Abstract

This study delves into the impacts of the 2008 global financial crisis (GFC) and the COVID-19 health crisis on U.S. financial indices, exploring the intricate relationship between economic shocks and these indices during downturns. Using Markov switching regression models and control variables, including GDP, consumer sentiment, industrial production, and the ratio of inventories-to-sale, it quantifies the effects of these crises on the CBOE Volatility Index (VIX), Standard & Poor’s 500 (S&P 500), and the Dow Jones Industrial Average (DJIA) from Q1 2000 to Q2 2023, covering crucial moments of both crises and stable periods (dichotomous variables). Results reveal that the 2008 crisis significantly heightened financial volatility and depreciated the valuation of S&P 500 and DJIA indicators, while the COVID-19 crisis had a diverse impact on market dynamics, particularly negatively affecting specific sectors. This study underscores the importance of consumer confidence and inventory management in mitigating financial volatility and emphasises the need for robust policy measures to address economic shocks, enhance financial stability, and alleviate future crises, especially during endogenous crises such as financial downturns. This research sheds light on the nuanced impact of crises on financial markets and the broader economy, revealing the intricate dynamics shaping market behaviour during turbulent times.

1. Introduction

The occurrence of recessive periods (a.k.a. crises) in the global economy, when viewed through the lens of financial indicators, can be attributed to several factors. These include information asymmetries in goods and services markets, the influence of economic policies, and the productive dynamics of economic sectors (Kendrick 1961a, 1961b; Østrup et al. 2009). Furthermore, exogenous factors, such as health crises or natural disasters, also impact the nature of key macroeconomic indicators, introducing a certain degree of volatility to financial benchmarks (Prasad et al. 2022).

According to Moseley (2011), the U.S. economy has undergone multiple economic fluctuations in the growth of its Gross Domestic Product (GDP), leading to periods where the cycle becomes recessive, thus establishing structural crises within the economy (Kotz 2013). Since the Great Depression in 1929, only the GFC (where high-risk loans were present) and the COVID-19 crisis have had a similar impact on the levels of macroeconomic indicators, financial benchmarks, and social welfare of both the U.S. and global population (de la Luz Juárez et al. 2015; Shibata 2021).

Despite the similar impacts of these two crises on the U.S. economy, they exhibit three important differences. According to Borio (2020), the first characteristic is the exogenous nature of the COVID-19 crisis compared to the crisis stemming from asymmetries in economic sectors, such as the financial sector (GFC). The second differentiating factor is the uncertainty generated by the lack of control over independent factors of the economy in the COVID-19 crisis, an aspect that is entirely controllable during the GFC since it stems from human behaviours. Finally, global magnitude, where the COVID-19 crisis had a much broader contagion effect compared to the GFC, albeit with greater depth and economic repercussions (Borio 2020).

Although both crises had important impacts and transmissions on the global economy and market efficiency, they differed in several key characteristics. Choi (2021) states that the GFC primarily affected consumption and investment levels through reduced credit availability and widespread interest rate hikes in the aggregate demand equation. Conversely, the COVID-19 crisis impacted the population through aggregate supply via a radical decrease in the labour force and production due to lockdown measures.

Moreover, Strauss-Kahn (2020) highlights the differences between the GFC and the COVID-19 crisis in terms of their impact on global banking stability. While the GFC stemmed from overleveraged real estate growth, resulting in a burst bubble and subsequent wealth consolidation impacting aggregate demand, the COVID-19 crisis, like an exogenous shock, primarily affected production and, soon after, aggregate demand. During the COVID-19 crisis, banks played a supportive role by implementing global credit freezing measures to prevent widespread bankruptcies and job losses.

Furthermore, the transition from recession to recovery was slower in the COVID-19 crisis due to the lack of control over the pandemic compared to the GFC. Monetary policy responses also differed, seeking a shift from an expansive to a recessive policy in the GFC while, in the COVID-19 crisis, supporting an expansionary response to promote economic recovery. In terms of international cooperation, the response to the COVID-19 crisis involved greater multilateral cooperation compared to the GFC, aiming to establish a monetary policy conducive to economic recovery (Strauss-Kahn 2020).

On the other hand, the effects of central bank interventions differ significantly between the two crises. For instance, during the COVID-19 crisis, policies promoting stability among international goods and services markets have yielded positive effects, complemented by counter-cyclical measures aimed at stabilising economies and bolstering consumer confidence. In contrast, during the GFC, the application of pro-cyclical policies exacerbated economic downturns, hindering recovery efforts and amplifying market volatility (Cortes et al. 2022). Bhar and Malliaris (2021) examined the U.S. monetary policy and its effectiveness in the 2008 financial crisis, comparing it with the COVID-19 crisis. They concluded that, although there were some differences between both crises, the unconventional monetary policy used in the financial crisis provided valuable lessons for the COVID-19 crisis, where monetary policy was more assertive in economic reactivation. During the GFC, monetary policy was tighter in terms of adjustment in the money supply, unlike the COVID-19 crisis.

Also, during the COVID-19 pandemic, fiscal policy responded with unprecedented stimulus measures worldwide, including direct payments, enhanced unemployment benefits, and business support programmes, aiming to cushion the economic impact of lockdowns and bolster consumer spending (Cortes et al. 2022). In contrast, during the GFC, fiscal policy initially leaned towards austerity measures, characterised by budget cuts and reduced government spending, exacerbating economic downturns and prolonging recovery efforts (Stiglitz 2010).

Furthermore, a key element in the COVID-19 crisis, absent in the GFC, is the widespread uncertainty and the quick reaction of policymakers. According to Spatt (2020), uncertainty was much higher during COVID-19 compared to the GFC. However, policymakers’ response was slower during the COVID-19 crisis than in the GFC owing to multiple exogenous factors that were beyond their control.

Additionally, the 2008 financial crisis and the 2020 COVID-19 health emergency caused turbulence in financial markets that had, in itself, a deep and widespread impact internationally. This situation was reflected in the performance of the VIX index and market valuation indicators, such as the S&P 500 and the DJIA. Examining the behaviour of the VIX index, which reflects the levels of volatility associated with the U.S. financial market, during the GFC (2007–2009), the index peaked in the fourth quarter of 2008, reaching a maximum average of 58.59 points over the analysis period. Conversely, during the COVID-19 pandemic (2020–2022), the second quarter of 2020 saw the index top at 34.49 points, on average. This indicates that during the financial crisis period, there was higher volatility compared to the health crisis (Federal Reserve Bank 2023).

During the GFC, the S&P 500 index hit its lowest point in the first quarter of 2009, dropping to 805 points. Conversely, during the COVID-19 pandemic, the lowest valuation occurred in the second quarter of 2020, with the index at 2926 points. This pattern is also observed in the DJIA, which stood at 7757 points in the first quarter of 2009 during the GFC and at 24,570 points during the second quarter of 2020 (Federal Reserve Bank 2023). The comparison between the 2008 financial crisis and the COVID-19 pandemic reveals the magnitude and global reach of these events, as evidenced by instability in the financial markets. While the higher volatility during the GFC suggests deeper systemic issues, the sharp fluctuations in market indices during both crises underline the disruptive effects on investor confidence and asset prices. These observations highlight the need for robust risk management strategies and proactive policy responses to mitigate future crises and safeguard financial stability globally.

In this regard, the principal objective of this study is to identify how the U.S. financial markets reacted to the presence of the GFC and the COVID-19 pandemic crisis in order to quantify which crisis had a greater impact on financial markets. Thus, given its endogenous nature, the GFC is expected to have had a greater impact on financial indicators compared to the COVID-19 crisis.

To reach our goal, we use a Markov switching model to estimate the GFC causal effects on volatility levels (meaning an increase in the VIX) and valuation (meaning a decrease in the S&P 500 and DJIA) compared to the COVID-19 pandemic crisis in the U.S. This article is divided into six sections in addition to this introduction. In the following section, we discuss the nature and consequences of both crises. Section 3 provides an empirical literature review, while the fourth describes the data source and presents the methodology employed. The following section displays the descriptive statistics and results. Finally, a discussion and conclusions are presented at the end of the article.

The contributions of this paper to the current financial literature are several. First, it compares the impacts of the GFC and the COVID-19 pandemic on financial markets. Second, it analyses how these crises differed in terms of their causes, economic consequences, and policy responses. And third, it aims to quantify which crisis had a greater impact on financial indicators. The novelty of our approach is that, while research exists on both crises individually, this paper focuses on a comparative analysis and establishing a quantifiable measure of their impact. Finally, understanding how different types of crises affect financial markets will help develop better risk management strategies and policy responses for future events.

2. Nature and Consequences of the GFC and COVID-19 Crisis

In order to analyse the nature of the GFC, it is recognised that the GFC is characterised by high-risk lending practices, stemming primarily from four key features (Gerardi et al. 2008). First, high-risk borrowers needed tailored assistance and stricter credit standards, but rating agencies failed to assess this risk effectively. Second, loans were extended to individuals with multiple debts, as relaxed selection criteria boosted the previous GFC conditions. Third, borrowers often lack awareness of the interest rates aligned with their risk profiles, and such knowledge could have deterred them from pursuing mortgages. Finally, bundling high-risk loans with low-risk mortgages obscured the true risk assessment, hence earning them the name Subprime. However, it is essential to understand the root causes before delving into the economic repercussions.

According to Schwartz (2009), the GFC was incubated amidst the U.S. economic dynamics of the 1990s, characterised by a housing bubble and mortgage leveraging from 2007 to 2009. Corporate relocations, labour-intensive production, and reduced production costs fostered lower inflation rates and subsequently lower mortgage interest rates during the 1990s. This led to a surge in real estate, driving economic expansion. Stiglitz (2010) adds to that consumption habits, particularly among low-income Americans, which further pumped the crisis. A graph illustrates a negative correlation between personal savings and logarithmic mortgage loans during periods of economic expansion, indicating increased borrowing and decreased savings, especially among low-income individuals.

Furthermore, structural interest rate shifts in 2005 globally escalated mortgage interest rates, stretching borrowers’ repayment capacities. The influx of high-risk applicants, coupled with relaxed loan approval standards, led to an accumulation of risky loans, increasing default probabilities and ultimately precipitating the financial crisis. Additionally, packaging high-risk mortgages with low-risk ones, known as “wrapped debt”, fostered hidden risk assessments and exacerbated liquidity issues in the financial system.

Thus, the GFC, a culmination of risky financial practices and macroeconomic factors, was pumped by lax lending criteria, multiple loan bundling, borrower risk perception gaps, and risky debt packaging. A combination of corporate relocations, relaxed monetary policies, and consumer spending habits amplified the crisis, compounded by inadequate risk evaluation by banking institutions and the practice of bundling debts. Policy responses included promoting responsible borrowing, implementing restrictive monetary policies, and imposing stricter lending criteria to mitigate mortgage defaults (Stiglitz 2010).

On the other hand, the initial nature of the COVID-19 health crisis is attributed to an external agent, in the form of a disease or a pandemic that not only affects human beings but also spreads to the global economy. The World Health Organization (WHO) declared a public health emergency in January 2020 and announced a pandemic in March, both in the U.S. and worldwide (Congressional Research Service 2021). The WHO traced the initial infection point to China, but Europe, particularly Italy, emerged as the global epicentre, leading to widespread transmission worldwide. By November 2021, there were approximately 246.6 million cases and 5 million deaths globally, with the U.S. recording 103.3 million cases and 1.13 million deaths by June 2023 (Congressional Research Service 2021; World in Data 2024).

To stop transmission, widespread quarantine policies were implemented globally, including at local levels. However, while effective in reducing virus spread, these measures had significant negative impacts on both economic and health aspects. Quarantines induced stress at the public health level and long-term economic pressure, exacerbating the growth of mental health disorders, particularly in households where remote work was feasible. The proliferation of COVID-19 also contributed to the rise of other diseases, notably mental illnesses, necessitating dynamic quarantine or isolation approaches (Dyer 2020; Zhang et al. 2022).

Simultaneously, governments worked to fortify hospital networks, particularly to address respiratory illnesses. However, even before the pandemic, hospital capacity to manage respiratory diseases was deficient, especially in low-income regions with high population densities. During peak transmission periods, ICU capacity was particularly strained, underscoring the importance of having enough resources, including iron lungs (Dyer 2020). The surge in demand for medical technology supplies during the pandemic, especially in the U.S., highlighted the urgent need for comprehensive emergency preparedness plans, particularly focusing on small ICU-equipped hospitals.

The GFC resulted from risky financial practices and lax lending standards, leading to defaults and a financial meltdown. In contrast, the COVID-19 health crisis, triggered by an external agent, caused widespread economic disruption through quarantine measures. While effective in reducing virus spread, these measures had significant negative economic and health impacts, underscoring the need for improved healthcare infrastructure and emergency preparedness for future pandemics.

In the comparative analysis of both crises, it is crucial to recognise that, despite their different roots, the economic results are remarkably similar. For example, both crises yield an important decrease in the GDP and other key macroeconomic variables. This similarity in outcomes suggests the existence of underlying patterns in economic dynamics that warrant deeper scrutiny. In this regard, while the causes may vary, it is essential to identify common factors perpetuating these cycles of slowdown and their devastating effects on the global economy (see Table 1).

Table 1.

Economic consequences comparison of the GFC and COVID-19 Crisis.

Both crises have intensified the susceptibility of credit-dependent firms and worsened economic disparities, notably impacting household spending ability and increasing poverty levels. While the GFC crisis mainly affected finance, COVID-19 has profoundly influenced global health, prompted unprecedented governmental actions, and widened disparities among demographic groups. Moreover, both crises spurred regulatory changes aimed at bolstering financial stability and averting future crises. These findings underscore the intricate and diverse nature of economic shocks, highlighting the need for comprehensive policy measures to alleviate their negative repercussions and foster resilience in the face of forthcoming adversities. Extensive studies have delved into the multifaceted impacts of both the GFC and the COVID-19 pandemic on various financial indicators, shedding light on the complexities of these economic upheavals and providing information on strategies for mitigation and recovery.

3. Literature Review

Financial markets are exposed to many forces that shape their behaviour. Crises, such as the recent COVID-19 pandemic and the GFC, represent significant disruptions with the potential to dramatically alter market dynamics. This review delves into the interplay between these crises, financial market volatility, and different approaches. For example, Grima et al. (2021) investigate the impact of the COVID-19 crisis in the U.S. on current volatility levels. The authors employed techniques such as Johansen cointegration to examine the long-term relationship between the VIX Index and COVID-19 cases, as well as major stock market indices. Additionally, they applied Fully Modified Least Squares to estimate the long-term effects of the analysed variables on stock markets (Grima et al. 2021).

Based on the findings introduced, a close relationship between COVID-19 cases and financial market volatility is obvious. Cointegration was found between the VIX Index and COVID-19 cases in the U.S., indicating a significant impact of the pandemic on market volatility in the country. Furthermore, cointegration was identified between the VIX Index and major international stock market indices, suggesting an interaction between market volatility and the performance of global stock markets (Grima et al. 2021). Such cointegration also implied a cross-cutting impact of pandemic-related events on risk perception and the performance of financial markets both nationally and internationally.

Manda (2010) conducted a study to gauge the behaviour of the S&P 500 index during periods of crisis, focusing particularly on the GFC and the COVID-19 crisis. A Markov switching model was employed with three regimes to characterise periods of calm, volatility, and turbulence in market behaviour, aiming to identify explanatory variables that could anticipate the likelihood of volatile or turbulent regimes in the market (Manda 2010).

The study findings suggest that the VIX index, along with other assets such as gold, WTI oil futures, and the dollar index, play a significant role in volatile and turbulent market regimes, particularly in assessing the S&P 500 during crises like the GFC and the COVID-19 pandemic. These conclusions underscore the importance of investor risk perception and its impact on market dynamics. Moreover, the study indicates that the S&P 500, being one of the most widely tracked and representative stock indices of the U.S. market, may be influenced by these volatility factors, potentially carrying significant implications for investors and financial stability overall (Manda 2010).

The conclusions of the study emphasise the relevance of analysing movements in the S&P 500 as a barometer of overall market sentiment and investor confidence, especially during times of economic uncertainty. Furthermore, they highlight the importance of understanding market volatility drivers, such as VIX index behaviour and other relevant assets (Manda 2010). This understanding could be crucial for investors and analysts in making more informed decisions and crafting more effective risk management strategies in a financial environment characterised by its complexity and increasing dynamism (Manda 2010).

Shehzad et al. (2021) examine the asymmetric impact of the COVID-19 pandemic and the GFC on the valuation of companies associated with the DJIA index and oil price formations. They seek to determine how these crises affect financial markets disparately, especially in terms of peril, variability, and risk. Simultaneously, they explore the risk premium associated with post-crisis periods by means of an Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) methodology used in the subsequent chapter to calculate the risk premium.

During this crisis, the volatility of both markets reached historically high levels, even surpassing those observed during the GFC. This underscores the importance of understanding how different crises affect financial and energy markets, emphasising the need for policies that promote financial sustainability and help investors when facing future crises (Shehzad et al. 2021). Also, Gomez-Gonzalez et al. (2024) employ a multi-country FAVAR model to analyse how financial, macroeconomic, and policy uncertainty shocks in the U.S. affect credit growth and stock returns in five major recipients of U.S. investment from 1950 to 2019. This approach captures the intricate global interdependencies, revealing that U.S. macroeconomic shocks predominantly act as demand shocks in developed economies, reducing credit availability and adversely affecting financial markets and real production. The findings underscore the importance of policies that bolster domestic demand and mitigate financing costs during periods of heightened uncertainty in the U.S. (reflected in recessive GDP periods), emphasising the need to monitor uncertainty in both the U.S. and local markets to design effective economic policies.

On the other hand, Chen and Yeh (2021) examine how the GFC and COVID-19 impacted U.S. financial indices, controlling for producers’ confidence through the Industrial Production Index (IPI). Using an event study combined with a GARCH specification, where the event study variables are the valuations of the NYSE and AMEX, the authors show that the announcements of these crises and the IPI had significant effects on the valuation of the indices. The COVID-19 crisis highlighted more pronounced differences between the returns of the NYSE and AMEX. The effect of the IPI was aimed at controlling the variability of returns in the NYSE and AMEX series, exogenising the productive capacity of investors, and allowing the valuation of these indicators to be influenced solely by market conditions.

Kanzari et al. (2023) develop a novel approach employing long short-term memory (LSTM) networks to investigate the role of sentiment in predicting macro-financial instability. Their methodology utilises emotional data from various sentiment indices, demonstrating that incorporating such data significantly improves the predictive accuracy of financial stress levels compared to models relying solely on historical financial stress and risk values. It concludes that sentiment, particularly consumer and investor sentiment, plays a crucial role in destabilising the financial system and can serve as a vital tool for forecasting financial instability. This has important implications for policymakers and investors, suggesting that monitoring sentiment indices can lead to improved portfolio management and proactive measures against financial instability. Additionally, the study highlights the potential of hybrid models combining LSTM and GRU to further enhance predictive performance, albeit noting limitations related to input feature sensitivity and memory requirements.

The growth of GDP, the increase in industrial production, and the rise in the consumer sentiment index have positive effects on financial indicators such as the S&P 500 and DJIA. This economic growth and resulting confidence drive up stock prices and reduce market volatility, as investors tend to hold onto their investments for the long term in a stable economic environment. In summary, these economic factors strengthen financial indicators and stabilise the market. In this regard, once the social and economic consequences of both crises have been assessed, we proceed to analyse the effects of each crisis on the behaviour of financial indicators in the U.S. economy. We employ an additional set of control variables to determine which of the crises had a greater impact on macroeconomic indicators.

4. Data and Methods

To compute the effects of the 2008 financial crisis and the COVID-19 pandemic crisis, this analysis proposes the use of Markov switching regression models or regime switching models. The goal is to establish the impacts that different crises have on each regime, considering periods of high volatility and absence of volatility in the case of the analysis of the VIX index or the appreciation and depreciation of financial indicators such as the S&P 500 and the DJIA. At the same time, this study will identify the probabilities of regime changes.

4.1. Data

Seeking to assess the effects of the financial and COVID-19 crises on the financial indicators of the United States, quarterly data was collected from the third quarter of 2000 to the second quarter of 2023. This timeframe is chosen so as to encompass key moments of both crises and contrast them with periods of economic stability. Financial indicator data is recorded daily and averaged quarterly to ensure comparability in the analysis with the vector of control covariates. This approach allows for a precise evaluation of the impacts, while ensuring consistency in capturing temporal effects (Baba and Sakurai 2011).

The data on the main financial indicators were obtained from Investing.com (2023), using the daily market closing values and subsequently weighting them quarterly. Simultaneously, information was gathered for the vector of control covariates, which includes key economic efficiency measures. These measures encompass the U.S. GDP, the University of Michigan Consumer Sentiment Index, the Industrial Production Index, and the inventory-to-sales ratio (Baba and Sakurai 2011; Chowdhury et al. 2022).

The GDP represents the total value of all goods and services produced within the U.S. economy in a specific quarter. The University of Michigan Consumer Sentiment Index shows consumer confidence in the economy, where low values imply a loss of consumer confidence, and conversely when it is ascending. Additionally, the Industrial Production Index reflects the variation in total production across manufacturing, mining, and public utility sectors in the country. Finally, the inventory-to-sales ratio consolidates information on companies’ ability to sell their inventories, offering a measure of economic health. The data were obtained from the Federal Reserve Bank in 2023.

These variables provide a comprehensive overview of the state of the economy, evaluating everything from aggregate production to consumer confidence and industrial sector performance. The selection of these covariates is based on previous research (Baba and Sakurai 2011; Chen and Yeh 2021; Chowdhury et al. 2022; Federal Reserve Bank 2023; Gomez-Gonzalez et al. 2024; Kanzari et al. 2023; Ratanapakorn and Sharma 2007), supporting their relevance for analysing the effects of the financial and COVID-19 crises on the U.S. economy.

The choice to utilise these variables in levels is underpinned by a multitude of advantages that enhance the analytical process: (i) Employing transformations on indices can lead to model underspecification, potentially missing the precise effects of these indices on dependent financial variables; (ii) Application of logarithms to indices could produce skewed interpretations of the variables’ impacts on financial indicators; and (iii) Comparable studies advocate for the use of variables in levels, enhancing the precision and robustness of the model estimation process (Baba and Sakurai 2011; Chowdhury et al. 2022).

Finally, to measure the effects of the crises, two dichotomous variables are used, reflecting the quarters in which the duration of the crises is perceived. The time period of the financial crisis spanned from the first quarter of 2007 to the last quarter of 2009, and of the COVID-19 pandemic crisis from the last quarter of 2019 until the second quarter of 2021 (Bhatia and Gupta 2020; Centers for Disease Control and Prevention 2022).

4.2. Econometric Strategy

The regime-switching model (a.k.a. Markov switching Model) is a tool that allows for parameter estimation based on regime changes or states. This model, developed by Goldfeld and Quandt (1973) and expanded by Hamilton (1989), is primarily used to estimate asymmetries in the economy and, in this case, to calculate asymmetries between financial indicators in the presence of different states of the economy (Baba and Sakurai 2011; Di Persio and Vettori 2014). In this regard, we will employ the approach of Goldfeld and Quandt (1973) for the estimation process.

This model establishes states or regimes, defined according to the dynamics of financial indicators. Goldfeld and Quandt (1973) propose computing the equation of these states (see Equation (1)). The regimes represent changes in the mean and/or variance of a time series, facilitating the analysis of data with different behaviours in different periods. For example, in the VIX index, regime changes range from low volatility to medium or high volatility, and vice versa. As for the S&P 500 and DJIA indicators, it involves transitioning between periods of low to medium or high valuation, and vice versa.

The scale corresponds to time measured in quarters from Q3 2000 to Q2 2023, while the scale represents the unobserved states or regimes of the estimation process. The selection of the number of states primarily depends on the ability of the modelling structure to capture the complexity of economic series and compute the levels of variability among them. Therefore, the choice of the number of states relies on minimising the Markov switching criterion. Finding the value that minimises this criterion determines the desired number of states (Smith et al. 2006).

In the case of the estimating equation, the dependent variable comprises a set of financial variables of interest, namely, financial indices. On the other side of the equation, corresponds to the intercept of each state. Additionally, represents the matrix of invariant independent variables of their state, which corresponds to our set of dichotomous variables reflecting the quarters where events occurred. Finally, the formation of the matrix of independent variables that vary depending on the state represents our vector of independent variables showing macroeconomic dynamics. Lastly, the error variable is included.

Using a probabilistic approach, the conditional transition probability matrix between regimes is estimated, considering a maximum of four states. This matrix, size , where represents the number of states, is derived from the maximisation of likelihood and the minimisation of the Akaike Information Criterion (AIC) statistic (Baba and Sakurai 2011). It is important to highlight that the probabilities between regimes are determined through two equations established through this likelihood maximisation process. Based on this probability matrix, the propensity of the economy to experience periods of high volatility and low returns in U.S. financial indicators is analysed. The analysis was conducted using R.

In the formation of the transition matrix:

It is important to note that this analysis focuses on examining the effects of short-term economic and financial crises on financial indicators. Therefore, methods such as cointegration are not employed in the analytical process. Instead, this study prioritises approaches that can effectively capture the immediate impacts and fluctuations resulting from these crises on financial markets.

Markov switching models are indispensable for our research, offering a robust method to capture economic asymmetries and analyse diverse financial environments. With these models, we can study how key financial indicators, such as the VIX, S&P 500, and DJIA, respond to different conditions, from high volatility to stability. Moreover, they help us identify regime changes and predict their likelihood, which is crucial for understanding the impact of disruptive events like financial and health crises on market dynamics and economic indicators. This predictive capability informs decision making and enables proactive planning for future scenarios.

5. Descriptive Statistics and Results

5.1. Descriptive Statistics

This section provides a descriptive analysis of the variables of interest to examine the prospective outlook of the financial and economic series associated with the study. Accordingly, we proceed to examine the corresponding series of financial indicators across multiple time periods, considering contexts with and without volatility stemming from financial or COVID-19 pandemic crises. The goal is to identify the initial behaviour of the variables used in this study in the contexts mentioned.

Additionally, unit root tests are employed to evaluate the behaviour of the series. These tests determine whether or not the series is stationary, thereby shedding light on how crises could impact changes in the financial index series. They reveal the effects of both external and internal factors on series volatility. To assess this, an analysis is conducted both at levels and with logarithmic transformation using the Augmented Dickey–Fuller (ADF) test (Pandey and Kumari 2021).

In this regard, we check the average of financial indicators for the U.S. in the current context of the financial crisis, the pandemic, and regular periods (when the economy is unaffected by any economic or social crisis) (see Table 2). It is possible to identify that for the VIX index, the average volatility during the 2008 GFC was much higher compared to the COVID-19 pandemic health crisis, and even more so for regular periods. This pattern is also seen when logarithms are applied to this index (Pandey and Kumari 2021).

Table 2.

Economic variables average across crises and regular periods.

The values of financial indicators, such as the S&P 500 and the DJIA indices, are clearly lower during the period associated with the financial crisis, followed by regular periods. In contrast, during the COVID-19 pandemic health crisis, the values of these indices were higher compared to regular periods. These outcomes suggest a positive influence on the average valuation of these indicators. At first glance, the COVID-19 pandemic crisis, being exogenous to the economy, did not have a substantial effect on the valuation of the corresponding indices.

Additionally, one of the sectors that gained the most strength during the pandemic was the technology sector (Günsür and Bulut 2022). This implies that the demand for technological goods due to the pandemic was reflected in an increase in the market value of the stocks of companies within the sector. This led to an appreciation of their value and thus contributed to the increase in the valuation of these financial indices.

In the same way, with respect to GDP growth, the context of the financial crisis clearly had a negative impact on the continuous growth of production. However, the COVID-19 crisis and regular periods entailed maintaining consistent growth over time. Initially, this was due to the decrease in the installed capacity of companies during the mortgage crisis compared to the COVID-19 crisis, where there was no massive destruction of entrepreneurship, coupled with policies to stimulate consumption and investment in the pandemic.

In the case of the industrial production index and the consumer sentiment index, it is possible to perceive that during the financial crisis, the rebound of the index was low in comparison to other periods. This indicates that structural economic crises negatively affect both continuous production and consumer confidence. The inventory-to-sales ratio increased during the COVID-19 pandemic, indicating that production or inventories continued to grow, but consumption of these products did not grow at the same rate.

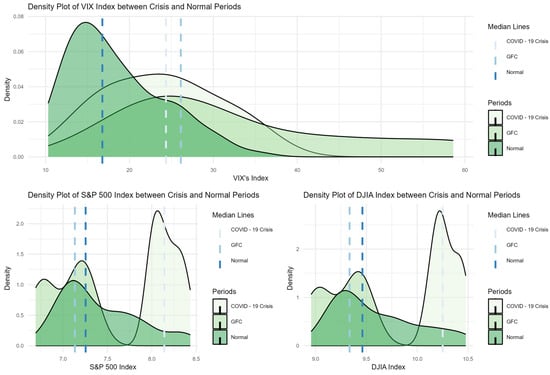

On the other hand, we examine the behaviour of financial indicators in the United States across normal and crisis periods through a density plot. This analysis is pivotal for understanding how economic crises impact financial markets compared to periods of stability. By comparing data distributions in these diverse contexts, we can pinpoint significant patterns and changes in the volatility and valuation of financial indices. Such an approach enables us to assess market resilience and provides a robust foundation for shaping economic policies that mitigate the adverse effects of future crises (Figure 1).

Figure 1.

Comparison of Density Plots for Financial Indices in the United States During Crisis and Normal Periods. Source: Prepared by authors.

In the case of the VIX index, which reflects the levels of volatility present in the United States financial market, an intriguing trend in its behaviour can be observed across different economic contexts. During periods of economic stability, the density distribution tends to skew towards the right side of the graph, indicating normal levels of volatility within the analysed period (Figure 1).

However, upon examining both crises, a distinct pattern emerges. During these crises, the density distribution exhibits a leftward skew on the graph, implying an accumulation of higher levels of volatility in the market. It is noteworthy that, between the two crises, the GFC is perceived as the one that generated a greater level of volatility in the market (Bhar and Malliaris 2021). This is because the median of the density distribution is more skewed towards the left side of the graph, indicating a higher concentration of observations at higher volatility levels (Figure 1). This could be attributed to the endogenous nature of the crisis (Bhar and Malliaris 2021).

In the case of the Standard & Poor 500 and the Dow Jones Industrial Average indices, distinct behaviour is observed. While both crises resulted in increased volatility levels above stable periods, a significant divergence in their impact is also noticeable. During the COVID-19 crisis, a growth in the valuation of the financial assets of leading U.S. companies was evident compared to the GFC. This phenomenon suggests a greater resilience and adaptability of the market amid the COVID-19 crisis in terms of financial asset valuation.

Conversely, during the GFC, characterised by a widespread systemic crisis affecting aggregate demand, consumption, and investment levels, the economic landscape underwent a significant downturn. The crisis reverberated across multiple sectors, leading to widespread job losses, business closures, and a contraction in economic activity. Consequently, amidst this turbulent period, there were no discernible winners, as reflected in the right-skewed density distribution on the graph (Figure 1). The pervasive economic challenges faced by industries and individuals alike underscored the severity and depth of the crisis, highlighting the need for comprehensive interventions and policy measures to stabilise the economy and restore confidence in the financial markets (Bhar and Malliaris 2021).

The following lines focus on estimating the process of time series stationarity. In this regard, the Augmented Dickey–Fuller (ADF) tests are applied to the financial indicators and associated macroeconomic indicators. Initially, most variables in levels lack stationarity, except for the inventory-to-sales ratio index and the industrial production index. This may be due to the influence of volatility within the series at points where there are market asymmetries or to the COVID-19 crisis. On the other hand, in the analysis of their growth rates, the estimation processes are completely stationary. However, the application of growth rates is determined because the condition of stationary series persists in a logarithmic transformation. Nevertheless, for the rest of the analysis, logarithm series are preferred, as they enhance the analysis and allow for better verification of the hypotheses. Subsequently, estimation processes or regressions associated with the object of analysis are encouraged (see Table 3).

Table 3.

Stationarity analysis of variables in levels and growth rates.

5.2. Results of the Markov Switching Model

This study focuses on examining in detail the behaviour of financial variables in the face of different regimes and states of behaviour, taking into account a set of control variables. The primary objective is to understand the causal relationships underlying changes in volatility, represented by the VIX index, as well as the appreciation of key financial indices, such as the S&P 500 and the DJIA, in the context of economic crises. The likelihood ratio is used to evaluate the efficiency of the model compared to other possible regimes, thus providing a quantitative measure of the model’s fit to the observed data. Additionally, these results are reinforced by implementing the Akaike Information Criterion statistic to gauge the relative quality of the model for a given dataset. To assess the modelling efficiency, preference is given to the model that exhibits an AIC closer to minus infinity.

When analysing the behaviour of the VIX index, it is evident that three regimes or states are the most representative in modelling financial volatility. Specifically, during periods of financial crisis, a significant and positive impact on VIX growth is observed, suggesting that these events have a disproportionate influence on the market volatility level. On the other hand, the COVID-19 crisis exhibits a lesser impact on volatility than the GFC, highlighting the endogenous nature of the GFC, which impacts volatility levels in three states (Di Persio and Vettori 2014). Thus, the same approach proposed by Di Persio and Vettori (2014) is resumed, where abrupt changes in financial indicators are evidenced in the context of the financial crisis.

The research findings suggest that, overall, the relationships between different economic and financial indicators and market volatility are stable across various market conditions. This implies that the financial crisis in the U.S. resulted from interdependencies between different markets rather than only financial contagion. However, there is limited evidence to support the idea that deterioration in the quality of underlying assets can explain the transition from “normal” market conditions to a state or regime of high volatility. In a Markov switching regime model, these implications could be reflected in the stability or changes in transition probabilities between different states or regimes, as well as in the significance of the factors driving these state changes (Di Persio and Vettori 2014; Flavin and Sheenan 2015).

For instance, an analysis of the VIX index’s performance and an exploration of how different economic and financial indicators affect market volatility reveal that increasing GDP economic growth reduces market volatility. While in the initial state or regime, it may contribute to heightened volatility with a non-significant effect (an increase of 1 percentage point in economic growth generates an increase of 0.77 points in volatility), in subsequent states, it tends to stabilise by decreasing volatility, particularly across the second state with a negative effect of −1.77 points (Table 4). Also, economic growth may heighten volatility due to investor expectations, restrictive monetary policies, and reactions to unforeseen economic events, which are determined by the third state, which increases volatility by 0.28 points (Baba and Sakurai 2011; Bhar and Malliaris 2021). Similarly, the analysis of the industrial production index reveals that an increase in this indicator tends to be associated with a decrease in financial market volatility (an increase of one point in the IPI has a negative effect on reducing volatility, as follows: −1.01 points in the first state, −0.54 points in the second state, and −0.86 points in the third state), suggesting an inverse relationship between industrial activity and market volatility (Di Persio and Vettori 2014; Flavin and Sheenan 2015).

Table 4.

Coefficients associated with the Markov switching model for financial indices.

Moreover, the impact of consumer confidence on financial volatility is tested, finding that an increase in consumer confidence can have significant effects on reducing market volatility. Specifically, in the first and third states, an increase in consumer confidence reduces volatility by −0.42 and −0.17 points, respectively. Conversely, in the second state, it increases volatility by 0.08 points. Finally, the inventory-to-sales index is analysed, highlighting the importance of efficient inventory management in reducing financial volatility (Flavin and Sheenan 2015). An increase in inventory levels relative to consumption can mitigate the effects on volatility growth, underscoring the absence of market capacity to deplete stocks and revealing consumption patterns (Table 4).

In the analysis of the logarithm of the S&P 500 financial indicator, the optimal number of states is selected using a likelihood statistic, suggesting three states: low, medium, and high index values. On assessing the impact of crises, it can be observed that the financial crisis has significant negative repercussions on the behaviour of the S&P 500 series in logarithms. There are notable repercussions in states one and three of the analysis. This shows how the very nature of the crisis affected index dynamics, reflecting uncertainty and volatility in the financial markets during those periods.

On the other hand, when examining the COVID-19 health crisis, the presence of this crisis is found to be associated with positive and significant coefficients. Specifically, it increases volatility by 0.46 points in the first state, 0.06 points in the second state, and 0.08 points in the third state. This finding can be attributed to the nature of the crisis, which not only did not negatively affect the financial market but also boosted certain sectors, such as technology companies. It is important to note how external events can have variable impacts on financial markets, depending on their nature and the broader economic context (Baiardi et al. 2020; Chevallier 2012).

Analysing the relationship between GDP growth and the S&P 500 financial indicator reveals a significant positive effect in most states. This suggests that during periods of economic expansion, the index tends to appreciate, reflecting confidence in the overall health of the economy and the potential growth of firms (see Table 4). Similarly, according to Chevallier (2012), the increase in global imbalances and the lack of control in the development of the GFC had a particular effect on aggregate indicators, where financial indicators related to economic behaviour and futures prices suffered a setback in economic growth. These periods were characterised by high volatility and witnessed a decline in economic growth and market growth (Chevallier 2012).

The industrial production index exhibits a positive relationship with the financial index, highlighting the ability of the industrial sector, particularly of publicly traded companies, to positively influence its valuation (an increase of one point in the industrial production index has a positive effect on the market valuation of the S&P 500, resulting in an increase of 0.04 points in the first state, and 0.6 points in both the second and third states). This underscores the industrial sector’s importance in the overall performance of the financial market (Chevallier 2012; Flavin and Sheenan 2015). When considering the consumer sentiment index, inconsistent effects are identified among states, showing a positive or negative relationship, depending on the context. This emphasises the complexity of factors influencing financial markets, including consumer confidence and its impact on investor behaviour (Flavin and Sheenan 2015).

Testing the relationship between inventories and sales and the valuation of the S&P 500 index reveals positive and statistically significant relationships. These results are inconsistent with conventional theory because an increase in inventories relative to sales is generally considered a sign of economic weakness (Table 4). However, in this case, there appears to be a positive market perception towards this association, suggesting a more nuanced interpretation of the data and the factors influencing the index valuation. This may suggest an optimistic outlook on future economic growth and business confidence (Smith et al. 2006).

A similar dynamic can be identified for the DJIA financial index to that of the S&P 500 index. The likelihood index indicates a preference for estimating three states in the Markov switching model for the DJIA. The presence of the GFC is not statistically significant in the first two states but is significant and negative in the last one, with −0.12 points in the valuation of the index. In contrast, the COVID-19 crisis has a positive impact on the DJIA, indicating that the companies comprising the index have been affected differently than expected during a COVID-19.

As before, theoretically consistent results are observed regarding economic growth measures, where an increase has a positive effect on the logarithmic series of the Dow Jones. Similarly, a one percent increase in GDP generates expansionary effects on the index, resulting in an increase of 0.01 percentage points in the first state and 0.08 percentage points in both the second and third states. In the case of the Consumer Confidence Index, the results suggest that it is not as relevant in the analysis process in most states. Finally, for the industrial production index and the inventory-to-sales ratio, these effects are positive and statistically significant, resembling those calculated with the previous financial index (Bhar and Malliaris 2021; Chowdhury et al. 2022; Flavin and Sheenan 2015; Prasad et al. 2022).

Additionally, when examining the transition of states or regimes, a matrix is estimated to measure probabilities. For the VIX index, the states consist of: (1) low volatility, (2) medium volatility, and (3) high volatility. Meanwhile, for the Dow Jones and S&P 500 financial indices, the states consist of: (1) low valuation, (2) medium valuation, and (3) high valuation. Therefore, the desirable state for the VIX index would be low volatility, and for the other two indices, high valuation. Thus, the following table shows the transition probabilities between each state and each variable.

In the formation of transition probabilities applied to the VIX index, the transition capability from state or regime 1, which refers to low volatility, to states or regimes of high and medium probability is around 43%, of which only approximately 20% tend to approach spectrums where volatility is high. On the other hand, state or regime 2 has a propensity to move towards scenarios where volatility is high and is less likely to establish points of low volatility. Finally, in a scenario of high volatility, the transition to scenarios of low and medium volatility is around 30% overall (see Table 5).

Table 5.

Estimations of probabilities in regime switching for financial indicators.

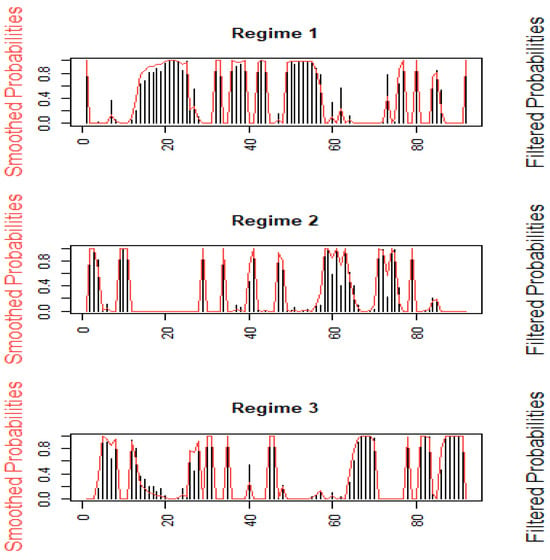

Regime 1 shows frequent shifts away from low volatility, indicating dynamic market changes. Regime 2 highlights frequent transitions to and from medium volatility, reflecting moderate market uncertainty. Regime 3 demonstrates prolonged periods of high volatility, indicating sustained market stress, which is more pronounced during the peak periods of the COVID-19 pandemic and the GFC (Figure 2) (Bhar and Malliaris 2021).

Figure 2.

Filtered probabilities of three regimes in VIX Index: (Regime 1) low volatility; (Regime 2) medium volatility; (Regime 3) high volatility. Source: Prepared by authors.

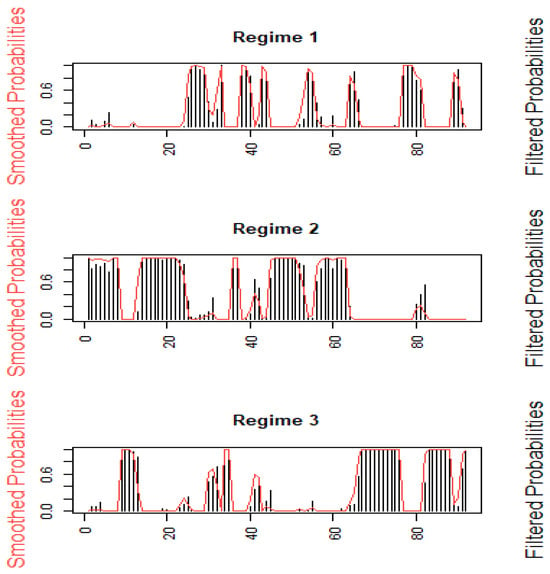

The analysis of the S&P 500 index reveals distinct market behaviours across three regimes: low, medium, and high valuation. Regime 1 (low valuation) shows a 25% propensity to transition to high valuation, indicating quick recovery periods. Regime 2 (medium valuation) frequently transitions to low valuation, reflecting market volatility and susceptibility to external shocks. Regime 3 (high valuation) sustains longer periods of market confidence and strong performance but remains susceptible to transitions, reaching high levels of valuation in the final periods encompassing COVID-19. This analysis highlights the dynamic nature of the U.S. financial market, with the S&P 500 index demonstrating resilience and significant fluctuation patterns (Figure 3).

Figure 3.

Filtered probabilities of three regimes in S&P 500 Index: (Regime 1) low valuation; (Regime 2) medium valuation; (Regime 3) high valuation. Source: Prepared by authors.

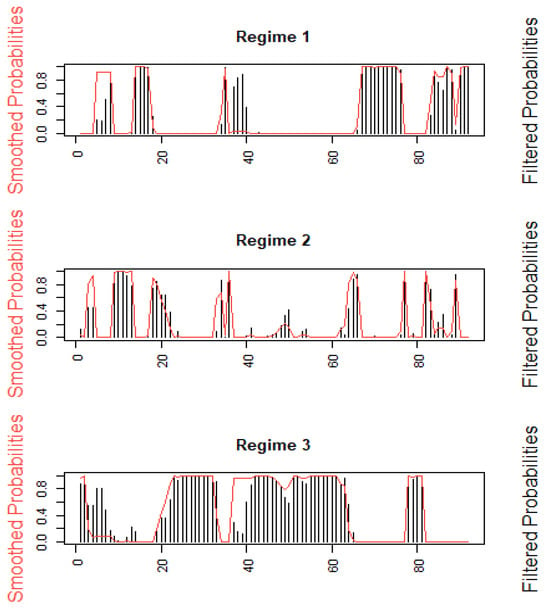

The analysis of the DJIA index reveals that most financial assets within it are highly valued, with periods of average and low valuation coinciding with major events like the onset and transition of the COVID-19 pandemic and the GFC. Notably, periods of low valuation were briefer during the COVID-19 crisis compared to the GFC. In summary, high valuation is typical for DJIA companies, while lower valuation tends to occur during economic crises and disruptive events, with the COVID-19 pandemic demonstrating less pronounced and shorter periods of such valuation downturns (Figure 4).

Figure 4.

Filtered probabilities of three regimes in DJIA Index: (Regime 1) low valuation; (Regime 2) medium valuation; (Regime 3) high valuation. Source: Prepared by authors.

6. Discussion

The detailed and exhaustive research on the behaviour of financial variables in different regimes and states of behaviour provides a deep understanding of the causal relationships underlying changes in market volatility. The findings demonstrate how financial crises and the COVID-19 crisis have had distinct impacts on market volatility, underscoring the importance of considering specific contexts when analysing financial volatility, and how external events can have variable effects on financial markets, depending on their nature and the broader economic context.

Regarding the financial crisis, profound and widespread repercussions were observed in key financial indicators such as the S&P 500 and the DJIA, with a large decrease in their valuations due to widespread risk aversion, credit contraction, and uncertainty about the future of the economy. Also, market volatility reached historically high levels, reflecting instability and investor concern (Baily et al. 2008; Stiglitz 2010; Strauss-Kahn 2020).

In contrast to previous crises, the COVID-19 pandemic shows a different landscape in financial markets. Although there was initially a negative reaction and significant volatility, especially during the early months of the pandemic, divergent trends in the valuation of financial indices were observed (Baiardi et al. 2020). While some sectors experienced drastic declines in their valuations, others, such as technology and pharmaceutical companies, saw an increase due to demand for products and services related to the pandemic (Chan et al. 2022).

These differences in impact stem from the underlying causes of each crisis and the associated policy and economic responses. The financial crisis was triggered by systemic issues in the financial sector, such as the housing bubble and the proliferation of toxic assets, while the COVID-19 pandemic crisis was caused by a global disease and the associated containment measures. It is important to highlight how these differences in the origin and nature of crises have influenced the response of financial markets and the dynamics of key indicators. While the financial crisis was characterised by widespread risk aversion and a general decline in markets, the COVID-19 pandemic crisis has been more heterogeneous in its effects, with opposite results in different sectors, affecting the economy as a whole to a lesser extent (Amanda 2021; Strauss-Kahn 2020).

The economic and social implications of a crisis like the GFC having effects across economies are huge and long lasting. Also, this financial crisis negatively affected multiple sectors and markets, leading to a downward spiral in economic activity, employment, and consumer confidence. Consequences spread globally, with a contraction of credit and a decrease in investment and spending, resulting in a prolonged recession and an increase in economic and social inequality (Gerardi et al. 2008).

On the other hand, a crisis like the COVID-19 pandemic, which selectively affects certain sectors, has uneven impacts on the economy and society. While some sectors face significant challenges, others experience unexpected growth due to changes in demand and consumer behaviour. This amplifies economic and social disparities. For example, individuals located in negatively affected sectors may face financial and labour challenges, while others enjoy benefits. Additionally, containment measures can have social consequences, such as increased unemployment and inequality, which may persist even after the crisis has passed (Baiardi et al. 2020).

7. Conclusions

The presence of economic crises, driven by exogenous or endogenous factors, alongside market asymmetries, signifies a flaw in the real economy, jeopardising individual welfare. Despite abundant literature and data availability about macroeconomic variables during crises, their diverse nature leads to varied impacts on the economy, be they endogenously or exogenously driven (Pandey and Kumari 2021). In financial markets, these crisis periods escalate market volatility levels and diminish market valuation indices, impacting both company prospects and global markets. This article primarily contributes to the comparative literature on assessing the impact of financial and health crises on the evolution of the financial market in the U.S.

The objective of the paper is to determine the impacts of the 2008 GFC and the COVID-19 pandemic health crisis on key financial indices in the U.S. (i.e., the Volatility Index, VIX; S&P 500: and the DJIA), testing the following hypothesis: The 2008 financial crisis has a huge causal effect on increasing volatility and reducing the valuation of key financial indicators in the U.S. vs. the COVID-19 pandemic health crisis, owing to its endogenous component.

The analysis is conducted using closing data from the major financial indices, along with control variables from key macroeconomic indicators (Bureau of Economic Analysis 2023; Federal Reserve Bank 2023). The analysis used computes a Markov switching model to estimate short-term causal relationships and the impact of each time-indicator variable during the respective crises, identifying which crisis had the greatest repercussion in terms of increasing volatility and reducing financial index valuation (Bhar and Malliaris 2021).

In terms of the causal analysis, the effects of the dichotomous variables associated with the GFC appear to be considerably higher than those of the COVID-19 pandemic health crisis in the Markov switching model. This is depicted by the huge increase in financial volatility and the notable reduction in the valuation of major financial indices. Thus, the findings suggest that the GFC had negative implications for both aggregate supply and demand because of higher financial volatility and a higher reduction in the valuation of major financial indices. This crisis negatively affected aggregate supply through decreased investment and business confidence, as well as aggregate demand by reducing consumer spending and investment. On the other hand, the COVID-19 pandemic health crisis negatively affected aggregate supply due to disruptions in the supply chain and production constraints resulting from social distancing measures and business closures. This aspect confirms the hypothesis outlined in the introduction.

An analysis of the effect of control variables in the Markov switching model shows that the GDP growth rate highly impacts the behaviour of major financial indices and volatility. An increase in the GDP growth rate enhances the valuation of financial indices and reduces volatility levels in most states of the model. Furthermore, considering consumer sentiments towards economic performance, it can be observed that consumer confidence positively influences the valuation of financial indices and reduces volatility. These results align with expectations associated with the industrial production index (Bhar and Malliaris 2021; Flavin and Sheenan 2015).

These findings emphasise the importance of economic growth and consumer confidence in financial market dynamics. Higher economic growth and increased consumer confidence can contribute significantly to financial stability, as reflected in the positive valuation of financial indices and low volatility. This relationship highlights the need to implement policies that promote sustainable economic growth and strengthen consumer confidence to foster long-term financial stability and economic development. Additionally, the analysis of the inventory-to-sales index shows that during periods of high volatility, the index tends to increase, implying that during different crises, the level of sales is less than that of inventories (Bhar and Malliaris 2021; Di Persio and Vettori 2014).

In summary, the detailed analysis of the GFC and the COVID-19 pandemic health crisis in the U.S. reveals important differences in their impacts on key financial indices and the economy overall. The GFC was characterised by the generation of a climate of financial panic, with high volatility and a notable reduction in the valuation of financial indices, affecting both aggregate supply and demand. On the other hand, the COVID-19 pandemic crisis also created market turbulence, albeit of a lesser magnitude than the GFC subprime crisis, with more evident effects on aggregate supply due to disruptions in the supply chain and production constraints. These findings emphasise the importance of understanding the specificities of each crisis to implement effective public policies that promote financial stability and economic resilience, seek to foster sustainable economic growth, and strengthen consumer confidence to mitigate the adverse impacts of future contingencies.

This comprehensive analysis of the impacts of the GFC and the COVID-19 crisis on key financial indices in the U.S. not only sheds light on the divergent effects of these crises but also underscores the critical role of economic policies in mitigating their adverse consequences. The findings underscore the necessity for policymakers to implement measures aimed at fostering sustainable economic growth and bolstering consumer confidence to enhance long-term financial stability and resilience. Moreover, the nuanced understanding of the distinct dynamics of each crisis presented in this study provides valuable insights for future research endeavours. Also, the research solely examines U.S. financial markets. Analysing the impact on a broader range of countries or regions could provide a more comprehensive picture.

Further investigations could delve into exploring the efficacy of specific policy interventions during periods of heightened financial volatility, as well as examining the interplay between macroeconomic indicators and financial market dynamics in times of crisis. Such endeavours hold promise for informing evidence-based policy decisions and bolstering the capacity of economies to withstand future contingencies. Moreover, future research would delve into global policy responses because our research acknowledges the role of policy responses. A comparative analysis of policy responses across different countries during these crises could provide valuable lessons for future events.

Author Contributions

Conceptualisation, D.I.A.L., J.A.L.C., J.A.N.M. and D.A.C.L.; methodology, D.A.C.L. and D.I.A.L.; software, D.A.C.L.; validation, D.A.C.L., J.A.L.C. and D.I.A.L.; formal analysis, D.I.A.L. and D.A.C.L.; investigation, D.I.A.L. and D.A.C.L.; resources, D.I.A.L.; data curation, D.A.C.L.; writing—original draft preparation, D.I.A.L., D.A.C.L. and J.A.L.C.; writing—review and editing, J.A.L.C. and D.A.C.L.; visualisation, D.A.C.L.; supervision, J.A.L.C. and J.A.N.M.; project administration, D.I.A.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

All the data used is publicly available.

Conflicts of Interest

The authors declare that there is no conflicts of interest.

References

- Abrams, Elissa M., and Stanley J. Szefler. 2020. COVID-19 and the impact of social determinants of health. The Lancet Respiratory Medicine 8: 659–61. [Google Scholar] [CrossRef]

- Almeida, Vanda, Salvador Barrios, Michael Christl, Silvia De Poli, Alberto Tumino, and Wouter van der Wielen. 2021. The impact of COVID-19 on households’ income in the EU. The Journal of Economic Inequality 19: 413–31. [Google Scholar] [CrossRef]

- Amanda, Citra. 2021. The risk of sub-prime mortgage crisis and COVID-19 pandemic: Lesson learned from Indonesia. Indonesian Journal of Business and Entrepreneurship 7: 73–81. [Google Scholar]

- Baba, Naohiko, and Yuji Sakurai. 2011. Predicting regime switches in the VIX index with macroeconomic variables. Applied Economics Letters 18: 1415–19. [Google Scholar] [CrossRef]

- Baiardi, Lorenzo Cerboni, Massimo Costabile, Domenico De Giovanni, Fabio Lamantia, Arturo Leccadito, Ivar Massabó, Massimiliano Menzietti, Marco Pirra, Emilio Russo, and Alessandro Staino. 2020. The Dynamics of the S&P 500 under a Crisis Context: Insights from a Three-Regime Switching Model. Risks 8: 71. [Google Scholar] [CrossRef]

- Baily, Martin N., Robert E. Litan, and Matthew S. Johnson. 2008. The Origins of the Financial Crisis. Fixing Finance Series; Hoboken: John Wiley & Sons. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Bureau of Economic Analysis. 2023. Gross Domestic Product (GDP). Available online: https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDMsM10sImRhdGEiOltbImNhdGVnb3JpZXMiLCJTdXJ2ZXkiXSxbIk5JUEFfVGFibGVfTGlzdCIsIjUiXSxbIkZpcnN0X1llYXIiLCIyMDAwIl0sWyJMYXN0X1llYXIiLCIyMDIzIl0sWyJTY2FsZSIs (accessed on 20 June 2024).

- Bhar, Ramaprasad, and Anastasios G. Malliaris. 2021. Modeling U.S. monetary policy during the global financial crisis and lessons for COVID-19. Journal of Policy Modeling 43: 15–33. [Google Scholar] [CrossRef]

- Bhatia, Parul, and Priya Gupta. 2020. Sub-prime Crisis or COVID-19: A Comparative Analysis of Volatility in Indian Banking Sectoral Indices. FIIB Business Review 9: 286–99. [Google Scholar] [CrossRef]

- Borio, Claudio. 2020. The COVID-19 economic crisis: Dangerously unique. Business Economics 55: 181–90. [Google Scholar] [CrossRef]

- Centers for Disease Control and Prevention. 2022. CDC Museum COVID-19 Timeline. Available online: https://www.cdc.gov/museum/timeline/covid19.html (accessed on 22 November 2023).

- Chan, Kam Fong, Zhuo Chen, Yuanji Wen, and Tong Xu. 2022. COVID-19 vaccines and global stock markets. Finance Research Letters 47: 102774. [Google Scholar] [CrossRef] [PubMed]

- Chen, Hsuan-Chi, and Chia-Wei Yeh. 2021. Global financial crisis and COVID-19: Industrial reactions. Finance Research Letters 42: 101940. [Google Scholar] [CrossRef] [PubMed]

- Chevallier, Julien. 2012. Global imbalances, cross-market linkages, and the financial crisis: A multivariate Markov-switching analysis. Economic Modelling 29: 943–73. [Google Scholar] [CrossRef]

- Choi, Sun-Yong. 2021. Analysis of stock market efficiency during crisis periods in the US stock market: Differences between the global financial crisis and COVID-19 pandemic. Physica A: Statistical Mechanics and Its Applications 574: 125988. [Google Scholar] [CrossRef]

- Chowdhury, Emon Kalyan, Bablu Kumar Dhar, and Alessandro Stasi. 2022. Volatility of the US stock market and business strategy during COVID-19. Business Strategy & Development 5: 350–60. [Google Scholar] [CrossRef]

- Congressional Research Service. 2021. Global Effect of COVID-19. In CSR REPORT. Available online: https://apps.dtic.mil/sti/pdfs/AD1152929.pdf (accessed on 23 January 2024).

- Cortes, Gustavo S., George P. Gao, Felipe B. G. Silva, and Zhaogang Song. 2022. Unconventional monetary policy and disaster risk: Evidence from the subprime and COVID–19 crises. Journal of International Money and Finance 122: 102543. [Google Scholar] [CrossRef] [PubMed]

- de la Luz Juárez, Gloria, Alfredo Sánchez Daza, and Jesús Zurita González. 2015. La crisis financiera internacional de 2008 y algunos de sus efectos económicos sobre México. Contaduría y Administración 60: 128–46. [Google Scholar] [CrossRef]

- Di Persio, Luca, and Samuele Vettori. 2014. Markov Switching Model Analysis of Implied Volatility for Market Indexes with Applications to S&P 500 and DAX. Journal of Mathematics 2014: 1–17. [Google Scholar] [CrossRef]

- Dufrénot, Gilles, Valérie Mignon, and Anne Péguin-Feissolle. 2011. The effects of the subprime crisis on the Latin American financial markets: An empirical assessment. Economic Modelling 28: 2342–57. [Google Scholar] [CrossRef]

- Dyer, Owen. 2020. COVID-19: Hospitals brace for disaster as US surpasses China in number of cases. BMJ: British Medical Journal (Online) 368: m1278. [Google Scholar] [CrossRef]

- Federal Reserve Bank. 2023. Macroeconomic Data. Available online: https://fred.stlouisfed.org/categories (accessed on 10 November 2023).

- Flavin, Thomas J., and Lisa Sheenan. 2015. The role of U.S. subprime mortgage-backed assets in propagating the crisis: Contagion or interdependence? North American Journal of Economics and Finance 34: 167–86. [Google Scholar] [CrossRef]

- Gambau, Borja, Juan C. Palomino, Juan G. Rodríguez, and Raquel Sebastian. 2022. COVID-19 restrictions in the US: Wage vulnerability by education, race and gender. Applied Economics 54: 2900–15. [Google Scholar] [CrossRef]

- Gerardi, Kristopher, Shane M. Sherlund, Andreas Lehnert, and Paul Willen. 2008. Making Sense of the Subprime Crisis. Brookings Papers on Economic Activity 2008: 69–145. [Google Scholar] [CrossRef]

- Goldfeld, Stephen M., and Richard E. Quandt. 1973. A Markov model for switching regressions. Journal of Econometrics 1: 3–15. [Google Scholar] [CrossRef]

- Gomez-Gonzalez, Jose E., Jorge Hirs-Garzon, and Jorge M. Uribe. 2024. US uncertainty shocks on real and financial markets: A multi-country perspective. Economics Systems 101180. [Google Scholar] [CrossRef]

- Grima, Simon, Letife Özdemir, Ercan Özen, and Inna Romānova. 2021. The interactions between COVID-19 cases in the USA, the VIX index and major stock markets. International Journal of Financial Studies 9: 26. [Google Scholar] [CrossRef]

- Günsür, Başak Tanyeri, and Emre Bulut. 2022. Investor reactions to major events in the sub-prime mortgage crisis. Finance Research Letters 47: 102703. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 57: 357. [Google Scholar] [CrossRef]

- Han, Jeehoon, Bruce D. Meyer, and James X. Sullivan. 2020. Income and Poverty in the COVID-19 Pandemic. NBER Working Paper Series; Cambridge, MA: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Investing.com. 2023. Finance Indicators. Available online: https://es.investing.com/ (accessed on 19 January 2024).

- Jermann, Urban, and Vincenzo Quadrini. 2016. Macroeconomic Effects of Financial Shocks. American Economic Review 102: 238–71. [Google Scholar] [CrossRef]

- Kanzari, Dalel, Mohamed Sahbi Nakhli, Brahim Gaies, and Jean-Michel Sahut. 2023. Predicting macro-financial instability—How relevant is sentiment? Evidence from long short-term memory networks. Research in International Business and Finance 65: 101912. [Google Scholar] [CrossRef]

- Kendrick, John W. 1961a. Productivity and Economic Growth. In Productivity Trends in the United States: Vol. I, 1st ed. Edited by John W. Kendrick. Princeton: Princeton University Press, pp. 78–110. Available online: http://www.nber.org/books/kend61-1 (accessed on 24 November 2021).

- Kendrick, John W. 1961b. The Significance of Productivity Change: Introduction and Preview of Study. In Productivity Trends in the United States, 1st ed. Edited by John W. Kendrick. Princeton: Princeton University Press, pp. 3–19. Available online: http://www.nber.org/chapters/c2236 (accessed on 24 November 2021).

- Kotz, David M. 2013. The Current Economic Crisis in the United States: A Crisis of Over-investment. Review of Radical Political Economics 45: 284–94. [Google Scholar] [CrossRef]

- Lyócsa, Štefan, Eduard Baumöhl, Tomáš Výrost, and Peter Molnár. 2020. Fear of the coronavirus and the stock markets. Finance Research Letters 36: 101735. [Google Scholar] [CrossRef]

- Manda, Kiran. 2010. Stock Market Volatility during the 2008 Financial Crisis. In Glucksman Fellowship Program Student Research Reports: 2009–2010. New York: The Glucksman Institute, p. 32. [Google Scholar]

- Mian, Atif, and Amir Sufi. 2010. The Great Recession: Lessons from Microeconomic Data. American Economic Review: Papers & Proceedings 100: 51–56. [Google Scholar] [CrossRef]

- Moseley, Fred. 2011. The U. S. Economic Crisis: Fundamental Causes and Possible Solutions. International Journal of Political Economy 40: 59–71. [Google Scholar] [CrossRef]

- Ocampo, José Antonio. 2009. Impactos de la crisis financiera mundial sobre América Latina. Revista de la CEPAL 2009: 9–32. [Google Scholar] [CrossRef]

- Østrup, Finn, Lars Oxelheim, and Clas Wihlborg. 2009. Origins and Resolution of Financial Crises: Lessons from the Current and Northern European Crises. Asian Economic Papers 8: 178–220. [Google Scholar] [CrossRef][Green Version]

- Pandey, Dharen Kumar, and Vineeta Kumari. 2021. Event study on the reaction of the developed and emerging stock markets to the 2019-nCoV outbreak. International Review of Economics & Finance 71: 467–83. [Google Scholar] [CrossRef]

- Prasad, Akhilesh, Priti Bakhshi, and Arumugam Seetharaman. 2022. The Impact of the U.S. Macroeconomic Variables on the CBOE VIX Index. Journal of Risk and Financial Management 15: 126. [Google Scholar] [CrossRef]

- Ratanapakorn, Orawan, and Subhash C. Sharma. 2007. Dynamic analysis between the US stock returns and the macroeconomic variables. Applied Financial Economics 17: 369–77. [Google Scholar] [CrossRef]

- Schwartz, Herman. 2009. Origins and Consequences of the U.S. Subprime Crisis. In The Politics of Housing Booms and Busts, 1st ed. Edited by Herman M. Shwartz and Leonard Seabrooke. Basingstoke: Palgrave Macmillan. [Google Scholar]

- Shehzad, Khurram, Umer Zaman, Xiaoxing Liu, Jarosław Górecki, and Carlo Pugnetti. 2021. Examining the Asymmetric Impact of COVID-19 Pandemic and Global Financial Crisis on Dow Jones and Oil Price Shock. Sustainability 13: 4688. [Google Scholar] [CrossRef]

- Shen, Huayu, Mengyao Fu, Hongyu Pan, Zhongfu Yu, and Yongquan Chen. 2020. The Impact of the COVID-19 Pandemic on Firm Performance. Emerging Markets Finance and Trade 56: 2213–30. [Google Scholar] [CrossRef]

- Shibata, Ippei. 2021. The distributional impact of recessions: The global financial crisis and the COVID-19 pandemic recession. Journal of Economics and Business 115: 105971. [Google Scholar] [CrossRef]

- Smith, Aaron, Prasad A. Naik, and Chih-Ling Tsai. 2006. Markov-switching model selection using Kullback–Leibler divergence. Journal of Econometrics 134: 553–77. [Google Scholar] [CrossRef]

- Spatt, Chester S. 2020. A Tale of Two Crises: The 2008 Mortgage Meltdown and the 2020 COVID-19 Crisis. The Review of Asset Pricing Studies 10: 759–90. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 2010. Caída Libre, El Libre Mercado y el Hundimiento de la Economía Mundial, 1st ed. Edited by Joseph E. Stiglitz. New York: W.W. Norton & Company Inc. [Google Scholar]

- Strauss-Kahn, Marc-Olivier. 2020. Can We Compare the COVID-19 and 2008 Crises? (No. 164; SUERF Policy Note, Issue 164). Available online: www.suerf.org/policynotes (accessed on 12 January 2024).

- World in Data. 2024. Daily New Confirmed COVID-19 Cases per Million People. Available online: https://ourworldindata.org/covid-cases#what-is-the-daily-number-of-confirmed-cases (accessed on 22 November 2023).

- Yeager, Timothy J. 2011. Causes, consequences and cures of the subprime financial crisis. Journal of Economics and Business 63: 345–48. [Google Scholar] [CrossRef]

- Zhang, Renquan, Yu Wang, Zheng Lv, and Sen Pei. 2022. Evaluating the impact of stay-at-home and quarantine measures on COVID-19 spread. BMC Infectious Diseases 22: 1–13. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |