Estimating Structural Shocks with the GVAR-DSGE Model: Pre- and Post-Pandemic

Abstract

:1. Introduction

2. Methodology

3. Data

4. Estimating the GVAR Model

5. Empirical Results and Long-Run Forecasts

6. DSGE-GVAR Model

7. Model Estimation

8. Shock Analysis

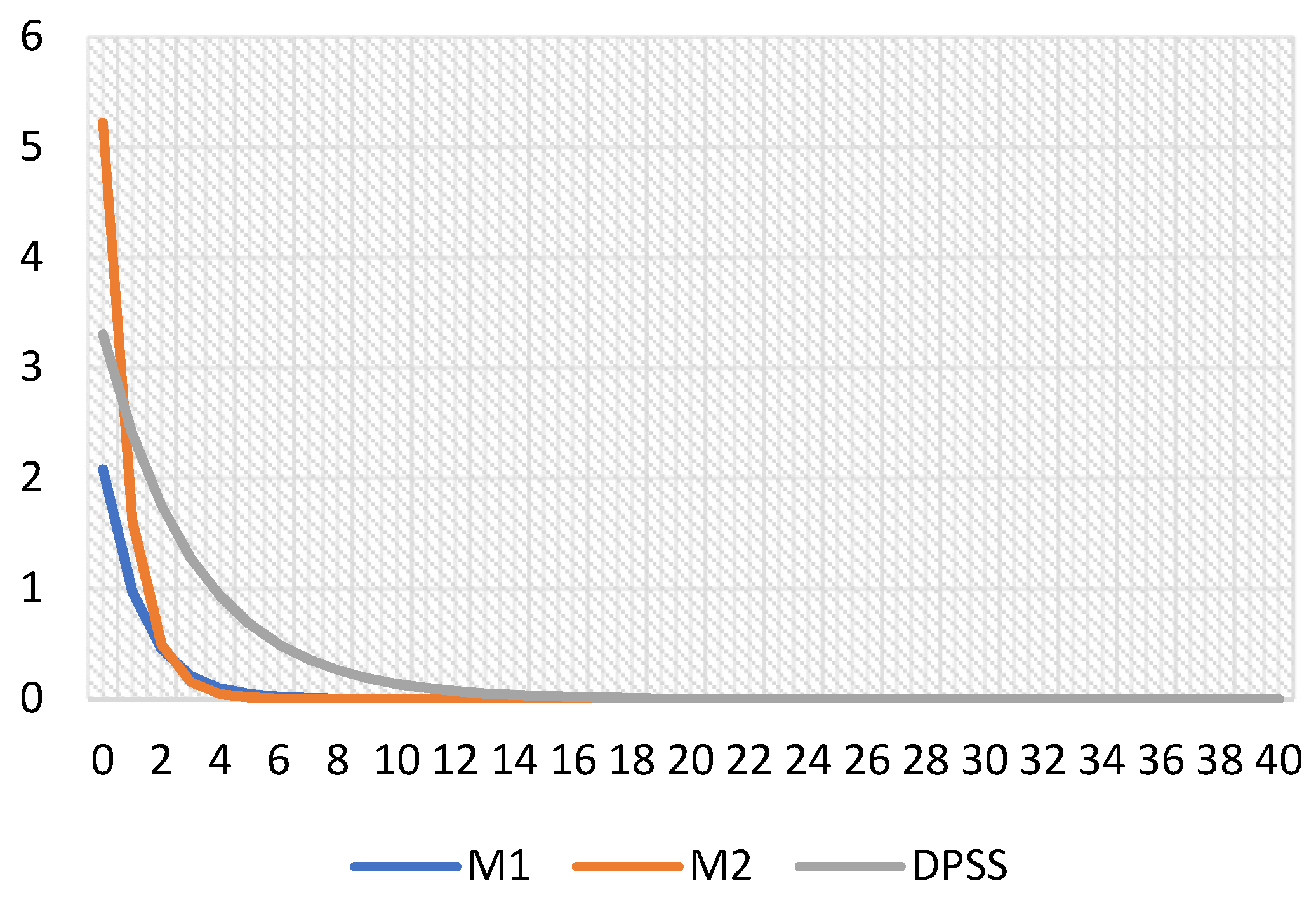

- Global Demand on oil price

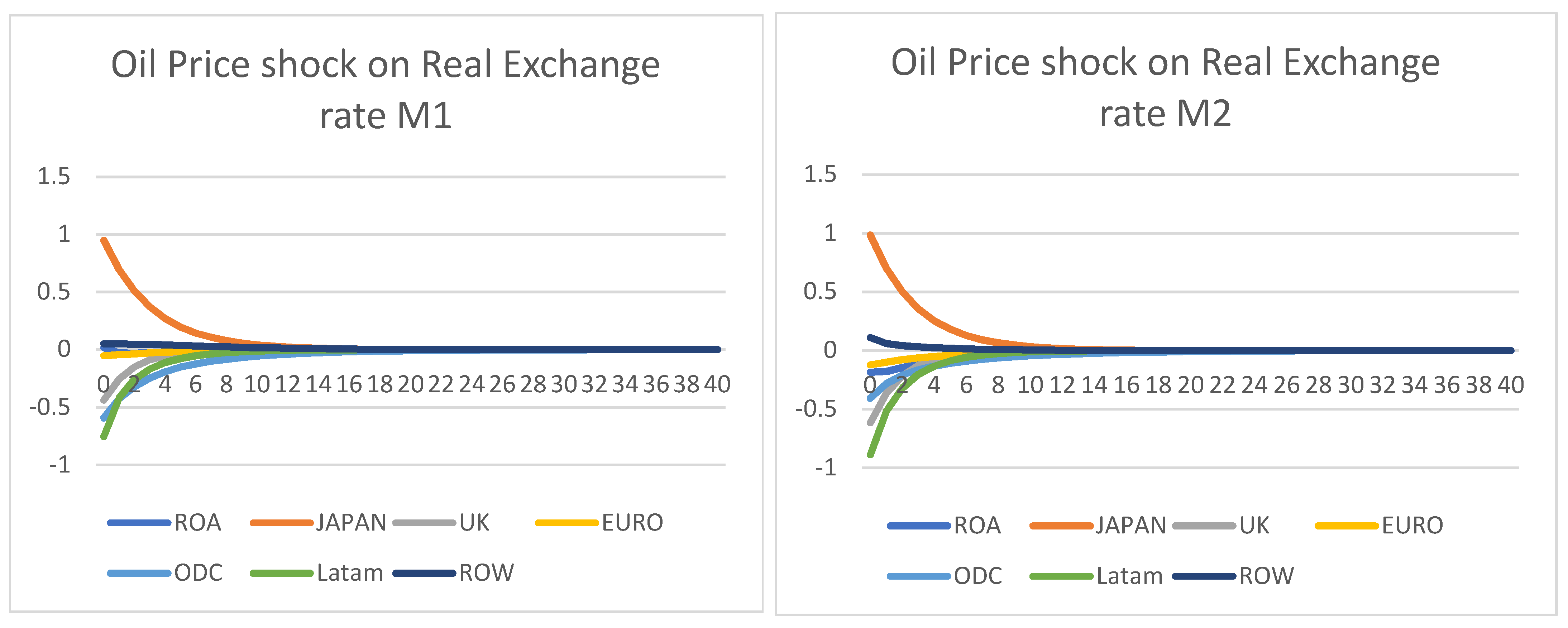

- Oil Price shock on real exchange rate

- US rate on inflation

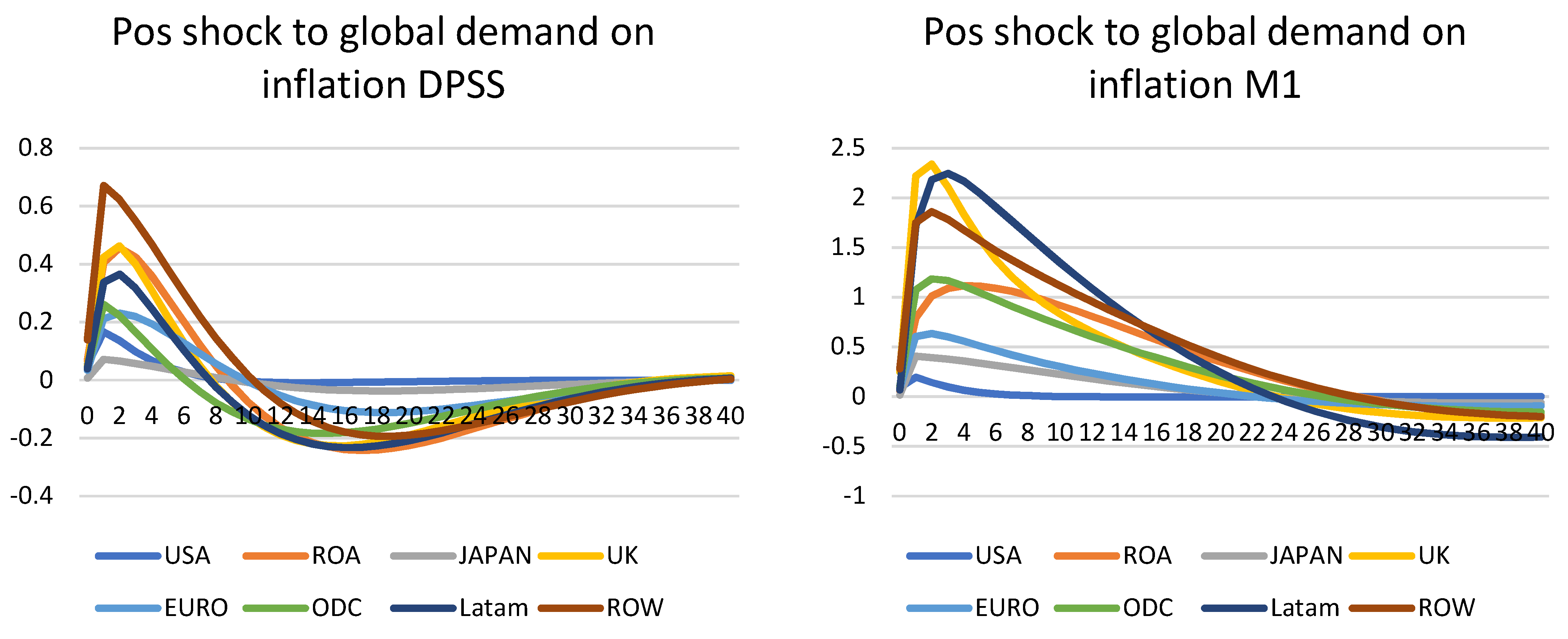

- Global demand on inflation

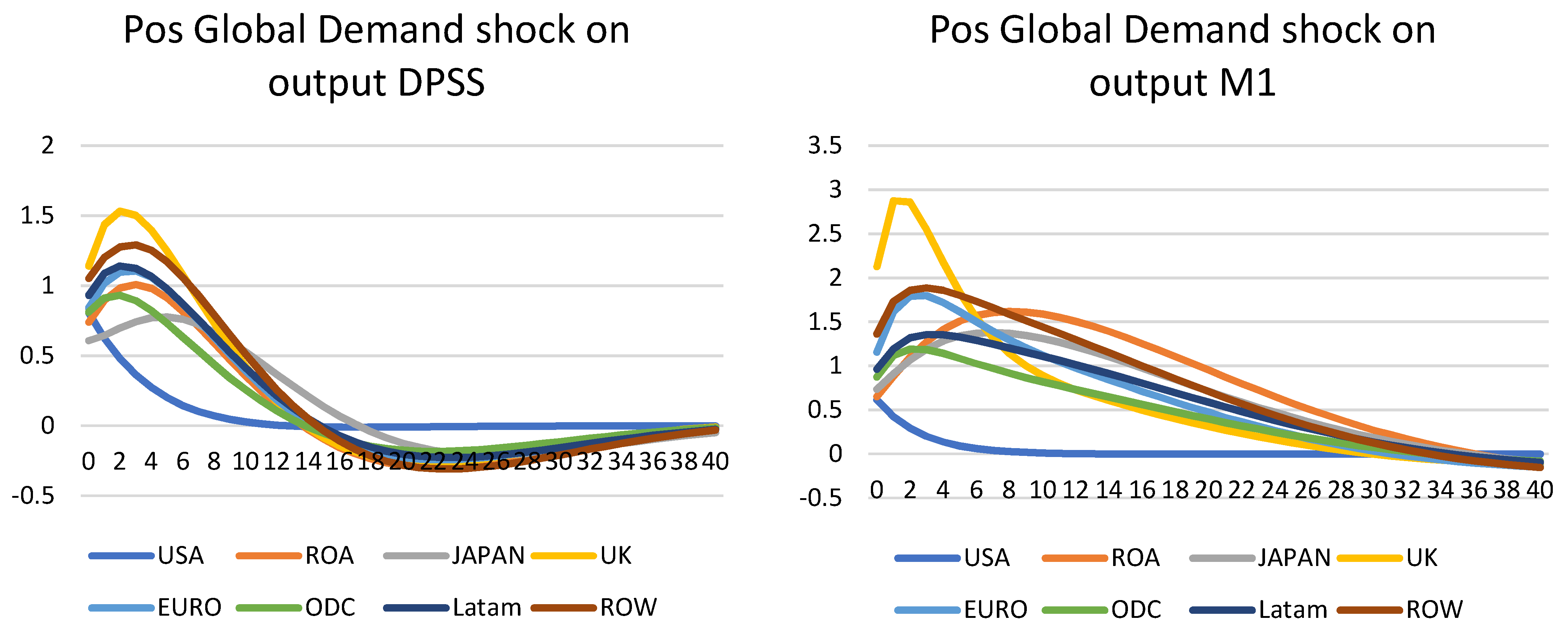

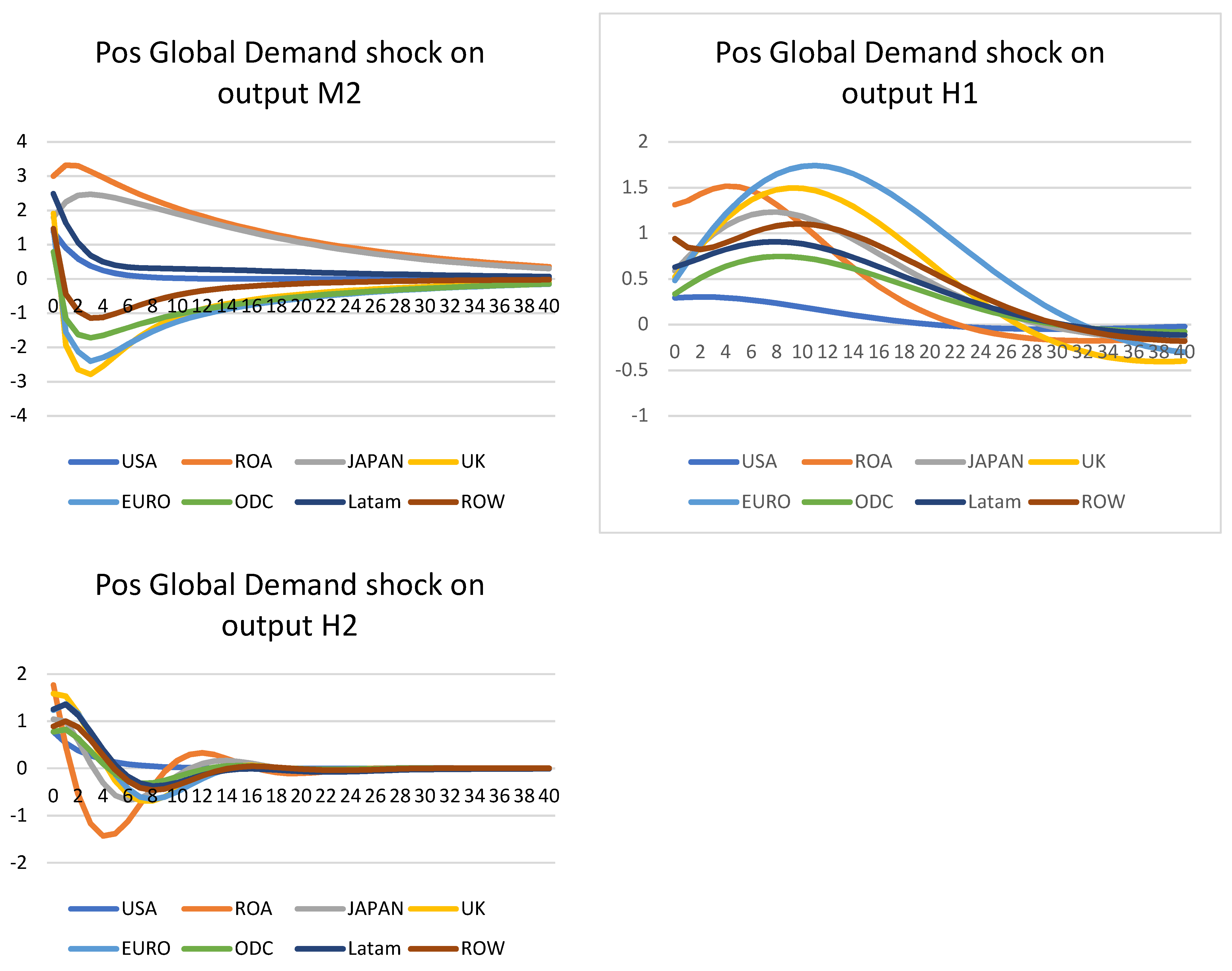

- Global demand on output

- Global supply on output

- Additional negative shocks

9. Comparison with the DSGE Literature

10. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| p | q | |

| ARGENTINA | 2 | 1 |

| AUSTRALIA | 1 | 1 |

| AUSTRIA | 1 | 1 |

| BELGIUM | 1 | 1 |

| BRAZIL | 2 | 1 |

| CANADA | 1 | 1 |

| CHINA | 2 | 1 |

| CHILE | 2 | 1 |

| FINLAND | 2 | 1 |

| FRANCE | 2 | 1 |

| GERMANY | 2 | 1 |

| INDIA | 2 | 1 |

| INDONESIA | 2 | 1 |

| ITALY | 2 | 1 |

| JAPAN | 2 | 1 |

| KOREA | 2 | 1 |

| MALAYSIA | 1 | 1 |

| MEXICO | 1 | 1 |

| NETHERLANDS | 2 | 1 |

| NORWAY | 2 | 1 |

| NEW ZEALAND | 2 | 1 |

| PERU | 2 | 1 |

| PHILIPPINES | 2 | 1 |

| SOUTH AFRICA | 2 | 1 |

| SAUDI ARABIA | 2 | 1 |

| SINGAPORE | 2 | 1 |

| SPAIN | 2 | 1 |

| SWEDEN | 2 | 1 |

| SWITZERLAND | 1 | 1 |

| THAILAND | 2 | 1 |

| TURKEY | 2 | 1 |

| UNITED KINGDOM | 2 | 1 |

| USA | 2 | 1 |

| Country | # Cointegrating Relations |

| ARGENTINA | 2 |

| AUSTRALIA | 5 |

| AUSTRIA | 3 |

| BELGIUM | 2 |

| BRAZIL | 2 |

| CANADA | 4 |

| CHINA | 2 |

| CHILE | 2 |

| FINLAND | 2 |

| FRANCE | 3 |

| GERMANY | 3 |

| INDIA | 2 |

| INDONESIA | 3 |

| ITALY | 2 |

| JAPAN | 2 |

| KOREA | 4 |

| MALAYSIA | 2 |

| MEXICO | 3 |

| NETHERLANDS | 2 |

| NORWAY | 5 |

| NEW ZEALAND | 3 |

| PERU | 4 |

| PHILIPPINES | 3 |

| SOUTH AFRICA | 3 |

| SAUDI ARABIA | 3 |

| SINGAPORE | 2 |

| SPAIN | 3 |

| SWEDEN | 2 |

| SWITZERLAND | 3 |

| THAILAND | 3 |

| TURKEY | 1 |

| UNITED KINGDOM | 1 |

| USA | 2 |

| Fcrit_0.05 | y | Dp | eq | ep | r | lr | ||

| ARGENTINA | F(4,140) | 2.44 | 1.16 | 0.98 | 1.05 | 0.75 | 0.89 | |

| AUSTRALIA | F(4,142) | 2.44 | 2.69 | 0.35 | 0.20 | 1.90 | 3.16 | 1.23 |

| AUSTRIA | F(4,144) | 2.43 | 3.86 | 1.34 | 3.29 | 3.18 | 0.68 | 7.25 |

| BELGIUM | F(4,145) | 2.43 | 2.47 | 1.96 | 1.48 | 5.03 | 5.36 | 1.92 |

| BRAZIL | F(4,141) | 2.44 | 2.77 | 2.28 | 0.63 | 1.09 | ||

| CANADA | F(4,143) | 2.43 | 1.24 | 2.20 | 1.80 | 3.85 | 2.93 | 1.08 |

| CHINA | F(4,141) | 2.44 | 3.97 | 4.28 | 1.09 | 6.00 | ||

| CHILE | F(4,140) | 2.44 | 1.12 | 2.29 | 1.27 | 2.14 | 0.34 | |

| FINLAND | F(4,140) | 2.44 | 1.37 | 4.98 | 2.33 | 1.52 | 1.80 | |

| FRANCE | F(4,138) | 2.44 | 1.39 | 3.50 | 0.34 | 0.26 | 2.31 | 3.02 |

| GERMANY | F(4,138) | 2.44 | 1.81 | 0.31 | 0.51 | 1.46 | 0.48 | 1.22 |

| INDIA | F(4,139) | 2.44 | 0.87 | 3.27 | 1.30 | 1.04 | 1.13 | 0.18 |

| INDONESIA | F(4,140) | 2.44 | 2.06 | 3.86 | 2.35 | 3.02 | ||

| ITALY | F(4,139) | 2.44 | 4.00 | 2.12 | 1.04 | 0.59 | 2.05 | 2.40 |

| JAPAN | F(4,139) | 2.44 | 1.65 | 0.20 | 0.53 | 4.27 | 1.37 | 2.39 |

| KOREA | F(4,137) | 2.44 | 3.41 | 4.00 | 2.00 | 2.27 | 0.47 | 1.61 |

| MALAYSIA | F(4,145) | 2.43 | 0.71 | 0.19 | 1.91 | 3.82 | 2.84 | |

| MEXICO | F(4,144) | 2.43 | 2.35 | 1.27 | 1.18 | 2.21 | ||

| NETHERLANDS | F(4,139) | 2.44 | 0.99 | 0.69 | 1.90 | 1.99 | 3.19 | 2.32 |

| NORWAY | F(4,136) | 2.44 | 2.36 | 1.64 | 1.25 | 1.43 | 1.99 | 3.50 |

| NEW ZEALAND | F(4,138) | 2.44 | 1.09 | 3.72 | 2.21 | 2.28 | 3.53 | 5.67 |

| PERU | F(4,139) | 2.44 | 2.56 | 4.69 | 3.02 | 6.10 | ||

| PHILIPPINES | F(4,139) | 2.44 | 4.10 | 1.29 | 0.42 | 0.07 | 3.11 | |

| SOUTH AFRICA | F(4,138) | 2.44 | 3.73 | 2.98 | 1.07 | 2.30 | 1.02 | 0.79 |

| SAUDI ARABIA | F(4,141) | 2.44 | 19.56 | 1.21 | 0.78 | |||

| SINGAPORE | F(4,140) | 2.44 | 2.32 | 2.21 | 2.12 | 1.48 | 3.86 | |

| SPAIN | F(4,138) | 2.44 | 4.07 | 3.01 | 1.01 | 1.80 | 1.63 | 1.45 |

| SWEDEN | F(4,139) | 2.44 | 0.99 | 4.96 | 4.09 | 1.89 | 2.03 | 3.07 |

| SWITZERLAND | F(4,144) | 2.43 | 5.93 | 4.06 | 1.37 | 2.00 | 1.01 | 1.68 |

| THAILAND | F(4,139) | 2.44 | 0.75 | 3.10 | 1.06 | 2.45 | 0.67 | |

| TURKEY | F(4,142) | 2.44 | 1.15 | 2.65 | 0.78 | 2.63 | ||

| UNITED KINGDOM | F(4,140) | 2.44 | 1.56 | 1.98 | 0.67 | 2.79 | 1.21 | 0.66 |

| USA | F(4,142) | 2.44 | 1.05 | 1.45 | 0.99 | 4.59 | 0.50 |

| Supply_Supply | Supply_Demand | Supply_MP | Supply_RE | Supply_Oil | Demand_Demand | Demand_MP | Demand_RE | Demand_Oil | MP_MP | MP_RE | MP_Oil | RE_RE | RE_Oil | Oil_Oil | |

| OIL | 1 | ||||||||||||||

| USA | 0.31 | 0.11 | 0.22 | 0.04 | −0.03 | 0.04 | 0.05 | −0.07 | 0.42 | 0.27 | −0.05 | 0.10 | |||

| CHINA | 0.02 | 0.01 | −0.08 | −0.07 | −0.01 | 0.07 | 0.07 | 0.00 | 0.02 | 0.09 | 0.03 | 0.20 | −0.04 | 0.01 | |

| JAPAN | 0.57 | 0.22 | 0.04 | 0.02 | −0.05 | 0.09 | 0.13 | 0.02 | 0.14 | 0.26 | −0.03 | −0.05 | −0.15 | 0.26 | |

| UNITED KINGDOM | 0.62 | 0.25 | 0.04 | 0.03 | −0.18 | 0.23 | 0.05 | 0.02 | −0.14 | 0.29 | 0.00 | 0.09 | −0.01 | −0.27 | |

| AUSTRIA | 0.62 | 0.24 | 0.02 | 0.04 | −0.15 | 0.19 | 0.04 | 0.01 | −0.11 | 0.34 | 0.00 | 0.19 | −0.02 | 0.11 | |

| BELGIUM | 0.62 | 0.25 | 0.03 | 0.03 | −0.18 | 0.21 | 0.05 | 0.03 | −0.13 | 0.32 | 0.00 | 0.00 | −0.01 | 0.10 | |

| FINLAND | 0.62 | 0.25 | 0.04 | 0.03 | −0.17 | 0.05 | 0.01 | −0.05 | −0.13 | 0.30 | 0.01 | 0.01 | −0.02 | 0.16 | |

| FRANCE | 0.63 | 0.25 | 0.05 | 0.03 | −0.15 | 0.13 | 0.08 | 0.00 | −0.05 | 0.31 | 0.00 | −0.05 | −0.03 | 0.06 | |

| GERMANY | 0.07 | 0.03 | 0.00 | 0.00 | 0.42 | 0.01 | 0.02 | −0.01 | 0.08 | 0.30 | 0.00 | 0.02 | −0.01 | 0.13 | |

| ITALY | 0.44 | 0.15 | 0.06 | 0.03 | 0.10 | 0.07 | 0.11 | 0.03 | 0.05 | 0.28 | 0.05 | −0.09 | 0.01 | −0.21 | |

| NETHERLANDS | 0.51 | 0.18 | 0.03 | 0.03 | 0.01 | 0.06 | 0.02 | 0.00 | −0.12 | 0.31 | 0.00 | 0.09 | −0.05 | −0.18 | |

| SPAIN | 0.62 | 0.24 | 0.05 | 0.03 | −0.09 | 0.06 | 0.05 | 0.02 | −0.19 | 0.23 | 0.04 | −0.09 | 0.03 | −0.12 | |

| NORWAY | 0.53 | 0.20 | 0.03 | 0.01 | −0.08 | 0.00 | 0.00 | 0.03 | −0.02 | 0.11 | 0.01 | −0.02 | 0.04 | −0.23 | |

| SWEDEN | 0.62 | 0.25 | 0.04 | 0.03 | −0.20 | 0.21 | 0.05 | 0.02 | −0.14 | 0.24 | 0.01 | 0.10 | 0.05 | −0.31 | |

| SWITZERLAND | 0.62 | 0.25 | 0.03 | 0.03 | −0.18 | 0.04 | 0.05 | 0.02 | 0.05 | 0.10 | −0.02 | 0.09 | 0.00 | 0.16 | |

| AUSTRALIA | 0.60 | 0.24 | 0.03 | 0.02 | −0.11 | 0.05 | 0.05 | −0.02 | 0.04 | 0.12 | 0.00 | −0.01 | 0.09 | −0.46 | |

| CANADA | 0.60 | 0.24 | 0.05 | 0.02 | −0.09 | 0.10 | 0.10 | −0.03 | 0.03 | 0.24 | −0.04 | 0.11 | 0.09 | −0.50 | |

| NEW ZEALAND | 0.62 | 0.24 | 0.04 | 0.03 | −0.16 | 0.06 | 0.09 | 0.03 | −0.04 | 0.09 | 0.01 | −0.04 | 0.09 | −0.33 | |

| ARGENTINA | 0.10 | 0.04 | 0.04 | −0.01 | −0.06 | −0.03 | −0.04 | 0.00 | 0.09 | 0.07 | 0.03 | 0.01 | −0.04 | −0.08 | |

| BRAZIL | 0.47 | 0.18 | 0.00 | 0.00 | −0.12 | 0.08 | 0.04 | 0.05 | −0.03 | 0.01 | 0.03 | −0.07 | 0.06 | −0.19 | |

| CHILE | 0.29 | 0.07 | 0.06 | 0.02 | 0.04 | 0.01 | 0.05 | 0.05 | −0.09 | 0.06 | 0.00 | −0.09 | 0.09 | −0.18 | |

| MEXICO | 0.16 | 0.04 | 0.00 | 0.07 | −0.17 | 0.00 | 0.10 | −0.03 | 0.13 | 0.09 | 0.01 | 0.01 | 0.11 | −0.47 | |

| PERU | −0.03 | 0.00 | 0.00 | 0.01 | 0.09 | 0.04 | 0.05 | −0.01 | −0.06 | −0.08 | −0.03 | 0.00 | 0.01 | 0.14 | |

| INDONESIA | −0.06 | −0.03 | −0.02 | −0.01 | −0.02 | 0.11 | 0.10 | −0.01 | −0.05 | 0.12 | 0.01 | 0.07 | −0.01 | −0.10 | |

| KOREA | 0.62 | 0.24 | 0.05 | 0.03 | −0.18 | 0.01 | −0.04 | −0.02 | 0.11 | 0.13 | 0.02 | −0.04 | 0.04 | −0.31 | |

| MALAYSIA | 0.62 | 0.25 | 0.02 | 0.02 | −0.16 | 0.07 | 0.07 | −0.05 | 0.05 | 0.06 | −0.01 | 0.04 | 0.09 | −0.08 | |

| PHILIPPINES | 0.62 | 0.25 | 0.03 | 0.03 | −0.19 | 0.05 | −0.02 | −0.03 | 0.10 | 0.13 | −0.01 | −0.02 | 0.06 | −0.08 | |

| SINGAPORE | 0.56 | 0.23 | 0.05 | 0.02 | −0.05 | 0.10 | −0.03 | −0.01 | −0.12 | 0.22 | 0.00 | 0.07 | 0.06 | −0.20 | |

| THAILAND | 0.62 | 0.25 | 0.02 | 0.02 | −0.13 | 0.00 | 0.00 | −0.04 | 0.04 | 0.20 | −0.04 | 0.11 | 0.03 | 0.14 | |

| INDIA | −0.13 | −0.06 | −0.11 | −0.01 | 0.02 | 0.02 | −0.09 | 0.01 | 0.04 | 0.10 | 0.02 | −0.13 | 0.03 | 0.28 | |

| SOUTH AFRICA | 0.18 | 0.05 | 0.10 | 0.01 | 0.14 | 0.06 | 0.02 | 0.03 | −0.06 | 0.09 | 0.01 | −0.18 | 0.01 | −0.12 | |

| SAUDI ARABIA | −0.13 | −0.05 | −0.08 | −0.01 | 0.04 | 0.00 | 0.06 | 0.01 | 0.11 | −0.04 | 0.37 | ||||

| TURKEY | 0.49 | 0.21 | −0.02 | 0.02 | −0.20 | 0.16 | −0.01 | 0.03 | 0.03 | 0.03 | 0.02 | −0.13 | 0.02 | 0.01 |

| Country | Dp_c | y_c | r_c | ep_c |

| ARGENTINA | 0.010 | 0.010 | 0.010 | 0.010 |

| AUSTRALIA | 0.015 | 0.015 | 0.015 | 0.015 |

| AUSTRIA | 0.006 | 0.006 | 0.006 | 0.006 |

| BELGIUM | 0.007 | 0.007 | 0.007 | 0.007 |

| BRAZIL | 0.035 | 0.035 | 0.035 | 0.035 |

| CANADA | 0.024 | 0.024 | 0.024 | 0.024 |

| CHINA | 0.134 | 0.134 | 0.136 | 0.134 |

| CHILE | 0.004 | 0.004 | 0.004 | 0.004 |

| FINLAND | 0.003 | 0.003 | 0.004 | 0.003 |

| FRANCE | 0.039 | 0.039 | 0.039 | 0.039 |

| GERMANY | 0.054 | 0.054 | 0.054 | 0.054 |

| INDIA | 0.059 | 0.059 | 0.059 | 0.059 |

| INDONESIA | 0.016 | 0.016 | 0.016 | 0.016 |

| ITALY | 0.035 | 0.035 | 0.035 | 0.035 |

| JAPAN | 0.081 | 0.081 | 0.082 | 0.081 |

| KOREA | 0.024 | 0.024 | 0.025 | 0.024 |

| MALAYSIA | 0.007 | 0.007 | 0.007 | 0.007 |

| MEXICO | 0.028 | 0.028 | 0.029 | 0.028 |

| NETHERLANDS | 0.012 | 0.012 | 0.012 | 0.012 |

| NORWAY | 0.005 | 0.005 | 0.005 | 0.005 |

| NEW ZEALAND | 0.002 | 0.002 | 0.002 | 0.002 |

| PERU | 0.004 | 0.004 | 0.004 | 0.004 |

| PHILIPPINES | 0.006 | 0.006 | 0.006 | 0.006 |

| SOUTH AFRICA | 0.009 | 0.009 | 0.009 | 0.009 |

| SAUDI ARABIA | 0.011 | 0.011 | 0.011 | |

| SINGAPORE | 0.004 | 0.004 | 0.004 | 0.004 |

| SPAIN | 0.026 | 0.026 | 0.027 | 0.026 |

| SWEDEN | 0.006 | 0.006 | 0.006 | 0.006 |

| SWITZERLAND | 0.006 | 0.006 | 0.006 | 0.006 |

| THAILAND | 0.010 | 0.010 | 0.010 | 0.010 |

| TURKEY | 0.018 | 0.018 | 0.018 | 0.018 |

| UNITED KINGDOM | 0.040 | 0.040 | 0.041 | 0.040 |

| USA | 0.260 | 0.260 | 0.263 | 0.260 |

| Region | Country | Dp_c | y_c | r_c | ep_c |

| japan | japan | 1.00 | 1.00 | 1.00 | 1.00 |

| la | arg | 0.12 | 0.12 | 0.12 | 0.12 |

| la | bra | 0.43 | 0.43 | 0.43 | 0.43 |

| la | chl | 0.05 | 0.05 | 0.05 | 0.05 |

| la | mex | 0.35 | 0.35 | 0.35 | 0.35 |

| la | per | 0.05 | 0.05 | 0.05 | 0.05 |

| odc | nor | 0.08 | 0.08 | 0.08 | 0.08 |

| odc | swe | 0.11 | 0.11 | 0.11 | 0.11 |

| odc | switz | 0.10 | 0.10 | 0.10 | 0.10 |

| odc | austlia | 0.26 | 0.26 | 0.26 | 0.26 |

| odc | can | 0.41 | 0.41 | 0.41 | 0.41 |

| odc | nzld | 0.04 | 0.04 | 0.04 | 0.04 |

| restworld | safrc | 0.24 | 0.24 | 0.33 | 0.24 |

| restworld | sarbia | 0.28 | 0.28 | 0.28 | |

| restworld | turk | 0.48 | 0.48 | 0.67 | 0.48 |

| uk | uk | 1 | 1 | 1 | 1 |

| usa | usa | 1 | 1 | 1 | 1 |

| euro | austria | 0.032 | 0.032 | 0.032 | 0.032 |

| euro | bel | 0.038 | 0.038 | 0.038 | 0.038 |

| euro | fin | 0.019 | 0.019 | 0.019 | 0.019 |

| euro | france | 0.214 | 0.214 | 0.214 | 0.214 |

| euro | germ | 0.295 | 0.295 | 0.295 | 0.295 |

| euro | italy | 0.190 | 0.190 | 0.190 | 0.190 |

| euro | neth | 0.067 | 0.067 | 0.067 | 0.067 |

| euro | spain | 0.145 | 0.145 | 0.145 | 0.145 |

| restasia | indns | 0.061 | 0.061 | 0.061 | 0.061 |

| restasia | kor | 0.094 | 0.094 | 0.094 | 0.094 |

| restasia | mal | 0.026 | 0.026 | 0.026 | 0.026 |

| restasia | phlp | 0.022 | 0.022 | 0.022 | 0.022 |

| restasia | sing | 0.017 | 0.017 | 0.017 | 0.017 |

| restasia | thai | 0.038 | 0.038 | 0.038 | 0.038 |

| restasia | india | 0.226 | 0.226 | 0.226 | 0.226 |

| restasia | china | 0.517 | 0.517 | 0.517 | 0.517 |

| Country | Yvar | Xvar1 | coeffs1 | se1 | t-ratio1 | se_NW1 | t-ratioNW1 | LM_CHSQ(4) | GRsq |

| OIL | poil_c | poil_c(-1) | 0.47 | 0.08 | 5.66 | 0.12 | 3.89 | 7.11 | 0.40 |

| Country | coeffs1 | coeffs2 | coeffs3 | t-ratio1 | t-ratio2 | t-ratio3 |

| USA | 0.06 | 0.91 | 0.14 | 0.55 | 4.77 | 3.09 |

| CHINA | 0.47 | 0.21 | 0.14 | 5.51 | 2.74 | 1.58 |

| JAPAN | 0.00 | 0.99 | 0.02 | |||

| UNITED KINGDOM | 0.16 | 0.79 | 0.12 | 1.67 | 6.51 | 4.36 |

| AUSTRIA | 0.06 | 0.93 | 0.05 | |||

| BELGIUM | 0.04 | 0.95 | 0.11 | |||

| FINLAND | 0.35 | 0.62 | 0.04 | 4.05 | 5.16 | 2.65 |

| FRANCE | 0.09 | 0.86 | 0.06 | 0.76 | 6.24 | 2.27 |

| GERMANY | 0.04 | 0.00 | 0.09 | |||

| ITALY | 0.18 | 0.81 | 0.00 | |||

| NETHERLANDS | 0.18 | 0.57 | 0.07 | 1.95 | 3.89 | 2.18 |

| SPAIN | 0.08 | 0.91 | 0.04 | 0.69 | 6.08 | 1.78 |

| NORWAY | 0.06 | 0.93 | 0.03 | |||

| SWEDEN | 0.04 | 0.87 | 0.15 | 0.36 | 5.64 | 3.38 |

| SWITZERLAND | 0.28 | 0.71 | 0.11 | |||

| AUSTRALIA | 0.06 | 0.78 | 0.19 | 0.54 | 3.97 | 2.49 |

| CANADA | 0.16 | 0.74 | 0.08 | 1.69 | 6.67 | 2.88 |

| NEW ZEALAND | 0.00 | 0.99 | 0.10 | |||

| ARGENTINA | 0.01 | 0.98 | 0.00 | |||

| BRAZIL | 0.25 | 0.74 | 0.13 | |||

| CHILE | 0.30 | 0.65 | 0.00 | |||

| MEXICO | 0.41 | 0.58 | 0.00 | |||

| PERU | 0.26 | 0.49 | 0.00 | |||

| INDONESIA | 0.38 | 0.59 | 0.00 | |||

| KOREA | 0.19 | 0.80 | 0.14 | |||

| MALAYSIA | 0.03 | 0.96 | 0.04 | |||

| PHILIPPINES | 0.29 | 0.70 | 0.16 | |||

| SINGAPORE | 0.15 | 0.70 | 0.05 | 1.59 | 3.72 | 1.88 |

| THAILAND | 0.18 | 0.81 | 0.02 | |||

| INDIA | 0.13 | 0.50 | 0.00 | |||

| SOUTH AFRICA | 0.07 | 0.92 | 0.00 | |||

| SAUDI ARABIA | 0.35 | 0.29 | 0.00 | |||

| TURKEY | 0.11 | 0.74 | 0.27 | 0.93 | 1.64 | 1.28 |

| Country | coeffs1 | coeffs2 | coeffs3 | coeffs4 | coeffs5 | coeffs6 |

| USA | 0.69 | −0.01 | 0.01 | |||

| CHINA | 0.64 | −0.43 | 0.43 | 0.00 | 0.00 | 0.22 |

| JAPAN | 0.71 | −0.34 | 0.34 | −0.05 | 0.05 | 0.27 |

| UNITED KINGDOM | 0.29 | −0.49 | 0.49 | 0.09 | −0.09 | 1.08 |

| AUSTRIA | 0.18 | −0.49 | 0.49 | −0.14 | 0.14 | 1.06 |

| BELGIUM | 0.15 | −0.13 | 0.13 | −0.11 | 0.11 | 1.00 |

| FINLAND | 0.09 | 0.00 | 0.00 | 0.12 | −0.12 | 1.32 |

| FRANCE | 0.27 | 0.00 | 0.00 | −0.04 | 0.04 | 0.73 |

| GERMANY | 0.06 | −0.07 | 0.07 | −0.05 | 0.05 | 1.27 |

| ITALY | 0.08 | 0.00 | 0.00 | −0.21 | 0.21 | 0.57 |

| NETHERLANDS | 0.07 | −0.03 | 0.03 | 0.00 | 0.00 | 0.82 |

| SPAIN | 0.24 | 0.00 | 0.00 | −0.17 | 0.17 | 0.71 |

| NORWAY | −0.09 | 0.00 | 0.00 | −0.06 | 0.06 | 0.52 |

| SWEDEN | 0.04 | −0.32 | 0.32 | 0.08 | −0.08 | 1.21 |

| SWITZERLAND | 0.01 | 0.00 | 0.00 | −0.03 | 0.03 | 0.79 |

| AUSTRALIA | 0.19 | 0.00 | 0.00 | −0.01 | 0.01 | 0.53 |

| CANADA | 0.51 | 0.00 | 0.00 | −0.02 | 0.02 | 0.81 |

| NEW ZEALAND | 0.03 | 0.00 | 0.00 | −0.04 | 0.04 | 0.54 |

| ARGENTINA | 0.46 | 0.00 | 0.00 | 0.00 | 0.00 | 0.64 |

| BRAZIL | 0.09 | −0.01 | 0.01 | −0.04 | 0.04 | 1.20 |

| CHILE | 0.20 | −0.29 | 0.29 | −0.32 | 0.32 | 1.10 |

| MEXICO | 0.32 | −0.15 | 0.15 | −0.02 | 0.02 | 1.01 |

| PERU | 0.57 | 0.00 | 0.00 | −0.02 | 0.02 | 0.32 |

| INDONESIA | 0.64 | 0.00 | 0.00 | −0.11 | 0.11 | 1.23 |

| KOREA | 0.46 | 0.00 | 0.00 | 0.01 | −0.01 | 0.39 |

| MALAYSIA | 0.20 | 0.00 | 0.00 | 0.00 | 0.00 | 1.52 |

| PHILIPPINES | 0.72 | 0.00 | 0.00 | 0.04 | −0.04 | 0.63 |

| SINGAPORE | 0.06 | −0.11 | 0.11 | 0.12 | −0.12 | 1.46 |

| THAILAND | 0.67 | 0.00 | 0.00 | 0.04 | −0.04 | 1.38 |

| INDIA | 0.27 | 0.00 | 0.00 | −0.12 | 0.12 | 0.00 |

| SOUTH AFRICA | 0.56 | 0.00 | 0.00 | −0.12 | 0.12 | 0.57 |

| SAUDI ARABIA | 0.50 | 0.00 | −0.15 | 0.15 | 0.34 | |

| TURKEY | −0.01 | −0.22 | 0.22 | −0.15 | 0.15 | 1.40 |

| Country | coeffs1 | coeffs2 | coeffs3 | se1 | se2 | se3 | t-ratio1 | t-ratio2 | t-ratio3 |

|---|---|---|---|---|---|---|---|---|---|

| USA | 0.92 | 0.15 | 0.02 | 0.03 | 0.05 | 0.01 | 34.94 | 3.00 | 1.77 |

| CHINA | 0.85 | 0.03 | 0.02 | 0.07 | 0.03 | 0.02 | 12.53 | 1.10 | 1.16 |

| JAPAN | 0.91 | 0.16 | 0.00 | 0.03 | 0.05 | 34.97 | 3.28 | ||

| UNITED KINGDOM | 0.83 | 0.28 | 0.00 | 0.03 | 0.05 | 26.16 | 5.47 | ||

| AUSTRIA | 0.96 | 0.00 | 0.03 | 0.03 | 0.06 | 31.14 | 0.50 | ||

| BELGIUM | 0.94 | 0.11 | 0.03 | 0.03 | 0.06 | 0.01 | 30.14 | 1.81 | 2.15 |

| FINLAND | 0.90 | 0.20 | 0.02 | 0.03 | 0.05 | 0.01 | 34.26 | 4.22 | 2.43 |

| FRANCE | 0.84 | 0.24 | 0.03 | 0.04 | 0.06 | 0.01 | 23.69 | 4.08 | 2.17 |

| GERMANY | 0.85 | 0.10 | 0.03 | 0.04 | 0.07 | 0.01 | 20.95 | 1.47 | 2.98 |

| ITALY | 0.84 | 0.23 | 0.03 | 0.04 | 0.09 | 0.02 | 19.86 | 2.71 | 1.30 |

| NETHERLANDS | 0.95 | 0.02 | 0.04 | 0.03 | 0.06 | 0.01 | 28.82 | 0.27 | 3.40 |

| SPAIN | 0.92 | 0.09 | 0.01 | 0.04 | 0.07 | 0.02 | 24.23 | 1.24 | 0.57 |

| NORWAY | 0.84 | 0.11 | 0.04 | 0.07 | 0.06 | 0.03 | 12.79 | 1.70 | 1.41 |

| SWEDEN | 0.92 | 0.10 | 0.01 | 0.03 | 0.05 | 0.02 | 27.49 | 1.87 | 0.69 |

| SWITZERLAND | 0.49 | 0.03 | 0.07 | 0.06 | 0.04 | 0.01 | 8.73 | 0.67 | 6.50 |

| AUSTRALIA | 0.42 | 0.12 | 0.14 | 0.05 | 0.03 | 0.02 | 9.04 | 4.43 | 8.66 |

| CANADA | 0.80 | 0.29 | 0.00 | 0.04 | 0.05 | 22.38 | 5.49 | ||

| NEW ZEALAND | 0.49 | 0.33 | 0.18 | 0.05 | 0.04 | 0.04 | 9.33 | 7.66 | 5.11 |

| ARGENTINA | −0.27 | 0.28 | 0.00 | 0.12 | 0.12 | −2.27 | 2.34 | ||

| BRAZIL | −0.61 | 1.51 | 0.00 | 0.14 | 0.22 | −4.37 | 6.88 | ||

| CHILE | 0.40 | 0.63 | 0.01 | 0.11 | 0.18 | 0.04 | 3.56 | 3.49 | 0.33 |

| MEXICO | 0.01 | 0.37 | 0.06 | 0.04 | 0.02 | 0.02 | 0.33 | 18.22 | 2.48 |

| PERU | −0.19 | 0.39 | 0.04 | 0.18 | 0.11 | 0.22 | −1.03 | 3.52 | 0.19 |

| INDONESIA | 0.67 | 0.22 | 0.10 | 0.04 | 0.04 | 0.02 | 16.27 | 4.88 | 4.69 |

| KOREA | 0.72 | 0.20 | 0.09 | 0.06 | 0.06 | 0.03 | 12.40 | 3.35 | 3.16 |

| MALAYSIA | 0.54 | 0.00 | 0.01 | 0.07 | 0.02 | 7.96 | 0.15 | ||

| PHILIPPINES | 0.73 | 0.22 | 0.01 | 0.05 | 0.05 | 0.02 | 15.57 | 4.60 | 0.59 |

| SINGAPORE | 0.97 | 0.06 | 0.02 | 0.02 | 0.04 | 0.01 | 47.89 | 1.42 | 3.62 |

| THAILAND | 0.81 | 0.13 | 0.00 | 0.04 | 0.07 | 18.10 | 1.95 | ||

| INDIA | 0.49 | 0.16 | 0.00 | 0.12 | 0.08 | 4.01 | 2.06 | ||

| SOUTH AFRICA | 0.64 | 0.14 | 0.06 | 0.05 | 0.04 | 0.01 | 12.63 | 3.12 | 7.06 |

| TURKEY | 0.64 | 0.12 | 0.09 | 0.06 | 0.05 | 0.03 | 10.98 | 2.51 | 2.74 |

| Country | coeffs1 | coeffs2 | coeffs3 | se1 | se2 | t-ratio1 | t-ratio2 |

|---|---|---|---|---|---|---|---|

| USA | 0.01 | 0.00 | 3.24 | ||||

| CHINA | 0.79 | −0.79 | 1.00 | 0.05 | 0.05 | 15.07 | 15.07 |

| JAPAN | 0.73 | −0.73 | 1.00 | 0.06 | 0.06 | 12.43 | 12.43 |

| UNITED KINGDOM | 0.58 | −0.58 | 1.00 | 0.07 | 0.07 | 7.98 | 7.98 |

| AUSTRIA | 0.55 | −0.55 | 1.00 | 0.07 | 0.07 | 7.94 | 7.94 |

| BELGIUM | 0.66 | −0.66 | 1.00 | 0.06 | 0.06 | 10.60 | 10.60 |

| FINLAND | 0.58 | −0.58 | 1.00 | 0.07 | 0.07 | 8.69 | 8.69 |

| FRANCE | 0.39 | −0.39 | 1.00 | 0.08 | 0.08 | 5.02 | 5.02 |

| GERMANY | 0.49 | −0.49 | 1.00 | 0.07 | 0.07 | 6.62 | 6.62 |

| ITALY | 0.49 | −0.49 | 1.00 | 0.07 | 0.07 | 6.55 | 6.55 |

| NETHERLANDS | 0.73 | −0.73 | 1.00 | 0.06 | 0.06 | 12.52 | 12.52 |

| SPAIN | 0.84 | −0.84 | 1.00 | 0.05 | 0.05 | 17.99 | 17.99 |

| NORWAY | 0.42 | −0.42 | 1.00 | 0.08 | 0.08 | 5.64 | 5.64 |

| SWEDEN | 0.71 | −0.71 | 1.00 | 0.06 | 0.06 | 12.19 | 12.19 |

| SWITZERLAND | 0.49 | −0.49 | 1.00 | 0.07 | 0.07 | 6.70 | 6.70 |

| AUSTRALIA | 0.59 | −0.59 | 1.00 | 0.07 | 0.07 | 8.94 | 8.94 |

| CANADA | 0.84 | −0.84 | 1.00 | 0.04 | 0.04 | 19.33 | 19.33 |

| NEW ZEALAND | 0.35 | −0.35 | 1.00 | 0.07 | 0.07 | 4.90 | 4.90 |

| ARGENTINA | 0.54 | −0.54 | 1.00 | 0.07 | 0.07 | 7.46 | 7.46 |

| BRAZIL | 0.28 | −0.28 | 1.00 | 0.09 | 0.09 | 3.15 | 3.15 |

| CHILE | 0.52 | −0.52 | 1.00 | 0.07 | 0.07 | 7.04 | 7.04 |

| MEXICO | 0.69 | −0.69 | 1.00 | 0.06 | 0.06 | 11.84 | 11.84 |

| PERU | 0.59 | −0.59 | 1.00 | 0.07 | 0.07 | 8.64 | 8.64 |

| INDONESIA | 0.48 | −0.48 | 1.00 | 0.07 | 0.07 | 6.88 | 6.88 |

| KOREA | 0.73 | −0.73 | 1.00 | 0.05 | 0.05 | 14.37 | 14.37 |

| MALAYSIA | 0.53 | −0.53 | 1.00 | 0.07 | 0.07 | 7.60 | 7.60 |

| PHILIPPINES | 0.71 | −0.71 | 1.00 | 0.06 | 0.06 | 11.80 | 11.80 |

| SINGAPORE | 0.66 | −0.66 | 1.00 | 0.06 | 0.06 | 10.36 | 10.36 |

| THAILAND | 0.56 | −0.56 | 1.00 | 0.07 | 0.07 | 8.02 | 8.02 |

| INDIA | 0.29 | −0.29 | 1.00 | 0.08 | 0.08 | 3.66 | 3.66 |

| SOUTH AFRICA | 0.68 | −0.68 | 1.00 | 0.06 | 0.06 | 11.56 | 11.56 |

| SAUDI ARABIA | 0.82 | −0.82 | 1.00 | 0.05 | 0.05 | 16.54 | 16.54 |

| TURKEY | 0.20 | −0.20 | 1.00 | 0.10 | 0.10 | 1.98 | 1.98 |

References

- Carabenciov, I.; Freedman, C.; Garcia-Saltos, M.R.; Laxton, M.D.; Kamenik, M.O.; Manchev, M.P. Gpm6: The Global Projection Model with 6 Regions; International Monetary Fund: Washington, DC, USA, 2013. [Google Scholar]

- Eichenbaum, M.S.; Rebelo, S.; Trabandt, M. The Macroeconomics of Epidemics. Rev. Financ. Stud. 2021, 34, 5149–5187. [Google Scholar] [CrossRef]

- Chudik, A.; Mohaddes, K.; Pesaran, M.H.; Raissi, M.; Rebucci, A. A counterfactual economic analysis of Covid-19 using a threshold augmented multi-country model. J. Int. Money Financ. 2021, 119, 102477. [Google Scholar] [CrossRef] [PubMed]

- Dées, S.; Pesaran, M.H.; Smith, L.V.; Smith, R.P. Constructing Multi-Country Rational Expectations Models. Oxf. Bull. Econ. Stat. 2013, 76, 812–840. [Google Scholar] [CrossRef]

- Smith, R.P. The GVAR approach to structural modelling. In The GVAR Handbook: Structure and Applications of a Macro Model of the Global Economy for Policy Analysis; Oxford University Press: Oxford, UK, 2013; pp. 56–69. [Google Scholar]

- Di Mauro, F.; Pesaran, M.H. (Eds.) The GVAR Handbook: Structure and Applications of a Macro Model of the Global Economy for Policy Analysis; OUP Oxford: Oxford, UK, 2013. [Google Scholar]

- Dées, S.; Pesaran, M.H.; Smith, L.V.; Smith, R.P. Identification of New Keynesian Phillips Curves from a Global Perspective. J. Money Crédit. Bank. 2009, 41, 1481–1502. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H. Time Series and Panel Data Econometrics; Oxford University Press (OUP): Oxford, UK, 2015. [Google Scholar]

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling Regional Interdependencies Using a Global Error-Correcting Macroeconometric Model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- Johansen, S. Testing weak exogeneity and the order of cointegration in UK money demand data. J. Policy Model. 1992, 14, 313–334. [Google Scholar] [CrossRef]

- Granger, C.W.; Lin, J.L. Causality in the long run. Econom. Theory 1995, 11, 530–536. [Google Scholar]

- Smith, L.; Galesi, A. GVAR Toolbox 2.0; University of Cambridge, Judge Business School, 2014; Available online: https://sites.google.com/site/gvarmodelling/gvar-toolbox/download (accessed on 13 December 2021).

- Quandt, R.E. The estimation of the parameters of a linear regression system obeying two separate regimes. J. Am. Stat. Assoc. 1958, 53, 873–880. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Smith, R.P. Beyond the Dsge Straitjacket1. Manch. Sch. 2011, 79, 5–16. [Google Scholar] [CrossRef] [Green Version]

- Ploberger, W.; Krämer, W. The Cusum Test with Ols Residuals. Economet 1992, 60, 271. [Google Scholar] [CrossRef]

- Nyblom, J. Testing for the constancy of parameters over time. J. Am. Stat. Assoc. 1989, 84, 223–230. [Google Scholar] [CrossRef]

- Quandt, R.E. Tests of the hypothesis that a linear regression system obeys two separate regimes. J. Am. Stat. Assoc. 1960, 55, 324–330. [Google Scholar] [CrossRef]

- Andrews, D.W.K.; Ploberger, W. Optimal Tests when a Nuisance Parameter is Present Only Under the Alternative. Econometrica 1994, 62, 1383. [Google Scholar] [CrossRef]

- Canova, F.; Sala, L. Back to square one: Identification issues in DSGE models. J. Monetary Econ. 2009, 56, 431–449. [Google Scholar] [CrossRef] [Green Version]

- Koop, G.; Potter, S.M. Time varying VARs with inequality restrictions. J. Econ. Dyn. Control 2011, 35, 1126–1138. [Google Scholar] [CrossRef] [Green Version]

- Smets, F.; Wouters, R. Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach. Am. Econ. Rev. 2007, 97, 586–606. [Google Scholar] [CrossRef] [Green Version]

- Christiano, L.J.; Eichenbaum, M.; Evans, C. The Effects of Monetary Policy Shocks: Evidence from the Flow of Funds. Rev. Econ. Stat. 1996, 78, 16. [Google Scholar] [CrossRef]

- Central Banking. “Benchmarking 2021, Advanced Economies Draw on Wider Range of Models”. 2021. Available online: https://www.centralbanking.com/benchmarking/economics/7907091/advanced-economies-draw-on-wider-range-of-models (accessed on 12 October 2021).

- Giacomini, R. The relationship between DSGE and VAR models. In VAR Models in Macroeconomics–New Developments and Applications: Essays in Honor of Christopher A Sims; Emerald Group Publishing Limited: Bingley, UK, 2013. [Google Scholar]

- An, S.; Schorfheide, F. Bayesian Analysis of DSGE Models. Econ. Rev. 2007, 26, 113–172. [Google Scholar] [CrossRef] [Green Version]

- Lee, K.Y. A Comparison Analysis of Monetary Policy Effect Under an Open Economy Model. East Asian Econ. Rev. 2018, 22, 141–176. [Google Scholar] [CrossRef]

- Boivin, J.; Giannoni, M.P. Has Monetary Policy Become More Effective? Rev. Econ. Stat. 2006, 88, 445–462. [Google Scholar] [CrossRef] [Green Version]

- Consolo, A.; Favero, C.A.; Paccagnini, A. On the statistical identification of DSGE models. J. Econ. 2009, 150, 99–115. [Google Scholar] [CrossRef] [Green Version]

- Christoffel, K.; Coenen, G.; Warne, A. The New Area-Wide Model of the Euro Area; ECB working paper: Frankfurt, Germany, 2008. [Google Scholar]

- Karadi, P.; Schmidt, S.; Warne, A. The New Area-Wide Model ii: An Updated Version of the Ecb’s Micro-Founded Model for Forecasting and Policy Analysis with a Financial Sector; European Central Bank: Frankurt, Germany, 2018. [Google Scholar]

- Erceg, C.; Guerrieri, L.; Gust, C. SIGMA: A New Open Economy; IFDP Discussion Paper No.835; 2006. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjdzqmk1fT3AhUp6mEKHcH8DC8QFnoECAIQAQ&url=https%3A%2F%2Fwww.federalreserve.gov%2Fpubs%2Fifdp%2F2005%2F835%2Fifdp835r.pdf&usg=AOvVaw2quRYrPH-jku9AqZYlJOKp (accessed on 15 December 2021).

- Burriel, P.; Fernández-Villaverde, J.; Rubio-Ramírez, J.F. MEDEA: A DSGE model for the Spanish economy. SERIEs 2010, 1, 175–243. [Google Scholar] [CrossRef]

- Stähler, N.; Thomas, C. FiMod—A DSGE model for fiscal policy simulations. Econ. Model. 2012, 29, 239–261. [Google Scholar] [CrossRef] [Green Version]

- Kilponen, J.; Orjasniemi, S.; Ripatti, A.; Verona, F. The Aino 2.0 model. In Bank of Finland Research Discussion Paper; 2016; Volume 16, Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2795479 (accessed on 15 December 2021).

- Gadatsch, N.; Hauzenberger, K.; Stähler, N. Fiscal policy during the crisis: A look on Germany and the Euro area with GEAR. Econ. Model. 2016, 52, 997–1016. [Google Scholar] [CrossRef]

- Kwok, J. Macroeconometric Models for Portfolio Management; Vernon Press: Malaga, Spain, 2021. [Google Scholar]

- Welfe, W. Macroeconometric Models; Springer: Berlin, Germany, 2013. [Google Scholar] [CrossRef]

- Lubik, T.A.; Schorfheide, F. Testing for Indeterminacy: An Application to U.S. Monetary Policy. Am. Econ. Rev. 2004, 94, 190–217. [Google Scholar] [CrossRef] [Green Version]

- Lubik, T.A.; Schorfheide, F. Do central banks respond to exchange rate movements? A structural investigation. J. Monetary Econ. 2007, 54, 1069–1087. [Google Scholar] [CrossRef] [Green Version]

| Demand | Monetary | Real Ex | Oil | |

|---|---|---|---|---|

| Supply | 0.160 | 0.026 | 0.018 | −0.069 |

| Demand | - | 0.039 | 0.000 | 0.001 |

| Monetary | - | - | 0.003 | 0.009 |

| Model Name | Type | Period | Countries | Number of Shocks | Additional Shocks | Remarks |

|---|---|---|---|---|---|---|

| DPSS | DSGE-GVAR | 1980Q2–2006Q4 | 26 | 4-Oil, Demand, Supply and Monetary. | Reference model | |

| M1 | DSGE-GVAR | 1984Q2–2019Q4 | 33—(8 regions) | 5-Oil, Demand, Supply, Monetary and Exchange rate. | GVAR estimation. Most shocks are stable. | |

| M2 | DSGE-GVAR | 1986Q2–2020Q4 | 33—(8 regions) | 5-Oil, Demand, Supply, Monetary and Exchange rate. | Negative shock to global interest rates. Model includes short term rates from Saudi Arabia (derived from repo rates). | GVAR estimation. Some shocks are not stable. |

| H1 | DSGE-HP | 1987Q2–2019Q4 | 33—(8 regions) | 5-Oil, Demand, Supply, Monetary and Exchange rate. | HP estimation. Most shocks are stable. | |

| H2 | DSGE-HP | 1988Q2–2020Q4 | 33—(8 regions) | 5-Oil, Demand, Supply, Monetary and Exchange rate. | HP estimation. Most shocks are not stable. |

| Coefficients | Phillips Curve | IS Equation | Taylor Rule |

|---|---|---|---|

| Lubik and Schorfheide (2007) 1 (LS) | 0.99 | 0.52 −0.42 | 0.69 |

| Smets and Wouters (2007) 2 (SW) | 0.99 | N/A | 0.96 |

| Dées et al., 2014 (1980Q2/2011Q20) p. 840 3 (DPSS) | 0.94 | 0.33 −0.13 | 0.65 |

| GVAR-NK 1986Q2_2019Q4 4 (M1) | 0.89 | 0.30 −0.09 | 0.63 |

| GVAR-NK 1986Q2_2020Q4 (M2) | 0.84 | 0.26 −0.16 | 0.64 |

| HP-NK 1987Q2–2019Q2 (H1) | 0.97 | 0.66 −0.18 | 0.82 |

| HP-NK 1988Q2–2020Q2 (H2) | 0.95 | 0.43 −0.18 | 0.81 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kwok, C. Estimating Structural Shocks with the GVAR-DSGE Model: Pre- and Post-Pandemic. Mathematics 2022, 10, 1773. https://doi.org/10.3390/math10101773

Kwok C. Estimating Structural Shocks with the GVAR-DSGE Model: Pre- and Post-Pandemic. Mathematics. 2022; 10(10):1773. https://doi.org/10.3390/math10101773

Chicago/Turabian StyleKwok, Chunyeung. 2022. "Estimating Structural Shocks with the GVAR-DSGE Model: Pre- and Post-Pandemic" Mathematics 10, no. 10: 1773. https://doi.org/10.3390/math10101773

APA StyleKwok, C. (2022). Estimating Structural Shocks with the GVAR-DSGE Model: Pre- and Post-Pandemic. Mathematics, 10(10), 1773. https://doi.org/10.3390/math10101773