The empirical analysis was conducted separately for agricultural and food industry enterprises to account for potential sectoral differences in profitability and circular economy performance.

4.1. Agricultural Enterprises

Before estimating the econometric models, descriptive statistics were calculated to provide an overview of the main characteristics of the variables used in the analysis (

Table 2). The dataset refers to Serbian agricultural enterprises for the period 2014–2021 and includes financial indicators, macroeconomic variables, and circular economy metrics.

Table 2 presents the descriptive statistics for agricultural enterprises in Serbia during the 2014–2021 period. The average return on assets (ROA) is 4.5%, with a median of 2.7%, indicating a right-skewed distribution. Most firms achieve modest profitability, while a small subset reports exceptionally high returns. The leverage ratio (LEV) exhibits substantial variability (SD = 178.72), confirming substantial heterogeneity in firms’ capital structures. The mean debt ratio (DEBT) equals 0.50, suggesting that, on average, half of total assets are financed through debt. The tangibility ratio (TANG), with a mean of 0.40, reflects the capital-intensive nature of agricultural production, where physical assets dominate. Macroeconomic indicators show relative stability, with an average GDP growth rate of 2.6% and inflation averaging 2.1%. These results indicate that the broader economic environment was stable but not dynamic enough to stimulate profitability growth strongly. Circular economy indicators display considerable variation. CE1 (representing the level of by-products or residues generated) averages 332, and CE2 (recycling and recovery rate) shows high dispersion (SD = 6.81). At the same time, CE3 (resource efficiency or emission performance) remains relatively stable with a mean of 7700. The pronounced heterogeneity in CE2 values indicates that only a limited number of firms consistently apply advanced circular practices, while the majority still operate under conventional production models.

The descriptive statistics revealed a wide dispersion in the leverage ratio (LEV), driven by a few extreme values. These cases correspond to firms with very low or negative equity, resulting in exceptionally high liabilities-to-equity ratios. Such instances reflect genuine financial distress rather than input errors. To limit their impact, all continuous variables were winsorized at the 1st and 99th percentiles.

To explore the interrelationships among the examined variables and identify potential multicollinearity issues before model estimation, a correlation matrix was computed, with detailed results presented in

Appendix A (

Table A1).

The correlation results indicate several expected patterns. Profitability (ROA) shows a negative correlation with the debt ratio (DEBT; r = −0.19), suggesting that firms with higher financial leverage tend to exhibit lower profitability. This finding aligns with prior empirical research on agricultural enterprises, which shows that excessive borrowing often increases financial risk and reduces liquidity. The relationship between ROA and tangibility (TANG) is weak (r = −0.02), implying that asset composition exerts only a limited direct effect on profitability. Similarly, macroeconomic variables—GDP growth and inflation (CPI) show low correlations with firm-level indicators, confirming that internal rather than external factors primarily drive profitability fluctuations. Among the circular economy indicators, CE1 (by-product generation) is positively correlated with CE2 (r = 0.47) and CE3 (r = 0.32), suggesting that firms generating higher quantities of by-products also tend to engage more actively in recovery and efficiency-enhancing practices. Furthermore, ROA exhibits a moderate positive correlation with CE2 (r = 0.21), indicating that enterprises adopting recycling and reuse measures may achieve superior financial outcomes. Overall, the relatively low correlation coefficients across most variables suggest the absence of serious multicollinearity, which is further confirmed by subsequent VIF diagnostics. This confirms that the variables included in the regression model capture distinct economic dimensions without redundancy.

Before proceeding with regression estimation, it was essential to examine the time-series properties of the variables used in the model. Non-stationary variables can produce spurious relationships and biased coefficient estimates. Therefore, panel unit root tests were applied to determine whether the series were stationary over the observed period. The Im-Pesaran-Shin (IPS) test was chosen, as it allows for individual unit root processes and is suitable for unbalanced panels with heterogeneous dynamics.

Table 3 summarizes the results of the stationarity analysis for all variables.

The results presented in

Table 3 indicate that most firm-level variables, such as ROA, LEV, DEBT, TANG, CE1, and CE3, are stationary at the level, as evidenced by statistically significant IPS test statistics (

p < 0.05). This suggests that their mean and variance remain stable over time, implying that these variables revert to equilibrium after short-term fluctuations. In contrast, the macroeconomic variables GDP and inflation (INF), as well as the circular economy indicator CE2, are non-stationary (

p > 0.10). Their non-stationarity likely reflects broader economic trends and gradual structural changes rather than firm-specific short-term variations. To address this issue, CE2 was transformed into its first difference (ΔCE2 = CE2 − lag(CE2)), after which the differenced series was confirmed to be stationary. This adjustment ensured that all variables in the econometric model met the stationarity requirement, preventing spurious correlations. Overall, these findings confirm that profitability and firm-level financial indicators exhibit stable behavior over time, while macroeconomic and policy-related factors display persistence typical of aggregate economic processes.

After confirming the stationarity of the variables and transforming the non-stationary series, a dynamic panel data model was estimated to analyze the determinants of profitability in agricultural enterprises. In this process, both the inflation rate (CPI) and asset tangibility (TANG) were excluded from the final model specification. The CPI variable, although conceptually relevant as a proxy for price stability, was found to be non-stationary according to the Im-Pesaran-Shin (IPS) test (

p = 0.176). Including it in the dynamic model led to weak instrumentation and instability due to its limited within-firm variation, which is typical of macro-level variables (

Bond, 2002;

Roodman, 2009). The variable TANG, while stationary, was consistently insignificant across preliminary estimations and showed a strong correlation with leverage (LEV) and the debt ratio (DEBT), leading to inflated standard errors and reduced estimator efficiency. Therefore, both variables were excluded in accordance with the parsimony principle to improve the robustness and interpretability of the final GMM specification (

Baltagi, 2021;

Wooldridge, 2019). Given the potential endogeneity of explanatory variables such as leverage (LEV), debt ratio (DEBT), and circular economy indicators (CE1-CE3), the Arellano–Bond Generalized Method of Moments (GMM) estimator was employed. This approach effectively controls for unobserved heterogeneity, simultaneity bias, and autocorrelation by using lagged values of endogenous variables as instruments.

Table 4 presents the estimated coefficients, standard errors, z-values, and significance levels for the dynamic GMM model, along with key diagnostic tests assessing instrument validity and serial correlation.

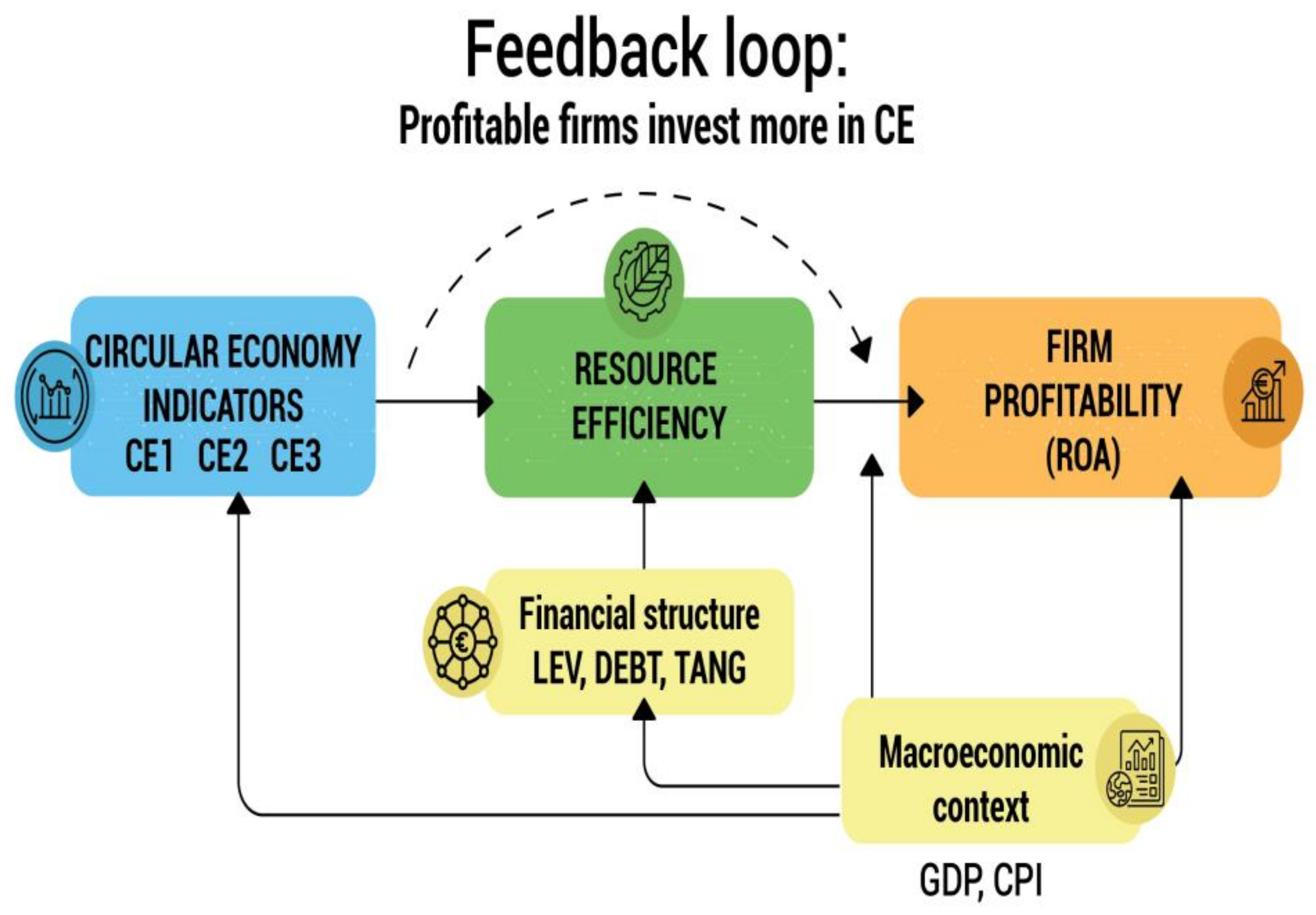

The results of the Arellano–Bond dynamic GMM estimation offer deeper insights into the financial and circular determinants of profitability in Serbian agricultural enterprises. The lagged dependent variable (lag(ROA,1)) is positive but statistically insignificant—an expected finding in a highly competitive, policy-sensitive sector such as agriculture. Regarding internal financial factors, leverage (LEV) shows a positive and significant association with profitability (p < 0.01), indicating that moderate indebtedness may enhance profitability by improving capital utilization efficiency. Conversely, the debt ratio (DEBT) shows a pronounced adverse effect (p < 0.001), confirming that excessive financial exposure undermines liquidity and reduces firms’ ability to maintain stable profit margins. Macroeconomic dynamics, as reflected in GDP growth, positively affect profitability (p < 0.001), suggesting that periods of economic expansion stimulate agricultural output and financial performance. The circular economy indicators reveal heterogeneous impacts. CE1 (waste reduction and by-product management) is negatively associated with ROA (p < 0.001), indicating that initial investments in resource efficiency may temporarily reduce profitability. In contrast, CE2 (recycling and reuse rate) and CE3 (resource efficiency or emission performance) are both positive and significant (p < 0.001 and p < 0.01, respectively), suggesting that advanced circular practices contribute to long-term cost reduction, competitiveness, and overall financial resilience.

Diagnostic tests confirm the robustness of the model. The Hansen J test (χ2(98) = 50.80, p = 0.999) confirmed the joint validity of the instruments, indicating that they are appropriate and not over-specified. The number of instruments (306) remained lower. than the number of cross-sectional units, reducing the risk of instrument proliferation. The AR(1) test detects first-order autocorrelation, expected in differenced panels, and the AR(2) test confirms the absence of higher-order serial correlation. Finally, the Wald test (p < 0.001) validates the joint significance of all regressors.

Overall, the results highlight that both financial structure and circular economy practices jointly shape the profitability of agricultural enterprises. Firms adopting recycling and efficiency-enhancing strategies tend to achieve superior performance, while excessive indebtedness undermines returns. These findings reinforce the dual necessity of prudent financial management and sustainable resource utilization as key pillars of competitiveness and long-term resilience in the agricultural sector.

Robustness Analysis (Agricultural Enterprises)

To ensure the reliability and stability of the estimated results, several robustness checks were performed. The analysis included the Variance Inflation Factor (VIF) test to assess multicollinearity among explanatory variables, as well as the estimation of a Fixed-Effects (FE) model as a static counterpart to the dynamic GMM model. An additional attempt to estimate a Random Effects model resulted in a singular matrix, confirming that firm-specific heterogeneity is better captured by fixed- or dynamic-effect estimators.

The VIF test results, presented in

Table 5, show that all values are well below the critical threshold of 10, indicating that multicollinearity is not a significant concern in the estimated model. In addition to VIF values, tolerance (TOL) values, calculated to confirm further independence of the explanatory variables. Tolerance values close to 1 suggest a low degree of linear dependence, while values below 0.1 would indicate potential multicollinearity.

The highest VIF values were as observed for CE1 (6.86) and CE2 (6.63), reflecting a moderate degree of correlation among circular economy indicators, as expected given their conceptual interdependence. However, the corresponding tolerance values (0.146 and 0.151) remain above the conventional lower limit of 0.1, confirming that multicollinearity does not bias the estimation. Low VIF and high tolerance values for financial indicators (LEV = 1.01; DEBT = 1.01) and macroeconomic variables (GDP = 1.33; CE3 = 1.28) further confirm that each regressor contributes independent explanatory power. These results suggest that the estimated coefficients are stable, and the observed relationships between financial structure, circular practices, and profitability remain statistically reliable and unaffected by multicollinearity.

To further verify the robustness of the dynamic specification, a Fixed-Effects (FE) specification was estimated to test whether the signs and statistical significance of the coefficients remained consistent across different estimation techniques. The FE specification controls for unobserved, time-invariant heterogeneity such as managerial efficiency, production technology, or regional characteristics that could bias coefficient estimates if omitted.

Table 6 reports the results of the FE model for agricultural enterprises.

The Fixed-Effects estimation confirms the robustness of the main findings obtained from the dynamic GMM model. The coefficients of the key variables DEBT, CE1, CE2, and CE3 retain their direction and statistical significance, confirming that the identified relationships between financial structure, circular economy indicators, and profitability are not dependent on the estimation technique. Specifically, the negative for DEBT (p < 0.001) reaffirms that excessive indebtedness constrains profitability by increasing financial risk and limiting liquidity. The coefficient of CE1 remains negative and significant (p < 0.01), indicating that waste reduction and resource management efforts may temporarily elevate operational costs. Conversely, CE2 (p < 0.05) and CE3 (p < 0.001) continue to exert positive effects on profitability, suggesting that firms efficiency practices gain long-term competitive advantages through lower costs and improved performance stability. The insignificance of LEV and GDP in the static model suggests that short-term leverage adjustments and macroeconomic fluctuations are better captured by dynamic specifications, which reinforces the appropriateness of the GMM estimator for this dataset.

Taken together, the robustness checks confirm the validity and internal consistency of the econometric results obtained for agricultural enterprises. The absence of multicollinearity among explanatory variables, as demonstrated by the VIF and tolerance values, ensures the stability of parameter estimates. At the same time, the consistency of results between the GMM and FE models further reinforces their reliability. These findings indicate that both financial structure and circular economy practices are fundamental determinants of profitability in the Serbian agricultural sector. Enterprises that strategically integrate resource efficiency and circular innovations tend to achieve superior long-term financial performance, highlighting the importance of combining economic and environmental sustainability in the agri-food system.

The subsequent section applies the same analytical framework to the food industry, enabling a comparative assessment of financial and circular performance across different segments of the agri-food value chain.

4.2. Food Industry Enterprises

Before estimating the econometric models for food industry enterprises, descriptive statistics were computed to provide an overview of the main characteristics of the variables used in the analysis (

Table 7). The dataset covers the period 2014–2021 and includes profitability indicators, financial structure ratios, macroeconomic variables, and circular economy metrics for 319 Serbian food processing companies. Compared to agricultural enterprises, food industry firms operate in a more integrated value chain, have better market access, and typically achieve higher profitability due to the added value generated through processing and branding activities.

The descriptive statistics in

Table 7 indicate that the average Return on Assets (ROA) for food industry enterprises is 6.1%, which is notably higher than in agricultural firms (4.5%). This difference reflects the greater profitability and operational stability characteristic of the food processing sector. The median value of 3.9% and the standard deviation of 6.7% suggest moderate dispersion and right skewness, indicating that most firms achieve stable returns, while a few record exceptionally high profitability. The leverage ratio (LEV) shows considerable variability (SD = 7.88), of financing structures. The mean debt ratio (DEBT) equals 0.50, implying that, on average; half of the assets are financed through external debt.

The tangibility (TANG) ratio, with a mean of 0.42, demonstrates that the food sector remains asset-intensive, though slightly less so than agriculture, due to the inclusion of processing equipment and logistics infrastructure alongside fixed agricultural assets. Macroeconomic indicators reveal a relatively stable environment, with GDP growth averaging 2.6% and inflation at 2.1%, conditions that support predictable and long-term investment planning. Circular economy indicators display substantial heterogeneity. CE1 (by-product generation) and CE3 (resource efficiency) show relatively consistent values, whereas CE2 (recycling and recovery rate) shows substantial dispersion (SD = 6.81), suggesting unequal adoption of circular practices across companies.

Compared with agricultural enterprises, food industry firms demonstrate more structured waste and energy management systems but exhibit substantial significant differences in recycling and reuse intensity, highlighting the diverse stages of circular transition currently present within the sector.

To explore the relationships among profitability, financial indicators, macroeconomic factors, and circular economy metrics, pairwise Pearson correlation coefficients were calculated. The detailed correlation matrix is presented in

Appendix A (

Table A2).

The correlation results reveal several notable patterns. Profitability (ROA) is negatively correlated with DEBT (r = −0.30) and LEV (r = −0.10), indicating that higher indebtedness is associated with lower profitability due to greater interest expenses and repayment pressures. The correlation between ROA and TANG is weak (r = −0.11), implying that the share of tangible assets has a limited direct effect on profitability in the food industry, which relies more on efficiency and branding than on fixed assets. Among the circular economy variables, CE1 and CE2 are strongly correlated (r = 0.92), reflecting the close link between by-product generation and recycling activity. CE3 (resource efficiency) is moderately correlated with GDP (r = 0.44) and CE1 (r = 0.23), suggesting that improvements in production efficiency often accompany periods of economic expansion.

Unlike agricultural enterprises, where recycling (CE2) demonstrated a moderate association with profitability, food firms show weaker links between financial outcomes and circular indicators. This finding suggests that circular practices in food processing—while environmentally beneficial—are not yet fully monetized or reflected in financial performance.

Overall, the relatively low pairwise correlations confirm the absence of serious multicollinearity, later validated by VIF results, supporting the robustness of the subsequent econometric models.

Before proceeding to model estimation, the time-series properties of the variables were tested using the Im-Pesaran-Shin (IPS) panel unit root test (

Table 8).

The results indicate that most firm-level variables—ROA, LEV, DEBT, TANG, CE1, and CE3—are stationary at level, meaning their statistical properties remain stable over time. In contrast, GDP, CPI, and CE2 are non-stationary, likely reflecting longer-term structural adjustments, inflationary cycles, and gradual adoption of circular practices within the food sector. To ensure model validity, CE2 was transformed into its first difference (ΔCE2), after which the new series was confirmed to be stationary. Despite being stationary, TANG (asset tangibility) and CPI (inflation rate) were excluded from the final model for two methodological reasons. First, diagnostic pre-tests revealed a high correlation between TANG and LEV/DEBT, indicating that asset structure is already indirectly captured through leverage indicators, which could introduce multicollinearity and distort coefficient estimates. Second, CPI exhibited a strong correlation with GDP and other macroeconomic variables, leading to model instability in preliminary estimations.

To prevent redundancy and ensure estimator efficiency, these variables were omitted, consistent with previous studies that reported similar collinearity issues in profitability models using firm-level data (

Baltagi, 2021;

Gujarati & Porter, 2009;

Hair et al., 2019).

After confirming stationarity and refining the variable set, a dynamic panel data model was estimated (

Table 9) to analyze the determinants of profitability in food industry enterprises. Given the potential endogeneity of variables such as leverage, debt ratio, and circular economy indicators, the two-step Arellano–Bond Generalized Method of Moments (GMM) estimator was applied. This approach effectively controls for unobserved heterogeneity, simultaneity bias, and autocorrelation by using lagged values of endogenous variables as instruments.

The results of the dynamic GMM model offer valuable insights into the determinants of profitability among food industry firms. The lagged ROA term (p < 0.001) is positive and highly significant, indicating strong profit persistence and confirming that past profitability serves as a reliable predictor of future performance. Both leverage (LEV) and debt ratio (DEBT) exhibit significant, adverse effects, emphasizing that excessive reliance on debt financing weakens financial stability. The negative coefficient of CE3 (p < 0.01) suggests that investments in cleaner technologies and energy-efficient machinery may initially reduce profit margins due to high capital costs and delayed payback periods. The insignificant effects of CE1 and ΔCE2 imply that short-term changes in by-product utilization and recycling intensity have not yet translated into measurable financial gains. Overall, the model shows that profitability in food industry enterprises is primarily driven by internal financial structures and historical performance rather than macroeconomic fluctuations or short-term circular efforts.

Diagnostic tests confirm the robustness of the model. The Hansen J test (χ2(10) = 24.99, p = 1.000) indicates that the instruments are valid and not overidentified, confirming the reliability of the System GMM specification. A total of 319 instruments were used, which remains within acceptable limits relative to the number of cross-sectional units, ensuring that the model is not overfitted. The AR(1) test (z = −5.998, p < 0.001) detects first-order autocorrelation expected in differenced panel data, while the AR(2) test (z = 0.886, p = 0.376) confirms the absence of second-order serial correlation. The Wald test (χ2(7) = 138.33, p < 0.001) demonstrates the joint significance of all explanatory variables.

Robustness Analysis (Food Industry Enterprises)

To verify the robustness and reliability of the estimated results for food industry enterprises, several diagnostic tests were performed. The Variance Inflation Factor (VIF) test was first applied to detect possible multicollinearity among the explanatory variables. In addition, a Fixed-Effects (FE) model was estimated as a static complement to the dynamic GMM model to verify whether the direction, magnitude, and statistical significance of the coefficients remained stable across specifications. Finally, a Random Effects (RE) specification was attempted in. Still, it resulted in a singular matrix, indicating that unobserved heterogeneity is better captured by fixed- or dynamic-effect estimators.

The results in

Table 10 show that all explanatory variables have VIF values well below the traditional threshold of 10, indicating no serious multicollinearity. Moderate correlations between the circular economy indicators (CE1 and CE2) are expected due to their conceptual interdependence, but their VIF values remain within acceptable bounds. Likewise, the low VIF scores for information. The financial and macroeconomic variables (LEV, DEBT, GDP, and CE3) confirm that each regressor provides unique explanatory power to the model. Therefore, the estimated coefficients can be considered stable, and the statistical inference drawn from both the dynamic and static models remains robust and reliable.

After confirming that no multicollinearity issues were present, a Fixed-Effects (FE) model was estimated to assess the robustness of the results from the dynamic specification (

Table 11). The FE estimator controls for unobserved, time-invariant firm characteristics such as managerial quality, production technology, or regional market effects that might otherwise bias coefficient estimates. Comparing the direction, magnitudes, and statistical significance of the coefficients across models allows an assessment of whether the relationships between financial indicators, circular economy variables, and profitability are consistent.

The Fixed-Effects estimation essentially confirms the results of the dynamic GMM model. The coefficient of DEBT remains strongly negative and highly significant (p < 0.001), reaffirming that excessive indebtedness diminishes profitability through higher financial costs and increased risk exposure. CE1 and CE3 retain, adverse, and significant effects, indicating that investments in waste management and energy-efficient technologies impose short-term financial burdens before generating long-term savings and competitiveness gains. Conversely, LEV, GDP, and ΔCE2 remain statistically insignificant, suggesting that short-term financial leverage adjustments and recycling intensity exert limited immediate influence on profitability when static effects are isolated.

Overall, the robustness analysis validates the internal consistency and reliability of the estimated relationships for food industry enterprises. The absence of multicollinearity, together with the stability of coefficient signs across GMM and FE models, demonstrates that the identified determinants of profitability are structurally sound. Profitability in food processing firms is thus primarily shaped by financial structure and past performance. In contrast, the, economic, and environmental longer payback periods. These findings highlight the importance of targeted policy support—such as green financing schemes, innovation incentives, and tax relief—to accelerate circular transformation and enhance the long-term sustainability and competitiveness of Serbia’s food industry.