Abstract

This study analyses the current debate around central bank-backed digital currency (CBDC). A comparative study was carried out considering countries for and against implementing a CBDC and their reasons, looking for common causes, differences, etc. The conclusion was that there are opposite tendencies between defenders and detractors of establishing a CBDC. However, today—and taking into account the positions of three large banking institutions (the Federal Reserve of the United States of America, the Bank of Japan and the Bank of England) on establishing (at least in the short term) a CBDC)—it seems that large-scale implementation is still far off. On the contrary, the Chinese Central Bank and banking systems of other countries that have less weight in the world, such as Uruguay, Lithuania and the Bahamas, seem to go against the trend of rejection and are seriously considering its implementation. Although this matter has been dealt with in the theoretical field, more pilot tests such as the one carried out by Uruguay are necessary in order to understand specific effects on the economy, on one hand, and on acceptance of its use by the population, on the other.

JEL Classification:

E52; E58; E59

1. Introduction

The reasons why governments study the creation of central bank digital currencies are varied (security, control of monetary policy, alternatives to cash, etc.) and depend on many factors, such as the digitization of the economy, geographic dispersion, the level development of the financial sector and the decline in the use of cash.

In recent years, a debate has opened about the possibility of central banks issuing their own digital currencies due to the presence of multiple virtual means of payment in the private sector (debit and credit cards, PayPal, Bizum, etc.) and innovations, such as cryptocurrency based on the blockchain system (Nuño 2018). The introduction of state cryptocurrencies can offer benefits as a digital alternative in countries where the demand for cash is decreasing, allowing greater financial inclusion, reducing tax fraud, achieving greater control over money laundering, etc. However, it is not clear whether they can compete with decentralized cryptocurrencies (Bitcoin, Ethereum, Ripple); an important component of the demand for the latter is the rigidity of their offerings and the absence of discretion. In recent years, some authors have pointed out that competition between currencies is not the only possible form of relationship in an environment of monetary plurality, and that attention must be paid to complementarity (Blanc 2009).

However, the main private cryptocurrencies have great volatility that hinders their adoption as a general medium of exchange. Among the drawbacks is the risk of suffering a cyber-attack and how it can affect the profitability of private banks, because in the event of a confidence crisis, economic agents may withdraw their deposits more quickly. Central bank-backed digital currency (CBDC) would be deposited in a central bank by users (a liability for state banks) who could be anonymous (as with bank reserves) or nominal (as with banknotes) and be remunerated.

Throughout the study, several initiatives to create state cryptocurrencies by governments based on blockchain and other technology as a form of electronic money in countries such as Uruguay and the Bahamas are presented. Governments are tasked with identifying the appropriate balance between fostering innovation and safeguarding security.

2. CBDC: Characteristics, Safety and Sustainability

As we indicated, the development of cryptocurrency in recent years (guided by Bitcoin) has prompted a debate on whether central banks should issue digital cash (Náñez Alonso 2019). For this reason, central banks of various countries have analyzed the viability of creating their own CBDC, considering the substitution of cash for digital money (Gómez-Fernández and Albert 2019). Even countries such as Uruguay, which is analyzed later in the study, have completed pilot tests and are in the phase of analyzing the results. Others, such as the Bahamas, are about to launch their pilot tests, as we will also see later.

According to Fernández de Lis and Gouveia (2019), cash is a type of asset that combines four characteristics: (1) it is exchanged between pairs (without the issuer’s knowledge), (2) it is universal (anyone can have it), (3) it is anonymous and (4) it does not earn interest. CBDC is an alternative to cash that is also peer-to-peer, that is, it meets the first characteristic, but due to its digital nature, it may be different regarding the other three characteristics.1

CBDC can be designed to allow universal or restricted access to a group of users (Raskin and Yermack 2016; Niepelt 2018; Bordo and Levin 2017). It can be anonymous or identified (Niepelt 2018). Finally, according to Bordo and Levin (2017), the decoupling of digital cash from paper money “opens up the possibility of including interests as a characteristic” (Fernández de Lis and Gouveia 2019). Kuroda (2008) pointed out that “an assortment of monies could do what any single money could not, and supply what the market required.” In other words, CBDC could act not only as a substitute, but as a complement to classic currency (banknotes and metal coins) to adapt to market situations (preference for virtual transactions for part of the population, and preference for money transactions for another part).

Although it is not the objective of this study, it is interesting to note that virtual currency also implies a series of challenges for sustainability. According to Sánchez-Cano (2019), “Mining is profitable as long as the cost of electricity is carefully taken into account”, since a large amount of electrical energy must be invested in equipment to generate virtual currency. Dolader Retamal et al. (2017) point out that in 2014 “the mining of Bitcoin consumed as much electrical energy as Ireland”. The reason is that air-conditioning is needed to cool the computers, so they do not overheat, because they are working 24 h a day, 365 days a year. Therefore, despite the advantage of saving in physical costs (paper and metal money) derived from the implementation of a CBDC, it is also possible that an environmental cost is incurred, derived from an increase in electricity usage for its generation and maintenance.

Regarding the use of virtual currency and the possible increase in crime, according to some studies there is a certain correlation. According to Van Wegberg et al. (2018), in most cases in which a subject is infected by a “ransomware” virus, it is required to release the electronic device for payment in Bitcoin or similar digital currency. The reason is that it is relatively anonymous and not well legislated in countries. This could be perfectly avoided with CBDC, as it is backed, controlled and legislated by a central bank, it would provide more security to citizens and the money trail can be followed. Another problem brought about by virtual currency is a “concern about the tax evasion of those who use Bitcoin instead of more traditional online payment methods” (Slattery 2014). This situation is easily solvable with CBDC, since the central bank or monetary authority would oversee its control and supervision, and, in addition, cooperative information exchange agreements can be signed through multilateral fiscal agreements. Another problem derived from virtual currency is its potential use for “money laundering”. As Campbell-Verduyn (2018) stated, virtual currency facilitates its use by criminals for two reasons: it can be used in a “quasi-anonymous” way, and due to the speed of the transaction, the proceeds of crime can be transferred to another country, since it occurs in real time and it is difficult for the authorities to oversee and stop the transaction in time. Again, these two issues could be settled by CBDC and the control exercised over it by the banking authority.

Given all of the above, Möser, Böhme and Breuker (Möser et al. 2014) point out: “Blacklisted Bitcoins will be hard to spend and therefore less liquid and less valuable”; that is to say, the supervisory authorities can establish lists of sites where Bitcoin and other cryptocurrencies have an illegal origin and ban the use of those funds. In CBDC, as we have already mentioned, this control would be exercised by the central bank or banking authority.

3. Methodology

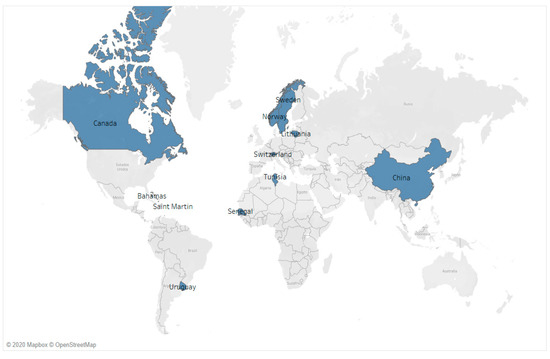

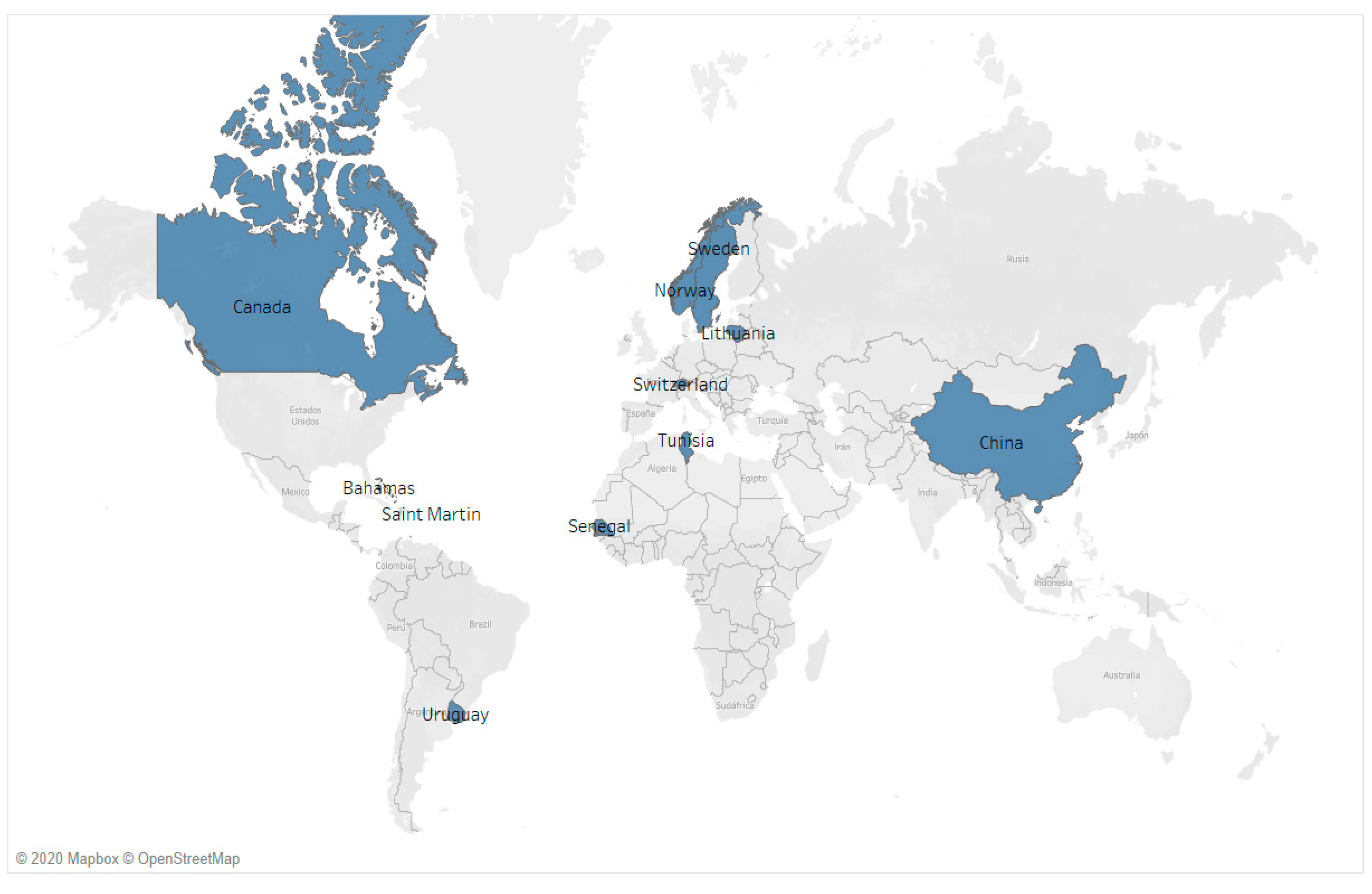

The methodology followed to carry out the analysis of this study is based on the methodology followed by Mancini-Griffoli et al. (2018) and the International Monetary Fund (IMF), which consists of a literary review of the pronouncements of banks and central authorities on their position on CBDC. Hence, a search was carried out in the databases of countries’ central banks to analyze whether via report, press release from the bank’s governor or the banking authority itself they ruled on the advisability or not of establishing a CBDC in the country. This allowed us to detect a series of reasons and a list of countries that have spoken about CBDC, which are grouped horizontally and vertically in Table 1, respectively.

Table 1.

Reasons for establishing central bank-backed digital currency (CBDC) by country. Source: author’s elaboration.

The same methodology was followed in selecting the countries that have rejected establishing a CBDC for now. After the analysis, a table was generated (Table 2), which shows the reasons for rejection horizontally and the countries vertically.

Table 2.

Reasons for not establishing CBDC by country. Source: author’s elaboration.

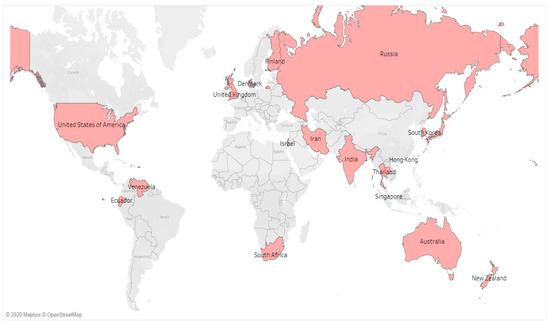

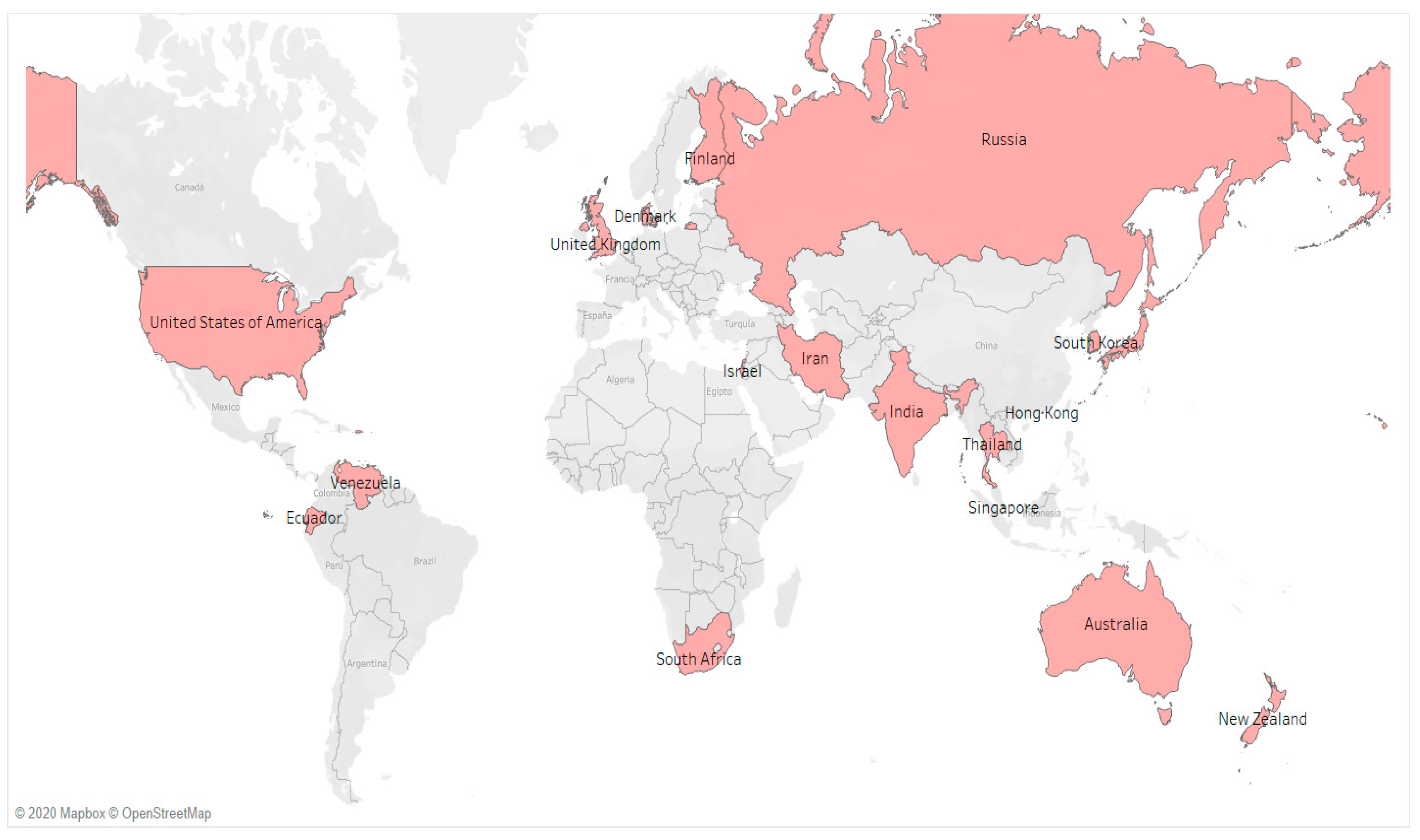

In addition, external desk research was carried out. The data were collected from government published data, in our case information published by the central bank of the country in question, the central monetary authority or its equivalent. To extract information from the databases of the central banks or monetary authorities, the keywords “central bank”, “digital currency” and “virtual currency” and the abbreviation “CBDC” were used. This methodology allowed the elaboration of the two tables that are shown below, and also a map (see Figure A1 and Figure A2 in Appendix A).

All this allowed the authors to carry out a comparative analysis of the reasons for and against establishing CBDC, and to continue the open debate within the scientific community, with the most current data on pronouncements to date.

4. Analysis of the Arguments of Countries Defending the Establishment of CBDC

4.1. Geographic Dispersion and Access to Financial Services

Geographic dispersion of access to financial services as a reason to establish CBDC is mainly used by developing countries that present a supposedly high geographic dispersion. It is striking that this is not a reason for Canada or Norway, given their size and dispersion and low density per km2: Canada, four inhabitants/km2 and Norway, 16 inhabitants/km2 versus Tunisia, 69 inhabitants/km2 and Senegal, 76 inhabitants/km2 (The World Bank 2020e).

As for increasing the rate of bank access and access to financial services, this is a motive for Senegal and Tunisia, along with the Bahamas, Saint Martin and Curaçao.

Tunisia has already started the process of digitizing its national currency using blockchain technology, with the electronic dinar or e-dinar. The establishment of the e-dinar as the official virtual currency does not mean the elimination of the Tunisian dinar, the physical currency. The e-dinar will be backed by the value of the physical currency. According to Chehade (2015), “Currently, there is a great demand for financial services in Tunisia from both individuals (from 2.5 to 3.5 million) and companies (from 245,000 to 425,000 small and very small companies)”; in other words, approximately 81% of Tunisians are interested in banking services, especially microcredit.

Africa seems a priori a propitious place to establish this new blockchain-based monetary technology, virtual currency. Hence, we can ask ourselves, what is driving these African countries to make this decision? The answer in the case of Senegal and many others basically derives from geographic dispersion. Many inhabitants of the African continent live in remote areas and do not have access to traditional banking services (see Figure 1), therefore have difficulty managing cash. The key, therefore, is geographic dispersion.

Figure 1.

Commercial bank branches per 100,000 inhabitants and average: Canada, Bahamas, Sweden, Norway, Tunisia and Senegal, 2004–2018. Source: author’s elaboration. Data from (The World Bank 2020b). https://datos.bancomundial.org/indicador/FB.CBK.BRCH.P5?end=2018&locations=CA-BS-SE-NO-SN-TN&start=2004&view=chart.

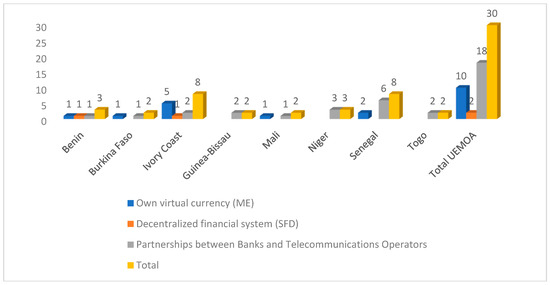

Beyond the case of Senegal, in other African countries with geographic dispersion and a low bank penetration rate (which is analyzed in the following section), mobile payments have a large presence. This can be seen in Figure 2.

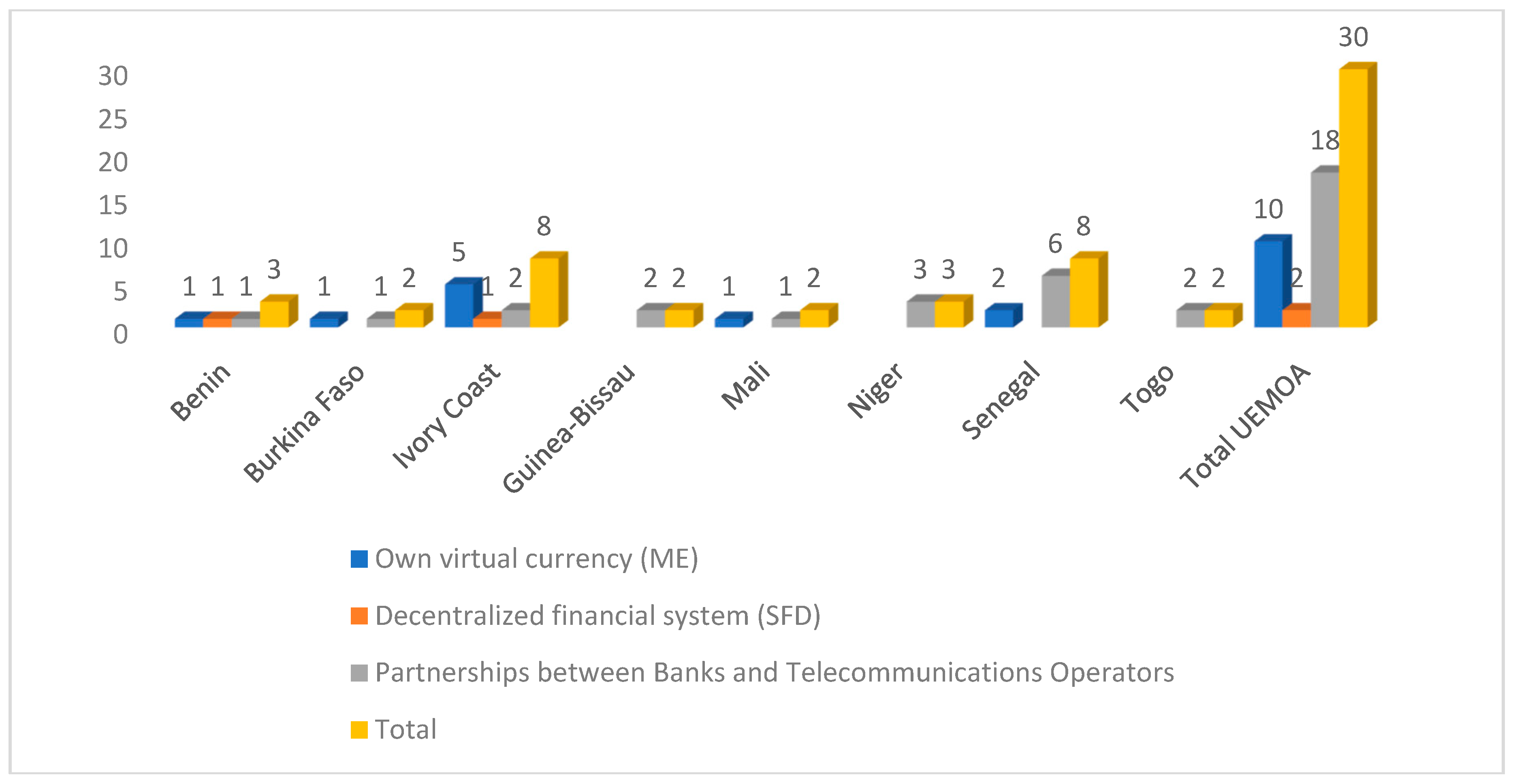

Figure 2.

Electronic money establishments in West Africa. Source: Author’s elaboration based on data from (Banque Centrale des Etats de l’Afrique de l’Ouest (BCEAO) 2020) Data (https://www.bceao.int/fr/content/etablissements-de-monnaie-electronique).

As we can see in Figure 2, these African countries have developed their own virtual currency (ME) and decentralized financial system (SFD).

To these cases, we can add Kenya. In 2015, a private company launched M-Pesa as a form of mobile payment. However, we comment on it, but we do not delve into it as it is not a virtual currency backed by a central bank.

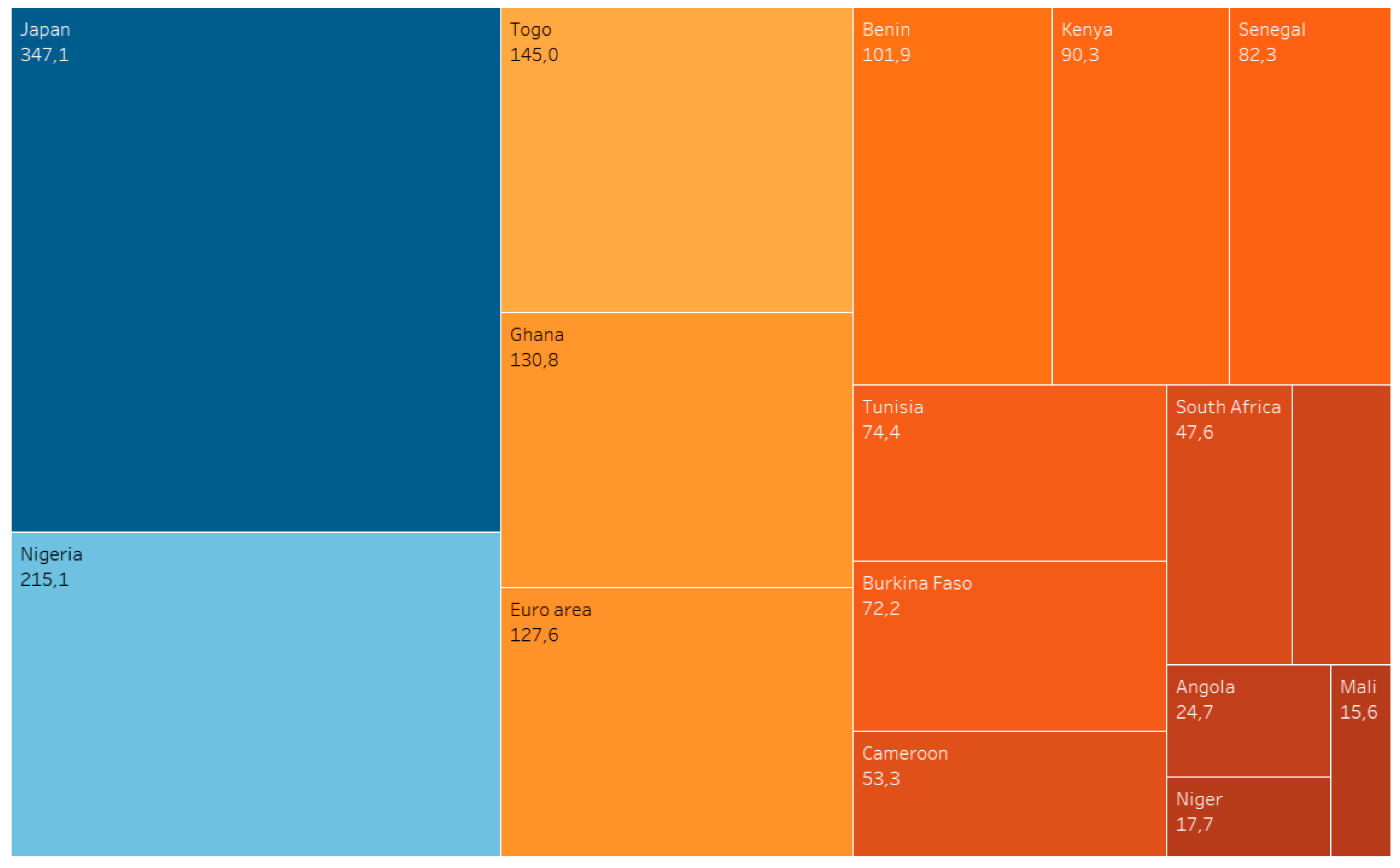

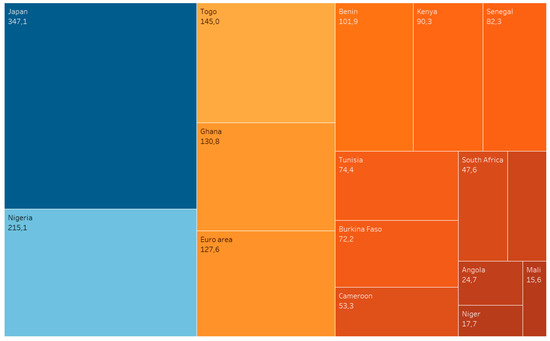

As we can see in Figure 3, if we take population density as a measure, we can easily see how the population density on the African continent is very low compared to the Euro area and Japan. The low population density and greater dispersion make it difficult to access traditional banking services carried out in an office. The latter is analyzed in the following section.

Figure 3.

Population density (people per sq. km of land area) of South Africa, Tunisia, Angola, Ghana, Senegal, Zimbabwe, Togo, Kenya, Mali, Nigeria, Benin, Burkina Faso, Cameroon, Niger, Japan and the Euro area. Source: author’s elaboration. Data from The World Bank population estimates, (The World Bank 2020d). https://data.worldbank.org/indicator/EN.POP.DNST?end=2018&locations=ZA-TN-AO-GH-SN-ZW-TG-KE-ML-NG-BJ-BF-CM-NE-JP-XC&start=2018&view=bar.

4.2. Increased Bank Penetration Rate and Access to Financial Services

Financial inclusion has several positive effects in an economy. First, it improves the effectiveness of financial intermediaries by increasing the number of actors in the financial system, along with the volume and value of transactions. At the macroeconomic level, a developed financial system, measured by its level of financial intermediation, has a positive correlation with growth, employment and poverty and, therefore, reduced inequality, according to Cull et al. (2014). The reason that prompted Tunisia to establish its virtual currency backed by the central bank via e-dinar was financial inclusion. Along with this would be the reason already seen in the African case: geographic dispersion. The inhabitants of the African continent live in remote areas and do not have access to traditional banking services.

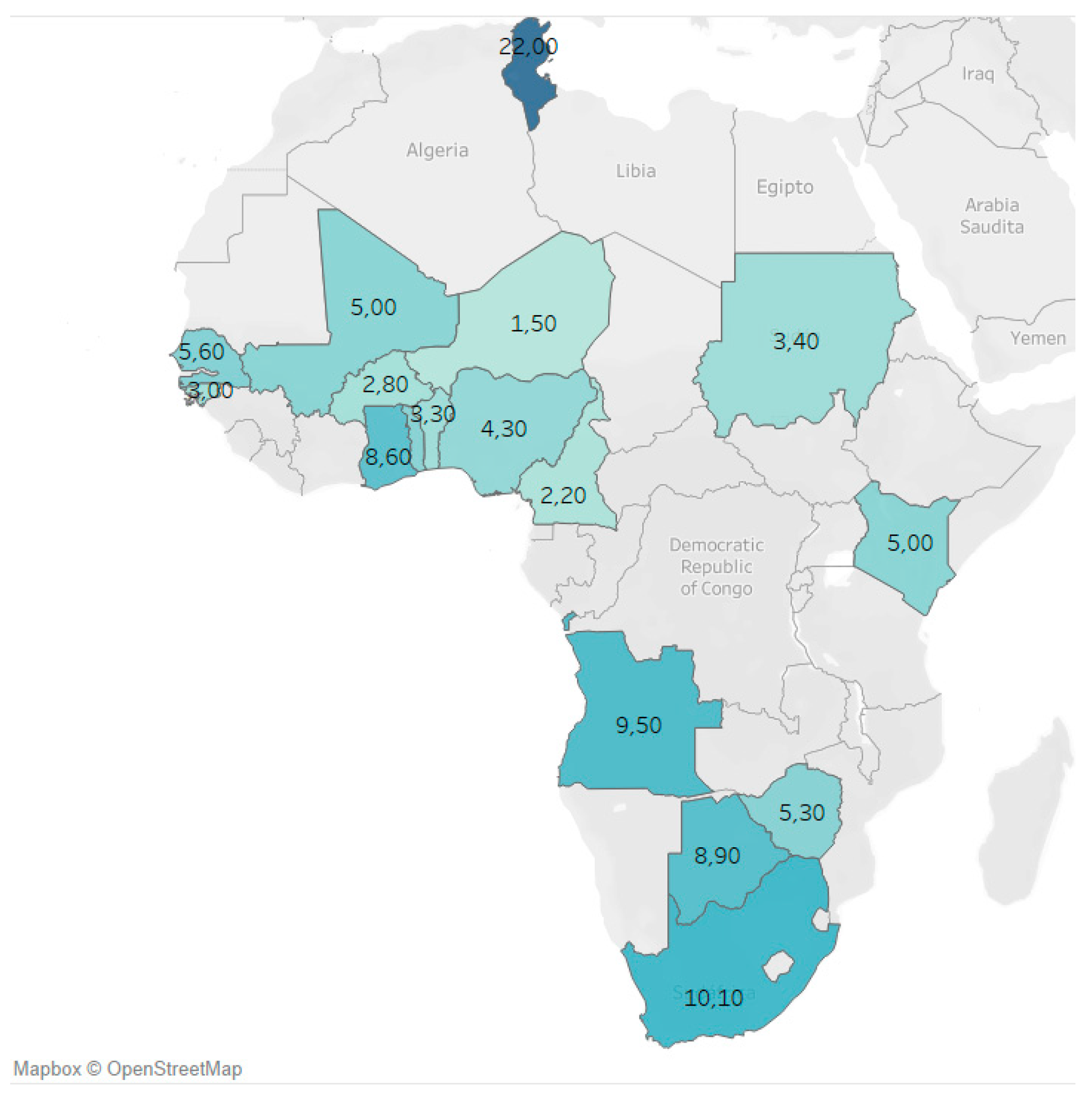

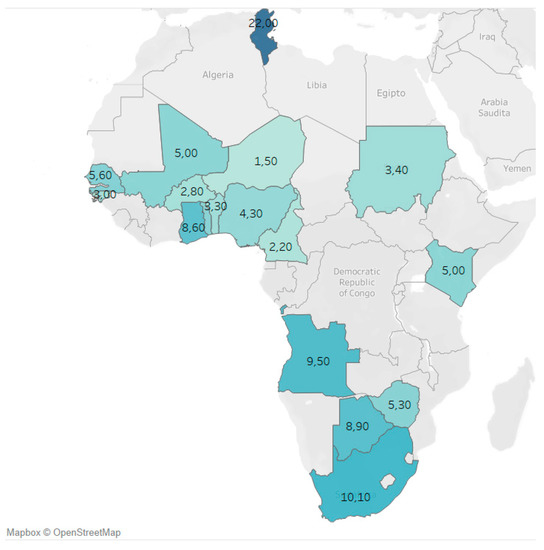

In Senegal’s case, the new money system will be known as electronic CFA or e-CFA and will “circulate” along with the CFA franc, the national fiat currency. e-CFA would be issued only by the central bank but would confer the benefits of transparency and cryptography to avoid counterfeiting and false transactions. The low African banking penetration rate greatly restricts its growth possibilities (see Figure 4). Banking rates in Africa have historically been below 20%, according to Ghalib and Hailu (2008). Considering the African reality—and the physical, media, cultural and other kinds of limitations that we can find—many of them considered the impossibility of massively banking the lowest-income Africans (most of the continent). CBDC is thus configured as a tool to try to increase the rate of bank penetration and access to financial services.

Figure 4.

Commercial bank branches (per 100,000 adults) in Senegal, Tunisia, Kenya, South Africa, Ghana, Niger, Nigeria, Mali, Guinea-Bissau, Togo, Benin, Burkina Faso, Angola, Zimbabwe, Cameroon, Sudan and Botswana. Source: author’s elaboration. Data from The World Bank, Financial Access Survey, (The World Bank 2020a). https://data.worldbank.org/indicator/FB.CBK.BRCH.P5?end=2018&locations=SN-TN-KE-ZA-GH-NE-NG-ML-GW-TG-BJ-BF-AO-ZW-CM-TZ-SD-BW&start=2018&view=bar.

The Central Bank of Curaçao and Saint Martin (CBCS) set the monetary policy of both autonomous countries. In 2018, this bank reported in a statement that it had set the objective of creating and backing a digital currency based on blockchain. Already in the initial note, the bank indicated as a reason for its implementation “to facilitate digital financial payments within the monetary union of Curaçao and San Martin”. Therefore, this central bank will offer a digital version of its current legal tender currency, the Antillean guilder. This legal tender is available on both islands due to its monetary union, and the digital version will be soon. Mancini-Griffoli et al. (2018) point out that one reason why these small islands in the Caribbean have adopted a virtual currency backed by a central bank is to increase the financial inclusion of its inhabitants.

Regarding the case of the Caribbean country of the Bahamas, it should be noted that its interest in a virtual currency backed by a central bank began in 2018. According to The Nassau Guardian (2020), The Central Bank of the Bahamas (CBOB) signed an official contract in 2018 to create an evolved payment structure to provide the country’s first cryptocurrency. CBOB plans to introduce a digital version of the Bahamian dollar in the Exuma district. According to The Central Bank of the Bahamas (2019a), a digital currency pilot test backed by the Bahamas Central Bank (CBDC) was to be launched on 27 December and extend into the first half of 2020, affecting a group of barrier islands and cays in northern Bahamas. The digital currency is being developed under an initiative called Project Sand Dollar and will be the first in the Bahamas. CBOB itself published an article explaining how this virtual currency will work, especially for the purposes of studying this article. Among the reasons for launching this initiative was to improve financial inclusion. The virtual currency backed by the central bank is seen as a great tool to improve financial inclusion, especially for remote communities. The scope of banking services would be broader, going beyond physical branches. “Banks would, in turn, be empowered to reduce costly branch networks” (The Central Bank of the Bahamas 2019a).

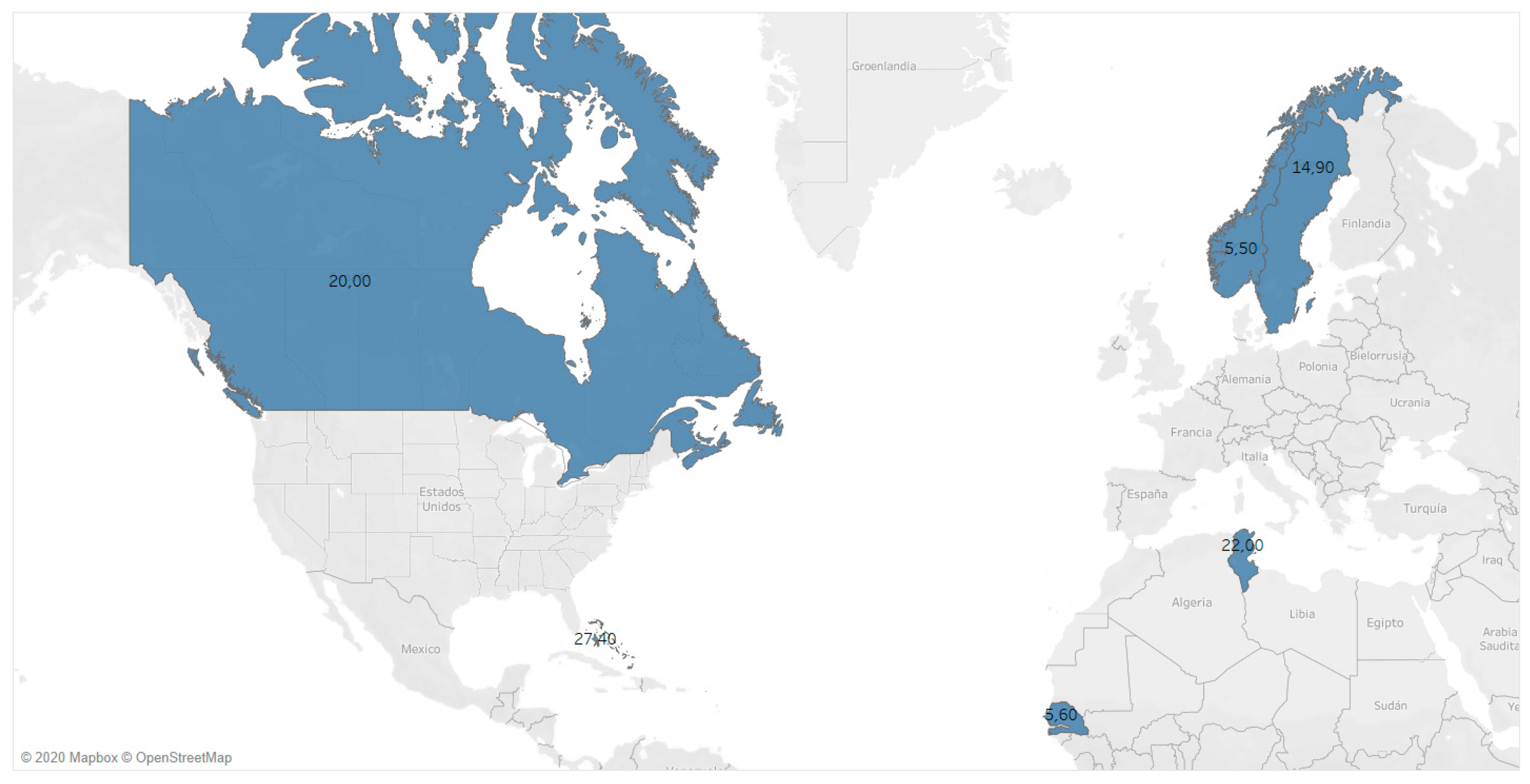

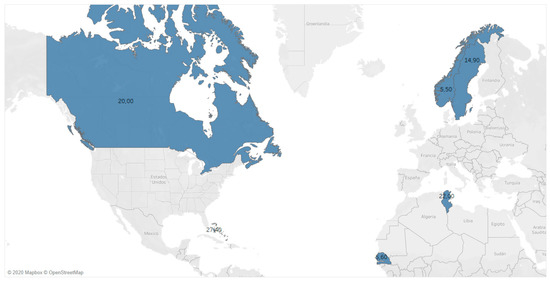

However, this reason, as we observed, seems somewhat contradictory, since the Bahamas and Tunisia have more bank branches for every 100,000 inhabitants, 27 and 22, respectively, compared to 14.9 in Sweden, 5.5 in Norway and 20 in Canada (see Figure 5).

Figure 5.

Country, year, number of ATMs per 100,000 inhabitants. Source: author’s elaboration. Data from The World Bank data, (The World Bank 2020c). https://databank.worldbank.org/reports.aspx?source=2&series=FB.ATM.TOTL.P5&country=CAN,BHS,SWE,NOR,SEN,TUN.

Central banks around the world are examining the possibility of issuing central bank-backed digital currency (CBDC), and some are already testing theirs for different uses, as we have already indicated. Countries that have advanced their digital currency projects include Canada and Australia; Uruguay has also considered establishing the e-Peso, according to Bitcoin News (2020).

Representatives of the Central Bank of Uruguay (BCU) have participated in various forums organized to represent the entity. In the communication presented, they indicated as an advantage of establishing CBDC improved financial inclusion, according to Licandro (2018). The presentation also added other advantages, such as following the global trend of a drop in cash and improved operating and transaction costs (Banco Central del Uruguay 2019).

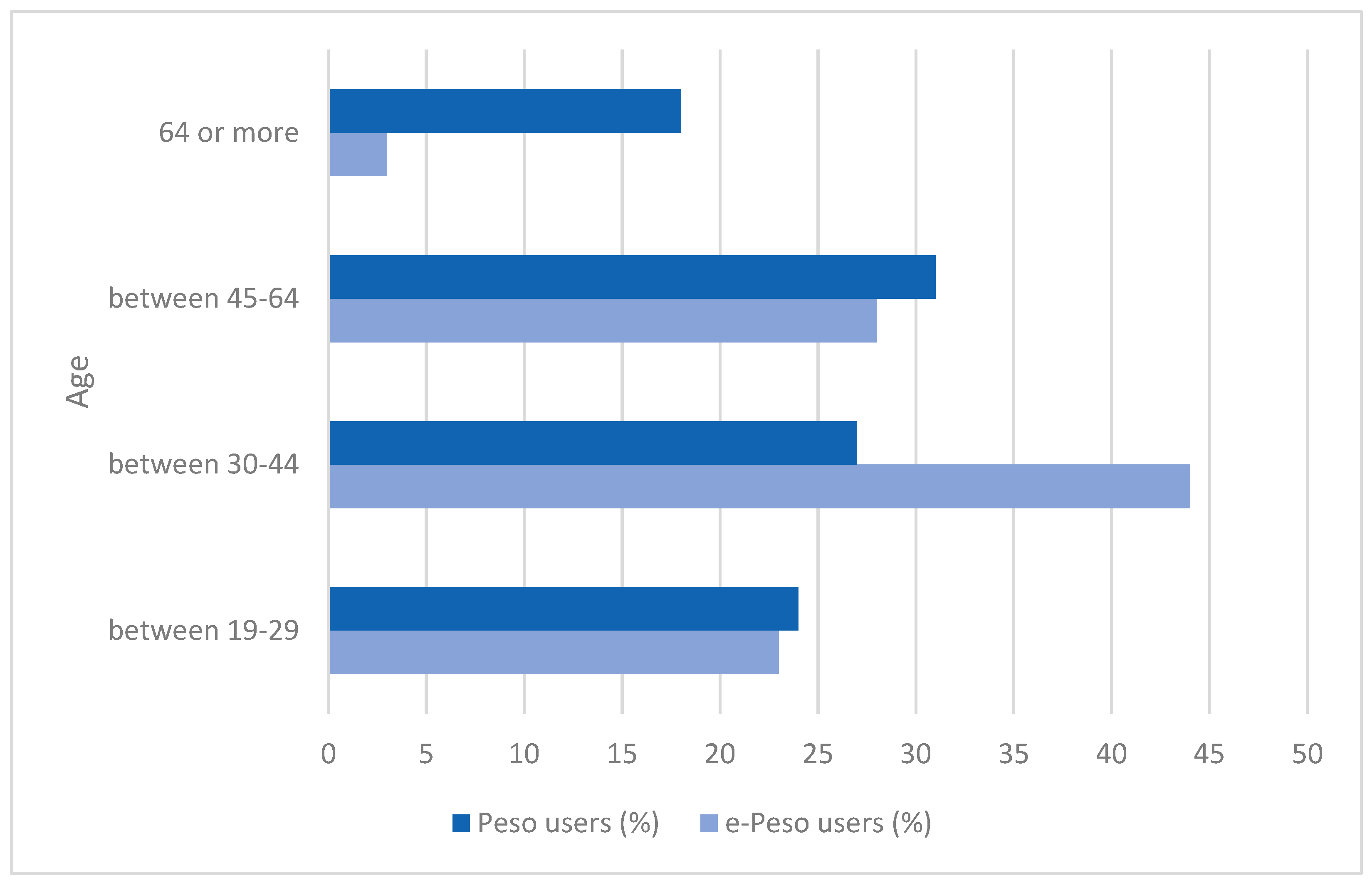

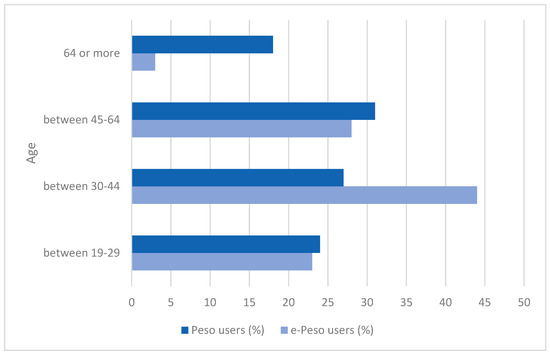

Due to the above, the BCU completed a pilot program with a retail CBDC in April 2018 as part of a broader government financial inclusion program (see Figure 6). The pilot test began in November 2017. An e-weight was issued, circulated and tested. In this way, “Transfers were carried out instantly and as a peer, through mobile phones using text messages or the e-peso application” (Berkmen et al. 2019). However, blockchain was not used. Twenty million electronic pesos were issued, all of which were cancelled when the pilot ended (Wilson 2018). The program is now in an evaluation phase before a decision can be made about additional trials and possible release. At present, the BCU has not yet responded. As important information, we extract the use of digital money versus cash by age range, derived from the test carried out by the BCU.

Figure 6.

Users of the e-peso against traditional currency in cash, by age. Source: author’s elaboration. Data from (Licandro 2018) and the Central Bank of Uruguay (BCU) (Central Bank of Uruguay 2018) https://www.bcu.gub.uy/Acerca-de-BCU/Resoluciones%20de%20Directorio/RD_282_2017.pdf#search=Billete%20electr%C3%B3nico.

As we can see, at a young age, cash and digital money are used equally, but between 30 and 44 years, the use of digital money shoots up compared to cash. In the next age range, it is even—and as expected, at older ages, cash prevails over digital. This test gives hopeful data on acceptance (albeit on a small scale and in a small country) on the adoption of CBDC and its possible use by consumers: it would be well accepted.

In the case of Switzerland, two Swiss National Bank (SWN) reports analyzed the possibility of creating a CBDC to operate with virtual Swiss francs. The first report concluded that a CBDC “increases financial inclusion, decreasing the demand for physical cash” (Federal Reserve Bank of St. Louis (Switzerland) 2018; Swiss National Bank 2020).

4.3. The Financial Sector Is Not Obsolete

The reason for establishing a CBDC so that the financial sector will not become obsolete is given by Canada and Norway as a priority. Therefore, once again, two highly developed countries try to protect their banking sector to prevent them from being left behind in digitization.

In Canada, this priority is evident, according to Ducas and Wilner (2017). On the one hand, there is the use of this new technology, which in most countries, but specifically in Canada, has great weight in the economy. According to EY Fintech Adoption Index: Canadian Findings (2017), the Canadian financial sector is of great economic importance, accounting for 7% of GDP and employing almost 800,000 workers. In the words of the Bank of Canada, “Creating a digital central bank currency is a rather complicated decision. We are working to determine under what conditions it may make sense, one day, to issue a digital currency; analyzing their pros and cons” (The Road to Digital Money 2020). In mid-2016, the Bank of Canada and the Royal Bank of Canada reported that they had been conducting experiments with a legal tender digital currency called CAD-COIN, according to Chapman et al. (2017). Among the participants of the experiment are the five great banks of Canada: Bank of Montreal, Canadian Imperial Bank of Commerce (CIBC), RBC, Toronto-Dominion Bank (TD Bank) and Scotiabank, according to Diariobitcoin (2016).

Therefore, one reason why Canada has proposed establishing its own virtual currency can be summarized as follows: so that its financial sector does not become obsolete and to follow the global trend in the use of virtual currency.

In the small Nordic country of Norway, virtual currency not backed by a central bank came to the fore and focused the attention of the banking regulator, Norges Bank. The wake-up call came when the media reported in 2013 that a young Norwegian man had bought 5000 Bitcoins (equivalent to around 150 Norwegian kroner or about USD 27), and when he consulted it again they were equivalent to USD 27,000 (Wu and Pandey 2014). This situation led the banking regulator to be alert to the possible risks of operating with decentralized virtual currency, given its volatility. Following this, Christian Holte, CEO of Norwegian tax collection, stated, “Bitcoin does not fall within the current definition of money or currency. We are investigating to see how this currency fits into our tax system” (Novoa 2020). He added, as stated by Náñez Alonso (2019), that Norway will treat Bitcoin as an asset and will apply a capital benefits tax. The benefits obtained from its use will be subjected to wealth tax and the losses will be deductible.

All of the above is meant as a commentary on a warning by the Norwegian banking regulator, Norges Bank, and the dangers (Johan and Pant 2018). In January 2018 and February 2019, Norges Bank issued two work reports stating its position on CBDC. The first report points out the reasons that could push Norway to implement a virtual currency backed by the central bank: “Ensure a public and risk-free alternative to deposits in private banks, in addition to the cash” and “To function as a standalone backup solution for ordinary electronic payment systems” (Norges Bank 2018). All of these reasons, as indicated by Canada, show Norges Bank’s interest in following the global trend in the use of virtual currency.

4.4. Security Reasons: Avoid Money Laundering and Terrorist Financing

The motive for establishing a CBDC based on promoting national security and avoiding the financing of illicit activities such as money laundering and terrorist financing have been put forward by Canada, Saint Martin, Curaçao and the Bahamas.

We have already seen the importance of the financial sector in Canada, and we analyzed the logic of its central bank exploring the possibility of using virtual currency. According to Ponsford (2015), the introduction of concrete measures to regulate businesses that facilitate cryptocurrency transactions in Canada occurred in 2014. This involved amendments to federal legislation, including the Proceeds of Crime Act on money laundering and terrorism financing laws. The reason given is that emerging technologies (including virtual currency) can be used for money laundering and terrorist financing. In other words, the new virtual currency was a threat to the security of Canada.

As for Curaçao and Saint Martin, according to the CBCS president, digital currency backed by the central bank could bring several advantages. One would be “to overcome the volatility risks of an asset without backing and without intrinsic value,” in clear reference to Bitcoin and other virtual currencies that do not have the backing of a central bank (Centrale Bank van Curaçao en Sint Maarten 2018). Thus, CBDC would allow the banking supervisor to fight more effectively against money laundering, terrorist financing and other illegal actions. This reason coincides with that reported by Choo (2015).

As for the Bahamas, as has already been mentioned, its interest in a virtual currency backed by a central bank began in 2018. According to The Nassau Guardian (2020), Project Sand Dollar will produce the first digital currency in the Bahamas. CBOB itself published an article in which it explains how the virtual currency will work, and among the advantages is “greater power for the banking supervisor in its fight against money laundering, terrorist financing and other illegal actions” (The Central Bank of the Bahamas 2019b).

As for Switzerland, the Swiss Financial Market Supervisory Authority (FINMA) in a statement also recognized “Blockchain innovative potential for the financial industry,” alluding to virtual currency and the possible CBDC Switzerland. However, the authority also stated that “Blockchain-based business models cannot be allowed to circumvent the existing regulatory framework,” showing clear concern about possible money laundering2 derived from the use of virtual currency (Swiss Financial Market Supervisory Authority 2019).

4.5. Consumer Protection

Establishing a CBDC in order to achieve greater consumer protection was a reason identified by Canada and Norway. The Canadian government intends to regulate virtual currencies (to achieve consumer protection) through various laws such as the Federal Competition Act, which incorporates consumer protection provisions, for example. In addition, at the provincial level, consumer protection has been established when using virtual currency. Examples of this are the Business Practices and Consumer Protection Act in British Columbia and the Consumer Protection Act in Ontario (Fintech in Canada: Towards Leading the Global Financial Technology Transition 2016).

As regards Norway, together with the reasons stated in the 2018 report that were cited again, two other reasons are added for establishing a CBDC: “Provide a solution of independent support for ordinary electronic payment systems and guarantee that payments can always be made, even in the case of substantial changes in the structure of the market and the profile of the interested parties” and “Provide digital currency of course adequate legal” in order to protect consumers from other alternatives (Norges Bank 2019).3

Lithuania has shown itself to be a favorable country for establishing a CBDC for a long time. The Bank of Lithuania recently published a press release announcing that “it is redoubling its efforts towards its digital currency initiative (CBDC) of the central bank. Leading the way in blockchain-based projects (LBChain and LBCOIN), both first of their kind among central banks” (Bank of Lithuania 2019). Based on this, the bank released a report on CBDC design options, as well as monetary policy and financial stability implications, defending the establishment of a CBDC for the following reasons (Juškaitė et al. 2019): (1) it is a means of satisfying the need of citizens living in a global world for a secure, reliable and profitable instrument for cross-border payments; that is, it protects the consumer; and (2) financial and monetary stability are guaranteed, and therefore control can be maintained.

4.6. Maintaining Control over Monetary and Macroeconomic Policy

One of the fundamental concerns of any country, from the economic point of view, is to be able to maintain control of macroeconomic policy, and together with the fiscal policy, to be able to control whether the monetary policy is possible. This reason was put forward by Canada and Norway. Certainly, maintaining control of monetary policy is essential for any country, because it allows the banking authority to decide on amounts of money and interest rates, maintaining control over the decision to increase the quantity of money (expansive monetary policy or quantitative easing) or to reduce it (restrictive monetary policy). This will control and maintain economic stability.

The Bank of Canada “has raised concerns that future iterations of cryptocurrencies may influence national monetary policy objectives” (Johnson and Pomorski 2014). The reason would be simple, that the use of these virtual currencies could have an influence “on the demand for cash in all jurisdictions and impact the ability of central banks to carry out an effective monetary and macroeconomic policy” (Digital Currencies and Fintech 2020).

Norges Bank (2019) noted that 70% of payments in Norway were made via credit or debit card and this shows that cash is being used increasing on a residual basis. Therefore, establishing a CBDC is an option since it would allow converting the CBDC into bank deposits and vice versa simply and inexpensively. The reason is basic: monetary competition. The competition of cryptocurrencies (such as Bitcoin and Tether) and other national currencies that offer CBDC could threaten the position of the Norwegian crown in the country’s payment system; not only that, but the same report points out that derived from the above, Norway could find it difficult to “maintain control of monetary and macroeconomic policy.”

China has successfully completed a simulation examining the use of digital currency in transfers between the central bank and commercial banks (Bank of China 2017). No more data are known about this test, only that the Chinese vice governor commented that the evaluation was positive and that his country would issue CBDC, and it would be concentrated and not distributed. As stated by Jinze (2019), two representatives of the Bank of China commented that the “pound represented a threat to China’s national payment systems and to the national currency,” and they advised that China “take precautions” in response to the threat posed by digital currencies backed by foreign corporations like Libra. Despite the Chinese secrecy, it seems that its commitment to CBDC would come from maintaining macroeconomic and currency policy and preventing the sector from becoming obsolete. Currently, it is speculated that the Bank of China is actively developing a CBDC: “at least 15 companies are assisting PBOC with the development of their legal digital currency, including the large state banks, the three largest telecommunications companies in China and some of its main technology companies,” according to China Banking News (2020).

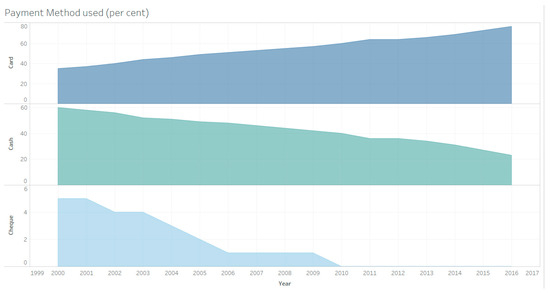

4.7. Drop in Use of Cash (Alternative)

The falling use of cash—and therefore its being an alternative—is a reason given by most of the countries, all of them developed. This derives from the rise of electronic transactions (purchases, online bank accounts, etc.).

According to the Bank of Canada, in 2019 “people used cash only for one in three transactions; and it is difficult to imagine that this trend is reversed”, especially since cash is not an available option when people shop online (The Road to Digital Money 2020). The idea of a digital currency issued by a central bank makes sense. In theory, it could provide cash security, with the benefits of modern electronic payment. Basically, the central bank’s digital cash would act as the current electronic payment method; the only difference would be that it would not be linked to a commercial bank in the same way as bank accounts and debit cards. The creation of such virtual currency has implications; in the words of the Bank of Canada, “Creating a digital central bank currency is a rather complicated decision. We are working to determine under what conditions it may make sense, one day, to issue a digital currency; analyzing their pros and cons” (The Road to Digital Money 2020). In mid-2016, the Bank of Canada and the Royal Bank of Canada reported that they had been conducting experiments with a legal tender digital currency called CAD-COIN (Chapman et al. 2017). Among the participants of the experiment are the five largest banks in Canada: Bank of Montreal, Canadian Imperial Bank of Commerce (CIBC), RBC, Toronto-Dominion Bank (TD Bank) and Scotiabank, according to DiarioBitcoin (2016).

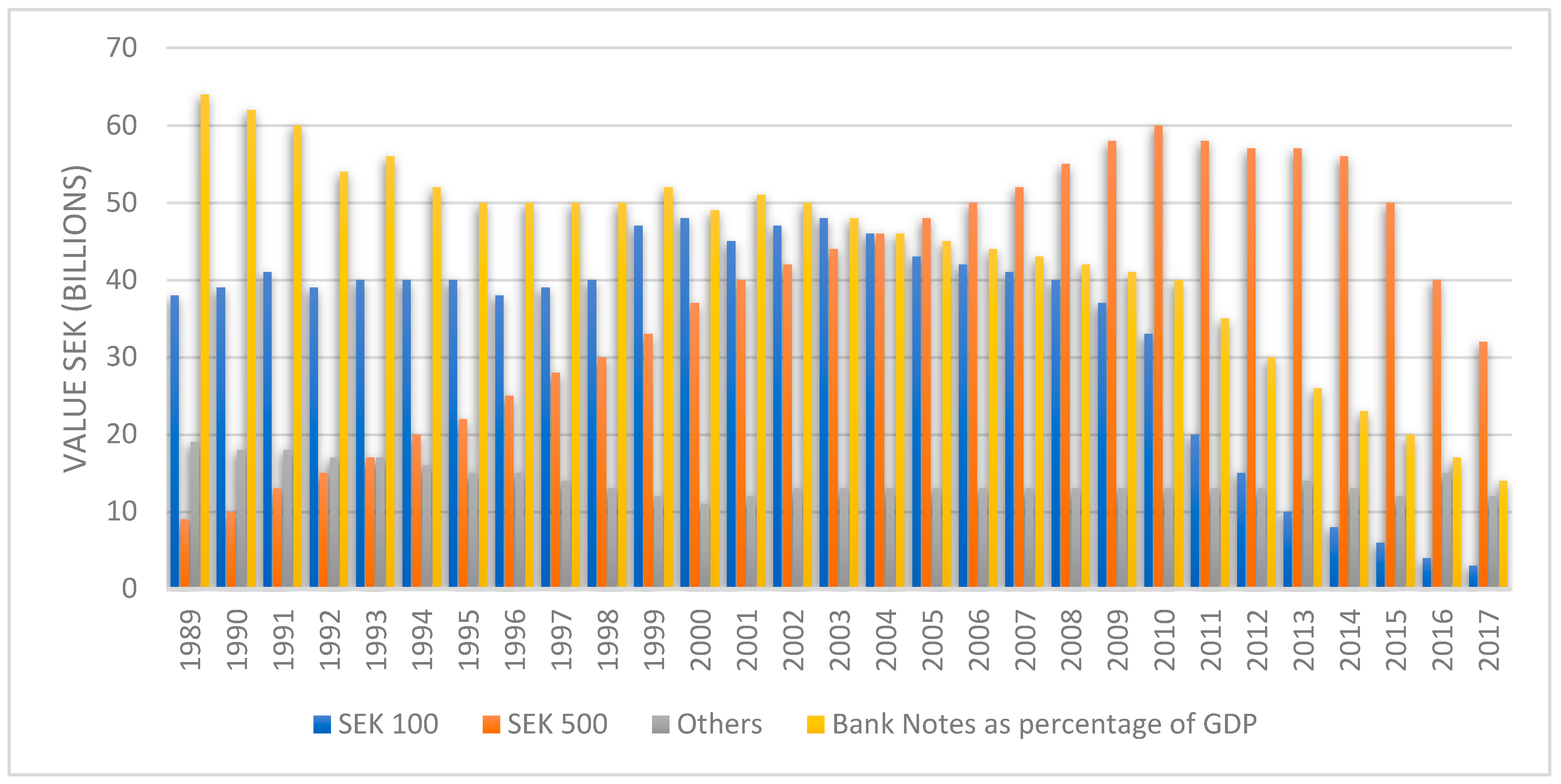

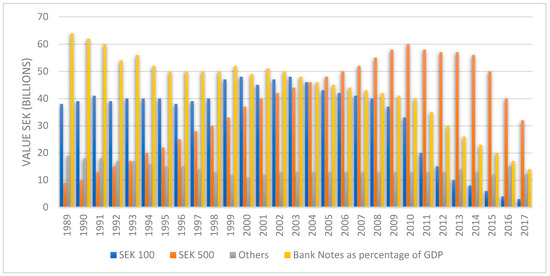

Sweden is one of the countries with the least presence of cash and many businesses and restaurants no longer accept cash payments. According to data from the central bank (Riksbank), the amount of cash in circulation has been cut in half since 2007. Thus, while in other areas the number of banknotes in circulation is growing, the same is not happening in this Nordic country (Nuño 2018). According to Fabris (2019), “Sweden heads the vanguard. According to the Riksbank (Sveriges Riksbank 2018), at the last count only 13% of Sweden’s payments were made using cash, compared with a European average of nearly 80%.” In Figure 7, it can be seen how Sweden constitutes a paradigmatic case of cash reduction since the middle of the last decade.

Figure 7.

Banknotes in circulation in Sweden, 1989–2017. Source: author’s elaboration. Data from Engert, W., Fung, B. S. C. and Hendry, S. (Engert et al. 2018) Is a Cashless Society Problematic? Staff Discussion Paper 2018-12, Bank of Canada.

One reason for this is the high level of digitization of the economy. According to the Digital Economy and Society Index (DESI) (2017), Sweden ranks third in digitization, behind Denmark and Finland.

Regarding Norway, the Norges Bank (2018) indicated that among the reasons that could push Norway to implement a virtual currency backed by the central bank would guarantee the existence of an adequate legal tender as a supplement to cash. In the report itself, the Norges Bank working group points out the great decline in the use of cash because of card payments and electronic purchases.

According to data from the report, 70% of payments made in Norway were via credit or debit card, which shows that cash is being used increasing on a residual basis. Hence, with the decline in the use of cash, a CBDC is planned as an alternative.

In Curaçao and Saint Martin, according to the CBCS president, a digital currency backed by the central bank could bring several advantages. One would be to follow the global trend: “digital cash will one day dominate the payment infrastructure” (Centrale Bank van Curaçao en Sint Maarten 2018), clearly alluding to Bitcoin and other virtual currencies that do not have the support of a central bank. In addition, central banks are better placed to develop a robust financial infrastructure that provides a secure environment, and they point to facilitating “national as well as cross-border transactions” as another potential advantage when cash is no longer used.

Regarding the Bahamas, according to The Central Bank of the Bahamas (2019b), among the reasons to launch its initiative (Project Sand Dollar) are the gradual reduction in the use of cash and better supervision of financial transactions.

Switzerland is another state that has shown interest in developing its own virtual currency backed by a central bank, in this case the Swiss National Bank (SWN). One of the reasons that the SWN argues is an advantage of establishing a CBDC is the drop in the use of cash. In a report (Swiss National Bank 2019), the SWN analyses the role that central banks play in the current payment system, and concludes that the large drop in the use of cash poses a challenge for central banks that have the “mandate to facilitate and ensure the operation of cashless payment systems.”

4.8. Lower Costs and Greater Efficiency of the Banking System

Saint Martin, Curaçao, the Bahamas and Sweden point out that the reasons for establishing a CBDC are lower costs and greater efficiency of the banking system. The use of a virtual currency would reduce the costs of maintaining cash and transaction costs would also be lower.

In Sweden, the central bank will launch a pilot test with the cryptocurrency e-krona (digital crown) in collaboration with the company Accenture. The truth is that for years the Riksbank has been analyzing the introduction of this cryptocurrency to replace the scarce cash that is still circulating in the country. Among the objectives of creating this cryptocurrency at the state level is to offer an alternative means to the private digital market, avoiding the concentration of business in a few providers and there are telephone payment services such as Swish, which have more than six million users, approximately 60% of the population of Sweden (Riksbank 2018). This application was created in late 2012 and allows users to make and receive payments by linking the data with the user’s bank account. The presence of a state cryptocurrency would increase competition in the system. Another objective is to create a secure and efficient payment system. According to a report by the Bank of Sweden prepared in 2018: “In serious crises, when private payment systems may fail, an e-krona could work as an alternative system and thus increase stability in the payment system. The e-krona could hence help to promote a safe and efficient payment system” (Sveriges Riksbank 2018). Another intention of the central bank is to avoid financial exclusion of those groups of the population who are still using cash (older people, disabled people, etc.) and may not be served by the private sector.

Among the main challenges facing the Swedish government is to make the legal reforms that allow the central bank to issue this cryptocurrency and develop the most appropriate technology to turn e-krona into a cryptocurrency that generates trust (Sveriges Riksbank 2018).

In the Bahamas, they have put forward as a defense of establishing a CBDC the reduction of transaction costs. Increased transfers in digital currency would reduce the costs derived from the current use of electronic transfers, checks, interbank transfers and invoice payment mechanisms. A digital currency would not eliminate these transactions but would offer a lower-cost alternative that in turn would reach more audiences (The Central Bank of the Bahamas 2019b).

Furthermore, regarding Curaçao and Saint Martin, the Centrale Bank van Curaçao in Sint Maarten has pointed out as another possible advantage of adopting a virtual currency backed by a central bank “lower costs and greater efficiency of the banking system” (Centrale Bank van Curaçao en Sint Maarten 2018).

Regarding Switzerland, both the Federal Reserve Bank of St. Louis (Switzerland) (2018) and Swiss National Bank (2020) point out that a CBDC “reduces monopoly and increases the efficiency of the system by reducing costs.” In a recent press release, the Swiss National Bank (2020) pointed out that a group of central banks are analyzing the potential of CBDCs. The conclusion is that this group “will evaluate the CBDC use cases; the various economic, functional and technical design options including cross-border interoperability; and the exchange of knowledge on emerging technologies.” However, they have not set a defined time period for this.

5. Analysis of Reasons for Not Establishing a CBDC

The cases of Ecuador and Venezuela in Latin America, Denmark in Europe and Australia are included in the table. In Australia, the refusal to establish a state cryptocurrency stands out. In Ecuador, the public electronic money system was not based on a state cryptocurrency, and although in principle it was managed through the central bank, the service has been delegated to private banking. Venezuela, the first country to establish a state cryptocurrency, is exceptional because the system was created with the idea of circumventing certain diplomatic sanctions; there is great distrust in the issuing government and there is not much transparency about the Petro system. In Denmark, despite the initial rejection of CBDCs and measures enacted to keep cash in circulation, the debate on whether to bet on a CBDC remains open.

We proceed to analyze the reasons for rejecting a CBDC.

5.1. Preference for Private Virtual Currency

Ecuador officially adopted the US dollar as legal tender in January 2000 after the 1999 financial crisis and a long period of devaluation of the local currency, the sucre. Dollarization has brought great advantages to the economy of the Andean country (reduced interest rates, lower inflation, macroeconomic stability, etc.) and some disadvantages (loss of seigniorage and difficulty dealing with external shocks). Former President Rafael Correa was very critical of this system and supported the creation of an electronic money system to be managed under a monopoly by the central bank as of 2015 (Echarte-Fernández 2019). It was established in the Organic Monetary and Financial Code of the previous year. The reason for the creation of electronic money was to save money for the state by replacing deteriorated banknotes and to provide a fast service to make financial transactions, especially for sectors of the population with a low level of bank penetration (financial inclusion). The government invested many resources in advertising to promote the system and tax incentives were given by reducing the VAT by four points. From the first moment, some authors perceived that behind this scheme there was an attempt to “de-dollarize” the economy, something that did not finally occur, since the cost of exiting this system would be very high and dollarization has wide popular support.

In 2018, Lenin Moreno, the current president, transferred the electronic money project to private banks, since the objectives regarding the number of users of this medium had not been achieved (Campuzano et al. 2018). The interbank network BANRED launched the mobile wallet (BIMO) in September 2019, but now the percentage of the population that uses it is very low.

5.2. Lack of Demand/Inability to function

In December 2017, the Nicolás Maduro regime announced the creation of a state cryptocurrency, the Petro, based on blockchain technology and backed by the country’s oil reserves and other natural resources. This is the first state cryptocurrency in history. The main reason for its creation was to circumvent the international sanctions imposed by the US and try to cope with the shortage of dollars, without which imports cannot be financed. The initial idea was that each Petro was backed by a barrel of oil from the reserves. Currently, there is broad consensus that the Petro is failing because there is no confidence in the government that supports the cryptocurrency. In the last years, Venezuela experienced one of the highest inflation rates in the world and the demand for local money (the bolivar) plummeted, taking the economy to a high degree of dollarization and towards the use of decentralized cryptocurrencies such as Bitcoin. Due to the deep economic crisis the country has been suffering for several years, a debate opened on the monetary system in the academic field; there are organizations and authors that promote official dollarization (Observatorio Económico Legislativo de CEDICE Libertad 2015) and others who oppose this measure, such as the Venezuelan economist and Harvard professor Ricardo Hausmann.

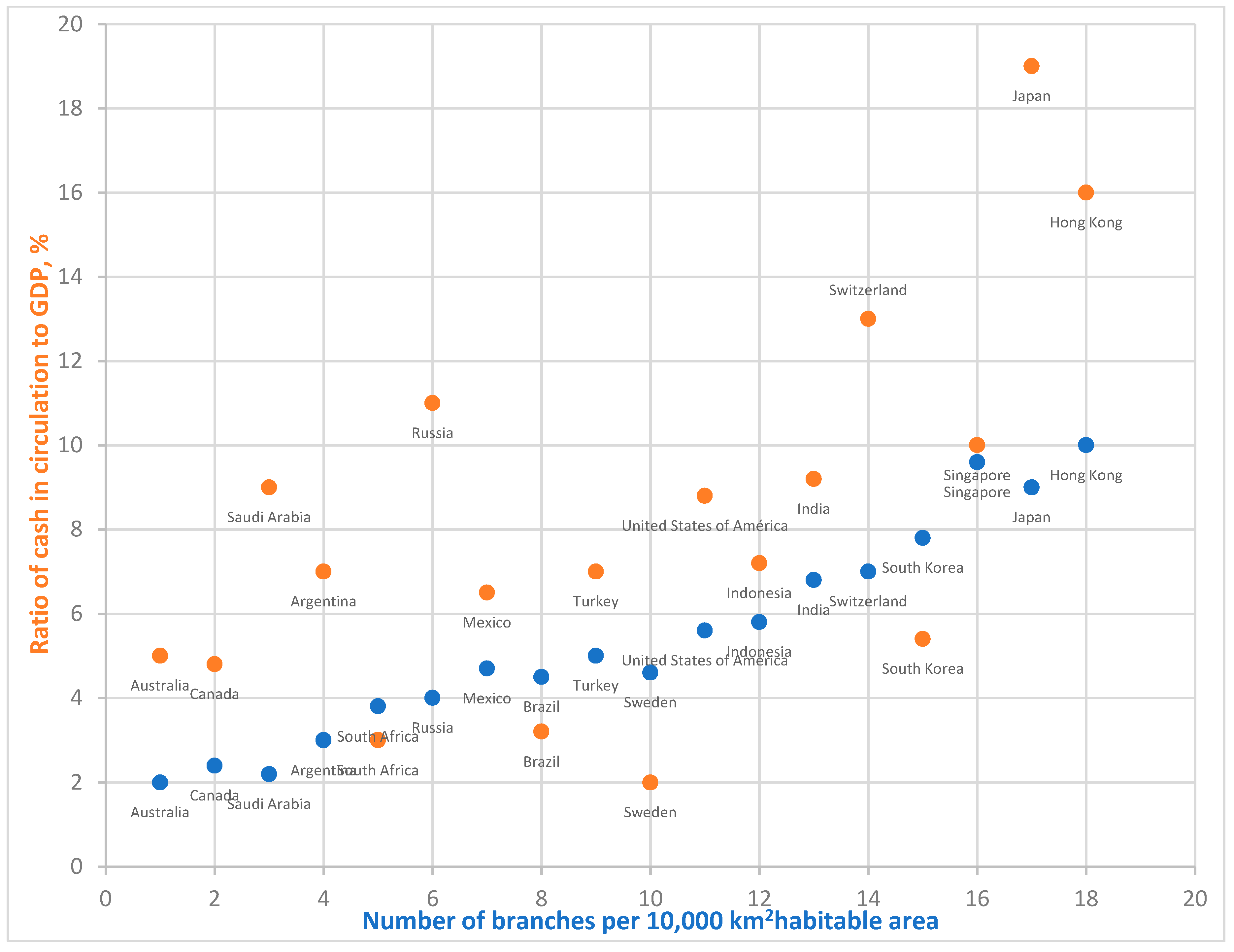

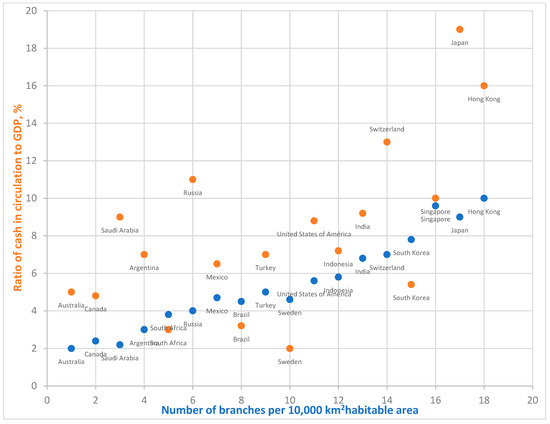

Regarding Japan, the Bank of Japan (BOJ), in the words of its governor, has communicated that, “…it will continue working to improve the efficiency and security of payment systems. It will examine, from various perspectives, the nature of these systems, including a CBDC” according to Amamiya (2019). Therefore, there is currently no demand in the country for a non-virtual currency, as cash is widely accepted (see Figure 8), and more research is needed.

Figure 8.

Correlation between cash in circulation and GDP and number of branches per habitable area. Source: author’s elaboration. Data from (Amamiya 2019). https://www.boj.or.jp/en/announcements/press/koen_2019/ko190712a.htm/.

In turn, Hayashi et al. (2019) point out: “Before launching a CBDC, a more detailed discussion is needed to further clarify the legal problems that may occur.” Hence, Japan is ruling out establishing its own CBDC in the short term.

In the case of Singapore, one of the most developed countries in the world, two communications on possible implementation of a CBDC have been made. The first states that “central banks must carefully evaluate each change and the greatest impact on financial stability and monetary policy, before getting on the train” in clear reference to the establishment of this CBDC (Loh 2018). The second points out that “the possible implications of CBDCs have been debated, but this remains a relatively green field” and therefore they did not see a current need to establish a CBDC (Chong Tee 2018).

South Africa initially started a project to establish a CBDC, the Khokha Project, but the country’s banking authorities seem reluctant to follow through with it. This was shown by the governor of the South African Reserve Bank (SARB), who pointed out that “All South Africans, young and old, use money. Despite all the talk about a ‘cashless society,’ digital transactions, mobile money and so-called cryptocurrencies, millions of South Africans still depend on cash for daily transactions […], public demand for tickets continues to grow, but not everyone has a phone with Internet access or a digital wallet” (Kganyago 2018). Thus, it can be argued that in a “cashless” society, people who do not have access to banking services could end up being excluded from the economy. The other reference can be found in the SARB report, which limits itself to reviewing the South African payment system and issuing a series of recommendations should it decide in the future to establish a CBDC, without further contributing to the debate (South African Reserve Bank 2018).

5.3. Failed Test/Need for More Security and Investigation

Australia was one of the countries that, with Canada, initially tried to comment on the phenomenon of virtual currency as a result of the use of Bitcoin in their territory. The Australian financial authorities established that “exchanges of goods and services for BTC and changes of these for legal tender are taxed” (Burleson 2013; Navas Navarro 2015). According to Lowe (2017), despite the great interest aroused by Bitcoin and the other virtual currencies, the Reserve Bank of Australia (RBA) does not see the need to implement a CBDC because “households would demand little of this asset, given that they already have a good access to digital money in the form of commercial bank deposits that provide payment services, earn interest and are protected up to $250,000 per account.” The RBA itself points out another possible negative effect of ruling out the establishment of a CBDC: “there would be a drop in commercial bank deposits and a reduction in the availability of funds for loans to households and companies” (Reserve Bank of Australia 2019). Another reason given by the RBA was a report (Ernst and Young 2019) that concluded in a devastating way that “a government-backed digital sovereign currency has been classified as the least effective of the 14 political initiatives possible to promote growth in the Australian fintech industry.”

Thus, the RBA appears to have ruled out establishing a CBDC at least in the short term; however, the bank itself recently reported that the Innovation Lab is being used to explore whether there is a role for a digital Australian dollar (i.e., an Australian CBDC).

Finland is in the initial stages of investigation. The country sees the need to regulate virtual currencies and that they would be more efficient if they were managed by a central bank, but according to Grym et al. (2017), “the introduction of money from the electronic central bank could have significant implications for the functioning of the financial system and for the stability of credit institutions. These implications must be carefully analyzed. Some central banks have explored the possibilities of issuing money electronically. It is still unclear what kind of technical solution would be feasible.” Therefore, it is argued that more research is necessary. Subsequently, the Bank of Finland continued to discuss the option of establishing a CBDC, but without taking any further steps (Pankki 2018).

Iran and India have stated that they are interested in participating in projects related to CBDC, but more research on its operation and characteristics is still required before they would start, pointing out that, “…its current forms are immature to be used and implemented” (Reserve Bank of India 2020). In the case of Iran, along with the above can be added a reason also given by Venezuela: avoiding international sanctions.

New Zealand, following the arguments of Australia and Canada, among others, has stated that, “…following the arguments made by other developed economies, more research and evidence is needed to determine the advantages and disadvantages of establishing a CBDC” (Reserve Bank of New Zealand 2018), a reason why the Reserve Bank of New Zealand currently rejects its establishment in the short term.

Regarding Russia, the head of the Russian Central Bank indicated that “If we are talking about a national currency that works in the country, that is, not private assets, this requires that technology provide reliability and continuity. Technologies must be mature, including distributed ledger technologies” (Huillet 2019). Given its interest in CBDCs, the Russian Central Bank is currently conducting a test in order to obtain results and perform an analysis. “We are testing stable coins in our ‘test environment,’ we are learning the potential uses of digital currencies, but we assume that they will not work as a means of payment or that they will become a substitute for money” (Partz 2019). Thus, Russia has ruled out establishing a CBDC in the short term, pointing out that more research is needed on its operation and effects, so it is conducting tests.

South Korea, Singapore and Japan constitute a group of highly economically developed countries that have analyzed the effects of establishing a CBDC on their economy. In South Korea, a report by the Central Bank of Korea (BOK) merely analyses the effects on the financial stability of establishing a CBDC. The report notes: “The introduction of deposits into the CBDC account essentially decreases the supply of private credit by commercial banks” (Sik Kim and Kwon 2019), adding that “it will be useful to explicitly investigate whether introducing a CBDC would improve welfare.” Therefore, the study found problems with financial stability and pointed out that it is necessary to further investigate the effects of a CBDC before establishing one.

The Bank of England (BOE) initially showed interest in studying the impact of establishing a CBDC on the bank. To do this, a multidisciplinary team of members began a study indicating that if the introduction of a CBDC followed a series of principles, “bank financing is not necessarily reduced, the provision of credit and liquidity for the private sector would not contract, and the risk of a withdrawal of bank deposits to a CBDC is controlled” (Kumhof and Noone 2018). However—and after this promising initial analysis—BOE later indicated that although “a digital currency of the Central Bank (CBDC) would allow households and businesses to make electronic payments directly with money issued by the Bank of England, we have not yet made a decision on whether to introduce CBDC”(Bank of England 2020). Therefore, now they refuse to establish a CBDC because more research is needed and in the last report, they considered that the current digital means of payment play an important role and proposed some improvements on them.

5.4. There Is No Advantage over Electronic Payment

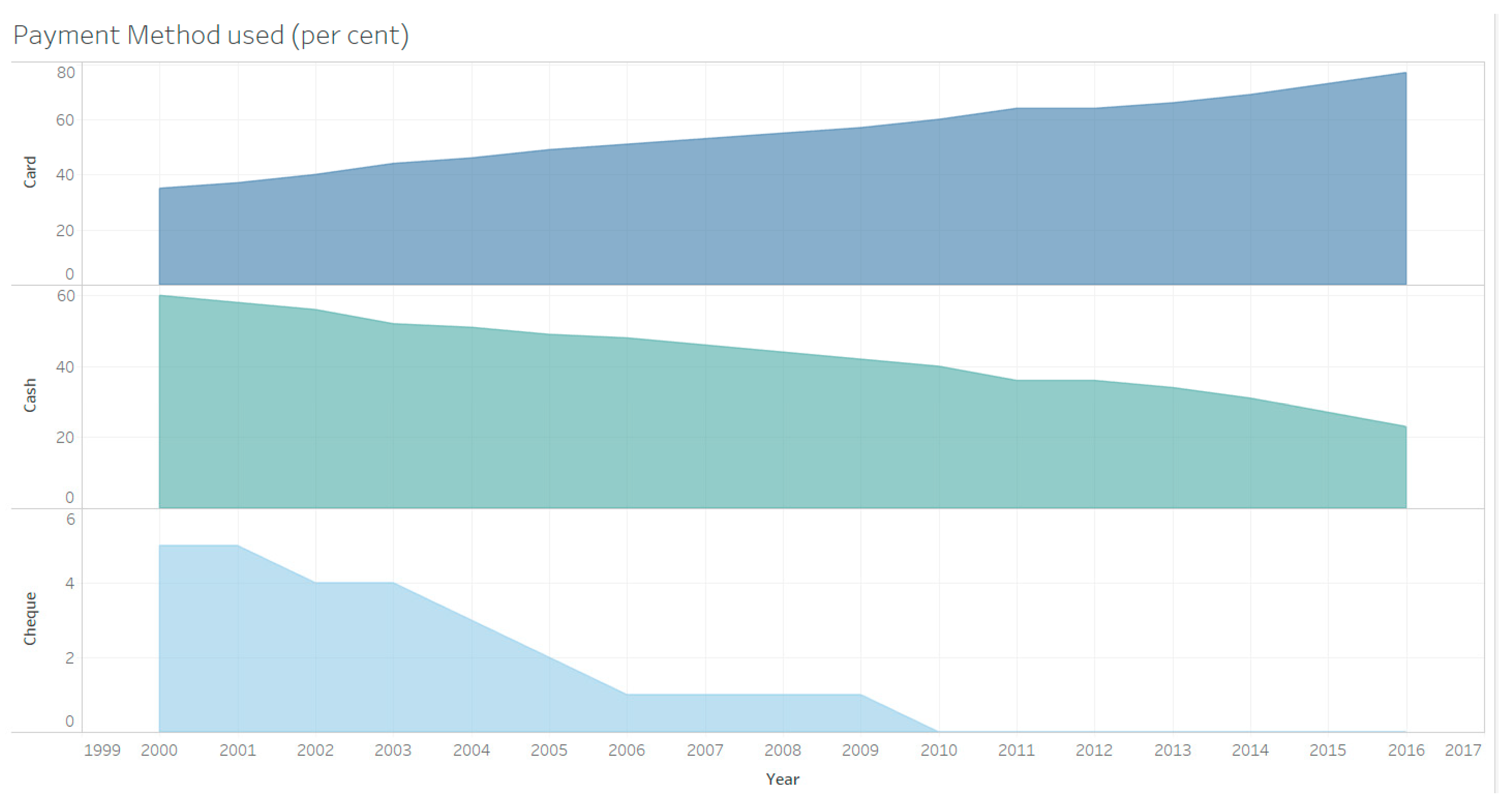

The small Nordic country of Denmark, following the example of Norway and Sweden, has also valued the option of establishing a CBDC, backed in this case by the Danmarks Nationalbank (DNB). A report published in 2017, which included an analysis of previous works, stated that “In the international debate, several potential benefits of the introduction of CBDC are mentioned, including opportunities to achieve a more effective payment system safe and effective and to establish a backup system for the existing payment infrastructure. However […] in a country like Denmark, with a safe and effective payment system, it is difficult to understand what a CBDC will contribute which is not covered by existing payment solutions. In the Danish context, the digital currency already exists as bank deposits” (Danmarks Nationalbank 2017). However, despite agreeing that current electronic payment systems work, they point out that the spectacular drop in the use of cash is undeniable (at least in Denmark).

As we see in Figure 9, the fall in the use of cash has been constant over time. In turn, the use of digital payments has not stopped growing, and with the data available in the last year of the series, it was close to 80%. Therefore, the fundamental reasons for the DNB to reject the implementation of e-krona are that it does not add efficiency or functionality to existing payment solutions, and it would interfere with monetary policy.

Figure 9.

Drop in the use of cash in Denmark: comparison of electronic payments vs. checks and cash. Source: author’s elaboration. Data from (Danmarks Nationalbank 2017).

After the previous report Bjerg and Nielsen (2018) criticized DNB because it overlooks the fact that “money users may also be concerned about the risks that accumulate in the banking sector and, therefore, have a legitimate need for a risk-free place to store their money”; second, they point to another failure of the analysis carried out by the DNB: “the implementation of CBDC would put pressure on the market for banks to manage their businesses in a way that does not expose clients’ money to more risks than justified.” Finally, regarding monetary policy, the authors again criticize the DNB analysis because “the idea of CBDC is rejected by the argument that it would interfere with the crown’s fixed exchange rate policy against the euro” when that would not be the case.

Therefore, Denmark has determined that currently the costs of a retail CBDC would outweigh the benefits (Auer and Böhme 2020), while many other countries continue to actively develop CBDC as they consider it “a medium-term possibility” (Boar et al. 2020).

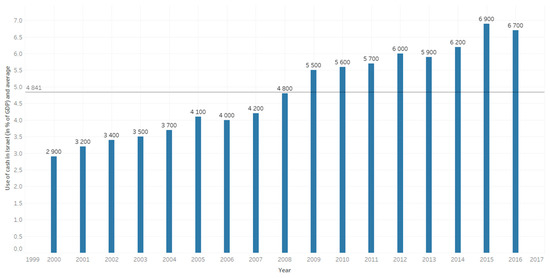

As for Israel, its central bank (BoI) released a summary of the work of its interdepartmental team to examine the digital currency and its eventual use in the country’s financial system, the so-called e-shekel. The research found that there is still no adequate basis for a decision to recommend the issuance of digital currency, at least in the medium term (Bank of Israel 2018). This decision is based on two fundamental reasons. The first is somewhat subjective: “So far, no central bank of any advanced economy has issued digital currency for broad use”; and the second is in line with what Denmark has previously analyzed: “The CBDCs are similar to current electronic payment systems, and both means are convenient and accessible.” In short, for them, there is no clear advantage of one over the other (Bank of Israel 2018).

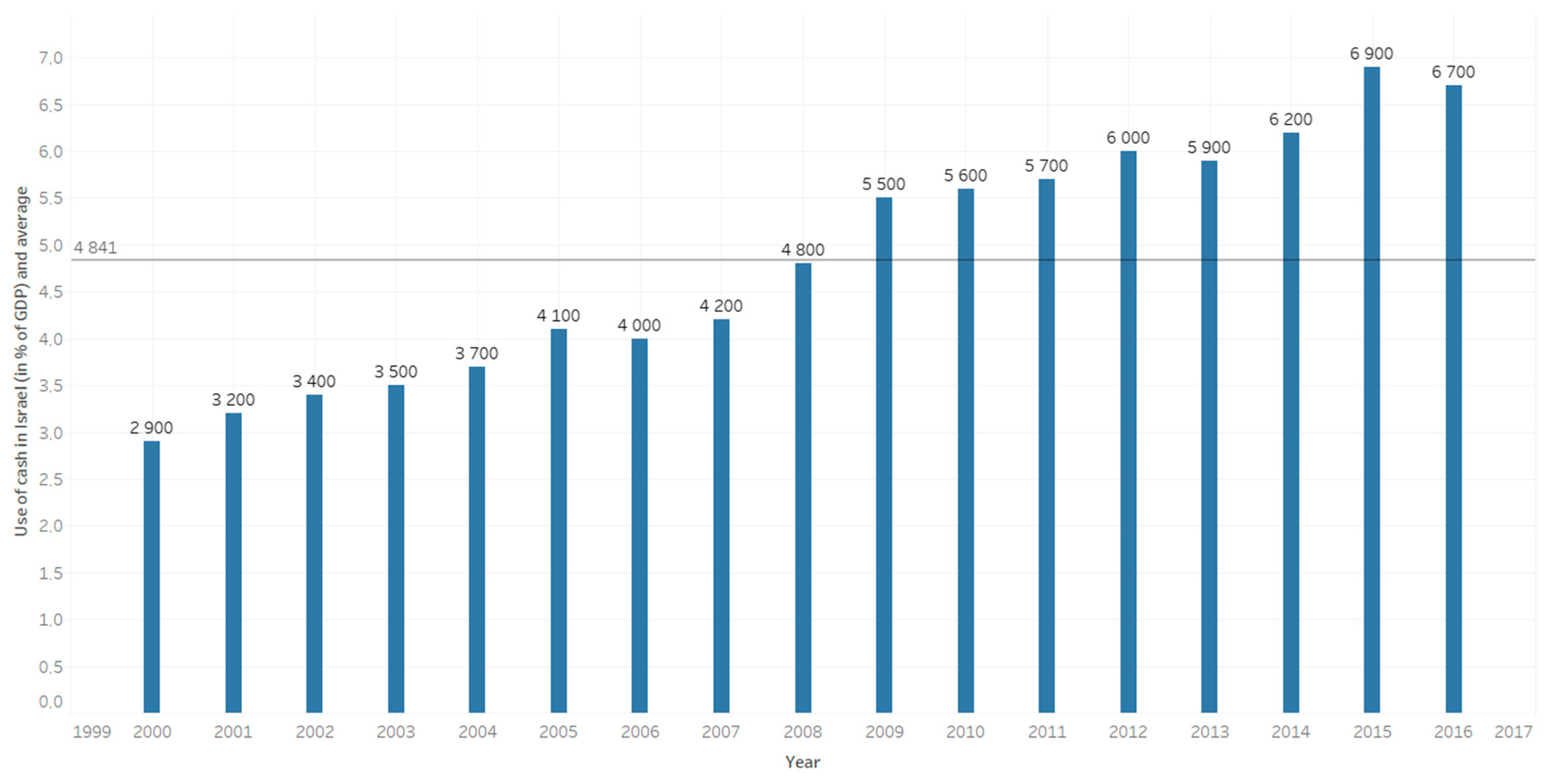

As we see in Figure 10, adding to the previous argument by Israel, the use of cash in the country has not stopped growing, except for a slight decrease in the last year of the referenced series, which seems to motivate even more its position of not establishing a CBDC, at least in the short term.

Figure 10.

Use of cash in Israel, percentage of GDP, 2000–2016 series and average. Source: author’s elaboration. Data from (Bank of Israel 2018).

Hong Kong has indicated that “the current electronic payments market has very good efficiency and performance, and a CBDC will not significantly improve that efficiency” (Chan 2018). However, the country has announced that it intends to continue studying the effects and implementation of a CBDC. Therefore, Hong Kong currently falls within our study within those countries that currently reject a CBDC because the current electronic payment system is already efficient. On 22 January 2020, The Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BOT) announced that they would publish the results and a report on a joint research project on CBDC, called the Inthanon-Lion Rock Project (The Hong Kong Monetary Authority 2020).

As for the United States of America, the Federal Reserve is interested in the possibility of implementing blockchain technology, but not in issuing a CBDC that some speculated would be called Fed Coin and would replace the American dollar. The Fed does not currently see the need to issue a CBDC for two main reasons: the current payment system is efficient and innovative enough, and the demand for a CBDC due to a drop in the use of cash is not taking place in the USA, in contrast with the situation in Sweden (Brainard 2018, 2019, 2020).

6. Conclusions

Despite the many possible advantages as described in the present study that could encourage a country to establish its own central bank-backed digital currency (CBDC), all of these arguments are made in a theoretical way—without testing the real implications that this monetary innovation would have in the monetary policy and the functioning of the real economy (except for some limited evidence). In addition, it is difficult to guess what the real acceptance of CBDCs would be among citizens—as well as the efficiency of this new money to prevent money laundering and the financing of illegal activities. Therefore, we can conclude that more pilot tests, such as those carried out in Uruguay (or intended to be carried out in the Bahamas), are needed before choosing to establish a CBDC, to be able to test these situations.

Other advantages do seem clear to authors and central banks, such as lower operating costs (by reducing or eliminating the printing of banknotes and minting of physical coins) and consumer protection. In these cases using virtual currencies controlled by central banks would prevent the use of other cryptocurrencies that are very volatile, such as Ethereum or Bitcoin.

Regarding the motives of those who defend not establishing a CBDC, we find the arguments of Denmark and Israel as representing probably the biggest obstacle: “We have not found an advantage that a CBDC presents compared to current payment systems (card, etc.).” This line of thought may be followed by more countries in opting for not establishing a CBDC. However, it may also be valid for highly developed countries with a high financial inclusion rate, such as Sweden and Norway. However, for countries with wide geographic dispersion, a low financial inclusion rate and low consumer protection, this would not be a strong argument.

We therefore find opposite tendencies between those who defend the implementation of CBDCs and its detractors.

It is clear that three of the larger banking institutions—the Federal Reserve of the United States of America, the Bank of Japan and the Bank of England—will, for the moment, postpone the creation of their own CBDCs. For this reason, it seems that large-scale implementation is still far off. The countries that more likely will launch their own CBDCs are China, Uruguay, Lithuania and the Bahamas. Probably, if this happens, the central banks of the more developed countries will pay close attention to the problems and advantages of this new digital money.

In any case, in this new world where private digital currencies exist, the creation of CDBCs is only a matter of time. In addition, we can say that once a few countries take steps in this direction, others will follow quickly.

Author Contributions

Conceptualization, S.L.N.A. and M.Á.E.F.; methodology, S.L.N.A.; validation, D.S.B.; formal analysis, S.L.N.A., M.Á.E.F. and J.K.; investigation, S.L.N.A. and M.Á.E.F. and J.K.; data curation, S.L.N.A. and M.Á.E.F.; writing—original draft preparation, D.S.B. and S.L.N.A.; writing—review and editing, S.L.N.A and D.S.B.; project administration, S.L.N.A., M.Á.E.F., D.S.B. and J.K. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was partially funded by an incentive granted to the authors by the Catholic University of Ávila.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Countries that defend establishing CBDCs. Source: author’s elaboration.

Figure A1.

Countries that defend establishing CBDCs. Source: author’s elaboration.

Figure A2.

Countries that have rejected establishing CBDCs. Source: author’s elaboration.

Figure A2.

Countries that have rejected establishing CBDCs. Source: author’s elaboration.

References

- Amamiya, Masayoshi. 2019. Should The Bank of Japan Issue a Digital Currency? Speech at a Reuters Newsmaker Event in Tokyo, Speech. Tokyo, Japan, July 5; Available online: https://www.boj.or.jp/en/announcements/press/koen_2019/ko190712a.htm/ (accessed on 18 March 2020).

- Auer, Raphael, and Rainer Böhme. 2020. The Technology of Retail Central Bank Digital Currency. BIS Quarterly Review. Bank for International Settlements. Available online: https://www.bis.org/publ/qtrpdf/r_qt2003j.pdf (accessed on 16 March 2020).

- Banco Central del Uruguay. 2019. The Cost of Using Cash and Checks in Uruguay. Documentos De Trabajo Del Banco Central Del Uruguay. Montevideo: Banco Central del Uruguay. Available online: https://www.bcu.gub.uy/Estadisticas-e-Indicadores/Documentos%20de%20Trabajo/4.2019.pdf#search=e%2DPeso (accessed on 3 March 2020).

- Bank of China. 2017. 2016 Annual Report: Serving Society, Delivering Excellence. Annual Report. Beijing: Bank of China Limited. Available online: https://pic.bankofchina.com/bocappd/report/201704/P020170427553394747733.pdf (accessed on 5 March 2020).

- Bank of England. 2020. Discussion Paper Central Bank Digital Currency: Opportunities, Challenges and Design. Discussion Paper: Future of Money. London: Bank of England. Available online: https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf?la=en&hash=DFAD18646A77C00772AF1C5B18E63E71F68E4593 (accessed on 6 March 2020).

- Bank of Israel. 2018. Report of the Team to Examine the Issue of Central Bank Digital Currencies. Tel Aviv: Bank of Israel (BoI). Available online: https://www.boi.org.il/en/NewsAndPublications/PressReleases/Documents/Digital%20currency.pdf (accessed on 2 March 2020).

- Bank of Lithuania. 2019. In an Effort to Boost Debate on CBDC, The Bank of Lithuania Publishes an In-Depth Analysis. Available online: https://www.lb.lt/en/news/in-an-effort-to-boost-debate-on-cbdc-the-bank-of-lithuania-publishes-an-in-depth-analysis (accessed on 10 February 2020).

- Banque Centrale des Etats de l’Afrique de l’Ouest (BCEAO). 2020. Bceao.Int. Available online: https://www.bceao.int/fr/content/etablissements-de-monnaie-electronique (accessed on 16 January 2020).

- Berkmen, Pelin, Kimberly Beaton, Dmitry Gershenson, Javier Arze del Granado, Kotaro Ishi, Marie Kim, Emanuel Kopp, and Marina Rousset. 2019. Fintech in Latin America and the Caribbean: Stocktaking. IMF Working Papers 19: 1. [Google Scholar] [CrossRef]

- Bitcoin News. 2020. Central Banks Worldwide Testing Their Own Digital Currencies. Bitcoin News. Available online: https://news.bitcoin.com/central-banks-testing-digital-currencies/ (accessed on 12 January 2020).

- Bjerg, Ole, and Rasmus Hougaard Nielsen. 2018. Who Should Make Kroner?—A Review of Danmarks Nationalbank’s Analysis of CBDC. SSRN Electronic Journal, 22–24. [Google Scholar] [CrossRef]

- Blanc, Jérome. 2009. Beyond the Competition Approach to Money: A Conceptual Framework applied to the Early Modern France. Paper presented at the XVth World Economic History Congress, Utrecht, The Netherlands, August 3–7; Available online: https://halshs.archives-ouvertes.fr/halshs-00414496/document (accessed on 2 May 2020).

- Boar, Codruta, Henry Holden, and Amber Wadsworth. 2020. Impending Arrival—A Sequel to the Survey on Central Bank Digital Currency. BIS Papers. Basel: Bank for International Settlements. Available online: https://www.bis.org/publ/bppdf/bispap107.pdf (accessed on 10 January 2020).

- Bordo, Michael D., and Andrew T. Levin. 2017. Central Bank Digital Currency and the Future of Monetary Policy. NBER Working Papers. National Bureau of Economic Research, Cambridge, MA, USA. Available online: http://www.nber.org/papers/w23711 (accessed on 10 December 2019).

- Brainard, Lael. 2018. Cryptocurrencies, Digital Currencies, and Distributed Ledger Technologies: What Are We Learning? Governor Lael Brainard at The Decoding Digital Currency Conference Sponsored by The Federal Reserve Bank of San Francisco. Presentation, San Francisco, CA, USA, May 15. Available online: https://www.federalreserve.gov/newsevents/speech/brainard20180515a.htm (accessed on 22 December 2019).

- Brainard, Lael. 2019. Delivering Fast Payments for All. Remarks by Lael Brainard Member Board of Governors of the Federal Reserve System. Presentation, Federal Reserve Bank of Kansas City Town Hall, Kansas City, MI, USA, August 5. Available online: https://www.federalreserve.gov/newsevents/speech/files/brainard20190805a.pdf (accessed on 24 December 2019).

- Brainard, Lael. 2020. The Digitalization of Payments and Currency: Some Issues for Consideration. Remarks by Lael Brainard Member Board of Governors of The Federal Reserve System. Symposium on the Future of Payments. Speech, Stanford Graduate School of Business, Stanford, CA, USA, February 5. Available online: https://www.federalreserve.gov/newsevents/speech/files/brainard20200205a.pdf (accessed on 24 December 2019).

- Burleson, Joseph. 2013. Bitcoin: The Legal Implications of A Novel Currency. EV. BANKING & FIN. L. Available online: https://www.bu.edu/rbfl/files/2014/03/RBFL-V.-33_1_Burleson.pdf (accessed on 2 November 2019).

- Campbell-Verduyn, Malcolm. 2018. Bitcoin, Crypto-Coins, and Global Anti-Money Laundering Governance. Crime, Law and Social Change 69: 283–305. [Google Scholar] [CrossRef]

- Campuzano, Vásquez, John Alexander, Gonzalo Junior Chávez Cruz, and José Maza Iñiguez. 2018. El fracaso del dinero electrónico en ecuador. 3C Empresa: Investigación Y Pensamiento Crítico 7: 82–101. [Google Scholar] [CrossRef]

- Banco Central del Uruguay. 2018. Autorización Prueba Piloto Para La Transformación De Dinero En Billete Electrónico. Bcu.Gub.Uy. Available online: https://www.bcu.gub.uy/Acerca-de-BCU/Resoluciones%20de%20Directorio/RD_282_2017.pdf#search=Billete%20electr%C3%B3nico (accessed on 17 January 2020).

- Centrale Bank van Curaçao en Sint Maarten. 2018. Central Banks Should Emerge as Innovation Leaders. Available online: https://cbcs.spin-cdn.com/media/speeches_2018_2019/20190330_opening_speech_l_matroos_lasten_june_29th_2018.pdf (accessed on 10 November 2019).

- Chan, Norman T. L. 2018. Keynote Speech at Treasury Markets Summit 2018: Crypto-Assets and Money. Norman T. L. Chan, Chief Executive. Hong Kong Monetary Authority Speech, Hong Kong, September 21. Available online: https://www.hkma.gov.hk/eng/news-and-media/speeches/2018/09/20180921-1/ (accessed on 13 February 2020).

- Chapman, James, Rodney Garratt, Scott Hendry, Andrew McCormack, and Wade McMahon. 2017. Project Jasper: Are Distributed Wholesale Payment Systems Feasible Yet? Ebook. Ottawa: Bank of Canada. Available online: https://www.bankofcanada.ca/wp-content/uploads/2017/05/fsr-june-2017-chapman.pdf (accessed on 3 January 2020).

- Chehade, Nadine. 2015. Financial Inclusion in Tunisialow-Income Households and Micro-Enterprises. Ebook. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/22940/Snapshot000fin0nd0micro0enterprises.pdf?sequence=1&isAllowed=y (accessed on 6 November 2019).

- China Banking News. 2020. 15 Companies Reportedly Participating in Development of China’s Central Bank Digital Currency. Chinabankingnews.Com. Available online: http://www.chinabankingnews.com/2020/01/02/15-companies-reportedly-participating-in-development-of-chinas-central-bank-digital-currency/ (accessed on 12 March 2020).

- Chong Tee, Ong. 2018. The Post-Crisis Financial Landscape: What Next?—Remarks by Mr. Ong Chong Tee, Deputy Managing Director, Monetary Authority of Singapore, at Society for Financial Studies Cavalcade Asia-Pacific Conference’s. Lecture, December 13. Available online: https://www.mas.gov.sg/news/speeches/2018/the-postcrisis-financial-landscape-what-next (accessed on 26 November 2019).

- Choo, Kim-Kwang Raymond. 2015. Cryptocurrency and Virtual Currency: Corruption and Money Laundering/Terrorism Financing Risks? In Handbook of Digital Currency. Cambridge: Academic Press, pp. 283–307. [Google Scholar]

- Cull, Robert, Tilman Ehrbeck, and Nina Holle. 2014. La Inclusión Financiera Y El Desarrollo: Pruebas Recientes De Su Impacto. Ebook. Washington, DC: World Bank. Available online: https://www.cgap.org/sites/default/files/FocusNote-Financial-Inclusion-and-Deelopment-April-2014-Spanish.pdf (accessed on 8 November 2019).

- Danmarks Nationalbank. 2017. Central Bank Digital Currency in Denmark? Analysis. Copenhaguen: Danmarks Nationalbank. Available online: https://www.nationalbanken.dk/en/publications/Documents/2017/12/Analysis%20-%20Central%20bank%20digital%20currency%20in%20Denmark.pdf (accessed on 12 November 2019).

- Diariobitcoin. 2016. Canadá Experimenta Con La Primera Moneda Digital De Curso Legal De La Historia: CAD-COIN. Available online: https://www.diariobitcoin.com/index.php/2016/06/19/canada-experimenta-con-la-primera-moneda-digital-de-curso-legal-de-la-historia-cad-coin/ (accessed on 24 December 2019).

- Digital Currencies and Fintech. 2020. Bankofcanada.Ca. Available online: https://www.bankofcanada.ca/research/digital-currencies-and-fintech/ (accessed on 26 November 2019).

- Digital Economy and Society Index (DESI). 2017. Shaping Europe’S Digital Future—European Commission. Available online: https://ec.europa.eu/digital-single-market/en/news/digital-economy-and-society-index-desi-2017 (accessed on 3 December 2019).

- Dolader Retamal, Carlos, Joan Bel Roig, and José Luis Muñoz Tapia. 2017. La Blockchain: Fundamentos, Aplicaciones Y Relación Con Otras Tecnologías Disruptivas. Economía Industrial 405: 33–40. Available online: https://www.mincotur.gob.es/Publicaciones/Publicacionesperiodicas/EconomiaIndustrial/RevistaEconomiaIndustrial/405/DOLADER,%20BEL%20Y%20MU%C3%91OZ.pdf (accessed on 23 January 2020).

- Ducas, Evangeline, and Alex Wilner. 2017. The Security and Financial Implications of Blockchain Technologies: Regulating Emerging Technologies in Canada. International Journal: Canada’s Journal of Global Policy Analysis 72: 538–562. [Google Scholar] [CrossRef]

- Echarte-Fernández, Miguel Àngel. 2019. La Dolarización En América Latina, 1st ed. Madrid: Unión Editorial. [Google Scholar]

- Engert, Walter, Ben Fung, and Scott Hendry. 2018. Is A Cashless Society Problematic? Ottawa: Bank of Canada. Available online: https://www.bankofcanada.ca/wp-content/uploads/2018/10/sdp2018-12.pdf (accessed on 23 December 2019).

- Ernst and Young. 2019. EY Fintech Australia Census 2019 Profiling and Defining the Fintech Sector. Ernst & Young. Available online: https://fintechauscensus.ey.com/2019/Documents/EY%20FinTech%20Australia%20Census%202019.pdf (accessed on 2 November 2019).

- EY Fintech Adoption Index: Canadian Findings. 2017. Ebook. Ernst & Young. Available online: http://www.ey.com/ca/en/services/advisory/advisory-for-financial-services/ey-fintech-adoption-index-canadian-findings,2016 (accessed on 12 November 2019).

- Fabris, Nikola. 2019. Cashless Society—The Future of Money Or A Utopia? Journal of Central Banking Theory and Practice 8: 53–66. [Google Scholar] [CrossRef]

- Federal Reserve Bank of St. Louis (Switzerland). 2018. Assessing the Impact of Central Bank Digital currency on Private Banks. Federal Reserve Bank of St. Louis. Available online: https://www.snb.ch/n/mmr/reference/sem_2019_05_31_andolfatto/source/sem_2019_05_31_andolfatto.n.pdf (accessed on 5 February 2020).

- Fernández de Lis, Santiago, and Olga Gouveia. 2019. Monedas Digitales Emitidas Por Bancos Centrales: Características, Opciones, Ventajas Y Desventajas. Documento De Trabajo. Madrid: BBVA Research. Available online: https://www.bbvaresearch.com/wp-content/uploads/2019/03/WP_Monedas-digitales-emitidas-por-bancos-centrales-ICO.pdf (accessed on 28 January 2020).

- Fintech in Canada: Towards Leading the Global Financial Technology Transition. 2016. Ebook. Digital Finance Institute, McCarthy Tétrault LLP. Available online: http://www.digitalfinanceinstitute.org/wp-content/uploads/2017/02/Digital-Finance-Institute-FinTech-Report-1.pdf (accessed on 12 January 2020).

- Ghalib, Asad Kamran, and Degol Hailu. 2008. Bancarización De Los No Bancarizados: Mejorar El Acceso A Servicios Financieros. Ebook. Brasília: International Policy, Centre for Inclusive Grotwth. Available online: https://ipcig.org/pub/esp/IPCPolicyResearchBrief9.pdf (accessed on 28 October 2019).

- Gómez-Fernández, Nerea, and Juan-Francisco Albert. 2019. ¿Es La Eurozona Un Área Óptima Para Suprimir El Efectivo? Un Análisis Sobre La Inclusión Financiera Y El Uso De Efectivo. Cuadernos De Economía 43. [Google Scholar] [CrossRef]

- Grym, Aleksi, Päivi Heikkinen, Karlo Kauko, and Kari Takala. 2017. Central Bank Digital Currency. Bof Economics Review. Helsinki: Bank of Finland. Available online: https://pdfs.semanticscholar.org/9fa6/e095fa409d199e7aec8b50b657a7075fbe9e.pdf (accessed on 16 December 2019).

- Hayashi, Kenji, Hiroyuki Takano, Makoto Chiba, and Yasuhiro Takamoto. 2019. (Research Lab) Summary of The Report of The Study Group on Legal Issues Regarding Central Bank Digital Currency: Bank of Japan. Available online: https://www.boj.or.jp/en/research/wps_rev/lab/lab19e03.htm/ (accessed on 1 February 2020).

- Huillet, Marie. 2019. Jefe Del Banco Central De Rusia: Estamos Considerando Una CBDC, Pero No Para El Futuro Cercano. Cointelegraph. Available online: https://es.cointelegraph.com/news/russian-central-bank-head-cbdc-under-consideration-but-not-for-near-future (accessed on 1 March 2020).

- Jinze, Etienne. 2019. First Look: China’s Central Bank Digital Currency. Binance Research. Available online: https://research.binance.com/analysis/china-cbdc (accessed on 22 October 2019).

- Johan, Sofia A., and Anshum Pant. 2018. Regulation of The Crypto-Economy: Securitization of The Digital Security. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Johnson, Grahame, and Lukasz Pomorski. 2014. Briefing on Digital Currencies. Ebook. Ottawa: Bank of Canada. Available online: https://www.bankofcanada.ca/wp-content/uploads/2014/04/Senate_statement.pdf (accessed on 29 October 2019).

- Juškaitė, Aistė, Sigitas Šiaudinis, and Tomas Reichenbachas. 2019. CBDC—In A Whirlpool of Discussion. Occasional Paper Series; Vilnius: Bank of Lithuania. Available online: https://www.lb.lt/en/publications/no-29-aiste-juskaite-sigitas-siaudinis-tomas-reichenbachas-cbdc-in-the-whirpool-of-discussion (accessed on 22 January 2020).

- Kganyago, Lesetja. 2018. Governor Speech at the Nelson Mandela Commemorative Banknotes and R5 Circulation Coin Launch. Speech, Freedom Park, Pretoria, July 13. Available online: https://www.resbank.co.za/SiteAssets/Lists/Speeches/NewForm/Governor’s%20address%20Commemorative%20Banknotes%20and%20coin%20launch.pdf (accessed on 1 March 2020).

- Kumhof, Michael, and Clare Noone. 2018. Ccentral Bank Digital Currencies—Design Principles and Balance Sheet Implications. Working Paper. Bank of England, London, UK. Available online: https://www.bankofengland.co.uk/working-paper/2018/central-bank-digital-currencies---design-principles-and-balance-sheet-implications (accessed on 24 November 2019).