Abstract

Financial inclusion is the process of including the people who lack formal financial services. The concept of financial inclusion emerged globally in the times of millennium and is defined as the availability and usage of formal financial services. It essentially facilitates economic growth; the financially included individuals can invest in business, education, and entrepreneurship, which can pave way to poverty alleviation and economic development. In the context of Pakistan, a developing economy of South Asia, the financial landscape presents a grim picture of financial inclusion where only 16 percent of the population is financially included. Despite the current focus of policies and regulations devoted to enhancing access to finance in Pakistan from the supply side, the current state of financial inclusion is limited. Therefore, this study investigates the financial inclusion process for Pakistan from the supply side. We analyze the supply-side dimension of access by employing econometric technique of autoregressive distributive lag (ARDL) and using time series data of banking sector of Pakistan. Our empirical findings suggest that the greater the size, geographic outreach, and demographic outreach of the banks, the greater the contribution to the financial inclusion. Additionally, improvement in soft consumer loans and increase in small-sized advances reinforces the financial inclusion process.

JEL Classification:

G21; G29; C22

1. Introduction

“Financial inclusion implies individual’s ability to gain access to and effectively utilize appropriate conventional financial services and products” (Clark et al. 2005). Financial inclusion does not only mean the opposite of “financial exclusion”; it goes beyond that and is more profound in meaning. Allen et al. (2012) term financial inclusion as circumstances that exhibit broader access of financial services without price/nonprice impediments to their use. As per Chakravarty and Pal (2013), financial inclusion is deliverance of financial system of an economy to its participants and members and is considered to be synonymous with banking inclusion.

Although it is not rational to assume that all individuals have a preference for using mainstream banking services compared to use of cash, it still is essential to provide them equal opportunity and access to banking services. Thus, the role of banking services, credit, and debt in modern times cannot be disregarded, and all players in the market can benefit from the use of formal financial services properly. In particular, the supply side of financial inclusion offers prospects to individuals who can enhance financial stability by borrowing from banks and financial institutions.

The supply side of financial inclusion comprises of dimension of “access”. Access to financial services presents the possibilities for individuals to use them. As per theoretical literature, access is one of the crucial dimensions for measuring supply-side financial inclusion. The literature suggests that supply of financial services (formal) matters (Camara and Tuesta 2014), banking services have a positive effect on financial inclusion (Mihasonirina and Kangni 2011), and there exists robust positive impact of financial inclusion on economic growth (Toxopeus and Lensink 2007).

Globally, the populace that is financially excluded is predominantly in developing countries, with only 41 percent adults having a formal account; only 37 percent of females holding formal account against 46 percent of men; the gender gap further widens because of varying income inequalities among developing countries. For high-income countries, account-based financial inclusion is much greater, with 89% of adults holding accounts with formal entities.

Pakistan’s financial landscape presents a grim picture of limited financial inclusion. In a cross-country comparison, Pakistan was ranked the lowest in the context of financial inclusion not only in the region but also worldwide when juxtaposed with developing countries with similar demographic and socioeconomic profiles. The financial inclusion deprivation in Pakistan is evident from the Access to Finance Survey (A2F 2015) by the State Bank of Pakistan (SBP), which states that only 16% of the population is financially included. Thus, there is a dire need for financial sector to incorporate processes and channels to enhance financial inclusion to marginalized sections of Pakistani society.

Despite the current focus of policies devoted to enhancing access to finance in Pakistan, there are number of underlying factors causing financial exclusion. Therefore, the main goal and importance of the study is to identify those factors that determine the level of financial inclusion from the supply side in Pakistan. The research aim and objective are

- ❖

- To establish the determinants of supply-side financial inclusion for Pakistan through the mainstream banking sector;

- ❖

- To investigate the impact of supply-side dimension of “access” on the financial inclusion process for Pakistan;

- ❖

- To determine if the banking sector of Pakistan is inclusive per se.

The significance of this study is twofold. First, this study gives the supply side of financial inclusion the due focus and explores the financial inclusion process for Pakistan from the supply side—the top–down approach; measures the supply-side dimension of “access”, a first-time secondary data assessment by using the autoregressive distributive lag (ARDL) approach and data from 1973 to 2017 of all bank types in Pakistan. Moreover, unlike previous studies (Demirguc-Kunt et al. 2013; Efobi et al. 2014; Tuesta et al. 2015; Mohammed et al. 2017), this study uses both financial inclusion determinants of supply side and macroeconomic factors, financial development indicators, and micro determinants of the stylized banking sector of Pakistan.

Another significant contribution is that this study constructs new variables, especially the micro determinants of the banking sector for financial inclusion, based on and fully supported by theoretical literature—e.g., personal advances of financial inclusion, which only takes into account the advances that are financially inclusive in nature (credit cards, consumer durable and personal loans).

This study employs an extensive and authentic secondary data base of the State Bank of Pakistan (SBP) in the form of Statistic on Scheduled Banks in Pakistan and The Hand Book of Statistics on Pak Economy. We model important financial inclusion and micro determinants of the banking sector and find that the supply-side predictors of personal advances, advances by rate of interest, advances by size of account, and super inclusive advances impact the financial inclusion process. Our research shows that improvement in soft consumer loans and increase in small-sized, no-frill advances contribute to the financial inclusion process.

The structure of the study is as follows: Section 1 describes the financial inclusion output of the supply side of the banking sector and contains a brief introduction and literature review. Section 2 explains the methodology and data and variable construction. Section 3 presents the empirical findings and diagnostics, while Section 4 involves the discussion upon findings. Section 5 concerns the robustness of results. Section 6 shows the graphical analysis, while Section 7 gives conclusions and policy recommendations.

1.1. Literature Review

Considering the significant role of consumer spending in economic activity, it is presumed that a functioning market economy relies majorly on credit availability. Consumer credit may well promote economic growth by permitting the anticipation of purchases and shifting demand toward durable goods industries, which have great potential for expansion. By contrast, failure to provide access to reasonable credit can reduce consumer spending and hinder economic growth. When lending is hindered, progressive commerce comes to a halt.

However, there is not much evidence on the exact effect of credit availability for low-income–high-risk consumer groups on the macroeconomy. There is a possibility that the lower level of the personal credit market has fewer progressive influences on the economy, but there are several reasons that justify the provision of affordable credit to less affluent groups. Foremost is that credit allows people to avail that which they cannot afford with their current income; thus, credit can shift the time of cash flow. Credit demand in low-income–high-risk groups is more intense as compared to rich segments by virtue of mismatched income–expense because vulnerable segments have less spendable income and less saving. Availing manageable credit to a certain limit is therefore unescapable, although not desirable.

Second, affordable credit availability acts as a cushion for unforeseen events and a source of transitory income for consumption smoothing. In this context, credit is an external support for people who are unable to overcome difficulty by themselves. Therefore, nonaccess to affordable credit is regarded as an aspect of financial exclusion. However, despite the perpetual requirement for credit, it is difficult for some household and individuals to obtain credit from the banking sector. Ironically, those who require credit the most are often the “least credit worthy” among would-be borrowers.

The same applies to Pakistan, where there is a problem of financial exclusion in consumer credit. The exclusion is evident as A2F 2015 (SBP) shows that 84% of the population of Pakistan have absolutely no access to “high street credit” from the banking sector. In the context of this grim and infant landscape of financial inclusion in Pakistan, very few studies have investigated the financial inclusion scenario. Amin and Jalil (2017) studied remittances and the financial inclusion nexus for Pakistan, while Rizvi et al. (2017, 2018) investigated mobile banking and the Fin-tech revolution as a potential catalyst for financial inclusion and growth in Pakistan. Research upon the demand and supply dimension of financial inclusion has received little attention in the local literature and context.

1.1.1. The Supply Side of Financial Inclusion

The supply side of financial inclusion is a multidimensional phenomenon and cannot be captured by a single indicator but is determined by a much larger set of indicators. Literature shows the employment of various indicators of supply-side data at the country level for determining access to financial services. Honohan (2008) formulated the indicator of financial access to study the impact of country-specific characteristics such as population density, age dependency ratio, and gross national income on the financial inclusion process of 160 countries. Looking at the cross-country link between poverty and financial access, his results showed that financial access significantly reduces poverty. Kumar (2013) investigated the state of financial inclusion in India and concluded that branch network level significantly and positively impacts financial inclusion. He further added that ease of access and geographical region are also the determinants of financial inclusion level in certain segments of the population. Most studies used basic indicators such as automated teller machine (ATM)/100,000 adults, ATM/1000 km2, commercial bank branches/100,000 adults, and commercial bank branches/1000 km2. These indicators depict the “physical point of services” offered by financial service providers (commercial banks, rural and agri-banks, saving banks, saving and credit co-operations, microfinance institutions, and money market funds).

Certain studies used the variables of land mass, adult population, geographic outreach, and demographic outreach in terms of supply of financial services. The results of the studies suggested that population indicators contain more information in explaining the access dimension of the supply side of financial inclusion to geographic (area) indicators. Park and Mercado (2015) studied financial inclusion determinants; investigated the relationships between inequality, poverty, and financial inclusion; and found that demographic determinants such as age dependency ratio, literacy rate, per capita income, and state of law impact the financial inclusion process in developing countries in Asia. Corrado and Corrado (2015) employed extensive data of the “life in transition survey” conducted in Europe during the 2008–2010 global crisis and showed that financial inclusion likelihood is dependent upon a household’s economic, social, and demographic aspects.

Another variable of “having a loan” also depicts a consolidated stage of financial inclusion, as it belongs to that level in the hierarchy of availing financial services where such individuals have already utilized other forms of financial products such as bank accounts, pay roll accounts, etc. Having a loan may be an accurate indicator to identify more advance stages of financial inclusion (Camara and Tuesta 2014). The literature also shows that the efficiency of the financial system is another variable that determines the supply-side level of financial inclusion. The efficiency of the financial system minimizes the barrier of the affordability of financial services (formal), as efficient financial systems provide services at a competitive price. Arora (2014) measured financial inclusion in the context of transactions, and the dimensions included “ease of transaction, cost of transaction, and outreach”. Further, the supply side of financial inclusion is not only dependent on idiosyncratic financial market issues such as efficiency of financial institutions and financial stability but also on broader issues beyond the financial market, such as governance and macro factors like GDP, inflation, and the net interest margin. Financial inclusion is highly correlated with the net interest margin, as shown by Allen et al. (2012).

A number of studies have tried to establish the root causes, repercussions, and possible solutions concerning financial exclusion, but the majority of studies are either cross-country investigations or in a single country where the socioeconomic landscape considerably differs from that of Pakistan.

Sarma (2008) derived a financial inclusion index but was unable to define a common determinant for all countries due to the diversity in country-specific regulations. Characteristics and preferences giving way to financial inclusion greatly differ among countries (Kempson et al. 2004; Sinclair et al. 2009; Kendall et al. 2010; The World Bank 2008). Despite these studies, the literature still lacks information on the determining factors of financial inclusion in Pakistan.

Most scholars adopted the Global Findex Database for understanding the financial inclusion process around the world (Allen et al. 2012; Efobi et al. 2014; Tuesta et al. 2015; Mohammed et al. 2017) and studied individual behavior in terms credit, payments, saving, and risk management based on Findex data of 148 countries. Other researchers used survey data; Swamy (2014) analyzed the relationships among financial inclusion, economic development, and gender using household survey data from India. However, little work has been done to identify financial inclusion by secondary data and country-specific characteristics. Explicitly, current literature mainly focuses on individual features to recognize the financially excluded ones. Banking determinants and the roles they play to provide the background for understanding microlevel factors of financial inclusion have gained little attention. Further, there have been few attempts to model and realize financial inclusion in a holistic way. This study differs from previous studies and attempts to model the financial inclusion supply side in a comprehensive manner.

1.1.2. The Banking Sector and Financial Inclusion Landscape in Pakistan

The banking industry, as a segment of financial market, is unique due to its stylized features, market power, interest rates, and accumulation of bank capital. It offers stylized products, loans, deposit contracts, and financial products from a composite basket that are differentiated at different prices. It is also exclusive due to its stylized credit risk (only the banking and insurance sectors have to deal with both the idiosyncratic and systematic risk, where the former is non-diversifiable) and balance sheet composition.

In Pakistan, the financial sector comprises the State Bank of Pakistan (2005, 2020), commercial banks, insurance companies, and nonbanking financial institutions (NBFIs). The commercial banking sector constitutes the nationalized commercial bank (NCB), state-owned provincial banks, privatized commercial banks, domestic private banks, foreign banks, and Islamic banks. Commercial banks offer short-/medium-term financing, retail banking, and trade finance. In terms of government securities and asset holdings, banks account for a major portion, but their share in the investment and total financial sector loan portfolio is considerably low.

In less developed countries, banks exhibit market power and operate in a concentrated market; the same applies to Pakistan, where a stylized banking sector operates under monopolistic competition where commercial banks prefer extending risk-free loans to the government for the purpose of improving the credit adequacy ratio (CAR). The government crowds out private investment by acquiring sizeable chunks of private-sector credit, bank corporate loan portfolios are skewed toward specific sectors/giants, and public sector banks finance loss-making public enterprises.

Concerning financial inclusion, the landscape is limited in Pakistan. A gap exists between the mainstream credit market and prospective borrowers, and low-income individuals in Pakistan are affected by this problem; nearly 50% of people save, yet only 8% entrust financial institutions with their money. One third of people borrow, but just 3% borrow from mainstream financial institutions. International remittances have risen by 29%, but only 2.3% of Pakistanis send or receive those remittances (A2F Survey 2015).

Additionally, the vast majority of women are excluded from the formal financial system. There is a significant gender difference in access to credit in Pakistan—women remain less likely to gain access to the overall financial sector compared to men. Notably, fewer females attain access to banking services (5.5% of women vs. 21.1% of men), money transfers (1.4% of women vs. 3.3% of men), and insurance (0.6% of women vs. 3.3% of men) as per the Access to Finance Survey.

There is a need for the formal financial sector to align with and incorporate informal channels and processes in order to increase financial outreach to the marginalized sections of the population.

2. Methodology

Although financial inclusion has remained a priority for years, the policy and approach regarding financial inclusion has remained questionable, essentially showing bias toward the measurement of financial inclusion. Our study, therefore, attempts to plug these analysis gaps from the supply side.

We presume that there are three dimensions that determine the magnitude of full financial inclusion—the usage and barriers dimensions from the demand side of financial inclusion, and the access dimension from the supply side of financial inclusion.

Concerning the supply side, the dimension of access is concurrently determined by various country-level supply-side characteristics. For establishing determinants and the measurement of financial inclusion from the supply side, we employed two aspects of the access dimension based on strong support from literature—availability and accessibility. The dimension of availability accounts for financial system outreach and the size and shape of banking outlets, as the distance covered to the financial services point can prove to be a crucial hindrance to financial inclusion (Allen et al. 2013). Availability is represented in the forms of banking industry branch network, penetration, assets, agents, or ATMs (Ahamed and Mallick 2019). For accessibility, the volume of bank loans, types of loan portfolios, and mobile accounts has been employed in studies to incorporate the level of financial accessibility. Based on a holistic approach, Sarma (2008) built a financial inclusion index stressing that precise measurements require the “availability and accessibility” of services and products from the supply side and the “usability” of services and products from the demand side.

Studies have also revealed the aggregate-level impacts of financial inclusion and shown that the bank-specific micro variables impact financial inclusion, translating into increased financial services and better solutions to user capital issues, improved consumption and convenience of use (Corrado and Corrado 2015). Concerning the macro-impact, the supply and availability of economic services enhances the number of channels for users and enables equitable and more balanced distribution of resources (Chakravarty and Pal 2013).

Thus, for the supply side, we approached financial inclusion from a two-sided perspective. On one side, we considered the inclusiveness of the banking side by measuring the real use of financial services, namely, the inclusion output of financial system (LHS). On the other side, denoted as RHS, we took information from:

- -

- the “Availability” aspect of the Access dimension of the supply side given by Equation (1), comprising the variables of banking industry size, network and outreach/penetration (macro-impact);

- -

- the “Accessibility” aspect of the Access dimension of the supply side given by banking micro specific variables of the supply side in Equation (2) comprising banking portfolios of loans and advances, the size of loans and rate of interest (micro-impact).

2.1. Financial Inclusion—Supply-Side Model

The ARDL (autoregressive distributive lag) approach of co-integration developed by Pesaran et al. (2001) is employed to analyze the long-term relationship among variables. Co-integration is a powerful method of determining long-term relationships and steady state equilibria among variables. A number of co-integration techniques were devised to establish long-term relationships amongst the time series. For all these co-integration techniques, there is an important restriction that all series must be integrated in the same order. However, there is a co-integration approach developed in recent times which is called the autoregressive distributive lag (ARDL) approach, proposed by Pesaran et al. (2001), also known as bound testing In contrast to other co-integration approaches, e.g., Engle and Granger (1987) and Johansen and Juselius (1990), the ARDL is superior due to the fact that both the short- and long-term parameters of the specified model can be applied irrespective of the order of integration, whether the series under consideration are I (0), stationary at level or I (1), stationary at first difference. For convenience, the ARDL is extensively used, especially in multivariant models. Considering that we are dealing with time series data, and the main research objective of this study was to establish supply-side determinants of financial inclusion and their impact on the financial inclusion process, we employed the ARDL approach to analyze the long-term relationship among the variables in this study.

The empirical investigation method of ARDL comprises three steps. The first explores the stationarity of variables using unit roots tests. The second step tests the presence of long-term relationships among the variables. The third step is to study the short-term dynamics using the error correction mechanism (ECM).

Testing the Unit Root: As the first step of empirical analysis, we tested the order of integration of the series. This step is essential, as the ARDL technique requires the explanatory variables to be integrated in the order I (0) or I (1). If any series is I (2), then Wald (F-test) will generate biased results. Thus, we employed the standard version of ADF, augmented Dickey–Fuller test (Dickey and Fuller 1979) to check the non-stationarity assumptions. Apart from ADF unit root tests, we also performed PP (Phillips–Perron) and KPSS (Kwiatkowski–Phillips–Schmidt–Shin) tests. The results of the ADF, PP, and KPSS unit root tests, displayed in Table A1 of Appendix A, suggest that certain variables are nonstationary at level but attain stationarity after taking the first difference, which implies the possibility of long-term relationships among the variables.

Lag Length: The ARDL bound testing approach is highly sensitive to the selection of lag structure. Generally, the AIC (Akaike information criteria), SBC (Schwartz–Bayesian criteria), and LR (likelihood ratio) criteria are used. However, the most popular research approach is SBC due to its parsimonious nature. We selected the appropriate lag on the basis of lowest AIC/SBC values and fixed the lag length throughout the model for the purpose of making the study comparable to others.

ARDL Co-integration Test and Long-Term Relation: The existence of a long-term relationship is tested by restricting the coefficient of the lagged variables equals to zero. That is, the null hypothesis of the presence of no long-term relationship is φ1 = φ2 = φ3 = 0. This hypothesis testing was done by an F-test under bound testing.

Short-Term Dynamics: The short-term dynamics of the model were then explored by an error correction mechanism (ECM) which explains the adjustment process of the parameters to a long-term equilibrium.

2.2. Data Source

This study is based on data from all banks1 operating in Pakistan, which are classified into three main groups, namely, public sector banks, domestic private banks, and foreign banks. Public sector banks are further divided into public sector commercial banks and specialized banks.

The time series data for Financial Inclusion determinants, micro determinants of the banking sector, comprising all categories of banks and macro- and financial determinants, are based on annual data of the “Statistics on Scheduled Banks in Pakistan” (SBP), “Hand Book of Statistics on Pakistan Economy” (SBP) and “Statistical Publications” (SBP). For financial inclusion determinants and macro determinants, time series data were used for the period ranging from December 1973 to December 2017. For micro determinants of the banking sector, data comprising four bank types were employed for a period ranging from December 1973 to December 2017. For certain variables, the Global Economy data set was used.

If we compare our study with the studies of developed countries, then data time series from 1973 to 20172 provide only 44 data points, seemingly a small sample; however, for a developing country like Pakistan, banking sector data are available only for this time frame. Because of this limitation, we performed the ARDL technique as it is consistent for small sample sizes.

Variable Construction The construction of Financial Inclusion—Supply-Side variables is as follows (Table 1):

Table 1.

Variable construction of financial inclusion—supply side.

3. Empirical Findings

3.1. ARDL Co-integration Test—Access Dimension

The ARDL-Co-integration testing comprises a number of steps; the results are as follows:

3.1.1. Unit Root Test

The results of the augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) unit root tests are given in Table A1—Summary of Unit Root Test—Supply Side of Appendix A. Certain variables display stationarity, while others do not depict any form of non-stationarity; thus, we cannot reject the null hypothesis of non-stationarity at their level form. On applying tests to first difference of these variables, we obtained stationarity for all. The variables in the supply dimension model are integrated both in the order 0 or 1 and are thus appropriate for ARDL.

3.1.2. Test of Lag Choice Criteria

As stated earlier, the optimal lag length turned out to be the same for all models.

3.1.3. ARDL Co-integration Test

We devised the following equation3:

Here, our dependent variable is “Inclusion output of the financial system-Supply4 side” based on the theoretical stance that the use of formal financial services is considered an output of financial inclusion rather than a measure of the inclusiveness of a financial system (Tuesta et al. 2015). This study used advances/loan portfolios as a dependent variable for measuring financial inclusion. Considering total deposits and total advances of the banking sector as proxies for financial inclusion is strongly supported by previous studies5, such as Beck et al. (2007); Honohan (2008), Amidžić et al. (2014) and Uddin et al. (2017). The literature suggests that using the total advance portfolios of the banking sector to measure the financial inclusion of the supply side takes into account the broader perspective, where financial inclusion is not just limited to opening saving accounts, but availing other banking products that encompass loans and credits.

Uddin et al. (2017) in their study “Determinants of Financial Inclusion in Bangladesh: Dynamic GMM and Quantile Regression Approach” developed two separate models to depict both the depositor’s side and borrowers’ side of financial inclusion in Bangladesh. In the first model, Total deposits are considered a dependent variable, whereas in the second model, Total loan and advances are considered a dependent variable. The inclusion measured by the total deposits indicates that size, deposit interest rate, literacy rate, age dependency ratio, and gross national income have a significant impact on financial inclusion. The second model using loan and advances as an indicator of financial inclusion indicates size, the efficiency of the banks, interest charged on loans, and age dependency ratio; these are all important for financial inclusion.

Kumar (2013) modeled the credit ratio to determine financial inclusion from the supply side. Asuming et al. (2019) also modeled a number of bank loans and mobile accounts/1000 adult population to assess the depth of financial access. Chen et al. (2018) modeled the indicator of loan balance of financial inclusion/GDP, which demonstrated the financial inclusion promoted by the financial sector.

The prime aim of this research and the selected measure of financial inclusion was to establish how bank-specific factors influence the use of banking services by the population. It is worth noting that the microlevel impact of financial inclusion can be reflected at a bank-specific level, which promotes the participation of users and improves bank performance. In addition, the macrolevel impact of inclusive finance can be reflected in the banking industry level, which strengthens the intensity of capital networks.

Thus, we applied the ARDL co-integration technique6 to test the long-term relationship between financial inclusion and the “Access” dimension of supply side. Table 2 presents the results of bounds test. The lower bound–upper bound critical values were obtained. The estimated Wald F-Statistic for the model is 13.47, which is larger than the lower bound critical value of 3.93 and upper bound critical value of 5.23 at 1 percent level of significance.

Table 2.

Bound tests for the existence of a long-term relationship.

Thus, co-integration exists between the variables in the Access model, and we reject the null hypothesis of no long-term relationship. Since the long-term relationship is evident through the bounds test approach, we proceeded to estimate the long-term equation and coefficient of the specified model.

3.1.4. ARDL Long-Term Estimates—Access Dimension of Supply Side

We estimated the long-term coefficient. The first model contains determinants of the Access dimension. The long-term result of the ARDL model is given in Table 3. All the variables are statistically significant. For the first generic specification, the coefficient of LTA (log of total asset) is highly significant, indicating that a 1 percent increase in assets of the banking sector leads to an increase of about 0.663 percent in the financial inclusion on the supply side. We employed log of total assets as a determinant of bank size based on the research of Beck et al. (2010) and Uddin et al. (2017).

Table 3.

Long-term estimate of supply-side model—access dimension.

The long-term estimates show that the variable of number of banks LBNK (log of number of banks) is statistically significant and shows a positive relationship with financial inclusion measures and the geographic outreach of banks. The coefficient is reported to be 0.862. The coefficient of DOUT (demographic outreach) equals 0.844, confirming the relationship between the variables. This suggests that a 1 percent rise in DOUT will cause financial inclusion to increase by 0.84 percent.

3.1.5. ARDL Short-Run Estimates—Access Dimension Model

Table 4 summarizes the short-term parameters of the “Access Dimension Model”. Again, the elasticity of the supply model is significant at 1 and 5 percent levels of significance. This implies that the series is not explosive, and equilibrium in the long-term is attainable. The coefficient reveals that a 9 percent disequilibrium in financial inclusion function for the current period will be corrected in the next year. The short-term model is estimated, as short-term dynamics are very important due to the coefficient of ECM. ECMt-1 signifies the speed of adjustment of a parameter, implying how quickly a series achieves long-term equilibrium. The coefficient must be significant and negative. According to Banerjee et al. (1993), a highly significant ECM coefficient confirms the presence of stable long-term relationships.

Table 4.

Short-term estimate of supply-side model—access dimension.

3.1.6. Diagnostics

The validity of the results hinges upon the goodness of fit and stability of the model; hence, Table 3 summarizes the results of a diagnostic check. The reported residual diagnostic of the “Access Model” shows normally-distributed residuals. The stats also reveal that no autocorrelation in the model appears as non-heteroscedastic due to passing a hetero test.

3.2. ARDL Co-Integration Test—Banking Determinants of Supply-Side Model

We estimate the fourth model of demand side using the following equation. The test of unit root indicates the integration of order (1) or order (0) in all series, with no exception of any series of order (2). This makes it possible to test the long-term relationship between financial inclusion and banking determinants of the supply side by employing bounds testing. Equation (1) is calculated using OLS, while the long-term relationship of Equation (2) is established by calculating joint F-Statistics.7

The calculated F-Statistics, along with the critical values proposed by Pesaran et al. (2001) at significant levels, are as per Table 2 of the Access dimension model. At the optimum lag length of order (1), the F statistic exceeds the critical value at 1 percent significance level. Thus, a strong long-term relation exists among the variables.

3.2.1. ARDL Long-Term Estimates—Banking Determinants of Supply Side

Next, we proceed to ARDL co-integration for long-term estimates of the banking determinants of the supply side8. The long-term estimates are given in Table 5.

Table 5.

Long-term estimate of supply-side model—banking determinants.

The coefficient of LADV MFI (log of advances to MFIs) is 0.319, implying that a 1 percent increase in advances to microfinance leads to a 0.3 percent rise in the supply side of financial inclusion.

We also modeled other important predictors of LADV PER (log of advances—personal), ADV ROI (advances by rate of interest), and LADV SOA (log of advances by size of account) and LSIAM (log of super-inclusion advances for upmarket). The coefficient of LADV PER indicates that a 1 percent increase in personal advances, keeping everything else the same, will lead to a 0.53 percent increase in the gross advances portfolio of banking, which also infers that improvement in soft consumer loans reinforces financial inclusion.

Similarly, the highly significant and positive coefficient of ADV SOA implies that a 1 percent increase in small, no-frill advances contributes to financial inclusion of almost 0.48 percent. No-frill advances are primarily designed for individuals with low incomes. Through a bank-specific view analysis, it is evident that the problem of NPL is largely affected by the size of loans and the bank management structure. We also modeled the super-inclusion of upmarket in the supply-side model of financial Inclusion. Super-inclusion exhibits a negative relationship with financial inclusion, and unit rise in large loans decreases the financial inclusion of the supply side by 0.28%.

3.2.2. ARDL Short-Term Estimates—Banking Determinants of the Supply Side

Here, we present the short-term result and the coefficient of ECM. The short-term estimates are similar in signs to the long-term estimates and are in line with prior expectations. The short-term dynamics are very important due to the coefficient of ECM. The ECMt-1 lagged error correction coefficient is given in the last row of Table 6. Therefore, the co-integrating relationship among the variables has been confirmed. The ECMt-1 coefficient depicts the pace of adjusting the long-term equilibrium after a short-term shock. ECMt-1 coefficient 0.993 indicates that approximately 10 percent of last year’s shock disequilibria adjust back to long-term equilibrium in the present year.

Table 6.

Short-term estimate of supply-side model—banking determinants.

3.2.3. Diagnostic Test

Our model qualifies the diagnostic test. The results are presented in the lower panel of Table 5. The p-values show the nonexistence of serial correlation. The p-value, 0.1178, of the functional form for the model shows a well-specified model. Finally, the p value of normality, 0.6583, indicates the acceptance of the null hypothesis of the normality assumption of residuals.

4. Discussion

For the first generic specification of the Access dimension model, the coefficient of the log of total assets, LTA, is highly significant. The literature shows that the Total Assets of commercial banks are the prime factors affecting financial inclusion and economic development by controlling the capital flow. Zopounidis and Kosmidou (2008) showed that with greater assets and larger banks, there is more capability of reaching a greater part of the population and enhancing financial inclusion. Concerning statistically significant LBNK, which exhibits a positive relationship with financial inclusion measures, there is strong evidence in literature for using the number of bank/branches as a determinant of financial inclusion on the supply side. The literature cites physical distance between the individual and point of financial services as an important determinant of financial inclusion (Allen et al. 2013). The pervasiveness of outreach of the banking sector is measurable by bank branch network, Agents, and ATMs (Ahamed and Mallick 2019).

Since commercial banks take a leading role in the provision of access to finance, we used the penetration of the banking sector as a measure of access to finance in the form of DOUT, i.e., demographic outreach, which turned out to be highly significant, showing a positive relationship with financial inclusion. By contrast, the study of Kumar (2013) for India showed that branch density had a negative and significant impact on financial inclusion. The outcome suggested that though credit and deposit accounts improved over time, their penetration failed to match the population growth that was witnessed, thus generating a negative impact.

For the second model of banking determinants of the supply side, LADV MFI, the advances to microfinance institutions coefficient implies that a rise in advances to microfinance leads to an increase in the supply side of financial inclusion. The results are in line with literature such as Kipesha and Zhang (2013), who found that financial inclusion in developing countries was primarily spearheaded by microfinance institutes, and that these MFI presented considerable advances and deposit portfolios with banks and a sound repayment capacity when loans were channeled to them by government-owned banks.

There is still a debate in the literature concerning the relationship between interest rates and financial inclusion. Certain studies have shown a negative relationship between the two, whereas some favor a positive relationship between both. Our results are in line with the latter. We found a statistically significant positive sign with a magnitude of 0.836 for the rate of interest for loan portfolios.

The LSIAM, super-inclusion, exhibits a negative relationship with financial inclusion. The results are consistent with those of Espinoza and Prasad (2010), who showed that larger loans have a negative impact on NPLs, and that it is harder for bank managers to tackle the repercussions of timely credit risk. Scrutiny of banks’ view indicates that increases in the NPL problem could be affected by the size of loans and bank management (Guan et al. 2017).

5. Robustness

The gross advances on the dependent side may be criticized, keeping the right-hand-side variables in view. Consequently, the question of spurious correlation may be raised. Therefore, we took an alternative measure to test the robustness of the estimates. We estimated two additional models by taking two different scaled variables on the dependent side. These are “Number of Borrowers” and “Number of Bank Accounts” as a measure of financial inclusion. Furthermore, in the model with “Number of Bank Accounts” as a dependent variable, we incorporated some important variables which can determine financial inclusion along with supply-side variables. These are the per capita GDP of Pakistan, level of education, and life expectancy.

Another important issue is estimation methodology. The dependent variable of regression, that is, the number of borrowers or number of bank accounts, is a count variable. The usual ordinary least square methodology or ARDL is not a valid estimation technique. The literature suggests that this type of regression should be estimated using Poisson regression to avoid the biasness or the loss of efficiency and consistency. Therefore, we shall now estimate regression using Poisson regression. Notably, we shall use the autoregressive version of Poisson regression to handle time series issues in the model. Poisson regression is based on the maximum likelihood method. Therefore, the marginal effects of the estimates are interpreted in terms of probability.

| Marginal Effects of Poisson Regression with Number of Borrowers | |||

|---|---|---|---|

| Supply-Side Model—Access Dimension | |||

| dy/dx | Standard Errors | Z-Stats | |

| LTA | 0.1836 ** | 0.0801 | 2.2913 |

| LBNK | 0.2359 *** | 0.0713 | 3.3096 |

| LDOUT | 0.5806 *** | 0.1899 | 3.0573 |

| Pseudo R2 | 0.6357 | ||

Note: **, and *** depict 5, and 1 percent level of significance, respectively.

We do not present a direct estimate of Poisson regression, but rather the marginal effects of the regression, to be consistent with the last model. The marginal effect of LTA is 0.1836, implying that there is an 18 percent chance of increasing the number of borrowers based on the increase of the total assets of the banking sector. Similarly, the marginal effects of loan portfolios, LADV MFI, LADV PER, and LADV SOA show that the probability of an increase in the number of borrowers (a measure of financial inclusion) increases by increasing these portfolios, whereas the chances of an increase in number of borrowers occurring declines with an increase in LSIAM.

| Marginal Effects of Poisson Regression with Number of Borrowers: Banking Dimension | |||

|---|---|---|---|

| dy/dx | Standard Errors | Z-Stats | |

| LADVMFI | 0.2549 *** | 0.0552 | 4.6196 |

| LADVPER | 0.2782 * | 0.1497 | 1.8589 |

| LADVROI | 0.2869 ** | 0.1239 | 2.3148 |

| LADVSOA | 0.2485 *** | 0.1048 | 2.3725 |

| LSIAM | −0.0615 | 0.0574 | −1.0724 |

| Pseudo R2 | 0.6911 | ||

Note: *, **, and *** depict 10, 5, and 1 percent level of significance, respectively.

More on Robustness: The other important variable to measure financial inclusion is the number of bank accounts. This is also a count variable which may be estimated through an autoregressive version of Poisson regression. The results are in line with the previous model9, that is, the sign and significance of the coefficient do not change. However, the size of the coefficient varies a bit. Similarly, the results do not change by including other macroeconomic variables such as per capita GDP, number of years of schooling, and life expectancy.

6. Graphical Analysis

It is convenient to establish from a graphical analysis whether the banking sector in Pakistan (supply side) is inclusive in nature.

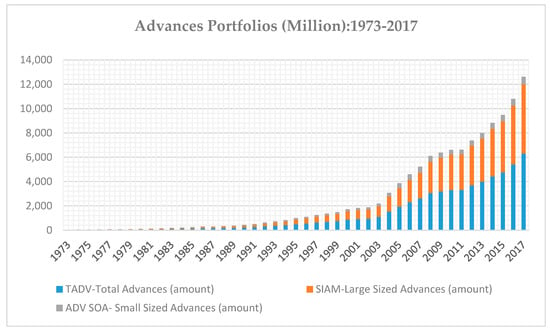

Advances of the banking sector in Pakistan are given in Figure 1 for the period of study, where out of the total advances, a considerable portion comprises large advances and a small portion comprises small advances. It is evident that gross advances have increased over time, but the disbursed loans are essentially large and not meant for the disadvantaged segments of society.

Figure 1.

Total advances of the banking sector of Pakistan and their distribution into advance type.

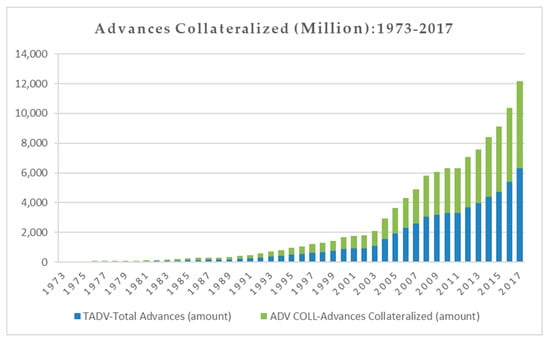

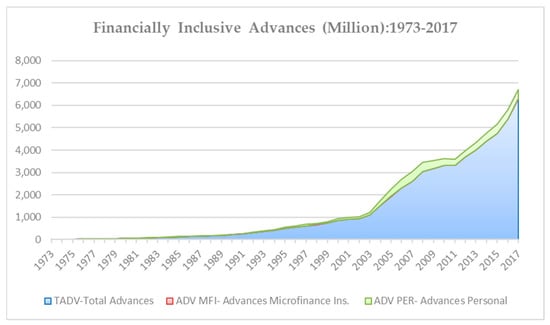

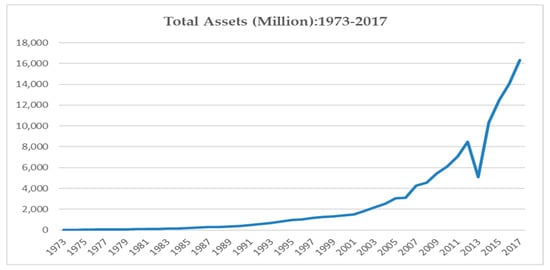

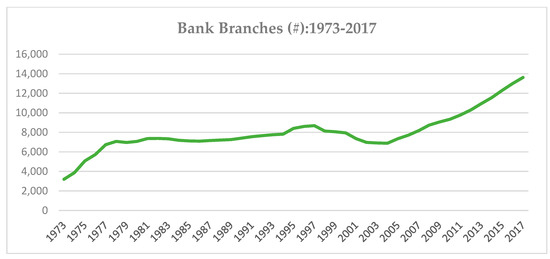

Similarly, as per Figure 2, the proportion of collateralized advances is quite large. According to the evidence, collateralized loans discourage financial inclusion, as excluded individuals do not have the capacity to offer collateral. Figure 3 shows the small proportion of financially inclusive advances (soft, low-interest loans). Figure 4 and Figure 5 highlight the notion that the size and outreach of the banking industry progressively increases over time. The graphs indicate that although the banking sector in Pakistan and the supply-side factors expanded over time, the advances were generally non financially inclusive in nature.

Figure 2.

Collateralized advances out of total advances of the banking sector of Pakistan.

Figure 3.

Financially inclusive advances out of total advances of the banking sector of Pakistan.

Figure 4.

Total assets of the banking sector in Pakistan.

Figure 5.

Total bank branches in Pakistan.

7. Conclusions

This study focused on the Supply Side of Financial Inclusion and investigated the financial inclusion process for Pakistan using the supply-side top–down approach by employing a number of indicators of the supply side. It also measured the supply-side dimension of Access, a secondary data measurement, using data from all bank types in the banking sector of Pakistan. In this context, the study dealt with the economic and financial determinants of financial inclusion in Pakistan. The empirical findings suggest that the greater the size, geographic outreach, and demographic outreach of the banks, the greater the contribution to financial inclusion. We also modeled other important predictors, i.e., advances—personal (LADV PER), advances by rate of interest (ADV ROI), advances by size of account (LADV SOA), and advances—super-inclusion of upmarket (LSIAM). The results signify that improvement in soft consumer loans and increases in small, no-frill advances contributes to financial inclusion.

We also investigated the super-inclusion of an upmarket supply-side model of financial inclusion. Super-inclusion exhibited a negative relationship with financial inclusion, and unit rise in large loans decreases the financial inclusion of the supply side.

Our findings lead us to make certain policy recommendations. First, according to the empirical results, the total assets of banks, the bank network, and the demographic outreach of banks significantly and positively enhance financial inclusion processes in the supply-side dimension. Additionally, advances to individuals and the size of loans also have an impact on financial inclusion, while collateralized loans are a product with a negative impact on the financial inclusion process. The banks must consider these aspects when devising products.

Second, to overcome the disconnect of Access and Usage, where access essentially does not translate into usage, and to ensure mass access to financial services, effective and evidence-based policy making can prove instrumental to overcoming the problem.

Finally, for Pakistan, which is at a low stage of financial inclusion progressiveness, the government should promote the opening up of domestic financial markets, which would have the ability to absorb the positive effects of the international financial inclusion development. Global financial market synergy and linkage can help to absorb these spatial spillover effects brought on by developed countries.

Author Contributions

Conceptualization, F.A.; Data curation, F.A.; Formal analysis, A.J.; Investigation, F.A.; Methodology, A.J.; Supervision, A.J.; Writing—original draft, F.A.; Writing—review & editing, A.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) unit root test.

Table A1.

Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) unit root test.

| ADF | PP | KPSS | ADF | PP | KPSS | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Constant | Trend | Constant | Trend | Constant | Trend | Constant | Trend | Constant | Trend | Constant | Trend | |

| Level | First Difference | |||||||||||

| LTADV | −1.640 | −3.670 | −1.630 | −3.810 | 1.110 | 0.080 | −10.480 | −10.440 | 10.480 | −10.440 | 0.030 | 0.030 |

| LSIAM | −1.190 | −3.070 | −1.170 | −3.200 | 1.090 | 0.090 | −11.010 | −10.960 | −11.020 | −10.970 | 0.040 | 0.040 |

| LDOUT | −0.750 | −2.900 | −0.850 | −3.110 | 1.130 | 0.090 | −8.890 | −8.860 | −8.820 | −8.800 | 0.060 | 0.050 |

| LTA | −3.900 | −4.090 | −4.170 | −8.170 | 0.990 | 0.110 | -- | -- | -- | -- | -- | -- |

| LBNK | −3.590 | −5.510 | −4.510 | −5.550 | 0.870 | 0.100 | −15.280 | −15.250 | −15.820 | −15.800 | 0.060 | 0.020 |

| LBBR | −1.690 | −3.570 | −2.480 | −5.670 | 1.060 | 0.080 | −4.930 | −4.840 | −19.930 | −19.870 | 0.040 | 0.040 |

| LADVMFI | −1.560 | −4.860 | −1.670 | −3.670 | 0.970 | 0.120 | −9.590 | −9.540 | −9.520 | −9.470 | 0.040 | 0.040 |

| LADVPER | −1.250 | −3.997 | −1.047 | −3.083 | 1.067 | 0.120 | −4.243 | −4.167 | −8.790 | −8.717 | 0.027 | 0.053 |

| LADVROI | −3.765 | −3.672 | 3.373 | −4.143 | 1.117 | 0.130 | -- | -- | -- | -- | -- | -- |

| LADVSOA | −1.780 | −3.347 | 2.793 | −3.203 | 1.167 | 0.140 | 5.447 | 1.543 | −2.490 | −9.387 | 0.007 | 0.073 |

References

- Access to Finance Survey: A2F Survey. 2015. State Bank of Pakistan. Available online: www.sbp.org.pk (accessed on 23 April 2020).

- Ahamed, M. Mostak, and Sushanta K. Mallick. 2019. Is financial inclusion good for bank stability? International evidence. Journal of Economic Behavior & Organization 157: 403–27. [Google Scholar]

- Allen, Franklin, Asli Demirguc-Kunt, Leora Klapper, and Maria Soledad Martinez Peria. 2012. The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. Policy research working paper No. 6290. Washington, DC: World Bank. [Google Scholar]

- Allen, Franklin, Elena Carletti, Robert Cull, Jun Qian, Lemma Senbet, and Patricio Valenzuela. 2013. Improving Access to Banking: Evidence from Kenya. World Bank Policy Research Working Paper No. 6593. Washington, DC: World Bank. [Google Scholar]

- Amidžić, Goran, Alexander Massara, and André Mialou. 2014. Assessing Countries’ Financial Inclusion Standing: A New Composite Index. IMF Working Papers 14: 1. [Google Scholar]

- Amin, Yasir, and Abdul Jalil. 2017. Remittances and Financial Inclusion: Micro-econometric Evidences from Pakistan. Asian Journal of Economics, Business and Accounting, 1–13. [Google Scholar] [CrossRef]

- Arora, Rashmi Umesh. 2014. Access to Finance: An Empirical Analysis. The European Journal of Development Research 26: 798–814. [Google Scholar] [CrossRef]

- Asuming, Patrick Opoku, Lotus Gyamfuah Osei-Agyei, and Jabir Ibrahim Mohammed. 2019. Financial inclusion in sub-Saharan Africa: Recent trends and determinants. Journal of African Business 20: 112–34. [Google Scholar] [CrossRef]

- Banerjee, Anindya, Juan J. Dolado, John W. Galbraith, and David Hendry. 1993. Co-integration, Error Correction and the Econometric Analysis of Non-Stationary Data. Oxford: Oxford University Press. [Google Scholar]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ross Levine. 2007. Finance, inequality and the poor. Journal of Economic Growth 12: 27–49. [Google Scholar] [CrossRef]

- Beck, Thorsten, Aslı Demirgüç-Kunt, and Ross Levine. 2010. Financial institutions and markets across countries and over time: The updated financial development and structure database. The World Bank Economic Review 24: 77–92. [Google Scholar] [CrossRef]

- Cámara, Noelia, and David Tuesta. 2014. Measuring Financial Inclusion: A Multi-dimensional Index. BBVA Research Paper (14/26). Birmingham: BBVA. [Google Scholar]

- Chakravarty, Satya R., and Rupayan Pal. 2013. Financial inclusion in India: An axiomatic approach. Journal of Policy Modeling 35: 813–37. [Google Scholar] [CrossRef]

- Chen, Feng-Wen, Yuan Feng, and Wei Wang. 2018. Impacts of Financial Inclusion on Non-Performing Loans of Commercial Banks: Evidence from China. Sustainability 10: 3084. [Google Scholar] [CrossRef]

- Clark, A., A. Forter, and F. Reynolds. 2005. Banking the Unbanked: A Snapshot. London: Toynbee Hall. [Google Scholar]

- Corrado, Germana, and Luisa Corrado. 2015. The geography of financial inclusion across Europe during the global crisis. Journal of Economic Geography 15: 1055–83. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, Leora Klapper, and Dorothe Singer. 2013. Financial Inclusion and Legal Discrimination against Women: Evidence from Developing Countries. Washington, DC: The World Bank. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Efobi, Uchenna, Ibukun Beecroft, and Evans Osabuohien. 2014. Access to and use of bank services in Nigeria: Micro-econometric evidence. Review of Development Finance 4: 104–14. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Espinoza, Raphael A., and Ananthakrishnan Prasad. 2010. Nonperforming Loans in the GCC Banking System and Their Macroeconomic Effects (No. 10-224). Washington, DC: International Monetary Fund. [Google Scholar]

- Guan, Rong, Haitao Zheng, Jie Hu, Qi Fang, and Ruoen Ren. 2017. The higher carbon intensity of loans, the higher non-performing loan ratio: The case of China. Sustainability 9: 667. [Google Scholar] [CrossRef]

- Honohan, Patrick. 2008. Risk management and the costs of the banking crisis. National Institute Economic Review 206: 15–24. [Google Scholar] [CrossRef][Green Version]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kempson, Elaine, Adele Atkinson, and Odile Pilley. 2004. Policy Level Response to Financial Exclusion in Developed Economies: Lessons for Developing Countries. Bristol: Report of Personal Finance Research Centre, University of Bristol. [Google Scholar]

- Kendall, Jake, Alejandro Ponce, and Nataliya Mylenko. 2010. Measuring Financial Access around the World. Washington, DC: The World Bank. [Google Scholar]

- Kipesha, Erasmus Fabian, and Xianzhi Zhang. 2013. Sustainability, profitability and outreach tradeoffs: Evidences from microfinance institutions in East Africa. European Journal of Business and Management 5: 8. [Google Scholar]

- Kumar, Nitin. 2013. Financial inclusion and its determinants: Evidence from India. Journal of Financial Economic Policy 5: 4–19. [Google Scholar] [CrossRef]

- Mihasonirina, Andrianaivo, and Kpodar Kangni. 2011. ICT, Financial Inclusion, and Growth: Evidence from African Countries. IMF Working Paper WP/11/73. Washington, DC: IMF. [Google Scholar]

- Mohammed, Jabir Ibrahim, Lord Mensah, and Agyapomaa Gyeke-Dako. 2017. Financial inclusion and poverty reduction in Sub-Saharan Africa. African Finance Journal 19: 1–22. [Google Scholar]

- Park, Cyn-Young, and Rogelio Mercado. 2015. Financial Inclusion, Poverty, and Income Inequality in Developing Asia. Asian Development Bank Economics Working Paper Series; Mandaluyong: Asian Development Bank. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Rizvi, Syed Kumail Abbas, Bushra Naqvi, and Fatima Tanveer. 2017. Mobile Banking: A Potential Catalyst for Financial Inclusion and Growth in Pakistan. The Lahore Journal of Economics 22: 251–81. [Google Scholar] [CrossRef]

- Rizvi, Syed Kumail Abbas, Bushra Naqvi, and Fatima Tanveer. 2018. Is Pakistan Ready to Embrace Fintech Innovation? Punjab: Lahore School of Economics. [Google Scholar]

- Sarma, Mandira. 2008. Index of Financial Inclusion (No. 215). Working Paper. New Delhi: ICRIER. [Google Scholar]

- Sinclair, Stephen, Fiona McHardy, Louise Dobbie, Kate Lindsay, and Morag Gillespie. 2009. Understanding Financial Inclusion. Dorking: Friends Provident Foundation. [Google Scholar]

- State Bank of Pakistan. Department of Statistics. 2005. Handbook of Statistics on Pakistan Economy; Karachi: Statistics Department, State Bank of Pakistan.

- State Bank of Pakistan. Department of Statistics. 2020. Statistics on Scheduled Banks in Pakistan. Available online: www.sbp.org.pk (accessed on 23 April 2020).

- Swamy, Vighneswara. 2014. Financial inclusion, gender dimension, and economic impact on poor households. World Development 56: 1–15. [Google Scholar] [CrossRef]

- Toxopeus, Helen S., and Robert Lensink. 2007. Remittances and Financial Inclusion in Development (No. 2007/49). Research Paper. Tokyo: UNU-WIDER, United Nations University (UNU). [Google Scholar]

- Tuesta, David, Gloria Sorensen, Adriana Haring, and Noelia Camara. 2015. Financial Inclusion and Its Determinants: The Case of Argentina. Madrid: BBVA Research. [Google Scholar]

- Uddin, Ajim, Mohammad Ashraful Ferdous Chowdhury, and Md Nazrul Islam. 2017. Determinants of Financial Inclusion in Bangladesh: Dynamic Gmm & Quantile Regression Approach. The Journal of Developing Areas 51: 221–37. [Google Scholar]

- World Bank. 2008. Banking the Poor: Measuring Banking Access in 54 Economies. Washington, DC: The World Bank. [Google Scholar]

- Zopounidis, Constantin, and Kyriaki Kosmidou. 2008. The determinants of banks’ profits in Greece during the period of EU financial integration. Managerial Finance 34: 146–59. [Google Scholar]

| 1 | In terms of Section 13 of Companies Ordinance 1962, the scheduled banks maintain the minimum required capital and reserve balance, which is determined by SBP from time to time. Currently, as per BSD circular No. 7 of 2009, an aggregate value should be not less than Rs. 10 billion by 31 December 2013 and onwards. |

| 2 | Due to the separation of East Pakistan (now Bangladesh) from West Pakistan (now Pakistan) in 1971, economic data for studies concerning Pakistan were used from 1973 onwards. In Pakistan, financial inclusion is a slow process. We were not able to find structural breaks or even outliers in the data. |

| 3 | L in the equation refers to the log value. |

| 4 | Since the focus of the research is supply side inclusion output of the banking sector of Pakistan, we used mainly banking industry data from Pakistan, comprising advance portfolios and financial inclusion determinants from the supply side. Certain data types such as data concerning the percentage of adults with a loan from a financial institution or a share of SMEs with a line of credit are present in the Global Findex dataset and global enterprise survey, upon which we are not focusing, as Global Findex data are demand side aggregates, missing in supply side aggregates, while enterprise survey data are incomplete for Pakistan. |

| 5 | The literature suggests that to measure financial inclusion, primarily, three dimensions are used: availability, accessibility, and usage. For accessibility, certain studies used the number of bank loans to investigate the depth of financial inclusion (Ahamed and Mallick 2019). Essentially, the number and volume of advances relates to the pervasiveness of outreach of the financial sector. On similar lines, Beck et al. (2010) employed volume of deposits plus credits to measure the usage dimension of financial inclusion. |

| 6 | The statistical software of E-Views was used for the ARDL technique. |

| 7 | In Equation (2), the banking determinants of the supply side given in Figure 1 are used in log form. |

| 8 | The right-hand-side variables are financial inclusion determinants of the supply side. They can lead to increases in financial inclusion of the supply side through the disbursement of financially inclusive personal loans (small soft loans with low interest), while super-inclusive loans (large-sized loans for upmarket clientele) impede the financial inclusion process, as shown by our results. Concerning the positive relationship of advances to MFI and financial inclusion, the relationship is also supported by the literature; e.g., Kipesha and Zhang (2013) found that in developing countries, financial inclusion was primarily spearheaded by Microfinance Institutes, and that loans given to MFIs by the banking sector actually facilitate financial inclusion. In order to see whether causality runs the other way, we performed a Granger causality test, and causality was not found from dependent to independent variables. However, the estimation results are not presented here in the interest of brevity. |

| 9 | Therefore, we are not presenting detailed tables of the results here in the interest of brevity. However, these are available on request. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).