Abstract

We examine the effects of receiving remittances on household saving behaviour and expenditure patterns in Vietnam. We consider the amount of saving, the saving rate, and the share of expenditure, as well as per capita expenditure on education, health, assets, house repairs, food, non-food, and utilities. We apply propensity score matching to data from the Vietnam Household Living Standard Survey (VHLSS) of 2012. We find that remittances have a positive impact on household savings and increase both the amount of saving and the saving rate. As far as expenditure patterns are concerned, our results indicate that receiving households spend more on health, assets, and house repairs, and less on food. This finding suggests that households tend to use remittances productively, with receiving households increasing their investments in human and physical capital. For the economy as a whole, remittances can create more opportunities for the development of services provided by banks, financial institutions, hospitals and healthcare centres, and give incentives to the production of building materials and tangible assets.

1. Introduction

Remittances are a common source of income for households in many developing countries (McKenzie and Sasin 2007), and Vietnam is no exception (Nguyen 2008). The flow of external remittances into the country increased significantly between 2000 and 2021. According to the World Bank’s Migration and Development Brief 36, in 2021, Vietnam received an inflow of remittances estimated at 18 billion USD, equal to 4.9% of GDP (Ratha et al. 2022, p. 31). In addition, Vietnam’s rapid urbanisation and the migration of labourers from rural to urban areas have led to an increasing trend in internal remittances (World Bank 2012). In spite of the fact that both external and internal remittances have become more prevalent in the country, there are only a few papers that have investigated the effects of remittances on income and welfare (Nguyen 2008; Nguyen and Mont 2012; Nguyen et al. 2017; Nguyen and Vu 2018). This paper contributes to the literature on the effects of remittances in Vietnam by studying how they affect saving behaviour and expenditure patterns.

In general, quite a few papers have examined the effect of remittances on savings and expenditure patterns (see, e.g., Castaldo and Reilly 2007; Ang et al. 2009; Tabuga 2010; Clément 2011; Haider et al. 2016; Quartey et al. 2019; Opiniano 2021; Salahuddin et al. 2022). Both the life-cycle theory of Modigliani and Brumberg (1954) and the permanent income hypothesis proposed by Friedman (1957) have been influential with regard to the identification of possible relations among remittances, expenditures, and savings. According to the life-cycle theory, how much households consume and save depends on the total income they receive rather than on the specific sources from which they derive their income. This means that remittances are fungible and used like income from other sources, such as wages. The implication is that remittances, like any other income, can influence both household consumption and household saving (Haider et al. 2016; Nguyen and Vu 2018). Likewise, remittances can be used both for investment expenditures (such as education, health, and housing) and consumption expenditures (such as food, non-food, and utilities), as shown by Castaldo and Reilly (2007), Adams et al. (2008), Ang et al. (2009), and Tabuga (2010). In this view, there would be no significant differences between the expenditure patterns of households that receive remittances and those that do not.

According to the permanent income hypothesis, however, remittances can be either a type of permanent income or a type of transitory income. In the first case, remittance income is perceived as stable over time, and households tend to use it for consumption. Therefore, remittances are predominantly used for consumption expenditures rather than for savings and investments. For example, Clément (2011) found that, in Tajikistan, households receiving remittances allocated a higher share of expenditure to food and utilities and a lower share to housing and investment than households not receiving remittances, concluding that remittances are not used productively. Likewise, Zhu et al. (2014) found that Chinese rural households tend to use their remittances for consumption rather than for investment, concluding that, in rural areas of China, remittances should be considered as permanent income. Their findings were confirmed by Démurger and Wang (2016), who stressed that remittances could be detrimental to sustaining investment in human capital for rural families in China. By contrast, if remittances are treated as a form of transitory income with unexpected, accidental occurrence, then they will be used mainly for saving and investment due to the zero propensity to consume from this income component. In this way, remittances would have a productive use and influence the growth and development capabilities of households (Yang 2008; Randazzo and Piracha 2019). For example, Adams and Cuecuecha (2010) found that, in Guatemala, households receiving external remittances used these productively on two forms of investment expenditure: education and housing. Moreover, these households also spent less on food than households not receiving remittances. The productive use of remittances for education was also found in the studies of Cardona-Sosa and Medina (2006) in Colombia, Yang (2008) in the Philippines, and Randazzo and Piracha (2019) in Senegal. In addition, Taylor and Mora (2006) found that, in Mexico, remittances increased expenditures on education, health, and housing rather than those on consumption goods. Similar findings were obtained by Ponce et al. (2011) for Ecuador, and by Berloffa and Giunti (2019) for Peru. Using a dataset of 141 countries, Ait Benhamou and Cassin (2021) found that remittances tended to increase investment in education at the expense of investment in physical capital.

As far as Vietnam is concerned, the literature about the impact of remittances has focused mainly on income and expenditure. Most studies have relied on the Vietnamese Household and Living Standards Survey (VHLSS) datasets and defined remittances as receipts of households from other people, such as migrant members, relatives, and friends. Using the VHLSS 2002 and 2004 datasets, Nguyen (2008) found that, as far as external remittances are concerned, the impact on income was much higher than the impact on consumption expenditures, which suggests that a large proportion of these remittances were used for saving and investment. For internal remittances, by contrast, the effect on consumption expenditures was only slightly smaller than the effect on income.

The effect of external remittances on investment expenditures was confirmed by Nguyen and Mont (2012), who used the updated VHLSS 2006 and 2008 datasets. Households receiving remittances were likely to invest these in housing, land, debt payments, and saving, rather than to increase their consumption. In addition, Nguyen and Vu (2018) examined the patterns and impact of migration and remittances on household welfare in Vietnam using data from the VHLSS 2010 and 2012 datasets. They found that remittances help households increase per capita income and per capita expenditure, with the effect of remittances on expenditure being smaller than the effect on income. They concluded that households receiving remittances use these not only for consumption but also for saving.

Lastly, Nguyen et al. (2017) conducted a study to investigate the effect of remittances on the expenditures of internal migrant households in rural areas of three provinces (Ha Tinh, Thua Thien Hue, and Dak Lak) for the years 2007, 2008, and 2010, using data from a non-VHLSS survey. Remittances were defined as household receipts from migrant members who had moved to urban areas outside the original province for at least 1 month. The authors showed that migration with remittances had a positive effect on housing and other non-food expenditures, while migration without remittances had a positive effect on food, healthcare, and other non-food expenditures, but a negative one on education expenditures.

This paper focuses on the impact of remittances on the saving behaviour and expenditure patterns of Vietnamese households. More specifically, our research question was the following: when it comes to saving, investment, and consumption, do households that receive remittances differ from households that do not receive remittances? Using the propensity score matching (PSM) approach proposed by Rosenbaum and Rubin (1983), we compare households that receive remittances to households that do not, as well as explore how the former use their remittances. As far as saving behaviour is concerned, we look at the saving amount and the saving rate. Regarding expenditure patterns, we consider both the shares and the per capita expenditures on education, health, assets, house repairs, food, non-food, and utilities. We treat the first four categories as household investment expenditures, and the last three as household consumption expenditures. We also explore whether remittances increase household income, by comparing the incomes of receiving and non-receiving households.

2. Methodology

2.1. Methods

Two approaches have been dominant in the empirical research on the impact of remittances on saving behaviour and expenditure patterns: the Working–Leser Engel curve regression approach (Working 1943; Leser 1963) and the PSM approach (Rosenbaum and Rubin 1983). The first relies on the hypothesis of household utility maximisation to construct a basic model to estimate the shares of expenditure as a function of the logarithm of total household expenditure. The basic model has then been extended to include other variables assumed to affect the shares, such as household characteristics (Deaton 2019). In this way, empirical researchers have added a dummy variable to study the impact of remittances on household expenditure patterns (Taylor and Mora 2006; Castaldo and Reilly 2007; Tabuga 2010). The Working–Leser Engel curve regression model then looks as follows:

where is the share of expenditure of good j by household i, is the total expenditure of household i, is the vector of household characteristics of household i, is a binary variable indicating whether household i receives remittance or not , and the error term.

The coefficient in Equation (1), considered as the difference in the shares of expenditure on good j by a receiving and non-receiving household, is often estimated by OLS regression. However, since the remittance variable is also influenced by the household characteristics , this can lead to an endogeneity problem. Unobserved variables may affect both the household expenditure pattern and its remittance status. Theoretically, this is a major problem that needs to be solved. If not, the estimated impact of household remittances on expenditure patterns will be biased (Deaton et al. 1989).

One popular method to avoid endogeneity in this approach is to use instrumental variables. With aggregate data, Aggarwal et al. (2011) suggested using per capita GDP and the unemployment rate as instrumental variables in studying the impact of remittances on financial development. With microdata, however, it is difficult to identify a suitable instrumental variable for remittances (Randazzo and Piracha 2019). Furthermore, McKenzie and Sasin (2007) argued that it is difficult to determine a valid instrumental variable that strongly correlates with the receipt of remittances but has no direct influence on the household expenditure pattern. Using invalid instruments can result in an even larger bias in impact estimates (Nguyen and Mont 2012; Randazzo and Piracha 2019).

Instead, the PSM approach proposed by Rosenbaum and Rubin (1983) performs well when it comes to estimating the effect of remittances on expenditure patterns (Caliendo and Kopeinig 2008; McKenzie et al. 2010; Clément 2011; Li 2012; Randazzo and Piracha 2019). That is why we apply this alternative method in our paper. In general, PSM has been applied to estimate causal treatment effects in various fields of study. The basic idea of PSM is to compare and match households in the treated group with those in the non-treated group in terms of similar observable characteristics. In other words, the causal effect of the treatment is measured by the difference in outcomes between the treated and non-treated groups that have similar observable characteristics. In this way, selection bias between treated and non-treated households can be reduced (Clément 2011). Usually, this approach consists of six steps as shown in an application by Caliendo and Kopeinig (2008).

Step 1. We begin by constructing a logit/probit model to estimate the propensity score, i.e., the probability that a household receives remittances, as a function of a set of household characteristics. According to Caliendo and Kopeinig (2008), the choice between logit and probit is not critical since both usually yield similar results in the case of a binary dependent variable. Following previous papers (Caliendo and Kopeinig 2008; McKenzie et al. 2010; Clément 2011; Li 2012), we use a logit regression,

where is the probability of receiving remittances for household i with observed covariates , is the effect of on (the logit of) the probability of receiving remittances, and is the error term.

The observed covariates to estimate the propensity score using Equation (2) should be chosen on the basis of relevant theories, institutional settings, and previous empirical studies, and they should have a simultaneous impact on the treatment (receiving remittances) and on the potential outcomes (expenditure patterns and saving behaviour) to attain a reliable result (Heckman et al. 1997; Caliendo and Kopeinig 2008; Li 2012). We followed Clément (2011), Randazzo and Piracha (2019), and other remittance studies applying the PSM approach by not including income as a covariate to estimate the propensity score, for two reasons. First, according to the authors of these studies, household income does not have an impact on receiving remittances; thus, its addition in the logit regression would not be meaningful. Second, theories of consumption state that household characteristics influence household income. Hence, including income as a covariate together with these characteristics could cause an endogeneity bias.

Step 2. We determine the region of common support by comparing the range of the propensity scores of households receiving remittances (the treated group) to that of households not receiving remittances (the non-treated group). The determination is based on the minima, maxima, and density of the propensity scores in the treated and non-treated groups (Caliendo and Kopeinig 2008). The purpose is to ensure that treated households can be matched with some non-treated households having a similar propensity score. Any treated household which has a propensity score lying outside the region of common support is dropped, since we cannot find any non-treated household with which it can be matched (Caliendo and Kopeinig 2008).

Step 3. We use PSM estimators to match each observation in the treated group with one or more observations in the non-treated group. Rosenbaum and Rubin (1983) constructed several PSM estimators, which differ in the way the neighbourhood for each treated observation is defined and in the weights that are assigned to the neighbours. Each estimator presents advantages and drawbacks in terms of the quality and quantity of the matches (Caliendo and Kopeinig 2008). Asymptotically, all PSM estimators should yield the same results; in practice, however, various matching estimators should be implemented to compare the results and check the robustness of the findings (Caliendo and Kopeinig 2008; Garrido et al. 2014; Randazzo and Piracha 2019). Following previous empirical studies, we consider the k-nearest neighbour (kNN) estimator (with k = 5), the radius calliper estimator (with caliper r = 0.001), and the kernel estimator.

The kNN estimator matches each treated household with the k closest non-treated households in terms of propensity score. We applied both k = 5 and k = 10, but report the results for k = 5 only, since the results for k = 10 are similar. Using the kNN estimator, bad matches can occur if there are treated households for which the nearest non-treated households lie relatively far away. This problem can be avoided by applying the radius calliper estimator. The calliper is the maximum propensity score difference that can be allowed. A calliper fixed at 0.001 means that each treated household must be matched with non-treated households with a propensity score that differs at most 0.001 from the propensity score of the treated household. For both of these estimators, each treated household is matched with only a few households in the non-treated group. As a result, non-treated households not matched with any treated household are excluded from the matched sample. By contrast, typical of the kernel estimator is that it matches each treated household with a weighted average of all households in the non-treated group.

Step 4. It is crucial to check whether the observed covariates and propensity score distributions of the treated and non-treated groups are balanced after matching. If these distributions are not balanced or equivalent after matching, the results of the PSM approach could be misleading and biased, and the propensity scores estimated by the selected covariates need to be re-examined (Rosenbaum and Rubin 1983; Caliendo and Kopeinig 2008; Garrido et al. 2014). Various tests have been proposed to check the balancing property of the observed covariates and propensity score distributions after matching (Rosenbaum and Rubin 1985; Sianesi 2004; Ho et al. 2007; Austin 2009). More details on the tests we apply can be found in the Supplementary Materials.

Step 5. If the matched sample is sufficiently balanced, the effect caused by the treatment can be determined by the average treatment effect on the treated (ATT), which is defined as the difference between the expected outcomes with and without treatment for households in the treatment group. In this paper, the ATT is the effect of remittances on saving behaviour and expenditure patterns, defined as follows:

where and are the expected outcomes with and without treatment for households in the treatment group. In PSM, the expected outcomes without treatment for households in the treatment group, , are simply the expected outcomes for households in the non-treated group after matching, . Hence, we obtain

Step 6. We apply the bounding approach proposed by Rosenbaum (2002) (see the Supplementary Materials for more details) to test whether our results are robust. In PSM, unobserved covariates are assumed not to influence the ATT. If there are any unobserved covariates that affect the treatment and the outcomes simultaneously, a hidden bias might occur. Rosenbaum’s test allows us to examine whether the ATT is sensitive to the influence of unobserved covariates under varying degrees of assumed hidden bias (Becker and Caliendo 2007).

As mentioned before, the PSM method performs well in situations where we cannot find suitable instrumental variables to avoid the endogeneity problems which often occur when studying the effect of remittances on household expenditure patterns and saving behaviour (Caliendo and Kopeinig 2008; McKenzie et al. 2010; Li 2012; Démurger and Wang 2016; Randazzo and Piracha 2019). An additional advantage of the PSM method is that it allows us to reduce the sources of bias in observational data (Heckman et al. 1998). Since non-matched households are excluded, the bias from non-overlapping observations is reduced. Moreover, the technique allows us to reweigh the non-treated households so as to obtain equivalent distributions for the treated and non-treated households, which diminishes the bias due to the difference in density weighting between these two groups. In the next section, we apply the PSM method making use of the psmatch2 module in Stata (Leuven and Sianesi 2018) and the statistical software package JMP (SAS Institute Inc., Cary, NC, USA).

2.2. Data

We use the VHLSS survey of the year 2012, which collected data on 9399 households. We deleted six households with household heads younger than 18 years. Next, we excluded three households which answered ‘do not remember’ to the question whether they received remittances, 608 households with missing educational information, and three households for which we could not determine the saving rate. Overall, our final sample consists of 8778 households of which 2174 households (24.73%) received remittances, and 6604 households (75.23%) did not. Regarding the sources of remittances, 2071 received internal remittances, and 159 households received external remittances. Because the sample of households receiving external remittances was small, we did not analyse the impact of internal and external remittances separately. Instead, we focused on total remittances.

In the literature, remittances have been defined in at least two different ways. Remittances can be conceived broadly as the sum of what a household receives from migrant members, relatives, friends, and neighbours (Castaldo and Reilly 2007; Clément 2011). Most studies of remittances in Vietnam have defined remittances in this way, by using available information of household receipts in the VHLSS dataset (Nguyen et al. 2008; Nguyen and Mont 2012; Nguyen and Vu 2018). A more narrow definition of remittances comes from the literature on the new economics of labour migration (Stark and Bloom 1985). Here, remittances are limited to what migrant members send to their families. This provides information on both remittances and migration, which has been used in numerous studies (Tabuga 2010; Démurger and Wang 2016; Nguyen et al. 2017; Randazzo and Piracha 2019).

In this study, we adopt the more narrow definition of remittances. One reason for this is that migration within Vietnam, as well as to other countries, has increased rapidly in recent years (Junge et al. 2015; Nguyen et al. 2017; Luong 2018; Nguyen and Vu 2018). Vietnam’s 2009 census showed that 8.5% of the population represented inter- and intra-provincial migrants, and the government expects that this percentage will continue to rise (World Bank 2016). Furthermore, around four million people of Vietnamese descent are living abroad (Ministry of Foreign Affairs of Vietnam 2012). Another reason is that most of the current literature on remittances in Vietnam is based on the broad definition.

We use the VHLSS 2012 dataset because it contains a special module on migration with extensive data on both migrants and how much they send home—information which is missing in earlier and later waves of the VHLSS survey. This also explains why the VHLSS 2012 dataset has been used in other studies of migration in Vietnam, such as the volume on rural–urban migration edited by Liu and Meng (2019). In accordance with the data of the special module, we define migrant members as people who have left their households, but are still considered as important to the household in terms of either filial responsibility or financial contributions. We also take our remittance data from this module. It should be noted, however, that these data do not coincide perfectly with the remittance data in other modules of the survey. Since the survey calculates a household’s total income on the basis of the remittance data of the other modules rather than on the data of the special migration module, we adjusted the income data of households. More precisely, we replaced the remittance data used by the survey to calculate total income using the remittance data from the migration module. In this way, we obtain what we call the adjusted income of households, which we use as an outcome variable.

We use two sets of outcomes for saving behaviour and expenditure patterns. Regarding saving behaviour, we study the saving amount (expressed in 1000 Vietnamese dong, VND) and the saving rate. With respect to expenditure patterns, we analyse the share of expenditure and per capita expenditure (1000 VND) on various categories, including education, health, assets, house repairs, food, non-food, and utilities. A description of the expenditure categories can be found in Table 1.

Table 1.

Description of expenditure categories.

Following previous empirical studies on remittances in developing countries, we include the following numerical covariates in the logit model: household size, number of members with a high-school degree or above, age of the household head and its squared mean-centred term (to observe a nonlinear relationship), number of elderly members over 70 years old, number of children below 6 years old, and number of children between 6 and 14 years old. We also explore the effect of the following categorical covariates: living area of the household (urban/rural), ethnicity of the household head (Kinh/minorities), marital status of the household head (married/otherwise), and the six regions of Vietnam (Red River Delta, Midlands and Northern Mountainous Areas, Northern and Coastal Central Region, Central Highlands, South-Eastern Area, and Mekong River Delta). We specify this region covariate by means of five dummy variables in the logit model, with Mekong River Delta as the base region group.

The characteristics of the households with and without remittances can be found in Table 2. Households receiving remittances tended to have a smaller size, lower educational levels, more elderly members, and fewer children than those not receiving remittances. In addition, households receiving remittances were more likely to be rural and of Kinh ethnicity, and to have an older and nonmarried household head. Furthermore, there were some differences in the regional distribution of both types of households; for example, the South-Eastern Area was characterised by a relatively small proportion of households receiving remittances.

Table 2.

Descriptive statistics of the sample characteristics.

Descriptive statistics of adjusted income, remittances, saving amount and rate, and expenditures (both shares and per capita amounts) for the whole sample, as well as for families with and without remittances, are shown in Table 3. For households receiving remittances, these constituted about 15% of their adjusted income. Nevertheless, their adjusted income, total expenditure, and per capita expenditure were on average lower than those of households who did not receive remittances. However, receiving households appeared to save more, as shown by a somewhat higher saving amount and saving rate. Lastly, concerning expenditure patterns, receiving households tended to spend more on health, assets, and house repairs, while non-receiving families tended to spend more on education, food, non-food, and utilities.

Table 3.

Descriptive statistics for adjusted income, remittances, saving behaviour, and expenditure with sample weights.

3. Results

We proceed in three steps. First, we present the results of the propensity score regression. Next, we derive the region of common support and compare the density distributions before and after matching. In the third and final step, we analyse to what extent receiving remittances influences saving behaviour and expenditure patterns.

3.1. Results of the Estimated Propensity Score by Logit Regression

Table 4 presents two models for the estimation of the propensity score based on the selected household characteristics. In an initial model, we included all observed covariates. However, the effects of the number of elderly members and of the number of children below 6 years old on the propensity score turned out to be insignificant at the 5% level. Therefore, we excluded these two variables from the final model, to only show the impact of the significant characteristics.

Table 4.

Initial and final logit model for propensity score estimation.

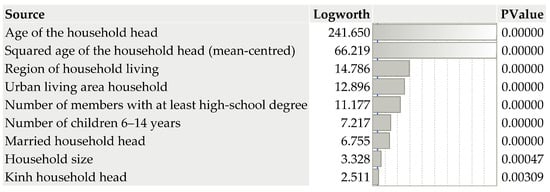

The importance of each explanatory variable was estimated by means of the log-worth, defined as −log10(p-value of the F-test) (Kessels and Erreygers 2019). In Figure 1, the horizontal bar graph depicts the log-worth values of the variables relative to the most important variable, age of the household head, for which the log-worth values of its main and squared term combined are normalised to 100%. The age of the household head and the squared age, thus, had the greatest effect on the propensity score, followed by region, urban living area, education, older children, marital status of the household head, household size, and ethnicity of the household head.

Figure 1.

Importance of the explanatory variables to the propensity score estimates obtained from logit regression.

The overall goodness of fit, as measured by the pseudo R2, indicates that the observed characteristics explain 18.9% of the propensity score. There is no threshold for this number in the PSM approach. Most of the previous papers set it around 10%, e.g., 10% and 8% in the research of Clément (2011) and Démurger and Wang (2016), respectively. Hence, the explanatory power of the logit model for the estimated propensity score in our study seems satisfactory. In addition, to check whether there is any indication of missing variables in our logit regression, we performed a lack-of-fit test. The test result (p = 0.9997) suggests that there is no immediate evidence of missing variables. Note that the PSM approach does not aim to maximise the fit of the model, but uses the propensity score as a balancing mechanism (Randazzo and Piracha 2019).

The final model in Table 4 suggests the following results:

- The probability of receiving remittances increases steeply with the age of the household head until the age of 70 is reached, after which the probability decreases.

- There are significant differences in the probability of receiving remittances between households in different regions. According to the coefficients of the different regions, the probability of households receiving remittances is the highest for the Midlands and Northern Mountainous Areas, followed by the Northern and Coastal Central Region, the Red River Delta, the Mekong River Delta, the Central Highlands, and the South-Eastern Area. However, the difference in the probability of receiving remittances of households in the Mekong River Delta and households in the Red River Delta is not significant.

- Rural households have a higher probability of receiving remittances than urban households.

- As far as education is concerned, the probability of receiving remittances depends negatively on the number of well-educated members. Migrants from a well-educated household could have less strong motives to send remittances to support their home families.

- With regard to the marital status of household head, married household heads have a higher probability of receiving remittances than the others.

- Older children negatively affect the probability of receiving remittances. Migrant members could have less responsibility to support their home families in cases where these consist of older children. As in Hua and Erreygers (2020), we considered older children as belonging to the household labour force, and not as dependent members, as in other empirical papers. This result confirms the role of older children as labourers in households.

- The probability of receiving remittances depends negatively on household size. This implies that small families tend to receive remittances more often than larger families.

- Lastly, the effect of the ethnicity covariate reveals that the Kinh have a higher probability of receiving remittances than other ethnic groups. This result supports the conclusion of Nguyen and Vu (2018) and Coxhead et al. (2019), who found that people from minor ethnicities were less likely to migrate than Kinh people.

3.2. Defining the Common Support for Propensity Scores of Treated and Non-Treated Groups

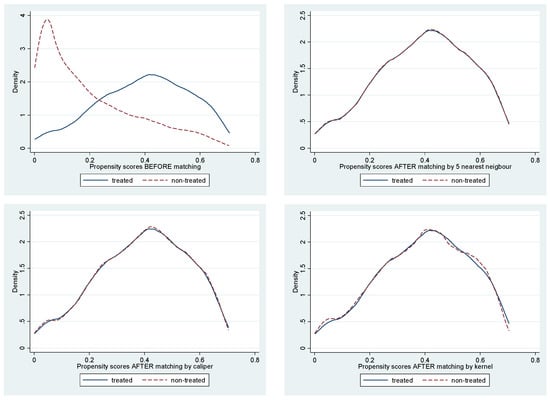

Table 5 contains the minima and maxima of the estimated propensity scores for treated and non-treated households. The range of propensity scores for both groups is largely overlapping with a region of common support ranging from 0.0017 to 0.7048. Any treated household with a propensity score outside this range was excluded.

Table 5.

Descriptive statistics of propensity score estimates from the final logit model.

The top left panel of Figure 2 plots the densities of the propensity scores of the treated and non-treated households before matching. The density plot for the treated households shows an inverted U-shaped distribution, while, for the non-treated households, the distribution is right-skewed. Hence, there is a substantial difference between the two distributions before matching. After matching, the distributions are nearly equivalent, as shown in the remaining panels of Figure 2.

Figure 2.

Propensity score distribution before and after matching.

3.3. Impact of Remittances on Saving Behaviour and Expenditure Patterns

3.3.1. Effect of Remittances on Saving, Adjusted Income, and Total Expenditure

The ATT estimates presented in Table 6 are the differences in saving amount and rate, adjusted income, and total expenditure between households with and without remittances. As far as the saving amount and rate before matching are concerned, we find that the effect of remittances is only significant for the saving rate. After matching, however, the results of all matching estimators show that the differences in both saving amount and rate between treated and non-treated households are significant. Mainly, households with remittances tend to save more in level (between 4.6 and 4.9 million VND), as well as in rate (between 16.8% and 20.7%) than those without remittances. These results imply that remittances impact saving behaviour positively. Moreover, the significant results for all matching estimators confirm the robustness of our findings.

Table 6.

ATT estimates of the effect of remittances on saving, adjusted income and total expenditure.

The high savings of remittance-receiving households could be caused by their higher income. Table 6 shows that the adjusted income of non-receiving households is significantly higher both before and after matching (between 4.7 and 5.8 million VND after matching). This finding supports the evidence of Nguyen and Vu (2018) that remittances help reduce poverty for the receiving households. By contrast, as Table 6 also shows, the difference in total expenditure between remittance receiving and non-receiving households is insignificant after matching.

3.3.2. Effect of Remittances on Household Expenditure Patterns

With respect to shares of expenditure, Table 7 shows a significant difference in the shares of expenditure on health, assets, house repairs, and food between households with and without remittances after matching. Receiving households spend significantly more on health (between 0.9% and 1.0% of their total expenditure), assets (between 0.6% and 0.7%), and house repairs (between 0.3% and 0.4%), but less on food (between 2.0% and 2.2%).

Table 7.

ATT estimates for the impact of remittances on the share of expenditure.

As far as per capita expenditure is concerned, we observe in Table 8 that receiving households have a higher per capita expenditure than non-receiving households, al-though the difference is not significant according to the radius estimator. Nguyen and Vu (2018) also found that remittances help receiving households increase per capita consumption. Furthermore, Table 8 shows significantly higher spending on health (between 228 and 243 thousand VND), assets (between 496 and 537 thousand VND), and house repairs (between 215 and 236 thousand VND) by receiving households compared with non-receiving households. These differences in expenditure patterns provide evidence that remittances tend to be used productively for human and physical capital investment, since spending on health, assets, and house repairs can be considered as investment expenditures (Taylor and Mora 2006; de Brauw and Rozelle 2008).

Table 8.

ATT estimates for the impact of remittances on per capita expenditure.

The higher spending on health by receiving households is consistent with the results of other studies on the role of remittances in developing countries such as Taylor and Mora (2006), Ponce et al. (2011), Wen and Lin (2012), and Berloffa and Giunti (2019). This remittance-induced expenditure on health confirms the altruism motive of migrant members who send money home to care for other family members. This also creates more opportunities for the development of hospitals and healthcare centres in the local economy. Furthermore, expenditures on assets and house repairs can improve the quality of life of the households, e.g., by expanding family business facilities for informal self-employed workers (Adams and Cuecuecha 2010). This is especially relevant for Vietnam, where there are large numbers of informal self-employed workers and small-scale family businesses.

As far as food is concerned, we find that remittance-receiving households have a lower expenditure share compared with non-receiving households. Nevertheless, per capita expenditures on food are not significantly different between the two groups. This suggests that remittances do not increase the demand for food.

In summary, we observe that remittances not only increase household saving, but also have a positive effect on investment categories such as human and physical capital investment. Our findings are consistent with those in the studies of Nguyen (2008), and Nguyen and Mont (2012). These results reveal that remittances tend to be used productively and, therefore, have a positive effect on the growth and development of households and the economy in Vietnam.

4. Discussion

In this section, we discuss the quality of our matching estimators and the sensitivity of our results. Since some of the material is quite technical, we relegated most of it to the Supplementary Materials.

4.1. Assessing the Quality of the Matching

As explained in more detail in Part I of the Supplementary Materials, two types of tests can be conducted to check the quality of the matching process. The first type looks at the difference in the distribution of the individual covariates between the treated and the control group after matching. We consider three specific tests and report the results in Tables S1–S3 of the Supplementary Materials. First, we use a t-test to check whether there is a difference in the means of a covariate between households with and without remittances after matching. Since the t-tests after matching are all insignificant, this is evidence of covariate balance between the treated and the control group. Second, we calculate the absolute standardised bias (ASB) for each covariate between households with and without remittances after matching. The matching is considered to be balanced if the ASB after matching is below a certain threshold. Different values have been suggested for this threshold, from 5% by Caliendo and Kopeinig (2008) to 20% by Jimenez-Soto and Brown (2012). In our case the bias percentages for the different estimators are all below 5%, with a maximum of 4.1% for the kernel matching estimator, which indicates sufficient covariate balance. Third, for the continuous covariates, we report the ratios of the variance in the treated group to that in the control group. After matching, these ratios are closer to unity compared with the ratios in the unmatched sample, providing further evidence of proper balancing.

The second type re-estimates the propensity score by logit regression for the matched sample and compares the joint explanatory power of all covariates to that of the initial regression from the unmatched sample. We report the results for the three matching estimators in Table S4 of the Supplementary Materials. First, while the pseudo R2 value is 18.9% before matching, it is only 0.1% after matching, indicating that the observed covariates can explain very little of the propensity score in the matched sample. Accordingly, the new regressions of the matched sample reveal that the likelihood ratio (LR) tests on the joint significance of all covariates are insignificant. This confirms that the distributions of the propensity scores for the treated and non-treated households after matching are balanced, as shown in Figure 2. In addition, we consider the mean and median of the absolute standardised difference or bias in the covariates across the treated and non-treated households. The means and medians for the unmatched sample (before matching) are rather high (25% and 18%), while, for the matched sample, they are low (between 1.3% and 1.6%). The kernel estimator has the lowest mean and median (1.5% and 1.3%), thus reducing the bias the most. This is line with Garrido et al. (2014) who found that the kernel estimator had the lowest bias in their empirical study.

In summary, the results of all the tests confirm that the balancing property is satisfied. Thus, the distributions of households with and without remittances after matching are equivalent. Therefore, the PSM approach can be applied to estimate the impact of remittances on saving behaviour and expenditure patterns.

4.2. Analysing Sensitivity

Since the ATT estimates for the outcomes obtained from PSM are based on the observed covariates only, other unobserved covariates are assumed not to impact these outcomes. The dominant view in the PSM literature is to conduct a sensitivity test to check whether the average treatment effects are sensitive to the influence of unobserved covariates or hidden biases, although some researchers argue it is not necessary to do so (see, e.g., Esquivel and Huerta-Pineda 2007; Randazzo and Piracha 2019). As described in Part II of the Supplementary Materials, the bounding approach proposed by Aakvik (2001) and Rosenbaum (2002) allows us to analyse the sensitivity of the ATT estimates. In this approach, the sensitivity of the ATT to hidden bias is indicated using the critical value of the odds ratio. A higher critical value indicates the greater extent to which an unobserved confounder would have to alter the odds of receiving remittances to completely determine the ATT. If this critical value is relatively low, i.e., smaller than 2, the ATT is likely sensitive to hidden bias (Clément 2011; Li 2012).

We used the rbounds command in Stata developed by Gangl (2004) to calculate the bounds of the confidence intervals for different critical values. Table S5 of the Supplementary Materials shows that the critical values producing a 95% confidence interval including zero fluctuate around 1 to 1.2 for the saving amount and adjusted income for the three matching estimators. This implies that households with the same observed characteristics can differ in their odds of receiving remittances by as much as 20% before the confidence interval on the ATT starts including zero. That is to say, an unobserved characteristic would have to increase the odds ratio by at most 20% before it could bias the ATT. Saving amount and adjusted income are, therefore, susceptible to hidden bias. Nevertheless, this finding does not mean we have to reject the impact of remittances on the saving level and adjusted income of households. It means that, if there were an unobserved characteristic, the result could be different. In other words, it is considered a ‘worst-case scenario’ that could happen if an unobserved covariate caused the odds ratio of treatment assignment to differ between the treated and non-treated groups (Clément 2011; Li 2012). In this research, we defined remittances as receipts of households from migrant members, but other factors affecting income of those members could have an impact on household remittances. Due to lack of information in the dataset, we could not observe these covariates in our study. For the saving rate, the critical odds ratio is at least equal to 2, highlighting that the impact of remittances on the household saving rate is robust to the presence of unobserved characteristics.

Concerning the shares of expenditure, Table S6 of the Supplementary Materials reveals that the ATT of house repairs is robust to hidden bias since the critical odds ratios are larger than 2 for all matching estimators. However, there is no robustness guarantee for the other outcomes, health, assets, and food, as indicated by critical odds ratios smaller than 2. Regarding per capita expenditures, Table S7 shows that the ATT estimates of assets and house repairs are robust, while the effect of health is likely sensitive to hidden bias.

The critical odds ratios of saving behaviour and expenditure patterns in our research are of the same magnitude as those identified in other studies (Clément 2011; Li 2012). Hence, the impact of remittances in our study has the same degree of sensitivity to unobservables as in other studies.

5. Conclusions

This study was an econometric analysis to analyse the impact of remittances on the saving and expenditure behaviour of Vietnamese households. We applied the PSM approach proposed by Rosenbaum and Rubin (1983) to the VHLSS 2012 dataset, which allowed us to avoid the endogeneity problem when investigating the impact of remittances using the Working–Leser Engel method. PSM has been widely used in the study of causal treatment effects. The impact of remittances on saving behaviour and expenditure patterns is determined by estimating the average treatment effect on the treated (ATT) for the outcomes.

We found that households with remittances tend to have a higher saving amount and rate than those without, while expenditures per capita of the two household groups did not differ significantly. As far as expenditure patterns are concerned, remittances were used productively in human and physical capital investment. We also observed that households receiving remittances had a significantly lower expenditure share on food. This implies that remittances stimulated investment rather than consumption. Our findings are consistent with those of Nguyen (2008), as well as Nguyen and Mont (2012), who studied the impact of external and internal remittances separately. Our study adds to the existing literature on the effect of remittances by considering both external and internal remittances together.

Households receiving remittances were unlikely to consider their remittances as expected and stable income. This suggests that remittances were treated as transitory income, in accordance with the permanent income hypothesis. Since remittances were used mainly for investment in human and physical capital, they created more opportunities for the development of services provided by banks, financial institutions, hospitals, and healthcare centres, also in addition to providing incentives for the production of building materials and tangible assets. Nevertheless, consistent with the study of Nguyen et al. (2017), we found that remittances did not influence education. Therefore, we agree with their suggestion that other capital sources should be considered for improving education, especially in rural areas in Vietnam. More generally, as Yoshino et al. (2020) found, the importance of remittances for investment in human and physical capital tends to diminish as countries become richer. Remittances are gradually replaced by other forms of capital inflows, such as foreign direct investment (FDI). To what extent this applies to a country like Vietnam, which has grown quickly from the group of low-income countries to that of middle-income countries, remains to be seen. As long as the flow of remittances is relatively large, policymakers should encourage the productive use of these resources, e.g., by improving the efficiency of the banking system. In the long run, however, they must take into account that the role of remittances will probably become smaller and smaller.

There are still some limitations to our research. Firstly, we were not able to investigate the impact of external and internal remittances separately, due to the small size of foreign receipts (only 159 households). Secondly, the matching method is based on the propensity score estimated from the observed covariates. The ATT does not reflect the possible effect of unobserved factors. Even when the impact of the observed covariates is significant, there might still be some variables that remain unexplored. Lastly, while the PSM approach allows us to test whether remittances have an impact on saving behaviour and expenditure patterns, it does not reveal the extent of the effect. This means that other methods should be applied to estimate the magnitude of the effect.

Supplementary Materials

The following supporting information can be downloaded at https://www.mdpi.com/article/10.3390/economies10090223/s1: Additional explanation and Tables S1–S7 on the tests of the matching quality (Part I) and the robustness (Part II).

Author Contributions

Conceptualization, T.X.H.; methodology, T.X.H. and R.K.; validation, T.X.H. and R.K.; data curation, T.X.H.; writing—original draft preparation, T.X.H.; writing—review and editing, R.K. and G.E.; supervision, R.K. and G.E. All authors read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

This study used data from the Vietnam Household Living Standard Survey (VHLSS) for the year 2012. This dataset was collected by the General Statistics Office of Vietnam (https://www.gso.gov.vn/en/homepage/) (accessed on 23 December 2019).

Acknowledgments

Thanh Xuan Hua acknowledges the support of the Ministry of Education and Training in Vietnam which allowed her to work on this paper as part of her PhD research. Roselinde Kessels acknowledges the JMP Division of SAS Institute for financial support. We are grateful to the reviewers of this journal for their comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aakvik, Arild. 2001. Bounding a matching estimator: The case of a Norwegian training program. Oxford Bulletin of Economics and Statistics 63: 115–43. [Google Scholar]

- Adams, Richard H., Jr., and Alfredo Cuecuecha. 2010. Remittances, household expenditure and investment in Guatemala. World Development 38: 1626–41. [Google Scholar] [CrossRef]

- Adams, Richard H., Jr., Alfredo Cuecuecha, and John Page. 2008. Remittances, Consumption and Investment in Ghana. Policy Research Working Paper No. 4515. Washington, DC: World Bank. [Google Scholar]

- Aggarwal, Reena, Asli Demirgüç-Kunt, and Maria Soledad Martínez Pería. 2011. Do remittances promote financial development? Journal of Development Economics 96: 255–64. [Google Scholar] [CrossRef]

- Ait Benhamou, Zouhair, and Lesly Cassin. 2021. The impact of remittances on savings, capital and economic growth in small emerging countries. Economic Modelling 94: 789–803. [Google Scholar] [CrossRef]

- Ang, Alvin P., Guntur Sugiyarto, and Shikha Jha. 2009. Remittances and Household Behavior in the Philippines. Asian Development Bank Economics Working Paper No. 188. Manila: Asian Development Bank. Available online: https://www.adb.org/publications/remittances-and-household-behavior-philippines (accessed on 15 July 2022).

- Austin, Peter C. 2009. Balance diagnostics for comparing the distribution of baseline covariates between treatment groups in propensity-score matched samples. Statistics in Medicine 28: 3083–107. [Google Scholar] [CrossRef] [PubMed]

- Becker, Sascha O., and Marco Caliendo. 2007. Sensitivity analysis for average treatment effects. The Stata Journal 7: 71–83. [Google Scholar] [CrossRef]

- Berloffa, Gabriella, and Sara Giunti. 2019. Remittances and healthcare expenditure: Human capital investment or responses to shocks? Evidence from Peru. Review of Development Economics 23: 1540–61. [Google Scholar] [CrossRef]

- Caliendo, Marco, and Sabine Kopeinig. 2008. Some practical guidance for the implementation of propensity score matching. Journal of Economic Surveys 22: 31–72. [Google Scholar] [CrossRef]

- Cardona-Sosa, Lina, and Carlos Medina. 2006. Migration as a Safety Net and Effects of Remittances on Household Consumption: The Case of Colombia. Borradores de Economía No. 414. Bogotá: Banco de la Republica de Colombia. [Google Scholar]

- Castaldo, Adriana, and Barry Reilly. 2007. Do migrant remittances affect the consumption patterns of Albanian households? South-Eastern Europe Journal of Economics 5: 25–44. [Google Scholar]

- Clément, Matthieu. 2011. Remittances and household expenditure patterns in Tajikistan: A propensity score matching analysis. Asian Development Review 28: 58–87. [Google Scholar] [CrossRef]

- Coxhead, Ian, Viet Cuong Nguyen, and Hoang Linh Vu. 2019. Internal migration in Vietnam: 2002–2012. In Rural-Urban Migration in Vietnam. Edited by Amy Y. C. Liu and Xin Meng. Cham: Springer, pp. 67–96. [Google Scholar]

- Deaton, Angus S. 2019. The Analysis of Household Surveys: A Microeconometric Approach to Development Policy. Washington, DC: World Bank. [Google Scholar]

- Deaton, Angus S., Javier Ruiz-Castillo, and Duncan Thomas. 1989. The influence of household composition on household expenditure patterns: Theory and Spanish evidence. Journal of Political Economy 97: 179–200. [Google Scholar] [CrossRef]

- de Brauw, Alan, and Scott Rozelle. 2008. Migration and household investment in rural China. China Economic Review 19: 320–35. [Google Scholar] [CrossRef]

- Démurger, Sylvie, and Xiaoqian Wang. 2016. Remittances and expenditure patterns of the left behinds in rural China. China Economic Review 37: 177–90. [Google Scholar] [CrossRef]

- Esquivel, Gerardo, and Alejandra Huerta-Pineda. 2007. Remittances and poverty in Mexico: A propensity score matching approach. Integration and Trade 27: 45–71. [Google Scholar]

- Friedman, Milton. 1957. A Theory of the Consumption Function. Princeton: National Bureau of Economic Research, Inc. [Google Scholar]

- Gangl, Markus. 2004. RBOUNDS: Stata Module to Perform Rosenbaum Sensitivity Analysis for Average Treatment Effects on the Treated. Statistical Software Components S438301, Boston College Department of Economics. Available online: https://ideas.repec.org/c/boc/bocode/s438301.html (accessed on 28 August 2022).

- Garrido, Melissa M., Amy S. Kelley, Julia Paris, Katherine Roza, Diane E. Meier, R. Sean Morrison, and Melissa D. Aldridge. 2014. Methods for constructing and assessing propensity scores. Health Services Research 49: 1701–20. [Google Scholar] [CrossRef]

- Haider, Mohammed Ziaul, Tanbir Hossain, and Ohidul Islam Siddiqui. 2016. Impact of remittance on consumption and savings behavior in rural areas of Bangladesh. Journal of Business 1: 25–34. [Google Scholar] [CrossRef]

- Heckman, James J., Hidehiko Ichimura, and Petra E. Todd. 1997. Matching as an econometric evaluation estimator: Evidence from evaluating a job training programme. Review of Economic Studies 64: 605–54. [Google Scholar] [CrossRef]

- Heckman, James J., Hidehiko Ichimura, Jeffrey Smith, and Petra E. Todd. 1998. Characterizing selection bias using experimental data. Econometrica 66: 1017–98. [Google Scholar] [CrossRef]

- Ho, Daniel E., Kosuke Imai, Gary King, and Elizabeth A. Stuart. 2007. Matching as nonparametric preprocessing for reducing model dependence in parametric causal inference. Political Analysis 15: 199–236. [Google Scholar] [CrossRef]

- Hua, Thanh Xuan, and Guido Erreygers. 2020. Applying quantile regression to determine the effects of household characteristics on household saving rates in Vietnam. Journal of Asian Business and Economic Studies 27: 175–93. [Google Scholar] [CrossRef]

- Jimenez-Soto, Eliana V., and Richard P. C. Brown. 2012. Assessing the poverty impacts of migrants’ remittances using propensity score matching: The case of Tonga. Economic Record 88: 425–39. [Google Scholar] [CrossRef]

- Junge, Vera, Javier Revilla Diez, and Ludwig Schätzl. 2015. Determinants and consequences of internal return migration in Thailand and Vietnam. World Development 71: 94–106. [Google Scholar] [CrossRef]

- Kessels, Roselinde, and Guido Erreygers. 2019. A direct regression approach to decomposing socioeconomic inequality of health. Health Economics 28: 884–905. [Google Scholar] [CrossRef]

- Leser, Conrad E. V. 1963. Forms of Engel functions. Econometrica 31: 694–703. [Google Scholar] [CrossRef]

- Leuven, Edwin, and Barbara Sianesi. 2018. PSMATCH2: Stata Module to Perform Full Mahalanobis and Propensity Score Matching, Common Support Graphing, and Covariate Imbalance Testing. Available online: https://EconPapers.repec.org/RePEc:boc:bocode:s432001 (accessed on 15 July 2022).

- Li, Mingxiang. 2012. Using the propensity score method to estimate causal effects: A review and practical guide. Organizational Research Methods 16: 188–226. [Google Scholar] [CrossRef]

- Liu, Amy Y. C., and Xin Meng, eds. 2019. Rural-Urban Migration in Vietnam. Cham: Springer. [Google Scholar]

- Luong, Hy V. 2018. The changing configuration of rural-urban migration and remittance flows in Vietnam. Sojourn: Journal of Social Issues in Southeast Asia 33: 602–46. [Google Scholar] [CrossRef]

- McKenzie, David, and Marcin J. Sasin. 2007. Migration, Remittances, Poverty, and Human Capital: Conceptual and Empirical Challenges. Policy Research Working Paper No. 4272. Washington, DC: World Bank. [Google Scholar]

- McKenzie, David, Steven Stillman, and John Gibson. 2010. How important is selection? Experimental vs. non-experimental measures of the income gains from migration. Journal of the European Economic Association 8: 913–45. [Google Scholar] [CrossRef]

- Ministry of Foreign Affairs of Vietnam. 2012. Review of Vietnamese Migration Abroad; Ha Noi: Consular Department, Ministry of Foreign Affairs of Vietnam.

- Modigliani, Franco, and Richard Brumberg. 1954. Utility analysis and the consumption function: An interpretation of cross-section data. In Post-Keynesian Economics. Edited by Kenneth K. Kurihara. New Brunswick: Rutgers University Press, pp. 388–436. [Google Scholar]

- Nguyen, Duc Loc, Ulrike Grote, and Trung Thanh Nguyen. 2017. Migration and rural household expenditures: A case study from Vietnam. Economic Analysis and Policy 56: 163–75. [Google Scholar] [CrossRef]

- Nguyen, Thu Phuong, Ngo Thi Minh Tam Tran, Thi Nguyet Nguyen, and Remco Oostendorp. 2008. Determinants and Impacts of Migration in Vietnam. Working Papers 2008/01. Ha Noi: Development and Policies Research Center (DEPOCEN). [Google Scholar]

- Nguyen, Viet Cuong. 2008. Impacts of international and internal remittances on household welfare: Evidence from Viet Nam. Asia-Pacific Development Journal 16: 59–92. [Google Scholar] [CrossRef]

- Nguyen, Viet Cuong, and Daniel Mont. 2012. Economic impacts of international migration and remittances on household welfare in Vietnam. International Journal of Development Issues 11: 144–63. [Google Scholar]

- Nguyen, Viet Cuong, and Huang Linh Vu. 2018. The impact of migration and remittances on household welfare: Evidence from Vietnam. Journal of International Migration and Integration 19: 945–63. [Google Scholar]

- Opiniano, Jeremaiah M. 2021. Remittances and the financial capabilities of migrant households in the Philippines. Asian and Pacific Migration Journal 30: 370–85. [Google Scholar] [CrossRef]

- Ponce, Juan, Iliana Olivié, and Mercedes Onofa. 2011. The role of international remittances in health outcomes in Ecuador: Prevention and response to shocks. International Migration Review 45: 727–45. [Google Scholar] [CrossRef]

- Quartey, Peter, Charles Ackah, and Monica Puoma Lambon-Quayefio. 2019. Inter-linkages between remittance and savings in Ghana. International Journal of Social Economics 46: 152–66. [Google Scholar] [CrossRef]

- Randazzo, Teresa, and Matloob Piracha. 2019. Remittances and household expenditure behaviour: Evidence from Senegal. Economic Modelling 79: 141–53. [Google Scholar] [CrossRef] [Green Version]

- Ratha, Dilip, Eung Ju Kim, Sonia Plaza, Elliott J. Riordan, and Vandana Chandra. 2022. Migration and Development Brief 36: A War in a Pandemic: Implications of the Russian Invasion of Ukraine and the COVID-19 Crisis on Global Governance of Migration and Remittance Flows. Washington, DC: KNOMAD-World Bank. [Google Scholar]

- Rosenbaum, Paul R. 2002. Observational Studies. New York: Springer. [Google Scholar]

- Rosenbaum, Paul R., and Donald B. Rubin. 1983. The central role of the propensity score in observational studies for causal effects. Biometrika 70: 41–55. [Google Scholar] [CrossRef]

- Rosenbaum, Paul R., and Donald B. Rubin. 1985. Constructing a control group using multivariate matched sampling methods that incorporate the propensity score. The American Statistician 39: 33–38. [Google Scholar]

- Salahuddin, Sarah, Muhammad Mehedi Masud, and Kian Teng Kwek. 2022. Remittances and households’ savings behaviour in Bangladesh. Society and Business Review 17: 120–40. [Google Scholar] [CrossRef]

- Sianesi, Barbara. 2004. An evaluation of the Swedish system of active labor market programs in the 1990s. Review of Economics and Statistics 86: 133–55. [Google Scholar] [CrossRef]

- Stark, Oded, and David E. Bloom. 1985. The new economics of labor migration. American Economic Review 75: 173–78. [Google Scholar]

- Tabuga, Aubrey D. 2010. International remittances and family expenditure patterns: The Philippines’ case. Philippine Journal of Development 35: 103–23. [Google Scholar]

- Taylor, J. Edward, and Jorge Mora. 2006. Does Migration Reshape Expenditures in Rural Households? Evidence from Mexico. Policy Research Working Paper No. 3842. Washington, DC: World Bank. [Google Scholar]

- Wen, Ming, and Danhua Lin. 2012. Child development in rural China: Children left behind by their migrant parents and children of nonmigrant families. Child Development 83: 120–36. [Google Scholar] [CrossRef]

- World Bank. 2012. Well Begun, Not Yet Done: Vietnam’s Remarkable Progress on Poverty Reduction and the Emerging Challenges. Hanoi: World Bank. [Google Scholar]

- World Bank. 2016. Transforming Vietnamese Agriculture: Gaining More from Less. Washington, DC: World Bank. [Google Scholar]

- Working, Holbrook. 1943. Statistical laws of family expenditure. Journal of the American Statistical Association 38: 43–56. [Google Scholar] [CrossRef]

- Yang, Dean. 2008. International migration, remittances and household investment: Evidence from Phillipine migrants’ exchange rate shocks. Economic Journal 118: 591–630. [Google Scholar] [CrossRef]

- Yoshino, Naoyuki, Farhad Taghizadeh-Hesary, and Miyu Otsuka. 2020. Determinants of international remittance inflow in Asia-Pacific middle-income countries. Economic Analysis and Policy 68: 29–43. [Google Scholar] [CrossRef]

- Zhu, Yu, Zhongmin Wu, Liquan Peng, and Laiyun Sheng. 2014. Where did all the remittances go? Understanding the impact of remittances on consumption patterns in rural China. Applied Economics 46: 1312–22. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).