1. A Review of the Background and Goals of Modern Monetary Theory

Recently politicians, news analysts, and academic economists have become interested in Modern Monetary Theory (MMT). Many think that the United States (U.S.) government can and should use direct fiscal stimulus to provide a stable amount of employment in the economy. MMT takes the idea of direct fiscal stimulus further and proposes an active role for the federal government in providing jobs and stabilizing prices, which is the dual mandate usually left to the central bank. Economists, however, do not agree on how policymakers should enact this stimulus or the effect the MMT policy will have.

This paper will propose a Deficit Rule, similar to a Taylor Rule from

Taylor (

1993), as a guide to the level of spending and taxation that policymakers should follow under MMT. The rule would contribute a simple, algebraic rule to the MMT literature and provide a clear macroeconomic target for the actions of fiscal policy. While the foundations of MMT are addressed in the literature, there is no rule like the Taylor Rule to guide policy changes.

The monetary policy literature uses the short term interest rate as an intermediate target since interest rates are more controllable and measurable than inflation and unemployment. Likewise, deficits are determined directly by a government’s revenues and spending, and they can be quickly calculated and changed. Therefore, deficits are an excellent analogy to interest rates for fiscal policy. This paper, therefore, uses deficits as the variable of interest in a policy regime governed by Modern Monetary Theory. The results from our Deficit Rule fit the history of fiscal policy in the United States in the past 50 years with two exceptions: the stagflation of the 70s and the late 2010s.

MMT stems from the heterodox theory of macroeconomic fluctuations developed from the seminal work of

Knapp (

1924),

Lerner (

1947), and

Minksy (

1965). The theories presented by these researchers rethink the role of money in the economy, as it relates to employment, public policy, and wages. These papers provide a foundation for a monetary theory that posits that a central authority (a federal government or a central bank) is the monopolist controller of the money supply.

The federal government increases or decreases the supply of money through taxation and spending, providing the necessary liquidity for economic activity. A recession is a failure of the federal government and central bank to provide enough liquidity. MMT proposes debts and deficits as symptoms and not structural problems related to the actions of fiscal policy. As the monopolist provider of money, the federal government or central bank cannot default, as it can simply increase the money supply to pay off any debts.

Further, MMT does not recognize the problem of “crowding out” as public borrowing is not in competition with private bonds. While much of this is in line with the textbook monetary theory taught at universities and used at central banks, the neglect of debt and deficit limits distinguishes MMT from mainstream thought in economics.

More recently,

Wray (

1998),

Tcherneva (

2002), and

Mosler (

1995) derive a formal theory with policy applications and recommendations, specifically toward the goal of maximizing employment through a jobs guarantee. These papers attempt to provide support for more fiscal stimulus through deficit spending at higher levels than is commonly proposed while keeping an eye toward maintaining stable inflation. This literature provides the foundation for the MMT perspective on the role of the Federal Government for enacting a fiscal policy related to the traditional monetary policy goals of stable inflation and maximized employment.

This literature is best condensed in the recent textbook published by

Mitchell et al. (

2019), which contextualizes an undergraduate macroeconomics course in the framework of MMT. This paper will follow the

Mitchell et al. (

2019) foundations and not attempt to parse out the formulation of this theory. Instead, we focus on the assumptions and conclusions leading to a simplified, algebraic policy rule in the same way

Taylor (

1993) provides a simple guide for complex monetary policy actions through the Taylor Rule.

Different from the literature previously mentioned, such a rule does not deal with inequality in wages or employment, or the mechanics of setting up the desired level of employment. This follows the original monetary Taylor Rule, which did not deal with the mechanics of buying or selling bonds to supply money. This “macro” perspective allows for flexibility of context in how the MMT policymaker wishes to achieve a specific goal. This policy rule is constructed in a simplified and intuitive manner appropriate for a general audience familiar with macro-economic principles.

Specifically, as the Taylor Rule targets a short term interest rate considering a small collection of macroeconomic aggregates, MMT policy for stabilizing inflation and employment will target short term deficits. Recent critiques of MMT from varied perspectives such as

Rogoff (

2019), and

Mason and Jayadev (

2018) that address the problems of maintaining deficits and the challenges that arise from too much debt, while important, are not addressed here.

In other words, the assumptions and conclusions of the MMT literature are taken for granted in our work to construct a simple policy rule that reflects the stated goals of MMT with regards to macroeconomic targets. We will demonstrate with our algebraic rule that following the stated goals of MMT according to a “rules-based” approach as in

Taylor (

1993) provides an estimate that does not follow current policy proposals. In the short run, given current levels of inflation and unemployment, an MMT policymaker would wish to achieve a lower deficit intermediate target to balance unemployment and inflation.

Despite the extensive foundational literature summarized in

Mitchell et al. (

2019), the controllability of unemployment and inflation remain elusive in any economic model. An intermediate target rule focused on deficits would provide the MMT literature with a similarly useful baseline of the Taylor Rule.

The targeting of short term interest rates allows for the central bank to make effective policy changes (above the zero lower bound) in a relatively quick manner compared to the more slowly collected and changing inflation and unemployment data. The central bank can quickly change how it buys or sells bonds through open market operations to respond rapidly as macroeconomic data is released. Likewise, the deficit could serve fiscal policymakers with a similar guide to policy. Governments can adjust the deficit quickly by borrowing. Thus, the deficit can provide a reaction function that direct targeting of price and employment cannot.

The foundational guides for the MMT model, based on

Mitchell et al. (

2019), are listed below. These are the general motivating assumptions of the MMT model but are not a complete summary of the theory. Any simplified MMT policy rule will meet the following assumptions and goals.

Fiscal policy is the instrument to achieve full employment and stable inflation.

Budget deficits increase the level of employment (jobs guarantee).

Increased taxation leads to fewer bank reserves, lowering money supply, and inflation.

The policy rule will be agnostic regarding other vital aspects of MMT. There is no discussion of a debt limit in the economy, so one of the main assumptions in MMT, that an economy cannot face a debt default if it prints its own money is unnecessary

1. There is no treatment of the wages workers will make with the full-employment guarantee. The rule will only include specific, targeted macroeconomic variables. This simplicity is a feature, not a bug, of a policy rule that follows the one proposed in

Taylor (

1993).

If MMT is to be simplified to an algebraic expression as in

Taylor (

1993), then an observable and comprehensive intermediate target must be selected. Since the federal government cannot mandate employment as the central bank cannot mandate prices, budget deficits must encourage hiring just as short term interest rates are used to encourage deposits and borrowing.

Further, the intermediate target must be observable and have data available for use by the public. The target must be understandable by non-economists to be politically feasible. The U.S. government deficit relative to gross domestic product is the right choice for an intermediate target since it is available through public data and in line with the goal of MMT in stabilizing unemployment and inflation.

The paper contributes a simplified intermediate target rule for MMT in the same vein as

Taylor (

1993). While this rule does not provide a “how” for attaining maximized unemployment and inflation rates, it does offer a controllable intermediate target for the federal government in the same way a central bank can target short term interest rates.

2. The Intuition and Methodology of Constructing and Calculating a Deficit Rule

Following the intuition in

Taylor (

1993), we construct an algebraic “Deficit Rule” that would make the decisions of the federal government analogous to those of the central bank in stabilizing inflation and maximizing employment. With the Federal Reserve’s dual mandate of stable inflation and maximized employment,

Taylor (

1993) proposes a concise rule for short-term interest rate targeting. The benefit of the Taylor Rule is its clarity in dealing with macroeconomic variables to determine the direction of monetary policy. The

Taylor (

1993) policy rule adheres to the Fed’s dual mandate to equally weigh maximum employment and price stability by assigning equal weight to the inflation and output gap, relative to some benchmark equilibrium real interest rate:

Equation (1) relates the inflation gap between observed inflation and the target rate, the output gap between observed output growth and the long-run potential output growth, and an equilibrium real interest rate. The signs of the effect of the output gap and inflation gap contribute to the reasoning that if inflation and output are higher/lower than target, then the interest rate target should rise/fall accordingly.

In

Taylor’s (

1993) original form, the alpha weights on the inflation gap and the output gap are equal. Having equal weights on the inflation and output gaps is intuitive for policymakers. We focus on a similarly straightforward, equally-weighted Deficit Rule. As in the succeeding literature after

Taylor (

1993), it would be useful to explore different weights, and even allow for a dynamic estimation of those weights similar to

Maza and Sanchez-Robles (

2013) that follows the business cycle, potentially changing the weight each period.

Taylor (

1999) varies the

Taylor (

1993) weights, setting the weight in front of the output gap to 1 instead of 0.5.

The initial motivation behind the 0.5 weights flows from the stated goals of the Federal Reserve at the time to maximize employment and stabilize inflation.

Taylor (

1993) then asked whether the central bank behaved according to those rules and explored the periods where the Fed seemed to deviate from that rule according to its own “discretion.”

If the federal government is tasked with the same dual mandate in its fiscal policy to maximize employment by a proposed jobs guarantee and maintain a stable inflation rate, then this is simply another form of a Taylor Rule using fiscal policy as the primary source of stimulus. The goal of any fiscal stimulus is to increase aggregate demand by increasing deficits; that is cutting taxes and increasing spending. In this case, the federal government would target deficits to generate employment in the short term without creating excess inflation. Assuming an equal weighting of both gaps, this “Deficit Rule” would take the form:

Equation (2) defines the short term deficit target,

, as a function of the cyclically adjusted deficit which occurs from the automatic stabilizers inherent in U.S. tax policy that change with the business cycle,

, the inflation gap from the target inflation

, and the unemployment gap from the target unemployment rate needed for a full jobs guarantee

. As in

Taylor (

1993), the deficit at the current time-period

is determined by the lagged values in

.

If inflation is above the target, then there is a penalty on deficits, implying an increase in taxation or a decrease in spending to lower inflationary pressure. Note that the inflation gap relationship is positive. Higher inflation should be met with reduced deficits and lower inflation with larger deficits. The unemployment gap relationship, however, holds the opposite sign. If unemployment is above the target, then deficits should increase. If unemployment is below the target, then deficits should be reduced.

This unemployment gap rule would encourage both a policy of reducing taxes to incentivize private sector employment and increasing government spending to increase public sector employment. The details of how the government enacts this policy and its transmission mechanisms are beyond the scope of this paper, as long as those deficits rise or fall according to the suggested target. The fact that only changes in the deficit matter allows the same kind of agnosticism in the Taylor Rule regarding exactly how the Federal Reserve enacts its policy. Under the Taylor Rule, the Federal Reserve may lower or raise the money supply through any transmission mechanism necessary, so long as the short term interest rate target rises or lowers accordingly. Likewise, under the “Deficit Rule,” the federal government can increase or decrease the deficit by any means. The focus of the “Deficit Rule” is on the result of the policy on the target variable.

The inclusion of the automatic stabilizers in the term allows for a benchmark deficit that occurs with the business cycle. During booms, deficits decrease since tax revenues increase while government welfare spending decreases. In recessionary times, deficits increase since tax revenues decrease while government welfare programs increase. Accounting for this cyclically adjusted budget deficit is essential to determine the correct level of deficit.

Brown (

1956) and

Peppers (

1973) demonstrate and argue through cyclically adjusted budget deficits that the New Deal itself did not generate the kind of deficits required for a strong fiscal stimulus during the Roosevelt Administration. This is a textbook example used in principles courses regarding the effectiveness and size of fiscal stimulus needed to smooth the business cycle, with the conclusion from

Brown (

1956) that fiscal policy did not succeed in the thirties because the stimulus was not large enough.

To that end, the Deficit Rule must step above the cyclical automatic stabilizers to determine the level of deficit needed above and beyond what is already occurring. The CBO makes these estimates available each quarter and provides the data publicly, allowing for open access to a generally accepted measure of the estimated effect of automatic stabilizers without yet taking into account added action by the federal government to increase or decrease deficits. This inclusion of automatic stabilizers behaved similarly to the equilibrium real interest rate and lagged inflation rate terms at the beginning of the Taylor Rule equation, , in benchmarking the current period deficit target to the level of the previous period target.

Some crucial assumptions behind this rule must be recognized. First, the Deficit Rule includes a significant role for the job guarantee. The unemployment target of the job guarantee is the most crucial target of the federal government, according to MMT, while giving some consideration and weight to inflationary pressure. Likewise, the inflation target is the most critical target of the central bank while giving some consideration and weight to output growth.

In the MMT jobs guarantee case, the U3 unemployment rate reported by the Bureau of Economic Analysis (BEA) is suggested as a measure of unemployment as it measures those who are willing and able to work, but are not working due to macroeconomic conditions. In other words, U3 is the unemployment rate that measures within the labor force who are currently and actively seeking employment but do not currently have a job. U3 is not perfect, but despite its shortcomings, the U3 unemployment rate is the most widely used, has the most available data, and is generally well understood among the general population.

We also must assume in choosing a measure of unemployment that the calculated long-run potential unemployment rate, the Nonaccelerating Inflation Rate of Unemployment (NAIRU), is correctly estimated. At this potential unemployment rate, the inflation rate will remain stable. The NAIRU, in this case, is measured similarly to U3 in that it is an estimate of a lower bound of unemployment that does not count discouraged, marginally attached, or part time-workers. Like U3, it is the most readily available and the most understood measure available to the general public.

Another assumption in this rule is that while the Treasury may print money, it is not the executor of monetary policy. That responsibility remains with the central bank, which controls the money supply and thus directly influences interest rates. Deficits are then the intermediate target for the federal government, as money growth or issuance of bonds can finance them. If the central bank is independent in influencing the money supply, then borrowing is the primary tool left to the federal government, and money supply is not considered in the policy rule. If it is the case that the federal government controls the money supply, or the central bank is not independent, then a more complex rule must be considered more in line with the

Friedman (

1968) money growth target.

3. Data and Methodology

To estimate the deficit target using the proposed rule, we obtain data from the St. Louis Federal Reserve’s Economic Database (FRED). The coefficients are set to 0.5 to denote a balanced dual mandate of employment and inflation. Deficits are measured as a percentage of GDP to control for economic growth. In these examples, the inflation rate based on Personal Consumption Expenditures is used with an assumed 2% inflation target.

2 The U3 level of unemployment with the NAIRU as a target determines the unemployment gap. The portion of the deficits due to automatic stabilizers is calculated from the cyclically adjusted budget deficit available from the Congressional Budget Office (CBO). All data are annual observations.

For simplicity, the model assumes a one-period lag, that automatic stabilizers determine deficits, unemployment, and inflation from the observed previous year, and that the federal government can move promptly from this year to last. The deficit rule could potentially consider more lags by estimating the information content of several models with more lags. We keep a form similar to

Taylor’s (

1993) original form since it is familiar.

The data gathered on unemployment, inflation, and deficits are used in Equation (2) to estimate the target deficit for the current year based on what is known about the previous year’s figures. Equation (3) is the Deficit Rule.

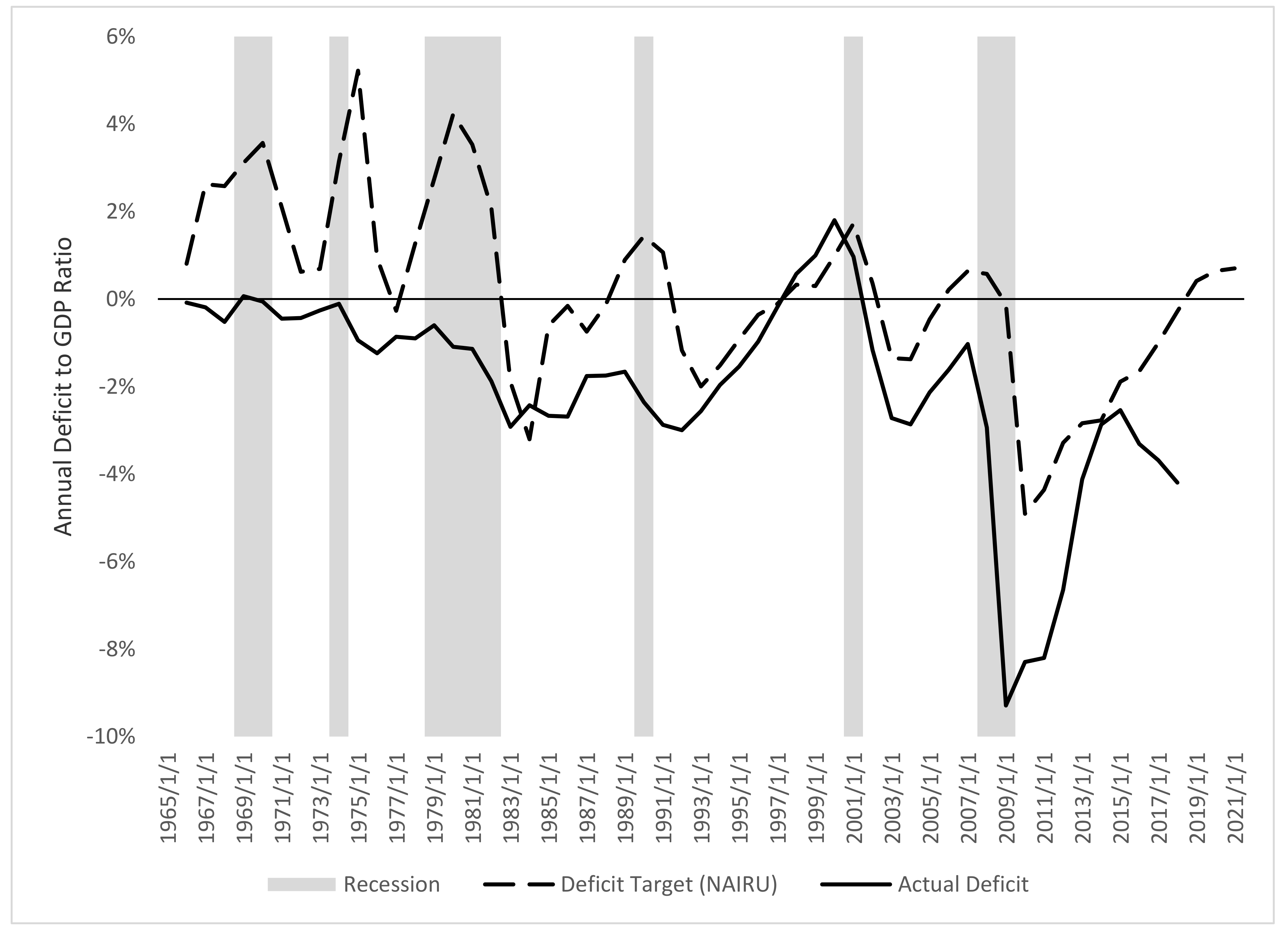

Once estimated, the policy target is compared with real-world deficits, as shown in

Figure 1.

Figure 1 demonstrates the recommended intermediate deficit target when attempting to maximize employment relative to stable inflation. Deviations from that rule would represent the discretionary power of the federal government in increasing or decreasing deficits relative to factors outside the proposed Deficit Rule (influencing unemployment outside of any consideration for inflation).

Taylor (

1993) points out similar deviations of “discretion” versus “rules” in terms of the historical behavior of the Federal Reserve with short term interest rates compared to what the Taylor Rule would have recommended.

For the Deficit Rule, major deviations can be seen in the stagflationary period of the 1970s. High inflation rates generate a policy rule of decreased deficits to decrease money circulation and stabilize prices to the 2% target. As can be seen in the graph, an MMT Deficit Rule implies a very different deficit path than was taken in the 1970s when inflation and unemployment were both higher than normal. In other periods, the Deficit Rule and the actions of the federal government are consistent. Interestingly, the U.S. government appears to behave similarly to a Deficit Rule during the tech boom under the Clinton Administration, which ran surpluses.

A new deviation begins recently in 2016 where the Deficit Rule proposes decreased deficits to surpluses just before the Tax Cuts and Jobs Acts of 2017 is passed and takes effect in the next year, creating higher deficits. According to the stated goals of MMT to stabilize inflation and provide a jobs guarantee, the Deficit Rule suggests surpluses instead of deficits into 2020 and 2021.

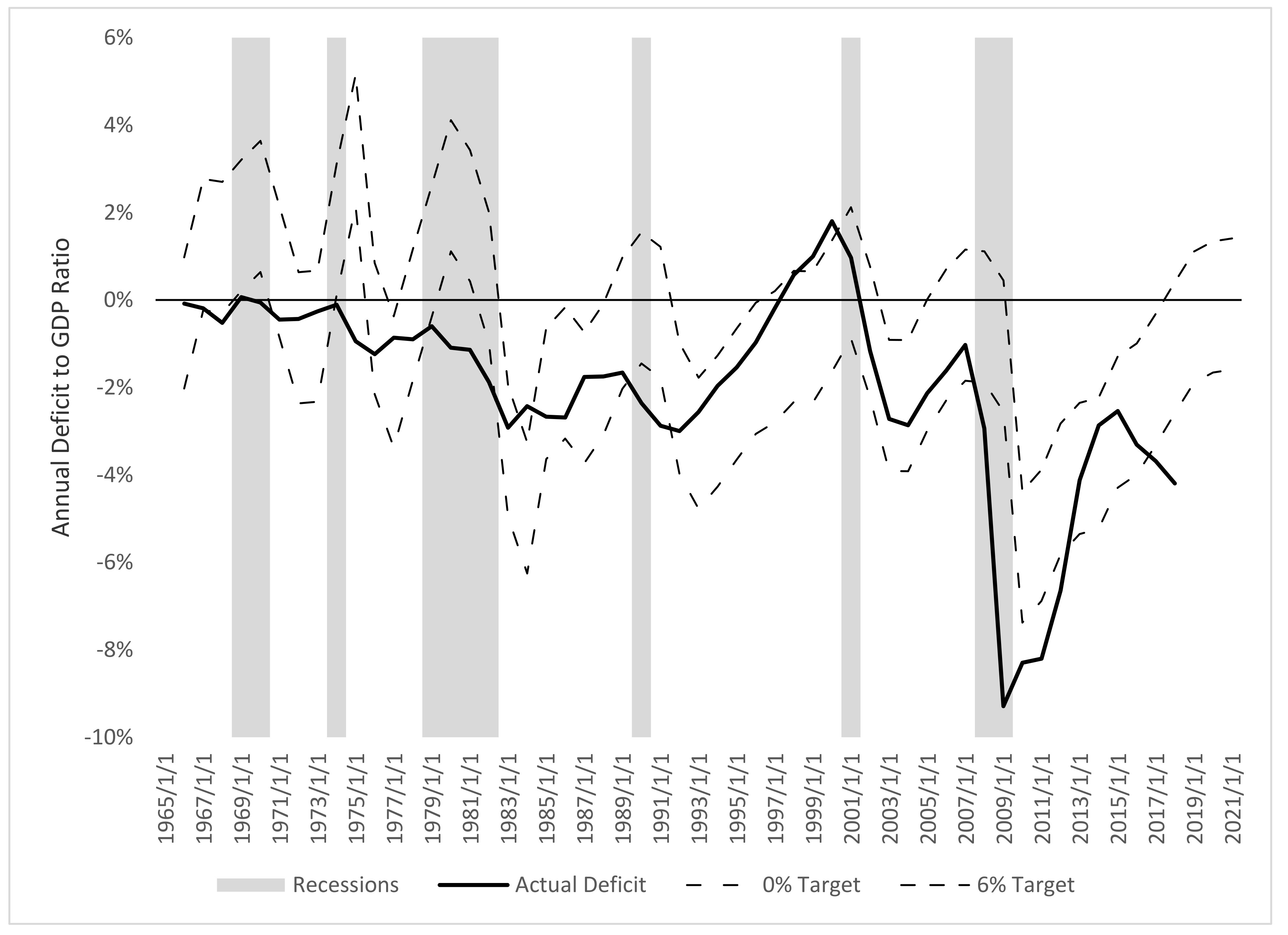

As an alternative case, we determine a Deficit Rule within a band in the same way that the St. Louis Federal Reserve determines a Taylor Rule for its Monetary Trends report. The Monetary Trends report uses FRED data to account for a range of Taylor Rule policies from a 0% inflation target to a 6% inflation target.

3 So the data are now plugged into variations of Equation (2) to create an upper and lower bound estimate of a 0% unemployment target and a 6% unemployment target.

Figure 2 demonstrates the “0–6 band” of unemployment, which allows for some flexibility in missing the target within a stated range.

The behavior of the Federal Government deviates within and outside the 0–6 band in

Figure 2, following along with actual fiscal policy reasonably well with some exceptions during “discretionary” periods.

Figure 2 suggests that an MMT rules-based approach to fiscal stimulus is not too far from the reality of what has occurred in the past. This similarity follows

Taylor’s (

1993) demonstration of how a simple algebraic rule could approximate the reality of history.

There are deviations, similar to those shown for the Taylor Rule in

Taylor (

1993), for the deficit rule which economists can attribute to some discretionary choices made outside the macroeconomic aggregates of inflation and unemployment in the Deficit Rule. For the 1960s and the 1970s, the actual deficit policy of the federal government deviates outside the bounds of the Deficit Rule until the more extended period within from the 1980s to the 2010s.

Taylor (

1993) posits that sometimes these seemingly discretionary actions could indeed be a transition to a new policy rule, which is credible for the apparent transition from fiscal policy goals in the 1960s and 1970s to the more MMT friendly goals in the 1980s to the 2010s. The recent major deviation could be argued as a transition similar to what

Taylor (

1993) describes or a discretionary aberration pushing the policy outside the bounds of the MMT prescription. These deviations are explored in the following section.

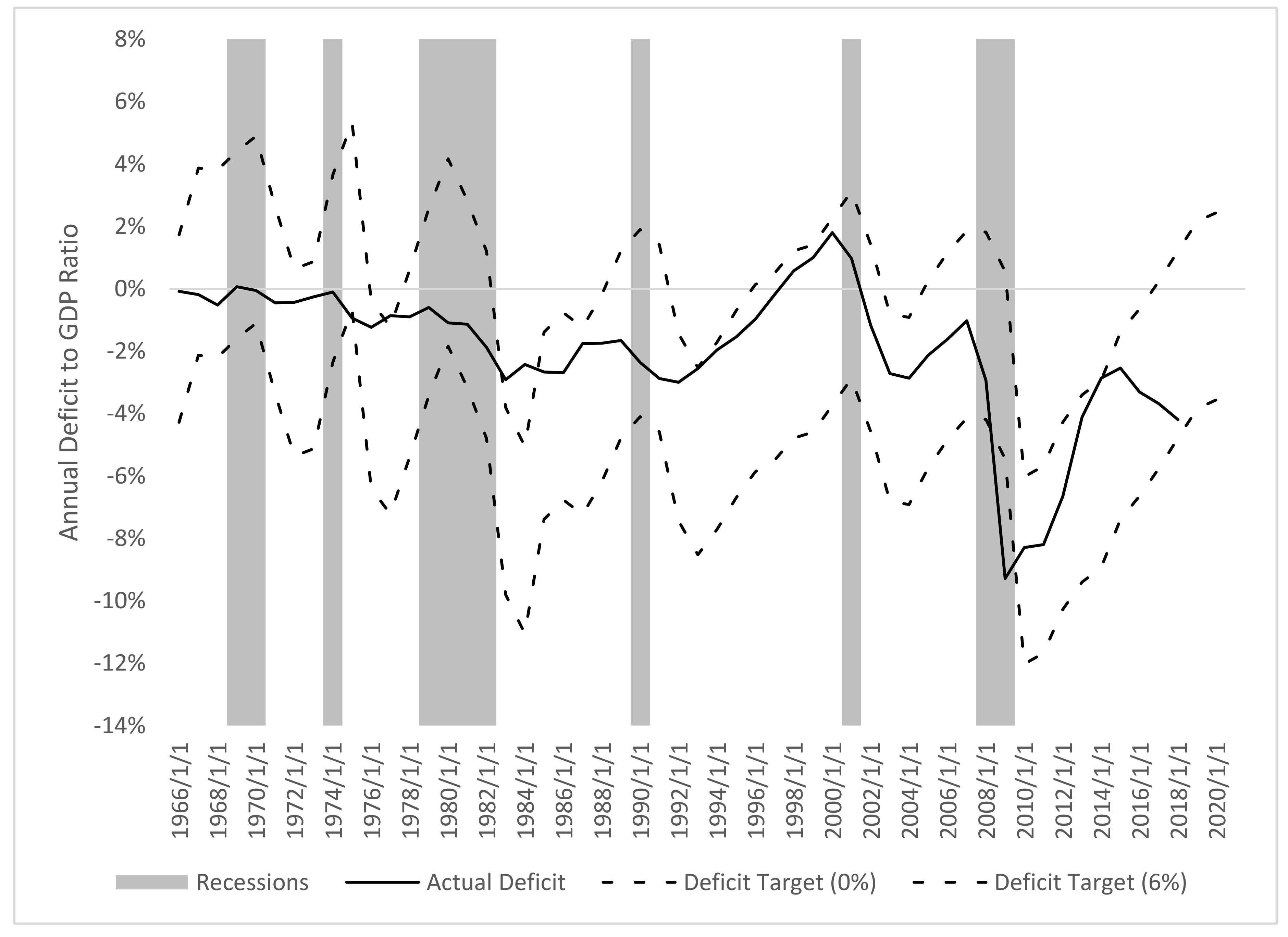

Using the flexibility in a Taylor-like Rule, we can get a simple estimate of the weights for the importance of unemployment and inflation using past values.

Figure 3 provides an estimate following the

Taylor (

1999) variation, with a weighting of 1 given to the unemployment gap and a weighting of 0.5 given to inflation; the federal government then puts more importance on maximizing employment than it does about inflation. The equations then take the form for a 0–6 band with a higher weight on unemployment:

The bands have expanded to include the actual deficit within the 0–6 Band even during the stagflationary era, though the actual deficit does not track well with the movement of the bands.

The recent divergence from the rule is still apparent even giving higher weight to unemployment and lower weight to inflation, which is in line with the observations in

Taylor (

1999) when he examined the difference between an equal weight rule and one that is unequal.

4. An Alternative History of MMT Policy

As seen in

Figure 1 and

Figure 2, an MMT policy that focuses on the dual mandate of a jobs guarantee and an inflation target does not always fit the actual policy of the federal government. The first case to be examined is the stagflation of the 1970s. The Deficit Target, relative to the stagflation effects throughout the decade, called for a budget surplus, a policy that was not followed by Congressional or Presidential administrations at the time. The political administration of both parties began to increase deficits in response to higher unemployment, as well as military spending increases due to the Cold War.

The Deficit Rule, if equal weight is given to the job guarantee and stable inflation, would predict a disinflationary policy of raising taxes and decreasing spending, both in the NAIRU and 0–6 band cases. In the case of the 1970s, when both inflation and unemployment were rising, any job guarantee policy would have been overwhelmed by the mandate to stabilize prices.

The federal government returns to a behavior similar to the Deficit Rule within the 0–6 band for most of the last part of the 20th century and into the 21st century. It seems as though an MMT policy based on the Deficit Rule fits well with the Reagan, Bush I, Clinton, Bush II, and Obama administrations. The deficit reductions in the 1990s line up exceptionally well with the full employment target of MMT. The 2008 financial crisis and succeeding Great Recession show a level of spending higher than prescribed by the Deficit Rule, however the reality and the prescription move in the same direction. The American Recovery and Reinvestment Act, with its fiscal stimulus through both tax cuts and government spending, fits the prescription of the Deficit Rule, as does the following period of shrinking deficit spending into 2016, but remains outside the 0–6 band target until 2013.

Interestingly, a Deficit Rule describes the fiscal behavior of the federal government for the past three decades, as

Taylor (

1993) showed that the Taylor Rule up to that point performs well in describing the Federal Reserve’s behavior. Recently, however, the federal government finds itself at odds with a policy derived from the Deficit Rule.

5. Recent Fiscal Stimulus and the Deficit Rule

Policymakers of both parties argue for fiscal stimulus to reach full employment. The Republican-supported Tax Cuts and Jobs Act (TCJA) implies, given its name, a stated goal of creating more jobs and decreasing unemployment. However, given the current unemployment gap based on NAIRU, the MMT policy would be to enact a fiscal contraction (increase taxes, decrease government spending) to line up with the stated goal of meeting a target employment rate. Even a zero lower bound unemployment rate, as seen in

Figure 2, suggests lower deficits, rising to a surplus over the next two years. The recent TCJA, therefore, violates the prescribed Deficit Rule policy in favor of a discretionary policy that falls outside the bands of unemployment maximization and inflation stability.

Democrats propose the Green New Deal as a massive stimulus to employment. Such a program calls for large deficits above and beyond current government spending to spur innovation in production, reduce pollution, and guarantee full employment. What is surprising is the use of MMT to justify these larger deficits, when the intermediate target rule based on deficits makes no such suggestion.

Given the current levels of unemployment and inflation, the forecast for a Deficit Rule using the FOMC’s projected unemployment and inflation figures for 2019 through 2021 calls for pushing the deficits toward positive territory (surplus). If it is the job of the federal government to maximize employment and stabilize inflation, then it should be raising taxes to cut the money supply and inflation, and even decreasing spending to stay on a lower bound unemployment target. A large New Deal-style deficit is not appropriate to the stated goals of MMT at the current time,

4 and the Deficit Rule cannot be used to justify this spending. The discretionary goals of both parties, outside the mandate of full employment and price stability, better explain current, more negative deficits.

While both parties in government may be willing to increase the inflation target to make room for a more negative deficit (and therefore a lower 0–6 band and NAIRU target in

Figure 1 and

Figure 2), this paper assumes the Federal Reserve will maintain its historical 2% inflation target through monetary policy. Assuming the Federal Reserve is still active, effective, and independent in its policy, the 2% target is a reasonable goal for any Deficit Rule in practice.

6. Feasibility in the Deficit Rule and Discretionary Fiscal Policy

The Deficit Rule presents one possible policy path in the same way that

Taylor (

1993) explained the short-term interest rate targeting of the Federal Reserve. The rule is derived with available data and compared to actual deficit spending data relative to output. While during certain time-periods, the Deficit Rule follows reality well (the 1980s to the early 2010s), it does not track as well in stagflationary times or periods with other discretionary pressures.

One conclusion from periods of policy discretion is that governments may lack the willingness and ability to enact unpopular policies. At the height of the worst years of high inflation and high unemployment in the 1970s, an MMT approach using deficits to maximize employment and stabilize inflation calls for increased taxation and reduced spending. Neither would have been popular with Republicans, Democrats, or the public. In a case of both rising inflation and rising unemployment, the weight of the policy prescription to stabilize inflation may call for unpopular policies, making it difficult for the federal government to act.

In the more recent case, an economy facing higher growth and higher inflation may also require a large increase in taxes and more reduction in spending than is desirable. Since 2017 the U3 unemployment rate is remarkably low while inflation has begun to recover toward the 2% target. According to the Deficit Rule, the policy prescription would be to raise taxes and cut spending to push the deficit toward a surplus (as seen in

Figure 1 and

Figure 2).

However, discretionary pressure from Congress and the President pushes in favor of maintaining low taxes to “jump-start” the economy after a period of unimpressive growth recovery.

5 On the other side, Democrats encourage further spending to reduce inequality and address climate change.

6 Neither of these cases is supported by a deficit targeting rule that seeks to maximize employment and stabilize inflation as in

Taylor (

1993). Maintaining a dual mandate for the federal government may not be feasible given cases of rising unemployment and rising inflation, along with the discretionary pressures faced by elected officials.

Therefore, the political pressure and ideological biases of Congress and the President make it unlikely that the federal government could commit to maintaining a dual mandate in the same way as the Federal Reserve. While the Federal Reserve is insulated from backlash for its unpopular policy prescriptions through central bank independence, the federal government is beholden to politics.

Finally, this simple Deficit Rule based on the foundational assumptions of MMT creates a dissonance between its proponents and the logical conclusion of their models. If fiscal policy is the tool to satisfy a dual mandate of price stability and full employment, and if borrowing and taxation can achieve their goals with employment and inflation, then the deficit-based rule developed here describes the policy prescription given the targets of inflation and employment. Given the present lower unemployment and on-target inflation, the proponents of MMT should be advocating for a reduced deficit or a surplus, and not a large spending plan. Such policies, even without the constraint of some upper limit to debt, are deviations from the rule, barring any outside discretionary policy targets or transitions in the target values.

7. Conclusions

A simple, rules-based approach to MMT is derived through the same methodology as

Taylor (

1993) to guide the targeting of deficits while following a dual mandate of maximum employment and stable inflation. However, this kind of rules-based approach to targeting budget deficits with macroeconomic variables produces policy prescriptions that may be unpopular.

Further, this approach shows that MMT is not a foundation for increased deficits in funding neither a New Deal-style government spending project nor the recently enacted TCJA. The utility of this kind of analysis with a simple rule is that it separates the macroeconomic targets from other considerations and focuses solely on the level of the intermediate target required to attain the true targets. There is no further consideration for how to reach the desired level of deficits, but only a calculation for what is necessary to maximize unemployment and stabilize inflation relative to their benchmarks.

For example, the deficit reduction conclusion is reached without considering a debt limit to deficit spending as addressed in

Mason and Jayadev (

2018) and

Mitchell et al. (

2019), but solely what an equally weighted policy decision would be on the unemployment and inflation target. We contribute, with this rule, a transparent and straightforward way to determine what the goal of an MMT policy should be if the macroeconomic aggregates of employment and price are the true targets.

The Deficit Rule takes MMT at face value with its prescription of using deficits to guarantee employment and stabilize the business cycle. As the Taylor Rule before it took inflation rate targets seriously using the intermediate target of short term interest rates, the Deficit Rule takes employment seriously using the intermediate target of deficits. The proposed target, using both NAIRU and a 0% to 6% unemployment band target supports a reduction in deficits, and even potentially a surplus in the coming years.

However, the rule still has limitations. We have only considered the case of an equally weighted rule, and not considered the possibility of more weight placed on unemployment by fiscal policy. We do not consider the effect of debts and deficits as they could affect inflation and unemployment as well. To give an example,

Reinhart and Rogoff (

2010) provide a strong case for slowing economic growth as a country’s debt to GDP ratio reaches unsustainable levels. Slowing economic growth leads to higher unemployment, so there are bi-directional issues to consider between the intermediate target of the deficit, which can lead to excessive debt levels, and the final target of unemployment.

These debt issues are approached in

Mason and Jayadev (

2018) and countered in

Mitchell et al. (

2019), but it remains an open debate as to whether a debt limit can prove fatal to the predictions and policies of MMT. We have not considered any structural breaks or regime changes that could affect the efficacy of the rule in approximating the behavior of government, and we have considered a static approach to the weighting, unlike much recent research into the Taylor Rule such as in

Maza and Sanchez-Robles (

2013). We have only considered the previous year’s levels of deficits, inflation, and unemployment and have not explored the potential for longer lags within the Deficit Rule. All of these are excellent extensions to the basic model we have proposed here, as

Taylor (

1993) sparked a series of different Taylor Rules now in use.

The targets we use, while mainstream, are up for debate on regarding their effectiveness. Two percent inflation, while traditional, may not be an appropriate target now as we are close to a zero lower bound on interest rates. The U3 unemployment rate does not consider certain populations that could be considered to be struggling with finding work.

Mitchell (

1998) provides an argument that a nonaccelerating employment ratio should be used; however, there is currently no updated and available data to be used in creating a target through the Deficit Rule. Until better data exists, we recommend following the most common and accepted measures.

Our rule contributes a simple, explanatory fiscal stimulus rule based on Modern Monetary Theory to the literature. If government policymakers someday become guided by the principles of MMT rather than mainstream economic theory regarding fiscal stimulus, then the simple, understandable rule presented here would provide a good approximation for what fiscal policy should be. Just as the Taylor Rule is based on well-established research on monetary theory takes a big-picture approach to monetary policy, this research takes a big-picture approach to how fiscal policy should be conducted under MMT.

The Taylor Rule does not concern itself with how the central bank lowers its intermediate target rate, whether through open market operations, quantitative easing, discount lending, or reserve requirements. Similarly, this Deficit Rule takes an agnostic approach to how the deficit will be raised or lowered but instead focuses only on the intermediate target needed to reach the goals of a jobs guarantee and inflation stabilization. There is to our knowledge, no similar research that explores a deficit rule within MMT in order to estimate an intermediate target.

Arguably, there are more implications for how the tax and spending policy is implemented, as compared to the implementation of monetary policy. The design of tax policy and how a deficit is increased or decreased matters a great deal to long term economic growth, for example. Also, deficits can be increased by increasing spending or by reducing taxes. The vast literature on fiscal policy demonstrates that the effects of these two methods of increasing the deficit do not have symmetric effects. How the government should implement the Deficit Rule is also a fruitful area for future research on this topic.