Bankruptcy Prediction for Sustainability of Businesses: The Application of Graph Theoretical Modeling

Abstract

1. Introduction

2. Material and Methods

- = working capital/total assets

- = retained earnings/total assets

- = earnings before interest and taxes/total assets

- = book value of equity/book value of total liabilities

- = sales/total assets

- = overall revised index

- Current Ratio = Current assets/Short-term liabilities (CR)

- Return on assets = EBIT/Total assets (ROA)

- Total assets turnover ratio = Total sales/Total assets (TATR)

- Total debt to total assets = Total debt/Total assets (TDTA)

- Credit period ratio = Short-term liabilities/Sales (CPR)

| Feature | Authors |

|---|---|

| CR | Li and Sun [65]; Chen and Du [66]; Kainulainen et al. [67]; Callejón et al. [68]; Lin et al. [69]; Režňáková and Karas [70]; Cultera and Bredart [61]; Liang et al. [71]; Zelenkov et al. [72]; Chou et al. [73]; Volkov et al. [74]; Son et al. [75]; Korol [43]; Farooq and Qamar [76]; Shen et al. [44]; Vuković et al. [77]; Tumpach et al. [78]; Yan et al. [79]; Chen et al. [31]; Rahman et al. [80]; Park et al. [81]; Pavlicko et al. [82]; Papíková and Papík [83]; Pavlicko and Mazanec [84]; Mousavi et al. [85]; Qian et al. [86]; Smith and Alvarez [87] |

| ROA | Altman [50]; Li and Sun [65]; Hu [88]; Chen and Du [66]; Premachandra et al. [89]; Kainulainen et al. [67]; Zhou et al. [90]; Cultera and Bredart [61]; Zelenkov et al. [72]; Volkov et al. [74]; Korol [43]; Farooq and Qamar [76]; Shen et al. [44]; Tumpach et al. [78]; Qian et al. [86]; Pavlicko and Mazanec [84] |

| TATR | Altman [50]; Platt and Platt [91]; Li and Sun [65]; Chen and Du [66]; Kainulainen et al. [67]; Tomczak et al. [92]; Režňáková and Karas [70]; Lin et al. [69]; Zelenkov et al. [72]; Du Jardin [93]; Chou et al. [73]; Vuković et al. [77]; Park et al. [81]; Chen et al. [31]; Rahman et al. [80]; Papíková and Papík [83]; Pavlicko and Mazanec [84] |

| TDTA | Šnircová [62]; Platt and Platt [91]; Premachandra et al. [89]; Chen and Du [66]; Hu [88]; Yeh et al. [94]; Kainulainen et al. [67]; Režňáková and Karas [70]; Lin et al. [69]; Zhou et al. [90]; Chou et al. [73]; Volkov et al. [74]; Zelenkov et al. [72]; Arroyave [95]; Le et al. [96]; Farooq and Qamar [76]; Vuković et al. [77]; Shen et al. [44]; Yan et al. [79]; Chen et al. [31]; Pavlicko et al. [82]; Park et al. [81]; Qian et al. [86]; Papíková and Papík [83]; Pavlicko and Mazanec [84] |

| CPR | Šnircová [62]; Mendes et al. [97]; Lin et al. [69]; Du Jardin [93]; Jabeur [98]; Wyrobek [99]; Karas and Srbova [63]; Shen et al. [44]; Park et al. [81]; Qian et al. [86]; Smith and Alvarez [87] |

2.1. Graph Theory Application

2.2. Confusion Matrix

- True Positive () is the total counts of correctly classified positive examples.

- False Positive () is the total counts of negative examples incorrectly classified as positive.

- False Negative () is the total counts of positive examples incorrectly classified as negative.

- True Negative (): is the total counts of correctly classified negative examples.

2.3. Precision-Recall Curves

2.4. Model Building

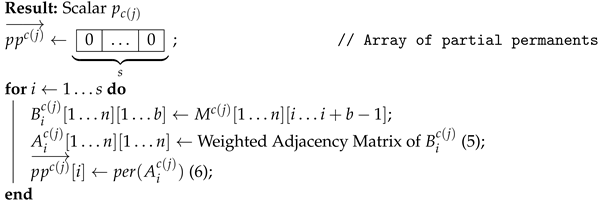

| Algorithm 1: Permanent of company |

Data: Matrix , Vector , Scalar s  ; |

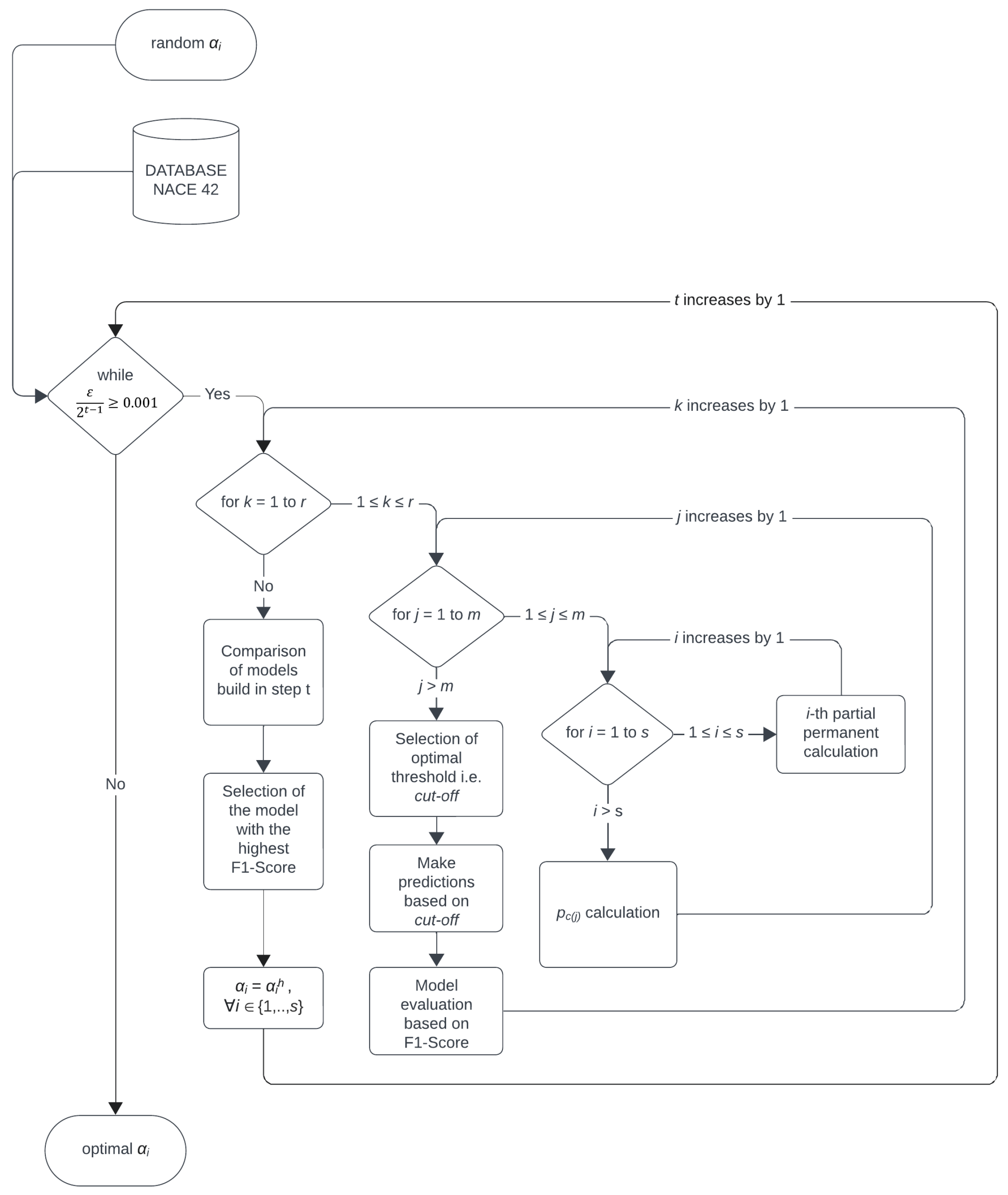

2.5. Optimization of Coefficients

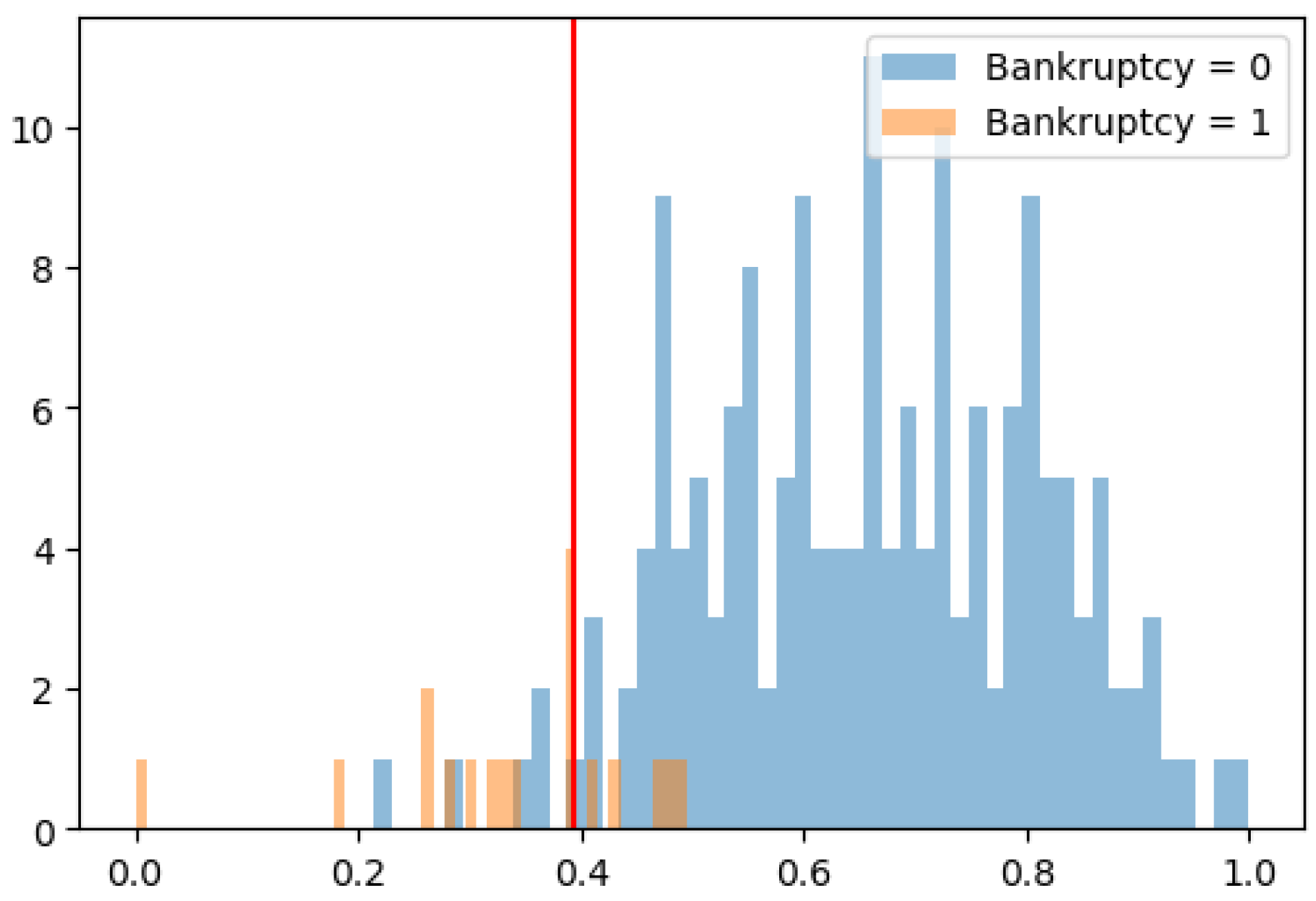

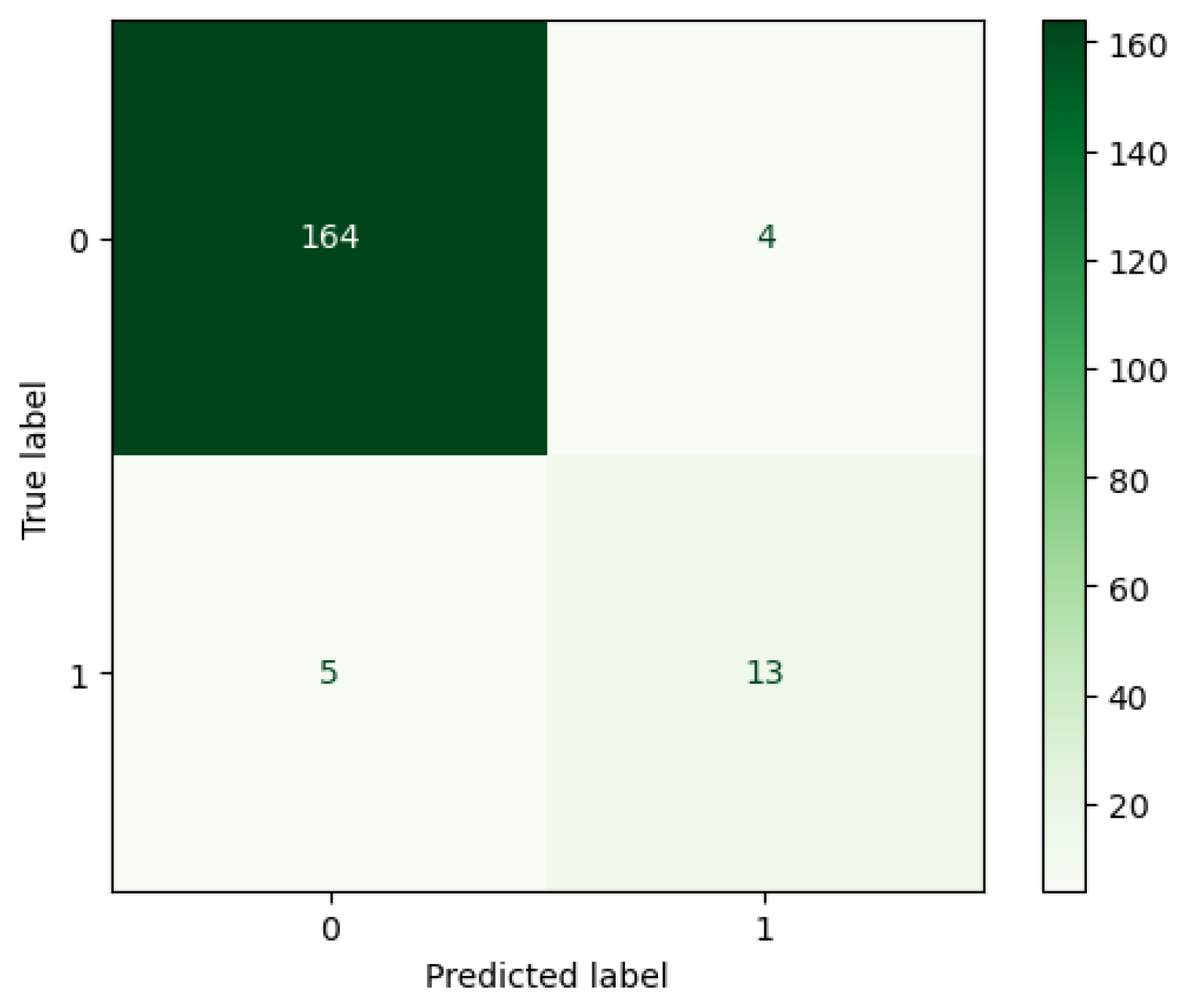

3. Results

| Metric | Value |

|---|---|

| Accuracy | 0.9516 |

| Precision | 0.7647 |

| Recall | 0.7222 |

| F1-score | 0.7429 |

| 0.3928 |

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Srebro, B.; Mavrenski, B.; Bogojevic Arsic, V.; Knezevic, S.; Milasinovic, M.; Travica, J. Bankruptcy Risk Prediction in Ensuring the Sustainable Operation of Agriculture Companies. Sustainability 2021, 13, 7712. [Google Scholar] [CrossRef]

- Ghodrati, H.; Moghaddam, A.H.M. A study of the accuracy of bankruptcy prediction models: Altman, Shirata, Ohlson, Zmijewsky, CA score, Fulmer, Springate, Farajzadeh genetic, and Mckee genetic models for the companies of the stock exchange of tehran. Am. J. Sci. Res. 2012, 59, 55–67. [Google Scholar]

- Araghi, K.; Makvandi, S. Evaluating Predictive power of Data Envelopment Analysis Technique Compared with Logit and Probit Models in Predicting Corporate Bankruptcy. Aust. J. Bus. Manag. Res. 2012, 2, 38–46. [Google Scholar]

- Sun, J.; Li, H.; Huang, Q.H.; He, K.Y. Predicting Financial Distress and Corporate Failure: A Review from the State-of-the-art Definitions, Modeling, Sampling, and Featuring Approaches. Knowl.-Based Syst. 2014, 57, 41–56. [Google Scholar] [CrossRef]

- Mihalovic, M. Applicability of Scoring Models in Firms’ Default Prediction. The Case of Slovakia. Politická Ekon. 2018, 66, 689–708. [Google Scholar] [CrossRef]

- Aziz, A.; Dar, H. Predicting Corporate Bankruptcy: Where We Stand? Corp. Gov. 2006, 6, 18–33. [Google Scholar] [CrossRef]

- Zhou, L.; Lai, K.K. AdaBoost Models for Corporate Bankruptcy Prediction with Missing Data. Comput. Econ. 2017, 50, 69–94. [Google Scholar] [CrossRef]

- Zopounidis, C.; Doumpos, M. Multi-criteria Decision Aid in Financial Decision Making: Methodologies and Literature Review. J. -Multi-Criteria Decis. Anal. 2012, 11, 167–186. [Google Scholar] [CrossRef]

- Balcaen, S.; Ooghe, H. 35 Years of Studies on Business Failure: An Overview of the Classical Statistical Methodologies and Their Related Problems; Working Papers of Faculty of Economics and Business Administration; Ghent University: Ghent, Belgium, 2004. [Google Scholar]

- Giordani, P.; Jacobson, T.; Schedvin, E.; Villani, M. Taking the Twists into Account: Predicting Firm Bankruptcy Risk with Splines of Financial Ratios. J. Financ. Quant. Anal. 2014, 49, 1071–1099. [Google Scholar] [CrossRef]

- Shi, Y.; Li, X. An overview of bankruptcy prediction models for corporate firms: A systematic literature review. Intang. Cap. 2019, 15, 114–127. [Google Scholar] [CrossRef]

- Kwak, W.; Shi, Y.; Kou, G. Bankruptcy prediction for Korean firms after the 1997 financial crisis: Using a multiple criteria linear programming data mining approach. Rev. Quant. Financ. Account. 2012, 38, 441–453. [Google Scholar] [CrossRef]

- Horváthová, J.; Mokrišová, M. Risk of Bankruptcy, Its Determinants and Models. Risks 2018, 6, 117. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical scale inefficiences in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Tone, K. A Slacks-Based Measure of Efficiency in Data Envelopment Analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Wang, Y.M.; Chin, K.S.; Yang, J.B. Measuring the performances of decision-making units using geometric average efficiency. J. Oper. Res. Soc. 2007, 58, 929–937. [Google Scholar] [CrossRef]

- Paradi, J.C.; Rouatt, S.; Zhu, H. Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega 2011, 39, 99–109. [Google Scholar] [CrossRef]

- Zhu, J. DEA based benchmarking models. In Data Envelopment Analysis. International Series in Operations Research & Management, Science; Zhu, J., Ed.; Springer: Boston, MA, USA, 2015; Volume 221. [Google Scholar]

- Färe, R.; Grosskopf, S.; Margaritis, D. Advances in Data Envelopment Analysis; World Scientific Publishing Company: Singapore, 2015. [Google Scholar]

- Ahmad, M.F.; Ishtiaq, M.; Hamid, K.; Khurram, M.U.; Nawaz, A. Data Envelopment Analysis and Tobit Analysis for Firm Efficiency in Perspective of Working Capital Management in Manufacturing Sector of Pakistan. Int. J. Econ. Financ. Issues 2017, 7, 706–713. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The valuation of option contracts and a test of market efficiency. J. Financ. 1973, 27, 399–417. [Google Scholar] [CrossRef]

- Kordestani, G.; Bakhtiari, M.; Biglari, V. Ability of combinations of cash flow components to predict financial distress. Bus. Theory Pract. 2011, 12, 277–285. [Google Scholar] [CrossRef]

- Theil, H. On the Use of Information Theory Concepts in the Analysis of Financial Statements. Manag. Sci. 1969, 15, 459–480. [Google Scholar] [CrossRef]

- Booth, P.J. Decomposition measure and the prediction of financial failure. J. Bus. Financ. Account. 1983, 10, 67–82. [Google Scholar] [CrossRef]

- Mar Molinero, C.; Ezzamel, M. Multidimensional scaling applied to corporate failure. Omega 1991, 19, 259–274. [Google Scholar] [CrossRef]

- Neophytou, E.; Molinero, C.M. Predicting corporate failure in the UK: A multidimensional scaling approach. J. Bus. Financ. Account. 2004, 31, 677–710. [Google Scholar] [CrossRef]

- Klieštik, T.; Klieštiková, J.; Kováčová, M.; Švábová, L.; Valášková, K.; Vochozka, M.; Oláh, J. Prediction of Financial Health of Business Entities in Transition Economies; Addleton Academic Publishers: New York, NY, USA, 2018. [Google Scholar]

- Tsai, C.F. Two-stage hybrid learning techniques for bankruptcy prediction. Stat. Anal. Data Min. 2020, 13, 565–572. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, C.-K.; Lo, C.-M.; Chen, S.-F.; Liao, Q.-J. Comparable Studies of Financial Bankruptcy Prediction Using Advanced Hybrid Intelligent Classification Models to Provide Early Warning in the Electronics Industry. Mathematics 2021, 9, 2622. [Google Scholar] [CrossRef]

- Heo, J.; Yang, J.Y. AdaBoost based bankruptcy forecasting of Korean construction companies. Appl. Soft Comput. 2014, 24, 494–499. [Google Scholar] [CrossRef]

- Choe, K.; Garas, S. The graph theoretical approach to bankruptcy prediction. J. Account. Manag. 2021, 11, 47–57. [Google Scholar] [CrossRef]

- Darvish, M.; Yasaei, M.; Saeedi, A. Application of the graph theory and matrix methods to contractor ranking. Int. J. Proj. Manag. 2009, 27, 610–619. [Google Scholar] [CrossRef]

- Wagner, S.M.; Neshat, N. Assessing the vulnerability of supply chains using graph theory. Int. J. Prod. Econ. 2010, 126, 121–129. [Google Scholar] [CrossRef]

- Singh, R.K.; Kumar, P. Measuring the flexibility index for a supply chain using graph theory matrix approach. J. Glob. Oper. Strateg. Sourc. 2020, 13, 56–69. [Google Scholar] [CrossRef]

- Gazda, V.; Horvath, D.; Resovsky, M. An application of graph theory in the process of mutual debt compensation. Acta Polytech. Hung. 2015, 12, 7–24. [Google Scholar]

- Yildirim, M.; Okay, F.Y.; Özdemir, S. Big data analytics for default prediction using graph theory. Expert Syst. Appl. 2021, 176, 114840. [Google Scholar] [CrossRef]

- Sun, J.; Li, H. Dynamic financial distress prediction using instance selection for the disposal of concept drift. Expert Syst. Appl. 2011, 38, 2566–2576. [Google Scholar] [CrossRef]

- Nyitrai, T. Dynamization of bankruptcy models via indicator variables. Benchmarking Int. J. 2019, 26, 317–332. [Google Scholar] [CrossRef]

- Niklis, D.; Doumpos, M.; Zopounidis, C. Combining market and accounting-based models for credit scoring using a classification scheme based on support vector machines. Appl. Math. Comput. 2014, 234, 69–81. [Google Scholar] [CrossRef]

- Du Jardin, P. Bankruptcy prediction using terminal failure processes. Eur. J. Oper. Res. 2015, 242, 286–303. [Google Scholar] [CrossRef]

- Korol, T. Dynamic Bankruptcy Prediction Models for European Enterprises. J. Risk Financ. Manag. 2019, 12, 185. [Google Scholar] [CrossRef]

- Shen, F.; Liu, Y.; Wang, R. A dynamic financial distress forecast model with multiple forecast results under unbalanced data environment. Knowl. Based Syst. 2020, 192, 105365. [Google Scholar] [CrossRef]

- Zhu, J.; Zhu, H.; Lin, N.; Farouk, A. A Dynamic Prediction Model of Financial Distress in the Financial Sharing Environment. Discret. Dyn. Nat. Soc. 2023, 2023, 6259689. [Google Scholar] [CrossRef]

- CRIF. Financial Statements of Analyzed Businesses; Slovak Credit Bureau, s.r.o.: Bratislava, Slovakia, 2022. [Google Scholar]

- Hafiz, A.; Lukumon, O.; Muhammad, B.; Olugbenga, A.; Hakeem, O.; Saheed, A. Bankruptcy Prediction of Construction Businesses: Towards a Big Data Analytics Approach. In Proceedings of the 2015 IEEE First International Conference on Big Data Computing Service and Applications, San Francisco, CA, USA, 30 March–3 April 2015; IEEE Computer Society: Washington, DC, USA, 2015; pp. 347–352. [Google Scholar]

- Strba, M. Rozhýbe Stavebníctvo po Koronakríze Slovenskú Ekonomiku? [Will the Construction Industry Drive the Slovak Economy after the Corona Crisis?]. 2020. Available online: https://podnikatelskecentrum.sk/rozhybe-stavebnictvo-po-koronakrize-slovensku-ekonomiku/ (accessed on 15 July 2023).

- MTSR. Ročenka Slovenského Stavebníctva 2019 [Yearbook of the Slovak Construction 2019]; Ministry of Transport of the Slovak Republic: Bratislava, Slovakia, 2019; Available online: https://www.mindop.sk/ministerstvo-1/vystavba-5/stavebnictvo/dokumenty-a-materialy/rocenky-stavebnictva (accessed on 22 March 2023).

- Altman, E.I. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bancruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Altman, E.I. Predicting Financial Distress of Companies: Revisiting the Z-Score and Zeta Models; Working Paper; Stern School of Business, New York University: New York, NY, USA, 2000. [Google Scholar]

- Kacer, M.; Ochotnicky, P.; Alexy, M. The Altman’s Revised Z’-Score Model, Non-financial Information and Macroeconomic Variables: Case of Slovak SMEs. Ekon. Cas. 2019, 67, 335–366. [Google Scholar]

- Ghosh, A.; Kapil, S. Is Altman’s Model efficient in predicting bankruptcy?—A comparison among the Altman Z-score, DEA, and ANN models. J. Inf. Optim. Sci. 2022, 43, 1191–1207. [Google Scholar] [CrossRef]

- Valaskova, K.; Svabova, L.; Durica, M. Verifikácia predikčných modelov v podmienkach slovenského poľnohospodárskeho sektora [Verification of prediction models in conditions of the Slovak agricultural sector]. Ekon. Manag. Inovace [Econ. Manag. Innov.] 2017, 9, 30–38. Available online: http://emijournal.cz/wp-content/uploads/2017/12/03_verifikacia-predik%C4%8Dn%C3%BDch-modelov.pdf (accessed on 13 May 2023).

- Dimitras, A.I.; Slowinski, R.; Susmaga, R.; Zapounidis, C. Business failure prediction using rough sets. Eur. J. Oper. Res. 1999, 114, 263–280. [Google Scholar] [CrossRef]

- Daubie, M.; Meskens, N. Bankruptcy prediction: Literature survey of the last ten years. Belg. J. Oper. Res. Stat. Comput. Sci. 2001, 41, 43–58. [Google Scholar]

- Akers, M.; Bellovary, J.; Giacomino, D. A review of bankruptcy prediction studies: 1930 to present. J. Financ. Educ. 2007, 33, 1–42. [Google Scholar]

- Bredart, X. Bankruptcy Prediction Model: The Case of the United States. Int. J. Econ. Financ. 2014, 6, 1–7. [Google Scholar] [CrossRef]

- Hussain, M.; Nassir, A.; Shamsher, M.; Hassan, T. Prediction of Corporate Financial Distress of PN4 Companies in Malaysia: A Logistic Model Approach. J. Restruct. Financ. 2005, 2, 143–155. [Google Scholar] [CrossRef]

- Von Thadden, E.L.; Berglöf, E.; Roland, G. The design of corporate debt structure and bankruptcy. Rev. Financ. Stud. 2010, 23, 2648–2679. [Google Scholar] [CrossRef]

- Cultrera, L.; Bredart, X. Bankruptcy prediction: The case of Belgian SMEs. Rev. Account. Financ. 2016, 15, 101–119. [Google Scholar] [CrossRef]

- Šnircová, J. Možnosti prognózovania finančnej situácie podnikov v slovenskej ekonomike [Possibilities of forecasting the financial situation of companies in the Slovak economy]. BIATEC 1997, 5, 15–22. [Google Scholar]

- Karas, M.; Srbova, P. Predicting bankruptcy in construction business: Traditional model validation and formulation of a new model. J. Int. Stud. 2019, 12, 283–296. [Google Scholar] [CrossRef]

- Spicka, J. The financial condition of the construction companies before bankruptcy. Eur. J. Bus. Manag. 2013, 5, 160–170. [Google Scholar]

- Li, H.; Sun, J. Ranking-order case-based reasoning for financial distress prediction. Knowl.-Based Syst. 2008, 21, 868–878. [Google Scholar] [CrossRef]

- Chen, W.-S.; Du, Y.-K. Using neural networks and data mining techniques for the financial distress prediction model. Expert Syst. Appl. 2009, 36, 4075–4086. [Google Scholar] [CrossRef]

- Kainulainen, L.; Yu, Q.; Miche, Y.; Eirola, E.; Séverin, E.; Lendasse, A. Ensembles of Locally Linear Models: Application to Bankruptcy Prediction. In Proceedings of the 2010 International Conference on Data Mining, DMIN 2010, Las Vegas, NV, USA, 12–15 July 2010; pp. 280–286. [Google Scholar]

- Callejón, A.M.; Casado, A.M.; Fernández, M.A.; Peláez, J.I. A System of Insolvency Prediction for industrial companies using a financial alternative model with neural networks. Int. J. Comput. Intell. Syst. 2013, 6, 29–37. [Google Scholar] [CrossRef][Green Version]

- Lin, F.; Liang, D.; Yeh, C.-C.; Huang, J.-C. Novel feature selection methods to financial distress prediction. Expert Syst. Appl. 2014, 41, 2472–2481. [Google Scholar] [CrossRef]

- Režňáková, M.; Karas, M. Bankruptcy Prediction Models: Can the Prediction Power of the Models be Improved by Using Dynamic Indicators? Procedia Econ. Financ. 2014, 12, 565–574. [Google Scholar] [CrossRef]

- Liang, D.; Lu, C.-C.; Tsai, C.-F.; Shih, G.-A. Financial ratios and corporate governance indicators in bankruptcy prediction: A comprehensive study. Eur. J. Oper. Res. 2016, 252, 561–572. [Google Scholar] [CrossRef]

- Zelenkov, Y.; Fedorova, E.; Chekrizov, D. Two-step classification method based on genetic algorithm for bankruptcy forecasting. Expert Syst. Appl. 2017, 88, 393–401. [Google Scholar] [CrossRef]

- Chou, C.-H.; Hsieh, S.-C.; Qiu, C.-J. Hybrid genetic algorithm and fuzzy clustering for bankruptcy prediction. Appl. Soft Comput. 2017, 56, 298–316. [Google Scholar] [CrossRef]

- Volkov, A.; Benoit, D.F.; van den Poel, D. Incorporating sequential information in bankruptcy prediction with predictors based on Markov for discrimination. Decis. Support Syst. 2017, 98, 59–68. [Google Scholar] [CrossRef]

- Son, H.; Hyun, C.; Phan, D.; Hwang, H.J. Data analytic approach for bankruptcy prediction. Expert Syst. Appl. 2019, 138, 112816. [Google Scholar] [CrossRef]

- Farooq, U.; Qamar, M.A.J. Predicting multistage financial distress: Reflections on sampling, feature and model selection criteria. J. Forecast. 2019, 38, 632–648. [Google Scholar] [CrossRef]

- Vuković, B.; Milutinović, S.; Milićević, N.; Jakšić, D. Corporate Bankruptcy Prediction: Evidence from Wholesale Companies in the Western European Countries. J. Econ. 2020, 68, 477–498. [Google Scholar]

- Tumpach, M.; Surovičová, A.; Juhászová, Z.; Marci, A.; Kubaščíková, Z. Prediction of the Bankruptcy of Slovak Companies Using Neural Networks with SMOTE. J. Econ. 2020, 68, 1021–1039. [Google Scholar] [CrossRef]

- Yan, D.; Chi, G.; Lai, K.K. Financial Distress Prediction and Feature Selection in Multiple Periods by Lassoing Unconstrained Distributed Lag Non-linear Models. Mathematics 2020, 8, 1275. [Google Scholar] [CrossRef]

- Rahman, M.; Sa, C.L.; Masud, M.A.K. Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model. J. Risk Financ. Manag. 2021, 14, 199. [Google Scholar] [CrossRef]

- Park, M.S.; Son, H.; Hyun, C.; Hwang, H.J. Explainability of machine learning models for bankruptcy prediction. IEEE Access 2021, 9, 124887–124899. [Google Scholar] [CrossRef]

- Pavlicko, M.; Durica, M.; Mazanec, J. Ensemble Model of the Financial Distress Prediction in Visegrad Group Countries. Mathematics 2021, 9, 1886. [Google Scholar] [CrossRef]

- Papíková, L.; Papík, M. Effects of classification, feature selection, and resampling methods on bankruptcy prediction of small and medium-sized enterprises. Intell. Syst. Account. Financ. Manag. 2022, 29, 254–281. [Google Scholar] [CrossRef]

- Pavlicko, M.; Mazanec, J. Minimalistic Logit Model as an Effective Tool for Predicting the Risk of Financial Distress in the Visegrad Group. Mathematics 2022, 10, 1302. [Google Scholar] [CrossRef]

- Mousavi, M.M.; Ouenniche, J.; Tone, K. A dynamic performance evaluation of distress prediction models. J. Forecast. 2023, 42, 756–784. [Google Scholar] [CrossRef]

- Qian, H.; Wang, B.; Yuan, M.; Gao, S.; Song, Y. Financial distress prediction using a corrected feature selection measure and gradient boosted decision tree. Expert Syst. Appl. 2022, 190, 116202. [Google Scholar] [CrossRef]

- Smith, M.; Alvarez, F. Predicting Firm-Level Bankruptcy in the Spanish Economy Using Extreme Gradient Boosting. Comput. Econ. 2022, 59, 263–295. [Google Scholar] [CrossRef]

- Hu, Y.-C. Bankruptcy prediction using ELECTRE-based single-layer perceptron. Neurocomputing 2009, 72, 3150–3157. [Google Scholar] [CrossRef]

- Premachandra, I.M.; Bhabra, G.S.; Sueyoshi, T. DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. Eur. J. Oper. Res. 2009, 193, 412–424. [Google Scholar] [CrossRef]

- Zhou, L.; Lu, D.; Fujita, H. The performance of corporate financial distress prediction models with features selection guided by domain knowledge and data mining approaches. Knowl.-Based Syst. 2015, 85, 52–61. [Google Scholar] [CrossRef]

- Platt, H.D.; Platt, M.B. Understanding differences between financial distress and bankruptcy. Rev. Appl. Econ. 2006, 2, 141–157. [Google Scholar]

- Tomczak, S.; Przybyslawski, B.; Górski, A. Comparative analysis of the bankruptcy prediction models. In Information Systems Architecture and Technology: The Use of IT Models for Organization Management; Part, 3; Wilimowska, Z., Borzemski, L., Grzech, A., Światek, J., Eds.; Oficyna Wydawnicza Politechniki Wrocawskiej: Wroclaw, Poland, 2012; pp. 157–166. [Google Scholar]

- Du Jardin, P. Dynamics of firm financial evolution and bankruptcy prediction. Expert Syst. Appl. 2017, 75, 25–43. [Google Scholar] [CrossRef]

- Yeh, C.C.; Chi, D.J.; Hsu, M.F. A hybrid approach of DEA, rough set and support vector machines for business failure prediction. Expert Syst. Appl. 2010, 37, 1535–1541. [Google Scholar] [CrossRef]

- Arroyave, J. A comparative analysis of the effectiveness of corporate bankruptcy prediction models based on financial ratios: Evidence from Colombia. J. Int. Stud. 2018, 11, 273–287. [Google Scholar] [CrossRef][Green Version]

- Le, T.; Vo, B.; Fujita, H.; Nguyen, N.-T.; Baik, S.W. A fast and accurate approach for bankruptcy forecasting using squared logistics loss with GPU-based extreme gradient boosting. Inf. Sci. 2019, 494, 294–310. [Google Scholar] [CrossRef]

- Mendes, F.; Duarte, J.; Vieira, A.; Gaspar-Cunha, A. Feature selection for bankruptcy prediction: A multi-objective optimization approach. In Soft Computing in Industrial Applications. Advances in Intelligent and Soft Computing; Gao, X.Z., Gaspar-Cunha, A., Köppen, M., Schaefer, G., Wang, J., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 109–115. [Google Scholar]

- Jabeur, S.B. Bankruptcy prediction using Partial Least Squares Logistic Regression. J. Retail. Consum. Serv. 2017, 36, 197–202. [Google Scholar] [CrossRef]

- Wyrobek, J. Predicting Bankruptcy at Polish Companies: A Comparison of Selected Machine Learning and Deep Learning Algorithms. Crac. Rev. Econ. Manag. 2018, 6, 41–60. [Google Scholar] [CrossRef]

- Grover, S.; Agrawal, V.; Khan, I. A digraph approach to TQM evaluation of an industry. Int. J. Prod. Res. 2004, 42, 4031–4053. [Google Scholar] [CrossRef]

- Thakkar, J.; Kanda, A.; Deshmukh, S. Evaluation of buyer-supplier relationships using an integrated mathematical approach of interpretive structural modeling (ISM) and graph theoretic matrix. J. Manuf. Technol. Manag. 2008, 19, 92–124. [Google Scholar] [CrossRef]

- Valiant, L.G. The complexity of computing the permanent. Theor. Comput. Sci. 1979, 8, 189–201. [Google Scholar] [CrossRef]

- Glynn, D.G. The permanent of a square matrix. Eur. J. Comb. 2010, 31, 1887–1891. [Google Scholar] [CrossRef]

- Caelen, O. A Bayesian interpretation of the confusion matrix. Ann. Math. Artif. Intell. 2017, 81, 429–450. [Google Scholar] [CrossRef]

- Miao, J.; Zhu, W. Precision-recall curve (PRC) classification trees. Evol. Intel. 2020, 15, 1545–1569. [Google Scholar] [CrossRef]

- Karas, M.; Reznakova, M. Predicting the Bankruptcy of Construction Companies: A CART-Based Model. Eng. Econ. 2017, 28, 145–154. [Google Scholar] [CrossRef]

- Sinha, A.P.; Zhao, H. Incorporating domain knowledge into data mining classifiers: An application in indirect lending. Decis. Support Syst. 2008, 46, 287–299. [Google Scholar] [CrossRef]

| … | ||||||

|---|---|---|---|---|---|---|

| … | ||||||

| ⋮ | ⋮ | ⋮ | ⋱ | ⋮ | ⋮ | |

| ⋮ | ||||||

| … |

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Time Period 1 | |||||||

| Time Period 2 | |||||||

| Time Period 3 | |||||||

| Time Period 4 | |||||||

| Time Period 5 | |||||||

| CR | … | ||||||

| ROA | … | ||||||

| TATR | … | ||||||

| TDTA | … | ||||||

| CPR | … | ||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||

|---|---|---|---|---|---|---|---|---|

| CR | Median | 1.17 | 1.24 | 1.21 | 1.28 | 1.34 | 1.33 | 1.34 |

| Mean | 1.92 | 1.84 | 1.90 | 1.73 | 1.92 | 2.11 | 2.34 | |

| ROA | Median | 0.07 | 0.06 | 0.06 | 0.07 | 0.05 | 0.04 | 0.03 |

| Mean | 0.11 | 0.08 | 0.08 | 0.11 | 0.05 | 0.05 | 0.02 | |

| TATR | Median | 1.73 | 1.41 | 1.50 | 1.58 | 1.50 | 1.30 | 1.22 |

| Mean | 1.89 | 1.67 | 1.68 | 1.69 | 1.66 | 1.43 | 1.40 | |

| TDTA | Median | 0.69 | 0.65 | 0.61 | 0.61 | 0.58 | 0.58 | 0.60 |

| Mean | 0.66 | 0.63 | 0.61 | 0.60 | 0.60 | 0.60 | 0.63 | |

| CPR | Median | 0.33 | 0.33 | 0.32 | 0.29 | 0.29 | 0.31 | 0.33 |

| Mean | 0.46 | 0.53 | 0.55 | 0.38 | 0.40 | 0.54 | 1.41 |

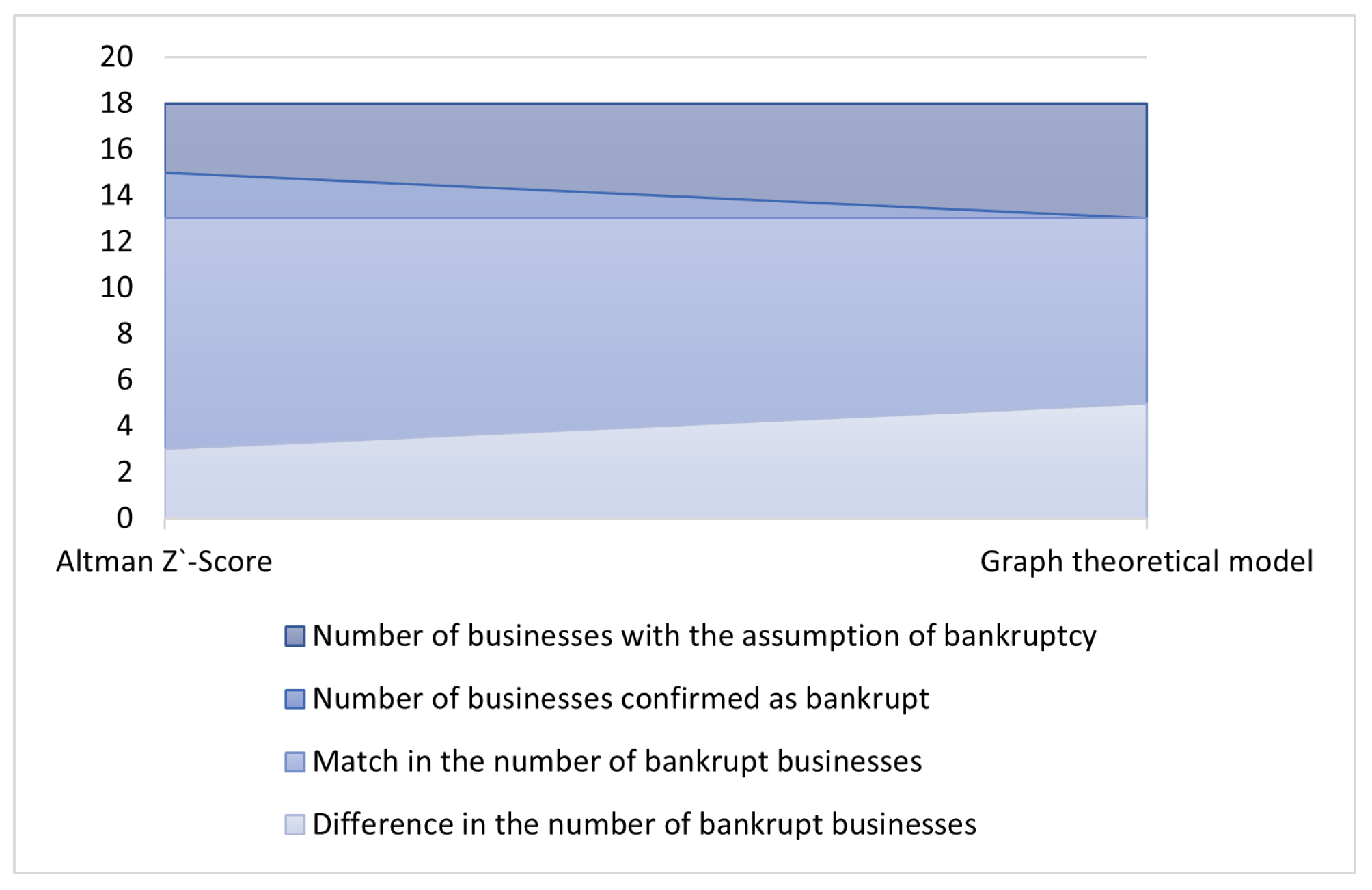

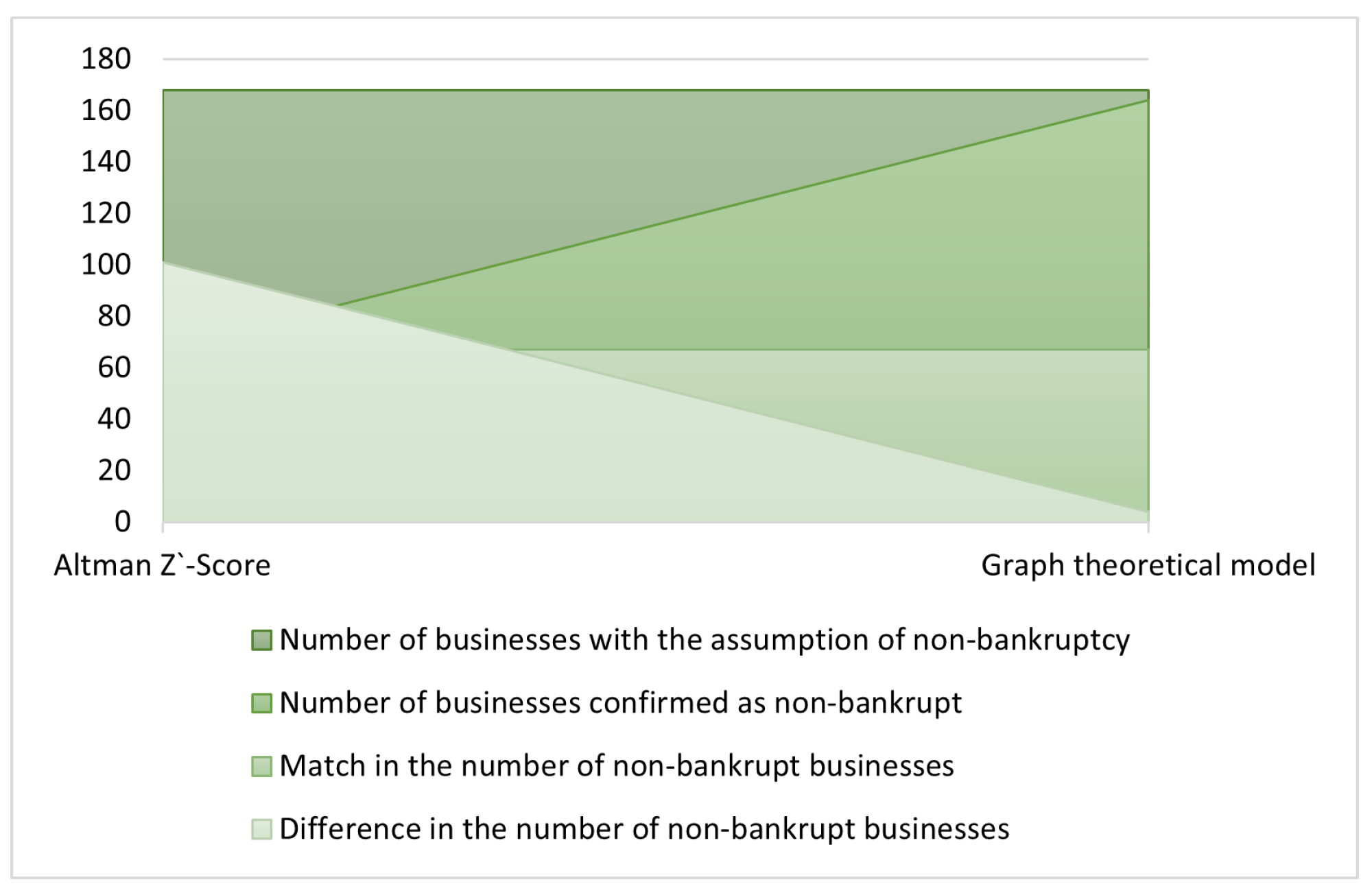

| Graph Theoretical Model | Altman Z’-Score | |

|---|---|---|

| Accuracy | 0.9516 | 0.4409 |

| F1-score | 0.7429 | 0.2239 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horváthová, J.; Mokrišová , M.; Bača, M. Bankruptcy Prediction for Sustainability of Businesses: The Application of Graph Theoretical Modeling. Mathematics 2023, 11, 4966. https://doi.org/10.3390/math11244966

Horváthová J, Mokrišová M, Bača M. Bankruptcy Prediction for Sustainability of Businesses: The Application of Graph Theoretical Modeling. Mathematics. 2023; 11(24):4966. https://doi.org/10.3390/math11244966

Chicago/Turabian StyleHorváthová, Jarmila, Martina Mokrišová , and Martin Bača. 2023. "Bankruptcy Prediction for Sustainability of Businesses: The Application of Graph Theoretical Modeling" Mathematics 11, no. 24: 4966. https://doi.org/10.3390/math11244966

APA StyleHorváthová, J., Mokrišová , M., & Bača, M. (2023). Bankruptcy Prediction for Sustainability of Businesses: The Application of Graph Theoretical Modeling. Mathematics, 11(24), 4966. https://doi.org/10.3390/math11244966