Abstract

This scientometric analysis delves into the current trajectory and anticipated prospects of assessing fiscal sustainability, emphasizing methodologies, trends, and pivotal literature in this critical economic realm. This study analyzed 324 studies from Scopus and Web of Science databases to generate the dataset through scientometric networks, using VOSviewer and Bibliometrix tools. Through a comprehensive review of scientific literature, this research traces the developmental trajectory of fiscal sustainability, trend topics, influential studies, and key contributors employing bibliometric and scientometric tools. The study maps the landscape of fiscal sustainability exploration, underscoring an evolving shift towards interdisciplinary methods encompassing environmental, social, and political factors. Furthermore, the keywords analysis accentuates three emergent trends, mainly (i) the relation between fiscal sustainability and economic growth, (ii) the methodologies and models for assessing fiscal sustainability, and (iii) demographic concerns and their impact on fiscal sustainability. This research provides insights into the evolving terrain of fiscal sustainability exploration and anticipates promising avenues for further studies. The examination reveals the significance of methodologies such as panel data, multicointegration analysis, probabilistic debt analysis, Markov-switching models, and wavelets analysis in assessing fiscal sustainability. By offering a comprehensive overview, this analysis aspires to direct forthcoming inquiries and contribute to the ongoing discussion surrounding the assessment of fiscal stability.

1. Introduction

Maintaining fiscal sustainability is a crucial economic and public policy concern for governments, widely recognized as vital for economic development and preserving the welfare state. However, the recent decades’ escalating public debt in numerous developed countries raised apprehension about its possible negative impacts on economic growth, inflation, international competitiveness, productivity, and unemployment (Brady and Magazzino 2018).

Regarding this concern, Golpe et al. (2023) indicate a substantial relationship between fiscal sustainability and economic growth within the Euro area. Through multivariate Granger Causality methods, it was revealed that fiscal sustainability is closely tied to economic growth. The research suggests that maintaining fiscal sustainability is essential for fostering economic growth, as imprudent spending policies causing increased expenditures can put pressure on raising revenues and potentially hamper GDP. It underscores the importance of coordinated fiscal and monetary policies for the region’s sustainable and balanced economic development.

Then, fiscal sustainability stands as a cornerstone for a government’s financial stability, playing a pivotal role in meeting long-term obligations, managing debt, and sustaining essential public services (Bostan et al. 2021). Research in this area holds immense importance as it assesses a government’s capacity to manage debt, provide crucial public services, and avert economic crises due to the importance of fiscal policy in economic growth. This scrutiny not only informs policymakers, investors, and the public but significantly influences vital decisions regarding taxation, spending, and economic stability.

In the landscape of economic research, fiscal sustainability has emerged as a topic of vital importance in recent years. Governments worldwide face the challenge of maintaining fiscal stability, ensuring long-term financial health, and meeting their obligations to citizens while navigating complex economic dynamics (Kaur et al. 2022). The literature on fiscal sustainability has grown substantially, reflecting the urgency of understanding the implications of fiscal policies for economic resilience, public welfare, and policy planning.

The fiscal and debt sustainability literature is extensive and continually expanding, lacking a universally agreed-upon definition. Approaches range from simple concepts like the debt-stabilizing primary balance to more intricate frameworks seeking to determine optimal debt levels for societal welfare. Several gaps persist in this literature, notably the inadequate consideration of economic uncertainty in current debt sustainability models and an overemphasis on empirical work focusing on developed and larger emerging market economies (Yartey and Turner-Jones 2014). Despite this significant growth in research, a discernible gap remains in understanding the consistency and evolution of the literature on fiscal sustainability. This gap involves the identification of key themes, influential publications, and emerging trends that have shaped scholarly discussions. A comprehensive evaluation of our current knowledge and identifying avenues for future research are indispensable for advancing our comprehension of fiscal sustainability.

This study reveals an absence of prior literature reviews within the domain of fiscal sustainability, focusing on its assessing methodologies. This research aims to fill that identified gap by conducting an extensive bibliometric and scientometric analysis of fiscal sustainability literature. Employing sophisticated tools such as Bibliometrix and VOSviewer, this study seeks to analyze the evolution of this research avenue, identify influential research streams, and underscore areas ripe for further exploration. The significance of this study lies in its potential to inform policymakers, economists, and scholars about the critical dimensions of fiscal sustainability and its impact on economic resilience. By providing an in-depth understanding of the current research landscape and identifying knowledge gaps, this study offers valuable insights for both policymakers and researchers. Moreover, it contributes to the ongoing discourse on fiscal sustainability, guiding informed policy decisions and future research endeavors in this critical domain. In this study, a bibliometric and scientometric analysis of fiscal sustainability literature available in the Web of Science (WoS) and Scopus databases was carried out. The research employed VOSviewer and Bibliometrix tools to explore academic research’s historical development and future prospects in the fiscal sustainability arena.

The paper is structured as follows: Section 2 outlines the methodology applied in this investigation, Section 3 presents the main results and their interpretation, Section 4 covers the discussion of the principal themes and insights extracted from the findings, and Section 5 summarizes the main conclusions in the context of fiscal sustainability research.

2. Methodology

2.1. Research Questions

The primary objective of this study is to provide valuable insights into the evolution and dynamics of fiscal sustainability research. By addressing several key research questions, this study seeks to unravel the trends, key contributors, thematic evolution, collaborative networks, and emerging keywords within the field of fiscal sustainability. This research not only serves as a valuable resource for scholars and policymakers interested in fiscal sustainability, but also lays the foundation for more focused investigations into specific aspects of this critical fiscal policy domain. The following research questions will guide our inquiry:

RQ1: What are the prominent years of interest in the fiscal sustainability research?

RQ2: Who are the leading researchers in the field of fiscal sustainability?

RQ3: What thematics are observed in the scholarly production of fiscal sustainability?

RQ4: What are the principal thematic clusters in the fiscal sustainability arena?

RQ5: Which topics are emerging and experiencing growth in the fiscal sustainability arena?

RQ6: What are the most popular methodologies of fiscal policy assessment?

This comprehensive study aims to contribute to understanding and advancing fiscal sustainability as a pivotal component of sound fiscal policy, economic stability, and long-term financial health.

2.2. Data Source, Search Strategy, and Processing

The data for this study comprise publications across various document types referencing fiscal sustainability, accessible through the WoS and Scopus databases. The selection of WoS is attributed to its inclusion of numerous specialized sources within its Core Collection, frequently utilized by the bibliometric and scientometric community. In parallel, the choice of Scopus stems from its ability to complement WoS by offering broader coverage.

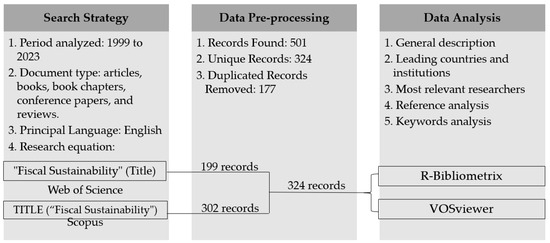

The data were collected on 8 October 2023, from both data sources. The search strategy employed the term [“fiscal sustainability”], requiring it to appear in the Title. The search yielded 199 studies in WoS, while Scopus returned 302 studies within the research field. In addition, our search comprised conditioning the search equation only to the title because this ensured that the research found fiscal sustainability as a central topic. A comparison of the data from both sources revealed 177 duplicate studies, which were subsequently eliminated, leaving 324 studies. Figure 1 summarizes the literature search strategy implemented.

Figure 1.

Literature search strategy.

2.3. Analytical Method and Tools

Bibliometrics and scientometrics are often used interchangeably, yet they have distinct focuses (Qiu et al. 2017). Bibliometrics examines numerical and pattern-based aspects of bibliographic data, such as paper counts and library usage. It falls under library and document science. On the other hand, scientometrics quantitatively analyzes the production, dissemination, and use of scientific information to understand scientific research mechanisms (Hood and Wilson 2001). A more scientific bibliometric approach is essential for comprehensively evaluating research literature in a field. Scientometrics quantitatively assesses scientific activities using bibliometrics and statistics, offering decision makers easily interpretable quantitative data. Traditional bibliometrics’ weaknesses include subjectivity and computational time (Chellappandi and Vijayakumar 2018). This research combines bibliometric and scientometric analyses to explore trends in fiscal sustainability literature.

With the progression of computer technology for handling electronic bibliometric data, various tools have been developed to generate two-dimensional visual representations referred to as knowledge maps. A knowledge map serves as a graphical representation that illustrates the interplay between the development and structure of scientific knowledge. It involves scientific knowledge as its primary focus, applying principles from various disciplines, including mathematics, information science, and computer science. This multidisciplinary approach employs diverse methods and techniques to craft two-dimensional visual representations called knowledge maps (Speel et al. 1999). Knowledge maps have evolved into potent data visualization tools thanks to advancements in computer technology, electronic information management, and document patenting. These maps empower researchers to analyze and assess the dynamics and frontiers of research domains. Numerous tools are available for generating knowledge maps, with each software offering its own set of unique features, techniques, and algorithms (Cobo et al. 2011).

These maps offer insights into the evolution and structure of scientific knowledge (Speel et al. 1999). The researchers utilized VOSviewer and Bibliometrix in this study for their bibliometric and scientometric analysis. VOSviewer (van Eck and Waltman 2017) encompasses several standard bibliometric features, such as bibliographic coupling, co-authorship, co-occurrence, and co-citation analyses. It has found extensive application in scientometric analysis across diverse domains. On the other hand, Bibliometrix identifies and illustrates the evolutionary trends in a particular subject area by scrutinizing literature publications (Aria and Cuccurullo 2017). Through reference burst detection, it can uncover research progress, current frontiers, and knowledge foundations in a given field.

3. Bibliometric and Scientometric Analysis

3.1. General Description

The Scopus and WoS databases contained 199 and 302 studies, respectively. After identifying and eliminating duplicated records, 324 unique records were available from both sources, comprising 281 primary research studies, four books, 25 book chapters, eight conference papers, and six reviews, as shown in Figure 1. These documents collectively cited a total of 9676 references. The publication period for these records ranged from 1999 to 2023. Analysis of publication outputs revealed a fluctuating growth pattern, with an average annual growth rate of 10.07%, 558 researchers, and 650 authors’ keywords, as shown in Figure 2.

Figure 2.

Summary of the studies. Source: Bibliometrix tool using Scopus and WoS databases.

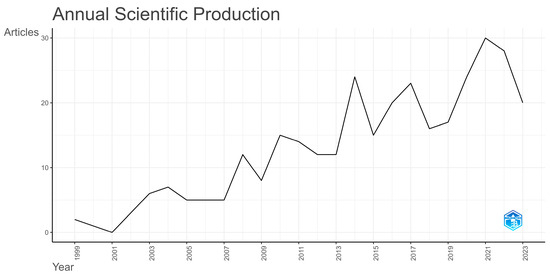

Figure 3 illustrates a substantial surge in published studies, underscoring the escalating interest in this subject within the academic community. The annual growth rate has undergone a noteworthy transformation, from two studies published in 1999 to 30 studies in 2021. As of October 2023, 20 additional studies have been published on the subject, signifying an anticipated continuation of this upward trend throughout 2023 and beyond. It is imperative, however, to delineate the annual publication trends into two distinct periods. The first period, extending until 2013, witnessed limited research contributions, with fewer than twelve studies published yearly.

Figure 3.

Scientific production output. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

In contrast, from 2014 until October 2023, the second period witnessed an average of 21 studies each year, marking a notable surge. This increase is attributed to the recent global crises, particularly the developments of COVID-19 in 2020–2021, which have significantly heightened governments’ concerns about the maintenance of fiscal sustainability. The impact of these recent crisis developments on the public debt burden has accentuated the significance of addressing the problem of fiscal sustainability, making it an increasingly pertinent issue for both developed and developing economies.

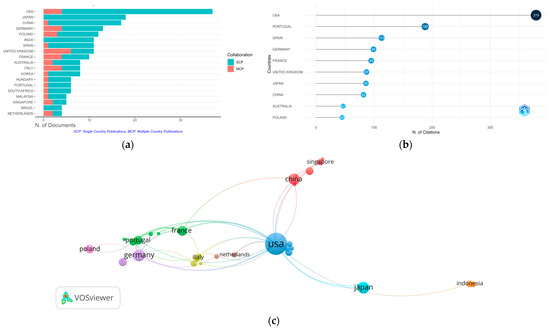

3.2. Leading Countries and Institutions

Publications related to public fiscal sustainability have seen contributions from 52 countries. Figure 4a displays the significant contributors to research on fiscal sustainability, with the United States leading the way, followed by Japan, China, Germany, and Poland. The United States of America (USA) is particularly dominant in this research field, accounting for 89% of single-country publications (SCP) and 11% of multi-country publications (MCP). Conversely, countries like Japan, India, and Brazil are mainly involved in SCP. Figure 4b highlights the most cited countries in this domain, with the USA and Portugal at the forefront. Figure 4c illustrates the study counts and collaboration networks among active countries. A total of 55 countries participated in collaborations worldwide, with the top three being the USA-Italy, USA-Germany, and Germany-Portugal.

Figure 4.

Authors’ country analysis: (a) corresponding authors’ countries, (b) most cited countries, and (c) cooperation networks among countries. Source: authors’ own research using Bibliometrix and VOSviewer tools, as well as Scopus and WoS databases.

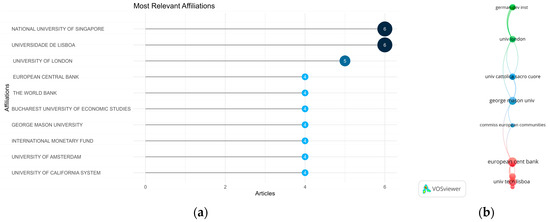

Between 1999 and 2023, 412 institutions were actively involved in the fiscal sustainability arena. Based on their publication records and centrality, the most prominent institutions are presented in Figure 5. The National University of Singapore and Universidade de Lisboa claim the top spot among institutions, having published six studies each. The University of London follows it with five studies. The list of institutions that hold the successive positions, each with four studies, is listed in Figure 5a.

Figure 5.

The top 10 institutions publishing studies. Source: authors’ own research using Bibliometrix and VOSviewer tools, as well as Scopus and WoS databases.

Figure 5b provides insight into the significant co-institution collaborations that have driven productivity in this area. The co-institution collaborations are led by George Mason University and the European Central Bank in fiscal sustainability, boasting four studies each. Università Cattolica del Sacro Cuore and Universidade Técnica de Lisboa closely followed it with three studies. It is worth noting that the top ten productive institutions in this field are all based in Europe and the USA.

Notably, leading institutions such as the National University of Singapore and Universidade de Lisboa and co-institution collaborations led by George Mason University and the European Central Bank have consistently focused on fiscal sustainability. They have fostered dedicated research teams and engaged in extensive collaborations, showcasing commitment, assigning resources, creating global awareness of the topic’s significance during economic crises, and effectively networking within the academic community. These factors have collectively propelled these institutions to the forefront. Emphasizing the quantity and quality of research output, they reflect a proactive approach to remain at the forefront of fiscal sustainability discussions and shape policy considerations.

Then, given the current concentration of research in fiscal sustainability in Europe and the USA, there exists a remarkable opportunity and necessity to delve more extensively into this subject within the Latin American context. Latin American institutions are uniquely positioned to offer invaluable perspectives and solutions to tackle regional and global fiscal sustainability challenges.

With Latin America’s distinctive fiscal challenges and socio-economic aspirations, fiscal sustainability research takes a vital significance. It can serve as a pivotal topic for shaping policies that advance economic stability, foster social inclusivity, and drive sustainable long-term growth while addressing the specific challenges prevalent in the region.

3.3. Most Relevant Researchers

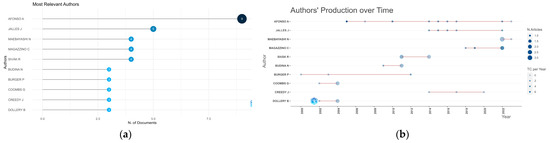

A total of 558 researchers made significant contributions in this field. Figure 6 provides a visual representation of the network of the most prominent researchers.

Figure 6.

Productivity of the Authors. (a) Number of publications by authors, (b) authors’ production over time. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

In Figure 6a, with nine studies, António Afonso from the ISEG Lisbon School of Economics and Management, Portugal emerged as the most prolific researcher. Other highly productive researchers included João Tovar Jalles (ISEG Lisbon School of Economics and Management, Portugal) with five studies. Additionally, Noritaka Maebayashi (University of Kitakyushu, Japan), Cosimo Magazzino (Università degli Studi Roma Tre, Italy), and Rudolf Sivák (University of Economics Bratislava, Slovakia), each appeared with four studies. Figure 6b illustrates the researchers’ productivity trends over time.

Table 1 lists the ten most cited researchers in this field of research, their affiliations, and other essential issues. The researchers are ordered by total citations in the subject (TCT) to identify the most influential researchers in fiscal sustainability according to citations. Additionally, this study was performed using Scopus, the total global citation indicator (TGC), and compared with the TCT indicator given by Bibliometrix in R. The purpose was to compare the topics in which the identified researchers are more influential. Then, based on the total citations in the topic (TCT), Table 1 shows the top 10 most relevant researchers in studies on fiscal sustainability between 1999 and 2023.

Table 1.

Top ten most relevant researchers on fiscal sustainability. TGC: total global citations; TCT: total citations in the topic; NP: number of publications; PY start: publication year start. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

Thus, for example, António Afonso appears as the most influential researcher on the topic of fiscal analysis and fiscal sustainability, contributing studies such as Afonso et al. (2005) with 310 citations, followed by Afonso and Furceri (2010) and Afonso et al. (2012) with 210 and 201 citations, respectively. And finally, Afonso and St. Aubyn (2006) and Afonso et al. (2011) with 198 and 168 citations. In these studies, Afonso, in collaboration with other researchers, covers various aspects of fiscal sustainability, government performance, expenditure efficiency, and sovereign debt ratings, providing insights into different economic and financial analysis dimensions.

The most cited study of Antonios about fiscal sustainability is Afonso and Rault (2010). It examines the sustainability of public finances in the EU-15 between 1970 and 2006 using stationarity and cointegration analysis, applying advanced panel unit root and cointegration techniques. It suggests that while fiscal sustainability might be a concern in specific countries, fiscal policy appears sustainable overall for the EU-15 and within specific time frames (1970–1991 and 1992–2006). This study contributes by evaluating the sustainability of government spending and revenues, offering insights into the long-term financial health of these economies. Additionally, the most recent study of Antonio Afonso about fiscal sustainability is Afonso and Alves (2023), which explores how efficient government spending affects fiscal sustainability in 35 OECD countries from 2007 to 2020. They find that using fewer resources while maintaining performance positively impacts fiscal balance. Additionally, improving government outputs leads to higher economic growth and increased revenues, contributing to better fiscal sustainability. The study highlights that optimizing public expenditures without reducing service quality is crucial for improving fiscal sustainability and the budget balance. Next, this study delves into the key studies that have profoundly influenced discussions on fiscal sustainability.

3.4. Reference Analysis

Table 2 presents the most cited studies, which focuses on specific research papers, studies, or studies that have garnered significant attention and citations from other researchers in the field of fiscal sustainability.

Table 2.

Top 10 cited studies in the research of fiscal sustainability. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

These highly cited studies tend to represent seminal or groundbreaking works that have significantly impacted the discourse on fiscal sustainability. The identified studies in Table 2 collectively evaluate the sustainability of fiscal policies across different regions and periods. They address the fiscal sustainability concerns by employing various empirical methodologies such as cointegration tests, probabilistic debt analysis, and Markov-switching models. These research efforts reveal the consequences of fiscal policies on debt, government financing, and output growth and highlight the role of factors such as demographic changes, government expenditure, and debt thresholds in shaping fiscal sustainability.

Then, we can identify three groups of topic studies. The first group is based on the analysis of Fiscal Sustainability in Developed Economies. Here, we can find Afonso (2005), Afonso and Rault (2010), and Mahdavi and Westerlund (2011), who focused their analysis on assessing fiscal sustainability in developed economies (EU-15, US) by examining the relationships between public revenues, expenditures, and debt. In turn, Buiter and Grafe (2004) address fiscal constraints related to EU accession and the Stability and Growth Pact in Central and Eastern Europe.

Meanwhile, the second group centers its analysis on Subnational Fiscal Sustainability and Pressures. Here, the studies of Chapman (2008) and Rose (2010) are included. These studies investigated the sustainability of state and local governments, examining pressures on fiscal sustainability from various sources like Medicaid, pensions, and infrastructure. Finally, the third group involves several methodologies and models to assess fiscal sustainability. The studies of Baharumshah et al. (2017), Celasun et al. (2006), Checherita-Westphal et al. (2014), and Faruqee and Mühleisen (2003) introduce and apply different methodologies and models that include probabilistic approach, debt-related fiscal rules, Markov-switching, and general equilibrium frameworks to analyze various aspects of fiscal sustainability, such as debt projections, growth-maximizing debt ratios, thresholds for public debt, and the impact of demographic changes on government finances.

Thus, the three groups of studies contribute to understanding contemporary fiscal sustainability challenges, emphasizing the necessity of sustainable practices, debt management, and policy responses in an ever-changing economic environment.

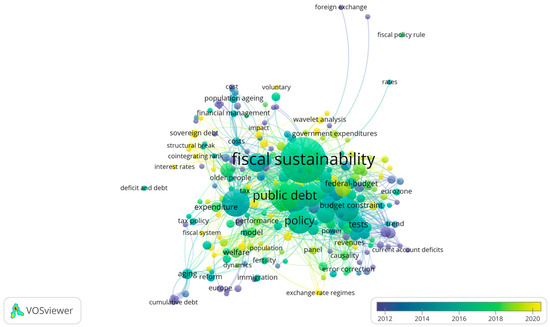

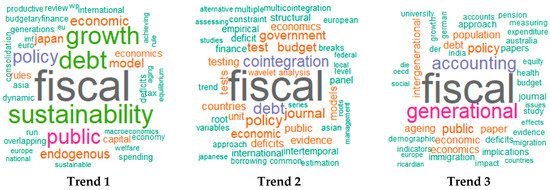

3.5. Keywords Analysis

The examination of keywords unveiled three distinct research trends in scholarly literature. In Figure 7, the upper section portrays connections among key studies on fiscal sustainability, while the lower section illustrates the three identified research trends. The initial trend, shown in Figure 7, centers on exploring the impacts of fiscal policy, fiscal sustainability, debt sustainability, and fiscal rules on economic growth. The relationship between output and government expenditures has been extensively explored. Wagner’s law suggests that national income growth triggers increased government spending, while the Keynesian perspective contends that higher government expenditures lead to national income growth (Arestis et al. 2021).

Figure 7.

Analyzing the interrelationships between keywords and research trends in publications retrieved from Scopus and WoS databases concerning fiscal sustainability. Source: elaborated by the authors using VOSviewer and Bibliometrix tools.

Despite numerous studies examining this link across different countries, including Arestis et al. (2021), Bazán et al. (2022), Durevall and Henrekson (2011), Katrakilidis and Tsaliki (2009), Kirikkaleli and Ozbeser (2022), Kuckuck (2014), Loizides and Vamvoukas (2005), Tessmann et al. (2022), Tri Wahyudi and Harjanto (2022), no definitive consensus has been reached on confirming either Wagner’s law or the Keynesian view. For instance, findings from Kirikkaleli and Ozbeser (2022) show that economic growth drives government expenditures over the long term, while government expenditures only positively influence short-term economic growth, particularly during times of recession. This leads to varied results, illustrating a lack of agreement among hypotheses. Additionally, studies like Balassone et al. (2010) and Cronin and McQuinn (2021) highlighted the issue of pro-cyclical government expenditure policies, which could adversely impact economic activity and conflict with EU fiscal rules.

Figure 7 shows the second trend, which includes the methodologies and models to quantify the fiscal sustainability concerns. For instance, (i) cointegration (Akram and Rath 2020; Chen 2016; Gabriel and Sangduan 2011; Liu et al. 2022; Silvestrini 2010). These studies offer diverse insights into the long-term fiscal health of economies, identifying sustainability variations among regions and suggesting potential policy adjustments for stronger fiscal health in the regions analyzed; (ii) multicointegration (Escario et al. 2012; Glavaški and Beker Pucar 2021; Kheifets and Phillips 2023). The studies contribute to fiscal sustainability theory by employing multicointegration analysis to assess long-term fiscal relationships and sustainability in different settings. They explore the application of multicointegration in understanding fiscal sustainability dynamics across regions like the US, the European Union (EU) economies, and Spain. By utilizing semiparametric formulations and exploring the explicit role of singularity in conditional covariance matrices, these studies reveal empirical insights into fiscal sustainability, examining fiscal adjustments, public debt dynamics, and the impact of joining economic unions like the EMU (European Monetary Union) on fiscal sustainability.

Furthermore, (iii) panel analysis (Abeysinghe et al. 2022; Bui 2019; Feld et al. 2020; Polat and Polat 2021; Ramos-Herrera and Prats 2020). These studies, employing various panel analysis techniques, contribute to understanding fiscal sustainability across different economies, identifying both sustainable and unsustainable fiscal trends, and providing insights into governments’ reactions to increasing debt levels. They shed light on the need for effective regulatory policies, cautious welfare spending, and the overall impact of fiscal sustainability on various countries. Recent studies employ (iv) wavelet analysis as an innovative approach to investigating fiscal sustainability, providing insights into long-term sustainability trends, fiscal policy responses to budget deficits, and the changing dynamics of fiscal sustainability in different countries (Cascio 2015; Magazzino and Mutascu 2019; and Sun et al. 2023). In this last trend, each study emphasizes the importance of their findings for policy implications. These studies advocate for reforms, cautionary measures, or further investigation to safeguard fiscal sustainability in the face of rising fiscal risks or to respond to different fiscal sustainability patterns identified in their analyses.

Finally, the third trend (Figure 7) includes demographic aspects for fiscal sustainability analysis. In this way, incorporating the keywords population, generational, and intergenerational. Here, we can find the studies of Alho and Lassila (2023), Dolls et al. (2017), Gruen and Spender (2012), Hansen and İmrohoroğlu (2023), Jensen et al. (2021), and Pinheiro (2021). The common thread across these studies is their exploration of how demographic changes, such as aging populations, fertility rates, labor force shifts, and other demographic factors, significantly impact fiscal policies and sustainability, thereby underlining the need for informed decision making and policy interventions.

It is widely recognized that shifts in population demographics significantly impact the sustenance of pension systems, healthcare expenditures, and the enduring financial obligations faced by forthcoming generations. These factors play an essential role in the discourse concerning fiscal sustainability (Rouzet et al. 2019). Then, integrating demographic analysis with various methodological approaches helps to holistically evaluate how population changes impact fiscal sustainability and understand how different fiscal policies might address these demographic challenges for long-term financial health.

3.6. Trend Topics

3.6.1. Evolution of the Topics

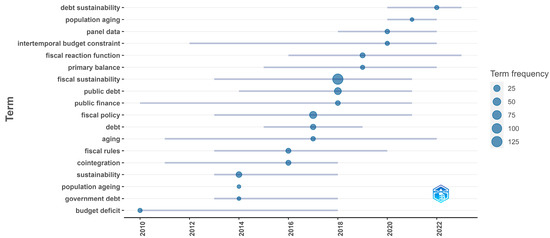

An influential mapping tool, trending topic analysis aids in illustrating the progression of literature. Figure 8 portrays the identified topics derived from the authors’ keywords, considering a minimum frequency of five words per article across intervals of three times a year.

Figure 8.

Trend topics over the years based on the authors’ keywords. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

An exploration of the authors’ keywords, between 1999 and 2023, reveals prevalent themes such as debt sustainability, population aging, panel data, intertemporal budget constraint, fiscal reaction function, primary balance, fiscal rules, and cointegration. This analysis underscores the evolving landscape of research interests over time, indicating a significant trend in comprehensive investigations into crucial elements shaping fiscal sustainability.

This trending topic analysis is vital for understanding the shifting focus of scholarly inquiries over the years. It illuminates the growing importance and attention toward multidimensional issues that influence fiscal stability. The comprehensive research and emphasis on debt sustainability, population aging, fiscal rules, cointegration, and other key components reflect an evolving landscape within the fiscal sustainability discourse. These trends signal a heightened awareness of the diverse challenges impacting fiscal policies, emphasizing the need for multifaceted approaches to address these complexities. As research expands into intertemporal budget constraints, fiscal reaction functions, primary balances, and various methods like cointegration alongside fiscal rules, it demonstrates an increasing emphasis on thorough analysis and a broader perspective in framing effective strategies to manage fiscal sustainability concerns across various countries and economic scenarios.

3.6.2. Topics with High Development and Relevance

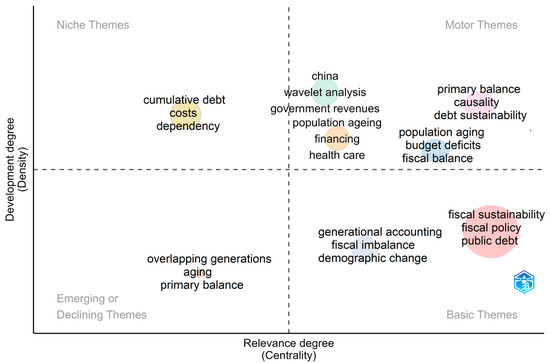

The analysis reveals a thematic map, dividing it into four distinct quadrants based on the density (development degree) and centrality (relevance degree) of the subjects explored (Figure 9). An essential focal point arises, urging a more thorough and comprehensive exploration of the themes situated within the upper-right quadrant due to their concentrated relevance and significance (Chansanam and Li 2022; Marín-Rodríguez et al. 2022, 2023). In the fiscal sustainability arena, particular attention and a deeper dive into the topics occupying this quadrant are vital for a more nuanced understanding and substantial insights into pertinent fiscal stability issues. The following four sets of keywords denote the most prospective areas for extended research in examining fiscal sustainability: (i) primary balance, causality, and debt causality, (ii) population aging, budget deficits, and fiscal balance, (iii) China, wavelet analysis, and government revenues, and (iv) population aging, financing, and healthcare. In the context of fiscal sustainability analysis, these keyword clusters represent promising avenues for deeper exploration and understanding of critical elements influencing fiscal stability.

Figure 9.

Thematic map. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

In the first group of keywords, further research should explore the causal relationships between a nation’s primary balance (the difference between government revenues and non-interest spending) and its debt dynamics. This research would entail examining the influence of fiscal policies on debt accumulation. Thus, it might focus on understanding how primary fiscal activities affect a nation’s debt accumulation and how changes in primary balances impact overall debt sustainability. Similarly, in the second group of keywords, additional research could concentrate on the impact of population aging on a nation’s fiscal balance and budget deficits. It is crucial to comprehend the complex connection between an aging population and fiscal imbalances. This exploration could involve forecasting the long-term fiscal effects of aging demographics, encompassing pension expenditures, healthcare costs, and their consequent impact on budget deficits and fiscal equilibrium.

In the third group of keywords, further research should concentrate on exploring China’s fiscal landscape using wavelet analysis. This study could unveil insights into the relationship between government revenues and various economic factors within China. Extending this analysis to other countries could offer a broader perspective on the impact of fiscal policies and economic cycles on government income, thereby providing comparative insights into fiscal dynamics across different nations. Furthermore, this endeavor might involve analyzing revenue patterns using wavelet techniques to detect non-stationary elements and identify how fiscal policies and economic cycles influence government income.

Finally, the fourth group of keywords explores population aging, financing, and healthcare. This set of keywords suggests examining the financial challenges related to aging populations and healthcare systems. Research in this domain could include studying the fiscal implications of healthcare costs concerning aging populations, evaluating funding models, exploring the effectiveness of healthcare financing under demographic shifts, and proposing strategies to ensure sustainable healthcare systems amid changing demographics. Each group of keywords presents opportunities to deepen understanding in different aspects of fiscal sustainability, covering causal relationships and demographic and economic impacts on government revenues, expenses, and broader fiscal policies.

4. Discussion

The studies of literature on fiscal sustainability are limited. The study conducted by Ayala and Blazsek (2014) introduces an empirical review of the past decade of the fiscal sustainability of eurozone governments. Then, extensively examines the European Union’s Economic and Monetary Union (EMU) in the context of the 2008 subprime mortgage crisis and subsequent global economic downturn. Through diverse unit root tests and models incorporating structural changes, the study evaluates the fiscal sustainability of Eurozone member states from 1999 to 2010. It delivers empirical insights into sovereign debt sustainability, establishing a correlation with fiscal sustainability in the Eurozone. By classifying Eurozone governments into three categories based on their fiscal behaviors, the research provides crucial information for predicting future government debt to GDP and primary deficit to GDP ratios.

Furthermore, Budina and van Wijnbergen (2009) examine fiscal sustainability in the context of Turkey post the 2001 crisis. It offers a comprehensive analysis that integrates various approaches to fiscal sustainability, proposing a model for studying fiscal stability. The study reviews and extends past approaches, combining them into a singular model applicable to Turkey and low-income and semi-industrialized countries. The research consolidates concepts from the International Monetary Fund’s (IMF) workhorse for standby programs, the Polak monetary programming model, and other fiscal sustainability analysis methodologies. It emphasizes the importance of assessing the consistency and stability of fiscal policies, introducing uncertainty and risk in the analysis. The study introduces methods such as stress tests and stochastic simulations, providing a broader perspective on the riskiness of debt projections and the necessary fiscal adjustments. Moreover, it includes the distribution of the fiscal adjustments required to restore consistency and stability, thus offering valuable insights to policymakers.

Additionally, according to Barnhill and Kopits (2003), the assessment of fiscal sustainability traditionally focuses on fiscal imbalances and the government’s long-term financial position, especially public debt. Then, the authors consider unconventional indicators such as contingent liabilities and revenue structure to evaluate fiscal risk. However, these methods fail to systematically quantify adverse scenarios, particularly in developing countries with volatile economic conditions. Addressing this deficiency requires an approach that captures the distribution of potential public sector net worth by quantifying underlying risk sources, involving valuing various assets and liabilities while explicitly quantifying associated risks.

Finally, in examining fiscal sustainability assessments across multiple countries, Croce and Juan-Ramon (2003) introduce a straightforward recursive algorithm grounded in the debt-to-GDP ratio. This algorithm serves the purpose of monitoring fiscal sustainability without requiring projections of future GDP and interest rates. Comparable to Blanchard’s indicator but offering distinct advantages, this algorithm has the potential to augment fiscal transparency and fortify commitment to policy consistency. The suggested fiscal policy strategy, reminiscent of inflation targeting in monetary policy, entails the adoption of a clearly defined target debt ratio. This approach adheres to a rules-based framework while retaining flexibility for discretionary responses to unanticipated shocks.

The collective findings of the previous studies demonstrate the importance of more comprehensive and adaptable methodologies in assessing fiscal sustainability in different economic landscapes.

The absence of recent investigations into methodologies for assessing fiscal sustainability highlights a critical gap in the current academic landscape. Understanding and refining methodologies for evaluating fiscal sustainability is crucial for governments, researchers, policymakers, and various stakeholders within the financial sphere. Such methodologies provide the foundation for determining nations’ fiscal health and stability, influencing critical policy decisions, economic planning, and investment strategies. The importance of robust and adaptable evaluation techniques extends beyond academic interest, profoundly impacting national economies and global financial markets. These methodologies are fundamental for governments in formulating and adjusting economic policies to ensure long-term fiscal stability. Researchers rely on these methods to provide comprehensive insights and recommendations, while investors and financial entities use them to gauge risk, make informed decisions, and protect against financial downturns. Closing this knowledge gap in methodology exploration is thus imperative for better-informed decision making across a spectrum of economic domains.

5. Conclusions

This research on fiscal sustainability utilizes bibliometric and scientometric methodologies, such as the VOSviewer and Bibliometrix, to conduct an extensive literature analysis. By reviewing 324 studies published from 1999 to October 2023, drawing from databases such as Scopus and Web of Science, this study uncovers pivotal trends and areas for future investigation.

The data analysis uncovered a sustained growth in the quantity of studies on fiscal sustainability research post 2014. This trend reflects an enduring academic focus on the subject, particularly heightened by the challenges posed by the global crisis, emphasizing the ongoing importance of investigating fiscal sustainability in economic contexts. Additionally, the analysis of influential researchers and studies on fiscal sustainability, notably led by António Afonso, Jeffrey I. Chapman, and João Tovar Jalles, underscores the enduring relevance of this research domain. Afonso’s significant contributions, exemplified in studies like Afonso et al. (2005) and Afonso and Rault (2010), provide valuable insights into the fiscal health of economies, emphasizing the importance of optimizing public expenditures without compromising service quality. Afonso’s recent work, such as Afonso and Alves (2023), reinforces the critical role of efficient government spending in fostering fiscal sustainability. Overall, the collective findings emphasize the ongoing need for adaptable methodologies to assess fiscal sustainability across diverse economic landscapes, highlighting the enduring significance of this research for policymakers, researchers, and various stakeholders.

Additionally, the analysis of literature on fiscal sustainability reveals three major research trends: examining the impact of fiscal policies on economic growth, employing diverse methodologies for quantifying fiscal sustainability, and considering demographic factors like population aging. The trending topics over the years underscore the evolving focus on crucial elements such as debt sustainability, population aging, and various analytical approaches. Furthermore, the thematic map highlights four key areas for extended research: understanding the causal relationships between primary balance and debt dynamics, exploring the impact of population aging on fiscal balance and budget deficits, investigating China’s fiscal landscape using wavelet analysis, and studying the financial challenges related to aging populations and healthcare. These areas represent promising avenues for in-depth exploration, providing substantial insights into the intricacies of fiscal stability and addressing emerging challenges in different economic contexts.

In the realm of fiscal sustainability, this study uncovers a critical gap: the lack of prior comprehensive literature reviews centered around evaluating its methodologies. Notably, a series of crucial assessment methodologies have emerged, shedding light on understanding fiscal sustainability across countries. Panel data analysis stands out, comprehensively assessing economic trends and fiscal health over time. Complementing this, cointegration analysis offers insights into the long-term relationships among economic variables, unveiling their interconnectedness and impact on sustainability. The introduction of probabilistic debt analysis proves to be a promising approach, offering a probabilistic framework to forecast and manage debt sustainability more effectively. Moreover, Markov-switching models reveal the dynamic nature of fiscal policies, showcasing how economies transition between different states and the impact on sustainability. Finally, wavelet analysis presents a novel perspective by examining the frequency domain of fiscal data, uncovering patterns and hidden information vital for understanding fiscal sustainability trends. These methodologies collectively address the dearth in the literature, providing a robust framework to evaluate and comprehend fiscal sustainability comprehensively. Their integration into future research endeavors is poised to enrich the understanding of fiscal dynamics and shape more effective fiscal policies across diverse nations.

The evolution of fiscal sustainability research opens avenues for exploring uncharted territories and emerging issues within economic and financial frameworks. Future research must consider delving deeper into the implications of demographic shifts, policy responses to changing economic conditions, and the effects of government financial decisions on long-term sustainability. Additionally, there is a need to explore the impacts of global economic interconnectivity and fiscal regulations on national economies. Understanding how emerging technologies, trade policies, and geopolitical shifts influence fiscal stability would be instrumental. Moreover, studying the interaction between fiscal sustainability and environmental concerns and integrating sustainable practices in fiscal policies emerges as a pertinent aspect. Exploring novel methodologies to analyze fiscal sustainability could enrich our understanding, emphasizing interdisciplinary approaches encompassing economic, social, and environmental dimensions. This approach should include evaluating the influence of fiscal rules, structural changes, and international policy cooperation on the economic sustainability of nations. As a result, further research directions aim to enhance the robustness of fiscal policies, adapting them to ever-evolving economic, social, and environmental landscapes.

This study on fiscal sustainability has unearthed valuable insights and methodologies, shedding light on various assessment approaches. However, certain limitations need acknowledgment. The findings’ reliability and scope rely on the availability and precision of data, which might vary in quality and accessibility across different sources, potentially affecting the study’s robustness. Methodological constraints inherent in panel data, cointegration analysis, probabilistic debt analysis, Markov-switching models, and wavelet analysis introduce specific assumptions and limitations that could influence the accuracy and applicability of the conclusions. Moreover, generalizing the study’s findings to a broader global context might be challenging, considering the specificity of economic conditions and regions examined.

Additionally, assumptions and subjective interpretations of applying these methodologies might introduce bias or affect conclusions. Finally, the study’s reliance on historical data might not encapsulate the impact of unforeseen future events or changes, which could significantly alter fiscal dynamics. Recognizing and addressing these limitations is critical for a nuanced understanding of the study’s findings and for directing future research efforts in the realm of fiscal sustainability.

Author Contributions

Conceptualization, N.J.M.-R.; methodology, N.J.M.-R. and J.D.G.-R.; validation, J.D.G.-R. and S.B.; formal analysis N.J.M.-R., J.D.G.-R. and S.B.; investigation N.J.M.-R.; data curation N.J.M.-R.; writing—review and editing, N.J.M.-R. and J.D.G.-R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Acknowledgments

The authors thank the anonymous reviewers for providing constructive comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abeysinghe, Tilak, Ke Mao, and Xuyao Zhang. 2022. Welfare spending and fiscal sustainability: Segmented-trend panel-regression analysis of Chinese provinces. Journal of the Asia Pacific Economy 27: 358–78. [Google Scholar] [CrossRef]

- Afonso, António. 2005. Fiscal Sustainability: The Unpleasant European Case. FinanzArchiv 61: 19–44. [Google Scholar] [CrossRef]

- Afonso, António, and Christophe Rault. 2010. What do we really know about fiscal sustainability in the EU? A panel data diagnostic. Review of World Economics 145: 731–55. [Google Scholar] [CrossRef]

- Afonso, António, and Davide Furceri. 2010. Government size, composition, volatility and economic growth. European Journal of Political Economy 26: 517–32. [Google Scholar] [CrossRef]

- Afonso, António, and José Alves. 2023. Does government spending efficiency improve fiscal sustainability? European Journal of Political Economy 102403. [Google Scholar] [CrossRef]

- Afonso, António, and Miguel St. Aubyn. 2006. Cross-country efficiency of secondary education provision: A semi-parametric analysis with non-discretionary inputs. Economic Modelling 23: 476–91. [Google Scholar] [CrossRef]

- Afonso, António, Davide Furceri, and Pedro Gomes. 2012. Sovereign credit ratings and financial markets linkages: Application to European data. Journal of International Money and Finance 31: 606–38. [Google Scholar] [CrossRef]

- Afonso, António, Ludger Schuknecht, and Vito Tanzi. 2005. Public sector efficiency: An international comparison. Public Choice 123: 321–47. [Google Scholar] [CrossRef]

- Afonso, António, Pedro Gomes, and Philipp Rother. 2011. Short- and long-run determinants of sovereign debt credit ratings. International Journal of Finance & Economics 16: 1–15. [Google Scholar] [CrossRef]

- Akram, Vaseem, and Badri Narayan Rath. 2020. What do we know about fiscal sustainability across Indian states? Economic Modelling 87: 307–21. [Google Scholar] [CrossRef]

- Alho, Juha, and Jukka Lassila. 2023. Assessing components of uncertainty in demographic forecasts with an application to fiscal sustainability. Journal of Forecasting 42: 1560–68. [Google Scholar] [CrossRef]

- Arestis, Philip, Hüseyin Şen, and Ayşe Kaya. 2021. On the linkage between government expenditure and output: Empirics of the Keynesian view versus Wagner’s law. Economic Change and Restructuring 54: 265–303. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–975. [Google Scholar] [CrossRef]

- Ayala, Astrid, and Szabolcs Blazsek. 2014. Fiscal Sustainability of Eurozone Governments: An Empirical Review of the Past Decade. Review of European Studies 6: 143–50. [Google Scholar] [CrossRef]

- Baharumshah, Ahmad Zubaidi, Siew-Voon Soon, and Evan Lau. 2017. Fiscal sustainability in an emerging market economy: When does public debt turn bad? Journal of Policy Modeling 39: 99–113. [Google Scholar] [CrossRef]

- Balassone, Fabrizio, Maura Francese, and Stefania Zotteri. 2010. Cyclical asymmetry in fiscal variables in the EU. Empirica 37: 381–402. [Google Scholar] [CrossRef]

- Barnhill, Theodore, and George Kopits. 2003. Assessing Fiscal Sustainability under Uncertainty. IMF Working Paper No. 03/79. Available online: https://ssrn.com/abstract=879155 (accessed on 1 October 2023).

- Bazán, Ciro, Víctor Josué Álvarez-Quiroz, and Yennyfer Morales Olivares. 2022. Wagner’s Law vs. Keynesian Hypothesis: Dynamic Impacts. Sustainability 14: 10431. [Google Scholar] [CrossRef]

- Bostan, Ionel, Mihaela Brindusa Tudose, Raluca Irina Clipa, Ionela Corina Chersan, and Flavian Clipa. 2021. Supreme Audit Institutions and Sustainability of Public Finance. Links and Evidence along the Economic Cycles. Sustainability 13: 9757. [Google Scholar] [CrossRef]

- Brady, Gordon Lee, and Cosimo Magazzino. 2018. Fiscal Sustainability in the EU. Atlantic Economic Journal 46: 297–311. [Google Scholar] [CrossRef]

- Budina, Nina, and Sweder van Wijnbergen. 2009. Quantitative Approaches to Fiscal Sustainability Analysis: A Case Study of Turkey since the Crisis of 2001. World Bank Economic Review 23: 119–40. [Google Scholar] [CrossRef]

- Bui, Duy-Tung. 2019. Fiscal sustainability in developing Asia—New evidence from panel correlated common effect model. Journal of Asian Business and Economic Studies 27: 66–80. [Google Scholar] [CrossRef]

- Buiter, Willem Hendrik, and Clemens Grafe. 2004. Patching up the Pact. Economics of Transition 12: 67–102. [Google Scholar] [CrossRef]

- Cascio, Iolanda Lo. 2015. A wavelet analysis of US fiscal sustainability. Economic Modelling 51: 33–37. [Google Scholar] [CrossRef]

- Celasun, Oya, Jonathan David Ostry, and Xavier Debrun. 2006. Primary surplus behavior and risks to fiscal sustainability in emerging market countries: A “fan-chart” approach. IMF Staff Papers 53: 401–25. [Google Scholar] [CrossRef]

- Chansanam, Wirapong, and Chunqiu Li. 2022. Scientometrics of Poverty Research for Sustainability Development: Trend Analysis of the 1964–2022 Data through Scopus. Sustainability 14: 5339. [Google Scholar] [CrossRef]

- Chapman, Jeffrey Ira. 2008. State and Local Fiscal Sustainability: The Challenges. Public Administration Review 68: S115–S131. [Google Scholar] [CrossRef]

- Checherita-Westphal, Cristina, Andrew Hughes Hallett, and Philipp Rother. 2014. Fiscal sustainability using growth-maximizing debt targets. Applied Economics 46: 638–47. [Google Scholar] [CrossRef]

- Chellappandi, Pandi, and Channaveerapla S. Vijayakumar. 2018. Bibliometrics, Scientometrics, Webometrics/Cybermetrics, Informetrics and Altmetrics--An Emerging Field in Library and Information Science Research. Shanlax International Journal of Education 7: 5–8. [Google Scholar] [CrossRef]

- Chen, Pei-Fen. 2016. US Fiscal Sustainability and the Causality Relationship between Government Expenditures and Revenues: A New Approach Based on Quantile Cointegration. Fiscal Studies 37: 301–20. [Google Scholar] [CrossRef]

- Cobo, Manuel Jesus, Antonio Gabriel López-Herrera, Enrique Herrera-Viedma, and Francisco Herrera. 2011. Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology 62: 1382–402. [Google Scholar] [CrossRef]

- Croce, Enzo, and Victor Hugo Juan-Ramon. 2003. Assessing Fiscal Sustainability: A Cross Country Comparison. IMF Working Papers 3: 1. [Google Scholar] [CrossRef]

- Cronin, David, and Kieran McQuinn. 2021. The (pro-) cyclicality of government consumption in the EU and official expectations of future output growth: New evidence. International Economics and Economic Policy 18: 331–45. [Google Scholar] [CrossRef]

- Dolls, Mathias, Karina Doorley, Alari Paulus, Hilmar Schneider, Sebastian Siegloch, and Eric Sommer. 2017. Fiscal sustainability and demographic change: A micro-approach for 27 EU countries. International Tax and Public Finance 24: 575–615. [Google Scholar] [CrossRef]

- Durevall, Dick, and Magnus Henrekson. 2011. The futile quest for a grand explanation of long-run government expenditure. Journal of Public Economics 95: 708–22. [Google Scholar] [CrossRef]

- Escario, Regina, María Dolores Gadea, and Marcela Sabaté. 2012. Multicointegration, seigniorage and fiscal sustainability. Spain 1857–2000. Journal of Policy Modeling 34: 270–83. [Google Scholar] [CrossRef]

- Faruqee, Hamid, and Martin Mühleisen. 2003. Population aging in Japan: Demographic shock and fiscal sustainability. Japan and the World Economy 15: 185–210. [Google Scholar] [CrossRef]

- Feld, Lars Peter, Ekkehard A. Köhler, and Julia Wolfinger. 2020. Modeling fiscal sustainability in dynamic macro-panels with heterogeneous effects: Evidence from German federal states. International Tax and Public Finance 27: 215–39. [Google Scholar] [CrossRef]

- Gabriel, Vasco J., and Pataaree Sangduan. 2011. Assessing fiscal sustainability subject to policy changes: A Markov switching cointegration approach. Empirical Economics 41: 371–85. [Google Scholar] [CrossRef]

- Glavaški, Olgica, and Emilija Beker Pucar. 2021. Heterogeneity of fiscal adjustments in EU economies in the pre- and post-crisis periods: Common correlated effects approach. Eurasian Economic Review 11: 191–226. [Google Scholar] [CrossRef]

- Golpe, Antonio Aníbal, Antonio Jesús Sánchez-Fuentes, and José Carlos Vides. 2023. Fiscal sustainability, monetary policy and economic growth in the Euro Area: In search of the ultimate causal path. Economic Analysis and Policy 78: 1026–45. [Google Scholar] [CrossRef]

- Gruen, David, and Duncan Spender. 2012. A Decade of Intergenerational Reports: Contributing to Long-Term Fiscal Sustainability. Australian Economic Review 45: 327–34. [Google Scholar] [CrossRef]

- Hansen, Gary Duane, and Selahattin İmrohoroğlu. 2023. Demographic change, government debt and fiscal sustainability in Japan: The impact of bond purchases by the Bank of Japan. Review of Economic Dynamics 50: 88–105. [Google Scholar] [CrossRef]

- Hood, William Wellesley, and Concepción Shimizu Wilson. 2001. The literature of bibliometrics, scientometrics, and informetrics. Scientometrics 52: 291–314. [Google Scholar] [CrossRef]

- Jensen, Svend Eggert Hougaard, Thorsteinn Sigurdur Sveinsson, and Filipe Bonito Vieira. 2021. From Here to There: Achieving Fiscal Sustainability Under Alternative Demographic Contingencies. De Economist 169: 427–44. [Google Scholar] [CrossRef]

- Katrakilidis, Constantinos, and Persefoni Tsaliki. 2009. Further evidence on the causal relationship between government spending and economic growth: The case of Greece, 1958–2004. Acta Oeconomica 59: 57–78. [Google Scholar] [CrossRef]

- Kaur, Amanpreet, Vikas Kumar, Rahul Sindhwani, Punj Lata Singh, and Abhishek Behl. 2022. Public Public debt sustainability: A bibliometric co-citation visualization analysis. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Kheifets, Igor Lev, and Peter Charles Bonest Phillips. 2023. Fully modified least squares cointegrating parameter estimation in multicointegrated systems. Journal of Econometrics 232: 300–19. [Google Scholar] [CrossRef]

- Kirikkaleli, Dervis, and Bugra Ozbeser. 2022. New insights into an old issue: Exploring the nexus between government expenditures and economic growth in the United States. Applied Economics Letters 29: 129–34. [Google Scholar] [CrossRef]

- Kuckuck, Jan. 2014. Testing Wagner’s law at different stages of economic development. Finanzarchiv/Public Finance Analysis 70: 128–68. [Google Scholar] [CrossRef]

- Liu, Qiongzhi, Bang Cui, and Chan Luo. 2022. A Study on the Fiscal Sustainability of China’s Provinces. Sustainability 14: 15678. [Google Scholar] [CrossRef]

- Loizides, John, and George Vamvoukas. 2005. Government Expenditure and Economic Growth: Evidence from Trivariate Causality Testing. Journal of Applied Economics 8: 125–52. [Google Scholar] [CrossRef]

- Magazzino, Cosimo, and Mihai Mutascu. 2019. A wavelet analysis of Italian fiscal sustainability. Journal of Economic Structures 8: 19. [Google Scholar] [CrossRef]

- Mahdavi, Saeid, and Joakim Westerlund. 2011. Fiscal stringency and fiscal sustainability: Panel evidence from the American state and local governments. Journal of Policy Modeling 33: 953–69. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Alejandro Valencia-Arias. 2023. Incorporating Green Bonds into Portfolio Investments: Recent Trends and Further Research. Sustainability 15: 14897. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero Botero. 2022. Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability 14: 12796. [Google Scholar] [CrossRef]

- Pinheiro, Jorge. 2021. Generational Accounting in Portugal. Portuguese Economic Journal 20: 181–221. [Google Scholar] [CrossRef]

- Polat, Gözde Eş, and Onur Polat. 2021. Fiscal sustainability analysis in EU countries: A dynamic macro-panel approach. Eastern Journal of European Studies 12: 219–41. [Google Scholar] [CrossRef]

- Qiu, Junping, Rongying Zhao, Siluo Yang, and Ke Dong. 2017. Informetrics. Singapore: Springer. [Google Scholar] [CrossRef]

- Ramos-Herrera, María del Carmen, and María Asunción Prats. 2020. Fiscal Sustainability in the European Countries: A Panel ARDL Approach and a Dynamic Panel Threshold Model. Sustainability 12: 8505. [Google Scholar] [CrossRef]

- Rose, Shanna. 2010. Institutions and fiscal sustainability. National Tax Journal 63: 807–37. [Google Scholar] [CrossRef]

- Rouzet, Dorothée, Aida Caldera Sánchez, Theodore Renault, and Oliver Roehn. 2019. Fiscal Challenges and Inclusive Growth in Ageing Societies. OECD Economic Policy Papers, No. 27. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Silvestrini, Aandrea. 2010. Testing fiscal sustainability in Poland: A Bayesian analysis of cointegration. Empirical Economics 39: 241–74. [Google Scholar] [CrossRef][Green Version]

- Speel, Piet-Hein, Nigel Shadbolt, Wouter de Vries, Piet Hein van Dam, and Kieron O’Hara. 1999. Knowledge mapping for industrial purposes. Paper presented at 12th Workshop on Knowledge Acquisition Modeling and Management, Dagstuhl Castle, Germany, May 26–29; pp. 2–7. [Google Scholar]

- Sun, Weihong, Huating Lai, and Ding Liu. 2023. Tracking China’s Fiscal Sustainability: A Time-Frequency Perspective. Emerging Markets Finance and Trade 59: 2851–65. [Google Scholar] [CrossRef]

- Tessmann, Mathias, Adolfo Sachsida, Anderson Possa, and Sérgio Gadelha. 2022. The Relationship Between Public Spending and National Income: Empirical Evidence from Brazil from 1997 to 2019. Review of Economics and Finance 20: 469–77. [Google Scholar] [CrossRef]

- Tri Wahyudi, Setyo, and Sigit Harjanto. 2022. The Toda-Yamamoto causality test for government expenditure and economic growth: A case study in Indonesia. Journal for Global Business Advancement 15: 181–95. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2017. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef]

- Yartey, Charles Amo, and Therese Turner-Jones. 2014. Caribbean Renewal. Tackling Fiscal and Debt Challenges. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).