1. Introduction

This study examines how trade policy uncertainty affects medical innovation investment in developing nations. Companies may benefit from delaying investment until business conditions improve, as has been described well by

Bernanke (

1983),

Dixit (

1989),

Dixit et al. (

1994), and

Rodrik (

1991). Emerging empirical literature explains that firms’ investment behavior is consistent with this basic mechanism (

Baker et al. 2016;

Gulen and Ion 2016;

Handley and Limão 2012,

2017;

Julio and Yook 2016;

Koijen et al. 2016). However, most empirical research focuses on employment, physical capital, productivity, or economic sectors, whereas investment in innovation or innovation across industries has received little attention.

Innovation, important to economic growth, is hampered by policy ambiguity, and policy uncertainty has accelerated in recent years. These two reasons make it vital to evaluate policy uncertainty’s impact on innovation (

Baker et al. 2016). The US–China trade conflict, Brexit, the North American Free Trade Agreement (NAFTA) renegotiation, and medical innovation pertaining to COVID-19 have all led to the increase of tariffs being a commercial concern. Investors, firms, and monetary authorities face the biggest global recession risk due to the trade war roller coaster. Some say tariff uncertainty is worse than actual tariffs.

Handley and Limão (

2015) adhere to the primary theoretical framework they created in 2014. In exchange for less protection, preferential trade agreements (PTAs) abolish some protections. There were 283 PTAs in July 2010, a significant rise from 1990. This demonstrated that trade policy uncertainty decreases investment and entry into export markets and that exporters can benefit from PTAs even when trade barriers are low or nonexistent.

Coelli et al. (

2016) used international firm-level patent data to quantify the impact of 1990s-era trade policy on innovation in 60 countries as trade liberalization influences innovation, affecting technical change and growth. Trade policy liberalization likely boosted knowledge generation by 7% in the 1990s; increased patenting demonstrated innovation, not just information protection. It concluded that trade liberalization improves market access and import competition, boosting innovation.

Amiti et al. (

2017) used Chinese firm-product data for 2000–2006 to investigate the country-to-country impact of trade policy on innovation. This aggregate model predicts exporter pricing and quantity due to World Trade Organization (WTO) participation. The authors say that China’s reduced input tariffs are the key source of U.S. welfare gains from China’s entry into the WTO.

Coelli (

2018) explored the exogenous and heterogeneous sensitivity to trade-policy-uncertainty resolutions after the U.S. discontinued tariff increases on Chinese imports. They documented that reducing tariff uncertainty has an economically and statistically significant effect. Moreover, the results are robust even when sectoral innovation trends, simultaneous policy changes, and foreign technology flow into China are considered. Health benefits and industrial growth depend on medical innovation and demand. Information, procedures, medications, biologics, technologies, and services help prevent and treat old and emerging diseases. This boom in medical innovation explains healthcare’s rapid growth, as asserted by some authors (

Cutler 1995;

Fuchs 1996;

Newhouse 1992). Understanding the rise of this enterprise and the medical research and development expenditures (R&D) that propelled it requires understanding investor returns.

According to

Newhouse (

1992), most countries invest in new technologies, medical services, and hospitals, as well as in medical innovation, which health economists argue is the driving force behind the rise in global health care spending. Innovation is stimulated by direct and indirect payments (prescription medicine reimbursement and indirect reimbursements are for medical devices). According to

Becker et al. (

2005) and

Murphy and Topel (

2006), advances in healthcare have led to economic growth and decreased worldwide inequality. By using data from developing nations, it can be seen that better healthcare is comparable to other forms of economic expansion over the past century, as measured by per capita income (GDP). Increased life expectancy and quality may be the most valuable shift of the century; thus, the size and growth of the healthcare sector have spurred public debate. Medical equipment, biologics, medications, and associated services drive U.S. healthcare expenses. Private and public reimbursement restrictions affect U.S. profitability, and the Centers for Medicare Services (CMS) says Medicare and Medicaid funded 44% of U.S. spending in 2012, and Europe’s government pays 85% of healthcare costs.

Because health care manufacturing is primarily unfunded by public markets, manufacturers use public capital markets to fund R&D. Hospitals pay 35% of the total cost of health care and rely on debt or donations to operate. Twenty-two percent of healthcare expenditures are attributable to privately funded clinics; consequently, for-profit medical innovation companies are overrepresented on public stock markets due to a lack of public equity financing in important healthcare fields. Due to the concentration of U.S. medical product sales, U.S. government policies influence medical R&D returns.

Egan and Philipson (

2013) estimate that in 2012, U.S. health care spending accounted for 48% of worldwide spending, although U.S. GDP accounted for only 24% of global GDP. The United States’ proportion of worldwide spending on biopharmaceuticals is 39%, as many rising nations spend more. Due to greater markups, U.S. markets contribute more to overall earnings than sales, concluding that medical R&D requires payment modifications that risk U.S. markups, whereas U.S. reimbursement policies impact asset values.

It is widely acknowledged that R&D expenditures in medical innovation are driven by global returns rather than returns on the domestic market. For example, Swedish medical product companies innovate to sell globally, not just domestically, because global returns stimulate innovation and boost healthcare spending. A country’s healthcare economy and policies affect its growth. A tiny European country’s growth depends on how U.S. policies affect global returns, as do future Medicare expenditures. Few health economists have studied how one country’s healthcare policies affect another.

Hammar and Belarbi (

2021) study the non-linear relationship between R&D spending and innovations like productivity and high-tech exports. It has been demonstrated that linearity is frequently conditioned by other macroeconomic factors like the degree of development and financial openness. According to the findings, the R&D, innovation, and productivity threshold effects are strongest in the U.S., and the data shows that R&D spending, innovation, productivity, and medium- and high-tech exports have mixed effects. In contrast, positive and negative effects depend on innovation indicators or threshold variable levels. Therefore, the findings support the notion that the level of economic development can be used as a target indicator for implementing an innovation policy.

This work utilizes medical patent applications from 65 developing nations from 1980 to 2020. Almost every company submits a patent that is tracked, including the filing date and the patent’s technical class, which we link to product codes, and the filing country. We generated a panel dataset on the patenting of medical technologies by using these data. The empirical strategy reduces industry-specific innovation by utilizing the differential between “column 2” and most favored nation (MFN) tariffs. We compare innovation in the uncertain medical industry before and after permanent-normal trade relations (PNTR) (the second difference) to analyze R&D and medical innovation, whereas innovation strategy takes into account industry and tech developments, which is a significant contribution to this study. Nonetheless, patentability and sunk R&D vary by industry, product, and time; industry-fixed effects erase only time-variable variations. Finally, to capture dynamic interdependencies and reverse causality, the panel vector autoregressive (PVAR) model will be implemented in the investigation of the timeliness of technological innovation.

The remainder of this study follows this pattern.

Section 2 will discuss the literature review and hypothesis development, which will help the author design a fundamental analysis.

Section 3 discusses the economic framework of study, and

Section 4 discusses the research methodology and design, including the population and sample size, variable and model descriptions, and data analysis technique. The results and discussion are discussed in

Section 5, and the conclusion and policy implications and limitations of study are discussed in

Section 6.

1.1. Real-World Case Study of Australia

Australia has high-quality data and a policy variation relevant to uncertainty (

Handley and Limão 2015). Australia has historically had significant trade barriers. Unilateral liberalization has created enormous gaps between protection and obligations. It recently imposed preferential trade agreements (PTAs) like many developed countries. Several agreements were with developing countries with preferential, discretionary market access. These considerations include various trade-policy-uncertainty sources from the start. Theoretically informed empirical assessments of Australia’s policy uncertainty and trade policy tools should be valid in a variety of applications and policy negotiations.

Australia currently has low tariffs, but this has not always been the case from a historical perspective.

Lloyd’s (

2008) study of 100-year time series for Australian tariffs demonstrates that some sectors were heavily protected in the early 1990s. Pre- and post-war protectionism and political meddling in tariff-making left a legacy according to

Glezer (

1982). The late 1980s and 1990s saw gradual, unilateral liberalization. Even in low-tariff sectors, a 2002–2006 exporter could look back a decade and fear a high-tariff system.

Australia’s binding commitments are large and dispersed due to the Uruguay Round (1986–1994) of multilateral negotiations (

Corden 1996). Many products have zero or near-zero imposed tariffs, whereas maximum bound rates range from 0% to 55%. This variance in the applied-to-bound gap is empirically utilized. In a procedure called “tariffication,” Australia lifted most import quotas and restrictions after the Uruguay Round negotiations (

Snape et al. 1998). Trade barriers are now measured uniformly across products.

Australia’s Productivity Commission cited backsliding n preferential trade agreements and liberalization. The Commission’s review of Australia’s trade agreements notes that even if agreements don’t reduce existing barriers, they can lock in present policies, preventing countries from adding hurdles in the future

Productivity Commission (

2010).

If Australia reverted all tariffs to their original form, the tariff profile would change. Only 24% of Australia’s MFN tariffs match the contractual pledge in 2004. Reversing bindings can cause huge changes.

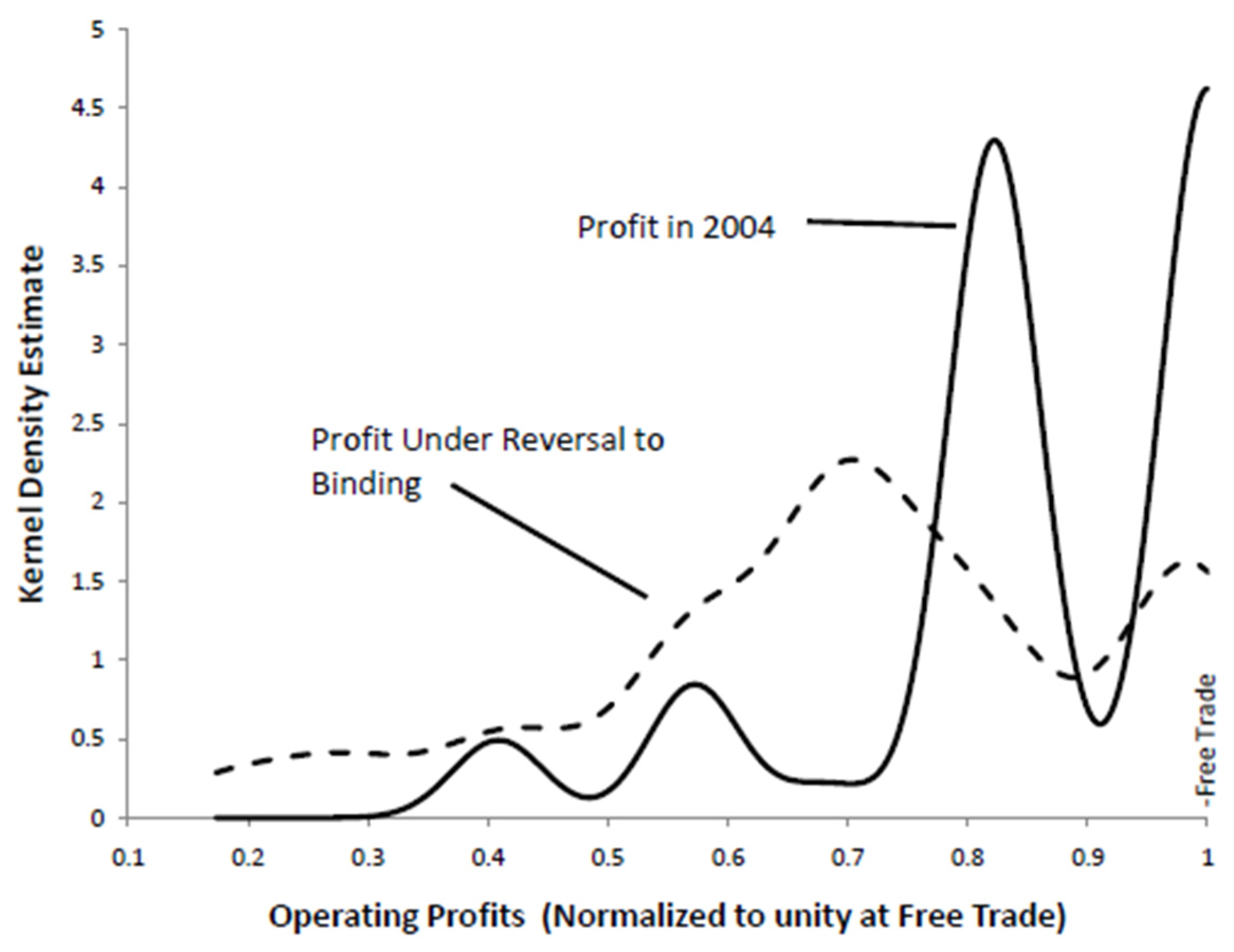

Figure 1’s histogram reveals that 73% of MFN tariffs could rise, some by 35%. Such reversals might diminish an exporter’s profits by 19% annually.

Figure 1 illustrates that profit losses are widespread. A full reversal to binds would reduce profit distribution from 2004 levels.

1.2. COVID-19 and Uncertainty

In the present time, COVID 19 is the factor that affects the medical industry and medical innovation. Innovation in the medical sector accelerated in the pandemic era and has had a huge impact on trade uncertainty, innovation, and investment, which is very important in the medical sector. After post-PNTR time, pre- and post-COVID time is also a recognizable shock to medical sector innovation.

The COVID-19 pandemic raised uncertainty in many elements of daily life (

Caggiano et al. 2020), and many characteristics of the virus remain unknown (

Fauci et al. 2020). No one knows when the world will return to normal; the authors underline the significance of global cooperation and the importance of international governmental, corporate, and non-profit sectors working together to continue manufacturing vaccines (

Corey et al. 2020;

Gates 2020). Lockdowns and quarantines exacerbated stress and fear in many countries (

Qiu et al. 2020). Scarce medical supplies, such masks and ventilators, have prompted nations to compete for them, forcing hospitals and health institutions to ration their inventory. These reasons have stoked global unease.

Baker et al. (

2020a) show that present uncertainty levels are higher than during the 2008–2009 Great Recession and are closer to the Great Depression. They also say the current economic slowdown is due to COVID-19’s excessive uncertainty.

Sharif et al. (

2020) validate COVID-19’s impact on political and regulatory uncertainties.

Albulescu (

2020) notes that everyday statements about infections and deaths boost EPU.

High uncertainty can complicate enterprises’ activities by causing them to delay investment decisions (

Chu and Fang 2020) and assume less debt (

Guo et al. 2020), which could worsen the economic crisis and reduce cash injections.

Baker et al. (

2020b) said no disease has ever affected the stock market as much as COVID-19.

These findings support the theory that COVID-19 uncertainty produced poorer economic growth, above-average bankruptcy rates, and high unemployment. This pandemic’s unpredictability has deterred government authorities, corporate executives, and even individuals from making decisions. This complicates decision-making for private, governmental, and nonprofit executives.

6. Conclusions, Policy Implications and Limitations

6.1. Conclusions

This study examines the impact of trade policy uncertainty on innovation and R&D spending in developing nations between 1980 and 2020. It employs exogenous and heterogeneous exposure to trade policy uncertainty and comprehensive data on innovation from all medical sectors and developing nations. The PNTR did not increase tariff levels, but innovation was stimulated by reducing tariff uncertainty and securing MFN tariffs through a genuine trade agreement. Reducing tariff uncertainty significantly impacts medical innovation, both economically and statistically, and this effect is indicative of genuine innovation, not merely an increase in patent applications. Additional study into the theoretical framework’s mechanisms reveals that the negative innovation response is driven by rising countries, whereas the positive innovation response is driven by R&D spending.

The findings are robust to policy changes and foreign technology inflows in emerging countries. These results highlight trade agreements’ vital role in reducing tariff uncertainty and generating economic growth. They are relevant in light of recent events like the US–China trade war, Brexit, and the renegotiation of major trade agreements like NAFTA, which have made tariff uncertainty an essential source for businesses.

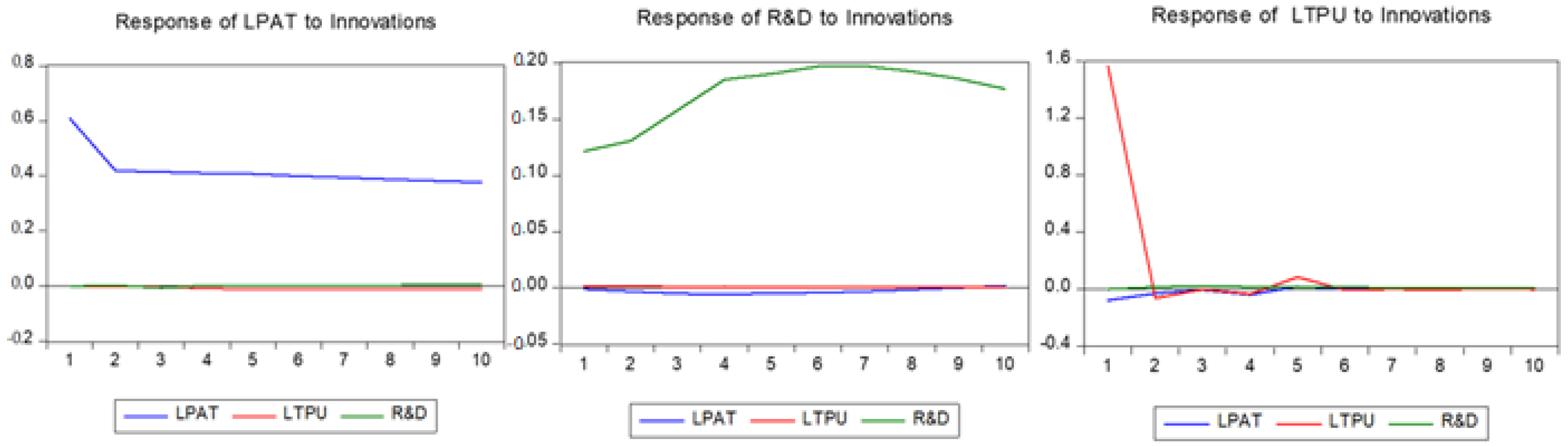

Moreover, this study examines the impact of trade policy uncertainty on innovation by using exogenous exposure and controlling for confounding variables. Determine the influence of TPU and R&D expenditures on innovation in developing countries over the short- and long-term. Long-term innovation fluctuations are statistically significant, both positively and adversely, indicating a rise in medical innovation in developing nations. Results are consistent with the medical innovation hypothesis. The PVAR model between innovation, TPU, and R&D expenses exhibited reverse causality. Innovation and research and development expenditures assist developing nations. TPU generates uncertainty, which reduces the prior year’s value.

6.2. Policy Implication

Economists have underlined the significance of facilitating medical innovation. Through the elimination of policy uncertainty and, subsequently, the encouragement of innovation in developing and low-income nations, our article suggests that trade liberalization may contribute to economic growth. Understanding the impact of policy uncertainty is crucial for economists and policymakers assessing the efficacy of economic programs. For instance, the time following the 2008 global financial crisis witnessed an increase in trade protectionism. Numerous nations employ non-tariff measures, such as anti-dumping probes, or identify others as “currency manipulators.” Recent events, such as the Brexit vote and open calls for protectionist measures by the U.S. government, have all suggested that the future of the global trading system is increasingly questionable. Such protectionist policies may not only impose more significant trade costs but also impede the innovation of businesses, as they generate market uncertainty.

6.3. Limitations and Future Study Direction

Concerning the limitations, this study analyzed the developments in the medical industry in 65 developing nations from 1980 to 2020. Consequently, this study’s scope and sample size are restricted to medical breakthroughs. The authors recommend that future researchers conduct relevant studies on the innovation of numerous sectors over an updated period or investigate the cross-sectional impact of innovation in developed countries (e.g., the U.S.) by focusing on the same sector.