

Mechanism design plays a crucial role in rule selection and contract formulation under conditions of incomplete information. An appropriate mechanism not only improves the operational efficiency of rules but also addresses practical issues such as adverse selection and moral hazard. In the field of e-commerce platforms, mechanism design theory has been widely applied: factors such as product display (i.e., platform storefront design), service quality, commission structures, product value differences, and franchise rights significantly influence sellers’ pricing mechanisms. Advertising is also extensively used to facilitate matching between sellers and buyers, with targeted advertising enhancing consumer surplus. However, few studies have explicitly endogenized advertising within mechanism design models or considered how dynamic advertising strategies affect pricing mechanisms. To address this gap, our study starts from the phenomenon of “traffic dominance” on e-commerce platforms and explores how advertising strategies influence pricing mechanisms in practice. Our research theoretically confirms the existence of the “big data price discrimination” phenomenon, demonstrating its consistency with the actual logic of sellers’ dynamic pricing strategies. Moreover, recognizing that many sellers prioritize sales volume during the early stages of market entry, we also analyze and simulate volume-first pricing mechanisms. In doing so, this study helps fill important gaps in the literature on mechanism design in the context of e-commerce platforms.

An increasing number of studies have underscored the critical role of advertising strategies and pricing mechanisms within e-commerce platforms, as merchants seek to expand their customer base and strengthen their competitive edge. Prior research has primarily concentrated on how pricing mechanisms influence consumer value perception and the ways in which advertising affects consumer decision making. However, the integration of advertising as an endogenous variable in pricing mechanisms—particularly how advertising expenditures influence consumer purchasing power and firm profitability—remains a relatively underexplored area. For years, the potential of price discrimination to enhance social welfare in markets characterized by incomplete information has been a central topic of research, often explored within the context of two-stage pricing models. However, there is a notable scarcity of studies examining the design of differentiated pricing mechanisms in the context of targeted advertising. Furthermore, little attention has been given to how these mechanisms evolve when merchants prioritize sales volume over profit maximization.

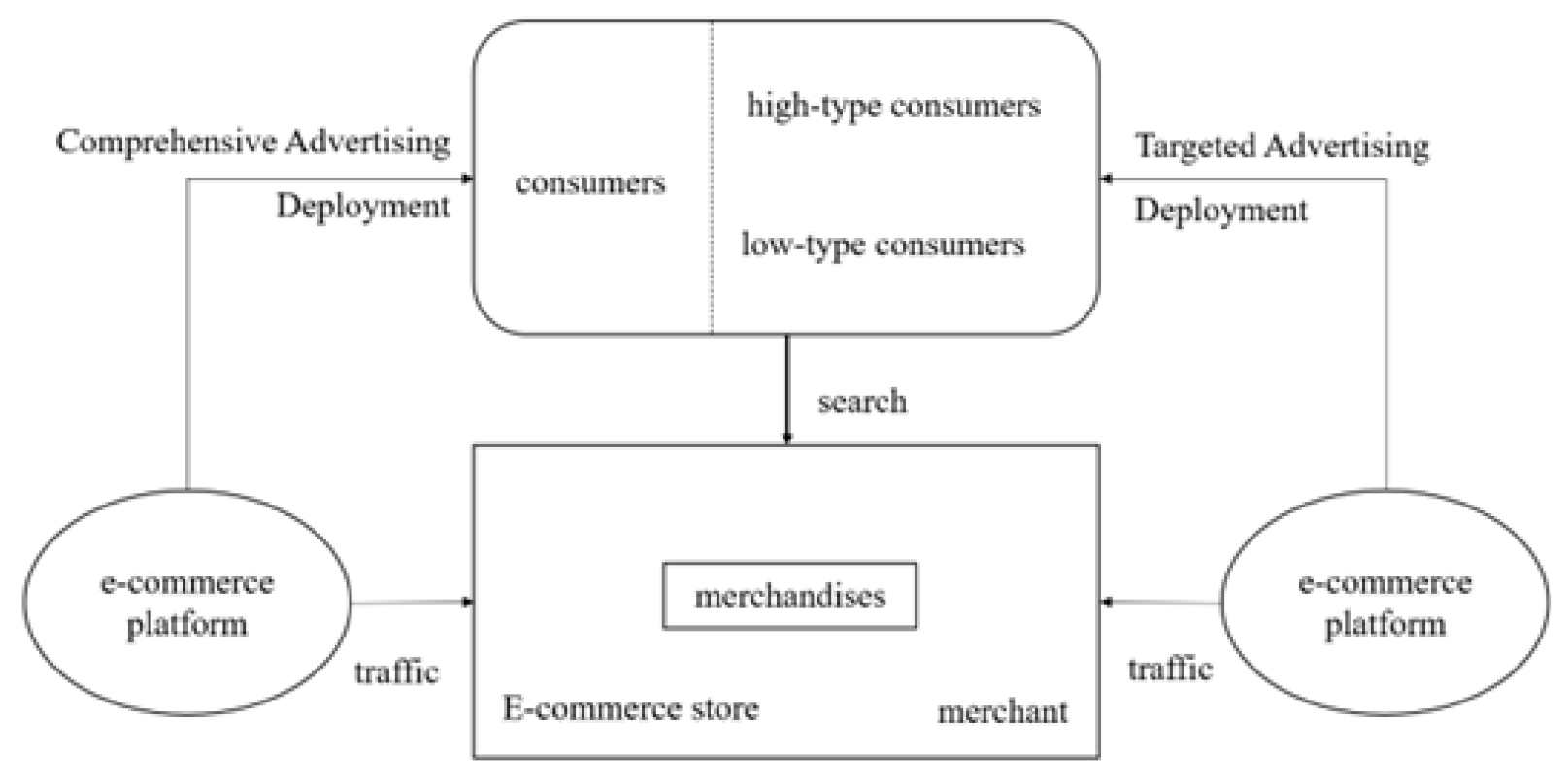

However, due to the decisive role of traffic in the Internet era, merchants who fail to adopt appropriate advertising strategies may not reach the stage where the pricing mechanism plays a central role, before achieving effective and sustained exposure. The key questions addressed in this study are as follows: First, how should merchants select pricing mechanisms at various stages of their development? Second, how do consumer characteristics, perceived product utility, price sensitivity, and advertising sensitivity influence the design of pricing strategies? Third, how should merchants determine the level and mode of advertising expenditures? Lastly, how should pricing mechanisms be structured when merchants prioritize driving sales volume?

This study stands out by considering the platform and merchants as a mutually beneficial community, where both share in the sales revenue of merchant products. The effectiveness of pricing mechanisms can strengthen this profit-sharing connection, thus incentivizing the platform to allocate more exposure and traffic to merchants. In order to address potential issues in previous studies, this research introduces assumptions regarding information uncertainty and advertising. Specifically, it assumes that merchants lack knowledge of consumer types, and that advertising expenditures are an endogenous variable within the pricing mechanism.

Using a mechanism design approach, this study examines the dynamic pricing strategies of platform merchants under two advertising conditions—broad advertising and targeted advertising—while also considering the heterogeneity of consumer preferences. This research compares pricing mechanisms and advertising levels in scenarios where merchants prioritize either profit or sales volume. It explores the underlying mechanism behind the “big data kills loyal customers” phenomenon and demonstrates how merchants’ pricing strategies evolve throughout their lifecycle. Additionally, it analyzes the critical role of consumer preferences, specifically how price sensitivity and advertising sensitivity impact pricing decisions.

In conclusion, this study constructs a mechanism design model that integrates advertising expenditure and pricing strategies under incomplete information conditions. It provides a relatively comprehensive framework for understanding competitive behavior in digital markets, thus contributing to the existing literature. The findings offer new insights for merchants into how to adjust their strategies at different stages of their lifecycle to optimize profitability, while also considering consumer welfare.

6. Numerical Simulation Analysis

The analysis is divided into five parts. MATLAB R2014b is used for numerical simulations, with parameters set as . The selection of the initial sales volume is based on the observations of products on the Taobao e-commerce platform in China, that are not prominently featured on the homepage or product search pages.

Throughout the merchant lifecycle, different pricing mechanisms are employed for different consumer types. How do pricing and advertising levels influence sales and profitability, thereby shaping merchants’ mechanism design? This section conducts numerical simulations based on the theoretical model, analyzing how changes in price and advertising intensity affect sales and profits under controlled sensitivity conditions. By examining graphical differences in fixed prices and advertising levels, this study explores the impact of sensitivity changes on enterprise outcomes.

Because pricing mechanisms are the core focus of this study, unless explicitly distinguishing between and , advertising levels are considered under uniform advertising. Most analyses in this section assume merchants aim to encourage higher purchases from high-type consumers by allocating more advertising resources to them, thereby considering the effects of differentiated advertising levels, i.e., targeted advertising.

6.1. Numerical Simulation of Merchant Pricing Mechanism Design

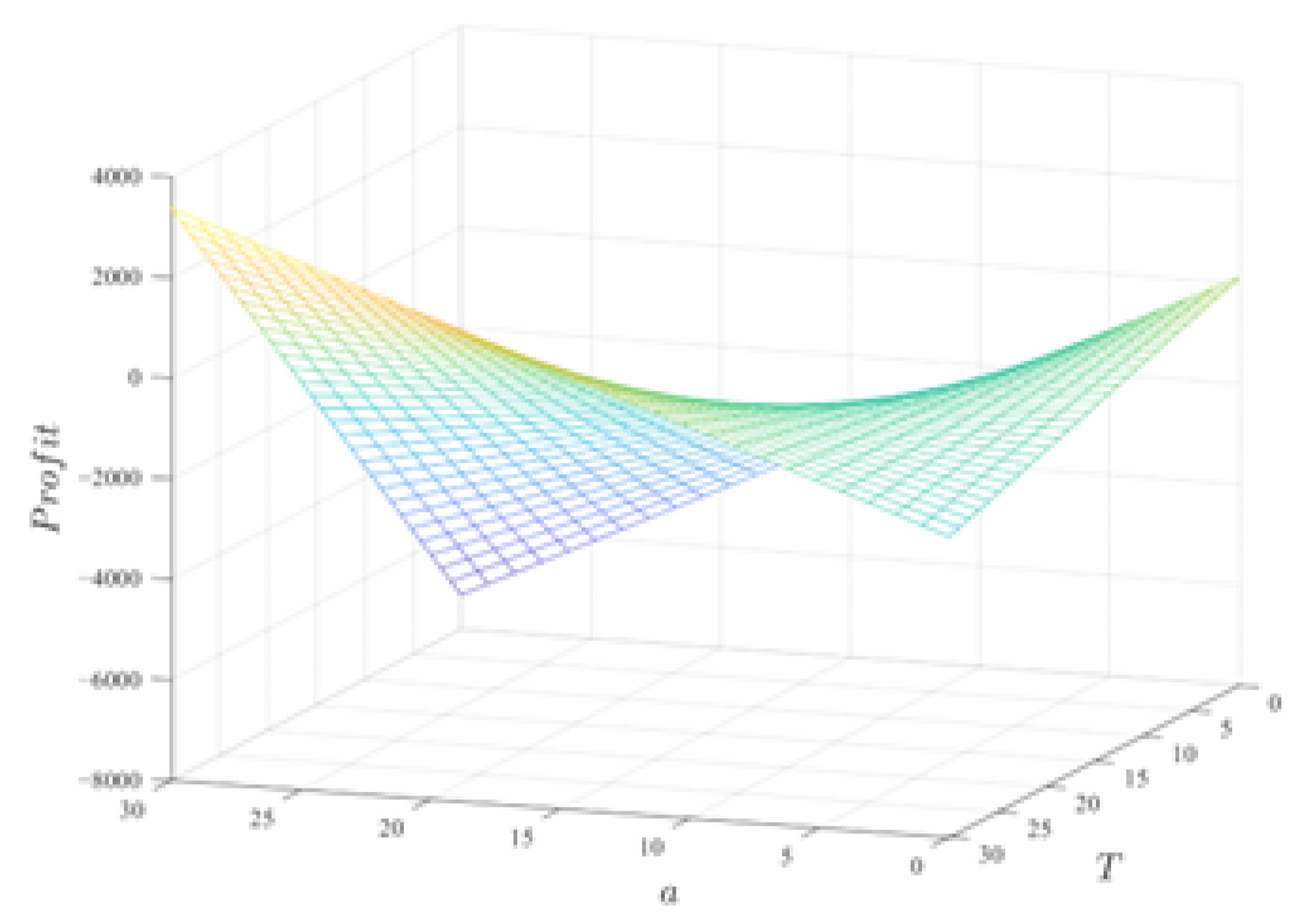

To analyze the effectiveness of pricing mechanisms for heterogeneous consumers under advertising, let

. The changes in product sales and profits with respect to product price

and advertising intensity

are examined (

Figure 2 and

Figure 3). To clearly observe the impact of price and advertising on sales and profits, the negative axes are not excluded; negative sales indicate no purchases and negative profit values represent merchant losses.

In

Figure 2, considering that businesses tend to allocate more advertisements to high-type consumers, i.e.,

, from the perspective of increasing sales volume,

should be set. Setting

leads to a decrease in sales volume; however, the impact on firm profits is more complex, as shown in

Figure 3.

Derived from

, the critical price

can be obtained. As shown in

Figure 3, the critical price

increases with the rise in advertising expenditure. When the price falls within the range

, the optimal pricing strategy is

, where low-type consumers are charged higher prices.

Conversely, when , the merchant designs , with high-type consumers charged at higher prices. For very high prices, merchants should target high-type consumers with a higher pricing plan. In practical scenarios, during the initial promotion phase of a product, the critical price rises with the level of advertising. Prices tend to fall below the critical price, indicating that merchants should offer high-type consumers a lower price. This strategy stems from the fact that consumers are more likely to compare prices. Offering lower prices to high-type consumers who purchase repeatedly ensures customer acquisition and loyalty.

As the fixed customer base stabilizes over time, merchants reduce advertising expenditure, causing the critical price to decrease. Prices are then more likely to exceed the critical price, prompting merchants to charge high-type consumers higher prices to distinguish between consumer types. This second scenario, commonly referred to as “price discrimination against loyal customers”, reflects a transition in business strategy.

In the early stages, merchants prioritized extensive promotion and customer acquisition, transitioning to higher prices for high-type consumers once a stable customer base is achieved. This transition is facilitated by enhanced customer experience, such as better service quality or improved search processes. For instance, merchants can train customer service teams to respond promptly, effectively resolve issues, and provide tailored purchasing advice. These efforts increase customers’ willingness to pay higher prices, ensuring that , while maintaining a balance such that .

For Internet platform merchants, considerations extend beyond immediate profit to future gains. Consumer purchasing decisions are significantly influenced by past and current sales volumes. Herd behavior is prevalent in online shopping, where consumers often filter products by “sales volume first”. Additionally, e-commerce platforms prioritize Gross Merchandise Volume (GMV) as a core metric. High-sales products naturally attract more traffic due to platform algorithms. To leverage this, merchants may sacrifice short-term profits by reducing prices to boost sales, enhance product reputations, and ultimately achieve long-term profitability. This analysis leads to Proposition 9.

Proposition 9. When merchants account for consumer behavior influenced by historical sales and platform emphasis on GMV, they are likely to lower prices to boost sales. This strategy not only ensures sustained consumer purchasing power, but also increases organic product traffic, ultimately driving GMV growth.

If a merchant places particular importance on sales volume, lower prices become a natural choice for achieving high sales. However, prices cannot be too low to ensure GMV growth. Given that the critical price remains constant under fixed advertising expenditure and consumer sensitivity, merchants are more inclined to set prices below the critical level, often offering high-type consumers lower prices.

Corollary 9.1. If boosting sales volume is the core strategy, merchants will adopt lower pricing strategies, with a greater likelihood of offering lower prices to high-type consumers.

Corollary 9.2. From the perspective of critical price, when merchants aim to maximize sales volume and consumer price sensitivity increases, they should reduce prices to maintain sales growth. To avoid declining sales, merchants should offer lower prices to consumers with greater price sensitivity.

Sales-driven strategies generally align with Scenario T1, where low-type consumers exhibit higher price sensitivity. To boost sales, merchants may charge lower prices to low-type consumers. However, from a profit perspective, high-type consumers’ lower price sensitivity suggests that merchants should offer them lower prices. The final pricing strategy depends on the merchant’s overarching goals.

Corollary 9.3. Regarding price differentiation, merchants aiming to maximize sales will set lower prices and minimize price differences to maintain sales growth.

In practice, merchants emphasize sales volume because it affects consumer perceptions of product quality. Platforms prioritize high-sales products to reduce consumer search costs. Under normal pricing mechanisms, prices must drop significantly to achieve large sales growth. However, this approach may lead to unsustainable outcomes, such as prices failing to cover production and logistics costs, exacerbating issues like fake orders. We will analyze the evolution of sales and profits under varying levels of price sensitivity and advertising sensitivity.

6.2. Numerical Simulation of Sensitivity’s Impact on Sales

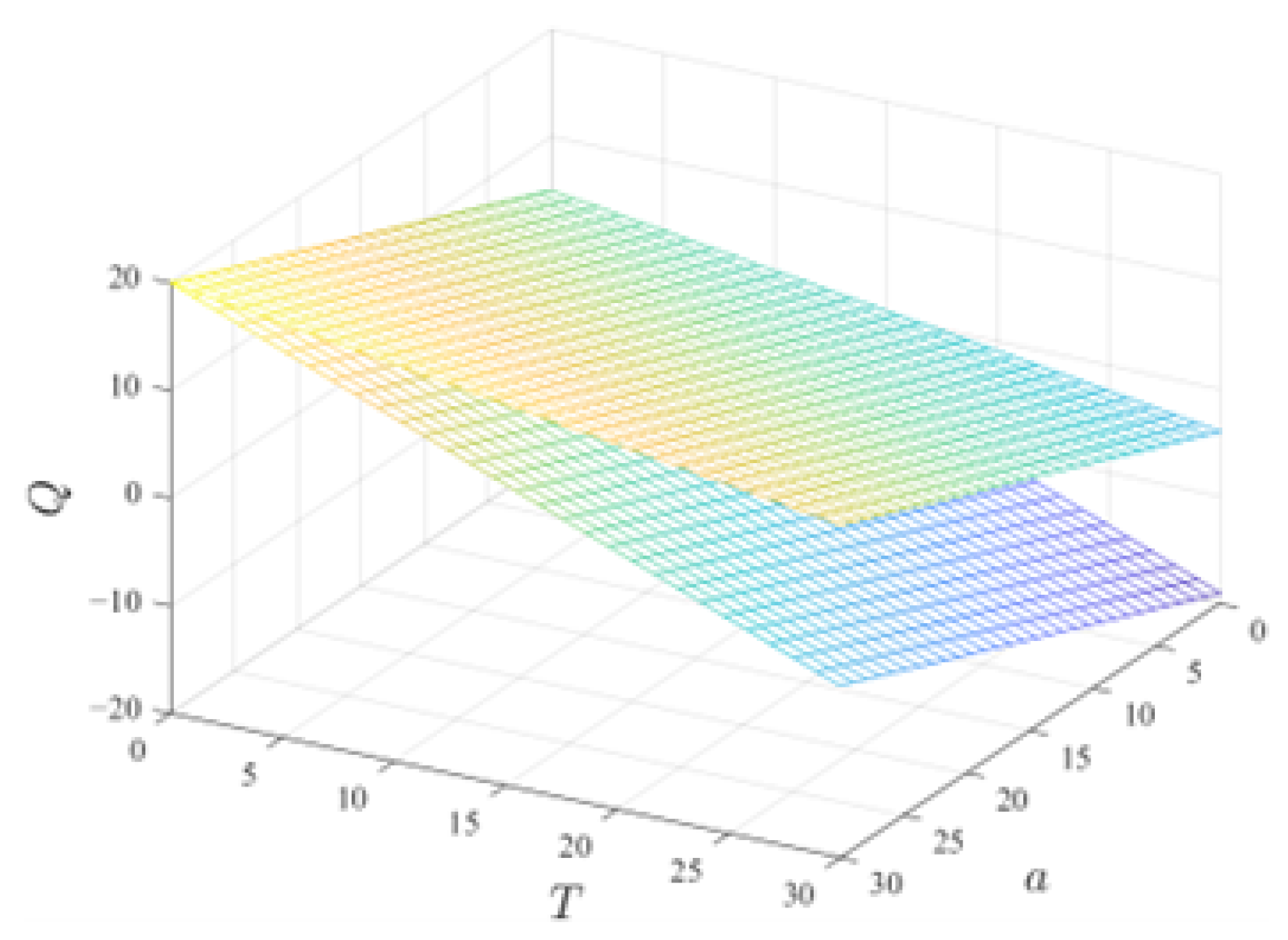

To examine the impact of sensitivity on sales, let

and select

and

. The variations in sales under different price sensitivities are shown in

Figure 4. Similarly, let

and select

and

. The changes in profit under different advertising sensitivities are shown in

Figure 5.

In

Figure 4, the upper and lower surfaces, respectively, represent the scenarios of

and

. An increase in price reduces sales, while an increase in advertising levels enhances sales. From a sales perspective, to ensure

, it is necessary to set

and

. Moreover, the higher the price sensitivity, the more the price gap

between high- and low-type consumers should be controlled to avoid a significant reduction in the sales of low-type consumers. From the perspective of price sensitivity, if

, the upper surface represents high-type consumers, and their sales are higher at the same price. When

, the condition

holds, and the price gap widens as the price increases. To ensure that

, it is necessary to set

. Under such conditions, high-type consumers will certainly purchase more, corresponding to Scenario T1. Conversely, if the upper surface represents low-type consumers and

, then it is essential to set

and for

to exceed

. Based on this analysis, Proposition 9 leads to Corollary 9.4.

Corollary 9.4. From the perspective of price sensitivity, regardless of whether high-type consumers exhibit higher or lower price sensitivity, to ensure higher sales from high-type consumers, businesses should set lower prices for high-type consumers.

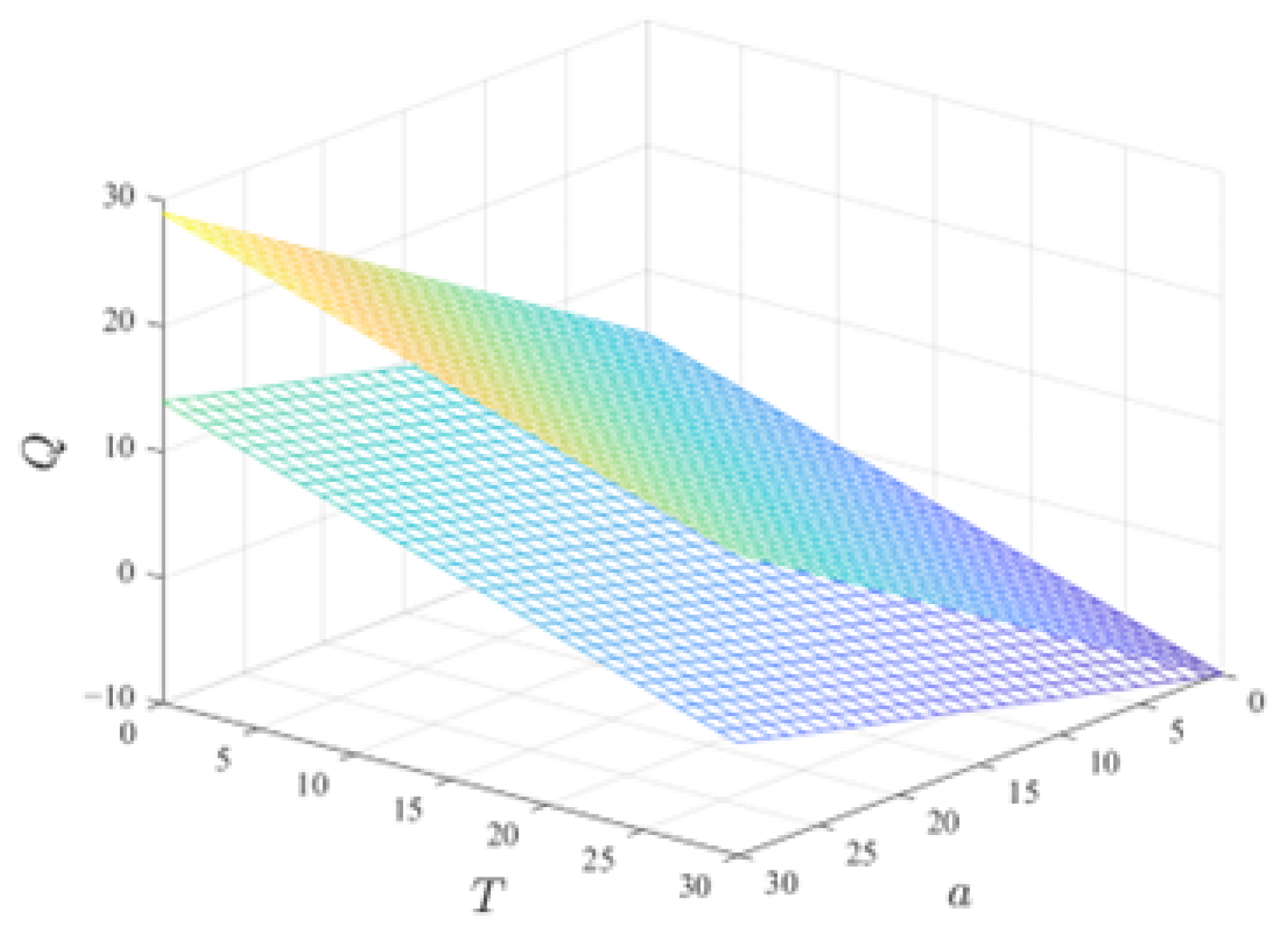

In

Figure 5, the upper and lower surfaces represent the scenarios of

and

. As consumer sensitivity to advertising increases, the reduction in sales caused by price increases is offset by advertising effectiveness. When advertising sensitivity is high, additional advertising can lead to an increase in sales compared with the (0, 0) scenario. When consumers exhibit different levels of advertising sensitivity, price variations have the same effect on sales; however, with higher advertising sensitivity, the interplay between price and advertising means that sales may eventually increase even as prices rise. From a sales perspective, to ensure

, businesses should set

. When advertising sensitivity is low, it is necessary to set

to prevent sales losses caused by price increases. As advertising sensitivity increases, businesses can ultimately set

. This leads to Corollary 9.5.

Corollary 9.5. From the perspective of advertising sensitivity, to ensure higher sales from high-type consumers, businesses should set lower prices for high-type consumers. However, as advertising sensitivity increases, when it becomes sufficiently high, businesses may also set higher prices for high-type consumers.

6.3. Numerical Simulation of Sensitivity’s Impact on Sales

To investigate the impact of sensitivity on e-commerce profits, let

, set

, and 0.3, and plot the changes in profit under different levels of price sensitivity, as shown in

Figure 6. Additionally, let

, set

, and plot the changes in profit under different levels of advertising sensitivity, as illustrated in

Figure 7. To fully observe the entire profit changing process, the negative axis has not been removed. Due to the presence of advertising and product procurement costs, businesses typically do not cease operations unless losses become unsustainable.

In

Figure 6, the surfaces from bottom to top represent the scenarios of

and

, reflecting different levels of price sensitivity. It can be observed that the lower the price sensitivity of consumers, the faster the increase in corporate profits. As shown in

Figure 3, profits initially decrease and then increase with price growth. Similarly, in

Figure 6, under varying price sensitivity, profit changes follow the same trend: a decrease followed by an increase as price rises. With higher price sensitivity, the critical price

decreases, meaning prices reach the critical point more quickly. Therefore, the higher the price sensitivity, the more important it becomes to control the price difference, ensuring that high-type consumers are charged higher prices, setting

. This is effectively illustrated in the figure.

Within the critical price range, the pricing mechanism should ensure , even when . The role of advertising expenditure on profits also follows a similar pattern of first decreasing and then increasing. When the advertising expenditure level is low, profits decline as prices increase. Conversely, when advertising levels are high, profits rise with increasing prices. At low price levels, higher advertising expenditure results in lower profits. For higher price levels, increasing advertising levels lead to profit growth. However, when price sensitivity is high, simultaneous increases in price and advertising expenditure may fail to yield positive profits until further increases in both factors occur.

Examining the surfaces, if , it is necessary to design to ensure equal or higher profits for high-type consumers. As the price increases, the price gap widens. Based on Proposition 3, this leads to Corollary 3.1

Corollary 3.1. The lower the price sensitivity of consumers, the faster the growth in corporate profits. As price sensitivity increases, the critical price is more easily achieved. When price sensitivity is high, an increase in advertising expenditure may temporarily fail to offset the profit loss caused by rising prices, necessitating further increases in advertising levels. For high-type consumers with higher price sensitivity, a pricing mechanism with higher prices for high-type consumers must be established.

In

Figure 7, the surfaces from top to bottom correspond to the cases of

and

, respectively. When the advertising level is low, an increase in price reduces profits. Conversely, when the level of advertising is high, an increase in price enhances profits, and the higher the advertising sensitivity, the faster the rate of profit growth with price increases. When prices are low, profits decline more rapidly as advertising sensitivity rises. In such cases, it is advisable to design

until the price surpasses the critical price

, at which point profits begin to rise, and

should be implemented. Moreover, as advertising sensitivity increases, the critical price

rises.

With increasing product prices, under the condition , the firm should ultimately design to achieve higher profits. Notably, in the case of , the critical price is never reached, and the profit function continues to decline. Under these circumstances, the firm will only design , necessitating further price increases until the price exceeds a critical value. Based on Proposition 3, Corollary 3.2 can be derived.

Corollary 3.2. As product prices rise, considering higher advertising allocation to high-type consumers, firms should ultimately design a higher price scheme for high-type consumers to maximize profits. However, if advertising sensitivity is low and advertising level is low, the firm will only implement a pricing mechanism with lower prices for high-type consumers.

The conclusion regarding the attainment of critical prices in Corollary 3.2 corroborates the findings in Corollary 1.3.

6.4. Numerical Simulation of the Impact of Advertising Sensitivity on Targeted Advertising Levels

When consumer types remain unchanged, the impact of advertising sensitivity on advertising levels is similar under both uniform and targeted advertising scenarios. The primary difference is that the advertising level is generally lower under uniform advertising, as outlined in Proposition 7.

Therefore, this analysis focuses on the targeted advertising scenario to examine the impact of advertising sensitivity on advertising levels. Let

, vary to explore the effect of changes in high-type consumers’ advertising sensitivity, setting

,

, and

, as shown in

Figure 8. Similarly, let

, vary to analyze the effects of changes in low-type consumers’ advertising sensitivity, setting

,

, and

, as illustrated in

Figure 9.

In

Figure 8, the lower, middle, and upper surfaces represent the cases of

,

, and

, respectively. The pricing issue can be illustrated through the plane of

. As the level of advertising increases with

, the advertising level increases with

. When

, there are many possible values for advertising level.

As advertising sensitivity increases, when the price for low-type consumers is fixed, increasing the price for high-type consumers leads to higher advertising levels. As the price gap

increases for high-type consumers, the optimal advertising level decreases as sensitivity increases. When advertising levels are low, to ensure

, as shown in

Figure 8, it is necessary to set

first; as advertising levels rise, with higher prices for low-type consumers, it is essential to first design

, and then switch to setting

. As advertising sensitivity increases, achieving the optimal advertising level becomes easier, and it is more appropriate to set

. From this analysis, the following Corollaries can be derived as follows:

Proposition 10. When advertising levels are low, the critical price is quickly reached, and firms tend to implement a higher price mechanism for high-type consumers. When advertising levels are high, the firm may implement a lower price mechanism for high-type consumers, where prices remain below the critical price.

Proposition 11. As the advertising sensitivity of high-type consumers increases, it becomes increasingly difficult for the price to exceed the critical price. The process of implementing a higher price mechanism for high-type consumers is delayed relative to the case of lower advertising sensitivity.

In

Figure 9, the upper, middle, and lower surfaces represent scenarios when

,

, and

, respectively. When the advertising level is low, the firm opt to design a higher price for low-type consumers (

). When the advertising level is higher, as the advertising sensitivity of low-type consumers increases, the firm chooses to set a lower price for low-type consumers (

). If the advertising sensitivity of low-type consumers is lower than that of high-type consumers, the total amount of advertising will remain at a certain level, and the firm will set

until the optimal advertising level is reached, after which

will be implemented.

From the perspective of low-type consumer advertising sensitivity, the following Corollaries can be derived as follows:

Proposition 12. From the low-type consumers’ perspective, if the advertising level is low, the firm will opt to design a higher price mechanism for low-type consumers; as the advertising level increases, the firm will change the pricing mechanism to a lower price for low-type consumers.

Proposition 13. From the perspective of low-type consumer advertising sensitivity, an increase in advertising sensitivity of low-type consumers will lead the firm to adopt a lower price mechanism for low-type consumers more quickly.

It can be observed that Proposition 10 and Proposition 12 seem contradictory. This is because the total amount of advertising expenditure is calculated by summing the advertising levels for high- and low-type consumers. However, in the case of precise advertising, the advertising levels for high- and low-type consumers can increase simultaneously or shift in opposition. The specific pricing strategy still depends on the product price, as described in Corollary 1.1 and Corollary 1.2.

6.5. Impact of Consumer Types on Full-Scale Advertising: Numerical Simulation

Compared to the precise advertising scenario, in the full-scale advertising scenario, the total advertising level is lower due to the influence of consumer type, but the advertising costs are relatively higher. Let

,

. Set

and

to analyze the impact of the proportions of consumer types on the merchant’s optimal advertising investment level. The optimal advertising levels are shown in

Figure 10.

Figure 10 shows the relationship between the advertising investment level and the prices of high- and low-type consumers under different conditions. The planes corresponding to the advertising investment level of 0, from left to right, are as follows:

,

, and

. Due to the price constraints on low-type consumers, the impact of high-type prices on the advertising investment level is not fully reflected in the figure, and the following analysis uses

as the dividing line. From

Figure 10, it can be observed that the price changes for high-type consumers have a relatively large impact on the advertising investment level. From the perspective of advertising investment, when the investment level is low, the price for high-type consumers should be higher. As the investment level increases, it may be more advantageous to set higher prices for low-type consumers. The proportion of consumers in the market significantly impacts the achievement of the optimal advertising investment level. As the proportion of high-type consumers increases, advertising investments should favor higher prices for high-type consumers. Therefore, based on Proposition 6, Corollary 6.1 can be concluded as follows:

Corollary 6.1. From the perspective of advertising investment, as the proportion of high-type consumers increases, the merchant should set higher prices for high-type consumers more quickly.

7. Research Conclusions and Policy Recommendations

This study develops a pricing model for merchants in platform-based economies that considers heterogeneous consumers, investigates merchant strategy choices and pricing mechanism designs under scenarios of both full and targeted advertising. This study explores the factors influencing pricing mechanisms.

7.1. Research Findings

The main findings are as follows:

First, the process of attracting and retaining consumers spans the entire merchant lifecycle. In the early stages, merchants attracted and retained high-type consumers by offering lower-priced schemes. In the later stages, once the existing customer base is secured, merchants may attract new customers through low prices for low-type consumers, while ultimately offering high prices to high-type consumers.

Second, the critical price is central to a merchant’s pricing mechanism. When the price is below the critical price, a pricing scheme with lower prices for high-type consumers should be designed. When the price exceeds the critical price, the pricing mechanism should be adjusted to a higher price for high-type consumers.

Third, the critical price determines the development stage. Factors such as an increase in advertising investment, a decrease in consumer price sensitivity, and the increase in advertising sensitivity all increase the critical price, thereby delaying the transition to the optimal pricing scheme. Similarly, the platform’s commission rate and the increase in production and shipping costs also delay the implementation of higher prices for high-type consumers. When advertising investment is low, the critical price is quickly reached, and merchants tend to set higher prices for high-type consumers.

Fourth, if high-type consumers derive greater utility from a product, a higher price mechanism for high-type consumers should be designed. The proportion of high-type consumers also influences the pricing mechanism by encouraging merchants to set higher prices for high-type consumers. As the price sensitivity of high-type consumers increases and eventually exceeds that of low-type consumers, merchants set higher prices for high-type consumers. As product prices rise, merchants will also prefer to invest more in advertising targeted at high-type consumers, which will result in higher prices for these consumers.

Fifth, the lower the price sensitivity of consumers, the faster the company’s profit increases. When price sensitivity is high, increasing advertising investment may not compensate for the profit losses caused by price hikes, leading to a decrease in profits. In such cases, the merchant may have to further increase advertising investment. If advertising sensitivity is low and the advertising investment is insufficient, merchants will only offer lower prices for high-type consumers.

Sixth, when advertising sensitivity is higher, the merchant should set lower prices for high-type consumers, and with the increase in advertising sensitivity, higher prices for high-type consumers may become more feasible. As advertising investment increases, the merchant should adjust the pricing mechanism to match advertising levels to consumer sensitivity.

Seventh, if the merchant prioritizes boosting sales, they will lower product prices to attract more buyers. When the price sensitivity of consumers increases, merchants should lower prices for more price-sensitive consumers to maintain sales volume. Advertising sensitivity has a similar effect, and increasing advertising sensitivity may allow for higher prices for high-type consumers, depending on the product’s pricing structure.

Eighth, with the same level of advertising investment, the cost of targeted advertising is relatively low, and merchants tend to favor targeted advertising. However, in full advertising scenarios, the total advertising cost may be relatively higher, but the investment might be spread more evenly across consumer types.

7.2. Managerial Implications

Based on the findings, the following recommendations are made for merchants on platform-based e-commerce platforms: First, before designing pricing schemes for different consumer types, merchants should first assess the consumer’s satisfaction with the product and their attitudes toward price increases and advertising. This will help in determining the price differences and the advertising investment model. Second, merchants should focus on maximizing profits by initially offering lower prices to high-type consumers, then progressively adjusting the pricing mechanism as they move into later stages of business development. When adjusting the pricing mechanism, merchants should be aware of the delayed effect of advertising investment and the dampening effect of consumer price and advertising sensitivity on the mechanism adjustments. Third, merchants should prioritize targeted advertising to lower advertising costs while achieving high levels of advertising investment. However, if platform constraints on advertising costs and commission rates are considered, merchants may need to balance their decision between targeted and full advertising models. Fourth, merchants aiming to increase sales volume should lower prices, considering consumer price sensitivity. In such cases, they should offer discounts to more price-sensitive consumers and consider using techniques such as hidden coupons or collaborations with influences to boost sales while maintaining competitive prices. Fifth, given that platforms often prioritize GMV, merchants may choose to sacrifice short-term profits in exchange for higher sales volume. In this case, they should reduce prices while minimizing the price gap between consumer types.

In conclusion, this study provides valuable theoretical insights into optimizing pricing and advertising strategies for merchants in platform-based e-commerce environments. However, it is important to acknowledge several limitations in the current model. First, the analysis is focused on a single-platform scenario, assuming that merchants operate exclusively within one platform. As such, the model does not address the complexities of cross-platform pricing coordination, which is an important issue in multi-platform environments. Second, the model does not fully capture the need for differentiated pricing strategies tailored to specific platform characteristics, which could be a valuable extension of the current approach. Third, the study does not account for the spillover effects of advertising from self-media and social media platforms on e-commerce platforms, which may lead to an underestimation of the actual impact of advertising strategies. Additionally, the potential negative externalities of advertising investment, such as consumer fatigue from excessive promotion, have not been considered, which could provide a more nuanced understanding of the effectiveness of advertising strategies. Lastly, the model does not incorporate the time dynamics of consumer preference evolution, advertising fatigue, or the development of brand loyalty, which could influence long-term pricing and advertising outcomes.

Future research could address these limitations in several ways. First, it would be beneficial to explore mechanisms under the assumption of varying initial consumer endowments, allowing for changes in consumer preferences over time, and potentially incorporating advertising fatigue effects. Second, expanding the model to consider multi-platform competition would be valuable, allowing for an exploration of cross-platform synergies in pricing and advertising strategies, as well as spillover effects between platforms. This would provide a more comprehensive understanding of merchant decision making in the fragmented digital system. Third, investigating the impact of self-media advertising on product sales across different e-commerce platforms could offer additional insights into how advertising strategies can be optimized in a fragmented digital market. Further research in these areas could offer more comprehensive strategies for merchants, ultimately enhancing the practical applicability of pricing and advertising models in real-world e-commerce environments.