A Novel Black-Litterman Model with Time-Varying Covariance for Optimal Asset Allocation of Pension Funds

Abstract

1. Introduction

- An efficient method for transforming the short-term covariance matrix to the long-term covariance matrix is given.

- The risk estimation in the BL model is improved, and the TVC-BL model is constructed and used in pension asset allocation decisions.

- The validity of the TVC-BL pension asset allocation model is verified through actual data.

2. Related Literature

3. Model

3.1. VARMA-GARCH Model

- 1.

- We denote assets in the market;

- 2.

- is considered as a column vector of asset returns ( dimension);

- 3.

- The mean of is assumed to obey the VARMA;

- 4.

- The residue of is assumed to obey a normal distribution and the GARCH;

- 5.

- The residue of the return of different assets is independent.

3.2. BL Model

3.3. Derivation of the Time-Varying Covariance Matrix

3.4. The Proposed TVC-BL Model

4. Experimental analysis

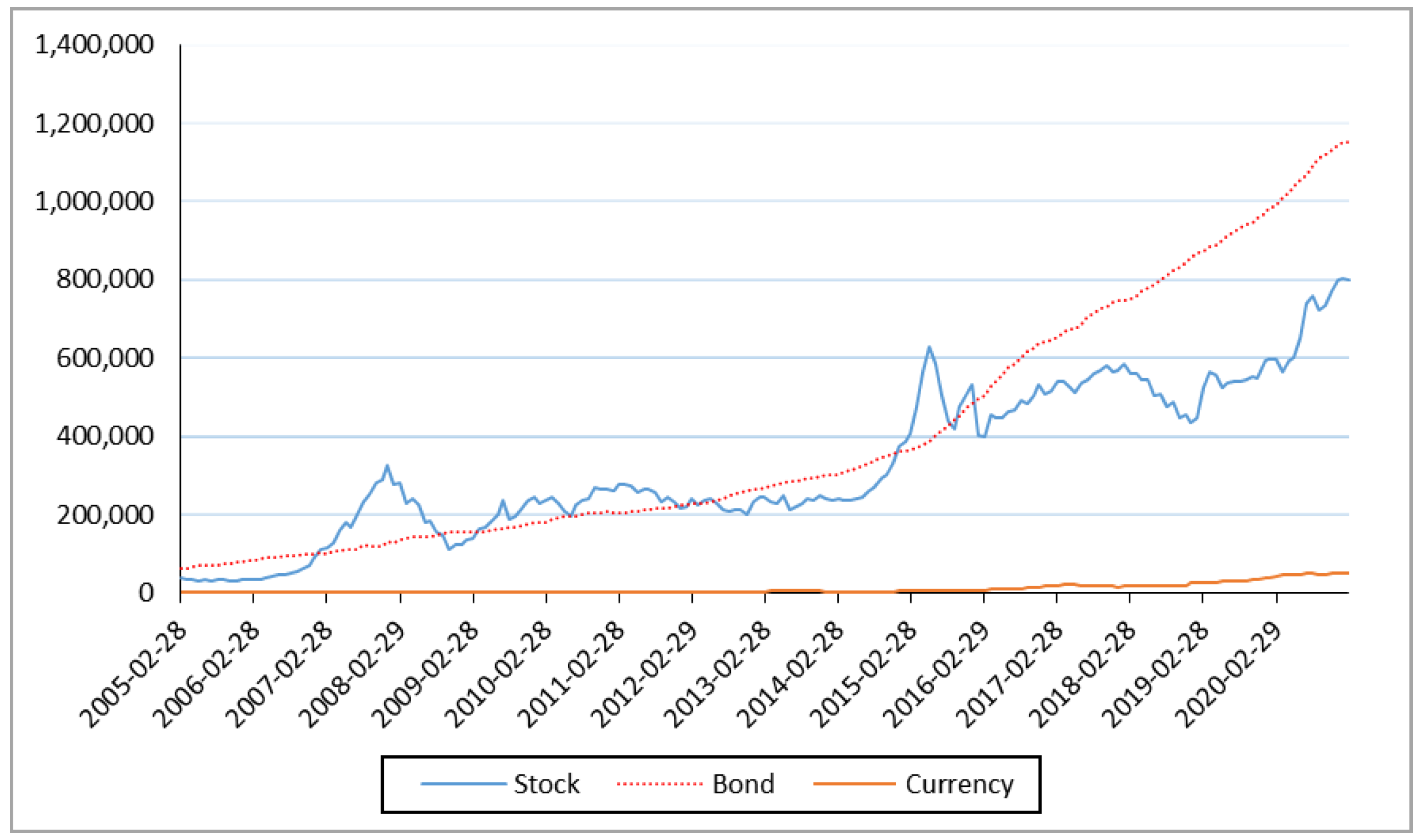

4.1. Data Selection and Description

4.2. Time-Varying Properties of the Covariance Matrix

4.3. Time-Varying Properties of the Covariance Matrix

4.4. Effectiveness Analysis for the TVC-BL Pension Asset Allocation Model

- No more than 30% of assets may be invested in stocks;

- No more than 135% of assets may be invested in bonds;

- The investments in monetary assets should account for 5% at least.

4.5. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yan, Y.P.; Huang, M.X.; Zheng, Y.R. Study on the Change and Trend of Age Structure of Chinese Population. Dongyue Trib. 2021, 1, 148–163. [Google Scholar]

- Hui, H.; Sun, H. A Research on the Contradiction between Private and Public Pension Industries in China—Take Chongqing as an Example. J. Serv. Sci. Manag. 2021, 14, 151–159. [Google Scholar] [CrossRef]

- Brennan, M.J.; Schwartz, E.S.; Lagnado, R. Strategic Asset Allocation. J. Econ. Dyn. Control. 1997, 21, 1377–1403. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Viceira, L.M. Appendix for "Strategic Asset Allocation: Portfolio Choice for Long-Term Investors"; Oxford University Press: Oxford, UK, 2002. [Google Scholar]

- Rey, D. Current Research Topics-Stock Market Predictability: Is it There? Financ. Mark. Portf. Manag. 2003, 17, 379–387. [Google Scholar]

- Farrell, J.L.; Reinhart, W.J. Portfolio Management: Theory and Application, 2nd ed.; Mc Graw-Hill Companies. Inc.: New York, NY, USA, 1997. [Google Scholar]

- Chowdhury, S.S.H.; Rahman, M.A.; Sadique, M.S. Stock return autocorrelation, day of the week and volatility: An empirical investigation on the Saudi Arabian stock market. Rev. Account. Financ. 2017, 16, 218–238. [Google Scholar] [CrossRef]

- Sim, N. Estimating the Correlation of Asset Returns: A Quantile Dependence Perspective; Handbook of Financil Economerics and Statistics; Springer: New York, NY, USA, 2015; pp. 1829–1855. [Google Scholar]

- Stoll, H.R.; Whaley, R.E. The Dynamics of Stock Index and Stock Index Futures Returns. J. Financ. Quant. Anal. 1990, 25, 441–468. [Google Scholar] [CrossRef]

- Ding, Z.; Engle, R.F. Large Scale Conditional Covariance Matrix Modeling, Estimation and Testing. Acad. Econ. Pap. 2001, 2. Available online: http://hdl.handle.net/2451/26888 (accessed on 1 January 2023).

- Campbell, J.Y.; Viceira, L.M. Strategic Asset Allocation; Oxford University Press: Oxford, UK, 2002. [Google Scholar]

- Markowitz, H.M. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investment; Basil Blackwell: New York, NY, USA, 1959. [Google Scholar]

- Tobin, J. Liquidity Preference as Behavior towards Risk. Rev. Econ. Studies. 1958, 25, 68–85. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Lintner, J. The Valuation of Risk Assets and The Selection of Risky Investments in Stock Portfolios and Capital Budgets. Rev. Econ. Stat. 1965, 47, 13–37. [Google Scholar] [CrossRef]

- Mossin, J. Equilibrium in a Capital Asset Market. Econometrica 1966, 34, 768–783. [Google Scholar] [CrossRef]

- Black, F.; Litterman, R. Global portfolio optimization. Financ. Anal. J. 1992, 48, 28–42. [Google Scholar] [CrossRef]

- Black, F.; Litterman, R. Asset allocation: Combining investor views with market quilibrium. J. Fixed Lncome. 1991, 1, 7–18. [Google Scholar] [CrossRef]

- Dutta, J.; Kapur, S.; Orszag, J.M. A portfolio approach to the optimal funding of pensions. Econ. Lett. 2000, 69, 201–206. [Google Scholar] [CrossRef]

- Parra, M.A.; Terol, A.B.; Uria, M.R. A fuzzy goal programming approach to portfolio selection. Eur. J. Oper. Res. 2001, 133, 287–297. [Google Scholar] [CrossRef]

- Booth, P.; Yakoubov, Y. Investment policy for defined-contribution pension scheme members close to retirement: An analysis of the “lifestyle” concept. North Am. Actuar. J. 2000, 4, 1–19. [Google Scholar] [CrossRef]

- Blake, D.; Cairns, A.J.; Dowd, K. Pensionmetrics: Stochastic pension plan design and value-at-risk during the accumulation phase. Insur. Math. Econ. 2001, 29, 187–215. [Google Scholar] [CrossRef]

- Haberman, S.; Vigna, E. Optimal investment strategies and risk measures in defined contribution pension schemes. Insur. Math. Econ. 2002, 31, 35–69. [Google Scholar] [CrossRef]

- Sherris, M. Portfolio Selection Models for Life Insurance and Pension Funds. 3rd AFIR Int. Colloq. 2022, 119, 87–105. [Google Scholar]

- Defau, L.; Moor, L.D. The investment behaviour of pension funds in alternative assets: Interest rates and portfolio diversification. Int. J. Financ. Econ. 2021, 26, 1424–1434. [Google Scholar] [CrossRef]

- Lin, C.W.; Zeng, L.; Wu, H.L. Multi-Period Portfolio Optimization in a Defined Contribution Pension Plan during the Decumulation Phase. J. Ind. Manag. Optim. 2019, 15, 401–427. [Google Scholar] [CrossRef]

- Luchko, M.; Lew, G.; Ruska, R.; Vovk, I. Modelling the optimal size of investment portfolio in a non-state pension fund. Cent. Sociol. Res. NGO 2019, 12, 239–253. [Google Scholar] [CrossRef]

- Tiro, K.; Basimanebotlhe, O.; Offen, E.R. Stochastic Analysis on Optimal Portfolio Selection for DC Pension Plan with Stochastic Interest and Inflation Rate. J. Math. Financ. 2021, 11, 579–596. [Google Scholar] [CrossRef]

- Bevan; Winkelmann, K. Using the Black-Litterman Globa1 Asset Allocation Model: Three Years of Practica1 Experience; Fixed Income Research; Goldman, Sachs& Company: New York, NY, USA, 1998. [Google Scholar]

- Qian, E.; Gorman, S. Conditional Distribution in Portfolio Theory. Financ. Anal. J. 2001, 57, 44–51. [Google Scholar] [CrossRef]

- Beach, S.L.; Orlov, A.G. An Application of the Black-Litterman Model with EGARCH-M-Derived views for International Portfolio Management. Financ. Mark. Portf. Manag. 2006, 21, 147–166. [Google Scholar] [CrossRef]

- Ta, B.Q.; Vuong, T. The Black-Litterman model for portfolio optimization on Vietnam stock market. Int. J. Uncertain. Fuzziness Knowl.-Based Syst 2020, 28 (Suppl. 1), 99–111. [Google Scholar] [CrossRef]

- Lin, W.H.; Teng, H.W.; Yang, C.C. A Heteroskedastic Black–Litterman Portfolio Optimization Model with Views Derived from a Predictive Regression. Handb. Financ. Econom. Math. Stat. Mach. Learn. 2020, 563–581. [Google Scholar] [CrossRef]

- Teplova, T.; Evgeniia, M.; Munir, Q.; Pivnitskaya, N. Black-Litterman model with copula-based views in mean-CVaR portfolio optimization framework with weight constraints. Econ. Change Restruct. 2022, 56, 515–535. [Google Scholar] [CrossRef]

- Martellini, L.; Ziemann, V. Extending Black-Littermman Analysis Beyond the Mean-Variance Framework. J. Portf. Manag. 2007, 33, 33–44. [Google Scholar] [CrossRef]

- Cheung, W. The Augmented Black-Litterman Model: A ranking-free approach to factou-based portfolio construction and beyond. Quant. Financ. 2013, 13, 301–316. [Google Scholar] [CrossRef]

- O'Toole, R. The Black–Litterman model: A Risk Budgeting Perspective. J. Asset Manag. 2013, 14, 2–13. [Google Scholar] [CrossRef]

- Miťková, V.; Mlynarovič, V. A performance and risk analysis on the Slovak private pension funds market. J. Econ. 2007, 3, 232–249. [Google Scholar]

- Park, Y.K.; Kim, H.; Joo, H. Alternative Investment Portfolio Analysis for the Korean National Pension Fund. Asian Rev. Financ. Res. 2015, 28, 235–267. [Google Scholar]

- Platanakis, E.; Sutcliffe, C. Asset–liability modelling and pension schemes: The application of robust optimization to USS. Eur. J. Financ. 2017, 23, 324–352. [Google Scholar] [CrossRef]

- Buriticá-Mejía, J.A. Modelo Black-Litterman con Support Vector Regression: Una alternativa para los fondos de pensiones obligatorios colombianos (Black-Litterman Model with Support Vector Regression: An Alternative for Colombian Pension Funds). ODEON 2020, 18, 205–257. [Google Scholar] [CrossRef]

- Stoilov, T.; Stoilova, K.; Vladimirov, M. Application of modified Black-Litterman model for active portfolio management. Expert Syst. Appl. 2021, 186, 115719. [Google Scholar] [CrossRef]

- Simos, T.E.; Mourtas, S.D.; Katsikis, V.N. Time-varying Black–Litterman portfolio optimization using a bio-inspired approach and neuronets. Appl. Soft Comput. 2021, 112, 107767. [Google Scholar] [CrossRef]

- Barua, R.; Sharma, A.K. Dynamic Black Litterman portfolios with views derived via CNN-BiLSTM predictions. Financ. Res. Lett. 2022, 49, 103111. [Google Scholar] [CrossRef]

- Klein, R.W.; Bawa, V.S. The effect of estimation risk on optimal portfolio choice. J. Financ. Econ. 1976, 3, 215–231. [Google Scholar] [CrossRef]

- Ankrim, E.; Fox, S.; Hensel, C. Commodities in Asset Allocation: A Real-Asset Alternative to Real Estate. Financ. Anal. J. 1993, 49, 20–29. [Google Scholar] [CrossRef]

- Ding, Z.; Martin, R.D. The Fundamental Law of Active Management: Redux. J. Empir. Financ. 2017, 43, 91–114. [Google Scholar] [CrossRef]

- Cong, F.; Oosterlee, C.W. Multi-period mean-variance portfolio optimization based on monte-carlo simulation. J. Econ. Dyn. Control. 2016, 64, 23–38. [Google Scholar] [CrossRef]

- De la Torre-Torres, O.V.; Venegas-Martínez, F.; Martínez-Torre-Enciso, M.I. Enhancing portfolio performance and VIX futures trading timing with markov-switching GARCH models. Mathematics 2021, 9, 185. [Google Scholar] [CrossRef]

- Escobar-Anel, M.; Gollart, M.; Zagst, R. Closed-form portfolio optimization under GARCH models. Oper. Res. Perspect. 2022, 9, 100216. [Google Scholar] [CrossRef]

- Dufour, J.M.; Pelletier, D. Practical methods for modeling weak VARMA processes: Identification, estimation and specification with a macroeconomic application. J. Bus. Econ. Stat. 2021, 40, 1140–1152. [Google Scholar] [CrossRef]

- Yilin, M.; Han, R.; Wang, W. Portfolio optimization with return prediction using deep learning and machine learning. Expert Syst. Appl. 2021, 165, 113973. [Google Scholar]

| Stocks | Bonds | Cash | |

|---|---|---|---|

| Index | CSI All Share Index | CSI All Bond Index | CSI Monetary Fund Index |

| Date sources | Choice | Choice | Choice |

| Sample interval | February 2005–February 2021 | February 2005–February 2021 | February 2005–February 2021 |

| Sample size | 194 | 194 | 194 |

| Mean | 1.295 | 0.373 | 0.251 |

| Min | −25.910 | −2.040 | 0.091 |

| Max | 29.535 | 4.124 | 0.538 |

| Median | 1.268 | 0.383 | 0.236 |

| Variance | 73.060 | 0.662 | 0.008 |

| Skewness | 1.133 | 3.563 | −0.490 |

| Kurtosis | −0.185 | 0.750 | 0.368 |

| Covariance Matrix Entries | Investment Terms | ||||

|---|---|---|---|---|---|

| 1 Month | 2 Months | 3 Months | 6 Months | 12 Months | |

| Stock asset variance | 73.439 | 178.483 | 318.448 | 908.031 | 2340.420 |

| Bond asset variance | 0.665 | 1.810 | 3.144 | 9.203 | 22.656 |

| Monetary asset variance | 0.008 | 0.028 | 0.062 | 0.242 | 0.866 |

| Stock-bond asset covariance | −1.459 | −5.486 | −12.362 | −41.173 | −106.991 |

| Stock-monetary asset covariance | −0.080 | −0.401 | −0.762 | −3.940 | −14.060 |

| Bond-monetary asset covariance | 0.011 | 0.035 | 0.056 | 0.270 | 0.711 |

| Covariance Matrix Entries | Investment Terms | ||||

|---|---|---|---|---|---|

| 1 Month | 2 Months | 3 Months | 6 Months | 12 Months | |

| Stock asset variance | 881.266 | 1070.898 | 1273.792 | 1816.062 | 2340.420 |

| Bond asset variance | 7.982 | 10.857 | 12.574 | 18.406 | 22.656 |

| Monetary asset variance | 0.094 | 0.170 | 0.247 | 0.484 | 0.866 |

| Stock-bond asset covariance | −17.509 | −32.918 | −49.446 | −82.347 | −106.991 |

| Stock-monetary asset covariance | −0.960 | −2.407 | −3.047 | −7.880 | −14.060 |

| Bond-monetary asset covariance | 0.137 | 0.211 | 0.225 | 0.539 | 0.711 |

| Risk Aversion Coefficient | Models | Annualized Rate of Return (%) | Annualized Volatility (%) | Sharpe Ratio |

|---|---|---|---|---|

| 1 | Traditional BL model | 4.77 | 5.05 | 0.69 |

| TVC-BL | 4.78 | 4.45 | 0.78 | |

| 1.5 | Traditional BL model | 4.76 | 4.56 | 0.76 |

| TVC-BL | 4.70 | 4.03 | 0.84 | |

| 2.5 | Traditional BL model | 4.68 | 4.32 | 0.78 |

| TVC-BL | 4.66 | 3.83 | 0.88 |

| Risk Aversion Coefficient | Model | Annualized Rate of Return (%) | Annualized Volatility (%) | Sharpe Ratio |

|---|---|---|---|---|

| 1 | RF-BL | 4.90 | 5.07 | 0.71 |

| RF-BL-TVC | 4.91 | 4.52 | 0.80 | |

| 1.5 | RF-BL | 4.82 | 4.62 | 0.76 |

| RF-BL-TVC | 4.83 | 4.13 | 0.85 | |

| 2.5 | RF-BL | 4.75 | 4.42 | 0.78 |

| RF-BL-TVC | 4.78 | 3.91 | 0.89 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Y.; Wu, Y.; De, G. A Novel Black-Litterman Model with Time-Varying Covariance for Optimal Asset Allocation of Pension Funds. Mathematics 2023, 11, 1476. https://doi.org/10.3390/math11061476

Sun Y, Wu Y, De G. A Novel Black-Litterman Model with Time-Varying Covariance for Optimal Asset Allocation of Pension Funds. Mathematics. 2023; 11(6):1476. https://doi.org/10.3390/math11061476

Chicago/Turabian StyleSun, Yuqin, Yungao Wu, and Gejirifu De. 2023. "A Novel Black-Litterman Model with Time-Varying Covariance for Optimal Asset Allocation of Pension Funds" Mathematics 11, no. 6: 1476. https://doi.org/10.3390/math11061476

APA StyleSun, Y., Wu, Y., & De, G. (2023). A Novel Black-Litterman Model with Time-Varying Covariance for Optimal Asset Allocation of Pension Funds. Mathematics, 11(6), 1476. https://doi.org/10.3390/math11061476