Empirical Measurement of Competition in the Thai Banking Industry

Abstract

1. Introduction

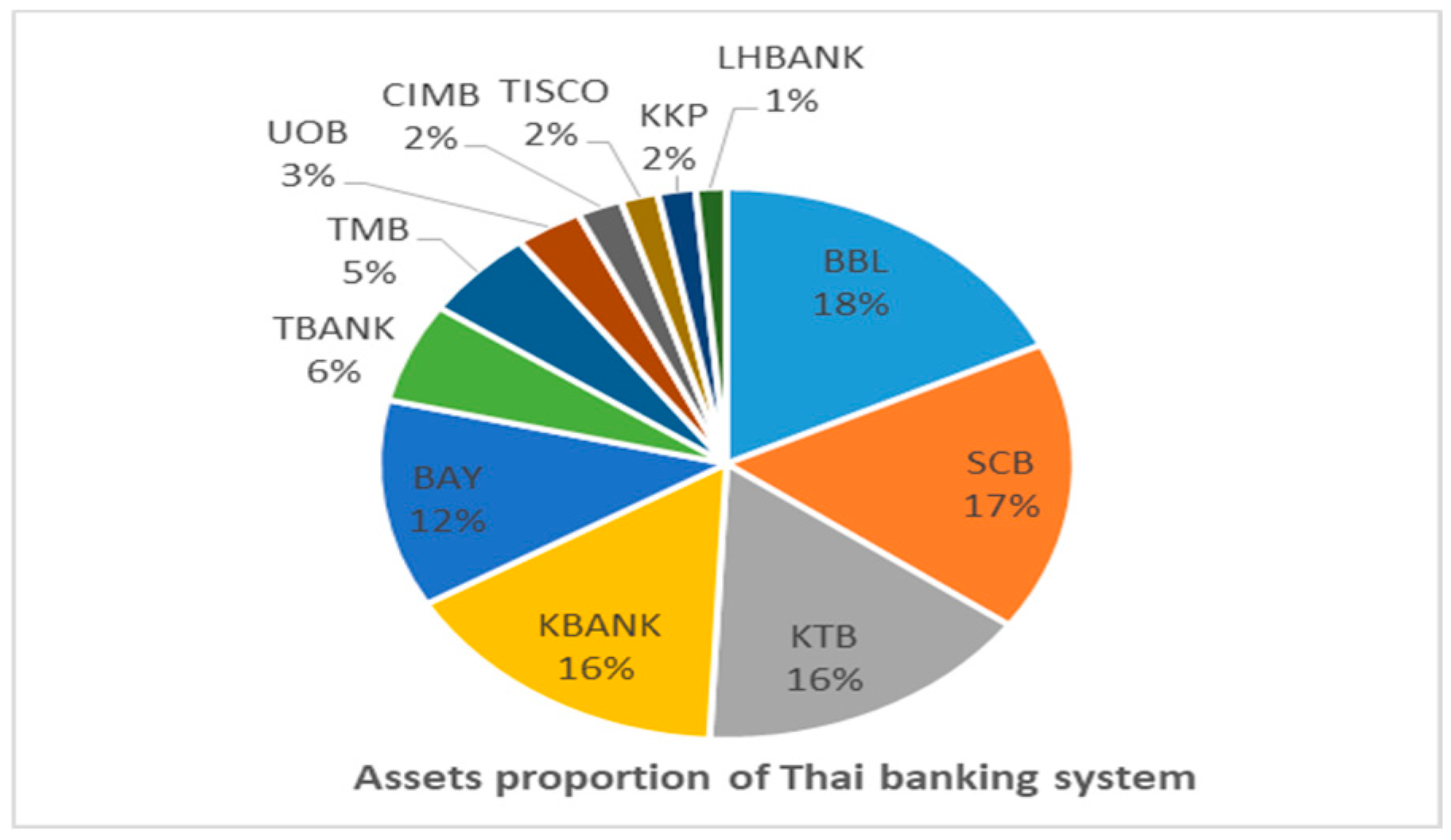

2. Competition of Banking Industry in Thailand

3. Literature Review

3.1. Structural Approach

3.2. Nonstructural Approach

4. Data and Methodology

4.1. Structural Approach

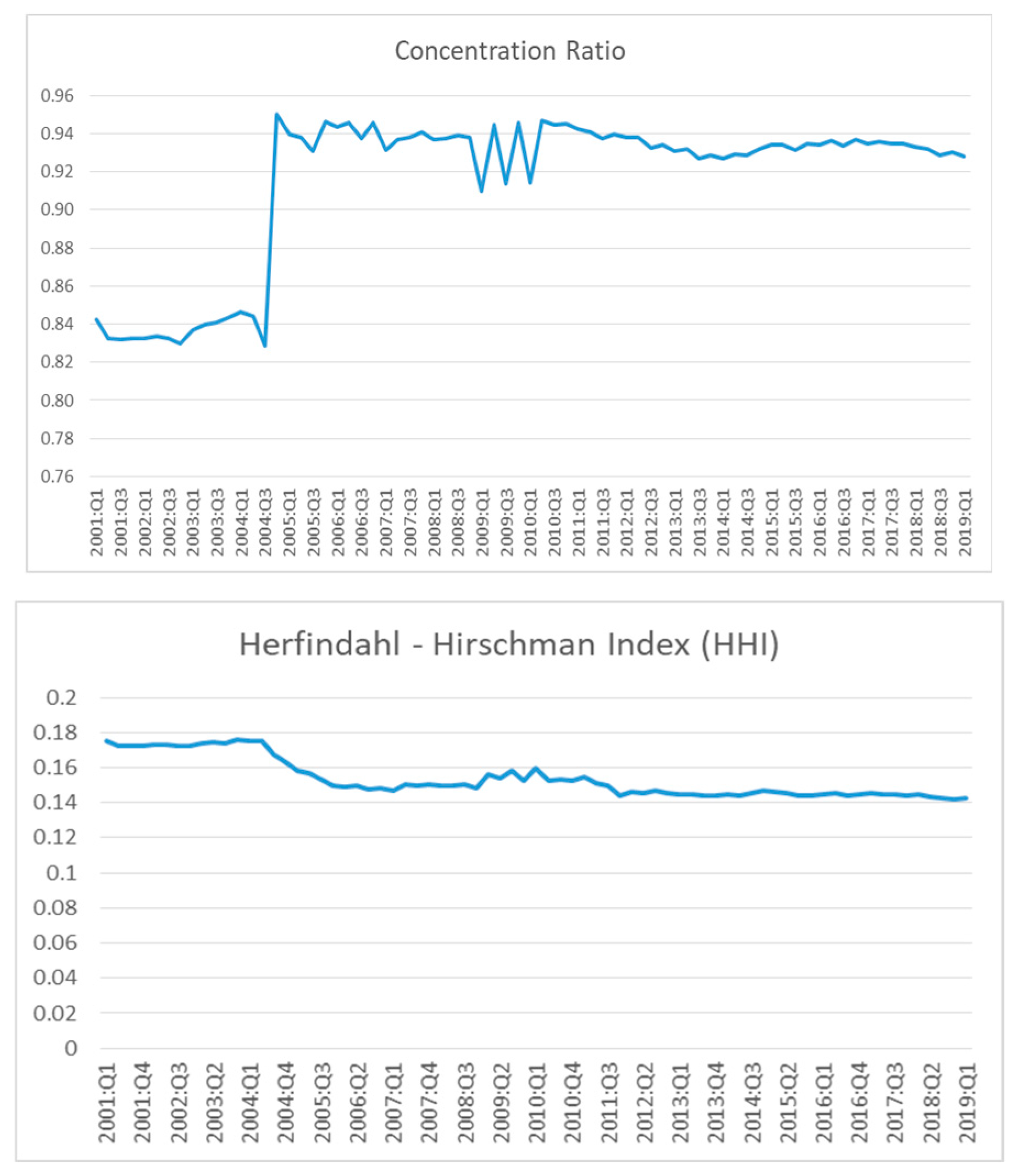

4.1.1. Concentration Ratio

4.1.2. Herfindahl–Hirschman Index

4.1.3. Interpretation of Competition by CR5 and HHI

4.2. Nonstructural Approach

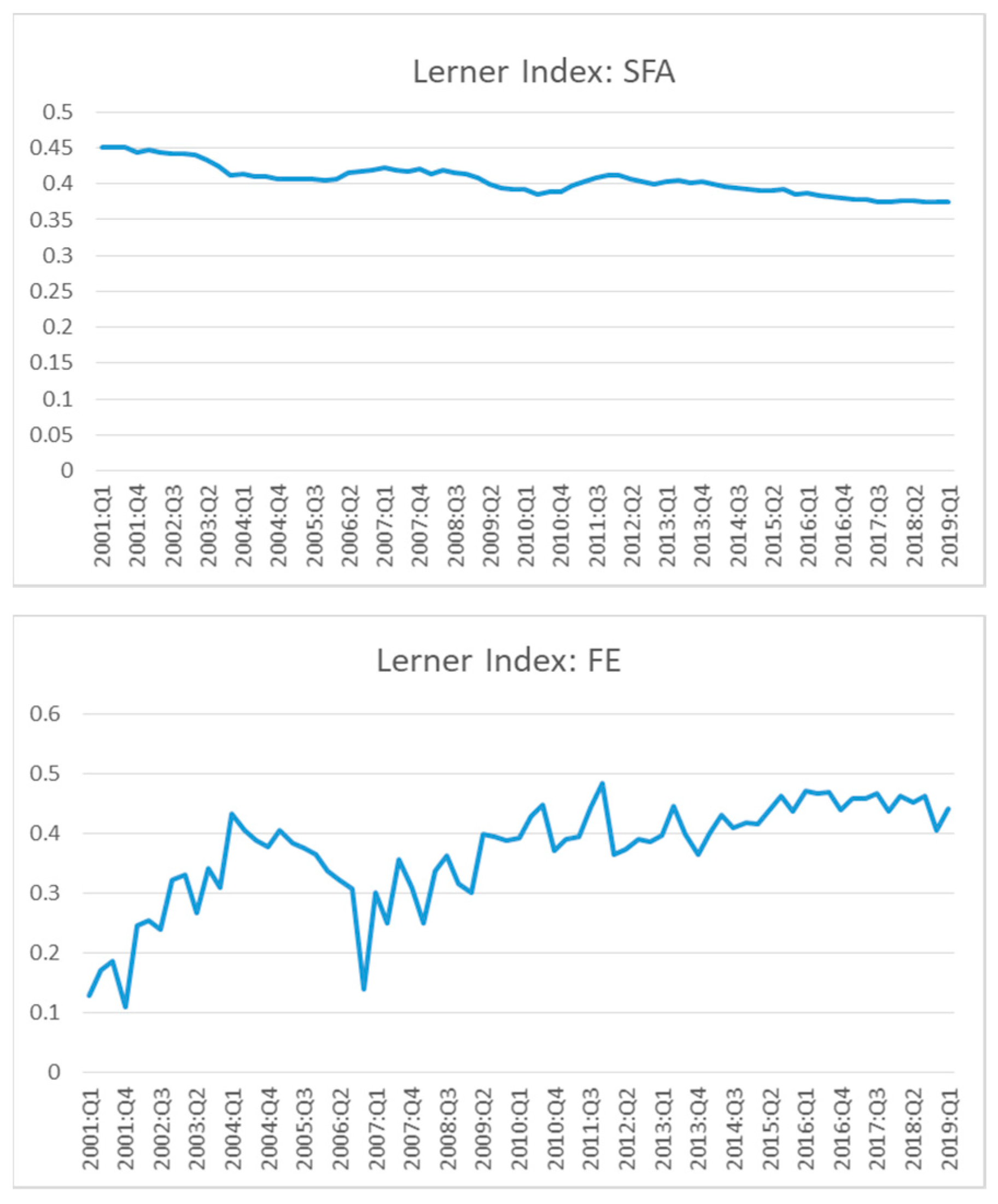

4.2.1. Lerner Index

4.2.2. PRH

4.2.3. Interpretation of Competition by LI and PRH

4.3. Data Descriptions

5. Empirical Results

5.1. Structural Approach

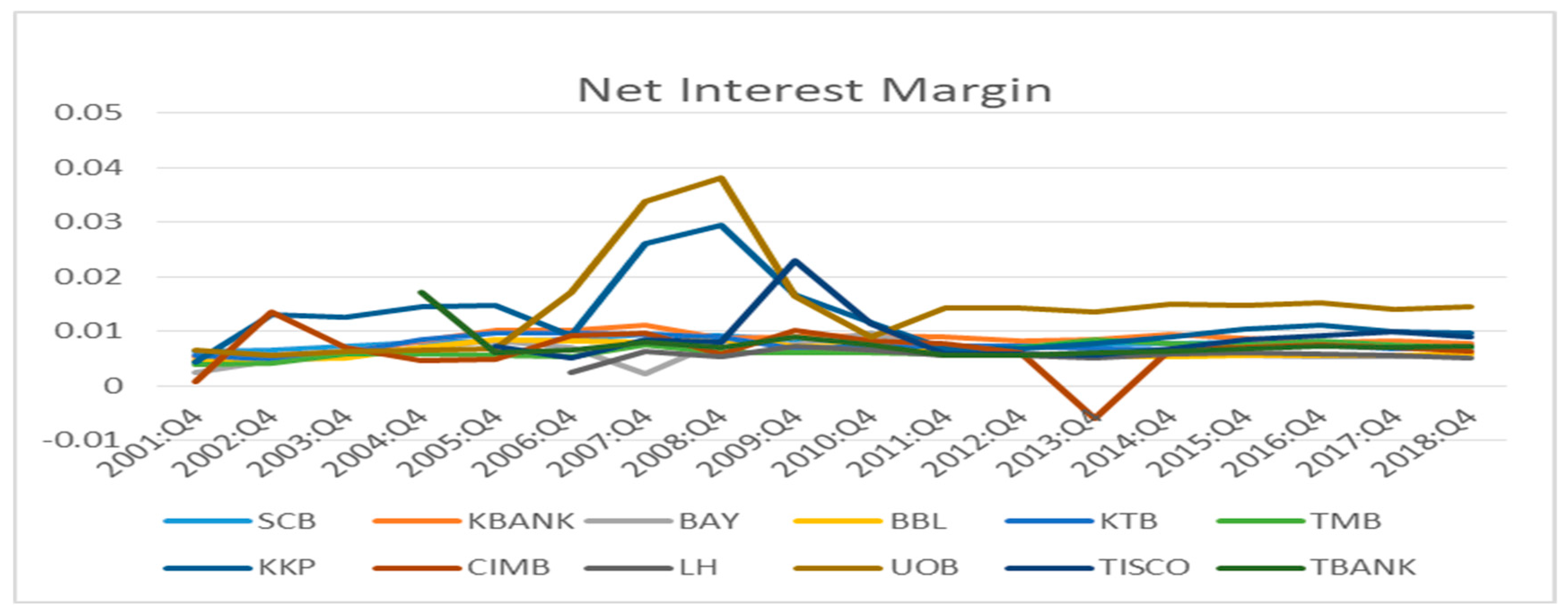

5.2. Nonstructural Approach

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Stochastic Frontier Model

- The probability density function (PDF) of the disturbance term has symmetric distribution.

- The two component errors, and , are statistically independent of each other.

- The two component errors, and , are independent and distributed across observations.

Appendix A.2. Fixed Effects Model

Appendix A.3. Dynamic Panel Model

Appendix B

| Variables | Correlation | p-Value |

|---|---|---|

| GDP | −0.5415 | 0.0000 |

| Profitability | 0.1914 | 0.0000 |

| Capitalization | 0.6591 | 0.0000 |

| Diversification | −0.3921 | 0.0000 |

| Cost efficiency | −0.0852 | 0.0166 |

References

- Agoraki, Maria-Eleni K., Manthos D. Delis, and Fotios Pasiouras. 2011. Regulations, competition and risk taking in transition economies. Journal of Financial Stability 7: 38–48. [Google Scholar] [CrossRef]

- Anderson, Theodore Wilbur, and Cheng Hsiao. 1981. Estimation of Dynamic Models with Error Components. Journal of the American Statistical Association 76: 598–606. [Google Scholar] [CrossRef]

- Anzoategui, Diego, Maria Soledad Martinez Peria, and Martin Melecky. 2010. Banking Sector Competition in Russia. Policy Research Working Paper 5449. Washington, DC: The World Bank Eastern Europe and Central Asia Finance and Private Sector Development Department. [Google Scholar]

- Anzoategui, Diego, Roberto Rocha, and Maria Soledad Martinez Peria. 2012. Bank Competition in Middle East and Northern Africa Region; Washington, DC: The World Bank. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/3846/WPS5363.pdf?sequence=1&isAllowed=y (accessed on 5 October 2019).

- Arellano, Manuel, and Stephen Bond. 1991. Some Test of Specification for panel data: Monte Carlo Evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Bank of Thailand. 2019. Financial Institution. Available online: https://www.bot.or.th/English/FinancialInstitutions/Scope/Documents/ScopeOfSupervision.pdf (accessed on 11 November 2019).

- Beck, Thorsten. 2008. Bank Competition and Financial Stability: Friends or Foes? Washington, DC: The World Bank Development Research Group Financial and Private Sector Team. Available online: https://pdfs.semanticscholar.org/8da6/8cc9632f7330a10efa2720b122c92d014795.pdf?_ga=2.47871399.1851743227.1581935058-933169886.1557211164 (accessed on 24 October 2019).

- Beck, Thorsten, Asli Dermirguc-Kunt, and Vojislav Maksimovic. 2004. Bank Competition and Access to Finance: International Evidence. Journal of Money, Credit, and Banking 36: 627–648. [Google Scholar] [CrossRef]

- Beck, Thorsten, Oliver De Jonghe, and Glenn Schepens. 2013. Bank Competition and Stability: Cross-country heterogeneity. Journal of Financial Intermediation 22: 218–44. [Google Scholar] [CrossRef]

- Bikker, Jacob A., and Katharina Haaf. 2002. Competition, concentration and their relationship: An empirical analysis of the banking industry. Journal of Banking and Finance 26: 2191–214. [Google Scholar] [CrossRef]

- Bikker, Jacob A., Laura Spierdijk, and Paul Finnie. 2006. Misspecification of the Panzar–Rosse Model: Assessing Competition in the Banking Industry. Netherlands Central Bank, Research Department Working Papers 114/2006. Available online: https://www.dnb.nl/binaries/Working%20Paper%20114-2006_tcm46-146771.pdf (accessed on 12 December 2019).

- Boyd, John H., and Gianni De Nicolo. 2005. The theory bank competition and risk taking revisited. Journal of Finance 60: 1329–43. [Google Scholar] [CrossRef]

- Cameron, A. Colin, and Pravin K. Trivedi. 2005. Microeconometrics Methods and Applications. Cambridge: Cambridge University Press. [Google Scholar]

- Carbó, Santiago, David Humphrey, Joaquin Maudos, and Philip Molyneux. 2009. Cross-Country Comparisons of Competition and Pricing Power in European Banking. Journal of International Money and Finance 28: 115–34. [Google Scholar] [CrossRef]

- Claessens, Stijn. 2009. Competition in the Financial Sector: Overview of Competition Policies. IMF Working Paper. Available online: https://www.imf.org/external/pubs/ft/wp/2009/wp0945.pdf (accessed on 20 July 2019).

- Claessens, Stjin, and Luc Laeven. 2003. What Drives Bank Competition? Some International Evidence. Journal of Money, Credit, and Banking 36: 563–83. [Google Scholar] [CrossRef]

- Coccorese, Paolo. 2014. Estimating the Lerner index for the banking industry: A stochastic frontier approach. Applied Financial Economics 24: 73–88. [Google Scholar] [CrossRef]

- Fungáčová, Zuzana, Laura Solanko, and Laurent Weill. 2013. Does Bank Competition Influence the Lending Channel in the Euro Area? Bank of Finland, Discussion Papers 17/2013. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.365.3842&rep=rep1&type=pdf (accessed on 17 July 2019).

- Ghosh, Amit. 2018. What drives banking industry competition in developing countries? Journal of Economic Development 43: 1–19. [Google Scholar] [CrossRef]

- John, Goddard, and John O. S. Wilson. 2009. Competition in Banking: A disequilibrium approach. Journal of Banking & Finance 33: 2282–92. [Google Scholar]

- Hellmann, Thomas F., Kevin C. Murdock, and Joseph E. Stiglitz. 2000. Liberalization, Moral Hazard in Banking, and Prudential Regulation: Are Capital Requirements Enough? American Economic Review 90: 147–65. [Google Scholar] [CrossRef]

- Khan, Habib Hussain, Rubi Binti Ahmad, and Chan Sok Gee. 2016. Bank competition and monetary policy through the bank lending channel: Evidence from ASEAN. International Review of Economics and Finance 44: 19–39. [Google Scholar] [CrossRef]

- Kubo, Koji. 2006. The Degree of Competition in the Thai Banking Industry before and after the East Asian Crisis. Asian Economics Bulletin 23: 325–40. [Google Scholar] [CrossRef]

- Leon, Florian. 2014. Measuring Competition in Banking: A Critical Review of Methods. Available online: https://ideas.repec.org/p/cdi/wpaper/1577.html (accessed on 29 November 2019).

- Lipczynski, John, John O. S. Wilson, and John A. Goddard. 2017. Industrial Organization Competition, Strategy and Policy, 5th ed. London: Pearson Education Limited. [Google Scholar]

- Olivero, María Pía, Yuan Li, and Bang Nam Jeon. 2011. Competition in banking and lending channel: Evidence from bank—Level data in Asia and Latin America. Journal of Banking & Finance 35: 560–71. [Google Scholar]

- Panzar, John C., and James N. Rosse. 1987. Testing for Monopoly Equilibrium. The Journal of Industrial Economics 4: 443–56. [Google Scholar] [CrossRef]

- Chileshe, Mumbi Patrick. 2017. Bank Competition and Financial System Stability in a Developing Economy: Does Bank Capitalization and Size Matter? Bank of Zambia, BoZ Working Paper 5/2017. Available online: https://mpra.ub.uni–muenchen.de/82758/1/MPRA_paper_82758.pdf (accessed on 6 October 2019).

- Rao Subramaniam, Vimal Prakash, Rossazana Ab-Rahim, and Sonia Kumari Selvarajan. 2019. Financial Development, Efficiency, and Competition of ASEAN Banking Market. Asia—Pacific Social Science Review 19: 185–202. [Google Scholar]

- Shaffer, Sherrill. 1983. The Rosses-Panzar Statistic and the Lerner index in the short run. Economics Letters 11: 175–78. [Google Scholar] [CrossRef]

- Sherrill, Shaffer. 2004. Comments on “what drives bank competition? some international evidence”. Journal of Money, Credit and Banking 36: 585–92. [Google Scholar]

- Tabak, Benjamin M., Dimas M. Fazio, and Daniel O. Cajueiro. 2012. The relationship between banking market competition and risk-taking: Do size and capitalization matter? Journal of Banking & Finance 36: 3366–81. [Google Scholar]

- Wooldridge, Jeffrey M. 2010. Econometric Analysis of Cross Section and Panel Data, 2nd ed. Cambridge and London: The MIT Press Cambridge. [Google Scholar]

- World Bank. 2019. World Bank Micro Data. Available online: https://data.worldbank.org/indicator/FS.AST.PRVT.GD.ZS?locations=TH (accessed on 25 October 2019).

- www.sec.or.th. 2020. The Securities and Exchange Commission, Thailand. Available online: https://market.sec.or.th/public/idisc/en/FinancialReport/ALL (accessed on 19 May 2020).

| 1 | TISCO upgraded its status from finance company to commercial bank according to the Financial Sector Master Plan of the Bank of Thailand in 2005. |

| 2 | LH bank was incorporated as a retail bank in 2006 and became a commercial bank in 2011. |

| 3 | Thai Credit for Retail (TCR) bank was incorporated as a retail bank in 2007. |

| 4 | See Lipczynski et al. (2017, pp. 1–6). |

| 5 | The NEIO comprises two generations: the first is based on oligopoly theory under the neoclassical concept, and the second is based on the Australian school concept (see Leon 2014). |

| 6 | Two approaches are used in modeling banking firms, production and intermediate (see Leon 2014). |

| 7 | The other indicators are rarely used in the banking industry. Some indicators, such as persistence of profit, are inappropriate for a developing country like Thailand (see Leon 2014). |

| 8 | This cost function is assumed to have symmetric and linear homogeneity restrictions in the three input prices. |

| 9 | See Appendix A. |

| 10 | The transformation is to multiply both terms of Equation (8) by output and total cost ratio , to get , where = . |

| 11 | See Appendix A. |

| 12 | See Appendix A. |

| 13 | Note that there are alternative ways to transform the model by taking the first difference as well. |

| Market Power | Value |

|---|---|

| Monopoly | |

| Perfect Competition |

| Market Structure | Value of PRH |

|---|---|

| Monopoly | |

| Monopolistic Competition | |

| Perfect Competition |

| Variable | Description | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Total revenue (1) | Sum of interest income and non-interest income | 13,452.35 | 12,271.11 | 27.58752 | 47,932.95 |

| Total cost (1) | Sum of interest expenses, personal expenses, and other operating expenses | 8756.12 | 7257.953 | 23.24 | 27,853.04 |

| Revenue share to total cost (2) | Total revenue to total cost ratio | 1.47 | 0.31 | 0.4 | 2.88 |

| Bank output (1) | Sum of loans and other earning assets | 885,558.60 | 813,554.80 | 8360.36 | 3,106,581 |

| Price of deposits (2) | Interest expenses to total deposits ratio | 7.63 | 4.73 | 2.06 | 47.64 |

| Price of labor (2) | Personal expenses to total assets ratio | 0.002 | 0.001 | 0.000 | 0.035 |

| Price of capital (2) | Other operating expenses to total fixed assets ratio | 0.1 | 0.08 | −0.11 | 0.95 |

| Total equity (1) | Sum of bank’s equity | 87,645.94 | 92,685.39 | 109.44 | 413,378.9 |

| Total assets (1) | Sum of bank’s total assets | 900,147.70 | 819,463.20 | 308.48 | 3,071,110 |

| Equity to total assets (2) | Equity to total assets ratio | 0.01 | 0.04 | 0.01 | 0.35 |

| Loans to total assets (2) | Loans to total assets ratio | 0.71 | 0.11 | 0.19 | 1.01 |

| Other operating income to total assets (2) | Other operating income to total assets ratio | 0.00 | 0.00 | −0.01 | 0.04 |

| Indicator | Mean | SD | Min | Max |

|---|---|---|---|---|

| CR5 | 0.91 | 0.04 | 0.83 | 0.95 |

| HHI | 0.15 | 0.01 | 0.14 | 0.18 |

| Approach | Indicator | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Nonstructural | Panzar–Rosse H statistic | 0.17 | 0.03 | - | - |

| Lerner Index (SFA method) | 0.40 | 0.03 | 0.36 | 0.60 | |

| Lerner Index (traditional method) | 0.37 | 0.17 | −1.25 | 0.69 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Prayoonrattana, J.; Laosuthi, T.; Chaivichayachat, B. Empirical Measurement of Competition in the Thai Banking Industry. Economies 2020, 8, 44. https://doi.org/10.3390/economies8020044

Prayoonrattana J, Laosuthi T, Chaivichayachat B. Empirical Measurement of Competition in the Thai Banking Industry. Economies. 2020; 8(2):44. https://doi.org/10.3390/economies8020044

Chicago/Turabian StylePrayoonrattana, Jirawan, Thanarak Laosuthi, and Bundit Chaivichayachat. 2020. "Empirical Measurement of Competition in the Thai Banking Industry" Economies 8, no. 2: 44. https://doi.org/10.3390/economies8020044

APA StylePrayoonrattana, J., Laosuthi, T., & Chaivichayachat, B. (2020). Empirical Measurement of Competition in the Thai Banking Industry. Economies, 8(2), 44. https://doi.org/10.3390/economies8020044