3.2.1. Evidence from Symmetric Causality Framework

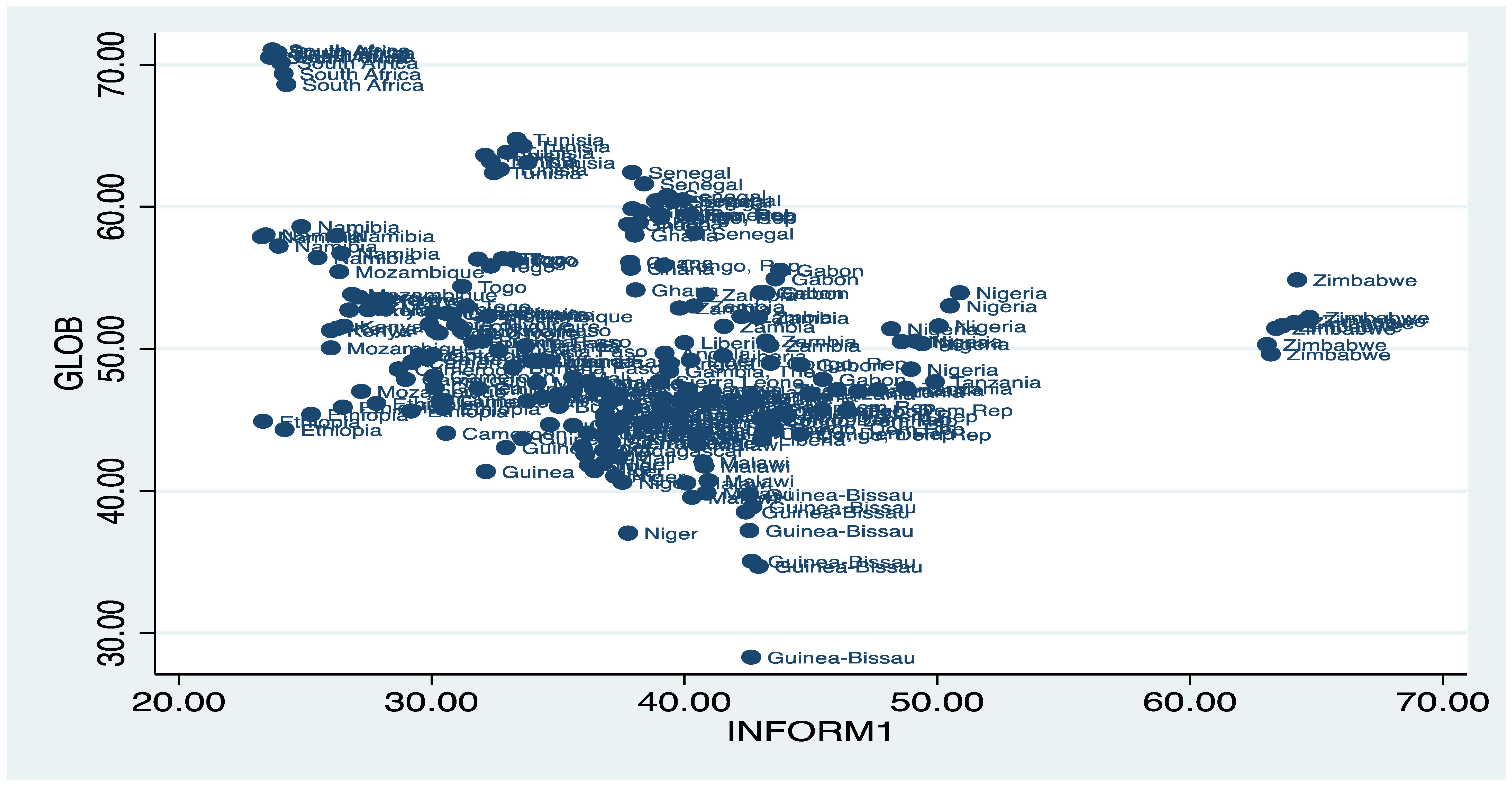

To investigate the causal relationship within the nexus, this study employed both linear/symmetric and nonlinear/asymmetric causality approaches from a homogeneous perspective. This choice is based on the recommendation of the dependency and slope homogeneity test, which enables the identification of country-specific findings for appropriate policy implications. The outcomes of the linear and symmetric causality analyses are presented in

Table 5,

Table 6 and

Table 7. In these analyses, three different measures of globalisation (i.e., overall, economic, and trade globalisation) are individually applied.

Table 5 reveals evidence of a causal relationship from the informal sector to overall globalisation in Cote d’Ivoire, Ghana, Guinea Bissau, Liberia, Mozambique, Malawi, Namibia, Tunisia, and Zambia. This finding suggests that the current size of the informal sector in these economies is influenced by past absorption of globalisation policies (

Bolarinwa and Simatele 2024;

Pham 2017). The collective engagement of these countries with the global economy significantly impacts their informal economies. Changes in globalisation patterns directly affect the dynamics of informal businesses, self-employment, and non-formal economic activities (

Bellakhal et al. 2024). Policymakers should be cognizant of the tangible effects that global economic shifts can have on local informal economies.

Consequently, when formulating economic policies, authorities should carefully consider how globalisation influences the informal sector. Strategies must be implemented to address the challenges and opportunities posed by global economic trends on local informal enterprises. Achieving a balance between participation in the global economy and support for the growth and stability of the informal sector is essential for promoting sustainable economic development. Ultimately, these findings suggest that the informal economies of these countries are not isolated from the broader global economic landscape. By managing the impact of globalisation on informal activities, more effective economic policies and development strategies can be formulated. Using economic globalisation as the primary indicator, this study confirms that Angola, Ethiopia, Gabon, Guinea, Guinea-Bissau, Liberia, Sierra Leone, Tunisia, and Tanzania provide evidence of Granger causality, indicating a causal relationship from globalisation to informality.

Furthermore, the measure of trade globalisation supports these findings in Angola, Ethiopia, Gambia, Guinea, Guinea-Bissau, Kenya, Madagascar, Mozambique, Nigeria, Togo, and Tanzania. These results suggest that the size of the informal sector is largely influenced by the absorption of globalisation, which significantly disrupts both formal and informal sectors within these African economies. These findings challenge the assumption of homogeneity in the existing literature on globalisation (

Olaniyi and Odhiambo 2024), thereby justifying the use of the DH causality method and highlighting the need for country-specific policy measures to address the implications of overall, economic, and trade globalisation.

Conversely, the first three columns of

Table 5 present evidence of causality from globalisation to informality. These results are reported for the overall globalisation measure and include Burkina Faso, Cameroon, Ethiopia, Ghana, Kenya, Madagascar, Malawi, Niger, Nigeria, Sierra Leone, Togo, Tanzania, Uganda, and Congo. The evidence suggests that the past economic activities and size of the informal sectors in these African economies explain the current levels of globalisation absorption. Therefore, changes in the informal sector have a consequential impact on subsequent changes in overall globalisation levels. Policymakers should acknowledge that the vibrancy or challenges within the informal economy of these countries can significantly affect their integration into the global economy. Consequently, economic policies must consider the role of the informal sector in shaping a country’s global engagement, with strategies addressing the impact of the informal economy on international economic relationships, trade patterns, and global integration. Moreover, evidence for economic globalisation causality is also validated in Ethiopia, Guinea-Bissau, Madagascar, Niger, Senegal, and Zambia.

3.2.2. Evidence from Asymmetric Causality Framework

One significant limitation of the symmetric causality analysis is its failure to incorporate shocks. To rectify this, the asymmetric analysis includes these shocks within the nexus. This section presents the findings of the asymmetric analysis. Following the established literature, such as the works of

Hatemi-J (

2020a,

2020b),

Olaniyi (

2020),

Olaniyi and Olayeni (

2020),

Olaniyi and Ologundudu (

2022), and

Olaniyi and Odhiambo (

2024), the asymmetric models employ 1000 bootstrapped iterations to adequately address shocks and policy responses. The results are shown in

Table 8,

Table 9,

Table 10,

Table 11,

Table 12,

Table 13,

Table 14 and

Table 15.

The findings derived from the asymmetric causality framework contribute significantly to our comprehension of the relationship between globalisation and informality within the African countries under study. To ensure robustness, this study further investigated this relationship within an asymmetric/nonlinear framework, which helped address shocks within the causal framework for policy formation. The paper follows the established literature (

Hatemi-J 2020a,

2020b;

Olaniyi 2020;

Olaniyi and Olayeni 2020;

Olaniyi and Ologundudu 2022;

Olaniyi and Odhiambo 2024) to analyse the asymmetric models and employs 1000 bootstrapped iterations. It is important to note that asymmetric causality effectively captures shocks and policy responses, making it more applicable for policy recommendations than the ordinary causality framework.

Accordingly, this paper presents the outcomes of the causal responses between positive shocks in globalisation (globalisation +, indicating an increase in globalisation absorption) and positive shocks in informality (informality +, suggesting an increase in the size of the informal sector), as shown in

Table 8. These results indicate that a notable positive change or shock in the levels of globalisation in the studied countries, attributable to increased international trade, foreign direct investment, or other factors indicating greater integration into the global economy, is accompanied by a subsequent positive shock in the size of the informal sector. In simpler terms, as globalisation increases, the informal sector in these nations also experiences growth, and conversely, when globalisation decreases, the size of the informal sector tends to decrease as well. In Uganda for instance, the persistent globalization absorption expands the informal sector. Thus, Uganda’s strategic initiatives to boost tourism and agriculture have facilitated informal employment in these sectors. Increased global demand for agricultural products can lead to a more robust informal sector, as small-scale farmers and traders benefit indirectly from enhanced export opportunities.

Furthermore, the study examined the causality flows from globalisation to informality using an overall measure of globalisation. The results of the asymmetric causality test reveal that the persistent and continuous absorption of globalisation has led to an expansion of the informal sector in Angola, Congo, Guinea, Gambia, Mozambique, Sierra Leone, Tunisia, Tanzania, Uganda, Zambia, and Zimbabwe. Therefore, these findings suggest a positive correlation between higher levels of globalisation and the growth of the informal sector. This trend could be attributed to the increased economic opportunities, changes in market dynamics, or shifts in labour patterns influenced by globalisation. It is important to note that positive shocks in globalisation can generate new economic prospects but can also contribute to the growth of the informal sector as individuals and businesses adapt to changing conditions.

In conclusion, the informal sector in the studied African countries is responsive to changes in globalisation levels, potentially playing a prominent role in labour absorption, providing employment opportunities, and adapting to market demands influenced by global economic trends. The validity of the results is supported by robustness checks using economic globalisation. This study investigated the reverse causal relationship between positive shocks in informality and positive shocks in globalisation. This relationship was examined and confirmed in twelve countries: Burkina Faso, Cameroon, Ghana, Guinea, Kenya, Madagascar, Mali, Niger, Nigeria, Togo, Uganda, South Africa, and Zimbabwe. The findings indicate that a positive shock in informality leads to a significant expansion in the size and dynamics of the informal sector. This expansion can be attributed to various factors, such as the growth of informal businesses, self-employment, and changes in labour patterns. Furthermore, the study concludes that positive shocks in informality also contribute positively to globalisation in the specified countries. This suggests that, as the informal sector grows, there is a corresponding positive effect on the level of global economic integration.

Conversely, the study also examined the causal relationship between negative shocks in globalisation and negative shocks in informality. The results of the asymmetric causality test, presented in

Table 9, support this relationship in three countries: Madagascar, Sierra Leone, and Zimbabwe. These findings suggest that the informal sector in these countries is vulnerable to changes in globalisation levels (

Canh and Thanh 2020;

Canh et al. 2021). For instance, in Sierra Leone, reductions in global economic activities can lead to significant impacts on informal sectors, notably in urban areas, where informal trade is a major livelihood. Economic downturns in the global economy can lead to a decreased demand for raw materials like minerals, affecting local informal mining operations. Therefore, policymakers should take into consideration the potential effects of globalisation shocks on the informal sector when devising economic policies. It may be crucial to implement strategies that support the resilience of informal businesses during periods of reduced globalisation. The study also emphasizes the responsiveness of the informal sector to changes in the global economic environment. As a result, policies that enhance the adaptability and resilience of the informal economy during economic contractions should be seriously considered.

Additional robustness checks using economic globalisation are presented in

Table 10. This paper conducts an analysis of alternate causality, specifically exploring the transmission of negative shocks from the informal sector to negative shocks in globalisation. Empirical evidence supports this relationship in several African countries, including Cameroon, Congo, Ghana, Gambia, Guinea-Bissau, Liberia, Mali, Malawi, Senegal, Togo, Tanzania, Uganda, South Africa, and Zimbabwe. These findings indicate that significant negative changes or shocks have occurred in the informal sector in these countries, such as reduced informal economic activities, increased formalization, or changes in local economic conditions. Moreover, the causality results suggest that, following a negative shock in informality, there is a subsequent negative shock in globalisation in these nations. This implies that, as the prevalence of informality decreases, the level of globalisation in these countries also experiences a decline. For instance, Zimbabwe’s economic policies, including land reform and sanctions, have led to a volatile economic environment where globalization shocks have a pronounced impact. For example, reduced trade or investment (negative globalization shocks) correlate with a contraction in the informal sector, possibly due to the decreased availability of goods to trade or reduced informal cross-border activities.

To provide further validation, we present robustness checks in

Table 10, employing economic globalisation as a control variable. Additionally, we investigate the causality within the framework of the policy mix. Specifically, we examine the effect of a surge in the size of the informal sector on globalisation, and vice versa. Firstly, we present the results of the nonlinear causal relationship between negative shocks in globalisation (i.e., decrease in globalisation absorption) and positive shocks in informality (i.e., increase in size of the informal sector) in

Table 11. These results are verified for Burkina Faso, Cameroon, Ethiopia, Guinea, Gambia, Kenya, Liberia, Mozambique, Malawi, Niger, and Togo. From a practical perspective, the observed causal relationship suggests that a negative shock in globalisation leads to a significant decrease in the level or intensity of global economic integration, which may encompass factors such as reduced international trade, investment, or economic interconnectedness.

Conversely, positive shocks in informality indicate an increase in the size or activities of the informal sector. This could be attributed to a surge in informal businesses and self-employment or changes in labour patterns within these African economies. The findings of this study reveal that there is a relationship between negative shocks in globalisation and positive shocks in the informal sector. These shocks refer to a decrease in globalisation absorption and an increase in the size of the informal sector, respectively. Several factors can account for this phenomenon, including economic downturns that lead individuals to seek informal activities for their livelihoods after experiencing job losses in the formal sector. From an economic perspective, this nonlinear and asymmetric causal relationship suggests that the response of the informal sector to positive and negative shocks in globalisation may differ. During periods of economic downturns, the informal sector may serve as a safety net, absorbing individuals who have been displaced from the formal sector. However, the reverse may not be true during periods of positive economic growth, as the informal sector may not shrink to the same extent.

Furthermore, this study found evidence of asymmetric shocks between negative shocks in informality (indicating a reduction in the size of the informal sector) and positive shocks in globalisation (representing an increase in globalisation adoption) in several African countries, namely Angola, Burkina Faso, Cote d’Ivoire, Congo, Cameroon, Ghana, Gabon, Kenya, Madagascar, Malawi, Namibia, Nigeria, and Zimbabwe. These findings have important implications for the economic context, suggesting that when there are negative shocks in informality resulting in a decrease in the size of the informal sector, there tends to be a positive response in the adoption of globalisation. One possible explanation for this relationship is that a decrease in informality may be associated with a more formalized and globalized economic environment. Additionally, the results indicate that a decrease in informality is associated with an increased embrace of globalisation, likely driven by factors such as improved regulatory frameworks, greater access to formal markets, or efforts to align with global standards.

This study examined the causal relationship between positive shocks in globalisation, signifying an increase in the absorption of globalisation, and negative shocks in informality, indicating a decrease in the size of the informal sector. These findings are validated in a sample of African countries consisting of Ethiopia, Gambia, Guinea-Bissau, Kenya, Malawi, Niger, Nigeria, Sierra Leone, Togo, Uganda, Congo, and Zimbabwe, as indicated in

Table 10. From an economic perspective, this implies that when positive shocks in globalisation occur, such as an increase in globalisation absorption, there tends to be a negative response in informality within these economies, resulting in a reduction in the size of the informal sector. This suggests that a more globally integrated economy is associated with a decline in informal economic activities in these countries. The presence of a nonlinear and asymmetric causal relationship suggests that an increase in globalisation absorption may be accompanied by policies, economic conditions, or regulatory changes that contribute to a reduction in the size of the informal sector.

Alternatively, the study explores the causal relationship between positive shocks in informality, indicating an increase in the size of the informal sector, and negative shocks in globalisation, suggesting a decrease in the adoption of globalisation, in a selected group of African countries, including Angola, Congo, Cote d’Ivoire, Ghana, Gambia, Guinea-Bissau, Mali, Malawi, Namibia, Tanzania, Uganda, Congo DR, and Zimbabwe. The results indicate that when positive shocks in globalisation occur, such as an increase in globalisation absorption, in these African economies, there is a negative response in informality, indicating a decrease in the size of the informal sector. This suggests a potential association between a more globally integrated economy and a decrease in informal economic activities. It also suggests that an increase in globalisation absorption could be linked to policies, economic conditions, or regulatory changes that result in a reduction in the size of the informal sector. The robustness of these findings is further supported by additional analyses using economic globalisation, presented in

Table 12,

Table 13,

Table 14 and

Table 15.