Exploring Knowledge Trajectories of Accounting Information Systems Using Business Method Patents and Knowledge Persistence-Based Main Path Analysis

Abstract

1. Introduction

2. Review of the Literature

2.1. Business Method Patents for Accounting Information Systems

2.2. Knowledge Persistence Measurement

2.3. Main Path Analysis

3. Data

4. Method

4.1. Constructing the Knowledge Network

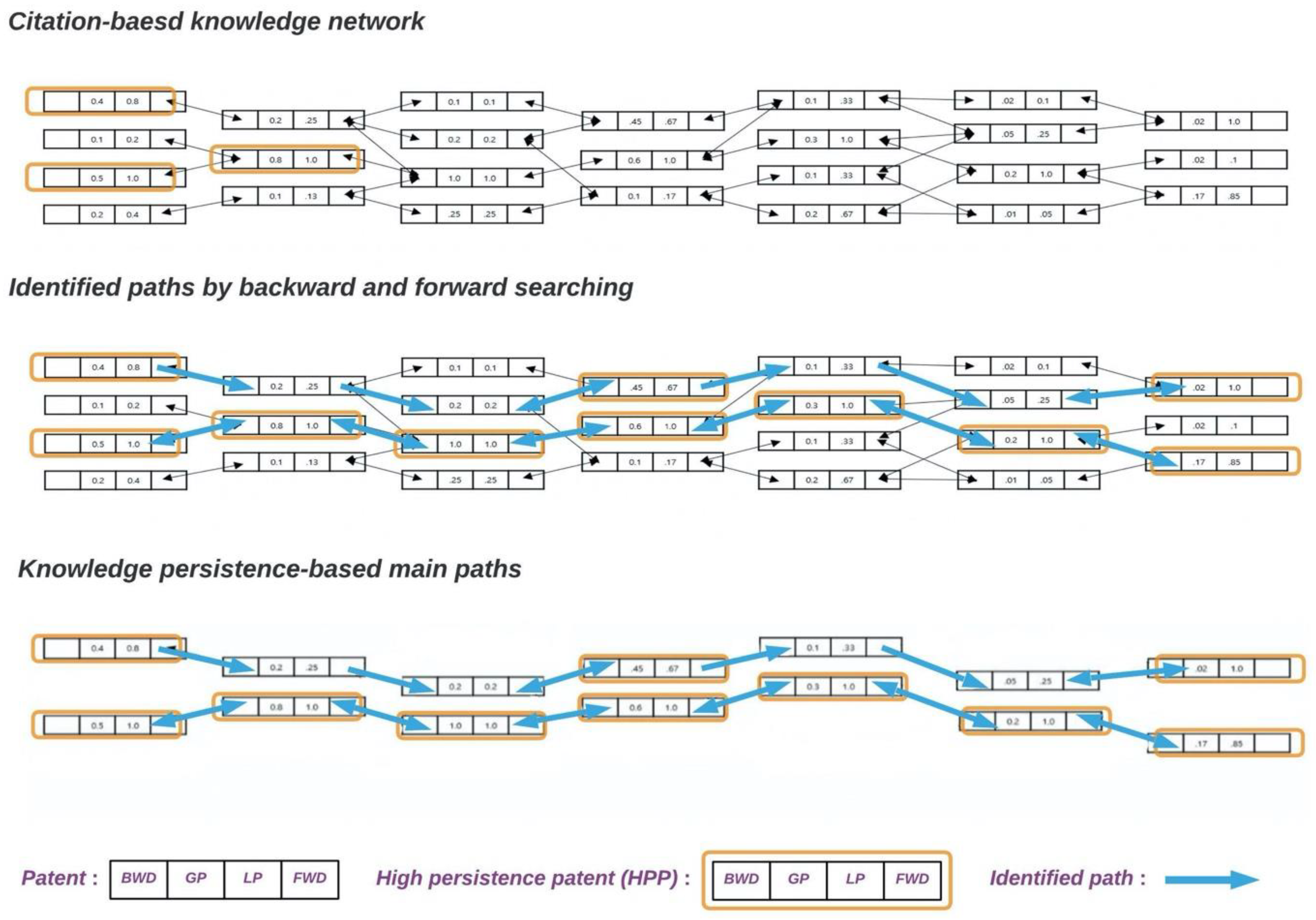

4.2. Generating Knowledge Persistence-Based Main Paths

4.3. Minimizing Last Knowledge Flows

5. Results

6. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Label | Patent Number | Application Year | KP | GKP | LKP | Layer | Title |

|---|---|---|---|---|---|---|---|

| 20 | US3294960A | 1964 | 12.8099 | 0.077085 | 0.13766 | 1 | Electronic tax calculation circuit for use in business accounting system |

| 27 | US3610902A | 1968 | 142.9563 | 0.86026 | 1 | 2 | Electronic statistical calculator and display system |

| 40 | US4264808A | 1978 | 82.5719 | 0.49689 | 0.88737 | 1 | Method and apparatus for electronic image processing of documents for accounting purposes |

| 43 | US4222109A | 1978 | 31.4522 | 0.18927 | 0.338 | 1 | Electronic checkbook |

| 55 | US4569029A | 1982 | 74.4135 | 0.44779 | 0.52053 | 2 | Check calculator |

| 58 | US4597045A | 1983 | 23.7614 | 0.14299 | 0.14299 | 3 | Tabulated data calculating apparatus |

| 66 | US4642767A | 1984 | 166.1778 | 1 | 1 | 3 | Bookkeeping and accounting system |

| 72 | US4737911A | 1985 | 68.6846 | 0.41332 | 0.41332 | 3 | Process for electronically maintaining financial records, especially for checkbook balancing and rectification |

| 78 | US4796181A | 1986 | 93.0526 | 0.55996 | 1 | 1 | Billing system for computer software |

| 91 | US4852000A | 1987 | 92.4311 | 0.55622 | 0.93822 | 4 | Method for expense report storage and calculation |

| 92 | US4843548A | 1987 | 73.373 | 0.44153 | 0.74477 | 4 | System for integrating related numerical functions |

| 94 | US4890228A | 1988 | 39.3462 | 0.23677 | 0.42284 | 1 | Electronic income tax refund early payment system |

| 105 | US5117356A | 1989 | 127.2898 | 0.76599 | 1 | 5 | Automated ledger account maintenance system |

| 106 | US5138549A | 1989 | 92.1597 | 0.55458 | 0.64467 | 2 | Automated tax deposit processing system |

| 118 | US5093787A | 1990 | 98.5177 | 0.59284 | 1 | 4 | Electronic checkbook with automatic reconciliation |

| 131 | US5193055A | 1991 | 50.8724 | 0.30613 | 0.30613 | 3 | Accounting system |

| 164 | US5285384A | 1993 | 84.217 | 0.50679 | 1 | 6 | Payroll trust check system |

| 187 | US5644724A | 1994 | 55.2345 | 0.33238 | 0.33238 | 3 | Point-of-sale tax collection system and method of using same |

| 204 | US5696906A | 1995 | 34.8854 | 0.20993 | 0.3749 | 1 | Telecommunication user account management system and method |

| 252 | US5774872A | 1996 | 87.9298 | 0.52913 | 0.52913 | 3 | Automated taxable transaction reporting/collection system |

| 257 | US5875433A | 1996 | 48.9613 | 0.29463 | 0.49698 | 4 | Point-of-sale tax reporting and automatic collection system with tax register |

| 279 | US5982891A | 1997 | 35.294 | 0.21239 | 0.24689 | 2 | Systems and methods for secure transaction management and electronic rights protection |

| 284 | US6128603A | 1997 | 54.6946 | 0.32913 | 0.32913 | 3 | Consumer-based system and method for managing and paying electronic billing statements |

| 288 | US5884284A | 1997 | 56.3917 | 0.33935 | 0.39447 | 2 | Telecommunication user account management system and method |

| 290 | US6029144A | 1997 | 71.8521 | 0.43238 | 0.56448 | 5 | Compliance-to-policy detection method and system |

| 293 | US6058375A | 1997 | 51.9911 | 0.31286 | 0.61735 | 6 | Accounting processor and method for automated management control system |

| 359 | US5875435A | 1998 | 94.9595 | 0.57143 | 0.74601 | 5 | Automated accounting system |

| 360 | US6202052B1 | 1998 | 60.6034 | 0.36469 | 0.61515 | 4 | Fully-automated system for tax reporting, payment, and refund |

| 389 | US6016479A | 1998 | 103.0336 | 0.62002 | 1 | 7 | Computer-based system, computer program product, and method for recovering tax revenue |

| 445 | US6446048B1 | 1999 | 24.1816 | 0.14552 | 0.18997 | 5 | Web-based entry of financial transaction information and subsequent download of such information |

| 476 | US6347304B1 | 1999 | 84.9073 | 0.51094 | 1 | 8 | Computer-based system, computer program product, and method for recovering tax revenue |

| 546 | US7234103B1 | 2000 | 46.4556 | 0.27955 | 1 | 9 | Network-based tax framework database |

| 688 | US7120597B1 | 2001 | 18.0833 | 0.10882 | 0.21298 | 8 | Computerized accounting systems and methods |

| 903 | US7188083B2 | 2002 | 9.4002 | 0.056567 | 0.20235 | 9 | System for and method of rapid collection of income taxes |

| 932 | US7069240B2 | 2003 | 25.9759 | 0.15631 | 0.30844 | 6 | System and method for capture, storage, and processing of receipts and related data |

| 984 | US7599865B2 | 2003 | 6.5 | 0.039115 | 0.13992 | 9 | Budgetary ledger |

| 1021 | US7454371B2 | 2003 | 8.6203 | 0.051874 | 0.83422 | 10 | System and method for managing login resources for the submission and performance of engagements |

| 1143 | US7610227B2 | 2004 | 9.6379 | 0.057998 | 0.9327 | 10 | System and method for creating cross-reference links, tables, and lead sheets for tax return documents |

| 1251 | US7716094B1 | 2005 | 9.3378 | 0.056192 | 0.90366 | 10 | Estimated tax reminder and payment facilitation service |

| 1253 | US7739160B1 | 2005 | 10.3333 | 0.062182 | 1 | 10 | Dynamic, rule-based, tax-decision system |

| 1432 | US7930226B1 | 2006 | 14.3059 | 0.086088 | 1 | 11 | User-driven document-based data collection |

| 1657 | US8315900B2 | 2007 | 2 | 0.012035 | 0.1398 | 11 | Architectural design for self-service procurement application software |

| 1854 | US8019687B2 | 2008 | 36.5333 | 0.21984 | 0.21984 | 3 | Distributed digital rights management node module and methods for use therewith |

| 1878 | US8635127B1 | 2008 | 13.8631 | 0.083424 | 0.96905 | 11 | System and method for identifying tax documents to customize preparation of a tax return |

| 2462 | US8055559B2 | 2009 | 1 | 0.0060177 | 0.096774 | 10 | Multi-company business accounting system and method for same including account receivable |

| 2586 | US8204805B2 | 2010 | 38.041 | 0.22892 | 1 | 12 | Instant tax return preparation |

| 2938 | US8924469B2 | 2011 | 0 | 0 | 0 | 5 | Enterprise access control and accounting allocation for access networks |

| 3177 | US8516552B2 | 2012 | 5.6667 | 0.0341 | 0.057519 | 4 | Verifiable service policy implementation for intermediate networking devices |

| 3279 | US8631102B2 | 2012 | 0 | 0 | 0 | 5 | Automated device provisioning and activation |

| 3451 | US9351193B2 | 2013 | 0 | 0 | 0 | 5 | Intermediate networking devices |

| 3457 | US9858559B2 | 2013 | 0 | 0 | 0 | 5 | Network service plan design |

| 3656 | US9760953B1 | 2014 | 35.3333 | 0.21262 | 1 | 13 | Computer implemented methods systems and articles of manufacture for identifying tax return preparation application questions based on semantic dependency |

| 3658 | US9922376B1 | 2014 | 9.6349 | 0.05798 | 0.80504 | 14 | Systems and methods for determining impact chains from a tax calculation graph of a tax preparation system |

| 3659 | US9916628B1 | 2014 | 10.6349 | 0.063997 | 0.88859 | 14 | Interview question modification during preparation of electronic tax return |

| 3698 | US10235721B1 | 2014 | 3.3333 | 0.020059 | 0.57971 | 15 | System and method for automated data gathering for tax preparation |

| 3719 | US8886162B2 | 2014 | 0 | 0 | 0 | 5 | Restricting end-user device communications over a wireless access network associated with a cost |

| 3735 | US10387969B1 | 2014 | 1 | 0.0060177 | 1 | 16 | Computer-implemented methods systems and articles of manufacture for suggestion-based interview engine for tax return preparation application |

| 3865 | US9990678B1 | 2015 | 11.9682 | 0.072021 | 1 | 14 | Systems methods and articles of manufacture for assessing trustworthiness of electronic tax return data |

| 3875 | US10176534B1 | 2015 | 5.75 | 0.034601 | 1 | 15 | Method and system for providing an analytics model architecture to reduce abandonment of tax return preparation sessions by potential customers |

| 3880 | US10165447B2 | 2015 | 0 | 0 | 0 | 5 | Network service plan design |

| 3956 | US10628894B1 | 2015 | 1 | 0.0060177 | 1 | 16 | Method and system for providing personalized responses to questions received from a user of an electronic tax return preparation system |

| 3992 | US9922328B2 | 2015 | 0 | 0 | 0 | 12 | Acceleration of system documentation conformance to differentiated regulations of multiple countries |

| 4003 | US10028144B2 | 2015 | 0 | 0 | 0 | 5 | Security techniques for device-assisted services |

| 4021 | US10204380B1 | 2015 | 0 | 0 | 0 | 12 | Categorically inductive taxonomy system, program product, and method |

| 4035 | US10325276B2 | 2015 | 0 | 0 | 0 | 11 | Financial reporting system integrating market segment attributes and accounting data |

| 4063 | US10664925B2 | 2015 | 0 | 0 | 0 | 17 | Systems, methods, and articles for determining tax recommendations |

| 4155 | US10621677B2 | 2016 | 0.5 | 0.0030088 | 0.5 | 16 | Method and system for applying dynamic and adaptive testing techniques to a software system to improve selection of predictive models for personalizing user experiences in the software system |

| 4169 | US10373064B2 | 2016 | 0.5 | 0.0030088 | 0.5 | 16 | Method and system for adjusting analytics model characteristics to reduce uncertainty in determining users’ preferences for user experience options, to support providing personalized user experiences to users with a software system |

| 4326 | US10937109B1 | 2016 | 0 | 0 | 0 | 17 | Method and technique to calculate and provide confidence score for predicted tax due/refund |

| 4339 | US11069001B1 | 2016 | 0 | 0 | 0 | 17 | Method and system for providing personalized user experiences in compliance with service provider business rules |

| 4538 | US10453151B2 | 2018 | 2 | 0.012035 | 0.19355 | 10 | Receipts scanner and financial organizer |

| 4549 | US10664294B2 | 2018 | 1 | 0.0060177 | 1 | 16 | Matching adopting users and contributing users for decentralized software localization |

| 4601 | US10694385B2 | 2018 | 0 | 0 | 0 | 5 | Security techniques for device assisted services |

| 4650 | US10869199B2 | 2018 | 0 | 0 | 0 | 5 | Network service plan design |

| 4755 | US10909361B2 | 2019 | 0 | 0 | 0 | 11 | Receipt processing apparatus, program, and report production method |

| 4775 | US11004158B2 | 2019 | 0 | 0 | 0 | 11 | Receipts scanner and financial organizer |

| 4803 | US10991045B2 | 2020 | 0 | 0 | 0 | 17 | Blockchain-based settlement method, apparatus, and electronic device |

References

- Mukhametzyanov, R.Z.; Nugaev, F.S.; Muhametzyanova, L.Z. History of accounting development. J. Hist. Cult. Art Res. 2017, 6, 1227–1236. [Google Scholar] [CrossRef]

- Qi, Y.; Peng, W.; Xiong, N.N. The effects of fiscal and tax incentives on regional innovation capability: Text extraction based on python. Mathematics 2020, 8, 1193. [Google Scholar] [CrossRef]

- Rezaee, Z.; Szendi, J.Z.; Shum, C.; Elmore, R.C. Trends in management accounting in the Asian pacific region. Int. Adv. Econ. Res. 1995, 1, 149–155. [Google Scholar] [CrossRef]

- Melnyk, N.; Trachova, D.Y.; Kolesnikova, O.; Demchuk, O.; Golub, N. Accounting trends in the modern world. Indep. J. Manag. Prod. 2020, 11, 2403–2416. [Google Scholar] [CrossRef]

- Cotton, W.D.; Jackman, S.M.; Brown, R.A. Note on a New Zealand replication of the Innes et al. UK activity-based costing survey. Manag. Account. Res. 2003, 14, 67–72. [Google Scholar] [CrossRef]

- Al-Sayed, M.; Dugdale, D. Activity-based innovations in the UK manufacturing sector: Extent, adoption process patterns and contingency factors. Br. Account. Rev. 2016, 48, 38–58. [Google Scholar] [CrossRef]

- Abad-Segura, E.; Infante-Moro, A.; González-Zamar, M.-D.; López-Meneses, E. Blockchain technology for secure accounting management: Research trends analysis. Mathematics 2021, 9, 1631. [Google Scholar] [CrossRef]

- Mun, C.; Kim, Y.; Yoo, D.; Yoon, S.; Hyun, H.; Raghavan, N.; Park, H. Discovering business diversification opportunities using patent information and open innovation cases. Technol. Forecast. Soc. Chang. 2019, 139, 144–154. [Google Scholar] [CrossRef]

- Chang, C.-Y.; Lin, K.-P. Developing Support Vector Machine with New Fuzzy Selection for the Infringement of a Patent Rights Problem. Mathematics 2020, 8, 1263. [Google Scholar] [CrossRef]

- Huang, C.-Y.; Wang, L.-C.; Kuo, Y.-T.; Huang, W.-T. A novel analytic framework of technology mining using the main path analysis and the decision-making trial and evaluation laboratory-based analytic network process. Mathematics 2021, 9, 2448. [Google Scholar] [CrossRef]

- Huang, C.-Y.; Yang, M.-J.; Li, J.-F.; Chen, H. A danp-based ndea-mop approach to evaluating the patent commercialization performance of industry–academic collaborations. Mathematics 2021, 9, 2280. [Google Scholar] [CrossRef]

- Mun, C.; Yoon, S.; Raghavan, N.; Hwang, D.; Basnet, S.; Park, H. Function score-based technological trend analysis. Technovation 2021, 101, 102199. [Google Scholar] [CrossRef]

- Koda, H. Business Models Patent; Nikel Kogyo Shinbunsha: Tokyo, Japan, 2000. [Google Scholar]

- Keeley-Domokos, F.M. State Street Bank & Trust Co. v. Signature Financial Group, Inc. Berkeley Technol. Law J. 1999, 14, 153–172. [Google Scholar]

- Niemann, H.; Moehrle, M.G.; Walter, L. Business method patents as a challenge for technology management in the logistics industry: The case of intelligent sensor networks. In Proceedings of the 2011 PICMET’11: Technology Management in the Energy Smart World (PICMET), Portland, OR, USA, 31 July–4 August 2011; pp. 1–10. [Google Scholar]

- Niemann, H.; Moehrle, M.G. Car2X-Communication mirrored by business method patents: What documented inventions can tell us about the future. In Proceedings of the 2013 PICMET’13: Technology Management in the IT-Driven Services (PICMET), San Jose, CA, USA, 28 July 2013–1 August 2013; pp. 976–984. [Google Scholar]

- No, H.J.; An, Y.; Park, Y. A structured approach to explore knowledge flows through technology-based business methods by integrating patent citation analysis and text mining. Technol. Forecast. Soc. Change 2015, 97, 181–192. [Google Scholar] [CrossRef]

- Lee, W.S.; Sohn, S.Y. Identifying emerging trends of financial business method patents. Sustainability 2017, 9, 1670. [Google Scholar] [CrossRef]

- Von Wartburg, I.; Teichert, T.; Rost, K. Inventive progress measured by multi-stage patent citation analysis. Res. Policy 2005, 34, 1591–1607. [Google Scholar] [CrossRef]

- Daim, T.U.; Rueda, G.; Martin, H.; Gerdsri, P. Forecasting emerging technologies: Use of bibliometrics and patent analysis. Technol. Forecast. Soc. Change 2006, 73, 981–1012. [Google Scholar] [CrossRef]

- Park, H.; Ree, J.J.; Kim, K. Identification of promising patents for technology transfers using TRIZ evolution trends. Expert Syst. Appl. 2013, 40, 736–743. [Google Scholar] [CrossRef]

- Li, R.; Chambers, T.; Ding, Y.; Zhang, G.; Meng, L. Patent citation analysis: Calculating science linkage based on citing motivation. J. Assoc. Inf. Sci. Technol. 2014, 65, 1007–1017. [Google Scholar] [CrossRef]

- Park, H.; Magee, C.L. Tracing technological development trajectories: A genetic knowledge persistence-based main path approach. PLoS ONE 2017, 12, e0170895. [Google Scholar] [CrossRef]

- Mun, C.; Yoon, S.; Kim, Y.; Raghavan, N.; Park, H. Quantitative identification of technological paradigm changes using knowledge persistence. PLoS ONE 2019, 14, e0220819. [Google Scholar] [CrossRef]

- Yoon, S.; Mun, C.; Raghavan, N.; Hwang, D.; Kim, S.; Park, H. Hierarchical main path analysis to identify decompositional multi-knowledge trajectories. J. Knowl. Manag. 2020, 25, 454–476. [Google Scholar] [CrossRef]

- Kim, S.; Yoon, S.; Raghavan, N.; Le, N.-T.; Park, H. Developmental Trajectories in Blockchain Technology Using Patent-Based Knowledge Network Analysis. IEEE Access 2021, 9, 44704–44717. [Google Scholar] [CrossRef]

- Verspagen, B. Mapping technological trajectories as patent citation networks: A study on the history of fuel cell research. Adv. Complex Syst. 2007, 10, 93–115. [Google Scholar] [CrossRef]

- Schilling, M.A.; Green, E. Recombinant search and breakthrough idea generation: An analysis of high impact papers in the social sciences. Res. Policy 2011, 40, 1321–1331. [Google Scholar] [CrossRef]

- Weitzman, M.L. Recombinant growth. Q. J. Econ. 1998, 113, 331–360. [Google Scholar] [CrossRef]

- Nakamura, H.; Suzuki, S.; Sakata, I.; Kajikawa, Y. Knowledge combination modeling: The measurement of knowledge similarity between different technological domains. Technol. Forecast. Soc. Change 2015, 94, 187–201. [Google Scholar] [CrossRef]

- Martinelli, A.; Nomaler, Ö. Measuring knowledge persistence: A genetic approach to patent citation networks. J. Evol. Econ. 2014, 24, 623–652. [Google Scholar] [CrossRef]

- Hummon, N.P.; Dereian, P. Connectivity in a citation network: The development of DNA theory. Soc. Netw. 1989, 11, 39–63. [Google Scholar] [CrossRef]

- Fontana, R.; Nuvolari, A.; Verspagen, B. Mapping technological trajectories as patent citation networks. An application to data communication standards. Econ. Innov. New Technol. 2009, 18, 311–336. [Google Scholar] [CrossRef]

- Chang, P.-L.; Wu, C.-C.; Leu, H.-J. Using patent analyses to monitor the technological trends in an emerging field of technology: A case of carbon nanotube field emission display. Scientometrics 2010, 82, 5–19. [Google Scholar] [CrossRef]

- Bhupatiraju, S.; Nomaler, Ö.; Triulzi, G.; Verspagen, B. Knowledge flows–Analyzing the core literature of innovation, entrepreneurship and science and technology studies. Res. Policy 2012, 41, 1205–1218. [Google Scholar] [CrossRef]

- Martinelli, A. An emerging paradigm or just another trajectory? Understanding the nature of technological changes using engineering heuristics in the telecommunications switching industry. Res. Policy 2012, 41, 414–429. [Google Scholar] [CrossRef]

- Kim, E.; Cho, Y.; Kim, W. Dynamic patterns of technological convergence in printed electronics technologies: Patent citation network. Scientometrics 2014, 98, 975–998. [Google Scholar] [CrossRef]

- Purina, M. Tax Accounting in the Russian Federation. Procedia Econ. Financ. 2015, 25, 127–133. [Google Scholar]

- Aisbitt, S. Tax and accounting rules: Some recent developments. Eur. Bus. Rev. 2002, 14, 92–97. [Google Scholar] [CrossRef]

- Shortridge, R.T.; Smith, P.A. Understanding the changes in accounting thought. Res. Account. Regul. 2009, 21, 11–18. [Google Scholar] [CrossRef]

- Kanakriyah, R. The Effect Of Using Accounting Information Systems On The Quality Of Account-ing Information According To Users Perspective In Jordan. Eur. J. Account. Audit. Financ. Res. 2016, 4, 58–75. [Google Scholar]

- Kanellou, A.; Spathis, C. Accounting benefits and satisfaction in an ERP environment. Int. J. Account. Inf. Syst. 2013, 14, 209–234. [Google Scholar] [CrossRef]

- Akrong, G.B.; Shao, Y.; Owusu, E. Evaluation of organizational climate factors on tax administration enterprise resource planning (ERP) system. Heliyon 2022, 8, e09642. [Google Scholar] [CrossRef]

- Cooper, R.; Kaplan, R.S. The Design of Cost Management Systems: Text and Cases; Prentice Hall: Hoboken, NJ, USA, 1999. [Google Scholar]

- Bose, S.; Dey, S.K.; Bhattacharjee, S. Big Data, Data Analytics and Artificial Intelligence in Accounting: An Overview. Handb. Big Data Methods Forthcom. 2022, 1–34. [Google Scholar]

- Vovchenko, N.; Ivanova, O.; Kostoglodova, E.; Khapilin, S.; Sapegina, K. Improving the Customs Regulation Framework in the Eurasian Economic Union in the Context of Sustainable Economic Development. Sustainability 2022, 14, 755. [Google Scholar] [CrossRef]

- Kitsantas, T.; Chytis, E. Blockchain Technology as an Ecosystem: Trends and Perspectives in Accounting and Management. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1143–1161. [Google Scholar] [CrossRef]

- Vărzaru, A.A. Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electronics 2022, 11, 2256. [Google Scholar] [CrossRef]

- Yang, H.-T. Artificial intelligence and Blockchain convergence trend and policy improvement plan. Informatiz. Policy 2020, 27, 3–19. [Google Scholar]

- Scapens, R.W. Never mind the gap: Towards an institutional perspective on management accounting practice. Manag. Account. Res. 1994, 5, 301–321. [Google Scholar] [CrossRef]

- Chi, D.-J.; Shen, Z.-D. Using Hybrid Artificial Intelligence and Machine Learning Technologies for Sustainability in Going-Concern Prediction. Sustainability 2022, 14, 1810. [Google Scholar] [CrossRef]

| Sub-Class | Main Group | Sub-Group (One-Dot) | Definition |

|---|---|---|---|

| G06Q | Data processing systems or methods, especially adapted for administrative, commercial, financial, managerial, supervisory, or forecasting purposes; systems or methods especially adapted for administrative, commercial, financial, managerial, supervisory, or forecasting purpose | ||

| G06Q-40/00 | Finance; insurance; tax strategies; processing of corporate or income taxes | ||

| G06Q-40/12 | Accounting |

| Search Query | # of Patents | Data Range | Relevancy |

|---|---|---|---|

| G06Q-40/12 & accounting | 4816 | U.S.-granted patents from 1 January 1933 to 31 December 2021 (Filling date) | 98% |

| Label | Publication Number | Year | Layer | KP | GP | LP | Title |

|---|---|---|---|---|---|---|---|

| 1251 | US7716094B1 | 2005 | 10 | 9.3378 | 0.056192 | 0.90366 | Estimated tax reminder and payment facilitation service |

| 1432 | US7930226B1 | 2006 | 11 | 14.3059 | 0.086088 | 1 | User-driven document-based data collection |

| 2586 | US8204805B2 | 2010 | 12 | 38.041 | 0.22892 | 1 | Instant tax return preparation |

| 3656 | US9760953B1 | 2014 | 13 | 35.3333 | 0.21262 | 1 | Computer-implemented methods systems and articles of manufacture for identifying tax return preparation application questions based on semantic dependency |

| 3865 | US9990678B1 | 2015 | 14 | 11.9682 | 0.072021 | 1 | Systems methods and articles of manufacture for assessing trustworthiness of electronic tax return data |

| 3658 | US9922376B1 | 2014 | 14 | 9.6349 | 0.05798 | 0.80504 | Systems and methods for determining impact chains from a tax calculation graph of a tax preparation system |

| 3659 | US9916628B1 | 2014 | 14 | 10.6349 | 0.063997 | 0.88859 | Interview question modification during preparation of electronic tax return |

| 3875 | US10176534B1 | 2015 | 15 | 5.75 | 0.034601 | 1 | Method and system for providing an analytics model architecture to reduce abandonment of tax return preparation sessions by potential customers |

| 3698 | US10235721B1 | 2014 | 15 | 3.3333 | 0.020059 | 0.57971 | System and method for automated data gathering for tax preparation |

| 4549 | US10664294B2 | 2018 | 16 | 1 | 0.0060177 | 1 | Matching adopting users and contributing users for decentralized software localization |

| 3956 | US10628894B1 | 2015 | 16 | 1 | 0.0060177 | 1 | Method and system for providing personalized responses to questions received from a user of an electronic tax return preparation system |

| 3735 | US10387969B1 | 2014 | 16 | 1 | 0.0060177 | 1 | Computer-implemented methods systems and articles of manufacture for suggestion-based interview engine for tax return preparation application |

| 4155 | US10621677B2 | 2016 | 16 | 0.5 | 0.0030088 | 0.5 | Method and system for applying dynamic and adaptive testing techniques to a software system to improve selection of predictive models for personalizing user experiences in the software system |

| 4169 | US10373064B2 | 2016 | 16 | 0.5 | 0.0030088 | 0.5 | Method and system for adjusting analytics model characteristics to reduce uncertainty in determining users’ preferences for user experience options, to support providing personalized user experiences to users with a software system |

| 4339 | US11069001B1 | 2016 | 17 | 0 | 0 | 0 | Method and system for providing personalized user experiences in compliance with service provider business rules |

| 4326 | US10937109B1 | 2016 | 17 | 0 | 0 | 0 | Method and technique to calculate and provide confidence score for predicted tax due/refund |

| 4063 | US10664925B2 | 2015 | 17 | 0 | 0 | 0 | Systems, methods, and articles for determining tax recommendations |

| Systems Aspects | Stage 1 Systems Broken | Stage 2 Systems Financial Reporting Driven | Stage 3 Systems Customized, Stand-Alone | Stage 4 Systems Integrated |

|---|---|---|---|---|

| Data quality | Many errors Large variances | No surprises Meets audit standards | Shared databases Stand-alone systems Informal linkages | Fully linked databases and systems |

| External Financial Reporting | Inadequate | Tailored to financial reporting needs | Stage 2 system maintained for financial transactions and periodic reporting | Financial reporting systems |

| Product/Customer Costs | Inadequate | Inaccurate Hidden costs and profits | PC-based ABC for costing activities products, and cost to serve customers | Integrated ABM systems |

| Operational and Strategic Control | Inadequate | Financial feedback: variances Delayed aggregate | Kaizen costing: pseudo profit centers; timely non-financial feedback | Operational and strategic performance measurement |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rhee, Y.; Yoon, S.; Park, H. Exploring Knowledge Trajectories of Accounting Information Systems Using Business Method Patents and Knowledge Persistence-Based Main Path Analysis. Mathematics 2022, 10, 3349. https://doi.org/10.3390/math10183349

Rhee Y, Yoon S, Park H. Exploring Knowledge Trajectories of Accounting Information Systems Using Business Method Patents and Knowledge Persistence-Based Main Path Analysis. Mathematics. 2022; 10(18):3349. https://doi.org/10.3390/math10183349

Chicago/Turabian StyleRhee, Yoonki, Sejun Yoon, and Hyunseok Park. 2022. "Exploring Knowledge Trajectories of Accounting Information Systems Using Business Method Patents and Knowledge Persistence-Based Main Path Analysis" Mathematics 10, no. 18: 3349. https://doi.org/10.3390/math10183349

APA StyleRhee, Y., Yoon, S., & Park, H. (2022). Exploring Knowledge Trajectories of Accounting Information Systems Using Business Method Patents and Knowledge Persistence-Based Main Path Analysis. Mathematics, 10(18), 3349. https://doi.org/10.3390/math10183349