Abstract

The retailer cannot often identify consumers’ preference for personalized and refined services. This poses a lower service than the consumer expects, which will lead to a decline in consumers’ satisfaction and loyalty. To cope with this problem, we consider a dual-channel supply chain composed of a manufacturer who has the online channel and an offline retailer and introduce the concept of underservice into the framework of pricing and service decision. The influence of consumers’ service expectations and the sensitive coefficient of consumers’ perceptive service on optimal decision-making were explored by optimization theory. First, the mathematical model of profit functions of the offline retailer and the manufacturer was developed by taking into account the service expectation respectively. Based on this, the Stackelberg game was adopted to prove that there is a linkage mechanism between the optimal retail price and the optimal service level under certain conditions. Second, we examined the conditions under which underservice occurs and the factors that influence them. Finally, we explored the stability condition under which the offline retailer’s optimal service level is against pricing. Results show that for newly launched products, the offline retailer will take the risk of increased service costs to adopt a strategy of high profit and good sales as a result of underservice. With regard to expiring products, it is impossible for the offline retailer to provide a lower-than-expected service level. Therefore, the offline retailer will adopt a strategy of small profits but quick turnover. In addition, the optimal service level of the offline retailer is stable against the optimal retail price, which greatly simplifies the service decision of the offline retailer, that is, the offline retailer does not need to consider the pricing strategy of the manufacturer and only needs to offer a level of service equal to the consumers’ service expectation.

Keywords:

mathematical modeling; underservice; dual-channel supply chain; pricing; service expectations MSC:

90B05

1. Introduction

The development of new concepts and technologies such as “Internet +” and big data has fundamentally changed the traditional retail distribution system, which allows consumers to shop without time and space constraints and promotes the rapid development of e-ecommerce [1]. For example, according to the European Commission in 2015, the growth of the online platform turnover accounted for 55% and 30% of GDP growth in the United States and Europe during 2001–2011, respectively [2]. In China, in 2020, Tmall’s turnover on “Double Eleven” reached a record high of $75.37 billion. However, in recent years, the promotion cost of the e-commerce platform has continued to rise, which has led to its gradual loss of price advantage. As a result, the problem of channel conflict caused by price gradually turns to the channel conflict caused by competition in marketing and service [3]. Compared with online channels, offline retailers have distinct advantages in serving consumers. For instance, offline retailers can provide consumers with retail showrooms, shelf displays, trial samples, and excellent shopping guide services. In reality, consumers consider the perceived service level, that is, they compare the service level they actually experience with their expected service level. If the actual service level is lower than their expected service level, they will be dissatisfied with the offline retailer, which may cause some consumers to abandon the purchases of offline channels. For example, due to the improvement of consumption level and optimization of consumption structure, in the process of purchasing electronic products, consumers need personalized and refined services, but offline retailers do not offer such services, so consumers will have dissatisfaction or even lose their loyalty to the product. Especially, in the era of more and more transparent product prices, consumers are no longer as sensitive to product prices as in the past but pay more attention to the service experience when purchasing products. The purpose of offline retailers’ services is to improve consumer satisfaction and loyalty, but when the services they provide are lower than what consumers expect, it might reduce consumer satisfaction and loyalty and even “drive away” consumers. Hence, investigating the impact of perceived service level on demand can help to improve the service decision-making of offline retailers.

The purpose of this paper is to explore the causes of underservice and how underservice affects pricing and service decisions. In particular, we are interested in investigating the following research questions:

- (1)

- How does the manufacturer’s pricing strategy affect the offline retailer’s service decisions?

- (2)

- Does underservice occur in offline retail stores, and what are the reasons for it?

- (3)

- Is the offline retailer’s optimal service level stable to the optimal retail price set by the manufacturer, and what are the conditions for its stability?

To address the questions mentioned above, we consider a dual-channel supply chain with a manufacturer who has the online channel and an offline retailer and incorporate the concept of underservice into the framework of pricing and service decision of this dual-channel supply chain. The influence of consumers’ service expectations and the sensitive coefficient of consumers’ perceptive service on optimal decision-making is studied. First, the service expectation is considered in the offline retailer’s demand function. The Stackelberg game is used to prove that under certain conditions, there is a linkage mechanism between the optimal retail price and the optimal service level. Second, we examine the conditions under which underservice and overservice occur and the factors that influence them. Finally, we establish the conditions under which the offline retailer’s optimal service level is stable.

This paper makes two contributions to the field of service and pricing decisions in dual-channel supply chain. First, different from previous studies on dual-channel supply chain pricing and service decision, which consider linear demand growth due to service and free riding due to positive service externalities, the pricing and service strategy in this paper consider demand reduction due to underservice and free riding due to positive service externalities respectively. We also study the impact of consumers’ service expectation and the sensitive coefficient of consumers’ perceptive service on pricing and service decisions. Second, we prove the existence of underservice and propose some reasons for such underservice. Finally, we find that when the sensitivity coefficient of perceived service level and service expectation are in a certain range, the offline retailer’s optimal service level is stable to the optimal retail price set by the manufacturer, which greatly simplifies the decision-making of the offline retailer’s service level. In other words, under the condition that the offline retailer understand consumers’ service expectations, (s)he can directly provide the service level expected by consumers without considering the manufacturer’s pricing strategy.

The remainder of this paper is organized as follows. In the next section, we provide a review of related literature. The problem formulation and assumptions are presented in Section 3. Section 4 represents the formulated mathematical models. Numerical results and sensitivity analyses are represented in Section 5, and in Section 6, we conclude our findings and suggest possible future research.

2. Literature Review

The reason for consumer dissatisfaction is that offline retailers fail to identify consumers’ preference for personalized and refined services, thus failing to meet consumers’ service demand and causing a psychological gap to consumers, which might lead to the decline of consumers satisfaction and loyalty and thus the loss of demand. In fact, this is a study of service expectations or service reference points [4]. When the service provided by offline retailers is lower than the service expectation of consumers for various reasons, that is, the actual service fails to meet the service demand of consumers, underservice will occur. Hence, we define the service studied in this paper. In dual-channel retailing, since consumer segmentation is unclear, offline retailers adopt a single service mode, which cannot accurately identify the service demand consumers, and the service level provided to consumers is lower than consumers’ service expectations, which might cause a psychological gap among consumers. For example, the salesman fails to respond promptly to consumers’ questions about products. Wu et al. identified the factors that contribute to service expectation, perceived service level, and consumer satisfaction in the food and beverage industry [5]. Chi et al. believe that there are three kinds of service expectations, which are focal-object expectation, other-object expectation, and self-based expectation. The actual service provided by offline retailers and service expectation jointly determine customers’ purchasing behavior [6]. Most previous studies have shown that service level has a positive impact on consumers’ purchasing behavior [7]. However, some scholars are skeptical about this. Ghobadian et al. found that perceived service level would affect the repurchase intention of existing and potential consumers [8]. In addition, market research shows that consumers who are dissatisfied with a service will reveal their experience to three other people. Hence, it can be concluded that underservice might reduce potential demand. Özkan et al. pointed out that consumers perceived service quality and satisfaction can significantly affect their loyalty to banks [9]. In the context of hotels, Mohammed studied the relationship among consumer perceived value, consumer satisfaction, and consumer loyalty by using structural equation modelling, and the results show that consumer satisfaction has a direct positive impact on consumer loyalty [10]. Öztürk demonstrated that higher consumer loyalty can encourage consumers to buy more products or bring in more consumers to offline retailers, while the opposite can “drive away” consumers and even take away other potential consumers [11]. Hence, when offline retailers fail to offer services that meet consumers’ demand, consumers will feel dissatisfied, which will reduce consumers’ loyalty to products, resulting in demand loss [10]. An important aspect of service expectation is the formation of expectation. Ho proposed that the formation of service expectation often has a certain reference [12]. Motivated by this, Zhao et al. considered the reference effect that risk-averse consumers need to consider in pricing, and gave three pricing strategies [13]. Zhao et al. investigated the single and combined influences of reference effect (RE) and quick replenishment (QR) policy on the customers’ purchasing behaviors, the retailer’s optimal decisions, and the total profit of two periods [14].

Another stream of study is the pricing and service decision of a dual-channel supply chain. In a dual-channel supply chain, since consumers consider not only the retail price but also the service level when purchasing products, an increasing number of scholars have investigated service decision-making. In fact, consumers are not only influenced by channel preference and price, but also by service level. Due to development of online channels, consumers can not only enjoy the services provided by offline channels, but also buy cheaper and more varieties of products through online channels, which leads to the decline of offline demand and the increase of service costs of offline retailers. Wu et al. considered the competition in the differentiated market, and the results show that in the case of “free riding”, offline retailers can obtain additional profits through information services [15]. In contrast to Wu et al., Shin believed that “free riding” is not always detrimental to offline retailers that offer their services, and the results suggest that “free riding” can reduce price competition between the two channels [16]. To reduce the impact of “free riding”, Xing and Liu designed price matching and selective compensate rebate contracts to coordinate offline retailers [17]. Dan et al. evaluated the influence of retail services and consumer loyalty to channels on pricing behavior of manufacturers and offline retailers [18]. In addition, Sarkar and Pal investigated the impact of retail service on pricing policies and profits in a dual-channel supply chain, considering four different return strategies [19]. Guo et al. investigated the impacts of the parameters related to pre-sales service and delivery lead time on the pricing/service/lead-time strategies and performance of the supply chain under centralized and decentralized settings [20]. Yi et al. took consumer value into account in the dual-channel supply chain and constructed a single unified pricing for the direct selling channel and online retail platform distribution channel, and discussed each pricing model in decentralized and centralized scenarios respectively [21].

As differentiated pricing between online and offline channels tends to increase conflicts between channels, an increasing number of companies, such as Suning and Uniqlo, choose undifferentiated pricing. Hence, Zhou et al. studied the influence of “free riding” on pricing, service, and profit of the two channels when differentiated and undifferentiated pricing were used respectively. Their results indicate that undifferentiated pricing is more favorable to offline retailers, but the opposite to manufacturers and the whole supply chain [22]. In addition, Li et al. studied the timing of service provision and considered three cases in a dual-channel supply chain, including no service, pre-service, and post-service. The result shows that post-service has the best effect [23]. Taleizadeh et al. studied pricing, service, and quality level decision-making in a two-echelon supply chain where products have substitutions [24]. Widodo et al. mentioned the advanced concept of the product-service system and investigated pricing strategies when considering additional services [25]. Their results show that, compared with offline channels, additional services can help online channels make more profits. Sun et al. studied the influence of the reference effect of official prices on pricing in a dual-channel supply chain [26].

The above literature does not consider the impact of service expectation on pricing and service decision in the dual-channel supply chain. Service expectation and the resulting underservice may affect offline retailers’ service decisions, which in turn directly affect consumer satisfaction, and thus affect the product demand of the two channels. Ma et al. is the only study about service expectation in the dual-channel supply chain [27]. They take the reciprocal altruism of supply chain members, the quality of consumers, and the reference effect of service level into account in a supply chain with a manufacturer and a retailer with online and offline channels. Meanwhile, the internal dynamics of operation mode were considered, and the continuous dynamic theory of Behrman adopted. The quality strategy of the manufacturer, the service strategy of the retailer, and the performance of supply chain under decentralized, centralized and reciprocal altruistic scenarios were analyzed and compared. However, they did not consider the impact of “free riding” on decisions. Hence, in this paper, the effect of the difference between actual service level and consumer service expectation on product demand is incorporated into pricing and service decision in a dual-channel supply chain. We investigate the effects of the perceived service level sensitivity coefficient and service expectation on the optimal decision-making of dual-channel supply chain members when consumers have “free-riding” behavior and service expectation.

3. Problem Formulation and Assumptions

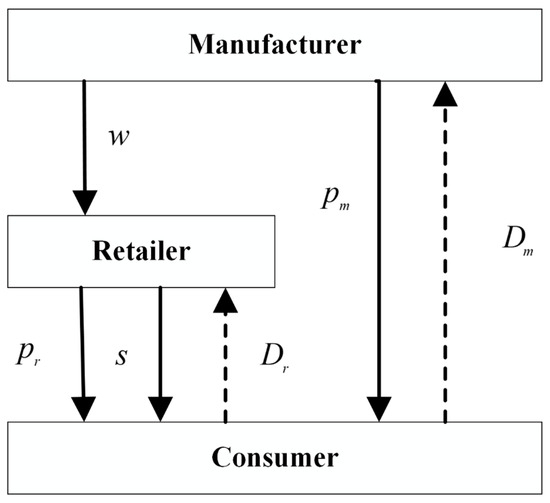

We consider a two-echelon supply chain, similar to Barman et al., with a manufacturer who wants to build up an online channel and an offline retailer, where this manufacturer can sell its products offline through retailers as well as the online channel [28]. On the one hand, the manufacturer sells its products to the offline retailer at a wholesale price agreed in advance through long-term contracts. Then, the offline retailer sells products to consumers at a unit price . On the other hand, the manufacturer can sell its products directly to consumers online at an online price per unit. Because of the difference between the online channel and offline channel, it is difficult for consumers to evaluate product quality and service through online channels. The structure of this dual-channel supply chain is shown in Figure 1.

Figure 1.

A dual-channel supply chain.

We assume that the retailer provides product introduction and after-sales services in the offline channel, while the online channel does not provide these services. The service effort cost function of the offline channel is defined as . Gronroos found that consumers compare the expected service level with the actual service level they experience when buying products [29]. If the actual service level is lower than the expected, they would be dissatisfied with the offline retailer (i.e., giving up on buying the product, reducing satisfaction, and unwillingness to generate positive word of mouth for the offline retailer). Hence, if the service level provided by the offline retailers is lower than consumers’ expectations, the demand will decline. According to the dual-channel demand function constructed by Dan et al. [18], we can define the following demand functions of the offline retailer and the manufacturer respectively.

Formula (1) and (2) represent the demand function of the retailer’s offline channel and the manufacturer’s online channel respectively. In addition to the retail price of the two channels, the demand of the offline channel is also affected by the level of service effort, and the demand of the online channel will also be passively affected by the level of service effort provided by the offline retailer. represents the market share obtained by the offline channel. (, ) is the cross-price elasticity coefficient between the two channels. is the coefficient in that the online channel is affected by the service provided by the offline channel. represents consumers’ expectation of the offline service level. If the actual service level of the offline channel is lower than consumers’ expectation, the demand of the offline channel will decrease. Hence, with the concept of reference effect function proposed by Ho et al. [30], we denote the demand loss caused by lower consumers’ perceptive service level as , where is the sensitive coefficient of consumers’ perceived service level and . We show all the notations and their meanings in Table 1.

Table 1.

List of notations.

To obtain the main results, we propose the following assumptions.

Assumption 1.

Since online and offline products are the same in quality, it is assumed that online and offline retail price are the same (i.e., ). In fact, to avoid conflicts between the two channels, many companies, such as Suning, Uniqlo, OPPO, and VIVO, set the same retail prices online and offline. Tsay and Agrawai (2004) made a detailed study of this problem [31]. In a survey, Ernst pointed out that two-thirds of dual-channel companies use undifferentiated pricing strategy [32]. Although online and offline prices are the same, differences between the two channels still exist. Hence, online consumers may appear to have “free ride” behavior. For example, for products such as computers, televisions and refrigerators, consumers usually go to the retailer to check the quality of the products before buying them. However, they will buy such products online if the offline retailer does not provide delivery services.

Assumption 2.

The cross-price elasticity coefficients between the two channels are the same (i.e.,

). A similar assumption is made in Yan and Zhou et al., which does not alter the nature of the results [22,33].

Assumption 3.

There is information symmetry between the manufacturer and the offline retailer, and they are both risk-neutral.

Assumption 4.

The production cost of the manufacturer is zero.

Motivated by the problem descriptions and assumptions above, in the next section, we set up the profit function of the offline retailer and manufacturer respectively and solve the model.

4. Model Analysis

In order to study the impact of offline retailers’ insufficient service to consumers on the supply chain, we establish the following profit functions according to the demand function of the offline retailers and the manufacturer.

The profit function of the offline retailer:

The profit function of the manufacturer:

Since, in reality, the manufacturer is generally in a strong position, the manufacturer can set the retail price . Then, the offline retailer determines its level of service effort based on the retail price set by the manufacturer to maximize its profit.

Taking the retail price as a constant and with Formula (3), it is easy to solve the optimal service effort level of the offline retailer. Then, according to the optimal service effort level and Formula (4), the optimal retail price can be obtained. Hence, we make the following proposition.

Proposition 1.

With the certain retail price

, the offline retailer’s optimal service effort level

can be represented by the following Formula.

Proof.

We first consider the case of , and convert the Formula (3) into the following optimization problem.

by Kuhn–Tucker conditions (K–T conditions), we can get the optimal service effort level as follow.

In other cases, the optimal solutions can be obtained in a similar way. Then, the proposition follows immediately. □

Proposition 1 indicates that the offline retailer would provide lower-than-expected service level to consumers if the retail price set by the manufacturer is relatively low (i.e., ). In addition, the optimal service effort level of the offline retailer is stable, that is, the offline retailer’s optimal service effort level remains unchanged when the retail price set by the manufacturer is within a certain range. The reason for such low service effort level is that the offline retailer provides lower service level than consumers’ expectations, which has little impact on product demand and can reduce service cost to make up for the loss of income caused by decreased demand. As the retail price increases, the revenue of the retailer will increase. Since the retail price is still low, the offline retailer has no incentive to improve the service level to obtain more profits.

In the case of , on the one hand, the increase in the retail price will increase revenue; on the other hand, this increase will decrease the demand of the offline retailer. While improving service levels will increase demand, it will also raise service costs for the offline retailer. Hence, in this case, the offline retailer would provide the same level of service that consumers expect.

In the case of a relatively high retail price (i.e., ), the offline retailer will provide a higher level of service than consumers expect. Due to the high retail price, providing a service level higher than consumer’s expectations will increase the service cost, but at the same time increase the demand of the offline retailer. The revenue increase caused by this increase in demand is greater than the revenue decrease caused by the increase in service cost. Hence, by Formula (5), with the increase of the retail price, the offline retailer will provide higher service levels than consumers expect in order to gain more profits.

Proposition 1 is based on the assumption that the retail price is an exogenous variable. In order to further study the endogenous optimal pricing of the manufacturer, we have to consider the optimal retail price and service level. Hence, we present proposition 2 as follows.

Proposition 2.

If the price cross elasticity coefficient

between channels is within a certain range that

the optimal retail price

and the optimal service effort level of the offline retailer can be derived as follows.

where,,,,,,.

Proof.

When , we can convert the Formula (4) into the following optimization problem.

By K–T conditions, the optimal retail price and service effort level can be derived as follows.

To guarantee that , the following inequalities should be satisfied.

, . Hence, the cross-price elasticity coefficient between channels should satisfy the following inequality.

Other scenarios can be solved in the same way. Finally, the cross-price elasticity coefficient between channels should satisfy the inequality that . □

Proposition 2 demonstrates that the manufacturer and the offline retailer have the optimal retail price and service level in the case of the Stackelberg game. The cross-price elasticity coefficient represents the degree of substitutability of products between the two channels. When is large (i.e., which indicates that the products of the two channels are completely substitutable), the effect of retail price changes on demand will be weakened. In contrast, when is small, the two channels will degenerate into one channel, and the impact of retail price changes on demand will also be weakened. In both extreme cases, pricing is ineffective.

In addition, in Formula (6), with the increase of consumers’ service expectations, the manufacturer does not decrease the optimal retail price and the offline retailer also does not decrease the optimal service level. The reason is that with the increase of consumers’ expected service level, the manufacturer will gradually raise the retail price to gain more profits, so that the offline retailer will also gradually improve its service level to increase demand. For products like mobile phones, although the manufacturer and the offline retailer belong to different decision-making bodies, there is a certain relationship between the optimal retail price and the optimal service level, that is, a higher retail price is accompanied by a higher service level, and vice versa.

However, is the offline retailer willing to offer a level of service that exceeds consumers’ expectations? If so, what conditions should be met? What is the reason why it provides a higher level of service than consumers expect? The answers can be found in the following corollary.

Corollary 1.

If

, the offline retailer will provide a level of service that exceeds consumers’ expectations.

Proof.

From Formula (6), it is easy to verify that if , then is true. □

Corollary 1 indicates that when consumers’ expected service is low, the optimal service level offered by the offline retailer may be higher than the expected service level of consumers. Due to the positive externality of service, even if the manufacturer does not induce the offline retailer to provide a higher service level, under the condition that the wholesale price is exogenous, the offline retailer will moderately improve its service level to gain more profits. As a result, the offline retailer will also be willing to offer a higher level of service than consumers expect when the retail price is low. In practice, electronic products that are about to become obsolete have such characteristics. Since consumers are more familiar with the product that will become obsolete, their expected services related to the product are low. Providing a higher level of service than consumers expect increases demand, which in turn increases revenue. This increase in revenue is greater than the increased cost of improving the service level. Therefore, with the risk of losing consumers, the offline retailer will sell this kind of obsolete product using a strategy of low profits and high volume.

Will the offline retailer offer a service level lower than consumers expect? If so, what conditions need to be met? What are the internal reasons for the offline retailer providing services that are lower than consumers’ expectations? The following corollary gives the answer.

Corollary 2.

If

, the offline retailer will provide a lower level of service than consumers expect.

Proof.

From Formula (6), it is easy to verify that if , then is true. □

Corollary 2 indicates that when consumers’ expected service is high, the optimal service level offered by the offline retailer may be lower than the expected service level of consumers. This is not consistent with our intuition. Due to the positive externality of service, in order to encourage the offline retailer to offer a higher service level, in the case of exogenous wholesale price, the manufacturer will increase the retail price to improve the revenue of the offline retailer.

However, the increase in revenue is less than the increase in costs needed to improve service levels. Therefore, the offline retailer is reluctant to offer a level of service equal to or higher than consumers expect when the retail price is high. In practice, new electronic products on the market have such characteristics. Hence, a high-margin strategy of appropriate sales would be adopted by the offline retailer.

Does the offline retailer always offer lower-than-expected service to electronic products that just hit the market? In other word, is the strategy of offering lower-than-expected service universal? Corollary 3 answers this question.

Corollary 3.

As the sensitive coefficient of consumers’ perceptive service level

increases, the range of offering lower-than-expected service becomes narrow.

Proof.

Taking the first derivative of with respect to , we obtain that . The corollary follows immediately. □

Is it necessary to consider the scenario of underservice? How is the result different from not considering underservice? We present the following proposition.

Proposition 3.

If

, the optimal service level provided by the offline retailer and the retail price set by the manufacturer are higher than the service level and retail price without considering underservice; otherwise, the optimal service level and retail price are equal to the corresponding values without considering underservice.

Proof.

Without considering the impact of underservice, the offline retailer’s profit function can be derived by Formula (3).

Formula (7) can be converted into the following optimization problem.

Taking the first derivative of Formula (8) with respect to , we can obtain the optimal service effort level as follows.

Replace in Formula (4) with , then the optimal retail price can be obtained immediately.

Finally, replace in Formula (9) with , we can derive the optimal service effort level.

Hence, , . If , by Proposition 2, , . Similarly, if , , and if , , . This completes the proof. □

Proposition 3 shows that when consumers’ expected service is low, the optimal service level and retail price considering the impact of underservice are equal to the optimal service level and retail price without considering the impact of underservice. When consumers’ expected service is high, the optimal service and retail price considering the impact of underservice are obviously higher than that without considering the impact of underservice. The reason is that when consumers expect a high level of service, for the offline retailer, overservice can not only increase demand, but also avoid the demand loss caused by underservice. As a result, the offline retailer is willing to offer a higher level of service than that when the impact of underservice is not taken into account. For the manufacturer, due to the positive externality of service, the manufacturer expects the offline retailer to provide as high a level of service as possible. As a result, to encourage the offline retailer to offer a higher level of service, the manufacturer will raise the retail price to compensate for the increase in service costs. When consumers expect a low level of service, the offline would offer a lower level of service. On the one hand, its service level is not lower than consumers’ expectations, on the other hand, there is no loss of demand due to underservice. The offline retailer does not consider the constraints caused by consumers’ expected service level. Hence, the retail price and the optimal service level are no longer constrained by what consumers expect. As consumers’ expected service level increases, the manufacturer would set a higher retail price to encourage the offline retailer to offer a higher service level to avoid the demand loss caused by underservice. When consumers’ expected service level reaches a certain level, the offline retailer will not always improve his (her) service level to meet consumers’ expectations, which may lead to underservice.

In practice, when a product has just been launched, on the one hand, consumers have high service expectations, on the other hand, they pay more attention to the service offered by the offline retailer than the retail price. However, the manufacturer and the offline retailer will not only take consumers’ service expectations into account but will ignore service costs when making decisions. Hence, the manufacturer and the offline retailer prefer to risk losing consumers by adopting a profitable and marketable strategy.

Proposition 4.

If

, the optimal service level of the offline retailer is stable relative to the retail price, and the greater the sensitive coefficient of consumers’ perceptive service level, the greater the range of service level stability.

Proof.

When , no matter what the retail price is, the offline retailer will choose the service effort level equal to consumers’ service expectation, i.e.,

Take the first derivative of respect to , then , thus as increases, the range of becomes larger. □

Proposition 4 indicates that when consumers’ service expectation is within a certain range, the offline retailer will always choose to offer the same service level as consumers’ service expectation. The reason is that when the offline retailer offers a relatively high level of service, there will be two effects, one is the increase of service cost, the other is underservice, which may lead to demand loss. When consumers’ service expectation is low, in order to motivate the offline retailer to offer a higher level of service than consumers expect, the manufacturer can set a high retail price to compensate for the cost increase caused by improving the service level. With the increase of consumers’ service expectation, it becomes more and more difficult for the manufacturer to compensate for the cost increase caused by improving the service level by setting a higher retail price, so that the offline retailer is only willing to provide a service level equal to the consumers’ service expectation. Once consumers’ service expectation reaches a threshold, it is impossible for the manufacturer to compensate for the cost increase caused by the offline retailer’s improvement of service level by setting a higher retail price, so that the offline retailer will provide a lower service level than consumers’ service expectation. In practice, it greatly simplifies the service decision for the offline retailer. With the knowledge of consumers’ service expectation, the offline retailer can directly provide the level of service consumers expect regardless of the retail price.

5. Numerical Study

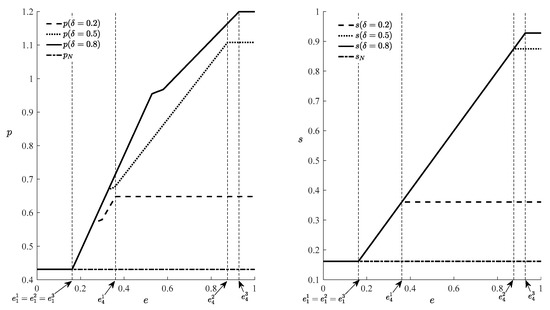

In this section, we carry out a numerical study to verify the results obtained above. Assume that , , , , . We consider three different sensitive coefficients of consumers’ perceived service level (, , ) and classify products into three categories by these three coefficients. The first category of products is those that must be consumed, and where people are less sensitive when underservice occurs, such as bread and water. The second category is those everyday items where people are moderately sensitive when underservice occurs, such as clothes books. The third category is luxury products, where people are highly sensitive to being underserved, such as luxury cars and designer watches. The relationship between the optimal retail price and consumers’ service expectation as well as the relationship between the optimal service and consumers’ service expectation is shown in Figure 2. Figure 2 demonstrates that regardless of the value of , the optimal retail price set by the manufacturer and the optimal service level provided by the retailer increase as consumer service expectation rises. However, due to the existence of service cost, if exceeds the threshold , the optimal retail price and the optimal service level remain unchanged. In addition, if , the optimal retail price and the optimal service level are constant, that is, the optimal retail and the optimal service are equal to the corresponding values without considering underservice (i.e., , ). When , the impact of underservice on the optimal retail price and the optimal service level is obvious, which leads to a higher optimal retail price and a higher optimal service level (i.e., , ). No matter how the optimal retail price changes, the offline retailer will choose the service level equal to the expected service level of consumers, that is to say, the optimal service level is stable relative to the optimal retail price, which is consistent with proposition 4.

Figure 2.

Relationship between , , and .

Although the general trend of the three categories of products is similar, there are differences in the optimal retail price and the optimal service level for each category. For the necessities (), the threshold is relatively low. If underservice occurs then (), the optimal price and the optimal service level are also low. This is because for essential goods, the manufacturer cannot easily motivate the retailer to improve service level by raising retail price, that is to say, the increase of service cost is greater than the increase of profit caused by the increase of the retail price. For the everyday items and luxury goods (, ), the thresholds , are relatively high, in other words, underservice occurs (, ) only when both the optimal retail price and the optimal service level are high. This is because, for both everyday items and luxury items, the manufacturer can easily incentivize the retailer to improve its service level by setting a higher retail price before underservice occurs. The right side of Figure 2 clearly shows that necessities have the highest probability of underservice, followed by everyday items, and luxuries have the lowest probability of under service, which is consistent with corollary 3 and also our intuition.

6. Conclusions and Future Research

In dual-channel retailing, when offline retailers are unable to identify consumers’ preference for personalized and refined services, they may provide lower service levels than consumers expect, which will lead to a decline in consumers’ satisfaction and loyalty, resulting in demand loss. To study this problem, we considered a dual-channel supply chain with a manufacturer who has the online channel and an offline retailer and incorporate the concept of underservice into the framework of pricing and service decision of this dual-channel supply chain. The influence of consumers’ service expectations and the sensitive coefficient of consumers’ perceptive service on optimal decision-making was studied. The conclusions of this paper are as follows.

- (1)

- when the cross-price elasticity coefficient between channels is within a certain range, for mobile phones and other electronic products, there is a link between the manufacturer’s optimal retail price and the offline retailer’s optimal service level. The cross-price elasticity coefficient between channels ensures the retail price set by the manufacturer can affect the offline retailer’s service decision. To encourage the offline retailer to improve its service level, the manufacturer can raise the retail price to compensate for the increase in service cost of the offline retailer. Therefore, higher retail price leads to higher service level, and vice versa. It also provides some managerial insight, that is, in a dual-channel supply chain where the upstream manufacturer controls the online channel and the downstream retailer controls the offline channel, the upstream manufacturer can encourage the downstream retailer to improve its service level by setting an attractive retail price, and thus the upstream manufacturer can obtain the benefit of the “free rider” in the online channel.

- (2)

- for newly launched electronic products, the offline retailer may not offer sufficient service and adopt a profitable and marketable strategy. Consumers are curious about the newly launched products and hope to get personalized and refined services, which makes their service expectations become higher. However, due to service costs, the offline retailer may not blindly meet consumers and often provides lower service levels than consumers expect. In contrast, it is possible for the offline retailer to provide higher service than expected for electronic products that will be obsolete. Consumers’ service expectations are low due to familiarity with outdated products. The offline retailer can not only increase demand by providing a service level higher than consumers’ service expectation, but also avoid the negative externalities caused by underservice. Hence, for outdated electronic products, the offline retailer will adopt a strategy of small profits but quick turnover. The management implication of this result is that the service level provided by the downstream retailer offline has a significant impact on product demand. Hence, the downstream retailer should formulate corresponding sales strategies according to their service level to avoid inventory shortage or surplus which might lead to the reduction of profits.

- (3)

- when the sensitive coefficient of perceived service level and service expectation are within a certain range, the optimal service level of the offline retailer is stable to the optimal retail price the manufacture set, which greatly simplifies the service decision of the offline retailer, that is, the offline retailer does not need to consider the pricing strategy of the manufacturer and only needs to offer a level of service equal to the consumers’ service expectation. This feature highlights an important management insight, namely that it is worthy for the downstream retailer to study consumers’ service expectations. Within a certain range, the optimal service level of the downstream retailer is equal to the service expectation of consumers. There is no need to consider the retail price set by the upstream manufacturer.

It should be pointed out that there are still some limitations of this paper as follows.

- (1)

- A key assumption of this paper is that the offline retailer can accurately know consumers’ service expectation level, which results in this paper having certain limitations.

- (2)

- In this paper, we do not consider consumer segmentation and assume that there is only one class of consumers whose service expectations are the same. However, in fact, different consumers may have different service expectations for the same product.

- (3)

- We only consider the demand loss due to underservice and assume that demand increases with the level of service. However, in fact, too considerate a service or overservice may cause consumers’ aversion, which will also lead to demand loss.

There are three directions for future research: First, the level of service expectation of consumers needs to be made observable. It would be possible to design a mechanism in which the consumers’ service expectation level is automatically displayed. Second, consumers with different service expectations and design different service strategies for different consumers should be classified. Third, it is further considered that when the service level provided by the offline retailer is higher than the expected service level, it will also cause demand loss, thus resulting in the need to design more appropriate service strategies for offline retailers.

Author Contributions

Conceptualization, P.W.; Project administration, Q.H.; Writing—original draft, T.S.; Writing—review and editing, Q.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported in part by a research grant from the National Natural Science Foundation of China (No. 72161004), Chinese Postdoctoral Science Foundation (No. 2017M610743), and Natural Science Foundation of Guizhou Province of China (No. ZK [2021]-323).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chen, Y.-J.; Dai, T.; Korpeoglu, C.G.; Körpeoğlu, E.; Sahin, O.; Tang, C.S.; Xiao, S. OM Forum—Innovative Online Platforms: Research Opportunities. Manuf. Serv. Oper. Manag. 2020, 22, 430–445. [Google Scholar] [CrossRef] [Green Version]

- Eu Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; A European Agenda on Migration; Eu Commission: Brussels, Belgium, 2015; p. 240. [Google Scholar]

- Caro, F.; Kök, A.G.; Martínez-De-Albéniz, V. The Future of Retail Operations. Manuf. Serv. Oper. Manag. 2020, 22, 47–58. [Google Scholar] [CrossRef]

- Kim, S.; Chung, J.-E.; Suh, Y. Multiple reference effects on restaurant evaluations: A cross-cultural study. Int. J. Contemp. Hosp. Manag. 2016, 28, 1441–1466. [Google Scholar] [CrossRef]

- Wu, P.H.; Huang, C.Y.; Chou, C.K. Service expectation, perceived service quality, and customer satisfaction in food and beverage industry. Int. J. Organ. Innov. 2014, 7, 171–178. [Google Scholar]

- Yim, C.K.; Chan, K.W.; Hung, K. Multiple reference effects in service evaluations: Roles of alternative attractiveness and self-image congruity. J. Retail. 2007, 83, 147–157. [Google Scholar] [CrossRef]

- Ryu, K.; Han, H. New or repeat customers: How does physical environment influence their restaurant experience? Int. J. Hosp. Manag. 2011, 30, 599–611. [Google Scholar] [CrossRef]

- Ghobadian, A.; Speller, S.; Jones, M. Service Quality. Int. J. Qual. Reliab. Manag. 1994, 11, 43–66. [Google Scholar] [CrossRef] [Green Version]

- Özkan, P.; Süer, S.; Keser, I.K.; Kocakoç, I.D. The effect of service quality and customer satisfaction on customer loyalty: The mediation of perceived value of services, corporate image, and corporate reputation. Int. J. Bank Mark. 2019, 38, 384–405. [Google Scholar] [CrossRef]

- El-Adly, M.I. Modelling the relationship between hotel perceived value, customer satisfaction, and customer loyalty. J. Retail. Consum. Serv. 2019, 50, 322–332. [Google Scholar] [CrossRef]

- Öztürk, R. Exploring the relationships between experiential marketing, customer satisfaction and customer loyalty: An empirical examination in Konya. Int. J. Soc. Behav. Educ. Econ. Bus. Ind. Eng. 2015, 9, 2817–2820. [Google Scholar]

- Ho, T.-H.; Zheng, Y.-S. Setting Customer Expectation in Service Delivery: An Integrated Marketing-Operations Perspective. Manag. Sci. 2004, 50, 479–488. [Google Scholar] [CrossRef] [Green Version]

- Zhao, N.; Wang, Q.; Cao, P.; Wu, J. Pricing decisions with reference price effect and risk preference customers. Int. Trans. Oper. Res. 2021, 28, 2081–2109. [Google Scholar] [CrossRef]

- Zhao, N.; Wang, Q.; Wu, J. Optimal pricing and ordering decisions with reference effect and quick replenishment policy. Int. Trans. Oper. Res. 2021, 29, 1188–1219. [Google Scholar] [CrossRef]

- Wu, D.; Ray, G.; Geng, X.; Whinston, A. Implications of Reduced Search Cost and Free Riding in E-Commerce. Mark. Sci. 2004, 23, 255–262. [Google Scholar] [CrossRef]

- Shin, J. How Does Free Riding on Customer Service Affect Competition? Mark. Sci. 2007, 26, 488–503. [Google Scholar] [CrossRef] [Green Version]

- Xing, D.; Liu, T. Sales effort free riding and coordination with price match and channel rebate. Eur. J. Oper. Res. 2012, 219, 264–271. [Google Scholar] [CrossRef]

- Dan, B.; Xu, G.; Liu, C. Pricing policies in a dual-channel supply chain with retail services. Int. J. Prod. Econ. 2012, 139, 312–320. [Google Scholar] [CrossRef]

- Sarkar, A.; Pal, B. Pricing and service strategies in a dual-channel supply chain under return–refund policy. Int. J. Syst. Sci. Oper. Logist. 2021, 1–21. [Google Scholar] [CrossRef]

- Guo, J.; Cao, B.; Xie, W.; Zhong, Y.; Zhou, Y.-W. Impacts of pre-sales service and delivery lead time on dual-channel supply chain design. Comput. Ind. Eng. 2020, 147, 106579. [Google Scholar] [CrossRef]

- Yi, S.; Yu, L.; Zhang, Z. Research on Pricing Strategy of Dual-Channel Supply Chain Based on Customer Value and Value-Added Service. Mathematics 2020, 9, 11. [Google Scholar] [CrossRef]

- Zhou, Y.-W.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sadeghi, R. Pricing strategies in the competitive reverse supply chains with traditional and e-channels: A game theoretic approach. Int. J. Prod. Econ. 2019, 215, 48–60. [Google Scholar] [CrossRef]

- Widodo, E.; Shabir, I.N.A.; Syairudin, B. Pricing for product-service system under dual-channel supply chain. AIP Conf. Proc. 2020, 2217, 030036. [Google Scholar] [CrossRef]

- Sun, L.; Jiao, X.; Guo, X.; Yu, Y. Pricing policies in dual distribution channels: The reference effect of official prices. Eur. J. Oper. Res. 2021, 296, 146–157. [Google Scholar] [CrossRef]

- Ma, D.; Hu, J.; Wang, W. Differential game of product–service supply chain considering consumers’ reference effect and supply chain members’ reciprocity altruism in the online-to-offline mode. Ann. Oper. Res. 2021, 304, 263–297. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K. Optimal pricing and greening decision in a manufacturer retailer dual-channel supply chain. Mater. Today Proc. 2021, 42, 870–875. [Google Scholar] [CrossRef]

- Grönroos, C. An Applied Service Marketing Theory. Eur. J. Mark. 1982, 16, 30–41. [Google Scholar] [CrossRef]

- Ho, T.-H.; Lim, N.; Cui, T.H. Reference Dependence in Multilocation Newsvendor Models: A Structural Analysis. Manag. Sci. 2010, 56, 1891–1910. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel Conflict and Coordination in the E-Commerce Age. Prod. Oper. Manag. 2009, 13, 93–110. [Google Scholar] [CrossRef] [Green Version]

- Ernst, Y. Consumer trends in online shopping. Global Online Retailing: An Ernst and Young Special Report. Stores 2001, 83, 5–9. [Google Scholar]

- Yan, R. Product brand differentiation and dual-channel store performances of a multi-channel retailer. Eur. J. Mark. 2010, 44, 672–692. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).