Abstract

In the era of the digital economy, how digital transformation (DT) contributes to economic development has become a topic of growing interest. This study focuses on business model innovation (BMI) driven by DT in the manufacturing sector. From this perspective, we aim to explore how DT can reshape the fundamental connotation of economic development. To this end, we construct a mathematical model grounded in a Multi-Structural Economic System framework and employ econometric models focusing on fixed effects, mediation effects, and moderation effects. We also compile a panel dataset using data from China spanning from 2008 to 2024. The empirical findings reveal that BMI serves as a mediation mechanism between the DT and competitive advantage (CA) of manufacturing enterprises. However, competitive imitation of BMI by peer enterprises partially offsets this effect, weakening the relationship between DT and enhanced CA. These findings offer evidence-based insights into the role of BMI in the digital era. For policymakers and industry regulators, this study provides practical implications for promoting knowledge spillovers from BMI, thereby fostering market dynamism and enabling structural transformation in the manufacturing industry.

1. Introduction

Digital transformation (DT) enables data to transcend time and space and integrate with traditional production factors, driving extensive enterprise-level change. Such transformation has proven effective in facilitating the upgrading and restructuring of manufacturing enterprises (Fu, 2022; Johns, 2022). These changes are not merely technological adoptions but reflect profound shifts in overall business models, offering crucial support for enterprises to remain competitive in the digital era (Omidvar et al., 2025). As traditional modes of production and operation struggle to meet the demands of the digital economy, DT has become a pressing necessity for the future development of manufacturing enterprises (Johns, 2022; Y. Zhou et al., 2019; Banga, 2022). Therefore, to better understand how manufacturing enterprises leverage digital technologies to enhance their performance, it is essential to examine the impact of business model innovation (BMI).

BMI refers to the process by which enterprises improve or redesign the methods through which they create value. It is considered a key mechanism for helping enterprises adapt to market changes or gain competitive advantages (Dewan & Kraemer, 2000). By understanding market demands, enterprises adjust and innovate their business models to build market power, which is widely recognized as an essential way for both enterprises and industries to enhance competitiveness (Hanelt et al., 2021; Mikalef & Pateli, 2017; Scuotto et al., 2021). With the advent of the digital economy, BMI has become an extensively discussed topic in the survival and development of the manufacturing sector. Typically, enterprises utilize digital technologies to strengthen network effects with upstream and downstream partners, improve market performance, and consolidate their market position. This view has been supported by the widespread adoption of digital technologies among global enterprises (Ibarra et al., 2018; Zott & Amit, 2007). Moreover, some scholars argue that dominant enterprises in the digital era are more likely to achieve economies of scale, resulting in the phenomenon of winner takes all among enterprises (Brettel et al., 2012; Forkmann et al., 2017).

However, the resource allocation patterns and value creation logic of manufacturing enterprises are undoubtedly different from those of platform enterprises. These differences present challenges to enterprises that are seeking to establish competitive advantage (CA) through DT. This issue remains underexplored in existing research on manufacturing. The resource allocation and production models of manufacturing enterprises are rooted in the physical economy, making their digital investments highly asset specific (Riordan & Williamson, 1985). Once such specific assets are formed, they become locked into particular forms and production or transaction models, resulting in high switching costs during transformation (Kermani & Ma, 2023). To cope with the lock-in effect and the risk of opportunism associated with asset specificity, enterprises often adopt conservative investment and management strategies. They may reduce or even cancel investments in high-risk projects and take a cautious stance toward further DT and innovation (Joskow, 1988; Kim, 2018). As a result, DT in these enterprises often yields benefits only within niche sectors or product categories, which contrasts with findings in studies on digital platform enterprises (Abrell et al., 2016; X. Sun et al., 2024).

Traditional value creation logic also brings security and privacy risks to the DT of manufacturing enterprises. In market competition, platform enterprises that create value through supply and demand matching can leverage digital networks and Metcalfe’s Law to achieve monopoly over supply chains and sales chains by expanding their user base (Cutolo & Kenney, 2021; Pan et al., 2023). However, manufacturing enterprises primarily rely on semi-standardized industrial production; consequently, they cannot rely solely on scale advantages to build market exclusivity. As digital integration deepens, the exposure of sensitive information in areas such as product design, production processes, and supply chains becomes more likely (Tilson et al., 2010; Y. Chen & Zeng, 2022). Competitive imitation by peer enterprises can also undermine the positive effects of DT (Kiveu et al., 2019; Mahesh et al., 2020). Furthermore, uncertainties in production technologies, product development, and market responses can elevate operational risks for these enterprises (Chavez et al., 2023; Björkdahl, 2020; Buer et al., 2021).

These challenges contribute to the ongoing debate over the impact of DT on enterprise competitiveness. Some scholars posit that DT helps reduce transaction costs (Dewan & Kraemer, 2000; Hanelt et al., 2021), automate and enhance production processes (Mikalef & Pateli, 2017), strengthen capital spillovers (Horvat et al., 2019; S. Chen & Zhang, 2021), and improve innovation performance (J. Zhou, 2013; Trabucchi & Buganza, 2019). All of them can enhance the competitiveness of enterprises (Y. Q. Wu et al., 2021; Wen et al., 2022; Gao et al., 2023). However, opposing views highlight that the complex production systems of manufacturing enterprises make DT costly and time-consuming (Vasylyshyna et al., 2022; Chavez et al., 2023), potentially leading to structural unemployment or production stagnation due to workforce adjustments (Bertschek & Kaiser, 2004; Black & Lynch, 2001). Others, from a cybersecurity perspective, warn that DT exposes sensitive data, which may result in the leakage of production technologies and supply chain resources (Björkdahl, 2020; Buer et al., 2021). This not only boosts the capabilities of potential competitors but also creates legal risks associated with privacy breaches, potentially damaging reputation and social capital (Choi et al., 2019). Therefore, it is of both theoretical and practical significance to investigate the mechanisms through which DT influences CA in the manufacturing sector.

Although most studies acknowledge that digital technologies can enable manufacturing enterprises to build competitive advantage, few are grounded in formal mathematical models (Hanelt et al., 2021). Moreover, limited attention has been given to the role of business model innovation and competitive imitation in this process (Z. Zhang et al., 2022). The study addresses this gap by focusing on the role of BMI. Specifically, it investigates how digital technology investment influences enterprise competitiveness in manufacturing and elucidates the underlying mechanisms, providing both theoretical insight and empirical evidence for evaluating the performance outcomes of DT.

To be specific, (a) the study develops a theoretical framework based on a Multi-Structural Economic System (MSES) Model, which explains how DT promotes BMI and enhances the competitiveness of production-oriented enterprises. It also incorporates industrial organization theory to examine the impact of competitive imitation. (b) We construct a panel dataset using data from Chinese listed enterprises between 2008 and 2024, covering 50 sub-industries. A series of econometric models, including fixed-effects models and chain mediation models, are developed to test the effect of DT on the market competitiveness of manufacturing enterprises, with a particular focus on the mediating role of BMI. (c) We further incorporate the moderation effects of market competition by using moderation models, in order to examine the impact of imitation by competitors.

This paper consists of seven sections. Section 2 reviews the relevant literature on BMI, the benefits of DT in enterprises, and competitive imitation. Section 3 constructs a theoretical analysis framework based on the MSES model and derives research hypotheses through theoretical modeling. In Section 4, we describe the data sources, measurement methods, and analytical methods. Section 5 presents the empirical results validated through econometric models. In Section 6, we discuss the main findings and propose theoretical and practical implications. Section 7 summarizes the main conclusions, contributions, and directions for future research.

2. Literature Review

2.1. Digital Technology and Business Model Innovation

Research on BMI driven by DT in enterprises has developed relatively recently. Most scholars agree that DT has a positive effect on enterprises’ exploration of new approaches and logics to create value. Given the different focal points of DT, enterprises exhibit diverse paths toward realizing BMI (Han & Zhang, 2022). Early studies argued that DT enables enterprises to identify patterns in customer behavior from data, thereby facilitating value matching for consumers or downstream supply chains (Zott & Amit, 2010). This represents a demand-driven model of innovation for value creation (Gu & Zhang, 2024). Some scholars emphasize the role of digital technologies in internal business operations, suggesting that DT helps optimize internal business structures, operational processes, and work patterns (Soukhoroukova et al., 2012; Ancillai et al., 2023; Mittra et al., 2015). This reflects a supply-side innovation mechanism. In addition, other studies highlight digital technologies in promoting value interaction between enterprises and customers, arguing that DT improves the ability to capture customer needs and to adjust operations accordingly (Ciampi et al., 2021), showcasing interactive innovation based on supply–demand interplay.

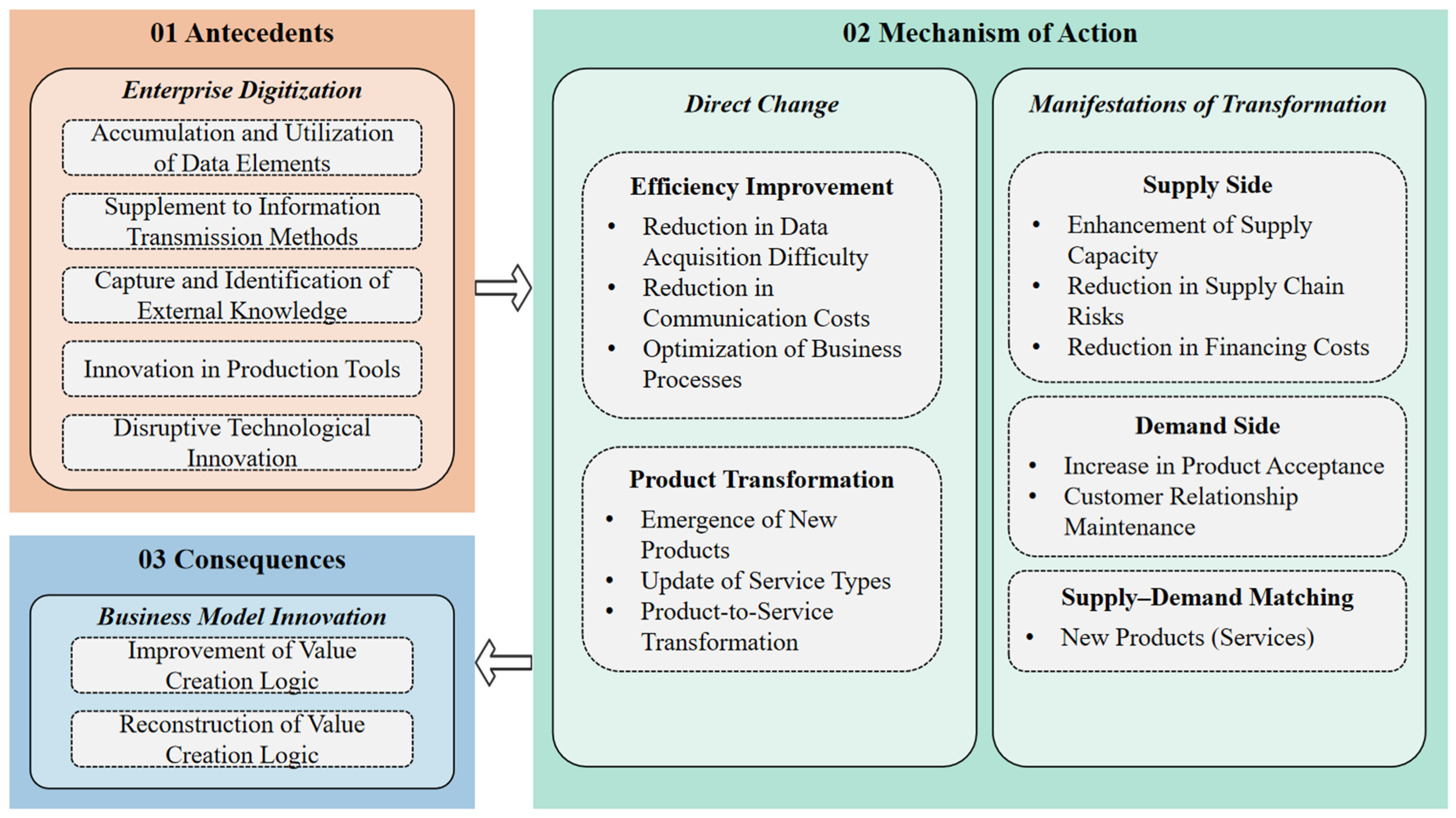

The relationship between DT and BMI in manufacturing enterprises can be illustrated as shown in Figure 1. Digital technologies impact enterprises through efficiency enhancement and product innovation across three dimensions: the supply side, the demand side, and supply–demand alignment. These impacts serve to refine or reconstruct the value creation logic of enterprises (S. Z. Wang & Nie, 2011; Picciotti, 2017), thereby achieving BMI.

Figure 1.

Logic of digitalization and business model innovation in manufacturing enterprises in the literature.

Some scholars have analyzed the relationship between the enterprise life cycle and BMI. They argue that the growth stage is the phase with the greatest freedom for BMI (Trimi & Berbegal-Mirabent, 2012; Taran et al., 2015). In the maturity stage, the impact of DT on BMI in manufacturing enterprises weakens (Freisinger et al., 2021), while in the decline stage, BMI in manufacturing enterprises is more reflected in thorough business transformation (Meier & Massberg, 2004; Chandler et al., 2014).

2.2. The Impact of Enterprises Adopting Digital Technology

Tracing the theoretical lines of performance research on enterprise DT, it is evident that most studies are based on the breakthrough of technological revolutions in the scale boundaries of enterprises. Classical economic theory posits that economies of scale are the primary drivers of enterprise growth. The intrinsic motivation behind enterprise growth lies in the pursuit of scale economies, wherein enterprises continuously adjust and optimize to achieve an optimal scale (Xiao & Huang, 2006; Morroni, 2007; Valerdi et al., 2008). In contrast, new institutional economics views enterprise growth not only as functional expansion but also as boundary expansion. As enterprises expand boundaries, they internalize transactions previously handled through markets to minimize market transaction costs (Gulbrandsen et al., 2017). Technological revolutions lead to economic revolutions (Gawer, 2021), and each technological revolution results in the modernization of the entire production system, ultimately generating new production practices (Foresman, 2016).

Most studies on the impact of DT in manufacturing on CA focus on the optimization of production and operations through the basic characteristics of DT, such as real-time capability, connectivity, and replicability. These studies argue that DT helps break down information silos between business systems within enterprises, reducing transaction costs in operations and improving management efficiency (Peng & Tao, 2022). DT is beneficial for automating and intelligentizing production processes in manufacturing enterprises, thereby enhancing the predictability of production risks and improving production efficiency (D. Wang & Shao, 2024; Rangaswamy et al., 2020). It also helps strengthen the spillover effects of knowledge and human capital, promoting the integration of innovation resources and improving innovation capabilities, thereby enhancing innovation performance (Bielig, 2023; Bhandari et al., 2023). There is a positive impact on enterprises forming CA (Di Silvestre et al., 2018; Oliveira et al., 2021), or affirming the positive role of DT from the perspective of improving financing capabilities and avoiding entrepreneurial myopia (Zaman et al., 2025). However, some studies suggest that the complex production processes in manufacturing enterprises increase the difficulty of digitalizing production, while the asymmetry of production data and supply chain information pose challenges for complex data integration. The need for updating equipment and infrastructure puts financial and time pressures on enterprises, and even adjusting human resource structures may lead to structural unemployment or production stagnation risk (Black & Lynch, 2001), thus bringing the risk of failure to DT in manufacturing enterprises (Sandulli et al., 2014).

2.3. The Dynamics of Competitive Advantage and Competitive Imitation

Competitive advantage refers to the relative position of an enterprise in the market, representing the level and stance of the enterprise leadership in value creation, such as resource development, integration, and utilization, compared with its competitors. Existing research explains the sources of competitive advantage from perspectives such as resource exclusivity, cost advantage, differentiation strategy, technological innovation, economies of scale, brand advantage, and network effects (Cantwell & Vertova, 2004; Amir & Lazzati, 2011; Shim & Lee, 2012; Fast et al., 2023). The establishment of competitive advantage is not static; it is influenced by factors such as competitor behavior, business environment, customer demand, and technological innovation. As a result, the competitive ability of an enterprise in the market evolves dynamically (L. L. Wang & Gao, 2021).

Among these factors, the influence of competitor behavior has always been present, directly affecting the establishment of the competitive advantage (Rivkin, 2001). Research on competitive imitation originates from the Herding Effect Theory. Industrial organization theory constructs theoretical frameworks, such as the Cournot model, the Bertrand model, the Stackelberg model, and the Beloff model. In these models, regardless of the game strategy employed by enterprises, the response decisions of competing enterprises always cause enterprise profits to deviate from expectations, corroborating the significant impact of competitor behavior on the establishment of CA. Some scholars, starting from the innovation behavior of enterprises, construct game models to analyze the decision-making logic of innovation and imitation, suggesting that in highly competitive markets, the innovation efforts and business model optimization of the enterprise may become a reference for other competitors to maintain competitive balance (L. Wang et al., 2024; Li, 2025). This phenomenon is more evident in platform enterprises (Duffy & Ralston, 2020; Park & Yi, 2024), which challenges the CA of first-mover enterprises.

3. The Theoretical Framework and Hypotheses

We construct the theoretical framework in three main steps. First, we develop an MSES model to analyze the relationship between DT and BMI. Our theoretical contribution lies in introducing digital technology as a tradable service, which serves as the starting point for modeling DT. Changes in the production and consumption structures of economic agents across products X, Y, and the digital service DT reflect the emergence of BMI. Second, we examine how BMI contributes to CA. This part builds upon the Cournot model and the Bertrand model, in which we solve for the impact of BMI on firm-level equilibrium output under monopolistic competition. Third, we incorporate the effect of competitive imitation by analyzing dynamic responses from rival enterprises within a Stackelberg competition framework.

3.1. The Relationship Between Digital Technology and Business Model Innovation

This section focuses on the mechanistic research of how DT leads to BMI. Based on the MSES model of neoclassical economics (Miller, 2004), we incorporate information technology elements into the analysis of production growth (Huang et al., 2019) and examine how the increasing level of DT in production-oriented enterprises alters their business models and the potential productivity incentives and competitive advantages brought by innovations in value creation methods.

First, the MSES model is constructed. It is assumed that there are two products, X and Y, in the economic system, with economic agents producing and consuming these two products. Labor endowment serves as the production factor, and the scale of economic agents is sufficiently large, with production following the law of diminishing marginal returns. In the context of DT, resources are not only used for the production of products X and Y, but also flow into the production of DT or the trade of digital services, such that the production functions and budget constraints faced by economic agents are as shown in Equations (1) and (2).

In this context, represents the quantity of product X produced and sold by the economic agent, represents the quantity of product X supplied to the market by the economic agent as a producer, and represents the share of productivity spent on producing product X. The same economic meanings apply to , , and for product Y, and represents the degree of specialization, which in turn indicates the efficiency of labor resource transformation in producing products X and Y. As the degree of specialization increases, the production transformation efficiency gradually increases (). The character indicates the economic agent’s self-supply of DT, and represents the provision of digital services by the economic agent to the market. The represents the digital services obtained by the economic agent from market transactions, and represents the share of productivity invested in DT. The codability of DT makes a high level of expertise a key factor in improving production efficiency. It is still assumed that the accumulation of labor skills has a positive impact on production transformation efficiency (). The characters , , and represent the prices of products X, Y, and digital services in the market.

Then, the influence of DT is introduced. The theoretical derivation primarily focuses on the ability of DT to solve information asymmetry problems, using the Cobb–Douglas utility function to measure the utility of economic agents, as shown in Equation (3). To make the utility model more aligned with the market transaction environment, the Iceberg Cost paradigm is borrowed to introduce the concept of transaction costs, assuming that there are transaction costs between economic agents, and can be understood as market transaction efficiency. As the integration of DT with economic agents deepens, the degree of information asymmetry in the market decreases, and transaction efficiency improves. Therefore, market transaction efficiency is positively influenced by the level of DT. This can be characterized by .

Furthermore, the potential business models of economic agents and their conditions are derived. For different economic agents, their business models can be summarized into three categories: the first category of economic agents adopts a fully self-sufficient business model (). The second category adopts a partially market-divided business model (), engaging in market transactions for certain products and services while maintaining the ability to produce and sell most products and services internally. The third category adopts a fully market-participating business model (), participating in the market division of labor as part of a multi-structured market. These business models can be represented by Equation (4).

where is the coefficient matrix, representing the shares of products X, Y, and DT in the equilibrium state, and indicates the production and transaction status of products or services under the respective business model. Value 1 is assigned to the first column if the economic agent produces a given product or service; otherwise, it is 0. The second column reflects the sales status of the corresponding product, and the third column indicates whether the product is purchased from the market. For example, in the first row, the entry denotes whether the agent produces product X, indicates whether the agent supplies product X to the market, and shows whether the agent purchases product Y from the market.

These economic agents make decisions regarding their business models, optimizing constraints around the utility function (Equation (3)), production function (Equation (1)), and budget constraint (Equation (2)) under the respective constraints of each business model (). Assuming equivalence of preferences for products X and Y across economic agents (), the optimal responses of economic agents under each business model, along with the equilibrium utility conditions and transaction efficiency thresholds, are shown in Table 1.

Table 1.

Multi-structural economy model solution results.

The study then analyzes the relationship between DT in enterprises and BMI. In Table 1, when the degree of DT is low, market transaction efficiency conforms to . In this scenario, economic agents face high transaction costs. The cost for economic agents to acquire products and services through market transactions is much higher than self-production, leading to the adoption of a self-sufficient business model (). As DT deepens, the digital services acquired by economic agents () continuously increase, and market transaction efficiency improves to . It is suggested that the decline in transaction costs leads to greater utility from market-acquired products than from internal production using equivalent labor input; however, due to residual information asymmetry, economic agents may still lack sufficient incentive for full market participation. At this point, the optimal business model is partial market division (). As the integration of DT and the economy deepens further (), market transaction efficiency increases to a higher level (), and the labor input required by economic agents to produce both products begins to exceed the need for market transactions to achieve the same utility. At this stage, the business model of the economic agent gradually evolves into a fully market-participating business model (). In summary, DT reduces TC among economic agents, promotes more efficient market specialization, and drives the evolution and innovation of business models.

3.2. The Establishment of Enterprise Market Competitive Advantage

Further analysis is conducted on how enterprise DT enhances competitiveness and expands CA through BMI. Enterprises with different levels of DT have varying abilities to overcome information asymmetry, resulting in differentiated business models under optimal decision making. The study on the formation of competitive advantage focuses primarily on enterprises involved in market transactions. Taking the market for product X as an example, when the DT level of an enterprise is low, the optimal business model is . At this point, the average cost of production can be understood as the labor input required to produce a unit of the product, as shown in Equation (5). As DT progresses, the optimal business model gradually evolves into , and the average cost of production is shown in Equation (6).

Assume there are two enterprises in the market for product X, Enterprise 1 and Enterprise 2, both of which only produce product X and are homogeneous except for their DT levels. Market demand is understood as a linear relationship, as shown in Equation (7).

When the two enterprises engage in price competition, each enterprise will attempt to lower its price to gain a larger market share. Under the assumption of homogeneity, the competitive advantage of the enterprises is based on the optimization of production costs due to DT. The price competition outcomes for Enterprise 1 and Enterprise 2 at different levels of DT are solved using the Bertrand model, and the results are shown in Table 2.

Table 2.

Equilibrium supply solution for two enterprises under price competition.

From Table 2, it can be seen that when a price competition strategy is adopted, regardless of the DT level of Enterprise 2, as the DT level of Enterprise 1 increases, the business model of Enterprise 1 shifts toward , which will increase its market supply of product X; in other words, the DT of Enterprise 1 expands its market share in the equilibrium state, benefiting the expansion of its CA. When Enterprise 2 has an extremely low level of DT, its optimal business model is . At this point, the equilibrium supply of Enterprise 1 at different levels of DT is 0, and . Since , the equilibrium output of Enterprise 1 gradually increases with DT. This conclusion holds when the business model of Enterprise 2 is or , indicating that DT still positively impacts its CA.

Considering market share competition, the impact of DT on its CA is examined. The market share competition outcomes for Enterprise 1 and Enterprise 2 at different levels of DT are solved using the Cournot model, and the results are shown in Table 3.

Table 3.

Equilibrium supply solution for two enterprises under market share competition.

From Table 3, it can be seen that as both enterprises adjust their supply to compete for market share, with the deepening of DT, BMI increases the equilibrium market supply of both enterprises, thereby forming competitive advantages and promoting the expansion of their CA. Specifically, when Enterprise 2 has a low level of DT and is in , equilibrium supply at different DT levels of Enterprise 1 is , . Due to the assumption of the model (, , ), it can be proven that holds. As DT progresses, Enterprise 1 gradually establishes an advantage in market competition with Enterprise 2. Similarly, when Enterprise 2 has a higher level of DT and is in , Enterprise 1 can still increase its market share gradually to 50% through DT, indicating that enterprise DT has a positive impact on expanding CA.

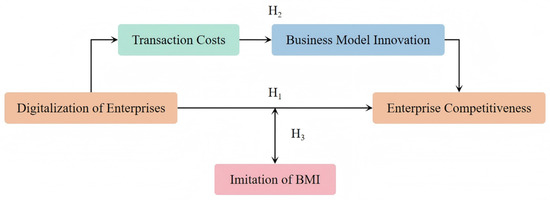

In summary, our theoretical framework clarifies how DT in manufacturing reduces TC, facilitates BMI, and enhances CA. Based on the analyses in Section 3.1 and Section 3.2, we propose the following hypotheses:

Table 2 and Table 3 consistently indicate that DT in manufacturing significantly contributes to the expansion of market power, thereby fostering CA.

H1.

Digital transformation of manufacturing enterprises is beneficial for establishing competitive advantages.

Section 3.1 explores the relationship between DT, TC, and BMI. The application of digital technologies helps alleviate information asymmetry and reduce TC between economic agents. As the degree of DT increases, the utility of obtaining intermediate goods or services via market exchange begins to exceed that of internal production, leading to deeper market specialization and driving BMI. Section 3.2 discusses how BMI enhances CA. The evolution of business models is accompanied by increasing returns to unit input. This improvement allows enterprises to achieve lower production costs in price-based competition or stronger economies of scale in quantity-based competition, thereby strengthening CA.

These findings suggest that digital transformation in manufacturing can reduce transaction costs and promote business model innovation. And the BMI helps enhance enterprise competitiveness. This implies the existence of a chain transmission mechanism linking DT to CA, leading to the formulation of the following hypothesis:

H2.

Digital transformation enhances competitive advantage in manufacturing firms through a chain mechanism of reduced transaction costs and improved business model innovation.

3.3. The Impact of Competitive Imitation

In a highly competitive market, technological innovation and business model optimization may be imitated by other competitors, eroding the competitive advantage established by the first mover and forming a new market equilibrium. Research on CA must consider the impact of competitors. To further analyze the impact of imitation on market structure under the security and privacy risks of DT, the perspective of the Stackelberg model is incorporated into the analysis. It is assumed that Enterprise 2 has established strong CA and has become the leading enterprise in market production decisions, while Enterprise 1 is the market follower. The BMI and imitation effects are shown in Table 4.

Table 4.

Equilibrium supply solution for two enterprises under competitive imitation.

Considering DT led by the leading enterprise, from Table 4, it can be seen that when the DT level of Enterprise 2 increases, its business model evolves to , and the market equilibrium output increases from to . DT leads to BMI, effectively promoting the leading enterprise to form a competitive advantage. As a competitor, Enterprise 1 recognizes the improvements in transaction efficiency and production efficiency brought about by DT, and similarly undertakes DT to imitate Enterprise 2. Under the new competitive framework, as Enterprise 1 deepens its DT, its business model gradually transitions from to . The imitation reduces the equilibrium supply of Enterprise 2 from to . It indicates that in a DT led by the leading enterprise, the imitation behavior of the follower enterprise constrains the expansion of CA through DT.

We then consider DT led by the follower enterprise in Table 4. It can be seen that when Enterprise 1 undertakes DT and achieves BMI, its equilibrium output increases from to , and its market share increases from to , thus facilitating the expansion of its CA. Enterprise 2, as the leading enterprise, may imitate Enterprise 1 to maintain its market advantage, evolving from to . The equilibrium output of Enterprise 1 then decreases from to , while the market share gradually shrinks from to . This means that in a DT led by the followers, the imitation by the leading enterprise also constrains the ability of the followers to expand CA.

In summary, in a static competitive relationship, enterprises use DT to eliminate the negative impact of information asymmetry and achieve business model optimization and innovation, establishing a competitive advantage in the market and benefiting from the positive effects of DT. From a dynamic perspective, however, both leading and follower enterprises have incentives to imitate competitors’ DT and BMI to establish or maintain market dominance. Competitive imitation causes the effects of DT to spill over within the industry, improving the production efficiency of competitors within the industry. It also opens up the black box of manufacturing production, lowering entry barriers for external enterprises, intensifying industry competition, and constraining enterprises from expanding their CA through DT.

H3.

Business model innovation has become the subject of observation and imitation by competitors, and the imitation has a negative impact on the effectiveness of enterprise DT, constraining enterprises from achieving competitive advantage through DT.

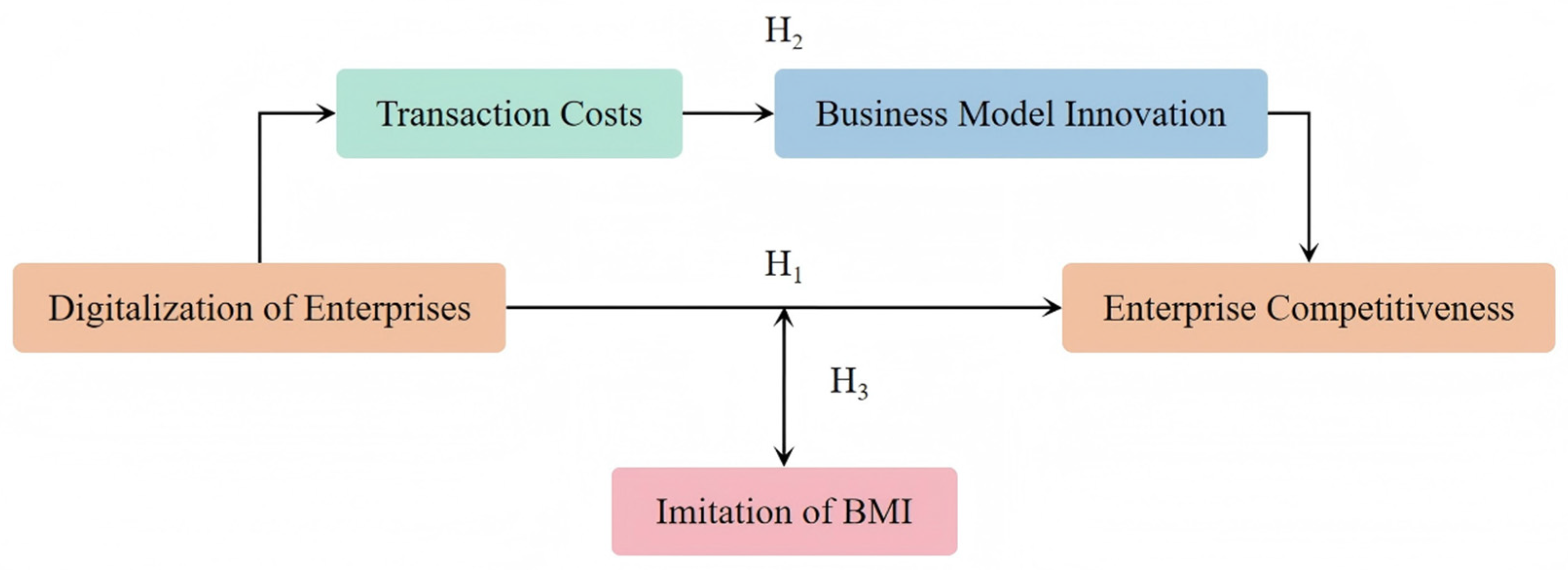

Based on the above analysis, our research framework is shown in Figure 2.

Figure 2.

The research model.

4. Methodology

4.1. Data Sources

This study selects Chinese publicly listed manufacturing enterprises from 2008 to 2024 as the primary research subjects. A panel dataset is constructed, covering 50 sub-industries and comprising a total of 29,131 samples. The dataset includes several categories of core variables. Enterprise-level operational data are obtained from the CSMAR database. Industry-level data are derived from Chinese official business registration records and macroeconomic statistical yearbooks. Regional economic indicators related to the locations of enterprises are collected from the statistical yearbooks of Chinese cities.

4.2. Variable Measurement

4.2.1. Dependent Variable

Competitive Advantage (CA). The competitive advantage of enterprises in the market is calculated using the price markup to avoid the issues of missing data for non-listed companies and difficulties in marginal cost estimation that exist in methods such as HHI and the Lerner Index. Referring to the approach by Loecker and Warzynski (2012), the price markup is calculated using the ratio of variable cost elasticity to the share of variable input in production under the condition of minimizing production cost.

The methodological steps are as follows:

- (1)

- Firms are first grouped according to their respective industries.

- (2)

- A Translog production function is then constructed, as shown in Equation (8), where denotes the price of labor input for firm in year , proxied by the average employee compensation. represents the price of capital input, proxied by the long-term return on capital. and denote the total factor productivity estimated using the Olley–Pakes (OP) method and the error term.

- (3)

- Equation (8) is estimated separately for each industry sample, yielding the regression coefficients , and .

- (4)

- They are then substituted into Equation (9) to compute the elasticity of variable costs for firm in year .

- (5)

- The share of variable input in total output is calculated, with the numerator and denominator represented by operating costs and total operating revenue, respectively.

- (6)

- Finally, we obtain the CA indicator for sub-sectors, as shown in Equation (10).

The data are summarized in Table 5.

Table 5.

Definitions and explanations of core variables.

4.2.2. Independent Variable

Digital Transformation (DT). The number of intangible assets associated with digital technologies is used as the indicator for digital transformation, where the definition of digital technology intangible assets refers to the treatment of Fan et al. (2023). When measuring DT at the enterprise level, existing studies have gradually developed three main methods of calculation: digital system applications (Z. Sun & Hou, 2019), annual report disclosure keyword frequency (F. Wu et al., 2021), and the proportion of digital assets. The characteristics of DT make DT in enterprises have relatively low marginal costs (J. Zhang & Li, 2023). The cost of the digital economy primarily arises from the high threshold for technology adoption, meaning that the relationship between the investment in DT and the production scale is not linear. Using the proportion of intangible assets associated with DT to measure the degree of DT will underestimate the transformation level of larger enterprises, as listed companies tend to be larger in scale; therefore, the number of intangible assets associated with DT should be used to measure the DT of enterprises.

4.2.3. Mediation and Moderation Variables

Transaction Costs (TC). The study focuses on the internal and external organizational efforts enterprises expend to maintain smooth business operations. From the perspective of external transactions, some scholars argue that selling expenses reflect the costs incurred in the process of product sales or service delivery and can thus serve as a proxy for transaction costs (Cai et al., 2024). Others further include administrative expenses—those incurred by corporate administrative departments for organizing and managing production activities—as part of transaction costs. This broader view regards both selling and administrative expenses as relevant indicators (Huang et al., 2019). We align with the latter view, using the sum of operating expenses and management expenses as the indicator for TC.

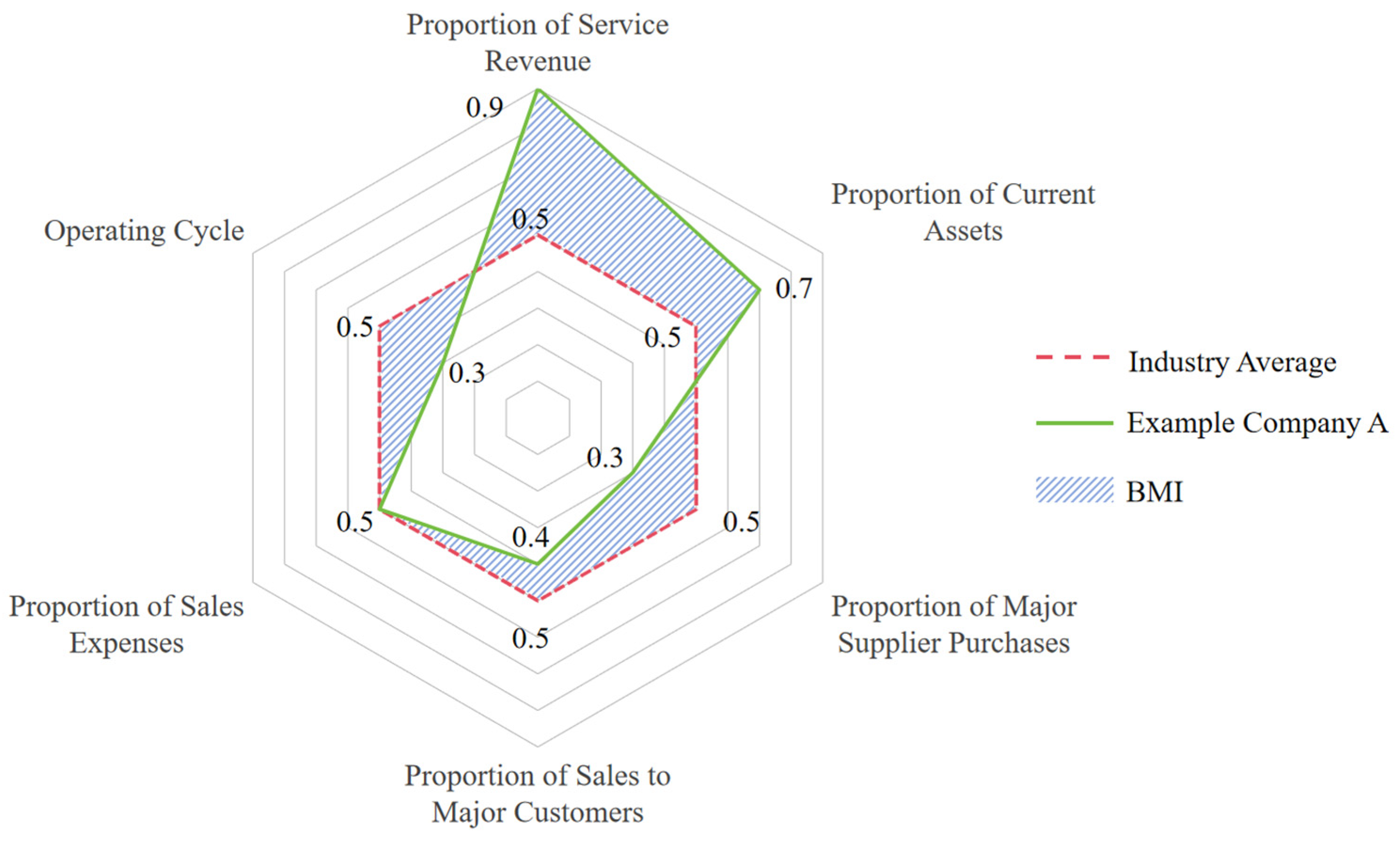

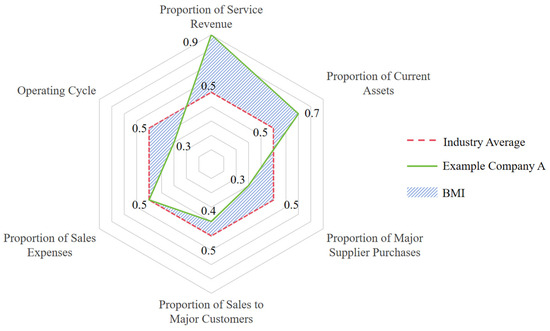

Business Model Innovation (BMI). The BMI indicator is constructed based on the approach of Guo et al. (2018), using a multi-dimensional vector of the revenue model, value proposition, and cost structure, and measuring the cosine distance to the industry vector. Although the paths and forms of BMI in each module vary, the changes brought by a new business model are directly reflected in the revenue model, value proposition, and cost structure. Therefore, BMI is measured by the differences in these three aspects between the enterprise and the industry. The revenue model is represented by the proportion of service revenue to total revenue and the proportion of current assets to total revenue. The value proposition is represented by the proportion of purchases from the top five suppliers and the proportion of sales to customers. The cost structure is represented by the proportion of sales expenses and the operating cycle. These indicators are normalized at the industry level, and then the cosine similarity between the business model vector of enterprises and that of the sub-sector is calculated. The indicator for BMI is set based on the cosine distance, as shown in the shaded area of Figure 3.

Figure 3.

Example of business model innovation variable calculation.

Competitive Imitation. Market behavior evolves dynamically. When digital enterprises emerge in the market, the digital economy generates technological spillovers to the traditional economy, promoting the transformation and upgrading of other enterprises within the industry (Li et al., 2024; Montemari et al., 2024). Changes in business models are more direct (Climent et al., 2024) and more easily recognized by competitors than other DT measures. Thus, the study measures the spillover effect within the industry using the average BMI level in the sub-sector (I_BMI).

4.2.4. Control Variables

Control variables are incorporated to account for two categories of factors influencing enterprise CA: enterprise-specific characteristics and city-level contextual variables (Y. Zhang et al., 2024; Xie & Wu, 2024; Sui et al., 2024). At the enterprise level, resource exclusivity is measured using the ownership structure and power concentration of the enterprise, controlling for the competitive advantage brought by policy assistance and entrepreneurial resources. The scale of the enterprise is used to control for the positive impact of economies of scale on establishing CA, measured as the natural logarithm of the total assets. Labor costs, capital costs, and operational conditions represent the cost advantages established by the enterprise, with operational conditions measured by the total asset growth rate. The founding year variable is also controlled. At the city level, the GDP of the location city is used to control for the advantages gained from local economic development. The development potential and orientation are represented by the total population at the end of the year and the administrative level. The market segmentation index and actual foreign investment are used to control the impact of the business environment.

4.3. Model Building

We construct econometric models based on the results of the theoretical framework, aiming to investigate the impact of DT on the CA of manufacturing enterprises. Since CA is inevitably influenced by year-specific and industry-specific characteristics, we adopt a fixed-effects (FE) model to control for these unobserved heterogeneities. A Hausman Test is also conducted to ensure the validity of the model selection, as shown in Equation (11):

Here, , , and represent a specific manufacturing enterprise, the industry category of the enterprise, and the year of the sample, respectively. represents the enterprise-level control variables, represents the city-level control variables, and and are the coefficient vectors of the control variables. The model controls individual fixed effects () and time fixed effects ().

We propose that DT reduces TC and promotes BMI in H2, suggesting a mediation pathway among the core variables. To examine the underlying causal mechanisms, we employ a mediation analysis framework. Referring to the method of Gelbach (2016), a chain mediation effect model that includes DT, TC, BMI, and CA is constructed (Equation (12)). In this model, represent the variables for TC or BMI. Sobel Tests are used to assess the significance of the decomposed indirect effects.

Finally, we explore the moderating role of competitive imitation in shaping the relationship between DT and CA. As shown in the theoretical analysis in Section 3, competitive advantage is dynamic. The BMI may be subject to observation and imitation by rival enterprises, leading to new competitive equilibria. In this context, the relationship between competitive imitation and DT is not strictly causal but reflects complex interactions and strategic motivations. Since Hypothesis 3 focuses on how competitive imitation influences the effectiveness of DT in establishing CA, we construct a moderation model (Equation (13)) to empirically test this interaction effect.

Before conducting the empirical analysis, all continuous variables were standardized using Z-score standardization.

5. Empirical Results and Analysis

5.1. Benchmark Regression

Panel regression of Equation (11) was conducted using a sample of listed manufacturing companies to study the impact of DT on the CA of manufacturing enterprises. The results are shown in Table 6. Columns (1) to (4) of Table 6 display the random effects without control variables, the random effects with control variables, and the results with fixed effects. In all these results, the coefficient of DT is significantly positive, indicating that there is a positive correlation between DT and price markup. By applying DT to address information asymmetry, enterprises break the information silo effect, effectively reduce the circulation costs of information and products within departments, between departments, and between enterprises, and improve the management and production efficiency of manufacturing enterprises. This enables enterprises to better utilize economies of scale in output competition, facilitating the expansion of CA. H1 is thus confirmed.

Table 6.

Benchmark regression results.

5.2. The Endogenous Test

Some studies suggest that enterprises with competitive advantages may be more likely to implement DT (Rangaswamy et al., 2020). Considering the possible reverse causality between DT and competitive advantage, as well as potential omitted variable bias, we conduct an endogenous analysis using the Two-Stage Least Squares (2SLS) model and design two instrumental variables. The first one is the average DT investment of other enterprises in the same industry, as there is a network externality in technological diffusion within the industry. The DT of other enterprises in the same industry influences the DT decisions of the target enterprise through supply chains, competitive pressure, or knowledge spillovers (Y. Chen & Guo, 2024), while the characteristics of a single enterprise are unlikely to affect the DT level of the entire industry or region. The second instrumental variable is the internet infrastructure level of these locations, calculated using a weighted entropy method based on the number of internet users per 100 people, the proportion of workers in computer services and software, per capita telecom business volume, the number of mobile phone users per 100 people, and the annual Peking University Digital Financial Inclusion Index of the city. Since regional internet infrastructure is a necessary condition for enterprise DT, it directly impacts the cost and feasibility of adopting digital technologies, and the DT level is clearly the primary path through which regional digital infrastructure affects its development, thus meeting the relevance and exogeneity requirements.

Columns (1) and (2) of Table 7 show the results using the instrumental variables. It is found that, whether using the industry instrumental variable or the regional instrumental variable, the first-stage estimated coefficients of IV_I and IV_C are significantly positive, indicating a positive correlation between the DT levels of the same region or the same industry and the DT of the enterprise. The relevance between the instrumental variables and the explanatory variables is confirmed. In the second-stage results, the coefficients remain significant, and the Anderson LM statistic is significant at the 1% level. The Cragg–Donald Wald F-statistic is greater than 10, indicating the validity of the instrumental variables. After addressing the endogeneity issue, the conclusion that DT in manufacturing enterprises promotes the enhancement of their competitive ability remains valid.

Table 7.

Instrumental variable regression results.

5.3. The Mediation Effect of Business Model Innovation

We examine the chain mediation effect of TC and BMI in the relationship between DT and CA, based on the model specified in Equation (12). Specifically, we apply the Baron–Kenny approach to test the causal relationships among the four core variables in a stepwise manner. We then compute the corresponding Sobel statistics for each step. The results are presented in Table 8, columns (1) through (4). Based on the confirmed causal paths, we further construct a chain mediation effect model and estimate the path coefficients for TC and BMI, as reported in column (5) of Table 8.

Table 8.

Mediation effect test results.

The results in Result (1) of Table 8 show the mediation effect of BMI in the DT of enterprises. The coefficient is significantly positive, indicating a positive correlation between DT and IBM. The coefficient is positive, suggesting that BMI plays a positive role in the expansion of CA. In the independent variable model, the coefficient is significantly positive and greater than after including the mediator variable. The Sobel value is 0.023, indicating that BMI plays a positive mediating role in the process of CA expansion through enterprise DT.

In the results of Result (2), where TC is the mediator variable, the Sobel value is 0.135, indicating that DT reduces TC both internally and externally, thereby promoting the expansion of CA. The chain mediation effect tests the interaction between TC and business model paths, and the results show that the TC path coefficient and the interaction path coefficient are significantly positive, while the path coefficient for BMI and the direct effect are no longer significant. This suggests that BMI in manufacturing enterprises is primarily driven by the reduction in TC. There is a sequential relationship between the reduction in TC and BMI. The application of DT in the design, production, and sales processes of enterprises can optimize the organization of certain production factors, reduce internal and external TC, promote BMI, and improve management and production efficiency, thereby facilitating the expansion of CA and forming a chain mediation path between TC and business models.

5.4. The Moderation Effect of Competitive Imitation

To test the effect of competitor imitation behavior, a regression analysis of the Moderation Effect model in Equation (13) is conducted; the results are presented in Table 9. The estimated coefficient of the competitive imitation is significantly negative, indicating a negative correlation between the level of industry BMI and the competitiveness of enterprises within the industry. This suggests that due to the presence of competitive imitation, the outcomes of BMI may quickly spill over to other enterprises in the industry, eroding the competitive advantage that the enterprise has established. The interaction coefficient is significant and opposite to the coefficient of DT, indicating that competitive imitation plays a negative moderating role in the process of expanding CA through DT. This means that DT makes the new business model easier to recognize and imitate, weakening the market barriers formed by technology and information resources, intensifying the market competition faced by enterprises undergoing DT, and constraining the establishment of competitive advantages in the industry.

Table 9.

Moderation effect test results.

5.5. The Robustness Test

Rationale for FE Model Selection. We tested the validity of using an FE model in Equation (11); the results of the Hausman test are presented in Table 10. The Hausman_Chi in the results is 407.06, and the Hausman_P is below 1%, indicating that there are significant differences between the FE model and the RE model, with the FE model better capturing individual differences.

Table 10.

Robustness test results of the regression model.

Collinearity and Autocorrelation Issues. The impact of DT on enterprise competitive advantage involves multiple pathways, and the establishment of competitive advantage is not solely reliant on the application of digital technologies, meaning that it is systematically influenced by multi-dimensional factors. To overcome potential issues such as heteroscedasticity and endogeneity, the benchmark model and path analysis included as many enterprise-level and city-level control variables as possible, and an FE model was constructed. However, the broad selection of control variables has, to some extent, increased the risk of multicollinearity in the regression model and does not directly reduce the possibility of residual autocorrelation. Therefore, the multicollinearity and autocorrelation issues in the regression model are tested. The Variance Inflation Factor (VIF) is used to check for multicollinearity, and the Wooldridge test is applied to analyze serial autocorrelation in the residuals. The results are shown in Table 10. It was found that in the results of Equation (11), the average VIF of the variables ranges from 1.5 to 2, with all variables, including control variables, having VIF values less than 5. Additionally, the p-value of the Wooldridge test is greater than 10%, indicating that there are no issues of multicollinearity or autocorrelation in the regression model.

Core Variable Representation Issues. Considering that the benchmark regression uses the original value of intangible assets containing digital technology as the DT indicator, the approach overcomes potential biases inherent in word frequency statistical methods and asset ratio methods. However, it may reduce the credibility of the results in traditional samples. Using the price markup to calculate enterprise competitive advantage, we avoid the issue of missing data for non-listed companies and difficulties in estimating marginal costs in methods such as the industry concentration approach and the Lerner index. However, it may weaken the direct representation of competitive advantage. Therefore, the explanatory variables are replaced by the proportion of intangible assets associated with digital technology in the enterprise, the frequency of digital technology-related keywords in the annual report1, and the explained variable is replaced by the market share calculated from the main business income and from the total assets at the end of the year. The robustness of the benchmark regression model is tested. The results are shown in Table 11. Columns (1) and (2) present the robustness results when replacing the DT indicator, and Columns (3) and (4) present the results when using the new indicators to measure enterprise competitive advantage. The positive correlation between DT and enterprise competitive advantage remains valid through the robustness test of replacing the core variables.

Table 11.

Robustness test of replaced core variables and the regression model.

Extreme Value Issues. The median regression and truncated regression methods are used for testing. Although the data have been standardized, a small number of extremely large or small values exist in the sample, which means that regression models based on mean regression may be affected by extreme values, leading to bias in the results. Therefore, median regression and a method of removing the extreme values of the CA indicator at the 1% threshold are used for robustness testing. The results are shown in Columns (5) and (6) of Table 11. The conclusions of the benchmark regression remain robust after removing the influence of extreme values in the objective data.

6. Discussion

6.1. Key Findings

This study constructed a theoretical model and three econometric models to analyze the role of BMI in the DT process of manufacturing enterprises from both a theoretical framework and an empirical evidence perspective. (a) We explored the theoretical mechanisms based on the inferences from the MSES model. The model illustrates the mechanism through which DT in manufacturing enterprises reduces transaction costs, facilitates BMI, and ultimately enhances CA. (b) We constructed an FE model and applied econometric methods to study the impact of DT on the competitiveness of manufacturing enterprises. The findings indicate that the DT significantly increases the markup of enterprises. (c) We used a chain mediation effect model to test the role of BMI in this process. The results show a sequential relationship between the reduction in transaction costs and the emergence of BMI. (d) We considered the spillover of BMI between enterprises (Park & Yi, 2024). The findings show that the rapid spillover of BMI across enterprises may constrain the enhancement of competitive advantage.

The study focused on the role of BMI in the DT process of manufacturing enterprises. We found that BMI is a crucial mediating factor in how DT enhances CA. DT improves transaction efficiency and reduces TC. The reduction in TC leads to improvements or restructuring of value creation methods, achieving BMI. The BMI, in turn, enhances market competitiveness, promoting the CA of the enterprises. This viewpoint can be corroborated by recent studies (X. Sun et al., 2024; Mikalef & Pateli, 2017), which affirm the significant role of BMI in the development of enterprises in the digital age.

The study further suggests that competitive imitation by other enterprises of BMI may limit the expansion of the enterprise. This conclusion implies that, although enterprises can maintain the exclusivity of DT results in the short term, the improvements in production organization and supply chain optimization brought about by BMI will be observed and imitated (Climent et al., 2024). This imitation behavior can weaken entry barriers for external enterprises and intensify cross-industry competition (Li et al., 2024), negatively impacting the effectiveness of enterprise DT. However, when viewed from an industry-wide perspective, this finding also implies that BMI can serve as a conduit for knowledge spillovers, ultimately contributing to the collective advancement of the industry (Posen et al., 2023). As such, our study offers a novel perspective on business model innovation in the digital era and provides policy insights for governments and industry regulators seeking to promote innovation diffusion and sustainable industrial transformation.

In terms of overall effects, despite the various challenges faced by the DT of manufacturing enterprises (Chavez et al., 2023) digital technologies continue to play an important role in the pursuit of competitive advantage (Johns, 2022). This finding aligns with existing research (Omidvar et al., 2025), which has affirmed the role of digital technologies in the growth and development of manufacturing enterprises. However, this does not imply that the observed pattern will remain unchanged. It is important to note that DT in most manufacturing enterprises remains at a relatively early stage (Zhao & Li, 2024). At this stage, the spillover effects of digital achievements such as BMI across industries are not yet prominent. As DT progresses, two issues may become increasingly salient: whether enterprises can sustain a high return on digital investment, and whether enhanced information flow will intensify the negative impacts of competitive imitation. Both issues may shape the direction and evolution of future research.

6.2. Theoretical Implications

The study has certain theoretical significance. First, it supplements and refines a possible theoretical framework for analyzing the growth of manufacturing economies or enterprises in the digital age. Most existing studies remain at the level of literature reviews, case summaries, or empirical descriptions (Hanelt et al., 2021). By contrast, this study develops a formal mathematical model. Existing research has proposed many insights and views on the pathways through which DT affects enterprises, such as production efficiency, management efficiency, and innovation performance (Peng & Tao, 2022; Omidvar et al., 2025). However, we argue that these pathways have complex interdependencies. Including all such factors in a theoretical model may result in logical inconsistencies. Therefore, the model focuses only on the ability of DT to eliminate information asymmetry. This modeling strategy reduces the impact of excessive assumptions on theoretical inference.

Second, the study explores the mathematical and econometric aspects of BMI in manufacturing enterprises. Many studies affirm the positive role of DT in updating the value creation methods of enterprises (X. Sun et al., 2024). However, the relationship between BMI and CA remains unclear; thus, we addressed whether the BMI brought by DT improves enterprise performance. The results confirm the mediating role of BMI between DT and CA. We conclude that digital technologies enhance CA by lowering transaction costs and promoting BMI. This viewpoint enriches theoretical perspectives on the growth and development of manufacturing enterprises in the context of the digital economy.

The study also offers a new understanding of the role of BMI in the digital economy era. Existing research has pointed out that DT in enterprises brings risks associated with privacy issues (Björkdahl, 2020; Buer et al., 2021). These risks may enhance the competitive capabilities of potential competitors. Based on these points, the study further focuses on the demonstration effect of BMI (Climent et al., 2024). We find that BMI is more easily observed and imitated compared with other changes. This means the BMI can become a window for knowledge spillovers in manufacturing. Although imitation of BMI may impose some constraints on the development of the first innovating enterprises, this phenomenon could drive the overall transformation and vitality enhancement of the industry.

6.3. Practical Implications

The study reveals the distinctive features of DT in the manufacturing sector. The BMI provides an entry point for competitors to observe and imitate successful practices (Posen et al., 2023). This imitation may accelerate knowledge spillovers across the industry and intensify market competition; in other words, competitive imitation constrains the sustained expansion of CA for any single firm. Therefore, to foster the development of manufacturing, governments should not only support firm-level digital investment but also recognize the strategic role of BMI in promoting sector-wide progress.

In terms of enterprises, more effort should be made to direct DT outcomes toward production and operational scenarios. Our findings indicate that manufacturing enterprises expand CA by reducing transaction costs through DT and implementing BMI. Thus, breakthroughs in production and operational scenarios should be prioritized to form new growth momentum. Policies such as subsidies for digital equipment can accelerate the digital upgrade of production assets. Additionally, governments may support short-term financing and leasing solutions to promote lightweight industrial platform software among manufacturing enterprises, thereby lowering the cost of experimentation and transition.

In terms of market governance, special attention should be paid to facilitating entry and exit mechanisms in the manufacturing sector. The imitation of BMI by competitors can stimulate market vitality. A key condition for this process is the existence of smooth entry and exit mechanisms (Yang & Deng, 2024). Governments should thus focus on removing outdated barriers to market access and withdrawal in the manufacturing sector. This includes establishing clear and fair access rules as well as streamlining approval processes. At the same time, a flexible exit mechanism should be established to prevent non-competitive enterprises from inefficiently occupying production resources.

7. Conclusions, Contributions, and Future Research

This study investigates the role of BMI in the digital era by integrating theoretical modeling and empirical analysis. A theoretical framework linking DT to CA is developed based on an MSES model. Using fixed-effects, mediation-effects, and moderation-effects models, we confirm the existence of a transmission mechanism whereby DT reduces TC, thereby enabling BMI. This mechanism mediates the establishment of CA from DT. In addition, we find that competitive imitation by peer enterprises can weaken the CA achieved through DT.

The study makes three main contributions. First, it enriches the theoretical understanding of the economic benefits of DT for manufacturing enterprises by incorporating digital technologies into the MSES model. This provides a theoretical foundation for explaining how DT fosters BMI and enhances CA. Second, it clarifies the relationship between business model innovation and competitive advantage. BMI in manufacturing enterprises is identified and quantified by analyzing changes across production, transaction, and pricing functions, and its mediating role between DT and CA is empirically tested. Third, we propose a new perspective on BMI in the digital age by incorporating the observation and imitation behavior of competitors. This imitation helps explain the failure of DT in certain manufacturing contexts and suggests that BMI may serve as a channel for knowledge spillover. This perspective offers a novel lens for understanding the broader implications of BMI.

However, the study has some limitations, providing areas for future research. First, the study focuses on listed companies. However, under the strict Initial Public Offering (IPO) policies in China, listed companies are more likely to reflect oligopolistic monopolies within their respective sub-sectors. There remains untapped potential in the vast number of small enterprises (M. Chen et al., 2024). Future researchers could consider conducting field studies targeting small enterprises. Second, the construction of the BMI indicator primarily relies on the use of proxy variables. Because of limitations in data disclosure by listed companies, we have to determine the degree of BMI from the operational outcomes results. Future studies may improve upon this by using more detailed firm-level data. Additionally, future research could benefit from the perspective of Life Cycle Theory. As DT progresses, the returns on digital investment may exhibit diminishing marginal productivity or other nonlinear effects.

Author Contributions

Conceptualization, S.Z. and Y.Z.; methodology, S.Z.; software, S.Z.; validation, S.Z. and Y.Z.; formal analysis, S.Z.; investigation, S.Z.; resources, S.Z.; data curation, S.Z.; writing—original draft preparation, S.Z.; writing—review and editing, S.Z.; visualization, S.Z.; supervision, Y.Z.; project administration, Y.Z.; funding acquisition, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (24BJY018) and the Fundamental Research Funds for the Central Universities of China (2023JBWB001).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data presented in the study are openly available in [data-for-me] at [https://github.com/zheng3qiang666/data-for-me.git] (accessed on 9 June 2025).

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| BMI | Business Model Innovation |

| CA | Competitive Advantage/Advantages |

| DT | Digital Transformation |

| 2SLS | Two-Stage Least Squares |

| MSES | Multi-Structural Economic System |

| TC | Transaction Costs |

Note

| 1 | Referring to the method of F. Wu et al. (2021), we use the proportion of digital technology-related nouns in the annual report to the total nouns as an indicator, then apply Min–Max Normalization to the variable. |

References

- Abrell, T., Pihlajamaa, M., Kanto, L., Vom Brocke, J., & Uebernickel, F. (2016). The role of users and customers in digital innovation: Insights from B2B manufacturing firms. Information & Management, 53(3), 324–335. [Google Scholar] [CrossRef]

- Amir, R., & Lazzati, N. (2011). Network effects, market structure and industry performance. Journal of Economic Theory, 146(6), 2389–2419. [Google Scholar] [CrossRef]

- Ancillai, C., Sabatini, A., Gatti, M., & Perna, A. (2023). Digital technology and business model innovation: A systematic literature review and future research agenda. Technological Forecasting and Social Change, 188, 122307. [Google Scholar] [CrossRef]

- Banga, K. (2022). Digital technologies and product upgrading in global value chains: Empirical evidence from Indian manufacturing firms. The European Journal of Development Research, 34(1), 77–102. [Google Scholar] [CrossRef]

- Bertschek, I., & Kaiser, U. (2004). Productivity effects of organizational change: Microeconometric evidence. Management science, 50(3), 394–404. [Google Scholar] [CrossRef]

- Bhandari, K. R., Zámborský, P., Ranta, M., & Salo, J. (2023). Digitalization, internationalization, and firm performance: A resource-orchestration perspective on new OLI advantages. International Business Review, 32(4), 102135. [Google Scholar] [CrossRef]

- Bielig, A. (2023). The propensity to patent digital technology: Mirroring digitalization processes in Germany with intellectual property in a European perspective. Journal of the Knowledge Economy, 14(3), 2057–2080. [Google Scholar] [CrossRef] [PubMed]

- Björkdahl, J. (2020). Strategies for digitalization in manufacturing firms. California Management Review, 62(4), 17–36. [Google Scholar] [CrossRef]

- Black, S. E., & Lynch, L. M. (2001). How to compete: The impact of workplace practices and information technology on productivity. Review of Economics and Statistics, 83(3), 434–445. [Google Scholar] [CrossRef]

- Brettel, M., Strese, S., & Flatten, T. C. (2012). Improving the performance of business models with relationship marketing efforts—An entrepreneurial perspective. European Management Journal, 30(2), 85–98. [Google Scholar] [CrossRef]

- Buer, S. V., Strandhagen, J. W., Semini, M., & Strandhagen, J. O. (2021). The digitalization of manufacturing: Investigating the impact of production environment and company size. Journal of Manufacturing Technology Management, 32(3), 621–645. [Google Scholar] [CrossRef]

- Cai, J., Sharkawi, I., & Taasim, S. I. (2024). How does digital transformation promote supply chain diversification? From the perspective of supply chain transaction costs. Finance Research Letters, 63, 105399. [Google Scholar] [CrossRef]

- Cantwell, J., & Vertova, G. (2004). Historical evolution of technological diversification. Research Policy, 33(3), 511–529. [Google Scholar] [CrossRef]

- Chandler, G. N., Broberg, J. C., & Allison, T. H. (2014). Customer value propositions in declining industries: Differences between industry representative and high-growth firms. Strategic Entrepreneurship Journal, 8(3), 234–253. [Google Scholar] [CrossRef]

- Chavez, C. A. G., Unamuno, G., Despeisse, M., Johansson, B., Romero, D., & Stahre, J. (2023). Analyzing the risks of digital servitization in the machine tool industry. Robotics and Computer-Integrated Manufacturing, 82, 102520. [Google Scholar] [CrossRef]

- Chen, M., Sui, Y., & Liu, Y. (2024). Regional development and its spatial structure in the information age. In The transforming spatial organization in the information age. Springer Nature. [Google Scholar] [CrossRef]

- Chen, S., & Zhang, H. (2021). Does digital finance promote manufacturing servitization: Micro evidence from China. International Review of Economics & Finance, 76, 856–869. [Google Scholar] [CrossRef]

- Chen, Y., & Guo, H. (2024). Corporate performance: Green supply chain management, digital transformation and carbon neutrality. Management Decision, 63, 2432–2451. [Google Scholar] [CrossRef]

- Chen, Y., & Zeng, F. (2022). Dark side of digitalisation: Discussion on digital assets leakage and its protection mechanisms in operations and supply chain research. In responsible innovation management (pp. 65–78). Springer Nature. [Google Scholar] [CrossRef]

- Choi, J. P., Jeon, D. S., & Kim, B. C. (2019). Privacy and personal data collection with information externalities. Journal of Public Economics, 173, 113–124. [Google Scholar] [CrossRef]

- Ciampi, F., Demi, S., Magrini, A., Marzi, G., & Papa, A. (2021). Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. Journal of Business Research, 123, 1–13. [Google Scholar] [CrossRef]

- Climent, R. C., Haftor, D. M., & Staniewski, M. W. (2024). AI-enabled business models for competitive advantage. Journal of Innovation & Knowledge, 9(3), 100532. [Google Scholar] [CrossRef]

- Cutolo, D., & Kenney, M. (2021). Platform-dependent entrepreneurs: Power asymmetries, risks, and strategies in the platform economy. Academy of Management Perspectives, 35(4), 584–605. [Google Scholar] [CrossRef]

- Dewan, S., & Kraemer, K. L. (2000). Information technology and productivity: Evidence from country-level data. Management Science, 46(4), 548–562. [Google Scholar] [CrossRef]

- Di Silvestre, M. L., Favuzza, S., Sanseverino, E. R., & Zizzo, G. (2018). How Decarbonization, Digitalization and Decentralization are changing key power infrastructures. Renewable and Sustainable Energy Reviews, 93, 483–498. [Google Scholar] [CrossRef]

- Duffy, J., & Ralston, J. (2020). Innovate versus imitate: Theory and experimental evidence. Journal of Economic Behavior & Organization, 177, 727–751. [Google Scholar] [CrossRef]

- Fan, H. J., Wu, T., & He, S. (2023). Research on the industrial chain linkage effect of enterprise digitalization. China Industrial Economics, 3, 115–132. [Google Scholar] [CrossRef]

- Fast, V., Schnurr, D., & Wohlfarth, M. (2023). Regulation of data-driven market power in the digital economy: Business value creation and competitive advantages from big data. Journal of Information Technology, 38(2), 202–229. [Google Scholar] [CrossRef]

- Foresman, T. W. (2016, July 7–8). Beyond Moore’s law: Harnessing spatial-digital disruptive technologies for digital earth. In IOP conference series: Earth and environmental science (Vol. 46, No. 1, p. 012055). IOP Publishing. [Google Scholar] [CrossRef]

- Forkmann, S., Ramos, C., Henneberg, S. C., & Naudé, P. (2017). Understanding the service infusion process as a business model reconfiguration. Industrial Marketing Management, 60, 151–166. [Google Scholar] [CrossRef]

- Freisinger, E., Heidenreich, S., Landau, C., & Spieth, P. (2021). Business model innovation through the lens of time: An empirical study of performance implications across venture life cycles. Schmalenbach Journal of Business Research, 73(3), 339–380. [Google Scholar] [CrossRef]

- Fu, Q. (2022). How does digital technology affect manufacturing upgrading? Theory and evidence from China. PLoS ONE, 17(5), e0267299. [Google Scholar] [CrossRef] [PubMed]

- Gao, J., Zhang, W., Guan, T., Feng, Q., & Mardani, A. (2023). The effect of manufacturing agent heterogeneity on enterprise innovation performance and competitive advantage in the era of digital transformation. Journal of Business Research, 155, 113387. [Google Scholar] [CrossRef]

- Gawer, A. (2021). Digital platforms’ boundaries: The interplay of firm scope, platform sides, and digital interfaces. Long Range Planning, 54(5), 102045. [Google Scholar] [CrossRef]

- Gelbach, J. B. (2016). When do covariates matter? And which ones, and how much? Journal of Labor Economics, 34(2), 509–543. [Google Scholar] [CrossRef]

- Gu, L., & Zhang, X. (2024). Motivations, mechanisms, and paths of business model innovation driven by the digital economy. Frontiers of Business Research in China, 18(2), 83–94. [Google Scholar] [CrossRef]

- Gulbrandsen, B., Lambe, C. J., & Sandvik, K. (2017). Firm boundaries and transaction costs: The complementary role of capabilities. Journal of Business Research, 78, 193–203. [Google Scholar] [CrossRef]

- Guo, B., Pang, X., & Li, W. (2018). The role of top management team diversity in shaping the performance of business model innovation: A threshold effect. Technology Analysis & Strategic Management, 30(2), 241–253. [Google Scholar] [CrossRef]

- Han, X., & Zhang, J. (2022). Business model innovation paths of manufacturing oriented towards green development in digital economy. International Journal of Environmental Research and Public Health, 19(24), 16454. [Google Scholar] [CrossRef] [PubMed]

- Hanelt, A., Firk, S., Hildebrandt, B., & Kolbe, L. M. (2021). Digital M&A, digital innovation, and firm performance: An empirical investigation. European Journal of Information Systems, 30(1), 3–26. [Google Scholar] [CrossRef]

- Horvat, D., Kroll, H., & Jäger, A. (2019). Researching the effects of automation and digitalization on manufacturing companies’ productivity in the early stage of industry 4.0. Procedia Manufacturing, 39, 886–893. [Google Scholar] [CrossRef]

- Huang, Q., Yu, Y., & Zhang, S. (2019). The development of the internet and the improvement of manufacturing productivity: The intrinsic mechanism and Chinese experience. China Industrial Economics, 8, 5–23. [Google Scholar] [CrossRef]

- Ibarra, D., Ganzarain, J., & Igartua, J. I. (2018). Business model innovation through Industry 4.0: A review. Procedia Manufacturing, 22, 4–10. [Google Scholar] [CrossRef]

- Johns, J. (2022). Digital technological upgrading in manufacturing global value chains: The impact of additive manufacturing. Global Networks, 22(4), 649–665. [Google Scholar] [CrossRef]

- Joskow, P. L. (1988). Asset specificity and the structure of vertical relationships: Empirical evidence. The Journal of Law, Economics, and Organization, 4(1), 95–117. [Google Scholar] [CrossRef]

- Kermani, A., & Ma, Y. (2023). Asset specificity of nonfinancial firms. The Quarterly Journal of Economics, 138(1), 205–264. [Google Scholar] [CrossRef]

- Kim, J. H. (2018). Asset specificity and firm value: Evidence from mergers. Journal of Corporate Finance, 48, 375–412. [Google Scholar] [CrossRef]

- Kiveu, M. N., Namusonge, M., & Muathe, S. (2019). Effect of innovation on firm competitiveness: The case of manufacturing SMEs in Nairobi County, Kenya. International Journal of Business Innovation and Research, 18(3), 307–327. [Google Scholar] [CrossRef]

- Li, Y. (2025). Literature review on business model innovation: Digital technology perspective and suggestions for future research. SAGE Open, 15(2), 21–58. [Google Scholar] [CrossRef]

- Li, Y., Cui, L., Wu, L., Lowry, P. B., Kumar, A., & Tan, K. H. (2024). Digitalization and network capability as enablers of business model innovation and sustainability performance: The moderating effect of environmental dynamism. Journal of Information Technology, 39(4), 687–715. [Google Scholar] [CrossRef]

- Loecker, J. D., & Warzynski, F. (2012). Markups and firm-level export status. American Economic Review, 102(6), 2437–2471. [Google Scholar] [CrossRef]

- Mahesh, P., Tiwari, A., Jin, C., Kumar, P. R., Reddy, A. N., Bukkapatanam, S. T., Gupta, N., & Karri, R. (2020). A survey of cybersecurity of digital manufacturing. Proceedings of the IEEE, 109(4), 495–516. [Google Scholar] [CrossRef]

- Meier, H., & Massberg, W. (2004). Life cycle-based service design for innovative business models. CIRP Annals, 53(1), 393–396. [Google Scholar] [CrossRef]

- Mikalef, P., & Pateli, A. (2017). Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. Journal of Business Research, 70, 1–16. [Google Scholar] [CrossRef]

- Miller, S. M. (2004). New classical versus neoclassical frameworks: A review of Yang. Journal of Economic Behavior & Organization, 55(2), 175–185. [Google Scholar] [CrossRef]

- Mittra, J., Tait, J., Mastroeni, M., Turner, M. L., Mountford, J. C., & Bruce, K. (2015). Identifying viable regulatory and innovation pathways for regenerative medicine: A case study of cultured red blood cells. New Biotechnology, 32(1), 180–190. [Google Scholar] [CrossRef] [PubMed]

- Montemari, M., Taran, Y., Schaper, S., Nielsen, C., Thomsen, P., & Sort, J. (2024). Business model innovation or business model imitation–That is the question. Technology Analysis & Strategic Management, 36(3), 393–407. [Google Scholar] [CrossRef]