1. Introduction and Background

Small and medium-sized enterprises (SMEs) play a pivotal role in stimulating global economic growth and generating employment opportunities [

1]. The World Bank highlights that SMEs represent 90% of all businesses and account for more than half of global employment. However, their growth continuously faces a major obstacle: SMEs are less likely to be able to secure bank loans than larger enterprises [

2]. In this context, Supply Chain Finance (SCF) has emerged as a viable financing alternative, offering SMEs access to low-cost, short-term loans and enhancing the liquidity of their cash flows [

3]. In recent years, SCF has emerged as a crucial element of global supply chain development and has demonstrated significant growth potential. According to the Supply Chain Finance Global Market Report 2023 by ReportLinker, the SCF market was valued at

$5.65 billion in 2022, with forecasts predicting growth to

$8.86 billion by 2027, achieving a compound annual growth rate (CAGR) of 9.2% [

4].

In SCF, three primary categories are identified:

accounts receivable financing (ARF),

advance payment financing, and

inventory financing, with ARF being the most widely used method. In the ARF process, financial institutions extend credit to businesses based on accounts receivable generated from legitimate trade agreements between the financing entity (seller) and the core business (buyer). Upon the repayment term’s conclusion, the core business is obliged to settle the loan and interest with the financial institution, leveraging the sales revenue earned [

5]. Practically, ARF could enable SMEs upstream of the supply chain to more easily access finance, improve the flexibility of their cash flows, and promote their further development [

6].

However, in its practical operations, the traditional ARF business still faces some challenges, including information asymmetry, ineffective credit transmission, a lack of reliable information systems, and low efficiency in operational processes [

7]. These issues cause problems such as high financing thresholds, high financing costs, and sluggish financing processes for SMEs that remain unsolved [

8]. In addition, financial institutions that provide loans for SMEs face high credit risks and may potentially deal with the phenomena of SMEs defaulting or even colluding with core enterprises.

Fortunately, with the advancement of blockchain technology, the aforementioned barriers to the ARF process could be effectively overcome. Blockchain technology has four fundamental features: decentralization, traceability, tamper-proof nature, and smart contracts [

9,

10]. Because of these characteristics, all stakeholders in the ARF process can break information barriers and achieve genuine transaction transparency while protecting data privacy [

11,

12,

13,

14]. For financial institutions, utilizing blockchain technology can resolve information asymmetry issues and mitigate credit risks. All transactions and invoices are recorded and transferred on the blockchain platform, rendering the ARF process more efficient and transparent. For small and medium-sized suppliers, lower financing costs and a reduced accounts receivable period are possible due to the expedited loan acquisition from financial institutions using the blockchain platform. For core enterprises, blockchain technology can extend the repayment period of accounts receivable, thus enhancing cash flow flexibility. Therefore, integrating ARF with blockchain technology creates a win-win-win situation for all three parties. In practice, some financial institutions have successfully integrated blockchain technology into the ARF process. For instance, in 2017, China Zheshang Bank launched the Accounts Receivable Chain Platform to enhance mutual trust between enterprises and financial institutions, easing financing challenges for small and medium-sized enterprises. Furthermore, the Supply Chain Receivables Service Platform by China Ping An Bank enhances accounts receivable management and offers trading services for primary companies and their associated SMEs upstream. The effective deployment of such platforms demonstrates blockchain’s role in elevating operational efficiency across businesses.

Apart from ARF, another emerging concept in SCF is

collaborative finance [

15], which is enabled using blockchain. In this approach, multiple inter-organizational payments are withheld, and final settlements are made at specific intervals by calculating incoming and outgoing payments among the organizations in the supply chain. Collaborate finance differs from ARF because it involves multiple parties and focuses on net settlement rather than financing based on individual accounts receivable. In addition, it leverages blockchain’s transparency and immutability to facilitate trust and coordination among supply chain participants, enabling more efficient financial flows and reducing the need for intermediaries.

Current research into blockchain’s integration with SCF, particularly within ARF transactions, has yielded significant insights.

Evolutionary Game Theory serves as a reliable method for studying the mechanism of blockchain technology in SCF. It describes the dynamic process of equilibrium evolution when participants have limited rationality [

16,

17]. Zhou et al. (2021) [

8] explored blockchain’s role in enhancing supply chain finance by building an evolutionary game model to examine interactions among financial institutions, SMEs, and both core and smaller enterprises. Their analysis showed that for financial institutions, embracing blockchain platforms becomes a key strategy, aiding SMEs in making reliable decisions by improving credit distribution, elevating financial efficiency, escalating the costs associated with defaults, and diminishing interest rates. Sun et al. (2021) in [

7] also designed an evolutionary game model, this time focusing on the dynamic between SMEs and financial institutions, to assess how blockchain could lessen the financial uncertainties faced by supply chains. They discovered that blockchain not only lowers the financial risks for banks but also addresses the financing hurdles faced by SMEs. In addition, Zhu et al. (2023) [

18] introduced a three-party stochastic evolutionary game model involving financial institutions, core enterprises, and MSMEs. They found that while the incentive for information sharing motivates financial institutions to adopt blockchain, the risks associated with information sharing and the degree of regulation have a discouraging effect on blockchain implementation. Despite progress, the examination of blockchain’s mechanisms within supply chain finance remains underdeveloped, with few studies delving into the adoption factors and the response of banks and SMEs to blockchain in this context. Our research aims to explore these areas, particularly focusing on how blockchain maturity and financial institutions’ risk preferences influence ARF strategy development and the practical deployment of smart contracts. We hope to answer the following primary questions:

Q1: How do the maturity of blockchain technology and risk preferences of financial institutions affect the evolution of the ARF strategy of financial institutions and SMEs?

Q2: How can the application of smart contracts on the ARF process be realized in real-world scenarios from a technical perspective?

Hence, the research subject in this study is accounts receivable factoring. The evolutionary game analysis method serves to classify SMEs’ default behavior as either unilateral or collaborative schemes with principal companies, aiming to evaluate the evolutionary stable strategies (ESSs) of both financial entities and SMEs. Based on relevant research, this study examines two additional factors: the maturity level of blockchain implementation and the risk preferences of financial institutions. Through scrutinizing the equilibrium strategies’ stability, we delineate key elements that shape decision-making processes and investigate blockchain’s role in bolstering system robustness by mitigating risks. In addition, drawing on existing research [

19,

20,

21,

22,

23], we design smart contracts for the ARF process that are feasible in real-world applications.

The rest of the paper is organized as follows: We formulate the problem in

Section 2 and provide the assumptions and parameter settings for the model.

Section 3 describes the evolutionary game model for introducing blockchain technology into the ARF process.

Section 4 presents a numerical example using MATLAB version 2021b.

Section 5 describes a simulation of the smart contracts that can be used in real-world scenarios. In

Section 6, the main conclusions are discussed.

2. System Modeling and Problem Formulation

2.1. Blockchain-Enabled Evolutionary Game Model for ARF

Blockchain was first proposed by Nakamoto in 2008 [

24]. It can be viewed as a public ledger where all submitted transactions are stored in the blockchain. The chain keeps growing as new blocks are added to it [

25]. The tamper-proof feature of blockchain guarantees authenticity and transparency, allowing ARF participants to monitor transactions and fund usage closely, while financial institutions can prevent fraud and contract violations.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They are stored and replicated on a blockchain network, automatically executing when predetermined conditions are met. Smart contracts enable the automation of complex processes, reducing the need for intermediaries and increasing efficiency [

26].

There are primarily three types of blockchains: public, private, and consortium. Public blockchains, such as Bitcoin and Ethereum, are open to anyone and are fully decentralized [

27]. Private blockchains, on the other hand, are permissions and controlled by a single entity. Consortium blockchains, like Hyperledger Fabric, use more efficient consensus algorithms, such as Practical Byzantine Fault Tolerance (PBFT) or Raft, which rely on a selected group of nodes to validate transactions and update the ledger [

28]. This approach eliminates the need for resource-intensive mining processes used in public blockchains, resulting in faster transaction confirmation times and lower energy consumption. The improved efficiency and performance of modern blockchain systems, particularly Consortium blockchains, make them well-suited for supply chain finance applications. These advancements enable the processing of a large volume of transactions in real time, facilitating the smooth operation of the ARF process and enhancing the overall efficiency of supply chain finance.

Specifically, blockchain technology streamlines the process by enabling SMEs and core enterprises to upload transaction details and electronic accounts receivable onto a blockchain-based ARF platform, where SMEs can easily apply for and receive loans online.

Figure 1 shows the process of blockchain-based ARF. Conventionally, SMEs deliver products to core enterprises (step 1), and core enterprises provide receivable accounts (step 2). With the blockchain-based ARF platform, SMEs can easily apply for loans online (step 3). Then, financial institutions can efficiently evaluate supplier credit (step 4), significantly easing and lessening the financing process’s expenses. After uploading the transaction information (step 5), SMEs can receive funds rapidly (step 6), often on the same day they apply for financing. Consequently, SMEs and core enterprises can concentrate on growth and reap greater benefits (step 7). In step 8, the core enterprise pays the loan and interest.

2.2. Parameter Setting and Model Assumptions

Though an evolutionary game model for the ARF process has been proposed, the existing research fails to consider financial institutions’ preferences regarding risk or to highlight the influence of the maturity of blockchain technology on the game process.

Table 1 shows the definitions of parameters.

Our model is based on the following assumptions.

Assumption 1. In real business scenarios, ARF primarily occurs upstream in the supply chain, which is simplified into a business system consisting of an SME, a core enterprise, and a financial institution. The core enterprise has two strategies: it can either serve as a guarantor for the loan when an SME applies or not do so. If the core enterprise chooses not to serve as a guarantor for the SME, it violates the core requirements of the ARF, which does not have any research point. Consequently, the discussion here focuses solely on the strategy choices of the financial institution and the SME, both of which are finite rational game players that aim to maximize their utility.

Assumption 2. The financial institution can choose to either approve or deny the SME’s ARF request. We assign the probabilities of approval and denial as x (0 < x < 1) and 1 − x, respectively. The SME also faces two strategic options: adherence or defiance, with probabilities labeled y (0 < y < 1) and 1 − y, respectively.

Assumption 3. SMEs adhere to contracts by delivering goods in a timely and up to the specified standards. Non-adherence could lead to the creation of fraudulent contracts with the core enterprise to secure loans, with a likelihood represented by α (0 < α < 1), or it might result in a unilateral breach or incomplete fulfillment of the contract, with the likelihood of such instances indicated by 1 − α.

Assumption 4. The total accounts receivable held by the SME are represented as . Upon applying for factoring financing from financial institutions, these institutions first assess the credit of the SME and the core enterprise, a process costing . If the application is approved, the institution disburses a loan amounting to to the SME, who, in turn, transfers the accounts receivable documents and creditor rights. Should the institution reject the application after reviewing the credit, it reallocates the funds to alternative ventures, yielding a return denoted by .

Assumption 5. The return rate of the SME during standard operations is denoted by , and the cost of meeting the contract’s production requirements is denoted by . Following the loan receipt, the SME may default or fulfill the contract. In default scenarios, if the SME collaborates with the core enterprise for a loan scam, the proceeds are split with a predefined ratio of (0 < < 1). If the SME defaults independently, the core enterprise repays less than the debt’s face value, and the SME covers the shortfall. This default leads to the forfeiture of future collaboration opportunities with the core enterprise, with the total payable by the SME indicated by .

Assumption 6. Blockchain technology enables direct transaction validation and authenticity verification, obviating the need for intermediaries, thus enhancing SME financing avenues and overall supply chain profitability. In the blockchain-enhanced ARF platform, information transparency significantly reduces the cost of information acquisition for all supply chain participants to nearly zero. Consequently, the default cost for SMEs post-blockchain implementation approaches infinity, i.e., . Moreover, financial institutions are spared the credit investigation expenses, , but must cover the blockchain platform’s establishment and upkeep costs, denoted by , which are substantially lower than .

Assumption 7. In the real world, financial institutions mainly have three types of risk preferences, namely, risk-taking, risk-neutral, and risk-averse, and these three kinds of risk preferences are accompanied by different costs, respectively. In the evolutionary game model incorporating blockchain, the financial institution incurs an additional cost from the risk preference only when it chooses to accept the SME’s factoring application. We denote the risk preference of the financial institution (, with indicating that the financial institution is completely risk-averse and indicating no aversion to risk. The additional cost from the risk preference is largest when the financial institution has no aversion, which is denoted . Therefore, the corresponding additional cost of risk preference to the financial institution is simplified as .

Assumption 8. With the development of blockchain technology, the Blockchain-enabled ARF Platform is increasingly mature and facilitates the ARF process more efficiently, thus generating additional benefits only when the financial institution chooses to accept the SME’s factoring application. The maturity of the existing Blockchain-enabled ARF Platform is denoted (, with indicating that the blockchain platform is not exiting and indicating that the blockchain platform is completely mature. The additional benefits are largest when the exiting platform is completely mature, which is denoted . Therefore, the corresponding additional benefits from the development of blockchain technology are simplified as .

2.3. Game Payoff Matrix Development

Within this game, the financial institution’s choices are binary: to approve or reject the SME’s application for factoring. The SME may either adhere to the contract or refuse, potentially engaging in collusion with the core enterprise. Consequently, six distinct outcomes could arise from the interaction between the financial institution and the SME, as illustrated in

Table 2.

Scenario 1. The financial institution’s approval of the SME’s application entails costs such as the blockchain ARF platform’s maintenance fee , potential deposit interest , and additional costs due to risk preferences . If the SME abides by the contract, and the financial institution recovers the accounts receivable, which is ensured on the blockchain-enabled ARF platform, an income, , is generated, as well as additional benefits from the maturity of the blockchain technology, , for the financial institution. Hence, the financial institution’s net income equates to for this scenario. Conversely, the SME secures a loan of for its production activities, leading to revenue of . Given the production expenses is , the SME’s net income is calculated as in this situation.

Scenario 2. When the financial institution accepts the SME’s application for factoring but does not comply with the contract, the core enterprise is hindered in its standard production activities due to the inferior quality of goods supplied by the SME. The core enterprise then pays for the loan at an amount below the book value, and the blockchain-enabled ARF platform automatically withdraws an amount of money, , from the SME to punish its default behavior and compensate for the remainder of the loan. Compared with Result 1, in this scenario, the financial institution’s net income remains unchanged, but the SME’s net income decreases dramatically, represented as and , respectively.

Scenario 3. In cases where a financial institution approves factoring, fraudulent cooperation between the SME and core enterprise may result in unrecoverable bad debt for the financial institution. In this scenario, the financial institution incurs the loss on the debt, , the deposit interest, , the maintenance fee for the blockchain-enabled ARF platform, , and the additional cost from its risk preference, , within the corresponding period. Hence, the financial institution’s net income is . Because the contract is fraudulent, the SME is not obliged to deliver products to the core enterprise and has no corresponding production cost, C, while it obtains a part of the normal production income, , from the loan. Thus, the SME’s net income is .

Scenario 4. If a financial institution declines a factoring application after reviewing an SME’s credit on the Blockchain-enabled ARF Platform, the core enterprise can still ensure smooth operations by paying the SME’s accounts receivable on time. The financial institution has an income, , generated by the amount of that it declines to provide a loan for the SME, but it still must pay the maintenance fee of the Blockchain-enabled ARF Platform, , so its net income is . After the core enterprise repays the loan (R), the SME recovers the loan amount; thus, the net income is .

Scenario 5. In this scenario, after the financial institution rejects the factoring request upon reviewing the SME’s credit via the blockchain ARF platform, the SME provides substandard products to the core enterprise and breaches the contract. The core enterprise settles the receivables for less than their full value, with the SME covering the shortfall, reflected in the standard default cost, . This leaves the financial institution’s net income unchanged from Scenario 4, while the SME’s net income drops, calculated as and .

Scenario 6. When a financial institution rejects an SME’s factoring application after evaluating credit using a blockchain-based ARF platform, it effectively blocks any potential fraudulent loan arrangements between the SME and the core enterprise. This action results in the SME not generating any income from such schemes. The financial institution’s net income remains consistent with Scenarios 4 and 5, at , whereas the SME’s net income falls to zero.

3. Analysis of the Game Model

This section explores how evolutionary game theory can be utilized to analyze supply chain remanufacturing. Because evolutionary game theory is an effective tool for analyzing and predicting the evolution of an individual’s behavior in a given environment, it is particularly applicable to analyzing the interactions between financial institutions and SMEs in a supply chain remanufacturing environment.

3.1. Applicability of Evolutionary Game Theory

In the first place, evolutionary game theory provides a framework for analyzing the dynamic interaction between financial institutions and SMEs. This dynamism is a key feature of supply chain remanufacturing environments, in which behaviors and strategies evolve over time and under changing conditions. Second, the theory can serve to model the complex decision-making processes that occur in supply chain remanufacturing. For example, an SME’s decision whether to comply with or violate a contract is influenced not only by immediate financial rewards but also by considerations regarding long-term credibility and partnership. On the other hand, supply chain remanufacturing is fraught with risk and uncertainty, and evolutionary games can take into account the impact of these factors on strategy choices. For example, financial institutions must evaluate credit risk and operational risk when considering whether to accept a factoring application.

3.2. Replication Dynamic Equation of the Financial Institution and the SME

Referring to the previous literature [

29,

30], we introduced parameters such as blockchain technology maturity and update frequency during the modeling process in order to synthesize the blockchain technology factors that would affect the decision-making of financial institutions and the strategic choices of small and medium-sized enterprises.

Specifically,

represents the anticipated return of the financial institution when it chooses to accept the application. Conversely,

represents its anticipated return if it declines the application and

represents average return. All of them can be expressed as a probability-weighted payoff as

The replicator dynamic equation of the financial institution is given by the following differential equation

The equilibrium exists when

F(

x) = 0. When

F(

x) = 0, we obtain the stationary point as

Equation (4) reveals that equals zero when the SME’s probability of compliance is at , indicating a state of equilibrium unaffected by external variables. In such instances, any value of solves , establishing all values as equilibrium points, signifying a state of stasis across all scenarios.

The stability of the differential equation indicates that if , equilibrium is achieved when and simultaneously. If , with , it suggests an evolutionarily stable strategy at . If the probability of the SME honoring the contract exceeds a specific threshold , the system will evolve towards a state where the financial institution chooses to accept factoring applications. Conversely, if , with , an evolutionarily stable strategy emerges, guiding the system towards a state where the financial institution rejects applications.

At the heart of replication dynamics is the principle that within a group, the adoption of more effective strategies by individuals steadily grows. Equation (6) illustrates that the financial institution’s decision-making process regarding factoring applications is not influenced by the costs associated with credit checks; rather, it is determined by assessing credit risk. Thus, while blockchain technology may enhance a financial institution’s profits by lowering operational risks, the pivotal factor in its decision-making remains the effect of blockchain on assessing credit risk.

Equation (6) also clarifies that the financial institution’s commitment rate, , has a direct relationship with the SME’s likelihood of adhering to the contract, y. This is because the commitment rate largely hinges on the SME’s creditworthiness and contractual terms. When an SME is deemed low-risk due to high creditworthiness, the financial institution is more inclined to approve its factoring requests, leading to an increase in the commitment rate. Additionally, aiming for sustained relations, SMEs regulate their actions to uphold a strong reputation with the financial institution. Moreover, the chance of collusion, α, is inversely related to y, indicating that as α escalates, the propensity for SMEs to engage in fraudulent collusion rises, consequently diminishing their likelihood of fulfilling contractual obligations. This underscores collusion as a critical factor in credit risk and a primary reason for contract violations.

3.3. Replication Dynamic Equation of the SME

The SME’s expected return is expected to be

when it fully complies with the contract and

when it does not comply with the contract. The average expected return is denoted as

, and its calculation is as follows

The replication dynamic equation of the SME is

, thus we have

Thus, these equations pinpoint the equilibrium of the differential equation, establishing that for , the value of P must exceed .

Equation (12) reveals that equals zero when the financial institution’s acceptance probability is , indicating a static state unaffected by external variables. In such circumstances, any value of y resolves , making every value an equilibrium point and all states stable.

Based on the differential equation’s stability criteria, for a scenario where deviates from , achieving an Evolutionarily Stable Strategy necessitates that equals zero and its derivative, is less than zero.

If is below , with , it establishes as an ESS. This implies that if the financial institution’s probability of approving the application falls beneath the dynamic leads to the SME adhering to the contract. Conversely, if , and F′(0) is below zero, then becomes an ESS, indicating that if the likelihood of the financial institution approving the application exceeds the threshold , the dynamic of the system shifts, leading to a scenario where the SME is more likely to default on its obligations.

Furthermore, if P exceeds , as demonstrated in Equation (12), a smaller results in a larger value. Consequently, a risk-averse financial institution is more hesitant to approve the SME’s application. Nonetheless, if the financial institution decides to proceed with the approval, the SME is likely to leverage this opportunity. The SME thoroughly evaluates the long-term advantages of continued cooperation and opts to comply with the contract. Conversely, if the financial institution shows a higher propensity to approve the application, the SME may be swayed to default due to the allure of significant profits through collusion.

Equation (12) also illustrates that and have a positive relationship with x. An increase in suggests higher SME profits post-loan, prompting the SME to engage in genuine transactions to boost the financial institution’s lending inclination. If diminishes, so do the SME’s profits, increasing its tendency towards deception or submission of fraudulent transactions. In this scenario, to verify the authenticity of the SME’s receivables, the financial institution increases penalties. To enhance x, i.e., the probability of genuine transactions from the SME, decreasing and increasing becomes essential. Hence, when concealment or fraudulent risks outweigh potential income, the SME, after evaluating its operational status and repayment capacity, is deterred from deceit. Under poor operational conditions, the SME refrains from seeking loans via factoring with recourse, thus mitigating the financial institution’s credit risk.

Further, the differential equation for financial institutions suggests a low probability of SMEs adhering to contracts, leading risk-averse institutions to typically reject applications. Conversely, the SME’s replication dynamic equation shows that the chance of financial institutions accepting applications inversely relates to SMEs’ contract compliance likelihood. Thus, SMEs’ compliance probability inversely affects their acceptance by larger financial institutions, highlighting a paradox where traditional decision-making is hindered by information asymmetry, complicating risk management for these institutions. As SMEs’ compliance probability increases, enhancing their creditworthiness, financial institutions become more open to accepting applications. Nonetheless, a rise in shareable profit through collusion makes SMEs prone to risk-taking and defaulting, thereby reducing their likelihood of compliance and the financial institutions’ willingness to accept their applications again.

3.4. Examination of Equilibrium State and Stability Strategy of Evolutionary Game System

In summary, there are five equilibrium points in this evolutionary game system:

. If we take the derivatives from Equations (4) and (10), then we will get the Jacobian matrix

where

Subsequently, we proceed to compute the determinant value,

detJ, and trace the value matrix,

trJ, of the equilibrium points

E1,

E2,

E3,

E4, and

E5 to analyze the stability of these equilibrium points within the evolutionary game framework. The findings of this analysis are presented in

Table 3.

4. Simulation Experiments

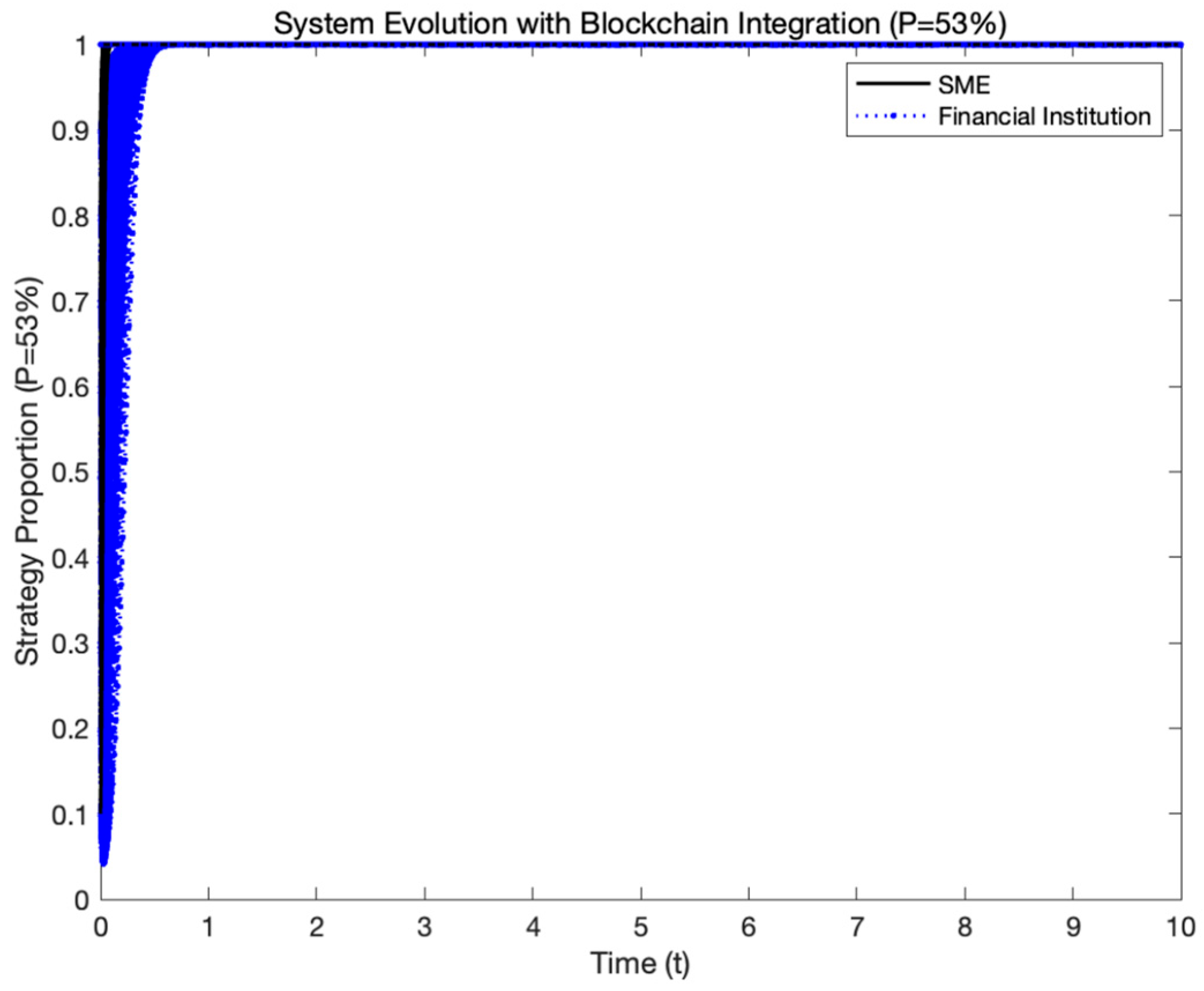

We simulated the result using MATLAB based on Intel Xeon Gold 5222 CPU@3.80GHz and 128 GB Memory. To observe the behavioral changes in various collision risks, we let the parameter alpha (probability of collision) range from 0.1 to 0.9. The rate of return, r, ranged from 50 to 150 to simulate the profitability in various market environments. The k, rb, and rp ratios and returns were set from 0 to 1 to simulate profitability under various market conditions k, rb, and rp. The probability of cooperation, P, was set between 0 and 1 to simulate scenarios ranging from complete non-cooperation to complete cooperation. The behavior of the evolutionary games under various market and economic conditions was simulated by adjusting these parameters. With these settings, we were able to analyze the strategic choices of the financial institutions and SMEs in the supply chain remanufacturing and their evolution.

MATLAB was utilized to vividly and clearly depict the evolutionary dynamics between the two parties in the receivables financing scenario within supply chain finance. This approach also served to validate the conclusion that blockchain technology facilitates ARF for SMEs, which was derived from the above derivation. Prior to the analysis, specific values were assigned to the parameters under the assumptions outlined in

Section 2, establishing a set of default parameter values for the study:

. We set the ratio of profit distribution to SMEs in collusion,

, to 30% and 53%. The corresponding system evolutionary tracks after introducing the blockchain technology are shown in

Figure 2 and

Figure 3, respectively.

As can be seen from

Figure 2 and

Figure 3, after the introduction of blockchain technology, no matter what the profit distribution ratio

is, the strategic choices of small and medium-sized enterprises and financial institutions tend to be 1, that is, SMEs choose compliance, and financial institutions tend to choose to accept or prove the applications, which is a system evolution stability strategy.

5. Implementation of the Proposed Smart Contract

Smart contracts are self-executing contracts based on blockchain technology [

26,

31]. In the context of supply chain finance, we designed a practical smart contract for facilitating automated transactions between financial institutions and SMEs.

Algorithm 1 shows the financial transactions addressed in this contract, which pertain to the fundamental interactions between the financial institutions and the SMEs. The detailed code is given in

Appendix A. These interactions include deposits, withdrawals, loan approvals, and repayments. To ensure transparency and immutability, all of these transactions are diligently recorded on the blockchain platform. The smart contract incorporates various functionalities, such as order creation, order confirmation, order delivery, order completion, and payment processing. SMEs have the authority to generate orders, while suppliers are responsible for confirming and delivering them. On the other hand, financial institutions take on the role of paying for completed orders. As with financial transactions, these activities are recorded on the blockchain platform to ensure transparency and immutability. Moreover, this smart contract has been specifically designed to consider the distinctive attributes of remanufactured supply chain finance, thereby facilitating seamless transactions among financial institutions, SMEs, and core enterprises.

| Algorithm 1: SupplyChainFinance Smart Contract Operations |

| 1: | Input: Transactions from financial institutions and SMEs |

| 2: | Output: Updated balances and event logs |

| 3: | FinancialInstitutionAddress ← Get the deploying address |

| 4: | Balances ← Initialize a map to store SME balances |

5: | Constructor:

Set FinancialInstitutionAddress to the message sender |

6: | Function Deposit:

Input: Payment value |

7:

8:

9:

10:

11:

12:

13:

14:

15:

16:

17:

18:

19:

20:

21:

22: | Update the sender’s balance in Balances by adding the payment value

Emit a Deposited event with the sender’s address and payment value

Function Withdraw:

Input: Amount to withdraw

Require that the sender’s balance is the amount

Reduce the sender’s balance in Balances by the amount

Transfer the amount to the sender

Emit a Withdrawn event with the sender’s address and amount

Function ApproveLoan:

Input: Payee’s address, Amount to lend

Require that the message sender is the FinancialInstitutionAddress

Update the payee’s balance in Balances by adding the amount

Emit a Deposited event with the payee’s address and amount

Function RepayLoan:

Input: Amount to repay

Require that the sender’s balance is the amount

Reduce the sender’s balance in Balances by the amount

Transfer the amount to the FinancialInstitutionAddress

Emit a Withdrawn event with the sender’s address and amount |

Algorithm 2 shows a smart contract that provides the functions of creating, confirming, delivering, and completing orders and making payments. SMEs can create orders, suppliers can confirm and deliver the orders, and financial institutions can pay for the completed orders. The detailed code is given in

Appendix B. All of the transactions are recorded on the blockchain platform to ensure transparency and immutability. This smart contract takes into account the characteristics of remanufactured supply chain finance and ensures that all of the transactions among financial institutions, SMEs, and suppliers go smoothly.

| Algorithm 2: Remanufacturing Supply Chain Smart Contract Operations |

| 1: | Input: Transactions from financial institution, SME, and suppliers |

| 2: | Output: Updated balances, order status, and event logs |

3:

4:

5:

6: | FinancialInstitutionAddress ← Get the deploying address

SMEAddress ← Get the provided SME address

Balances ← Initialize a map to store balances

Orders ← Initialize a map to store orders

Constructor: |

7:

8:

9: | Set FinancialInstitutionAddress to the message sender

Set SMEAddress to the provided SME address

Function CreateOrder:

Input: Supplier’s address, Amount |

| 10: | Require that the message sender is the SMEAddress |

11:

12: | Store the new order in Orders with created status

Increment the next order ID |

13:

14:

15:

16:

17:

18:

19:

20:

21:

22:

23:

24:

25:

26:

27:

28:

29:

30:

31: | Emit an OrderCreated event with order details

Function ConfirmOrder:

Input: Order ID

Require that the order is in Created status and the message sender is the supplier

Update the order’s status to Confirmed

Emit an OrderConfirmed event with the order ID

Function DeliverOrder:

Input: Order ID

Require that the order is in Confirmed status and the message sender is the supplier

Update the order’s status to Delivered

Emit an OrderDelivered event with the order ID

Function CompleteOrder:

Input: Order ID, Payment value

Require that the order is in Delivered status, the message sender is the SMEAddress, and the payment value matches the order amount

Update the FinancialInstitution’s balance by adding the payment value

Update the order’s status to Completed

Emit an OrderCompleted event with the order ID

Function MakePayment:

Input: Order ID

Require that the order is in Completed status, the message sender is the FinancialInstitutionAddress, and the FinancialInstitution’s balance is sufficient

Reduce the FinancialInstitution’s balance by the order amount

Transfer the order amount to the supplier

Emit a PaymentMade event with the supplier’s address and order amount |

The Supply Chain Finance smart contract is designed to facilitate basic financial interactions between SMEs and a financial institution. It includes functions that allow for depositing funds, withdrawing balances, approving loans, and repaying loans. Each transaction is logged as an event, providing transparency and enabling traceability. The RemanufacturingSupplyChain smart contract, on the other hand, is aimed at managing the lifecycle of orders in a remanufacturing supply chain setting. It encompasses order creation, confirmation by suppliers, delivery, and completion, along with payment functionalities. The smart contract maintains a state for each order and ensures secure financial transactions between the SME and the financial institution. These snippets illustrate the specific Solidity code used to implement functions such as createOrder, confirmOrder, deliverOrder, completeOrder, and makePayment.

The two smart contracts possess three prominent attributes: (1) Security. Both contracts effectively employ the “require” statement to ensure the necessary validations, thereby preventing unauthorized actions and mitigating potential security vulnerabilities. (2) Transparency and immutability. By utilizing events, all of the transactions and changes in state are meticulously recorded on the blockchain, thereby guaranteeing transparency and immutability. (3) Ultimately, these contracts can serve as a solid foundation for versatile supply chain finance scenarios, offering a comprehensive solution. With further testing and optimization, they have the potential to operate efficiently in real-world blockchain environments.

6. Discussions

The findings of this study contribute significantly to the existing literature on blockchain-based supply chain finance and have important implications for both researchers and practitioners.

Our research builds upon and extends the growing body of knowledge on the application of blockchain technology in supply chain finance. Previous studies have explored the potential benefits of blockchain in reducing information asymmetry, improving transparency, and enhancing trust among supply chain participants [

9,

10,

11,

12,

13,

14]. However, these works have largely focused on the general prospects and challenges of blockchain adoption in supply chain finance without delving into the specific dynamics and strategic interactions between key players.

Our study addresses this gap by developing an evolutionary game model that captures the decision-making processes of financial institutions and SMEs in the context of ARF. By incorporating factors such as blockchain maturity and risk preferences, we provide a more nuanced understanding of the adoption dynamics and equilibrium strategies. The analysis reveals that the integration of blockchain technology can significantly mitigate financial risks, reduce the probability of collusion, and enhance collaboration between financial institutions and SMEs. These findings extend the existing literature by highlighting the specific mechanisms through which blockchain can transform the ARF process and improve supply chain finance outcomes.

Moreover, our study goes beyond theoretical modeling by proposing a practical implementation of smart contracts for the ARF process. The designed smart contracts leverage the security, transparency, and immutability features of blockchain to ensure efficient and cost-effective operations. This contribution bridges the gap between conceptual frameworks and real-world applications, demonstrating the feasibility and potential benefits of blockchain-based solutions in supply chain finance.

The insights generated from this research have significant practical implications for industry experts and supply chain managers. As blockchain technology continues to gain traction in supply chain management, decision-makers are increasingly interested in understanding its potential applications and benefits in financial processes. Our study provides valuable guidance for industry practitioners considering the adoption of blockchain-based ARF solutions.

First, the evolutionary game analysis highlights the key factors that influence the strategic behaviors of financial institutions and SMEs in the ARF process. By understanding the dynamics of blockchain maturity, risk preferences, and the likelihood of collusion, industry experts can make more informed decisions when designing and implementing blockchain-based supply chain finance solutions. The findings suggest that as blockchain technology matures and the costs of adoption decrease, financial institutions are more likely to embrace blockchain-based ARF platforms, leading to improved collaboration and reduced financial risks.

Second, the practical smart contract implementation serves as a blueprint for industry practitioners to develop and customize blockchain applications tailored to their specific supply chain finance needs. The proposed smart contracts demonstrate how blockchain’s core features can be leveraged to automate and streamline the ARF process, reducing manual interventions and increasing efficiency. Supply chain managers can use this framework as a starting point to explore the integration of blockchain technology into their existing financial processes, potentially unlocking significant cost savings and operational improvements.

Furthermore, our research highlights the importance of considering the strategic interactions and incentives of all stakeholders in the supply chain finance ecosystem. By aligning the interests of financial institutions, SMEs, and core enterprises, blockchain-based solutions can foster trust, transparency, and collaboration, ultimately leading to a more resilient and efficient supply chain. Industry experts and supply chain managers should, therefore, adopt a holistic approach when implementing blockchain technology, taking into account the perspectives and requirements of all parties involved.

7. Conclusions

This study outlines the development of an evolutionary game model between financial institutions and SMEs within the ARF framework, incorporating blockchain technology. It analyzes how blockchain influences the decision-making process on both sides of the game and discusses the creation and application of smart contracts for the actual ARF procedure. The specific findings from the conducted research are as follows:

- (1)

The results of the analysis demonstrate the significant benefits of blockchain technology in mitigating financial risks within supply chains, addressing the issue of information asymmetry, and enhancing collaboration between financial institutions and SMEs. Furthermore, blockchain technology could significantly reduce the probability of collusion during the ARF process.

- (2)

Our approach introduces smart contracts for real-world supply chain finance scenarios, leveraging blockchain’s inherent properties of security, transparency, and immutability. Consequently, this guarantees the efficiency of supply chain finance operations and leads to a reduction in operational costs.

Despite the contributions of this research, there are some limitations to acknowledge. First, the evolutionary game model assumes a simplified supply chain structure involving a single financial institution, SME, and core enterprise. Future studies could explore more complex network structures and the impact of multiple players on the adoption dynamics. Second, the smart contract implementation, while demonstrating feasibility, would benefit from further testing and optimization in various real-world scenarios. Future research could also investigate the integration of advanced features, such as machine learning and predictive analytics, to enhance the performance and adaptability of blockchain-based supply chain finance solutions.