Abstract

The performance of tax administrations (TAs) is usually described as their capacity to complete activities with the minimum of resources engaged. Accordingly, tax administration performance is a multifaceted phenomenon, and measuring and benchmarking its performance against other countries or regions remains a puzzle for researchers and practitioners. This paper introduces a new approach for measuring tax administration performance using the Composite I-Distance Indicator (CIDI) based on 11 individual performance measures from 35 European tax administrations over two consecutive years (2018–2019). For the given scores of tax administrations, we conducted a correlation analysis with (a) tax evasion loss and (b) the fiscal deficit of countries in which these tax administrations operate, aiming to assess the strength of the statistical relationship between these variables. The study highlights Denmark and the Netherlands as exemplary models for tax administration, with “Revenue Collection” being identified as a crucial driver of excellence and “Operational Performance” (such as “e-filing” and “on-time filing”) forming critical aspects of TA efficiency. Also, the study finds a negative correlation between tax avoidance and tax administration performance.

1. Introduction

The performance of tax administrations (TAs) is usually described as their capacity to complete activities with the minimum of resources engaged (Savić et al. 2015). As inferred by OECD (2011), tax administration performance depends on its internal organizational structures, allocated budgeted funds to meet new or changed priorities, utilization of novel ICT initiatives to reduce costs, and the capacity of its staff.

Accordingly, tax administration performance is a multifaceted phenomenon, and measuring and benchmarking its performance against other countries or regions remains a puzzle for researchers and practitioners (Arltová and Kot 2023; Belmonte-Martin et al. 2021). Many attempts have been made to measure the performance of tax administrations (Cordero et al. 2021; Crandall 2010; Aktaş 2023; Nguyen et al. 2020). Moreover, in the last few decades, an enormous amount of research has been carried out to explain, examine, and measure the performance of TAs (Gerritsen 2023). However, scant attention has been paid to creating any comprehensive, multiple performance measures of tax administration that could be used to measure the relative performance of tax administrations between and among countries.

Previous attempts to measure the performance of tax administrations have been either idiosyncratic or overly biased in subjective judgments, making them highly judicious and speculative. We aim to fill the lacuna in the present body of knowledge by creating a comprehensive and unbiased score for tax administration performance. The framework we proposed is rooted in the concept algorithmic governance. Algorithmic governance allows for human-free decision making, or, in our case, human-free country rankings. Our approach is based on a neutral, data-driven aggregation of individual measures into a comprehensive performance index based on a Composite I-Distance Indicator (CIDI) methodology. Concurrent literature offers a myriad of different neutral, data-driven aggregation techniques based either on statistical or machine learning approaches (Milosavljević et al. 2023a). However, these approaches are complex with hard-to-understand black boxes. The main rationale behind the selection of the CIDI as a methodology is its simplicity. Alongside the main aim, we explored the relationship between TA performance and tax avoidance.

The specific goals of our study are as follows:

- Compare the performance of TAs across the dataset of selected European tax jurisdictions and isolate the one that can serve as a role model;

- Examine the most critical driver of tax administration and where the most energy, planning, and resources should be invested;

- Examine the correlation between TA performance and tax evasion, building upon the prior works showing that, even if tax administrations improve their operations, there are exogenous factors inflating different irregularities, including tax avoidance;

- Examine the relationship between TA performance and fiscal deficit, building upon the work of Cowx et al. (2022), which shows that, when governments incur large fiscal deficits, firms avoid more taxes because they perceive that the enforcement capability of the tax authority is undermined.

To our knowledge, a study of this kind has never been conducted before. The same class of problem has already been approached in a recent survey by Milosavljević et al. (Milosavljević et al. 2023a). However, the rankings obtained from this study are based on the machine learning algorithm as described in Milosavljevic et al. (2021). It is noteworthy to mention that the CIDI methodology has been vastly used in recent studies related to the efficiency of public administration (Maricic et al. 2019; Milosavljević et al. 2019). However, it has never been applied to the analysis of tax administration performance.

Our study is motivated by the practical need to create a universal approach to measuring the performance of a very important societal structure—tax administration. Following the ideals of the New Public Management (Kostic et al. 2013), measuring the performance of public administration in an effective manner is vital for policymaking purposes (Brignall and Modell 2000).

Our paper contributes to the extant body of knowledge in several ways. First, we isolated ‘the polar star’, a tax administration that can serve as a benchmark in further studies on the efficiency, effectiveness, or different method of performance of tax administrations, a goal that has been highly valued by policymakers and scholars (Vazquez-Caro and Bird 2011). Our results show that the role model tax administration is Denmark (with SKAT as the central tax authority of Denmark). The ‘first runner-up’ in our analysis was the tax administration of the Netherlands. The results are the same for both observed years. Accordingly, the main contribution of our study is a data-driven neutral ranking. Second, we show that Value Revenue Collected is the most important group of performance drivers for efficient tax administration. Additionally, the results show that, over the two observed years, e-taxation has become more important. In contrast, human resources have become a less important determinant of the overall performance of tax administrations. Third, this study provides a novel approach to measuring the performance of tax administrations and accordingly allows for ex post analyses of public policies related to taxation. Finally, we find that our rankings have a statistically significant positive relationship with the fiscal deficits of the observed countries.

The remainder of this paper is organized as follows. The next section presents a brief literature review of tax administration and the concept of algorithmic governance. Section 3 explains the methodology of this study, outlining the analytical framework used to rank the TAs and the data sources. Section 4 shows the study results based on the CIDI methodology. Section 5 contextualizes the study findings, elaborating on key findings, contributions, and implications. Section 6 is reserved for the concluding remarks—the novelties of the approach, limitations, and further recommendations.

2. Literature Review

In this section, we first provide a literature review on the concept and importance of tax administration performance. Afterwards, we provide an explanation of the background concept for the analytical framework—algorithmic governance.

2.1. Tax Administration Performance

Efficient tax administration is crucial for economic growth and development, as it ensures that taxes are collected effectively, funds are appropriately allocated, and public services are adequately provided (Evans 2001). Even when the tax rates are high and tax perception leans towards viewing taxation as a burden, efficient tax administrations can lead towards the optimal collection of public funds (Mohammed and Tangl 2023).

The definition of efficient tax administration is still vague, and no unanimous and standardized definition of such efficiency exists. Efficiency in tax administration can be understood as the ability to collect taxes effectively, allocate funds efficiently, and provide public services adequately. This critical role of tax administration in economic and societal development has prompted the focus on measuring and improving its efficiency. However, a universally accepted definition of efficiency in tax administration is yet to be established.

Despite the lack of a standardized definition, the significance of efficient tax administration cannot be overstated. Studies have highlighted its role in stabilizing revenue generation, minimizing tax gaps, and optimizing public revenues. These approaches, while important, may not fully address the potential for enhancing taxation efficiency through improvements in tax administration performance (Taufik 2018).

In the European context, there has been a vivid debate on which tax administration has been the best-performing one. Factors such as the use of technology, organizational capacity, administrative efficiency, and the ability to reduce tax evasion have been identified as key drivers for the performance of European tax administrations (Okunogbe and Santoro 2022). Some countries have been marked as highly efficient in tax administration, such as Estonia, which has a fully digitalized tax system and efficient online services for taxpayers. Also, Nordic countries were categorized as efficient due to their effective use of technology, high administrative capacity levels, and low tax evasion rates (Hanna and Olken 2019). Conversely, some European countries, particularly new EU member states, have been criticized for their inefficient tax administration, characterized by bureaucratic processes, limited use of technology, and high levels of tax evasion. This is mainly attributed to the lack of political will, inadequate resources, perceived corruption, and ineffective governance structures (Ponomariov et al. 2017).

2.2. The Background Concept of Algorithmic Governance

The idea and the concept of algorithmic governance are only a decade old, although the roots and the idea have been present for much longer (D’Agostino and Durante 2018). The concept refers to the use of algorithms, computational models, and automated decision-making processes in the management and regulation of various aspects of society. At this point, it should be noted that we do not advise absolute automation in decision-making processes, as they can lead to a number of pitfalls (Sanchez-Graells 2024).

This concept is particularly relevant in the context of modern digital technologies and the increasing reliance on algorithms to inform or automate decision making in areas such as government, business, and social institutions. Algorithmic governance involves the use of algorithms to make decisions that were traditionally made by humans. These decisions can range from simple tasks, such as sorting and filtering data, to more complex decisions like resource allocation, policy enforcement, and risk assessment (Janssen and Kuk 2016). The system critically depends on data analysis to drive decision making. Extensive datasets are systematically analyzed to identify underlying patterns, trends, and correlations, which can subsequently inform predictive modeling or process optimization.

For the purpose of our study, the value-neutral weighting of policy choices is a particularly relevant feature of algorithmic governance. From a philosophical point of view, value-neutral strategy is restricted to data and decision outcomes, thereby omitting internal value-laden design choice points (Katzenbach and Ulbricht 2019). Traditional systems (such as the World Bank Ease of Doing Index, for instance) rely heavily on the subjective weighting of idiosyncratic performance measures. The algorithmic approach, however, allows for very efficient and expert-free, neutral decision making.

When such a concept is applied to tax administration performance measurement, it allows for the expert-neutral ranking of countries in terms of the efficiency of their tax administrations. The use of algorithms in governance has several potential benefits, including increased efficiency, objectivity, and consistency in decision-making processes (Gritsenko and Wood 2020).

3. Materials and Methods

This section explains the data sources used for the analysis, the analytical framework based on the CIDI methodology, and data preparation, emphasizing normalization.

3.1. Data Sources

The main source of data comes from the OECD “The International Survey on Revenue Administration” (ISORA) database (OECD 2019), a specialized database that covers many indicators related to tax administration outcomes. Crandall et al. (2021) infer that this database’s main purpose is to provide reliable and comparable indicators for tax administration efficiency. The OECD’s statistical products, in general, are thought to be of excellent quality and reliability, and the ISORA data are no different. The survey uses defined procedures and stringent quality controls to ensure accuracy and consistency. One of the strengths of the ISORA is its comprehensive coverage of tax administration practices across tax jurisdictions, including both OECD member countries and non-member countries. This allows for comparisons and the benchmarking of tax administration performance across various jurisdictions.

We retrieved the data from the ISORA database and filtered them for the missing values. Accordingly, we used only data for two consecutive years (2018–2019), since most of the tax administrations had complete data included for these two years. The other important reason for using only these two years in the analysis are the changes in the structure of indicators in the ISORA database. Using a different set of indicators might jeopardize any intertemporal comparability in the rankings. Following the recommendations given in Milosavljević et al. (Milosavljević et al. 2023a), some data were retrieved as original (when the indicators were presented as relative measures), while some were transformed into ratios to provide a sound basis for cross-tax-administration comparison. A detailed explanation for the retrieved and computed (calculated) indicators is given in Table 1.

Table 1.

Tax administration performance indicators.

To further explain the logic of the use of these indicators, we provide detailed explanations for (1) retrieving original or recalculating some indicators and (2) for the use of this set of indicators.

The logic of retrieving the first three indicators is grounded in their relative value, thus being comparative among the observed tax administrations no matter if the tax administration is large or small. The remainder of the indicators has been recalculated to the relative rather than absolute numbers so not to allow for large differences among the observed tax administrations. Another option could be the use of natural logarithms. However, even then, the difference between tax administrations (for instance, Germany and Albania) would have been large.

As for the use of this specific dataset, our logic was straightforward. ISORA is by far the most frequently used dataset to benchmark tax administration performance across the globe. This dataset has been agreed upon by the following five large international organizations: the International Monetary Fund (IMF), the Asian Development Bank (ADB), the Inter-American Center of Tax Administration (CIAT), the Intra-European Organization of Tax Administrations (IOTA), and the Organization for Economic Co-operation and Development (OECD). Furthermore, it has been empirically confirmed that these measures of operational excellence positively affect the tax efficiency of a country (Chang et al. 2020).

As for the indication of tax avoidance, we selected the data provided by the Tax Justice Network. Specifically, we used the State of Tax justice (SOTJ) dataset, from which we retrieved the Tax Avoidance Loss indicator. Since this indicator is given as an absolute number, we used natural logarithm (ln) to normalize its value. Finally, for the indication of fiscal deficit, we used IMF statistics (Fiscal Monitor datasets).

3.2. Analyzed Countries (Units of Observations)

We selected 35 tax administrations from the list of European countries which participated in the ISORA survey: Denmark, the Netherlands, Slovenia, Finland, Norway, Latvia, the United Kingdom, Portugal, Belgium, Russia, Ireland, Austria, Estonia, Sweden, Poland, Israel, Czechia, Georgia, Lithuania, Greece, Bulgaria, Croatia, Serbia, Albania, Slovakia, France, Iceland, Montenegro, Armenia, Spain, Moldova, Italy, Cyprus, Turkey, and Switzerland. These tax administrations were filtered from the full list of European countries when missing values were taken into consideration.

These countries show some elements of similarity and convergence. However, they differ in terms of the historical roots (Menjot et al. 2022), as well as efficiency and outputs (Pîrvu et al. 2021). More importantly for the purpose of this paper, these administrations differ in the selection of preferred performance measures related to tax administration (van Stolk and Wegrich 2008).

3.3. Analytical Framework for the Composite I-Distance Indicator (CIDI)

To create a single indicator adequate to rank the economies for which we measure the tax administration performance, we propose the Composite I-Distance Indicator (CIDI) methodology. The CIDI methodology is based on the I-distance methodology developed by Ivanovic in the 1970s (Ivanovic 1973; Ivanovic 1977; Ivanovic and Fanchette 1973). Both methodologies, the I-distance and CIDI, are characterized by the fact that they are unbiased. The majority of composite indicators are created from the subset of individual indicators, which are weighted according to the specific methodology. In most cases, they require opinions from experts, making them biased. The CIDI methodology forms a composite indicator created from the subset of individual indicators that are given data-driven rather than expert-driven weights. This objectiveness of the method is the main precedence of the procedure, which is why we propose the CIDI methodology for measuring tax administration performance.

To further elaborate on the methodology, we will first describe the I-distance methodology in detail. The I-distance methodology calculates the distances between the observed entities in the research concerning the single one chosen as the reference entity (Išljamović et al. 2015; Jeremic et al. 2011). According to Ivanovic, it is more suitable to use the squared I-distance if the number of selected variables is large, so we do not lose the influence of lower-ranked variables, or if all of the variables are not of the same direction, so negative correlation coefficients and negative partial correlation coefficients may occur.

The squared I-distance, also known as squared Ivanovic distance (Ivanovic 1973; Ivanovic 1977), is presented with the following formula (Ivanovic and Fanchette 1973):

In the formula, D2 represents the squared I-distance measure between two observed entities, es and ew, while s and w are the indices of these two observed entities, es and ew. The measure represents the distance between the values of the individual indicator Xi, one of the k indicators, i = 1 … k, and for entities and . The variance is the variance of the individual indicator Xi. Further, ri.12…j−1 is a partial correlation coefficient between the individual indicators Xi and Xj, where j < i (Dobrota et al. 2012).

The squared I-distance measure can also be used to rank the observed entities unbiasedly. However, it may suffer from weaknesses, since it is not transparent and its values are harder to explain and comprehend, especially compared to other composite indices. This is why we propose a Composite I-distance Indicator (CIDI) based on I-distance. The CIDI approach is a methodology that creates a synthesized indicator from a list of separate indicators (in this case, the list of indicators given in Table 1), which is transparent and easier to comprehend.

To obtain the CIDI, after the squared I-distance is calculated, we can calculate the correlation coefficients between the I-distance values and each individual sub-indicator in the methodology (Milosavljević et al. 2019). These correlation coefficients are mainly positive analogously to the squared I-distance methodology. If, in rare cases, the correlation coefficient fabricates as negative, they are then scaled from 0 to their maximum value.

The CIDI weights of any given composite indicator are constructed by weighing the above empirical correlations. Specifically, the values of the correlations are divided by the sum of the correlations, thus creating a CIDI weighting system. These are the data-driven aspects that are responsible for building large or small weights for the sub-indicators. The idea behind the principle comes from the particular feature of the I-distance method, which is that it can determine the relevance of individual indicators (Jeremic and Jovanovic-Milenkovic 2014). As a result, the CIDI weights are obtained as follows:

Here, ri, i = 1 … k represents the Pearson correlation between the individual indicator Xi and the squared I-distance value. In the described methodology, instead of predefining the values of weights in a biased manner, the CIDI is based on a methodological and statistical concept defined by the squared I-distance method (Milosavljević et al. 2019).

The specific feature of the CIDI is its independence from any expert opinions and viewpoints. It rather relies on the given data. Many global composite indicators are criticized, particularly for using the sub-indicator weights created by experts in the field. Those weights may suffer from shortcomings such as the bias or prejudice of the artists behind the methodologies. Moreover, the indicators are often not even examined by experts, but instead simply given equal weights.

As noted, the CIDI creates an aggregated index using weights that are data-driven rather than expert-driven (Dobrota et al. 2016). It extracts the weights from the derived data (Dobrota et al. 2015b). The CIDI is accordingly widely applicable to any ranking methodology where one wants to overpower the impact of bias.

In the final step, we conducted a correlation analysis (2-tailed Spearman correlation test) to measure the existence and the strength of the relationship between the TA performance and tax avoidance.

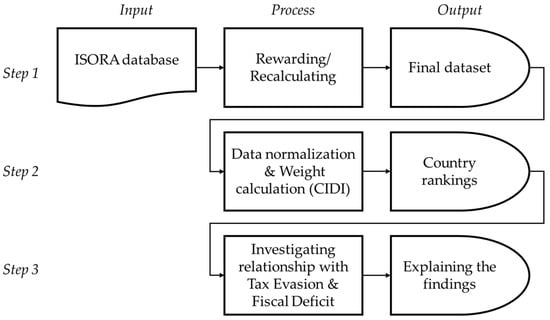

The summary and the graphical display of the analytical framework used in this study are given in Figure 1.

Figure 1.

Graphical diplay of the analytical framework.

3.4. Data Preparation

To calculate the total score of the observed economies for which we measured the tax administration performance, we needed to prepare the data in terms of normalization. To do so, we used min–max normalization, where we rescaled the range of all individual indicators, given in Table 1, to scale the range in [0, 100]. In addition, the CIDI methodology proposes the additive data aggregation model, which was applied to normalized individual indicators.

4. Results

This section first explains the pre-analysis—how we obtained weights for the individual performance measures using the CIDI methodology—and, later, the main analysis—the ranking of the tax jurisdictions.

4.1. Pre-Analysis

We first created a set of data-driven weights for the distinctive set of sub-indicators based on the CIDI methodology. The novel weighting scheme, calculated according to formula 2 (Section 3.3), is given in Table 2. The weights are given as decimals, but, in essence, they present the percentages of importance for the sub-indicators. Since the method is cross-sectional, the weights were obtained for two consecutive years, 2018 and 2019. The largest weight for FY2018 was obtained for the three indicators related to the Value of Revenue Collected (REV1 = 11.5%, REV2 = 14.1%, and REV3 = 14.7) and for one indicator from the group of Resources and Staff Indicators (RES1 = 13.8%). They maintained the same level of relevance in 2019, but their importance shrunk over the observed period. When we observe the change, the results show that Operational Efficiency (particularly OE2, with a positive change of 70.97%) has risen in importance.

Table 2.

CIDI indicators’ weights.

4.2. Main Analysis

After obtaining the weights, we analyzed the performance of 35 tax administrations for two consecutive years. The results are given in Table 3. The results in the table display the obtained value for each tax administration, the rank for a specific year, and the relative change in the difference in ranks. The obtained values range from 0 to 100, while the tax administrations are ranked from the largest to the smallest value.

Table 3.

CIDI scores and CIDI ranks of the tax administration performance of selected European countries.

Table 3 shows that the Danish tax authority held the first place in both observations. The Netherlands held second place. The difference to the second place is relatively high (the Relative Efficiency Score calculated as a relation between the first and the second place was 1.254 and 1.169, respectively). This finding implies that Denmark’s tax authority was 25.4 and 16.9% more efficient than its counterpart, holding the second position. The ‘second runner-up’ was changed—Norway replaced Slovenia in this position. The most significant decline in rank was attributed to Russia (from the 10th to the 22nd position), whilst the tax administration of Greece made the largest incline on the scale (from the 20th to the 11th position). The last place was reserved for Switzerland in both years.

It should, however, be noted that the comparison between the two observed years has some limitations. First, this methodology is a cross-sectional rather than time-series analysis. Comparison between the two or many more years is, therefore, a discretionary, rather than continuous analysis. Second, sharp changes in the total ranking might be viewed as an imperfection of the CIDI methodology. Contrary to that, this is an upside of the methodology, as it augments the differences in the country rankings with smaller changes in the difference in individual indicators. Finally, comparison between the years is a demonstration of a ‘clay pigeon’ effect created with a ranking provided with this methodology. Improving only one performance indicator might not reflect on the overall score. Accordingly, tax administrations must improve the overall score.

When grouped into the quantiles (groups of five), we see that the ‘Old Continent’ was divided into the efficient north and the inefficient south (see Figure 2). As for Tier 1, six tax jurisdictions remained in this stratum in both years: Denmark, the Netherlands, Slovenia, Finland, Norway, and the United Kingdom, whereas Latvia was replaced by Portugal in 2019.

Figure 2.

Heatmap for tax administration performance in 2018 (left) and 2019 (right). Notes: Russian Federation was excluded from the map for the clarity of presentation. This country was in Tier 2 and Tier 4 respectively.

Finally, we conducted a correlation analysis between the TA performance (CIDI-based scores) and tax avoidance for a single year. The results are presented in the following Table 4.

Table 4.

Correlation matrix for the CIDI score and tax avoidance.

As shown in Table 4, the relationship between our ranking and tax avoidance had the p-value (0.00) was below the traditional threshold of 0.05 (Milosavljević et al. 2023b), and we confirmed that there is a positive correlation between the two observed variables. It should be noted, though, that the strength of this relationship is rather small (b = 0.175). As for the relationship between our ranking and fiscal deficit, the p-value (0.013) was also below the standard threshold, but the strength of the relationship was modest (b = 0.414).

5. Discussion

This section contextualizes our findings by explaining the key findings, delineating the main contributions, and providing implications for scholars and practitioners.

5.1. Key Findings

This study offers a fresh approach to the objective ranking of the effectiveness of selected European tax administrations. This study assesses the overall performance of tax administrations over two years, 2018 and 2019. In both years, Denmark served as a “role model” for the tax administrations. Several explanations can be found for this finding. First, The Danish tax authority (SKAT) has invested significantly in cutting-edge technologies, such as data analytics, to enable effective and efficient tax collection and compliance procedures. The digitalization process is ongoing, with some aspects (i.e., legality and transparency) still being questioned (Fjord and Schmidt 2023). Considering the total tax burden of the Danish taxpayers, we were surprised by this finding. Other studies indicate that ‘Danish taxpayers generally appear to be content with the situation’, particularly when knowing that these funds are used to finance the Danish welfare system.

The ‘first runner-up’ in our analysis is the Dutch tax administration. Contrary to the central system in Denmark, the Dutch tax administration (Belastingdienst) is decentralized and complex. The system is highly digitalized, with even some reports on mismanaging algorithms for fraud detection in processing and storing personal information in a “blacklist” used to detect fraud (EDPB 2022).

The first tier is reserved for North and West European countries. Surprisingly, one tax jurisdiction from the ‘New EU’, Slovenia, has been ranked in the first tier. Although some studies point out that Slovenian tax administration requires a myriad of IT and procedurally related measures for further improvements (Ravšelj et al. 2019), the tax administration of Slovenia can be a ‘small role model’ for the countries that are behind the ‘iron curtain’.

In both observed years, Switzerland served as the worst-ranked tax jurisdiction. The explanation for this phenomenon is that the Swiss tax system is highly complex, with 26 cantons having their own tax laws. Swiss fiscality offers profound diversity but comes with the price of complexity (Soguel 2019). It should be noted, however, that some tax jurisdictions were out of the scope of our analysis. Some studies find that the Swiss tax compliance burden (at least for businesses) is far lower than those of Germany or the USA (Braunerhjelm et al. 2021). These observations and discussions should be taken into account with a lot of precaution. This means that the specificity of national tax systems, the quality of law, rates, structure, computerization, and other factors should be more profoundly related to the purely quantitative findings of this study.

Finally, we confirmed that there is a positive relationship between the performance of TAs and tax avoidance. This finding might be puzzling, since it would be expected that the more efficient the tax administration, the lower the tax avoidance would be. However, this conundrum is similar to the strength of police forces and the crime in a country. The higher the first one, the higher the later one.

5.2. Contributions

This study adds to the developing body of knowledge on tax administration performance measurement in several ways.

First, different European tax jurisdictions have been pointed out as ‘good examples’ of tax administration performance. Our study finds that Denmark can be viewed as a role model for policymakers and researchers interested in tax administration performance analyses. Denmark was even anecdotally known for having a highly efficient tax administration prioritizing taxpayer service and compliance. This finding is aligned with the findings of Milosavljević et al. (Milosavljević et al. 2023a), who found that the Nordic countries generally outperform other European regions regarding tax authority efficiency. Contrary to this, some analyses, such as the one conducted by Athanasios et al. (2022), find that the ‘tax administrations of Germany, Ireland, the Netherlands, Spain and the United Kingdom are the most decisive efficient units, forming the efficiency frontier.’ In our analysis, Spain can serve as a ‘bad example’ rather than an efficient frontier. An explanation for the difference in results is the weight given to the indicators reflecting the efficiency of human resources in tax administration. By comparing Denmark to Spain, we can see that the SKAT (Danish tax authority) has a smaller workforce than the AEAT (Agencia Tributaria—Spanish tax authority) but has a decentralized organizational structure. However, this explanation is only judicious speculation requiring further in-depth examination.

Second, our findings prioritize Value Revenue Collected as the main group of drivers for the overall performance of TAs. Usual ‘suspects’ investigated in other studies are digitalization and the use of novel technologies (Faúndez-Ugalde et al. 2020; Martínez et al. 2022), and human resources and the culture of taxation (Chuenjit 2014; Radonić and Milosavljević 2019). Contrary to the findings of previous studies, we identified the variables in the operational excellence group (on-time filling and e-filling) as indicators that will drive excellence in the years to come. Consequently, investments in a modern and reliable IT infrastructure will be crucial for efficient tax administration. Simply put, automated systems will speed up processing times and reduce the risk of errors.

Third, our approach allows for changes in the weighting and overall ranking. Thus, it mitigates the potential risk of policy implementers’ fast adherence to a previously defined output, as with stable-weight indices (such as the Ease of Doing Business Index).

Fourth, we also emphasize that the CIDI methodology used in this research is data-driven rather than biased. Although some authors would prefer that a weighting scheme of composite indicators should reflect the intuitive and biased importance of the individual sub-indicators, our research is predominantly guided by the methods that advocate data-driven results, such as Data Envelopment Analysis (DEA) (Charnes et al. 1978; Milanović et al. 2022) or Distance-Based Analysis (DBA) (Dobrota et al. 2015a). Additionally, through the CIDI methodology, we provide a transparent composite indicator that is easily interpretable and comprehensive.

Fifth, this study contributes to a growing body of research that examines tax administration performance and tax avoidance. Contrary to other studies suggesting that simplifying tax systems and fortifying institutions (such as tax administration) inevitably leads to the decrease in tax avoidance, our study finds that (at least in the short term) institutional quality only pushes taxpayers (both corporate and individual) to be more prone to tax avoidance. Simply put, strong tax administrations will only create “stronger” tax optimization strategies.

This study directly contributes to the proliferation of machine learning and artificial intelligence in taxation studies in an indirect manner. Artificial intelligence can certainly have an even more direct effect on tax administrations than indicated in this study (Brynjolfsson and Unger 2023). Artificial intelligence may reduce the demand for labor, in which case, tax collection via income taxes may become an obsolete policy. Moreover, AI may increase the efficiency of the tax authority and reduce both tax evasion and tax avoidance. These two premises provide tension as to what is the direction of the overall effect. If labor income is irrelevant, then artificial intelligence is undermining tax collection. Conversely, if capital (especially artificial intelligence capital investments) is taxed, then artificial intelligence is ultimately increasing tax collection. Along these lines, tax administration performance plays a central role, insofar as an efficient tax authority is needed to adjust to different forms of taxation.

5.3. Implications

This study provides several valuable implications for both practitioners and scholars. As for the practitioners, the findings are significant for policymakers and implementors, regulators, and public administration analysts. The analytical framework described in this study allows for the ex ante analysis of tax administration-related policy. The most important implication is that this approach enables changes in the weights for individual factors without any expert-based bias. The more the policymakers work on individual performance measures, the less it becomes vital for the overall score. Accordingly, a tax system will never become atrophied in any sphere of performance. Policymakers in the tax administration realm should always consider clear tax policies and regulations, adequate staffing and training, efficient and streamlined processes, adequate IT support, and effective electronic services for taxpayers.

This study also sheds a new light on the relationship between taxation efficiency and countries’ debt-to-GDP trends. In fact, even highly developed countries that have the benefit of capital markets regarding its sovereign debt as a “safe asset” (He et al. 2016), the consequences of a sovereign default are simply catastrophic (Govindarajan et al. 2023). Efficient tax collection policies can be a financing substitute for raising sovereign debt. Because of population aging and growing social inequality, it is unlikely that governments would be able to cut down on spending. Hence, to finance government spending, governments either need to raise sovereign debt or collect taxes more efficiently (or the classic Ricardian equivalence argument that suggests that larger spending increases expectations of future tax increases).

This study might be useful for scholars, as well. The field of tax administration performance measurement is a developing field with several approaches used so far (Dabla-Norris et al. 2020; Doiar et al. 2022; Pîrvu et al. 2021). Our approach, however, utilizes neutral aggregation based on empirical data to obtain a single performance measure. Thus, this approach can evaluate many other multi-criteria problems in public economics.

6. Conclusions, Limitations, and Further Recommendations

In this study, we analyzed the performance of 35 European tax administrations and created a unique and comprehensive performance measurement score for each tax administration. Rooting our analytical framework in the broad area of algorithmic governance, the score for each tax administration was obtained in a data-driven manner. By applying the CIDI methodology to rank the ‘Old Continent tax administrations’, we demonstrated that Denmark and the Netherlands are exemplary models for tax administration, with revenue collection being identified as a crucial driver of excellence and operational performances, such as e-filing and on-time filing forming critical aspects of future efficiency. Such methodology can benefit policymakers, public administration analysts, and other stakeholders interested in the efficiency of tax administrations.

The study has several restrictions that can jeopardize the generalizability of the findings. These are elaborated as follows.

First, it only employs a limited number of performance indicators for tax administration. A more comprehensive range of indicators should be considered in follow-up studies, particularly those pertaining to the effectiveness of internal processes, taxpayer expectations, segmentations, corruption, and other factors.

Then, this study uses information from 35 tax administrations in two consecutive years. Accordingly, this study is cross-sectional by nature and as such has some downsides typical for cross-sectional examinations (Radonić et al. 2021). Even though we provided results for two years in a row, this does not imply that the study is robust to time-varying factors. The analysis of time series and the use of larger samples might be advantageous for future investigations.

Next, due to the incomplete datasets utilized as input data, only a few performance metrics and observation units (tax administrations) are used. Additional studies could also include other performance measures. To name a few, follow-up studies could incorporate indicators depicting the service quality of tax administrations as public bodies (Milanović et al. 2019), or taxpayer convenience and the reduction in taxation costs (Saragih et al. 2022). Additionally. The inclusion of tax administrations outside ‘the Old Continent’ would additionally improve the benchmarking capacity of the ranking provided in this study.

Finally, the nature of this research is quantitative. From a broader perspective, every quantitative study fails to capture the in-depth characteristics of observed units (Milosavljevic et al. 2016). Accordingly, any profound discussion on the performance of tax administrations would require an in-depth analysis of every tax jurisdiction and its tax system. Some studies even find that different tax systems in Europe react in the same manner to any efficiency changes (Ottone et al. 2018), which could imply that our study extensively emphasizes slight differences between and among European tax administrations (somewhat similar to the Freud’s explanation of the narcissism of minor differences). Following this, an avenue for further research is digging deep into the drivers and consequences of tax administration performance, which could be acquired through qualitative research.

Author Contributions

Conceptualization M.M.; methodology M.I. and A.Đ.; software M.I. and A.Đ.; writing—original draft preparation M.M., N.M. and Ž.S.; writing—review and editing M.M., A.Đ. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original dataset was retrieved from the ISORA database https://data.rafit.org/?sk=ba91013d-3261-42f8-a931-a829a78cb1ec accessed on 15 March 2023.

Acknowledgments

We are truly thankful to the editors and anonymous reviewers for their support throughout the publication process.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Aktaş, Emin Efecan. 2023. How Tax Wedge of Low and Upper-income Households Affects Income Distribution: Findings from OECD Countries. Prague Economic Papers 32: 246–72. [Google Scholar] [CrossRef]

- Arltová, Markéta, and Julia Kot. 2023. Do Environmental Taxes Improve Environmental Quality? Evidence from OECD Countries. Prague Economic Papers 32: 26–44. [Google Scholar] [CrossRef]

- Athanasios, Anastasiou, Kalligosfyris Charalampos, and Kalamara Eleni. 2022. Assessing the effectiveness of tax administration in macroeconomic stability: Evidence from 26 European Countries. Economic Change and Restructuring 55: 2237–61. [Google Scholar] [CrossRef]

- Belmonte-Martin, Irene, Lidia Ortiz, and Cristina Polo. 2021. Local tax management in Spain: A study of the conditional efficiency of provincial tax agencies. Socio-Economic Planning Sciences 78: 101057. [Google Scholar] [CrossRef]

- Braunerhjelm, Pontus, Johan E. Eklund, and Per Thulin. 2021. Taxes, the tax administrative burden and the entrepreneurial life cycle. Small Business Economics 56: 681–94. [Google Scholar] [CrossRef]

- Brignall, Stan, and Sven Modell. 2000. An institutional perspective on performance measurement and management in the ‘new public sector’ . Management Accounting Research 11: 281–306. [Google Scholar] [CrossRef]

- Brynjolfsson, Erik, and Gabriel Unger. 2023. The Macroeconomics of Artificial Intelligence. In IMF Finance & Development Magazine. Available online: https://www.imf.org/en/Publications/fandd/issues/2023/12/Macroeconomics-of-artificial-intelligence-Brynjolfsson-Unger (accessed on 15 April 2024).

- Chang, Eui Soon, Nikolay Gueorguiev, Elizabeth Gavin, and Jiro Honda. 2020. Raising Tax Revenue: How to Get More from Tax Administrations? IMF Working Papers 2020: 1. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Chuenjit, Pakarang. 2014. The Culture of Taxation: Definition and Conceptual Approaches for Tax Administration. Journal of Population and Social Studies 22: 14–34. [Google Scholar] [CrossRef]

- Cordero, Jose Manuel, Carlos Díaz-Caro, Francisco Pedraja-Chaparro, and Nickolaos G. Tzeremes. 2021. A conditional directional distance function approach for measuring tax collection efficiency: Evidence from Spanish regional offices. International Transactions in Operational Research 28: 1046–73. [Google Scholar] [CrossRef]

- Cowx, Mary, Felipe Bastos G. Silva, and Kelvin Yeung. 2022. Government Deficits and Corporate Tax Avoidance. SSRN Electronic Journal, 1–46. [Google Scholar] [CrossRef]

- Crandall, William, Elizabeth Gavin, and Andrew Masters. 2021. ISORA 2018: Understanding Revenue Administration. Departmental Papers 2021: 025. [Google Scholar] [CrossRef]

- Crandall, William Joseph. 2010. Revenue Administration: Performance Measurement in Tax Administration. Technical Notes and Manuals 2010: 1. [Google Scholar] [CrossRef]

- Dabla-Norris, Era, Florian Misch, Duncan Cleary, and Munawer Khwaja. 2020. The quality of tax administration and firm performance: Evidence from developing countries. International Tax and Public Finance 27: 514–51. [Google Scholar] [CrossRef]

- D’Agostino, Marcello, and Massimo Durante. 2018. Introduction: The Governance of Algorithms. Philosophy & Technology 31: 499–505. [Google Scholar] [CrossRef]

- Dobrota, Marina, Milan Martic, Milica Bulajic, and Veljko Jeremic. 2015a. Two-phased composite I-distance indicator approach for evaluation of countries’ information development. Telecommunications Policy 39: 406–20. [Google Scholar] [CrossRef]

- Dobrota, Marina, Milica Bulajic, Lutz Bornmann, and Veljko Jeremic. 2016. A new approach to the QS university ranking using the composite I-distance indicator: Uncertainty and sensitivity analyses. Journal of the Association for Information Science and Technology 67: 200–11. [Google Scholar] [CrossRef]

- Dobrota, Marina, Veljko Jeremic, and Aleksandar Markovic. 2012. A new perspective on the ICT Development Index. Information Development 28: 271–80. [Google Scholar] [CrossRef]

- Dobrota, Marina, Veljko Jeremić, Milica Bulajić, and Zoran Radojičić. 2015b. Uncertainty and Sensitivity Analyses of PISA Efficiency: Distance Based Analysis Approach. Acta Polytechnica Hungarica 12: 41–58. [Google Scholar] [CrossRef]

- Doiar, Yevhenii, Pavlo Liutikov, Illia Skvirskyi, Yevgen Garmash, and Serhiy Kuvakin. 2022. Tax administration in the context of effective public administration: The case Eastern European Countries. Cuestiones Políticas 40: 410–22. [Google Scholar] [CrossRef]

- EDPB. 2022. Tax Administration Fined for Fraud ‘Black List’. Available online: https://edpb.europa.eu/news/national-news/2022/tax-administration-fined-fraud-black-list_en (accessed on 5 July 2023).

- Evans, Chris. 2001. The operating costs of taxation: A review of the research. Economic Affairs 21: 5–9. [Google Scholar] [CrossRef]

- Faúndez-Ugalde, Antonio, Rafael Mellado-Silva, and Eduardo Aldunate-Lizana. 2020. Use of artificial intelligence by tax administrations: An analysis regarding taxpayers’ rights in Latin American countries. Computer Law & Security Review 38: 105441. [Google Scholar] [CrossRef]

- Fjord, Louise Blichfeldt, and Peter Koerver Schmidt. 2023. The Digital Transformation of Tax Systems Progress, Pitfalls, and Protection in a Danish Context. Indiana Journal of Global Legal Studies 30: 227–72. [Google Scholar] [CrossRef]

- Gerritsen, Aart. 2023. Optimal nonlinear taxation: A simpler approach. International Tax and Public Finance 31: 486–510. [Google Scholar] [CrossRef]

- Govindarajan, Vijay, Anup Srivastava, Felipe. B. G. Silva, and Manuela. M. Dantas. 2023. How Companies Should Prepare for Repeated Debt-Ceiling Standoffs. Harvard Business Review. Available online: https://hbr.org/2023/08/how-companies-should-prepare-for-repeated-debt-ceiling-standoffs (accessed on 15 April 2024).

- Gritsenko, Daria, and Matthew Wood. 2020. Algorithmic governance: A modes of governance approach. Regulation & Governance 16: 45–62, Portico. [Google Scholar] [CrossRef]

- Hanna, Rema, and Benjamin A. Olken. 2019. Tax Administration vs. Tax Rates: Evidence from Corporate Taxation in Indonesia. National Bureau of Economic Research 111: 3827–71. [Google Scholar] [CrossRef]

- He, Zhiguo, Arvind Krishnamurthy, and Konstantin Milbradt. 2016. What Makes US Government Bonds Safe Assets? American Economic Review 106: 519–23. [Google Scholar] [CrossRef]

- Išljamović, Sonja, Veljko Jeremić, Nataša Petrović, and Zoran Radojičić. 2015. Colouring the socio-economic development into green: I-distance framework for countries’ welfare evaluation. Quality & Quantity 49: 617–29. [Google Scholar] [CrossRef]

- Ivanovic, Branislav. 1973. A Method of Establishing a List of Development Indicators. Paris: United Nations Educational, Scientific and Cultural Organization. [Google Scholar]

- Ivanovic, Branislav. 1977. Classification Theory. Belgrade: Institute for Industrial Economic. [Google Scholar]

- Ivanovic, Branislav, and Serge Fanchette. 1973. Grouping and Ranking of 30 Countries of Sub-Saharan Africa, Two Distance-Based Methods Compared. Paris: United Nations Educational, Scientific and Cultural Organization. [Google Scholar]

- Janssen, Marijn, and George Kuk. 2016. The challenges and limits of big data algorithms in technocratic governance. Government Information Quarterly 33: 371–77. [Google Scholar] [CrossRef]

- Jeremic, Veljko, and Marina Jovanovic-Milenkovic. 2014. Evaluation of Asian university rankings: Position and perspective of leading Indian higher education institutions. Current Science 106: 1647–53. [Google Scholar]

- Jeremic, Veljko, Milica Bulajic, Milan Martic, and Zoran Radojicic. 2011. A fresh approach to evaluating the academic ranking of world universities. Scientometrics 87: 587–96. [Google Scholar] [CrossRef]

- Katzenbach, Christian, and Lena Ulbricht. 2019. Algorithmic governance. Internet Policy Review 8: 1–18. [Google Scholar] [CrossRef]

- Kostic, Slavica Cicvaric, Milan Okanovic, Milos Milosavljevic, and Jovanka Vukmirovic. 2013. Antecedents of citizens’ satisfaction with local administration in Serbia. Transylvanian Review of Administrative Sciences 9: 22–34. [Google Scholar]

- Maricic, Milica, Jose A. Egea, and Veljko Jeremic. 2019. A Hybrid Enhanced Scatter Search—Composite I-Distance Indicator (eSS-CIDI) Optimization Approach for Determining Weights Within Composite Indicators. Social Indicators Research 144: 497–537. [Google Scholar] [CrossRef]

- Martínez, Yolanda Ubago, Pedro Pascual Arzoz, and Idoia Zabaleta Arregui. 2022. Tax collection efficiency in OECD countries improves via decentralization, simplification, digitalization and education. Journal of Policy Modeling 44: 298–318. [Google Scholar] [CrossRef]

- Menjot, Denis, Pere Verdés Pijuan, and Mathieu Caesar. 2022. History of taxation in Medieval Europe. In The Routledge Handbook of Public Taxation in Medieval Europe. Abingdon: Taylor & Francis Group, pp. 15–54. [Google Scholar] [CrossRef]

- Milanović, Nemanja, Miloš Milosavljević, and Nela Milošević. 2019. Failure Management Approaches and Public Service Quality: Empirical Evidence from Serbia. Lex Localis—Journal of Local Self-Government 17: 417–34. [Google Scholar] [CrossRef] [PubMed]

- Milanović, Tijana, Gordana Savić, Milan Martić, Maja Milanović, and Nataša Petrović. 2022. Development of the Waste Management Composite Index Using DEA Method as Circular Economy Indicator: The Case of European Union Countries. Polish Journal of Environmental Studies 31: 771–84. [Google Scholar] [CrossRef]

- Milosavljević, Miloš, Marina Dobrota, and Nemanja Milanović. 2019. A New Approach to the Evaluation of Public Procurement Efficiency among European Countries. European Review 27: 246–59. [Google Scholar] [CrossRef]

- Milosavljevic, Miloš, Nemanja Milanović, and Slađana Benković. 2016. Politics, Policies and Public Procurement Efficiency: A Quantitative Study of 25 European Countries. Lex Localis—Journal of Local Self-Government 14: 537–58. [Google Scholar] [CrossRef]

- Milosavljevic, Miloš, Sandro Radovanovic, and Boris Delibasic. 2021. Evaluation of Public Procurement Efficiency of the EU Countries Using Preference Learning TOPSIS Method. Economic Computation and Economic Cybernetics Studies and Research 55: 187–202. [Google Scholar] [CrossRef]

- Milosavljević, Miloš, Sandro Radovanović, and Boris Delibašić. 2023a. What drives the performance of tax administrations? Evidence from selected European countries. Economic Modelling 121: 106217. [Google Scholar] [CrossRef]

- Milosavljević, Miloš, Milan Okanović, Slavica Cicvarić Kostić, Marija Jovanović, and Milenko Radonić. 2023b. COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia. Sustainability 15: 3188. [Google Scholar] [CrossRef]

- Mohammed, Hunar, and Anita Tangl. 2023. Taxation Perspectives: Analyzing the Factors behind Viewing Taxes as Punishment—A Comprehensive Study of Taxes as Service or Strain. Journal of Risk and Financial Management 17: 5. [Google Scholar] [CrossRef]

- Nguyen, Trang TT, Diego Prior, and Stefan Van Hemmen. 2020. Stochastic semi-nonparametric frontier approach for tax administration efficiency measure: Evidence from a cross-country study. Economic Analysis and Policy 66: 137–53. [Google Scholar] [CrossRef]

- OECD. 2011. Efficiency of tax administrations. In Government at a Glance 2011. Paris: OECD Publishing. [Google Scholar]

- OECD. 2019. Data tables. In Tax Administration 2019: Comparative Information on OECD and other Advanced and Emerging Economies. Paris: OECD Publishing, pp. 1–490. [Google Scholar] [CrossRef]

- Okunogbe, Oyebola, and Fabrizio Santoro. 2022. The Promise and Limitations of Information Technology for Tax Mobilization. Oxford: Oxford University Press. [Google Scholar] [CrossRef]

- Ottone, Stefania, Ferruccio Ponzano, and Giulia Andrighetto. 2018. Tax compliance under different institutional settings in Italy and Sweden: An experimental analysis. Economia Politica 35: 367–402. [Google Scholar] [CrossRef]

- Pîrvu, Daniela, Amalia Duţu, and Carmen Mihaela Mogoiu. 2021. Clustering tax administrations in European Union member states. Transylvanian Review of Administrative Sciences 63: 110–27. [Google Scholar] [CrossRef]

- Ponomariov, Branco, Oleksii Balabushko, and Gregory Kisunko. 2017. The decisive impact of tax administration practices on firms’ corruption Experience and Perceptions: Evidence from Europe and Central Asia. International Journal of Public Administration 41: 1314–23. [Google Scholar] [CrossRef]

- Radonić, Milenko, and Miloš Milosavljević. 2019. Human Resource Practices, Failure Management Approaches and Innovations in Serbian Public Administration. Transylvanian Review of Administrative Sciences SI2019: 77–93. [Google Scholar] [CrossRef]

- Radonić, Milenko, Miloš Milosavljević, and Snežana Knežević. 2021. Intangible Assets as Financial Performance Drivers of IT Industry: Evidence from an Emerging Market. E+M Ekonomie a Management 24: 119–35. [Google Scholar] [CrossRef]

- Ravšelj, Dejan, Polonca Kovač, and Aleksander Aristovnik. 2019. Tax-related burden on SMEs in the European Union: The case of Slovenia. Mediterranean Journal of Social Sciences 10: 69–79. [Google Scholar] [CrossRef]

- Sanchez-Graells, Albert. 2024. Resh(AI)ping Good Administration: Addressing the Mass Effects of Public Sector Digitalisation. Laws 13: 9. [Google Scholar] [CrossRef]

- Saragih, Arfah Habib, Qaumy Reyhani, Milla Sepliana Setyowati, and Adang Hendrawan. 2022. The potential of an artificial intelligence (AI) application for the tax administration system’s modernization: The case of Indonesia. Artificial Intelligence and Law 31: 491–514. [Google Scholar] [CrossRef]

- Savić, Gordana, Aleksandar Dragojlović, Mirko Vujošević, Milojko Arsić, and Milan Martić. 2015. Impact of the efficiency of the tax administration on tax evasion. Economic Research-Ekonomska Istraživanja 28: 1138–48. [Google Scholar] [CrossRef]

- Soguel, Nils. 2019. Tax Power and Tax Competition. In Swiss Public Administration. Governance and Public Management. Edited by Ladner, Andreas, Nils Soguel, Ybes Emery, Sophie Weerts and Stéphane Nahrath. Cham: Palgrave Macmillan, pp. 273–90. [Google Scholar] [CrossRef]

- Taufik, Kurniawan. 2018. Modernization of the tax administration system: A theoretical review of improving tax capacity. E3S Web of Conferences 73: 10022. [Google Scholar] [CrossRef]

- van Stolk, Christian, and Kai Wegrich. 2008. Convergence without diffusion? A comparative analysis of the choice of performance indicators in tax administration and social security. International Review of Administrative Sciences 74: 589–614. [Google Scholar] [CrossRef]

- Vázquez-Caro, Jaime, and Richard M. Bird. 2011. Benchmarking Tax Administrations in Developing Countries: A Systemic Approach. ICEPP Working Papers. p. 9. Available online: https://scholarworks.gsu.edu/cgi/viewcontent.cgi?article=1085&context=icepp (accessed on 15 April 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).