1. Introduction

As a common market mechanism, an oligopoly market refers to the market structure in which a certain industry is completely controlled by a few manufacturers. The classic Cournot game model is used to study the equilibrium quantity problem of a duopoly industry. However, the application of the classical Cournot game model in practical problems is often limited by many uncertain factors (such as consumer demand or production fluctuations). For example, the outbreak of COVID-19 in 2019 made the home office a normal situation, leading to a surge in demand for electronic products such as PCs and smart phones. Although manufacturers worked overtime to purchase components and expand production, the supply of products still was not adequate for demand, and delayed delivery became a problem faced by many enterprises (

https://www.chinatimes.com/cn/realtimenews/20201226004090260410?chdtv accessed on 26 December 2020). After 2022, the demand for PCs, smart phones, and other electronic products slowed, resulting in a glut of products (

https://www.expreview.c-om/83750.html accessed on 25 December 2022). The classical Cournot game fails to approach to such situations with uncertain information. Therefore, the Cournot game under uncertain scenarios has received extensive attention.

To address such uncertainties, Zadeh proposed the concept of a fuzzy set in 1965 [

1]. Some scholars combined the Cournot model with fuzzy set theory and proposed a kind of Cournot game model with fuzzy parameters. Yao and Wu [

2] applied the sorting method to change the fuzzy numbers in the supply and demand function into real numbers to calculate the consumer surplus and producer surplus. Wu and Yao [

3] constructed the inventory model based on [

2]. Ouyang and Yao [

4] studied the inventory model based on the demand function with triangular fuzzy numbers and statistical fuzzy numbers. Yao and Wu [

5] studied the optimal prices of two complementary commodities in a fuzzy environment. Yao and Chang [

6] obtained the optimal output by using a fuzzy profit function whose parameters were fuzzy numbers. Yao and Shih [

7] obtained the membership function of the profit function based on the optimal production. Xu and Zhai [

8] proposed an optimization scheme based on fuzzy set theory to solve the uncertainty problem of demand in the supply chain. Liang et al. [

9] constructed the Cournot model based on fuzzy cost to obtain the optimal production of each enterprise. Wang et al. [

10] proposed a fuzzy Bayesian game based on credibility theory. Dang and Hong [

11] ensured that the equilibrium quantity is positive by strict definition and constructed the Cournot model through a control mechanism. Dang et al. [

12] constructed the Cournot game of multiple manufacturers in a competitive market under a fuzzy environment and provided the solution steps for each manufacturer’s equilibrium quantity. Tan et al. [

13] discussed the Cournot game with asymmetric information under a fuzzy environment based on the hierarchical dependent utility theory. The differences between this paper and existing literatures are shown in

Table 1.

It is worth noting that the extant literature on the Cournot game with fuzzy parameters mainly focuses on “perfect rationality”. However, in real-game problems, players tend to show the behavior characteristic of “limited rationality”, including loss aversion [

14,

15,

16,

17], risk aversion [

18,

19], altruistic and spiteful preferences [

20,

21], and reference-dependent preferences [

22,

23,

24]. In particular, when faced with gains, people tend to show risk aversion instead of seeking to maximize their gains. Risk aversion has received attention extensively in the classical non-cooperative game [

25,

26,

27], while it has received little attention in the fuzzy environment. In the fuzzy environment, the optimistic value criterion derived from credibility theory is often used to describe the behavior of decision makers [

28,

29]. The decision makers are risk-averse and want to maximize the optimistic value of their own payoffs for a given confidence level. The confidence levels reflect the risk aversion levels of the decision makers [

28]. Since Gao et al. applied credibility theory to solve the matrix game problem with fuzzy payment, risk aversion has received attention in the fuzzy game [

28,

29,

30].

An interesting observation is that the existing literature on the fuzzy game with credibility theory mainly focuses on the fuzzy matrix and bimatrix games with rational preferences and loss aversion [

31], but the fuzzy games with risk aversion have received little attention, especially the Cournot game. In real-game situations, players usually show risk aversion. For example, Samsung and Apple have all reduced their planned smart phones in 2023 to avoid the risk of demand reduction (

https://www.chinanews.com.cn/cj/2022/11-11/9891967.shtml accessed on 11 November 2022). Another example of risk aversion for firms is in the PC industry, such as HP’s and Lenovo’s reduction in PC production (

https://www.jiemian.com/article/8440198.html accessed on 22 November 2022). Therefore, it is essential to explore the influence of risk aversion on decisions for a Cournot game under an uncertain environment. Our work focuses on a Cournot game with risk aversion, where the optimistic value criterion derived from credibility theory is used to characterize players’ behaviors of risk aversion. The influences of risk aversion on equilibrium quantity and market-clearing price are discussed.

The arrangement of this paper is as follows.

Section 2 briefly reviews credibility theory.

Section 3 constructs the credibilistic Cournot game model and defines the concept of the (

α1,

α2)-optimistic equilibrium quantity, whose uniqueness is shown. A case analysis is shown in

Section 4. In

Section 5, the conclusions are shown.

2. Credibility Theory

Credibility theory [

32,

33] is often used to describe the decision behavior of decision makers in a fuzzy environment and is widely used in many fields, such as transportation planning, portfolio selection, and so on.

Definition 1 ([

33])

. Let be the non-empty set and let be the power set of . Then Cr{·} is the credibility measure if the following axioms are satisfied.

Axiom 1. Cr{} = 1;

Axiom 2. Cr{A} Cr{B}, where A B;

Axiom 3. Cr{A} + Cr{Ac} = 1, where ;

Axiom 4. Cr{∪i Ai} = supiCr{ Ai}, for any {Ai} with supiCr{Ai} < 0.5.

Definition 2 ([

33])

. The triple is called the credibility space. Definition 3 ([

33])

. A fuzzy variable is a measurable function from a credibility space to the set of real numbers. Lemma 1 ([

33])

. If is a fuzzy variable and its membership function is , then for real set R, the credibility measure is Even if the possibility of a fuzzy event reaches one, it may still fail, and even though its necessity is zero, it may still occur. Nevertheless, the fuzzy event must occur if its possibility is equal to one and fail if its credibility is equal to zero [

34].

As a special class of fuzzy variables, the triangular fuzzy numbers are denoted as

, where

is the median of

, and

and

are the lower and upper bounds of

[

35]. Its membership function is

If , is called the non-negative triangular fuzzy number.

Let

and

be two triangular fuzzy numbers; the operation rules are shown as follows [

36].

In our work, the triangular fuzzy numbers are used to characterize the parameters in the Cournot game, since the triangular fuzzy number is more consistent with the fuzziness of human thinking and the complexity and uncertainty of objective things and can reflect the problems studied more objectively and accurately [

37,

38].

Definition 4 [

33]

. Let be a fuzzy variable and let be a confidence level. Then, for real r,is called the α-optimistic value of .is called the α-pessimistic value of . Under fuzzy decision-making scenarios, the optimistic value criterion tends to be applied to the situation where decision makers are risk-averse and want to maximize the α-optimistic value of their own fuzzy payoffs. Each confidence level reflects the risk aversion level that decision makers can endure [

28,

29].

Given the triangular fuzzy number

and confidence level

, the

α-optimistic and

α-pessimistic values of

can be shown as follows, respectively [

33].

and

Definition 5 [

33]

. are set as fuzzy variables. If any subset of real number set R satisfiesthen are independent fuzzy variables. Lemma 2 [

33]

. Let and be independent fuzzy variables. For non-negative real numbers a and b, Lemma 3 [

32]

. Let and be independent fuzzy variables and let be the confidence level. The optimistic value criterion satisfieswhere α reflects the risk aversion degree of the decision maker [28]. 3. The Fuzzy Cournot Game Model

3.1. Related Parameters and Assumptions

This section discusses the Cournot game between two manufacturers in a fuzzy environment to describe the uncertainty in the real world. Two manufacturers are denoted as manufacturer 1 and manufacturer 2. The relevant parameters are defined as follows.

qi: Output of the manufacturer i, where i ∈ {1,2};

Q: Total market demand;

: The market-clearing price;

: Profit of the manufacturer i, where i ∈ {1,2};

: Unit production cost of the manufacturer i, where i ∈ {1,2};

: Unit price of the product;

: A drop in price for every unit of product produced.

are non-negative triangular fuzzy numbers and are mutually independent.

The fuzzy inverse demand function is

, where

. According to Equation (4), it can be obtained as follows.

where

represents non-negative market demand.

Therefore, the profit function of manufacturer

i is:

3.2. Credibilistic Cournot Game Model Based on Risk Aversion

Since people in the real world often show the behavior characteristics of risk aversion in the face of gains, we consider the fuzzy Cournot game between two manufacturers with risk aversion behavior in this part. The optimistic value criterion is often used to describe the behavior of decision makers in a fuzzy decision-making environment. The decision maker is risk-averse and wants to maximize the optimistic value of his payoff for given confidence levels. Each confidence level reflects the risk aversion degree of the decision maker [

28]. Therefore, this paper adopts the optimistic value criterion to describe the risk aversion behavior of decision makers.

For manufacturer 1, given the output of the second manufacturer

, the optimal response is

Similarly, the optimal response for manufacturer 2 is

where

α1 and

α2 represent the confidence levels of manufacturers 1 and 2, and

π1 and

π2 are real numbers.

Definition 6. If satisfiesthen is called the (α1, α2)-optimistic equilibrium quantity. When manufacturer 1 has a preference for risk aversion, according to the optimistic value criterion and Equation (4), the profit of manufacturer 1 is

According to Equation (7), the profit of manufacturer 1 is

Therefore, we can derive the following:

Similarly, the profit of manufacturer 2 is

The (

α1,

α2)-optimistic equilibrium quantity is the following optimization problem.

Definition 7. For the fuzzy Cournot game with risk aversion preference, there is a unique (α1, α2)-optimistic equilibrium quantity that makes the return of the two manufacturers reach the optimal level, as follows: Proof. The first partial derivative of Equation (15) is

Let

; then

The second partial derivative of Equation (15) is

Therefore, is the optimal solution of Equation (15).

The first partial derivative of Equation (16) is

Let

; then

The second partial derivative of Equation (16) is

Therefore, is the optimal solution of Equation (16).

Finally, in combination with Equations (20) and (22), the (

α1,

α2)-optimistic equilibrium quantity is

□

Since the triangular fuzzy number is more consistent with the fuzziness of human thinking and the complexity and uncertainty of objective things and can reflect the problems studied more objectively and accurately [

28,

29], the parameters of the credibilistic Cournot game are triangular fuzzy numbers. Therefore, the (

α1,

α2)-optimistic equilibrium quantity has the following four scenarios:

- (1)

If , then

- (2)

If , then

- (3)

If , then

- (4)

If , then

Accordingly, the market-clearing price is

- (1)

If , then

- (2)

If , then

- (3)

If , then

- (4)

If , then

4. Case Analysis

The Taiwan glass substrate industry currently has two competitive companies as follows: Corning Display Technologies (CDT) and Asahi Glass (AG). Generally speaking, the companies in the market tend to show risk aversion behavior characteristics when facing market risks. Based on this, this section uses the fuzzy Cournot game model established above to explore the optimistic equilibrium quantity of the two companies under risk aversion behavior. The sensitivity analysis of the optimistic equilibrium quantity of the two companies is carried out to provide some management enlightenment for the management activities of the two companies.

The products of the two companies account for about 90% of the Taiwan market share [

23]. Therefore, the glass substrate industry in Taiwan can be regarded as a duopoly market. Due to the influence of various uncertain factors, this paper can only make a rough assessment of the production cost, the maximum price per unit of product, and the price drop caused by each unit of product. The unit production costs of CDT and AG are as follows:

and

. The maximum price per unit of product is about

dollars, and the price decline caused by each unit of product is about

dollars [

23]. To characterize such uncertainty, let these parameters be triangular fuzzy numbers, where

. Let

α1 and

α2 represent the confidence levels of CDT and AG, respectively. In addition,

q1 and

q2 represent the yields of CDT and AG, respectively.

4.1. (α1, α2)-Optimistic Equilibrium Quantity

Different confidence levels of α1 and α2 correspond to a different (α1, α2)-optimistic equilibrium quantity. There are four scenarios of (α1, α2)-optimistic equilibrium quantity.

- (1)

If , according to Equations (25) and (26), the (α1, α2)-optimistic equilibrium quantity is

- (2)

If , according to Equations (27) and (28), the (α1, α2)-optimistic equilibrium quantity is

- (3)

If , according to Equations (29) and (30), the (α1, α2)-optimistic equilibrium quantity is

- (4)

If , according to Equations (31) and (32), the (α1, α2)-optimistic equilibrium quantity is

Different confidence levels lead to different market-clearing prices.

- (1)

If , according to Equation (33), the market-clearing price of CDT is

According to Equation (34), the market-clearing price of AG is

- (2)

If , according to Equation (35), the market-clearing price of CDT is

According to Equation (36), the market-clearing price of AG is

- (3)

If , according to Equation (37), the market-clearing price of CDT is

According to Equation (38), the market-clearing price of AG is

- (4)

If , according to Equation (39), the market-clearing price of CDT is

According to Equation (40), the market-clearing price of AG is

4.2. Sensitivity Analysis

Given each confidence level of the decision makers, we distinguish the following situations: when the confidence level is less than or equal to 0.5, the risk aversion degree of the decision maker is low; when the confidence level is greater than 0.5, the risk aversion of decision makers is high. The sensitivity analysis of the (α1, α2)-optimistic equilibrium quantity with respect to α1 and α2 is performed under four scenarios: Scenario I, low risk aversion levels for CDT and AG; Scenario II, low risk aversion level for CDT and high risk aversion level for AG; Scenario III, high risk aversion level for CDT and low risk aversion level for AG; Scenario IV, high risk aversion levels for CDT and AG.

4.2.1. Scenario I

We discuss three scenarios as follows. (1) Given the risk aversion level of CDT, the risk aversion level of AG gradually increases. Let

α1 = 0.3 and

α2 be increasing. (2) Given the risk aversion level of AG, the risk aversion level of CDT gradually increases. Let

α2 = 0.3 and

α1 be increasing. (3) The levels of risk aversion of CDT and AG increase gradually. According to Equations (41), (45) and (46),

are shown in

Table 2,

Table 3 and

Table 4.

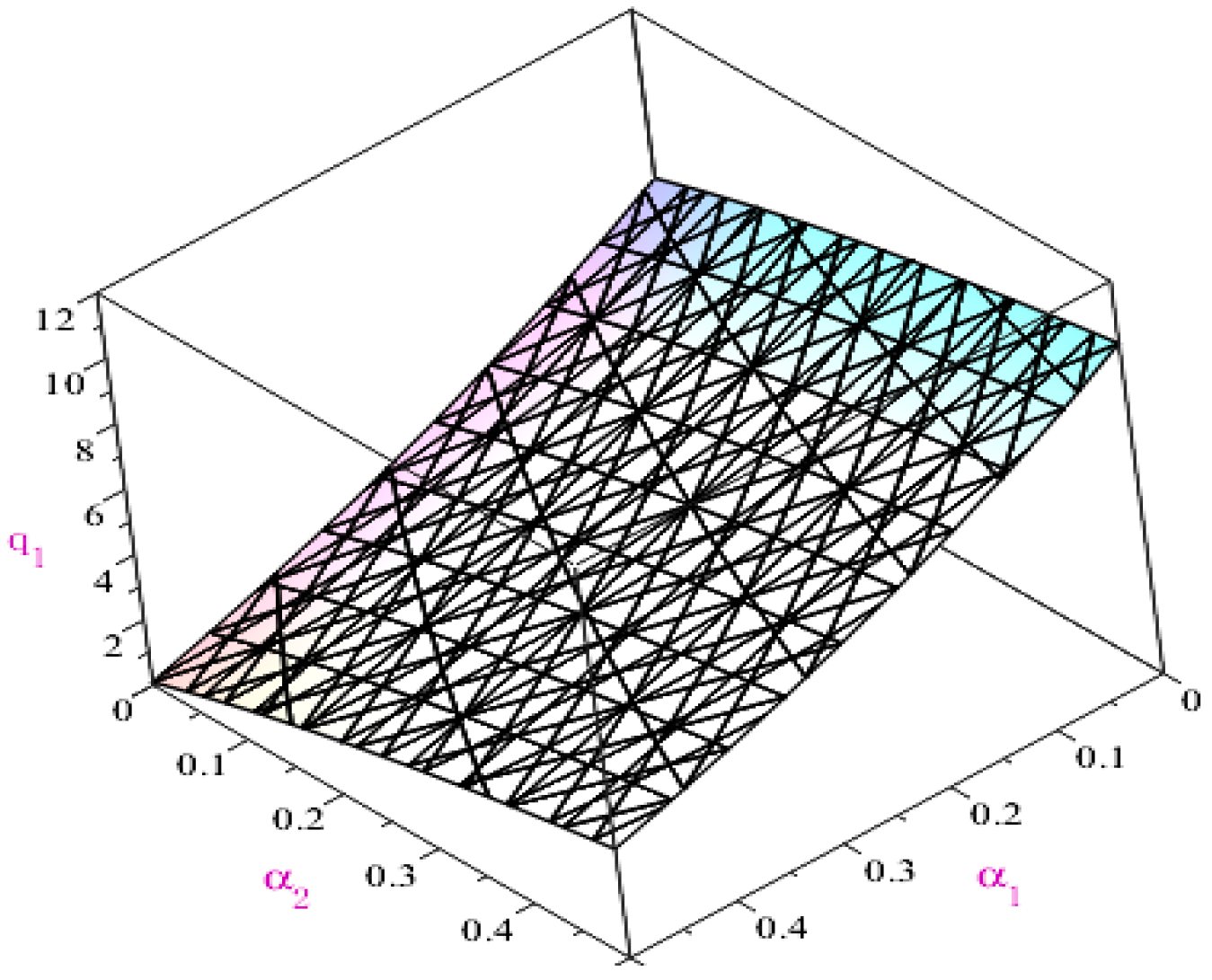

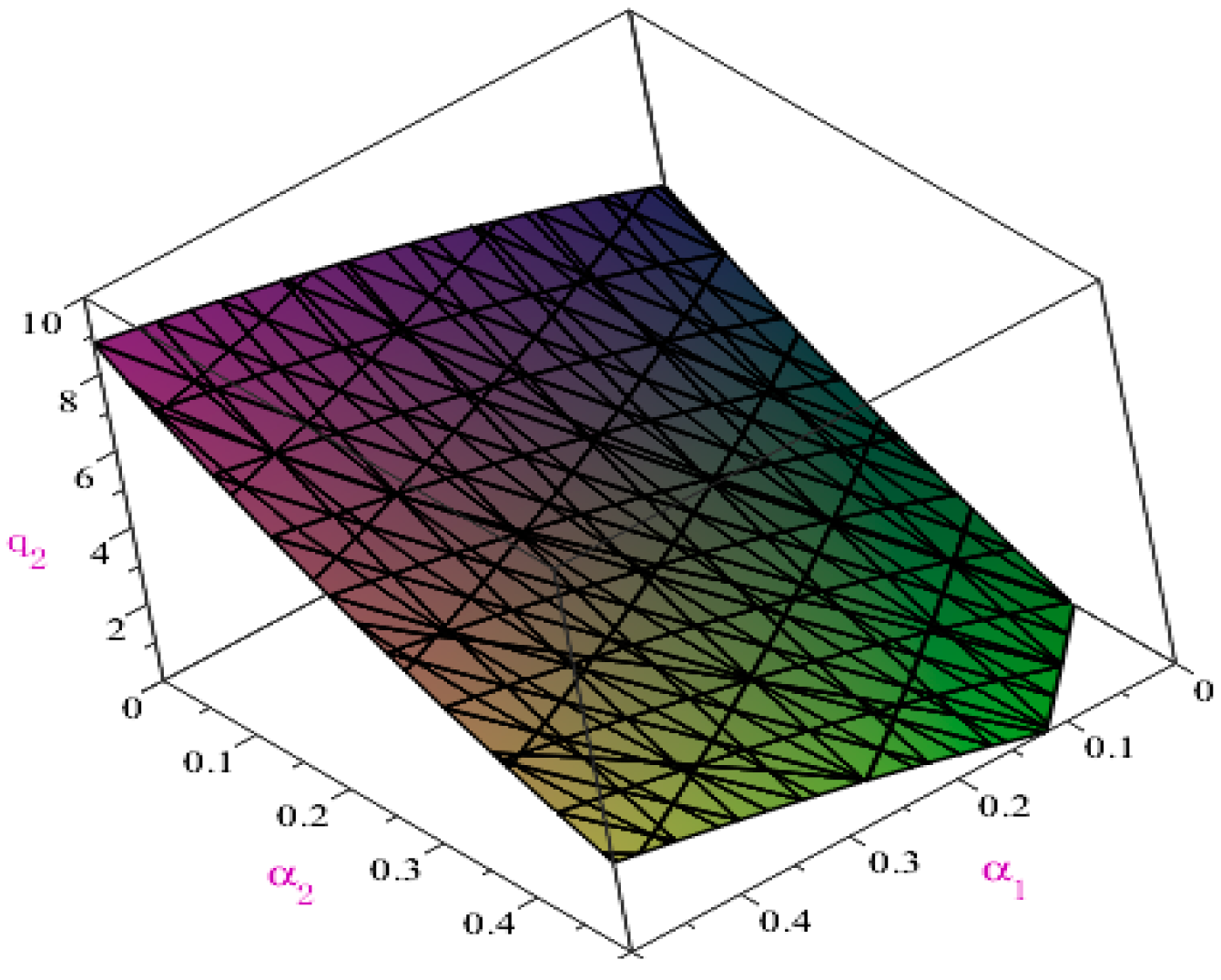

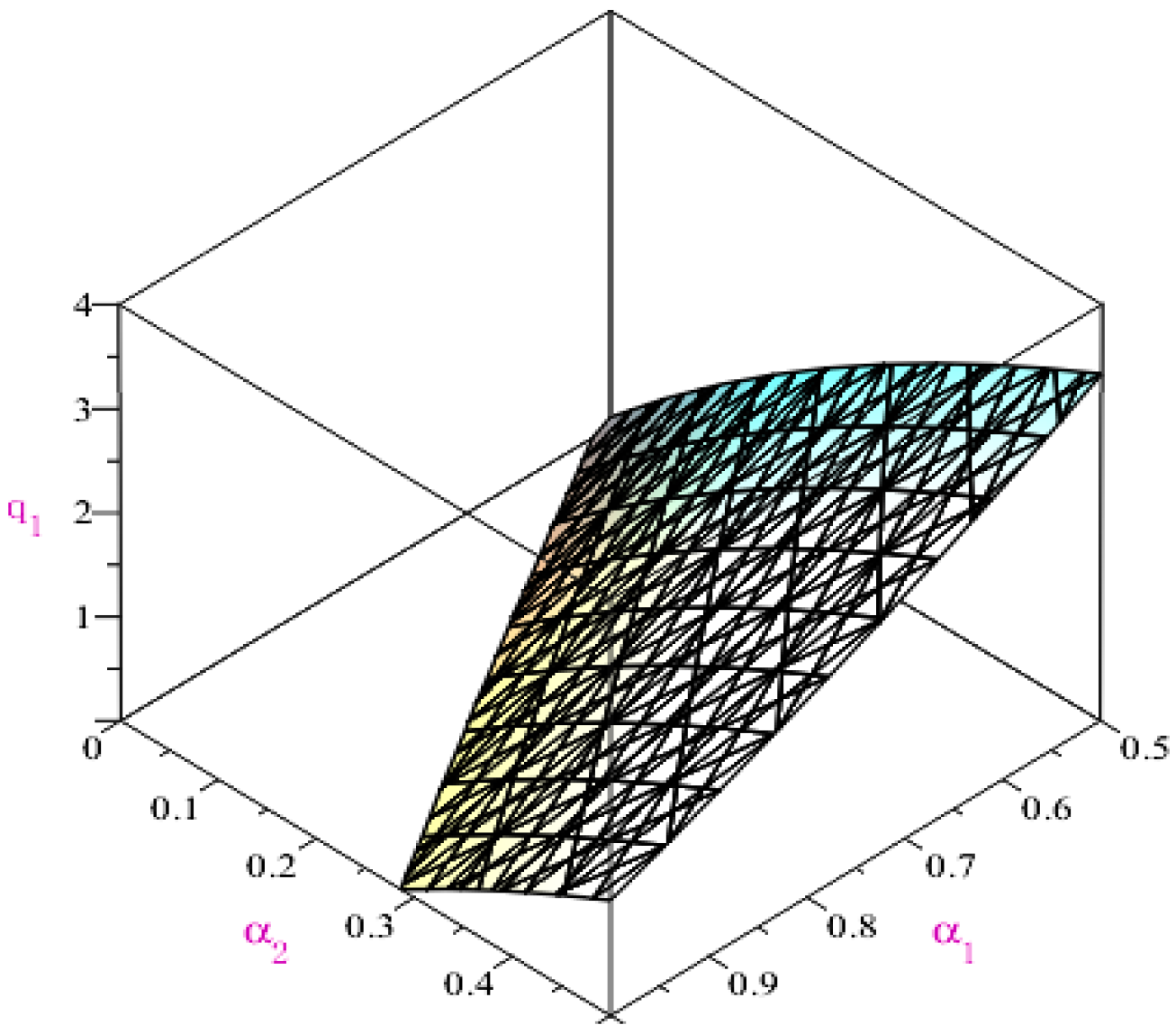

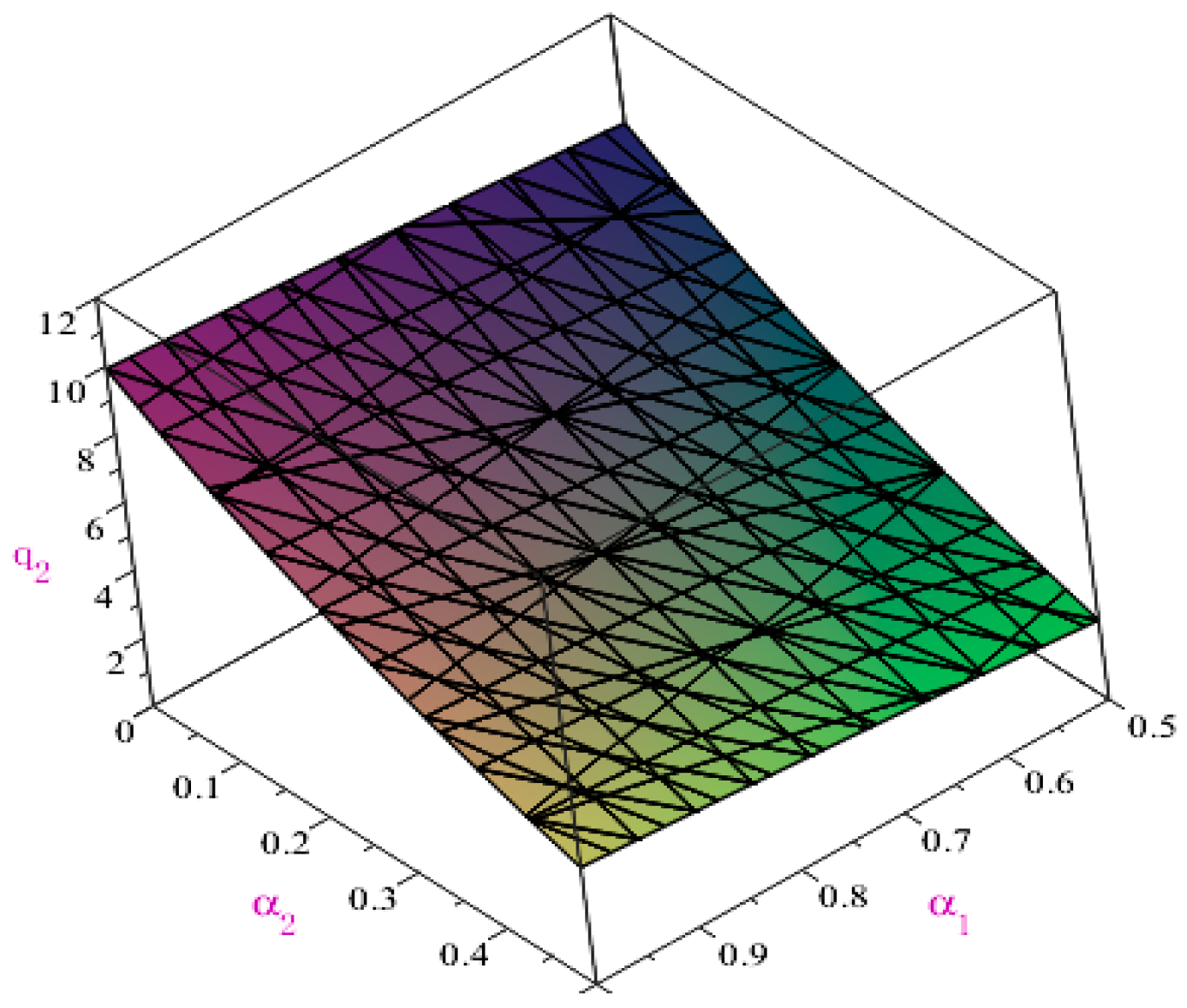

If

α1 and

α2 are continuous, then we can describe the variation trend of (

α1,

α2)-optimistic equilibrium quantity of CDT and AG, as shown in

Figure 1 and

Figure 2.

According to

Table 2 and

Figure 1 and

Figure 2, given

α1 (i.e., CDT’s risk aversion level), the equilibrium quantity of CDT increases gradually with

α2 (i.e., AG’s risk aversion level), while the equilibrium quantity of AG decreases gradually with

α2. According to

Table 3 and

Figure 1 and

Figure 2, given

α2 (i.e., AG’s risk aversion level), the equilibrium quantity of CDT decreases gradually with

α1 (i.e., CDT’s risk aversion level), while the equilibrium quantity of AG increases gradually with

α1. According to

Table 4 and

Figure 1 and

Figure 2, if

α1 and

α2 (i.e., the risk aversion levels for CDT and AG) are increasing, then the equilibrium quantity of CDT and AG will decrease. Furthermore, according to Equations (45) and (46), if CDT and AG have the same confidence level (i.e., risk aversion level), the market-clearing price of both companies is equal.

4.2.2. Scenario II

We discuss three scenarios as follows. (1) Given the risk aversion level of CDT, the risk aversion level of AG gradually increases. Let

α1 = 0.3 and

α2 be increasing. (2) Given the risk aversion level of AG, the risk aversion level of CDT gradually increases. Let

α2 = 0.8 and

α1 be increasing. (3) The levels of risk aversion of CDT and AG increase gradually. According to Equations (42), (47) and (48),

are shown in

Table 5,

Table 6 and

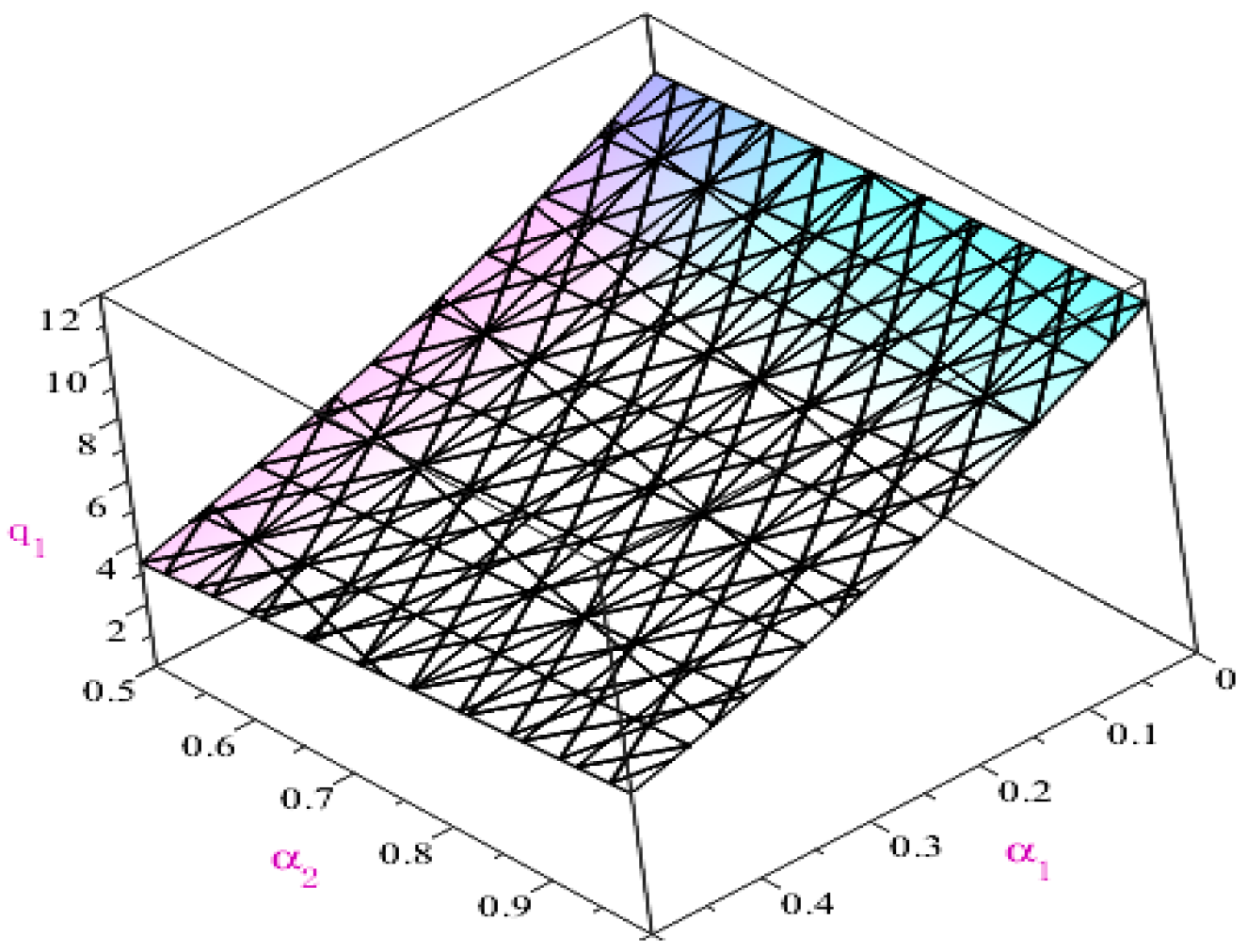

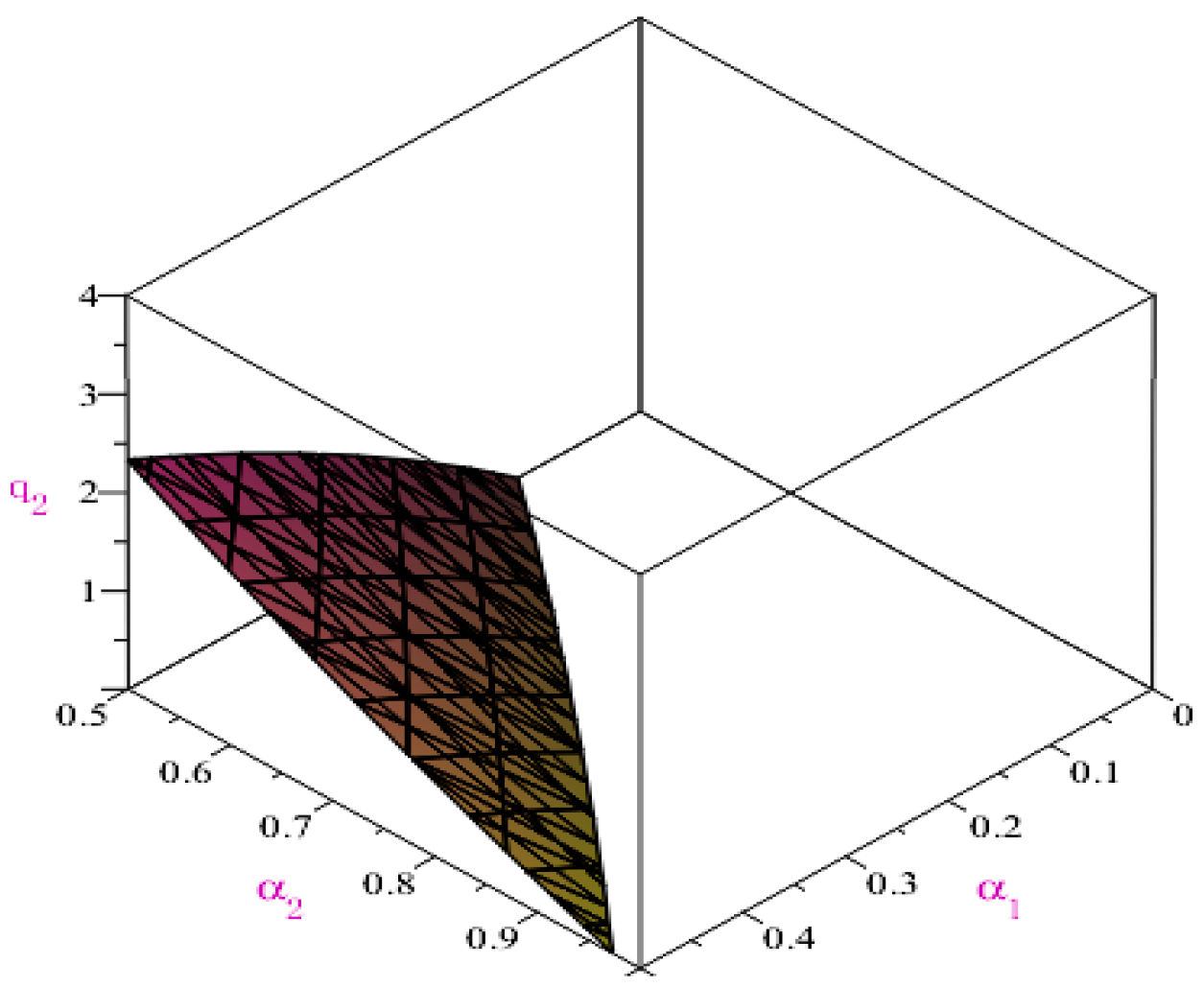

Table 7. The variation trend of CDT’s (

α1,

α2)-optimistic equilibrium quantity and the changes of the (

α1,

α2)-optimistic equilibrium quantity of CDT and AG are shown in

Figure 3 and

Figure 4, respectively.

According to

Table 5 and

Figure 3 and

Figure 4, given

α1 (i.e., CDT’s risk aversion level), the equilibrium quantity of CDT increases gradually with

α2 (i.e., AG’s risk aversion level). For AG, only when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) meet certain intervals will AG engage in production activities, and its equilibrium quantity is negatively correlated with

α2.

According to

Table 6 and

Figure 3 and

Figure 4, given

α2 (i.e., AG’s risk aversion level), the equilibrium quantity of CDT decreases with

α1 (i.e., CDT’s risk aversion level). For AG, if

α2 (i.e., AG’s risk aversion level) is sufficiently high, AG will not engage in productive activities. Only when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) meet certain intervals will they engage in production activities, and their equilibrium quantity will be positively correlated with

α1 (i.e., CDT’s risk aversion level).

According to

Table 7 and

Figure 3 and

Figure 4, when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) increase simultaneously, the equilibrium quantity of CDT gradually decreases. When

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) meet certain intervals and increase simultaneously, AG will engage in production activities and its equilibrium quantity will gradually decrease.

By Equations (47) and (48), if , , then the market-clearing price of CDT is higher than that of AG. That is, when the risk aversion level of CDT is small and the risk aversion level of AG is large, the market-clearing price of CDT is higher than the market-clearing price of AG.

4.2.3. Scenario III

We discuss three scenarios as follows. (1) Given the risk aversion level of CDT, the risk aversion level of AG gradually increases. Let

α1 = 0.8 and

α2 be increasing. (2) Given the risk aversion level of AG, the risk aversion level of CDT gradually increases. Let

α2 = 0.3 and

α1 be increasing. (3) The levels of risk aversion of CDT and AG increase gradually. According to Equations (43), (49) and (50),

are shown in

Table 8,

Table 9 and

Table 10. The variation trend of CDT’s (

α1,

α2)-optimistic equilibrium quantity and the changes of the (

α1,

α2)-optimistic equilibrium quantities of CDT and AG are shown in

Figure 5 and

Figure 6, respectively.

According to

Table 8 and

Figure 5 and

Figure 6, given

α1 (i.e., CDT’s risk aversion level), the equilibrium quantity of AG decreases with

α2 (i.e., AG’s risk aversion level). For CDT, the production of CDT will be carried out only when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) meet certain intervals, and its equilibrium production is positively correlated with

α2.

According to

Table 9 and

Figure 5 and

Figure 6, given

α2 (i.e., AG’s risk aversion level), the equilibrium quantity of AG increases with

α1 (i.e., CDT’s risk aversion level). For CDT, the production of CDT will be carried out only when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) meet certain intervals, and its equilibrium production is negatively correlated with

α1.

According to

Table 10 and

Figure 5 and

Figure 6, when

α1 (i.e., CDT’s risk aversion level) and

α2 (i.e., AG’s risk aversion level) increase simultaneously, the equilibrium quantity of AG gradually decreases. When

α1 and

α2 meet certain intervals and increase simultaneously, CDT will engage in production activities and its equilibrium quantity will gradually decrease.

It follows from Equations (49) and (50) that the market-clearing price of CDT is less than that of AG if , . That is, when the risk aversion level of CDT is high and the risk aversion level of AG is low, the market-clearing price of CDT is less than that of AG.

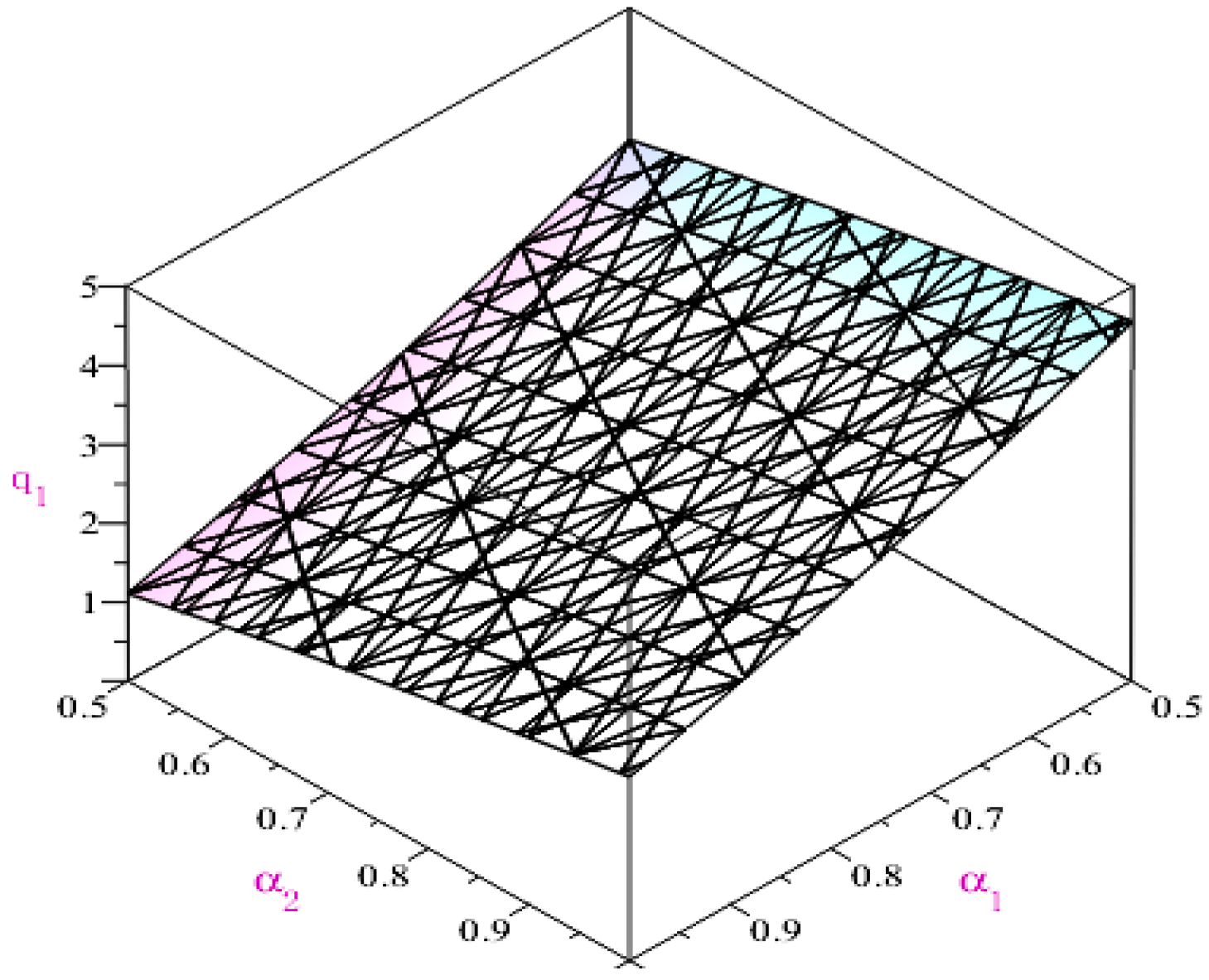

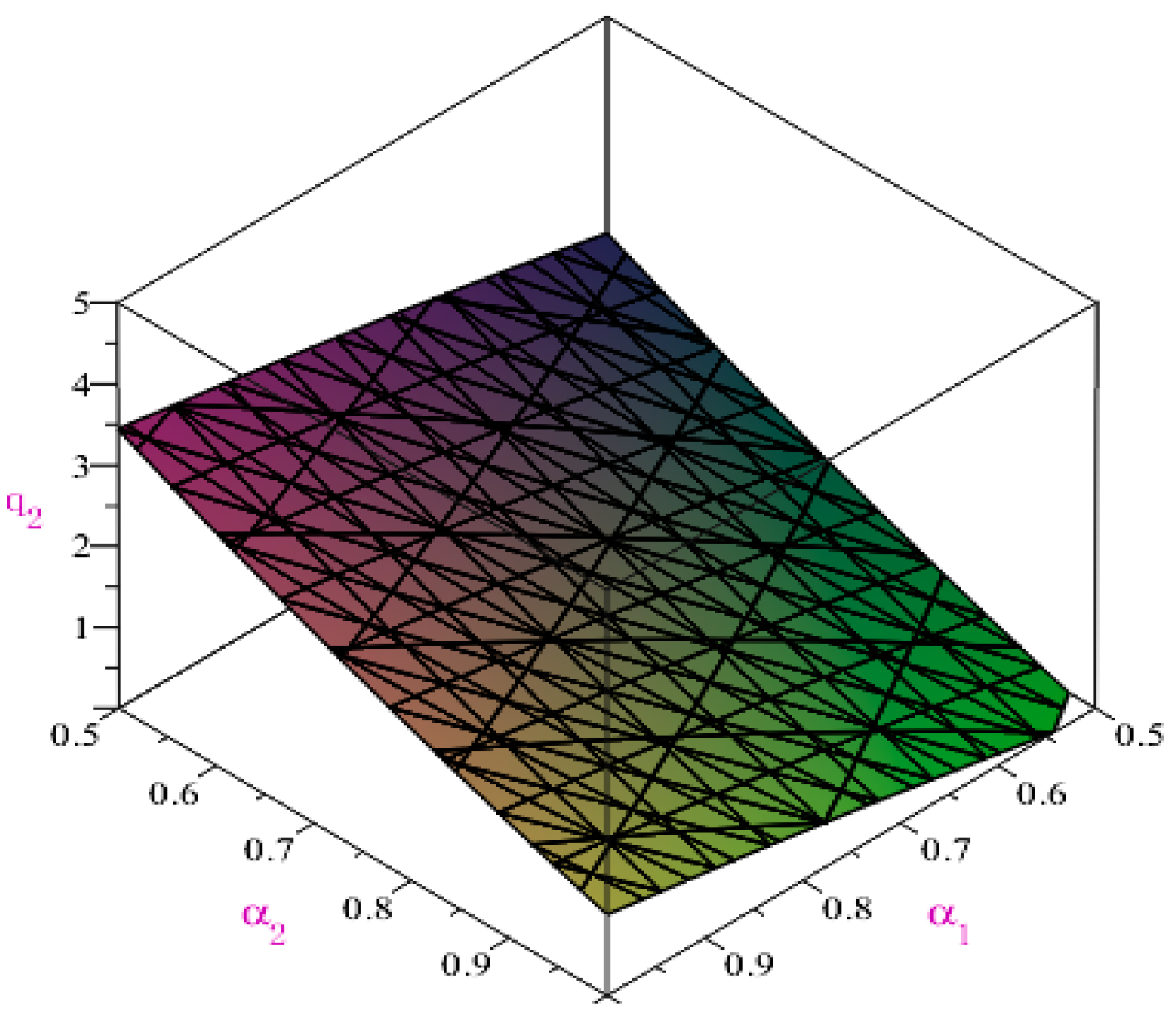

4.2.4. Scenario IV

We discuss three scenarios as follows. (1) Given the risk aversion level of CDT, the risk aversion level of AG gradually increases. Let

α1 = 0.8 and

α2 be increasing. (2) Given the risk aversion level of AG, the risk aversion level of CDT gradually increases. Let

α2 = 0.8 and

α1 be increasing. (3) The levels of risk aversion of CDT and AG increase gradually. According to Equations (45), (51) and (52),

are shown in

Table 11,

Table 12 and

Table 13. The variation trend of CDT’s (

α1,

α2)-optimistic equilibrium quantity and the changes of the (

α1,

α2)-optimistic equilibrium quantities of CDT and AG are shown in

Figure 7 and

Figure 8, respectively.

According to

Table 11 and

Figure 7 and

Figure 8, given

α1 (i.e., CDT’s risk aversion level), the equilibrium quantity of CDT increases gradually with

α2 (i.e., AG’s risk aversion level), while the equilibrium quantity of AG will gradually decrease. According to

Table 13 and

Figure 7 and

Figure 8, if

α1 and

α2 are increasing simultaneously, the equilibrium quantity of CDT and AG will decrease. In addition, it follows from Equations (51) and (52) that the market-clearing price for CDT and AG will be equal if they have the same confidence level (i.e., risk aversion level).

5. Conclusions

The extant research on the Cournot game model is mainly based on the assumption that the decision maker is completely rational. However, the decisions of the decision maker are more or less influenced by his own behavioral characteristics and psychological preferences in many real situations. In the fuzzy environment, this paper studies the Cournot game between two manufacturers with risk aversion. Based on credibility theory, this paper describes the risk aversion behavior of manufacturers by using the optimistic value criterion and constructs the fuzzy Cournot game model with risk aversion. The definition of optimistic equilibrium quantity and its existence theorem are shown. Finally, a case is used to illustrate the effectiveness and significance of the model proposed in this paper. The sensitivity of optimistic equilibrium quantity with respect to confidence level (or risk aversion levels) is analyzed, and the effect of manufacturers’ risk aversion levels on the market-clearing price is discussed. It is shown that manufacturers’ optimistic equilibrium quantity is positively related to the risk aversion levels of their competitors and negatively related to their own risk aversion levels if the two manufacturers show risk aversion preferences. It is also shown that the market-clearing price of a manufacturer with a higher risk aversion level is less than that of another with a lower risk aversion level.

In this paper, the Cournot game with risk aversion is considered under the fuzzy environment. The conclusions have stronger explanatory ability for the actual situation. However, the model constructed in this paper fails to address the case where two manufacturers show loss aversion, fairness concerns, reciprocal altruistic behavior, and so on. Therefore, the Cournot game with other behavior of bounded rationality will be an interesting exploration. In addition, our work focuses on the equilibrium quantity when the parameters in the credibilistic Cournot game are denoted by the triangular fuzzy numbers. However, it is still unknown whether the equilibrium quantity exists when the parameters in the credibilistic Cournot game are denoted by other fuzzy numbers, such as the interval fuzzy numbers, the trapezoidal fuzzy numbers, etc. Therefore, future research will focus on exploring the existence of the equilibrium quantity when the parameters of the credibilistic Cournot game are other fuzzy numbers.