Market Volatility Spillover, Network Diffusion, and Financial Systemic Risk Management: Financial Modeling and Empirical Study

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Volatility Spillover Measure and Network Diffusion Method Based on Vine Copula

3.2. Volatility Spillover Measure and Network Diffusion Method Based on DY Spillover Index

3.2.1. Total Spillover Index

3.2.2. Direction Spillover Index

3.2.3. Net Spillover Index

4. Empirical Study

4.1. Data Analysis

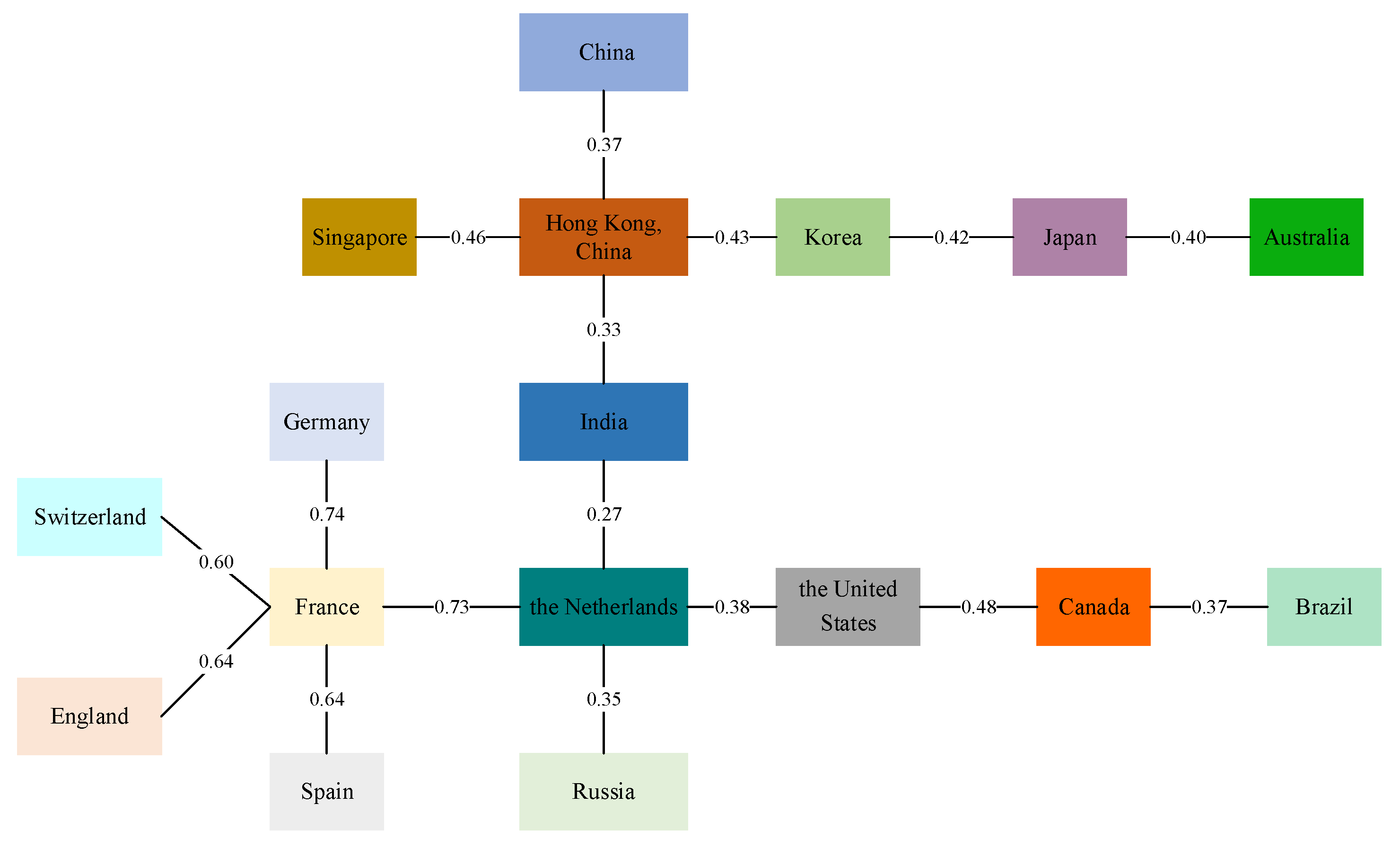

4.2. Risk Spillover and Network Diffusion from the Static Perspective

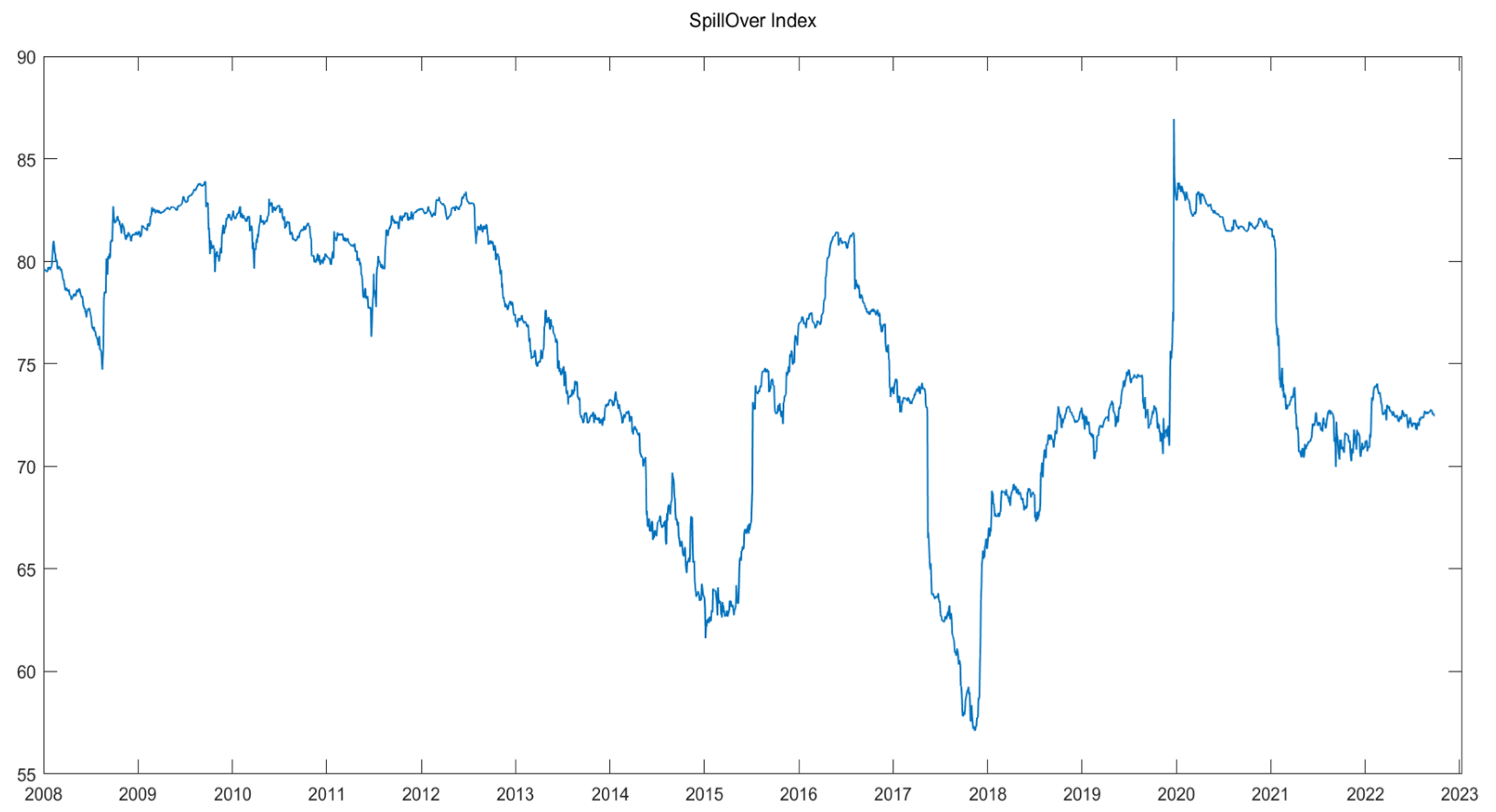

4.3. Risk Spillover and Network Diffusion from the Dynamic Perspective

4.4. Further Discussion

- ➢

- First, the R-Vine Copula modeling reveals that there is a distinct geographical feature of the global equity market risk diffusion phenomenon, i.e., countries and regions on the same continent are more closely connected to each other. Specifically, developed countries in Europe and the United States are at the center of the volatility spillover network, while other countries, especially emerging market countries, are at the edge of the volatility spillover network. This finding is consistent with Baumöhl et al. [61] and suggests that there is a clear regional dimension to the volatility spillover phenomenon of global equity market risk.

- ➢

- Second, the development of equity market shows an uneven phenomenon globally, with more mature development of securities market in countries with a higher level of economic development. The net spillover effect of developed European countries is greater than 0, which reflects the output side of risk. The net spillover effect of other countries is less than 0, which indicates the input side of risk. Zhou et al. [62] measured the volatility spillover effects in the stock markets of Asian countries and other countries, and also found the same results. Unlike them, this paper considers the direction of risk spillovers and identifies the input side and output side of risk.

- ➢

- Finally, the rolling window method is used to measure the dynamic volatility spillover effect, and it is found that shocks from crisis events have an impact on the volatility spillover effect in equity markets. For example, during the subprime mortgage crisis, the European debt crisis, and the COVID-19 epidemic, the linkage among global equity markets increases significantly and the volatility spillover effect rises. Choi et al. [63] provided a dynamic measure of the volatility spillover effect across industries in the U.S. and reached similar conclusions. The difference is that the measurement results are more reflective of reality because they are based on the rolling window-based DY spillover index approach.

5. Conclusions

- (1)

- There is a certain aggregation feature in the network diffusion of global financial market volatility spillover. The entire network diffusion is centered on developed countries in Europe and the United States, with the remaining countries on the periphery.

- (2)

- Developed European countries such as the Netherlands, France, the UK, and Germany are at the center of the network and have a strong influence. Once a country’s financial market generates a volatile spillover of risk, it will cause a linkage reaction of risk in other important countries, and the network will become very rapidly connected.

- (3)

- Asian countries such as China, Japan, and India are at the periphery of the network. On the one hand, it is necessary for these countries to guard against the negative effects of risk volatility spillovers from important and key countries. On the other hand, it is also necessary for these countries to draw on the positive experience of financial market development to promote the development of their own national financial markets.

- (4)

- Shocks from crisis events can enhance volatility spillovers in global financial markets. During the subprime mortgage crisis, the European debt crisis, and the COVID-19 epidemic, the linkages in global financial market were enhanced, which led to an increase in volatility spillovers.

- (1)

- Firstly, by focusing on the financial market of key countries in the network, such as the Netherlands, the UK, France, and Germany. Key markets are the center of risk diffusion in the network, and effective regulation of these markets can weaken the spread of risk to the greatest extent.

- (2)

- Second, the uneven development among global financial markets can be mitigated, reducing the high degree of correlation among financial markets. Market correlation is the basis for generating volatility spillover network diffusion. Reducing the correlation between markets and increasing the independence of each country’s financial market can effectively weaken network diffusion and prevent the accumulation of systemic risks.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, Y.; Giles, D.E. Modelling volatility spillover effects between developed financial markets and Asian emerging financial markets. Int. J. Financ. Econ. 2015, 20, 155–177. [Google Scholar] [CrossRef]

- Jebran, K.; Iqbal, A. Dynamics of volatility spillover between financial market and foreign exchange market: Evidence from Asian Countries. Financ. Innov. 2016, 2, 3. [Google Scholar] [CrossRef]

- Christiansen, C. Volatility-Spillover Effects in European Bond Markets. Eur. Financ. Manag. 2007, 13, 923–948. [Google Scholar] [CrossRef]

- Wu, F.; Guan, Z.; Myers, R.J. Volatility spillover effects and cross hedging in corn and crude oil futures. J. Futur. Mark. 2011, 31, 1052–1075. [Google Scholar] [CrossRef]

- Zhou, W.; Gu, Q.; Chen, J. From volatility spillover to risk spread: An empirical study focuses on renewable energy markets. Renew. Energy 2021, 180, 329–342. [Google Scholar] [CrossRef]

- Lee, S.J. Volatility spillover effects among six Asian countries. Appl. Econ. Lett. 2009, 16, 501–508. [Google Scholar] [CrossRef]

- Katsiampa, P.; Corbet, S.; Lucey, B. Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Financ. Res. Lett. 2019, 29, 68–74. [Google Scholar] [CrossRef]

- Calvo, G.A.; Mendoza, E.G. Rational contagion and the globalization of securities markets. J. Int. Econ. 2000, 51, 79–113. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR (No. w17454). Am. Econ. Rev. 2011, 106, 1705–1741. [Google Scholar] [CrossRef]

- Mink, M.; de Haan, J. Contagion during the Greek sovereign debt crisis. J. Int. Money Financ. 2013, 34, 102–113. [Google Scholar] [CrossRef]

- Yang, J.; Zhou, Y. Credit Risk Spillovers Among Financial Institutions Around the Global Credit Crisis: Firm-Level Evidence. Manag. Sci. 2013, 59, 2343–2359. [Google Scholar] [CrossRef]

- Troster, V.; Shahbaz, M.; Uddin, G.S. Renewable energy, oil prices, and economic activity: A Granger-causality in quantiles analysis. Energy Econ. 2018, 70, 440–452. [Google Scholar] [CrossRef]

- Wen, D.; Wang, G.J.; Ma, C.; Wang, Y. Risk spillovers between oil and financial markets: A VAR for VaR analysis. Energy Econ. 2019, 80, 524–535. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Roubaud, D.; Shahzad, S.J.H. Risk spillover between energy and agricultural commodity markets: A dependence-switching CoVaR-copula model. Energy Econ. 2018, 75, 14–27. [Google Scholar] [CrossRef]

- Ardia, D.; Bluteau, K.; Rüede, M. Regime changes in Bitcoin GARCH volatility dynamics. Financ. Res. Lett. 2019, 29, 266–271. [Google Scholar] [CrossRef]

- Fakhfekh, M.; Jeribi, A. Volatility dynamics of crypto-currencies’ returns: Evidence from asymmetric and long memory GARCH models. Res. Int. Bus. Financ. 2020, 51, 101075. [Google Scholar] [CrossRef]

- Ali, G. EGARCH, GJR-GARCH, TGARCH, AVGARCH, NGARCH, IGARCH and APARCH models for pathogens at marine recreational sites. J. Stat. Econom. Methods 2013, 2, 57–73. [Google Scholar]

- Lama, A.; Jha, G.K.; Paul, R.K.; Gurung, B. Modelling and Forecasting of Price Volatility: An Application of GARCH and EGARCH Models. Agric. Econ. Res. Rev. 2015, 28, 73–82. [Google Scholar] [CrossRef]

- Bhatnagar, M.; Özen, E.; Taneja, S.; Grima, S.; Rupeika-Apoga, R. The Dynamic Connectedness between Risk and Return in the Fintech Market of India: Evidence Using the GARCH-M Approach. Risks 2022, 10, 209. [Google Scholar] [CrossRef]

- Jones, P.M.; Olson, E. The time-varying correlation between uncertainty, output, and inflation: Evidence from a DCC-GARCH model. Econ. Lett. 2012, 118, 33–37. [Google Scholar] [CrossRef]

- Yu, L.; Zha, R.; Stafylas, D.; He, K.; Liu, J. Dependences and volatility spillovers between the oil and financial markets: New evidence from the copula and VAR-BEKK-GARCH models. Int. Rev. Financ. Anal. 2020, 68, 101280. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, M.; Xiong, X.; Zou, G. Volatility spillovers between stock, bond, oil, and gold with portfolio implications: Evidence from China. Financ. Res. Lett. 2021, 40, 101786. [Google Scholar] [CrossRef]

- Chen, J.; Chen, Y.; Gu, Q.; Zhou, W. Network evolution underneath the volatility spillover in traditional and clean energy markets. Appl. Econ. 2023, 1–17. [Google Scholar] [CrossRef]

- Fischer, M.; Köck, C.; Schlüter, S.; Weigert, F. An empirical analysis of multivariate copula models. Quant. Financ. 2009, 9, 839–854. [Google Scholar] [CrossRef]

- Oh, D.H.; Patton, A.J. Time-Varying Systemic Risk: Evidence from a Dynamic Copula Model of CDS Spreads. J. Bus. Econ. Stat. 2018, 36, 181–195. [Google Scholar] [CrossRef]

- Fang, L.; Balakrishnan, N.; Jin, Q. Optimal grouping of heterogeneous components in series–parallel and parallel–series systems under Archimedean copula dependence. J. Comput. Appl. Math. 2020, 377, 112916. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Tiwari, A.K.; Ji, Q. Copula-based local dependence among energy, agriculture and metal commodities markets. Energy 2020, 202, 117762. [Google Scholar] [CrossRef]

- Pho, K.H.; Ly, S.; Lu, R.; Van Hoang, T.H.; Wong, W.-K. Is Bitcoin a better portfolio diversifier than gold? A copula and sectoral analysis for China. Int. Rev. Financ. Anal. 2021, 74, 101674. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, J. Co-movement between oil, gas, coal, and iron ore prices, the Australian dollar, and the Chinese RMB exchange rates: A copula approach. Resour. Policy 2019, 63, 101471. [Google Scholar] [CrossRef]

- Dißmann, J.; Brechmann, E.; Czado, C.; Kurowicka, D. Selecting and estimating regular vine copulae and application to financial returns. Comput. Stat. Data Anal. 2013, 59, 52–69. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, W.; Liu, C.; Wang, Z.; Hou, Y. Probabilistic Forecast for Multiple Wind Farms Based on Regular Vine Copulas. IEEE Trans. Power Syst. 2017, 33, 578–589. [Google Scholar] [CrossRef]

- Zhang, D.; Yan, M.; Tsopanakis, A. Financial stress relationships among Euro area countries: An R-vine copula approach. Eur. J. Financ. 2018, 24, 1587–1608. [Google Scholar] [CrossRef]

- Schepsmeier, U. A goodness-of-fit test for regular vine copula models. Econ. Rev. 2019, 38, 25–46. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, T.; Lee, C.-C. The path of financial risk spillover in the stock market based on the R-vine-Copula model. Phys. A Stat. Mech. Its Appl. 2022, 600, 127470. [Google Scholar] [CrossRef]

- Zhou, W.; Chen, Y.; Chen, J. Risk spread in multiple energy markets: Extreme volatility spillover network analysis before and during the COVID-19 pandemic. Energy 2022, 256, 124580. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasreen, S.; Ullah, S.; Shahbaz, M. Analysing spillover between returns and volatility series of oil across major financial markets. Int. J. Financ. Econ. 2021, 26, 2458–2490. [Google Scholar] [CrossRef]

- Wang, H.; Li, S. Asymmetric volatility spillovers between crude oil and China’s financial markets. Energy 2021, 233, 121168. [Google Scholar] [CrossRef]

- Fasanya, I.O.; Oyewole, O.; Odudu, T. Returns and volatility spillovers among cryptocurrency portfolios. Int. J. Manag. Financ. 2021, 17, 327–341. [Google Scholar] [CrossRef]

- Gong, X.; Liu, Y.; Wang, X. Dynamic volatility spillovers across oil and natural gas futures markets based on a time-varying spillover method. Int. Rev. Financ. Anal. 2021, 76, 101790. [Google Scholar] [CrossRef]

- Antonakakis, N.; Gabauer, D. Refined Measures of Dynamic Connectedness Based on TVP-VAR; Munich Personal RePEc Archive: Munich, Germany, 2017. [Google Scholar]

- Antonakakis, N.; Cunado, J.; Filis, G.; Gabauer, D.; de Gracia, F.P. Oil volatility, oil and gas firms and portfolio diversification. Energy Econ. 2018, 70, 499–515. [Google Scholar] [CrossRef]

- Boss, M.; Elsinger, H.; Summer, M.; Thurner, S. Network topology of the interbank market. Quant. Financ. 2004, 4, 677–684. [Google Scholar] [CrossRef]

- Zou, Y.; Donner, R.V.; Marwan, N.; Donges, J.F.; Kurths, J. Complex network approaches to nonlinear time series analysis. Phys. Rep. 2019, 787, 1–97. [Google Scholar] [CrossRef]

- Xu, H.; Wang, M.; Jiang, S.; Yang, W. Carbon price forecasting with complex network and extreme learning machine. Phys. A Stat. Mech. Its Appl. 2020, 545, 122830. [Google Scholar] [CrossRef]

- Alavifard, F. Modelling default dependence in automotive supply networks using vine-copula. Int. J. Prod. Res. 2019, 57, 433–451. [Google Scholar] [CrossRef]

- Xu, Q.; Fan, Z.; Jia, W.; Jiang, C. Fault detection of wind turbines via multivariate process monitoring based on vine copulas. Renew. Energy 2020, 161, 939–955. [Google Scholar] [CrossRef]

- Marcot, B.G.; Penman, T.D. Advances in Bayesian network modelling: Integration of modelling technologies. Environ. Model. Softw. 2019, 111, 386–393. [Google Scholar] [CrossRef]

- Algieri, B.; Leccadito, A. Assessing contagion risk from energy and non-energy commodity markets. Energy Econ. 2017, 62, 312–322. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Shahzad, U.; Asl, M.G.; Ben Jabeur, S. Investigating the spillovers between energy, food, and agricultural commodity markets: New insights from the quantile coherency approach. Q. Rev. Econ. Financ. 2023, 88, 63–80. [Google Scholar] [CrossRef]

- Nekhili, R.; Bouri, E. Higher-order moments and co-moments’ contribution to spillover analysis and portfolio risk management. Energy Econ. 2023, 119, 106596. [Google Scholar] [CrossRef]

- Trivedi, J.; Spulbar, C.; Birau, R.; Mehdiabadi, A. Modelling volatility spillovers, cross-market correlation and co-movements between stock markets in european union: An empirical case study. J. Bus. Manag. Econ. Eng. 2021, 19, 70–90. [Google Scholar] [CrossRef]

- Sakthivel, P.; Bodkhe, N.; Kamaiah, B. Correlation and Volatility Transmission across International Stock Markets: A Bivariate GARCH Analysis. Int. J. Econ. Financ. 2012, 4, 253. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Correlation dynamics of crude oil with agricultural commodities: A comparison between energy and food crops. Econ. Model. 2019, 82, 453–466. [Google Scholar] [CrossRef]

- Chang, K.; Zhang, C.; Wang, H.W. Asymmetric dependence structures between emission allowances and energy markets: New evidence from China’s emissions trading scheme pilots. Environ. Sci. Pollut. Res. 2020, 27, 21140–21158. [Google Scholar] [CrossRef]

- Patton, A.J. A review of copula models for economic time series. J. Multivar. Anal. 2012, 110, 4–18. [Google Scholar] [CrossRef]

- Erhardt, T.M.; Czado, C.; Schepsmeier, U. R-vine models for spatial time series with an application to daily mean temperature. Biometrics 2015, 71, 323–332. [Google Scholar] [CrossRef]

- Hernandez, J.A.; Hammoudeh, S.; Nguyen, D.K.; Al Janabi, M.A.M.; Reboredo, J.C. Global financial crisis and dependence risk analysis of sector portfolios: A vine copula approach. Appl. Econ. 2017, 49, 2409–2427. [Google Scholar] [CrossRef]

- Czado, C.; Nagler, T. Vine copula based modeling. Annu. Rev. Stat. Its Appl. 2022, 9, 453–477. [Google Scholar] [CrossRef]

- Baumöhl, E.; Kočenda, E.; Lyócsa, Š.; Výrost, T. Networks of volatility spillovers among stock markets. Phys. A Stat. Mech. Its Appl. 2018, 490, 1555–1574. [Google Scholar] [CrossRef]

- Zhou, X.; Zhang, W.; Zhang, J. Volatility spillovers between the Chinese and world equity markets. Pac. -Basin Financ. J. 2012, 20, 247–270. [Google Scholar] [CrossRef]

- Choi, S.-Y. Dynamic volatility spillovers between industries in the US stock market: Evidence from the COVID-19 pandemic and Black Monday. N. Am. J. Econ. Financ. 2022, 59, 101614. [Google Scholar] [CrossRef]

| Country (Region) | Stock Index | Country (Region) | Stock Index |

|---|---|---|---|

| England | FTSE100 Index | Canada | S&P_TSX Index |

| India | S&P CNX NIFTY Index | the Netherlands | AEX Index |

| Hong Kong, China | Hang Seng Index | Korea | KOSPI Index |

| Spain | IBEX35 Index | France | CAC40 Index |

| China | SSE Index | Russia | MOEX Russia Index |

| Switzerland | SWI20 Index | Brazil | IBOVESPA Index |

| Japan | N225 Index | Germany | DAX30 Index |

| the United States | NASDAQ Index | Australia | S&P_ASX200 Index |

| Singapore | Straits Times Index |

| Min | Max | Mean | Median | Skew | Kurtosis | JB | ARCH | ADF | |

|---|---|---|---|---|---|---|---|---|---|

| UK | −0.1087 | 0.0905 | −0.0004 | 0.0004 | −0.4900 | 9.2900 | 1055 *** | 702 *** | −39.14 *** |

| IN | −0.1298 | 0.0876 | 0.0003 | 0.0005 | −0.6400 | 9.0700 | 1013 *** | 634 *** | −36.68 *** |

| HKG | −0.0865 | 0.1435 | −0.0002 | 0.0003 | 0.2700 | 7.5900 | 6990 *** | 467 *** | −39.48 *** |

| ES | −0.1406 | 0.0942 | −0.0006 | 0.0005 | −0.5200 | 7.6600 | 7226 *** | 342 *** | −38.03 *** |

| CHN | −0.0840 | 0.0945 | 0.0002 | 0.0005 | −0.4000 | 5.2400 | 3393 *** | 301 *** | −38.32 *** |

| CH | −0.0964 | 0.0702 | 0.0001 | 0.0004 | −0.6000 | 8.2100 | 8321 *** | 669 *** | −38.73 *** |

| JPN | −0.1141 | 0.1415 | 0.0001 | 0.0003 | −0.2900 | 8.5500 | 8883 *** | 788 *** | −41.11 *** |

| USA | −0.1232 | 0.0953 | 0.0002 | 0.0009 | −0.4500 | 6.9800 | 5989 *** | 714 *** | −38.04 *** |

| CAN | −0.1234 | 0.1196 | 0.0002 | 0.0008 | −0.2900 | 19.4200 | 4562 *** | 898 *** | −37.65 *** |

| NL | −0.1075 | 0.0909 | 0.0000 | 0.0005 | −0.5800 | 8.1700 | 8229 *** | 751 *** | −37.11 *** |

| KOR | −0.1057 | 0.0860 | 0.0001 | 0.0005 | −0.7000 | 8.4100 | 8779 *** | 695 *** | −38.65 *** |

| FR | −0.1228 | 0.0927 | 0.0000 | 0.0005 | −0.4800 | 6.9200 | 5895 *** | 477 *** | −38.00 *** |

| RUS | −0.3328 | 0.2869 | −0.0000 | 0.0003 | −1.1400 | 54.3200 | 3570 *** | 254 *** | −40.94 *** |

| BR | −0.1478 | 0.1391 | −0.0001 | 0.0003 | −0.3800 | 9.0600 | 9987 *** | 844 *** | −38.31 *** |

| GER | −0.1224 | 0.1128 | 0.0001 | 0.0007 | −0.3500 | 7.4400 | 6750 *** | 484 *** | −37.36 *** |

| AUS | −0.0970 | 0.0700 | 0.0001 | 0.0006 | −0.6300 | 7.5200 | 7029 *** | 912 *** | −38.45 *** |

| SG | −0.0832 | 0.06163 | −0.0056 | 0.0086 | −0.4400 | 7.5800 | 7042 *** | 706 *** | −38.06 *** |

| Tree | Edge | Copula | Par | Par1 | Tau |

|---|---|---|---|---|---|

| 1 | 7, 16 | t | 0.59 | 6.64 | 0.40 |

| 3, 5 | t | 0.54 | 14.39 | 0.37 | |

| 11, 7 | t | 0.61 | 7.17 | 0.42 | |

| 3, 11 | t | 0.62 | 10.96 | 0.43 | |

| 3, 17 | t | 0.66 | 7.39 | 0.46 | |

| 2, 3 | t | 0.49 | 11.14 | 0.33 | |

| 9, 14 | t | 0.55 | 7.21 | 0.37 | |

| 8, 9 | t | 0.69 | 7.37 | 0.48 | |

| 10, 8 | t | 0.56 | 5.80 | 0.38 | |

| 10, 2 | t | 0.41 | 11.36 | 0.27 | |

| 12, 6 | t | 0.81 | 4.97 | 0.60 | |

| 10, 13 | t | 0.52 | 7.97 | 0.35 | |

| 12, 1 | t | 0.84 | 6.34 | 0.64 | |

| 12, 4 | t | 0.86 | 4.96 | 0.64 | |

| 12, 10 | t | 0.91 | 4.49 | 0.73 | |

| 15, 12 | t | 0.92 | 5.25 | 0.74 | |

| 2 | 11, 16; 7 | t | 0.30 | 11.47 | 0.20 |

| 17, 5; 3 | Gaussian | −0.07 | / | −0.04 | |

| 3, 7; 11 | Frank | 1.61 | / | 0.17 | |

| 17, 11; 3 | t | 0.24 | 30.00 | 0.16 | |

| 2, 17; 3 | t | 0.23 | 15.78 | 0.15 | |

| 10, 3; 2 | t | 0.22 | 16.59 | 0.14 | |

| 8, 14; 9 | t | 0.24 | 15.75 | 0.15 | |

| 10, 9; 8 | t | 0.29 | 17.60 | 0.19 | |

| 12, 8; 10 | Frank | 0.66 | / | 0.07 | |

| 13, 2; 10 | Frank | 0.93 | / | 0.10 | |

| 1, 6; 12 | t | 0.27 | 11.96 | 0.17 | |

| 12, 13; 10 | t | 0.11 | 27.71 | 0.07 | |

| 10, 1; 12 | t | 0.34 | 12.34 | 0.22 | |

| 15, 4; 12 | t | 0.10 | 12.33 | 0.07 | |

| 15, 10; 12 | t | 0.32 | 9.88 | 0.21 | |

| … | … | … | … | … | … |

| 16 | 6, 16; 4, 14, 9, 8, 15, 1, 12, 13, 5, 10, 2, 17, 3, 11, 7 | Survival Clayton | 0.06 | / | 0.03 |

| UK | IN | HKG | ES | CHN | CH | JPN | USA | CAN | NL | KOR | FR | RUS | BR | GER | AUS | SG | Into | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| UK | 14.78 | 2.65 | 2.37 | 9.09 | 0.46 | 9.34 | 1.62 | 4.47 | 5.83 | 11.46 | 2.09 | 11.49 | 4.30 | 4.33 | 10.20 | 2.37 | 3.15 | 85.22 |

| IN | 5.12 | 27.04 | 7.59 | 4.04 | 1.53 | 3.77 | 3.11 | 3.57 | 4.03 | 5.06 | 5.58 | 4.80 | 3.40 | 3.62 | 4.94 | 4.07 | 8.73 | 72.96 |

| HKG | 4.19 | 6.22 | 22.13 | 2.97 | 5.46 | 2.98 | 5.86 | 3.68 | 3.79 | 4.00 | 8.58 | 3.64 | 2.71 | 3.30 | 4.00 | 5.94 | 10.57 | 77.87 |

| ES | 10.33 | 2.36 | 1.73 | 16.79 | 0.27 | 8.35 | 1.49 | 4.51 | 4.98 | 11.17 | 1.52 | 13.04 | 3.62 | 4.00 | 11.10 | 1.99 | 2.74 | 83.21 |

| CHN | 2.51 | 2.92 | 12.16 | 1.53 | 50.01 | 1.60 | 3.15 | 1.84 | 1.71 | 2.31 | 4.41 | 2.17 | 1.91 | 1.94 | 2.20 | 2.92 | 4.71 | 49.99 |

| CH | 10.90 | 2.33 | 1.81 | 8.57 | 0.26 | 17.26 | 1.69 | 5.27 | 5.23 | 11.11 | 1.67 | 11.27 | 3.72 | 3.70 | 10.36 | 2.12 | 2.74 | 82.74 |

| JPN | 4.33 | 2.99 | 6.39 | 4.02 | 1.55 | 4.25 | 24.69 | 5.59 | 4.74 | 4.99 | 8.27 | 4.89 | 2.63 | 2.72 | 5.15 | 6.39 | 6.42 | 75.31 |

| USA | 6.53 | 1.93 | 1.64 | 6.07 | 0.28 | 6.28 | 0.70 | 24.44 | 12.57 | 8.21 | 1.58 | 7.75 | 2.23 | 8.22 | 8.31 | 1.45 | 1.82 | 75.56 |

| CAN | 8.01 | 2.54 | 2.12 | 6.11 | 0.39 | 6.17 | 1.40 | 10.43 | 20.67 | 7.70 | 2.27 | 7.44 | 3.67 | 8.44 | 7.19 | 2.60 | 2.86 | 79.33 |

| NL | 11.11 | 2.51 | 2.05 | 9.52 | 0.34 | 9.20 | 1.49 | 5.49 | 5.52 | 14.33 | 1.81 | 12.28 | 4.29 | 4.07 | 11.27 | 1.86 | 2.85 | 85.67 |

| KOR | 4.21 | 4.78 | 8.91 | 3.19 | 2.04 | 3.21 | 7.92 | 3.97 | 4.34 | 4.23 | 23.01 | 3.97 | 2.72 | 3.50 | 4.31 | 6.99 | 8.70 | 76.99 |

| Fr | 11.02 | 2.37 | 1.82 | 11.00 | 0.35 | 9.26 | 1.47 | 4.99 | 5.21 | 12.15 | 1.62 | 14.17 | 4.01 | 4.04 | 12.01 | 1.85 | 2.66 | 85.83 |

| RUS | 7.84 | 3.34 | 3.11 | 5.84 | 0.80 | 5.84 | 2.08 | 3.15 | 5.05 | 8.09 | 2.85 | 7.65 | 27.19 | 4.19 | 6.91 | 2.18 | 3.89 | 72.81 |

| BR | 7.02 | 2.72 | 2.60 | 5.86 | 0.67 | 5.18 | 0.93 | 8.45 | 10.40 | 6.78 | 2.28 | 6.91 | 3.55 | 25.40 | 6.49 | 1.84 | 2.90 | 74.60 |

| GER | 10.33 | 2.62 | 2.14 | 9.87 | 0.40 | 8.96 | 1.41 | 5.48 | 5.27 | 11.72 | 1.94 | 12.65 | 3.84 | 3.91 | 14.93 | 1.72 | 2.82 | 85.07 |

| AUS | 5.26 | 3.66 | 6.37 | 4.13 | 1.45 | 4.30 | 6.22 | 4.72 | 5.55 | 5.03 | 7.23 | 4.84 | 2.62 | 3.23 | 4.62 | 23.98 | 6.79 | 76.02 |

| SG | 5.04 | 6.65 | 9.86 | 4.01 | 1.96 | 3.92 | 5.33 | 3.68 | 4.30 | 4.84 | 7.79 | 4.62 | 3.20 | 3.67 | 4.79 | 5.75 | 20.59 | 79.41 |

| Out | 113.74 | 52.62 | 72.66 | 95.80 | 18.20 | 92.61 | 45.86 | 79.31 | 88.52 | 118.85 | 61.48 | 119.4 | 52.43 | 66.87 | 113.8 | 52.05 | 74.37 | |

| Net | 28.52 | −20.3 | −5.21 | 12.59 | −31.7 | 9.87 | −29.4 | 3.74 | 9.19 | 33.18 | −15.5 | 33.55 | −20.3 | −7.73 | 28.77 | −23.97 | −5.04 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Meng, S.; Chen, Y. Market Volatility Spillover, Network Diffusion, and Financial Systemic Risk Management: Financial Modeling and Empirical Study. Mathematics 2023, 11, 1396. https://doi.org/10.3390/math11061396

Meng S, Chen Y. Market Volatility Spillover, Network Diffusion, and Financial Systemic Risk Management: Financial Modeling and Empirical Study. Mathematics. 2023; 11(6):1396. https://doi.org/10.3390/math11061396

Chicago/Turabian StyleMeng, Sun, and Yan Chen. 2023. "Market Volatility Spillover, Network Diffusion, and Financial Systemic Risk Management: Financial Modeling and Empirical Study" Mathematics 11, no. 6: 1396. https://doi.org/10.3390/math11061396

APA StyleMeng, S., & Chen, Y. (2023). Market Volatility Spillover, Network Diffusion, and Financial Systemic Risk Management: Financial Modeling and Empirical Study. Mathematics, 11(6), 1396. https://doi.org/10.3390/math11061396