Abstract

In this paper, we test the dynamic symmetric and asymmetric causality relationship between the ecological footprint and trade openness in G7 countries by suggesting a new bootstrap panel causality test based on seemingly unrelated regressions. We analyzed the time-varying behavior of the symmetric and asymmetric panel causality relationship test to reveal the instabilities in the causality relationships. The obtained results suggest a relationship between the trade openness and ecological footprint in some years of the analysis period and between the negative and positive shocks.

Keywords:

symmetric and asymmetric bootstrap panel causality test; ecological footprint; trade openness; dynamical analysis MSC:

62K99; 91B76

1. Introduction

Achieving stable economic growth is one of the leading purposes of countries and increasing production can be attributed as the engine of economic growth. Production is generally carried out with the acceleration of industrialization and the spread of international trade, which puts pressure on natural resources and causes nature to exceed the carrying capacity limit since the energy needed is predominantly obtained from fossil fuels. Therefore, the economic growth and trade openness of countries can create a disruptive effect on the ecological balance if required improvements are not achieved in the medium and long term. Especially in developed economies, the quality of life supported by economic growth and the change in consumption behaviors reveal many environmental problems. These environmental problems are generally: climate change, depletion of the ozone layer as a result of the increase in CO2 emissions, decrease in natural resources, biological diversity, global warming, and increase in desertification by decreasing forest, etc.

Environmental degradation occurs with economic growth, and trade openness entails transitioning to clean and renewable energy. Trade openness refers to the total share of exports and imports in GDP. In other words, trade openness generally shows the foreign trade power of countries. With this viewpoint, the concepts of foreign trade and trade openness can be expressed as equivalent. The overall sense in the economics literature states that trade openness positively affects economic growth. The impact of foreign trade-oriented growth on the environment differs according to the development levels of the countries. Advanced economies try to develop environmentally friendly production systems to overcome environmental challenges. Due to the high per capita income in these countries, consumer preferences consist of better products that are recyclable and less harmful to the environment. This reduces the damage and pollution to the environment. However, in developing countries, it seems very difficult to implement these systems due to their higher cost. In addition, the flexibility or absence of environmental standards in developing countries creates harmful effects for the environment. In fact, due to this flexibility, some developed countries escape from the high environmental standards in their own countries and carry out industrial production in developing countries. When the trade barriers are removed, trade between countries increases and its various effects on the environment arise in this way. Accordingly, trade liberalization leads to specialization: countries that specialize in less pollution-intensive products create a cleaner environment, or countries that specialize in more pollution-intensive products cause a more polluted environment. However, even if policies to protect the environment are adopted and clean technologies are used in production, the total volume of various pollutants may increase due to the continuous increase in production (see [1] for details).

Several issues, such as non-environmental industrial production, rapid urbanization, and negative effects of technological development, raise ecological problems. Scientists conducting solution-oriented research on environmental challenges have been developing different methods and techniques to measure the productivity of natural resources. In this context, one may consider the ecological footprint proposed by Wackernagel and Rees [2] as an important proxy for sustainability and sustainable development. They also perceive the ecological footprint as a computational method to measure the consumption of natural resources and the assimilation capacity needed for waste generated in the economy. Beyond the ecological footprint, several variables such as CO2, water pollution rate, and SO2 are used as environmental indicators in the literature. Recent works involving the ecological footprint have been carried out [3,4,5,6,7,8,9,10]. Since the ecological footprint is more inclusive because it has several sub-components, such as cropland, grazing land, forest products, fishing grounds, built-up land, and the carbon footprint, we make use of the ecological footprint as a proxy for the environmental indicator in this study, which seems to be interesting and a more general method from previous works.

The level of the ecological footprint varies depending on macroeconomic variables, social values, and technological development (see [11] for details). International trade is an important factor in terms of environmental challenges because it is the core dynamic of economic development. The market mechanism fails to impose the environmental costs of economic activities on products, and the ecological footprint emerges as a quantitative tool for balancing consumption and biocapacity. Consumption, one of the main indicators affecting the ecological footprint, is not limited to domestic resources; in other words, the goods and services consumed in a country can be obtained from other countries’ resources (see [12] for more information). If there is a negative relationship between environmental problems and international trade, this is interpreted as the country will be able to reduce its greenhouse gas emissions as it opens up to international markets. On the other hand, if there is a positive relationship between environmental problems and international trade, this indicates that trade liberalization is not yet at an optimal level in the country. Accordingly, environmental pollution will occur in the early stages of free trade, but after a certain threshold level is exceeded, the necessary conditions for the environment will be improved in the countries because more liberalization of trade conditions will cause countries to make more efforts to meet international environmental standards, in line with international trade, cooperation, and competition purposes (see [13]). Since both trade openness and the environment respond to positive and negative shocks, the existence of a relationship between trade openness and the environment indicates an asymmetrical relationship. Granger and Yoon [7] investigate what would be the cointegration and causality relationship between economic time series when they only respond to certain types of shocks (negative or positive). There may be an implicit relationship between two seemingly unrelated time series. This relationship can be revealed by considering the asymmetry between the components of the series. In other words, the dynamic relationships between the series can be revealed by considering asymmetry.

This is where the impact of trade openness on the ecological footprint emerges since international trade is necessary for the use of resources belonging to other countries. Therefore, the footprint of goods and services consumed by foreign trade can be achieved beyond the borders of a country; in other words, exporting the production created by domestic resources also means exporting the ecological footprint as well. Similarly, the import of goods and services means that countries import ecological footprints. To sum up, foreign trade also shows that countries are exporters or importers of the ecological footprint. Countries can be classified according to various categories based on their ecological footprint (see [4]). According to this:

- ➢

- In countries with more ecological surpluses than their net biocapacity exports, ecological capital does not deteriorate or increase.

- ➢

- In countries whose ecological surpluses are less than their net biomass exports, ecological capital is declining, even though the consumption of the population requires less biomass than they have.

- ➢

- Even though they are biomass importers, the ecological capital of countries with an ecological deficit is already eroding.

- ➢

- Ecological capital is decreasing in countries whose ecological deficits are greater than their biomass imports.

- ➢

- Ecological capital is preserved or increased in countries whose ecological deficits are less than their biomass imports.

- ➢

- Countries that have an ecological surplus and are net biomass importers can also improve their ecological capital.

Foreign trade affects the ecological footprint in various ways by its production and consumption dimensions. Therefore, using the ecological footprint indicator, the actual use of the world’s biophysical production capacity can be revealed. The effects of trade on the ecological footprint are expressed in four ways: allocation effect, income effect, rich country illusion effect, and deterioration in terms of trade. These can be explained as follows ([14], pp. 119–121):

- ✓

- In the allocation effect, international trade provides specialization through high efficiency and low production cost. The increase in productivity by specialization reduces the ecological footprint unless the consumption does not increase. However, needing more foreign currency may lead to the export of goods that are produced with lower productivity. In this case, even if consumption remains constant, the ecological footprint will increase. However, in general, it can be said that the ecological footprint is reduced thanks to the allocation effect of foreign trade.

- ✓

- In the income effect, consumption is expected to increase due to the increase in the national income thanks to foreign trade. As per capita income increases, domestic consumption and import demand will increase as well. Therefore, the income effect creates a more ecological footprint on the national and global scale.

- ✓

- In the rich country illusion effect, advanced economies increase their expenditure to protect and develop the ecological resources and import biocapacity from developing and developed countries. In doing so, the advanced economies ensure ecological sustainability, unlike the low-income countries.

- ✓

- Under the deterioration in terms of trade, there has been a higher inflation risk since the wage level is higher and full employment is achieved in advanced economies. Therefore, the aggregate demand should be reduced to protect the ecological balance.

As stated, the effect of trade openness on the ecological footprint exists through several factors and the existing literature mainly focuses on the impacts of economic growth on environmental issues. However, a limited number of studies investigate the impact of trade openness on the environment as well as modeling the ecological footprint as an environmental indicator. Therefore, the main motivation of the study is to analyze the dynamic symmetric and asymmetric causality relationship between trade openness and ecological footprint and to present policy proposals towards the gap in related literature. This study deals with the G7 (group of seven), established as an unofficial forum in 1975. The group of countries, consisting of Germany, the USA, the UK, France, Italy, Japan, and Canada, dominates more than 60% of the global economy. For this reason, the solution to environmental problems created by global production depends on the policies to be implemented by these countries. In addition, we prefer to investigate the G7 since these countries are the biggest actors in global trade. The Section 2 of the study presents the theoretical framework literature review and then discusses how we contribute to the existing literature. The Section 3 deals with the dynamic, symmetric, and asymmetric causality relationships between foreign trade and ecological footprint using the econometric techniques. Empirical findings and policy recommendations are discussed in the Section 4.

2. Literature Review

Many studies in the literature focus on the relationship between the economy and the environment. On the one hand, these studies investigate the impact of economic growth on the environment by referring to the Environmental Kuznets Curve (EKC) hypothesis. On the other hand, studies examining the relationship between trade openness and the environment are still limited, and existing studies are mainly within the scope of the EKC hypothesis, pollution refuge hypothesis, and pollution haven hypothesis, in which CO2 emission is employed as an environmental indicator. However, it is hard to say that there is a sufficient number of studies where the ecological footprint is considered. To the best of our knowledge, no study investigates the dynamic of the asymmetric causality relationship between foreign trade and the ecological footprint.

Quite recently, Ali et al. [15] explored the trade openness–environmental quality nexus in the ten most open Organization of Islamic Cooperation (OIC) countries for the years 1991 to 2018. The findings suggest that a negative openness–CO2 emissions association is dominant in seven out of ten selected OIC countries (i.e., Suriname, Malaysia, Jordan, UAE, Libya, Brunei, and Qatar). On the other hand, a positive impact of trade openness on ecological footprint is dominant in eight out of ten selected OIC countries (i.e., Oman, Jordan, UAE, Libya, Bahrain, Brunei, Qatar, and Kuwait). The outcomes indicated that the asymmetric strength of openness-induced environmental quality differs with countries at both the upper and bottom quantiles of data distribution that need specific attention in contending trade and environment policies in OIC countries. Rehman et al. [8] investigated the effects of globalization, energy consumption, and foreign trade on the ecological footprint in Pakistan through the annual data for the period 1974–2017. They used the ARDL limit test to suggest that there is a relationship between the variables determined both in the long and short term and between the foreign trade and ecological footprint. Usman et al. [16] examined the causal relationship between economic growth, foreign direct investment, renewable energy, trade openness, and ecological footprint for 33 upper- and middle-income countries in Africa, Europe, and America between the 1994 and 2017 periods. Using the Dumitrescu–Hurlin causality test and FMOLS, DOLS, FGLS, and AMG coefficient estimators, they show that there is a negative relationship between trade openness and ecological footprint. In addition, a unidirectional causality from trade openness to the ecological footprint has been observed in Africa, Asia, and America. Dam [17] investigated the ecological aspect of international trade determinants over 32 countries covering the 1996–2012 periods, based on the comparative advantage theory and the Heckscher–Ohlin–Vanek approach. As a result of panel data analysis including fixed and random effects, he concluded that high-income countries are more likely to be importers of the ecological footprint, while the less developed countries are exporters. Accordingly, it can be said that relatively richer countries have a stricter environmental policy. Gao and Tian [18] investigated the impact of international trade on the ecological footprint of China between 1978 and 2010. The findings suggest that China is a net importer country in terms of its ecological footprint. Based on this result, it is suggested that China should improve its foreign trade policies in terms of raw material import and primary product export and increase its investments in products with high added value. Al-Mulali et al. [19] considered the effects of variables such as GDP, urbanization, energy consumption, trade openness, and financial development on the ecological footprint of 93 countries during the 1980–2008 period. Using the panel data method, the study finds that energy consumption, urbanization, and trade openness increase the ecological footprint in all income groups and many countries. Therefore, it has been suggested that the ecological footprint will increase if consumption increases as well. Moran et al. [20] analyzed 187 high-, middle-, and low-income countries for the period 1990–2010 in Leontief’s environmentally expanded multi-regional input–output analysis. They empirically tested the three hypotheses to explain the extent to which ecologically unequal change occurs. According to the first hypothesis result, from a biophysical viewpoint, interregional trade balances are not equally proportional to the financial balances of trade. The second hypothesis test result shows that exports from low-income countries are ecologically more intense than the exports from high-income countries. According to the result of this hypothesis, the study concludes that the high-income countries are mostly exporters, not importers, of biophysical resources. Fotros and Maaboudi [21] investigated the effect of trade openness and economic growth on CO2 emissions in Iran. Accordingly, while the economic growth has a negative effect on CO2 emissions for the 1971–2005 period, trade openness has a positive effect on CO2 emissions. Moran et al. [20] dealt mainly with the size of the ecological footprint of countries within their trading partners using the Crop Land Matrix of 150 countries. The study uses the ecological footprint as a proxy to measure the biophysical value of foreign trade. It is seen that the high- and middle-income countries mainly trade with the other high- and middle-income countries, and trade much less with the low-income countries, and thus the ecological footprint is effective in determining the trade partners. Jorgenson and Rica [22] introduced a new methodological approach to examine the environmental effects of international trade. As a result of the OLS analysis, they observe that there is a negative relationship between the exports and the ecological footprint.

One can infer from the literature review that the studies investigating the linkage between trade openness and the ecological footprint are limited, and it is hard to see any attempt that deals mainly with the dynamic, symmetric, and asymmetric causality relationship methods. Existing studies show that there is a negative relationship between the trade openness and ecological footprint by a majority, and this result is compatible with the relevant theory. The main distinction originated from the selection of the environmental indicator. Even though the ecological footprint is mostly used in recent years because it is much more inclusive, it is known that the CO2 emission is also used in some papers. Moreover, the main topics in which the studies in the literature differ from each other are methodology, selected countries, and control variables. The point where this study differs from the literature is the use of ecological footprint as an environmental indicator and the analysis of the dynamic, symmetric, and asymmetric causality relationships. In addition, we consider that our specifications regarding the study, such as the selected period, the analysis of the G7, and the policy proposals to be attained from the empirical findings, will make an original contribution to the existing literature.

3. Dynamic, Symmetric, and Asymmetric Bootstrap Panel Causality Test

To test whether past and present values of a variable help predict the value of another variable, one can conclude that there is a causality running from the former to the latter. Since the study of Granger [23], there have been several causality tests introduced, used for both individual time series and panel data. This study relies on the methodology of Kónya [22] due to its attractive properties, such as there is no need to test for the stationarity of the variables before testing causality, or to test for cointegration between the variables if they have a unit root since we compute unit-specific critical values via bootstrap simulations. Besides, the bootstrap panel causality test of Kónya [22] considers both cross-sectional dependence and heterogeneity.

To implement the symmetric bootstrap panel causality test, we employ the variables without decomposing and estimate the following set of equations via seemingly unrelated regression (SUR):

and

where N, , , and show the number of individuals, the optimal lag length chosen using Akaike information criteria, lag lengths, and the time period, respectively. Since we compute the necessary critical values through bootstrap simulations, we do not impose any restrictions on the stochastic properties of the variable. To estimate Equations (1) and (2), we first reveal whether there is a contemporaneous correlation across individual equations. In the case of the presence of the contemporaneous correlation, since ordinary least squares estimators will not be efficient due to neglecting the extra information, we estimate the equations via the SUR estimator proposed by Zellner [24].

We can rewrite Equations (1) and (2) for the jth member of the panel in a matrix form as follows:

where indicates a vector of ones, and and show the vectors of observed values of and . , and are matrices of lagged and that have dimensions of , , , and . and show the intercept terms, and , , , and are the , , , and vectors of slope coefficients. and show the vectors of error terms.

For all (), Equations (3) and (4) can be stacked as follows:

where,

are vectors,

, , , and matrices, and

are , , , and vectors. There are several methods to estimate Equations (5) and (6), such as ordinary least squares (OLS), generalized least squares (GLS), Gaussian quasi-maximum likelihood, minimum distance, and Bayes.

By following the suggestion of Konya [20], we employ Aitken’s [3] GLS method. Since the variance–covariance matrix () is unknown, we first obtain an estimate of as:

where represents the OLS residuals. Therefore, we can obtain the GLS estimator as follows:

where shows the estimators of the parameters.

To test the null hypothesis that there is no causality from X to Y, we should test the significance of in Equation (1) using the following Wald test statistic:

where shows the matrix of restrictions, and indicates the variance matrix of .

Using the bootstrap panel causality test with original series, one can test the symmetric causality relationship in a panel dataset. To analyze the presence of an asymmetric causality nexus, one should decompose the original data into negative and positive components and test the causality between decomposed series by following the suggestion of Granger and Yoon [25].

Granger and Yoon [7] clarified that traditional cointegration tests reveal whether considered series respond together to a shock or not. In the case of reacting to only a kind of shock together, these tests are not able to reveal this kind of relationship. Therefore, they also suggested obtaining the positive and negative components of the series and testing the long-run relationship between these components using the standard Engle–Granger cointegration test and called this test the “hidden cointegration” test. By following the study of Granger and Yoon [7], Hatemi [25] introduced an asymmetric causality test, while Yilanci and Aydin [26] suggested an asymmetric panel causality test.

To apply the asymmetric bootstrap panel causality test, we first obtain negative and positive shocks of the variables in a cumulative form as:

where,

and

where and are the initial values. and show the country index and the number of observations, respectively. Therefore, if we use the positive and negative shocks instead of the original series while testing for causality using Equations (1) and (2), we would have implemented an asymmetric bootstrap panel causality test.

Due to wars, economic and financial crises, disasters, and outbreaks, both the direction and presence of the causality relationship may change over time. However, the Konya [20] and Yilanci and Aydin [26] panel bootstrap causality tests do not allow the investigation of these fluctuations; that is, these tests assume a constancy in the causality relationship in the full sample. However, when there is a structural shift in the testing model, or a change in the causality relationship in the subsamples, the assumption of constancy is violated, and the causality test produces misleading results and may lead to missing policy recommendations. Therefore, in this study, we employ these tests in a dynamic form to consider the changes of causality relationship in the subsamples. We call these tests the dynamic symmetric bootstrap panel causality test and the dynamic asymmetric bootstrap panel causality test. The main advantage of the dynamic causality tests is to detect the periods when the causality relationship exists, so one can reveal the underlying sources of temporary causality, suggesting the appropriate policies considering the periods.

To employ dynamic symmetric/asymmetric bootstrap panel causality tests, we apply tests to the subsamples successively. The number of observations of subsamples (ss) can be determined by the following formula [9]:

Therefore, the first three samples that the tests are applied to will be as follows:

- 1, 2, 3, …, ss.

- 2, 3, 4, …, ss + 1

- 3, 4, 5, …, ss + 2

As can be seen from these samples, we exclude the first observation and add a new observation to the sample in every new step. We continue this procedure until the last observation is used. After obtaining all test statistics, we compute bootstrap p-values and draw a figure with these p-values and a traditional significance level (for instance, 0.10). The p-values, which are higher than 0.10, show that we cannot reject the null hypothesis of no causality in this subsample. We can determine the existence and direction of causality in all the subsamples using this dynamic analysis (see [27]).

The suggested dynamic panel bootstrap causality tests have some superior features compared to their alternatives. For example, the Quantile-on-Quantile approach suggested by Sim and Zhou [28] is useful for handling asymmetries, however our approach considers both asymmetries and instabilities. Additionally, revealing the stochastic properties of the variables is not a prerequisite for the suggested test.

4. Empirical Results

This paper analyzes the causality relationship between trade and environment in G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, the United States) by using trade openness (OPEN) as a proxy of trade and ecological footprint (TOTAL) and its components: built-up land (BUILT), carbon (CARBON), cropland (CROP), fishing grounds (FISHING), forest products (FOREST), and grazing land (GRAZING), as an indicator of environmental degradation over the period 1970–2017. We retrieved data of ecological footprint and its components from Global Footprint Network and OPEN from the data service of the World Bank. We used the logarithms of the ecological footprint and its components.

We first present the descriptive statistics of the raw data in Table 1 to obtain insights from the data.

Table 1.

Descriptive Statistics.

Table 1 shows that France has the highest mean for BUILT, the highest mean for CROP, FOREST, GRAZING, and OPEN belong to Canada, Japan has the highest mean for FISH, and highest mean of TOTAL belongs to the USA. Italy has the lowest mean for BUILT, CARBON, and TOTAL, while Japan has the lowest average for CROP, FOREST, and GRAZING, Germany has the lowest mean for FISHING, and the USA has the lowest mean for OPEN. The test statistics of the Jarque-Bera normality test show that most of the series are normally distributed.

Next, we examined the causality relationship by using symmetric and asymmetric panel causality tests, and the results are presented in Appendix A. The results of the symmetric panel causality test show that there is unidirectional causality from CARBON to OPEN in Canada and Germany, and from OPEN to CARBON in Italy and Japan. We also found that causality runs from OPEN to CROP for Germany and the UK, from OPEN to FISHING for the UK, from FOREST to OPEN for Japan, and from OPEN to FOREST for France, Germany, the UK, and the USA. There exists a causality relationship from GRAZING to OPEN for only Germany, from TOTAL to OPEN for Canada and Germany, and from OPEN to TOTAL for France, Italy, and Japan. To reveal the hidden causality relationship between the series, we also applied the asymmetric panel causality test. The results are tabulated in Appendix A. For positive shocks, we found a one-way causality that runs from GRAZING to OPEN for Canada and the UK, and for negative shocks we conclude that there is a unidirectional causality that runs from FISHING to OPEN for Italy, and from FOREST to OPEN for Japan. These findings prove that considering asymmetric causality may help to reveal the causal relationship that could not be detected by traditional causality tests.

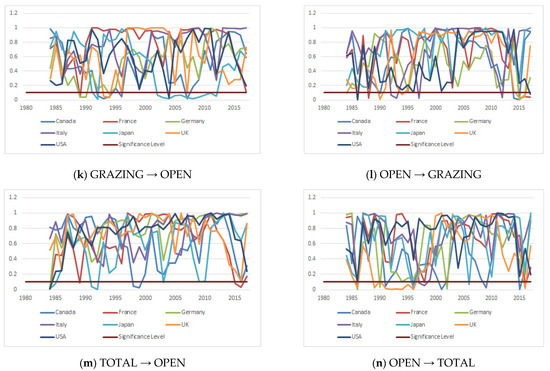

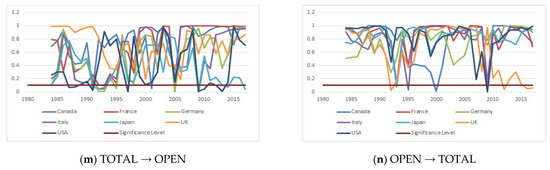

In symmetric and asymmetric panel causality tests, we suppose that there are no instabilities in the causality relationship; however, due to economic crises, wars, and pandemics, the existence and direction of causalities may change over time. To detect these kinds of instabilities, we first employed a dynamic symmetric panel causality test and present the results as follows.

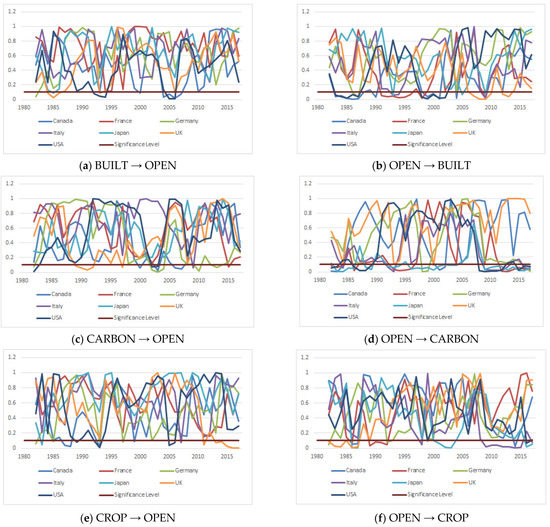

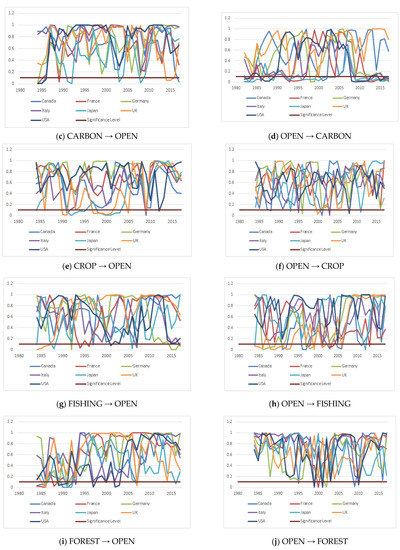

It is important to establish a connection between economic theory and hypothesis testing by investigating the causal relationship of two or more variables. To this end, we first tested the relationship between the environment and OPEN using the dynamic symmetrical causality techniques. In doing so, we checked the causality relationship without considering the positive or negative shocks on variables. The results of the dynamic symmetric causality analysis suggest a bidirectional causality relationship between the sub-components of the ecological footprint and OPEN in many periods. Although the findings in Appendix A reveal a few causality relationships, the results in Figure 1 support the existence of causality for more relationships. For instance, by ignoring instabilities, the findings in Appendix A show that there is no causality relationship between BUILT and OPEN for any countries. However, the first part of Figure 1 shows that there is an episodic causality relationship in the analysis period. Therefore, we can conclude that by testing the causality relationship in a dynamic framework, we can reveal some hidden causalities. Appendix B periodically presents the existence and direction of the relationship between the variables. It is seen that there is a bidirectional dynamic symmetric causality relationship between all sub-components of the ecological footprint and OPEN in G7 countries in different periods. If one considers the OPEN variable in terms of production and consumption patterns, its environmental effect is much more powerful, and improvements in the environmental factors or negative developments can affect the foreign trade balance. Considering all the sub-components of the ecological footprint, Appendix B shows the date ranges for which bidirectional causality exists.

Figure 1.

The results of the symmetric panel causality test.

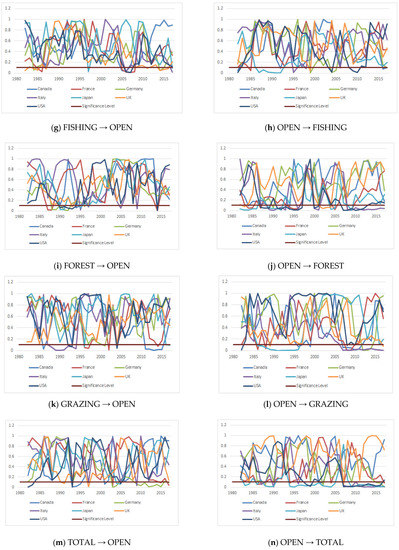

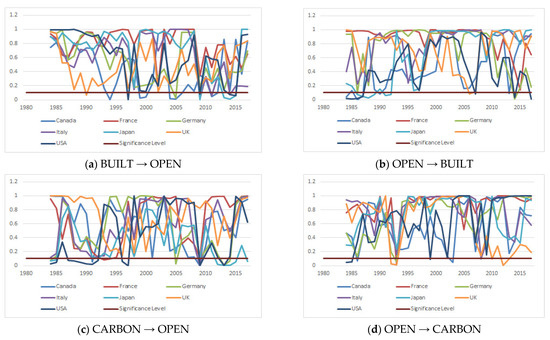

As stated by Granger and Yoon [7], a separate examination of positive and negative shocks on the variables is required in causality tests. For this reason, we re-analyzed the causal inference by separating the positive and negative shocks. In dynamic asymmetric causality analysis, positive shocks to the sub-components of the ecological footprint may trigger environmental problems even more. In that sense, we exemplified those problems, such as the increase in the production of sectors harmful to the environment, incentives for these sectors, increase in fossil fuel consumption, decrease in environmental awareness, excessive consumption, increase in investment costs that will reduce environmental pollution in the production process, etc. Positive shocks to the OPEN variable, on the other hand, express negative processes on foreign trade. In other words, it supports negative scenarios on imports and exports. In this context, policies such as increasing the costs of decision-makers on foreign trade, inability to take strong steps in global competition, reducing government incentives, increasing quota and customs tariffs, etc., can be counted.

In the next step, we investigated the causal inference between the positive shocks in a dynamic form and report the findings in Figure 2.

Figure 2.

The results of the asymmetric panel causality test for positive shocks.

As seen in Figure 2, there is a bidirectional dynamic asymmetric causality relationship from a positive shock to all sub-components of the ecological footprint to a positive shock to OPEN between different dates. Appendix C shows which years and variables have a dynamic causal relationship on a country basis.

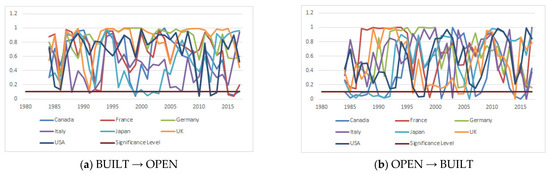

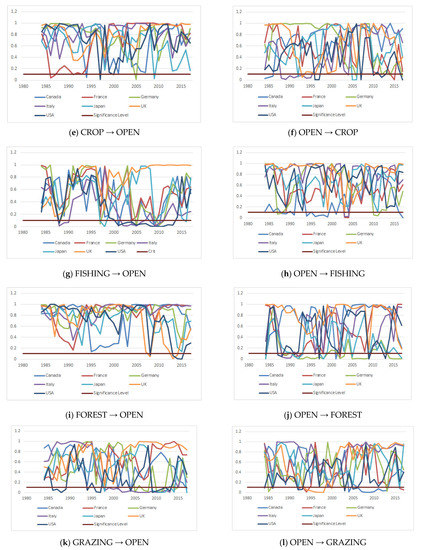

Negative shocks to the sub-components of the ecological footprint may occur in a way that will reduce environmental problems, for instance, developments such as increasing renewable energy sources, taking measures to reduce environmental pollution in production, policy implications to prevent excessive consumption, establishing cooperation to prevent climate change, etc. The negative shocks to the OPEN are the policies that will enable the development of foreign trade, such as supporting foreign trade companies, removing obstacles such as quotas and tariffs on foreign trade, establishing regional cooperation that can improve the volume of trade, etc. In the next stage, we investigated the causality relationship between negative shocks by considering these issues, and the results are presented in Figure 3.

Figure 3.

The results of the asymmetric panel causality test for negative shocks.

As seen in Figure 3, there is a bidirectional dynamic asymmetric causality relationship from a negative shock to all sub-components of the ecological footprint to a negative shock to OPEN between different dates. Appendix D shows which years and variables have a dynamic causal relationship on a country basis.

In the global economy, the interdependence of countries has strengthened. Important developments in other countries or extraordinary situations within the country can affect many factors, especially socioeconomic variables. The important developments mentioned above are war, natural disasters, major policy changes, terrorist incidents, economic crises, etc. These situations are considered in the research and can affect relationships such as symmetric and asymmetric causality and cointegration between the variables. Due to the stated reasons, it is thought that significant changes, both in that country and in the global world, affect this causality relationship during periods of strong causality relationships in the countries included in the analysis. When we look at some periods in which these strong causality relationships are experienced, this situation is even more clear. For example,

- ➢

- In the OPEN → BUILT causality relationship in Annex 2, where the results of dynamic symmetric causality analysis are included, a strong causality relationship is observed in almost all countries in 2009. This date, on the other hand, can be interpreted as the effect of both the collapse experienced in all world economies after the 2008 global crisis and the recovery efforts afterward. Again, it is seen that there was a strong causality relationship in all countries in 1986 between many variables, especially the OPEN → CROP causality relationship. The year 1986 was the year of the Chernobyl nuclear power plant explosion, which is seen as the biggest environmental disaster in the history of the world.

- ➢

- If one examines Annex 3, which includes the results of dynamic asymmetric causality analysis between positive shocks, there is a strong causal relationship between many variables in Canada in 2015. As the reason for this, it is thought that the federal elections held in Canada in 2015 will have significant effects in terms of both environmental and economic policies.

- ➢

- Looking at Annex 4, which includes the results of dynamic asymmetric causality analysis between negative shocks, the year 2014 in Germany draws attention due to the strong causality relationship between many variables. The year 2014 is the period when an armament budget of 100 billion Euros was accepted for the modernization of the army in Germany after the Crimean conflict between Ukraine and Russia. It is estimated that this budget will create effects between variables, especially in the economic field.

Our findings are generally in line with the limited studies in the literature, such as [8,14,20,28,29,30,31,32]. We would like to note that Moran et al. [33] also suggested contradictory results in some perspectives. Considering the method, variables, and sample, our study offers an original contribution to the environmental economics literature.

5. Conclusions

In this study, we have investigated and analyzed the relations between the ecological footprint (including its sub-components) and trade openness in G7 countries (Germany, France, Canada, Italy, Japan, the UK, the USA) from 1970 to 2017. By making use of mathematical modeling, given as Equations (1)–(6), we have derived not only the symmetric and asymmetric panel causality test but also dynamics of symmetric and asymmetric panel forms to observe possible instabilities. The obtained results suggested a possible relationship between the trade openness and environmental pollution indicators in some years of the analysis period and between the negative and positive shocks. Our analysis can be numerically summarized as follows.

The outputs of the symmetric panel causality test showed that there is a unidirectional causality:

- From CARBON to OPEN in Canada (14.874 test statistics value at 1% significance level) and Germany (16.436 test statistics value at 5% significance).

- From OPEN to CARBON in Italy (4.451 test statistics value at 1% significance level) and Japan (4.785 test statistics value at 5% significance).

- From OPEN to CROP for Germany (8.379 test statistics value at 10% significance level) and the UK (13.918 test statistics value at 5% significance level).

- From OPEN to FISHING for the UK (2.681 test statistics value at 5% significance level).

- From FOREST to OPEN for Japan (3.008 test statistics value at 5% significance level).

- From OPEN to FOREST for France (8.194 test statistics value at 1% significance level), Germany (10.694 test statistics value at 1% significance level), the UK (4.550 test statistics value at 1% significance level), and the USA (15.705 test statistics value at 5% significance level).

- From GRAZING to OPEN for only Germany (19.706 test statistics value at 1% significance level).

- From TOTAL to OPEN for Canada (3.001 test statistics value at 10% significance level) and Germany (11.595 test statistics value at 1% significance level).

- From OPEN to TOTAL for France (8.483 test statistics value at 10% significance level), Italy (3.649 test statistics value at 1% significance level), and Japan (25.416 test statistics value at 1% significance level).

The outputs of the asymmetric panel causality test showed:

- For positive shocks, we found a one-way causality that runs from GRAZING to OPEN for Canada (3.742 test statistics value at 1% significance level) and the UK (7.640 test statistics value at 10% significance level).

- For negative shocks, we conclude that there is a unidirectional causality that runs from FISHING to OPEN for Italy (33.333 test statistics value at 10% significance level), and from FOREST to OPEN for Japan (21.487 test statistics value at 10% significance level).

One may infer from the obtained results that there may be a good relationship between the positive and negative components of the variables, which supports the dynamics of symmetric and asymmetric causality relationships. Seemingly, these types of works will continue to be studied for a while due to their interesting reflections in the fields of mathematical modeling in economics, ecology, and the environment.

Author Contributions

Writing—original draft preparation, V.Y. and İ.Ç.; writing—review and editing, V.Y., İ.Ç. and S.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No data were used to support the study.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Results of Symmetric and Asymmetric Panel Causality Tests

| H0: BUILT ↛ OPEN | Symmetric Causality | Positive Shocks | Negative Shocks | |||

|---|---|---|---|---|---|---|

| Test Stat. | Bootstrap p-Value | Test Stat. | Bootstrap p-Value | Test Stat. | Bootstrap p-Value | |

| Canada | 0.038 | 0.777 | 0.889 | 0.946 | 5.941 | 0.841 |

| France | 2.394 | 0.957 | 2.594 | 0.994 | 4.056 | 1.000 |

| Germany | 10.918 | 0.332 | 19.490 | 0.275 | 6.148 | 0.965 |

| Italy | 0.226 | 0.528 | 6.065 | 0.870 | 3.423 | 1.000 |

| Japan | 0.014 | 0.876 | 0.752 | 0.986 | 0.085 | 0.999 |

| UK | 0.230 | 0.539 | 0.897 | 0.998 | 5.769 | 0.963 |

| USA | 6.045 | 0.129 | 3.710 | 0.850 | 1.464 | 0.906 |

| H0: OPEN ↛ BUILT | ||||||

| Canada | 1.038 | 0.892 | 4.206 | 0.365 | 0.048 | 0.998 |

| France | 1.677 | 0.847 | 6.271 | 0.785 | 0.984 | 0.999 |

| Germany | 6.134 | 0.972 | 6.572 | 0.975 | 2.538 | 0.989 |

| Italy | 0.680 | 0.215 | 0.299 | 0.957 | 2.455 | 0.993 |

| Japan | 0.067 | 0.949 | 1.776 | 0.945 | 2.997 | 0.926 |

| UK | 0.029 | 0.886 | 8.777 | 0.743 | 2.011 | 0.993 |

| USA | 20.158 | 0.286 | 0.927 | 0.900 | 3.919 | 0.423 |

| H0: CARBON ↛ OPEN | ||||||

| Canada | 14.874 * | 0.000 | 1.238 | 0.336 | 2.457 | 0.944 |

| France | 3.133 | 0.608 | 1.314 | 0.940 | 3.239 | 0.998 |

| Germany | 16.436 ** | 0.025 | 0.254 | 0.826 | 2.539 | 1.000 |

| Italy | 0.041 | 0.804 | 0.315 | 0.999 | 2.890 | 0.971 |

| Japan | 1.652 | 0.223 | 0.054 | 0.960 | 13.135 | 0.964 |

| UK | 0.080 | 0.744 | 4.292 | 0.734 | 1.483 | 1.000 |

| USA | 0.000 | 0.993 | 0.139 | 0.996 | 11.313 | 0.985 |

| H0: OPEN ↛ CARBON | ||||||

| Canada | 0.031 | 0.729 | 3.980 | 0.169 | 0.472 | 0.997 |

| France | 5.022 | 0.290 | 0.808 | 0.999 | 2.220 | 0.725 |

| Germany | 1.042 | 0.991 | 7.225 | 0.922 | 4.887 | 0.933 |

| Italy | 4.451 * | 0.007 | 3.487 | 0.949 | 1.337 | 0.978 |

| Japan | 4.785 ** | 0.013 | 3.827 | 0.423 | 0.051 | 1.000 |

| UK | 2.329 | 0.877 | 1.120 | 0.903 | 0.203 | 0.999 |

| USA | 14.974 | 0.102 | 2.054 | 0.979 | 4.398 | 0.995 |

| H0: CROP ↛ OPEN | ||||||

| Canada | 0.216 | 0.597 | 0.685 | 0.926 | 1.370 | 0.997 |

| France | 0.061 | 0.814 | 2.386 | 0.948 | 11.483 | 0.932 |

| Germany | 0.017 | 0.901 | 12.899 | 0.526 | 7.082 | 0.963 |

| Italy | 1.411 | 0.755 | 4.093 | 0.726 | 3.350 | 0.993 |

| Japan | 0.539 | 1.000 | 0.061 | 0.899 | 9.460 | 0.552 |

| UK | 0.082 | 0.895 | 3.093 | 0.857 | 4.296 | 0.999 |

| USA | 2.839 | 0.260 | 1.916 | 0.726 | 0.030 | 0.975 |

| H0: OPEN ↛ CROP | ||||||

| Canada | 0.015 | 0.911 | 3.238 | 0.590 | 2.685 | 0.930 |

| France | 0.027 | 0.883 | 10.965 | 0.832 | 3.562 | 0.848 |

| Germany | 8.379 *** | 0.054 | 9.166 | 0.934 | 3.651 | 0.931 |

| Italy | 2.164 | 0.426 | 0.059 | 0.983 | 10.648 | 0.639 |

| Japan | 9.127 | 0.909 | 0.579 | 0.697 | 0.136 | 0.677 |

| UK | 13.918 ** | 0.047 | 6.342 | 0.373 | 5.367 | 0.998 |

| USA | 1.242 | 0.317 | 0.262 | 0.783 | 0.461 | 0.479 |

| H0: FISHING ↛ OPEN | ||||||

| Canada | 0.170 | 0.918 | 0.009 | 0.985 | 5.061 | 0.922 |

| France | 2.066 | 0.384 | 0.273 | 0.985 | 16.961 | 0.694 |

| Germany | 1.482 | 0.837 | 3.190 | 0.932 | 8.921 | 0.811 |

| Italy | 0.904 | 0.182 | 2.147 | 0.668 | 33.333 *** | 0.093 |

| Japan | 0.002 | 0.972 | 0.068 | 0.820 | 12.134 | 0.775 |

| UK | 0.016 | 0.842 | 5.236 | 0.602 | 5.640 | 0.997 |

| USA | 0.032 | 0.993 | 0.005 | 0.986 | 3.009 | 0.886 |

| H0: OPEN ↛ FISHING | ||||||

| Canada | 0.001 | 0.999 | 5.017 | 0.776 | 0.196 | 0.937 |

| France | 0.792 | 0.961 | 9.463 | 0.739 | 1.940 | 0.949 |

| Germany | 0.718 | 0.894 | 2.640 | 1.000 | 3.403 | 0.554 |

| Italy | 0.313 | 0.780 | 3.859 | 0.628 | 0.035 | 0.997 |

| Japan | 2.375 | 0.773 | 1.010 | 0.954 | 0.241 | 0.858 |

| UK | 2.681 ** | 0.015 | 2.610 | 0.908 | 0.332 | 0.999 |

| USA | 1.076 | 0.981 | 1.879 | 0.973 | 0.101 | 0.997 |

| H0: FOREST ↛ OPEN | ||||||

| Canada | 1.129 | 0.285 | 0.293 | 0.645 | 3.940 | 1.000 |

| France | 0.999 | 0.518 | 0.034 | 1.000 | 4.252 | 1.000 |

| Germany | 0.836 | 0.317 | 2.074 | 0.999 | 22.297 | 0.533 |

| Italy | 0.028 | 0.948 | 0.021 | 1.000 | 5.619 | 0.922 |

| Japan | 3.008 ** | 0.014 | 0.116 | 0.962 | 21.487 *** | 0.061 |

| UK | 1.005 | 0.450 | 0.265 | 1.000 | 1.109 | 1.000 |

| USA | 0.111 | 0.568 | 0.046 | 0.997 | 20.257 | 0.815 |

| H0: OPEN ↛ FOREST | ||||||

| Canada | 10.488 | 0.109 | 4.949 | 0.646 | 0.003 | 1.000 |

| France | 8.194 * | 0.001 | 0.494 | 0.999 | 0.276 | 1.000 |

| Germany | 10.694 * | 0.006 | 2.079 | 1.000 | 5.239 | 0.960 |

| Italy | 0.009 | 1.000 | 0.170 | 1.000 | 1.036 | 1.000 |

| Japan | 0.880 | 0.569 | 6.115 | 0.571 | 0.635 | 0.974 |

| UK | 4.550 * | 0.003 | 0.616 | 0.979 | 1.204 | 1.000 |

| USA | 15.705 ** | 0.021 | 1.137 | 0.853 | 0.342 | 0.997 |

| H0: GRAZING ↛ OPEN | ||||||

| Canada | 0.589 | 0.799 | 3.742 * | 0.003 | 14.973 | 0.732 |

| France | 10.334 | 0.724 | 0.001 | 0.997 | 10.545 | 0.980 |

| Germany | 19.706 * | 0.002 | 3.641 | 0.598 | 1.816 | 0.985 |

| Italy | 2.014 | 0.928 | 0.881 | 0.984 | 8.449 | 0.941 |

| Japan | 0.002 | 0.985 | 0.409 | 0.358 | 8.777 | 0.469 |

| UK | 0.068 | 0.846 | 7.640 *** | 0.093 | 5.800 | 0.984 |

| USA | 0.216 | 1.000 | 4.465 | 0.161 | 19.451 | 0.245 |

| H0: OPEN ↛ GRAZING | ||||||

| Canada | 0.324 | 0.999 | 2.542 | 0.455 | 6.433 | 0.411 |

| France | 5.870 | 0.683 | 1.584 | 0.985 | 8.819 | 0.633 |

| Germany | 0.021 | 0.981 | 21.641 | 0.258 | 2.575 | 0.721 |

| Italy | 3.535 | 0.414 | 2.444 | 0.998 | 0.965 | 0.993 |

| Japan | 0.007 | 1.000 | 10.318 | 0.540 | 1.418 | 0.853 |

| UK | 0.704 | 0.497 | 0.090 | 0.788 | 6.319 | 0.940 |

| USA | 4.358 | 1.000 | 2.410 | 0.933 | 1.466 | 0.457 |

| H0: TOTAL ↛ OPEN | ||||||

| Canada | 3.001 *** | 0.051 | 0.015 | 0.976 | 4.440 | 0.997 |

| France | 1.381 | 0.476 | 1.268 | 0.949 | 9.233 | 0.998 |

| Germany | 11.595 * | 0.009 | 0.859 | 0.999 | 6.524 | 1.000 |

| Italy | 0.008 | 0.894 | 0.351 | 0.998 | 3.711 | 0.980 |

| Japan | 3.426 | 0.176 | 0.072 | 0.910 | 16.839 | 0.889 |

| UK | 0.166 | 0.745 | 2.919 | 0.885 | 3.304 | 1.000 |

| USA | 0.837 | 0.339 | 1.375 | 0.882 | 8.307 | 0.991 |

| H0: OPEN ↛ TOTAL | ||||||

| Canada | 1.943 | 0.863 | 5.193 | 0.465 | 2.445 | 0.941 |

| France | 8.483 *** | 0.058 | 0.844 | 0.966 | 0.124 | 1.000 |

| Germany | 0.844 | 0.950 | 11.598 | 0.939 | 4.109 | 0.985 |

| Italy | 3.649 * | 0.000 | 1.910 | 0.980 | 1.626 | 0.995 |

| Japan | 25.416 * | 0.000 | 5.133 | 0.270 | 0.003 | 1.000 |

| UK | 3.773 | 0.756 | 1.000 | 0.963 | 0.399 | 1.000 |

| USA | 11.960 | 0.175 | 1.566 | 0.967 | 0.038 | 0.998 |

Note: *, **, and *** show the statistical significance at the 1%, 5%, and 10% levels, respectively. Bootstrap p-values are obtained using 10,000 simulations.

Appendix B. Results of Dynamic Symmetric Panel Causality Test

| Direction of Causality | Canada | France | Germany | Italy | Japan | UK | USA |

|---|---|---|---|---|---|---|---|

| BUILT → OPEN | 2000-2004-2005-2006-2007 | - | 1982 | - | 1985 | 1984-1985-1986-1993-2006 | 1992-1993-1994-2005-2006 |

| OPEN → BUILT | 1983-1984-1985-1986-1987-1990-1999-2000-2001-2004-2009 | 1991-1992-1993-1994-1995-1996-1998-2009 | 1986-1987-2004 | 1993-1994-2009 | 1993-2005-2009 | 2007-2008-2009-2010-2012-2013 | 1983-1984-1985-1986-1987-1998-1999-2000-2001-2002 |

| CARBON → OPEN | 2000-2003-2006-2007 | 2015 | 1982-2002-2003-2004-2010-2013 | 2009 | - | 1989-1990-1991-1992-1997 | 1982-2002-2003 |

| OPEN → CARBON | 1982-1983-1984-2001-2002 | 1982-1983-1984-1986-1993-1994-1995-1996-2012-2013-2014-2015-2016-2017 | 1998-1999-2016-2017 | 1984-1992-1993-2009-2010-2011-2012-2013-2016-2017 | 1983-1984-1985-1986-1988-1989-1992-1993-1994-1996-1997-1998-1999-2000-2001-2002-2003-2004-2009-2010-2011-2012-2013-2014-2015-2016-2017 | 2000 | 1982-1983-1986-1987-1988-1989-2008-2009-2010-2011-2012-2015-2016-2017 |

| CROP → OPEN | 1987-1988-1993-1999 | - | 1982-1985-1993-1997 | 2007 | 1983 | 2011-2013-2014-2015-2016-2017 | 1989-1993-2005-2006 |

| OPEN → CROP | 1986-1987-2014 | 1986-1989-1990-1991-1992 | 1982-1992 | 1998-2009-2010-2011-2012-2013-2014-2015-2017 | 1986-1987-2001-2002-2003-2016-2017 | 1982-1983-1984-1986-1987 | 1999-2016 |

| FISHING → OPEN | 2005-2006 | 1985-1986-2005-2006-2007-2008 | 1984-2014 | 1987-2006-2017 | 1997-2017 | 1982-1984-1985-1987-2008-2011-2014-2015-2016 | 2006-2007 |

| OPEN → FISHING | 1982-1992-2016 | 1985 | 1999-2004-2005-2017 | 1995-1998-2006 | 1987-1988-1989-1990-1991-1992 | 1999 | 1982-2004-2009-2010 |

| Forest → OPEN | 1994-2014 | 1987-1988-2014 | 1988-1989-1991-1992-1996 | 1995-1997-2005-2009 | 1990-1991-1993-1995-1997 | 1993 | 1990-1991-1992-1993-1994-2014 |

| OPEN → Forest | 1984-1994 | 1984-1985-1987-1994-1995-1996-2005-2008-2009 | 1990-2001 | 1989-1990-1991-1992-1993-1996-2000-2001-2008-2009-2010-2011-2012-2013-2014-2015-2016-2017 | 1982-1983-1984-1985-1986-1989-1990-1991-1992-2004-2005-2009 | 1983-2001-2002-2003-2004 | 1987-1988-1989-1991-1992-1993-1994-1995-1996-1997-2000-2001-2007-2008-2009-2010-2011-2012 |

| GRAZING → OPEN | 1986-2011-2012-2013-2014-2015 | 1996-1997-2002-2004-2014 | 2001 | 1988-1989-1990-1991-1992-1993-1994 | 1996-2017 | - | 1992-1993-2004 |

| OPEN → GRAZING | 1996-1999-2007-2008-2009-2010-2011 | 1986-1988-2008-2009 | 2012-2013-2014 | 2007-2008-2009-2010-2011-2012-2013-2014-2015-2016-2017 | 1986-1987-1988-1989-1990-1991-1992-1993-1994-1995-1996 | 1989-2017 | 1982-2008-2010 |

| TOTAL → OPEN | 1993-1994-1995-2001 | 2003-2015-2017 | 1993-2003-2004-2009-2010-2011-2012-2013-2014-2015-2017 | 1997-2009 | 2004-2005 | 1991-1997 | 1982-1983-1993-2005 |

| OPEN → TOTAL | 2001-2002 | 1986-1987-1988-1990-1994-2004-2007-2017 | 1988-1999-2002-2009-2015-2016-2017 | 1987-1988-1990-1996-2007-2008-2009-2011-2012-2013-2014-2015-2016-2017 | 1983-1984-1986-1988-1989-1989-1990-1994-1995-1996-1997-1998-1999-2000-2001-2002-2003-2004-2005-2009-2010-2011-2012-2013-2014-2015-2016-2017 | 1984-2007 | 1998-1999-2007-2008-2009-2010-2011-2012-2013-2014-2015-2016 |

Appendix C. Results of Dynamic Asymmetric Panel Causality Test between Positive Shocks

| Direction of Causality | Canada | France | Germany | Italy | Japan | UK | USA |

|---|---|---|---|---|---|---|---|

| BUILT → OPEN | 1999-2010-2015-2016 | 2015-2016 | - | 1988-1991 | 1999-2001-2002-2003 | - | 2010-2012-2013 |

| OPEN → BUILT | 1985-1986-1987-1988-1990-1991-2001-2007-2008-2014-2015-2016 | 1999 | - | 2003-2016 | 1985-1986-1987-1988- 1989-1990-1991-1992-2006 | 1996-2004-2005-2014 | 1997-1998 |

| CARBON → OPEN | 2017 | 1984-1985-1989 | 1984 | - | 1984-1985-1991- 1992-2003-2008 | 2014-2015 | 1984-1985-1986 |

| OPEN → CARBON | 1984-2000-2015 | - | 1996-1997-1998-2004-2014 | 1999 | 1985-2000-2010 | 1988-1989-1990-1991-1992-1993-1994-1996 | - |

| CROP → OPEN | - | - | 2009 | 1991-2009 | 1984-1991-1992- 1993-1994-1995- 1998-1999-2000- 2001-2002-2003 | 1986-1990-1991-1997-1998-1999-2000-2001-2005-2009 | 2012 |

| OPEN → CROP | 1988-2001 | - | 1996 | 1995-2003 | 1993-2011 | 2000 | 2008 |

| FISHING → OPEN | 1997 | 1994-1996 | 1992-2015-2016 | 2007-2017 | 1984-1988-2006 | 1984-1985-1986-1987 | 2001 |

| OPEN → FISHING | 1991-1992-1996-1997-2003-2005-2006-2011 | 1997-1998-2001-2003-2004-2013 | 1986-1987-1988-1989-1991-1997-1998-1999 | 2001 | 1984-2012 | 1984-1985-1986-1988-1989-1990-1991-1992-1993-1999-2001-2002-2003-2006 | - |

| FOREST → OPEN | 1984-1985-1986-1990-1991-1992-2007 | 1984-1985-1986-1988-1991 | 1986-1989-1991-2007 | 1993-2000 | 1986-1991-1992-2007-2016 | 1986-2007 | 1989-1990-1991-1997-2000-2002-2003 |

| OPEN → FOREST | 1995-2009 | 2000 | 2002 | 1999-2001 | - | - | 1999-2001-2010 |

| GRAZING → OPEN | 1992-1993-1994-1996-2007 | 1989 | 1989-1990-1994 | - | 1992-2002-2003-2004- 2005-2006-2007- 2008-2009-2010-2011-2012 | 1993-1994-1996-2007 | 2004 |

| OPEN → GRAZING | 1990-2014-2015 | 1986-1988-2015-2016-2017 | 1984-2015-2016 | 1992-1993-1997-2012 | - | 1990-1994-2015-2016 | 1986-2017 |

| TOTAL → OPEN | 1998-1999-2016 | 1984-1989-2015-2016 | 1984 | - | 1984-1985-1991- 1992-2003 | - | 1984 |

| OPEN → TOTAL | 1991-1996-2001-2009-2015 | 1986-1998-2016 | 1986-1990-2002 | 1986-1997-1998 | 1996-2006 | 1986-1989-1991-1992-1993-1994-1995-1996-2016 | - |

Appendix D. Results of Dynamic Asymmetric Panel Causality Test between Negative Shocks

| Direction of Causality | Canada | France | Germany | Italy | Japan | UK | USA |

|---|---|---|---|---|---|---|---|

| BUILT → OPEN | 1994-1999-2000-2004-2005-2006-2011-2012 | - | 2005 | 2009-2011-2014 | 2009- 2013- 2014- 2015 | 1990 | 1997-2009-2014-2015 |

| OPEN → BUILT | 1984-1986-1987-1990-2013 | - | 1986-2014 | - | 1986- 1987- 1988- 1989- 1991- 1992 | 2006 | 1984-1985-1986-1987-2007-2014-2017 |

| CARBON → OPEN | 1991-2009 | 1993-1994 | 1984-2005-2013-2014 | 2009 | 1984- 1985- 1992- 2012- 2013- 2014- 2015- 2017 | 1984-1985-1987-1988-1989-1990-1991-1992-1996-1997-2009-2013 | - |

| OPEN → CARBON | 1986-2003 | 1993 | 1993 | 2008 | - | 1992-1993-2010-2012-2013 | 1984-1985-1999 |

| CROP → OPEN | 1994 | 1986-1987-1991 | 2005 | - | 2009 | - | 1997-2000 |

| OPEN → CROP | 1984-1985-1986 | 2015 | 2006-2012-2014-2017 | 1988-1989-1990-1991-1992-1993-1994-1995-2004 | 1992- 2005-2006 | 1993-1996 | 1996-1997-2007-2010-2012-2017 |

| FISHING → OPEN | 2001-2004-2005-2008-2009-2010 | 2009 | 1988-1997-2005-2010-2011 | 1988-1989-1990-2002-2003-2004-2005-2006-2009-2010-2011 | 1997- 1998- 2009-2016 | 1988-2001-2002-2003-2004-2005-2006-2007-2008-2009-2010-2011-2012-2013 | - |

| OPEN → FISHING | 1988-1989-1991-1994-1996-1997-1998-1999-2001-2017 | 2003-2004 | 1987-1988-2010-2011 | - | - | - | - |

| FOREST → OPEN | - | - | - | - | - | 2008-2013-2014 | 2008-2013-2014-2015 |

| OPEN → FOREST | 1984-2001 | 1988-1989-1991-1992-1998-2002 | 1984-1988-1989-1991-1992-1993-1994-1995-1996-1997-1998-1999-2002-2003-2005-2006-2007-2008-2009-2014-2015-2016-2017 | 1988-1989-1990-1992-1993-1996-2009 | 1984-1991- 1992-1993- 1998- 2005- 2009- 2017 | - | 1984-1987-1988-1991-1997-2002-2009-2013 |

| GRAZING → OPEN | 2001-2004-2017 | - | 2005-2007-2008-2010-2011-2012-2014 | 1998-1999-2000-2001-2002-2003-2005-2006-2007-2008-2009-2010-2011-2012-2013 | 1998- 2009- 2010- 2011- 2012- 2014- 2017 | - | 1986-1987-1988-1989-1994-1996-1997-2004-2009-2010-2011-2013 |

| OPEN → GRAZING | 2004-2007-2008-2009-2010-2011-2012-2013 | 1992-1994-2016-2017 | 1985-2013 | - | 1992-2016 | 1994-1995-1996-1997-1998-2000 | 1984-1986-1992-1993-2003-2005-2006 |

| TOTAL → OPEN | 1991-2001 | 1992-1993-2005 | 1984-1992-1993-1995-2005 | 1993-2009 | 1991- 1992- 1993- 2009- 2014- 2017 | - | 1987-1988-1991-1997-2009-2010-2013 |

| OPEN → TOTAL | 2000 | 2009 | - | 1995 | 1993 | 1992-2012-2016-2017 | 2009 |

References

- Moran, D.D.; Lenzen, M.; Kanemoto, K.; Geschke, A. Does ecologically unequal exchange occur? Ecol. Econ. 2013, 89, 177–186. [Google Scholar] [CrossRef]

- Wackernagel, M.; Rees, W. Our Ecological Footprint: Reducing Human Impact on the Earth; New Society Publishers: Gabriola Island, BC, Canada, 1996. [Google Scholar]

- Aitken, A.C. On Least-squares and Linear Combinations of Observations. In Proceedings of the Royal Society of Edinburgh; Cambridge University Press: Cambridge, UK, 1936; Volume 55, pp. 42–48. [Google Scholar]

- Andersson, J.O.; ve Lindroth, M. Ecologically unsustainable trade. Ecol. Econ. 2001, 37, 113–122. [Google Scholar] [CrossRef]

- Dam, T.A.; Pasche, M.; Werlich, N. Trade patterns and the ecological footprint a theory-based empirical approach. In Jena Economic Research Papers; No. 2017-005; Friedrich Schiller University Jena: Jena, Germany, 2017. [Google Scholar]

- Destek, M.A.; Sarkodie, S.A. Investigation of Environmental Kuznets Curve for Ecological Footprint: The Role of Energy And Financial Development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Granger, C.W.; Yoon, G. Hidden Cointegration; Economics Working Paper (2002-02); University of California: San Diego, CA, USA, 2002. [Google Scholar]

- Proops, J.L.R.; Atkinson, G.; Schlotheim, B.F.V.; Simon, S. Analysıs International Trade and The Sustainability Footprint: A Practical Criterion For İts Assessment. Ecol. Econ. 1999, 28, 75–97. [Google Scholar] [CrossRef]

- Rehman, A.; Radulescu, M.; Ma, H.; Dagar, V.; Hussain, I.; Khan, M.K. The Impact of Globalization, Energy Use, and Trade on Ecological Footprint in Pakistan: Does Environmental Sustainability Exist? Energies 2021, 14, 5234. [Google Scholar] [CrossRef]

- Udemba, E.N. Ascertainment of Ecological Footprint and Environmental Kuznets in China. In Assessment of Ecological Footprints. Environmental Footprints and Eco-Design of Products and Processes; Muthu, S.S., Ed.; Springer: Singapore, 2021. [Google Scholar] [CrossRef]

- Phillips, P.C.; Shi, S.; Yu, J. Testing for multiple bubbles: Historical episodes of exuberance and collapse in the S&P 500. Int. Econ. Rev. 2015, 56, 1043–1078. [Google Scholar]

- Gao, J.; Tian, M. Analysis of over-consumption of natural resources and the ecological trade deficit in Chin abased on ecological footprints. Ecol. Indic. 2016, 61, 899–904. [Google Scholar] [CrossRef]

- Choi, E.; Heshmati, A.; ve Cho, Y. An Empirical Study of the Relationship between CO2 Emissions, Economic Growth and Openness; IZA Discussion Paper Series 5304; IZA: Bonn, Germany, 2010. [Google Scholar]

- Al-Mulali, U.; Weng-Wai, C.; Low, S.T.; Mohammed, A.H. Investigating the environmental kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 2014, 48, 315–323. [Google Scholar] [CrossRef]

- Ali, S.; Yusop, Z.; Meo, M.S. Asymmetric openness-environment nexus in most open OIC countries: New evidence from quantile-on-quantile (QQ) estimation. Environ. Sci. Pollut. Res. 2022, 29, 26352–26370. [Google Scholar] [CrossRef]

- Usman, M.; Kousar, R.; Yaseen, M.R.; Makhdum, M.S.A. An empirical nexus between economic growth, energy utilization, trade policy, and ecological footprint: A continent-wise comparison in upper-middle-income countries. Environ. Sci. Pollut. Res. 2020, 27, 38995–39018. [Google Scholar] [CrossRef]

- Ansari, M.A.; Ahmad, M.R.; Siddique, S.; Mansoor, K. An environment Kuznets curve for ecological footprint: Evidence from GCC countries. Carbon Manag. 2020, 11, 355–368. [Google Scholar] [CrossRef]

- Fotros, M.H.; Maaboudi, R. The Impact of Trade Openness on CO2 Emissions in Iran, 1971–2005. 2010. Available online: https://www.gtap.agecon.purdue.edu/resources/download/5112.pdf (accessed on 14 February 2022).

- Kónya, L. Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Econ. Model. 2006, 23, 978–992. [Google Scholar] [CrossRef]

- Erdoğan, S.; Gedikli, A.; Kırca, M. A note on time-varying causality between natural gas consumption and economic growth in Turkey. Resour. Policy 2019, 64, 101504. [Google Scholar] [CrossRef]

- Jorgenson, A.K.; Rice, J. Structural dynamics of international trade and material consumption: A cross-national study of the ecological footprints of less-developed Countries. J. World Syst. 2005, 11, 57–77. [Google Scholar] [CrossRef] [Green Version]

- Ghita, S.I.; Saseanu, A.S.; Gogonea, R.M.; ve Huidumac-Petrescu, C.E. Perspectives of ecological footprint in european context under the ımpact of ınformation society and sustainable development. Sustainability 2018, 10, 3224. [Google Scholar] [CrossRef] [Green Version]

- Zellner, A. An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. J. Am. Stat. Assoc. 1962, 57, 348–368. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Hatemi-j, A. Asymmetric causality tests with an application. Empir. Econ. 2012, 43, 447–456. [Google Scholar] [CrossRef]

- Yilanci, V.; Aydin, M. Oil prices and stock prices: An asymmetric panel causality approach. J. Appl. Res. Financ. Econ. 2016, 2, 9–19. [Google Scholar]

- Dogan, E.; Ulucak, R.; Kocak, E.; Isik, C. The Use of Ecological Footprint in Estimating the Environmental Kuznets Curve Hypothesis for BRICST by Considering Cross-Section Dependence and Heterogeneity. Sci. Total Environ. 2020, 723, 138063. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Hervieux, M.-S.; Darné, O. Environmental Kuznets curve and ecological footprint: A time series analysis. Econ. Bull. 2015, 35, 814–826. [Google Scholar]

- Alam, S. Globalization, poverty and environmental degradation: Sustainable development in Pakistan. J. Sustain. Dev. 2010, 3, 103–114. [Google Scholar] [CrossRef] [Green Version]

- Saqib, M.; Benhmad, F. Does ecological footprint matter for the shape of the environmental Kuznets curve? Evidence from European countries. Environ. Sci. Pollut. Res. 2021, 28, 13634–13648. [Google Scholar] [CrossRef]

- Yilanci, V.; Pata, U.K.; Cutcu, I. Testing the Persistence of Shocks on Ecological Footprint and Sub-accounts: Evidence from the Big Ten Emerging Markets. Int. J. Environ. Res. 2022, 16, 10. [Google Scholar] [CrossRef]

- Moran, D.D.; Wackernagel, M.C.; Kitzes, J.A.; Heumann, B.W.; Phan, D.; Goldfinger, S.H. Trading spaces: Calculating embodied ecological footprints in international tradeusing a product land use matrix (PLUM). Ecol. Econ. 2009, 68, 1938–1951. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).