Abstract

The article is devoted to the method of determining the risk surcharge in rental rates for special technological equipment. The relevance and features of the task, as well as existing approaches to solve it in other subject areas, are described. The risk of landlords is highlighted as “the inability to fully ensure the receipt of a stable income recorded in the lease agreement”. The three most significant risk-forming factors are highlighted: the early return of equipment, the emergence of debt on payments from the tenant, and the breakdown of equipment due to the fault of the tenant. A fuzzy model for estimating the likelihood of the manifestation of risk-forming factors is proposed depending on the following challenges of the rental pillar: the size of the enterprise, financial stability, the age of the enterprise, the number of current trials, and the reputation of the enterprise. Describes: universal linguistics for input and output values characterizing risky components, logical output rules, and the assessment of the likelihood of risk in general. Based on the SciKit-Fuzzy library for the Python language, the model studies all available values of input variables, and tenants are presented separately on the boundary values of the enterprise parameters. A methodology for determining the rental rate, taking into account the risk surcharge, is proposed.

Keywords:

fuzzy logic; rental of technological equipment; rental rate; risk and risk-forming factors; risk surcharge MSC:

03B52; 94D05

1. Introduction

Today, there is an increasing trend towards the emergence of a “sharing economy“ [] wherein one asset is used by many users to perform a specific task and is provided “on demand”. The user of the asset pays only for the time that the asset is used. Renting an apartment, car, or electronic device has become a common thing for citizens. According to a study by the Russian Association for Electronic Communications (RAEC) and the TIARCenter [], the sharing economy showed a growth of 39% in 2020 with a total volume of 1.07 trillion rubles in 2020.

It is rather difficult for organizations (especially large enterprises with concerns) to move into a new reality in which only the main assets of the enterprise are necessary and the rest of the equipment is provided “on demand”. However, funds for the purchase of equipment are now limited as part of overhead costs, while, on the contrary, rent is allocated as a separate cost item with the possibility of attracting the temporary use of equipment to perform certain stages of a comprehensive project (according to Government Decrees No. 2136 and No. 109 “About the provision of subsidies to Russian organizations for financial support for R&D activities in the field of radio electronics” [,]). The described support measures form an effective demand from companies.

In turn, lessors are faced with the problem of finding a balance between making the lease of equipment attractive in comparison with the purchase of the lessee’s own equipment, while also maximizing their own profits and minimizing the risks associated with a shortfall in profit or loss of an asset. The key tool in finding this balance is the cost of rent over a period of time (which offsets the potential risks involved).

For the “equipment lessor–lessee” relationship, this article considers the potential risks that the lessee bears for the lessor of equipment. When these risks are realized by the lessee, the lessor of the equipment incurs losses. Today, the company applies a single pricing policy for all types of customers. However, based on the company’s analytical materials, it was noted that different categories of customers have different likelihoods of risk. This article deals with the problem of determining a balanced premium to the rate of fixed monthly rent. This additional value indicates the likelihood of a risk occurring during the use of the equipment by the tenant.

Within the framework of this study, the authors set two main goals, which, in their opinion, are indicators that the study was successful:

- The developed algorithm will be able to carry out the price differentiation of customers and form the price of monthly rent taking into account the risk premium. This goal is qualitative in nature.

- The application of the developed artifact in practice will be more effective in comparison with the absence of price differentiation in terms of the lessor’s profit.

2. Literature Sources Analysis and Purpose of Study Formulation

The task of risk assessment is a fairly extensive field of research, with too much research devoted for this task in various fields of knowledge. For example, too much research focused on risk assessment in the insurance field. For example, the work of O. Kozminykh [] used Markov chains as a tool for assessing the risks of insurance companies; the work of Wei [], or A. Saptura et al. [], assessed credit risk using genetic algorithms; the work of A. Zanotto et al. [] used special frameworks to check dependencies between different events; the work of Marufu et al. [] and M. Park et al. [] used wide application of risk analysis in medicine.

In markets that are associated with the provision of services to individuals, scoring models are widely used to assess the risks of insurance, credit, and a number of other organizations [,,,]. These models are based on statistical data about the history of creditworthiness of an individual person. The input of the models is based on data from the individual person from official open sources, such as the National Bureau of Credit Histories as well as social networks and banking history in a particular credit institution. Too much research devoted itself to defining risk in banking with neural networks [], machine learning [], and some classification and clusterization methods [].

Related topics show the work devoted to determining the rent of specialized assets [] in an undeveloped market. In this article, the authors propose to use the current value of the object and the market rate of return on capital to obtain the amount of rent for an asset that is offered for rent. To calculate the rent in the historically formed real estate rental market, it is standard to use a formula that is based on taking the market value of the land plot, multiply it by the minimum yield coefficient corresponding to the yield of Federal Loan Bonds with a maturity of 30 years, then multiply that result by the adjustment coefficient []. However, the presented sources do not take into account the characteristics of the tenant and the risks of negative events, relying only on the expected income, which is not suitable for technological equipment used in production.

In general, this task is similar to “ski renting” [,]. In the classical version, the algorithm needs to decide when to switch from renting to buying. The classic wording is as follows: each time you go skiing, you need to either rent or buy skis if you do not already have a pair. Renting is cheaper (e.g., $50), but you only get one use out of the skis. Buying is expensive (e.g., $500), but you never have to rent or buy again. Here’s the problem: you do not know in advance how many times you’ll go skiing. How do you spend as little as possible? Too many articles studied these topics because this task has not only directed application—it is a financial and technological task too.

For example, Z. Lotker et al. [] extended the main task with the added option of buying after some leasing time. Karlin et al. [] made a great contribution to online analyses of what they call “the ski-rental family of problems”. They showed that there exists a deterministic online algorithm such that its average cost is e/(e − 1) ≈ 1.58 times the average offline cost, without assuming any specific input distribution. They also gave a randomized online algorithm for the ski-rental problem whose competitive ratio is optimal e/(e − 1).

Fujiwara H. et al. [] included competitive analyses in the ski-rental problem and researched the average cost for the ski rental problem. They concluded that the strategy “buy after rent” is not as optimal as buying outright or forever renting. Zhang G. et al. [] extended this topic and introduced multiple discount options. The authors presented a competitive online algorithm for our problem and showed that no deterministic algorithm can have a smaller competitive ratio when n is large enough. Z. Lotker [] et al. offered to use randomized algorithms for multi slope ski rentals. The authors have shown that the competitive factor is never more than the factor for the classical two-slope case, namely e/(e − 1).

In general, this task inverts the famous “ski-renting” task []. In this case, we are a company of ski renters, and we have a skiing session with some people in the mountain. We want to provide the best conditions for renting, but we have a bad tolerance for risk and need to save money. An important assumption in this case—you do not have too many statistical data points in open access and must make a decision based only on tenant data. The base terms of rent for each category of equipment include the time of rent and the rental price for regular payment. As the company, you are interested in receiving a stable income during the rental period. A key risk in this case—you will not receive a stable income during the rental period. This may be caused by some reasons, but, in this research, we focused on the reasons caused by tenant troubles. Based on some tenant parameters, we can define risk probability.

Our task is the reverse to the work of Xin et al. [], as well as Hu Maolin et al. []. Based on the article by S. al-Binali [], the problem of managing the “risk premium” depending on the risk tolerance of the decision maker is considered using the example of the classic Karp problem of “ski rental”. The probability of the early return of skis and the cost of used equipment in the secondary market, as well as the levels of competitiveness, were chosen as the main factors affecting the rental price. The authors propose to apply various risk strategies to manage the price of the final service in a competitive market. However, in this case, the authors do not pay attention to assessing the profile of the tenant themselves. Feng X. et al. [] also researched online leasing problems with price fluctuations and second-hand transactions. They added price fluctuations during these periods and second-hand market prices to their model for a more realistic approach. Xu Y. et al. [] described leasing cases with parallel machines working, with the provided discount depending on the q-ty of machines in work now.

In our case, we want to provide the best conditions for rent, but we have a bad tolerance for risk and need to save money. An important assumption in this case—you do not have too many statistical data points in open access and must make a decision based only on tenant data. The base terms of rent for each category of equipment include the time of rent and the rental price for regular payment. As the company, you are interested in a stable income during the rental period. A key risk in this case—you will not receive a stable income during the rental period. This may be caused by some reasons, but, in this research, we focused on reasons on the reasons caused by tenant troubles. Based on some tenant parameters, we can define risk probability.

The assessment of risk characteristics and risk-forming factors should be taken into account and carried out in a statistically correct environment using qualitative categories. In this case, it is advisable to use the mathematical apparatus of the theory of fuzzy sets [,]. These methods of inference [] allow you to convert qualitative estimates into numerical ones, taking into account the degree of confidence of the expert in this assessment. We can single out the following publications devoted to risk assessment in project activities using fuzzy logic tools among domestic authors [,,,,].

Examples of the use of fuzzy logic tools can also be found in foreign literature. In [,], a fuzzy system for assessing the credit rating for micro-, small-, and medium-sized businesses is described. The result of the work was the development of a creditor unreliability rating scale. Sinan Essen and colleagues [] applied fuzzy logic to analyze the risks of the “best cost country” selection strategy. In [,,,], the materials contain information on adaptive neuro-fuzzy inference systems for choosing vehicle routes under conditions of uncertainty, determining economical volumes of orders (for example, for planning purchases or production), analyzing the use of human resources, planning a route for transporting hazardous materials, and location planning for urban logistics.

Despite the existing groundwork, the task of assessing the “payment risk” when renting technological equipment has been set for the first time. In this article, in the development of existing risk management approaches, the authors propose a model for calculating a balanced premium to the rental rate when renting equipment, which is commensurate with the emerging risk, based on fuzzy logic tools.

Due to the lack of detailed statistical data, the authors are quite limited in their ability to solve this problem. Because part of the estimate is expressed in qualitative variables that do not have an unambiguous numerical definition, fuzzy logic was chosen as the most suitable tool.

3. Identification of Risks and Risk-Forming Factors When Renting Technological Equipment

A transaction for the lease of technological equipment is considered as a separate project—a temporary enterprise of the lessor (the terms of the lease are limited by the contract) to provide services to the lessee (directly renting equipment) in accordance with the specified resources (contract value) and requirements (terms of the contract, technical parameters of the leased product) []. The goal of the project on the part of the lessor can be formulated as follows: “Sustainable receipt of income from the rental of equipment during the period fixed in the lease contract”. Taking into account the logical connection between the purpose of the project and the possible risk [,], the lessor’s risk is defined as “The inability to fully ensure the receipt of a stable income fixed in the lease agreement”. We will consider the following events and/or phenomena presented in Table 1 as possible risk-forming factors that affect the manifestation of risk.

Table 1.

Compensation systems variability.

We single out risk-forming factors that depend only on tenants that have a high or moderate scale of influence. Four negative events fit this characteristic: the early return of equipment, bankruptcy of the tenant, occurrence of debt on payments from the tenant, and equipment breakdown due to the fault of the tenant. It should be noted that, in order to declare an enterprise bankrupt, a number of conditions must be met, the main of which is the inability of the enterprise to fulfill its current financial obligations. Accordingly, before the company is declared bankrupt, there is a delay in payments, which is one of the risk factors described above. In this regard, these factors were combined into one, so only three risk-forming factors will be considered further.

Early return of equipment—the tenant notifies that they will return the equipment earlier than stipulated by the terms of the contract. In this case, the lessor bears the losses associated with equipment downtime (delivery by the transport company back to the lessor, input diagnostics and maintenance of the received equipment, the search for a new tenant, and procedures for creating a new lease contract). Let us designate the probability of the occurrence of this event as “SPer—the probability of the early return of the equipment”.

Breakdown of equipment due to the fault of the lessee—in this case, the lessor bears the losses associated with equipment downtime during the repair, as well as the costs associated with resolving the conflict with the lessee if the latter does not admit their guilt (examination and justification of the lessee’s guilt, services of lawyers, etc.). Let us designate the probability of the occurrence of this event as “SPef—the probability of equipment failure”.

Late payment under the lease contract—due to unbalanced financial obligations, the tenant does not fulfill their obligations to pay rent payments on time. In the event of the occurrence of this event, the schedule of financial receipts is violated, which generally affects the fulfillment of the financial obligations of the lessor. Let us designate the probability of the occurrence of this event as “SPlp—probability of late payments”.

4. Analysis of Factors Influencing the Manifestation of Risk by the Organization

To identify the risk-forming factors described in paragraph one, we highlight the key parameters of the enterprise that affect their manifestation. Note that the data for evaluation should be available in one of the corporate information aggregation services, since the tenant is not required to provide full financial statements to another private organization. SPARK Interfax [] was chosen as an example of an information aggregator as one of the most popular services in the Russian Federation. In addition to the information about the founders, the aggregator provides the following information: the size of the enterprise, financial stability, the age of the enterprise, and the number of ongoing court cases. It is also worth considering the history of interaction with this counterparty by interviewing managers on a five-point scale.

The tenant’s parameter “size of the enterprise” [] is characterized by the number of employees. Larger enterprises tend to have more streamlined processes and long-term financial strength. The tenant parameter “financial stability” is estimated based on the two-factor Z-model [] proposed by Edward Altman in 1968. This model is formed on the basis of the company’s balance sheet data and characterizes the company’s liquidity as well as the share of borrowed funds in liabilities. Equation (1) is used for calculation:

where X1 is “Current liquidity ratio” and X2 is “Capitalization ratio” from the balance sheet.

Z = −0.3877 − 1.0736 X1 + 0.579X2

The tenant’s parameter “age of the enterprise“ characterizes the time period during which the enterprise conducts its economic activity. The tenant’s parameter “open litigation” reflects the commercial activities of the tenant in terms of the presence of disagreements and the ability to resolve them. The presence of a large volume of open court proceedings shows that the company is incapable of negotiating. In case of disagreement, there is a risk of blocking the technological equipment until a court decision is made. The tenant’s parameter “reputation of the enterprise” characterizes the experience of working with the enterprise in terms of established contacts and resolution of emerging disagreements. It is proposed to determine a qualitative level by interviewing the lessor’s employees who work directly with the tenant.

For a qualitative interpretation of the influence of the characteristics of the tenant’s enterprise on the manifestation of risk factors, it is proposed to use the following scale of intervals (“excellent”—“good”—“average”—“bad”) (Table 2).

Table 2.

Parameters of the tenant’s enterprise and their linguistic interpretation.

Each of the parameters described in Table 2 indirectly and directly affect the likelihood of a specific risk-forming factor (Table 3). For example, the parameter “financial stability” can be directly related to how quickly an enterprise is able to fulfill its financial obligations to pay rent in a timely manner and in full. The assessment of the probability of occurrence of the risk-forming factor “equipment failure due to the fault of the tenant” is influenced by parameters such as the number of employees of the enterprise, age, and reputation. This is due to the fact that large and “adult” enterprises tend to have more standardized processes and quality control systems. Young, small enterprises (which are at the stage of high activity and youth according to I. Adizes []) are guided by the potential of each employee separately, and, therefore, lack the rules and procedures for organizing labor.

Table 3.

Relationship between risk-forming factors and parameters of the tenant’s enterprise.

5. A General Fuzzy Algorithm for Renting

In general view, this task inverts the famous “ski-renting” task []. The base terms of rent for each category of equipment include the time of rent and the rental price for regular payment. As the company, you are interested in a stable income during the rental period. A key risk in this case—you will not receive a stable income during the rental period. This may be caused by some reasons, but, in this research, we focused on the reasons caused by tenant troubles. Based on some tenant parameters, we can define risk probability.

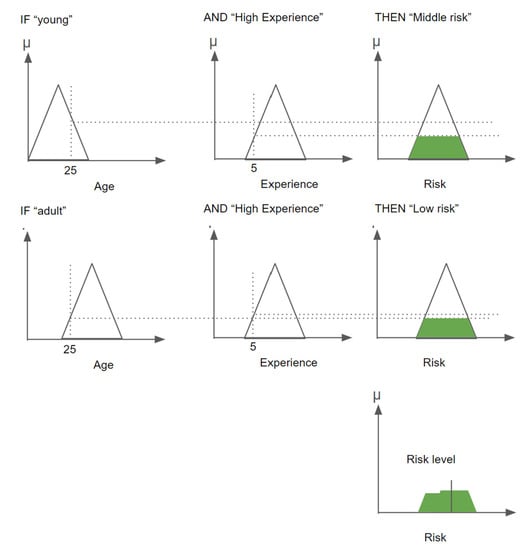

Step 1

Define tenant parameters: (it can be any important information such as income, age, etc.). For example, is defined as 25 years old under “Age”. is defined as 5 years old under experience age, etc.

Step 2

For each parameter, defines the measurement scale. In the example “Age”, it is scaled with numbers from 0 to 140 (max age). We defined some intervals on this scale and named them names such as “child” (0–18), “young” (16–25), “adult” (25–65) and “elderly” (60–140).

Each parameter belongs to set (a set of numbers that associate with linguistic variables), and, for fuzzy sets, we have the membership function (1), where is the membership degree to the set of A. For example, our tenant parameter 25 years belongs to sets A “adult” and C “young” with a coefficient of 0.5 for each. After creating some fuzzy sets for tenant parameters such as input variables, fuzzy set outputs are created for variable —risk probability, which includes some output sets with the linguistic variables . It is made according to Equation (2).

Step 3

When we define tenant parameters, we can operate with them. For this we need to define universal inputs for defining . In this case, set A for the finite number of elements will show:

Step 4

Then, we can use modus ponens rule , for sets and . It seems that “if then . According to the fuzzy rules, we can find output variables at based on input variables at . For our system it will be:

Step 5

Then, we can defuzzy the variable with the Mamdani fuzzy output rules (b equal y) by center of figure weight:

The result of Equation (4) will be the numeric risk probability variable depending on tenant input parameters.

The graphic interpretation is displayed on Figure 1.

Figure 1.

Graphic interpretation of system work.

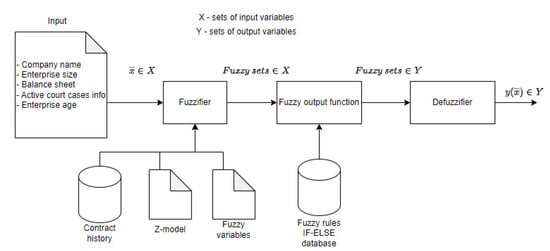

The main diagram of the supposed system shows on Figure 2. The system must include input data about the company (name, enterprise size, balance sheet, information about active court cases, and age of the company). Then, we can make these variables fuzzy —where X is the set of output variables—and call the fuzzy output function for these sets. The fuzzy output function determines the output variables of set Y using the pre-uploaded IF-ELSE rules database. After the defuzzifier process, we receive numerical variables and calculate average risk-forming factors probability.

Figure 2.

Main diagram of the fuzzy logic system for determining risk premium.

6. A Fuzzy Model for Determining Risk and Risk-Forming Factors in the Process of Renting Technological Equipment

We propose to use the theory of fuzzy sets to quantify the risk-forming factor (probability of presence)—Mamdani’s fuzzy inference algorithm [,]. This is explained by the fact that, in the absence of reliable statistical data about the enterprise, or the impossibility of expressing them quantitatively (such as interaction experience), the characteristics of risk factors are formed by conducting a survey of many experts who use qualitative and quantitative scales for evaluation. At the same time, the expert cannot always clearly define the boundaries between the selected qualitative assessments, and, in this case, the quantitative assessment scales may overlap.

The input and output values of the model are formulated as fuzzy variables. A fuzzy variable is a tuple of the form <α, X, A>, where α is the name of a fuzzy variable, X is the area in which the fuzzy variable is defined, and A is a fuzzy set on the universal X. A linguistic variable is the tuple

<β, T, X, M>, where β is the name of a linguistic variable, T is a set of values (terms) of a linguistic variable, X is a universe of fuzzy variables, and M is a semantic procedure that forms fuzzy sets for each term of a given linguistic variable. A fuzzy statement is formulated as follows: “the name of a linguistic variable” is “one of the terms used within the universe”.

Taking into account the introduced definitions, the output variables of the model are SPer + SPef + SPlp (the searched coefficients of the risk surcharge), which can be described in the following form.

⟨“Assessing the likelihood that risk factors will manifest themselves – early returns, equipment breakdowns and late payments”; x|0 < x < 1; A = {x, μ(x)}⟩: βR—the probability of manifestation of risk-forming factors of “early return”, “equipment breakdown”, and “late payments”; TR—{“Slow”, “Medium-Slow”, “Medium”, “High”, “Maximum”}; X1 = [0; 1]; M1—setting procedure on the universal X = [0; 1] values of a linguistic variable, i.e., terms from the set TR.

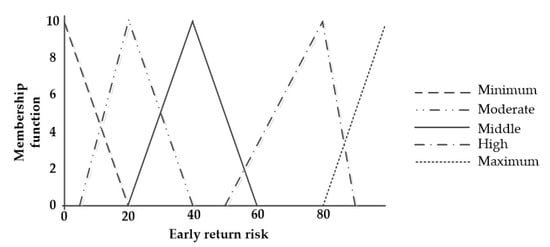

The quantitative values of the linguistic variable for each of the listed risk factors are determined on a five-level scale of intervals, the main feature of which is the equality of the intervals (Table 4).

Table 4.

Probability that risk factors will manifest themselves and the corresponding linguistic variable.

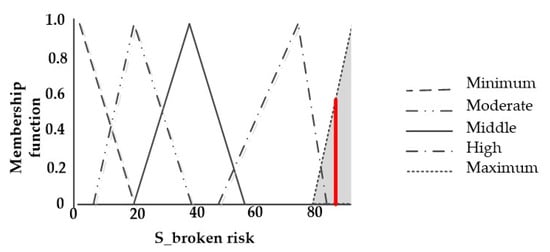

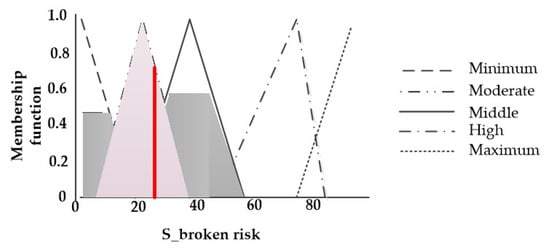

For scale categories described by the rules “less than” and “more than”, you can use S-functions and Z-functions, which are special cases of the trapezoidal membership function triangular functions. Due to the fact that the input term has the nature of uncertainty “approximately equal” in the work, we will use triangular numbers []. Since the described risk-forming factors have identical universes, linguistic variables, and their corresponding intervals, we will display the set and graph of membership functions T1 for the linguistic variable and β1 for the “probability of late payments”. The set is defined as follows:

T1 = {μH (0; 0.2; x), μY(0.05; 0.2; 0.4; x), μC(0.2; 0.4; 0.6; x), μB(0.5; 0.8; 0.9; x), μM(0.8; 1; x)}

Graphs of the membership functions of the set T1 are shown in Figure 3.

Figure 3.

Graphs of membership functions of linguistic variables of the set T1.

The input variables of the model are the parameters of the tenant’s enterprise, directly or indirectly indicating the manifestation of risk factors. Relationships between quantitative values and linguistic variables are shown in Table 5. In general, for all the proposed enterprise parameters, the description will be:

Table 5.

Correspondence of a linguistic variable to a value on the universe X.

⟨“Enterprise parameter N, indicating a risk factor”; x|0 < x < 10; A = {x, μ(x)}⟩ βn—the probability that the risk factor will manifest itself based on the parameter N; TN—{“Bad”, “Average”, “Good”, “Excellent”}; XN—universe for each of the input variables; MN—the procedure for setting the linguistic variable values of universe X, i.e., terms from the set TN.

The scale of the fact that a linguistic variable corresponds to a value in the universe is presented in Table 5.

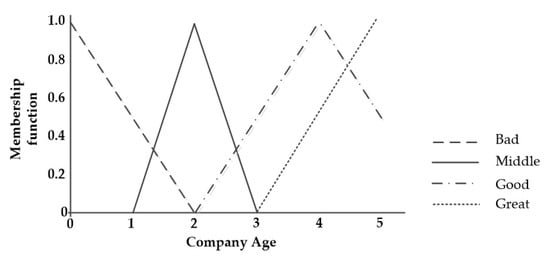

An example of the description of the function of the universe and the distribution of values for the input variable “age of the enterprise” is shown in Figure 4.

Figure 4.

The universe of the function and the distribution of linguistic variables for the parameter “Enterprise age”.

To determine the likelihood that risk factors may arise, a base of logical inference rules (72 rules) have been formed covering a range from absolutely bad estimates to the best ones, for example:

Assessing the likelihood that a risk factor for late payments will manifest itself

- -

- IF the financial stability of the enterprise is assessed as “good” AND the number of litigations is assessed as “good” AND the reputation of the enterprise is assessed as “good”, THEN the probability that the risk factor of late payments will manifest itself is assessed as “moderate”.

- -

- IF the financial stability of the enterprise is assessed as “average” AND the number of litigations is assessed as “good” AND the reputation of the enterprise is assessed as “excellent”, THEN the probability that the risk factor of late payments will manifest itself is assessed as “moderate”.

- -

- IF the financial stability of the enterprise is assessed as “bad” AND the number of litigations is assessed as “good” AND the reputation of the enterprise is assessed as “good”, THEN the probability that the risk factor of late payments will manifest itself is assessed as “high”.

Assessing the likelihood of risk occurrence in general.

We will assume that the selected risk factors are joint events (the occurrence of one of the events does not exclude the possibility of the others occurring during the lease). In this case, the probability that the risk of technological equipment leasing will arise is determined as the sum of the probability that risk factors will manifest themselves divided by their number:

7. Experimental Studies of the Model

Experimental studies of the model were carried out using the SciKit–Fuzzy library for the Python language [,]. The research was carried out according to the following scheme.

- The study of the model on the input variables of the tenant’s enterprise (all available values).

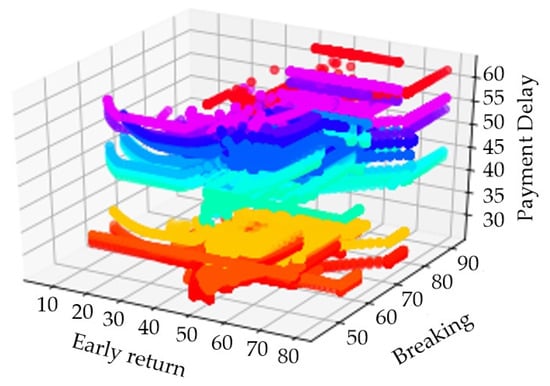

The values of the model data are presented in Figure 5 in the form of a three-dimensional graph, where each coordinate determines the probability of one of the risk-forming factors (in percent). The X axis contains the values of the risk factor “probability that the equipment will be returned early”, the Y axis contains the values of the risk factor “probability of equipment breakdown”, and the Z axis contains the values of the risk factor “probability of late payments”.

Figure 5.

Three-dimensional visualization indicating the results of the model.

Three-dimensional visualization of the results shows that the model is located on a fairly wide range of input parameters of the tenant’s enterprise, which makes it possible to determine specific values of the probability that risk-forming factors (influencing the manifestation of risk in the lessor) will manifest themselves. This allows us to conclude that the results can be used to determine the risk surcharge by other lessor enterprises. In addition to this, risk factors rely on intersecting input values. The model does not have abnormal points at which the probability that one risk factor would manifest itself would be at maximum. The remaining two would be minimal.

- 2.

- The study of the model on the boundary values of the parameters of the tenant’s enterprise.

Estimates of the probability that risk-forming factors will manifest themselves at the boundary values of the parameters of the tenant’s enterprise are determined according to the following rules of inference.

For an enterprise with absolutely negative parameters:

IF the financial stability of the enterprise is rated as “bad” AND the number of litigations is rated as “bad” AND the reputation of the enterprise is rated as “bad”, THEN the probability that the risk factor for late payments SPer will manifest itself at 79.07%.

IF the age of the enterprise is rated as “bad” AND the size of the enterprise is rated “bad” AND the reputation of the enterprise is rated as “bad”, THEN the probability that the risk factor for equipment breakdown due to the fault of the tenant SPer will manifest itself at 92.6%.

For an enterprise with maximum positive parameters:

IF the financial stability of the business is rated as “excellent” AND the number of litigation is rated as “excellent” AND the reputation of the business is rated as “excellent”, THEN there is a 27.3% chance that the late payment risk factor SPlp will manifest itself.

IF the financial stability of the business is rated as “excellent” AND the number of litigation is rated as “excellent” AND the size of the business is rated as “excellent” AND the age of the business is rated as “excellent”, THEN the probability that the risk factor for early return of equipment SPer will manifest itself at 7.7%.

IF the age of the facility is rated as “excellent” AND the size of the facility is rated “excellent” AND the reputation of the facility is rated as “excellent”, THEN there is a 26.6% chance that the tenant’s equipment failure risk factor SPef will manifest itself.

The results of fuzzy inference on the example assessing the risk factor of equipment breakdown through the fault of the tenant with the values “bad”, and the probability that the risk factor of equipment breakdown through the fault of the tenant with the values “excellent” are, respectively, presented in the graphical interpretation in Figure 6 and Figure 7.

Figure 6.

Graphical interpretation of the probability that the risk factor “probability of breakdown” with the parameters “bad” will manifest itself.

Figure 7.

Graphical interpretation of the probability that the risk factor “probability of breakdown” with the parameters “excellent” will manifest itself.

The equipment lessor can calculate the rental payment by multiplying the rental rate by a factor consisting of the sum of the values obtained as a result of the model. Reliable and large enterprises have a total coefficient of 0.616 units, while unreliable tenants have a total coefficient of 2.6337 units, which is 4.28 times higher than the minimum value. As a result, by using this model, an enterprise can differentiate the rental price by more than four times depending on the characteristics of the tenant.

8. Methodology for Calculating the Rent for the Lease of Technological Equipment

As a basic formula for determining the rental rate, it is proposed to use Equation (6) adopted in Innovative Enterprise from Tomsk city.

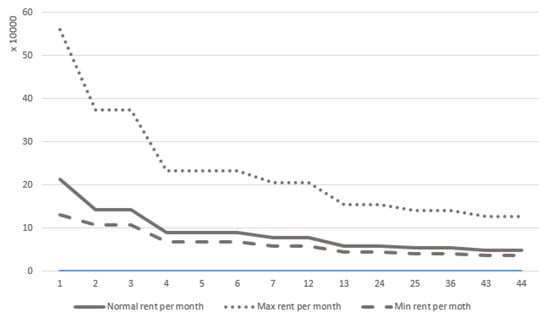

where RRPeq–recommended retail price of equipment at the moment of adding to the rental fleet; Tdep–depreciation time (in months) set for this model of technological equipment; Tax—property tax, which is equal to the average cost of equipment for the year, multiplied by the tax rate; Ameq–the amount of equipment, for which it is necessary, to have one replacement unit; ERPserv—this is the established retail price for equipment service per year, including equipment verification; M—coefficient of the month (which takes into account the possibility of the termination of the lease in a particular month, varying from 3 to 1). For the first month of rent, the coefficient will be equal to 3 (including the time of delivery to the tenant, as well as the return of equipment and maintenance in case of rent for exactly one month), for 2–3 months the coefficient is two, and 3–6 months—1.25. Starting from the 12th month, the coefficient is equal to one; E—the discount rate of the project, starting from the second year (for the first year it is equal to zero); t—discount period in years.

Taking into account the possible manifestation of risk-forming factors in the first month, the formula for the rent will be: Rmon ∗ M ∗ (SPer + SPef + SPlp). Starting from the second month it will be: Rmon ∗ M ∗ (SPef + SPlp). Charts of changes in the rental rate depending on time are shown in Figure 8.

Figure 8.

The result of applying risk factors to the rental rate.

As an example, the substantiation of the contract price for two potential tenants of the technological equipment of Innovative Enterprise will be considered (Table 6). Enterprise-1 is categorized as a large business and Enterprise-2 as a small business. The characteristics of the companies were formed on the basis of SPARK-Interfax data.

Table 6.

Characteristics of Tenant Companies.

The probabilities of the “early return of equipment”, “probability of equipment breakdown”, and “delays in payments” were determined based on the base of logical rules of fuzzy inference of the model. As a result, Enterprise-1 was offered a rental rate of 0.87 of the original rate, and Enterprise-2 1.37 of the original.

Using the model allows the equipment lessor to differentiate the pricing policy by changing the rent for various potential lessees depending on the age, size, financial stability, litigatory risk, and reputation of the enterprise. This differentiation makes it possible to make renting more affordable and, as a result, profitable for reliable tenants, and to build a price barrier for potential tenants who do not yet meet the specified criteria.

9. Discussion

The authors understand that it is not comprehensive method for this task. A more accurate result can be achieved with some changes such as:

- Including new company analysis factors—too much data about companies are available and the base model can be modified with new factors to match fuzzy variables. We chose main risk factors from our point of view for easier modelling and application in any case. For specific fields such as construction or mining, etc., data can be added with specific conditions such as the equipment application area (weather conditions, etc., which will be influenced by the degree of worn rental equipment). Additionally, it does not consider country risk, which needs to be added in the case of worldwide rental contracts. Some authors in our literature review use fuzzy logic models for work with these risks [].

- Modify risk-factor parameters:

- –

- For bankruptcy risks change the 2-variable Z-model [] to a 4-variable Z-model. After the presentation of the original model in 1968, Edward I. Altman extended their model for non-manufacturers, emerging markets, etc. Additionally, authors allow using other methods for bankruptcy prediction such as the Grover method [], etc. Authors focus on the simple bankruptcy model for working with companies, which does not have much public data.

- –

- Change the classification of company size. The authors used classification according to Russian law. Depending on economic size and type in any country, variables for company size can be changed in the greater or lesser side. Additionally, it should be correct to use other classifications for company sizes depending on the application.

- –

- Change the classification of company age. The authors based on I. Adizes’s company lifecycle classification [] define potential risks depending on company age. It is possible to use other classifications to provide more accurate results depending on economic type. An additional use for this point is to add more statistical data for the specific application.

- –

- Court case classification. The authors can use empirical data suitable for the Russian Federation with specific court law. Research can be improved by adding statistical data for this point and modifying variables.

- Use other methods for calculating the weight of risk-factors. The authors focused on fuzzy logic applications for calculating the weight of each risk factor for use model without much statistical data. Therefore, statistical data research can be improved with other solving methods such as Markov chains, discriminant analysis, neural networks, etc. It can increase the accuracy of output data and provide more flexible conditions for work with rental surcharges. Comparing these methods while using the fuzzy logic model can improve the results of research.

- Use rectangle membership functions instead of triangle. The authors, based on some articles [], choose triangle membership functions, but define the type of membership functions in fuzzy logic. It is a frequent question and using other types can improve the work too.

- Add the dynamic risk-surcharge calculation during the rental process. If the tenant’s parameters change at some point, then, now, we cannot re-calculate the risk surcharge to provide the best conditions.

Therefore, the authors should notice that developed systems can work without additional preparation, such as in neural network cases, and can be quickly changed in the testing process. It is an easy solution for working with rent in B2B fields with very limited data about the tenant.

10. Conclusions

This article is devoted to developing a simple model for calculating the risk premium of rental rates. The authors suggest an original fuzzy-logic-based system based on tenant parameters. The main conclusions are as follows:

- The risk of the lessor (with technological equipment for rent) is formulated as “The inability to fully ensure the receipt of a stable income fixed in the lease agreement”. Three key risk-forming factors, namely the “early return of equipment”, “arrears in payments by the tenant”, and “equipment breakdown due to the fault of the tenant”, were identified that affect the occurrence of the risk.

- An original fuzzy model for assessing the likelihood of risk factors manifesting themselves based on the age, size, financial stability, litigatory risks, and reputation of the tenant’s enterprise was proposed. The model uses triangle fuzzy sets for the likelihood calculation. The model is based on the Sci-Kit library for the Python programming language.

- Experimental studies of the model showed that the model makes it possible to differentiate the rent by more than 4.28 times to cover most of the possible combinations of parameters of the tenant’s enterprise.

- The practical use of the risk surcharge coefficient when renting technological equipment makes it possible to set a high price threshold for potentially risky tenants, and to make discounts for tenants who have good performance and enterprise reputation. Accordingly, the lessor receives a powerful tool for the price differentiation for their service, which, at the same time, allows you to save the fixed assets provided for rent.

- The results that were obtained may be useful for the risk managers of lessor organizations providing services for the rental of technological equipment in the B2B segment when calculating the lease payments.

- The direction of this work has a wide range of modifiable steps. The authors describe their ideas about work modification in the discussion points.

Author Contributions

Conceptualization, Y.E., S.S., P.S. and A.S.; review of sources, Y.E., S.S. and P.S.; description of the method, Y.E. and S.S.; experiment (testing, calculations), S.S.; writing—original draft preparation, Y.E. and S.S.; writing—review and editing, P.S.; visualization, Y.E. and S.S.; funding acquisition, P.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ministry of Science and Higher Education of the Russian Federation; project FEWM-2023-0013.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Seryogina, A.; Seryodina, M. Modern trends in the development of the economy of joint consumption (sharing economy). Sci. Methodical Electron. J. Concept 2019, 11, 154–159. [Google Scholar]

- The Sharing Economy in Russia 2020: Analytical Review; Russian Association of Electronic Communications, TIAR Center: Moscow, Russia, 2021; 22p.

- Resolution of the Government of the Russian Federation No. 2136, Paragraph 24. 2020. Available online: http://government.ru/docs/all/131685/ (accessed on 25 May 2022). (In Russian)

- Resolution of the Government of the Russian Federation No. 109, Paragraph 5. 2016. Available online: http://static.government.ru/media/files/5EQPfInTN3SqALKppKcX0DY56ZA3dOSO.pdf (accessed on 7 May 2022). (In Russian)

- Kozminikh, O. Markov chains as a tool for assessing the risks of insurance companies arising from the transfer of functions to outsourcing. Russ. J. Entrep. 2017, 18, 2491. [Google Scholar] [CrossRef]

- Wei, J.; Yang, H.; Wang, R. On the Markov-modulated insurance risk model with tax. Blätter Der DGVFM 2010, 31, 65–78. [Google Scholar] [CrossRef]

- Saputra, A.; Sukono; Rusyaman, E. Risk adjustment model of credit life insurance using a genetic algorithm. IOP Conf. Ser. Mater. Sci. Eng. 2018, 332, 012007. [Google Scholar] [CrossRef]

- Zanotto, A.; Clemente, G.P. An optimal reinsurance simulation model for non-life insurance in the Solvency II framework. Eur. Actuar. J. 2021, 100, 309–328. [Google Scholar] [CrossRef]

- Marufu, T.C.; Mannings, A.; Moppett, I.K. Risk scoring models for predicting peri-operative morbidity and mortality in people with fragility hip fractures: Qualitative systematic review. Injury 2015, 46, 2325–2334. [Google Scholar] [CrossRef]

- Park, M.H.; Shim, H.S.; Kim, W.H.; Kim, H.-J.; Kim, D.J.; Lee, S.-H.; Kim, C.S.; Gwak, M.S.; Kim, G.S. Clinical Risk Scoring Models for Prediction of Acute Kidney Injury after Living Donor Liver Transplantation: A Retrospective Observational Study. PLoS ONE 2015, 10, e0136230. [Google Scholar] [CrossRef]

- Bao, W.; Lianju, N.; Yue, K. Integration of Unsupervised and Supervised Machine Learning Algorithms for Credit Risk Assessment. Expert Syst. Appl. 2019, 128, 301–315. [Google Scholar] [CrossRef]

- Leong, C.K. Credit Risk Scoring with Bayesian Network Models. Comput. Econ. 2015, 47, 423–446. [Google Scholar] [CrossRef]

- Louzada, F.; Anderson, A.; Fernandes, G.B. Classification methods applied to credit scoring: Systematic review and overall comparison. Surv. Oper. Res. Manag. Sci. 2016, 21, 117–134. [Google Scholar] [CrossRef]

- Zhuravin, S.; Nemtsev, V. Prospects for Fuzzy-Multiple Descriptions of Innovation Risks. MIR Mod. Innov. Growth 2014, 4, 44–51. [Google Scholar]

- Gavrilova, E. Scoring Credit Risk Assessment Models: Russian and Foreign Experience. Actual Issues Mod. Econ. 2019, 1, 101–105. [Google Scholar]

- Aleksandrovskaya, Y. Development of scoring model of credit risk assessment. Econ. Bus. Theory Pract. 2019, 12, 9–11. [Google Scholar]

- Tkachev, A.; Shipunov, A. Credit scoring systems. Matrix approach. Bank. Bull. 2019, 10, 37–46. [Google Scholar]

- Pupentsova, S.; Shabrova, O. Determination of rental fees of specialized assets. Bus. Educ. Rule 2019, 4, 164–168. (In Russian) [Google Scholar]

- Kurchenkov, V.; Fetisova, O.; Makarenko, O. Actualization of methodological approaches to the calculation of rent for land plots in state and municipal property in urban districts. Reg. Econ. S. Russ. 2019, 2, 157–164. [Google Scholar]

- Karlin, A.; Manasse, M.; Rudolph, L.; Sleator, D. Competitive snoopy caching. Algorithmica 1988, 3, 77–119. [Google Scholar] [CrossRef]

- Karp, R. Online algorithms versus offline algorithms: How much is it worth to know the future? In Proceedings of the IFIP 12th World Computer Congress, Madrid, Spain, 7–11 September 1992; pp. 416–429. [Google Scholar]

- Lotker, Z.; Patt-Shamir, B.; Rawitz, D. Ski rental with two general options. Inf. Process. Lett. 2008, 108, 365–368. [Google Scholar] [CrossRef]

- Karlin, A.R.; Manasse, M.S.; McGeogh, L.; Owicki, S. Competitive randomized algorithms for nonuniform problems. Algorithmica 1994, 11, 542–571. [Google Scholar] [CrossRef]

- Fujiwara, H.; Iwama, K. Average-Case Competitive Analyses for Ski-Rental Problems. Algorithmica 2005, 42, 95–107. [Google Scholar] [CrossRef]

- Zhang, G.; Poon, C.K.; Xu, Y. The ski-rental problem with multiple discount options. Inf. Process. Lett. 2011, 111, 903–906. [Google Scholar] [CrossRef]

- Lotker, Z.; Patt-Shamir, B.; Rawitz, D. Rent, Lease, or Buy: Randomized Algorithms for Multislope Ski Rental. SIAM J. Discret. Math. 2012, 26, 718–736. [Google Scholar] [CrossRef]

- Xin, C.; Zhang, J.; Wang, Z. Risk strategy analysis for an online rental problem of durable equipment with a transaction cost. J. Algorithms Comput. Technol. 2021, 15. [Google Scholar] [CrossRef]

- Hu, M.; Xu, W.; Li, H.; Chen, X. Competitive Analysis for Discrete Multiple Online Rental Problems. J. Manag. Sci. Eng. 2018, 3, 125–140. [Google Scholar] [CrossRef]

- Al-Binali, S. A Risk-Reward Framework for the Competitive Analysis of Financial Games. Algorithmica 1999, 25, 99–115. [Google Scholar] [CrossRef]

- Feng, X.; Chu, C. Online leasing problem with price fluctuations and the second-hand transaction. J. Comb. Optim. 2022, 43, 1280–1297. [Google Scholar] [CrossRef]

- Xu, Y.; Zhi, R.; Zheng, F.; Liu, M. Competitive algorithm for scheduling of sharing machines with rental discount. J. Comb. Optim. 2022, 44, 414–434. [Google Scholar] [CrossRef]

- Zade, L. Fuzzy Sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Chevree, F.; Guely, F. Fuzzy Logic. Tech. Collect. Shneider Electr. 2009, 191, 1–32. [Google Scholar]

- Avdoshin, S. Business Informatization. In Risk Management—The Textbook; Litres: Moscow, Russia, 2014; 1476p. [Google Scholar]

- Taganov, A.; Gilman, D. Tasks and methods of fuzzy risk management of a software project. Control systems and information. Technologies 2012, 48, 79–83. [Google Scholar]

- Zubkova, T.; Ushakova, E. Automation of risk management of software projects based on fuzzy inference. Sci. Tech. Bull. Inf. Technol. Mech. Opt. 2015, 15, 877–885. [Google Scholar] [CrossRef]

- Glushenko, S. Application of the fuzzy logic mechanism for risk assessment of investment and construction projects. Bull. Rostov State Econ. Univ. 2014, 3, 58–68. [Google Scholar]

- Glushenko, S.; Dolzhenko, I. Fuzzy Risk Modeling System for Investment and Construction Projects. Bus. Inform. 2015, 2, 48–58. [Google Scholar]

- Yardi, A.; Hanne, T.; Wang, Y.; Wee, H. A Credit Rating Model in a Fuzzy Interference System Environment. Algorithms 2019, 12, 139–154. [Google Scholar]

- Erguzel, O.; Tunahan, H.; Esen, S. A Different approach to Global supplier risk: A finance based model. Alphanumer. J. 2019, 7, 12–26. [Google Scholar] [CrossRef]

- Pamukar, D.; Cirovic, G. Venichle route selection with an adaptive neuro fuzzy interference system in uncertainty conditions. Decis. Mak. Appl. Manag. Eng. 2018, 1, 13–37. [Google Scholar] [CrossRef]

- Scremac, S.; Tanackov, I.; Kopic, M.; Radovic, D. ANFIS model for determining the economic order quantity. Decis. Mak. Appl. Manag. Eng. 2018, 1, 81–92. [Google Scholar]

- Pamucar, D.; Vasin, L.; Atanaskovic, P.; Milicic, M. Planning the City Logistics Terminal Location by Applying the Green-Median Model and Type-2 Neurofuzzy Network. Comput. Intell. Neurosci. 2016, 2016, 6972818. [Google Scholar] [CrossRef]

- Lucovac, V.; Pamukar, D.; Popovic, M.; Dorovic, B. Portfolio model for analyzing human resources: An approach based on neuro-fuzzy modeling and the simulated annealing algorithm. Expert Syst. Appl. 2017, 90, 318–331. [Google Scholar] [CrossRef]

- Pamucar, D.; Ljuboevic, S.; Kostadinovic, D.; Dorovic, B. Cost risk aggregation in multi objective route planning for hazardous materials transportation—A neuro-fuzzy and artificial bee colony approach. Expert Syst. Appl. 2016, 65, 1–15. [Google Scholar] [CrossRef]

- PMBOK-7 Guide for Project Management. Project Management Institute. 2019. Available online: https://www.pmi.org/pmbok-guide-standards/foundational/PMBOK (accessed on 5 October 2022).

- GOST R 51897-2011—Risk Management: Terms and Definitions. 2019. Available online: https://docs.cntd.ru/document/1200088035 (accessed on 5 October 2022). (In Russian).

- SPARK Interfax. Available online: https://www.spark-interfax.ru (accessed on 5 October 2022). (In Russian).

- Federal Law No. 209-FZ, 24 July 2007. 2007. Available online: https://rulaws.ru/laws/Federalnyy-zakon-ot-24.07.2007-N-209-FZ/ (accessed on 5 October 2022). (In Russian).

- Altman, E. Corporate Financial Distress: A Complete Guide to Predicting, Avoiding, and Dealing with Bankruptcy, 1st ed.; Wiley: New York, NY, USA, 1983. [Google Scholar]

- Kupchinskaya, Y.; Chehovskaya, S. Analysis of the “Youth” stage in the model “Compan’s life cycle” Itzhaka Adizes on the example of major world brands. Bus. Educ. Knowl. Econ. 2017, 2, 80–83. [Google Scholar]

- Mamdani, E. Advances in the linguistic synthesis of fuzzy controllers. Int. J. Man-Mach. Stud. 1976, 8, 669–678. [Google Scholar] [CrossRef]

- Shushura, A. Formalization of Membership Functions of Many Variables in Problems of Fuzzy Control of Complex Systems. Sci. Eur. 2018, 27, 1. [Google Scholar]

- SciKit-Fuzzy. Available online: https://pythonhosted.org/scikit-fuzzy/overview.html (accessed on 5 October 2022).

- Welcome to Python. Available online: https://www.python.org (accessed on 5 October 2022).

- Saragih, F.; Sinambela, E.; Nurmala Sari, E. Bankruptcy Prediction by Using the Grover Method. In Proceedings of the 1st International Conference on Economics, Management, Accounting and Business, ICEMAB 2018, Medan, Indonesia, 8–9 October 2018. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).