Not Practicing What You Preach: How Is Accounting Higher Education Preparing the Future of Accounting

Abstract

1. Introduction

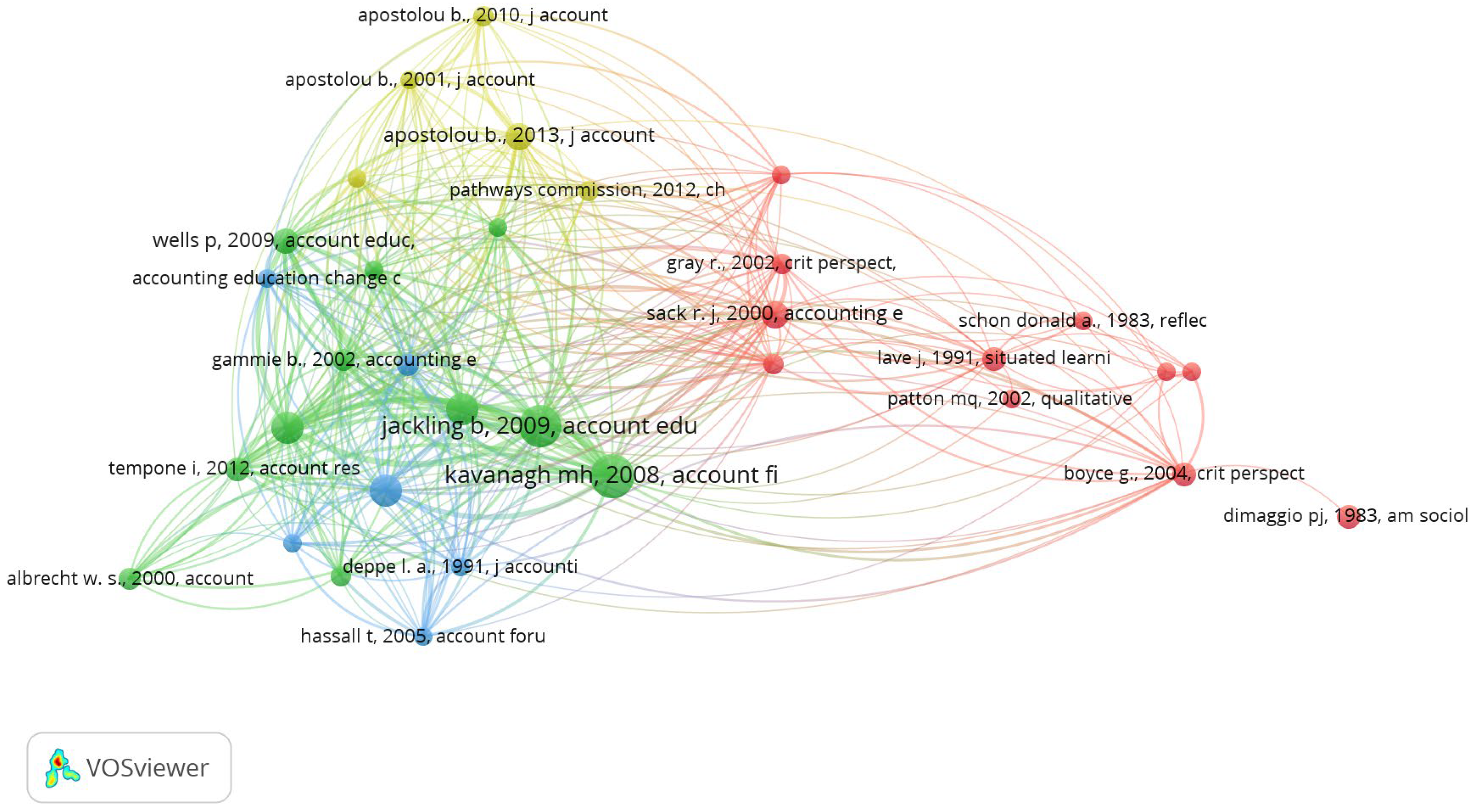

2. Theoretical Background

3. Method

3.1. Dimension 1: What We Preach

3.2. Dimension 2: What We Practice

4. Results

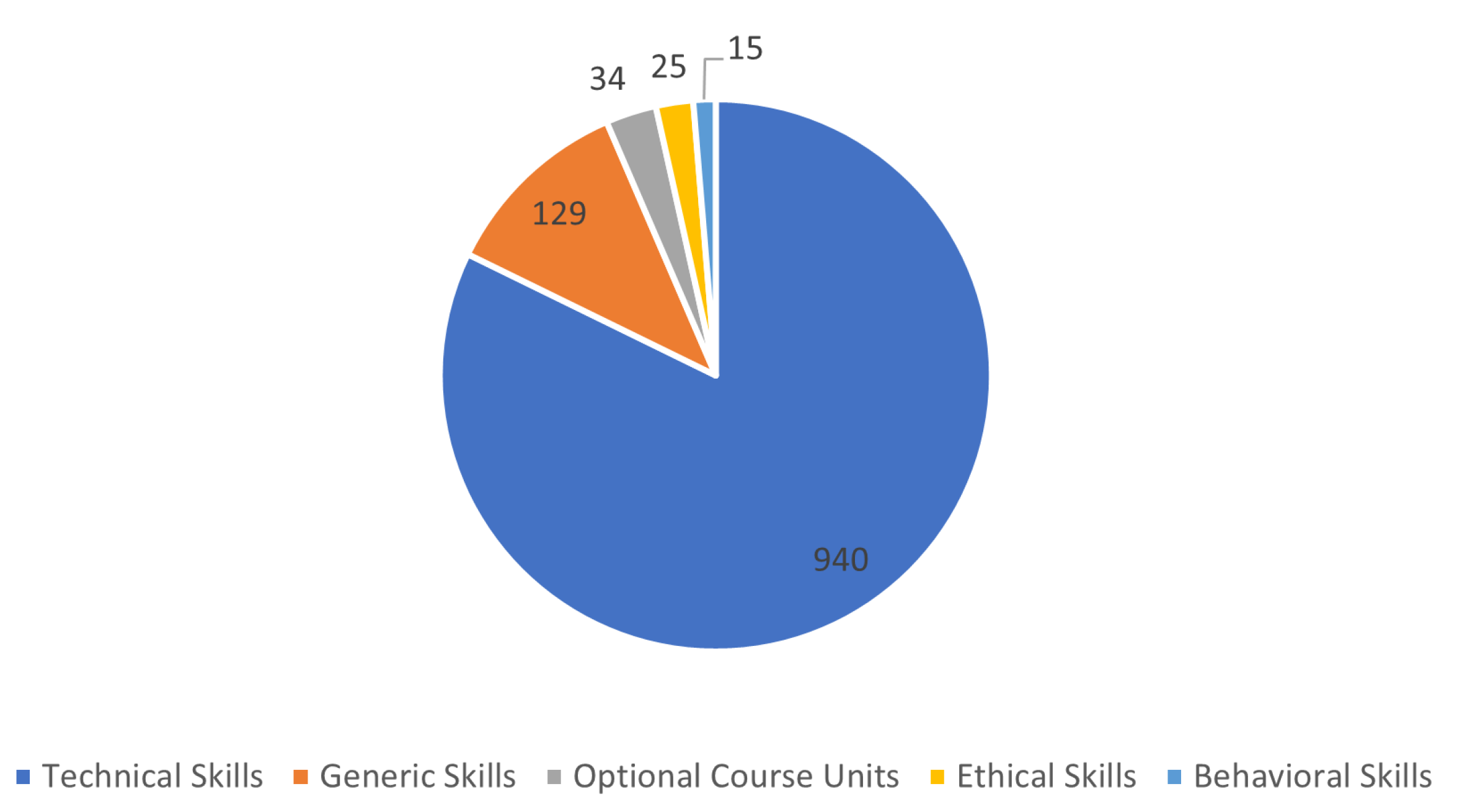

4.1. Dimension 1: What We Preach

4.2. Dimension 2: What We Practice

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | Authors | Title |

|---|---|---|

| 1991 | Albin, M. J. & Crockett, R. | Integrating Necessary Skills and Concepts into the Accounting Curriculum |

| 1998 | Usoff, C. & Feldmann, D. | Accounting Students Perceptions of Important Skills for Career Success |

| 2001 | Parker, L. D. | Back to the Future: the broadening accounting trajectory |

| 2002 | Jackson, R. B. & Cherrington, J.O. | IT Instruction Methodology and Minimum Competency for Accounting Students |

| 2003 | Howieson, B. | Accounting practice in the new millennium: is accounting education ready to meet the challenge? |

| 2003 | Mohamed, E. K. & Lashine, S. H. | Accounting Knowledge and Skills and the Challenges of a global Business Environment |

| 2003 | Scapens, R. W. & Jazayeri, M. | ERP systems and management accounting change: opportunities or impacts? A research note |

| 2005 | Hassal, T., Joyce, J., Montanto, J. L. & Anes, J.A. | Priorities for the Development of Vocational Skills in Management Accountants: a European Perspective |

| 2005 | Robley, W., Whittle, S. & Murdoch-Eaton, D. | Mapping Generic Skills Curricula: a Recommended Methodology |

| 2006 | De Lange, P., Jackling, B. & Gut, A. | Accounting graduates’ perceptions of skills emphasis in undergraduate courses: an investigation from two Victorian universities |

| 2006 | Duncan, J. & Schmutte, J. | Change in Accounting Programs: the impact of Influences and Constraints |

| 2007 | Hill, W. Y. & Milner, M. M. | The Placing of skills in Accounting Degree Programmes in Higher Education: Some Contrasting Approaches in the UK |

| 2008 | Kavanagh, M. H., & Drennan, L. | What skills and attributes does an accounting graduate need? Evidence from student perceptions and employer expectations. |

| 2009 | Jackling, B., & De Lange, P. | Do Accounting Graduates’ Skills Meet The Expectations of Employers? A Matter of Convergence or Divergence. |

| 2009 | Wells, P. K., Kranenburg, I., Gerbic, P. & Bygrave, J. | Professional Skills and Capabilities of Accounting Graduates: The New Zealand Expectation Gap? |

| 2010 | Bui, B., & Porter, B. | The Expectation-Performance Gap in Accounting Education: An Exploratory Study. |

| 2010 | Carniege, G. D. & Napier, C. J. | Traditional Accountants and Business Professionals: Portraying the Accounting Profession after Enron |

| 2010 | Paisey, C. & Paisey, N. J | Comparative research: An opportunity for accounting researchers to learn from other professions |

| 2011 | Severin V. G., Stewart A. L., & Pamela J. S. | A Review of ERP Research: A Future Agenda for Accounting Information Systems |

| 2012 | Carniege, G. D. & Napier, C. J. | Accounting’s past, present and future: the unifying power of history |

| 2014 | Carniege, G. D | The present and future of Accounting History |

| 2017 | Richins, G., Stapleton, A., Stratopoulos, T. C. & Wong C. | Big Data Analytics: Opportunity or Threat for the Accounting Profession? |

| 2018 | Akhter, A. & Sultana, R. | Sustainability of Accounting Profession at the Age of Fourth Industrial Revolution |

| 2018 | Fernandez, D. & Aman, A. | Impacts of Robotic Process Automation on Global Accounting Services |

References

- Terblanche, E.A.J.; De Clercq, B. A critical thinking competency framework for accounting students. Account. Educ. 2021, 30, 325–354. [Google Scholar] [CrossRef]

- Goh, C.; Pan, G.S.C.; Seow, P.S.; Lee, B.H.Z.; Yong, M. Charting the Future of Accountancy with AI. 2019. Available online: https://ink.library.smu.edu.sg/soa_research/1806 (accessed on 9 December 2020).

- Moore, W.B.; Felo, A. The evolution of accounting technology education: Analytics to STEM. J. Educ. Bus. 2022, 97, 105–111. [Google Scholar] [CrossRef]

- Asonitou, S. Impediments and pressures to incorporate soft skills in Higher Education accounting studies. Account. Educ. 2021. [Google Scholar] [CrossRef]

- Duff, A.; Hancock, P.; Marriott, N. The role and impact of professional accountancy associations on accounting education research: An international study. Br. Account. Rev. 2020, 52, 100829. [Google Scholar] [CrossRef]

- Mah’d, O.A.; Mardini, G.H. The quality of accounting education and the integration of the international education standards: Evidence from Middle Eastern and North African countries. Account. Educ. 2020. [Google Scholar] [CrossRef]

- Shortridge, R.T.; Smith, P.A. Understanding the changes in accounting thought. Res. Account. Regul. 2009, 21, 11–18. [Google Scholar] [CrossRef]

- Bui, B.; Porter, B. The expectation-performance gap in accounting education: An exploratory study. Account. Educ. 2010, 19, 23–50. [Google Scholar] [CrossRef]

- Murphy, B.; Hassall, T. Developing accountants: From novice to expert. Account. Educ. 2020, 29, 1–31. [Google Scholar] [CrossRef]

- Kavanagh, M.H.; Drennan, L. What skills and attributes does an accounting graduate need? Evidence from student perceptions and employer expectations. Account. Financ. 2008, 48, 279–300. [Google Scholar] [CrossRef]

- Strawser, J.A.; Flagg, J.C.; Holmes, S.A. Job perceptions and turnover behavior of tenure-track accounting educators. J. Account. Educ. 2000, 18, 315–340. [Google Scholar] [CrossRef]

- Bahador, K.M.K.; Haider, A. Information technology skills and competencies—A case for professional accountants. In Business Information Systems Workshops; Abramowicz, W., Domingue, J., Węcel, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2012; Volume 127, pp. 81–87. [Google Scholar] [CrossRef]

- Dolce, V.; Emanuel, F.; Cisi, M.; Ghislieri, C. The soft skills of accounting graduates: Perceptions versus expectations. Account. Educ. 2020, 29, 57–76. [Google Scholar] [CrossRef]

- Melnyk, N.; Trachova, D.; Kolesnikova, O.; Demchuk, O.; Golub, N. Accounting Trends in the Modern World. Indep. J. Manag. Prod. 2020, 11, 2403–2416. [Google Scholar] [CrossRef]

- Guragai, B.; Hunt, N.C.; Neri, M.P.; Taylor, E.Z. Accounting information systems and ethics research: Review, synthesis, and the future. J. Inf. Syst. 2017, 31, 65–81. [Google Scholar] [CrossRef]

- Bahador, K.M.K.; Haider, A. A framework of information technology based competencies for professional accountants in small and medium-sized accounting practices. In Proceedings of the 2012 Proceedings of PICMET ‘12: Technology Management for Emerging Technologies, Vancouver, BC, Canada, 29 July–2 August 2012. [Google Scholar]

- Uwizeyemungu, S.; Bertrand, J.; Poba-Nzaou, P. Patterns underlying required competencies for CPA professionals: A content and cluster analysis of job ads. Account. Educ. 2020, 29, 109–136. [Google Scholar] [CrossRef]

- Jackling, B.; De Lange, P. Do accounting graduates’ skills meet the expectations of employers? A matter of convergence or divergence. Account. Educ. 2009, 18, 369–385. [Google Scholar] [CrossRef]

- Caglio, A.; Cameran, M.; Klobas, J. What is an Accountant? An Investigation of Images, Eur. Account. Rev. 2019, 28, 849–871. [Google Scholar] [CrossRef]

- Marshall, T.E.; Lambert, S.L. Cloud-based intelligent accounting applications: Accounting task automation using IBM Watson Cognitive Computing. J. Emerg. Technol. Account. 2018, 15, 199–215. [Google Scholar] [CrossRef]

- Carnegie, G.D.; Napier, C.J. Accounting’s past, present and future: The unifying power of history. Account. Audit. Account. J. 2012, 25, 328–369. [Google Scholar] [CrossRef]

- Fontaine, R.; Khemakhem, H. A practitioner’s perspective on management accounting graduates’ competencies: A Canadian field study. Account. Educ. J. 2020, 30, 157–171. [Google Scholar]

- Baldvinsdottir, G.; Burns, J.; Nørreklit, H.; Scapens, R.W. The image of accountants: From bean counters to extreme accountants. Account. Audit. Account. J. 2009, 22, 858–882. [Google Scholar] [CrossRef]

- Parker, L.D.; Warren, S. The presentation of the self and professional identity: Countering the accountant’s stereotype. Account. Audit. Account. J. 2017, 30, 1895–1924. [Google Scholar] [CrossRef]

- Smith, M.; Briggs, S. From bean-counter to action hero: Changing the image of the accountant. Manag. Account. 1999, 77, 28–30. [Google Scholar]

- IAESB International Education Standards Board. IES 3, Initial Professional Development—Professional Skills; IFAC: New York, NY, USA, 2014. [Google Scholar]

- IAESB International Education Standards Board. IES 4, Initial Professional Development—Professional Values, Ethics, and Attitudes; IFAC: New York, NY, USA, 2014. [Google Scholar]

- Jackling, B. Are negative perceptions of the accounting profession perpetuated by the introductory accounting course? An Australian study. Asian Rev. Account. 2002, 10, 62–80. [Google Scholar] [CrossRef]

- Akhter, A.; Sultana, R. Sustainability of accounting profession at the age of fourth industrial revolution. Int. J. Account. Financ. Report. 2018, 8, 139–158. [Google Scholar] [CrossRef]

- Vafeas, N. Is accounting education valued by the stock market? Evidence from corporate controller appointments. Contemp. Account. Res. 2009, 26, 1143–1174. [Google Scholar] [CrossRef]

- Hassall, T.; Joyce, J.; Montaño, J.L.A.; Donoso Anes, J.A. Priorities for the development of vocational skills in management accountants: A European perspective. Account. Forum 2005, 29, 379–394. [Google Scholar] [CrossRef]

- Ariail, D.L.; Khayati, A.; Shawver, T. Perceptions by employed accounting students of ethical leadership and political skill: Evidence for including political skill in ethics pedagogy. J. Account. Educ. 2021, 55, 100716. [Google Scholar] [CrossRef]

- Van Rooyen, A.A. Social media is so easy to share. Account. Educ. 2020, 29, 356–371. [Google Scholar] [CrossRef]

- Cory, S.N. Quality and quantity of accounting students and the stereotypical accountant: Is there a relationship? J. Account. Educ. 1992, 10, 1–24. [Google Scholar] [CrossRef]

- Kurek, B.; Górowski, I. Importance of gender, location of secondary school, and professional experience for GPA—A survey of students in a free tertiary education setting. Sustainability 2020, 12, 9224. [Google Scholar] [CrossRef]

- Leão, F.; Gomes, D.; Carnegie, G.D. The portrayal of early accountants in nineteenth century Portuguese literature. Account. Audit. Account. J. 2019, 32, 658–688. [Google Scholar] [CrossRef]

- Miley, F.; Read, A. Jokes in popular culture: The characterisation of the accountant. Account. Audit. Account. J. 2012, 25, 703–718. [Google Scholar] [CrossRef]

- Carnegie, G.D.; Napier, C.J. Traditional accountants and business professionals: Portraying the accounting profession after Enron. Account. Organ. Soc. 2010, 35, 360–376. [Google Scholar] [CrossRef]

- Mohamed, E.K.A.; Lashine, S.H. Accounting knowledge and skills and the challenges of a global business environment. Manag. Financ. 2003, 29, 3–16. [Google Scholar] [CrossRef]

- Andiola, L.M.; Masters, E.; Norman, C. Integrating technology and data analytic skills into the accounting curriculum: Accounting department leaders’ experiences and insights. J. Account. Educ. 2020, 50, 100655C. [Google Scholar] [CrossRef]

- Sugahara, S.; Boland, G. Perceptions of the certified public accountants by accounting and non-accounting tertiary students in Japan. Asian Rev. Account. 2006, 14, 149–167. [Google Scholar] [CrossRef]

- Albrecht, W.S.; Sack, R.J. Accounting Education: Charting the Course through a Perilous Future; American Accounting Association: Sarasota, FL, USA, 2000. [Google Scholar]

- Srirejeki, K.; Faturahman, A.; Supeno, S. Understanding the intentions of accounting students to pursue career as a professional accountant. Binus Bus. Rev. 2019, 10, 11–19. [Google Scholar] [CrossRef]

- Wells, P.; Fieger, P. High School teachers’ perceptions of accounting: An international study. Aust. J. Account. Educ. 2006, 2, 1. [Google Scholar]

- Wambsganss, J.R.; Dosch, R.J. The blame game: Accounting education is not alone. J. Educ. Bus. 2006, 81, 250–254. [Google Scholar] [CrossRef]

- Asonitou, S.; Hassall, T. Which skills and competences to develop in accountants in a country in crisis? Int. J. Manag. Educ. 2019, 17, 100308. [Google Scholar] [CrossRef]

- Bolt-Lee, C.; Foster, S. The core competency framework: A new element in the continuing call for accounting education change in the United States. Account. Educ. 2003, 12, 33–47. [Google Scholar] [CrossRef]

- Wessels, P.L. Critical information and communication technology (ICT) skills for professional accountants. Meditari Account. Res. 2005, 13, 87–103. [Google Scholar] [CrossRef]

- Bahador, K.M.K.; Haider, A. Maturity of information technology competencies: A professional accountants’ perspective. In Proceedings of the 2013 Proceedings of Technology Management in the IT-Driven Services (PICMET), San Jose, CA, USA, 28 July–1 August 2013. [Google Scholar]

- Ballou, B.; Heitger, D.L.; Stoel, D. Data-driven decision-making and its impact on accounting undergraduate curriculum. J. Account. Educ. 2018, 44, 14–24. [Google Scholar] [CrossRef]

- Pratama, A. Bridging the gap between academicians and practitioners on accountant competencies: An analysis of International Education Standards (IES) implementation on Indonesia’s accounting education. Procedia Soc. Behav. Sci. 2015, 211, 19–26. [Google Scholar] [CrossRef][Green Version]

- Palmer, K.N.; Ziegenfuss, D.E.; Pinsker, R.E. International knowledge, skills, and abilities of auditors/accountants: Evidence from recent competency studies. Manag. Audit. J. 2004, 19, 889–896. [Google Scholar] [CrossRef]

- Berry, R.; Routon, W. Soft skill change perceptions of accounting majors: Current practitioner views versus their own reality. J. Account. Educ. 2020, 53, 100691. [Google Scholar] [CrossRef]

- Fink, A. Conducting Research Literature Reviews: From the Internet to Paper, 3rd ed.; SAGE: Thousand Oaks, CA, USA, 2010. [Google Scholar]

- Okoli, C.; Schabram, K. A Guide to Conducting a Systematic Literature Review of Information Systems Research. SSRN Electron. J. 2010. [Google Scholar] [CrossRef]

- Almeida, F. Canvas framework for performing systematic reviews analysis. Multidiscip. J. Educ. Soc. Technol. Sci. 2018, 5, 65–85. [Google Scholar] [CrossRef]

- Xiao, Y.; Watson, M. Guidance on conducting a Systematic Literature Review. J. Plan. Educ. Res. 2019, 39, 93–112. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. VOSviewer Manual: Manual for VOSviewer Version 1.6.8. Available online: https://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.8.pdf (accessed on 21 October 2020).

- Waltman, L.; Van Eck, N.J.; Noyons, E.C.M. A unified approach to mapping and clustering of bibliometric networks. J. Informetr. 2010, 4, 629–635. [Google Scholar] [CrossRef]

- Methley, A.M.; Campbell, S.; Chew-Graham, C.; McNally, R.; Cheraghi-Sohi, S. PICO, PICOS and SPIDER: A comparison study of specificity and sensitivity in three search tools for qualitative systematic reviews. BMC Health Serv. Res. 2014, 14, 579. [Google Scholar] [CrossRef] [PubMed]

- Richins, G.; Stapleton, A.; Stratopoulos, T.; Wong, C. Big data analytics: Opportunity or threat for the accounting profession? J. Inf. Syst. 2017, 31, 63–79. [Google Scholar] [CrossRef]

- Fernandez, D.; Aman, A. Impacts of robotic process automation on global accounting services. Asian J. Account. Gov. 2018, 9, 123–132. [Google Scholar] [CrossRef]

- Daff, L. Employers’ perspectives of accounting graduates and their world of work: Software use and ICT competencies. Account. Educ. 2021, 30, 495–524. [Google Scholar] [CrossRef]

- Tan, L.M.; Laswad, F. Professional skills required of accountants: What do job advertisements tell us? Account. Educ. 2018, 27, 403–432. [Google Scholar] [CrossRef]

- Parker, L.D. Back to the future: The broadening accounting trajectory. Br. Account. Rev. 2001, 33, 421–453. [Google Scholar] [CrossRef]

- Albin, M.J.; Crockett, J.R. Integrating necessary skills and concepts into the accounting curriculum. J. Educ. Bus. 1991, 66, 325–327. [Google Scholar] [CrossRef]

- Rebele, J.E.; Pierre, E.K.S. A commentary on learning objectives for accounting education programs: The importance of soft skills and technical knowledge. J. Account. Educ. 2019, 48, 71–79. [Google Scholar] [CrossRef]

- Robley, W.; Whittle, S.; Murdoch-Eaton, D. Mapping generic skills curricula: A recommended methodology. J. Furth. High. Educ. 2005, 29, 221–231. [Google Scholar] [CrossRef]

- Howieson, B. Accounting practice in the new millennium: Is accounting education ready to meet the challenge? Br. Account. Rev. 2003, 35, 69–103. [Google Scholar] [CrossRef]

- Scapens, R.W.; Jazayeri, M. ERP Systems and management accounting change: Opportunities or impacts? A Research Note. Eur. Account. Rev. 2003, 12, 201–233. [Google Scholar] [CrossRef]

- Aleqab, M.M.A.; Nurunnabi, M.; Adel, D. Mind the gap: Accounting information systems curricula development in compliance with IFAC standards in a developing country. J. Educ. Bus. 2015, 90, 349–358. [Google Scholar] [CrossRef]

- Aldredge, M.; Rogers, C.; Smith, J. The strategic transformation of accounting into a learned profession. Ind. High. Educ. 2021, 35, 83–88. [Google Scholar] [CrossRef]

- Chen, T.T.Y.; Fang, H.; Wang, Y.; Zhou, Q. Is the pause method in teaching auditing applicable in a different educational environment? A replication. Adv. Account. Educ. Teach. Curric. Innov. 2020, 24, 181–194. [Google Scholar] [CrossRef]

- Madsen, P.E. Research initiatives in accounting education: Transforming today’s students into accounting professionals. Issues Account. Educ. 2020, 35, 35–46. [Google Scholar] [CrossRef]

- Bonzanini, O.A.; Silva, A.; Cokins, G.; Gonçalves, M.J. The interaction between higher education institutions and professional bodies in the context of digital transformation: The case of Brazilian accountants. Educ. Sci. 2020, 10, 321. [Google Scholar] [CrossRef]

- Schafer, B.A.; Cleaveland, C.; Schafer, J.B. Stakeholder perceptions of the value of accounting student organizations. J. Account. Educ. 2020, 50, 100656. [Google Scholar] [CrossRef]

- Makridakis, S. The forthcoming Artificial Intelligence (AI) revolution: Its impact on society and firms. Futures 2017, 90, 46–60. [Google Scholar] [CrossRef]

- Howieson, B.; Hancock, P.; Segal, N.; Kavanagh, M.; Tempone, I.; Kent, J. Who should teach what? Australian perceptions of the roles of universities and practice in the education of professional accountants. J. Account. Educ. 2014, 32, 259–275. [Google Scholar] [CrossRef]

| Title (TI) | Title (TI) | Title (TI) | Title (TI) | |||

|---|---|---|---|---|---|---|

| account * education | OR | account * competences OR account * skills | OR | account * future | OR | account * profile |

| Timeline | Documents Type | Keywords | Web of Science Areas |

|---|---|---|---|

| 2007–2019 | peer reviewed papers | account * education account * competences account * skills account * future account * profile | Education Educational Research, Business Finance, Economics, Education Scientific Disciplines, Management, Business, Ethics, Computer Science Information Systems, Multidisciplinary Sciences, Computer Science Artificial Intelligence, and Computer Science Interdisciplinary Applications. |

| Private | Public | ||||||

|---|---|---|---|---|---|---|---|

| Mean | Standard Error | Mean | Standard Error | df | p-Value | t | |

| Behavioral skills | 0.190 | 0.393 | 0.111 | 0.361 | 103 | 0.303 | 1.035 |

| Technical skills | 8.905 | 1.509 | 8.984 | 1.732 | 103 | 0.806 | 0.246 |

| Ethics and deontology | 0.238 | 0.426 | 0.238 | 0.426 | 103 | 1.000 | 0.000 |

| Generic skills | 1.357 | 1.065 | 1.143 | 1.082 | 103 | 0.323 | 0.993 |

| Optional | 0.310 | 0.707 | 0.333 | 0.690 | 103 | 0.866 | 0.169 |

| Private | Public | ||||||

|---|---|---|---|---|---|---|---|

| Mean | Standard Error | Mean | Standard Error | df | p-Value | t | |

| Behavioral skills | 0.881 | 1.905 | 0.413 | 1.590 | 103 | 0.197 | 1.299 |

| Technical skills | 50.595 | 7.007 | 51.540 | 6.346 | 103 | 0.489 | 0.694 |

| Ethics and deontology | 0.810 | 1.547 | 0.730 | 1.461 | 103 | 0.795 | 0.260 |

| Generic skills | 6.286 | 5.266 | 5.286 | 5.105 | 103 | 0.342 | 0.954 |

| Optional | 1.429 | 3.506 | 2.032 | 4.645 | 103 | 0.455 | 0.749 |

| University | Polytechnic | ||||||

|---|---|---|---|---|---|---|---|

| Mean | Standard Error | Mean | Standard Error | df | p-Value | t | |

| Behavioral skills | 0.333 | 0.537 | 0.067 | 0.249 | 103 | 0.015 | 2.477 |

| Technical skills | 7.867 | 1.384 | 9.387 | 1.540 | 103 | 0.000 | 4.663 |

| Ethics and deontology | 0.133 | 0.340 | 0.280 | 0.449 | 103 | 0.078 | 1.782 |

| Generic skills | 1.500 | 1.118 | 1.120 | 1.045 | 103 | 0.120 | 1.566 |

| Optional | 0.600 | 0.917 | 0.213 | 0.549 | 103 | 0.040 | 2.080 |

| University | Polytechnic | ||||||

|---|---|---|---|---|---|---|---|

| Mean | Standard Error | Mean | Standard Error | df | p-Value | t | |

| Behavioral skills | 1.667 | 2.724 | 0.173 | 0.789 | 103 | 0.007 | 2.766 |

| Technical skills | 46.667 | 7.277 | 52.960 | 5.397 | 103 | 0.000 | 3.986 |

| Ethics and deontology | 0.367 | 0.948 | 0.920 | 1.639 | 103 | 0.036 | 2.128 |

| Generic skills | 7.933 | 6.049 | 4.787 | 4.504 | 103 | 0.015 | 2.477 |

| Optional | 3.367 | 5.701 | 1.160 | 3.277 | 103 | 0.057 | 1.921 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cunha, T.; Martins, H.; Carvalho, A.; Carmo, C. Not Practicing What You Preach: How Is Accounting Higher Education Preparing the Future of Accounting. Educ. Sci. 2022, 12, 432. https://doi.org/10.3390/educsci12070432

Cunha T, Martins H, Carvalho A, Carmo C. Not Practicing What You Preach: How Is Accounting Higher Education Preparing the Future of Accounting. Education Sciences. 2022; 12(7):432. https://doi.org/10.3390/educsci12070432

Chicago/Turabian StyleCunha, Tiago, Helena Martins, Amélia Carvalho, and Cecília Carmo. 2022. "Not Practicing What You Preach: How Is Accounting Higher Education Preparing the Future of Accounting" Education Sciences 12, no. 7: 432. https://doi.org/10.3390/educsci12070432

APA StyleCunha, T., Martins, H., Carvalho, A., & Carmo, C. (2022). Not Practicing What You Preach: How Is Accounting Higher Education Preparing the Future of Accounting. Education Sciences, 12(7), 432. https://doi.org/10.3390/educsci12070432