1. Introduction

In recent decades, theoretical contributions to macroeconomics have mainly been based on dynamic stochastic general equilibrium models (DSGE models) with rational expectations, where a representative agent is able to understand the complexity of the underlying mathematical model [

1,

2,

3]. The advantage of these models is, firstly, that they have microeconomic justifications, that is, it is assumed that consumers maximize the expected discounted sum of utility function values, and producers maximize their profits in dynamics. This implies that macroeconomic equations must be derived from this optimizing behavior of consumers and producers.

Secondly, it is assumed that consumers and producers have rational expectations, i.e., make predictions using all available information, including information embedded in the model [

4,

5,

6]. This assumption also means that agents know the true statistical distribution of all shocks hitting the economy. They then use this information in their optimization procedure. Because consumers and all producers share the same information, we can take only one representative consumer and one representative producer and model the entire economy. There is no heterogeneity in the behavior of consumers and producers.

Thirdly, there is a new Keynesian feature; it is assumed that prices are not set instantly. This feature contrasts with the new classical model (sometimes also called the “real business cycle” model), which assumes ideal price flexibility.

The global financial crisis, however, has shown that agents are not fully aware of the complexity of the world in which they live. Instead, their cognitive capacity seems to be very limited. Numerous data and pieces of evidence indicate the importance of including heterogeneous expectations in general equilibrium models [

7,

8,

9,

10,

11].

It should be noted that the DSGE-stylized model with rational expectations cannot capture the typical features of real business cycle movement, i.e., the correlation between subsequent observations of the output gap (auto-correlation) and the occurrence of large booms and busts (fat-tailed distributions of variables) without incorporating unsubstantiated assumptions. Therefore, it is necessary to develop macroeconomic models that do not impose implausible cognitive abilities on individual agents.

The vast majority of research is devoted to the analysis of behavioral models with rigid prices and flexible wages (references to these studies, both theoretical and using laboratory experiments, are given in the literature review). Therefore, it is of interest to study the influence of wage rigidity (along with price rigidity) on the behavior of agents with irrational expectations.

The integrative value of the paper, on the one hand, lies in the fact that, unlike behavioral models studied recently [

8,

12,

13,

14,

15,

16], the model proposed in the publication has imperfections in the form of wage rigidity, which cannot but impose changes in the behavior of agents in the context of their animal spirits and changes in the response of macro variables to impulse responses. In particular, the paper shows that incorporating wage rigidity in the model under study as compared to the baseline model leads to changes in the monetary policy of the authorities. On the other hand, the integrative value of the paper lies in its undeniable contribution to the analysis of the impact of price rigidity on monetary and fiscal policy changes in New Keynesian models. As noted above, all studies in this area refer to models with rational expectations of agents [

17,

18,

19] (the authors cite references to the most recent work in this field). The incremental knowledge in the proposed paper compared to those cited is that households offer differential labor. This imperfect interchangeability between types of labor gives them some market power and allows researchers to reflect on the consequences of wage rigidity.

Thus, the purpose and scientific novelty of the work is to analyze the changes and features of the economic agents’ behavior when incorporating labor market imperfections (wage rigidity) into a new Keynesian model compared to a model with flexible wages and rigid prices under cognitive constraints of agents. At the same time, the formation of expectations in these models will be considered as an interactive process between fundamentalist agents, who predict the output gap and inflation of prices and wages based on their stationary values, and agents who use the forecasting rule based on the extrapolation of the latest available data on inflation and the output gap.

Literature Review

The heterogeneity of the agents as well as their cognitive abilities have been verified using surveys as well as research data [

20,

21,

22,

23,

24,

25]. Researchers have only recently begun to incorporate elements of behavioral economics into dynamic macromodels [

26]. It is worth noting that some studies point out that the linearity inherent in DSGE models with rational expectations makes them of limited suitability for monetary and fiscal policy analysis. The use of macroeconomic models that take into account the cognitive limitations of agents can improve our understanding of the economic agents’ behavior in the real world. The studies [

27,

28,

29] consider dynamic macroeconomic models under the hypothesis that agents form expectations based on simple rules and have bounded rationality. Two types of agents are considered. The first type of agents predict the output gap and inflation based on their equilibrium (stationary) values. In the following, these agents will be referred to as fundamentalist agents. For the second type of agents, a forecasting rule is used which extrapolates the latest data on inflation and the output gap. In what follows, these agents will be referred to as extrapolator agents. De Grauwe [

29] implements these heterogeneous expectations in a standard new Keynesian model with fixed prices, consisting of three equations, and shows how such a structure is able to generate endogenous waves of agents’ optimistic and pessimistic beliefs (“animal spirit”), which are closely related to the business cycle. At the same time, in the studied models, agents are ready to learn, that is, they constantly evaluate the effectiveness of their forecast. At the same time, in the models under study, agents are willing to learn, i.e., they constantly evaluate the effectiveness of their forecast, and this ability is a fundamental definition of rational behavior. Thus, the agents analyzed in these models are rational because they learn from their mistakes. To characterize such behavior, the concept of “bounded rationality” is often used, which will be used in the following research.

In addition, agents can use simpler rules (heuristics) to predict future output and inflation. It is also noted that agents’ forecasts are biased because they do not understand how inflation and the output gap are determined. At the same time, it is believed that some agents are optimistic and regularly increase the output gap and inflation, while others are pessimistic and regularly underestimate these variables.

In all publications (including those listed above) that analyze the cognitive limitations of agents, the labor market is modeled as a market of perfect competition with flexible wages. The imperfections of the labor market and their consequences, in particular, for monetary policy are not considered there. Meanwhile, a feature of models with rigid wages and prices is that the full stabilization of price inflation is no longer considered optimal [

30,

31]. The central bank is therefore concerned about the stability of wages and prices because fluctuations in inflation and the output gap are a source of inefficient resource allocation, making households poorer.

The distribution of heterogeneity of agents changes over time, which is confirmed by many empirical data. For example, in [

32], various studies of inflation expectations show a wide, time-varying range of opinions. Results of research [

23,

33] confirm the time-varying distribution of agents with discrete (exogenous) predictors. The proposed model is an extension of the last listed publications, in which the ratio of fundamentalist agents and extrapolator agents, by analogy with [

34], is endogenous. Additionally, this article expands publications [

27,

28,

29] including the endogenous choice of predictors in a new Keynesian model with an imperfect labor market, which is the scientific novelty of the work.

The approach presented in this study is not the only one possible. There are now a large number of studies that use macroeconomic models with imperfect data. These studies are based on the statistical learning approach proposed in [

35,

36]. This approach leads to important new conclusions [

37,

38,

39]. Nevertheless, the authors believe that this approach overloads individual agents with an excessively large set of cognitive skills that they probably do not possess in the real world.

3. Research Results and Discussion

To solve Equation (17), the model coefficients were calibrated and their values corresponded to the values of these parameters in [

30]. The same coefficient values are used in the rigid price-flexible wage model being compared, which we will hereafter consider as the base model. The values of the model coefficients are given in

Table 2. Note that the standard deviations of all shocks in Equation (17) are 0.5.

De Grauwe in his works [

27,

28,

29] introduced a variable called the degree of animal spirit, characterizing the concentration of vitality. It shows the evolution of the number of agents that extrapolate a positive output gap. Thus, when the curve reaches 1 (

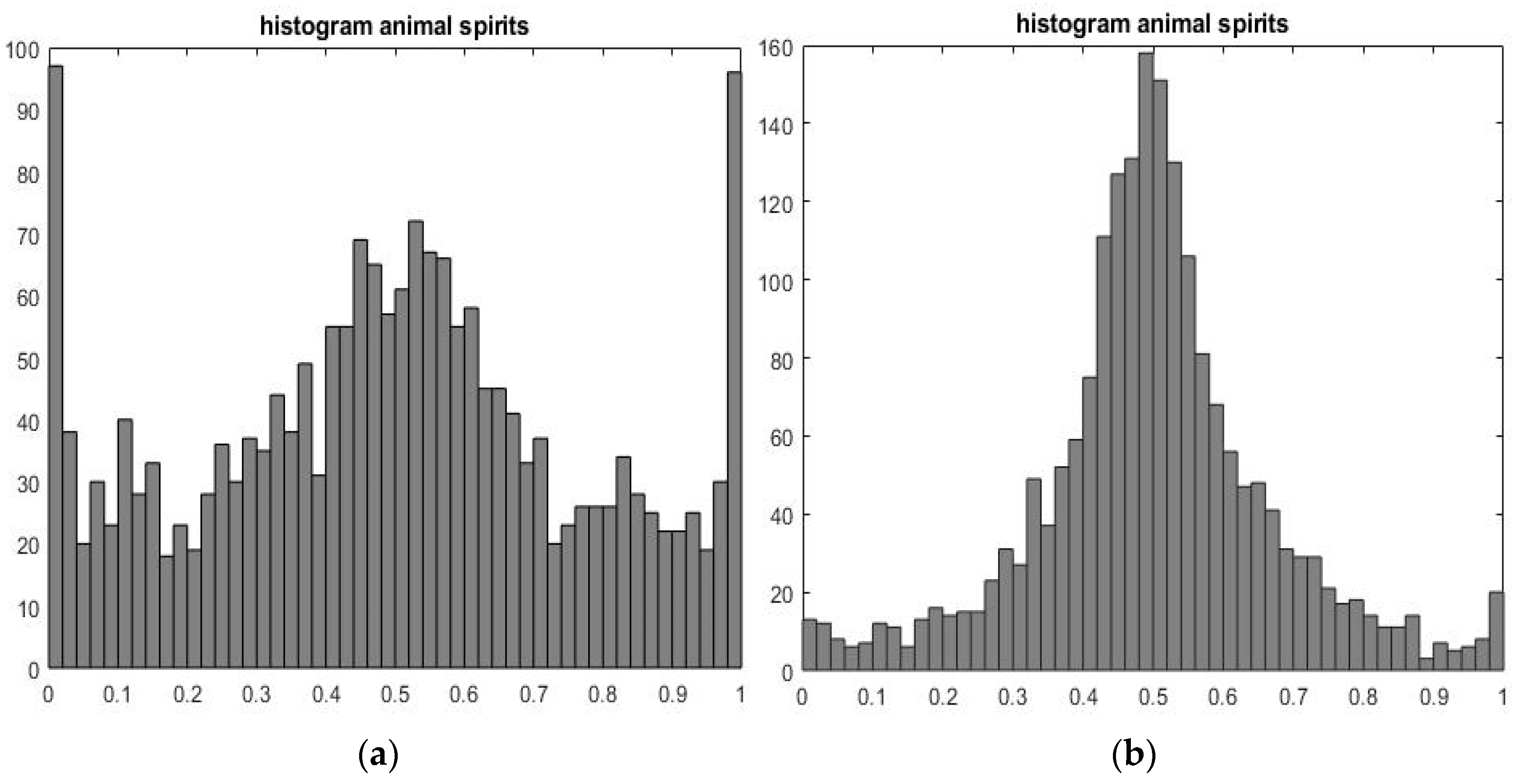

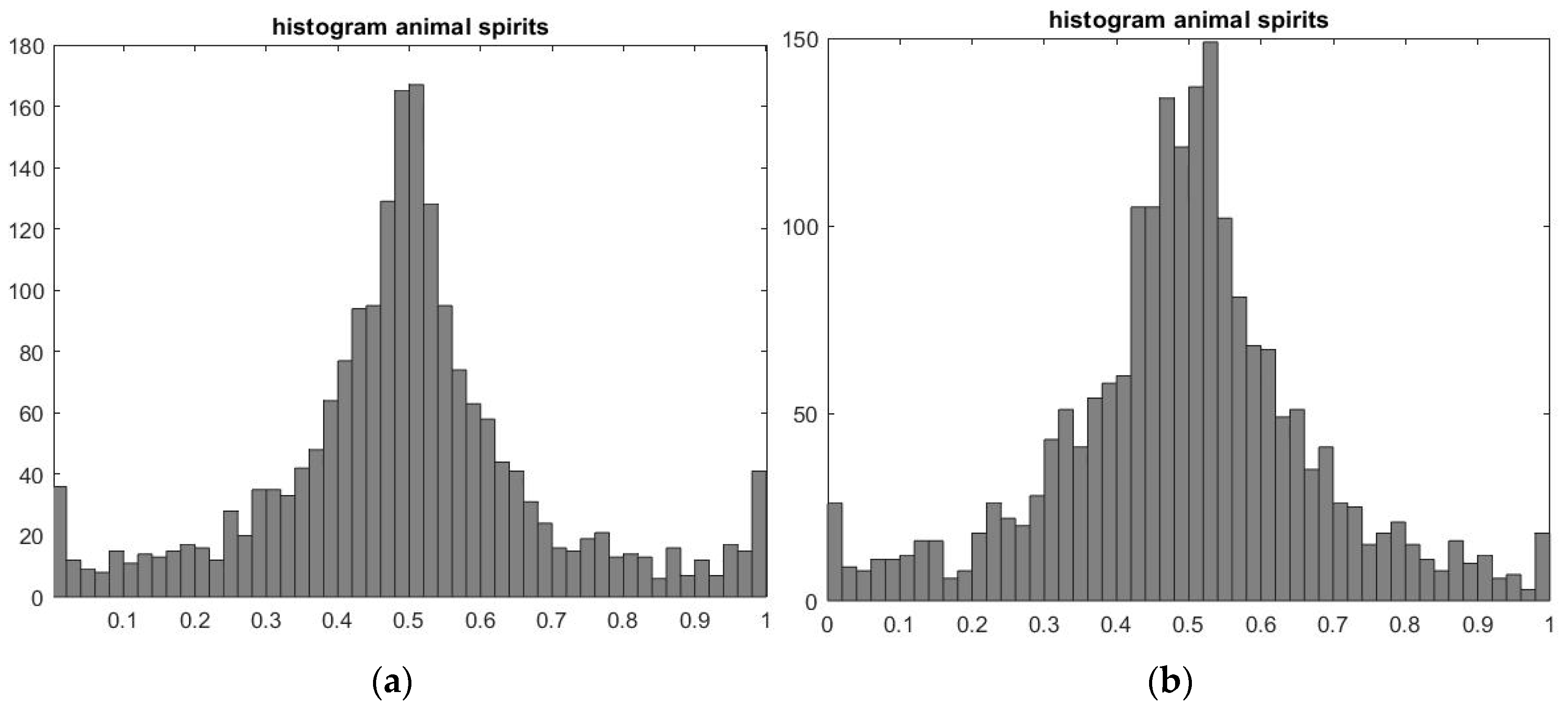

Figure 1), all agents extrapolate a positive output gap and are optimists; when the curve reaches 0, no agent extrapolates a positive output gap. Such agents are pessimists. In fact, in this case, they all extract a negative output gap. Thus, the curve shows the degree of optimism and pessimism of the agents predicting the output gap.

Figure 1 shows histograms of the frequency distribution of this variable for two compared models with coefficients from

Table 2. From a comparison of the histograms, it can be seen that the first model (with an imperfect labor market) is characterized by an increased concentration of vital forces at values of 0 and 1, as well as in the middle of the distribution. This feature provides a key explanation for the abnormal dynamics of variable evolution. The basic model is characterized by a lesser degree of concentration of vital forces at extreme values and in the middle of the distribution. However, the distribution of the concentration of the vital forces of this model, like the first one, has “fat tails”, which characterize the abnormality. Since the degree of optimism and pessimism of the agents of the first model is much higher than the second one, the model with an imperfect labor market is more subject to cyclical behavior compared to the base model.

From

Table 1 and Equation (8), it follows that the degree of wage rigidity depends on the parameter

. The value of this parameter, corresponding to the values of the coefficients in

Table 1, is 0.008. With an increase in the value of this parameter, the degree of wage rigidity decreases and its flexibility increases accordingly. Therefore, for an example,

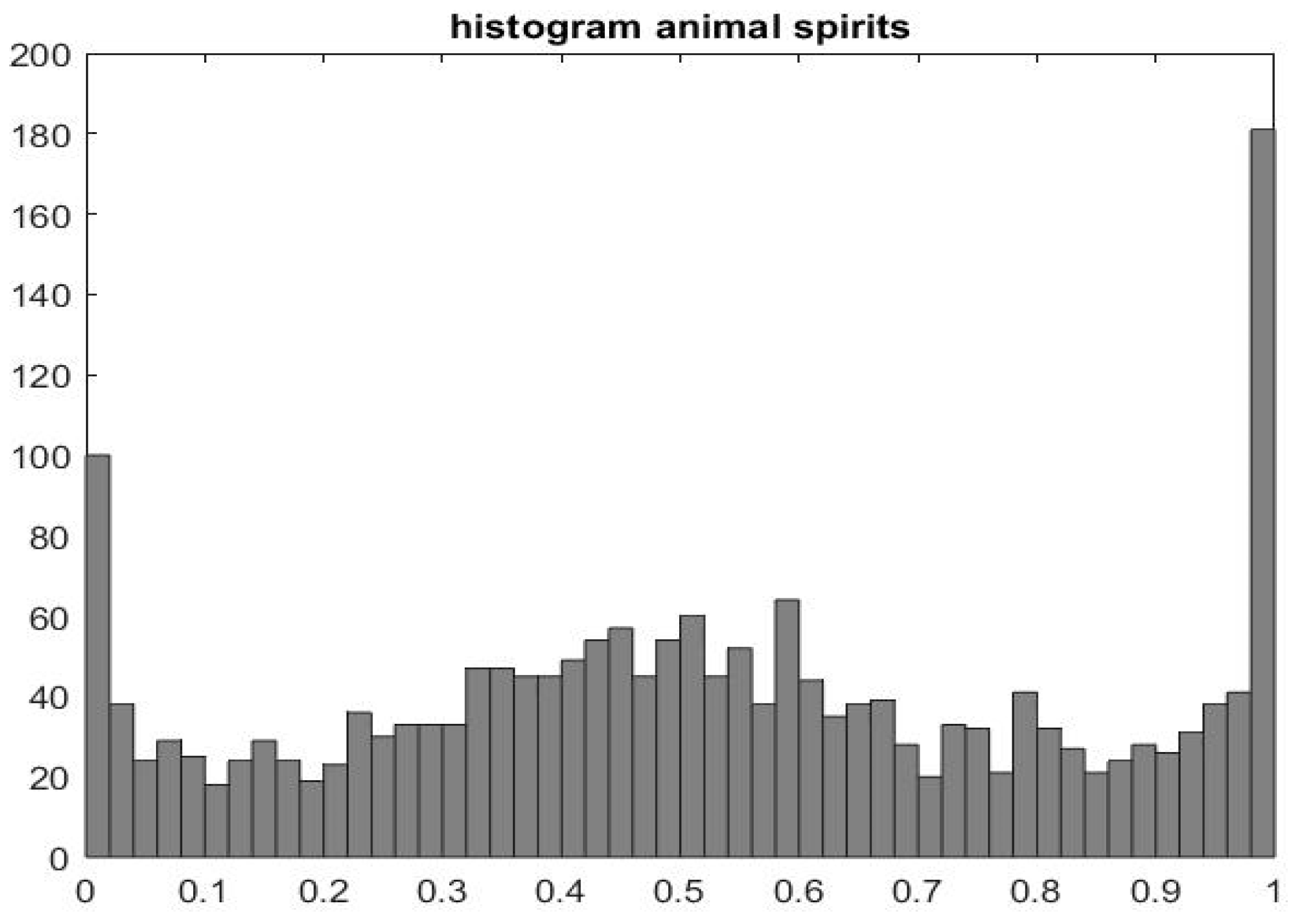

Figure 2 shows a histogram of the frequency distribution of the degree of animal spirits for the model under study with an imperfect labor market at

, that is, for a model with more flexible wages compared to the model shown in

Figure 1a.

The given histogram is characterized by an increased degree of agents’ optimism compared to the histogram for the base model. The degree of agents’ pessimism remained at the same level. In addition, the concentration of the vitality of agents in the middle of the distribution has decreased, and the above model with more flexible wages still reflects the abnormality of the dynamics of variables and is subject to cyclical behavior.

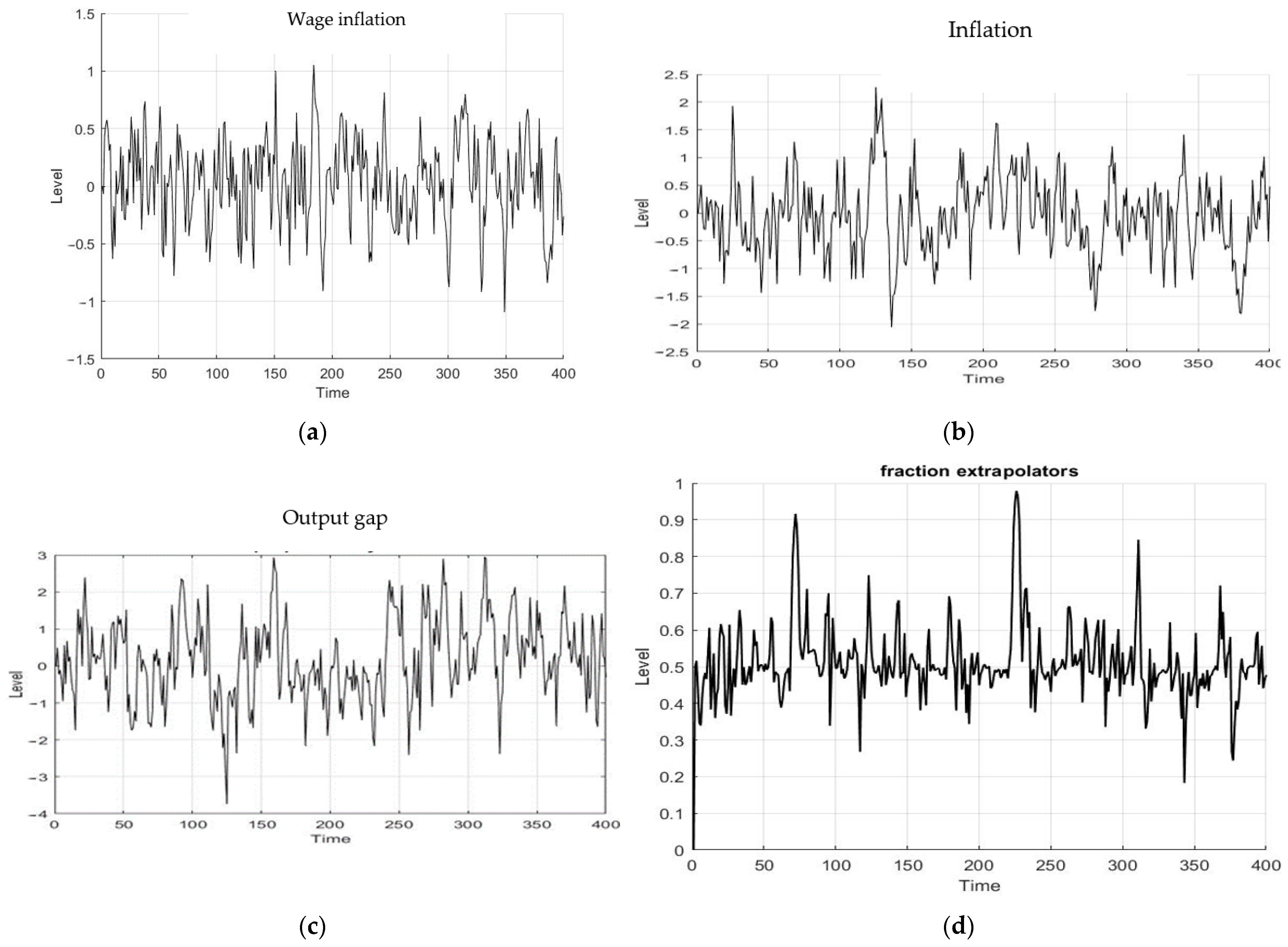

Figure 3 shows a strong cyclical movement of wage inflation, price inflation (hereinafter simply inflation) and the output gap in the studied behavioral model, the degree of cheerfulness of the agents of which corresponds to

Figure 1a.

The source of these cyclical movements is the weighting of optimists and pessimists in the market. In fact, the model generates endogenous waves of optimism and pessimism. In some periods, pessimists predominate, leading to below-average output growth. These pessimistic periods are followed by optimistic ones, where optimistic forecasts prevail and the output growth rate is above average. These waves of optimism and pessimism are inherently unpredictable. Note that this figure shows the results of a simulation in which the five shocks present in Equations (6) and (14) are independent and equally distributed with a standard deviation of 0.5. Other implementations of shocks produce other cycles with the same overall characteristics.

These endogenously generated output cycles are made possible by a self-fulfilling mechanism, which can be described as follows. A series of random exogenous shocks creates the possibility that one of the two forecasting rules, say the optimistic one, provides a higher return, i.e., a lower mean-square forecast error. This attracts agents who used the pessimistic rule. The “contagion effect” leads to an increasing use of optimistic beliefs to predict, for example, an output gap, and this stimulates aggregate demand. Thus, optimistic moods are self-fulfilling. At some point, negative stochastic shocks are detrimental to optimistic forecasts. Pessimistic moods become attractive again and the economy is in recession. It can be shown that the periods of economic growth and recession coincide with the share of extrapolators and fundamentalists in the market. In

Figure 2, under the output gap graph, there is a graph characterizing the change in the share of extrapolators in the market. It can be seen from this graph that the peaks in the output gap dynamics graph correspond to the peaks in the graph of changes in the share of extrapolators.

An analysis of the cycles shown in

Figure 3 shows that the volatility of the output gap exceeds the volatility of price inflation and wage inflation. The volatility of the latter is less than the volatility of price inflation.

In macroeconomic models with rational expectations, only exogenous shocks matter to explain changes in output and inflation. There are important endogenously generated dynamics in the behavioral model that explain changes in output and inflation and influence the transmission of these exogenous shocks. Therefore, it is relevant to consider the transmission mechanism of action of some exogenous shocks in the model under study.

The behavioral model is non-linear. Therefore, in the post-shock period, it is necessary to take into account random perturbations, which are the same for a series with and without a shock. The simulations were repeated 1000 times with 1000 different implementations of random perturbations. Following this, the average impulse response was calculated along with the standard deviation. The shock sizes were equal to one standard deviation.

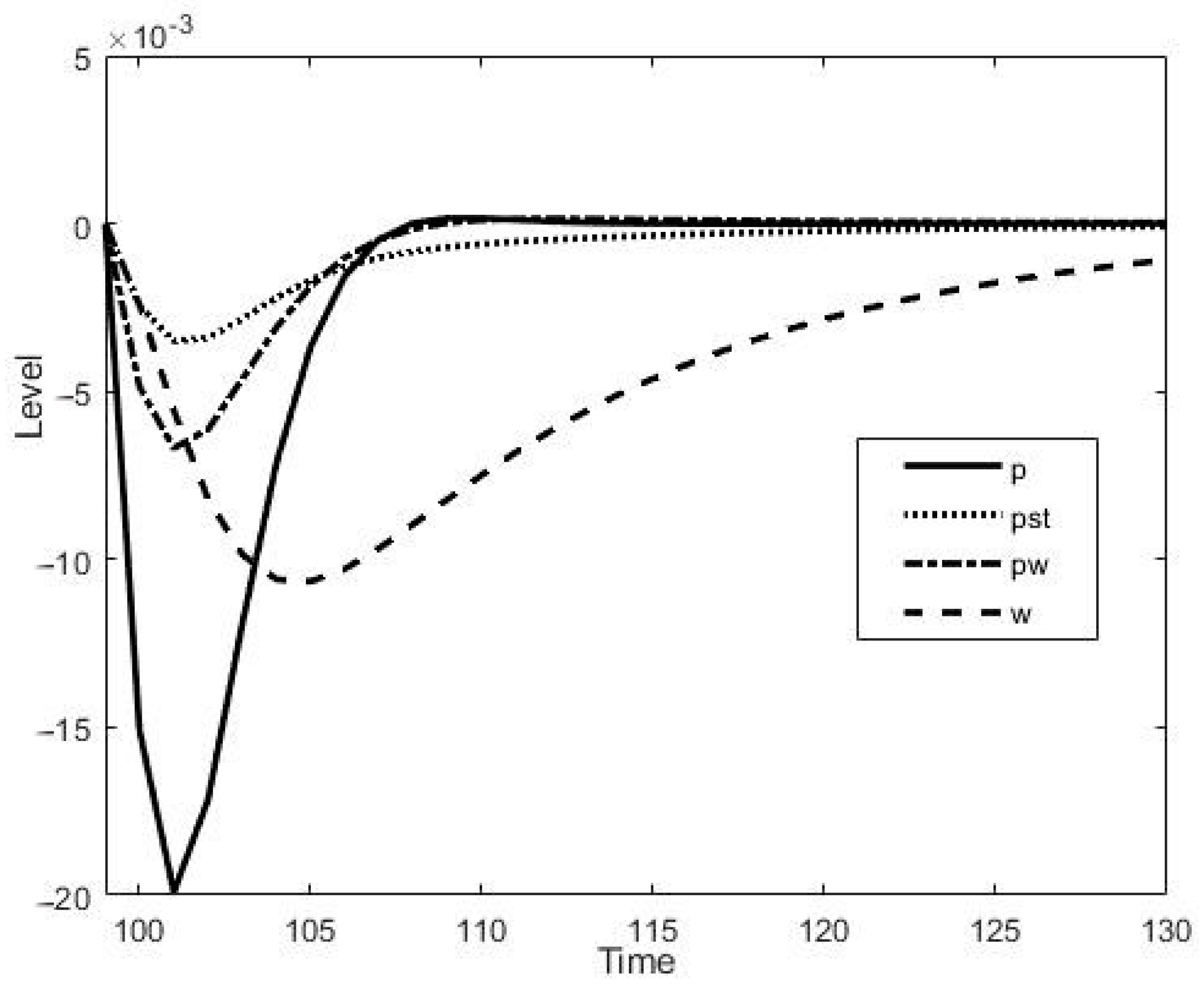

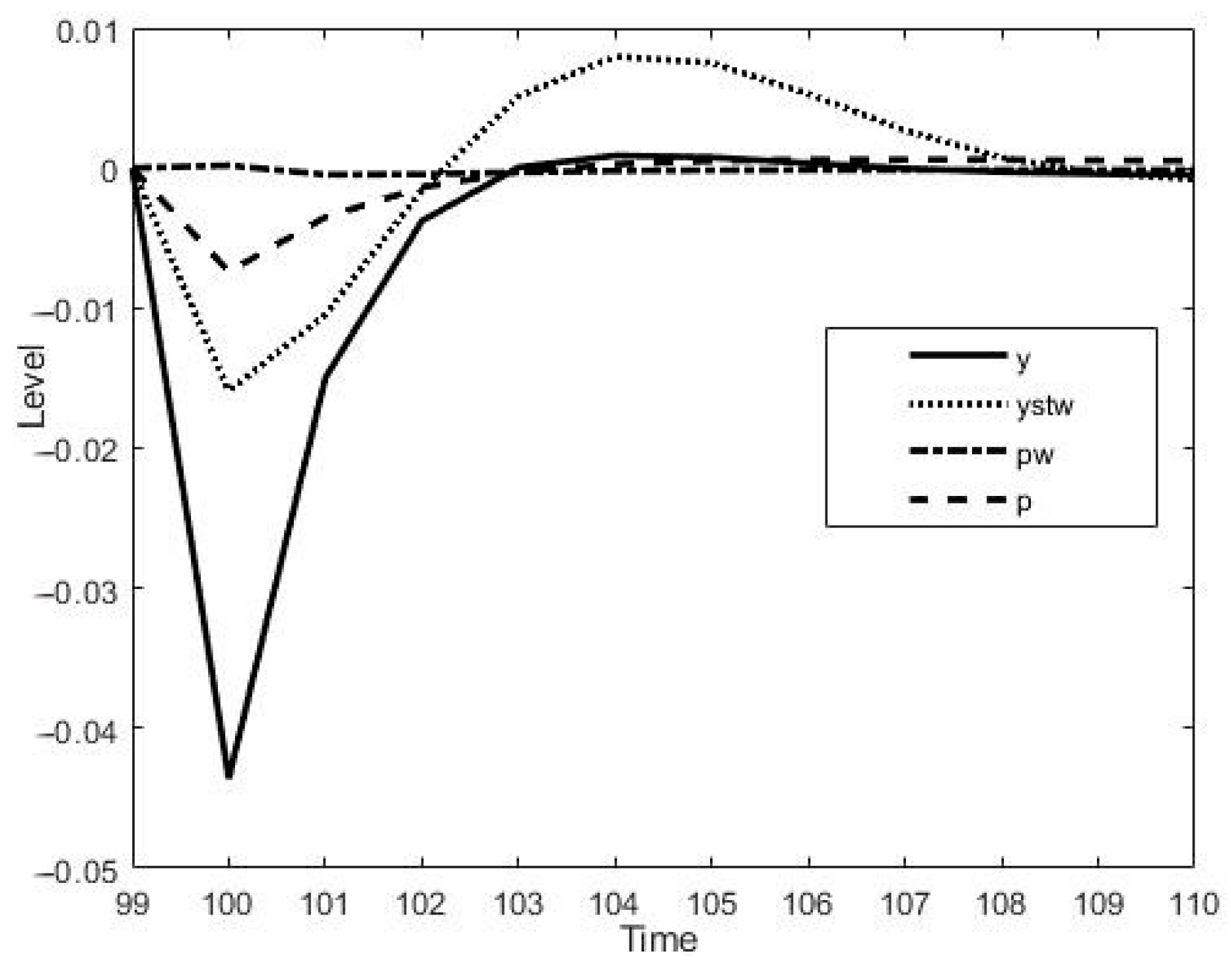

Figure 4 shows the effect of a temporary positive interest rate shock on the variables of the imperfect labor market model (wage inflation—pw, price inflation—pst, wage gap—w) and on the price inflation variable—

p for the model with rigid prices and flexible wages.

The presence of both rigid wages and prices (the response shown by dashed lines) generates, unsurprisingly, a more muted wage inflation response compared to the price inflation of the underlying model with flexible wages and rigid prices (solid line) and compared to the gap response real wages of the first model (dotted lines). Finally, the most sluggish is the price inflation response (dotted lines) in the model with rigid wages and prices. As a result, the monetary authorities’ endogenous response to lower inflation implies higher interest rates. The sharper price inflation response in an economy with flexible wages (and rigid prices) is explained by the fact that the decline in activity as a response to a positive interest rate shock leads to a significant and permanent reduction in real wages, which increases the size of the fall in price inflation.

Figure 5 shows the impact of a temporary technology shock on the variables of the imperfect labor market model (wage inflation—

pw, output gap

ystw) and on the variables of the flexible wage and rigid price model (price inflation—

p, output gap

y).

From the analysis of the impulse responses of a positive technological shock, it follows that the wage inflation of a behavioral model with an imperfect labor market and rigid prices (dash-dotted line) practically does not change (and even slightly increases) as a result of a technological shock. Fairly sluggish response is also observed in the price inflation model with flexible wages and rigid prices (dashed line). The negative output gap response of the model with a perfect labor market and rigid prices is significant (solid line) and the output gap response of the model with an imperfect labor market and rigid prices is less profound (dotted line). The negative output gap is due to the fact that, as a result of a technological shock, the actual volume of output grows more slowly than the potential one for a given monetary policy. It is, however, true that in a model with an imperfect labor market, after several periods, the output gap becomes positive, in contrast to the base model.

When both prices and wages are rigid, monetary policy must strike a balance between achieving output and adjusting real wages due to productivity growth and, on the other hand, keeping wage and price inflation close to zero to avoid distortions associated with nominal volatility. Therefore, given the convexity of welfare losses in price and wage inflation, the monetary authorities and the government should increase real wages smoothly, combining negative price inflation and positive wage inflation, which is observed in

Figure 5.

The resulting impulse responses are important. Based on their analysis, we can conclude that a more flexible economy is less prone to an economic cycle caused by abrupt waves of optimism and pessimism, different in nature to a more rigid economy. As mentioned above, the results obtained are original. The authors found confirmation of these results only in [

28] for the New Keynesian model with rigid prices and flexible wages and in [

44] for the neoclassical model. Thus, in the model under study, price flexibility is a determining factor in the self-organization of expectations and the self-development of this self-organization. The reason for this is as follows. Suppose there is a boom in economic activity: the output gap turns a positive. In a flexible economy, this increase in the output gap has a strong positive effect on inflation. Since the central bank places a high value on inflation in the Taylor rule, it reacts strongly by raising the interest rate. This tends to reduce the intensity of the boom. When the output gap widens in a rigid economy, this will have a weaker effect on inflation, forcing the central bank to raise interest rates less than in an elastic economy. The resulting boom in economic activity is stronger, which reinforces positive vitality, so that in a tight economy, the same initial shock in the output gap is more likely to cause an intense boom followed by a recession. Thus, a rigid economy will be more prone to booms and busts caused by a greater degree of animal spirits than a flexible economy. In other words, an economy with rigid prices and wages returns to a stationary state more slowly, having been brought out of it by exogenous shocks.

It is also very interesting to investigate what factors are the drivers of differences in the degree of vitality in the base model and in the model with rigid wages and prices (

Figure 1). In other words, what factors are responsible for these differences when incorporating wage rigidity into the base model.

Figure 6a shows a histogram of the frequency distribution of the degree of vitality for a model with an imperfect labor market when forecasting wage inflation using only the fundamentalist rule

and with a coefficient of zero

in the Taylor rule for the interest rate.

Figure 6b shows the histogram for the base model with fixed prices and flexible wages when predicting price inflation and the output gap using fundamental and extrapolation rules and non-zero coefficients

in the Taylor rule.

As follows from the figure, the histograms of the distribution of vital forces of both models are almost the same. From this we can conclude that the difference in the degree of vitality in the base model and in the model with fixed wages and prices is responsible for the complete trust of agents in the central bank in targeting wage inflation in the absence of the stabilization of this inflation by the bank.

Thus, the difference between the degree of optimism and pessimism in the baseline model and in the rigid wage and price model is due to the full confidence of agents in the central bank’s ability to target wage inflation. The central bank achieves this confidence in agents by responding more intensively to changes in inflation. This reduces the likelihood that the market will be dominated by extrapolators and, as a consequence, reduces the likelihood that agents will lose confidence in inflation targeting.

It should be noted that such a loss of confidence destabilizes both inflation and output. Thus, maintaining confidence in inflation targeting is an important source of macroeconomic stability in behavioral models.

As it was mentioned above, the degree of wage rigidity depends on the parameter

. The value of this parameter, corresponding to the values of the coefficients in

Table 1, is 0.008. With an increase in the value of this parameter, the degree of wage rigidity decreases and its flexibility increases accordingly.

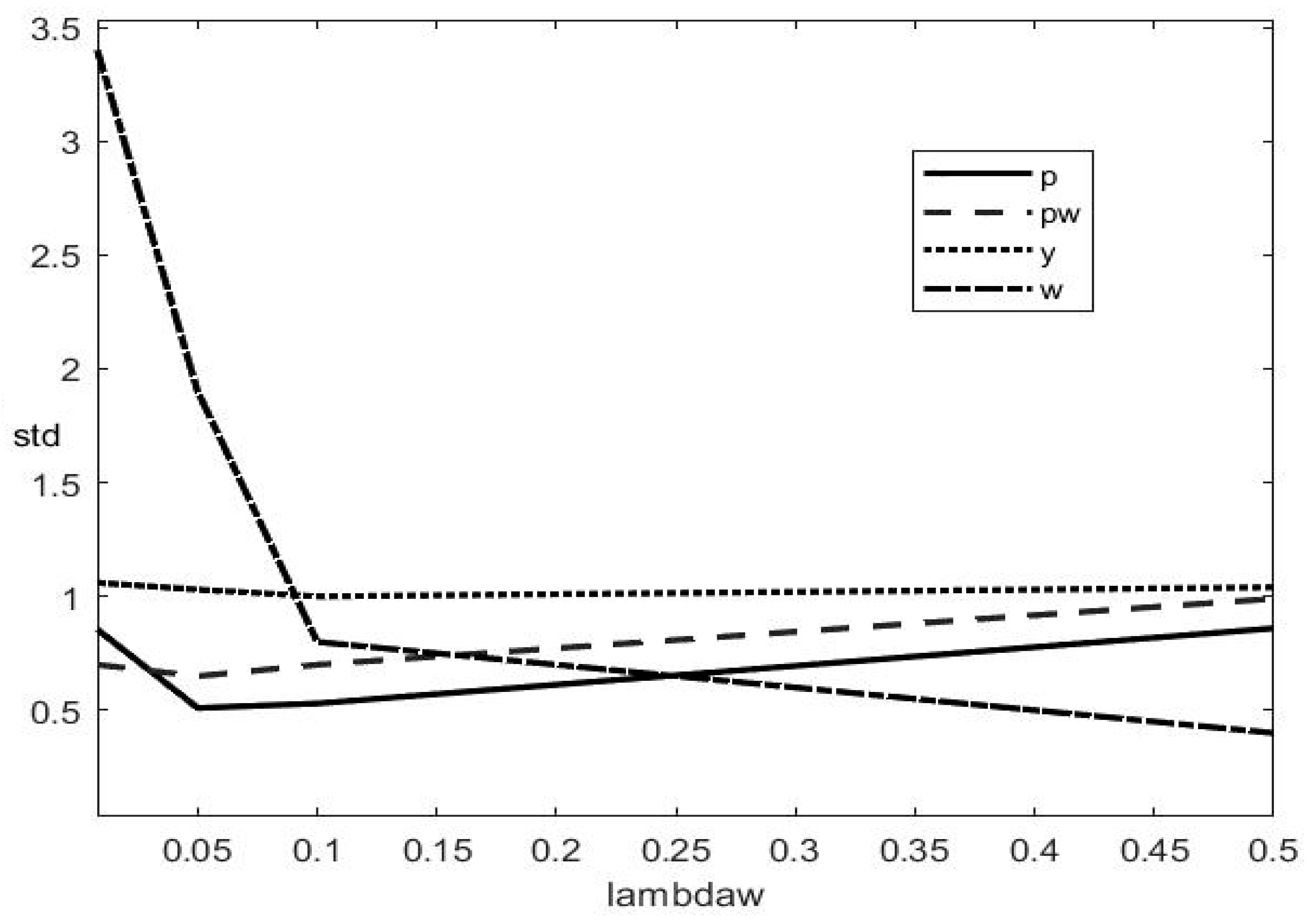

Figure 7 plots the standard deviation (the standard deviation was calculated as the mean value obtained from 1000-fold simulations with 1000 different realizations of random exogenous shocks) of price inflation (

p), wage inflation (pw), and output gap (y) against the degree of wage flexibility (lambdaw =

) for a behavioral model with rigid wages and prices. The standard deviation is a measure of the volatility of the respective variables. At

, the volatility of the output gap exceeds the volatility of price inflation and especially wage inflation. This exactly corresponds to the data in

Figure 3. As follows from

Figure 7, the volatility of the output gap remains almost unchanged with increasing wage flexibility. Wage inflation volatility increases with a small minimum around

. The volatility of the wage gap decreases very sharply in the initial period and then gradually falls. The authors believe that this behavior is due to a decrease in real wages. An interesting dynamic is shown by the graph of price inflation with an initial sharp drop and a subsequent gradual increase in volatility. According to the authors, the sharp decline in the volatility of price inflation is due to a sharp drop in real wages. Wage inflation also reacts to the decline in real wages, but to a lesser extent.

The increase in the volatility of inflation in wages and prices with an increase in the parameter

is associated with the monetary policy of the central bank. As has been already noted, in the presence of two distortions—inflexible prices and inflexible wages—a single instrument of monetary policy cannot simultaneously compensate for both distortions. This can be shown that with an increase in the parameter

in the Taylor rule. Due to the limited publication format, these graphs are not shown. According to Equation (6), price inflation stabilizes (volatility becomes constant or decreases) in the absence of the stabilization of wage inflation and the output gap (its stabilization will be violated), the volatility of which will continue to increase, as in

Figure 7.

The excess of the volatility of wage inflation as wage flexibility increases relative to the volatility of price inflation may suggest that the welfare cost of nominal rigidity is more related to wage rigidity than to price rigidity. The results shown in

Figure 7 may be useful in stabilizing the considered variables.