Financial Risk Measurement and Spatial Spillover Effects Based on an Imported Financial Risk Network: Evidence from Countries along the Belt and Road

Abstract

1. Introduction

2. Methodology

2.1. CoES

2.2. Imported Financial Risk Network

2.3. Multidimensional Risk Space

2.4. Multidimensional Risk Spatial Regression Model

3. Empirical Study and Results

3.1. Data Description

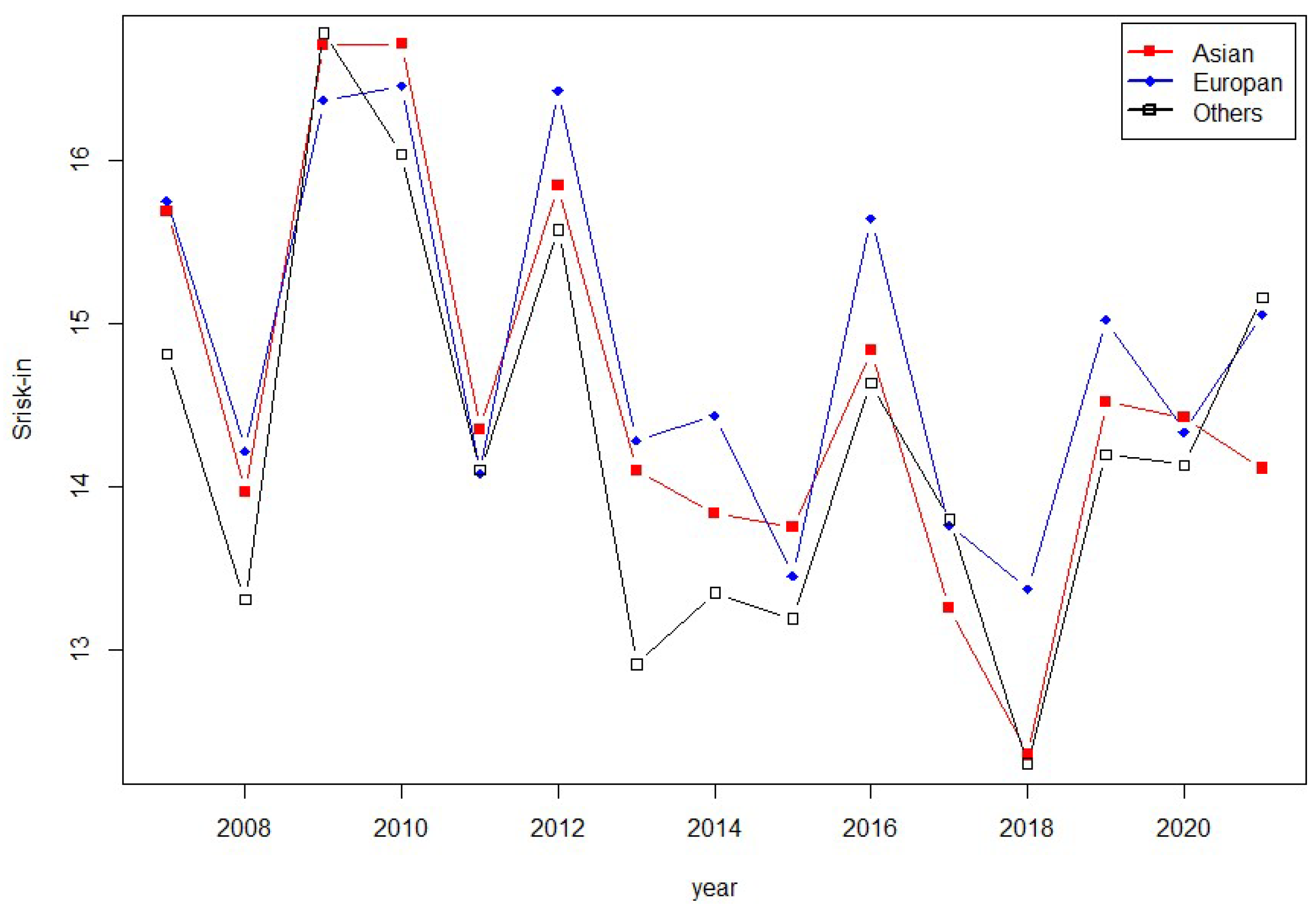

3.2. Measurement of Systemic Financial Risks

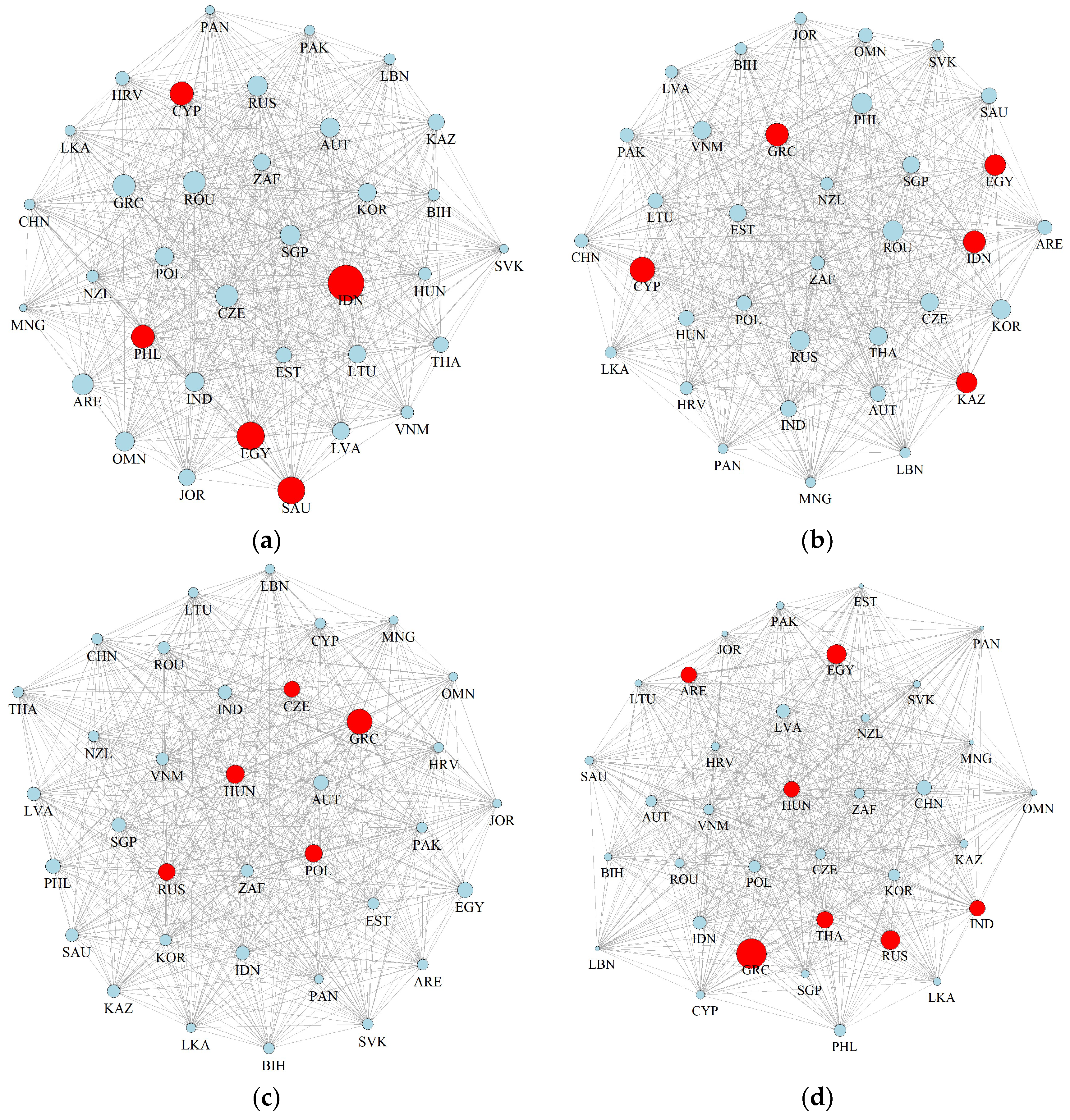

3.3. Spatial Spillover Effects of Financial Risks

3.4. Impact Analysis of Crisis Events

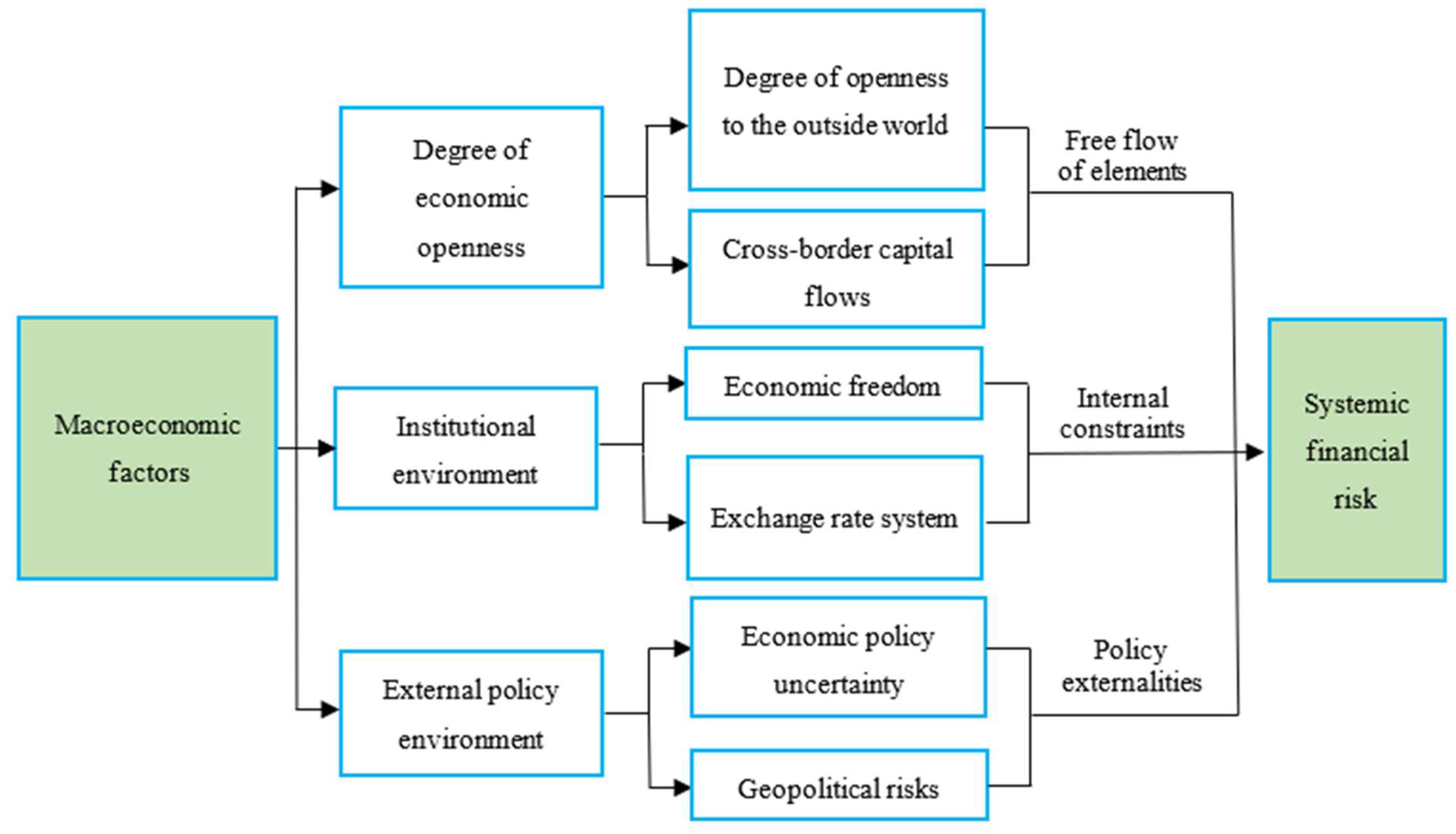

3.5. Macroeconomic Influences on Systemic Financial Risk

3.5.1. Influence Mechanism and Empirical Model

3.5.2. Regression Results and Robustness Test

3.5.3. Regional Heterogeneity Analysis

3.5.4. Further Analysis: The Shock Effects of Crisis Events

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Fang, Y.; Shao, Z.Q. Measurement of Imported Financial Risk under Major Shocks. Econ. Sci. 2022, 248, 13–30. [Google Scholar]

- Yang, H.F.; Wang, W.F.; Wang, Y.X. Imported financial risk in China: Measurement, affecting factors and sources. J. Quant. Tech. Econ. 2020, 37, 113–133. [Google Scholar]

- Chen, S.W.; Guo, L.; Qiang, Q. Spatial Spillovers of Financial Risk and Their Dynamic Evolution: Evidence from Listed Financial Institutions in China. Entropy 2022, 24, 1549. [Google Scholar] [CrossRef]

- Liu, X.Y.; An, H.Z.; Li, H.J.; Chen, Z.H.; Feng, S.D.; Wen, S.B. Features of spillover networks in international financial markets: Evidence from the G20 countries. Phys. A Stat. Mech. Its Appl. 2017, 479, 265–278. [Google Scholar] [CrossRef]

- Liu, B.Y.; Fan, Y.; Ji, Q.; Hussain, N. high-dimensional CoVaR network connectedness for measuring conditional financial contagion and risk spillovers from oil markets to the G20 stock system. Energy Econ. 2022, 105, 105749. [Google Scholar] [CrossRef]

- Yousaf, I.; Patel, R.; Yarovaya, L. The reaction of G20+ stock markets to the Russia-Ukraine conflict “black-swan” event: Evidence from event study approach. J. Behav. Exp. Financ. 2022, 35, 100723. [Google Scholar] [CrossRef]

- Naeem, M.A.; Pham, L.; Senthilkumar, A.; Karim, S. Oil shocks and BRIC markets: Evidence from extreme quantile approach. Energy Econ. 2022, 108, 105932. [Google Scholar] [CrossRef]

- Ma, X.X.; Zong, X.Y.; Chen, X.M. Economic fitness and economy growth potentiality: Evidence from BRICS and OECD countries. Financ. Res. Lett. 2022, 50, 103235. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Kang, S.H. Risk spillovers and portfolio management between developed and BRICS stock markets. N. Am. J. Econ. Financ. 2017, 41, 133–155. [Google Scholar] [CrossRef]

- Ordoñez-Callamand, D.; Gomez-Gonzalez, J.E.; Melo-Velandia, L.F. Sovereign default risk in OECD countries: Do global factors matter? N. Am. J. Econ. Financ. 2017, 42, 629–639. [Google Scholar] [CrossRef]

- Kim, H.; Batten, J.A.; Ryu, D. Financial crisis, bank diversification, and financial stability: OECD countries. Int. Rev. Econ. Financ. 2020, 65, 94–104. [Google Scholar] [CrossRef]

- Ji, Q.; Liu, B.Y.; Cunado, J.; Gupta, R. Risk spillover between the US and the remaining G7 stock markets using time-varying copulas with markov switching: Evidence from over a century of data. N. Am. J. Econ. Financ. 2020, 51, 100846. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Trabelsi, N.; Alqahtani, F.; Raheem, I.D. Systemic risk spillovers between crude oil and stock index returns of G7 economies: Conditional value-at-risk and marginal expected shortfall approaches. Energy Econ. 2020, 86, 104646. [Google Scholar] [CrossRef]

- Liu, J.Q.; Liao, W.X. The Financial Risk Effects of China’s Imported Uncertainties: Classification, Calculation and Dynamic Characteristics. Contemp. Financ. Econ. 2021, 443, 67–78. [Google Scholar] [CrossRef]

- Sui, J.L.; Yang, Q.W.; Liu, J.W. Global Exchange Rate Market Risk Contagion Measurement, Source Tracing and RMB Exchange Rate Market Imported Risk Decomposition. J. Int. Trade 2022, 475, 105–122. [Google Scholar] [CrossRef]

- Qin, X.; Zhou, C. Systemic risk allocation using the asymptotic marginal expected shortfall. J. Bank. Financ. 2021, 126, 106099. [Google Scholar] [CrossRef]

- Idier, J.; Lamé, G.; Mésonnier, J.S. How useful is the marginal expected shortfall for the measurement of systemic exposure? A practical assessment. J. Bank. Financ. 2014, 47, 134–146. [Google Scholar] [CrossRef]

- Nivorozhkin, E.; Chondrogiannis, I. Shifting balances of systemic risk in the Chinese banking sector: Determinants and trends. J. Int. Financ. Mark. Inst. Money 2022, 76, 101465. [Google Scholar] [CrossRef]

- Bonaccolto, G.; Caporin, M.; Paterlini, S. Decomposing and backtesting a flexible specification for CoVaR. J. Bank. Financ. 2019, 108, 105659. [Google Scholar] [CrossRef]

- Bianchi, M.L.; Luca, G.D.; Rivieccio, G. Non-Gaussian models for CoVaR estimation. Int. J. Forecast. 2022, 39, 391–404. [Google Scholar] [CrossRef]

- Zhao, R.B.; Tian, Y.X.; Tian, W. Research on the Asymmetric Risk spillover effect of financial market based on GAS t-Copula model. Oper. Res. Manag. Sci. 2021, 30, 176–183. [Google Scholar]

- Li, H.L.; Zhou, X.L.; Wang, C.H. Research on systematic risk measurement of China’s listed commercial banks based on AR-GARCH-CoES model. Sci. Technol. Econ. 2021, 34, 81–85. [Google Scholar]

- Li, Z.; Liang, Q.; Fang, Y. Monitoring and forewarning of systemic risk spillover in China’s financial sector based on modified CoES indicators. J. Financ. Res. 2019, 2, 40–58. [Google Scholar]

- Yang, Z.H.; Zhou, Y.G. Global systemic financial risk spillovers and their external impact. Soc. Sci. China 2018, 12, 69–90+200–201. [Google Scholar]

- Ren, Y.H.; Zhao, W.R.; Luo, L.Q. Research on risk spillover networks among major global stock markets based on Copula function. J. Stat. Inf. 2020, 35, 53–63. [Google Scholar]

- Gu, Y.; Zhang, D.H.; Du, Z.C.; Huang, Z.X. Modeling and Back Testing CoES for Systemic Risk Measure. Stat. Res. 2022, 39, 132–145. [Google Scholar]

- Zhang, W.P.; Zhuang, X.T.; Lu, Y. Spatial spillover effects and risk contagion around G20 stock markets based on volatility network. N. Am. J. Econ. Financ. 2020, 51, 101064. [Google Scholar] [CrossRef]

- Cohen-Cole, E.; Kirilenko, A.; Patacchini, E. Trading networks and liquidity provision. J. Financ. Econ. 2014, 113, 235–251. [Google Scholar] [CrossRef]

- Kelejian, H.H.; Prucha, I.R. Specification and estimation of spatial autoregressive models with autoregressive and heteroskedastic disturbances. J. Econom. 2010, 157, 53–67. [Google Scholar] [CrossRef]

- Kou, S.; Peng, X.H.; Zhong, H.W. Asset pricing with spatial interaction. Manag. Sci. 2017, 64, 2083–2101. [Google Scholar] [CrossRef]

- Zhang, W.P.; Zhuang, X.T.; Li, Y.S. Dynamic evolution process of financial impact path under the multidimensional spatial effect based on G20 financial network. Phys. A Stat. Mech. Its Appl. 2019, 532, 121876. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705. [Google Scholar] [CrossRef]

- Zhang, B.J.; Wang, S.Y.; Wei, Y.J.; Zhao, X.T. Measuring the systemic risk contribution of financial institutes in China based on CoES model. Syst. Eng. Theory Pract. 2018, 38, 565–575. [Google Scholar]

- Cui, J. Measurement of systematic financial risk based on CoES model. Stat. Decis. 2019, 35, 148–151. [Google Scholar]

- Cao, J.; Lei, L.H. Research on risk spillovers among stock markets using HAC generalized multi-CoES model. Stat. Res. 2022, 39, 142–153. [Google Scholar]

- Guo, S.H.; Ma, X.Y. Research on the tail risk spillover effect of core assets. J. Technol. Econ. 2021, 40, 113–126. [Google Scholar]

- Bai, X.M.; Shi, D.L. Measurement of the systemic risk of China’s financial system. Stud. Int. Financ. 2014, 6, 75–85. [Google Scholar]

- Fang, Y.; Jin, Z.B.; Ma, X. The spillover effect of Chinese real estate market on banking systemic risk. China Econ. Q. 2021, 21, 2037–2060. [Google Scholar]

- Yang, Z.H.; Li, D.C.; Wang, S.D. Research on imported financial risk from the new perspective of composite network. China Ind. Econ. 2022, 3, 38–56. [Google Scholar]

- Mantegna, R.N.; Stanley, H.E. Introduction to Econophysics: Correlations and Complexity in Finance; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Fernandez-Aviles, G.; Montero, J.M.; Orlov, A.G. Spatial modeling of stock market comovements. Financ. Res. Lett. 2012, 9, 202–212. [Google Scholar] [CrossRef]

- Li, L.; Tian, Y.X.; Zhang, H.L. S-VaR calculation considering generalized multidimensional space effect. Syst. Eng.-Theory Pract. 2015, 35, 3008–3016. [Google Scholar]

- Elhorst, J.P. Spatial Econometrics: From Cross-Sectional Data to Spatial Panels; Physica-Verlag HD; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Zhang, M.T.; He, J.; Zheng, Z.Y. Risk and development: The research of “double-edged sword” effect of import and export trade. Int. Bus. 2022, 1, 34–50. [Google Scholar]

- Guan, X.J.; Ren, B.Y.; Li, K.Q. Impact of short-term cross-border capital flows on systemic financial risks. ReformEcon. Syst. 2021, 3, 150–157. [Google Scholar]

- Wang, G.H.; Guo, J.L. Macro leverage ratio, structural distortion and systemic financial risk: Empirical research based on multinational panel data. Secur. Mark. Her. 2018, 12, 25–31. [Google Scholar]

- Santana-Gallego, M.; Pérez-Rodríguez, J.V. International trade, exchange rate regimes, and financial crises. N. Am. J. Econ. Financ. 2019, 47, 1062–9408. [Google Scholar] [CrossRef]

- Liu, Y.; Cai, S.J.; Wang, X.L. The impact of external uncertainty on systemic financial risk in China based on the perspective of cross-border capital flow and channels. J. Southwest Minzu Univ. 2019, 40, 136–143. [Google Scholar]

- Guo, P. The impact of geopolitical risk on international stock market from the perspective of quantile. Financ. Regul. Res. 2021, 5, 66–79. [Google Scholar]

- Zhang, C.; Jiao, W.W. Venture capital, regional institutional environment with regional innovation performance. Res. Financ. Econ. Issues 2022, 4, 75–82. [Google Scholar]

- Piao, J.S.; Li, T.Y. The impact of economic uncertainty and risk aversion on the transnational capital flow: Based on an empirical study in South Korea. Nankai J. 2018, 4, 22–32. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

| Continent | Country | Symbol | Stock Index |

|---|---|---|---|

| Asia | China | CHN | CHN, CSI300 Index |

| Asia | Oman | OMN | OMN, MSM30 Index |

| Asia | Saudi Arabia | SAU | SAU, SASEIDX Index |

| Asia | Mongolia | MNG | MNG, MSETOP Index |

| Asia | Kazakhstan | KAZ | KAZ, KZKAK Index |

| Asia | Vietnam | VNM | VNM, VNINDEX Index |

| Asia | United Arab Emirates | UAE | UAE, ADSMI Index |

| Asia | India | IND | IND, SENSEX Index |

| Asia | Indonesia | IDN | IDN, JCI Index |

| Asia | Sri Lanka | LKA | LKA, CSEALL Index |

| Asia | Philippines | PHL | PHL, PCOMP Index |

| Asia | Thailand | THA | THA, SET Index |

| Asia | Pakistan | PAK | PAK, KSE100 Index |

| Asia | Singapore | SGP | SGP, STI Index |

| Asia | Jordan | JOR | JOD, JOSMGNFF Index |

| Asia | Korea, Rep. | KOR | KOR, KRX100 Index |

| Asia | Lebanon | LBN | LBN, BLOM Index |

| Europe | Cyprus | CYP | CYP, CYSMMAPA Index |

| Europe | Russian | RUS | RUS, CRTX Index |

| Europe | Greece | GRC | GRC, ASE Index |

| Europe | Hungary | HUN | HUN, BUX Index |

| Europe | Poland | POL | POL, WIG Index |

| Europe | Austria | AUT | AUT, ATXPRIME Index |

| Europe | Czech Republic | CZE | CZE, PX Index |

| Europe | Estonia | EST | EST, TALSE Index |

| Europe | Romania | ROU | ROU, BET Index |

| Europe | Latvia | LVA | LVA, RIGSE Index |

| Europe | Lithuania | LTU | LTU, VILSE Index |

| Europe | Bosnia and Herzegovina | BIH | BIH, BIRS Index |

| Europe | Croatia | HRV | HRK, CRO Index |

| Europe | Slovak Republic | SVK | SVK, SKSM Index |

| Australasia | New Zealand | NZL | NZL, NZSE50FG Index |

| America | Panama | PAN | PAN, BVPSBVPS Index |

| Africa | Egypt, Arab Rep. | EGY | EGY, HERMES Index |

| Africa | South Africa | ZAF | ZAF, JALSH Index |

| Variable Name | Symbol | Definition |

|---|---|---|

| Global equity market sentiment index | Mr | The log returns of the Global Equity Market Index (MSCI) |

| International equity market volatility | Mvar | The standard deviation of the MSCI’s 22-day rolling returns |

| China manufacturing sentiment index | MCMI | The log returns of the SSE Industrial Index |

| U.S. term spread | MTS | The difference between the 10-year and 3-month U.S. Treasury yields to maturity |

| Interest rate trends | MIRT | The difference between 3-month and 4-week U.S. Treasury yields |

| 2007 | Rank | 2010 | Rank | 2013 | Rank | 2016 | Rank | 2019 | Rank | 2021 | Rank |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IDN (20.13) | 1 | ROU (18.88) | 1 | GRC (20.36) | 1 | GRC (21.53) | 1 | GRC (19.69) | 1 | RUS (19.01) | 1 |

| PHL (18.69) | 2 | KAZ (18.79) | 2 | CYP (19.01) | 2 | ROU (18.58) | 2 | AUT (16.78) | 2 | EGY (17.25) | 2 |

| SGP (18.57) | 3 | EGY (18.64) | 3 | PHL (16.40) | 3 | HUN (18.56) | 3 | POL (16.27) | 3 | GRC (16.62) | 3 |

| IND (17.81) | 4 | IDN (18.42) | 4 | IDN (16.21) | 3 | EGY (17.63) | 4 | PHL (15.97) | 4 | VNM (16.42) | 4 |

| BIH (17.57) | 5 | IND (18.35) | 5 | THA (15.73) | 4 | IND (17.53) | 5 | IDN (15.95) | 5 | IND (16.29) | 5 |

| CHN (15.51) | 20 | CHN (16.57) | 19 | CHN (13.53) | 19 | CHN (13.91) | 27 | CHN (14.65) | 19 | CHN (14.33) | 18 |

| Year | Moran’s I | ρ | λ |

|---|---|---|---|

| 2007 | 0.0925 *** (16.74) | 0.1678 *** (9.03) | 0.1678 *** (9.03) |

| 2008 | 0.2087 *** (38.62) | 0.3881 *** (26.7) | 0.3877 *** (26.66) |

| 2009 | 0.1388 *** (25.24) | 0.3374 *** (21.8) | 0.3374 *** (21.79) |

| 2010 | 0.1552 *** (27.86) | 0.3325 *** (21.4) | 0.3325 *** (21.40) |

| 2011 | 0.1463 *** (26.44) | 0.4159 *** (30.03) | 0.4162 *** (30.07) |

| 2012 | 0.0684 *** (12.46) | 0.2430 *** (14.01) | 0.2434 *** (14.04) |

| 2013 | 0.0934 *** (16.66) | 0.2027 *** (11.19) | 0.2027 *** (11.19) |

| 2014 | 0.0583 *** (10.60) | 0.1913 *** (10.57) | 0.1881 *** (10.37) |

| 2015 | 0.1779 *** (31.96) | 0.1666 *** (9.04) | 0.1666 *** (9.04) |

| 2016 | 0.1356 *** (24.73) | 0.2564 *** (15.04) | 0.2565 *** (15.05) |

| 2017 | 0.0404 *** (7.38) | 0.1736 *** (9.36) | 0.1736 *** (9.36) |

| 2018 | 0.1040 *** (18.79) | 0.1977 *** (10.95) | 0.1973 *** (10.93) |

| 2019 | 0.0824 *** (14.88) | 0.1382 *** (7.28) | 0.1384 *** (7.30) |

| 2020 | 0.2252 *** (40.77) | 0.5155 *** (43.78) | 0.5161 *** (43.90) |

| 2021 | 0.0591 *** (10.69) | 0.1571 *** (8.38) | 0.1569 *** (8.37) |

| Subprime Crisis Period | European Debt Crisis Period | Brexit Period | COVID-19 Pandemic Period |

|---|---|---|---|

| Country nodes | |||

| Indonesia (19.63) | Cyprus (17.66) | Greece (17.40) | Greece (19.36) |

| Egypt (18.00) | Greece (17.12) | Hungary (15.79) | Egypt (16.37) |

| Saudi Arabia (17.90) | Indonesia (16.93) | Poland (15.54) | UAE (15.95) |

| Cyprus (17.06) | Egypt (16.65) | Russia (15.36) | Cyprus (15.43) |

| Philippines (16.97) | Kazakhstan (16.60) | Czech Republic (15.06) | Austria (15.27) |

| China (13.32) | China (14.56) | China (13.32) | China (14.16) |

| Regions | |||

| Asia region (15.36) | Asia region (15.11) | Asia region (14.76) | Asia region (13.65) |

| European region (15.44) | European region (15.38) | Europe region (13.24) | Europe region (14.38) |

| Other regions (14.95) | Other regions (14.58) | Other regions (12.43) | Other regions (13.70) |

| Overall level of sample countries | |||

| 15.29 | 15.16 | 13.89 | 13.95 |

| SLM | SEM | |||||||

|---|---|---|---|---|---|---|---|---|

| Subprime Crisis | European Debt Crisis | Brexit | COVID-19 Pandemic | Subprime Crisis | European Debt Crisis | Brexit | COVID-19 Pandemic | |

| ρ | 0.3766 *** (39.00) | 0.3090 *** (41.12) | 0.1886 *** (18.87) | 0.5846 *** (34.67) | ||||

| λ | 0.3767 *** (39.01) | 0.3090 *** (41.10) | 0.1889 *** (18.90) | 0.5862 *** (34.86) | ||||

| lvar | −0.00033 (0.67) | −0.00034 * (−1.63) | −0.00011 (−0.61) | −0.00184 ** (−1.63) | −0.00040 (−0.62) | −0.00037 * (−1.70) | −0.00011 (−0.60) | −0.00158 * (−1.73) |

| hvar | 0.00005 (0.11) | 0.00020 ** (2.44) | 0.00030 * (1.82) | 0.00178 *** (1.69) | 0.00014 (0.26) | 0.00041 ** (2.04) | 0.00030 * (1.84) | 0.00217 * (1.81) |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 19,950 | 38,605 | 28,245 | 3830 | 19,950 | 38,605 | 28,245 | 3830 |

| Dimensions | Variable | Symbol | Definition |

|---|---|---|---|

| Economic openness | The growth rate of external openness | Growth-Opens | The ratio of total exports and imports to GDP of each country [50] |

| The growth rate of short-term capital flows | Growth-SCF | Short-term capital flows expressed according to the residual method proposed by the World Bank, i.e., the ratio of net foreign direct investment inflows to GDP [51] | |

| Institutional environment | Degree of economic freedom | Degree-Free | Published by the Wall Street Journal and the Heritage Foundation, contains 10 subindicators, including finance, investment, trade, etc. The values range from 0 to 100, and the higher the value, the freer the economy is |

| Fixed exchange rate regime Intermediate exchange rate regime Floating exchange rate regime | Fixed Intermediate Floating | The exchange rate regime, including fixed, intermediate, or floating, is divided according to the 10 exchange rate regimes proposed by the IMF and the World Bank (Exchange rate regimes are divided according to the 10 exchange rate regimes proposed by the IMF of the World Bank, among which the fixed exchange rate regime includes “stabilized arrangement exchange rate system”, “traditional pegged exchange rate system”, “currency board system” and “no independent legal tender”. The intermediate exchange rate regime includes the “other exchange rate regime”, the “in-range crawling peg”, the “crawling arrangement exchange rate regime” and the “crawling peg”. “crawling peg”, and floating exchange rate regimes include “managed floating exchange rate regimes” and “full floating exchange rate regimes”.) | |

| External policy environment | Economic policy uncertainty | GEPU | The economic and political uncertainty index constructed by Baker et al. [52] is used to measure global economic and political uncertainty (China Economic Policy Uncertainty Index from https://economicpolicyuncertaintyinchina.weebly.com/ (accessed on 6 October 2022).) |

| Geopolitical risk index | GPR | The geopolitical risk index based on news reports proposed by Caldarahe et al. [53] (Global Geopolitical Risk Index from https://www.matteoiacoviello.com/gpr.htm (accessed on 6 October 2022).) |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| C | 15.744 *** (29.09) | 15.681 *** (29.73) | 18.392 *** (16.78) | 15.16 *** (28.92) | 15.80 *** (30.22) | 16.238 *** (30.55) | 21.654 *** (32.62) | 26.305 *** (32.62) | 26.953 *** (20.69) |

| Growth-Opens | −1.518 *** (2.63) | −1.661 ** (−3.81) | −1.661 ** (−3.81) | ||||||

| Growth-SCF | 0.014 ** (2.13) | 0.014 * (1.93) | 0.014 * (1.93) | ||||||

| Degree-Free | −0.032 *** (−2.67) | −0.031 ** (−2.46) | −0.031 ** (−2.46) | ||||||

| Floating | 0.639 ** (4.42) | 0.647 *** (4.24) | |||||||

| Intermediate | 0.312 ** (2.06) | −0.639 ** (−4.42) | 0.118 (0.77) | −0.530 ** (−3.45) | |||||

| Fixed | −0.327 ** (−2.07) | −0.648 ** (−4.24) | |||||||

| GEPU | −0.004 *** (−6.25) | −0.007 ** (−8.51) | −0.007 ** (−8.51) | ||||||

| GPR | −0.063 ** (−17.67) | −0.077 ** (−17.67) | −0.076 ** (−13.93) | ||||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Mixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 490 | 490 | 490 | 490 | 490 | 490 | 490 | 490 | 490 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| C | 31.001 *** (1.25) | 31.026 *** (25.07) | 26.824 *** (10.74) | 29.95 *** (22.50) | 31.924 *** (24.02) | 32.701 *** (26.06) | 43.004 *** (30.16) | 43.73 *** (15.56) | 45.555 *** (15.98) |

| Growth-Opens | −1.089 * (−1.70) | −1.824 ** (−2.34) | −1.824 ** (−2.35) | ||||||

| GrowthSCF | 0.030 ** (2.09) | 0.040 *** (2.83) | 0.014 * (2.83) | ||||||

| Degree-Free | −1.76 *** (−2.67) | −0.029 * (−0.98) | −0.029* (−0.98) | ||||||

| Floating | 1.972 *** (6.35) | 1.822 *** (5.68) | |||||||

| Intermediate | 0.712 ** (2.64) | −1.971 ** (−6.36) | 0.328 (1.17) | −1.493 ** (−5.13) | |||||

| Fixed | −1.259 *** (−4.34) | −1.821 *** (−5.68) | |||||||

| GEPU | −0.010 * (−5.44) | −0.015 ** (−6.87) | −0.015 ** (−6.87) | ||||||

| GPR | −0.132 ** (−18.45) | −0.152 ** (−15.12) | −0.152 ** (−15.12) | ||||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pooling effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 490 | 490 | 490 | 490 | 490 | 490 | 490 | 490 | 490 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Asia region | |||||||||

| C | 15.983 *** (99.58) | 16.212 *** (129.31) | 16.654 *** (29.24) | 16.039 *** (149.80) | 16.869 *** 154.48) | 16.958 *** (105.27) | 22.772 *** (49.12) | 25.280 *** (22.82) | 25.945 *** (23.19) |

| Growth-Opens | −3.82 *** (−16.33) | −3.141 ** (−7.86) | −3.141 ** (−7.86) | ||||||

| Growth-SCF | 0.018 ** (3.16) | 0.022 * (1.97) | 0.022 * (1.97) | ||||||

| Degree-Free | −0.006 (−1.05) | −0.029 * (−0.98) | −0.029 * (−0.98) | ||||||

| Floating | 0.839 *** (6.35) | 0.665 *** (6.43) | |||||||

| Intermediate | −0.242 ** (−6.15) | −1.082 *** (−22.20) | −0.384 *** (−4.79) | −1.050 ** (−9.72) | |||||

| Fixed | −0.839 ** (−18.86) | −0.666 *** (−6.43) | |||||||

| GEPU | −0.004 *** (−8.35) | −0.008 ** (−6.33) | −0.008 ** (−6.33) | ||||||

| GPR | −0.070 *** (−16.29) | −0.081 ** (−10.93) | −0.081 ** (−10.93) | ||||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pooling effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 238 | 238 | 238 | 238 | 238 | 238 | 238 | 238 | 238 |

| European region | |||||||||

| C | 14.586 *** (36.56) | 14.725 *** (146.14) | 23.488 *** (30.12) | 12.151 *** (37.16) | 13.191 *** (43.01) | 15.142 *** (41.31) | 20.372 *** (29.62) | 31.194 *** (30.84) | 31.959 *** (31.63) |

| Growth-Opens | 0.20 (0.75) | −0.172 (−0.68) | −0.172 (−0.68) | ||||||

| Growth-SCF | 0.024 ** (49.07) | 0.026 *** (11.98) | 0.026 *** (11.98) | ||||||

| Degree-Free | −0.089 *** (−12.87) | −0.097 * (−12.86) | −0.097 * (−12.86) | ||||||

| Floating | 1.040 *** (14.33) | 0.765 *** (10.24) | |||||||

| Intermediate | 0.021 ** (0.21) | −1.019 *** (−12.67) | −0.791 *** (−8.72) | −1.493 ** (−10.24) | |||||

| Fixed | −1.040 ** (−14.33) | −1.557 *** (−18.16) | |||||||

| GEPU | −0.002 *** (−2.57) | −0.006 ** (−5.91) | −0.006 ** (−5.91) | ||||||

| GPR | −0.055 *** (−14.40) | −0.067 ** (−14.78) | −0.067 ** (−14.78) | ||||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pooling effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 | 196 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| C | 15.161 *** (28.26) | 15.063 *** (28.26) | 17.83 *** (15.96) | 13.338 *** (23.87) | 22.25 *** (25.40) |

| Crisis | 1.293 *** (11.54) | 1.278 *** (11.72) | 1.850 *** (2.22) | 3.693 *** (30.45) | 3.94 *** (4.51) |

| Growth-Opens | −1.798 *** (−2.80) | ||||

| Crisis × Growth-Opens | 0.092 (0.12) | ||||

| Growth-SCF | −0.004 (−0.32) | ||||

| Crisis × Growth-SCF | 0.029 * (1.95) | ||||

| Degree-Free | −0.032 * (−2.57) | ||||

| Crisis × Degree-Free | −0.009 (−0.70) | ||||

| GEPU | 0.009 *** (7.45) | ||||

| Crisis × GEPU | −0.014 *** (−8.42) | ||||

| GPR | −0.071 ** (−10.78) | ||||

| Crisis × GPR | 0.049 *** (5.27) | ||||

| Control | Yes | Yes | Yes | Yes | Yes |

| Pooling effect | Yes | Yes | Yes | Yes | Yes |

| Obs | 490 | 490 | 490 | 490 | 490 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S.; Guo, L.; Zhang, W. Financial Risk Measurement and Spatial Spillover Effects Based on an Imported Financial Risk Network: Evidence from Countries along the Belt and Road. Mathematics 2023, 11, 1349. https://doi.org/10.3390/math11061349

Chen S, Guo L, Zhang W. Financial Risk Measurement and Spatial Spillover Effects Based on an Imported Financial Risk Network: Evidence from Countries along the Belt and Road. Mathematics. 2023; 11(6):1349. https://doi.org/10.3390/math11061349

Chicago/Turabian StyleChen, Shaowei, Long Guo, and Weike Zhang. 2023. "Financial Risk Measurement and Spatial Spillover Effects Based on an Imported Financial Risk Network: Evidence from Countries along the Belt and Road" Mathematics 11, no. 6: 1349. https://doi.org/10.3390/math11061349

APA StyleChen, S., Guo, L., & Zhang, W. (2023). Financial Risk Measurement and Spatial Spillover Effects Based on an Imported Financial Risk Network: Evidence from Countries along the Belt and Road. Mathematics, 11(6), 1349. https://doi.org/10.3390/math11061349