An ETD Method for Vulnerable American Options

Abstract

1. Introduction

2. Vulnerable Option Modeling

3. Numerical Solution

3.1. Mixed Derivative Terms Removing

3.2. Semi-Discretization

3.3. Default Case Solution

- If (default occurs prior maturity) and , then

- If (no default), thenwhere is calculated by (37).

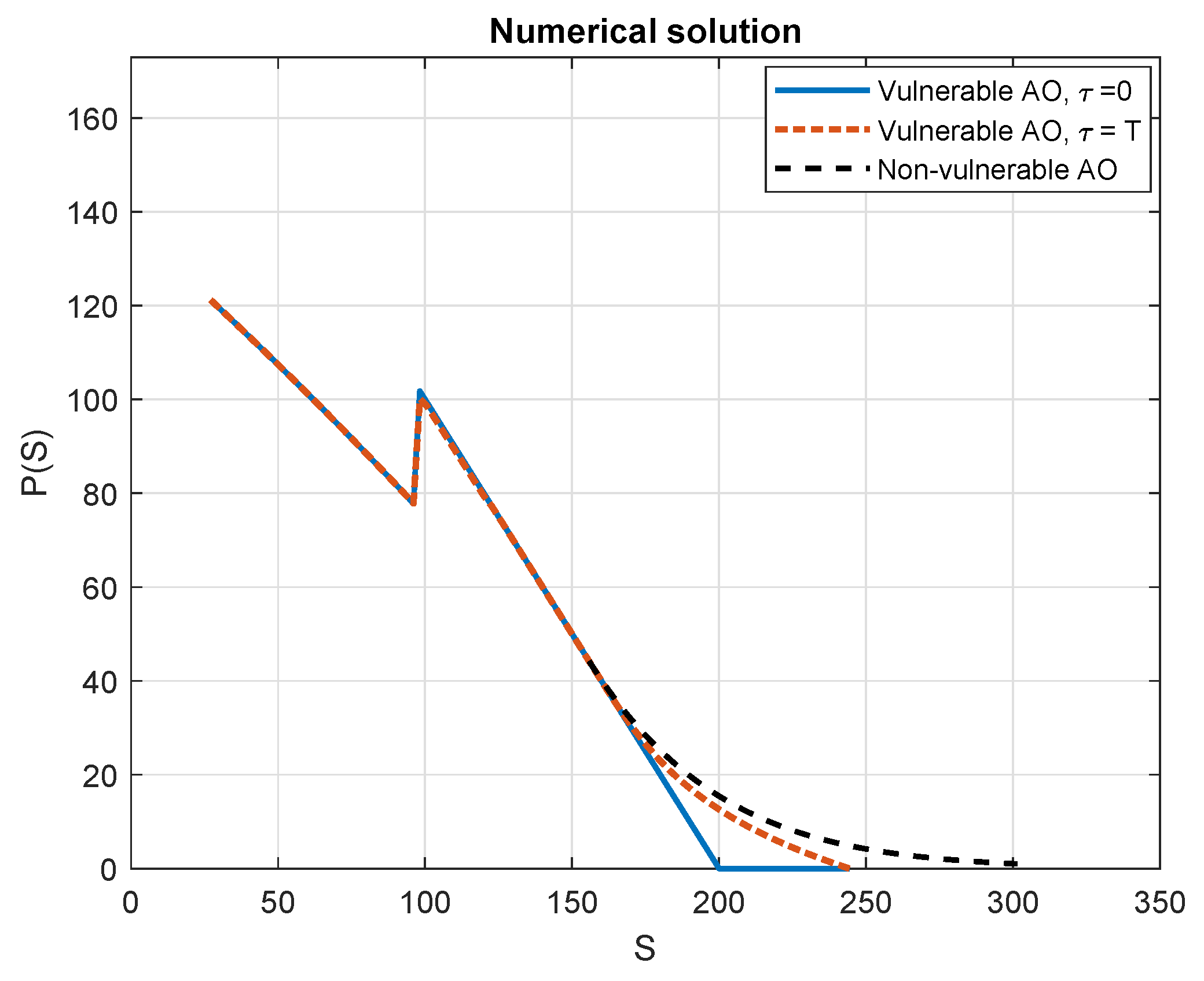

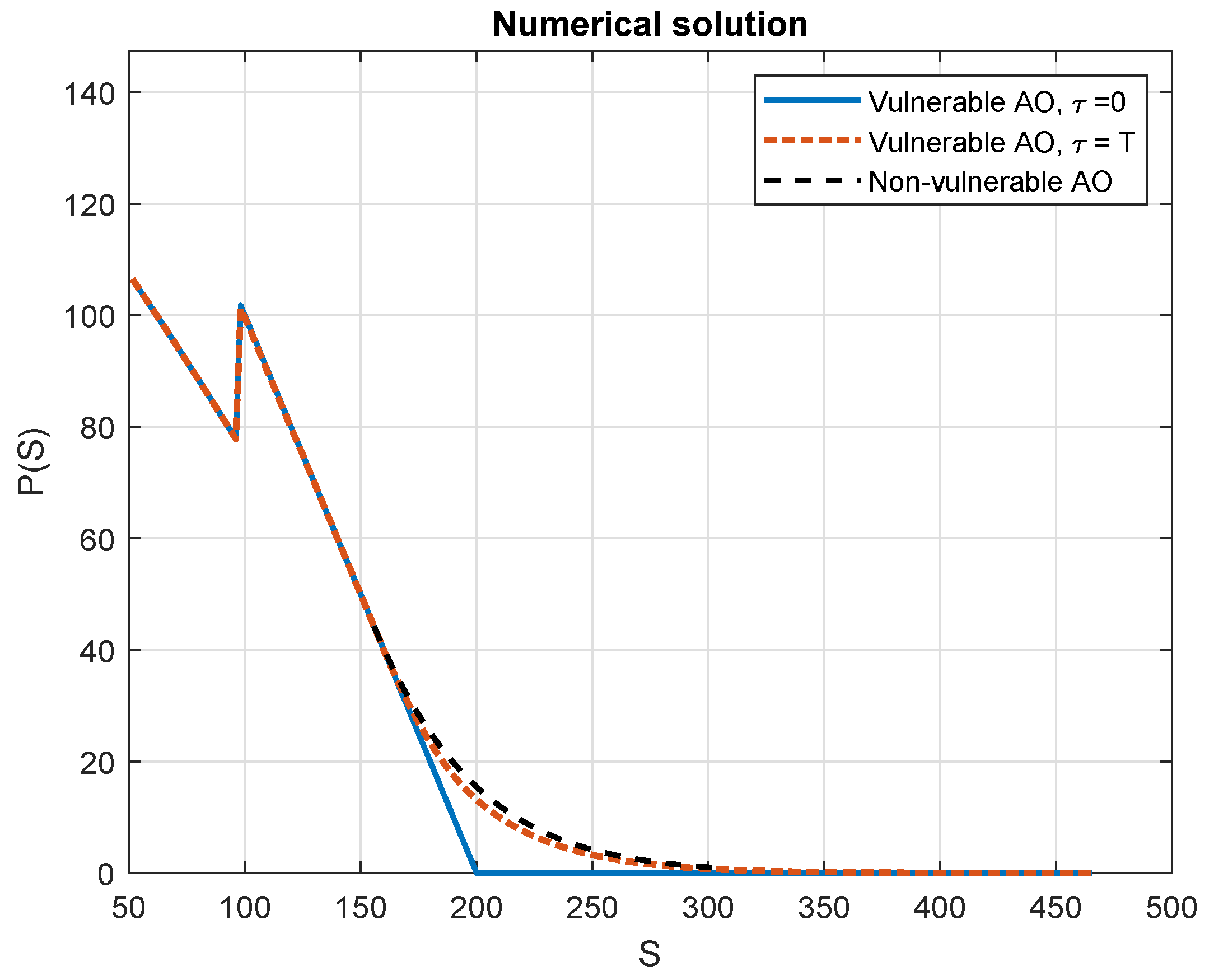

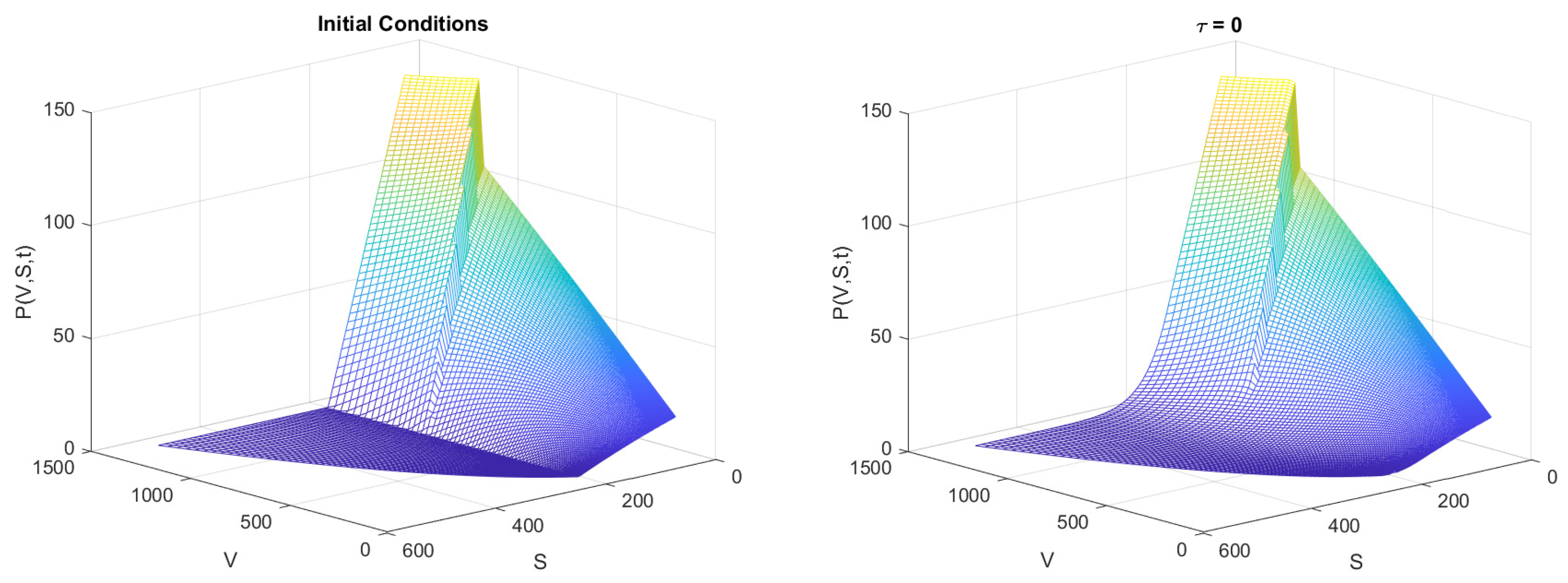

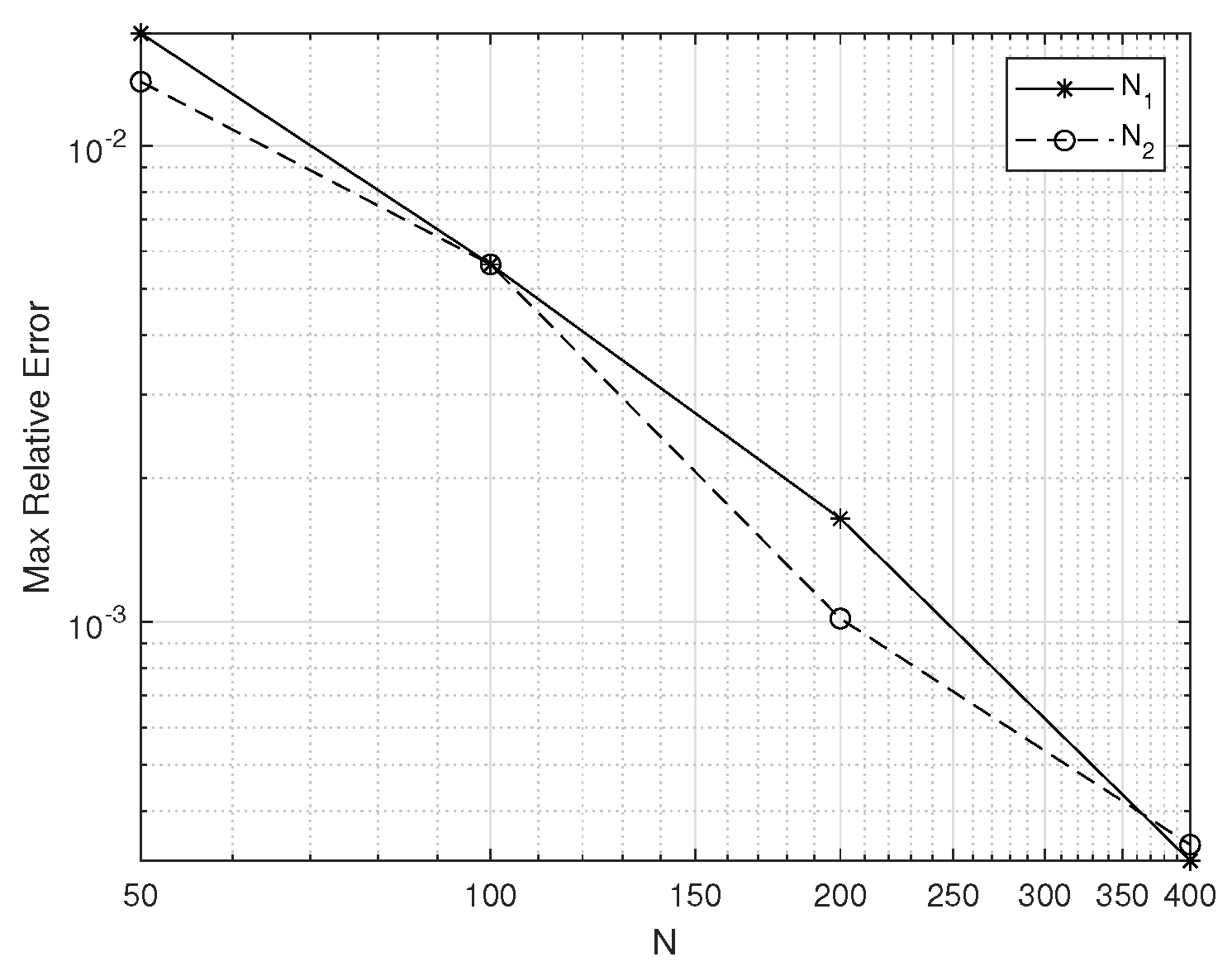

4. Numerical Results

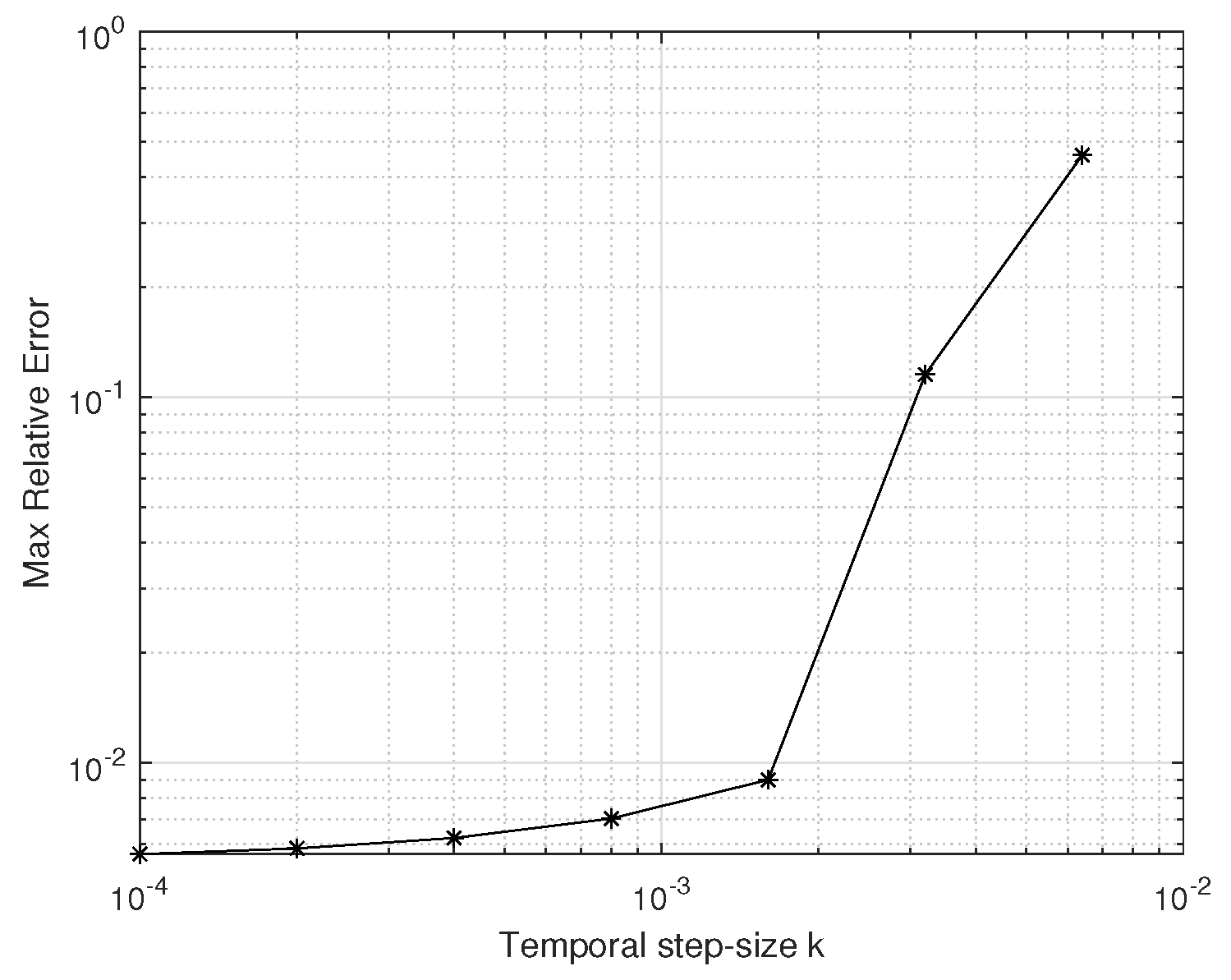

4.1. Numerical Stability

4.2. Numerical Convergence

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| ETD | Exponential time differencing |

| FD | Finite difference |

| FDM | Finite difference method |

| PDE | Partial differential equation |

| ODE | Ordinary differential equation |

References

- Johnson, H.; Stulz, R. The Pricing of Options with Default Risk. J. Financ. 1987, 42, 267–280. [Google Scholar] [CrossRef]

- Klein, P.G. Pricing Black-Scholes options with correlated credit risk. J. Bank. Financ. 1996, 20, 1211–1229. [Google Scholar] [CrossRef]

- Klein, P.; Inglis, M. Pricing vulnerable European options when the option’s payoff can increase the risk of financial distress. J. Bank. Financ. 2001, 25, 993–1012. [Google Scholar] [CrossRef]

- Liao, S.L.; Huang, H.H. Pricing Black–Scholes options with correlated interest rate risk and credit risk: An extension. Quant. Financ. 2005, 5, 443–457. [Google Scholar] [CrossRef]

- Hung, M.W.; Liu, Y.H. Pricing vulnerable options in incomplete markets. J. Futur. Mark. 2005, 25, 135–170. [Google Scholar] [CrossRef]

- Klein, P.; Yang, J. Vulnerable American options. Manag. Financ. 2010, 36, 414–430. [Google Scholar] [CrossRef]

- Zhou, R. Back to CVA: The Case of American Option. 2019. Available online: https://ssrn.com/abstract=3189805 (accessed on 14 February 2024).

- Chang, L.F.; Hung, M.W. Valuation of vulnerable American options with correlated credit risk. Rev. Deriv. Res. 2006, 9, 137–165. [Google Scholar] [CrossRef]

- Wang, G.; Wang, X.; Liu, Z. Pricing vulnerable American put options under jump-diffusion processes. Probab. Eng. Inform. Sci. 2016, 31, 121–138. [Google Scholar] [CrossRef]

- Wang, S.; Zhou, Q.; Xiao, W. Pricing vulnerable American put options under jump-diffusion processes when corporate liabilities are random. Commun. Stat. Simul. Comput. 2021, 52, 5462–5482. [Google Scholar] [CrossRef]

- Zvan, R.; Forsyth, P.; Vetzal, K. Negative coefficients in two-factor option pricing models. J. Comput. Financ. 2003, 7, 37–73. [Google Scholar] [CrossRef][Green Version]

- Gyulov, T.B.; Koleva, M.N. Penalty method for indifference pricing of American option in a liquidity switching market. Appl. Numer. Math. 2022, 172, 525–545. [Google Scholar] [CrossRef]

- Company, R.; Egorova, V.N.; Jódar, L.; Soleymanim, F. A mixed derivative terms removing method in multi-asset option pricing problems. Appl. Math. Lett. 2016, 60, 108–114. [Google Scholar] [CrossRef]

- Cox, S.M.; Matthews, P.C. Exponential Time Differencing for Stiff Systems. J. Comput. Phys. 2002, 176, 430–455. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Company, R.; Egorova, V.N.; Jódar, L. Conditional full stability of positivity-preserving finite difference scheme for diffusion-advection-reaction models. J. Comput. Appl. Math. 2018, 341, 157–168. [Google Scholar] [CrossRef]

- Company, R.; Egorova, V.N.; Jódar, L. A front-fixing ETD numerical method for solving jump-diffusion American option pricing problems. Math. Comput. Simul. 2021, 189, 69–84. [Google Scholar] [CrossRef]

- Nielsen, B.F.; Skavhaug, O.; Tvelto, A. Penalty and front-fixing methods for the numerical solution of American option problems. J. Comput. Financ. 2002, 5, 69–97. [Google Scholar] [CrossRef]

- Tangman, D.Y.; Gopaul, A.; Bhuruth, M. A fast high-order finite difference algorithm for pricing American options. J. Comput. Appl. Math. 2008, 222, 17–29. [Google Scholar] [CrossRef]

- Geske, R.; Johnson, H.E. The American Put Option Valued Analytically. J. Financ. 1984, 39, 1511–1524. [Google Scholar] [CrossRef]

- Ju, N. Pricing an American option by approximating its early exercise boundary as a multipiece exponential function. Rev. Financ. Stud. 1998, 11, 627–646. [Google Scholar] [CrossRef]

- Hon, Y.C. A Quasi-Radial Basis Functions Method for American Options Pricing. Comput. Math. Appl. 2002, 43, 513–524. [Google Scholar] [CrossRef][Green Version]

- Giribone, P.G.; Ligato, S. Option pricing via radial basis functions: Performance comparison with traditional numerical integration scheme and parameters choice for a reliable pricing. Int. J. Financ. Eng. (IJFE) 2015, 2, 1–30. [Google Scholar] [CrossRef]

- Company, R.; Egorova, V.N.; Jódar, L. Solving American option pricing models by the front fixing method: Numerical analysis and computing. Abstr. Appl. Anal. 2014, 2014, 146745. [Google Scholar] [CrossRef]

- Hull, J.; White, A. The impact of default risk on the prices of options and other derivative securities. J. Bank. Financ. 1995, 19, 299–322. [Google Scholar] [CrossRef]

- Chen, W.; Li, W.; Luo, Z.; Wang, C.; Wang, X. A stabilized second order exponential time differencing multistep method for thin film growth model without slope selection. ESAIM Math. Model. Numer. Anal. 2020, 54, 727–750. [Google Scholar] [CrossRef]

- Cheng, K.; Qiao, Z.; Wang, C. A Third Order Exponential Time Differencing Numerical Scheme for No-Slope-Selection Epitaxial Thin Film Model with Energy Stability. J. Sci. Comput. 2019, 81, 154–185. [Google Scholar] [CrossRef]

- Company, R.; Egorova, V.N.; Jódar, L.; Peris, J. A front-fixing method for American option pricing on zero-coupon bond under the Hull and White model. Math. Meth. Appl. Sci. 2022, 45, 3334–3344. [Google Scholar] [CrossRef]

| S | Non-Vulnerable | ||||||

|---|---|---|---|---|---|---|---|

| 157 | 43 | 42.99 | 43 | 42.99 | 43 | 43.00 | 43 |

| 158 | 42 | 41.99 | 42 | 41.99 | 42 | 42.00 | 42.00 |

| 159 | 41 | 40.99 | 41 | 40.99 | 41.01 | 41.03 | 41.08 |

| 160 | 40 | 39.99 | 40 | 39.99 | 40.07 | 40.09 | 40.17 |

| 161 | 39 | 38.99 | 39 | 39.02 | 39.14 | 39.13 | 39.27 |

| 162 | 38 | 37.99 | 38 | 38.05 | 38.22 | 38.22 | 38.37 |

| 163 | 37 | 37.01 | 37.02 | 37.09 | 37.30 | 37.32 | 37.49 |

| 164 | 36 | 36.02 | 36.11 | 36.14 | 36.38 | 36.42 | 36.65 |

| 165 | 35 | 35.08 | 35.18 | 35.22 | 35.47 | 35.52 | 35.83 |

| 166 | 34.03 | 34.14 | 34.26 | 34.31 | 34.56 | 34.63 | 35.01 |

| 167 | 33.10 | 33.18 | 33.34 | 33.40 | 33.72 | 33.74 | 34.19 |

| 168 | 32.16 | 32.30 | 32.43 | 32.52 | 32.84 | 32.85 | 33.40 |

| 169 | 31.23 | 31.42 | 31.52 | 31.66 | 31.96 | 31.97 | 32.63 |

| 170 | 30.39 | 30.55 | 30.63 | 30.79 | 31.11 | 31.12 | 31.89 |

| 0 | 10 | ||||

|---|---|---|---|---|---|

| 1.9246 | |

| 1.7748 | |

| 1.0765 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Company, R.; Egorova, V.N.; Jódar, L. An ETD Method for Vulnerable American Options. Mathematics 2024, 12, 602. https://doi.org/10.3390/math12040602

Company R, Egorova VN, Jódar L. An ETD Method for Vulnerable American Options. Mathematics. 2024; 12(4):602. https://doi.org/10.3390/math12040602

Chicago/Turabian StyleCompany, Rafael, Vera N. Egorova, and Lucas Jódar. 2024. "An ETD Method for Vulnerable American Options" Mathematics 12, no. 4: 602. https://doi.org/10.3390/math12040602

APA StyleCompany, R., Egorova, V. N., & Jódar, L. (2024). An ETD Method for Vulnerable American Options. Mathematics, 12(4), 602. https://doi.org/10.3390/math12040602