Abstract

Facing the current complicated situation of the COVID-19 pandemic, in addition to medical efforts on disease prevention and treatment, governments of countries also have to come up with solutions to deal with the negative impacts of the pandemic on the economy. This study aims to provide specific, comprehensive, and scientific estimates of the impact of the COVID-19 pandemic on the Vietnamese economy. By using the Bayesian method to estimate DSGE models, research results show that a shock increase by one standard deviation (about 1.49% increase in the probability of a COVID-19 outbreak) to the Covid status variable immediately reduces the output gap by 0.94%. However, this effect only lasts for one quarter, and the output gap widens again. Meanwhile, refinancing interest rates, inflation, and exchange rate changes also have an immediate decline in response to this shock, but the magnitude of the reduction is relatively small.

1. Introduction

The COVID-19 pandemic warned the world about unpredictable and difficult-to-control macro impacts on the economy. Since the complicated COVID-19 pandemic situation, state governments make efforts to prevent and treat disease, and also have to cope with the effects on the economy (not to mention other social influences). In addition, the forced implementation of measures such as Social distancing and Lockdown has led to economic consequences, such as businesses closing, increasing unemployment rate, decreasing consumer demand, etc. From the beginning of 2020 until now, the global circulation of goods production and services has been suddenly interrupted, leading to a local shortage of production materials in many parts of the world. Therefore, the question is, what is the impact of the COVID-19 pandemic on the economy? What is the policy response to the new-normal situation, especially the monetary policy of the central banks of other countries, as well as in Vietnam? As we know, the objectives of the monetary policy of all countries are basically aimed towards stabilizing prices, controlling inflation, controlling unemployment rate, and stabilizing the economy.

There has been much research conducted in many countries and regions to find answers to the abovementioned problems. On the regional level, studies have confirmed the severe impact of the COVID-19 pandemic on the regional economy, and that monetary policy helps the regional economy cope with the consequences of COVID-19 (Aguilar et al. 2020; Cúrdia 2020). However, within individual countries, on the one hand, the studies still show evidence of the severe impact of the COVID-19 epidemic on the economy, but on the other hand, the effectiveness of monetary policy is not the same (Pinshi 2020; Malata and Pinshi 2020; Zhang et al. 2021). Specifically, traditional monetary policy tools are not as effective as expected, or the policy lag is quite significant, leading central banks to actively consider applying non-traditional measures in management to deal effectively with immediate problems caused by the pandemic. Research results show that non-traditional tools are practical on time and are used by many central banks due to lessons learned from the global financial crisis in 2008.

In Vietnam, studies in the period from 2019 to the present still revolve around determining the consequences of the COVID-19 epidemic on the economy. In addition, the policy responses of the operator to the macro instability situation due to the COVID-19 epidemic also revolved around judgments based on the collected information. There have not been empirical studies to make specific conclusions and comprehensive estimates. This is also the driving force behind us to carry out this study. Unlike previous studies conducted in Vietnam, this study applies the DSGE model developed by the State Bank of Vietnam’s Monetary Forecasting and Statistic Department in consultation with experts from IMF and JICA Japan, which is considered suitable for Vietnam’s small and open economy to estimate the shocks that the model brings, thereby assessing the impact on the economy’s aggregate demand. Moreover, to quantify the effect of the COVID-19 epidemic, we also adjusted this model based on the studies of Zheng and Guo (2013), and Zhang et al. (2021). Therefore, this study can provide specific, comprehensive, scientific estimates of the impact of the COVID-19 pandemic on the Vietnamese economy and the effectiveness of monetary policy in the past. Furthermore, our study also has another critical contribution: estimating the DSGE model by the Bayesian method for an open and small economy like Vietnam.

2. Previous Studies Related to Monetary Policy in the Period of COVID-19

An epidemic of acute respiratory infections caused by a new strain of Coronavirus (COVID-19) appeared in December 2019. On 31 January 2020, the World Health Organization (WHO) announced a worldwide health emergency. Facing the challenging situation of the epidemic, the governments of other countries, in addition to health efforts in disease prevention and treatment, have to strain themselves to cope with the consequences on the economy due to the instability caused by the COVID-19 outbreak.

There have been many studies conducted in many countries and regions around the world in recent times to find answers to the effects of the epidemic on the economy. For example, Aizenman et al. (2022) studied the impact of above-normal government spending during the COVID-19 pandemic on loan growth of commercial banks between 2019Q4 and 2020Q4. Research by Baker et al. (2020) assesses the economic impact of the COVID-19 pandemic on stock market volatility and economic uncertainty based on press. In addition to its impact on public health, Bartik et al. (2020) studied the impact of the COVID-19 pandemic on the performance of small businesses and examined the effectiveness of economic stimulus policies. In addition to the aforementioned case studies, other studies have also assessed the impact of the COVID-19 pandemic on consumer spending (Coibion et al. 2020), the labor market, inequality income (Campello et al. 2020; Forsythe et al. 2020), and business immunity (Ding et al. 2021).

The above studies have pointed to unexpected macroeconomic consequences of the COVID-19 pandemic. Thus, in addition to public health interventions (e.g., restricting movement, controlling migration, increasing immunization), governments worldwide have implemented various fiscal and monetary policies to combat the unintended consequences of the pandemic on the economy. Accordingly, many studies on fiscal and monetary policy responses during the COVID-19 pandemic have also been carried out. Some case studies included below.

Cortes et al. (2022) compared interventions taken by the Federal Reserve in response to the subprime crisis and the COVID-19 pandemic crisis. In essence, these two crises are different, the subprime lending crisis has an endogenous origin from the economy, while the crisis caused by the COVID-19 epidemic has an exogenous origin. The results of the study and comparison show that the interventions in both these crises reduce the risk in the stock markets in the countries. However, the spillover effects of interventions during the subprime crisis negatively affected the economy.

Zhang et al. (2021) studied the impact of the COVID-19 pandemic on sustainable economic growth, government debt, and income inequality in China by the NK-DSGE1 model. The results show that the impact of the COVID-19 pandemic on aggregate demand and labor demand has posed severe challenges to the sustainable development of the economy and increasingly unequal societies. From the analysis of the pandemic’s impact on aggregate demand, the study suggests that the goals of monetary policy should focus more on price stability. In addition, the decrease in labor demand leads to the proposal that monetary policy should focus on the goal of economic growth. The study concludes that, depending on the manifestations and impact of the COVID-19 pandemic, monetary policy focuses more on that goal towards stimulating consumption, reducing unemployment, reducing unequal societies, and improving the sustainability of China’s economy.

Malata and Pinshi (2020) used an econometric framework with a self-regressing Bayesian vector approach to isolate the impact of monetary policy on inflation, output gap, and exchange rate, taking into account the volatility caused by the pandemic. The study confirms that the pressure caused by the COVID-19 epidemic affects the economy. Thus, to what extent can monetary policy obscure these effects? The study analyzed some tactics of the Central Bank of Congo (BCC) in response to the impact of the pandemic, such as easing monetary policy by buying large amounts of treasury bonds. This expanded monetary policy can revive the economy and save businesses, especially small and medium enterprises. In addition, the Central Bank of Congo also supports banks to help reduce lending conditions to make it easier for businesses to access credit.

Pinshi (2020) conducted a study on how the instability caused by the COVID-19 epidemic affects the economy’s aggregate demand and the role of monetary policy in overcoming instability in the Congo through an experimental Bayesian VAR model. The shock analysis in the model shows that the impact of COVID-19 is quite significant on aggregate demand, prices, exchange rates, and trade openness, making it difficult for monetary policy intervention. Moreover, the model results show that the response of monetary policy is temporarily ineffective for at least 24 months. The uncertainty of COVID-19 reduces the ability of the Central Bank of Congo to affect the economy and control inflation. Therefore, the study proposes to consider non-traditional monetary policy management measures, such as buying many long-term treasury bonds and liquidity relief packages.

Cúrdia (2020) experimented with an econometric model to examine the effectiveness of an active interest rate cut in monetary policy management to cope with the expected impact of the COVID-19 pandemic. The data are taken from 1989 to the end of 2019. The macro indicators used in the model include Inflation Rate2, Growth in real GDP, Unemployment rate, Effective funds Rate3, and Long-term Unemployment Rate. The impact of the pandemic is simulated through two negative effects on the economy: (i) reduced labor productivity (because businesses produce fewer goods than before); (ii) reduced willingness-to-pay (due to travel restrictions, social distancing, closure of non-essential businesses) reduces overall demand in the economy.

Bhar and Malliaris (2021) modeled the effects of a non-conventional monetary policy approach based on the arguments of Friedman (1968)4, a Markov transition econometric model with monthly period data from 2002 to 2015 that examines the effectiveness of applying non-conventional monetary policy during the global financial crisis to reduce unemployment. The results show that non-conventional monetary policy with quantitative easing and targeting tools has had an impact in reducing the unemployment rate. The study conducts a preliminary comparison of the balance sheet of the US Federal Reserve (Fed) during two crises (Global financial crisis and the COVID-19 pandemic), from which lessons may be drawn from experience for the Fed in operating monetary policy to contribute to mitigating the economic and financial impacts of the COVID-19 pandemic on businesses and households.

Đorđević et al. (2020) study the application of non-traditional tools in monetary policy administration to mitigate the economic consequences of the COVID-19 pandemic. The tools used are quantitative easing (QE) and quantitative alleviation. The study analyzes the effectiveness of applying these tools in the central banks of the USA, Japan, Europe, and other central banks. The use of these tools more or less affects aggregate demand, inflation, and GDP. The paper provides lessons learned for the Republic of Serbia in considering the application of these tools.

Aguilar et al. (2020) presented an overview of the timely and robust responses of the European Central Bank to the COVID-19 pandemic, and the meetings of The Committee on Economic and Monetary Affairs took place continuously. Various monetary policy measures have been applied since the outbreak of the COVID-19 pandemic. The paper evaluates these measures, explains their application, and examines and analyzes the impact of the efforts on the euro area economy. The study was updated in a report on 9 February 2021 (Aguilar et al. 2020).

In addition to the above studies, in recent times, assessing the impact of the COVID-19 pandemic on the macroeconomy of countries through the DSGE model is receiving much attention, since considering the impact of shocks through the DSGE model can give an overview of these impacts on the macro variables of the economy. Moreover, the DSGE model is also built on the basis of the theory of the real business cycle and shows the response of all sectors in the economy to shocks. Case studies include Eichenbaum et al. (2022) and Eichenbaum et al. (2021). Eichenbaum et al. (2022) studied epidemic factors in the Neoclassical and New-Keynesian Models, the basic models of the DSGE model. The results of Eichenbaum et al. (2022) show similar peak-to-trough volatility in both consumption, investment, and output during the COVID-19 pandemic. Following that study, Eichenbaum et al. (2021) extended the epidemiological model to study the interaction between economic decisions and epidemics. The results of Eichenbaum et al. (2021) imply that people cut back on consumption and employment to reduce the risk of infection. These decisions reduce the epidemic’s severity but exacerbate the scale of the associated recession.

In Vietnam, in recent years, there have also been many studies on the impact of the COVID-19 pandemic on the economy, as well as on the operation of monetary policy in the context of the pandemic. Some case studies include those below.

Pham Thanh Ha (2021a, 2021b) gave an overview of the monetary policy operation of the State Bank of Vietnam, along with monetary policy and fiscal policy in 2020 in the context of the COVID-19 pandemic taken place in 2019, and the orientation of monetary policy management in 2021. According to the study, the State Bank of Vietnam has had flexible responses in its management activities to control inflation, stabilize the macroeconomy, support production and business activities, and create momentum for a recovering economy. The results achieved in coordinating and administering Vietnam’s macro policies form an essential foundation for the operation orientation in 2021.

NEU-JICA (2020)5 conducted a comprehensive analysis and assessment of the impact of the COVID-19 epidemic on the economy. The study evaluates the effectiveness of Vietnam’s macro policies (including monetary policy) in responding to that impact, and makes appropriate recommendations for policymakers. Accordingly, the assessment stated that the interest rate tool of the monetary policy in this period would be less effective, so the credit support policy needs to apply other measures, in addition to reducing interest rates.

Bui Duy Hung (2020) researches monetary policy management in the context of the COVID-19 epidemic taking place in Vietnam, as well as around the world, from the end of 2019 until now. In order to limit the harmful effects of the outbreak on the economy, the article outlines flexible response measures in monetary policy management of the central banks of other countries, as well as the State Bank of Vietnam, such as cutting interest rates, supporting liquidity, and supporting businesses from there towards the common goal of supporting the economy. The article only stops at analyzing and synthesizing non-traditional measures of some central banks, giving preliminary comments on how the application of these measures has brought about specific positive effects.

In summary, it can be seen that domestic studies revolve around analyzing the policy responses of executives to the macroeconomic instability caused by the COVID-19 epidemic, mainly assessing the perception of the situation. There is no long-term-oriented policy and no empirical studies to make more specific and comprehensive estimates based on the collected information. Unlike previous studies, in this study, we try to make estimates of the impact of the COVID-19 pandemic on macro variables of the Vietnamese economy. At the same time, through the DSGE model estimated by the Bayesian method, we also show the response of variables related to monetary policy to the COVID-19 pandemic shock.

3. Methodology

3.1. Dynamic Stochastic General Equilibrium (DSGE)

From Table 1, we see that there are many methods to experimentally transmit monetary policy to the economy, among which the DSGE model is a comprehensive assessment model of shocks that affect macro variables.

Table 1.

Summary of research on monetary policy management during the COVID-19 pandemic.

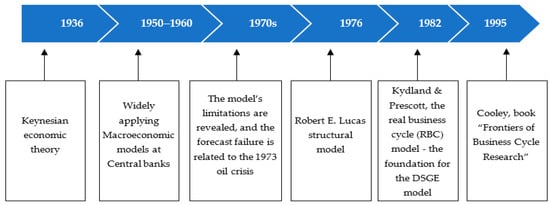

The DSGE model is based on Business Cycle Theory (see Figure 1). The real business cycle theory suggests that business cycles are how the economy responds to shocks, in which supply-side shocks such as labor productivity or technology shocks contribute the most. The model also eliminates demand-side shocks, as well as the need to intervene in the economy through short-term tools, such as fiscal policy and monetary policy. With the assumption that prices and wages are adjusted dynamically, this model does not recognize the effect of monetary policy on output and other macro variables. The DSGE model only began to be developed in the 1980s after Lucas’ criticism comparing it to traditional macro-econometric models. However, the model has received much attention from academic researchers and policymakers at central banks, especially banks with inflation targeting. More and more central banks of developed and developing countries are building their own DSGE models for economic analysis and forecasting, such as Canada’s central bank (ToTEM model), Bank of England (BEQM model), Central bank of Chile (MAS model), Central reserve bank of Peru (MEGAD model), ECB (NAWM model), Central Bank of Norway (NEMO model), Central Bank of Sweden (RAMSES model), and the Fed (SIGMA model).

Figure 1.

The development of DSGE model.

The paper uses the DSGE model built by the State bank of Vietnam’s Monetary Forecasting and Statistic Department in consultation with IMF and JICA experts, which is suitable for Vietnam’s small and open economy to estimate shocks, thereby assessing the impact on the aggregate demand of the economy. At the micro level, the DSGE Model comes from optimizing the interests of the actors in the economy, including consumers, businesses, and the government. Specifically, Consumers seek to optimize utility according to their budget and firms seek to maximize profits according to their level of technology. Governments run the economy through the tools of monetary policy.

Moreover, we also adjusted this model based on the research of Zheng and Guo (2013). To assess the impact of the COVID-19 epidemic on growth and monetary policy, we add the variable to the DSGE model, which represents the probability of an outbreak of the COVID-19 epidemic. The reality of Vietnam’s economic results in 2020 has shown that Vietnam can both control the COVID-19 pandemic well and ensure the development speed of the economy through solutions that flexibly combine both fiscal and monetary policy. Therefore, Vietnam’s inflation in 2020 remains stable through a series of macro measures, and there is no sign of high inflation as in some parts of the world. This also reflects the current situation of pandemic shock in Vietnam, which affects demand more than supply. Therefore, in this study, we evaluate the impact of COVID-19 on economic growth as a demand shock.

The proposed DSGE model for this study is as follows:

Equation (1) is built based on the IS curve equation for the small and open economy. In this equation, is Vietnam output gap. The rest of the world is represented by , which is the US output gap. The US output gap is chosen to represent the rest of the world in the case study in Vietnam because the import–export turnover between Vietnam and the US accounts for the largest proportion of the total import–export turnover of Vietnam. The current output gap of Vietnam depends on future expectations (). In this model, the SBV’s refinancing rate () is expected to have a negative effect on output gap. At the same time, current economic growth depends on future inflation (). is the Terms of Trade of Vietnam. According to growth theory, current economic growth also depends on the Terms of Trade. The impact of the COVID-19 pandemic () is expected to have a negative impact on the output gap. is a state variable, representing the shock of technological change.

Equation (3) is built based on the Phillips curve, in which, current inflation () depends on expectations of future inflation () and current and future change in the output gap of Vietnam. Moreover, unlike the traditional Phillips curve equation, as suggested by Zheng and Guo (2013), we add the impact of current and future Terms of Trade to reflect an open economy more precisely.

In this study, we assume that the central bank adjusts interest rates in response to changes in inflation and real output. Moreover, Taylor (2000) also argues that central banks in emerging economies should react to changes in exchange rates to improve the effectiveness of monetary policy. Accordingly, we have the following equation:

This study also assumes that purchasing power parity (PPP) holds. Therefore, changes in the nominal exchange rate would be expressed as:

The remaining variables in the model include Vietnam’s Terms of Trade, technology change, the US output gap, US inflation, and the probability of disease outbreaks. COVID-19 is assumed to be exogenous and has an appropriate growth rate. These variables are expressed in the following equations:

where:

- : Vietnam output gap

- : Refinancing rate of the State bank of Vietnam

- : Inflation rate of Vietnam

- : USD to VND exchange rate

- : US output gap

- : Terms of Trade of Vietnam

- : Inflation rate of US

- : Probability of outbreak of COVID-19

- : Shocks

In equations from (1) to (12), the main equations of the DSGE model include: (i) Equation (1) is the equation of the line IS, the aggregate demand equation, in (1) is the unobserved control variable in the model, which represents GDP (output gap is the difference between actual GDP and its potential output). Equation (3) is the Phillips curve equation representing the relationship between inflation and GDP. Equation (5) is an interest rate equation based on Taylor’s Rule. Equation (6) is the exchange rate equation.

3.2. Estimators of DSGE

Some estimators of DSGE can be mentioned as: (i) Calibration and parameter estimation, (ii) Generalized Method of Moments estimation of equations (GMM); (iii) Maximum Likelihood Estimation (MLE); (iv) Impulse response matching Estimation; and (v) Bayesian Estimation.

A review of related studies shows that the DSGE models are mostly estimated by the Maximum Likelihood Estimation—MLE—in previous studies. However, the limitation on the time series size of the variables affects the estimation of the parameters in the DSGE model by the MLE method. To overcome this limitation, we use the Bayesian method to estimate the DSGE model with the Vietnamese economy. In addition to the observed data, the Bayesian method also uses the a priori information of the parameters in the model obtained from previous studies. This information is expressed as a priori distribution. Following this, the Bayesian method combines the observed data with the a priori distribution to create the posterior distribution of the parameters in the model. This posterior distribution contains all the information about the parameters in the DSGE model. Therefore, this estimation method overcomes the data limitation of the time series in the DSGE model.

In the scope of this paper, the authors use data collected from the International Monetary Fund (IMF) with quarterly data for the period of 1996–2020. The results from the DSGE model built for the Vietnamese economy show the transmission effects of macro factors on the economy, especially the impact of the COVID-19 pandemic on Vietnam’s growth and monetary policy during the epidemic period from the end of 2019 until the end of 2020. In addition, we also analyzed the current situation of monetary policy management of the State Bank of Vietnam, in order to have empirical evidence to better explain monetary policy management before and during the epidemic outbreak.

4. Results

4.1. Research Context

The COVID-19 pandemic has had a huge impact on most countries around the world. Economic growth in many countries around the world has been significantly reduced since the outbreak of the pandemic. Therefore, the central banks of countries have come up with many policies to respond to the pandemic situation.

The State Bank of Vietnam has made quite detailed reports on monetary policy implementation, especially timely responses to the COVID-19 pandemic. Some typical activities can be summarized as follows (SBV 2020):

Promptly direct credit institutions to review customer situations, assess the impact of the COVID-19 epidemic on customers, and develop customer support scenarios when necessary.

Organize a conference to connect six key economic regions between banks and businesses to listen to opinions directly.

Direct credit institutions to take advantage of internal financial resources to implement programs, such as salary cuts, no dividends, cost reduction, profit reduction, etc., to support customers. Credit institutions have carried out debt restructuring, interest rate exemptions and reductions, new loans with preferential interest rates, exemption and reduction of payment fees, etc.

Implement credit growth and provide capital on time to the economy:

- SBV actively adjusted to increase credit growth in a few priority areas, directed credit institutions to study internal processes to reduce loan procedures, increase information technology applications, and increase loans unsecured by assets, etc.

- Implemented specific credit policies for the export and agriculture sectors.

- Promoted credit to poor households and policy beneficiaries.

Improve the business environment in the monetary and banking sector as part of the state administrative reform program. Increase the application of online public services and processing through the network environment. The year 2020 is the 5th consecutive year that the State Bank of Vietnam leads the PAR index ranking.

The scheme to restructure credit institutions associated with bad debts has been drastically implemented.

Promote the development of non-cash payments, develop e-banking, apply the achievements of the industrial revolution 4.0, but still ensure safety, security, and confidentiality. Research and supplement legal regulations related to digital banking and online banking services…

Actively, prudently and flexibly implement through monetary policy tools:

- For interest rates: in 2020, interest rates have been adjusted three times with a total reduction of about 1.5–2% to support liquidity and create conditions for credit institutions to access financial capital from SBV at low cost, reducing the ceiling interest rate of VND deposits by 0.6–1% for terms of less than 6 months, and reducing the ceiling interest rate of VND short-term loans by 1.5% for priority sectors. All of these interest rate reductions are aimed at helping credit institutions reduce costs, creating conditions for businesses and people to access capital at a low cost.

- For exchange rates: continue to operate the exchange rate tool flexibly, actively communicate, monitor exchange rate movements, and announce the central exchange rate daily, ready to intervene to stabilize the market. By the end of 2020, the central exchange rate remains at 23,131 VND/USD, ensuring stability in the foreign currency market, and supplementing the state’s foreign exchange reserves.

Thus, in addition to some administrative measures, such as guiding credit institutions to implement measures to support businesses and people, in 2020, SBV has operated through conventional monetary policy tools, such as interest rates and exchange rates, while unconventional monetary policy tools have not been used much.

Nguyen Minh Cuong (Nguyen Minh Cuong 2021), ADB’s chief economist in Vietnam, in his article affirmed Vietnam’s success in 2020, with economic growth reaching 2.91%, while many countries have negative economic growth. The article made insightful comments related to the monetary policy implementation of the State Bank of Vietnam in 2020, thereby recommending some notes for 2021. The analysis of the article also shows the timely flexible responses and certain achievements of the State Bank of Vietnam in monetary policy management.

4.2. Description of the Variables in the Model

The study used quarterly data for the period 1996Q1–2020Q4, including 100 observations. The variables in the DSGE model include the refinancing interest rate of SBV (r), the inflation rate of Vietnam (p), the USD/VND exchange rate (e), and Terms of Trade (q). In addition to the above variables, for the DSGE model to consider the impact of the rest of the world on Vietnam, we also include the variable (us) representing the output gap of the US and the variable (pus) representing US inflation. Descriptive statistics of the variables in the model are presented in Table 2.

Table 2.

Descriptive statistics.

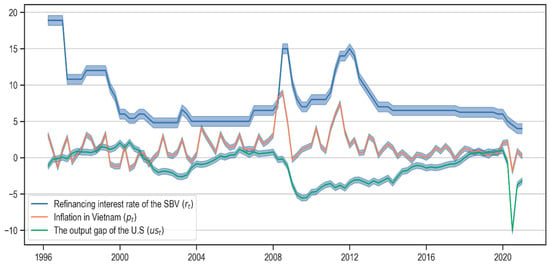

Figure 2 shows the fluctuations of the refinancing interest rate, Vietnam’s inflation, and the US output gap from the first quarter of 1996 to the fourth quarter of 2020. Accordingly, visually, the refinancing interest rate fluctuates in the same direction as inflation, representing the response of monetary policy. Except for the period of the COVID-19 outbreak from the end of 2019, the US output gap fluctuated inversely with Vietnam’s refinancing interest rate and inflation during the study period before the epidemic outbreak.

Figure 2.

Movements of refinancing interest rate, inflation in Vietnam, and the output deviation of the US in the period from 1996Q1 to 2020Q4.

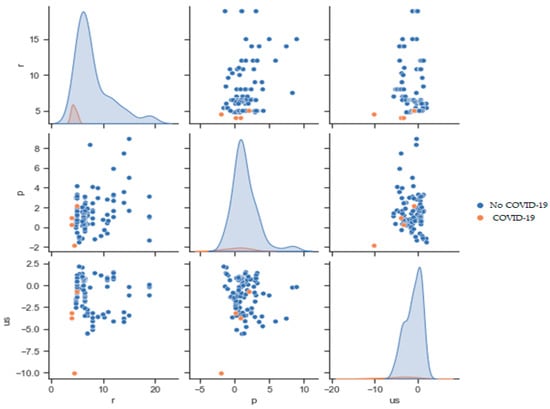

Figure 3 shows the relationship between these variables before and during the COVID-19 outbreak. Specifically, the orange points represent the value pairs of the variables of Vietnam’s refinancing interest rate, Vietnam’s inflation, and the US output gap during the COVID-19 outbreak period, while the blue points represent pairs of these variables in the period before the outbreak. Figure 3 shows the orange points evenly distributed in the lower and left quadrants of the graph. This result shows that, during the epidemic outbreak period, the value pairs of the variables of Vietnam’s refinancing interest rate, Vietnam’s inflation, and the US output gap all received lower values than before. This result indicates the simultaneous decrease of the variables of Vietnam’s refinancing interest rate, Vietnam’s inflation, and the US output gap during the outbreak period.

Figure 3.

Correlation between Vietnam’s refinancing interest rate, inflation, and US output gap before and during the COVID-19 outbreak.

For the DSGE model’s parameter estimation results to be reliable, the time series in the DSGE model must be stationary. Therefore, we perform the Dickey–Fuller test to evaluate the stationarity of the time series in the model. The test results are presented in Table 3:

Table 3.

Dickey–Fuller Test.

The Dickey–Fuller test results show that the variables of refinancing interest rate of the State Bank of Vietnam (r), inflation of Vietnam (p), output gap of the US (us), and inflation of America (pus) all stop at the original string. However, the USD/VND exchange rate (e) and Terms of Trade (q) stop at the first difference. Therefore, we use the first difference of the two variables instead of the original series when estimating the DSGE model.

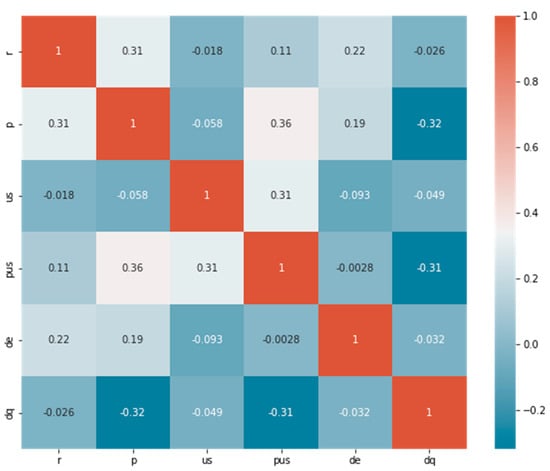

Next, we use the correlation coefficient matrix to consider the correlation between the variables in the research model. Figure 4 shows that the correlation coefficient between the pairs of variables in the model ranges from −0.32 to 0.36. Thus, the variables in the model have a low correlation with each other. This result also shows that multicollinearity does not occur in the research model.

Figure 4.

Correlation matrix between variables in the model.

4.3. The Prior Distributions of the Parameters in the DSGE Model

An important problem in the Bayesian method is determining the appropriate prior distributions for the parameters in the model. In this study, we determine the prior distributions for the parameters in the DSGE model based on the research of Zheng and Guo (2013), specifically as shown in Table 4:

Table 4.

The prior distributions of the parameters in the model.

The prior distributions of the parameters related to the impact of the COVID-19 epidemic in the DSGE model are proposed by us according to the study of Zhang et al. (2021). Specifically, the parameter representing the impact of COVID-19 on the output gap has a prior distribution of Beta (0.7, 0.1). Meanwhile, the parameter represents the probability that the outbreak has a prior distribution of Normal (0.0822, 0.0016). In the past, countries have been racing to produce vaccines to prevent the spread of the COVID-19 pandemic. In addition, vaccination rates have increased in most countries and continents. Therefore, in this study, we believe the outbreak probability is 8.22% as suggested by Zhang et al. (2021). Moreover, the selection of the outbreak probability of 8.22% is also based on the geographical similarity between the two neighboring countries. More specifically, Vietnam and China are also two countries with similar political institutions. Therefore, the response of two countries with the same institutions to the risk of disease may be similar.

Finally, we propose an inverse-gamma distribution (0.01, 0.01) for all standard deviation parameters in the model.

4.4. The Posterior Distributions of the Parameters in the DSGE Model

Bayesian analysis is used by us with the Metropolis–Hastings algorithm. The size of MCMC sequences corresponding to the parameters is 15,000, of which 2500 samples are removed in the Burn-in phase. Thus, the size of MCMC sequences corresponding to the parameters to form the posterior distribution is 12,500. The results of the DSGE model estimation by Bayesian method are presented in Table 5:

Table 5.

Estimation results of DSGE model by Bayes method.

Table 5 shows that the 95% confidence intervals of the parameters are clearly in the positive or negative range; none of the 95% confidence intervals contain the value 0. With Equation (1), the parameter takes a positive value (since the 95% confidence interval of this parameter is in the positive range). Moreover, the parameter calculated according to Equation (2) receives a positive value. Therefore, an increase in the refinancing interest rate harms the output gap. At the same time, expectations of rising inflation in the future widen the current output gap, by boosting current consumption with greater purchasing power. The parameter has a positive value (since the 95% confidence interval of this parameter is in the positive range), indicating that technological growth affects the increasing output gap. In addition, the research results also show that the output gap of the US has a positive impact on the output gap of Vietnam. Therefore, the US economic growth also has a positive impact on Vietnam’s economic growth.

Table 5 also shows that the coefficient in Equation (3) has a positive value. Thus, future growth expectations increase current inflation by boosting current consumption. With Equation (5), the coefficient takes a positive value, the 95% confidence interval of parameter has an upper-bound value less than 1. Therefore, the increase in output gap and inflation leads to the SBV’s response through an increase in the refinancing interest rate.

The above arguments help us explain the impact of the COVID-19 epidemic on economic growth and monetary policy. Specifically, the impact of the COVID-19 epidemic on the output gap is expressed through the parameter . Table 5 shows that the parameter has a positive value (since the 95% confidence interval of this parameter is in the positive range). Thus, the probability of an outbreak of the COVID-19 epidemic negatively affects the output gap. Holding other factors constant, as above mentioned, a decrease in the output gap reduces inflation. At the same time, monetary policy immediately responds to this situation by reducing the refinancing interest rate by the SBV.

The more specific effects of the transmission channel analyzed above are measured through the results of the impulse–response function shown below.

4.5. The Impulse–Response Function

The state–space form allows us to trace the path of control or state variable in response to a shock to a state variable. This path is called an impulse–response function (IRF), a complete set of impulse responses of variables to each shock.

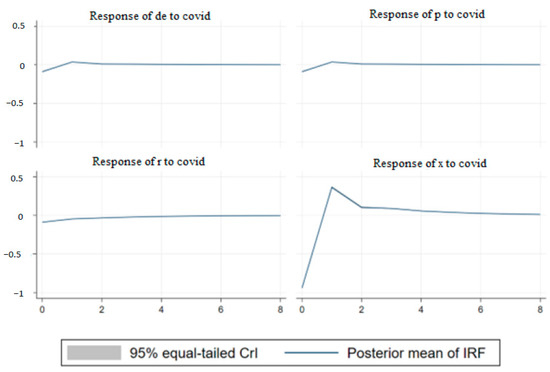

The state variable represents the probability of an outbreak of COVID-19. A shock to the variable would indicate an increased risk of disease outbreaks, and the IRF finds out how this shock causes temporary effects on the output gap, inflation, and the refinancing interest rate. Figure 5 shows that a shock of one standard deviation increase (about 1.49% increase in the probability of a COVID-19 outbreak) to the state variable immediately reduces the output gap by 0.94%; however, this effect only lasts for 1 quarter, and the output gap then increases again. Meanwhile, refinancing interest rate, inflation, and exchange rate changes also have an immediate decline in response to this shock, but the magnitude of the reduction is relatively small.

Figure 5.

The response of Vietnam’s output gap, refinancing interest rate, inflation, and exchange rate changes to the shock of the COVID-19 outbreak.

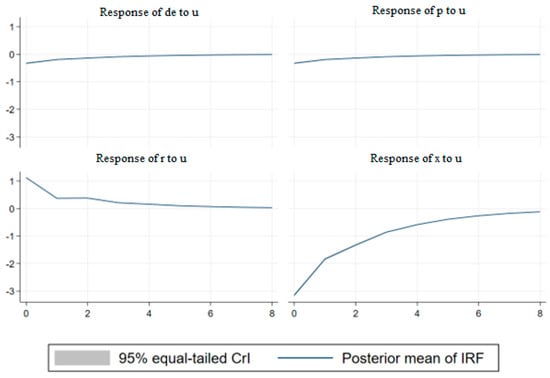

Figure 6 shows the response of Vietnam’s output gap, refinancing interest rate, inflation, and exchange rate changes to a monetary policy change shock. The state variable models monetary policy changes that occur in the refinancing interest rate for reasons other than inflation, output gap, and changes in the exchange rate. A shock to is an unexpected increase in interest rates and the IRF finds out how this shock affects the variables in the model. A shock of one standard deviation increase in the state variable causes the interest rate to increase immediately by about 1.12%, and this effect lasts for 6 quarters before disappearing. An increase in refinancing interest rate leads to a sharp decrease in the output gap, about 3.15%, and a slight decrease in inflation, about 0.3%. This result also shows that inflation seems to be less sensitive to the policy interest rate.

Figure 6.

Response of Vietnam’s output gap, refinancing interest rate, inflation, and exchange rate changes to a monetary policy change shock.

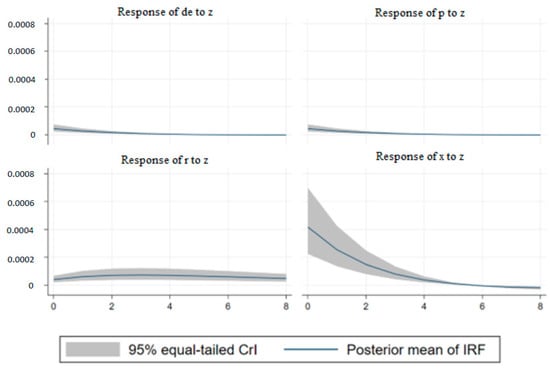

The response of Vietnam’s output gap, refinancing interest rate, inflation, and exchange rate changes to a technology change shock are shown in Figure 7. The state variable models the rate of technology change and is considered an exogenous variable in the growth model. A shock that increases by one standard deviation of the state variable causes the output gap to increase immediately, while the other variables have almost no response. The results are consistent with many previous studies that suggest that technological change has a positive impact on economic growth. However, it is worth mentioning here that the increase, although lasting for 6 quarters, is relatively small. This result reflects that the economy’s ability to absorb technology is very low.

Figure 7.

Response of Vietnam’s output gap, refinancing interest rate, inflation, and exchange rate changes to technology change shock.

The specific arithmetical responses of Vietnam’s output gap and inflation to the probability shocks of the COVID-19 outbreak, monetary policy, and technological changes are shown in Table 6.

Table 6.

The response of Vietnam’s output gap and refinancing interest rate to the shocks of the COVID-19 outbreak, changes in monetary policy, and changes in technology.

5. Conclusions and Recommendations

With the analysis from the DSGE model, combined with the epidemic situation and information on the macro indicators on monetary policy implementation of the State Bank of Vietnam in 2020, we can see that the analysis results from the DSGE model are quite consistent with the real situation, and there is strong empirical evidence that the effectiveness of the SBV’s monetary policy implementation in the past has adapted to the new normal. From a review of previous studies, combined with analysis of model results and the current situation, some recommendations are made for the State Bank of Vietnam as follows:

First, the results have shown a shock of one standard deviation increase (about 1.49% increase in the probability of a COVID-19 outbreak) to the state variable COVID-19 immediately reduces the output gap by 0.94%. Moreover, refinancing interest rate, inflation, and exchange rate changes also have an immediate decline in response to this shock, but the magnitude of the reduction is relatively small. It is clear that policymakers have learnt a lot from past crises. Therefore, the administration of monetary policy has been more cautious in reducing interest rates. In the near future, policymakers must study the impact of the pandemic on the economy in order to have timely supportive policies that ensure the economy’s safety and not lead to high inflation.

Second, an increase in the refinancing interest rate leads to a sharp decrease in the output gap, about 3.15%, and a slight decrease in inflation, about 0.3%. This result also shows that inflation seems to be less sensitive to the policy interest rate. Moreover, empirical studies on the impact of the COVID-19 epidemic all show that unconventional monetary policy tools can be effective promptly, so these tools should be considered more by the State Bank of Vietnam.

Third, in the long run, measures to reduce interest rates and support credit may lead to a local excess of capital in some areas, without flowing into the production sector, possibly causing further economic consequences, such as inflationary pressure and asset bubbles, etc.

Therefore, in addition to the monetary policy tools being implemented, the inspection and supervision of managers also need to be regular and continuous, creating a synchronous macro support system, in coordination with other macro policies of the government that are harmonized, aiming at stabilizing and recovering the economy.

Author Contributions

Conceptualization, T.D.N.; methodology, A.H.L. and L.K.T.; software, A.H.L. and E.I.T.; validation, L.K.T.; formal analysis, T.D.N.; investigation, T.D.N.; resources, A.H.L.; data curation, A.H.L.; writing—original draft preparation, T.D.N., A.H.L. and L.K.T.; writing—review and editing, L.K.T. and E.I.T.; visualization, A.H.L.; supervision, T.D.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by Ho Chi Minh University of Banking under grant number 01/HĐ-KHCN-NCM.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data should be accessed from the authors in request at anhlh_vnc@buh.edu.vn.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | New Keynesian Dynamic Stochastic General Equilibrium model. |

| 2 | Core personal consumption expenditures (PCE) price inflation. |

| 3 | Effective funds rate. |

| 4 | According to Friedman, a model is applicable even if the assumptions of the model do not necessarily reflect reality. A model is a representation of a concept that reflects some aspect of reality. The variables in the model can be a connected set of some representative data, whereby the model results can be used to predict, or the model can produce a prediction that we can test. So the model is like a tool; we can use it and, if it works, it is useful. We cannot have a precise set of assumptions about the behavior of economic agents. |

| 5 | The report was made part of a collaborative research project between scientists from the National Economics University and Japan International Cooperation Agency experts. |

References

- Aguilar, Pablo, Óscar Arce, Samuel Hurtado, Jaime Martinez-Martin, Galo Nuño Barrau, and Carlos Thomas. 2020. The ECB Monetary Policy Response to the Covid-19 Crisis. Occasional Paper 2026. Madrid: Banco de España, Available online: https://econpapers.repec.org/paper/bdeopaper/2026e.htm (accessed on 1 January 2022).

- Aizenman, Joshua, Yothin Jinjarak, and Mark M. Spiegel. 2022. Fiscal Stimulus and Commercial Bank Lending Under COVID-19. Working Paper. Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Stephen J. Terry. 2020. COVID-Induced Economic Uncertainty. Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Bartik, Alexander W., Marianne Bertrand, Zoë B. Cullen, Edward L. Glaeser, Michael Luca, and Christopher T. Stanton. 2020. How Are Small Businesses Adjusting to COVID-19? Early Evidence from a Survey. Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Bhar, Ramaprasad, and Anastasios George Malliaris. 2021. Modeling U.S. Monetary Policy during the Global Financial Crisis and Lessons for Covid-19. Journal of Policy Modeling 43: 15–33. [Google Scholar] [CrossRef] [PubMed]

- Bui Duy Hung. 2020. Monetary Policy in the Context of Covid-19 in Some Developed Countries and Vietnam. Banking Magazine 16: 50–54. [Google Scholar]

- Campello, Murillo, Gaurav Kankanhalli, and Pradeep Muthukrishnan. 2020. Corporate Hiring under COVID-19: Labor Market Concentration, Downskilling, and Income Inequality. Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Coibion, Olivier, Yuriy Gorodnichenko, and Michael Weber. 2020. The Cost of the Covid-19 Crisis: Lockdowns, Macroeconomic Expectations, and Consumer Spending. Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Cortes, Gustavo S., George P. Gao, Felipe B. G. Silva, and Zhaogang Song. 2022. Unconventional Monetary Policy and Disaster Risk: Evidence from the Subprime and COVID–19 Crises. Journal of International Money and Finance 122: 102543. [Google Scholar] [CrossRef] [PubMed]

- Cúrdia, Vasco. 2020. Mitigating COVID-19 Effects with Conventional Monetary Policy. FRBSF Economic Letter 9: 1–5. Available online: https://econpapers.repec.org/article/fipfedfel/87776.htm (accessed on 1 January 2022).

- Ding, Wenzhi, Ross Levine, Chen Lin, and Wensi Xie. 2021. Corporate Immunity to the COVID-19 Pandemic. Journal of Financial Economics 141: 802–30. [Google Scholar] [CrossRef] [PubMed]

- Đorđević, Marina, Jadranka Todorović, and Milica Ristic. 2020. Application of unconventional monetary policy instruments in mitigation of the economic consequences of the COVID 19 virus pandemic. Facta Universitatis, Series: Economics and Organization 17: 231–48. [Google Scholar] [CrossRef]

- Eichenbaum, Martin S., Sergio Rebelo, and Mathias Trabandt. 2022. Epidemics in the New Keynesian Model. Journal of Economic Dynamics and Control 140: 104334. [Google Scholar] [CrossRef]

- Eichenbaum, Martin, Sergio Rebelo, and Mathias Trabandt. 2021. The Macroeconomics of Epidemics. Review of Financial Studies 34: 5149–87. Available online: https://econpapers.repec.org/article/ouprfinst/v_3a34_3ay_3a2021_3ai_3a11_3ap_3a5149-5187..htm (accessed on 1 January 2022). [CrossRef]

- Forsythe, Eliza, Lisa B. Kahn, Fabian Lange, and David Wiczer. 2020. Labor Demand in the Time of COVID-19: Evidence from Vacancy Postings and UI Claims. Journal of Public Economics 189: 104238. [Google Scholar] [CrossRef] [PubMed]

- Friedman, Milton. 1968. The Role of Monetary Policy. The American Economic Review 58: 1–17. Available online: https://www.jstor.org/stable/1831652 (accessed on 1 January 2022).

- Malata, Alain K., and Christian Pinshi. 2020. Fading the Effects of Coronavirus with Monetary Policy. Available online: https://hal.archives-ouvertes.fr/hal-02889520 (accessed on 1 January 2022).

- NEU-JICA. 2020. Evaluation of Covid-19 Response Policies and Recommendations. Hanoi: National Economics University Publishing House. [Google Scholar]

- Nguyen Minh Cuong. 2021. Monetary Policy in Post-Covid-19 Economic Recovery and Growth. Banking Magazine 3+4: 23–24. [Google Scholar]

- Pham Thanh Ha. 2021a. Coordination of Fiscal and Monetary Policy: Achievements in 2020 and Orientation for 2021. Financial Review 2021: 27–31. [Google Scholar]

- Pham Thanh Ha. 2021b. Operating Monetary Policy to Support the Economy against the Covid-19 Pandemic and Orientation for 2021. Banking Review 6: 12–16. [Google Scholar]

- Pinshi, Christian P. 2020. COVID-19 Uncertainty and Monetary Policy. 100184. MPRA Paper. München: University Library of Munich, Available online: https://ideas.repec.org/p/pra/mprapa/100184.html (accessed on 1 January 2022).

- SBV. 2020. Speech of Deputy Governor Dao Minh Tu at the Conference on Implementing Tasks of the Banking Industry in 2021. Available online: https://www.sbv.gov.vn/webcenter/portal/vi/menu/rm/cbpbcldnhnn/cbpbcldnhnn_chitiet;jsessionid=O_VBmlLUdLuamr5PdCQFMrJdzzmtyeK2ABAilDH39JqzJCKNe-jY!527291070!-1636100262?centerWidth=80%25&dDocName=SBV426430&leftWidth=20%25&rightWidth=0%25&showFooter=false&showHeader=false&_adf.ctrl-state=s04la7t9x_498&_afrLoop=22234595784642297#%40%3F_afrLoop%3D22234595784642297%26centerWidth%3D80%2525%26dDocName%3DSBV426430%26leftWidth%3D20%2525%26rightWidth%3D0%2525%26showFooter%3Dfalse%26showHeader%3Dfalse%26_adf.ctrl-state%3D10ycmrfq6k_4 (accessed on 1 January 2022).

- Taylor, John Brian. 2000. Using Monetary Policy Rules in Emerging Market Economies. Working Paper. Stanford: Stanford University. [Google Scholar]

- Zhang, Xinping, Yimeng Zhang, and Yunchan Zhu. 2021. COVID-19 Pandemic, Sustainability of Macroeconomy, and Choice of Monetary Policy Targets: A NK-DSGE Analysis Based on China. Sustainability 13: 3362. [Google Scholar] [CrossRef]

- Zheng, Tingguo, and Huiming Guo. 2013. Estimating a Small Open Economy DSGE Model with Indeterminacy: Evidence from China. Economic Modelling 31: 642–52. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).