Selecting the Fintech Strategy for Supply Chain Finance: A Hybrid Decision Approach for Banks

Abstract

1. Introduction

2. Literature Review and Recent Developments

2.1. Blockchain Technique as a Financial Service Platform

2.2. Key Aspects for Selecting the Fintech Strategy for Supply Chain Finance

2.2.1. Legal Compliance

2.2.2. Organization and Operation Management

2.2.3. Technology

2.2.4. Finance

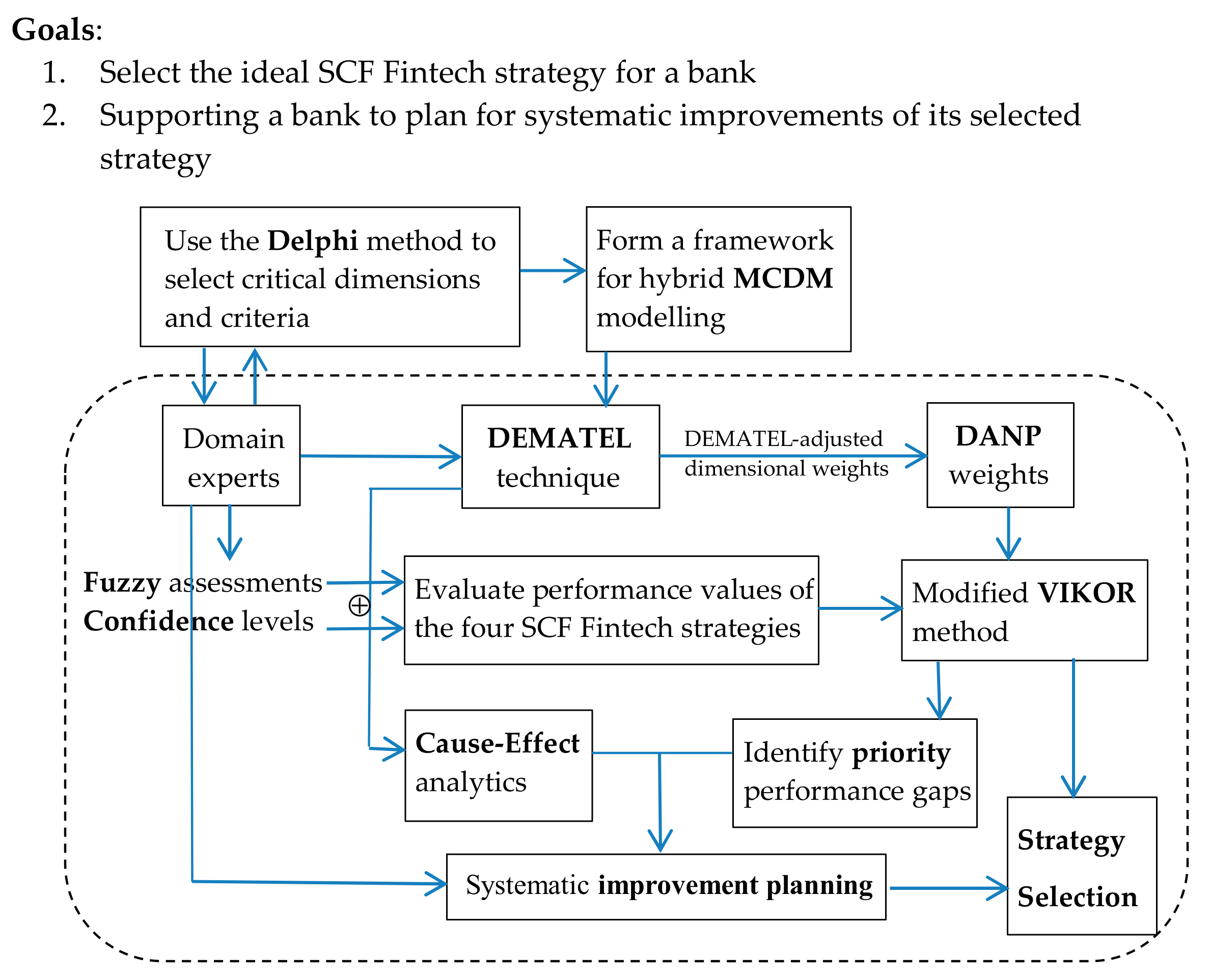

3. Hybrid Multiple Criteria Decision-Making (HMCDM) Approach

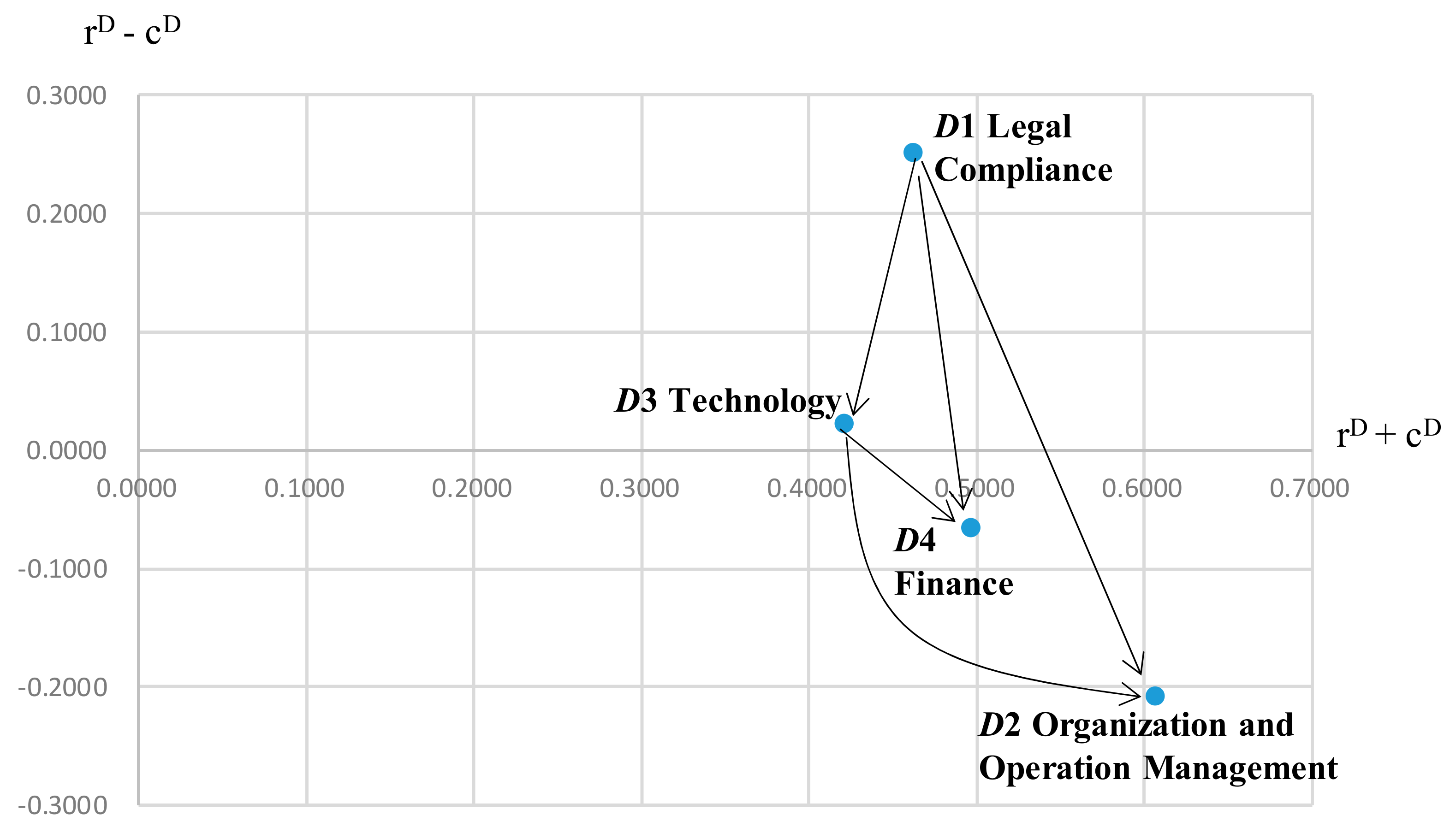

3.1. Decision-Making Trial and Evaluation Laboratory (DEMATEL) Technique

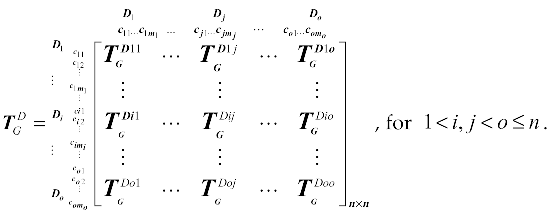

3.2. DEMATEL-Based ANP (DANP)

3.3. Fuzzy Confidence-Based Performance Aggregations

3.4. Modified VIKOR

4. Case Study from a Taiwan-Based Domestic Bank

5. Results and Discussion

5.1. Sensitivity Analysis

5.2. Discussion

6. Concluding Remarks

- Identify the critical dimensions and criteria for banks to evaluate the Fintech strategy on SCF;

- Clarify the cause–effect interrelationships among the dimensions and criteria for this problem;

- Construct a hybrid evaluation model for the KGI bank, as an illustrative example, to select its ideal Fintech strategy: blockchain-based leading operator.

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Indexes | (a) | (b) | (c) | (d) |

|---|---|---|---|---|

| IPCH | ISCH | BCL | BCP | |

| S | 0.471 | 0.367 | 0.333 | 0.398 |

| R | 0.052 | 0.051 | 0.051 | 0.051 |

| Q (v = 0.90) | 0.429 | 0.335 | 0.304 | 0.363 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.85) | 0.408 | 0.320 | 0.290 | 0.346 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.80) | 0.387 | 0.304 | 0.276 | 0.328 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.75) | 0.366 | 0.288 | 0.262 | 0.311 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.70) | 0.345 | 0.272 | 0.248 | 0.294 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.65) | 0.324 | 0.256 | 0.234 | 0.276 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

| Q (v = 0.60) | 0.303 | 0.241 | 0.220 | 0.259 |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) |

References

- Moretto, A.; Caniato, F. Can Supply Chain Finance help mitigate the financial disruption brought by Covid-19? J. Purch. Supply Manag. 2021, 27, 100713. [Google Scholar] [CrossRef]

- Liu, J.; Yan, L.; Wang, D. A Hybrid Blockchain Model for Trusted Data of Supply Chain Finance. Wirel. Pers. Commun. 2021, 30, 1–25. [Google Scholar] [CrossRef] [PubMed]

- Liu, L.; Zhang, J.Z.; He, W.; Li, W. Mitigating information asymmetry in inventory pledge financing through the Internet of things and blockchain. J. Enterp. Inf. Manag. 2021, 34, 1429–1451. [Google Scholar] [CrossRef]

- Daiy, A.K.; Shen, K.Y.; Huang, J.Y.; Lin, T.M.Y. A Hybrid MCDM Model for Evaluating Open Banking Business Partners. Mathematics 2021, 9, 587. [Google Scholar] [CrossRef]

- Amazon Managed Blockchain. Available online: https://aws.amazon.com/managed-blockchain/?nc1=h_ls (accessed on 16 May 2022).

- Yang, Y.; Chu, X.; Pang, R.; Liu, F.; Yang, P. Identifying and Predicting the Credit Risk of Small and Medium-Sized Enterprises in Sustainable Supply Chain Finance: Evidence from China. Sustainability 2021, 13, 5714. [Google Scholar] [CrossRef]

- Available online: https://www.jpmorgan.com/solutions/treasury-payments/global-trade/supply-chain-finance-working-capital (accessed on 16 May 2022).

- Li, M.; Shao, S.; Ye, Q.; Xu, G.; Huang, G.Q. Blockchain-enabled logistics finance execution platform for capital-constrained E-commerce retail. Robot. Comput.-Integr. Manuf. 2020, 65, 101962. [Google Scholar] [CrossRef]

- Alora, A.; Barua, M.K. Barrier analysis of supply chain finance adoption in manufacturing companies. Benchmarking Int. J. 2019, 26, 2122–2145. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Gurbaxani, V.; Xu, S.X. Migration to open-standard interorganizational systems: Network effects, switching costs, and path dependency. MIS Q. 2006, 30, 515–539. [Google Scholar] [CrossRef]

- Steinfield, C.; Markus, M.L.; Wigand, R.T. Through a Glass Clearly: Standards, Architecture, and Process Transparency in Global Supply Chains. J. Manag. Inf. Syst. 2014, 28, 75–108. [Google Scholar] [CrossRef]

- Demirkan, H.; Cheng, H.K.; Bandyopadhyay, S. Coordination Strategies in an SaaS Supply Chain. J. Manag. Inf. Syst. 2014, 26, 119–143. [Google Scholar] [CrossRef]

- Loukis, E.; Janssen, M.; Mintchev, I. Determinants of software-as-a-service benefits and impact on firm performance. Decis. Support Syst. 2019, 117, 38–47. [Google Scholar] [CrossRef]

- Liu, X.; Zhou, L.; Wu, Y.-C. Supply Chain Finance in China: Business Innovation and Theory Development. Sustainability 2015, 7, 14689–14709. [Google Scholar] [CrossRef]

- Dang, Y.; Singh, M.; Allen, T.T. Network Mode Optimization for the DHL Supply Chain. INFORMS J. Appl. Anal. 2021, 51, 179–199. [Google Scholar] [CrossRef]

- Jabbar, R.; Dhib, E.; Said, A.B.; Krichen, M.; Fetais, N.; Zaidan, E.; Barkaoui, K. Blockchain Technology for Intelligent Transportation Systems: A Systematic Literature Review. IEEE Access 2022, 10, 20995–21031. [Google Scholar] [CrossRef]

- Li, J.; Zhu, S.; Zhang, W.; Yu, L. Blockchain-driven supply chain finance solution for small and medium enterprises. Front. Eng. Manag. 2020, 7, 500–511. [Google Scholar] [CrossRef]

- Chen, N.P.; Shen, K.Y.; Liang, C.J. Hybrid decision model for evaluating Blockchain business strategy: A bank’s perspective. Sustainability 2021, 13, 5809. [Google Scholar] [CrossRef]

- Bahrami, Y.; Hassani, H.; Maghsoudi, A. Spatial modeling for mineral prospectivity using BWM and COPRAS as a new HMCDM method. Arab. J. Geosci. 2022, 15, 394. [Google Scholar] [CrossRef]

- Si, S.L.; You, X.Y.; Liu, H.C.; Zhang, P. Dematel Technique: A Systematic Review of the State-of-the-Art Literature on Methodologies and Applications. Math. Probl. Eng. 2018, 3696457. [Google Scholar] [CrossRef]

- Chiu, W.Y.; Tzeng, G.H.; Li, H.L. A new hybrid MCDM model combining DANP with VIKOR to improve e-store business. Knowl.-Based Syst. 2013, 37, 48–61. [Google Scholar] [CrossRef]

- Khan, S.; Maqbool, A.; Haleem, A.; Khan, M.I. Analyzing critical success factors for a successful transition towards circular economy through DANP approach. Manag. Environ. Qual. 2020, 31, 505–529. [Google Scholar] [CrossRef]

- Hofmann, E.; Belin, O. Supply Chain Finance Solutions; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Kim, H.M.; Laskowski, M. Toward an ontology-driven blockchain design for supply-chain provenance. Intell. Syst. Account. Financ. Manag. 2018, 25, 18–27. [Google Scholar] [CrossRef]

- Rijanto, A. Blockchain Technology Adoption in Supply Chain Finance. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3078–3098. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Sharma, R. Modeling the blockchain enabled traceability in agriculture supply chain. Int. J. Inf. Manag. 2020, 52, 101967. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Wamba, S.F. Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. Int. J. Inf. Manag. 2019, 46, 70–82. [Google Scholar] [CrossRef]

- Hofmann, E.; Strewe, U.M.; Bosia, N. Supply Chain Finance and Blockchain Technology: The Case of Reverse Securitisation; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Cantisani, A. Technological innovation processes revisited. Technovation 2006, 26, 1294–1301. [Google Scholar] [CrossRef]

- Kamble, S.; Gunasekaran, A.L.; Arha, H. Understanding the Blockchain technology adoption in supply chains-Indian context. Int. J. Prod. Res. 2019, 57, 2009–2033. [Google Scholar] [CrossRef]

- Schuetz, S.; Venkatesh, V. Blockchain, adoption, and financial inclusion in India: Research opportunities. Int. J. Inf. Manag. 2020, 52, 101936. [Google Scholar] [CrossRef]

- Schlecht, L.; Schneider, S.; Buchwald, A. The prospective value creation potential of Blockchain in business models: A delphi study. Technol. Forecast. Soc. Chang. 2021, 166, 120601. [Google Scholar] [CrossRef]

- Takeda, A.; Ito, Y. A review of FinTech research. Int. J. Technol. Manag. 2021, 86, 67–88. [Google Scholar] [CrossRef]

- Bu, Y.; Li, H.; Wu, X. Effective regulations of FinTech innovations: The case of China. Econ. Innov. New Technol. 2021, 1–19. [Google Scholar] [CrossRef]

- Hodson, D. The politics of FinTech: Technology, regulation, and disruption in UK and German retail banking. Public Adm. 2021, 99, 859–872. [Google Scholar] [CrossRef]

- Zhang, Z.; Song, Y.; Sahut, J.M.; Hong, P. How to establish a coordinated supervisory mechanism of internet finance companies in China? Can. J. Adm. Sci. 2021, 1–15. [Google Scholar] [CrossRef]

- PWC. Establishing Blockchain Policy. Available online: https://www.pwc.com/m1/en/publications/documents/establishing-blockchain-policy-pwc.pdf (accessed on 16 May 2022).

- Morikawa, M. Price competition vs. quality competition: Evidence from firm surveys. J. Econ. Bus. 2021, 116, 106007. [Google Scholar] [CrossRef]

- Bajaj, A. A study of senior information systems managers’ decision models in adopting new computing architectures. J. Assoc. Inf. Syst. 2000, 1, 4. [Google Scholar] [CrossRef][Green Version]

- Hsu, H.Y.; Liu, F.H.; Tsou, H.T.; Chen, L.J. Openness of technology adoption, top management support and service innovation: A social innovation perspective. J. Bus. Ind. Mark. 2019, 34, 575–590. [Google Scholar] [CrossRef]

- Khurana, S.; Haleem, A.; Luthra, S.; Mannan, B. Evaluating critical factors to implement sustainable oriented innovation practices: An analysis of micro, small, and medium manufacturing enterprises. J. Clean. Prod. 2021, 285, 125377. [Google Scholar] [CrossRef]

- Lustenberger, M.; Malešević, S.; Spychiger, F. Ecosystem readiness: Blockchain adoption is driven externally. Front. Blockchain 2021, 4, 720454. [Google Scholar] [CrossRef]

- Liu, S. Blockchain Technology Market Size Worldwide 2017–2027. Available online: https://www.statista.com/statistics/1015362/worldwide-blockchain-technology-market-size/ (accessed on 16 May 2022).

- Lingens, B.; Böger, M.; Gassmann, O. Even a Small Conductor Can Lead a Large Orchestra: How Startups Orchestrate Ecosystems. Calif. Manag. Rev. 2021, 63, 118–143. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain can impact financial services—The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. Chang. 2020, 158, 120166. [Google Scholar] [CrossRef]

- BBC. Hackers Steal Nearly $100m in Japan Crypto Heist. Available online: https://www.bbc.com/news/business-58277359 (accessed on 16 May 2022).

- BBC. Hackers Steal $600m in Major Cryptocurrency Heist. Available online: https://www.bbc.com/news/business-58163917 (accessed on 16 May 2022).

- BBC. BitMart: Crypto-Exchange Loses $150m to Hackers. Available online: https://www.bbc.com/news/technology-59549606 (accessed on 16 May 2022).

- Zheng, W.; Zheng, Z.; Chen, X.; Dai, K.; Li, P.; Chen, R. NutBaaS: A Blockchain-as-a-Service Platform. IEEE Access 2019, 7, 134422–134433. [Google Scholar] [CrossRef]

- Lu, Q.; Xu, X.; Liu, Y.; Weber, I.; Zhu, L.; Zhang, W. uBaaS: A unified blockchain as a service platform. Future Gener. Comput. Syst. 2019, 101, 564–575. [Google Scholar] [CrossRef]

- Ma, Z.; Zhao, W.; Luo, S.; Wang, L. TrustedBaaS: Blockchain-Enabled Distributed and Higher-Level Trusted Platform. Comput. Netw. 2020, 183, 107600. [Google Scholar] [CrossRef]

- Helo, P.; Shamsuzzoha, A.H.M. Real-time supply chain—A blockchain architecture for project deliveries. Robot. Comput.-Integr. Manuf. 2020, 63, 101909. [Google Scholar] [CrossRef]

- Zhu, X.N.; Peko, G.; Sundaram, D.; Piramuthu, S. Blockchain-Based Agile Supply Chain Framework with IoT. Inf. Syst. Front. 2021, 25, 1–2. [Google Scholar] [CrossRef]

- Ko, T.; Lee, J.; Ryu, D. Blockchain Technology and Manufacturing Industry: Real-Time Transparency and Cost Savings. Sustainability 2018, 10, 4274. [Google Scholar] [CrossRef]

- Chakuu, S.; Masi, D.; Godsell, J. Exploring the relationship between mechanisms, actors and instruments in supply chain finance: A systematic literature review. Int. J. Prod. Econ. 2019, 216, 35–53. [Google Scholar] [CrossRef]

- Zhao, L.; Huchzermeier, A. Supply Chain Finance; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Wang, L.; Luo, X.R.; Lee, F.; Benitez, J. Value creation in blockchain-driven supply chain finance. Inf. Manag. 2021, 103510. [Google Scholar] [CrossRef]

- Yan, N.; Tong, T.; Dai, H. Capital-constrained supply chain with multiple decision attributes: Decision optimization and coordination analysis. J. Ind. Manag. Optim. 2019, 15, 1831–1856. [Google Scholar] [CrossRef]

- Cocco, L.; Pinna, A.; Marchesi, M. Banking on Blockchain: Costs Savings Thanks to the Blockchain Technology. Future Internet 2017, 9, 25. [Google Scholar] [CrossRef]

- Melo, C.; Araujo, J.; Dantas, J.; Pereira, P.; Maciel, P. A model-based approach for planning blockchain service provisioning. Computing 2022, 104, 315–337. [Google Scholar] [CrossRef]

- Qin, B.Y.; Hao, Z.; Qiang, Z. Programmable Implementation and Blockchain Security Scheme Based on Edge Computing Firework Model. Int. J. Inf. Technol. Web Eng. 2021, 16, 1–22. [Google Scholar] [CrossRef]

- Xu, J.H.; Tian, Y.; Ma, T.H.; Al-Nabhan, N. Intelligent manufacturing security model based on improved blockchain. Math. Biosci. Eng. 2020, 17, 5633–5650. [Google Scholar] [CrossRef] [PubMed]

- Nazaritehrani, A.; Mashali, B. Development of E-banking channels and market share in developing countries. Financ. Innov. 2020, 6, 1–9. [Google Scholar] [CrossRef]

- Inoue, Y. Indirect innovation management by platform ecosystem governance and positioning: Toward collective ambidexterity in the ecosystems. Technol. Forecast. Soc. Chang. 2021, 166, 120652. [Google Scholar] [CrossRef]

- Opricovic, S.; Tzeng, G.H. Extended VIKOR method in comparison with outranking methods. Eur. J. Oper. Res. 2007, 178, 514–529. [Google Scholar] [CrossRef]

- BSOS Official Website. Available online: https://www.bsos.co/ (accessed on 31 May 2022).

- KGI Bank Official Website. Available online: https://www.kgibank.com.tw/en/ (accessed on 31 May 2022).

| Proprietary System | Partially Open System | Open System | ||

|---|---|---|---|---|

| Pure-Internet | Blockchain | |||

| Point-to-Point | LC | EDI | X | X |

| Private coordination hub | X | X |

| X |

| Shared coordination hub | X | X |

|

|

| Dimensions | Criteria | Reference |

|---|---|---|

| Legal Compliance (D1) | Financial Supervision and International Regulation (C1) | [32,33,34,35] |

| Authority Policy (C2) | [36,37,38] | |

| Organization and Operation Management (D2) | Competitor Movement (C3) | [39] |

| Top Management Support (C4) | [40,41,42,43] | |

| Increase Financing Business Opportunities (C5) | [44,45] | |

| Technology (D3) | Internet Security (C6) | [2,46,47,48,49] |

| Platform Maintenance Capability (C7) | [50,51,52] | |

| Improve the Timeliness of Information (C8) | [53,54,55] | |

| Enhanced Debt Guarantee (C9) | [56,57,58] | |

| Expand Business Application Scenarios (C10) | [18,59] | |

| Finance (D4) | System Construction Cost (C11) | [60] |

| System Maintenance Cost (C12) | [61,62,63] | |

| Increase Profitability and Market Share (C13) | [64,65] |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.000 | 3.923 | 3.231 | 3.538 | 2.231 | 1.154 | 0.538 | 1.154 | 1.923 | 1.615 | 1.538 | 1.385 | 1.231 |

| C2 | 0.154 | 0.000 | 3.615 | 3.308 | 2.846 | 1.308 | 0.615 | 1.385 | 1.923 | 1.385 | 1.231 | 0.923 | 1.231 |

| C3 | 0.154 | 0.538 | 0.000 | 3.077 | 1.385 | 0.769 | 0.538 | 0.462 | 0.538 | 0.923 | 0.538 | 0.692 | 1.769 |

| C4 | 0.154 | 0.462 | 1.077 | 0.000 | 0.692 | 0.462 | 0.538 | 0.769 | 0.615 | 0.769 | 0.538 | 0.692 | 0.462 |

| C5 | 0.231 | 0.846 | 0.923 | 3.538 | 0.000 | 0.692 | 0.615 | 0.615 | 0.692 | 3.077 | 1.769 | 1.462 | 3.462 |

| C6 | 0.538 | 0.308 | 0.308 | 1.615 | 0.615 | 0.000 | 1.000 | 0.462 | 0.615 | 0.615 | 1.231 | 1.154 | 0.538 |

| C7 | 0.615 | 0.385 | 0.538 | 1.538 | 0.462 | 1.385 | 0.000 | 1.154 | 0.538 | 0.615 | 1.923 | 2.692 | 1.231 |

| C8 | 0.231 | 0.308 | 0.231 | 2.000 | 1.769 | 1.308 | 1.308 | 0.000 | 2.692 | 1.923 | 1.077 | 1.077 | 1.538 |

| C9 | 0.385 | 0.538 | 0.385 | 2.769 | 2.000 | 0.538 | 0.462 | 0.615 | 0.000 | 1.769 | 0.615 | 0.462 | 2.462 |

| C10 | 0.308 | 0.385 | 0.462 | 2.846 | 3.538 | 0.615 | 0.462 | 1.538 | 0.462 | 0.000 | 1.231 | 1.308 | 3.385 |

| C11 | 0.231 | 0.231 | 1.462 | 2.154 | 0.538 | 0.846 | 0.615 | 0.385 | 0.462 | 0.538 | 0.000 | 1.846 | 0.769 |

| C12 | 0.308 | 0.308 | 1.385 | 2.000 | 0.615 | 0.615 | 0.538 | 0.615 | 0.462 | 0.692 | 2.615 | 0.000 | 0.538 |

| C13 | 0.462 | 0.308 | 3.231 | 3.615 | 3.077 | 0.385 | 0.462 | 0.615 | 1.231 | 3.308 | 1.769 | 1.462 | 0.000 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.011 | 0.140 | 0.150 | 0.204 | 0.129 | 0.065 | 0.040 | 0.066 | 0.094 | 0.103 | 0.092 | 0.085 | 0.097 |

| C2 | 0.014 | 0.016 | 0.145 | 0.179 | 0.133 | 0.063 | 0.039 | 0.065 | 0.085 | 0.088 | 0.075 | 0.064 | 0.089 |

| C3 | 0.010 | 0.026 | 0.025 | 0.137 | 0.071 | 0.036 | 0.028 | 0.029 | 0.032 | 0.056 | 0.040 | 0.043 | 0.081 |

| C4 | 0.008 | 0.020 | 0.047 | 0.031 | 0.040 | 0.024 | 0.024 | 0.033 | 0.030 | 0.041 | 0.032 | 0.036 | 0.034 |

| C5 | 0.016 | 0.040 | 0.069 | 0.179 | 0.050 | 0.042 | 0.036 | 0.043 | 0.046 | 0.135 | 0.090 | 0.079 | 0.148 |

| C6 | 0.021 | 0.018 | 0.028 | 0.083 | 0.039 | 0.011 | 0.039 | 0.026 | 0.031 | 0.038 | 0.056 | 0.053 | 0.037 |

| C7 | 0.025 | 0.023 | 0.044 | 0.096 | 0.043 | 0.058 | 0.013 | 0.050 | 0.035 | 0.046 | 0.086 | 0.106 | 0.064 |

| C8 | 0.015 | 0.023 | 0.037 | 0.123 | 0.093 | 0.058 | 0.055 | 0.020 | 0.102 | 0.095 | 0.065 | 0.063 | 0.088 |

| C9 | 0.018 | 0.029 | 0.042 | 0.139 | 0.097 | 0.032 | 0.027 | 0.036 | 0.019 | 0.089 | 0.047 | 0.041 | 0.110 |

| C10 | 0.018 | 0.027 | 0.053 | 0.156 | 0.149 | 0.038 | 0.032 | 0.067 | 0.039 | 0.047 | 0.074 | 0.073 | 0.145 |

| C11 | 0.012 | 0.015 | 0.064 | 0.102 | 0.038 | 0.037 | 0.029 | 0.024 | 0.027 | 0.037 | 0.020 | 0.074 | 0.045 |

| C12 | 0.014 | 0.018 | 0.063 | 0.100 | 0.042 | 0.032 | 0.027 | 0.031 | 0.028 | 0.042 | 0.098 | 0.021 | 0.040 |

| C13 | 0.023 | 0.027 | 0.134 | 0.189 | 0.142 | 0.035 | 0.033 | 0.044 | 0.062 | 0.144 | 0.092 | 0.081 | 0.055 |

| Dimensions | Criteria | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| D1 | 0.356 | 0.105 | 0.462 | 0.251 | C1 | 1.275 | 0.207 | 1.482 | 1.069 |

| D2 | 0.199 | 0.407 | 0.606 | −0.208 | C2 | 1.055 | 0.422 | 1.477 | 0.633 |

| D3 | 0.221 | 0.199 | 0.420 | 0.022 | C3 | 0.614 | 0.900 | 1.514 | −0.287 |

| D4 | 0.216 | 0.281 | 0.496 | −0.065 | C4 | 0.400 | 1.717 | 2.117 | −1.318 |

| C5 | 0.972 | 1.067 | 2.038 | −0.095 | |||||

| C6 | 0.481 | 0.529 | 1.010 | −0.049 | |||||

| C7 | 0.689 | 0.423 | 1.112 | 0.266 | |||||

| C8 | 0.837 | 0.533 | 1.370 | 0.304 | |||||

| C9 | 0.727 | 0.629 | 1.355 | 0.098 | |||||

| C10 | 0.918 | 0.961 | 1.879 | −0.042 | |||||

| C11 | 0.522 | 0.868 | 1.391 | −0.346 | |||||

| C12 | 0.555 | 0.818 | 1.373 | −0.264 | |||||

| C13 | 1.061 | 1.031 | 2.092 | 0.029 |

| D1 | D2 | D3 | D4 | |

|---|---|---|---|---|

| D1 | 0.045 | 0.157 | 0.071 | 0.084 |

| D2 | 0.020 | 0.072 | 0.042 | 0.065 |

| D3 | 0.022 | 0.081 | 0.044 | 0.074 |

| D4 | 0.018 | 0.097 | 0.042 | 0.058 |

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0.009 | 0.058 | 0.029 | 0.030 | 0.029 | 0.046 | 0.044 | 0.034 | 0.033 | 0.034 | 0.037 | 0.037 | 0.039 |

| C2 | 0.118 | 0.069 | 0.073 | 0.072 | 0.072 | 0.039 | 0.040 | 0.050 | 0.052 | 0.051 | 0.048 | 0.047 | 0.046 |

| C3 | 0.137 | 0.140 | 0.038 | 0.145 | 0.084 | 0.069 | 0.088 | 0.054 | 0.056 | 0.054 | 0.140 | 0.138 | 0.130 |

| C4 | 0.186 | 0.172 | 0.214 | 0.094 | 0.217 | 0.203 | 0.193 | 0.179 | 0.184 | 0.161 | 0.225 | 0.220 | 0.183 |

| C5 | 0.117 | 0.128 | 0.110 | 0.123 | 0.061 | 0.096 | 0.087 | 0.136 | 0.129 | 0.153 | 0.084 | 0.092 | 0.137 |

| C6 | 0.035 | 0.037 | 0.043 | 0.033 | 0.029 | 0.015 | 0.057 | 0.035 | 0.031 | 0.034 | 0.047 | 0.039 | 0.021 |

| C7 | 0.022 | 0.023 | 0.033 | 0.034 | 0.026 | 0.054 | 0.013 | 0.033 | 0.027 | 0.028 | 0.036 | 0.033 | 0.020 |

| C8 | 0.036 | 0.038 | 0.034 | 0.046 | 0.030 | 0.035 | 0.050 | 0.012 | 0.036 | 0.060 | 0.030 | 0.038 | 0.027 |

| C9 | 0.051 | 0.050 | 0.038 | 0.042 | 0.032 | 0.043 | 0.034 | 0.062 | 0.019 | 0.035 | 0.034 | 0.034 | 0.038 |

| C10 | 0.056 | 0.052 | 0.065 | 0.057 | 0.095 | 0.052 | 0.045 | 0.058 | 0.087 | 0.042 | 0.047 | 0.051 | 0.088 |

| C11 | 0.079 | 0.077 | 0.079 | 0.102 | 0.093 | 0.129 | 0.112 | 0.100 | 0.079 | 0.085 | 0.040 | 0.167 | 0.109 |

| C12 | 0.072 | 0.066 | 0.085 | 0.114 | 0.081 | 0.121 | 0.138 | 0.098 | 0.069 | 0.084 | 0.144 | 0.035 | 0.096 |

| C13 | 0.083 | 0.092 | 0.161 | 0.108 | 0.151 | 0.084 | 0.083 | 0.136 | 0.186 | 0.165 | 0.087 | 0.068 | 0.065 |

| Crisp Assessment | Confidence-Based Fuzzy | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Criteria | DANP Weights | (a) IPCH | (b) ISCH | (c) BCL | (d) BCP | DANP Weights | (a) IPCH | (b) ISCH | (c) BCL | (d) BCP |

| C1 | 3.47% | 2.75 | 3.75 | 4.00 | 3.75 | 3.47% | 1.53 | 1.63 | 1.65 | 1.63 |

| C2 | 6.10% | 3.75 | 4.00 | 4.75 | 4.63 | 6.10% | 1.63 | 1.65 | 2.86 | 2.85 |

| C3 | 10.67% | 4.63 | 5.75 | 6.38 | 6.25 | 10.67% | 2.80 | 4.54 | 5.10 | 5.06 |

| C4 | 18.09% | 8.13 | 8.13 | 8.63 | 8.13 | 18.09% | 8.23 | 7.91 | 8.46 | 7.91 |

| C5 | 11.07% | 7.13 | 7.88 | 8.50 | 7.38 | 11.07% | 6.56 | 8.12 | 8.40 | 6.65 |

| C6 | 3.48% | 3.25 | 4.00 | 4.13 | 3.63 | 3.48% | 1.58 | 1.65 | 1.66 | 1.61 |

| C7 | 2.99% | 3.88 | 4.38 | 4.25 | 3.88 | 2.99% | 1.64 | 2.10 | 2.09 | 1.64 |

| C8 | 3.67% | 7.75 | 7.63 | 7.88 | 7.75 | 3.67% | 7.95 | 7.57 | 8.00 | 7.63 |

| C9 | 3.85% | 5.88 | 7.75 | 7.63 | 7.50 | 3.85% | 4.85 | 7.95 | 7.57 | 7.54 |

| C10 | 6.36% | 5.63 | 7.75 | 8.50 | 8.38 | 6.36% | 4.50 | 7.71 | 8.40 | 8.34 |

| C11 | 9.66% | 6.25 | 5.88 | 6.38 | 6.50 | 9.66% | 4.68 | 4.96 | 5.11 | 5.14 |

| C12 | 9.34% | 6.13 | 6.13 | 6.38 | 6.38 | 9.34% | 4.65 | 5.03 | 5.11 | 5.11 |

| C13 | 11.24% | 6.50 | 8.13 | 8.38 | 6.63 | 11.24% | 5.14 | 8.23 | 8.35 | 5.46 |

| Score | 6.08 | 6.72 | 7.16 | 6.68 | Score | 5.00 | 6.04 | 6.38 | 5.73 | |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) | (Rank) | (4th) | (2nd) | (1st) | (3rd) | |

| Crisp Assessment | Confidence-Based Fuzzy | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Criteria | DANP Weights | (a) IPCH | (b) ISCH | (c) BCL | (d) BCP | DANP Weights | (a) IPCH | (b) ISCH | (c) BCL | (d) BCP |

| C1 | 3.47% | 0.725 | 0.625 | 0.600 | 0.625 | 3.47% | 0.847 | 0.838 | 0.835 | 0.837 |

| C2 | 6.10% | 0.625 | 0.600 | 0.525 | 0.538 | 6.10% | 0.837 | 0.835 | 0.714 | 0.715 |

| C3 | 10.67% | 0.538 | 0.425 | 0.363 | 0.375 | 10.67% | 0.720 | 0.546 | 0.490 | 0.494 |

| C4 | 18.09% | 0.188 | 0.188 | 0.138 | 0.188 | 18.09% | 0.177 | 0.209 | 0.154 | 0.209 |

| C5 | 11.07% | 0.288 | 0.213 | 0.150 | 0.263 | 11.07% | 0.344 | 0.188 | 0.160 | 0.335 |

| C6 | 3.48% | 0.675 | 0.600 | 0.588 | 0.638 | 3.48% | 0.842 | 0.835 | 0.834 | 0.839 |

| C7 | 2.99% | 0.613 | 0.563 | 0.575 | 0.613 | 2.99% | 0.836 | 0.790 | 0.791 | 0.836 |

| C8 | 3.67% | 0.225 | 0.238 | 0.213 | 0.225 | 3.67% | 0.205 | 0.243 | 0.200 | 0.237 |

| C9 | 3.85% | 0.413 | 0.225 | 0.238 | 0.250 | 3.85% | 0.515 | 0.205 | 0.243 | 0.246 |

| C10 | 6.36% | 0.438 | 0.225 | 0.150 | 0.163 | 6.36% | 0.550 | 0.229 | 0.160 | 0.166 |

| C11 | 9.66% | 0.375 | 0.413 | 0.363 | 0.350 | 9.66% | 0.532 | 0.504 | 0.489 | 0.486 |

| C12 | 9.34% | 0.388 | 0.388 | 0.363 | 0.363 | 9.34% | 0.535 | 0.497 | 0.489 | 0.489 |

| C13 | 11.24% | 0.350 | 0.188 | 0.163 | 0.338 | 11.24% | 0.486 | 0.177 | 0.165 | 0.454 |

| S (v = 1.00) | 0.392 | 0.328 | 0.284 | 0.332 | S (v = 1.00) | 0.471 | 0.367 | 0.333 | 0.398 | |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) | (Rank) | (4th) | (2nd) | (1st) | (3rd) | |

| R | 0.025 | 0.022 | 0.021 | 0.022 | R | 0.052 | 0.051 | 0.051 | 0.051 | |

| Q (v = 0.95) | 0.374 | 0.312 | 0.271 | 0.316 | Q (v = 0.95) | 0.450 | 0.351 | 0.318 | 0.380 | |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) | (Rank) | (4th) | (2nd) | (1st) | (3rd) | |

| Q (v = 0.90) | 0.355 | 0.297 | 0.258 | 0.301 | Q (v = 0.90) | 0.429 | 0.335 | 0.304 | 0.363 | |

| (Rank) | (4th) | (2nd) | (1st) | (3rd) | (Rank) | (4th) | (2nd) | (1st) | (3rd) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kao, Y.-C.; Shen, K.-Y.; Lee, S.-T.; Shieh, J.C.P. Selecting the Fintech Strategy for Supply Chain Finance: A Hybrid Decision Approach for Banks. Mathematics 2022, 10, 2393. https://doi.org/10.3390/math10142393

Kao Y-C, Shen K-Y, Lee S-T, Shieh JCP. Selecting the Fintech Strategy for Supply Chain Finance: A Hybrid Decision Approach for Banks. Mathematics. 2022; 10(14):2393. https://doi.org/10.3390/math10142393

Chicago/Turabian StyleKao, Yu-Cheng, Kao-Yi Shen, San-Ting Lee, and Joseph C. P. Shieh. 2022. "Selecting the Fintech Strategy for Supply Chain Finance: A Hybrid Decision Approach for Banks" Mathematics 10, no. 14: 2393. https://doi.org/10.3390/math10142393

APA StyleKao, Y.-C., Shen, K.-Y., Lee, S.-T., & Shieh, J. C. P. (2022). Selecting the Fintech Strategy for Supply Chain Finance: A Hybrid Decision Approach for Banks. Mathematics, 10(14), 2393. https://doi.org/10.3390/math10142393