The Impact of the National Economic Recovery Program and Digitalization on MSME Resilience during the COVID-19 Pandemic: A Case Study of Bank Rakyat Indonesia

Abstract

:1. Introduction

2. Theoretical Background and Hypothesis Development

3. Methodology

3.1. Data and Sampling Methodology

3.2. Variables

3.3. Method of Data Analysis

4. Findings and Discussions

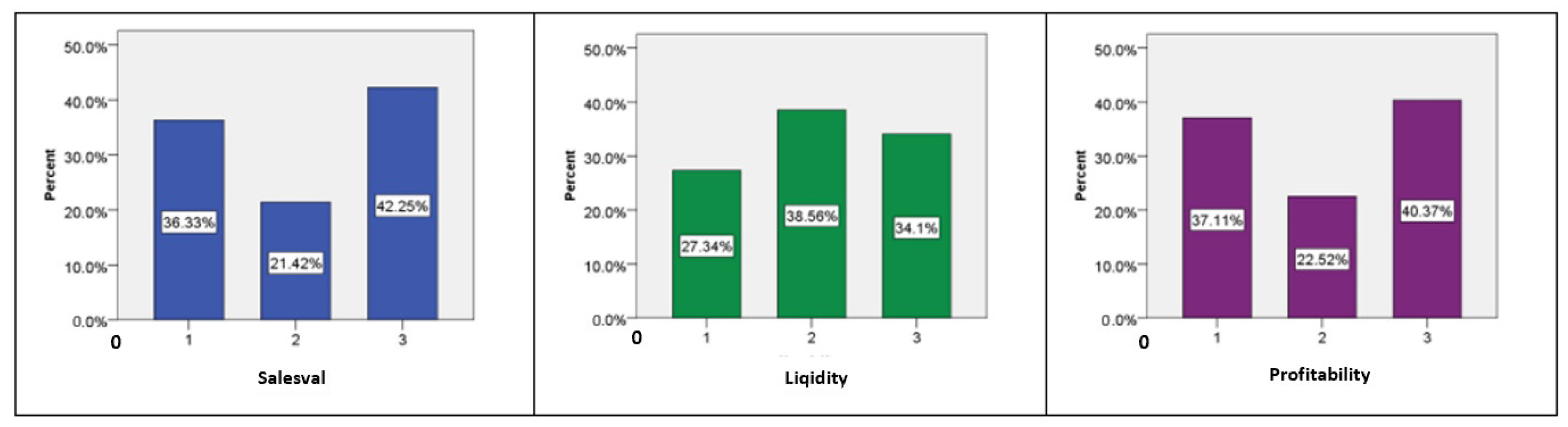

4.1. Descriptive Analysis

4.2. Model Estimation Using the Generalized Ordered Logit Model

4.3. Adjusted Predicted Value of Probability

5. Discussion

6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Adam, Latif, and Esta Lestari. 2017. Indonesia’s guaranteed microfinance programme (KUR): Lessons from the first stage of implementation. Journal of Southeast Asian Economies 34: 322–44. [Google Scholar] [CrossRef]

- ADB. 2020. Asia Small and Medium-Sized Enterprise Monitor 2020: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing Asia: Vol. II (Issue November). Available online: https://www.adb.org/publications/asia-sme-monitor-2020-country-regional-reviews (accessed on 23 November 2021).

- Agresti, Alan. 2003. Categorical Data Analysis. Hoboken: John Wiley and Sons. [Google Scholar]

- Ali, Imran, Sev Nagalingam, and Bruce Gurd. 2017. Building resilience in SMEs of perishable product supply chains: Enablers, barriers and risks. Production Planning and Control 28: 1236–50. [Google Scholar] [CrossRef]

- Barney, Jay, Mike Wright, and David J. Ketchen. 2001. The resource-based view of the firm: Ten years after 1991. Journal of Management 27: 625–41. [Google Scholar] [CrossRef]

- Beatty, Robert C., Jung P. Shim, and Mary C. Jones. 2001. Factors influencing corporate web site adoption: A time-based assessment. Information and Management 38: 337–54. [Google Scholar] [CrossRef]

- Bourletidis, Konstantinos, and Yiannis Triantafyllopoulos. 2014. SMEs Survival in Time of Crisis: Strategies, Tactics and Commercial Success Stories. Procedia—Social and Behavioral Sciences 148: 639–44. [Google Scholar] [CrossRef] [Green Version]

- Brant, Rollin. 1990. Assessing Proportionality in the Proportional Odds Model for Ordinal Logistic Regression. Biometrics 46: 1171. [Google Scholar] [CrossRef]

- Caballero-Morales, Santiago Omar. 2021. Innovation as recovery strategy for SMEs in emerging economies during the COVID-19 pandemic. Research in International Business and Finance 57: 101396. [Google Scholar] [CrossRef]

- Costa, Joana, and Rafael Castro. 2021. SMEs Must Go Online—E-Commerce as an Escape Hatch for Resilience and Survivability. Journal of Theoretical and Applied Electronic Commerce Research 16: 3043–62. [Google Scholar] [CrossRef]

- Djufri, Farhan, Basri Modding, Zainuddin Rahman, and Dahlia Baharuddin. 2021. The Effectiveness of Small Business Loans and People’s Business Loans on Increasing Competitiveness through Small Business Financial Performance at PT. Bank Mandiri, Sulawesi Maluku, Indonesia. American Journal of Humanities and Social Sciences Research (AJHSSR) 5: 194–203. [Google Scholar]

- Eller, Robert, Philip Alford, Andreas Kallmünzer, and Mike Peters. 2020. Antecedents, consequences, and challenges of small and medium-sized enterprise digitalization. Journal of Business Research 112: 119–27. [Google Scholar] [CrossRef]

- Fitriasari, Fika. 2020. How do Small and Medium Enterprises (SMEs) Survive the COVID-19 Outbreak? Jurnal Inovasi Ekonomi 5: 53–62. [Google Scholar] [CrossRef]

- Folta, Timothy B., Arnold C. Cooper, and Yoon Suk Baik. 2006. Geographic cluster size and firm performance. Journal of Business Venturing 21: 217–42. [Google Scholar] [CrossRef]

- Giotopoulos, Ioannis, Alexandra Kontolaimou, and Aggelos Tsakanikas. 2017. Drivers of high-quality entrepreneurship: What changes did the crisis bring about? Small Business Economics 48: 913–30. [Google Scholar] [CrossRef]

- Hermawan, Marko S., and Ubaidillah Nugraha. 2022. The Development of Small-Medium Enterprises (SMEs) and the Role of Digital Ecosystems During the COVID-19 Pandemic: A Case of Indonesia. In Handbook of Research on Current Trends in Asian Economics, Business, and Administration. Guangzhou: IGI Global. [Google Scholar]

- Holmes, Phil, Andrew John Hunt, and Ian Stone. 2010. An analysis of new firm survival using a hazard function. Applied Economics 42: 185–95. [Google Scholar] [CrossRef] [Green Version]

- ITC. 2020. International Trade Centre’s 2020 SME Competitiveness Outlook. Available online: https://www.intracen.org/smeco2020/ (accessed on 30 November 2021).

- Joseph, Emil, and M. M. Dhanabhakyam. 2021. Role of Digitalization Post-Pandemic for Development of SMEs. In Handbook of Research on Sustaining SMEs and Entrepreneurial Innovation in the Post-COVID-19 Era. Guangzhou: IGI Global, pp. 310–30. [Google Scholar] [CrossRef]

- Klein, Vinícius Barreto, and José Leomar Todesco. 2021. COVID-19 crisis and SMEs responses: The role of digital transformation. Knowledge and Process Management 28: 117–33. [Google Scholar] [CrossRef]

- Martí, José, and Anita Quas. 2018. A beacon in the night: Government certification of SMEs towards banks. Small Business Economics 50: 397–413. [Google Scholar] [CrossRef]

- Miceli, Antonio, Birgit Hagen, Maria Pia Riccardi, Francesco Sotti, and Davide Settembre-Blundo. 2021. Thriving, not just surviving in changing times: How sustainability, agility and digitalization intertwine with organizational resilience. Sustainability 13: 2052. [Google Scholar] [CrossRef]

- Najib, Mukhamad, Abdul Aziz Abdul Rahman, and Farah Fahma. 2021. Business survival of small and medium-sized restaurants through a crisis: The role of government support and innovation. Sustainability 13: 10535. [Google Scholar] [CrossRef]

- Nasco, Suzanne Altobello, Elizabeth Grandón Toledo, and Peter P. Mykytyn. 2008. Predicting electronic commerce adoption in Chilean SMEs. Journal of Business Research 61: 697–705. [Google Scholar] [CrossRef]

- Ndiaye, Ndeye, Lutfi Abdul Razak, Ruslan Nagayev, and Adam Ng. 2018. Demystifying small and medium enterprises’ (SMEs) performance in emerging and developing economies. Borsa Istanbul Review 18: 269–81. [Google Scholar] [CrossRef]

- Nitani, Miwako, and Allan Riding. 2015. Risk factors and the Canada Small Business Financing Program. Journal of Small Business and Entrepreneurship 27: 251–74. [Google Scholar] [CrossRef]

- Olawale, Fatoki, and David Garwe. 2010. Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. African Journal of Business Management 4: 729–38. Available online: http://www.academicjournals.org/AJBM (accessed on 29 November 2021).

- Park, Soonae, In Hyeock Lee, and Jung Eun Kim. 2020. Government support and small- and medium-sized enterprise (SME) performance: The moderating effects of diagnostic and support services. Asian Business and Management 19: 213–38. [Google Scholar] [CrossRef]

- Rajagopaul, Agesan, Nomfanelo Magwentshu, and Shakeel Kalidas. 2020. How South African SMEs can survive and thrive post COVID-19. In Providing the Right Support to Enable SME Growth Now and Beyond the Crisis. Brussels: McKinsey and Company, Available online: https://www.brookings (accessed on 30 November 2021).

- Supardi, and Syamsul Hadi. 2020. New Perspective on the Resilience of SMEs Proactive, Adaptive, Reactive from Business Turbulence: A Systematic Review. Journal of Xi’an University of Architecture and Technology 12: 1265–75. [Google Scholar] [CrossRef]

- Tambunan, Tulus T.H. 2018. The Performance of Indonesia’s Public Credit Guarantee Scheme for MSMEs: A Regional Comparative Perspective. Journal of Southeast Asian Economies (JSEAE) 35: 319–32. [Google Scholar] [CrossRef]

- Taneo, Stefanus Yufra M., Sunday Noya, Melany Melany, and Etsa Astridya SETIYATI. 2022. The Role of Local Government in Improving Resilience and Performance of Small and Medium-Sized Enterprises in Indonesia. Journal of Asian Finance 9: 245–56. [Google Scholar] [CrossRef]

- Teo, Thompson S.H., and Yujun Pian. 2003. A contingency perspective on Internet adoption and competitive advantage. European Journal of Information Systems 12: 78–92. [Google Scholar] [CrossRef]

- Verhoef, Peter C., and Tammo H.A. Bijmolt. 2019. Marketing perspectives on digital business models: A framework and overview of the special issue. International Journal of Research in Marketing 36: 341–49. [Google Scholar] [CrossRef]

- Williams, Richard. 2006. Generalized ordered logit/partial proportional odds models for ordinal dependent variables. Stata Journal 6: 58–82. [Google Scholar] [CrossRef] [Green Version]

- Wolk, Agnieszka, and Bernd Skiera. 2009. Antecedents and consequences of Internet channel performance. Journal of Retailing and Consumer Services 16: 163–73. [Google Scholar] [CrossRef]

- Wonglimpiyarat, Jarunee, and Napaporn Yuberk. 2005. In support of innovation management and Roger’s Innovation Diffusion theory. Government Information Quarterly 22: 411–22. [Google Scholar] [CrossRef]

| Variable | Description | Dimension |

|---|---|---|

| Dependent variables | ||

| Resilience 1 (Sales) | Sales volume | Ordinal, 1 = decrease, 2 = stagnant, 3 = increase |

| Resilience 2 (Liquidity) | Ability to pay current liabilities | Ordinal, 1 = decrease, 2 = stagnant, 3 = increase |

| Resilience 3 (Profitability) | Ability to generate profit | Ordinal, 1 = decrease, 2 = stagnant, 3 = increase |

| Independent variables | ||

| PEN and BRI support | Whether a respondent received National Economic recovery program and BRI Support for MSMEs during COVID-19 | Dummy categorical, 1 = none, 2 = receives a new credit support only 3 = receives a new credit support and interest rate subsidy and/or credit restructuring scheme 4 = receives interest rate subsidy only 5 = receives credit restructuring scheme only 6 = receives both interest rate subsidy and credit restructuring scheme |

| Length of digitalization | How long the respondent has been utilized internet application for transaction | Dummy categorical, 1 = never online; 2 = >one year; 3 = online one to three years; 4 = online >three years |

| Business characteristics | ||

| Location | Business location | Dummy, 1 = urban, 0 = other |

| Region | Region of business | Dummy categorical, 1 = Sumatra, 2 = Jawa and Bali, 3 = other |

| Sector | MSME sector | Dummy categorical, 1 = agriculture, 2 = industry, 3 = retail, 4 = service, 5 = others |

| Market area | Market coverage | Dummy categorical, 1 = local district, 2 = several districts in a province, 3 = national/international coverage |

| Firm size | Size of the MSMEs | Dummy categorical, 1 = micro 2 = small 3 = medium |

| Firm age | Age of the MSME | Continuous |

| Shifting | shifting business sector during pandemic | Dummy, 1 = yes, 0 = other |

| Owner characteristics | ||

| Owner education | Education of the MSME owners | Dummy categorical, 1 = elementary school and under, 2 = junior high school, 3 = senior high school, 4 = university/diploma |

| Owner gender | Gender of the MSME owners | Dummy, 1 = male, 0 = lainnya |

| Model (Dependent var.) | All | |

|---|---|---|

| chi-Squared | p > chi-Squared | |

| Salesval | 45.84 | 0.010 |

| Liquidity | 71.76 | 0.000 |

| Rentability | 125.89 | 0.000 |

| Variables | Description | Change Q2 2021 vs. QI 2021 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dist. | Sales Value | Liquidity | Profitability | ||||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | |||

| Location | Urban | 41.77 | 37.77 | 22.51 | 39.72 | 28.49 | 39.16 | 32.35 | 37.45 | 24.94 | 37.61 |

| Rural | 58.23 | 35.30 | 20.63 | 44.07 | 26.52 | 38.13 | 35.35 | 36.87 | 20.78 | 42.35 | |

| Region | Sumatra | 21.75 | 34.66 | 19.43 | 45.91 | 26.01 | 35.88 | 38.10 | 36.11 | 18.97 | 44.91 |

| Jawa & Bali | 52.22 | 39.01 | 20.84 | 40.15 | 29.92 | 39.32 | 30.75 | 39.99 | 22.02 | 37.99 | |

| Other | 26.03 | 32.35 | 24.23 | 43.41 | 23.27 | 39.26 | 37.47 | 32.16 | 26.47 | 41.37 | |

| Sector | Agriculture | 21.30 | 30.00 | 20.63 | 49.38 | 19.53 | 36.88 | 43.59 | 35.23 | 17.58 | 47.19 |

| Industry | 6.42 | 40.67 | 21.76 | 37.56 | 32.90 | 36.79 | 30.31 | 41.97 | 24.35 | 33.68 | |

| Retail | 52.44 | 36.69 | 21.36 | 41.95 | 29.04 | 38.21 | 32.75 | 35.45 | 22.56 | 41.99 | |

| Service | 10.6 | 42.54 | 22.14 | 35.32 | 31.71 | 41.60 | 26.69 | 43.80 | 27.47 | 28.73 | |

| Other | 9.24 | 38.74 | 22.52 | 38.74 | 26.85 | 42.16 | 30.99 | 39.82 | 26.67 | 33.51 | |

| Market Area | One district only | 77.47 | 36.67 | 22.13 | 41.20 | 27.28 | 39.4 | 33.32 | 37.21 | 23.35 | 39.44 |

| Several districts in one province | 14.73 | 35.25 | 18.53 | 46.21 | 28.02 | 34.8 | 37.18 | 36.16 | 19.66 | 44.18 | |

| Several provinces/national/export | 7.8 | 34.97 | 19.83 | 45.20 | 26.65 | 37.31 | 36.03 | 37.95 | 19.62 | 42.43 | |

| Online years | Never | 75.89 | 36.89 | 22.02 | 41.10 | 27.68 | 39.28 | 33.05 | 37.50 | 22.85 | 39.65 |

| Online <1 year | 2.53 | 28.95 | 27.63 | 43.42 | 26.97 | 41.45 | 31.58 | 32.89 | 28.29 | 38.82 | |

| Online 1–3 years | 14.44 | 35.25 | 17.86 | 46.89 | 26.04 | 34.79 | 39.17 | 35.71 | 20.39 | 43.89 | |

| Online >3 years | 7.14 | 35.20 | 20.05 | 44.76 | 26.57 | 37.53 | 35.90 | 37.30 | 21.21 | 41.49 | |

| Firm size | Micro | 84.16 | 35.71 | 21.67 | 42.61 | 26.97 | 38.32 | 34.70 | 36.50 | 22.88 | 40.62 |

| Small | 13.31 | 39.75 | 19.88 | 40.38 | 29.38 | 39.63 | 31.00 | 40.13 | 20.50 | 39.38 | |

| Medium | 2.53 | 38.82 | 21.05 | 40.13 | 28.95 | 40.79 | 30.26 | 41.45 | 21.05 | 37.50 | |

| Firm age (y) | <10 | 46.26 | 35.50 | 21.26 | 43.24 | 26.44 | 39.93 | 33.63 | 35.61 | 23.35 | 41.04 |

| 10–20 | 35.80 | 37.19 | 21.29 | 41.52 | 28.82 | 37.38 | 33.80 | 38.68 | 21.48 | 39.84 | |

| 21–30 | 13.75 | 36.80 | 22.03 | 41.16 | 27.85 | 37.17 | 34.99 | 37.05 | 23.00 | 39.95 | |

| 31–40 | 3.41 | 36.10 | 20.49 | 43.41 | 22.44 | 37.56 | 40.00 | 39.02 | 20.00 | 40.98 | |

| >40 | 0.78 | 38.30 | 29.79 | 31.91 | 25.53 | 40.43 | 34.04 | 46.81 | 23.40 | 29.79 | |

| Shifting | Yes | 1.36 | 45.12 | 20.73 | 34.15 | 31.71 | 35.37 | 32.93 | 48.78 | 15.85 | 35.37 |

| No | 98.64 | 36.21 | 21.43 | 42.37 | 27.28 | 38.60 | 34.12 | 36.95 | 22.61 | 40.44 | |

| Owner education | 1 = elementary and under | 19.27 | 35.75 | 21.16 | 43.09 | 26.60 | 36.79 | 36.61 | 38.26 | 22.19 | 39.55 |

| 2 = junior high | 18.77 | 38.03 | 22.43 | 39.54 | 28.55 | 38.83 | 32.62 | 38.65 | 23.67 | 37.68 | |

| 3 = senior high | 44.27 | 36.2 | 21.47 | 42.33 | 28.46 | 38.35 | 33.20 | 37.11 | 22.33 | 40.56 | |

| 4 = university/diploma | 17.69 | 35.47 | 20.51 | 44.03 | 24.08 | 40.73 | 35.18 | 34.24 | 22.11 | 43.65 | |

| Owner gender | Male | 68.35 | 36.3 | 20.89 | 42.8 | 27.85 | 37.76 | 34.38 | 37.50 | 21.82 | 40.69 |

| Female | 31.65 | 36.38 | 22.56 | 41.06 | 26.24 | 40.27 | 33.49 | 36.28 | 24.03 | 39.70 | |

| PEN | 1 = none | 39.29 | 34.52 | 23.3 | 42.19 | 24.82 | 41.42 | 33.76 | 34.18 | 25.75 | 40.07 |

| 2 = new credit | 13.53 | 32.6 | 21.65 | 45.76 | 20.3 | 41.7 | 38.01 | 35.92 | 19.56 | 44.53 | |

| 3 = new credit and rate subsidy and/or credit restructuring | 6.07 | 29.04 | 20.00 | 50.96 | 20.82 | 38.63 | 40.55 | 31.23 | 26.03 | 42.74 | |

| 4 = rate subsidy only | 7.19 | 36.81 | 21.76 | 41.44 | 28.24 | 35.19 | 36.57 | 36.57 | 19.91 | 43.52 | |

| 5 = credit restructuring only | 27.61 | 41.29 | 19.17 | 39.54 | 34.48 | 34.90 | 30.62 | 42.86 | 20.13 | 37.01 | |

| 6 = rate subsidy and credit restructuring | 6.31 | 40.37 | 20.05 | 39.58 | 32.19 | 33.77 | 34.04 | 39.05 | 18.73 | 42.22 | |

| Output | Sales Value | Liquidity | Profitability | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VARIABLES | Panel 1 (1 vs. 2, 3) | Panel 2 (1, 2 vs. 3) | Panel 1 (1 vs. 2, 3) | Panel 2 (1, 2 vs. 3) | Panel 1 (1 vs. 2, 3) | Panel 2 (1, 2 vs. 3) | ||||||

| coef. | RRR | coef. | RRR | coef. | RRR | coef. | RRR | coef. | RRR | coef. | RRR | |

| PEN (base = none) | ||||||||||||

| 2. Only receive new loan | 0.0985 | 1.104 | 0.0985 | 1.104 | 0.177 ** | 1.194 ** | 0.177 ** | 1.194 ** | −0.0772 | 0.926 | 0.176 ** | 1.192 ** |

| (0.0765) | (0.0844) | (0.0765) | (0.0844) | (0.0759) | (0.0906) | (0.0759) | (0.0906) | (0.0851) | (0.0788) | (0.0825) | (0.0984) | |

| 3. Receive new loan, and restructuring/interest rate subsidy | 0.313 *** | 1.367 *** | 0.313 *** | 1.367 *** | 0.261 ** | 1.298 ** | 0.261 ** | 1.298 ** | 0.126 | 1.134 | 0.126 | 1.134 |

| (0.108) | (0.147) | (0.108) | (0.147) | (0.106) | (0.138) | (0.106) | (0.138) | (0.105) | (0.119) | (0.105) | (0.119) | |

| 4. Only receive interest rate subsidy | −0.0377 | 0.963 | −0.0377 | 0.963 | −0.164 | 0.849 | 0.142 | 1.153 | −0.0878 | 0.916 | 0.153 | 1.166 |

| (0.0988) | (0.0952) | (0.0988) | (0.0952) | (0.118) | (0.100) | (0.110) | (0.127) | (0.110) | (0.101) | (0.107) | (0.125) | |

| 5. Only receive restructuring credit | −0.234 *** | 0.791 *** | −0.106 | 0.900 | −0.431 *** | 0.650 *** | −0.103 | 0.903 | −0.351 *** | 0.704 *** | −0.0914 | 0.913 |

| (0.0654) | (0.0517) | (0.0651) | (0.0586) | (0.0694) | (0.0451) | (0.0688) | (0.0621) | (0.0665) | (0.0468) | (0.0666) | (0.0607) | |

| 6. Receive interest rate subsidy and credit restructuring | −0.153 | 0.858 | −0.153 | 0.858 | −0.346 *** | 0.708 *** | 0.0369 | 1.038 | −0.202 * | 0.817 * | 0.131 | 1.140 |

| (0.105) | (0.0901) | (0.105) | (0.0901) | (0.120) | (0.0851) | (0.118) | (0.123) | (0.115) | (0.0938) | (0.113) | (0.129) | |

| Online (base = never online) | ||||||||||||

| 2. Online <one year | 0.247 | 1.281 | 0.247 | 1.281 | 0.0443 | 1.045 | 0.0443 | 1.045 | 0.0759 | 1.079 | 0.0759 | 1.079 |

| (0.153) | (0.196) | (0.153) | (0.196) | (0.153) | (0.160) | (0.153) | (0.160) | (0.152) | (0.164) | (0.152) | (0.164) | |

| 3. Online one to three years | 0.135 * | 1.145 * | 0.293 *** | 1.341 *** | 0.185 ** | 1.203 ** | 0.368 *** | 1.445 *** | 0.166 ** | 1.181 ** | 0.166 ** | 1.181 ** |

| (0.0802) | (0.0918) | (0.0774) | (0.104) | (0.0869) | (0.105) | (0.0797) | (0.115) | (0.0727) | (0.0859) | (0.0727) | (0.0859) | |

| 4. Online >three years | 0.199 ** | 1.220 ** | 0.199 ** | 1.220 ** | 0.205 ** | 1.228 ** | 0.205 ** | 1.228 ** | 0.121 | 1.129 | 0.121 | 1.129 |

| (0.0987) | (0.120) | (0.0987) | (0.120) | (0.0977) | (0.120) | (0.0977) | (0.120) | (0.0986) | (0.111) | (0.0986) | (0.111) | |

| Shifting (1 = yes) | −0.409 * | 0.664 * | −0.409 * | 0.664 * | −0.164 | 0.848 | −0.164 | 0.848 | −0.389 * | 0.678 * | −0.389 * | 0.678 * |

| (0.211) | (0.140) | (0.211) | (0.140) | (0.210) | (0.178) | (0.210) | (0.178) | (0.217) | (0.147) | (0.217) | (0.147) | |

| Control Variable | ||||||||||||

| Location (1 = urban) | −0.0858 | 0.918 | −0.0858 | 0.918 | −0.0105 | 0.990 | −0.0105 | 0.990 | −0.0862 | 0.917 | −0.0862 | 0.917 |

| (0.0539) | (0.0495) | (0.0539) | (0.0495) | (0.0534) | (0.0529) | (0.0534) | (0.0529) | (0.0540) | (0.0495) | (0.0540) | (0.0495) | |

| Region (base = Sumatra) | ||||||||||||

| 2. Jawa & Bali | −0.174 *** | 0.840 *** | −0.174 *** | 0.840 *** | −0.199 *** | 0.819 *** | −0.199 *** | 0.819 *** | −0.215 *** | 0.806 *** | −0.215 *** | 0.806 *** |

| (0.0651) | (0.0547) | (0.0651) | (0.0547) | (0.0647) | (0.0530) | (0.0647) | (0.0530) | (0.0651) | (0.0525) | (0.0651) | (0.0525) | |

| 3. others | 0.109 | 1.115 | −0.0545 | 0.947 | 0.0748 | 1.078 | 0.0748 | 1.078 | 0.140 * | 1.150 * | −0.0772 | 0.926 |

| (0.0780) | (0.0870) | (0.0753) | (0.0713) | (0.0713) | (0.0768) | (0.0713) | (0.0768) | (0.0780) | (0.0897) | (0.0757) | (0.0700) | |

| Sector (base = trade and retail) | ||||||||||||

| 1. Agriculture | 0.230 *** | 1.259 *** | 0.230 *** | 1.259 *** | 0.423 *** | 1.526 *** | 0.423 *** | 1.526 *** | −0.103 | 0.902 | 0.140 * | 1.150 * |

| (0.0699) | (0.0880) | (0.0699) | (0.0880) | (0.0696) | (0.106) | (0.0696) | (0.106) | (0.0760) | (0.0686) | (0.0737) | (0.0848) | |

| 2. Industry | −0.225 ** | 0.799 ** | −0.225 ** | 0.799 ** | −0.176 * | 0.839 * | −0.176 * | 0.839 * | −0.342 *** | 0.711 *** | −0.342 *** | 0.711 *** |

| (0.102) | (0.0814) | (0.102) | (0.0814) | (0.101) | (0.0851) | (0.101) | (0.0851) | (0.101) | (0.0720) | (0.101) | (0.0720) | |

| 4. Service | −0.288 *** | 0.750 *** | −0.288 *** | 0.750 *** | −0.228 *** | 0.796 *** | −0.228 *** | 0.796 *** | −0.374 *** | 0.688 *** | −0.625 *** | 0.535 *** |

| (0.0825) | (0.0618) | (0.0825) | (0.0618) | (0.0814) | (0.0648) | (0.0814) | (0.0648) | (0.0898) | (0.0617) | (0.0961) | (0.0514) | |

| 5. Others | −0.142 | 0.867 | −0.142 | 0.867 | −0.00967 | 0.990 | −0.00967 | 0.990 | −0.212 ** | 0.809 ** | −0.390 *** | 0.677 *** |

| (0.0868) | (0.0753) | (0.0868) | (0.0753) | (0.0853) | (0.0845) | (0.0853) | (0.0845) | (0.0957) | (0.0774) | (0.0980) | (0.0663) | |

| Market area (base = intra district) | ||||||||||||

| 2. Intra−province | 0.186 *** | 1.205 *** | 0.186 *** | 1.205 *** | 0.0271 | 1.027 | 0.213 *** | 1.237 *** | 0.114 | 1.120 | 0.262 *** | 1.300 *** |

| (0.0712) | (0.0858) | (0.0712) | (0.0858) | (0.0840) | (0.0863) | (0.0785) | (0.0971) | (0.0783) | (0.0877) | (0.0763) | (0.0992) | |

| 3. Inter−province/national/export | 0.162 * | 1.176 * | 0.162 * | 1.176 * | 0.124 | 1.132 | 0.124 | 1.132 | 0.112 | 1.119 | 0.112 | 1.119 |

| (0.0949) | (0.112) | (0.0949) | (0.112) | (0.0941) | (0.106) | (0.0941) | (0.106) | (0.0951) | (0.106) | (0.0951) | (0.106) | |

| Firm size (base = micro) | ||||||||||||

| 2. Small | −0.142 * | 0.868 * | −0.142 * | 0.868 * | −0.144 * | 0.866 * | −0.144 * | 0.866 * | −0.180 ** | 0.835 ** | −0.180 ** | 0.835 ** |

| (0.0749) | (0.0650) | (0.0749) | (0.0650) | (0.0737) | (0.0638) | (0.0737) | (0.0638) | (0.0749) | (0.0626) | (0.0749) | (0.0626) | |

| 3. Medium | −0.102 | 0.903 | −0.102 | 0.903 | −0.124 | 0.884 | −0.124 | 0.884 | −0.217 | 0.805 | −0.217 | 0.805 |

| (0.157) | (0.142) | (0.157) | (0.142) | (0.154) | (0.136) | (0.154) | (0.136) | (0.158) | (0.127) | (0.158) | (0.127) | |

| Firm age | −0.0149 * | 0.985 * | −0.0149 * | 0.985 * | −0.0135 | 0.987 | −0.0135 | 0.987 | −0.00816 | 0.992 | −0.00816 | 0.992 |

| (0.00882) | (0.00869) | (0.00882) | (0.00869) | (0.00882) | (0.00870) | (0.00882) | (0.00870) | (0.00883) | (0.00876) | (0.00883) | (0.00876) | |

| Firm age2 | 0.000336 | 1.000 | 0.000336 | 1.000 | 0.00046 * | 1.00 * | 0.00046 * | 1.00 * | 0.000147 | 1.000 | 0.000147 | 1.000 |

| (0.00024) | (0.00024) | (0.00024) | (0.00024) | (0.00025) | (0.00025) | (0.00025) | (0.00025) | (0.00025) | (0.00025) | (0.00025) | (0.00025) | |

| Owner education (base = elementary and below) | ||||||||||||

| 2. Junior high | −0.104 | 0.901 | −0.104 | 0.901 | −0.0941 | 0.910 | −0.0941 | 0.910 | −0.0255 | 0.975 | −0.0255 | 0.975 |

| (0.0786) | (0.0708) | (0.0786) | (0.0708) | (0.0783) | (0.0713) | (0.0783) | (0.0713) | (0.0784) | (0.0764) | (0.0784) | (0.0764) | |

| 3. Senior high | −0.00246 | 0.998 | −0.00246 | 0.998 | −0.0778 | 0.925 | −0.0778 | 0.925 | 0.0754 | 1.078 | 0.0754 | 1.078 |

| (0.0677) | (0.0676) | (0.0677) | (0.0676) | (0.0673) | (0.0623) | (0.0673) | (0.0623) | (0.0676) | (0.0729) | (0.0676) | (0.0729) | |

| 4.PT/diploma | 0.0621 | 1.064 | 0.0621 | 1.064 | 0.181 * | 1.198 * | −0.0186 | 0.982 | 0.226 *** | 1.254 *** | 0.226 *** | 1.254 *** |

| (0.0837) | (0.0890) | (0.0837) | (0.0890) | (0.0963) | (0.115) | (0.0898) | (0.0882) | (0.0835) | (0.105) | (0.0835) | (0.105) | |

| Owner gender (1 = male) | 0.0336 | 1.034 | 0.0336 | 1.034 | −0.0299 | 0.971 | −0.0299 | 0.971 | −0.00538 | 0.995 | −0.00538 | 0.995 |

| (0.0530) | (0.0548) | (0.0530) | (0.0548) | (0.0526) | (0.0510) | (0.0526) | (0.0510) | (0.0530) | (0.0527) | (0.0530) | (0.0527) | |

| Constant | 0.767 *** | 2.154 *** | −0.140 | 0.869 | 1.232 *** | 3.428 *** | −0.609 *** | 0.544 *** | 0.849 *** | 2.336 *** | −0.209 * | 0.812 * |

| (0.116) | (0.250) | (0.116) | (0.101) | (0.117) | (0.401) | (0.116) | (0.0630) | (0.118) | (0.275) | (0.117) | (0.0948) | |

| Pseudo R2 | 0.0122 | 0.0186 | 0.0179 | |||||||||

| LR chi−squared | 155.86 *** | 242.91 *** | 230.15 *** | |||||||||

| Observations | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 | 6009 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Supari, S.; Anton, H. The Impact of the National Economic Recovery Program and Digitalization on MSME Resilience during the COVID-19 Pandemic: A Case Study of Bank Rakyat Indonesia. Economies 2022, 10, 160. https://doi.org/10.3390/economies10070160

Supari S, Anton H. The Impact of the National Economic Recovery Program and Digitalization on MSME Resilience during the COVID-19 Pandemic: A Case Study of Bank Rakyat Indonesia. Economies. 2022; 10(7):160. https://doi.org/10.3390/economies10070160

Chicago/Turabian StyleSupari, Supari, and Hendranata Anton. 2022. "The Impact of the National Economic Recovery Program and Digitalization on MSME Resilience during the COVID-19 Pandemic: A Case Study of Bank Rakyat Indonesia" Economies 10, no. 7: 160. https://doi.org/10.3390/economies10070160

APA StyleSupari, S., & Anton, H. (2022). The Impact of the National Economic Recovery Program and Digitalization on MSME Resilience during the COVID-19 Pandemic: A Case Study of Bank Rakyat Indonesia. Economies, 10(7), 160. https://doi.org/10.3390/economies10070160