Financial Stability Index for the Financial Sector of Pakistan

Abstract

1. Introduction

2. Review of Literature

3. Indicators for Financial Stability Index

3.1. Profitability

3.2. Liquid Liability to Liquid Asset

3.3. Non-Performing Loan Portfolio

3.4. Uncovered Liabilities

3.5. Ratio of Interest Spread

3.6. Interbank Funds/Liquid Assets

4. Data, Sample and Research Methods

4.1. Sample Selection and Data Collection

4.2. Variables and Model

4.2.1. Variance-Equal Weighted Method

4.2.2. Linear Probability Model (LPM)

4.2.3. The Logit Model

4.3. Data Analysis Techniques

5. Results and Discussion

5.1. Descriptive Statistics

5.2. Variance-Equal Weighted Method

5.2.1. Standardized Financial Stability Index (SFSI)

5.2.2. Financial Stability Index by Type of Institution

5.2.3. Prediction Accuracy of the Standardized Financial Stability Index

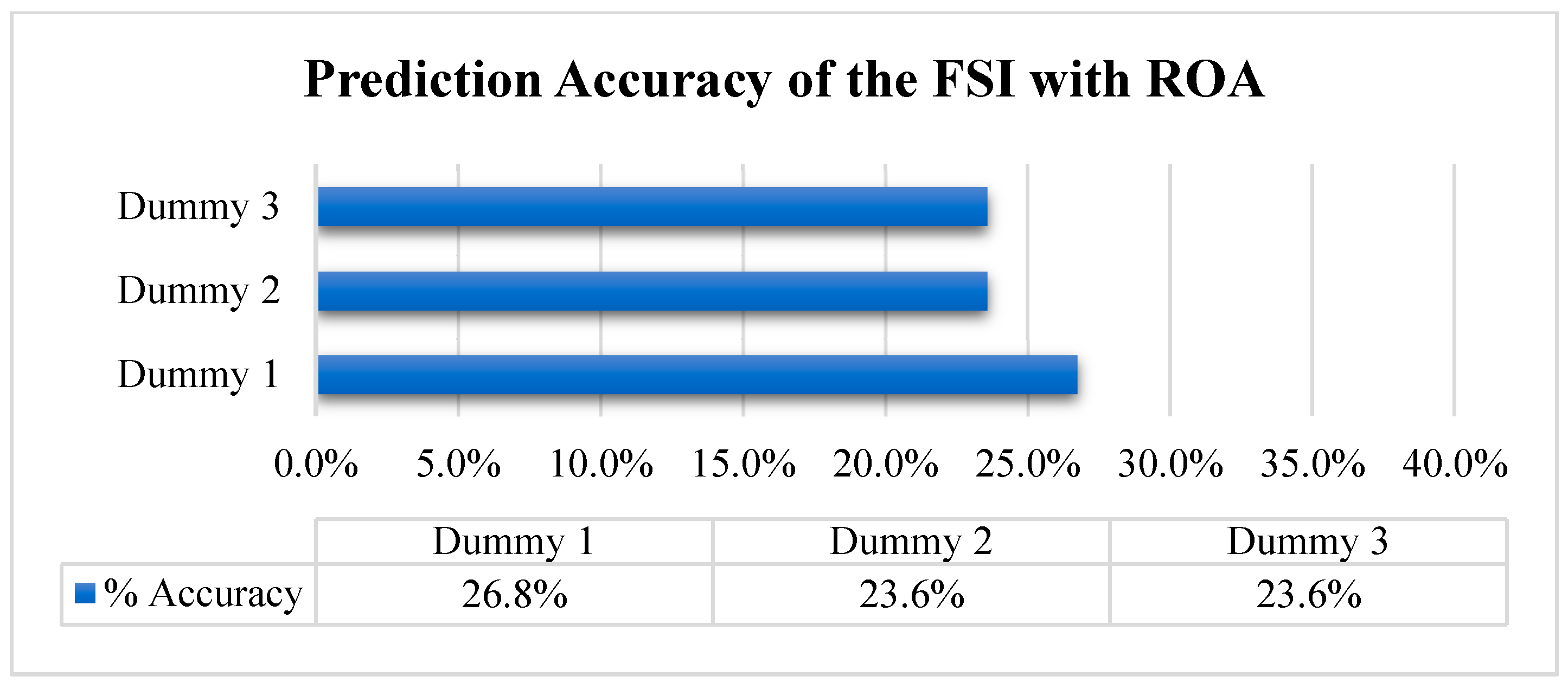

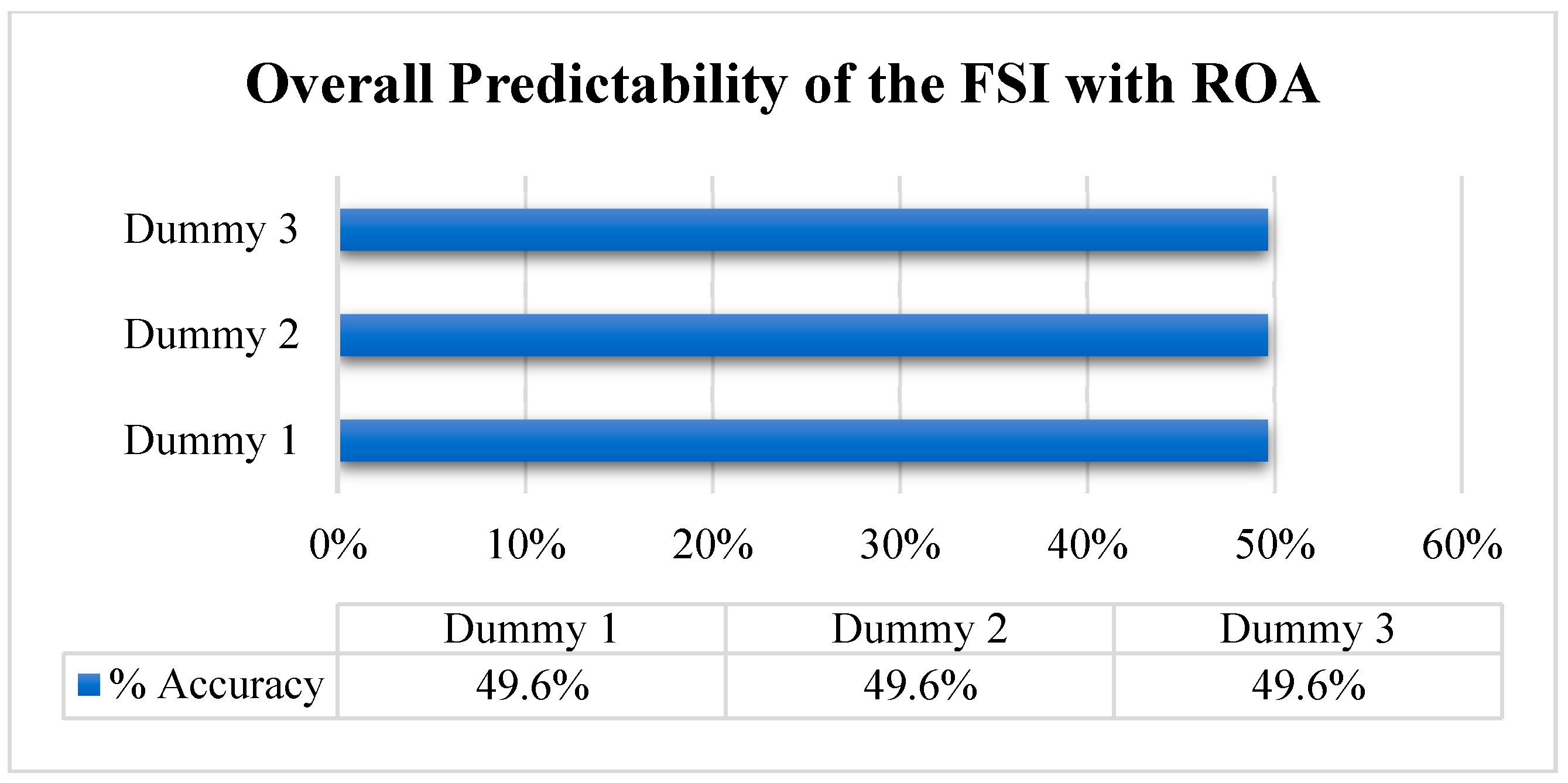

Financial Stability Index by Using the ROA

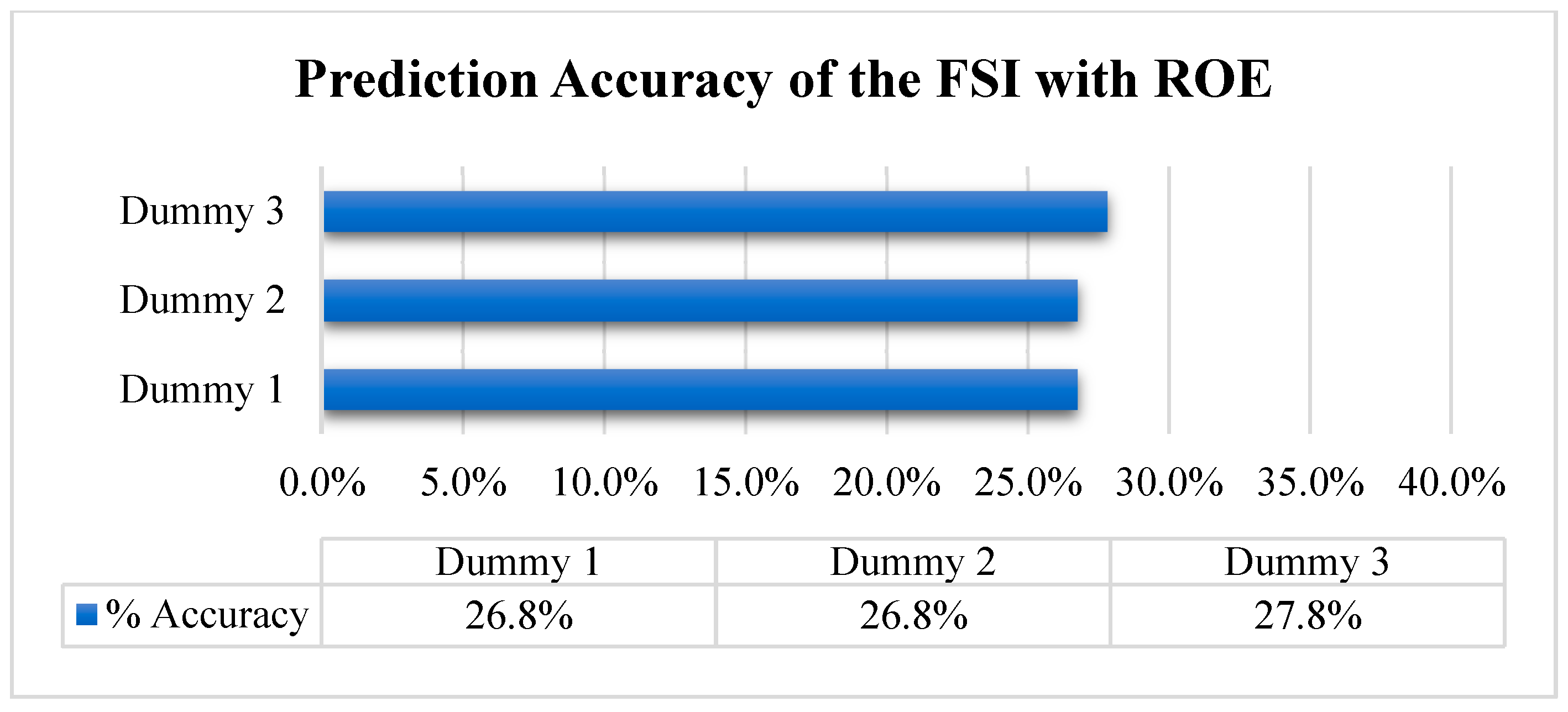

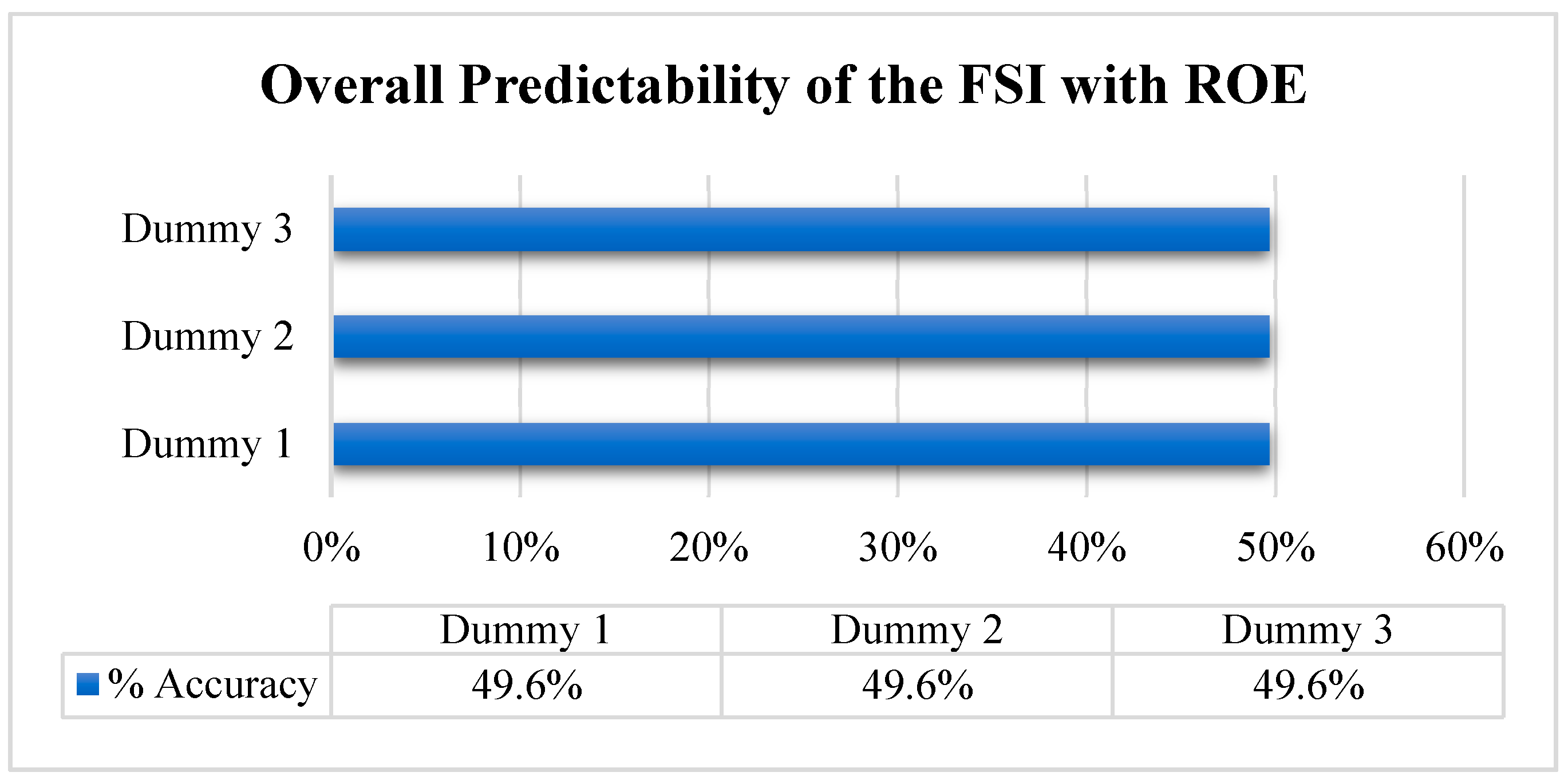

Financial Stability Index by Using the ROE

5.3. Financial Stability Index with a Logit Model

5.3.1. Financial Stability Index by Using the ROA

5.3.2. Financial Stability Index by Using the ROE

5.4. Financial Stability Index with a Linear Probability Model (LPM)

5.4.1. Financial Stability Index by Using the ROA

5.4.2. Financial Stability Index by Using the ROE

5.5. Comparison of Financial Stability Index Computed with Different Methods

5.5.1. Dependent Variable (Dummy 1 with 0.9 Lambda)

5.5.2. Dependent Variable (Dummy 2 with 0.8 Lambda)

5.5.3. Dependent Variable (Dummy 3 with 0.7 Lambda)

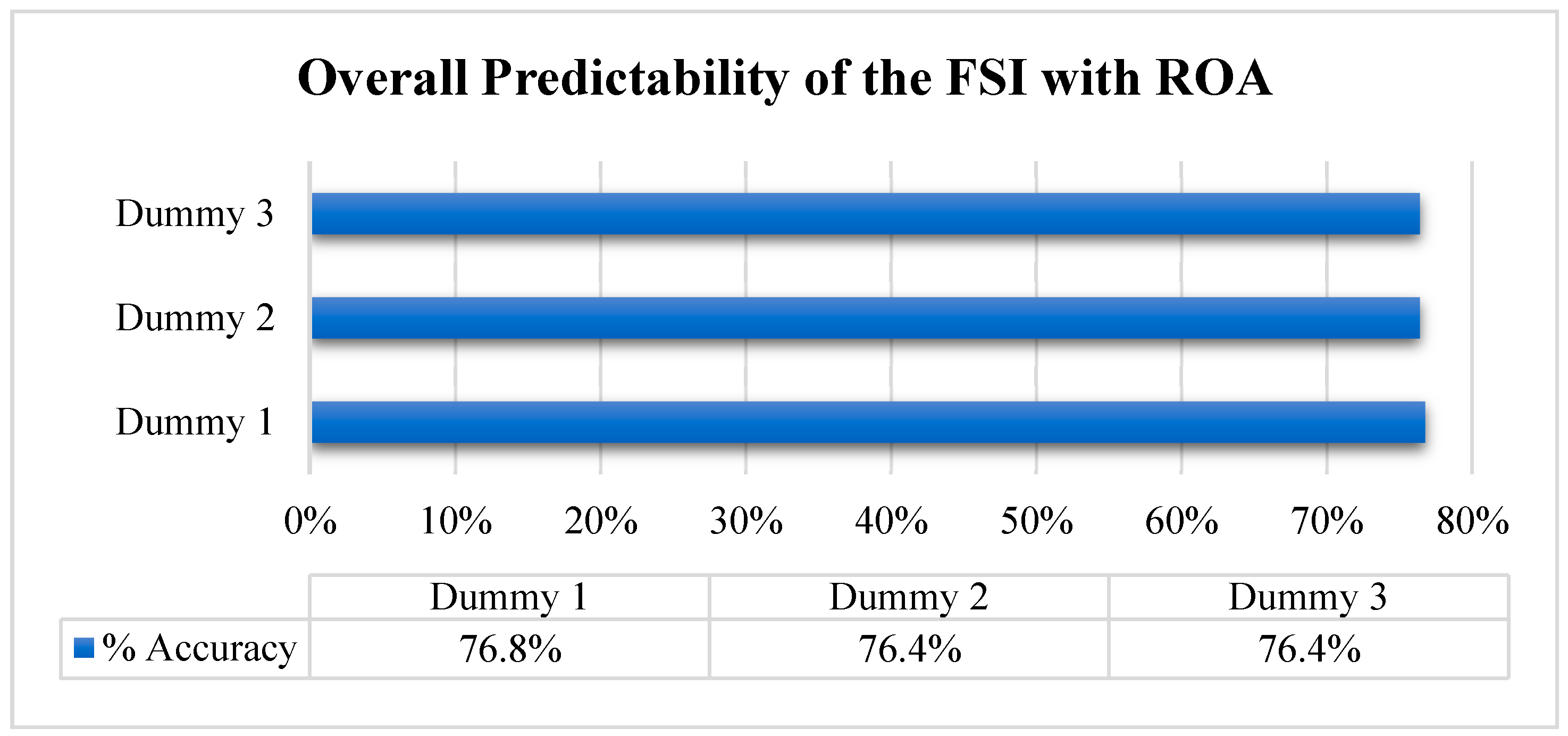

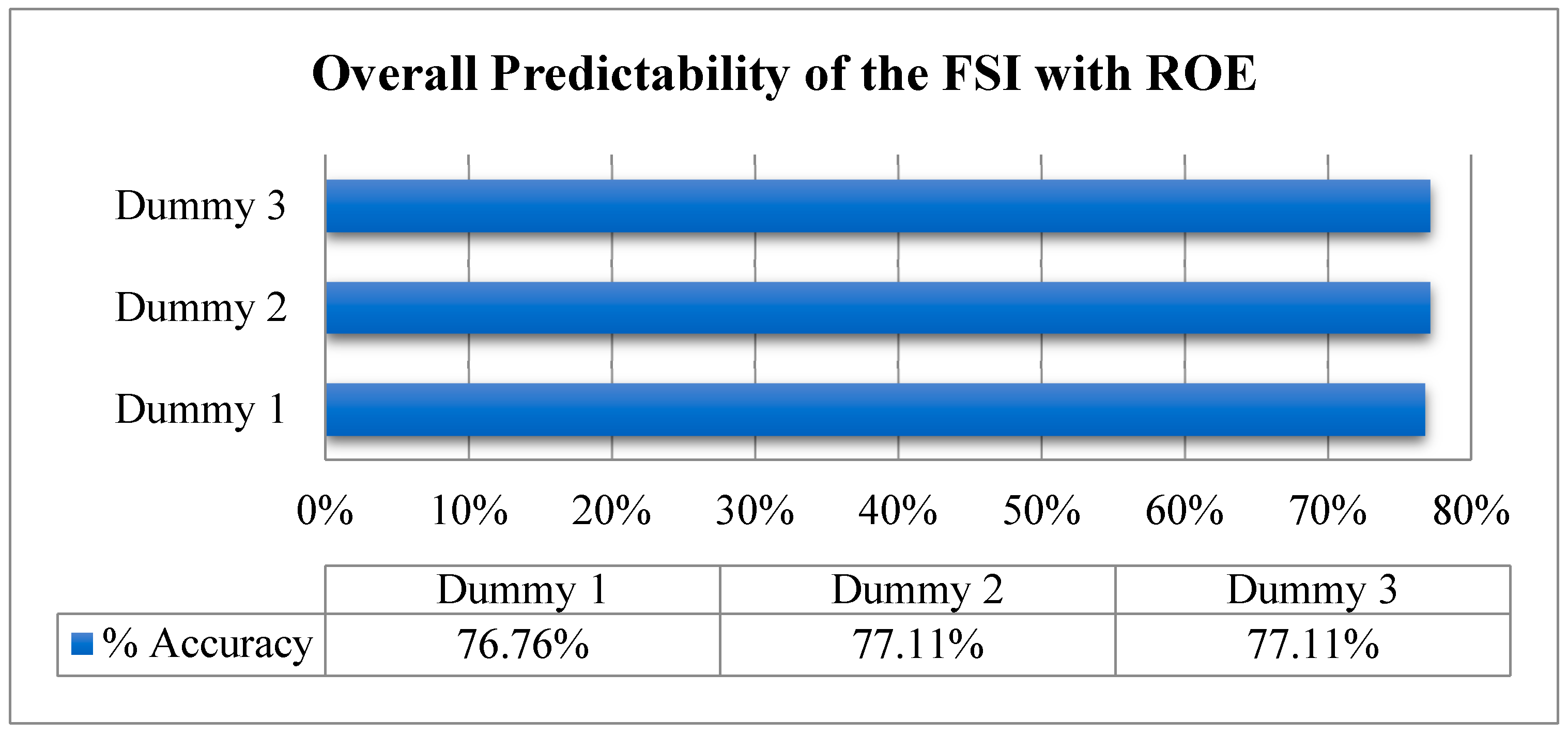

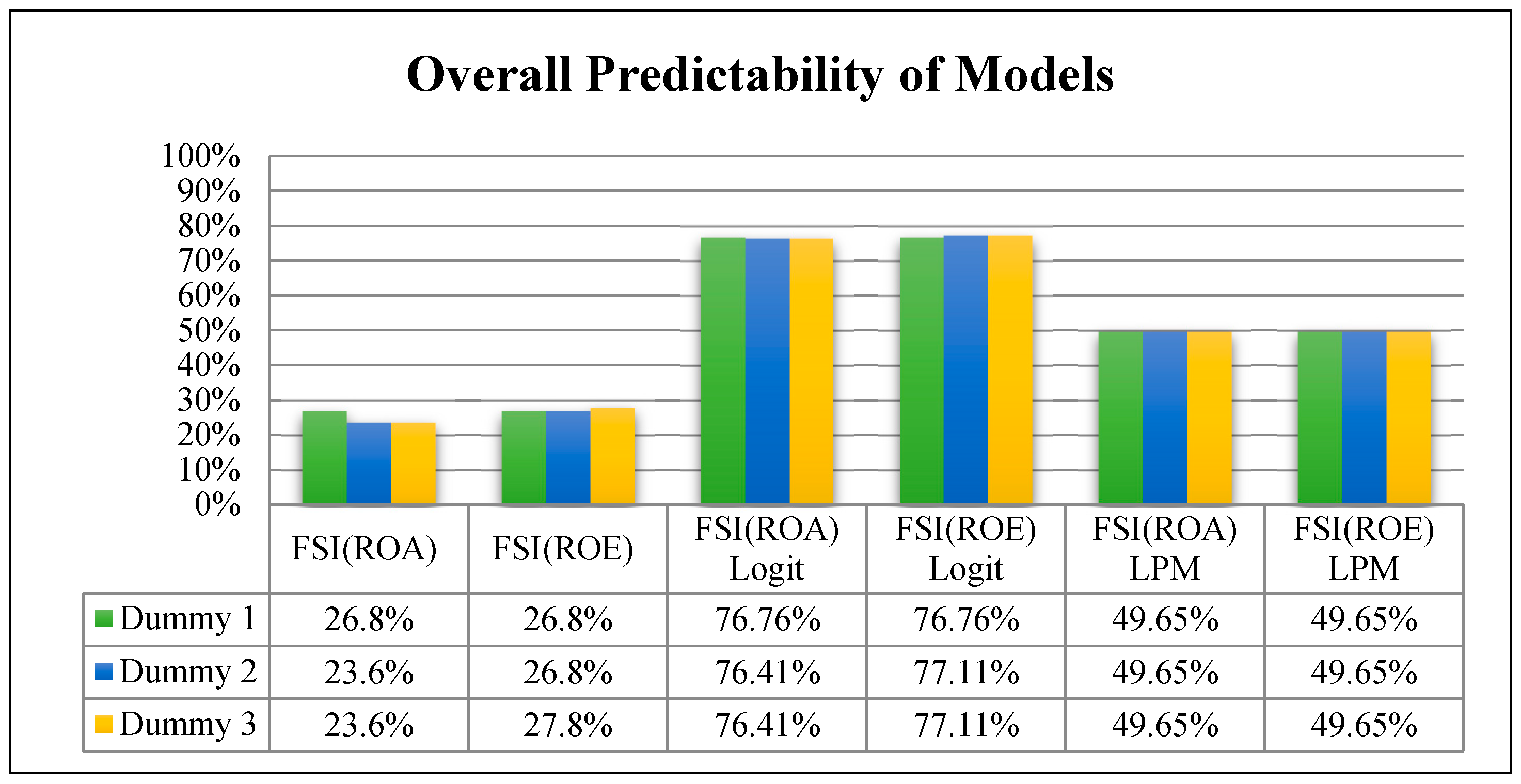

5.6. Overall Classification Accuracy of Models

6. Conclusions

Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abdullah, Hussin, Jauhari Dahalan, Khaw Lee Hwei, Mohammed Umar, and Md Mohan Uddin. 2017. Malaysian Financial Stress Index and Assessing its Impacts on the Economy. International Journal of Economics and Financial Issues 7: 227–35. [Google Scholar]

- Albulescu, Claudiu Tiberiu. 2008. Central Bank or Single Financial Supervision Authority: The Romanian Case. Munich, Germany: The Munich Personal RePEc Archive (MPRA), Munich University Library. [Google Scholar]

- Albulescu, Claudiu Tiberiu. 2009. Forecasting Credit Growth Rate in Romania: From Credit Boom to Credit Crunch? Munich, Germany: The Munich Personal RePEc Archive (MPRA), Munich University Library. [Google Scholar]

- Alessi, Lucia, and Carsten Detken. 2011. Quasi real time early warning indicators for costly asset price boom/bust cycles: A role for global liquidity. European Journal of Political Economy 27: 520–33. [Google Scholar] [CrossRef]

- Altunbas, Yener, Leonardo Gambacorta, and David Marques-Ibane. 2009. Securitisation and the bank lending channel. European Economic Review 53: 996–1009. [Google Scholar] [CrossRef]

- Berg, Andrew, and Catherine Pattillo. 1999. Are currency crises predictable? A test. IMF Staff Papers 46: 107–38. [Google Scholar]

- Borio, Claudio E.V., and Philip William Lowe. 2002. Asset Prices, Financial and Monetary Stability: Exploring the Nexus. BIS Working Paper No. 114. Available online: https://ssrn.com/abstract=846305 (accessed on 28 March 2019).

- Cheang, Nicholas. 2009. Early warning system for financial crises. Macao Monetary Research Bulletin 1: 61–77. [Google Scholar]

- Cihak, Martin, and Jaroslav Hermanek. 2005. Stress Testing the Czech Banking System: Where Are We? Where Are We Going? Praha: Czech National Bank, Research Department. [Google Scholar]

- Creel, Jérôme, Paul Hubert, and Fabien Labondance. 2015. Financial stability and economic performance. Economic Modelling 48: 25–40. [Google Scholar] [CrossRef]

- Diaconu, Raluca-Ioana, and Dumitru-Cristian Oanea. 2014. The Main Determinants of Bank’s Stability. Evidence from Romanian Banking Sector. Procedia Economics and Finance 16: 329–35. [Google Scholar] [CrossRef]

- Diamond, Douglas W., and Raghuram G. Rajan. 2001. Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of political Economy 109: 287–327. [Google Scholar] [CrossRef]

- Dumičić, Mirna. 2016. Financial Stability Indicators—The Case of Croatia. Journal of Central Banking Theory and Practice 5: 113–40. [Google Scholar] [CrossRef]

- End, Jan Willem. 2006. Indicator and Boundaries of Financial Stability. Amsterdam: Netherlands Central Bank, Research Department. [Google Scholar]

- Fadare, Samuel O. 2011. Banking sector liquidity and financial crisis in Nigeria. International Journal of Economics and Finance 3: 3. [Google Scholar] [CrossRef][Green Version]

- Fiordelisi, Franco, and Davide Salvatore Mare. 2013. Probability of default and efficiency in cooperative banking. Journal of International Financial Markets, Institutions and Money 26: 30–45. [Google Scholar] [CrossRef]

- Gadanecz, Blaise, and Kaushik Jayaram. 2008. Measures of financial stability—A review. Irving Fisher Committee Bulletin 31: 365–83. [Google Scholar]

- Gerdesmeier, Dieter, Hans-Eggert Reimers, and Barbara Roffia. 2010. Asset price misalignments and the role of money and credit. International Finance 13: 377–407. [Google Scholar] [CrossRef]

- Gersl, Adam, and Jaroslav Hermanek. 2007. Financial stability indicators: Advantages and disadvantages of their use in the assessment of financial system stability. In CNB Financial Stability Report. Occasional Publications-Chapters in Edited Volumes. Praha: Czech National Bank, pp. 69–79. [Google Scholar]

- Gray, Dale F., Robert C. Merton, and Zvi Bodie. 2007. New Framework for Measuring and Managing Macrofinancial Risk and Financial Stability; Cambridge: National Bureau of Economic Research.

- Hanschel, Elke, and Pierre Monnin. 2005. Measuring and forecasting stress in the banking sector: Evidence from Switzerland. BIS Papers 22: 431–49. [Google Scholar]

- Hawkins, John, and Marc Klau. 2000. Measuring Potential Vulnerabilities in Emerging Market Economies. BIS Working Paper No. 91. Available online: https://ssrn.com/abstract=849258 (accessed on 28 March 2019).

- Heckman, James J., and Thomas E. MaCurdy. 1985. A simultaneous equations linear probability model. Canadian Journal of Economics 18: 28–37. [Google Scholar] [CrossRef]

- Hollo, Daniel, Manfred Kremer, and Marco Lo Duca. 2012. CISS—A Composite Indicator of Systemic Stress in the Financial System. ECB Working Paper No. 1426. Available online: https://ssrn.com/abstract=2018792 (accessed on 28 March 2019).

- Husain, Ishrat. 2011. Financial Sector Regulation in Pakistan: The way forward. SBP Research Bulletin 7: 31–44. [Google Scholar]

- Illing, Mark, and Ying Liu. 2003. An Index of Financial Stress for Canada. Ottawa: Bank of Canada Ottawa Working Paper 2003-14. Available online: https://core.ac.uk/download/pdf/6253712.pdf (accessed on 28 March 2019).

- Illing, Mark, and Ying Liu. 2006. Measuring financial stress in a developed country: An application to Canada. Journal of Financial Stability 2: 243–65. [Google Scholar] [CrossRef]

- Islami, Mevlud, and Jeong-Ryeol Kurz-Kim. 2014. A single composite financial stress indicator and its real impact in the euro area. International Journal of Finance & Economics 19: 204–11. [Google Scholar]

- Kaminsky, Graciela L., Saul Lizondo, and Carmen M. Reinhart. 1998. Leading indicators of currency crises. Staff Papers 45: 1–48. [Google Scholar] [CrossRef]

- Karanovic, Goran, and Bisera Karanovic. 2015. Developing an Aggregate Index for Measuring Financial Stability in the Balkans. Procedia Economics and Finance 33: 3–17. [Google Scholar] [CrossRef]

- Kosmidou, Kyriaki. 2008. The determinants of banks’ profits in Greece during the period of EU financial integration. Managerial Finance 34: 146–59. [Google Scholar] [CrossRef]

- Lall, Mr. Subir, Roberto Cardarelli, and Selim Elekdag. 2009. Financial Stress, Downturns, and Recoveries. Washington: International Monetary Fund. [Google Scholar]

- Lo Duca, Marco, and Tuomas A. Peltonen. 2011. Macro-Financial Vulnerabilities and Future Financial Stress: Assessing Systemic Risks and Predicting Systemic Events. Working Paper Series; Frankfurt am Main: European Central Bank. [Google Scholar]

- Manolescu, Claudiu Mihail, and Elena Manolescu. 2017. The financial stability index—An insight into the financial and economic conditions of Romania. Theoretical and Applied Economics 4: 5–24. [Google Scholar]

- Mishkin, Frederic S. 1990. Asymmetric Information and Financial Crises: A Historical Perspective. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Moore, Winston. 2009. How Do Financial Crises Affect Commercial Bank Liquidity? Evidence from Latin America and the Caribbean. Munich, Germany: The Munich Personal RePEc Archive (MPRA), Munich University Library. [Google Scholar]

- Morales, Miguel A., and Dairo Estrada. 2010. A financial stability index for Colombia. Annals of Finance 6: 555–81. [Google Scholar] [CrossRef]

- Morris, Verlis. 2010. Measuring and Forecasting Financial Stability: The Composition of an Aggregate Financial Stability Index for Jamaica. Kingston: Bank of Jamaica. [Google Scholar]

- Nasreen, Samia, and Sofia Anwar. 2018. How Financial Stability Affects Economic Development in South Asia: A Panel data Analysis. European Online Journal of Natural And Social Sciences 7: 54–66. [Google Scholar]

- Nelson, William R., and Roberto Perli. 2007. Selected indicators of financial stability. Risk Measurement and Systemic Risk 4: 343–72. [Google Scholar]

- Neudorfer, Benjamin, Michael Sigmund, and Alexander Trachta. 2013. Detecting Financial Stability Vulnerabilities in Due Time: Can Simple Indicators Identify a Complex Issue? Available online: https://ssrn.com/abstract=2308863 (accessed on 28 March 2019).

- Puddu, Stefano. 2013. Optimal Weights and Stress Banking Indexes. IRENE Working Papers. Dublin: IRENE Institute of Economic Research. [Google Scholar]

- Rajan, Raghuram G., and Luigi Zingales. 2003. The great reversals: The politics of financial development in the twentieth century. Journal of Financial Economics 69: 5–50. [Google Scholar] [CrossRef]

- Rouabah, Abdelaziz. 2007. Mesure de la Vulnérabilité du Secteur Bancaire Luxembourgeois. Luxembourg: Central Bank of Luxembourg. [Google Scholar]

- Schinasi, Garry J. 2007. Preserving Financial Stability. Washington: International Monetary Fund, Volume 36. [Google Scholar]

- Schinasi, Garry J. 2004. Defining Financial Stability. IMF Working Paper No. 4-187. Washington, DC, USA: International Monetary Fund. [Google Scholar]

- Siņenko, Nadežda, Deniss Titarenko, and Mikus Āriņš. 2013. The Latvian financial stress index as an important element of the financial system stability monitoring framework. Baltic Journal of Economics 13: 87–112. [Google Scholar] [CrossRef]

- Tng, Boon Hwa, and Kian Teng Kwek. 2015. Financial Stress, Economic Activity and Monetary Policy in the ASEAN-5 Economies. Applied Economics 47: 5169–85. [Google Scholar] [CrossRef]

- Vila, Anne. 2000. Asset Price Crises and Banking Crises: Some Empirical Evidence. BIS Conference Papers. Basel: Bank for International Settlements, Volume 8, pp. 232–52. [Google Scholar]

- Walter, John R. 1991. Loan Loss Reserves Economic Review. Richmond: Federal Reserve Bank of Richmond, Volume 77, pp. 20–30. [Google Scholar]

- Zou, Yonghong, Erik R. Christensen, and An Li. 2013. Characteristic pattern analysis of polybromodiphenyl ethers in Great Lakes sediments: A combination of eigenspace projection and positive matrix factorization analysis. Environmetrics 24: 41–50. [Google Scholar] [CrossRef]

| Variables/Determinants | Abbreviation | Operational Definitions |

|---|---|---|

| Return on Assets | ROA | Net Income/Average of Total Assets |

| Return on Equity | ROE | Net Income/Shareholder’s Equity |

| Net Performing Loan Portfolio | NPM | Non-Performing Gross Loan/Total Gross Loan Portfolio |

| Uncovered Liabilities | UL | [(LL + TL) − {(LA − INS) + λ × INS)}]/(TA − LA) |

| Intermediation Spread | IS | Interest Paid by Borrower − Interest Paid by Depositor |

| Liquid Liability to Liquid Asset | LL | Liquid Liabilities/Liquid Assets |

| Interbank funds/Liquid Assets | IF | Interbank Funds/Liquid Assets |

| Variables | Mean | Median | Std. Dev. | Skewness |

|---|---|---|---|---|

| Return on Assets | 0.0066 | 0.0087 | 0.0200 | −0.5681 |

| Return on Equity | 0.1167 | 0.1094 | 0.3993 | 3.8418 |

| Non-Performing Loan Portfolio | 0.0168 | 0.0099 | 0.0240 | 2.0832 |

| Interest Spread | 0.0848 | 0.0932 | 0.4823 | −15.647 |

| Liquid Liability to Liquid Assets | 0.7266 | 0.5537 | 0.6125 | 1.5723 |

| Interbank Funds/Liquid Assets | 0.3087 | 0.1727 | 0.6547 | 1.2978 |

| ULR_0.9 | 0.1046 | 0.0923 | 0.0825 | 7.5088 |

| ULR_0.8 | 0.2055 | 0.1847 | 0.1255 | 2.8536 |

| ULR_0.7 | 0.3065 | 0.2770 | 0.1746 | 1.6855 |

| Years | FSI7 (0.9 Lambda) | FSI (0.8 Lambda) | FSI (0.7 Lambda) | SFSI (0.9 Lambda) | SFSI (0.8 Lambda) | SFSI (0.7 Lambda) |

|---|---|---|---|---|---|---|

| 2001 | 0.08370 | 0.0909 | 0.0982 | (0.2339) | (0.1462) | (0.0584) |

| 2002 | 0.16146 | 0.17704 | 0.19263 | (0.09564) | 0.09317 | 0.28190 |

| 2003 | 0.18777 | 0.20210 | 0.21643 | (0.05354) | 0.12006 | 0.29367 |

| 2004 | 0.13879 | 0.14871 | 0.15863 | (0.17499) | (0.05478) | 0.06543 |

| 2005 | 0.10595 | 0.11672 | 0.12750 | (0.18609) | (0.05552) | 0.07505 |

| 2006 | 0.09691 | 0.10627 | 0.11562 | (0.22104) | (0.10773) | 0.00559 |

| 2007 | 0.11740 | 0.13171 | 0.14603 | (0.07700) | 0.09648 | 0.26995 |

| 2008 | 0.18412 | 0.19865 | 0.21318 | 0.12664 | 0.30265 | 0.47865 |

| 2009 | 0.18013 | 0.19671 | 0.21329 | 0.27939 | 0.48025 | 0.68111 |

| 2010 | 0.20434 | 0.22401 | 0.24368 | 0.30056 | 0.53882 | 0.77708 |

| 2011 | 0.28204 | 0.30616 | 0.33028 | 0.24237 | 0.53457 | 0.82678 |

| Type of Banks | FSI (0.9 Lambda) w = 0.1429 | FSI (0.8 Lambda) | FSI (0.7 Lambda) | SFSI (0.9 Lambda) | SFSI (0.8 Lambda) | SFSI (0.7 Lambda) |

|---|---|---|---|---|---|---|

| Provincial Banks | 0.13154 | 0.14865 | 0.16577 | 0.02193 | 0.03486 | 0.03961 |

| Nationalized Banks | 0.0359 | 0.0522 | 0.0684 | (0.2649) | (0.2685) | (0.2721) |

| De-Nationalized Banks | 0.1359 | 0.1550 | 0.1741 | (0.1093) | (0.0886) | (0.0813) |

| Private Banks | 0.241 | 0.255 | 0.268 | 0.145 | 0.143 | 0.142 |

| Islamic Banks | 0.04247 | 0.05617 | 0.06987 | (0.18785) | (0.18827) | (0.18793) |

| Type of Institutions | FSI (0.9 Lambda) | FSI (0.8 Lambda) | FSI (0.7 Lambda) | SFSI (0.9 Lambda) | SFSI (0.8 Lambda) | SFSI (0.7 Lambda) |

|---|---|---|---|---|---|---|

| Non-Distressed | 249 | 256 | 261 | 105 | 105 | 107 |

| Distressed | 35 | 28 | 23 | 179 | 179 | 177 |

| Non-Distressed (%) | 88% | 90% | 92% | 37% | 37% | 38% |

| Distressed (%) | 12% | 10% | 8% | 63% | 63% | 62% |

| Basis of Comparison | Distressed | Non Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 9.71% | 93.20% | 36.46% | 61.88% |

| 10 | 96 | 66 | 112 | |

| Dummy 2 | 10.38% | 89.62% | 31.46% | 68.54% |

| 11 | 95 | 56 | 122 | |

| Dummy 3 | 10.38% | 89.62% | 31.46% | 68.54% |

| 11 | 95 | 56 | 122 | |

| Basis of Comparison | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 9.71% | 93.20% | 36.46% | 61.88% |

| 10 | 96 | 66 | 112 | |

| Dummy 2 | 9.71% | 93.20% | 36.46% | 61.88% |

| 10 | 96 | 66 | 112 | |

| Dummy 3 | 13.21% | 86.79% | 36.52% | 63.48% |

| 14 | 92 | 65 | 113 | |

| Financial Position | FSI | Dummy 1 | Dummy 2 | Dummy 3 |

|---|---|---|---|---|

| Non-Distressed | 50% | 65.85% | 62.68% | 62.68% |

| 142 | 187 | 178 | 178 | |

| Distressed | 50% | 34.00% | 37.32% | 37.32% |

| 142 | 97 | 106 | 106 |

| Basis of Comparison | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 87.40% | 12.60% | 70.70% | 29.30% |

| 90 | 13 | 128 | 53 | |

| Dummy 2 | 85.80% | 14.20% | 70.80% | 29.20% |

| 91 | 15 | 126 | 52 | |

| Dummy 3 | 85.80% | 14.20% | 70.80% | 29.20% |

| 91 | 15 | 126 | 52 | |

| Financial Position | FSI | Dummy 1 | Dummy 2 | Dummy 3 |

|---|---|---|---|---|

| Non-Distressed | 50% | 63.73% | 62.68% | 62.68% |

| 141 | 181 | 178 | 178 | |

| Distressed | 50% | 36.27% | 37.32% | 37.32% |

| 143 | 103 | 106 | 106 |

| Basis of Comparison | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 87.40% | 12.60% | 70.70% | 29.30% |

| 90 | 13 | 128 | 53 | |

| Dummy 2 | 86.80% | 13.20% | 71.30% | 28.70% |

| 92 | 14 | 127 | 51 | |

| Dummy 3 | 86.80% | 13.20% | 71.30% | 28.70% |

| 92 | 14 | 127 | 51 | |

| Financial Position | FSI | Dummy 1 | Dummy 2 | Dummy 3 |

|---|---|---|---|---|

| Non-Distressed | 50% | 63.73% | 62.68% | 62.68% |

| 142 | 181 | 178 | 178 | |

| Distressed | 50% | 36.27% | 37.32% | 37.32% |

| 142 | 103 | 106 | 106 |

| Basis of Comparison | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 13.60% | 86.40% | 70.20% | 29.80% |

| 14 | 89 | 127 | 54 | |

| Dummy 2 | 14.20% | 85.80% | 70.80% | 29.20% |

| 15 | 91 | 126 | 52 | |

| Dummy 3 | 13% | 87% | 71% | 29% |

| 14 | 92 | 127 | 51 | |

| Financial Position | FSI | Dummy 1 | Dummy 2 | Dummy 3 |

|---|---|---|---|---|

| Non-Distressed | 50% | 63.73% | 62.68% | 62.68% |

| 141 | 181 | 178 | 178 | |

| Distressed | 50% | 36.27% | 37.32% | 37.32% |

| 143 | 103 | 106 | 106 |

| Basis of Comparison | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Type-I Error | Correct | Type-II Error | |

| Dummy 1 | 14.60% | 85.40% | 69.60% | 30.40% |

| 15 | 88 | 126 | 55 | |

| Dummy 2 | 14.20% | 85.80% | 70.80% | 29.20% |

| 15 | 91 | 126 | 52 | |

| Dummy 3 | 14% | 86% | 71% | 29% |

| 15 | 91 | 126 | 52 | |

| Models | FSIs | Distressed | Non Distressed | ||

|---|---|---|---|---|---|

| Correct | Incorrect | Correct | Incorrect | ||

| (Type-I Error) | (Type-II Error) | ||||

| Variance-Equal Weighted Method | FSI (ROA) | 9.71% | 93.20% | 36.46% | 61.88% |

| 10 | 96 | 66 | 112 | ||

| FSI (ROE) | 9.71% | 93.20% | 36.46% | 61.88% | |

| 10 | 96 | 66 | 112 | ||

| Logit Model | FSI (ROA) | 87.38% | 12.62% | 70.72% | 29.28% |

| 90 | 13 | 128 | 53 | ||

| FSI (ROE) | 87.38% | 12.62% | 70.72% | 29.28% | |

| 90 | 13 | 128 | 53 | ||

| Linear Probability Model | FSI (ROA) | 13.59% | 86.41% | 70.17% | 29.83% |

| 14 | 89 | 127 | 54 | ||

| FSI (ROE) | 14.56% | 85.44% | 69.61% | 30.39% | |

| 15 | 88 | 126 | 55 | ||

| Models | FSIs | Distressed | Non-Distressed | ||

|---|---|---|---|---|---|

| Correct | Incorrect | Correct | Incorrect | ||

| (Type-I Error) | (Type-II Error) | ||||

| Variance-Equal Weighted Method | FSI (ROA) | 10.38% | 89.62% | 31.46% | 68.54% |

| 11 | 95 | 56 | 122 | ||

| FSI (ROE) | 9.71% | 93.20% | 36.46% | 61.88% | |

| 10 | 96 | 66 | 112 | ||

| Logit Model | FSI (ROA) | 85.85% | 14.15% | 70.79% | 29.21% |

| 91 | 15 | 126 | 52 | ||

| FSI (ROE) | 86.79% | 13.21% | 71.35% | 28.65% | |

| 92 | 14 | 127 | 51 | ||

| Linear Probability Model | FSI (ROA) | 14.15% | 85.85% | 70.79% | 29.21% |

| 15 | 91 | 126 | 52 | ||

| FSI (ROE) | 14.15% | 85.85% | 70.79% | 29.21% | |

| 15 | 91 | 126 | 52 | ||

| FSIs | Distressed | Non-Distressed | ||

|---|---|---|---|---|

| Correct | Incorrect | Correct | Incorrect | |

| (Type-I Error) | (Type-II Error) | |||

| FSI (ROA) | 10.38% | 89.62% | 31.46% | 68.54% |

| 11 | 95 | 56 | 122 | |

| FSI (ROE) | 13.21% | 86.79% | 36.52% | 63.48% |

| 14 | 92 | 65 | 113 | |

| FSI (ROA) | 85.85% | 14.15% | 70.79% | 29.21% |

| 91 | 15 | 126 | 52 | |

| FSI (ROE) | 86.79% | 13.21% | 71.35% | 28.65% |

| 92 | 14 | 127 | 51 | |

| FSI (ROA) | 13.21% | 86.79% | 71.35% | 28.65% |

| 14 | 92 | 127 | 51 | |

| FSI (ROE) | 14.15% | 85.85% | 70.79% | 29.21% |

| 15 | 91 | 126 | 52 | |

| Dependent Variable | Overall Classification Accuracy of FSIs | |||||

|---|---|---|---|---|---|---|

| FSI (ROA) | FSI (ROE) | FSI (ROA) Logit | FSI (ROE) Logit | FSI (ROA) LPM | FSI (ROE) LPM | |

| Dummy 1 | 26.80% | 26.80% | 76.76% | 76.76% | 49.65% | 49.65% |

| Dummy 2 | 23.60% | 26.80% | 76.41% | 77.11% | 49.65% | 49.65% |

| Dummy 3 | 23.60% | 27.80% | 76.41% | 77.11% | 49.65% | 49.65% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Babar, S.; Latief, R.; Ashraf, S.; Nawaz, S. Financial Stability Index for the Financial Sector of Pakistan. Economies 2019, 7, 81. https://doi.org/10.3390/economies7030081

Babar S, Latief R, Ashraf S, Nawaz S. Financial Stability Index for the Financial Sector of Pakistan. Economies. 2019; 7(3):81. https://doi.org/10.3390/economies7030081

Chicago/Turabian StyleBabar, Sadia, Rashid Latief, Sumaira Ashraf, and Sania Nawaz. 2019. "Financial Stability Index for the Financial Sector of Pakistan" Economies 7, no. 3: 81. https://doi.org/10.3390/economies7030081

APA StyleBabar, S., Latief, R., Ashraf, S., & Nawaz, S. (2019). Financial Stability Index for the Financial Sector of Pakistan. Economies, 7(3), 81. https://doi.org/10.3390/economies7030081